Global: Milder Omicron symptoms, faster normalization?

Global growth could slow down because of Omicron but impact would be limited; recovery is underway, allowing policy normalization in some major countries

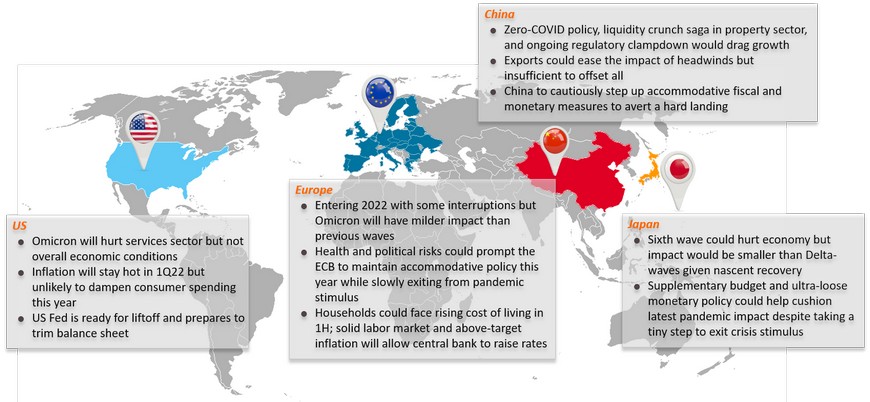

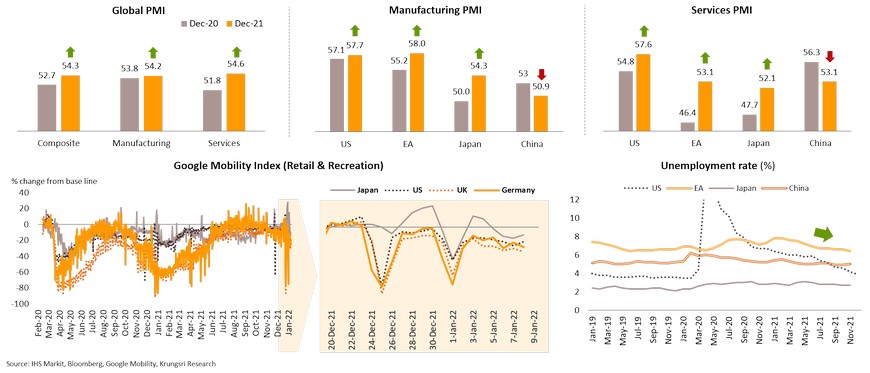

Global economic activities had improved markedly in 2021. Though supply-side problems limited growth in the manufacturing sector, services sector recovered strongly amid progress in vaccination in advanced countries. Most major countries, except China, registered stronger growth in 2021. The Omicron wave since late-2021 might hurt some activities, especially services, but it would have limited impact because of milder symptom and lower fatality rate amid higher vaccination rates. Economic recovery is underway with falling unemployment, allowing several countries to normalize crisis stimulus programs.

US: Omicron will hurt services sector but not overall economic conditions

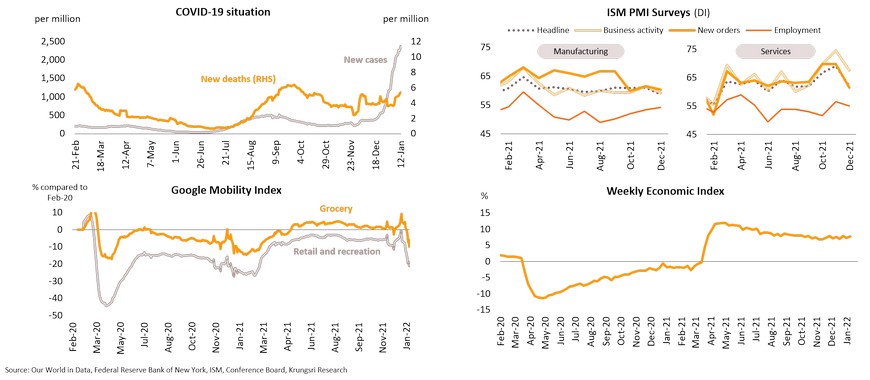

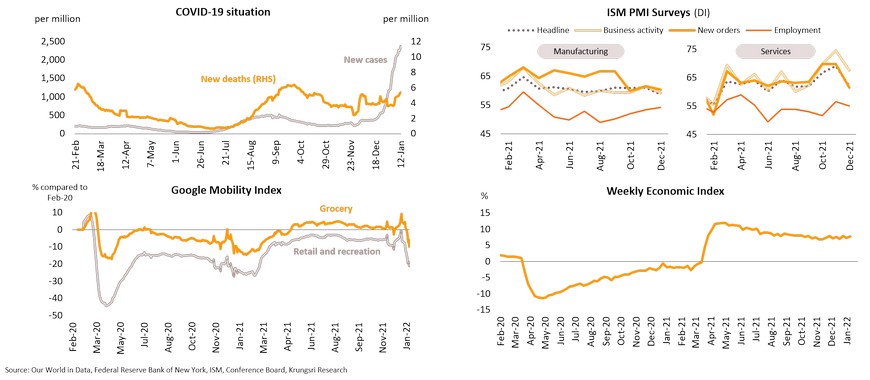

Omicron cases have surged in the US since late 2021, especially among the young and unvaccinated population, but there are fewer fatalities compared to the Delta wave. The latest outbreak has caused the largest drop in Services PMI from 69.1 November to 62 in December, particularly new orders and business activity indices. Employment index edged down, suggesting businesses continue to hire workers. Manufacturing sector is still demand-driven and has seen limited impact from the outbreak. For consumers, the Omicron variant is unlikely to halt spending as mobility data in grocery markets, restaurants and shopping centers are better than during previous waves. Looking forward, the CDC believes there would be a surge and sharp drop in Omicron cases, like in South Africa where cases have peaked and are falling. In the US, although daily new cases remain worrying, the situation is likely to improve ahead. The Weekly Economic Index suggests overall economic activities (as of 8 January 2022) remain strong and are unlikely to contract because of the latest outbreak. Hence, we expect economic activities to remain solid and the smaller-than-expected COVID-19 impact could lift consumer expectations and spending ahead.

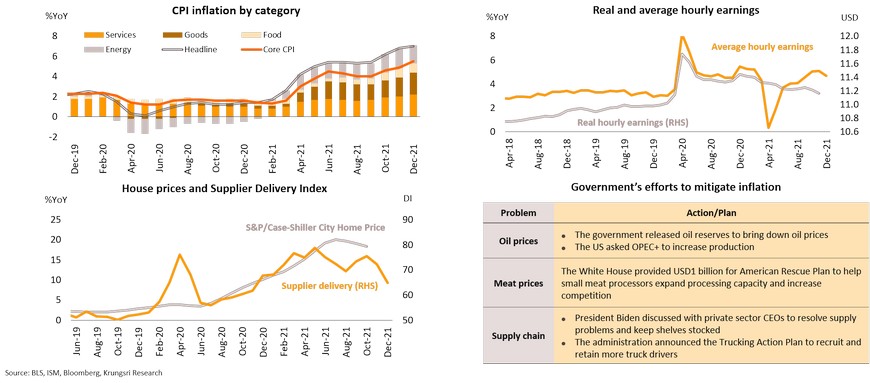

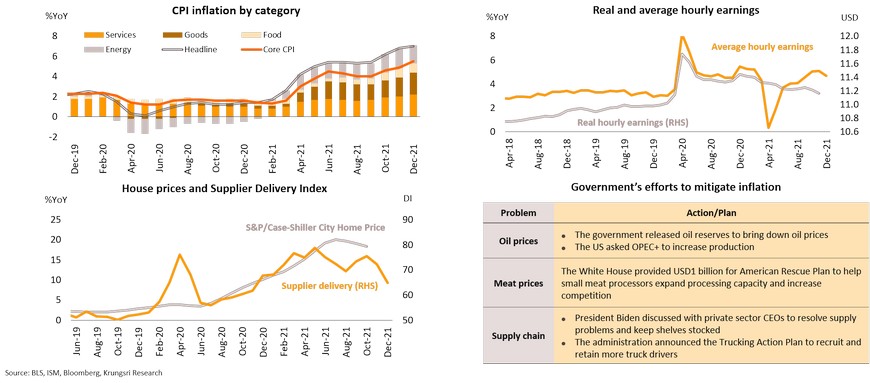

Inflation will stay hot in 1Q22 but unlikely to dampen consumer spending this year

CPI inflation will continue to run hot in 1Q22. Data shows broad price gains in general categories but there are signs inflation is unlikely to take a bite out of spending this year. Firstly, the Omicron outbreak has had minimal impact on spending on goods. Secondly, average wage grew 4.7% in December while real wage is higher than pre-pandemic trend. Thirdly, house prices are set to cool down in 2022 and delivery times are shorter, which would help firms to avoid goods shortage and allow consumers to save to spend in the future. Lastly, the Biden administration have attempted to control oil and meat prices while asking the private sector to help ease supply bottlenecks. Moreover, the mid-term elections might prompt the government to act to maintain popularity. These factors could support purchasing power and strong consumer demand. And as inflation remains above pre-pandemic trends and demand remains solid, that would allow the Fed to proceed with plans to tighten monetary policy.

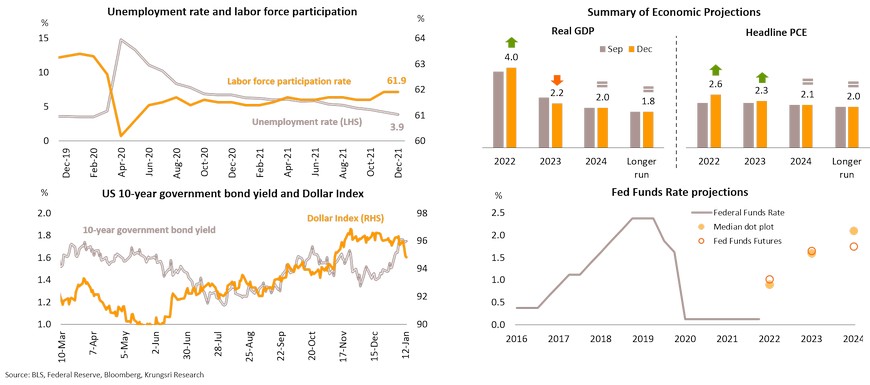

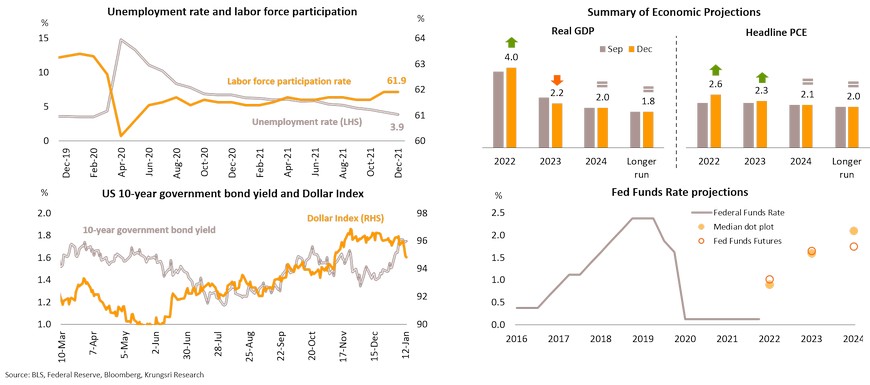

US Fed is ready for liftoff and prepares to trim balance sheet

A robust labor market, persistent inflation, milder COVID symptoms, and more hawkish Fed members, are supporting a faster-than-expected rate hike. Even with disappointing payrolls, the labor market might have reached maximum employment. Unemployment rate plunged to 3.9% in December last year, better than the Fed’s projection of 4.3%, while labor force participation rate is about 1.5% below Feb-20 level. The Fed expects Omicron to have only mild impact on the economy, reflected by the upward revision of 2022 GDP growth. In addition, investors are optimistic about the economy and had driven 10-year treasury yield to 1.7% early this year and caused the Dollar to appreciate. We see rising probability of the first-rate hike in March 2022, followed by at least 2 more hikes before the end of the year. The FOMC estimates rates would hit 0.9% by 2022 and 1.6% in 2023, suggesting a continuity of the hiking cycle. Moreover, the Fed might start to trim balance sheet (quantitative tightening) soon after starting to lift rates. This aggressive tightening could raise concerns in stock and currency markets worldwide but we maintain that global liquidity would remain abundant and is unlikely to drop sharply.

Europe: Entering 2022 with some interruptions but Omicron will have milder impact than previous waves

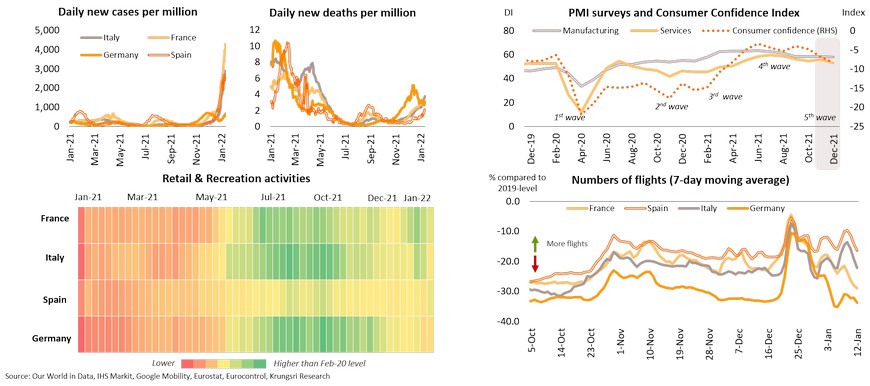

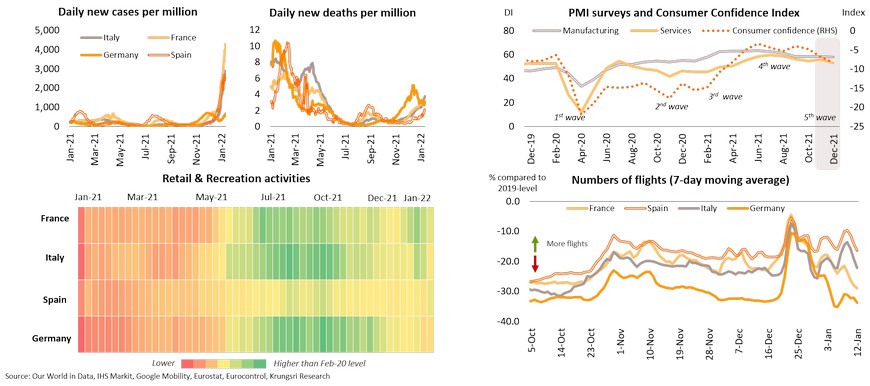

Omicron will hinder economic growth in the Eurozone in early-2022. Daily new cases are breaking records in many countries, led by France and Spain. This has hurt services activities, reflected by the 8-month low Services PMI index in December. Consumer Confidence Index in the same period was dented by rising COVID-19 cases and concerns over inflation, which sent the index below pre-crisis level. Despite Omicron being more infectious and disruption to services activities, the impact is expected to be less severe than during previous outbreaks because it causes milder symptoms and fewer fatalities. Signs of easing supply bottlenecks could also support the manufacturing sector, which could partly offset the negative economic impact of the outbreak. Furthermore, high-frequency data show milder interruptions to retail and recreation activities than prior waves. Activities in major countries remain stronger than Feb-20 levels. Lastly, countries did not halt air transportation, and the number of flights in major countries is only 10-30% below 2019-levels. Hence, we expect the latest outbreak to have limited impact on the economy and overall activities would resume from late-1Q22 onwards.

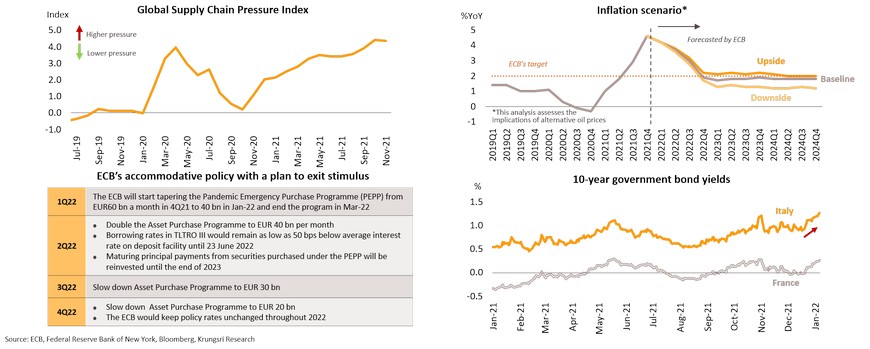

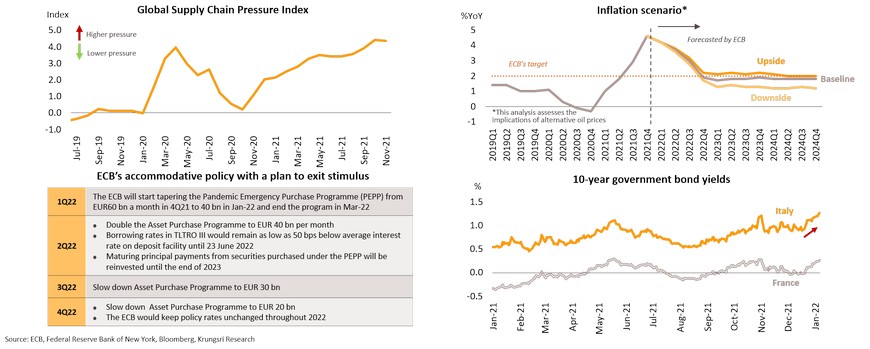

Health and political risks could prompt the ECB to maintain accommodative policy this year while slowly exiting from pandemic stimulus

The ECB could face several challenges in 2022, including Omicron, inflation and political risks. Although inflation likely peaked in 4Q21 due to easing energy prices, supply bottlenecks and labor shortage might continue to exert inflationary pressure in 1Q22. As inflation is expected to be higher than the ECB’s target in 2022 and overall activities are gradually returning to pre-crisis levels, the ECB decided to dial back its emergency stimulus by March 2022. However, Omicron and political risks could prompt the ECB to maintain an accommodative policy. They would increase monthly bond purchases under the Asset Purchase Program (APP) to EUR40 bn in 2Q22 before slowing down to EUR20 bn later this year. The ECB cited Omicron as a major risk that could reduce economic growth to 4.2% in 2022 from 5.1% in 2021. Plus, we suspect political uncertainty and public debt concerns in Italy and France could push up bond yields. Italy’s Prime Minister might step down from a position and the French presidential elections would be held in April, which might add to ECB’s tasks to control yields. Health and political risks will keep the ECB away from a tightening policy and hiking policy rates this year, but tensions between Russia and the West could limit natural gas supply, which would make it increasingly difficult for the ECB to extend its loosening policy.

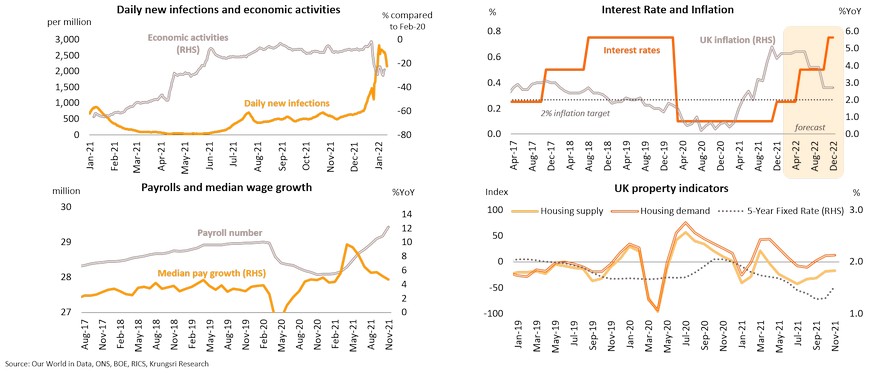

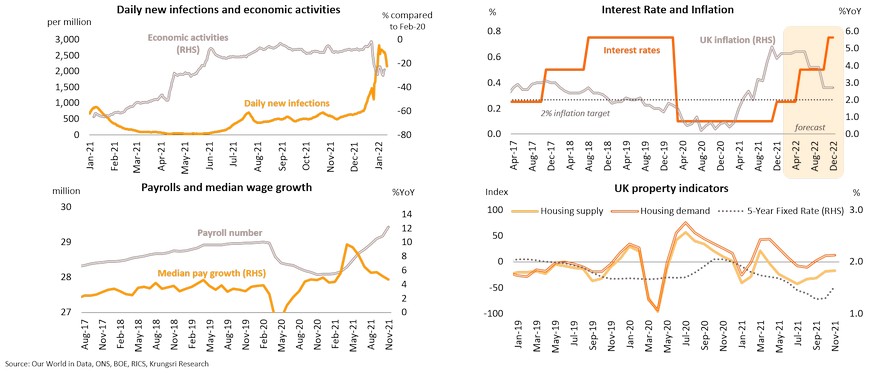

UK: Households could face rising cost of living in 1H; solid labor market and above-target inflation will allow central bank to raise rates

The UK economy could face major challenges, including higher daily COVID-19 cases and rising cost of living. It has seen about 150k cases a day since the detection of Omicron. This has brought economic activities to the lowest level since May 2021 although the Prime Minister has maintained ‘no more lockdowns’ to avoid economic contraction. At its December meeting, the Bank of England surprised markets by lifting interest rates for the first time since the pandemic, by 15 bps to 0.25% to curb rising prices. Looking ahead, there are also surprises for policymakers. We expect UK households to experience a deterioration in living standards as wage is slowing down while cost of living continues to rise. This could hurt consumer purchasing power at least until inflation peaks in 2Q22. In addition, property affordability remains subdued as housing demand exceeds supply and higher mortgage rates push up mortgage payments. However, payrolls have continued to increase and exceed pre-crisis level, which could support consumer demand. The stable labor market, coupled with above-target inflation, would allow the BOE to consider further rate hikes to about 0.75% by the end of this year.

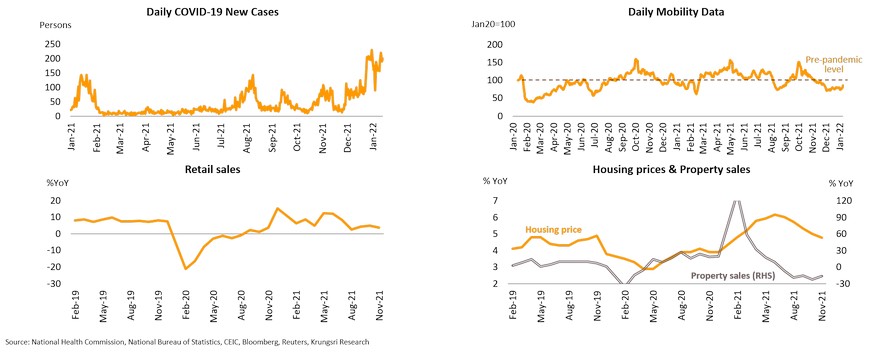

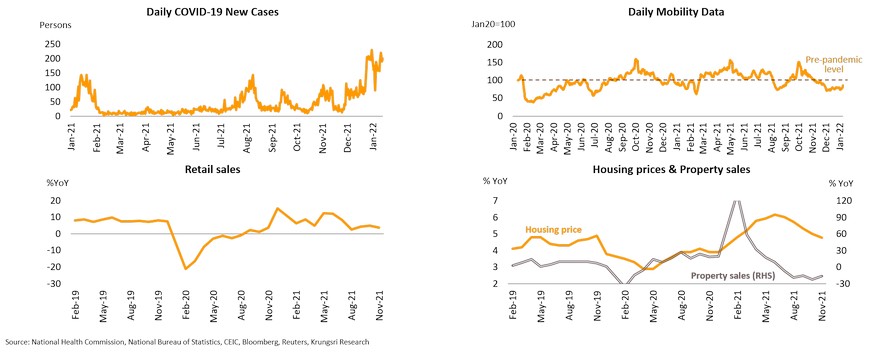

China: Zero-COVID policy, liquidity crunch saga in property sector, and ongoing regulatory clampdown would drag growth

There is still uncertainty over China’s economic growth trajectory, although the power shortage situation that started last year has eased. Since August 2021, China has experienced several waves, including the latest which started in December in Zhejiang, Henan, Shaanxi, Tianjin and Liaoning (these 5 provinces contribute 18.2% of national GDP). Despite recording much fewer cases than in other major economies, China’s strict containment measures are discouraging economic activities, indicated by a drop in daily mobility data to below pre-pandemic level and weaker retail sales growth since late 2021. China is expected to maintain its ‘zero-COVID policy’ throughout this year. In addition, real estate developers are struggling with a liquidity crunch. Evergrande’s debt instruments have been downgraded by global credit rating agencies to ‘restricted default’ status, while other developers including Kaisa and Shimao have defaulted on their latest interest payments. The latest developments in the property sector have shaken confidence and pushed down property sales and prices. Moreover, regulators will continue to crackdown on technology giants, unlike the broad regulatory onslaught last year. That would deter business investment ahead. Looking forward, recent outbreak amid China’s ‘zero-COVID policy’, low liquidity in the property sector, and regulatory crackdown, would dampen domestic spending in several areas and investment in some sectors.

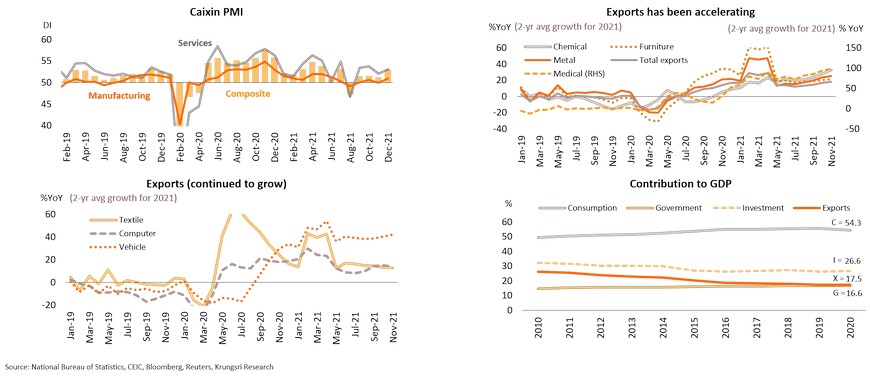

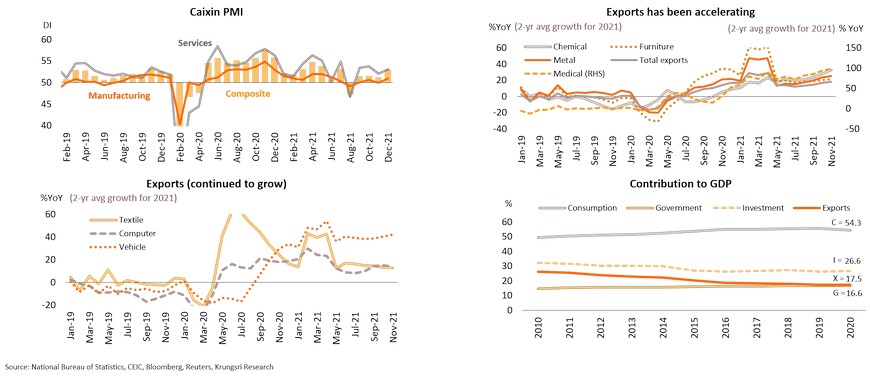

Exports could ease the impact of headwinds but insufficient to offset all

Several headwinds are hampering economic growth prospects but some key economic indicators are improving. Manufacturing PMI turned to expansion territory in December, suggesting easing impact of electricity shortage and supply disruption. The Output sub-index posted the strongest growth in a year, while delivery time component eased. Besides, external demand is resilient as 2-year average growth has accelerated to 18.4%, the strongest growth since April. Among the top 10 export items, pandemic-induced and work-from-home policy-related products (including medical products and furniture) remained buoyant, while demand for chemicals and metals are gaining momentum. In addition, demand for vehicles and computers (contribute combined 29.9% of total exports) will continue to grow going forward. However, exports - which contributed 17.5% of national GDP – would be insufficient to offset weaker consumption (54.3% of GDP) and investment (26.6% of GDP). And, port congestion has worsened because of strict containment measures at major gateways and temporary halt at some manufacturing sites, which could be a key risk factor for China's exports.

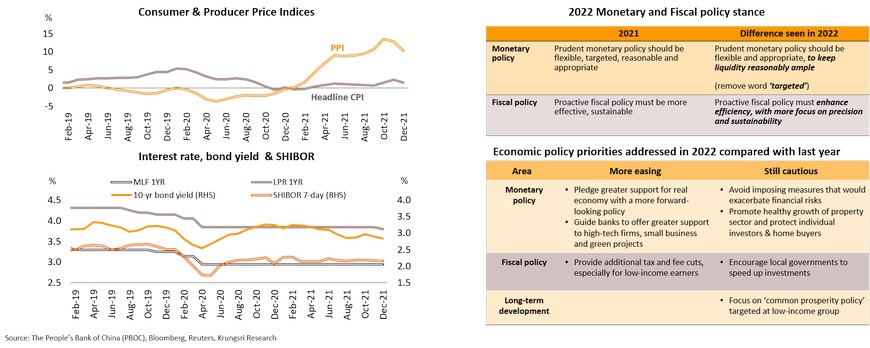

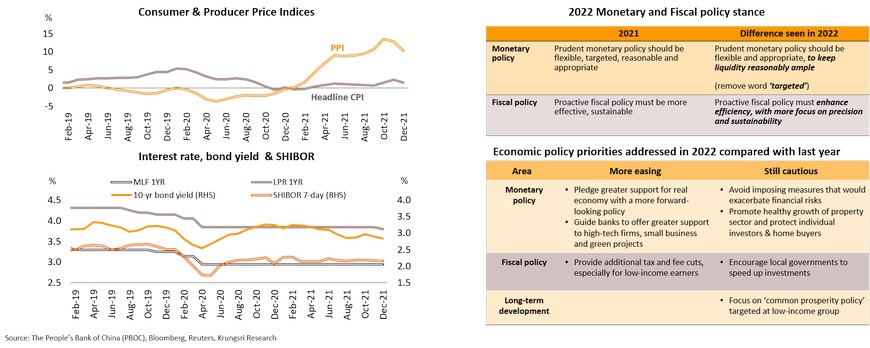

China to cautiously step up accommodative fiscal and monetary measures to avert a hard landing

Several major economies have started to normalize policies, but China still needs easing measures to boost domestic demand. This policy divergence is mainly due to different economic conditions - economic slowdown and lower inflationary pressure in China. Both headline and factory-gate inflation rates eased in December amid weak demand and the policy to curb commodity price hike. To avert a sharp slowdown, the People’s Bank of China (PBOC) cut commercial banks’ reserve requirement ratio (RRR) by 0.50% from 15 December. It also lowered the 1-year loan prime rate (LPR) on 20 December to 3.8% from 3.85%, the first cut since April 2020. These easing monetary measures led to cheaper financing costs, reflected by lower 7-day SHIBOR and 10-year government bond yields. Monetary policy would likely focus on economic growth as the PBOC has removed the term ‘targeted’, indicating more broad-based measures, while adding the words ‘keep liquidity reasonably ample’ which reflects a more accommodative policy. On the fiscal front, China will continue with a proactive fiscal policy by committing to step up tax and fee cuts by more than CNY1trn and urging local governments to speed up spending on investment through new bond issuance. Compared to its policy priorities last year, China now plans to employ ‘more easing measures’, despite a still-cautious policy. Hence, they would focus on averting a sharp economic slowdown in 2022 compared to maintaining economic and financial stability in 2021.

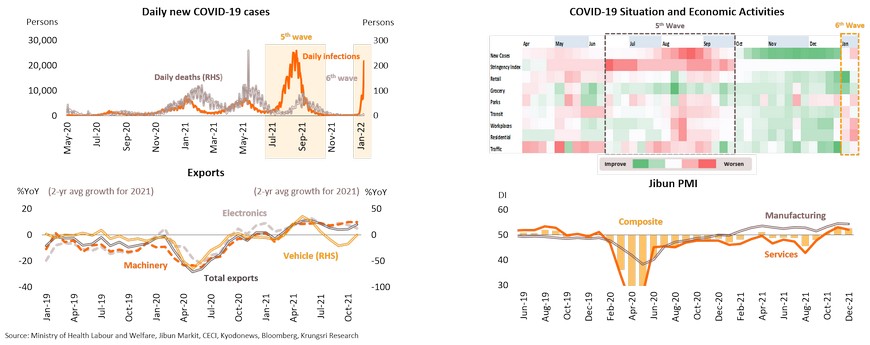

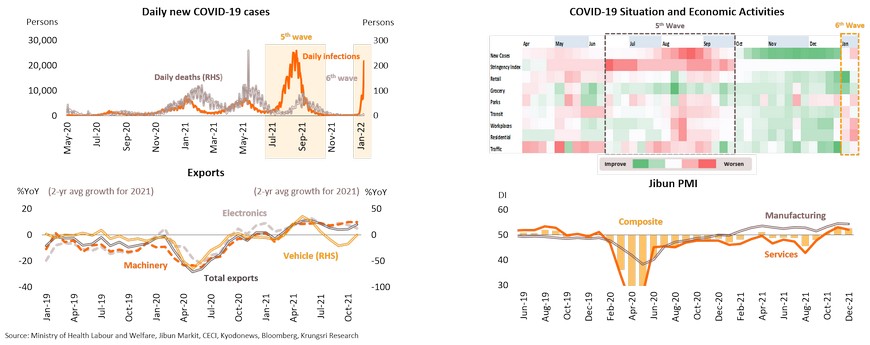

Japan: 6th wave could hurt economy but impact would be smaller than Delta-waves given nascent recovery

Daily new cases has exceeded 20,000 in mid-January, for the first time in over 4 months, driven by Omicron. The government has declared a quasi-state of emergency in 3 prefectures (which account for 4.1% of GDP). Although the Omicron impact is smaller than the Delta-driven wave, as reflected by high-frequency indicators, it will take a toll on some services sectors. The corresponding PMI data had edged down in December. The impact could be partly offset by a rebound of domestic travel during the New Year holiday by rail (up by 50% YoY) and air (up by 12%). Moreover, the latest outbreak would have limited negative impact because: (i) domestic spending on goods should be supported by stronger purchasing power (average cash income grew for 8 straight months) and progress in vaccination with 79.5% of the population fully-vaccinated, the highest among advanced economies; (ii) solid exports which grew 8.1% in November led by top-3 items (vehicle, machinery and electronics) which collectively contributed 55.1% of total exports; and (iii) an improvement in private investment - Tankan survey revealed firms plan to increase 2022 capital expenditure (CAPEX) to beyond 2020-2021 levels. This would also be supported by resilient manufacturing growth given robust exports and improving domestic demand going forward. In addition, the new stimulus package would support economic recovery.

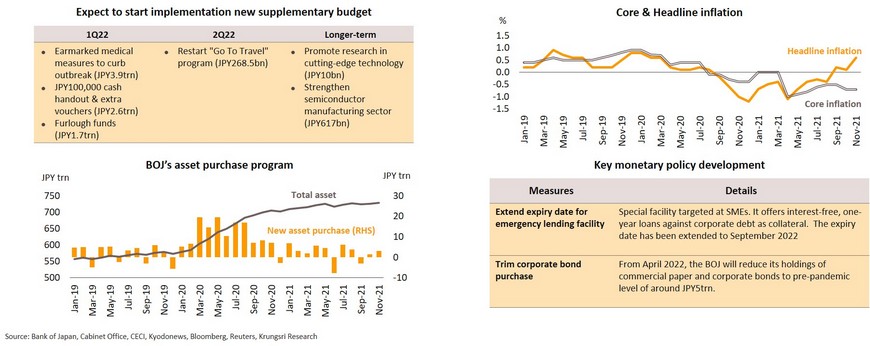

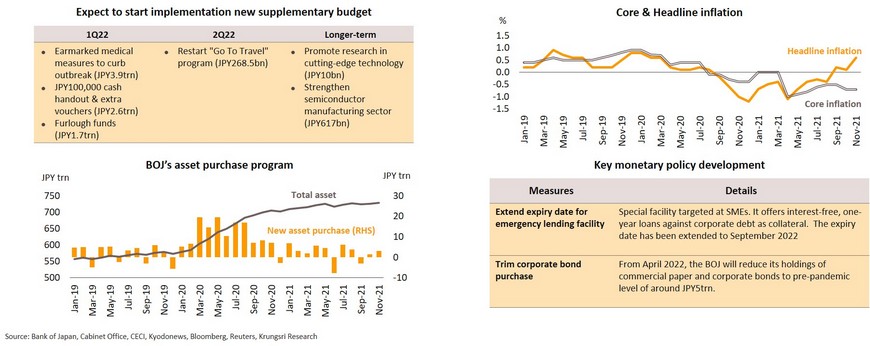

Supplementary budget and ultra-loose monetary policy could help cushion latest pandemic impact despite taking a tiny step to exit crisis stimulus

Recovery remains weak and uneven while the latest COVID-19 flare-up could delay the gradual economic recovery, Japan has to mitigate the negative effects. In December, the parliament passed Kuroda’s supplementary budget valued at JPY36trn (accounting for 6.7% of GDP) to ease the pandemic impact. However, they might postpone the ‘Go To Travel’ campaign aimed at promoting domestic tourism, possibly to 2Q22. On the monetary front, though the Bank of Japan (BOJ) continues with its ultra-loose policy, new asset purchases in November reached JPY3trn, more than the monthly average pre-pandemic. Meanwhile, core inflation is still in negative territory, implying the need to avert deflation. At the December meeting, the BOJ kept policy rates, QE and yield curve control program, and extended the expiry of its COVID-19 relief funds for hard-hit SMES from March to end-September. However, the BOJ has taken a cautious step to exit some crisis stimulus by scaling back commercial paper and corporate bond purchase program to pre-COVID level, starting from April, as the performance of large firms has improved. Japanese listed companies are projected to post 10% growth in pretax profit for 2022 fiscal year. Looking ahead, the BOJ would continue with large-scale monetary easing despite the policy tweak, while fiscal measures are likely to play a more important role to ease the pandemic impact.

Thailand: Omicron would delay, not derail, economic recovery

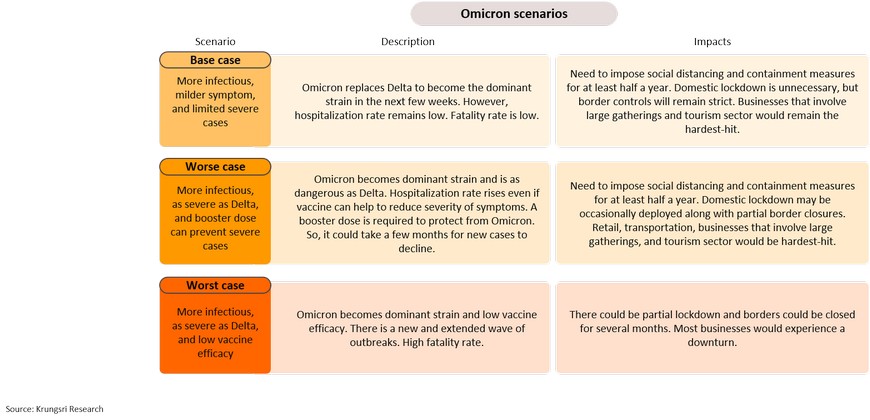

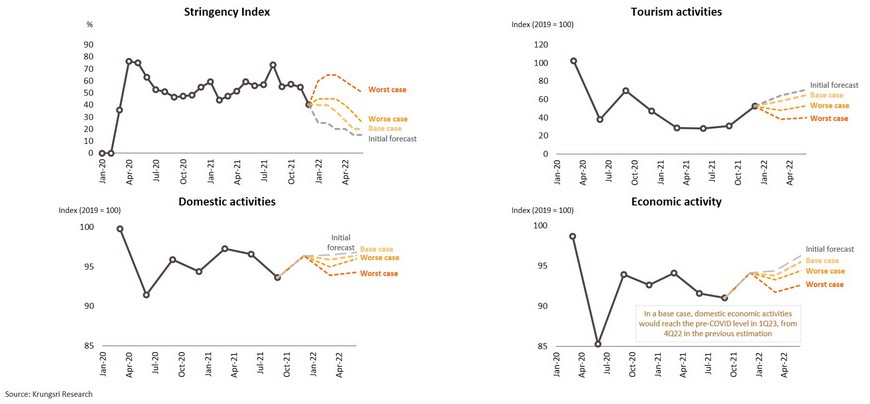

- Thai economic recovery might be delayed given rising concerns about new wave. Omicron and Delta have pushed daily cases to new highs worldwide. Though research show risk of hospitalization is less than for Delta variant, there is still uncertainty and risk, depending on hospitalization rate and vaccine efficacy.

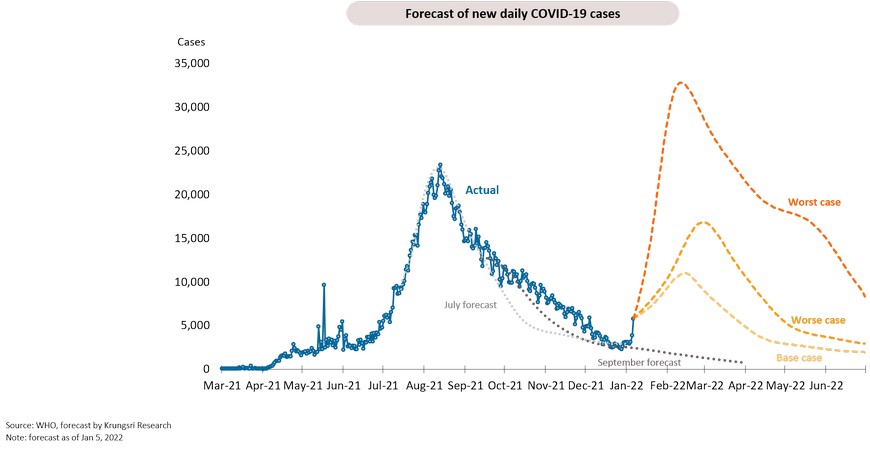

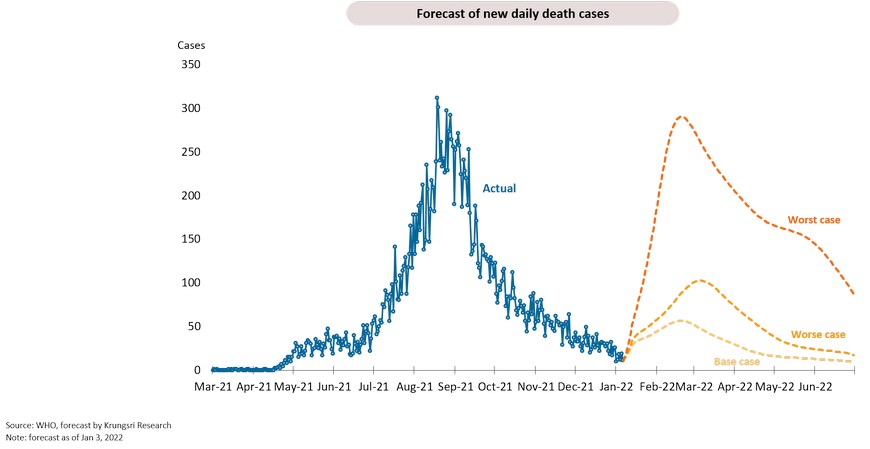

- In Thailand, daily COVID-19 cases would reach 11,000 under our base case and nearly 32,000 under worst-case scenario. Daily fatalities would peak at 50 under base case and reach 300 under worst-case scenario.

- Milder symptoms, lower fatality rate, and rising vaccination rate suggest containment measures should be less stringent than previous waves, implying limited impact on domestic activity. However, as border control remains strict, tourism is the hardest hit sector. Omicron impacts would reduce overall economic activities by 0.6%-3.0%.

- Exports performed well and would be a key driver of the Thai economy this year driven by larger volumes rather than higher prices. Private investment growth is stronger than pre-COVID level, underpinned by rising exports and recovering domestic demand. The government recently pledged to introduce additional stimulus measures to alleviate the impact from the coronavirus. We are awaiting the clarity of new stimulus package before adjusting our 3.7% GDP growth forecast for 2022.

- Inflation could rise faster than expected but would be capped by weak wage growth. Downside risks to growth and transitory inflation suggest MPC would hold policy rate in 2022.

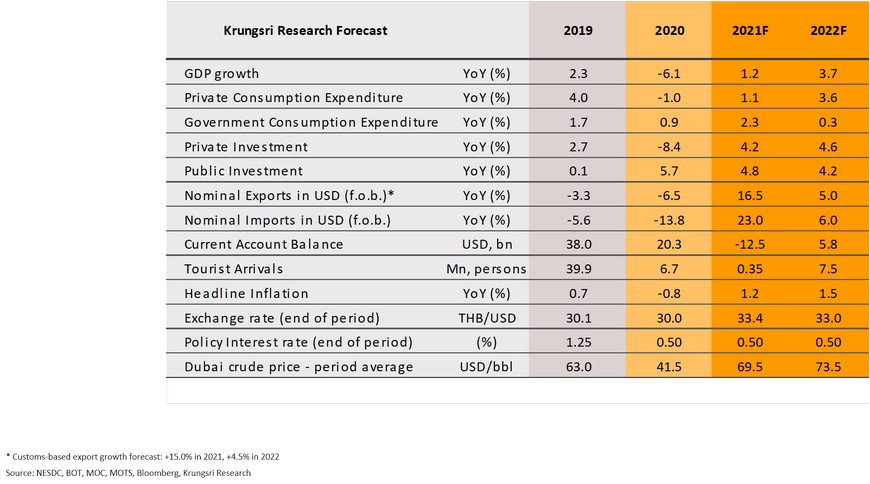

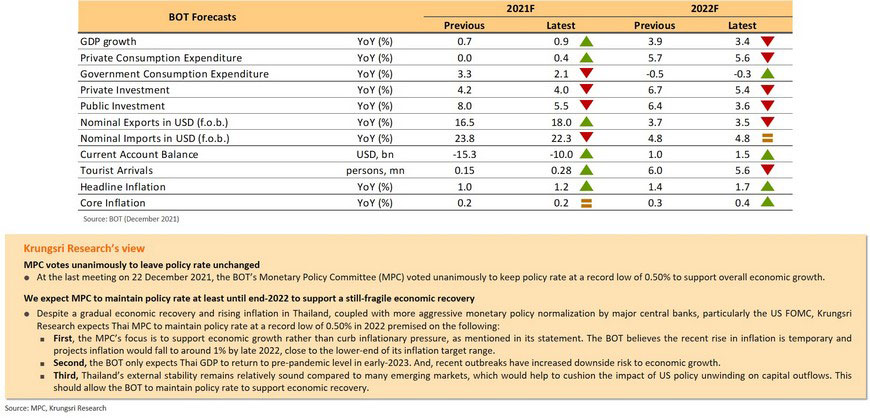

Krungsri Research forecasts 2021-2022

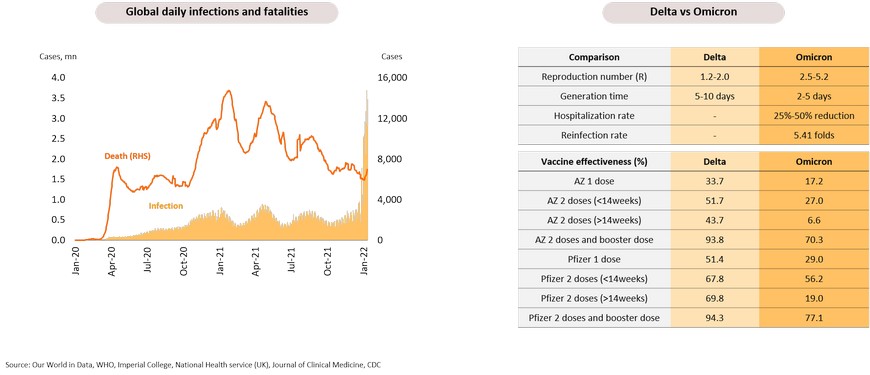

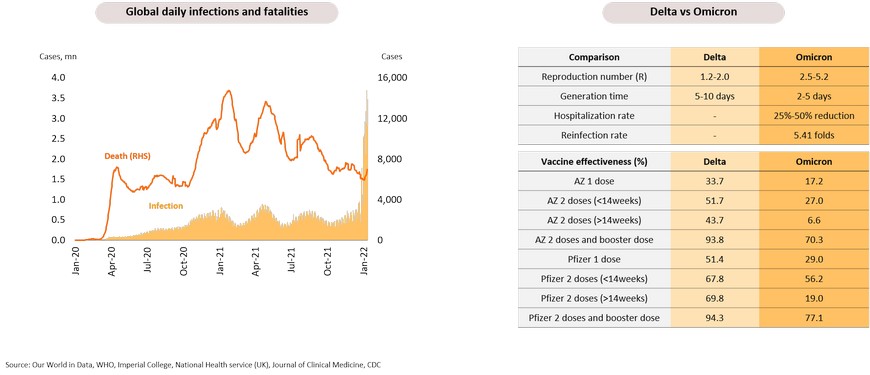

Omicron and Delta push daily cases to new highs worldwide

Global new daily cases has reached a new high of nearly 3.0 million following the recent Omicron outbreaks. The latest variant of concern has raised new concerns worldwide because it has quickly become the dominant strain in several countries. It is more contagious than the Delta variant; an Imperial College research report concluded Omicron replicates five times faster than Delta. More importantly, current vaccines are also less effective against Omicron and a booster dose would be needed to protect against Omicron. However, research shows risk of hospitalization is 25-50% less than for Delta variant. Hence, it would not stretch national healthcare systems.

There is still uncertainty as Omicron may create serious concerns

The number of infections would be high, but the risk factors are severity of symptoms and vaccine efficacy.

- Base case: Reproductive number 5.2, Hospitalization rate 50% below Delta, vaccine efficacy (85% with booster dose)

- Worse case: Reproductive number 5.2, Hospitalization rate 25% below Delta, moderate vaccine efficacy (85% with booster dose)

- Worst case: Reproductive number 5.2, Hospitalization rate 25% below Delta, low vaccine efficacy (25% with booster dose)

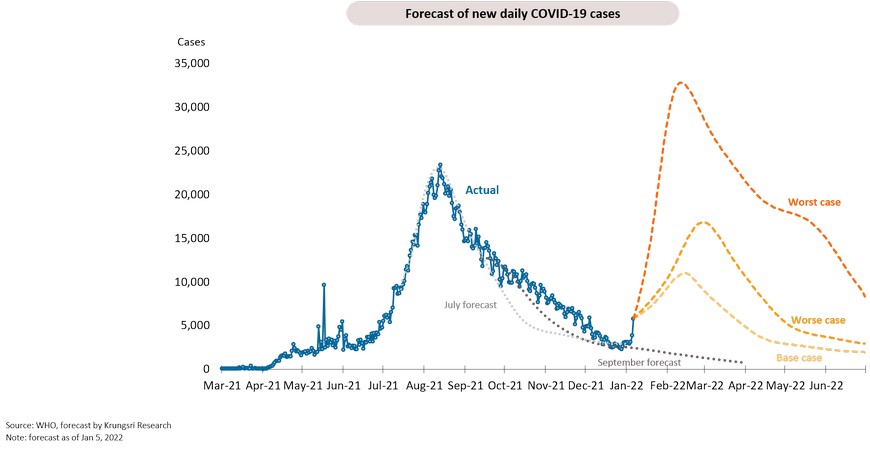

Daily COVID-19 cases would reach 11,000 under base case and nearly 32,000 under worst- case scenario

Our base case assumes daily new detected cases would peak by mid-Feb at 11,000. Total cases in the first half of 2022 could reach 0.88 million. In the worst-case scenario, daily cases would reach 32,000.

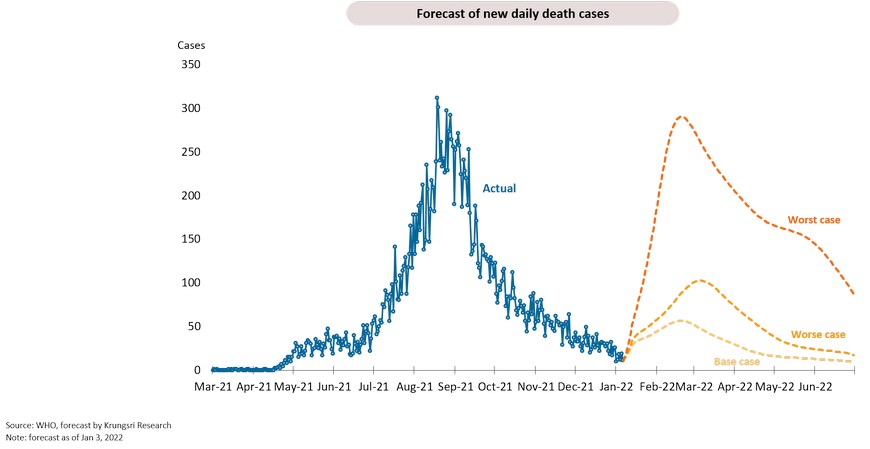

Daily fatalities would peak at 50 under base case and reach 300 under worst-case scenario

Our base case assumes fatality rate would be 0.2% with fatalities peaking at 50 a day by the end of Feb. The low fatality rate and fewer severe cases would leave room for authorities to continue to ease COVID-19 containment measures. Under worst-case scenario, daily fatalities could reach 300 cases.

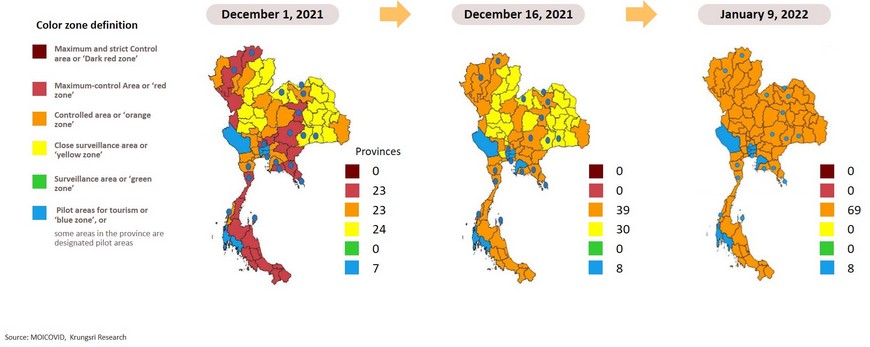

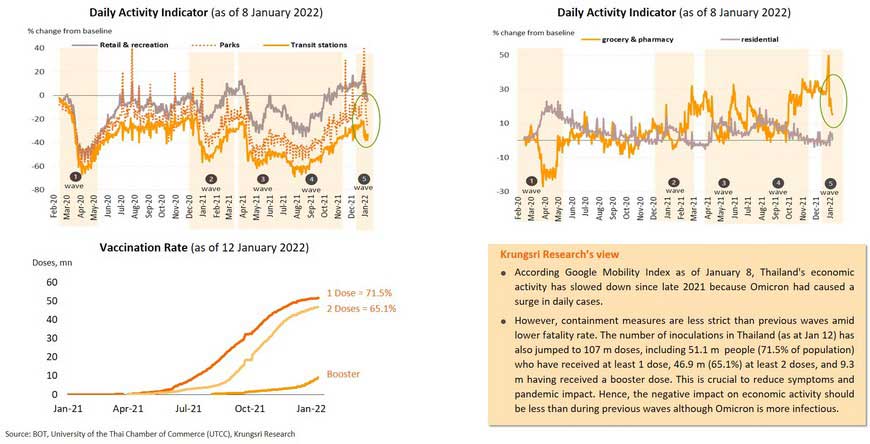

Milder symptoms, lower fatality rate, and rising vaccination rate suggest containment measures would be less strict than previous waves

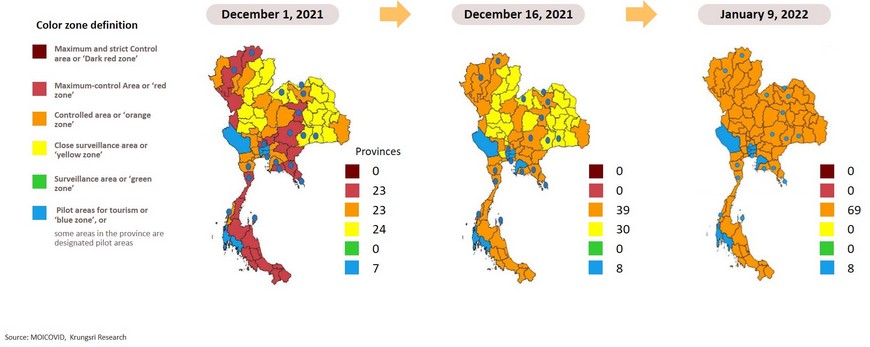

Government has only raised COVID-19 alert from level 3 to level 4 and expanded the list of restricted areas to 69 provinces (Orange Zone). As at January, 9, there are 8 provinces in the Blue Zone, which are considered as safe tourism zones. However, the containment measures are less stringent than last year. This means smaller impact on domestic economic activities than during previous waves.

High-frequency data indicates current wave could take a toll on domestic activity but impact would be limited given less stringent restrictions than last year

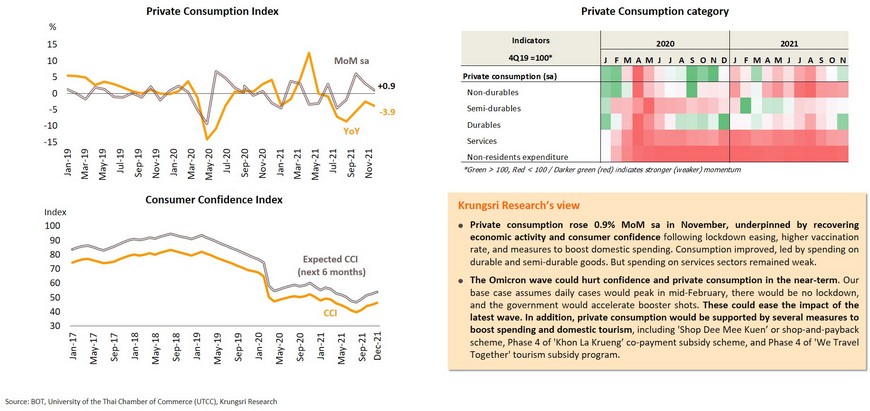

Private consumption could slow down in the near-term due to new wave; stimulus measures would continue to support domestic spending

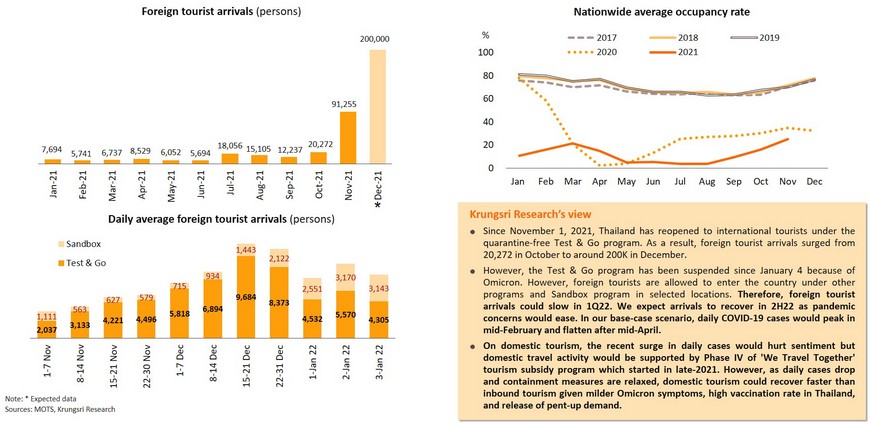

However, as border control remains strict, tourism is the hardest hit sector

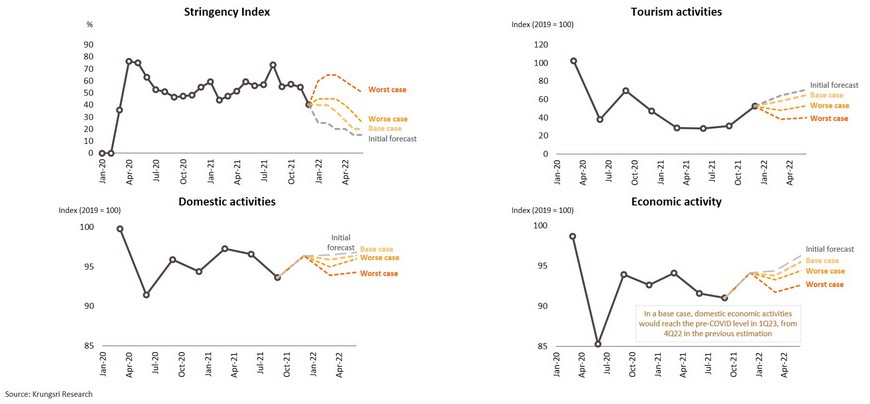

Recovery might be delayed; Domestic activity would be hit less than tourism sector

Concerns over Omicron outbreaks would slow the relaxation of COVID-19 containment measures, especially border controls. Stricter containment measures would limit domestic economic activities and delay economic recovery in Thailand. Our model suggests the stringency index would be higher than before Omicron. Domestic activities under each scenario would be reduced by 0.9%, 2.0% and 3.2% from our initial forecasts, respectively. Containment measures on domestic activity should be less stringent than last year but border control would remain strict. Tourism activities would drop by 7.1%, 21.7% and 36.8%, respectively. This suggests Omicron outbreak would hurt tourism-related sectors the most, rather than overall domestic economic activities. Overall economic activities under each scenario would drop by 0.6%, 1.4% and 3.0%, respectively. This would delay recovery in Thailand - to pre-COVID level - by a quarter, from Q422 to Q123.

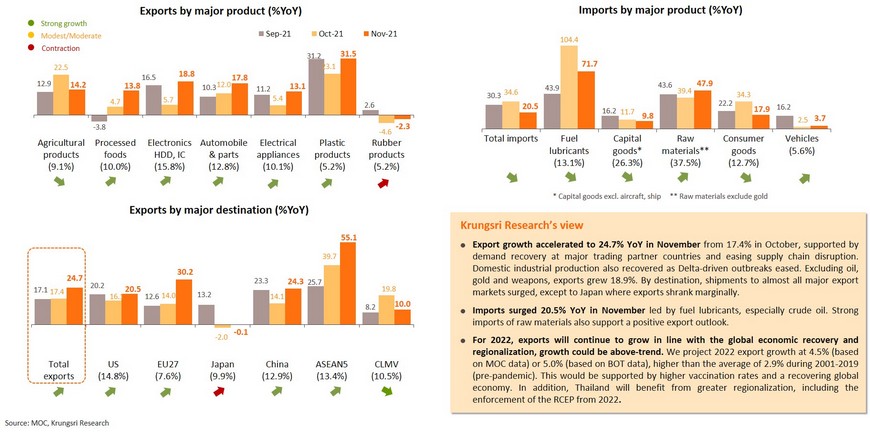

Exports performed well and would be a key driver of Thai economy this year

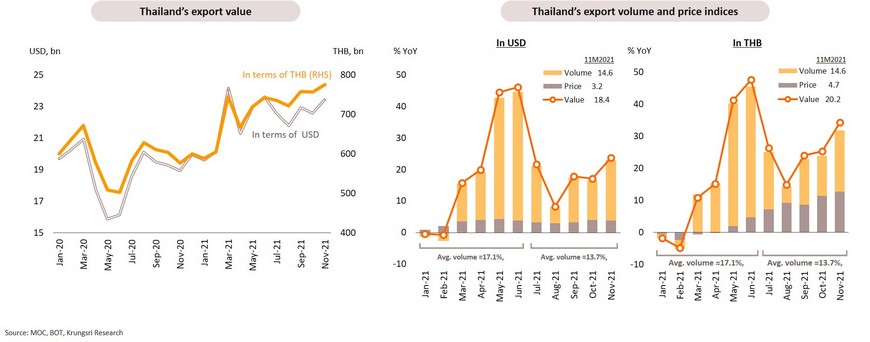

Robust Thai exports were led by larger volumes rather higher prices; weaker baht also helped to support export earnings

The main driver of Thai exports in 2021 was a surge in export volumes rather higher export prices, which is a positive sign for Thai exporters, producers and the overall economy. In 2H21, Thai export volume continued to grow at double-digit rate (averaging +13.7% in July-November vs +17.1% in 1H21). Growth in USD export prices has been steady at an average of 3.2% in the first 11 months of 2021. And, the Thai baht would likely weaken in 1H22, which would also support export earnings and Thai GDP growth. In the first 11 months of 2021, the weaker baht helped Thai export value (in THB) to expand by 20.2%, including a 4.7% rise in export prices. In USD, export value grew 18.4% while export prices rose 3.2%.

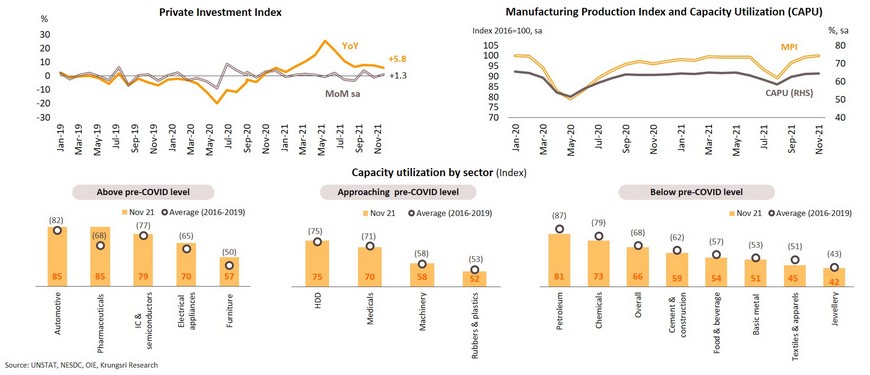

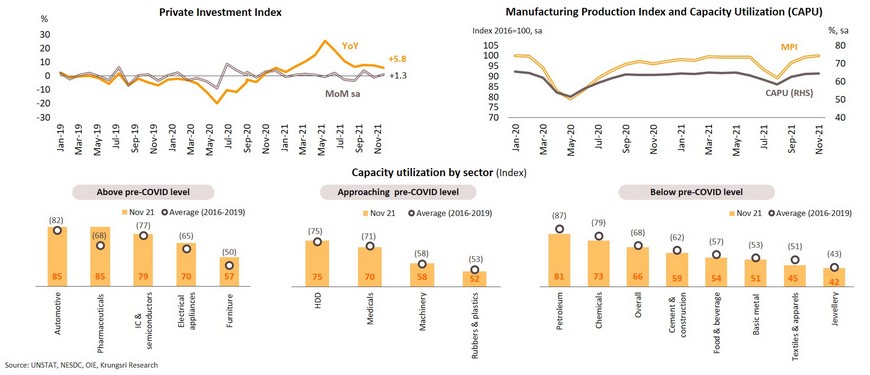

Private investment growth is stronger than pre-Covid level, underpinned by rising exports and recovering domestic demand

Private Investment Index (PII) expanded by 1.3% MoM sa in November driven by stronger external demand and recovering business sentiment recovery. Thai Manufacturing Production Index (MPI) and Capacity Utilization rebounded in November. Production capacity utilization has yet to reach pre-pandemic level but utilization rates in several key industries have exceeded pre-pandemic levels, especially automobile, pharmaceuticals, IC & semiconductors, electrical appliances and furniture. Production in some industries are approaching their pre-pandemic levels, including HDD, medicals, machinery and rubber & plastics. The impressive outlook for exports could encourage business investment this year.

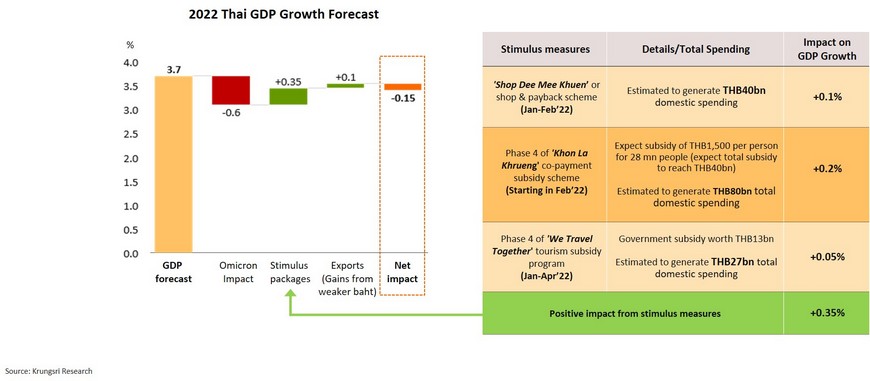

Overall economic growth: Omicron impact may be cushioned by gains from stimulus measures and exports

The new wave of COVID-19 outbreak in Thailand dominated by Omicron is estimated to reduce overall economic growth by 0.6 ppt under our base case. On a positive note, we expect government stimulus measures and export gains (from weaker baht) to add 0.35 ppt and 0.1 ppt to our GDP growth forecast, respectively. The initial impact on Thai GDP growth would be a net -0.15 ppt. However, since government recently pledged to utilize parts of funds worth over THB200bn under the Borrowing Bill to alleviate the impact from the coronavirus, implying there could be additional stimulus programs such as cash transfer for state welfare card holders and others. Hence, we are awaiting the clarity of new stimulus package in the coming period before adjusting our 3.7% GDP growth forecast for 2022.

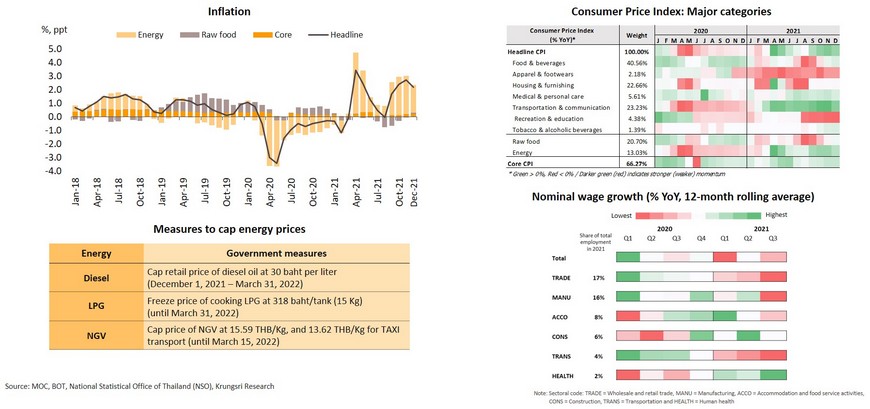

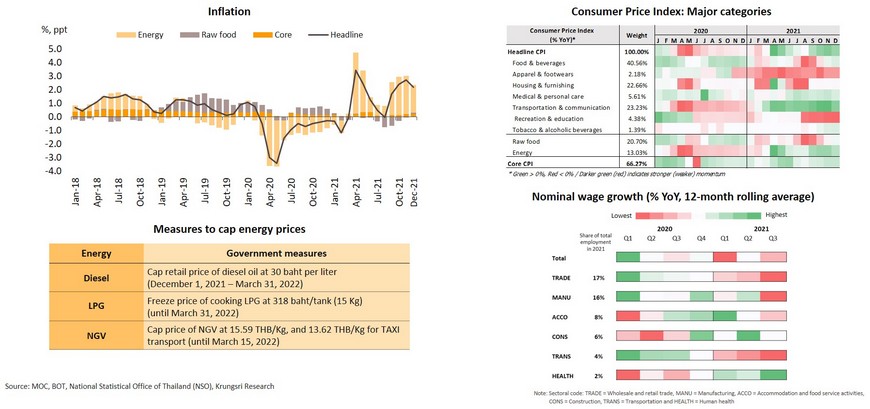

Inflation likely to rise faster than expected but would be capped by weak wage growth

In December, headline inflation dropped to 2.17% YoY from 2.71% in November, following the policy to cap domestic diesel price. But, raw food prices rose because of higher pork prices. Core inflation (excluding raw food and energy prices) was stable at 0.29%. For full-year 2021, headline and core inflation averaged 1.23% and 0.23%, compared to -0.85% and 0.29% in 2020, respectively. Looking ahead, inflationary pressure is likely to rise more than expected, particularly in the first half of this year, driven by rising energy prices and the AFS outbreak at pig farms which have pushed up prices of pork and related and substitute products. However, inflationary pressure would be capped by Thailand’s policy to freeze prices for several types of energy and some key necessities, as well as weak wage growth.

Downside risks to growth and transitory inflation suggest MPC would hold policy rate in 2022