Some major economies start to normalize monetary stance against inflation, while China would continue easing measures

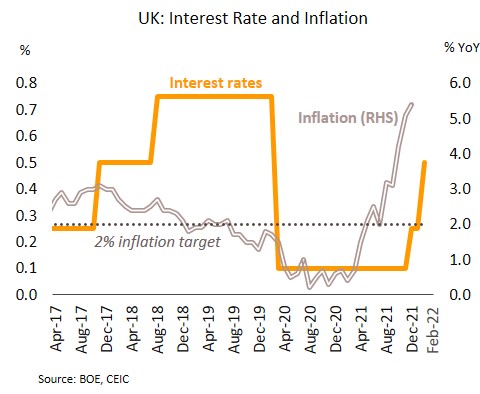

The UK hiked policy rates for the 2nd time in 3 months; The Eurozone signals to raise rate earlier than anticipated. The Bank of England (BOE) recently lifted policy rates from 0.25% to 0.50%. Meanwhile, the European Central Bank (ECB) left policy rates and its Pandemic Emergency Purchase Program (PEPP) unchanged. Nonetheless, the ECB’s president recognizes that inflation is higher than expected and inflation risks are tilted to the upside.

Europe is likely to adjust monetary stance towards normalization. The BOE is expected to raise rates by another 50 bps this year. (i) At its last meeting, 4 of the 9 members of the Monetary Policy Committee voted to raise rates by 50 bps. (ii) In December, inflation hit a 30-year high of 5.4%. Likewise, several factors point to the chance of ECB’s rate hike by this year. (i) The President of the ECB has acknowledged that “the situation has indeed changed” and contrary to the earlier assertion that price rises were temporary, these are now occurring across a broad front. (ii) Labor markets are recovering, and at 7%, December’s unemployment rate recorded its lowest since March 2020. Simultaneously, the spread of the Omicron variant appears to have peaked and results in improving economic activities, reflected by the rise in January’s Manufacturing PMI to the 5-month high of 58.7. (iii) Inflation continues to mount and in January this reached the all-time high of 5.1%, the 7th month of staying above the 2% target.

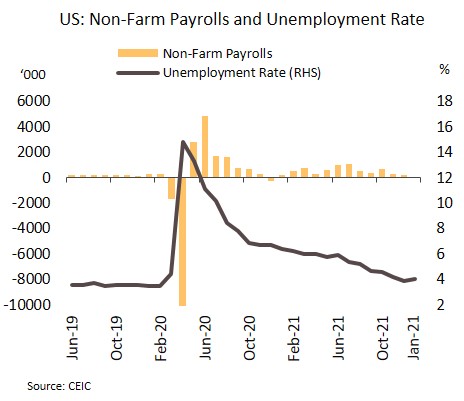

The US experiences inflationary pressure on both rising wages and oil prices; The Fed would accelerate rate hike. At 10.9m, December’s new job openings reached a 2-month high. In January, average hourly wages jumped 5.7% YoY, the fastest increase in 2 years. The unemployment rate stayed at 4.0%, close to December’s level that was the lowest since the start of the pandemic. Non-farm payrolls expanded by 467,000, beating analysts’ forecasts.

Labor markets are improving continuously and outpacing market expectations. The higher-than-expected increase in wage could add to inflationary pressures, though these have already been stoked by the rising cost of crude oil. WTI recently breached USD 90/bbl to hit a 7-year high. The elevated inflation and strengthening labour market would encourage the Fed to reduce its balance sheet and raise rates, with a 25 bps increase in policy rates likely after the completion of QE tapering in March. In total, as many as 5 rate hikes may be seen this year.

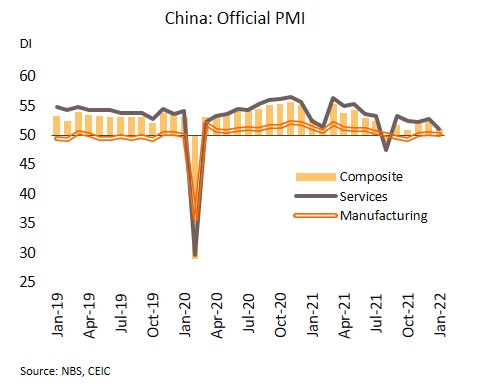

China is expected to loosen monetary policy further as it looks to avoid a hard landing. In January, China’s Composite PMI dropped to its lowest since November 2021, with the Manufacturing PMI sliding to a 3-month low of 50.1, while at 51.1, the Non-manufacturing PMI dropped to its lowest since September 2021.

The latest data point to a continuing slowdown, partly attributable to lockdowns that worsened supply constraints in manufacturing sectors and affected services sectors. The real estate sector also continues to struggle against default problems. Evergrande has recently been unable to pay its contractors, in particular to Jangho, the interior design company, which is now facing losses of up to CNY 1.68bn. To avoid these defaults multiplying and cushion a sharp slowdown, the People’s Bank of China (PBOC) will thus need to further loosen monetary policy.

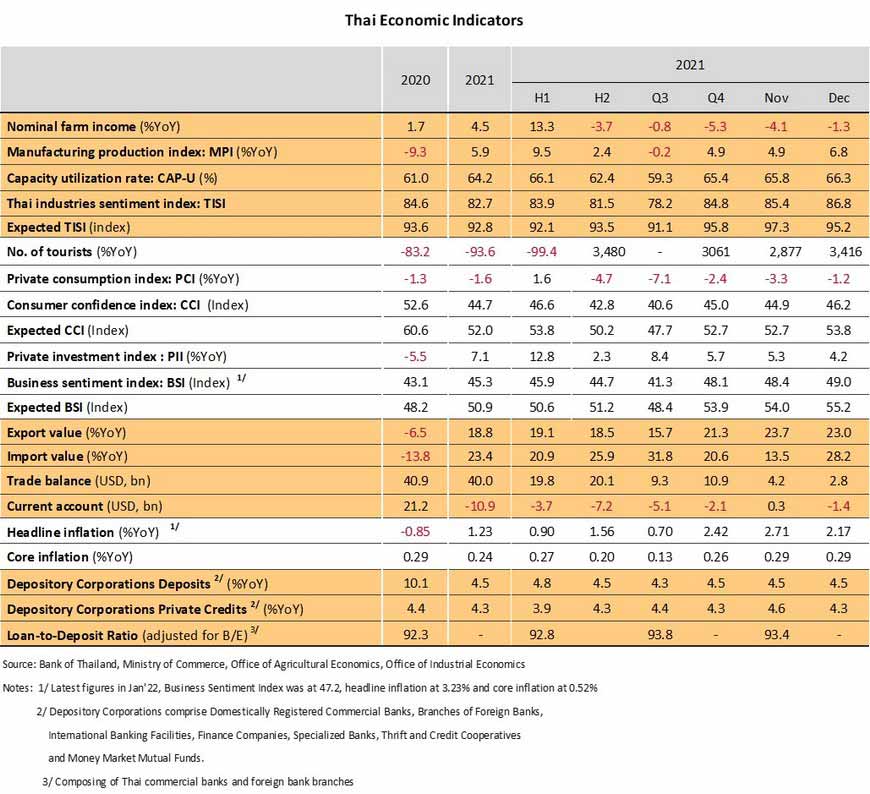

Inflation would likely be higher than expected amid a gradual economic recovery; The MPC is expected to maintain policy rates at 0.50% through 2022

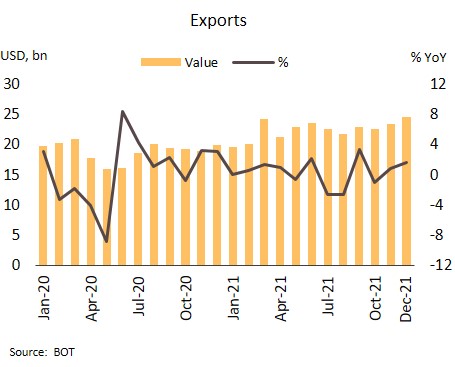

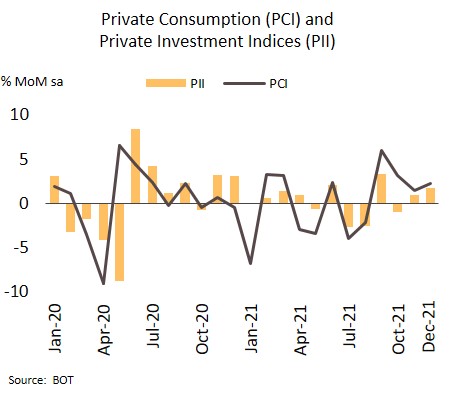

Omicron outbreak in early-2022 may temporarily stall momentum of recovery that started at last year end. Indicators show the economy continuing to improve in December on recovering demand at home and abroad, the latter feeding into a 23.0% YoY surge in the value of exports to reach the historic high of USD 24.5bn. Tourist arrivals were lifted by the introduction of Test & Go program in November, while the ease of containment measures in December helped to boost the Private Consumption Index by 2.3% MoM, though this was down -1.2% YoY. The Private Investment Index also improved (+1.7% MoM, +4.2% YoY) alongside stronger domestic and foreign demand.

The continuity of recovery that began during 4Q21 may slightly be disrupted in the face of the Omicron outbreak. Nonetheless, the impact are likely to be limited and short lived because the fatality rate is low despite high daily new infections. It thus allows the authorities to use a less stringent restrictions as compared to the earlier wave of infections. The situation is further helped by the progress of booster vaccination. In addition, officials have recently rolled out an additional stimulus package, worth THB 53.2bn, to strengthen purchasing power and promote domestic tourism, which is expected to boost over THB 100bn money in circulation. The situation will be further supported by the continuing expansion of exports, driven by global economic recovery, and by an improving outlook for the tourism sector after the relaunch of Test & Go program. In light of this, Krungsri Research thus maintain our Thai GDP growth projection at 3.7% in 2022.

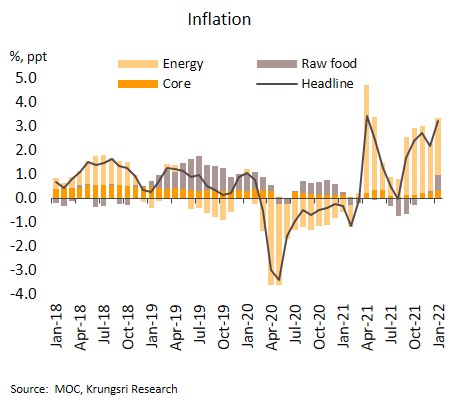

Inflation climbed to an 8-month high in January; For all of 2022, it is likely to exceed our prior forecast. Headline inflation rose by 3.23% YoY in January, up from 2.17% in December. This was driven by rising fuel prices (+27.9%) on the hike of global crude oil prices, and by higher food prices, especially for pork meat and vegetable oil. Core inflation (excluding raw food and energy prices) also increased, climbing to 0.52% from 0.29% in December.

Inflation significantly accelerated and is likely to stay above the official target through 1Q22, partly due to low base effect in comparison to last year and persistently high global crude oil prices. The latter has been caused by accelerating demand outpacing supply through 1H22 before abating in 2H22. In addition, rising tensions between Russia and Ukraine would intensify a surge in prices, especially those higher-than-expected energy prices. It may also cause higher manufacturing costs. Krungsri Research has thus upgraded outlook for inflation in 2022 to 2.0% (up from 1.5%).

Although inflationary pressures have risen, this is a result of supply-side issues related to higher energy costs. Meanwhile, consumer purchasing power remains weak with high household debt. The recovery is still fragile and dependent on fiscal measures. The accommodative monetary policy is thus also necessary. At its 9 February meeting, the Monetary Policy Committee is expected to keep policy rates unchanged from their historic lows of 0.50%, where they are likely to remain throughout the year.