Although monetary policy continues to diverge between countries, central banks are increasingly worried about the risk of a slowdown

US

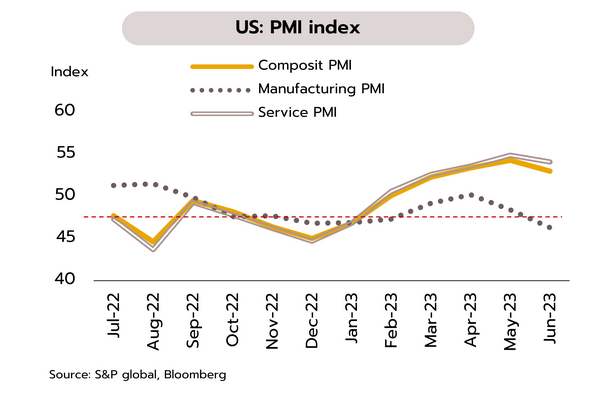

The Fed Chair has signaled two more rate hikes in 2023 but clear signs of a slowdown may curb rate hikes. In June, the Flash Manufacturing PMI slipped from 48.7 to a 6-month low of 46.3, while the Flash Services PMI dropped from 54.9 to 54.1. Likewise, although existing home sales were up 0.2% MoM, sales have slumped by 20.4% YoY to just 4.3m units. Average sale prices are also down -3.1% YoY. Last week’s initial jobless claims edged up to 264,000, the highest since October 2021.

In his statement to Congress, Fed Chair Powell said that to bring inflation back to the 2% target, further rate hikes may be necessary. Most Fed officials also projected two more rate hikes this year. Treasury Secretary Janet Yellen indicated that the risk of a recession has receded, but efforts to control inflation may nevertheless negatively impact consumption. Krungsri Research therefore expects that given a softer service sector and labor markets, positive real interest rates, a continuing drop off in inflation, and the possibility of a more-than-expected slowdown in economic activity in 2H23, the Fed may raise policy rates just once more this year, bringing the benchmark rate to 5.25-5.50%.

Eurozone

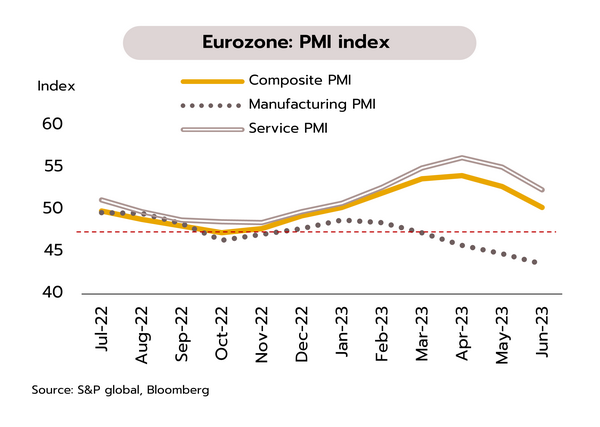

The Eurozone economy will likely remain sluggish for an extended period though lower energy costs and strong labor markets will help to head off the risk of a deep recession. In June, the Eurozone Composite PMI slipped to a 5-month low of 50.3. Within this, the Services PMI fell to 52.4 and the Manufacturing PMI dropped to 43.6, the 11th month of declines and a 3-year low. However, the Eurozone Flash Consumer Confidence Indicator came in at -16.1, beating the -17.0 expected by the markets.

Although the Eurozone slipped into a recession in 1Q23 on tighter financial conditions and rising interest rates that have then dragged on consumption and private sector investment, softer energy prices and continuing strength in labor markets will help to take the sting out of the slowdown and to restrict this to only a mild recession. Against this backdrop and given signals made by the bank at its meeting last week, we expect that the ECB may continue to hike rates until its deposit rate reaches 3.75-4.00% as the bank looks to stabilize prices and to pull mid-term inflation rates back to their 2% target.

China

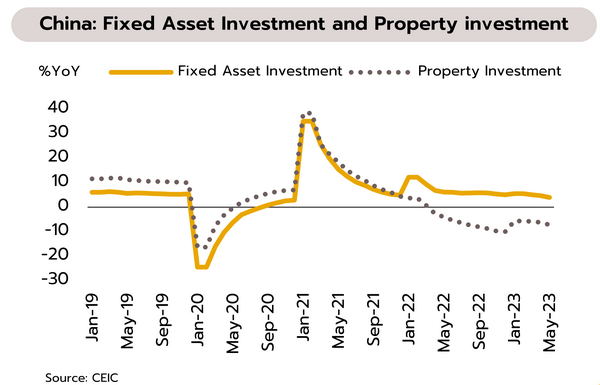

With the impetus given by the country’s reopening dissipating, China has cut interest rates, but structural factors may weigh on growth. The PBOC has cut its 1- and 5-year loan prime rate (LPR) by 10bps to respectively 3.55% and 4.2% from 20 June, the first such reduction in 10 months. This follows the release of a slew of indicators in May that point to a slowdown in the economy, including industrial output (growth of 3.6% YoY compared to 5.6% in April), retail sales (growth of 12.7% against 18.4%), and investment in fixed assets (growth of 4.0% over the first 5 months of 2023 compared to 4.7% for the first 4 months).

The boost given to domestic economic activity by China’s reopening is slowing, while growth will be restrained by structural factors that are showing up in different indicators, including falling investment in real estate (-7.2% over 5M23 vs -6.2% over 4M23), softening new house prices (+0.1% in May vs +0.4% in April), and a rise in unemployment among 16-24-year-olds to a historic high of 20.8%. In addition, exports have slipped back into contraction zone (-7.5% against +8.5%). However, a cut in rates of just 10bps is not expected to have a significant impact and so going forward, the economy is forecast to slow further, with major financial institutions now seeing Chinese growth reaching just 5.2-5.5% (down from 5.7-6.3%).

Thailand’s overall competitiveness is improving, but the country scores poorly on factors related to infrastructure. It is also uncertain when a new government will be installed, despite the election results being confirmed ahead of schedule

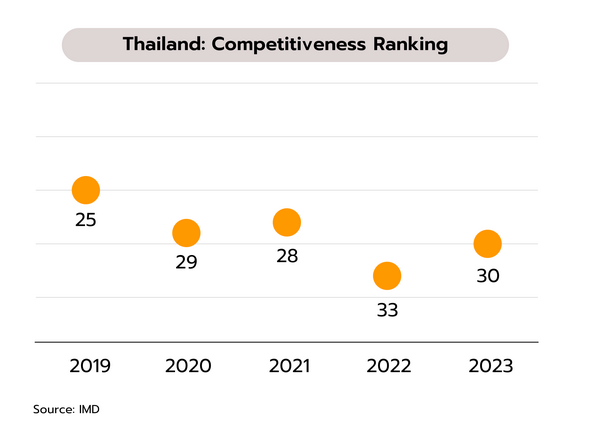

Thailand’s ranking in the international competitiveness league has risen to 30th in the world, though the country’s performance remains worse than in the pre-Covid period. The 2023 International Institute for Management Development (IMD) assessment of the competitiveness of 64 economies places Thailand 30th in the ranking, up 3 places from 2022. The assessment takes into account 4 factors: (i) national economic capacity (16th, up from 18th); (ii) public sector efficiency (24th, up 7 spots); (iii) private sector competitiveness (23rd, up 4 places); and (iv) infrastructure (43rd, up 1 place).

Although Thailand has risen to 30th place in the international competitiveness ranking, this is still below the 25th place the country occupied in 2019 pre-Covid. In the infrastructure category, Thailand’s performance is improving only slowly, rising to 43rd from 44th in 2022 and 45th in 2019. Worse, looking at some of the sub-factors, Thailand ranks very poorly or is even going in reverse. For example, Thailand has fallen 1 place in the educational infrastructure category (to 54th), 2 places in health and environment (to 53rd, largely as a result of the impacts of PM2.5 pollution), and 1 place in scientific infrastructure (to 38th). These declines reflect the relative lack of progress made in upgrading Thai infrastructure over the past 5 years. In addition, compared to its peers in the ASEAN zone, Indonesia and Malaysia have jumped by respectively 10 and 5 places to 34th and 27th.

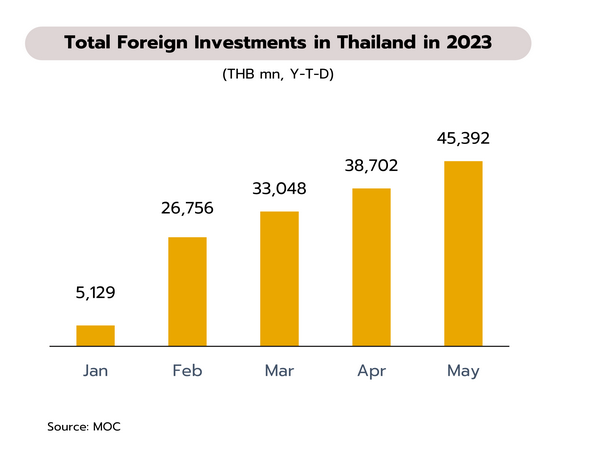

Although the election results have been confirmed quicker than expected, significant uncertainty remains over when a new government will be installed. Foreign investment inflows are also weakening. The Ministry of Commerce reports that as per the 1999 Foreign Business Act, 274 investment applications made by non-Thais were approved in the first 5 months of the year (January-May), but the total value of these dropped by 18% YoY to THB 45.39bn. The most important sources of FDI were Japan (63 applications, and FDI worth THB 15.87bn), the US (48 applications, THB 2.46bn), Singapore (46 applications, THB 6.36bn), China (19 applications, THB 11.48bn), and Hong Kong SAR (12 applications, THB 2.99bn).

On 19 June, the Election Commission confirmed the status of all 500 MPs, significantly ahead of the 60-day deadline that was due to expire on 13 July, and so progress is being made on establishing a new government. Deputy PM Wisanu Krea-ngam has laid out a timeline for winding up the current government and installing a new one, with this brought forward by 3 weeks from the earlier date of 11 August. Initially, the plan is as follows: (i) 3 July, open the new parliamentary session; (ii) 6 July, vote on the appointment of a new Speaker of the House of Representatives; (iii) 13 July, vote on the appointment of a new Prime Minister; and (iv) 21 July, appointment of a new cabinet and, on the following day, the conclusion of the work of the current government. However, we believe that it remains uncertain whether the coalition of 8 parties led by Move Forward will be able to establish a government and the prospective timeline may not be sufficient to complete this process, and this may drag on investor sentiment. The latest report showed that foreign investment in Thailand has fallen by 18% YoY for the first 5 months of the year, compared to an increase of 6% over the first 4 months.