Global: Recovery gathers momentum

Economic conditions are expected to improve in most regions, led by advanced economies

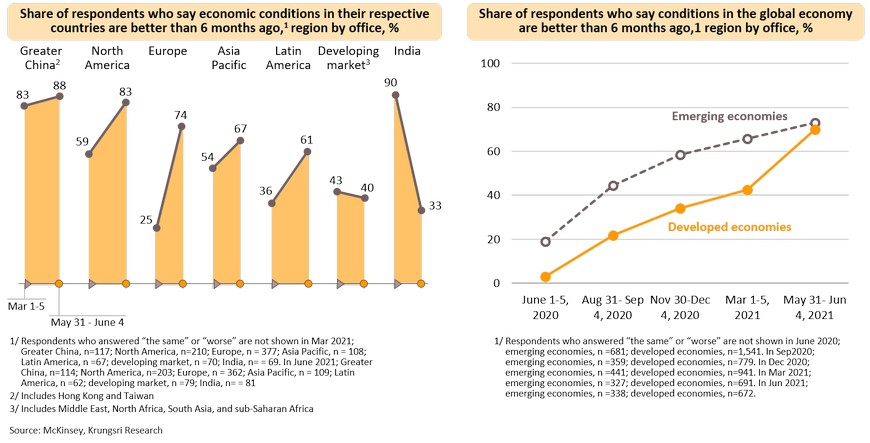

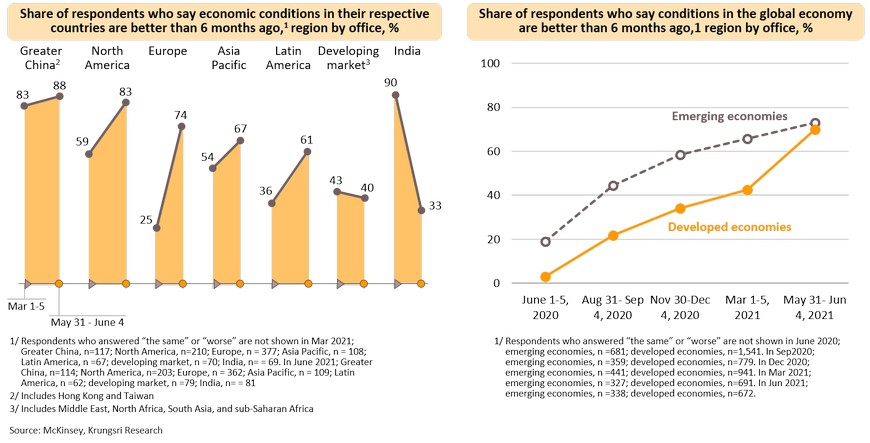

Economies in most parts of the world are improving, except for India and developing markets (including the Middle East, North Africa, South Asia, and sub-Saharan Africa). Executives are more upbeat about their own economies. According to a survey by McKinsey, 73% of respondents said conditions in their home economies are better now than they were six months ago compared to 53% in the previous quarter. This is the first time in three years that a majority of respondents reported improving conditions at home. In addition, the share of respondents who believe global economic conditions are better now than they were six months ago has risen to 70%, the largest in more than 10 years. Executives in developed economies are increasingly optimistic about global economic conditions, as are those of emerging-economies.

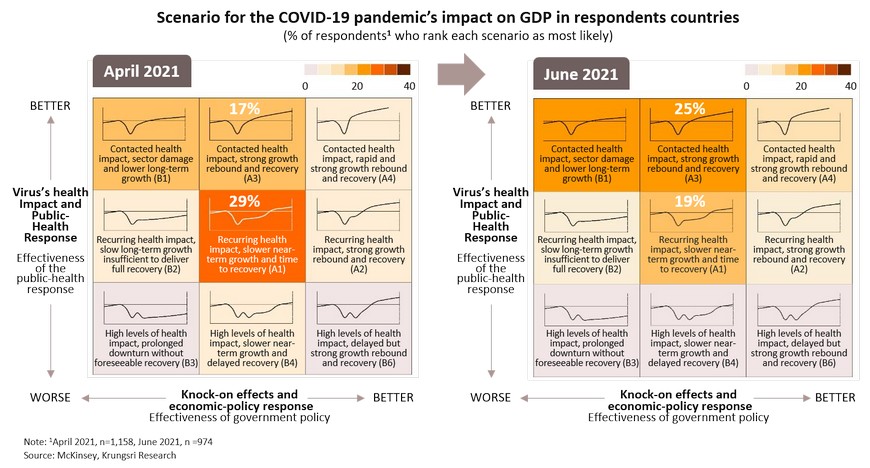

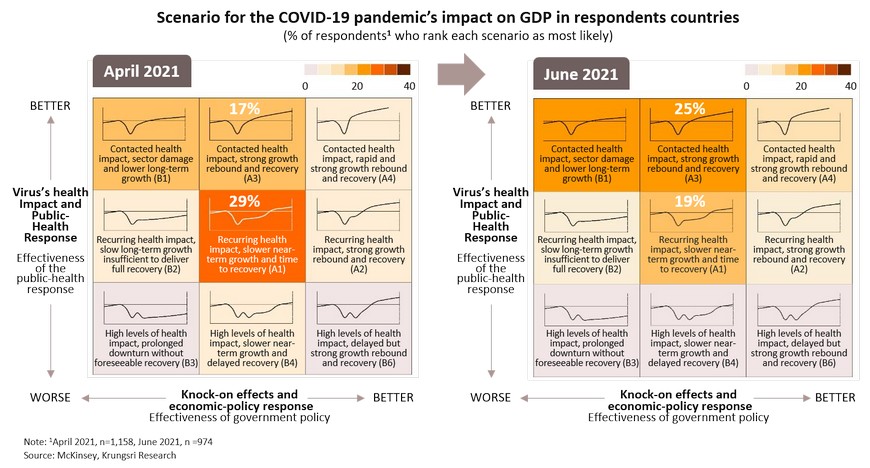

More respondents believe latest outbreak would be contained and economy would recover soon

In another sign of optimism, more respondents selected growth-oriented scenarios as the most likely outcome for their respective economies. All three scenarios involve effective control of COVID-19, instead of a recurrence of or failure to contain the virus in April’s survey. On the nine likely scenarios for pandemic impact on the economy, for the first time since July 2020, 25% of respondents selected A3 (characterized by successful containment of virus and public-health impact, and strong economic recovery) compared to only 17% in April. A3 replaces A1 (localized recurrences of the virus and slower near-term growth) as the most likely scenario. Only 19% of respondents now rank A1 as most likely, down from 29% previously.

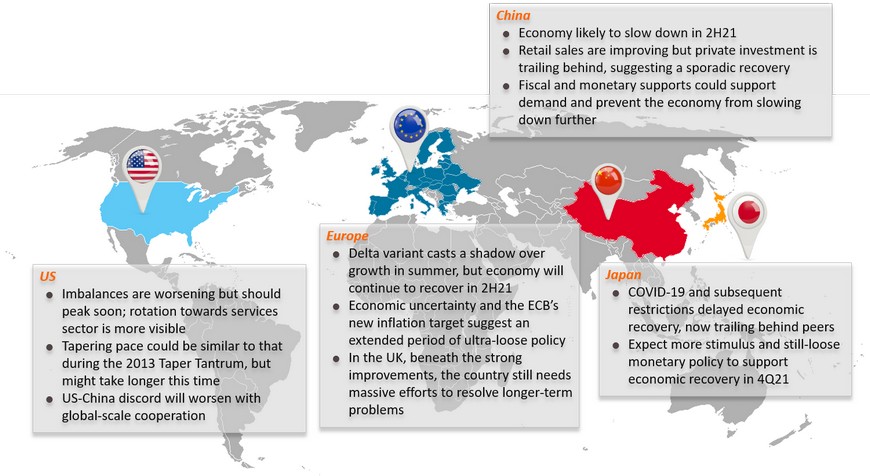

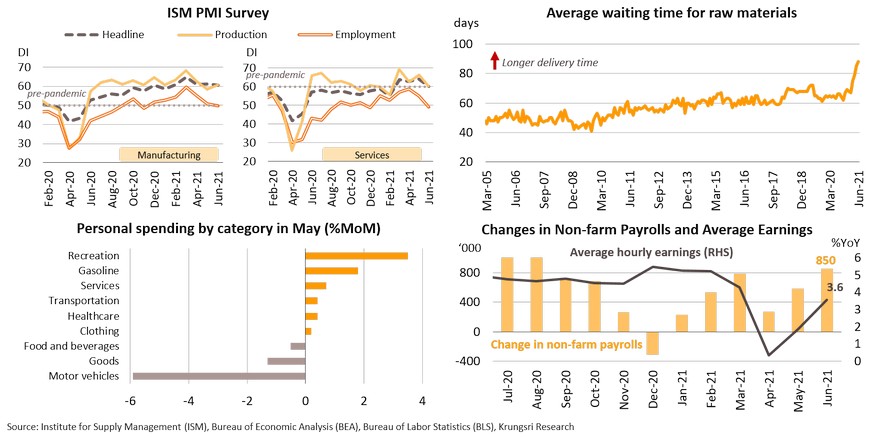

US: Imbalances are worsening but should peak soon; rotation towards services sector is more visible

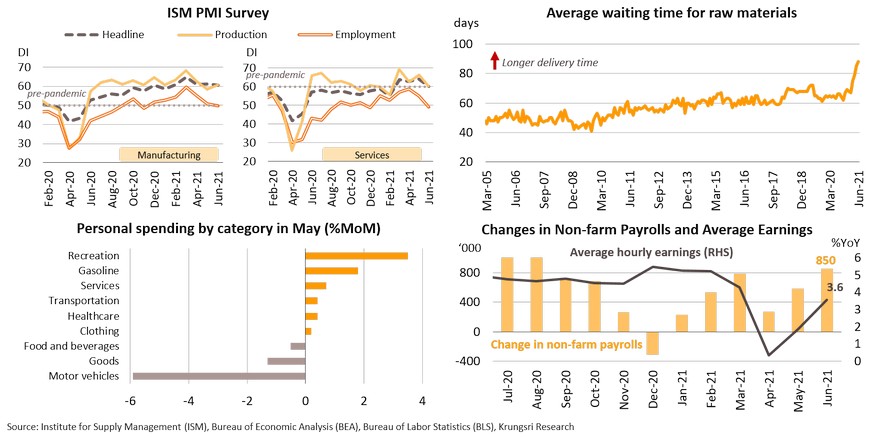

Economic growth remains strong but supply and demand imbalances are capping the upside of growth. Manufacturing PMI showed factory strains have eased only mildly in June but the waiting period for raw materials hit a record-high of 88 days. This would be near the worst supply bottleneck before easing in late 3Q21 due partly to fading effects of pent-up demand. Services PMI pulled back slightly after hitting record-high in the previous month. Employment sub-index signaled a larger contraction due to labor shortage, especially in tourism sector and restaurants. Rotation towards services spending is more visible since 2Q21 as spending on services rose 0.7% MoM in May led by recreation sector, while spending in goods dropped by 1.3%. Non-farm payrolls increased by 850k jobs, indicating labor is filling new jobs. Average hourly earnings were volatile in recent months due to the uncertain labor market and employees offering special bonus to return to work. Looking ahead, wages could trend up as the government supports a minimum wage hike. Although higher wages would push up prices, it could also lift consumer purchasing power. Coupled with accumulated savings and wealth from pandemic stimulus measures, consumption should be strong in 2H21.

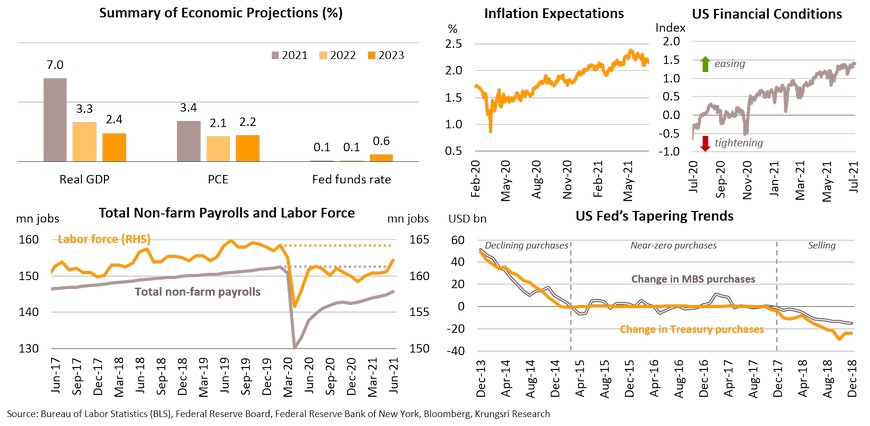

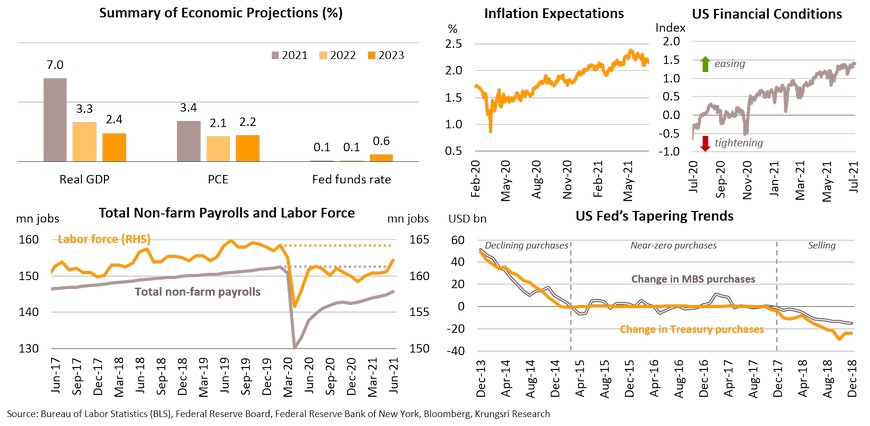

Tapering pace could be similar to that during the 2013 Taper Tantrum, but might take longer this time

The June FOMC meeting suggested the Fed might raise rates faster-than-expected, possibly to 0.6% in 2023, according to median projections. The Fed has already observed good economic progress and could meet their criteria for ‘substantial progress’ by the end of the year. Inflation has surged after reopening and inflation expectations remain above the Fed’s target. The Fed acknowledges inflation pressures are stronger and more persistent than anticipated. Moreover, financial conditions have eased since November last year. This suggests the central bank has achieved its objective of injecting liquidity. Amid the plentiful job openings, if the US can add about 600k jobs per month in 2H, that would bring unemployed workers to below 2 million (near pre-pandemic level) by year end, assuming a smaller labor force due to retirement and voluntary unemployment. We maintain that the Fed would announce tapering in 4Q21. Based on past trends, the Fed would taper gradually starting with reducing monthly purchases of Treasury and MBS by USD5–10bn each in the first year after the announcement. Subsequently, they would drop purchases to zero for few years before deciding to sell these assets. The tapering this time would be similar that during the 2013 Taper Tantrum, but the larger purchase volume during the pandemic suggest it would take about 2 years to taper down to near-zero.

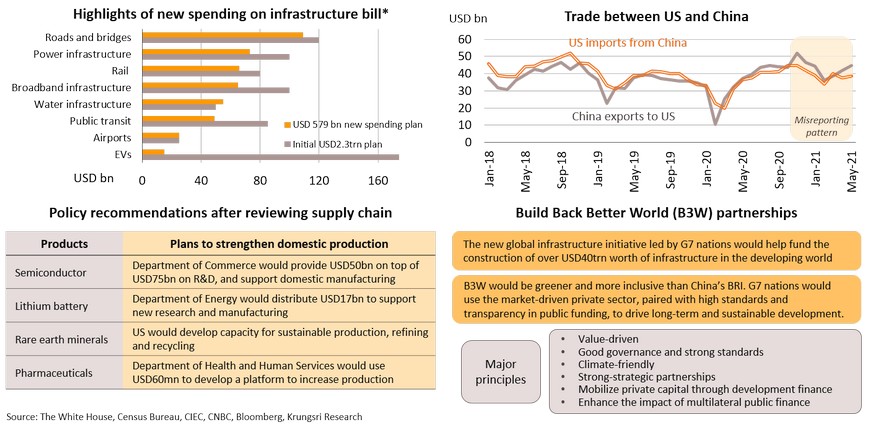

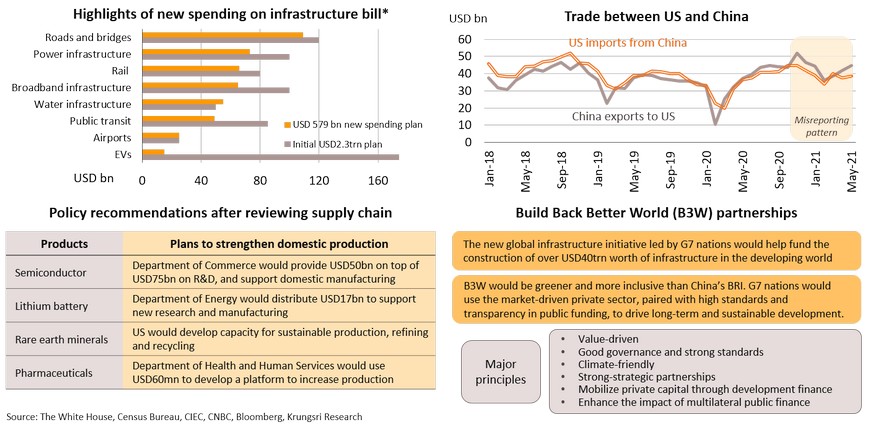

US-China discord will worsen with global-scale cooperation

Apart from the short-term goals of supporting recovery, the government will again address the local transportation and networks to maintain the US’s position to compete with China in the 21st century. The White House and senators have reached an agreement on the infrastructure bill comprising USD579bn in new spending. But combined with the renewal of existing funding for infrastructure, total spending would reach only USD 1.2trn over the next 8 years, short of the initial proposal of USD2.3trn. However, this is unlikely to be a final deal as the democrats could use the budget reconciliation process to pass relief packages together with the American Families Plan or the Congress could approve the rest of the packages as separate bills. US-China tension is likely to escalate, triggered by a range of disputes, from bilateral trade to cooperation with other major countries and sowing discord against China on a global scale. In trade, the US and China have both misreported trade data to benefit from tax policy, but that has caused the US to lose USD10bn in tax revenues in 2020 and widened US trade deficit. The US administration has announced steps to strengthen the domestic supply chain and build up manufacturing capacities, targeting critical products. Besides, the US would continue to seek more strategic alliances with the EU, Quad, NATO and developing countries by funding infrastructure under the Build Back Better World (B3W) program, to offer an alternative to China’s BRI. Looking ahead, US policies on China would remain aggressive with more strategic competition, the global supply chain would decouple gradually, and tensions could persist and become more difficult to resolve.

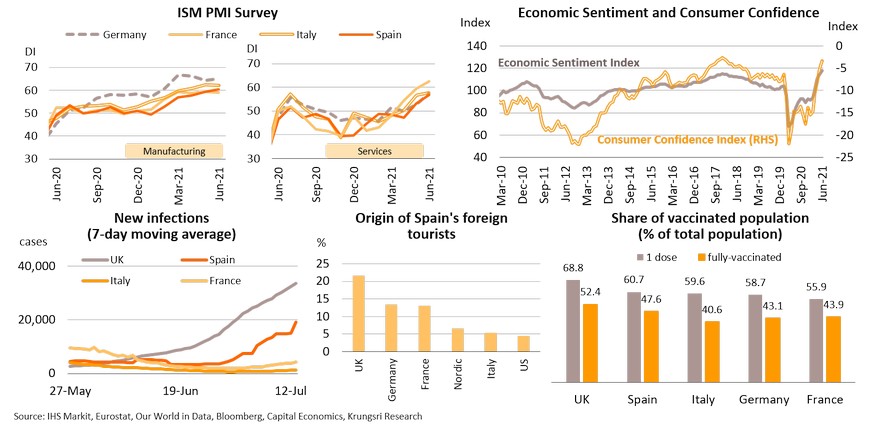

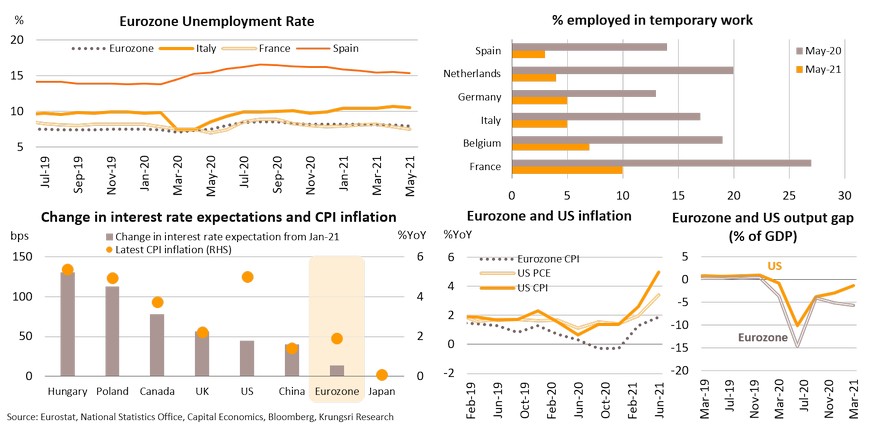

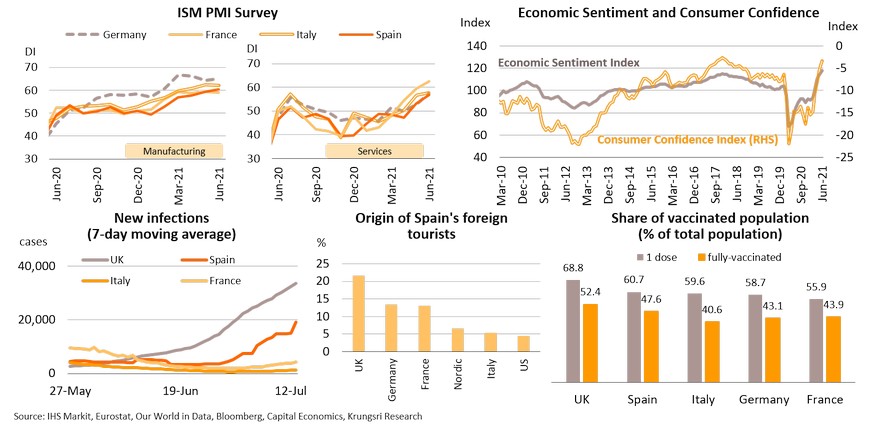

EU: Delta variant casts a shadow over growth in summer, but economy will continue to recover in 2H21

The economic recovery trajectory is being threatened by the more-infectious delta variant, leaving vaccination programs to bear the burden of supporting recovery. Manufacturing sector continues to expand but there are lingering supply problems. Eurozone is optimistic the services sector would recover fueled by more social gatherings. Consumer confidence has improved to above pre-pandemic levels and is close to a new high, which confirms expectations for domestic demand to recover in the coming quarters. Despite these developments, the delta variant continues to threaten recovery. New cases in the UK and Spain have almost tripled in early July, prompting some countries to apply stricter regulations for UK travelers. Spain would be hit hard because UK arrivals make up the majority of tourists in the country. However, more than half the population in major economies have received at least one dose of vaccine, suggesting it is still possible to ride on intra-EU tourism. In our view, the impact of new waves on tourism-reliant countries would be more visible in late July. This implies recovery could stumble in 3Q21, especially in the tourism and services sectors, but there would be limited impact on 2H21 economic growth because pent-up demand would partly offset the impact of rising daily cases, and initial disbursements under the EU Recovery Fund would start in 3Q21.

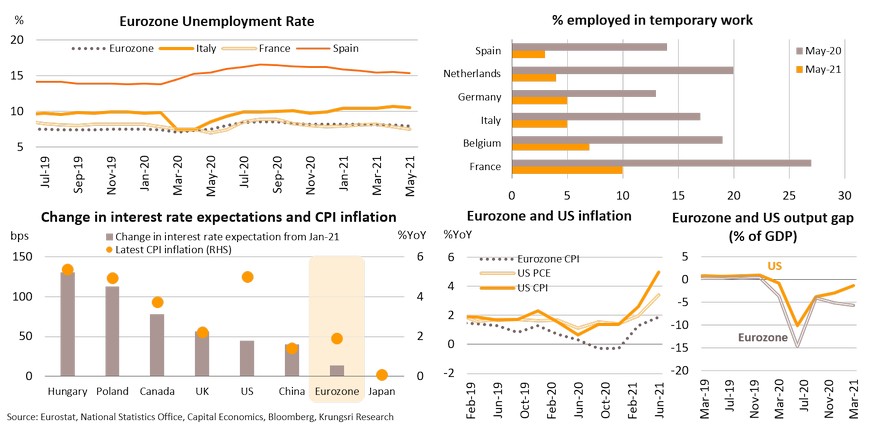

Economic uncertainty and the ECB’s new inflation target suggest an extended period of ultra-loose policy

Rapid economic developments and rising inflation worldwide will pressure central banks to tighten policy or hike rates, but the ECB is unlikely to do that. High uncertainty will continue to encourage the ECB to provide support to ensure a sustainable recovery. Jobless rate in Eurozone has not spiked because of the job retention programs. Although the number of furloughed workers had dropped across the bloc in 2Q21, jobless rate would rise later this year after the furlough schemes start to expire from September, which would make the labor market more volatile. On monetary policy, the ECB agreed on a new inflation target of 2% compared to ‘below but close to 2%’ and to allow inflation to overshoot target if needed. This would justify the move to maintain record-low interest rates and ultra-loose monetary policy for longer. The ECB would change its guidance at the July meeting to reflect the new framework, additional stimulus, and inflation outlook. Typically, interest rate expectations rise the most where inflation has been highest. Unfortunately, inflation in Eurozone is rising slower than in the US and other advanced economies, suggesting the underlying trend remains fragile, and the output gap in the Eurozone indicates there still needs to be supportive policies. The combined factors could push the ECB to continue to buy bonds under the PEPP program until March 2022, to increase purchases under the APP throughout next year, and to maintain record-low interest rates at least until 2023.

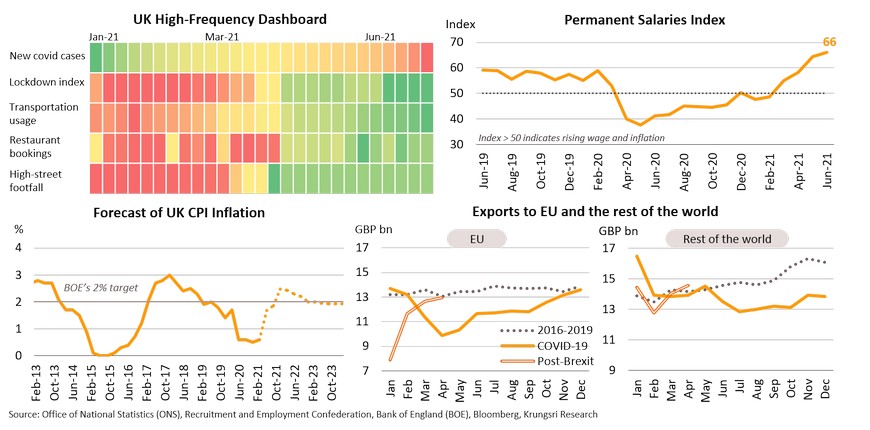

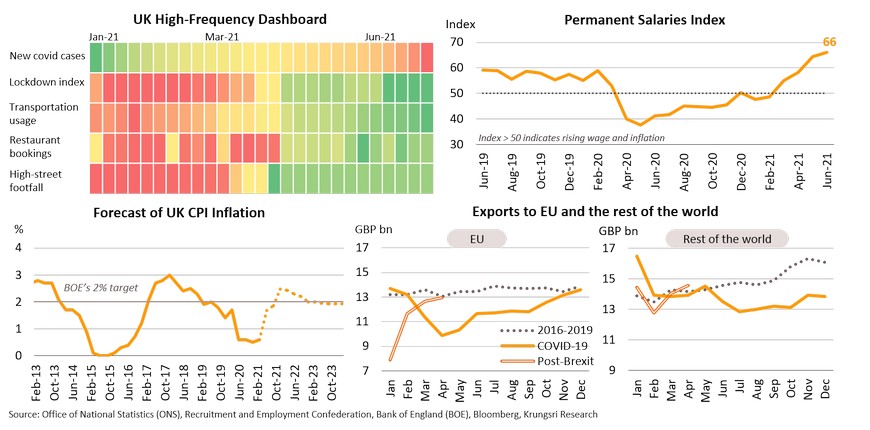

UK: Beneath the strong improvements, nation still needs massive efforts to resolve longer-term problems

Economic activity has improved significantly since the beginning of the year driven by the retail and services sectors. High-frequency data indicate notable developments in outdoor activities along with easing restrictions. However, new covid cases dominated by the more-infectious delta variant has delayed reopening to late-July. Shortage of several key inputs would affect recovery in 2H, including raw material, food and labor mainly due to logistics problems, supply disruptions, and lack of truck drivers. Permanent Salaries Index rose sharply in June, reflecting a shortage in both labor supply and skilled workers. The shortage problem might be extended due to slower immigration and additional red tape in dealing with EU consumers and suppliers after Brexit, which could feed into inflationary pressure. The BOE forecasts inflation would peak at 2.5% this year before falling to their 2% target. Rising inflation would encourage the central bank to raise interest rates sooner, with the first rate hike possible in 1H23. The UK has more to do to ease post-Brexit adjustments, especially in trade and business services. Despite rising exports, the UK could lose its regional hub status for the services sector and there could be reshoring of EU companies. That means the UK would need to negotiate new trade agreements such as the CPTPP, and pivot away from Europe to stay competitive. Thus, any reopening accomplishments would not guarantee long-term prosperity. The UK needs to put in greater efforts to avoid scars on the economy caused by Brexit.

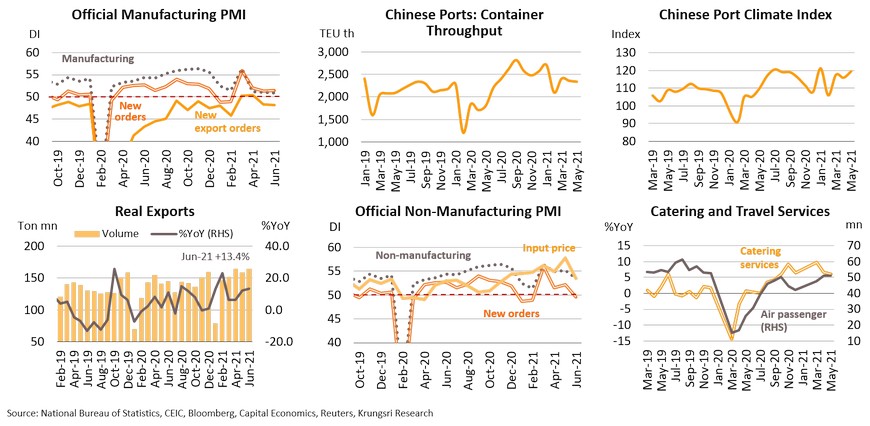

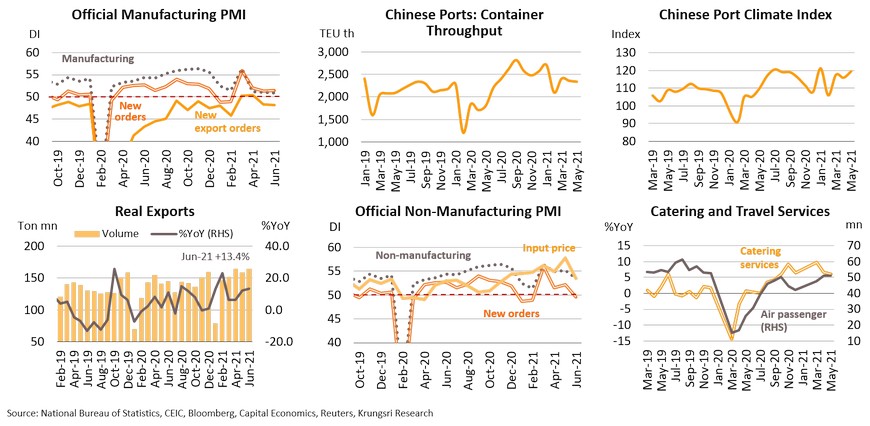

China: Economy likely to slow down in 2H

In 2Q21, China’s GDP growth improved to +1.3% QoQ sa (from +0.4% in 1Q21. However, it decelerated to +7.9% YoY, slower than market expectation (and compared to +18.3% in 1Q21). Towards the end of 2Q21, there were signs of a slowdown, with June Manufacturing PMI falling to a 4-month low of 50.9. However, that was partly due to temporary supply bottlenecks at Shenzhen’s Yantian Port as well as tight container shipping capacity, as reflected by falling container throughput. Since the port resumed operations, the congestion in marine traffic has gradually eased along with an improving Port Climate Index. And hard data (June exports) revealed that external demand continued to grow along with recovering global trade. Meanwhile, Non-Manufacturing PMI slipped to 53.5 as new orders decreased, partly due to stricter measures to control the outbreak in the southern region but the Input Price sub-index could grow amid the epidemic containment. Although China still has several growth drivers, the supply-side economy - manufacturing and non-manufacturing sectors – show signs of slowdown from the beginning of the year.

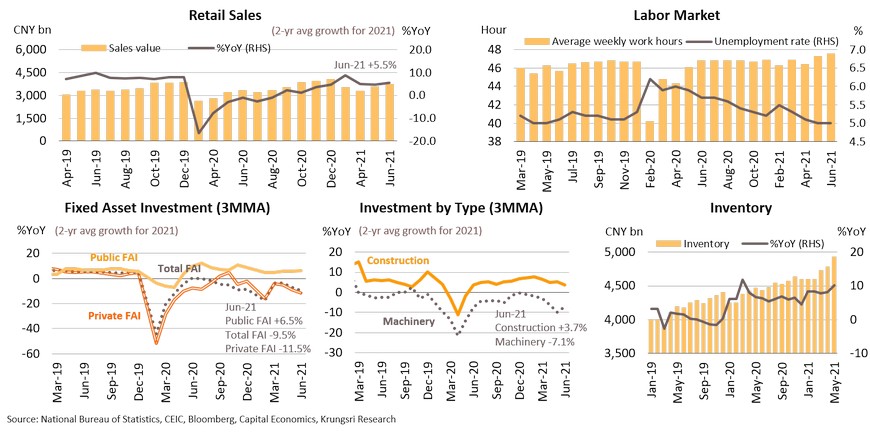

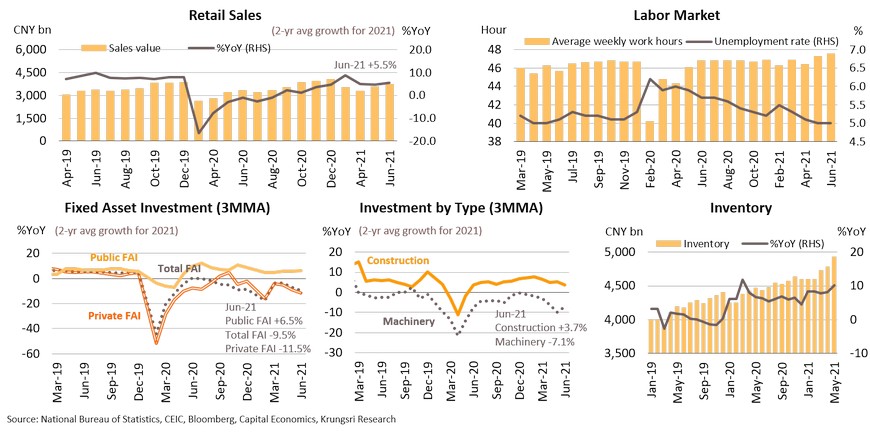

Retail sales are improving but private investment is trailing behind, suggesting a sporadic recovery

The post-pandemic recovery is not broad-based given private investment remains weak, but domestic consumption has improved. June retail sales posted positive growth for the 8th consecutive month, driven by the improving labor market. Unemployment rate remains at a 2-year low of 5.0% while average weekly working time is at a 4-year high of 47.6 hours, indicating a tightening labor market. These pressures will push up wages, which would in turn, support the recovery in household consumption. But in contrast, private investment remains weak and is even falling behind public investment. The 2-year average growth of private fixed asset investment has contracted for the 6th straight month. Meanwhile, public investment growth in 1H21 is slower than the year before. In addition, construction spending has outpaced spending on machinery & equipment, suggesting the business sector has slowed down expansion activity. And, the piling up of inventory would also prompt manufacturers to delay investment. Hence, the recovery in domestic demand is uneven and requires further supporting policy measures, especially to boost private investment.

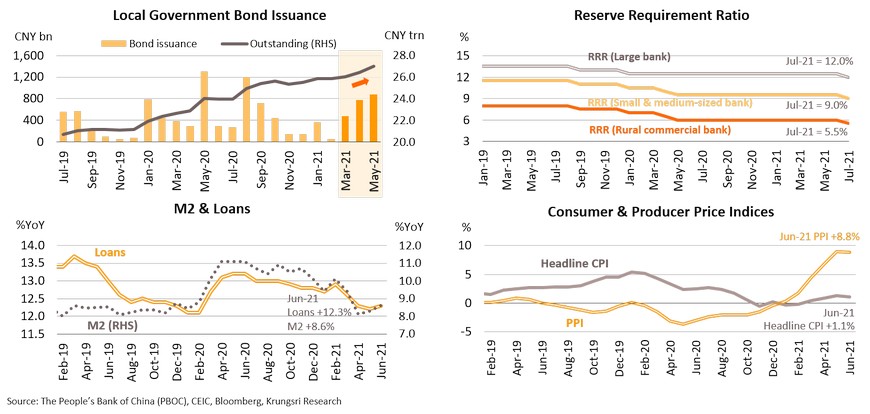

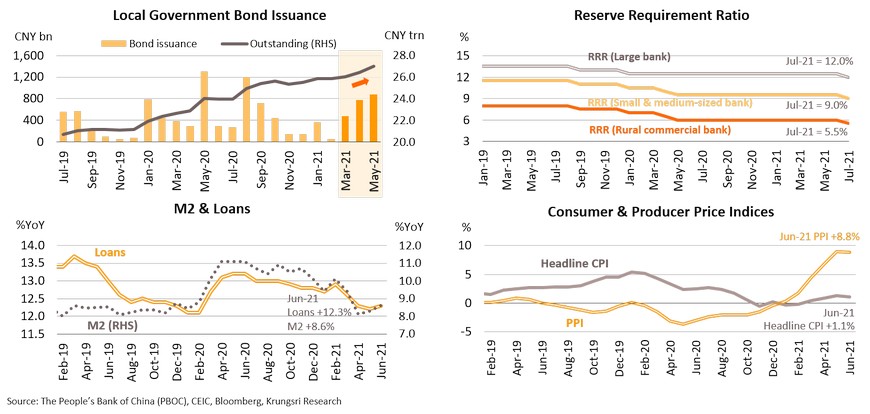

Fiscal and monetary measures could support demand and prevent the economy from slowing down further

To spur domestic demand, especially still-weak investment, China is stepping up public investment. Recently, local governments have issued more bonds to boost infrastructure investment. In May, it recorded CNY875bn, the highest since September 2020. On the monetary side, the People’s Bank of China (PBOC) announced it would cut reserve requirement ratio (RRR) for all banks by 50 bps, effective 15 July, 2021; this is the first reduction in 15 months (since the pandemic started). It will inject additional liquidity into the banking system, in order to increase credit supply to shore up domestic demand. In June, banks’ loan growth inched-up for the first time since February, alongside slowly expanding money supply. Reducing RRR would allow banks to lend out more. In terms of inflationary pressure, both headline and factory-gate inflation rates have passed the peak but have not led to broad-based accelerating prices, partly due to measures to mitigate the impact of higher commodity prices. The lower prices would allow the PBOC to continue to pursue monetary easing while keeping financing costs low to support domestic demand. Looking ahead, the PBOC would keep policy interest rates unchanged and continue to employ an accommodative policy to accelerate recovery in the real sector and prevent a sharp economic slowdown.

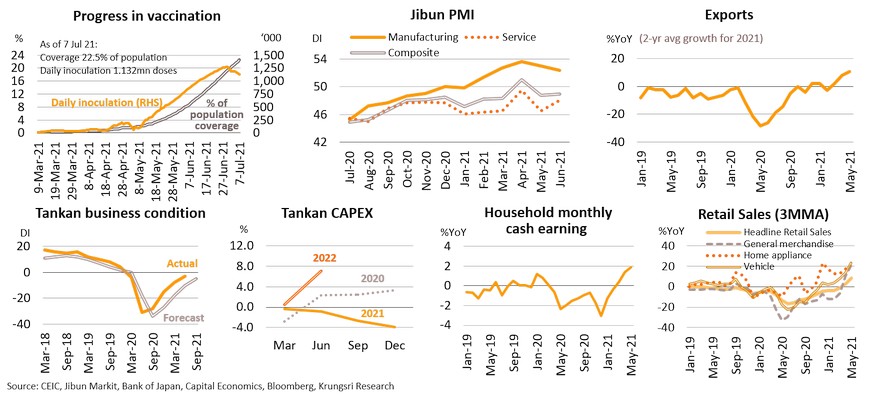

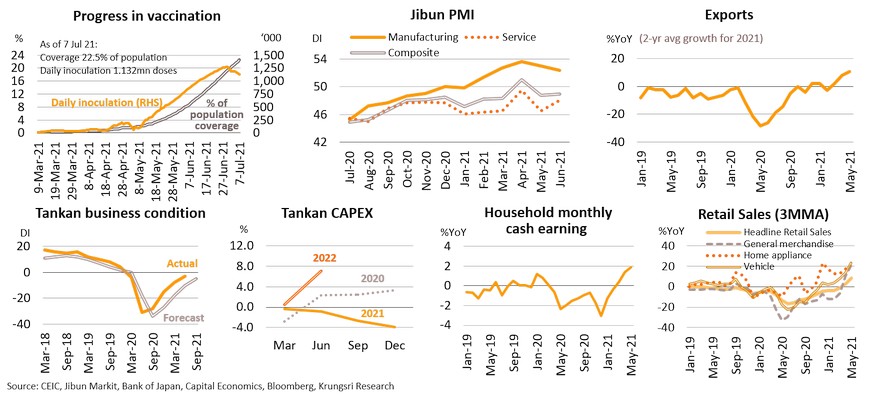

Japan: VoC and subsequent restrictions delayed economic recovery, now trailing behind peers

The COVID-19 situation has worsened in Japan since early July, with a rising number of daily cases mostly attributed to the Delta variant. That has prompted Japan to declare a state of emergency for the fourth time since the pandemic started, this time application to Tokyo and Okinawa. Consequently, the Tokyo Olympic Games will be held without domestic spectators but there would still be revenue from broadcasting rights. Meanwhile, the mass vaccination program has slowed down because of bottlenecks in vaccine supply and distribution. The latest outbreaks have hurt economic activities, especially in the services sector. Jibun Services PMI fell for the 17th consecutive month in June. However, Manufacturing PMI has been expanding since February. The resilient manufacturing sectors has been supported by the recovering exports with 2-year average export growth rising for the third consecutive month in May. In addition, business sentiment has recovered; 2Q21 Tankan survey is poised to swing up and companies have increased capital expenditure (CAPEX) budgets for 2022. The strong export and investment momentum also supported the labor market, as monthly household cash earnings grew 1.9% YoY, a 3-year high. That has led to improving purchasing power, which pushed up retail sales, especially sales of general merchandise and durable goods. To conclude, there are positive signs in manufacturing, exports, business expectations, labor market and retail sales, but the resurgence of new cases and outbreaks have pushed back reopening plans, and Japan’s recovery is now trailing behind that in other major economies.

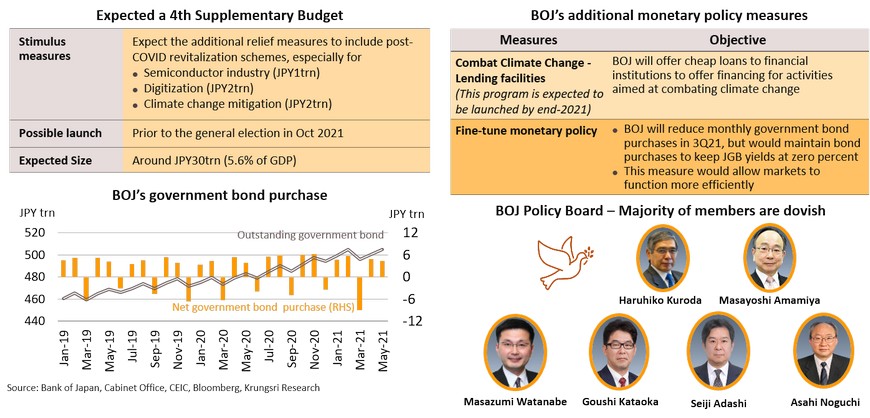

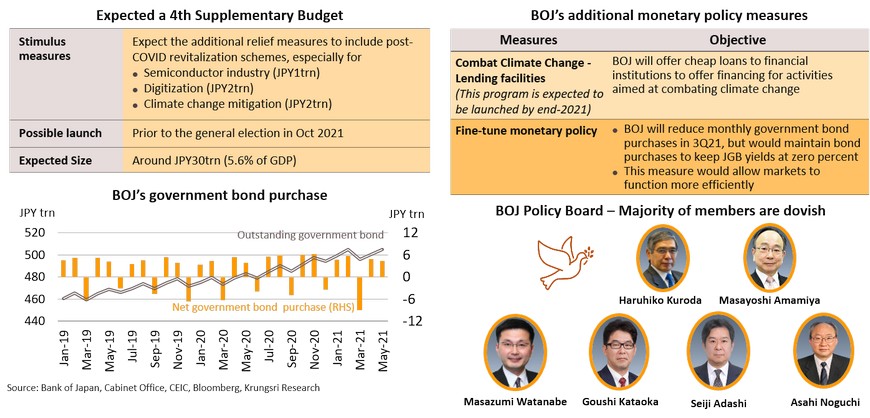

Expect more stimulus and still-loose monetary policy to support economic recovery in 4Q21

The recent outbreaks dominated by the Delta variant would hurt the Japanese economy in 3Q21. Hence, we expect the government to launch additional relief measures, including to help those hit by recent outbreaks. The Suga government might introduce another supplementary budget worth about JPY30trn or 5.6% of GDP, to help the hardest-hit individuals and businesses, as well as to drive a post-pandemic economy. In terms of monetary policy, the Bank of Japan (BOJ) has extended the emergency funding facility by 6 months to end-March 2022, and also announced a new lending facility (possibly start by end-2021) to spur private investment to address global warming. The BOJ has also continued to fine-tune monetary policy implementation by reducing monthly government bond purchases in 3Q21 to allow financial markets to be more efficient. The BOJ will reduce purchases of 1-to-3, 5-to-10 and 10-to-25 years-to-maturity buckets by at least JPY25bn. However, that adjustment is minimal compared to total quarterly net purchases of JPY1,462.9bn in 1Q21. We would not consider this policy tweak a tapering because it would not affect the pace of asset purchases. In terms of policy direction, 6 of the 9 monetary policy board members are dovish and likely to maintain an accommodative policy stance going forward. Looking ahead, the relief measures would ease the negative consequences of the pandemic in 3Q21 and support overall economic recovery in 4Q21.

Thailand: Recovery is pushed back again

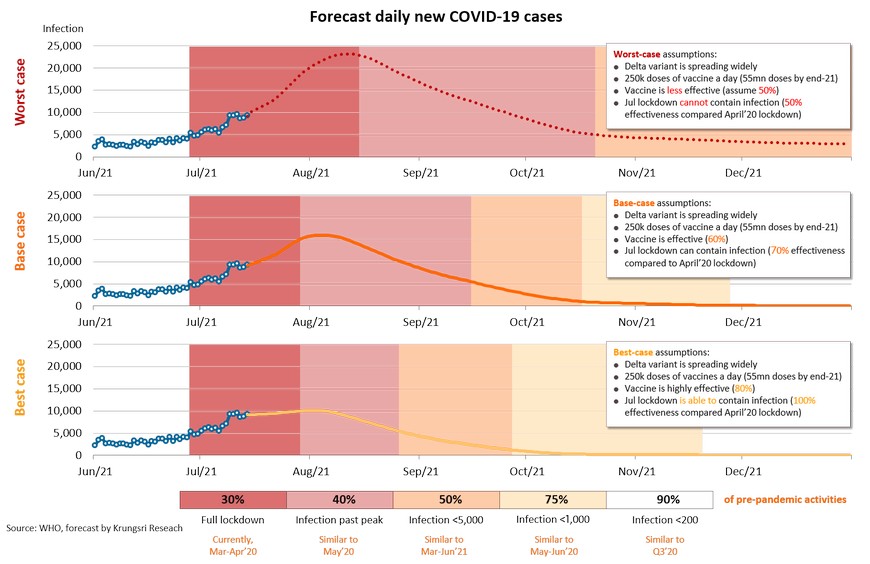

Our model suggests the latest wave of COVID-19 infections in Thailand would peak in August and drop below 1,000 in November, based on the current pace of inoculation.

- The worst-case scenario in our previous forecast of infections is now the baseline scenario for our current forecast as the number of new infections has risen to nearly 10,000 per day since early July. Vaccine efficacy remains key to driving down daily cases. In our latest baseline scenario, we expect the number of new cases to drop below 1,000/day by November this year. In the worst case, where the vaccines are less effective and July lockdown cannot contain the outbreaks, daily new cases could exceed 20,000 and the lockdown would last longer.

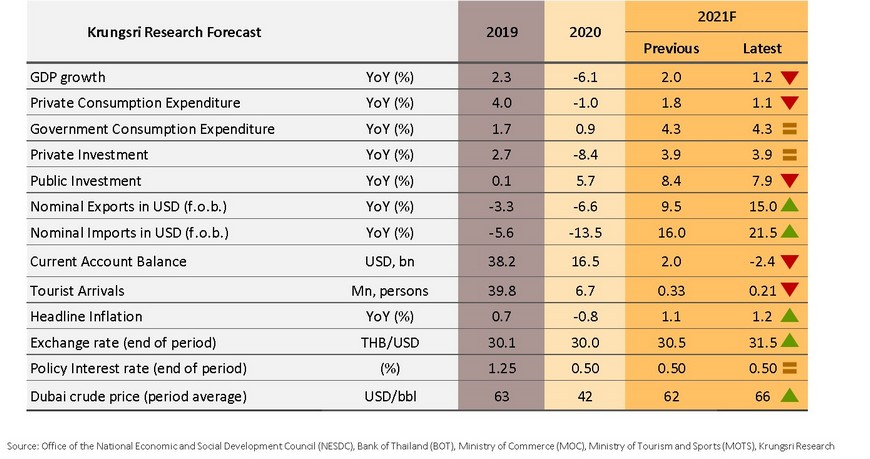

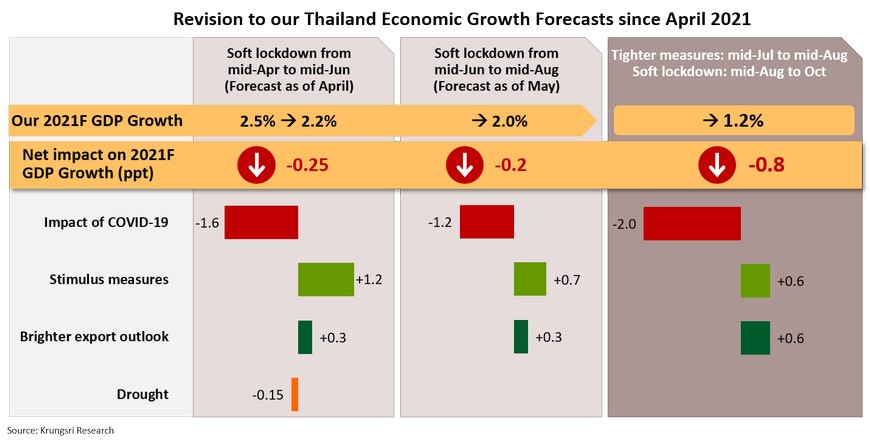

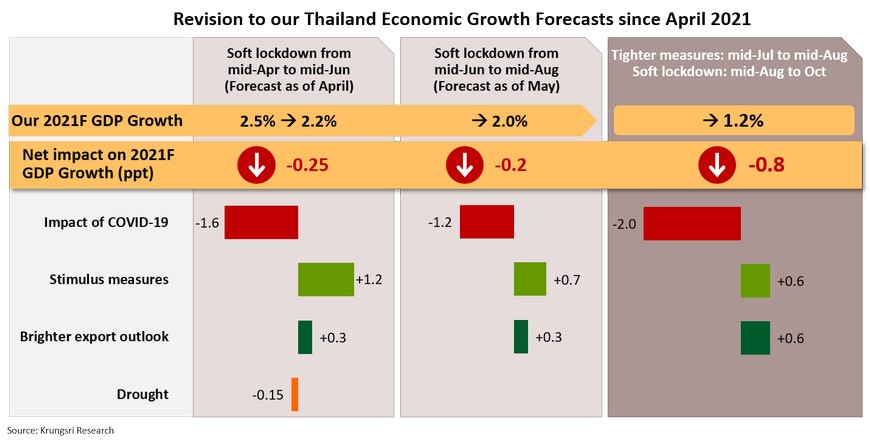

We cut 2021F GDP growth for the fourth time by 0.8 ppt to +1.2% to reflect Thailand’s worst COVID-19 outbreak and limited policy supports; promising exports could reduce some of the pain.

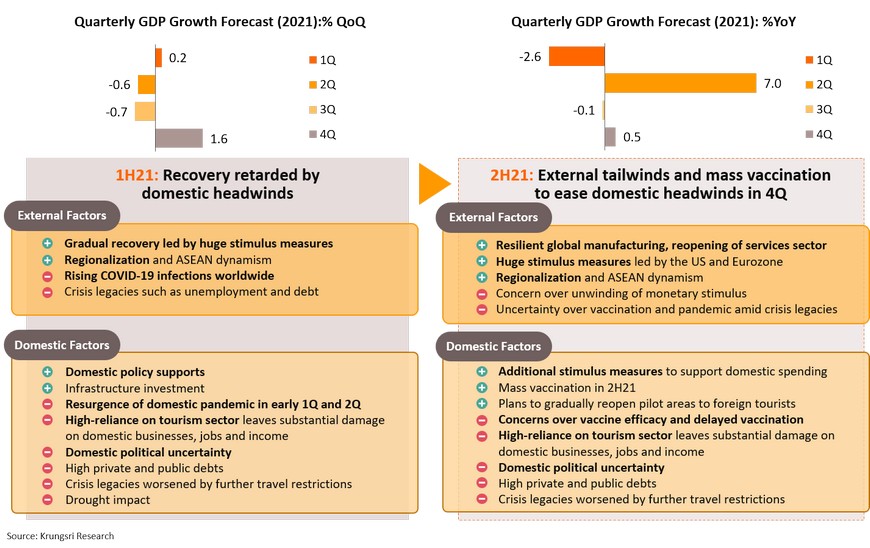

- The surge in COVID-19 cases in Thailand dominated by the Delta variant, concerns over vaccine efficacy and delayed vaccination program suggest the containment measures would continue into October. The large negative impact of the latest COVID-19 outbreak would substantially outweigh gains from limited policy supports and strong exports. The net impact on Thai GDP growth would be minus 0.8 ppt, taking our 2021 full-year growth projection to only +1.2% vs +2.0% in the previous forecast. The economy could slip into a technical recession in 3Q in response to worsening domestic outbreak since the Songkran holidays.

We downgraded 2021F foreign tourist arrivals and private consumption but raised export growth projection; K-shape recovery becomes more visible.

- The worse- and longer-than-expected outbreak in Thailand coupled with the dominant Delta variant in many countries prompted us to revise down 2021F foreign tourist arrivals to 210,000 (from 330,000) and to cut private consumption growth to +1.1% from +1.8%. However, we raised forecast export growth for this year (based on BOT data) to +15% from +9.5%. The strong exports outlook would alleviate some of the adverse impact on manufacturing production and business investment.

BOT is likely to maintain policy rate; need more targeted stimulus to limit scars.

- We expect the BOT to keep policy rates at record lows this year and next year because Thailand’s economic recovery is fragile and the nation could take longer to see a broad-based recovery. On targeted monetary policy, the current financial assistance was designed to address issues before the latest outbreaks, suggesting a need for more targeted monetary stimulus to help severely affected groups and to prevent permanent economic scars.

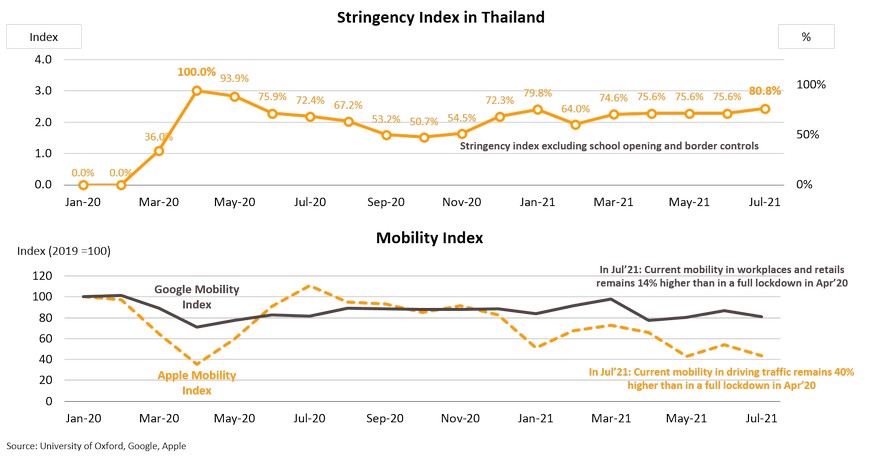

Third wave is the most severe but July lockdown is less strict than the previous year

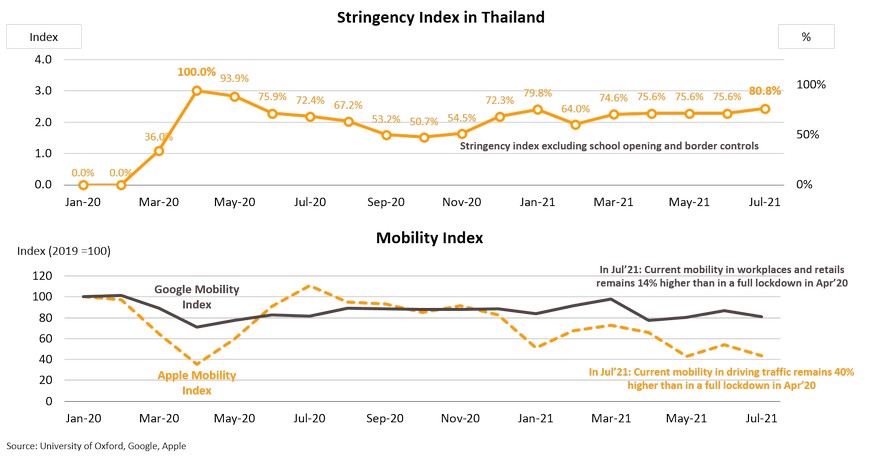

The third wave which started in April is the most severe in Thailand with new cases reaching 10,000/day. This has prompted the government to impose stricter containment measures and impose a 14-day (partial) lockdown in July. The Stringency Index by the University of Oxford reveals the current lockdown is only 81% as strict as the one in April 2020. Google Mobility Index, which reflect traffic congestion at workplace, retail, and recreation venues, is at 81.1 (pre-pandemic base = 100). Apple Mobility Index, which reflects driving traffic congestion, is at 43.4 (pre-pandemic base = 100). This means the latest mobility indicators are 14% higher than during the full lockdown in April 2020 for workplace and retail venues, and 40% higher for traffic.

Latest wave could peak in August and drop below 1,000/day in November, based on current pace of inoculation

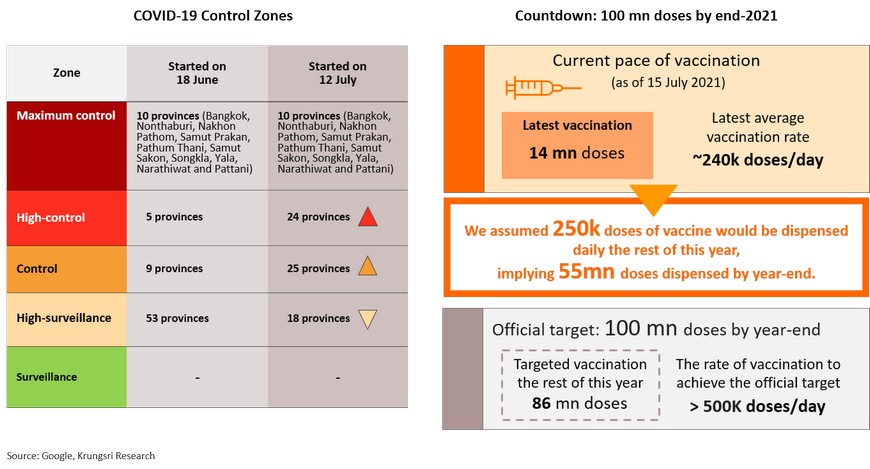

The worst-case scenario in our previous forecast is now our baseline scenario as new cases have risen to nearly 10,000 per day since early July. More importantly, it is dominated by the Delta variant and is spreading to several provinces. Our latest forecast assumes new cases in Thailand would be attributed to the Delta and Beta variants in the coming months, so we analyzed historical data for Thailand, India, South Africa, and the UK. The July lockdown in Thailand is assumed to be 70% as effective as the lockdown in April 2020, suggesting new cases would increase to 15,000/day by early-August. Thailand is expected to dispense 250,000 doses of vaccine per day the rest of this year, taking total vaccines dispensed to 55m doses by year-end. This could help to bring down daily new cases, especially after September. Vaccine efficacy remains key to driving down daily cases (assuming 60% vaccine efficacy). In our latest base case scenario, we expect the number of new cases to drop below 1,000/day by November this year. In the worst case, where the vaccines are less effective and July lockdown cannot contain the outbreaks, daily new cases could exceed 20,000 and the lockdown would last longer.

Assumption for each scenario and anticipated containment measures

Thailand Economic Outlook 2021

We trimmed GDP growth forecast again given more severe outbreak and limited policy support, despite strong exports

The surge in COVID-19 cases in Thailand dominated by the Delta variant, concerns over vaccine efficacy and delayed vaccination program suggest the containment measures would continue into October. On this note, we estimate the combined negative impact of supply disruption, demand shock, and weaker tourism activity, would reduce Thai GDP growth by 2.0 ppt this year. However, strong exports would lift GDP growth by 0.6 ppt. We also expect the government to introduce additional relief measures worth THB100bn this year which could add 0.6 ppt to GDP growth, but both fiscal and monetary policy supports seem limited compared to the pandemic impact and past relief measures. The large negative impact of the latest COVID-19 outbreak would substantially outweigh gains from limited policy supports and strong exports. The net impact on Thai GDP growth would be minus 0.8 ppt, taking our 2021 full-year growth projection to only +1.2% vs +2.0% in the previous forecast.

Thai economy could slip into a technical recession in 3Q given more severe domestic outbreak since April

Thailand expected to dispense 55m doses of vaccines by year-end, only half the official target of 100m doses

The Delta variant has taken a toll on domestic economic activity since mid-July. New cases have reached almost 10,000 per day. The government has imposed more stringent measures on 10 provinces designated as red zones (maximum & strict control zones), including the Bangkok Metropolitan Region. There have been stricter controls on movement and activities, including curfews, effective 12 July. Up to 15 July, the government has dispensed 14 million doses of vaccine or an average of 240,000 doses per day. Assuming the pace of vaccination is around 250,000/day, Thailand would have dispensed 55 million doses by year-end, far below the official target of 100 million doses.

Trimmed 2021F foreign tourist arrivals to 210,000 despite Phuket Sandbox and Samui Plus kicking-off in July

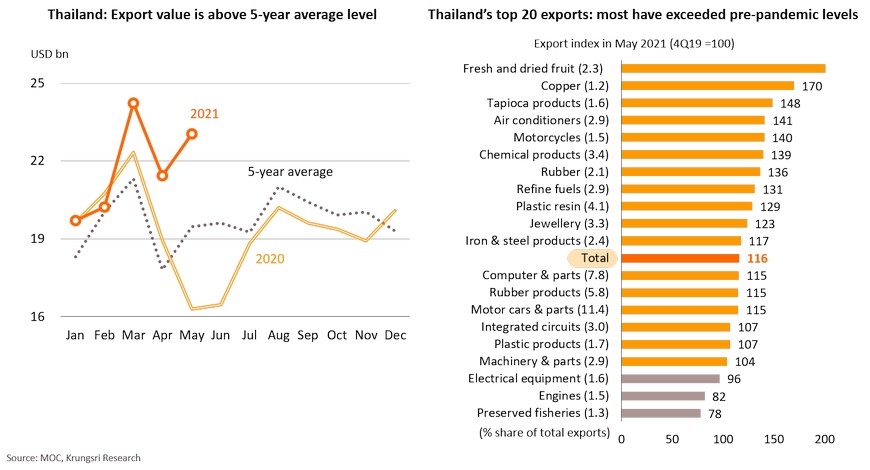

Raised export growth forecast for this year to +15% from +9.5%; growth reached an 11-year high in May

May export value is much higher than 5-year average data; more broad-based recovery by products

Thai exports are gaining momentum. May export value (USD23.1bn) is close to the recent high recorded in March and well above the last 5-years’ May average of USD19.47bn. Out of Thailand’s top 20 export products (64.8% of total exports), export values for 17 products (60.4% of total exports) have exceeded pre-COVID levels, led by fresh, frozen & dried fruit, tapioca products, air conditioners, chemical products, and rubber. If export values of more products improving (i.e. more broad-based improvement), that would support domestic manufacturing production and private investment ahead.

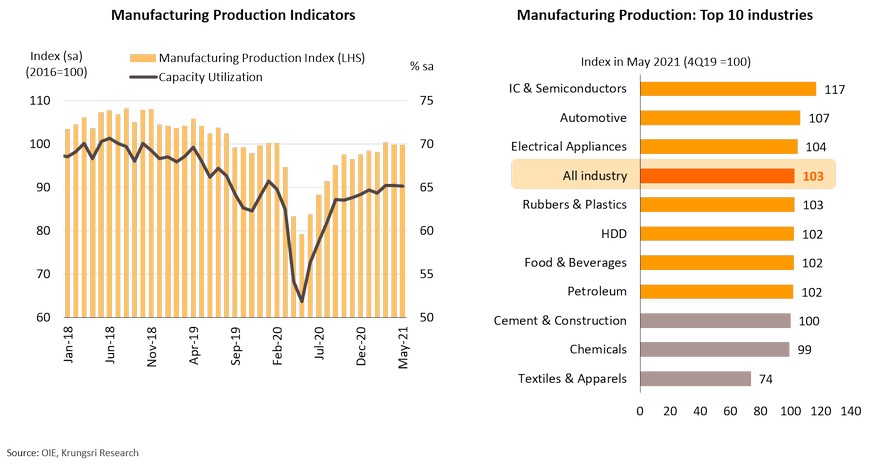

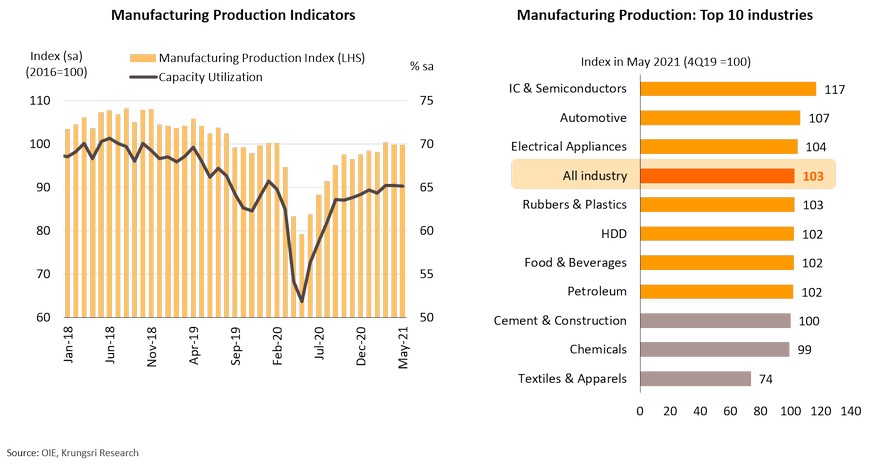

Strong exports would mitigate COVID-19 impact on manufacturing production

The latest COVID-19 situation in Thailand could dampen domestic demand. However, Manufacturing Production Index was steady in May and remained above pre-pandemic level for the 3rd straight month supported by stronger exports as trading partners’ economies recover. The improving index was led by the electronics, automotive, electrical appliances, and rubber & plastics industries. Capacity Utilization rate (sa) was steady at 65.2 in May, higher than at end-2019 (pre-pandemic level). For the second half of 2021, Krungsri Research expects the strong exports to mitigate the latest COVID-19 impact on manufacturing production.

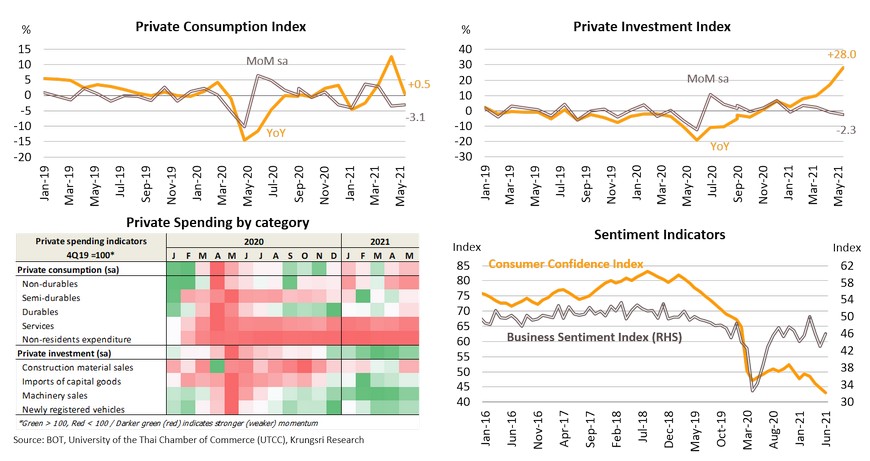

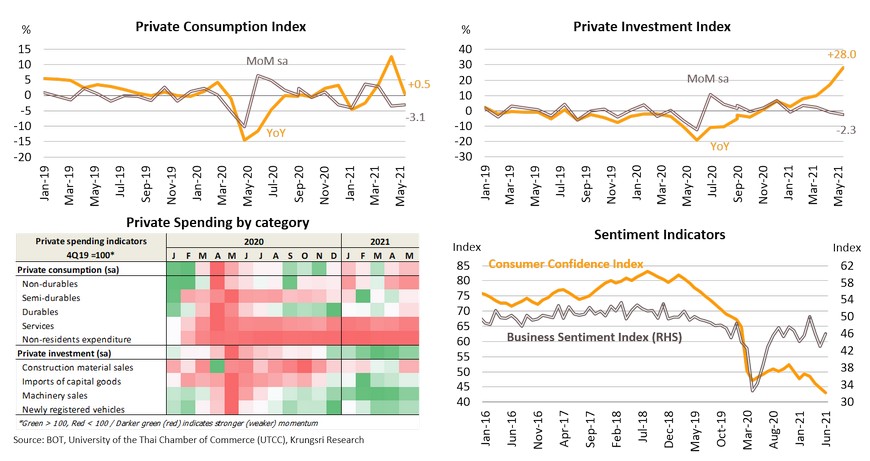

Private investment buoyed by promising exports, but consumption would be dragged by latest outbreak

Although Private Investment Index (PII) slipped 2.3% MoM sa in May, the index registered double-digit growth on year-on-year basis for the 2nd consecutive month, boosted by stronger export growth. The PII also has been rising since late 2020 and exceeded pre-pandemic level. The survey which was conducted before daily cases surged, revealed Business Sentiment Index picked up in June. We will maintain our private investment growth forecast for 2021 at 3.9% vs -8.4% in 2020, as a windfall from promising exports could be offset by weaker domestic demand. On household spending, Private Consumption Index (PCI) fell for the 2nd month in May (-3.1% MoM sa or +0.5% YoY), with declines in all categories attributed to the latest wave. The Consumer Confidence Index also continued to drop to a record low in June. Given a possible rise in unemployment, lower income, and limited stimulus measures, we revised down private consumption growth forecast for this year to +1.1% from +1.8% in the previous forecast.

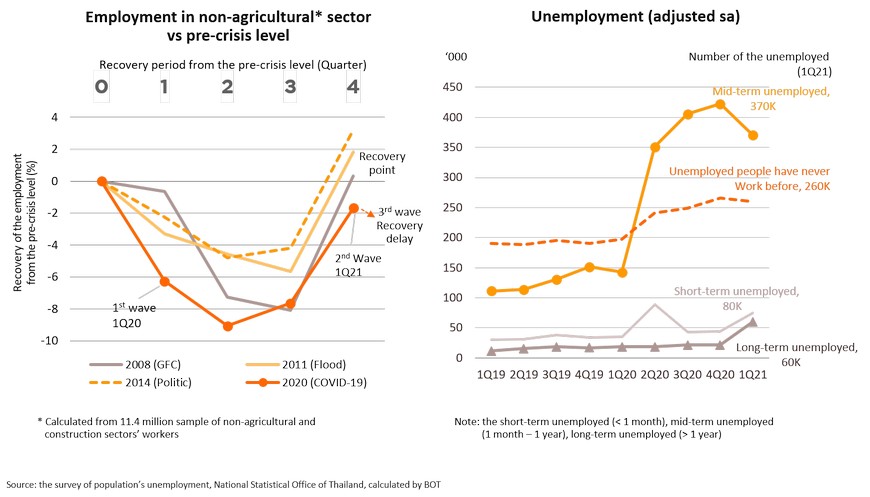

BOT expects recovery in the labor market tends to be slower than before, likely W-shaped

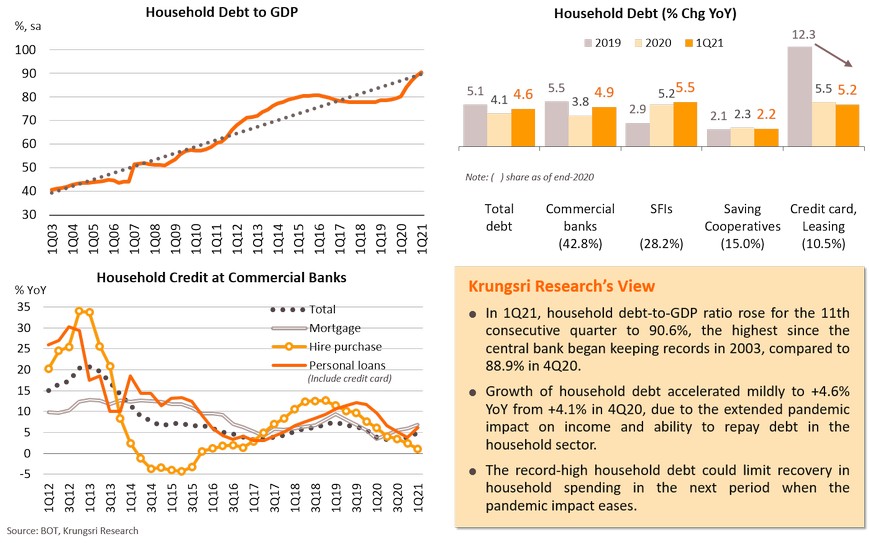

Household debt has risen to a new high of 90.6% of GDP, limiting consumption growth

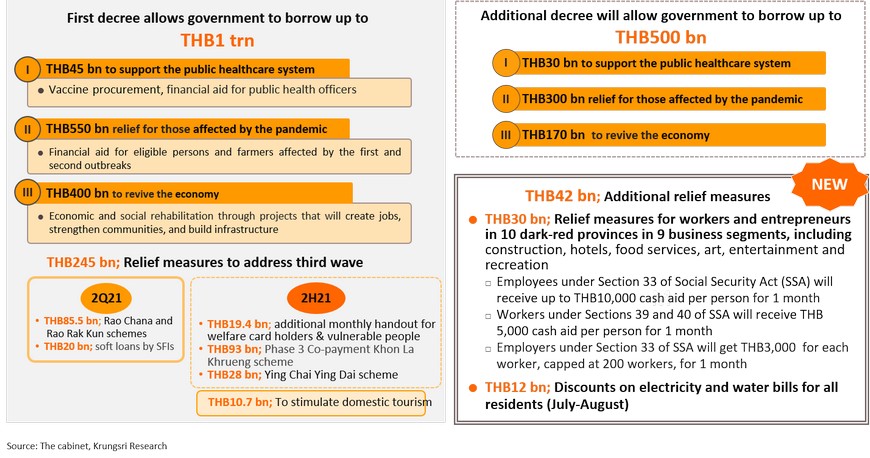

Additional policy supports seem limited compared to the pandemic impact and past relief measures

The Cabinet approved a THB42bn relieve package at the 13 July meeting. It includes (i) THB30bn in cash aid for businesses and workers in 9 business segments that are affected by the lockdown in dark-red zones, including Bangkok Metropolitan Region and 4 provinces in the South; (ii) THB12bn to subsidize 2-months of discounts on electricity and water bills nationwide. The relief measures would be partly-funded by THB500bn from the Borrowing Bill. In addition, the MOF and BOT are allowing financial institutions to offer two-month debt moratorium for individuals and SMEs hit by the latest lockdown. However, the latest supports seem limited compared to the pandemic impact and past relief measures.

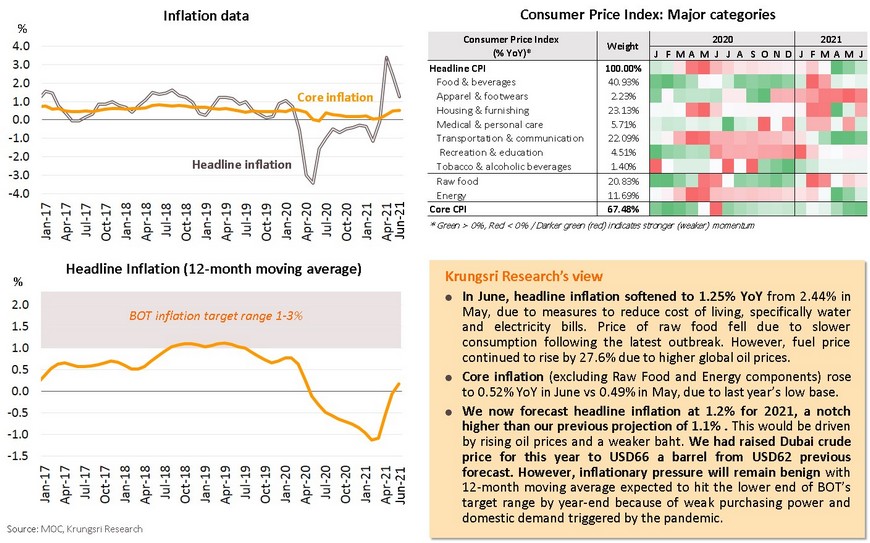

Measure to ease cost of living slowed down headline inflation; inflationary pressure will remain benign in 2H

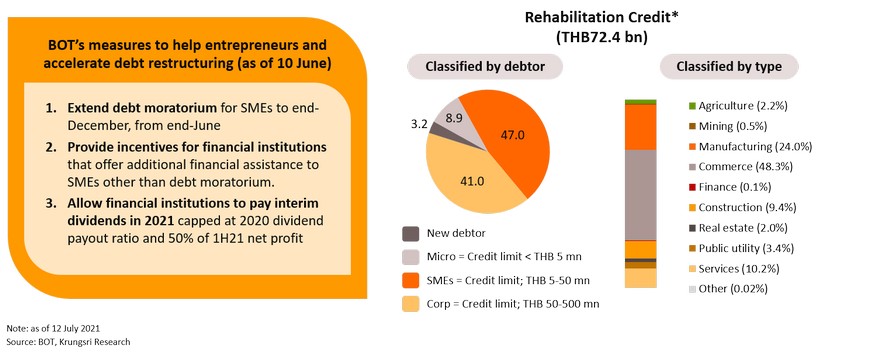

BOT likely to keep policy rate despite more pessimistic outlook; need more targeted stimulus to limit scars

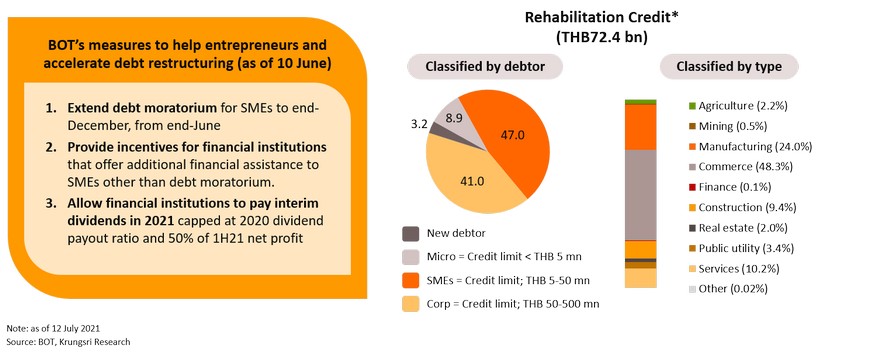

We expect the BOT to keep policy rate at a record low this and next year. Even though the global economic recovery is gaining momentum and several central banks have signaled they would unwind massive monetary stimulus sooner than expected, Thailand is in no hurry to raise policy rate. This is because the recovery in Thailand remains weak and the nation could take longer to see a broad-based recovery. In addition, the BOT recently indicated there was downside risk to its GDP growth forecast because of the longer-than-expected outbreak. Hence, Thailand is likely to employ a very-accommodative policy this year and next year to nurture a sustainable economic recovery. Looking at debt relief measures, as of 12 July, the BOT has approved THB72.4bn in financial aid for up to 23,687 borrowers, averaging THB3.1mn credit line per borrower. Around 47% of borrowers are SMEs involving THB50mn in existing loans, and 48% are in the commerce sector. Under the Asset Warehousing program, only THB0.9bn has been approved for 2 borrowers/hoteliers. Indeed, this financial assistance was designed before domestic cases started to surge, suggesting Thailand needs more targeted monetary stimulus to improve liquidity in affected groups and to prevent permanent economic scars.