Signs of a slowdown are becoming more evident in the advanced economies, while Chinese recovery remains fragile

US

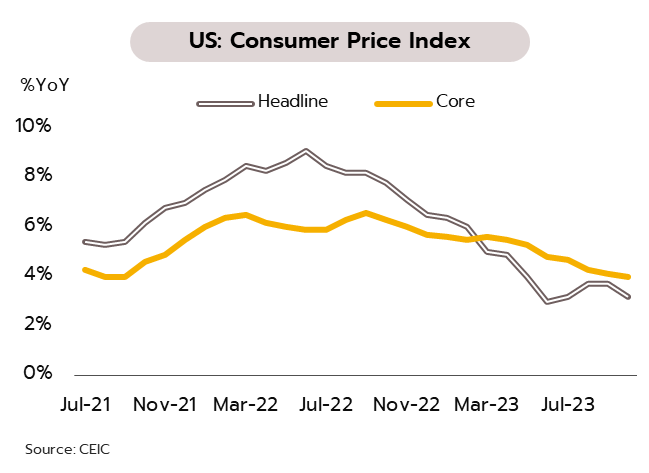

The US has avoided a government shutdown. The latest data indicate the Fed will keep policy rates unchanged this year. In October, headline inflation softened from 3.7% in September to 3.2% YoY, the core inflation slipped from 4.1% to 4.0%. The headline Producer Price Index (PPI) softened to 1.3% from 2.2%, and core PPI eased to 2.4%, down from 2.7%. Alongside this, growth in retail sales also slowed from 4.05% to 2.48%.

Although Q3 GDP growth came in at a surprising 4.5% YoY, going forward, elevated interest rates will drag on the US economy through Q4 and into 2024 as the higher cost of financing debt and difficulty accessing new credit increasingly affect the private sector. This will then help to further ease inflationary pressures. Hence, with real interest rates at their highest since 2007 credit crisis, domestic expenditure weakening, and inflation easing back, it is likely that the FOMC will leave the fed funds rate at 5.25-5.50% at the 13 December meeting of the FOMC.

Japan

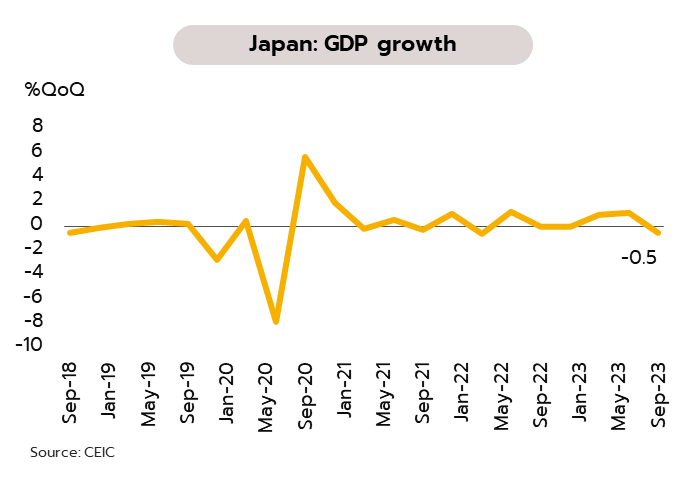

The risk of a recession in Japan has risen following an economic contraction in Q3. Having expanded 1.1% QoQ and 4.5% YoY in Q2, the Japanese economy went into reverse in Q3, shrinking -0.5% QoQ and -2.1% YoY. In October, export growth also slowed from 4.3% in September to 1.6% YoY, but following a -12.5% YoY fall in imports, the trade deficit fell to JPY 662.5bn.

With the economy contracting -0.5% QoQ in Q3, there is a growing risk that Japan will slip into recession as the economy continues to come under pressure from: (i) inflation that has outpaced growth in wages, and with real incomes declining, domestic purchasing power is softening; (ii) decelerating economies in overseas markets, which is undercutting income to the export sector; and (iii) slowing momentum across the manufacturing and service sectors. We therefore expect that the Bank of Japan (BOJ) will leave its ultra-loose monetary policy unchanged through the rest of 2023. However, the injection of an additional JPY 17tn into the economy should stimulate growth and alleviate some of the negative impact on households of the recent bout of inflation, and as domestic consumption rebounds, the need to leave monetary policy loose will ease through 2024.

China

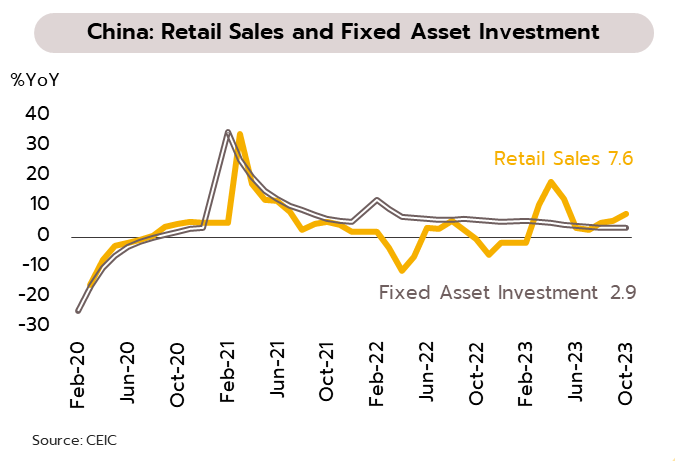

Consumption is lifting China’s economy at the start of Q4, though the outlook remains uncertain. In October, growth of retail sales accelerated to a 5-month high of 7.6% (vs 5.5% in September) and imports bounced back to growth of 3% (vs -6.2%). Industrial output growth edged up to 4.6% from 4.5%. Relations with the US have also improved slightly: (i) following a two-year hiatus, high-level military communications will resume; (ii) an intergovernmental dialogue will be established to discuss problems relating to AI; and (iii) at the start of 2024, the number of flights linking the two countries will be increased. Nevertheless, progress has stalled on a number of substantive issues, including the US ban on chip exports and the continuation of trade barriers.

Although domestic consumption improved, key indicators still point to fragility: (i) Sluggishness in real estate is reflected in the -0.38% drop in new house prices, the sharpest fall in 8 years; (ii) Over 10M23, investment in fixed assets rose just 2.9%, investment in real estate plunged -9.3%, and FDI inflows fell -9.4%; (iii) October exports fell for the 6th month, by -6.4%; (iv) At -0.2%, the CPI undershot expectations, while at -2.6%, the PPI contracted for the 13th month; and (iv) the credit growth is slowing. It is thus possible that monetary policy may be loosened further.

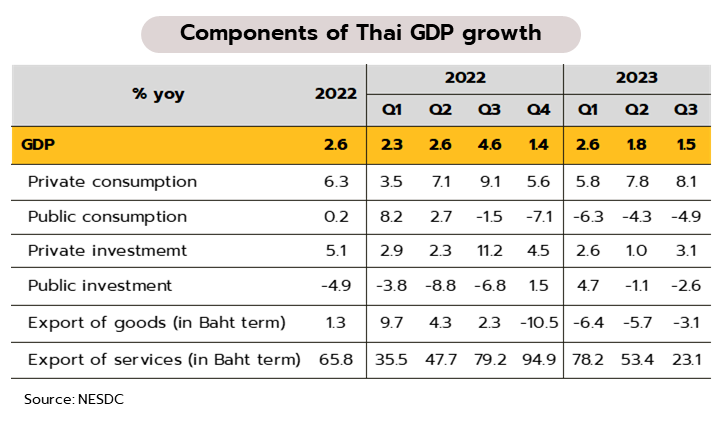

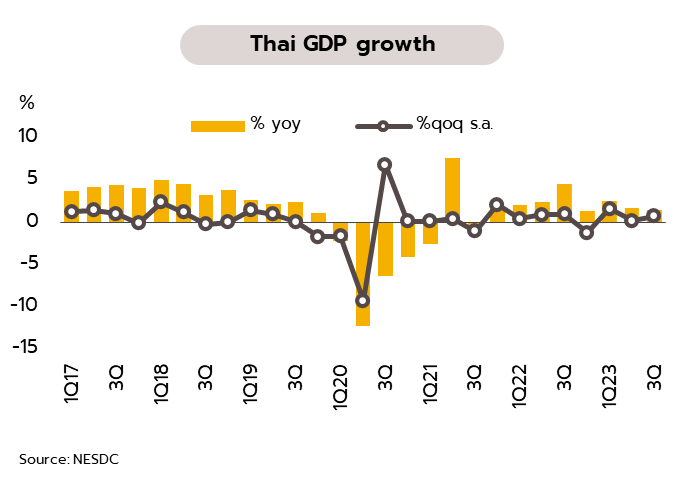

Thai economy in the first 9 months of this year grew only 1.9%. Krungsri Research intends to revise down our 2023 GDP forecast from 2.8% currently.

3Q23 GDP growth was lower than expected at 1.5% YoY. 2023 GDP could miss our previous estimate of 2.8%. The NESDC reported 3Q23 GDP growth at only 1.5% YoY, down from 1.8% in 2Q23 and below estimate by consensus (2.4%) and Krungsri Research (2.0%). The decelerating GDP growth was attributed to (i) weakening exports of goods; (ii) lower public spending due to a reduction in COVID-19-related public health expenditures and a contraction in public investment; and (iii) a sharp drop in inventories (-220%) which is a main factor dampening 3Q23 GDP. However, private consumption continued to expand well in line with a recovery in foreign and Thai tourists, while private investment growth also improved. On the supply side, the impact of weak exports following slowing growth in trading partners’ economies, caused manufacturing production to contract for the 4th straight quarter (-4.0%). Agriculture also grew at a slower pace (+0.9%). Nonetheless, tourism growth boosted growth in services sector, notably accommodation & food service activities (+14.9%). During 9M23, the Thai economy grew by 1.9% YoY. The NESDC revised down GDP growth forecast to 2.5% in 2023 (from a previous forecast of 2.7%) and projected 2024 growth at 2.7-3.7% (3.2% median).

Krungsri Research will revise down 2023 Thai GDP growth forecast from 2.8% currently to reflect the disappointing 3Q23 GDP figures and a lower-than-expected number of foreign tourist arrivals, which we previously projected to reach 28.5 mn for the whole of 2023. For 10M23, total foreign tourist arrivals stood at 22.2 mn. However, 4Q23 GDP growth is expected to pick up, supported by (i) low base effect in 4Q22; (ii) the government’s measures to alleviate the cost of living, including reducing energy and transportation expenses; and debt suspension for farmers; (iii) an anticipated improvement in exports in late 2023, and (iv) increased tourism activity during long holiday periods.

New policies have been announced alongside the release of more details on the digital wallet policy, though a number of hurdles remain to be cleared. On 10 November, the PM announced that payments would be made to digital wallets for all Thais aged 16 or over with an income of less than THB 70,000 a month and/or savings of not more than THB 500,000. Around 50mn people will qualify for this, with funding coming from an act authorizing additional borrowing of THB 500bn. Payments are planned to begin in May 2024 and the project will be completed by April 2027. For those not qualifying or whose earnings are above THB 70,000 a month, the government will roll out an ‘E-Refund’ scheme from January 2024. This will allow purchases of goods worth up to THB 50,000 to claim tax deductions. The Finance Ministry is also allowing investments in the Thailand ESG Fund (TESG) to be offset against tax when these are for up to THB 100,000 per person and for a period of 8 years. The scheme is expected to begin on 1 December 2023, and this is aimed to pull additional funds into the Thai capital market.

Although details of the digital wallet scheme have become clearer, authorizing the additional THB 500bn in financing may not be straightforward. In particular, article 53 of the State Fiscal and Financial Disciplines Act, B.E. 2561 (2018) states that “The making of loans by the Government otherwise than provided in the law on public debt administration is permissible, provided that the Ministry of Finance shall do so only by virtue of the law specifically enacted and only in the case where there occurs a need for action to be taken urgently and continually for resolving critical problems of the country, where annual appropriations cannot be fixed in due time”. The act will have to: (i) be interpreted by the Council of State; (ii) pass scrutiny by the House of Representatives and the Senate; and (iii) be approved by the Constitutional Court. It thus remains to be seen whether and how the policy will be enacted.