The Ukraine crisis has dramatically ramped up global risk; The Chinese crackdown on tech giants may weigh on growth

The Russian attack on Ukraine is adding to global inflation; The worsened situation would affect global and especially European recovery. In response to Russian attacks on Ukraine, the US, the UK and Europe have announced sanctions on Russian trade and investment, senior Russian officials, and parts of the Russian banking sector. Recently, the US and its allies are preparing to block some Russian banks from the global interbank payment system, so called SWIFT. However, Ukraine is not a NATO member and so NATO forces will not intervene directly.

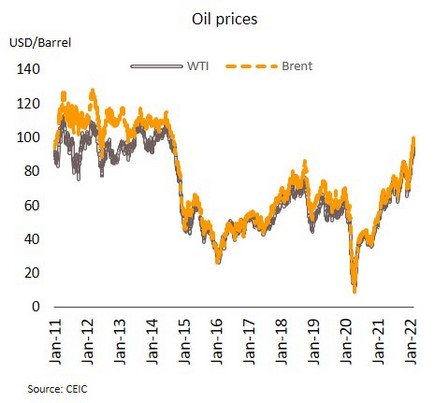

The attack on Ukraine has caused turbulence in global financial markets and added massively to Russian-Western tensions. The invasion has pushed commodity prices to highs not seen since 2014 and lifted crude prices north of the USD 100/bbl line, with energy prices particularly susceptible to risk since Russia is the world’s 2nd most important exporter of oil and 2nd greatest source of natural gas, exports of which are sent to Europe via Ukrainian pipelines. The combatants are also major exporters of other commodities including wheat and corn. We thus expect the invasion to push inflation above earlier forecasts, eroding purchasing power, adding production costs, and making it more difficult for governments to implement economic policy. If the situation deteriorates, this may further disrupt supply chains as Russia and Ukraine are sources of the neon and palladium used in chip manufacture, add to global chip shortages. The conflict and sanctions will thus drag on global recovery, though because Europe is tightly linked to Russia through energy, finance and trade channels, it is particularly at risk.

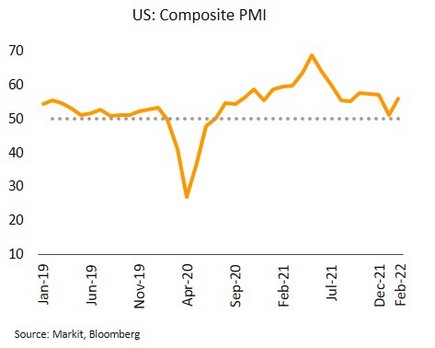

The US economy continues to grow amid rising inflation; The Ukrainian crisis would affect Fed’s normalization. In January, core PCE hit a 40-year high of 5.2% YoY, and personal spending was up 2.1% MoM, its sharpest rise since March 2021. In February, the Flash Composite PMI rose for the first time in 5 months to touch 56.0. Continuing jobless claims stood at 1.48m for the week ending 19 February, their lowest since the start of the pandemic.

US data remains positive on both labor markets and recovery in the manufacturing and service sectors, the latter reflected in the rebound in the Flash PMI from an 18-month low as the Omicron wave retreats. However, inflationary pressures continue to gather, and this may push the Fed to hike policy rates by 25 bps at their March meeting, though the worsening Ukrainian crisis will likely slow recovery and this may restrain further rate rises after March.

In China, signs of gradual improvement are threatened by the tech crackdown. Sales of new autos rose 0.9% YoY in January, the first growth in 9 months, while new house prices were up 0.1% MoM, the first increase since September 2021.

With monetary policy having been further relaxed by the cut in rates and in banks’ reserve requirement ratios, the latest data show positive signals of improvement. Nonetheless, the real estate sector remains troubled over credit crunch. Most recently by the warning from developer Zhenro of possible defaults on bonds worth USD 200m that are due to be redeemed in March. At the same time, the authorities are indicating that they will tighten controls on Tencent Metaverse, part of the tech giant Tencent Group, and investigate the activities of Ant Group, part of the Alibaba network. These moves may help to secure long-term economic and financial stability, though at the cost of short-term economic growth.

The Ukraine crisis will likely feed into higher domestic inflation and heighten uncertainties

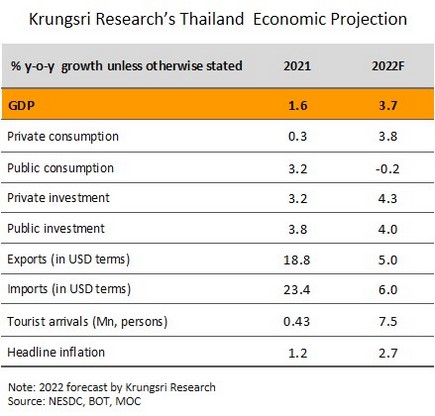

The Omicron variant has dragged on growth at the start of 2022; The Ukraine crisis will likely push inflation above earlier forecasts. The Fiscal Policy Office reports that in January, Thailand benefited from stronger private investment, which was reflected in an increase in the volume of cement and the number of commercial vehicles distributed domestically. The tourism sector is also improving on the domestic and international fronts, but private consumption slowed from December on the erosion of consumer sentiment by the spread of the Omicron variant.

Although Omicron infections have dragged on growth at the start of 2022, government measures are helping to sustain consumer spending and promote domestic tourism, which is then increasing private consumption. Strong exports help boost private investment, although this is being negatively affected by delays to work on government infrastructure projects and labor shortages in the construction sector. Government consumption expenditure is also expected to contract relative to last year in line with budget framework and the spending plans for the funds remaining from emergency borrowing, most of which was disbursed in 2021. Most recently, downside risks have built with the Russian attack on Ukraine. If the situation does not last long to significant affect global economy, the direct impacts on the Thai economy will be limited since trade with Russia and Ukraine accounts for respectively just 0.52% and 0.07% of Thailand’s international trade. However, the indirect effects are likely to be more intense and the surge in the global cost of commodities, and especially of crude oil, to heights not seen in many years. The average inflation in 2022 is now expected to reach 2.7% from the earlier prediction of 2.0%.

The authorities plan to accelerate recovery in tourism by relaxing the Test & Go program; The impacts of Russia-Ukraine tension have to be monitored. At a meeting held 23 February, the Center for COVID-19 Situation Administration agreed that to boost the number of foreign arrivals, the Test & Go regulations governing entry to the country would be relaxed: (i) Additional Test & Go centers will be established for those arriving by land (in Nong Khai, Udon Thani, and Songkhla) and by sea (for arrivals on yachts); (ii) for the 2nd test on the 5th day after arrival, a RT-PCR test will no longer be required and instead an ATK test will suffice; and (iii) health insurance requirements have been lowered from coverage worth USD 50,000 to USD 20,000. These measures will have effect from 1 March.

Following Thailand’s reopening on 1 November through to the end of 2021, around 300,000 tourists entered the country under the Test & Go program. In January, another 133,903 foreign arrivals were recorded, and further relaxing the system will help to improve impressions of Thailand and cut tourists’ expenses. However, the invasion of Ukraine may have consequences for Thai tourism. Since Thailand’s reopening last year, Russia has ranked in the 5 most important markets for Thailand, with these arrivals typically being high-spending independent travelers (so called ‘foreign individual tourists: FIT’). Although only a small number of Ukrainians travel to Thailand, most of whom arrive on charter flights. If the conflict worsens and its spread has an impact on flights across Europe, this will increase the difficulties involved in traveling to Thailand, and so recovery in the tourism sector may be even further delayed.