Worries over the stability of the US and European banking sectors are abating, but economic growth is slowing

US & Europe

The risk of a US and European banking crisis is fading, but rate hikes effect and tightening financial conditions may drag on growth. Rapid moves by authorities and private sector to add liquidity and to manage the situation have headed off the risk of wider contagion. This is reflected in recovery in prices for commodities and risk assets, as well as in stronger sell-side pressure in gold and bond markets, which has now displaced fears over the banking crisis. Treasury Secretary Janet Yellen has also stated that the overall banking sector remains strong and resilient, staying ready to act if the situation worsens. Likewise, the ECB is prepared to increase liquidity to financial markets if necessary

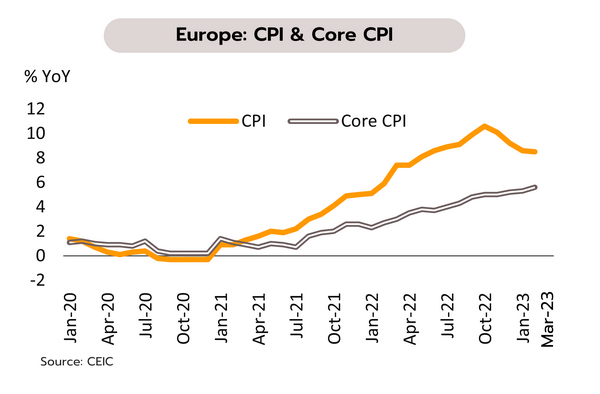

Nevertheless, the US and Eurozone economies are slowing and growth may remain flat this year as a result of the sharp increase in rates and a tightening of lending standards that will likely negatively impact consumption, investment, and employment. Assuming that inflationary pressures weaken and the banking crisis does not worsen, we see the Fed raising rates by another 25 bps in May, giving a terminal rate of 5.00-5.25%, where rates will stay for the rest of 2023. In Eurozone, March headline inflation remained high at 6.9% YoY and core inflation rose to 5.7%, and so we expect the ECB to raise policy rate to 4.00% this year

Japan

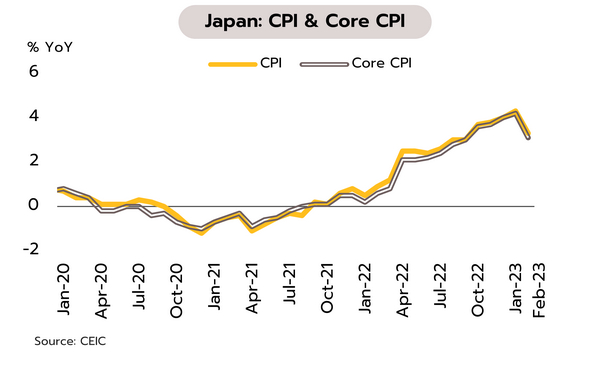

Japan’s consumption may come under threat from the rapid decline in real wages, but slowing inflation will help lift growth in 2H23. In February, core consumer inflation stood at 3.1% YoY, down from January’s 41-year high of 4.2% and the first drop in 13 months. However, due to the high cost of energy and of raw materials, Japanese corporate pre-tax profits dropped by 2.8% YoY in 4Q22, their first decline in 8 quarters.

Given high inflation and the limited room for raising wages as a result of weak corporate profits, real wages will likely continue to contract, and this will depress consumption through 1H23. However, the outlook should improve in 2H23 on softening energy prices, which will undercut inflation, and the reopening of China, which will boost the tourism and export sectors. The appointment of a new governor of the Bank of Japan (BOJ) may also lead to an unwinding of ultra-loose monetary policy as the BOJ looks to fight inflation and to bring policy closer into line with that of other developed economies. Some signals of the ending of the BOJ’s yield curve control (YCC) may thus be seen at April’s BOJ meeting, with this then expected to start implementation in the second half of the year.

China

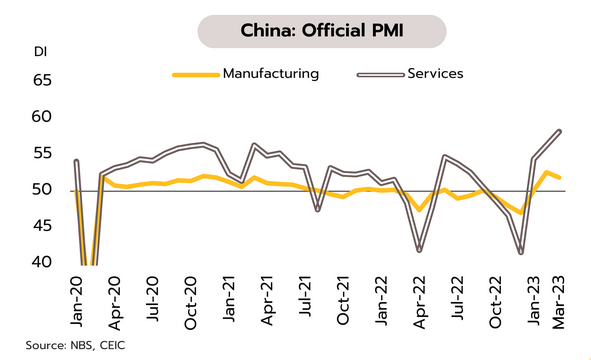

Services in China are strengthening but manufacturing growth is slowing. Data from the National Bureau of Statistics show that March’s manufacturing PMI fell from 52.3 in February to 51.9 on softer global demand. However, the services PMI rose from 56.3 to 58.2 on the boost to consumption given by the ending of Covid controls and stimulus measures on construction. In addition, the crackdown on tech companies that began at the end of 2020 may be ending. The e-commerce giant Alibaba is thus undergoing a major reorganization to strengthen competitiveness and add to shareholder value, while its founder Jack Ma has also now returned to China.

China’s reopening has lifted the economy, especially the services sector, and the World Bank has revised its forecast for 2023 Chinese growth up from the 4.6% predicted last October. It thus now sees growth hitting 5.1%, higher than the official target of 5.0%. However, momentum may slow down due to: (i) a weaker global economy that will undercut exports; (ii) the fading of pent-up demand; (iii) the continuing effects of the troubled real estate sector on overall investment; (iv) high levels of local government debts that will limit public spending; and (v) the effects of US technology restrictions on Chinese economic growth.

The economy continues to recover gradually, but uncertainty over the impact of external headwinds may lead to a pause in hiking rate by the MPC

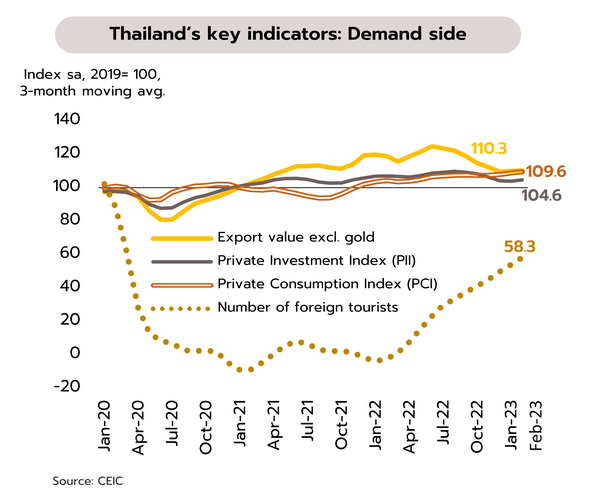

Economic growth has improved through February, led by tourism sector and domestic spending. The Bank of Thailand reported that on almost all components, private consumption rose in the month, though with this especially noticeable for durable goods. The economy was benefiting from improving household spending power, stronger labor markets, increased consumer confidence, and a rise in the number of domestic and foreign tourists that was then supporting greater expenditure on services. Private investment in machinery and equipment has also risen, though measured by both sales of construction materials and approved building permits, investment in construction remained flat. The outlook is also mixed for overseas markets, with Thai exports shrinking by 4.1% YoY, the 5th month of contraction, while the number of foreign tourist arrivals is largely unchanged at 2.11mn compared to 2.14mn in January.

Indicators show that through the first 2 months of the year, the economy continued to benefit from recovery in the tourism sector and growth in domestic demand, and with this driving the economy, a technical recession should be avoided in 1Q23. The general election will also help to inject additional funds into the economy, though exports will continue to come under pressure from a slowdown in the global economy. This will be caused in particular by sluggishness in the advanced economies, the rise in interest rates to a 15-year high, and continuing fears over the financial stability though the latter is now lessening.

The MPC is normalizing monetary policy in the face of worries about demand-pull inflation. At its 29 March meeting, the Monetary Policy Committee (MPC) agreed unanimously to raise policy rate by 25 bps to 1.75%. The MPC saw growth continuing to be driven by tourism and private consumption, with recovery in exports to become more evident in 2H23, though the GDP forecast has been trimmed from 3.7% to 3.6%. Inflation is expected to slip back into the target range in mid-2023, though there is a risk that this will remain elevated for longer than expected as a result of cost pass-throughs and increased pressure from demand-pull inflation as the economy improves. Nevertheless, the MPC expected headline and core inflation rates this year to average 2.9% and 2.4% respectively, down slightly from its prior prediction of 3.0% and 2.5%.

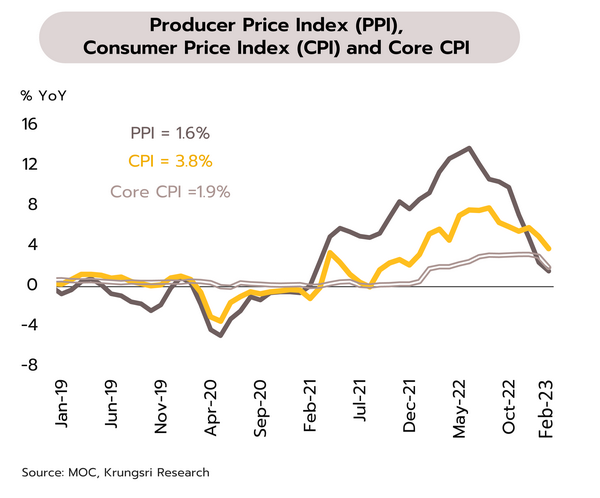

Given the assessment of outlook for inflation and the economy in the next few months, there may be lower chance of another rate hike at the MPC’s 31 May meeting. (i) Exports would remain weak, with a potential marked contraction in March and for Q2, while 1Q23 GDP growth is estimated to be under 3%, beneath the 3.7% long-term average (GDP figures will be released on 15 May, before the next MPC meeting). (ii) The Producer Price Index (PPI) softened to only 1.6% in February and headline inflation is likely to fall from February’s 3.8% to the BOT’s 1-3% target range by June. Core inflation has eased to just 1.9% from 3.0% in January, and this should remain less than 2% for the rest of 2023, thus lower than the BOT’s forecast of 2.4% for the year. (iii) Major countries’ interest rates have risen to their highest levels since the 2008 global financial crisis and this has hit the world economy, while turbulence in financial markets could have ripple effects on the real economy. Thus, while Thai tourism sector may see an upside on economic growth, in light of the growing external risks, the softening inflation, and the coming impacts of rate hikes, the MPC may take a pause in raising policy rate at its May meeting.