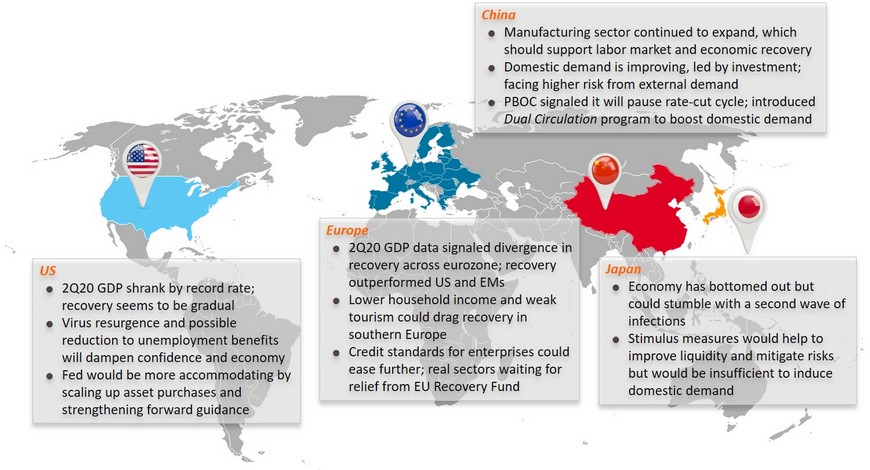

Global: Uncertain and divergent recovery

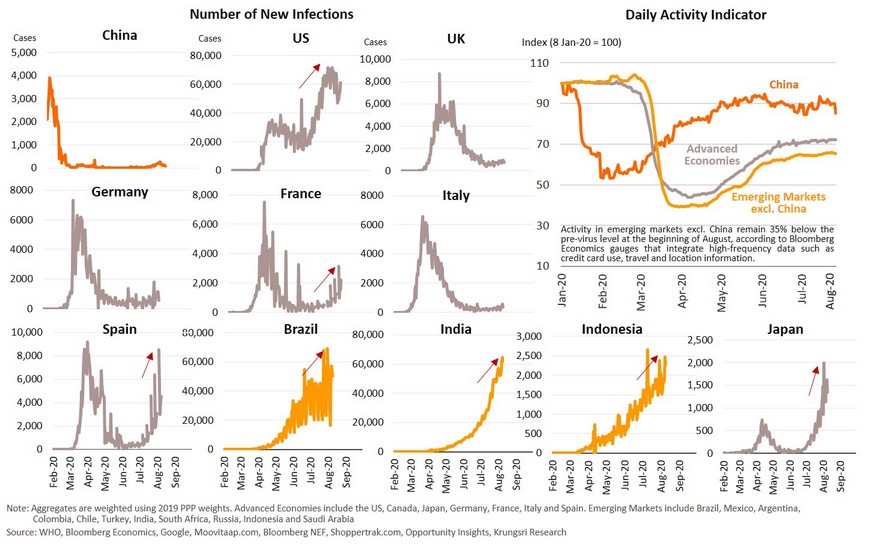

Different pandemic dynamics created divergent recovery trajectories; China economy outperformed

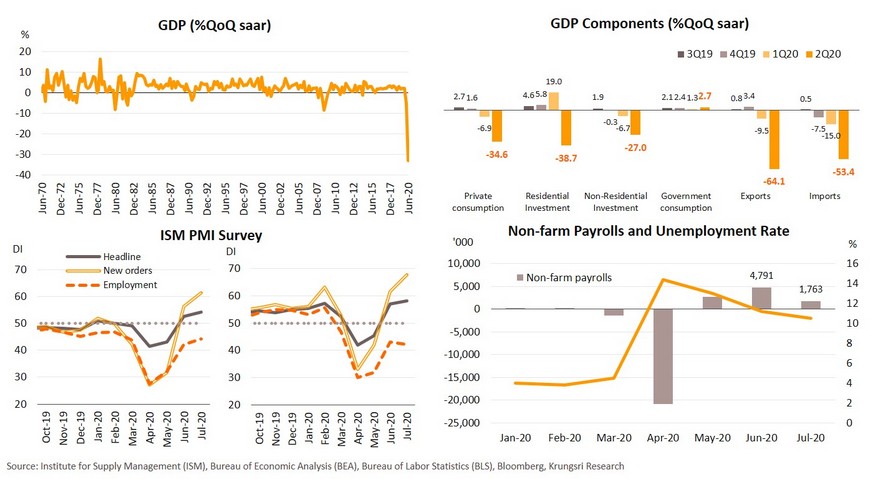

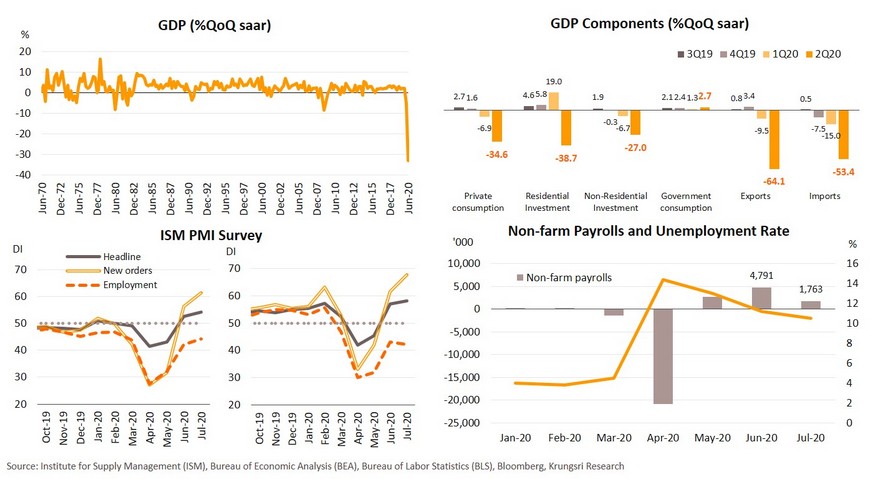

US: 2Q20 GDP contraction largest in its history; recovery is slow

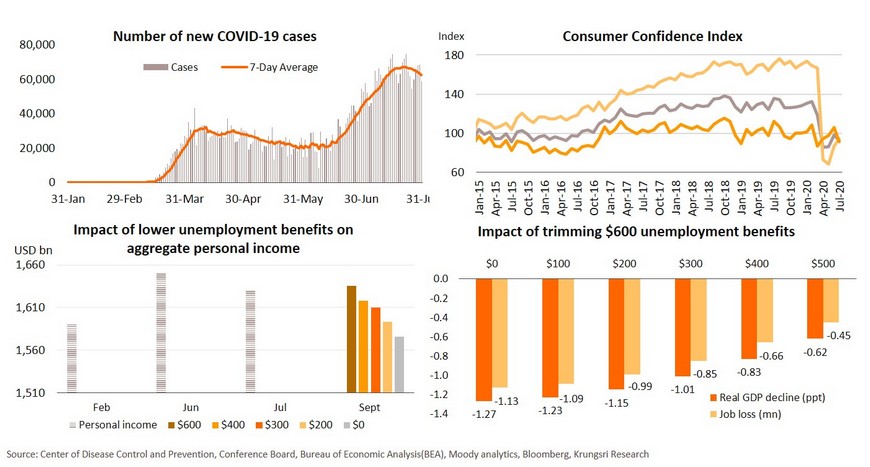

In 2Q20, US GDP shrank by 32.9% QoQ annualized, the largest contraction since 1947, reflecting the devastating impact of the lockdown. The economy was hammered by the sharp drop in personal spending (-34.6%), residential investment (-38.7%) and exports (-64.1%). But economic activities have been improving since May. Manufacturing PMI inched up from 52.6 in June to 54.2 in July, led by expanding production. Non-manufacturing PMI rose to 58.1 in July as new orders sub-index jumped to a record high, but employment sub-index fell for the 6th consecutive month. Other labor market indicators reflected a slight improvement. Non-farm payrolls increased by 1.76 million in July, slowing down from +4.8 million in June. July job gains still left employment at 13 million jobs below February level. Looking ahead, the economy would continue to recover in 3Q but it has been slow since early July with the resurgence of COVID-19 infections and the end of unemployment benefits.

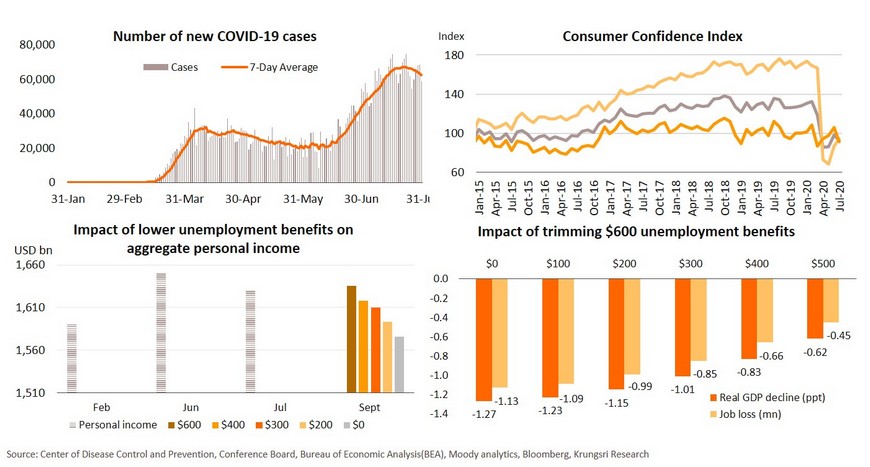

Virus resurgence and possible cut in unemployment benefits will weigh on confidence and the economy

New infections had exceeded 50,000 a day since early July, posing risks to consumer outlook and financial prospects. Consumer Confidence Index has dropped from 98.3 in June to 92.6 in July, while expectation index has tumbled to 91.5, the lowest since 2017. Household consumption will worsen after the $600-per-week unemployment benefit expires at end-July and lawmakers remains in a deadlock. Democrats has proposed to extend the benefits while Republicans wants to cut that to $200 a week pending the set-up of a system to cover 70% of prior earnings. Millions of Americans could lose a crucial financial lifeline and that could hurt economic recovery. If the benefit is not extended, aggregate personal income would drop by USD54bn in September from June level. This would reduce GDP by 1.27 percentage points (ppt) and the economy could lose 1.13 million jobs. Trump tried to assert executive orders by signing four orders, including a $400 weekly unemployment benefit, extend payroll tax deferral, eviction protection, and deferment of student loans, but this would be a struggle because only Congress has the power to approve such budgets. However, we expect Congress to finally approve the benefits but it might be less than $400 a week due to concerns over government debt levels.

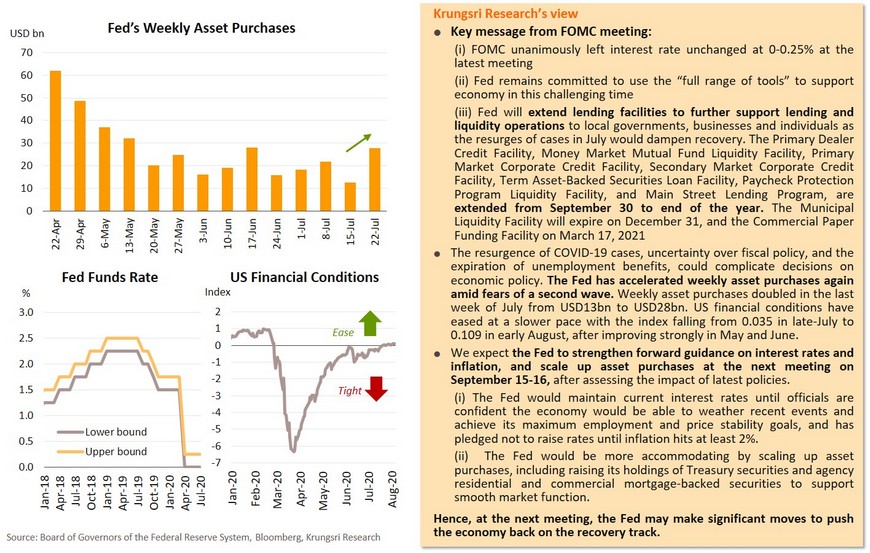

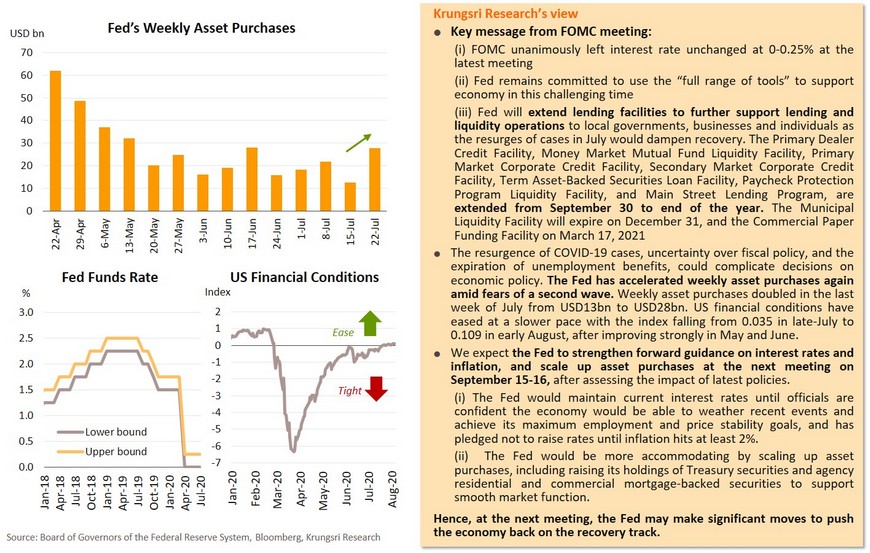

Fed would be more accommodating by scaling up asset purchases and strengthening forward guidance

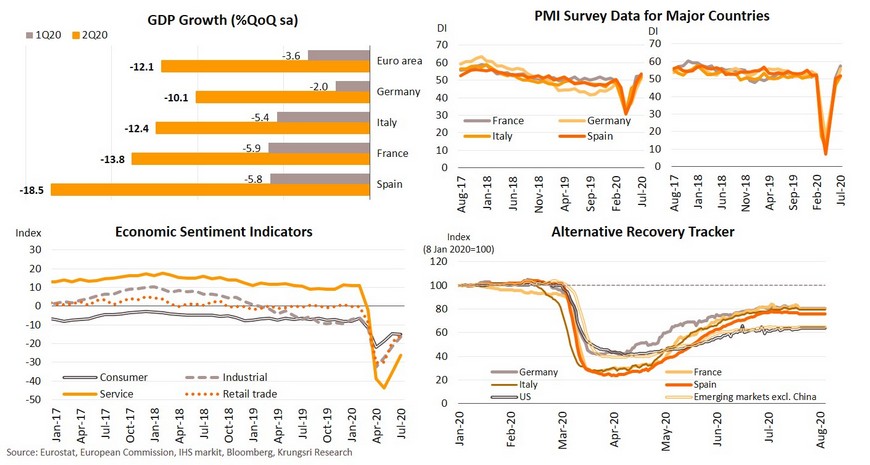

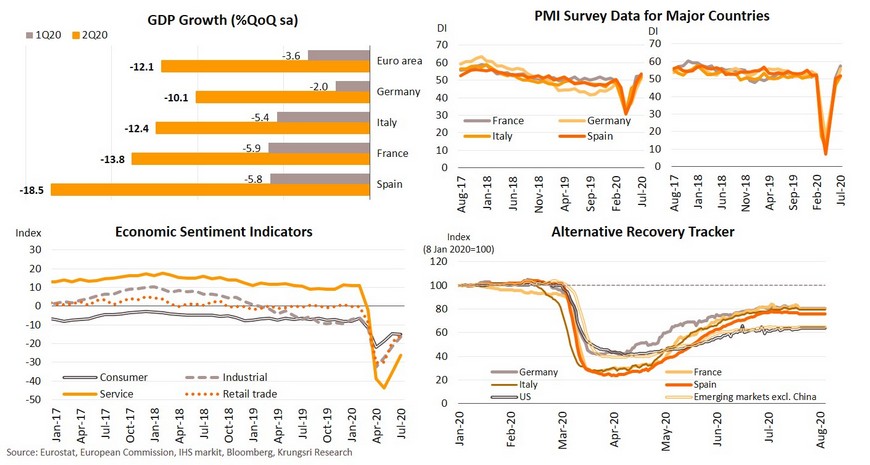

Eurozone: 2Q20 GDP show divergence in recovery across zone; recovery outperformed US and EMs

Eurozone GDP contracted by 12.1% QoQ in 2Q20. Spain was the worst performer at -18.5%, followed by France (-13.8%), Italy (-12.4%) and Germany(-10.1%). The severity of the pandemic impact differed across the eurozone, depending on the effectiveness of containment measures and stimulus measures. Overall indicators showed a broader recovery in early 3Q20. Manufacturing PMI in major countries rose above 50 in July, led by Spain at 53.5 and France at 52.4. Services PMI surged to 57.3 in France and 55.6 in Germany. Economic sentiment improved slightly in July, led by consumer confidence (-15), while the biggest rise was in services sector confidence, reflecting the late lifting of restrictions on parts of this sector. Alternative recovery trackers moved closer to pre-crisis levels in early August. Recovery is faster than in the US and emerging markets (EMs) partly due to relatively fewer new daily cases. Germany and France are recovering faster. However, a jump in new daily cases in France and Spain recently could threaten economic recovery prospects and pace.

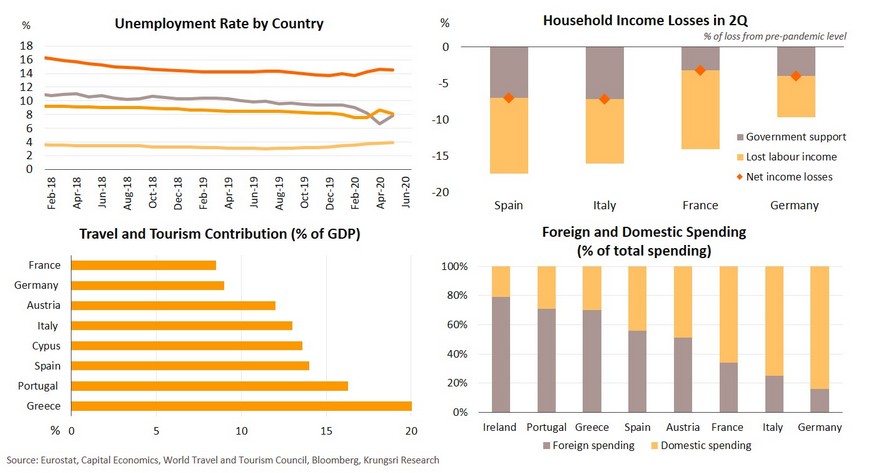

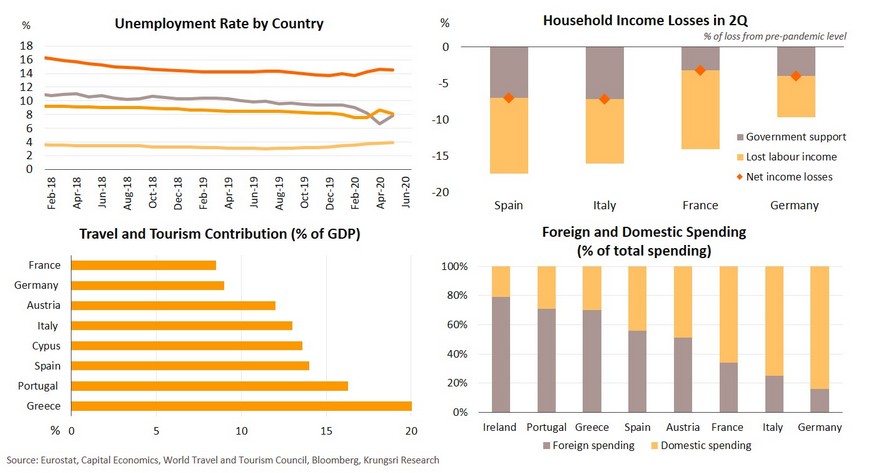

Weak household income and tourism sector could slow the pace of recovery in southern Europe

Unemployment rate has risen, especially in Spain where it rose from 14.4% in 1Q20 to 15.3% in 2Q20, more than double the EU average. This could drag economic recovery which is dependent on household consumption, stimulus programs, and tourism activity in each country in eurozone. Income losses in Germany might be offset by the Kurzarbeit program and other stimulus measures which are expected to trim income losses from 10% to closer 4%. Net loss of household income in Italy and Spain in 2Q20 reached 7.2% and 7.0%, respectively. The pace of economic recovery in southern Europe also depends on tourism activity. Tourism accounts for 14% of national GDP in Spain and 13% in Italy, while that in countries that are leading the recovery in eurozone like Germany and France, is less than 10% of GDP. Moreover, Spain’s economy relies on foreign spending more than domestic spending, unlike other major countries. Hence, we expect Spain to be hardest hit by the coronavirus pandemic and economic recovery could lag its neighbors because tourism activity would take longer to return to pre-pandemic level.

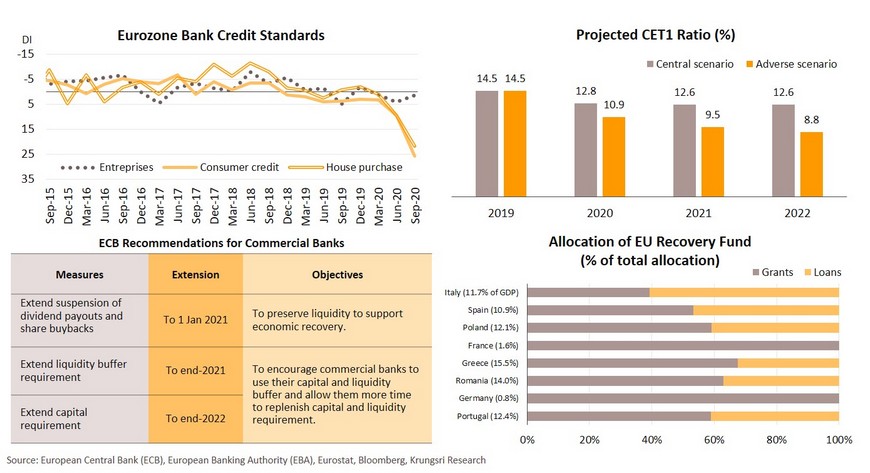

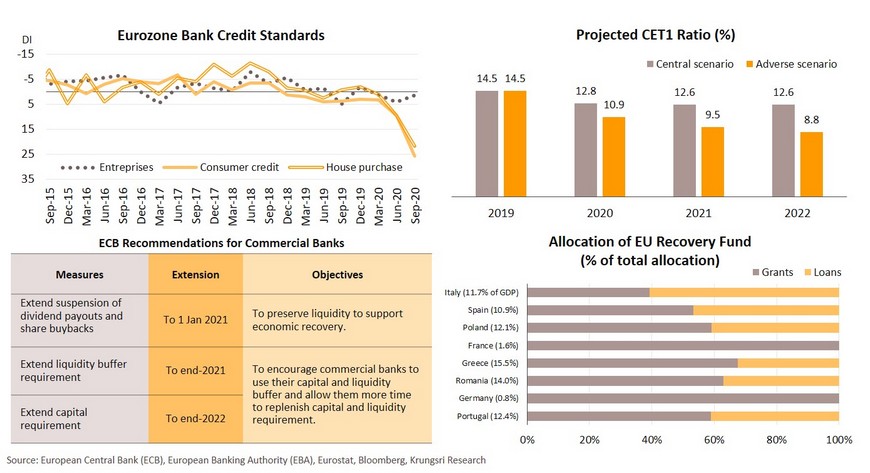

Credit standards for enterprises could ease further in 3Q; real sectors wait for relief from EU Recovery Fund

A survey of bank credit standards shows banks expect loans to enterprises to improve in 3Q20 following the ECB’s actions to create favorable credit conditions. The ECB’s vulnerability exercise conducted on 86 eurozone banks concluded that banks are resilient, with a 1.9 ppt depletion in Common Equity Ratio (CET1) under central scenario and 5.7 ppt under the severe scenario. Though banks would be able to cope with the COVID-19 repercussions, the ECB remains worried about the health of the financial sector. Hence, it has recently relaxed rules on capital requirements to give banks time to build up their capital bases and reserves as the Eurozone economy stumbles. Tighter credit conditions for housing loans and consumer credit suggest the real sector requires more support. Each country’s government has attempted to support their economies by extending the furlough program to at least the end of 3Q20 to maintain employment. However, Eurozone countries are waiting for relief from the EU Recovery Fund; 70% would be disbursed in 2021 and 30% in 2022 to help buoy household consumption and support economic recovery.

China: Continued expansion of production sector should support labor market and economic recovery

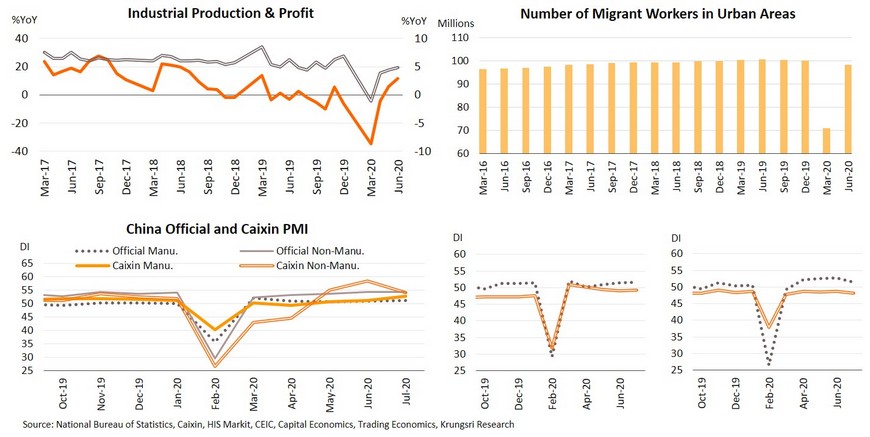

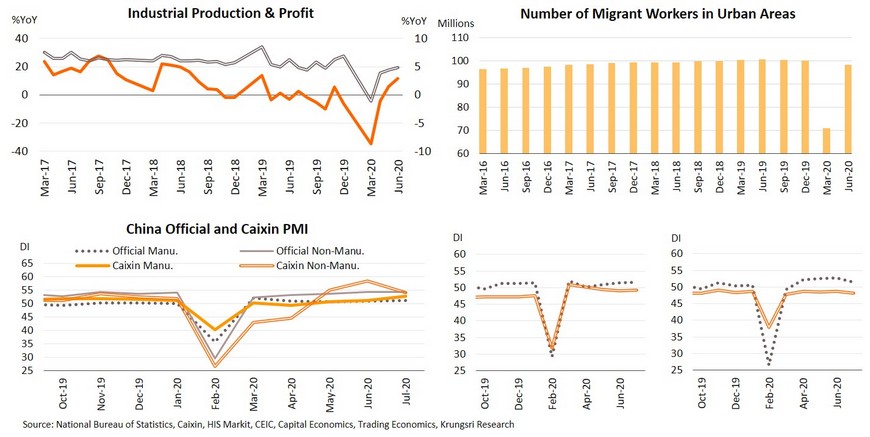

China’s economy continues to move towards pre-COVID conditions. In June, industrial production rose 4.8 YoY, the largest increase in six months, and industrial profits surged 11.5%, the strongest since March 2019. The rebound in economic activities support the re-absorption of migrant workers into the workforce and consequently ease unemployment rate to 5.7% in June from 5.9% in May. Recovery was more pronounced in July as the Caixin Manufacturing PMI rose to 52.8, the highest since 2011, while the official Manufacturing PMI rose to 51.1, rising for the fifth straight month. Similarly, both Caixin and official Non-manufacturing PMI remained above-50, marking the third and fifth consecutive month of expansion, respectively. The key recovery drivers were improvement in the new orders and employment sub-indices, which have returned to pre-outbreak levels. Specifically, new orders for manufacturing rose to 51.7 in July, the highest in four months. These improved PMI indicators suggest economic activity will continue to expand in 2H20.

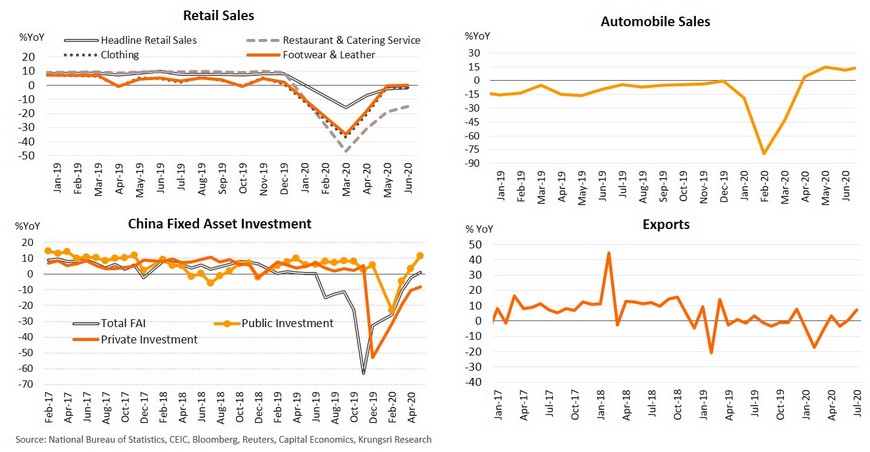

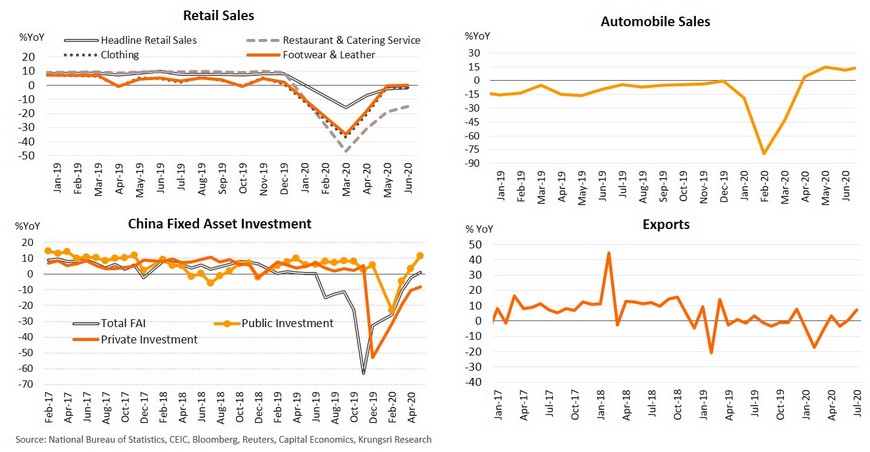

Domestic demand show signs of improvement led by investment; higher risk in external demand

Despite slow consumption growth, the continuous recovery in investment and the labor market are expected to propel domestic spending in the next period. In June, retail sales contracted by a smaller magnitude. Automobile sales surged 16.4% in July, rising for the fourth straight month. Improving public investment is expected to support private investment, as well as the labor market and domestic spending in the next period. On the external front, June exports grew 7.2%, the largest increase in 7 months, but growth was led by temporarily-higher demand for medical products and work-from-home equipment. Besides, exports are threatened by weak global trade and escalating China-US tension. Capital Economics estimates if China’s exports to the US and the world drop by 10%, China’s GDP would contract by 0.3% and 1.4%, respectively.

PBOC signals to pause rate-cut cycle; government introduces Dual Circulation to boost domestic demand

The People's Bank of China (PBOC) has maintained policy interest rates for three consecutive months, saying the “PBOC does not need to step up policy easing as an economic recovery is well under way”, suggesting liquidity is sufficient to support the economic recovery. In July, outstanding bank loans grew 13.0%, following 13.2% growth in June, the highest rate since May 2019. In the real sector, given lingering downside risk to external demand, China needs more fiscal stimulus to boost domestic demand. In the first 7 months of 2020, new issuance of local government bonds rose by 10.8% YoY, which could mean accelerating investment in infrastructure projects. The program to strengthen the domestic economy is called Dual Circulation; it was announced by President Xi Jinping at a symposium with corporate leaders in Beijing on July 21. Stronger growth of the domestic economy would help China to maintain its recovery trajectory in 2H20 and cushion the impact of external shocks.

Japan: Economy has bottomed out but could stumble with a second wave of infections

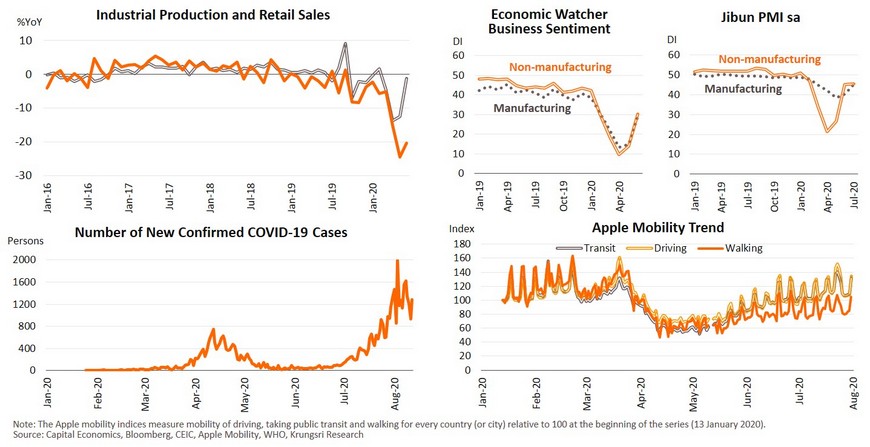

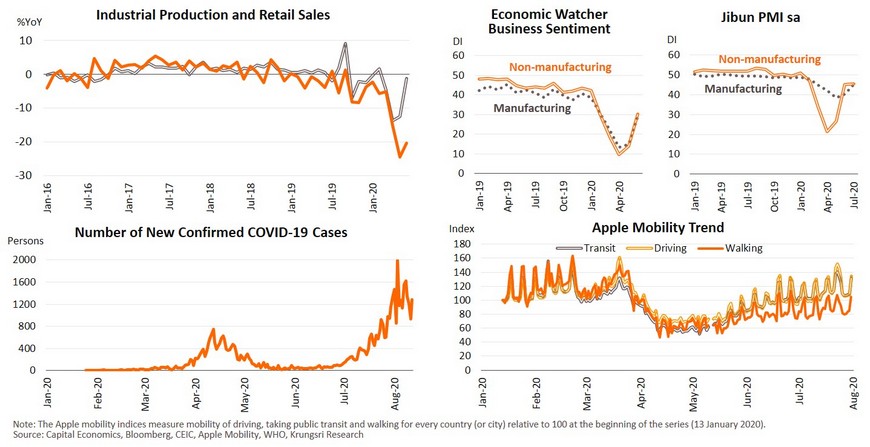

Several indicators suggest the worst is over for Japan. Key indicators reflected improvements after the first state of emergency was lifted in mid-May. In June, industrial production fell by 20.3% YoY, a mild improvement from May (which registered sharpest drop since the global financial crisis). Likewise, retail sales shank at a softer pace of -1.2%, improving from April which registered the largest drop in two decades. Economic sentiment continued to recover with Economic Watcher Business Sentiment indices climbing up for two straight months. July saw improvements in Manufacturing PMI (45.2) and Services PMI (45.4) from 11-year lows, although they remain below-50. However, in early August, new cases soared to nearly 2,000 per day. High-frequency data suggest the economy is recovering at a slower pace. Apple mobility data suggest traffic have flattened and remain below pre-outbreak. Levels. Looking forward, a new wave of infections could drag Japan’s economic recovery in 2H20.

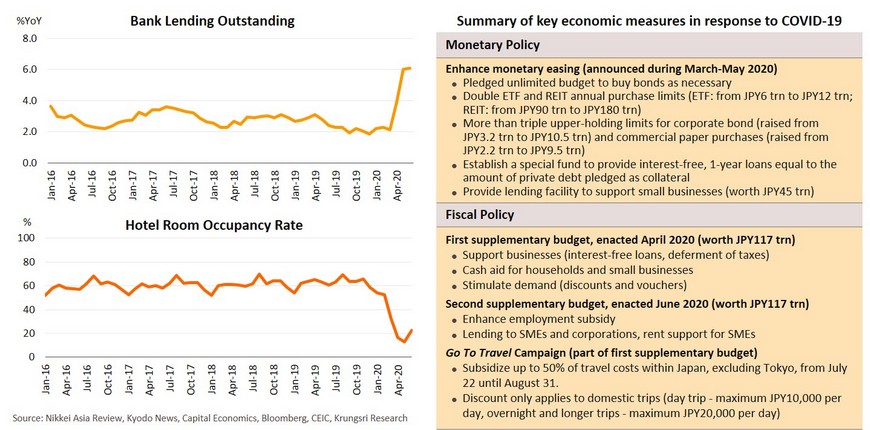

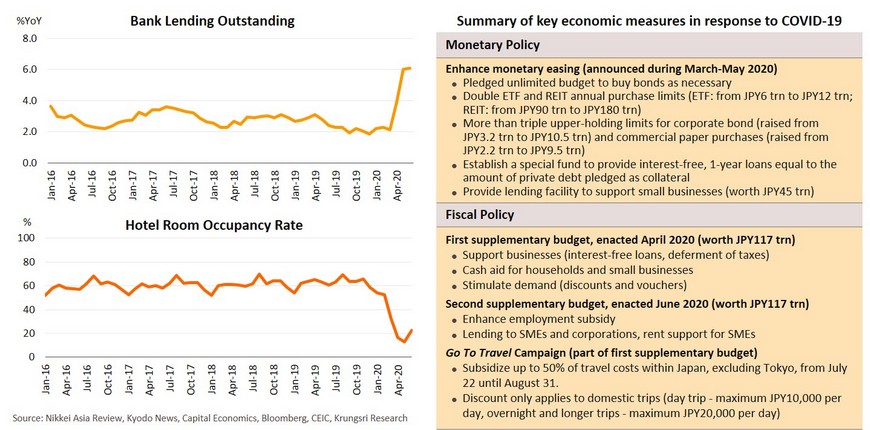

Stimulus measures would improve liquidity and mitigate risks, but insufficient to induce domestic demand

The Bank of Japan has provided large lending facilities to support liquidity, including credit guarantee program and buying up corporate debt securities. In June, bank lending surged 6.1% YoY, the strongest growth since the early-1990s. In terms of fiscal stimulus, the Japanese government also introduced an unprecedented fiscal package worth JPY234trn, equivalent to 40% of GDP. Actual fiscal spending is 10.4% of GDP, which would contribute 0.7 ppt to 2020 GDP growth. Recently, the government attempted to boost domestic spending by launching the Go To Travel campaign that offers to subsidize up to 50% domestic holiday expense, up to JPY20,000 per person per day. The COVID-19 pandemic has damaged the tourism industry; average hotel room occupancy was only 22.4% in June. However, the Go To Travel scheme has experienced hiccups, including a second wave of infection, and the exclusion of trips in Tokyo. Overall, these fiscal and monetary measures would help to mitigate the COVID-19 impact and improve liquidity in the economic system, but they may be insufficient to boost domestic spending and economic growth significantly.

Thailand: No visible economic growth drivers

Domestic consumption, business investment and manufacturing remain weak despite some improvement in June following the gradual easing of lockdown measures.

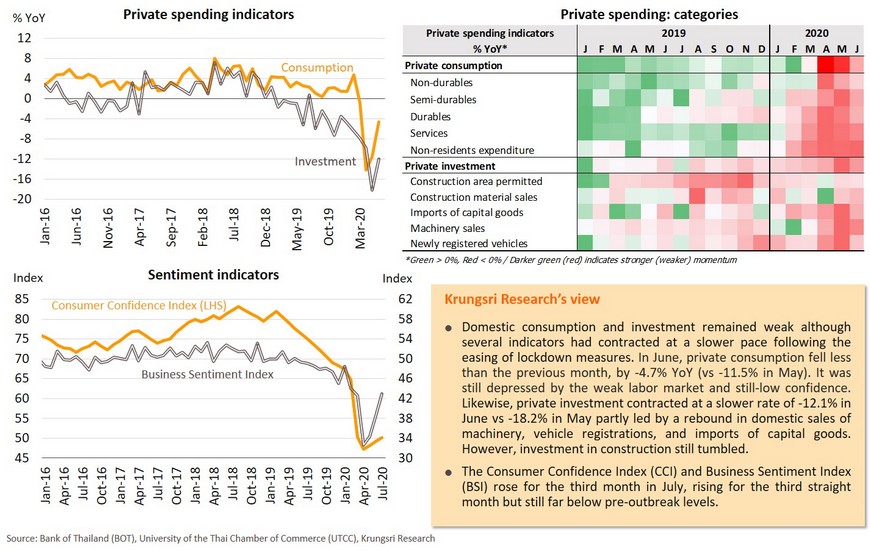

- Domestic consumption and investment continued to contract but indicators showed some improvement following the gradual easing of lockdown measures. In June, private consumption fell 4.7% YoY compared to -11.5% in May. Likewise, private investment contracted by a slower rate of -12.1% in June vs -18.2% in May but investment in construction still tumbled. The Consumer Confidence Index (CCI) and Business Sentiment Index (BSI) rose in July, rising for the third month in a row but remain below pre-outbreak levels.

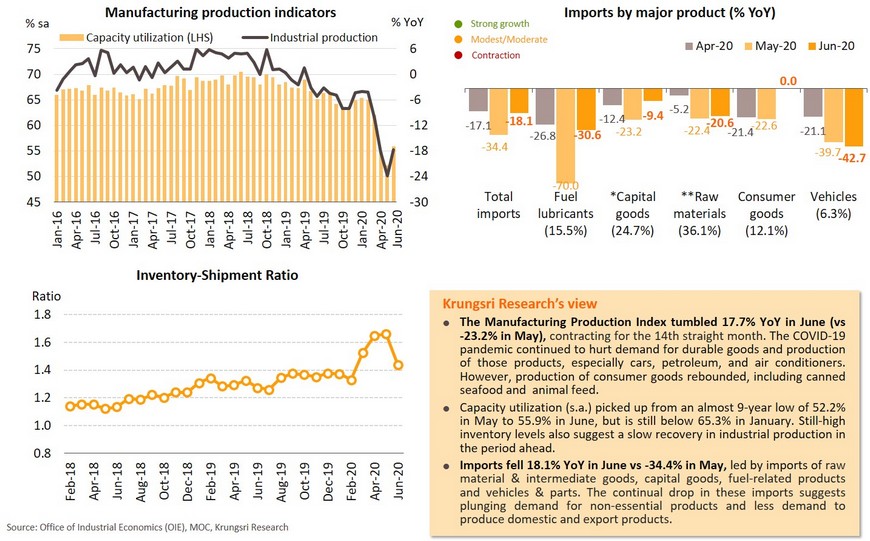

- Manufacturing Production Index tumbled 17.7% YoY in June (vs -23.2% in May), recording negative growth for the 14th straight month. Capacity utilization (s.a.) picked up from an almost 9-year low of 52.2% in May to 55.9% in June, but is still well below 65.3% in January. In addition, still-high inventory levels suggest a slow recovery in industrial production in the period ahead

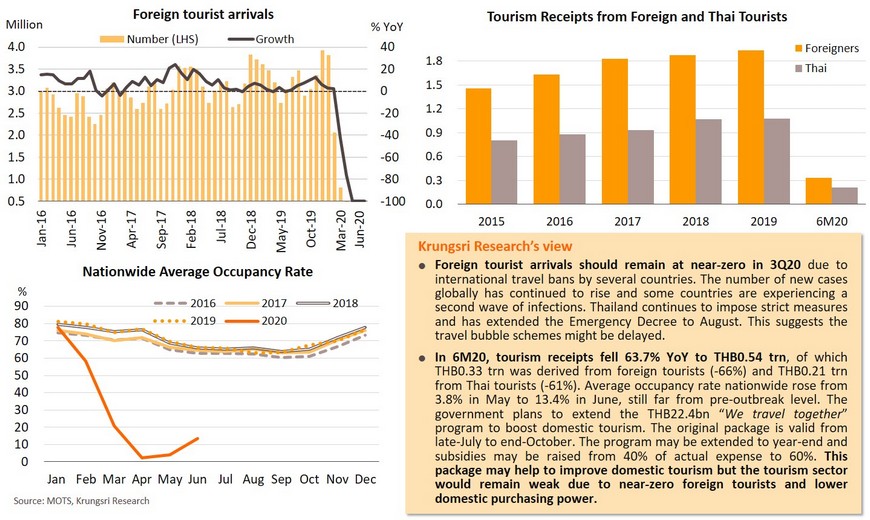

Tourism will not recover so soon; we expect near-zero foreign tourists in 3Q20. Weak external demand and high unemployment will weigh on pace of economic recovery.

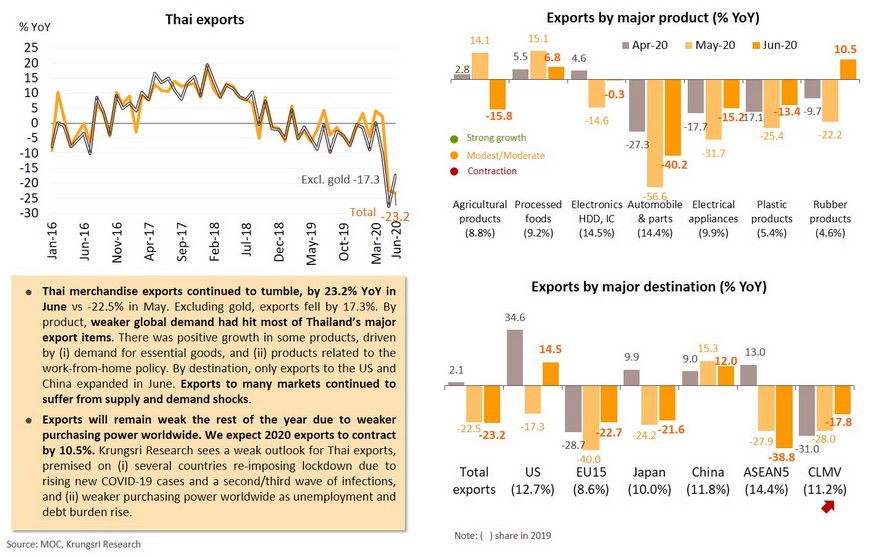

- Foreign tourist arrivals would be near-zero in 3Q20 due to the international travel bans by several countries, including Thailand. The number of COVID-19 cases worldwide continues to rise, which could prompt authorities to delay travel bubble schemes. The government’s “We travel together” campaign worth THB22.4bn may help to improve domestic tourism, but the overall tourism sector will remain weak due to near-zero foreign tourists and weaker domestic purchasing power. Despite signs of bottoming out, exports would remain weak the rest of the year due to (i) expectations of another lockdown in several countries where COVID-19 cases continue to rise, and (ii) weaker purchasing power worldwide. We expect Thai exports to contract by 10.5% in 2020.

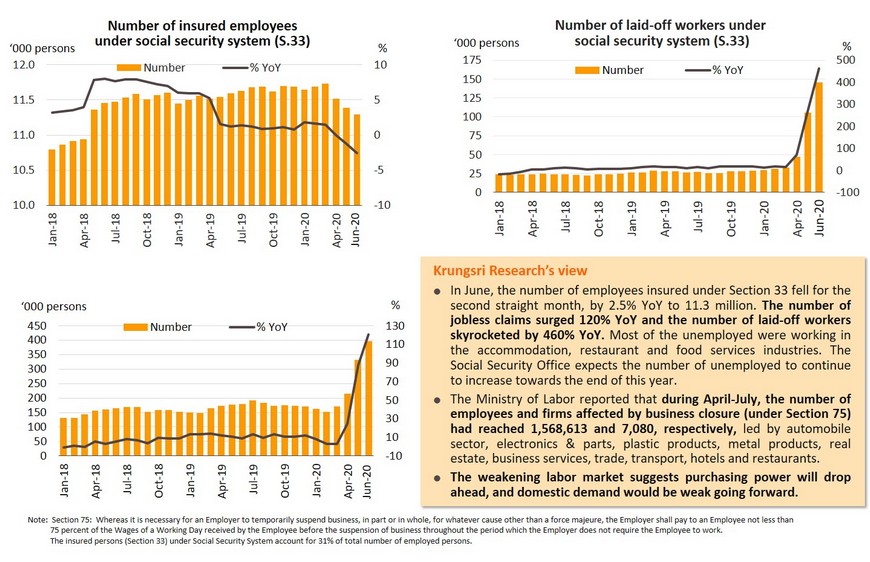

- Labor market is weakening. In June, the number of jobless claims jumped 120% YoY and the number of laid-off workers skyrocketed by 460%. During April-July, the number of employees affected by business closure reached 1,568,613. The weaker labor market suggests a drop in purchasing power and a bleak outlook for domestic demand.

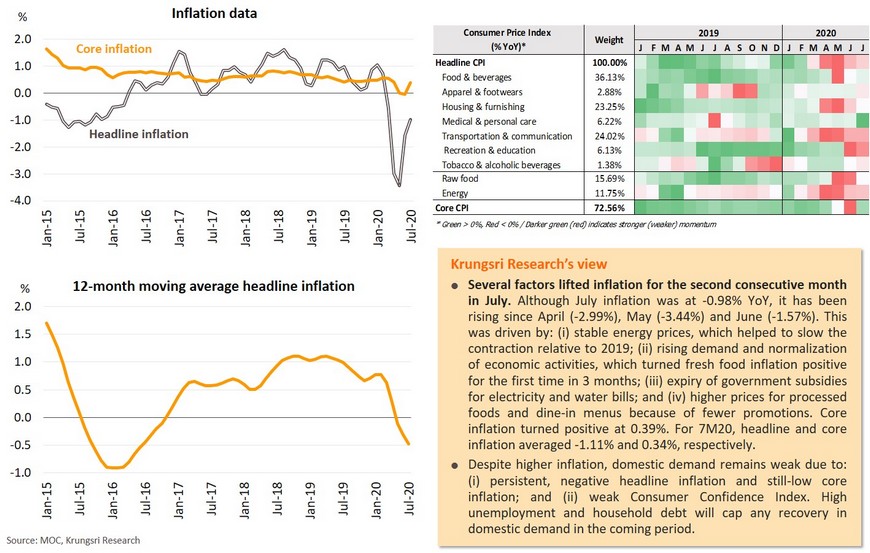

- Inflation should rise but remain negative the rest of this year.

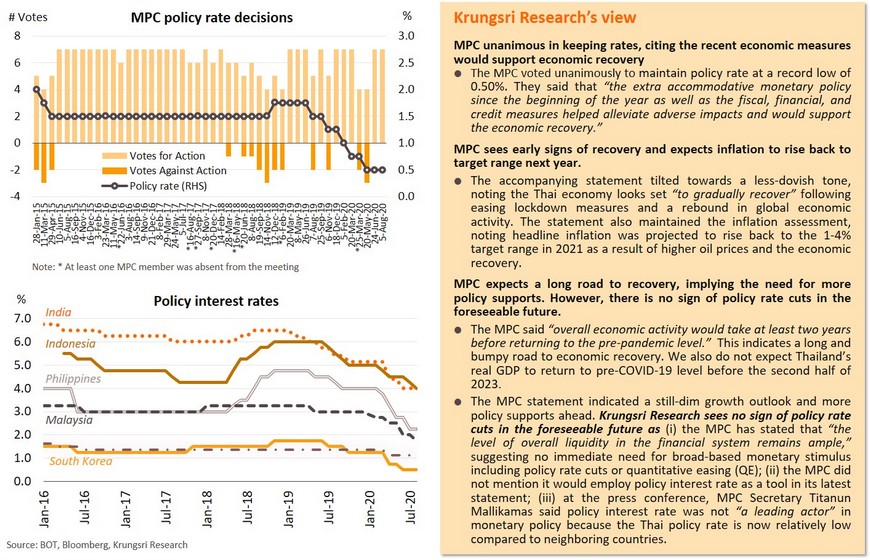

MPC holds rates, signaling it would employ non-interest rate policy tools

- The MPC was unanimous in keeping rates at the last meeting, citing the recent economic measures would support economic recovery. The MPC expects a long road to recovery, implying the need for more policy supports. Krungsri Research sees no sign of policy rate cuts in the foreseeable future, as (i) the MPC views “the level of overall liquidity in the financial system remains ample”; (ii) the MPC did not say it would employ policy interest rate as a tool in the latest statement; and (iii) MPC Secretary said policy interest rate is not “a leading actor” in monetary policy.

Recent developments: Domestic demand remains weak but is contracting at a slower pace since reopening

Industrial production contracted sharply amid large excess capacity and high inventories

Tourism will not recover so soon, and travel bubble schemes may be delayed; we expect near-zero foreign tourist arrivals in 3Q20

Labor market weakens as layoffs jump 400% in June, implying sluggish domestic demand ahead

Inflation will rise but remain negative the rest of this year

MPC holds policy rate, signals it would employ non-interest rate policy tools

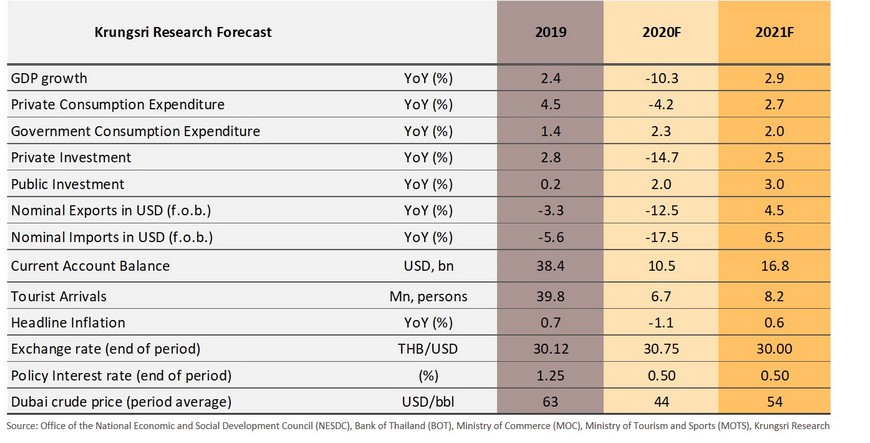

Krungsri Research Forecast

Special notes: Thailand in the new global supply chain after COVID-19

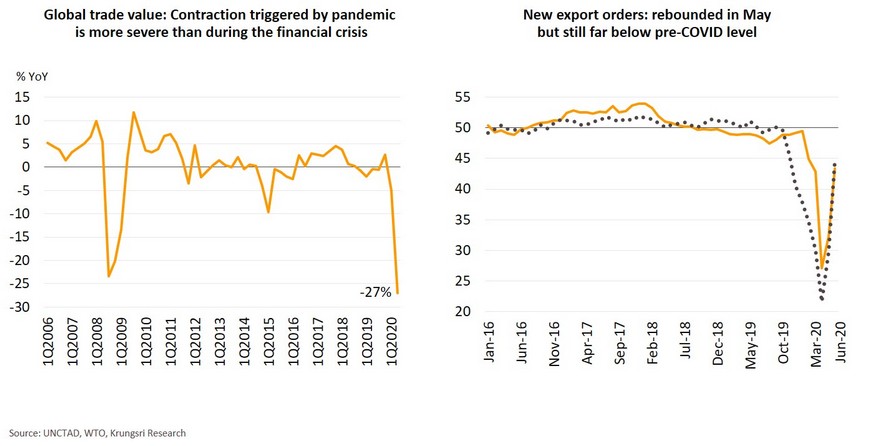

- Economic disruptions and weak demand triggered by COVID-19 have caused global trade to tumble. UNCTAD projects global trade would shrink by 20% in 2020. Thai exports have also plunged and would remain weak the rest of the year premised on weaker purchasing power worldwide and several countries imposing lockdown again.

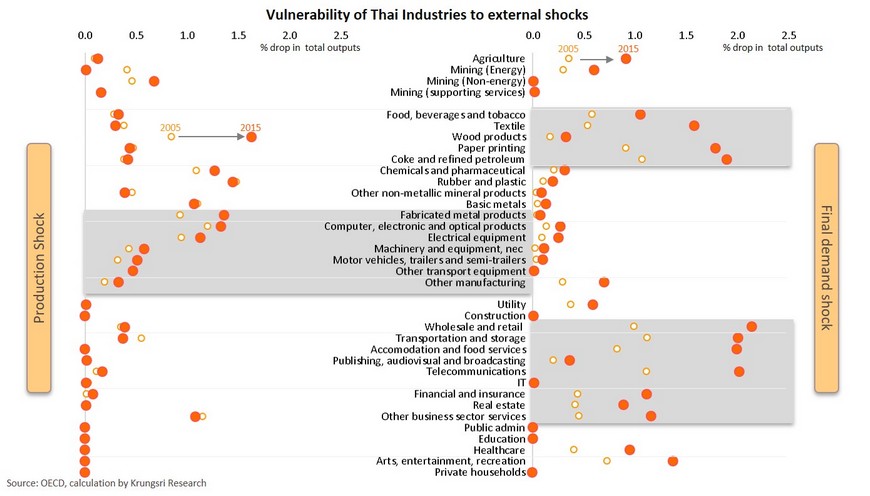

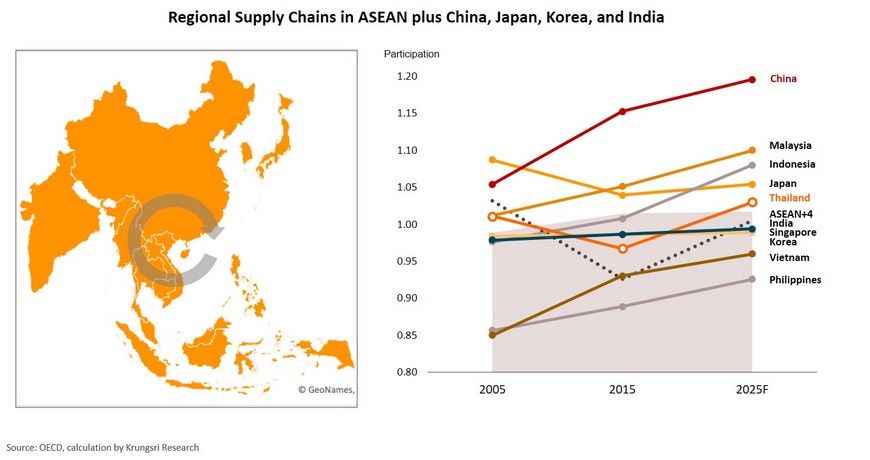

- Weaker global trade could hit Thai industries through global supply chains. Our analysis of the OECD input-output table suggests Thai industries are vulnerable to both global production and demand shocks. More importantly, risks from external shocks had increased in 2005-2015.

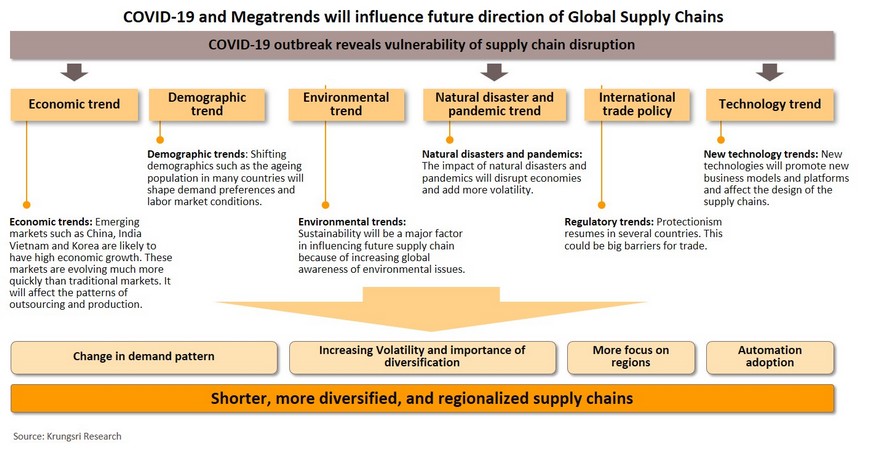

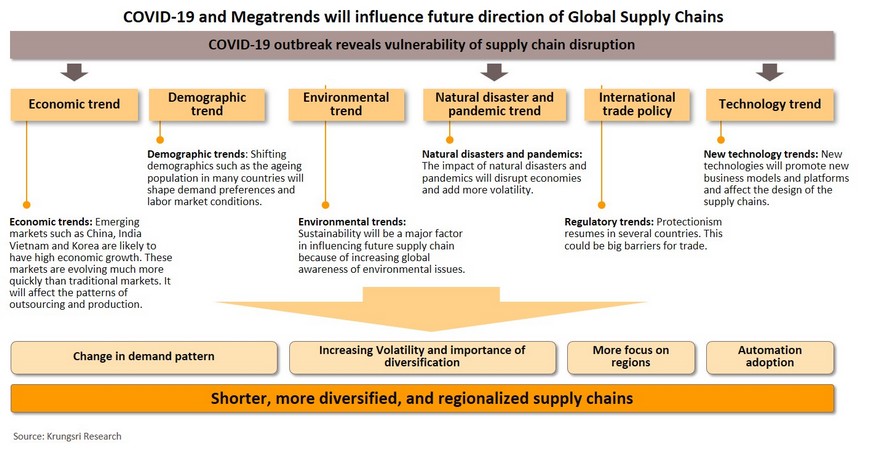

- The new global supply chain would be shaped by COVID-19 as well as global megatrends, such as automation/technology, rising risk and uncertainty, and shifts in international trade policies. The new global supply chain would be shorter, more diversified, and more regionalized.

- Thailand will play a larger role in new global supply chains. Thailand’s participation index is projected to rise from 0.93 in 2015 to 1.03 in 2025, but its position within the supply chain will be unchanged. By sector, Thailand will play a larger role in the global food & beverage (F&B), utility, and financial industries, while its participation would drop in agriculture and mining. It will move downstream in primary sectors and services. Overall exports would rise led by computer and F&B products.

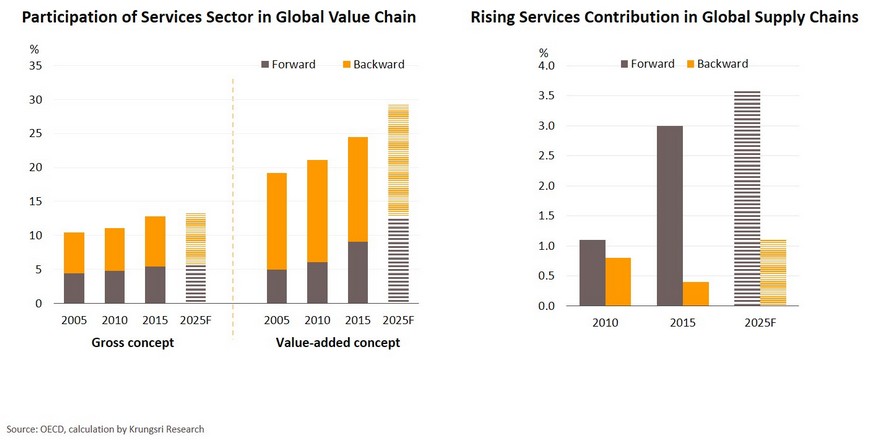

- Greater servicification in agriculture and manufacturing. Services sectors will play a larger role in the new global supply chain. Industries are transforming at the global level and that will induce greater interconnection between sectors.

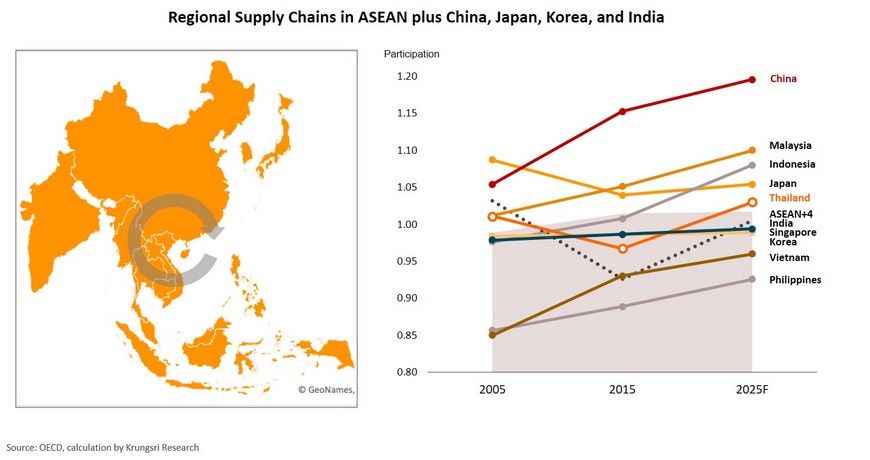

- Regionalized or glocalized supply chains help to build resilience and enhance efficiency to serve different demand needs. Industries may also need to focus on the regional market. Supply chains are shifting from “seeking materials” to “seeking customer satisfaction”.

- Servicification and regionalization would be the main challenges and could turn into either opportunities or threats to Thai industries. The ability to adapt to the new landscape would be a key success factor in the future. The F&B, computer, and financial sectors offer more opportunities abroad. The primary sector, including agriculture and mining, would offer limited opportunities and possibly higher risks.

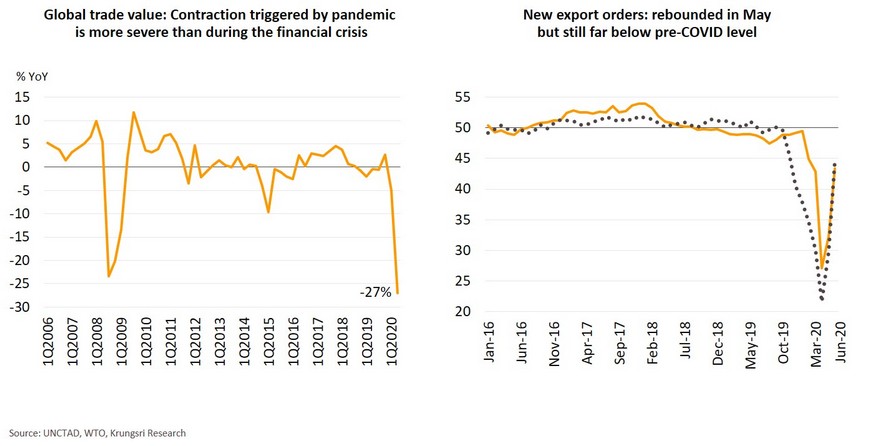

Economic disruptions and weak demand triggered by COVID-19 have shrunk global trade

The COVID-19 pandemic and the resulting containment measures have severely hit the supply and demand sides of economies worldwide. Total value of international trade in goods had dropped by about 5% YoY in 1Q20 and is projected to shrink by 27% in 2Q20, according to UNCTAD. Global PMI for new export orders also signals a further deterioration of international trade. The index suggests the contraction had slowed but remained below-50 and far below pre-COVID-19 levels. The magnitude of the contraction will depend on the severity of economic disruptions as well as economic policy response. UNCTAD projects global trade would shrink by 20% in 2020. This is in line with the World Trade Organization (WTO)’s expectation that international trade would drop by 13%-32%. The wide range of estimates suggests still-high uncertainty about an economic recovery in the period ahead.

Thai exports tumbled along with global trade, dragged by both production and demand shocks

Shrinking global trade could hit Thai industries as they are vulnerable to global supply and demand shocks

The COVID-19 global pandemic has hurt most industries though several channels. The disruption to global supply chains had the largest ramifications on the global economy and financial system because they are inter-connected. There was disruption to both the supply and demand side. Our analysis of the OECD input-output table suggests Thai industries are vulnerable to both global supply disruption and external shocks in final demand. In addition, risks from external shocks had increased during 2005-2015. The services and basic manufacturing sectors have large exposure to external demand. Hi-tech industries are exposed to supply disruption.

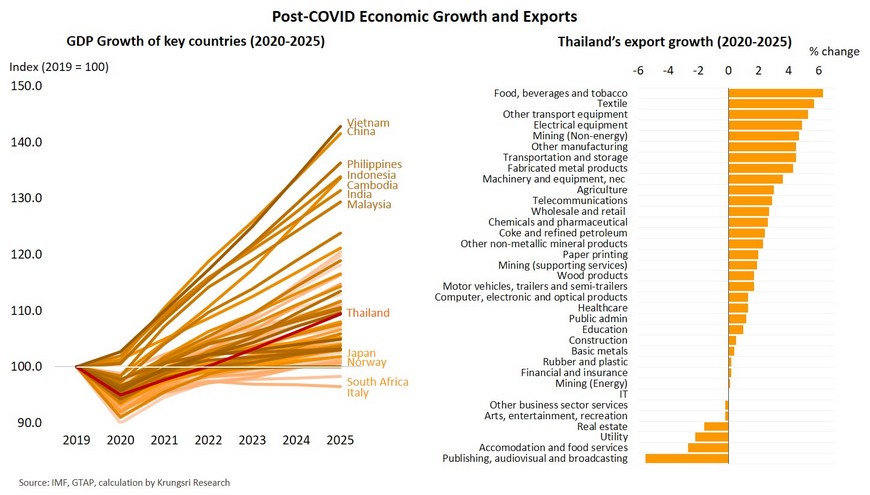

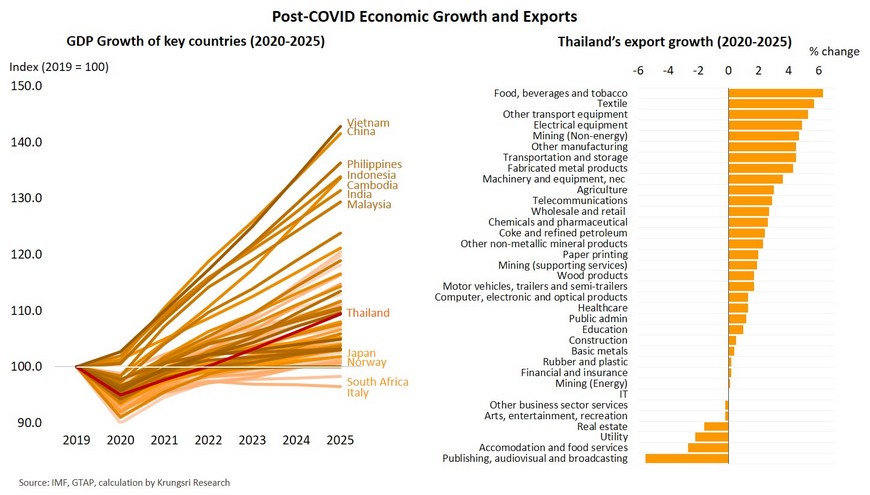

Most economies will return to pre-pandemic level by 2023

Most countries will experience a deep recession in 2020 due to supply disruption and demand shocks. However, our analysis also suggests most will return to pre-pandemic level by 2023. Vietnam, China, and the Philippines will be among the fastest-growing economies. However, Italy and South Africa might only recover to pre-pandemic levels after 2025. By sector, there are promising export prospects for the F&B and textile sectors. The changes in the economic trajectories and export trends in each sector will influence demand, trade and investment patterns.

New global supply chains will be shaped by COVID-19 as well as global megatrends

The COVID-19 pandemic will leave scars on global supply chains. It has revealed the vulnerability of global supply chains, and this is encouraging greater adoption of technology to mitigate the adverse impacts of COVID-19 and improve efficiency. The future of our supply chains is also being shaped by global megatrends. Changes in economic and demographic trends will trigger a shift in economic power, and change trade and consumption patterns. Environmental, natural disaster and pandemic trends have heightened risks and volatility. Protectionism, trade war, and other regulatory trends are encouraging regionalization. Meanwhile, advancements in technology are accelerating automation in industries and businesses. For new supply chain, the main consideration would be to balance efficiency and resilience as the global economy and international trade becomes more volatile. Consequently, we expect the new global supply chains to be shorter, more diversified, and regionalized.

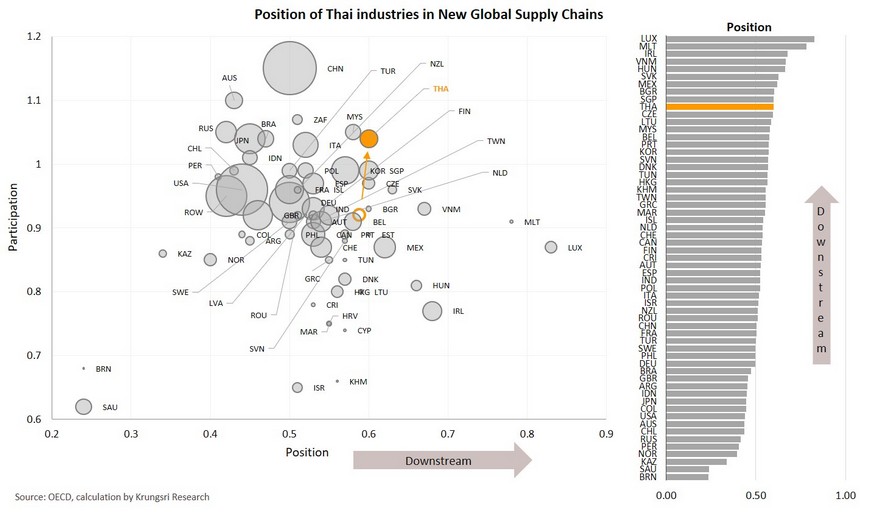

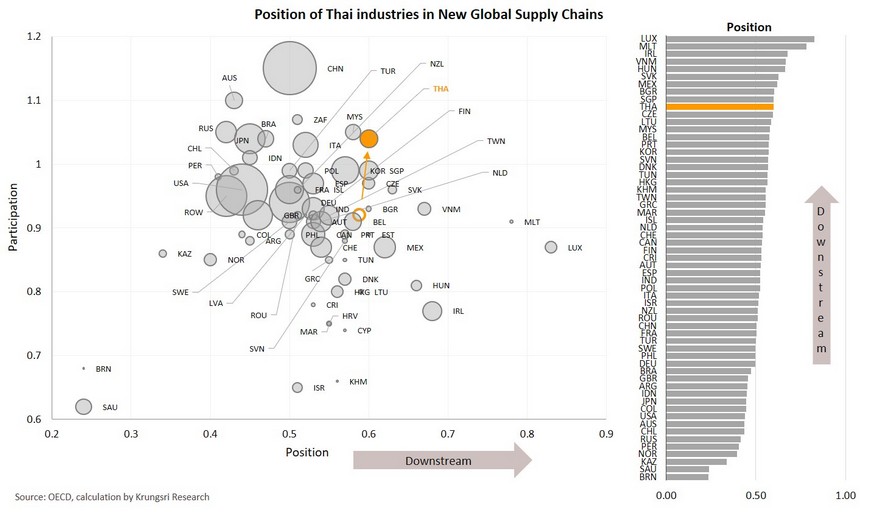

I. Thailand will increase participation in the new global supply chains

Our analysis of the OECD input-output table suggests Thailand will increase its participation in the global supply chains. The Participation Index will increase from 0.93 in 2015 to 1.03 in 2025 but Thailand’s position along the supply chain will be unchanged.

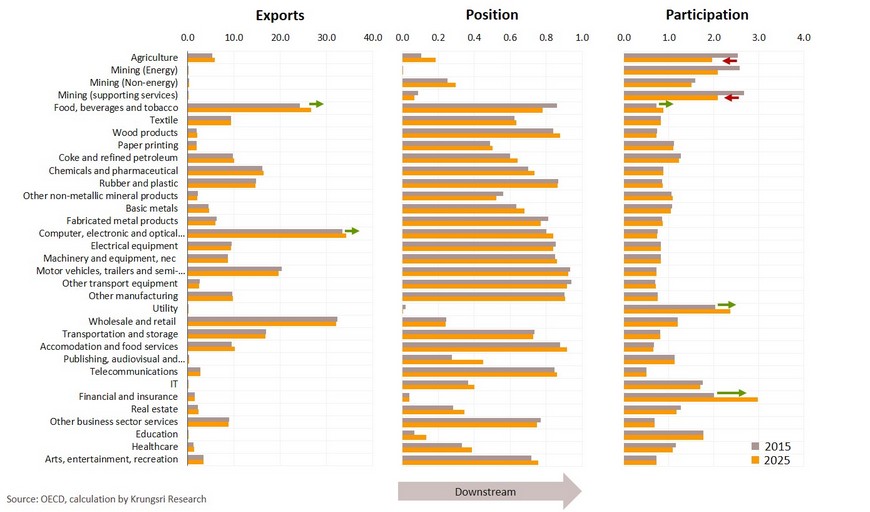

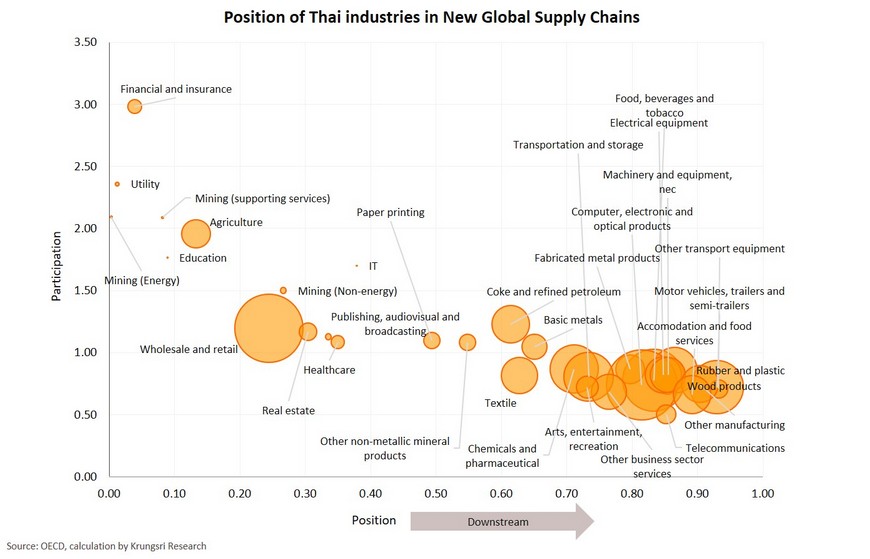

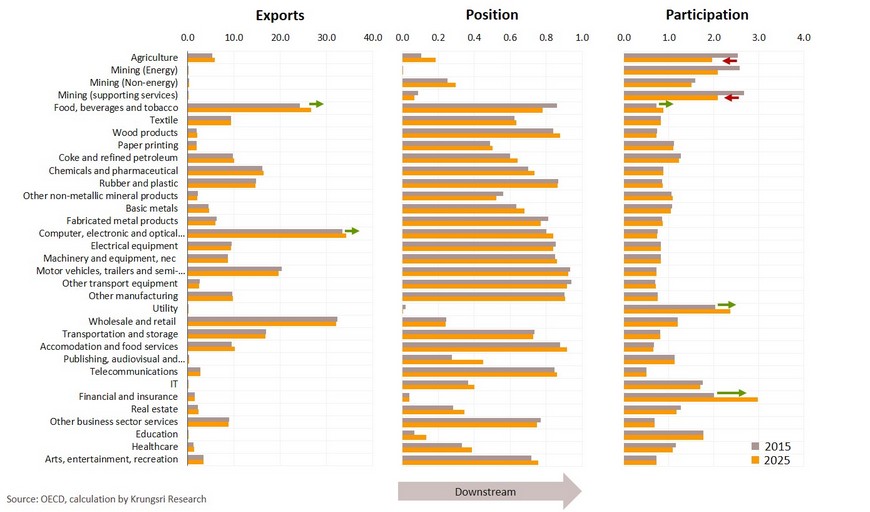

F&B sector will see strong export growth and move downstream; financial sector will increase role in GVC

F&B, utility, and financial sectors would be among those to see larger participation in global value chains (GVC). Agriculture and mining sectors would participate at a smaller level. This can be an opportunity to derive economic benefits in terms of enhanced productivity, sophistication and diversification of exports. Primary sectors and services will move downstream. Overall exports would rise led by strong growth at the computer and F&B sectors.

Most Thai industries will remain in downstream positions in the new global supply chain

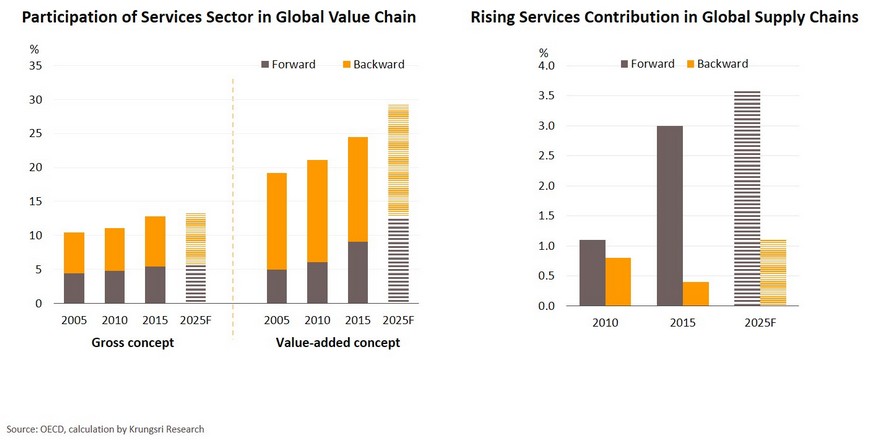

II. Servicification will accelerate in manufacturing sector with blurring borders between industries

The services sector will play a greater role in global value chains in both the gross and value-added concepts. The share of services in the value-added concept will be much higher, which suggests the services sector will increasingly blend into other sectors. The services sector would also see greater forward linkages, meaning it would be increasingly used as intermediate input in other sectors. This would lead to rising servicification in the agriculture and manufacturing sectors. It also implies industries are transforming in some ways at the global level and there would be greater inter-connection among the different sectors. One example is in the automotive industry – mobility services -- has become a new trend by blending digital technology and services in the industry.

III. Regionalization or glocalization is the new norm

The global supply chain is shifting from “seeking materials” to “seeking customer satisfaction”. Regionalized or glocalized supply chains help build resilience while enhancing efficiency to serve different demand needs. Several countries are increasing their participation in global supply chains, but regional participation is increasing at a faster pace. This implies greater value-creation within a region than at the global level, and suggests industries should focus on the regional market.

Regional Economic and Policy Developments in August

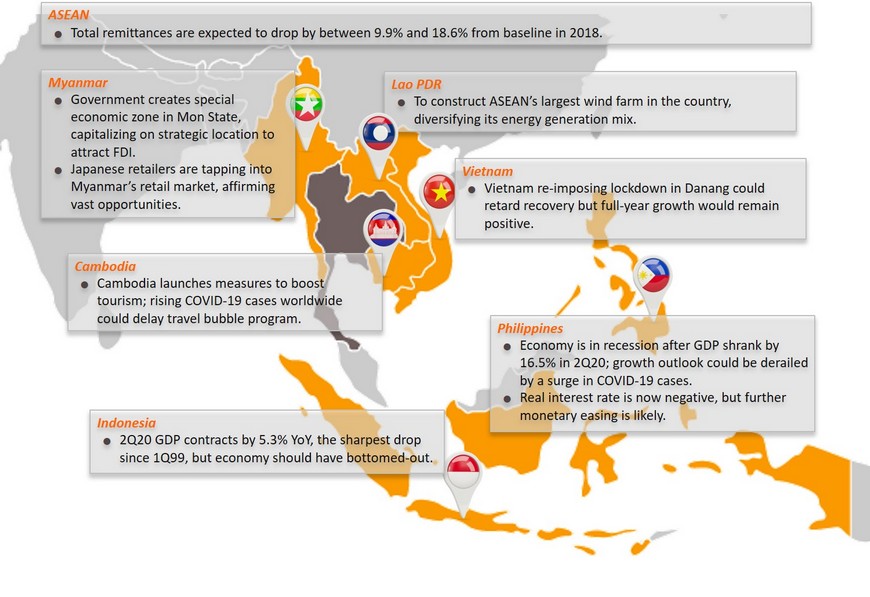

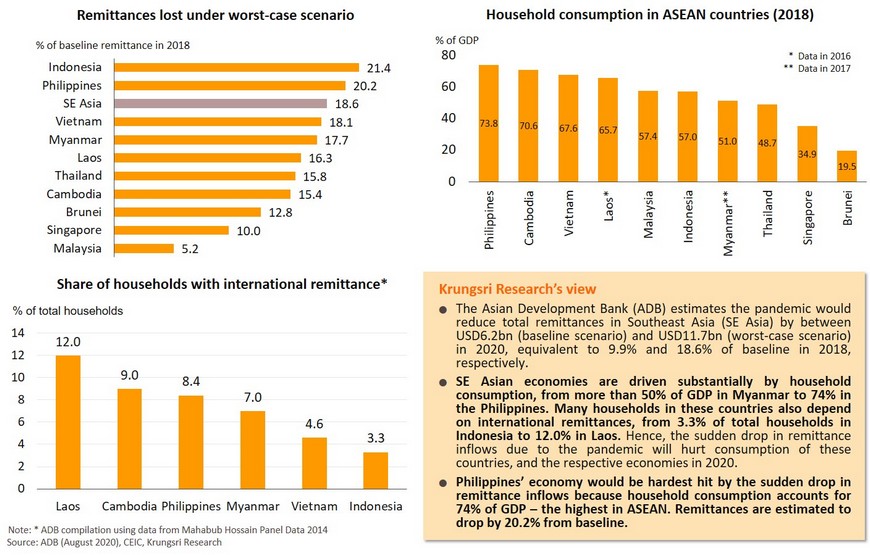

ASEAN: Total remittances are expected to drop by between 9.9% and 18.6% from baseline in 2018

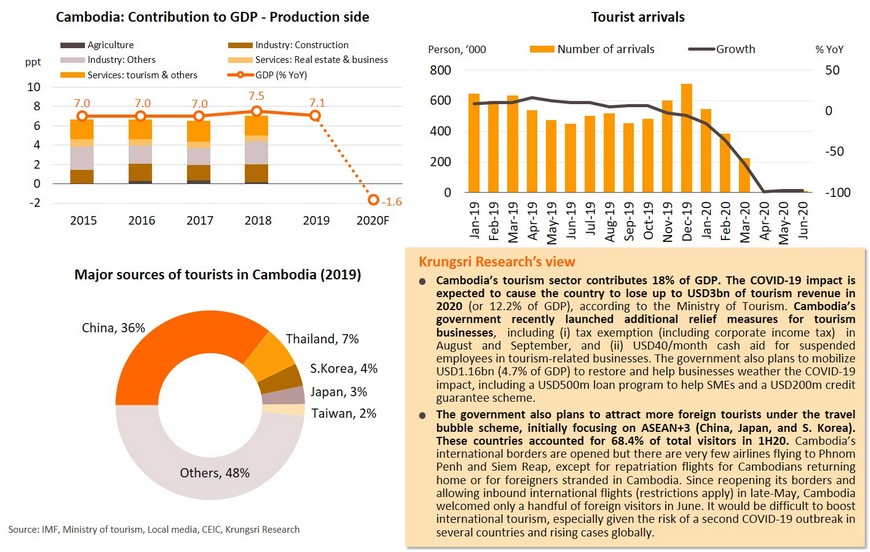

Cambodia launches measures to boost tourism; rising infections worldwide could delay travel bubble program

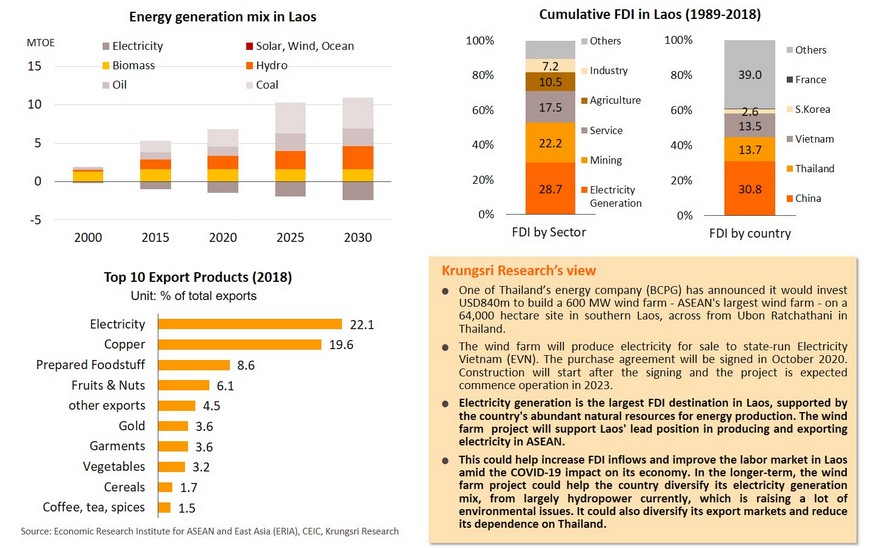

Lao PDR: To build ASEAN’s largest wind farm in the country, diversifying its energy generation mix

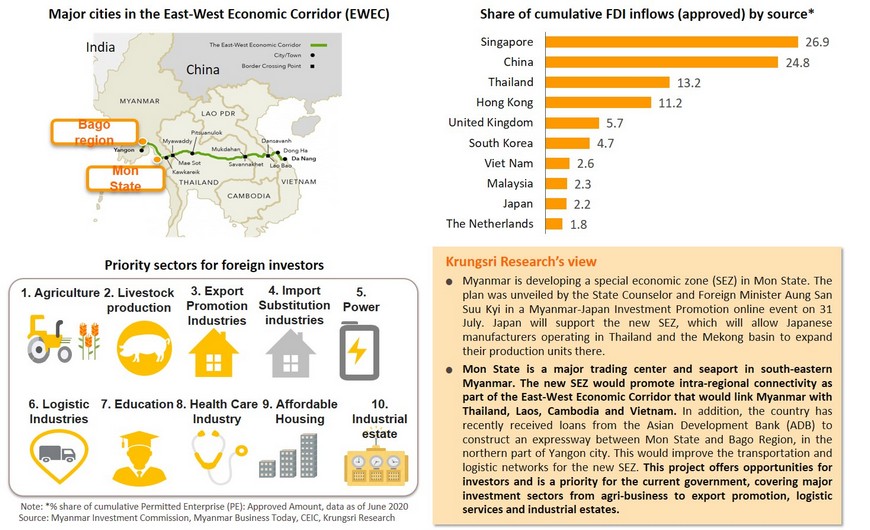

Myanmar: Government creates special economic zone in Mon State, capitalizing on strategic location to attract FDI

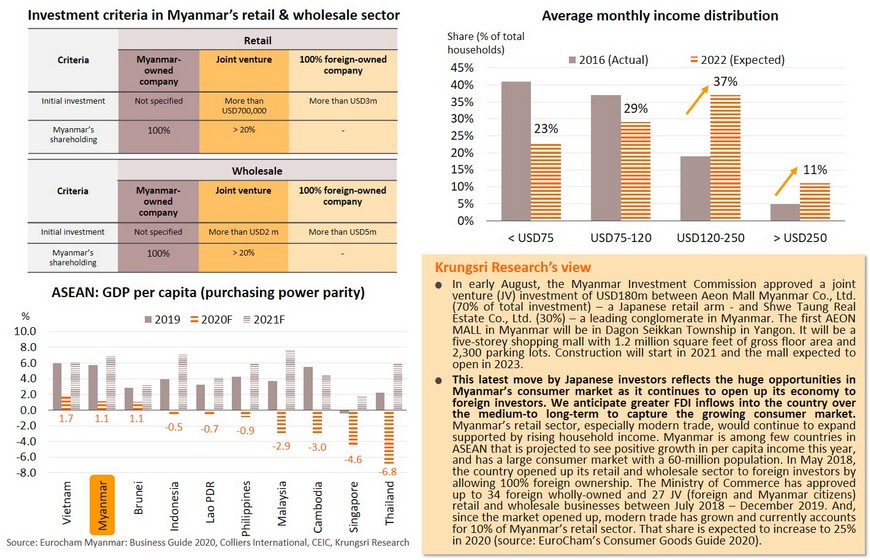

Japanese retailers are tapping into Myanmar’s retail market, affirming vast opportunities

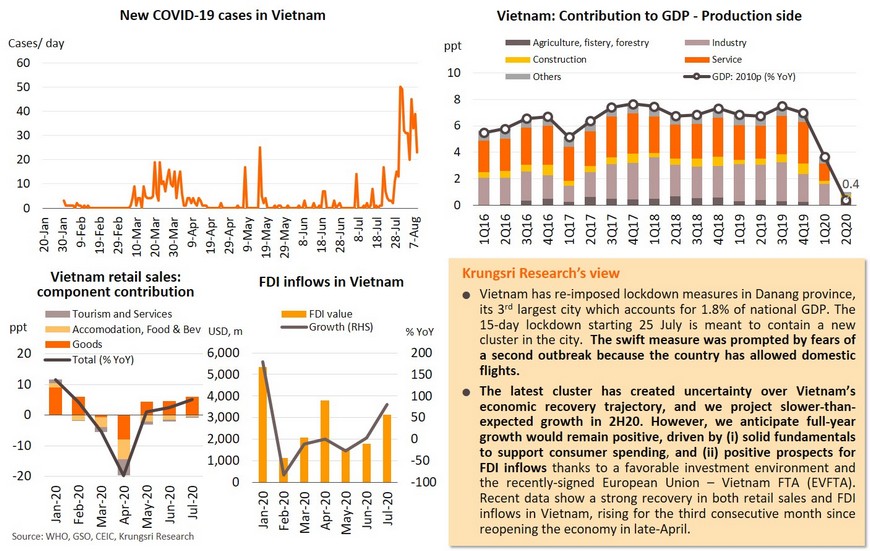

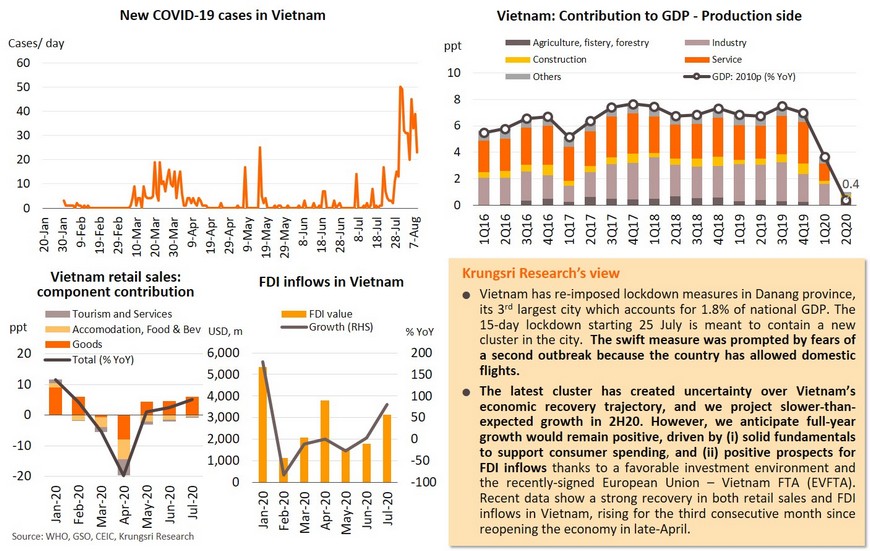

Vietnam: Re-imposing lockdown in Danang might drag recovery but full-year growth would remain positive

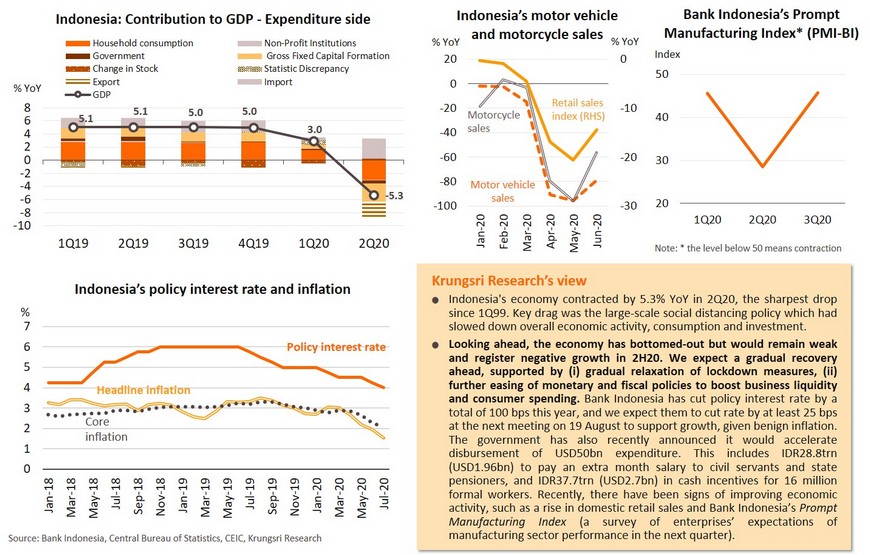

Indonesia: 2Q20 GDP contracts by 5.3% YoY, the sharpest drop since 1Q99; economy has bottomed-out

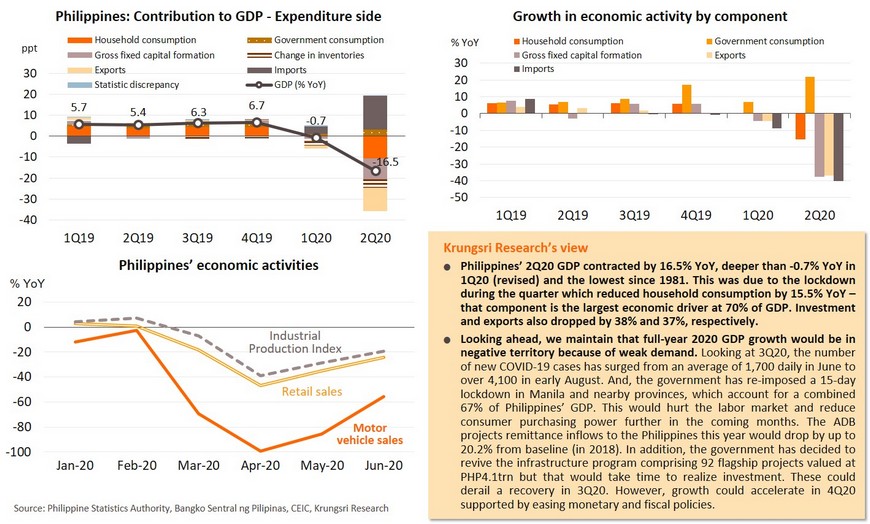

Philippines: Economy is in recession after GDP shrank by 16.5% in 2Q20; growth outlook could be derailed by a surge in COVID-19 cases

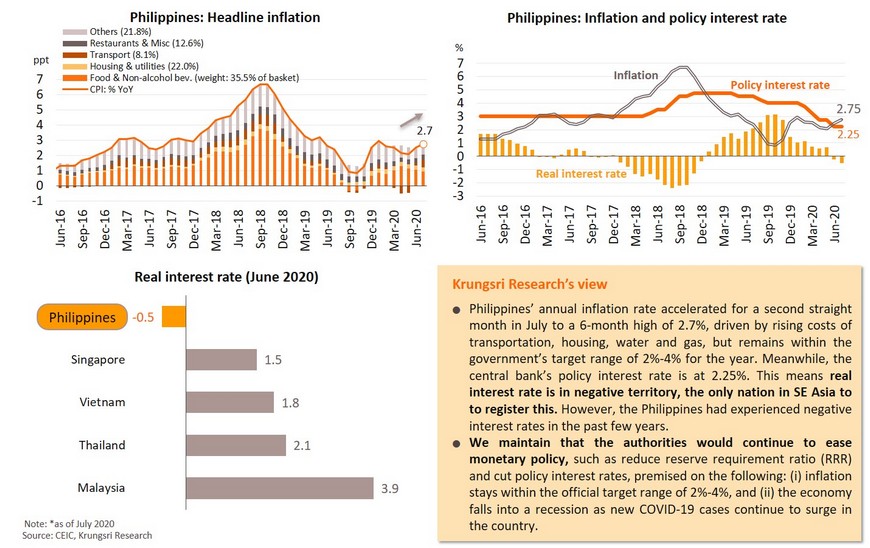

Philippines’ real interest rate is negative but further monetary easing is likely