Global: Troubling trade-off between inflation and growth

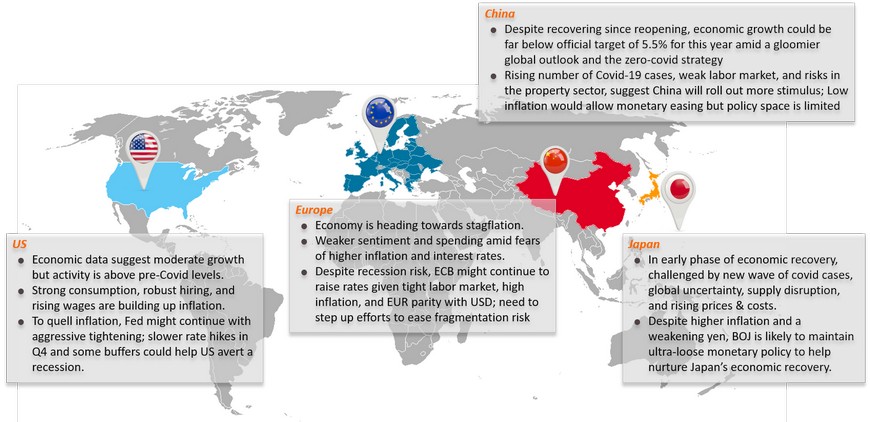

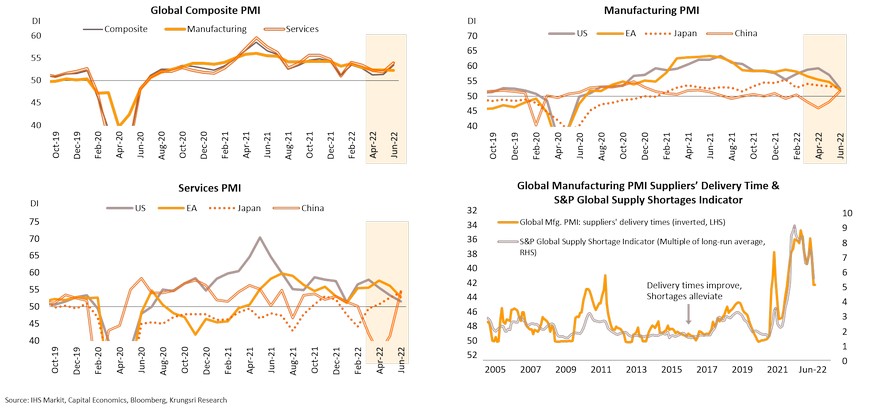

Major economies continue to slow down despite recovering economic activity in China, improving delivery times, and better supply situation

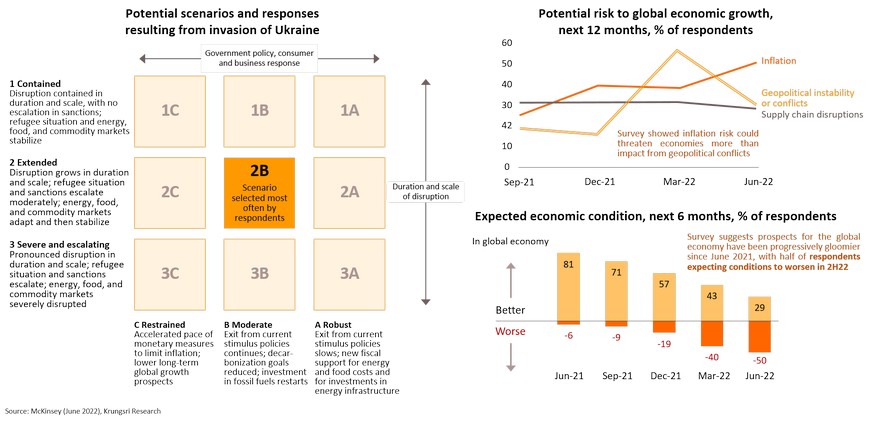

Survey suggests Ukraine war will continue to disrupt supply, moderate response; inflation could threaten economies more than geopolitical risks; sentiment is worsening

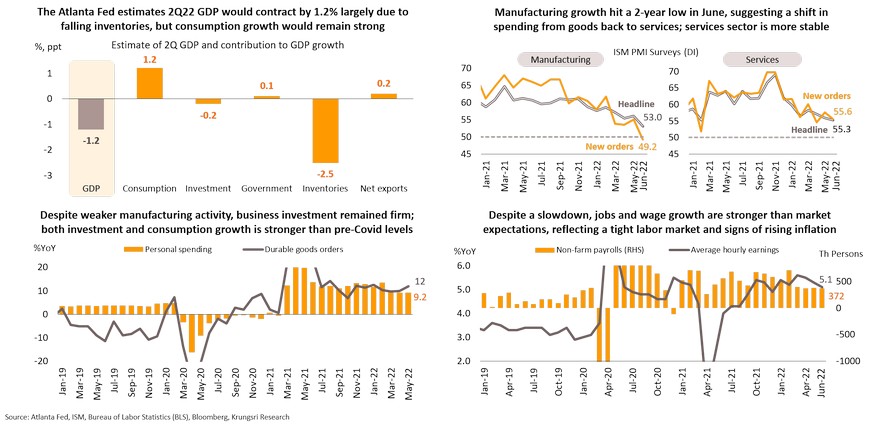

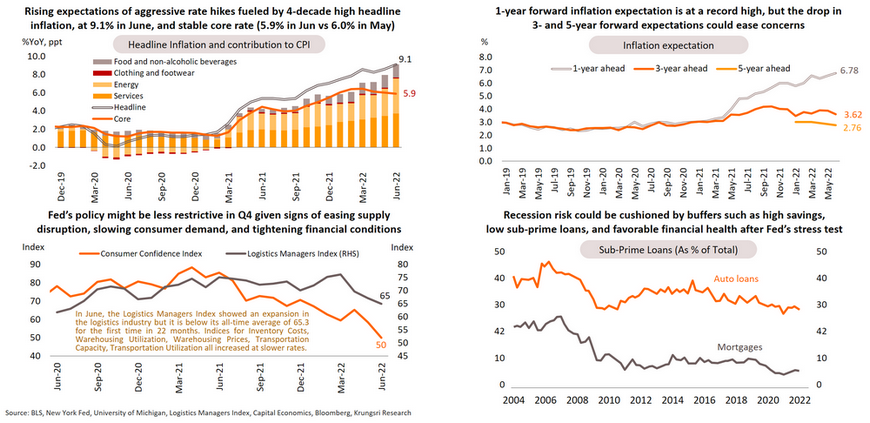

US: Economic data suggest moderate growth but activity is above pre-Covid levels; strong consumption, robust hiring, and rising wages are building up inflationary pressure

To quell inflation, Fed might continue with aggressive tightening and hike rate by 75 bps in July; slower rate hikes in Q4 and some buffers could help US to avert a recession

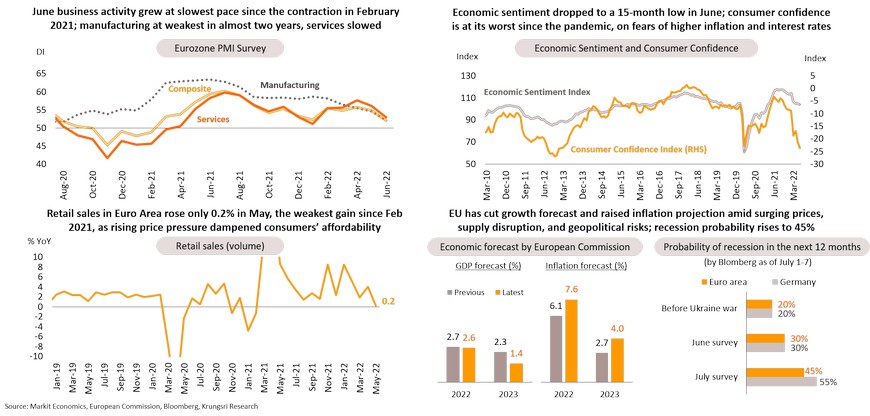

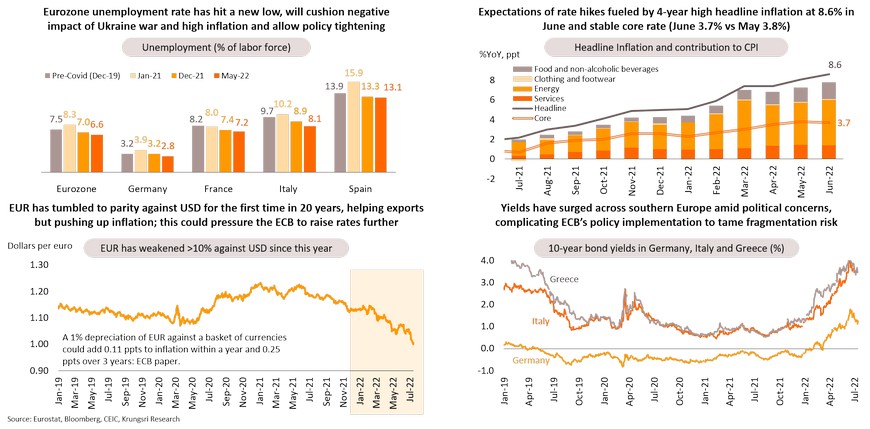

Eurozone: Economy is heading towards stagflation; weaker sentiment and spending amid fears of higher inflation and interest rates; EU has cut economic growth forecasts

Despite recession risk, ECB might continue to raise rates given tight labor market, high inflation, and EUR parity with USD; need to step up efforts to ease fragmentation risk

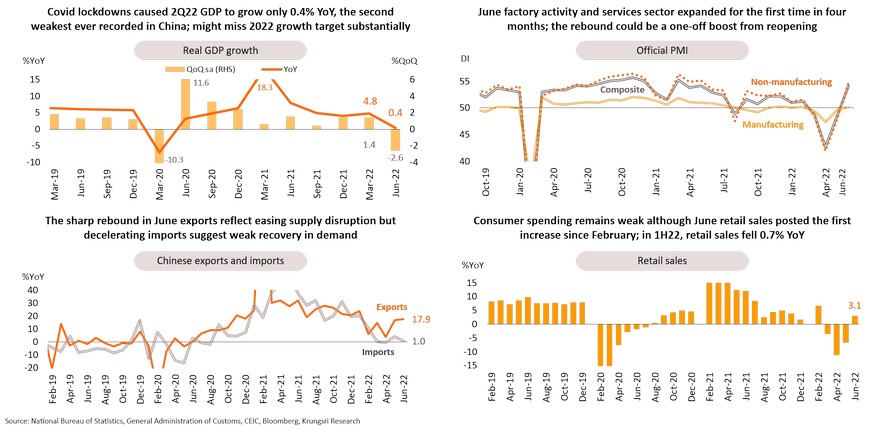

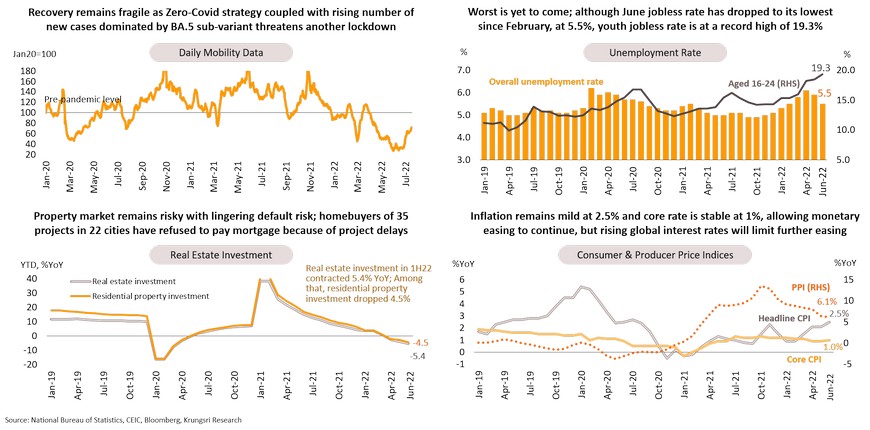

China: Despite recovering since reopening, economic growth could be far below official target of 5.5% for this year amid a gloomier global outlook and the zero-covid strategy

Emerging Covid-19 cases, weak labor market and risk in property sector suggest more stimulus ahead; low inflation allows monetary easing but policy space is limited

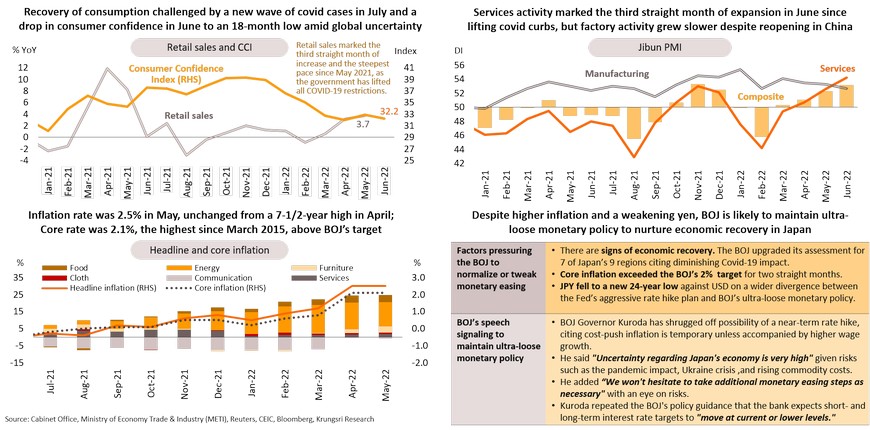

Japan: Services activity has rebounded since lifting covid restrictions but overall recovery is capped by new cases, global uncertainty, supply disruption, and higher prices & costs

Thailand: Choosing between managing inflation or stoking a sustainable recovery

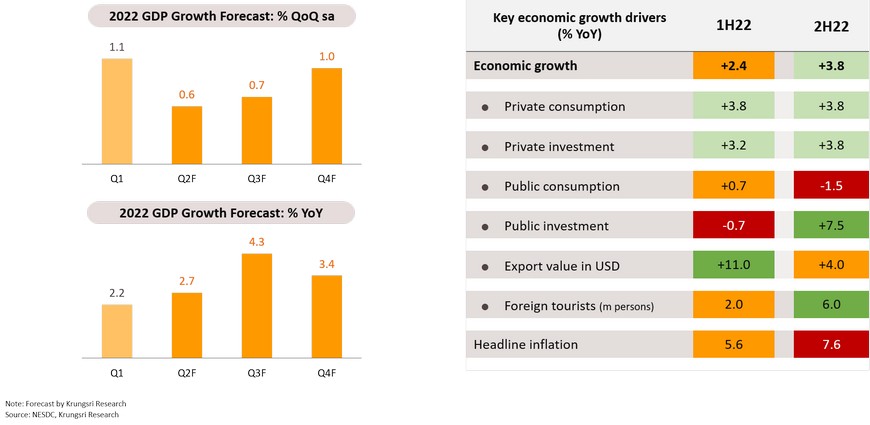

- Krungsri Research has fine-tuned 2022 GDP growth forecast to +3.1% to reflect better-than-expected growth in 1H22 and improving tourism activity, but overall, economic recovery remains fragile.

- The key economic growth drivers in 2H22 would be stronger tourism activity and rising pent-up demand, but growth would be capped by the global economic slowdown, unwinding of stimulus, and high inflation.

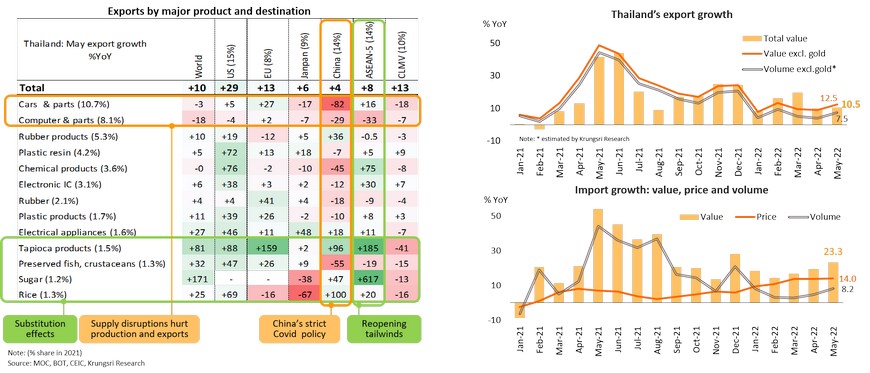

- Exports could see double-digit growth in 1H22, at 11%, but might slow down to 4% in 2H due to the global slowdown. Downside would be limited by price effect and trade diversion. Many industries in Thailand would gain from a weaker baht but the business sector would see limited benefits and it would not lead to a substantial growth in overall exports. This suggests authorities would not allow the baht to depreciate too much in their attempt to boost the economy; there should be a trade-off between the benefits and costs of a weaker baht.

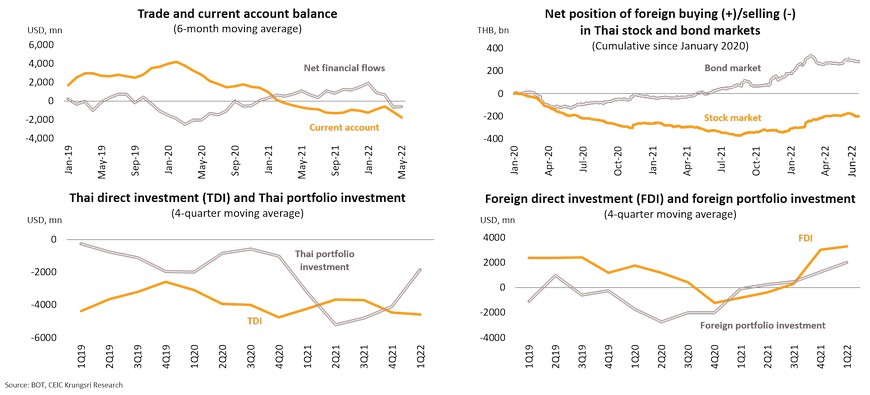

- Private investment could see a gradual recovery. Despite improving business sentiment with reopening tailwinds, weak manufacturing production would cap investment growth. Foreign Direct Investment (FDI) has turned to register net inflows in many industries, including rubber products, chemical products and electrical equipment. However, external headwinds could limit gains.

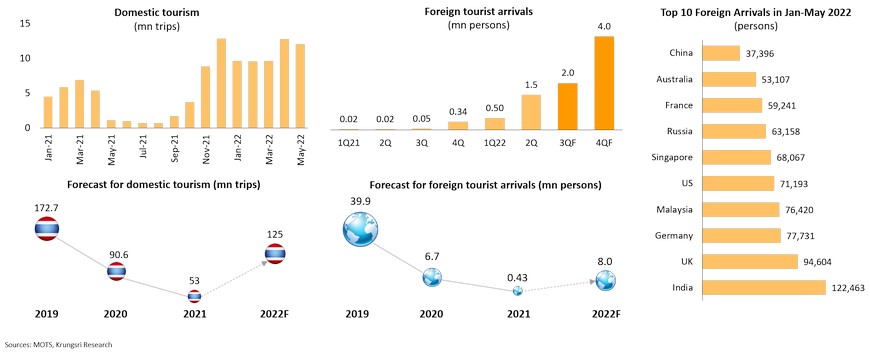

- Tourism activity would continue to improve, encouraged by the relaxation of strict measures and border controls as well as government measures to boost domestic tourism. Private consumption is also improving, supported by reopening tailwinds, but growth would be moderate due to higher cost of living and several headwinds the rest of this year.

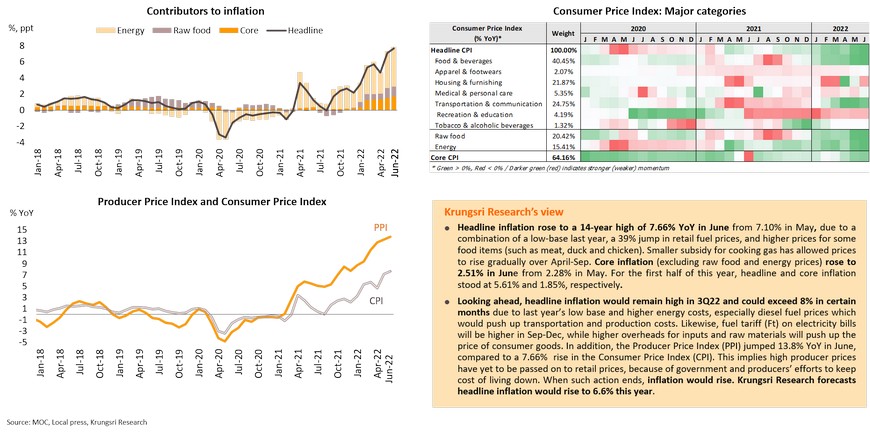

- Inflation looks set to keep rising in Q3 and could exceed 8% in some months in the quarter.

- On policy rate outlook, the first rate hike could happen in August. The weaker baht and high inflation might pressure the MPC to hike rates but the pace would likely be gradual and slower than that in neighboring countries.

Krungsri Research Forecasts for 2022

We fine-tuned 2022 GDP growth forecast to +3.1% to reflect better-than-expected growth in 1H22 and improving tourism activity, but overall economic recovery remains fragile

Key growth drivers in 2H22: stronger tourism activity and rising pent-up demand, but global slowdown, unwinding stimulus, and high inflation would limit growth

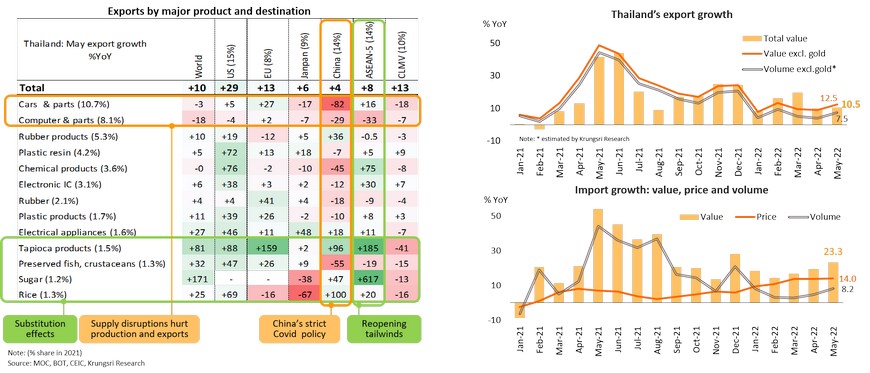

Exports could see double-digit growth in 1H22, at 11%, but might slow down to 4% in 2H due to global slowdown; downside capped by price effect and trade diversion

Krungsri Research now projects 2022 exports would grow by 7.5% (instead of 6.5%) after adjusting for better-than-expected export growth in 1H22, rising commodity and food prices, and substitution effect triggered by the Russia-Ukraine crisis. In the first 6 months of this year, Thai exports are expected to jump 11%. For the rest of the year, exports would expand at a slower rate of 4% in line with a slowing global economy amid the Russia-Ukraine crisis, China’s zero-Covid policy, and tightening monetary policies in major countries to curb accelerating inflation. However, exports might expand to some markets and for selected products given still-high commodity prices, trade diversion, and tailwinds from reopening of economic activity in ASEAN region.

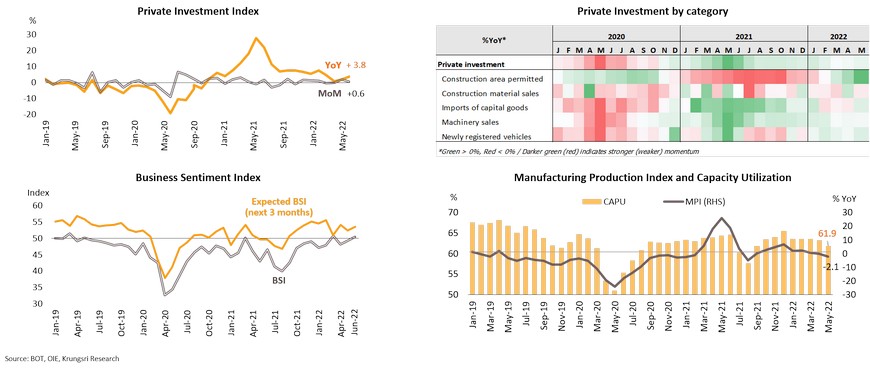

Private investment could see a gradual recovery; despite improving business sentiment with reopening tailwinds, weak manufacturing production will cap investment growth

Private investment is likely to recover gradually in 2H22, supported by (i) positive signal in the Business Sentiment Index which rose for the second consecutive month to above-50 for the first time in 3 months, (ii) better-than-expected export growth in some sectors; (iii) recovering domestic economic activity after lifting containment measures and border controls and reopening of economic activity. However, private investment growth would be limited as manufacturing production and capacity utilization rate are improving very slowly due to supply disruption in some industries which were hit by the Russia-Ukraine crisis and China’s strict Covid measures.

FDI turns to register net inflows in many industries, including rubber products, chemical products and electrical equipment; external headwinds could limit gains

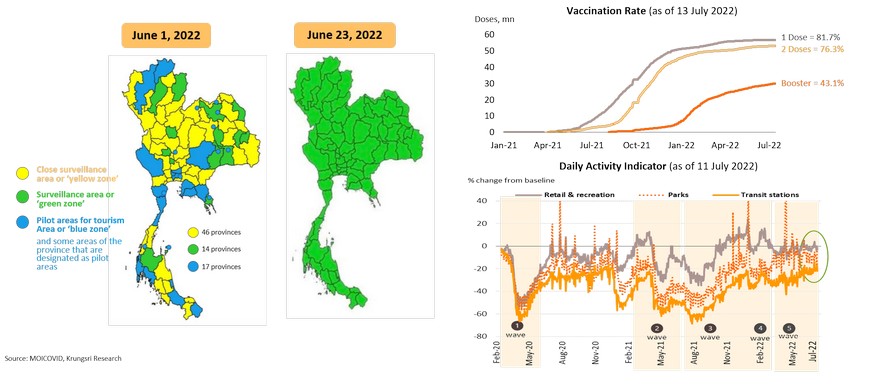

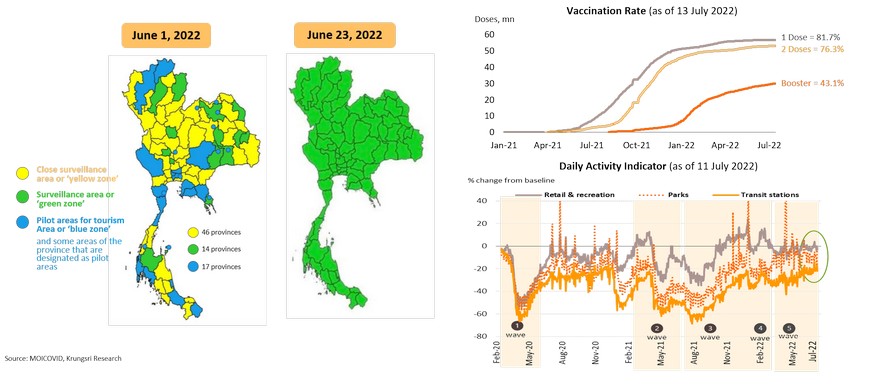

Wider reopening: Thailand has relaxed nationwide covid controls, including removing Thailand pass requirement for foreign arrivals

There are several tailwinds to support the resumption of normal daily and business activities including (i) higher vaccination rate with more than 40% of Thailand’s population having received a booster shot, (ii) relaxation of containment measures, (iii) all regions in Thailand being declared green zones, and (iv) the reopening of entertainment venues effective June 23. In addition, dropping the requirement for Thailand Pass and health insurance for foreign tourists since 1 July 2022 would encourage more visits to Thailand.

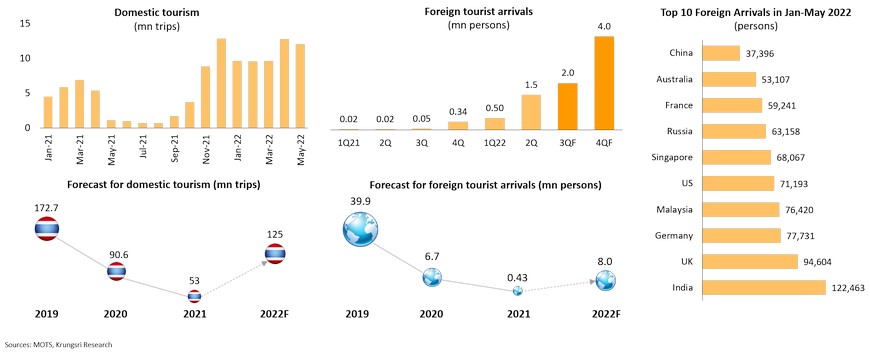

Tourism activity is recovering following relaxation of strict measures and border controls as well as introduction of measures to boost domestic tourism

Average occupancy rate rose to 41.8% in May compared to 35.6% in January and 5% in May 2021. This was encouraged by easing Covid-19 containment measures. In addition, domestic tourism would be supported by the extension of Phase 4 of ‘We travel together’ program to October this year. Domestic tourism activity reached 60 mn trips in 1H22 and is now projected to reach 125 mn trips in 2022 (instead of 105 mn trips in the previous forecast). In addition, Thailand Pass requirement has been halted since July 1. This would lure more foreign tourists to Thailand; we project daily arrivals would increase to 38,000-40,000 in July from 25,000-30,000 in June. In 2H22, foreign tourist arrivals are expected to increase to an average of one million persons per month, compared to a total of 2 million for 1H22. For the whole of 2022, foreign tourist arrivals is projected to increase to 8 million from previous forecast of 5.5 million.

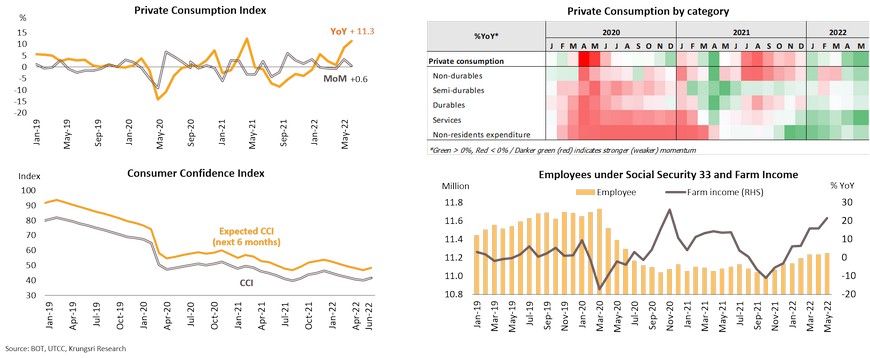

Private consumption is improving amid reopening tailwinds but growth would be moderate due to higher cost of living and several headwinds the rest of this year

Krungsri Research projects private consumption would grow by 3.8% in 2022 (instead of 3.0%) and against 0.3% in 2021. We expect 2H private consumption growth to be similar to 1H. Tailwinds for consumer spending in 2H22 would include easing containment measures, improving employment numbers, rising farm income, and high excess savings (THB1,349 bn or 8.2% of GDP at end-April 2022). Nonetheless, consumption growth would be stable because upside would be capped by rising cost of living in the wake of higher energy prices and the pass-through effects on consumer prices. Although the government has extended relief measures by 3 months (ending in September), these would only help low-income earners and those holding social welfare cards. Other headwinds for consumption include possibly higher interest rates, unwinding of government subsidies, and very-low consumer confidence as well as high household debt.

Inflation looks set to keep rising in Q3, could exceed 8% in some months

MPC: First rate hike possible in August; weaker baht and high inflation will pressure the MPC to hike rates but pace would be gradual and slower than that in neighboring countries

Weaker Thai baht: Impact on exports and business sectors

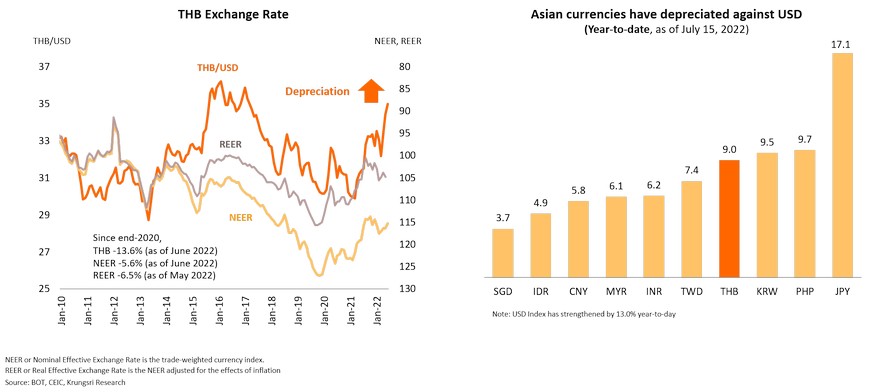

Thai baht movement: The baht has depreciated to a multi-year low against the USD. There are concerns whether a weaker baht would benefit exporters or hurt them through higher import costs.

Determinants of exports: Historical data show a weak relationship between a softer baht and exports, and that exports are influenced more by the economic health of Thailand’s trading partners.

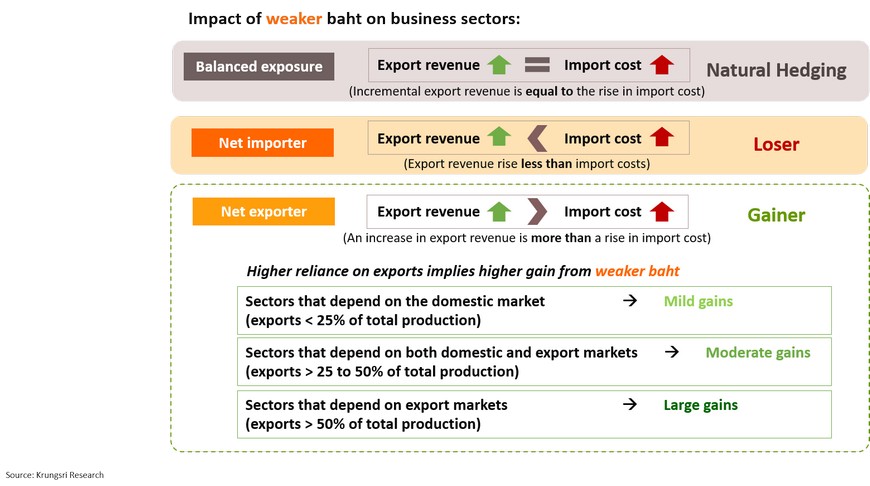

Sector-wise, it tells a different story. FX impact depends on natural hedging and size of imports and exports.

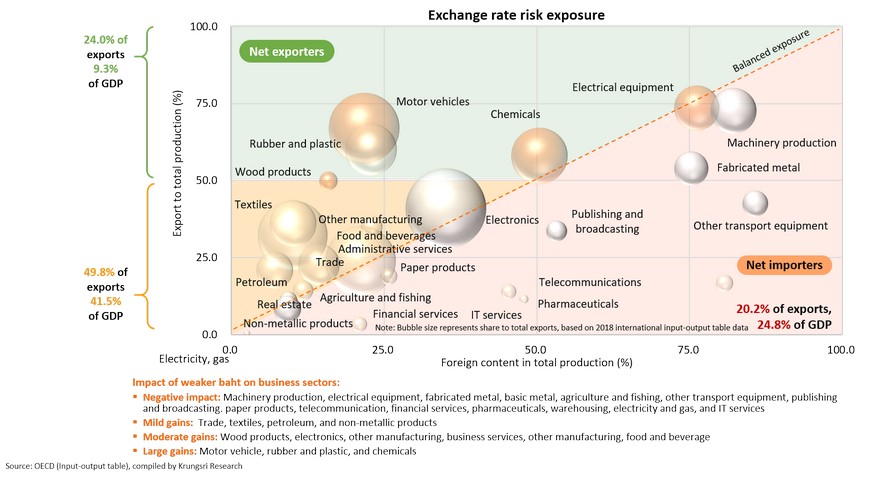

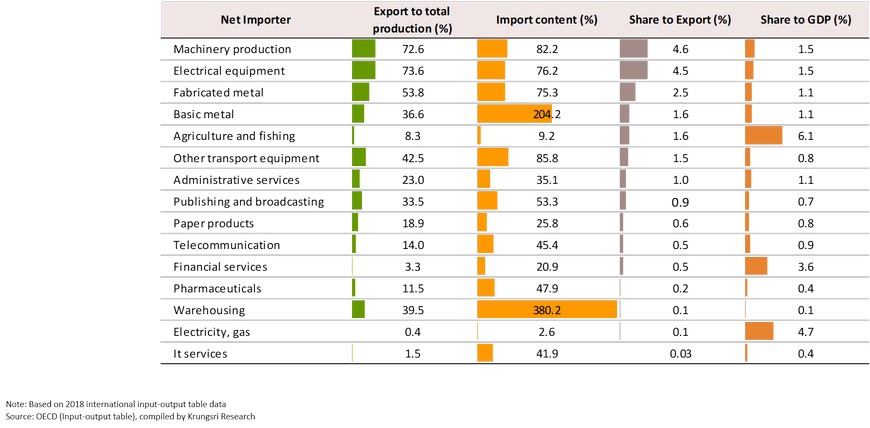

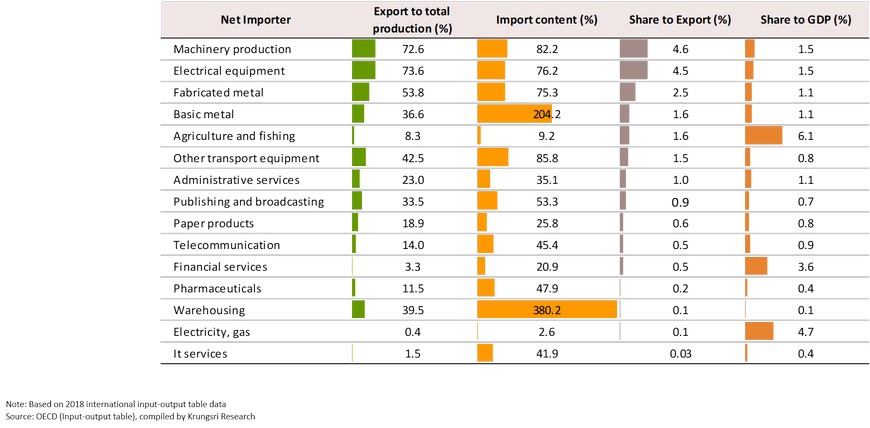

- Business sectors who are net importers may be hurt by a weaker baht. This group’s output accounts for 20.2% of total Thai exports and 25% of GDP. These include machinery production, electrical equipment, fabricated metal, basic metal, agriculture and fishing, other transport equipment, publishing and broadcasting, paper products, telecommunication, financial services, pharmaceuticals, warehousing, electricity and gas, and IT services.

- Net exporters could benefit from a weaker baht but gains would depend on the size of external and domestic markets.

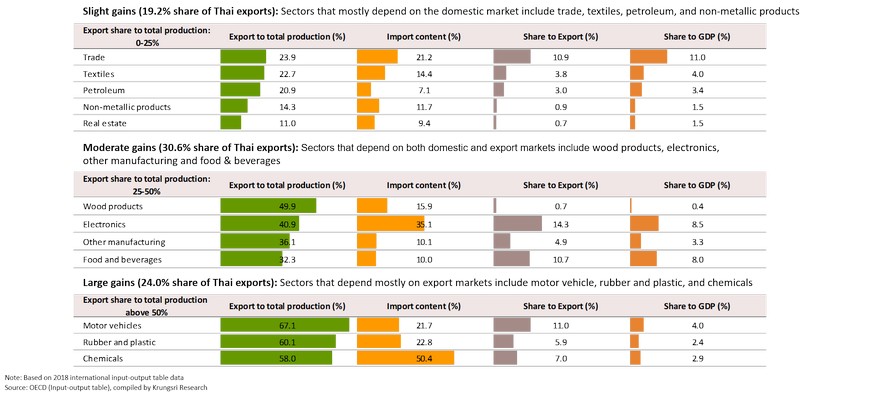

- Mild gains (19.2% share of Thai exports): Export sectors that depend strongly on the domestic market include trade, textiles, petroleum, and non-metallic products.

- Moderate gains (30.6% share of Thai exports): Export sectors that rely on both domestic and export markets include wood products, electronics, other manufacturing, and food & beverage.

- Large gains (24.0% share of Thai exports): Export sectors that depend mostly on export markets include motor vehicle, rubber & plastic, and chemical.

To conclude, many industries in Thailand would gain from a weaker baht but the business sector would see limited benefits and it would not lead to a substantial growth in overall exports. However, this suggests authorities would not allow the baht to depreciate too much in their attempt to boost the economy; there should be a trade-off between the benefits and costs of a weaker baht.

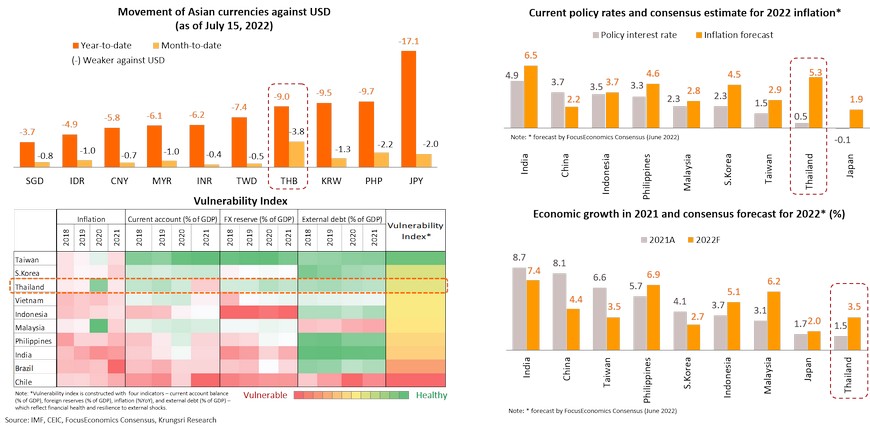

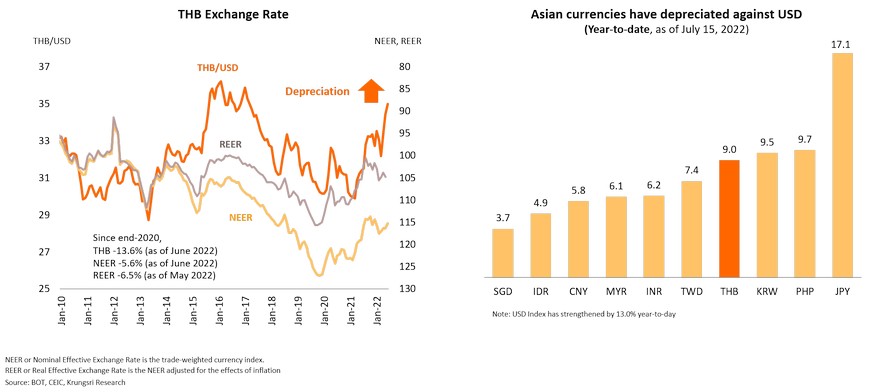

Thai baht has depreciated against the USD since last year to a multi-year low; baht has weakened 9% this year, in line with other Asian currencies

So far this year (as of July 15, 2022), the Thai baht has weakened by 9.0% against the USD to a 16-year low, in line with several of other currencies in the region such as the PHP (-9.7%), KRW (-9.5%), and TWD (-7.4%). The weaker baht could increase export revenues but could also hurt businesses through higher import costs.

Major causes of a weaker baht include a stronger USD as well as the country’s current account deficit and net fund outflows

The US dollar index has risen 13.0% year-to-date. In the first 5 months of this year, Thailand’s current account posted a deficit of USD8.9bn and registered USD7.9bn net outflows. All these factors had exerted downward pressure on the baht.

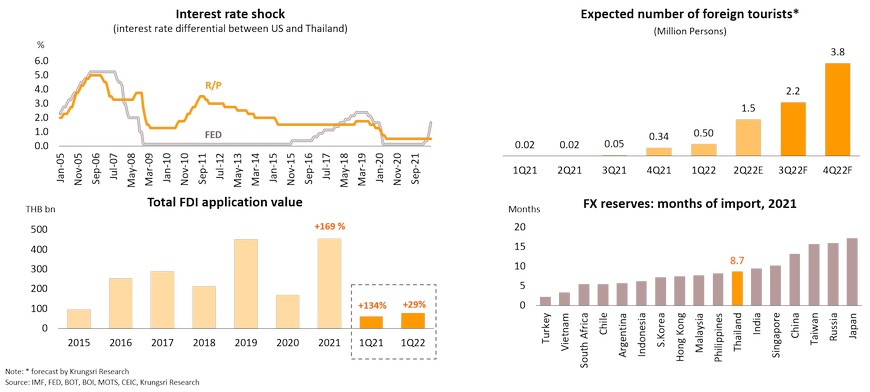

Baht could weaken further as the interest rate gap between US and Thailand widens but would be limited by FDI and gains in tourism sectors

In 1Q22, total applications by foreign investors for BOI privileges rose 29.1% YoY, following 169% growth in 2021. This was driven by industrial transformation and reopening of borders and the economy. Foreign tourist arrivals are expected to surge in 4Q22 and improve the country’s current account balance. Thailand’s foreign reserves remain relatively high, reflecting sound external stability which should help to cushion against external stocks. All these factors should help limit the baht’s weakness.

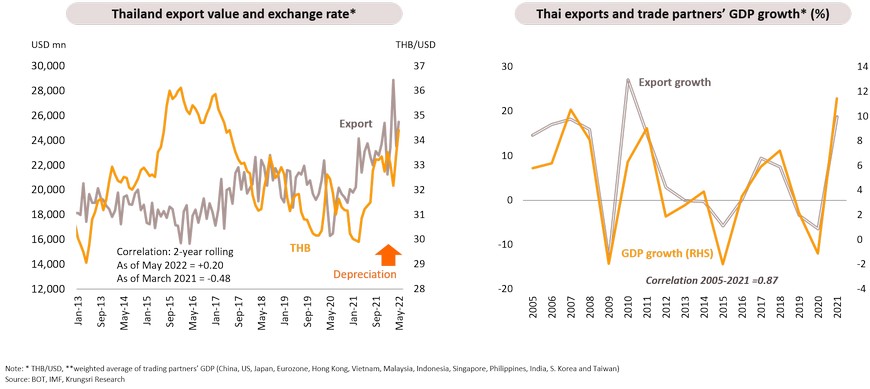

Relationship between weaker baht and overall exports is fuzzy, while Thai exports are influenced by growth at trading partners’ economies

In the past 2 years, correlation between baht movement and export value was weak at only 0.20, suggesting the weaker baht would not lead to a sharp increase in Thai exports. However, there is strong correlation between Thai export growth and trading partners’ GDP growth, implying that export performance would depend on external demand rather than exchange rates.

Sector-wise, natural hedging dictates the weaker baht would hurt sectors which are net importers but benefit sectors with large exposure to exports

Net importers are losers of a weaker baht but their output account for only 20% of Thai exports and 25% of GDP

Net importers are led by machinery production, electrical equipment, fabricated metal and basic metal

Net importers which could be hurt by a weaker baht account for a combined 20.2% of Thai exports. These include machinery production, electrical equipment, fabricated metal, basic metal, agriculture and fishing, other transport equipment, publishing and broadcasting. paper products, telecommunication, financial services, pharmaceuticals, warehousing, electricity and gas, and IT services

However, sectors that registered large gains from a weaker baht account for only 24% of total Thai exports and 9% of GDP