The Fed is ready to raise rates in March, but the world economy remains under pressure

Amid elevated inflation, the Fed is expected to hike rates 4 times in 2022, initially with a 25 bps rise. The Fed left both interest rates and its QE program unchanged at its January meeting. As inflation remains above the Fed’s target and labor markets have strengthened substantially, the Fed Chair thus stated that, “The committee is of a mind to raise the Fed funds rate at the March meeting”. This is in keeping with the latest data showing that 4Q21 GDP growth came in at the 5-quarter high of 6.9% QoQ, while overall 2021 growth hit 5.7%, its strongest since 1984. December’s Core PCE also climbed to a 40-year high of 4.9% YoY.

Strong growth and persistently escalated inflation have forced the Fed to indicate clearly that rates will soon be raised hard and fast. We expect a more rapid pace of policy normalization, and with QE tapering completed in March to pave the way to the first rate hike since 2018. The Fed is thus likely to raise rates 4 times of 25 bps each this year (in March, June, September, and December) and begin quantitative tightening in 2Q22.

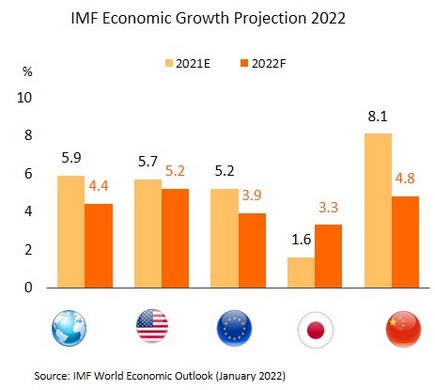

The IMF has downgraded its forecast for global GDP growth as several risks are surrounded. The IMF has revised its outlook for 2022 global growth downward, cutting this from 4.9% to 4.4%, significantly below 2021’s estimated growth of 5.9%. The outlook for most major economies has also been lowered, falling to 4.0% from 5.2% for the US, to 3.9% from 4.3% for the Eurozone, and to 4.8% from 5.6% for China. However, Japan’s GDP growth projection has been raised to 3.3% from 3.2%.

Global growth is slowing, partly due to high daily case numbers. In addition, pressures are rising from: (i) downside risk from the new COVD-19 variant, and the following restrictions that result in protracted supply constraints; (ii) persistent inflation, partly due to the supply-demand imbalance amid supply chain bottlenecks, and partly due to speculative pressure in commodities markets, leading the IMF to revise its 2022 inflation outlook upward in the US, the Eurozone, and emerging markets; and (iii) limited policy space. Given this, central banks may shift to policy normalization earlier than expected though recovery remains fragile and patchy. In addition, growing budget deficits and public debt means that the room to implement fiscal stimulus measures may also be limited.

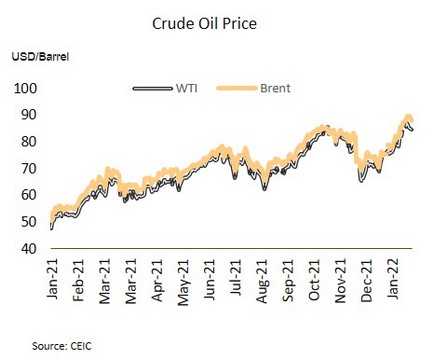

Rising tension between the US and Russia over Ukraine is adding to risk for the global economy. With troop numbers rising on the Ukrainian border, the US and its NATO allies have stated that they are ready to respond. President Biden has warned that a Russian attack would be the largest invasion since World War II and sanctions may be implemented. In response, President Putin has called for NATO to remove its forces from Eastern Europe, and threatened an increase in the use of military force.

Geopolitical risk from the US/NATO-Russian stand-off may lead to significant problems in energy markets because Russia is the world’s 2nd biggest oil exporter and 2nd most important source of natural gas, of which it is (via Ukrainian pipelines) Europe’s primary supplier. Ukraine is also the world’s 5th biggest exporter of wheat, and if conflict breaks out, supply chains could be severely disrupted. Commodity markets, especially for energy, and market for agricultural products would experience sharp price hikes. Sanctions on Russia would further affect trade and investment between the two countries. It would also place more obstacles to international trade and global economic growth while several pressures remain.

The authorities are introducing a range of fiscal and monetary measures to support recovery and resolve problems with NPLs

Government approved a further THB 53bn stimulus to boost spending and ease cost of living burden. The cabinet has approved the disbursement of THB 53.22bn under the THB 500bn loan decree for short-term stimulus, including (i) THB 34.8bn for Phase 4 of 'Khon La Khrueng' co-payment subsidy scheme (THB 1,200 will be transferred to individual g-wallet for using between 1 February to 30 April); (ii) THB 8.07bn for welfare card holders and THB 1.35bn for vulnerable groups by making additional payments of THB 200/month through g-wallets between February and April; and (iii) THB 9bn for Phase 4 of the ‘We Travel Together’ subsidy, which will run from February to July.

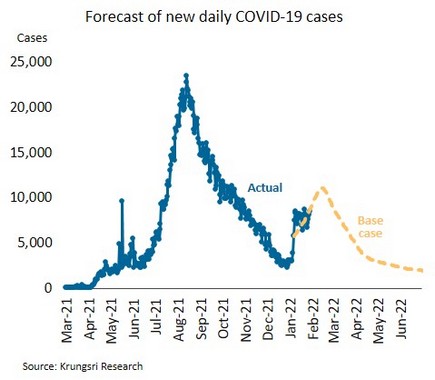

Krungsri Research expects that the Thai economy would remain on track to recovery, although the Omicron variant may delay the progress of improvement. Low fatality rate suggests the less restrictions as compared to measures that were used against the Delta variant, implying the economic impacts would be limited. According to our base-case scenario, daily case numbers would peak in mid-February and then slowly decline. The tourism sector would be most seriously affected by international traveling restrictions. The overall economic activities would drop by 0.6%. Nonetheless, the latest round of stimulus spending will inject at least THB 100bn into the economy. In addition, the progress on vaccinations will allow restrictions to be eased. Having combined those positive factors with the relaunch of Test & Go program and strong growth in exports mean that the net effect of Omicron will be limited, and GDP growth should remain close to our earlier forecasts.

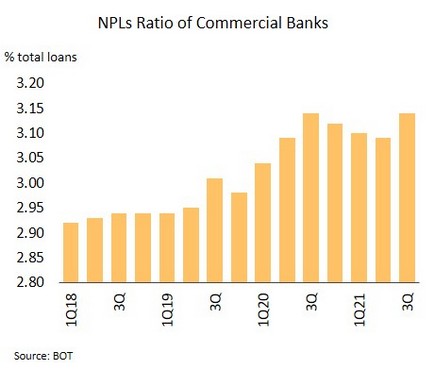

BOT launches measures to ease the problem of non-performing assets that would reduce any rise in NPLs. The Bank of Thailand (BOT) has introduced measures to promote the establishment of joint venture asset management companies (JVAMCs), or partnerships between commercial banks and asset management companies. The deadline for applications to set up JVMAC will be expired in 2024 (the measures has been effective from 27 January 2022 until 31 December 2024). The license for operation is valid for 15 years. The mechanism for purchasing non-performing loans (NPLs) and non-performing assets (NPAs) is focused on the provision of assistance through ongoing debt restructuring for transferred debts.

Although these are temporary measures, the authorities see the importance to increase flexibility in the financial system through the use of joint ventures to accommodate NPLs that may gradually increase in the future. In 3Q21, the level of NPLs in the commercial banking sector stood at 3.14%, slightly rising from 4Q20’s 3.12% due to positive impact of measures to help debtors and eased regulation for debt classification. In fact, recovery is still uneven, and tourism-related sectors have been hardly hit by the prolonged effects of the pandemic. These measures would thus represent another tool to be used by financial institutions that are trying to manage NPLs properly and would help debtors receive any additional assistance that might be available (e.g., debt restructuring or mediation). It would soften the need for asset fire sales, which might undermine economic recovery.