Global: Seeking balance and growth pendulum in motion

Global activity shows signs of stock-building; Growth pendulum swings toward stall on subdued forward indicators and onset of US reciprocal tariffs

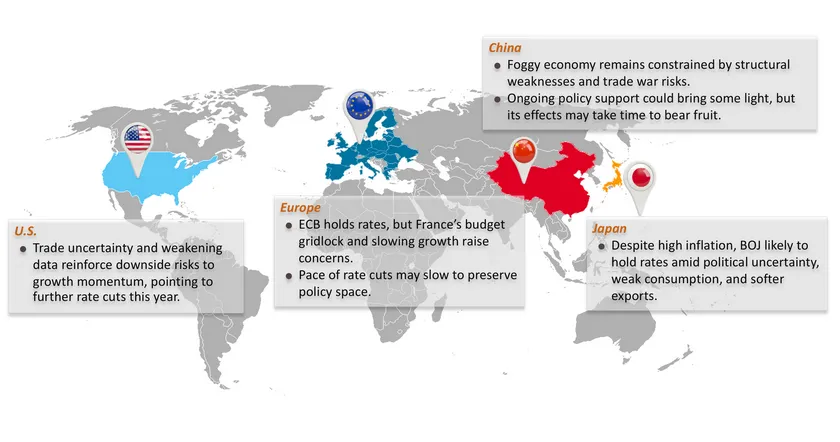

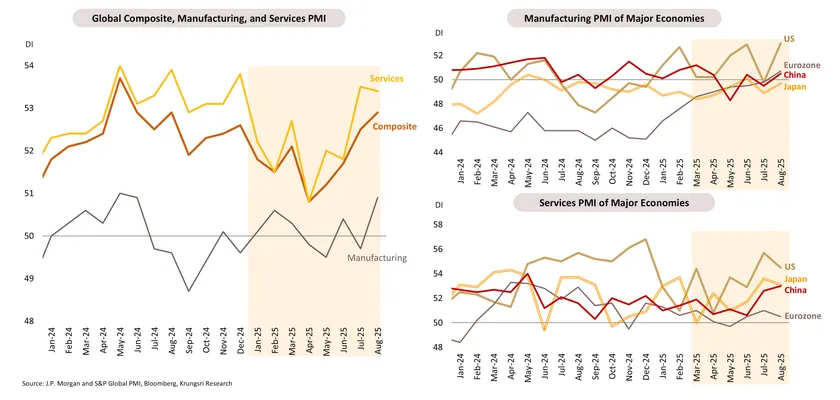

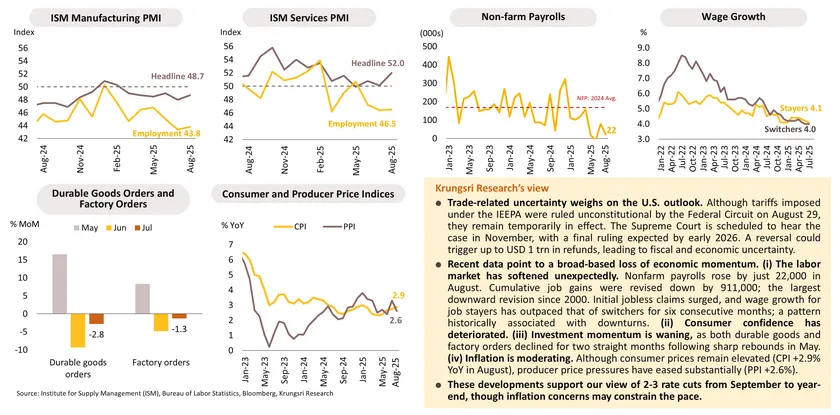

U.S.: Trade uncertainty and weakening economic data reinforce downside risks to growth momentum, pointing to further rate cuts this year

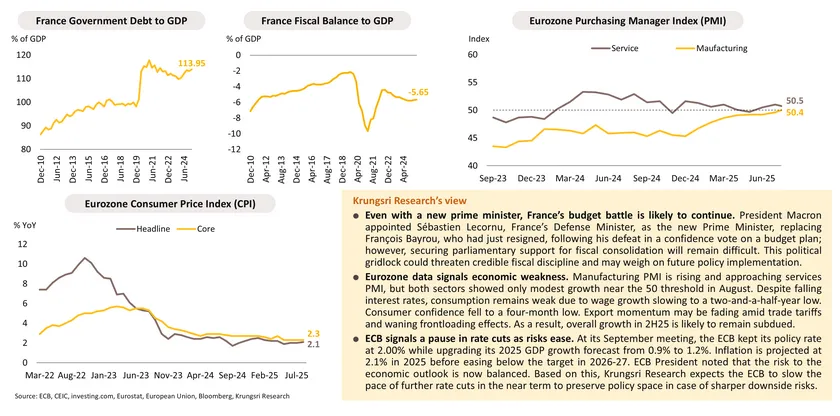

Eurozone: ECB holds rates, but France’s budget gridlock and slowing Eurozone growth raise concerns

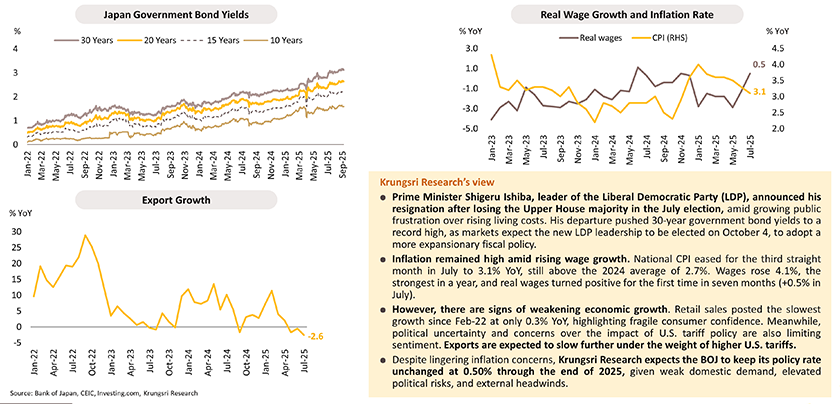

Japan: Despite high inflation, BOJ likely to hold rates amid political uncertainty, weak consumption, and

softer exports

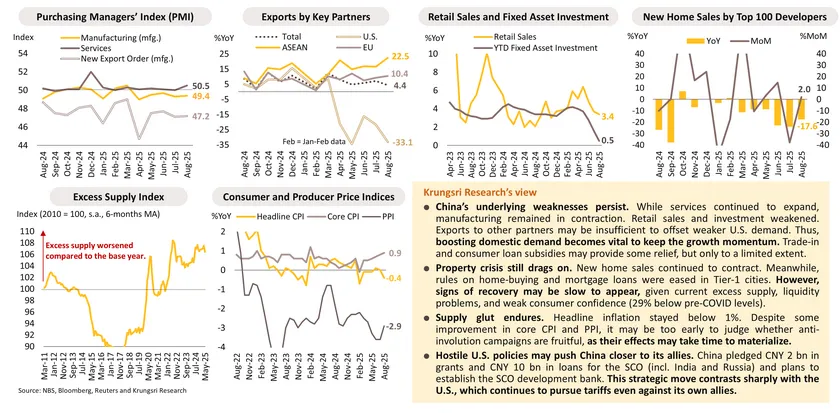

China: Foggy economy remains constrained by structural weaknesses and trade war risks; ongoing policy support could bring some light, but its effects may take time to bear fruit

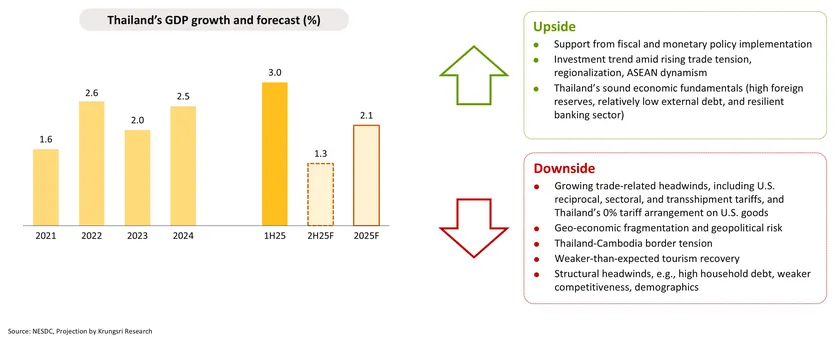

Thailand: Clinging to hopes of economic momentum during political transition

- We assess that the political transition will have a limited adverse impact on fiscal spending, given continuity of economic policy implementation. This should help Thai economic growth swing from a possible quarter-on-quarter contraction in 3Q25 to a slight expansion in 4Q25, avoiding a technical recession and remaining consistent with our base-case forecast of 2.1% growth for 2025. However, GDP growth is expected to slow to just 1.3% YoY in the second half of the year, compared to 3.0% in the first half, as front-loaded exports fade and tariff impacts take hold.

- Thai exports set to slow sharply after 19% U.S. tariff takes effect in August. Full-year growth is expected in the single digits. Thailand’s export momentum faces headwinds from U.S. tariffs and a stronger baht.

- US reciprocal tariffs under IEEPA face legal dispute. Even if struck down by U.S. courts, the Trump administration can still resort to other tools. Even without reciprocal tariffs, an expansion of Section 232 tariffs alone could inflict noticeable losses on Thai exports, especially if Thailand struggles to find alternative markets.

- Tourism recovery remains fragile, yet Q4 high season could lift arrivals.

- Private investment shows weak momentum, constrained by tariff concerns, sluggish industry, and slow tourism recovery.

- Private consumption falters amid service sector weakness and domestic headwinds. New government set to launch short-term stimulus in 4Q25.

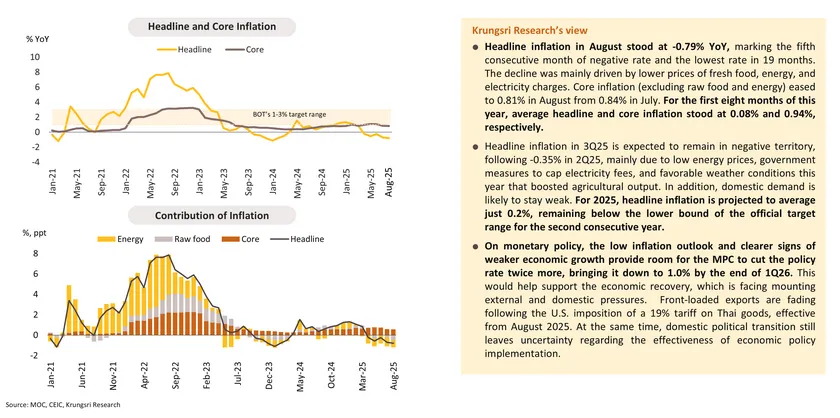

- Low inflation and weak growth open the door for the MPC to cut rates twice by 1Q26.

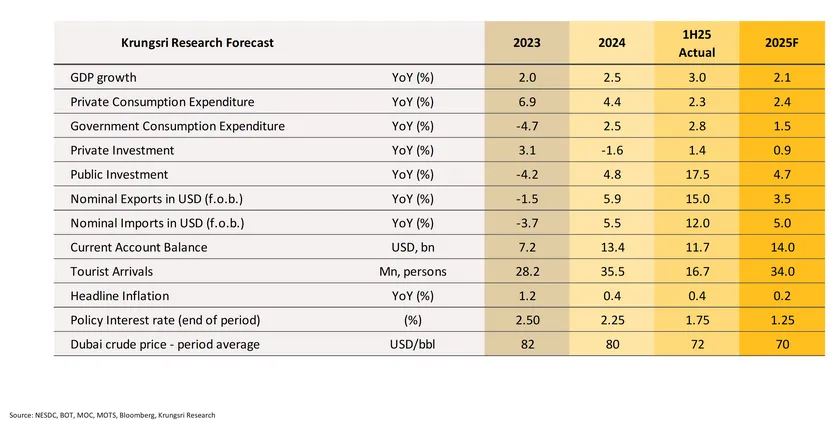

Krungsri Research Forecasts for 2025

Despite political transition, Thailand’s economy in 2025 still projected to grow 2.1%

We assess that the political transition will have a limited adverse impact on fiscal spending, given continuity of economic policy implementation.

This should help Thai economic growth swing from a possible quarter-on-quarter contraction in 3Q25 to a slight expansion in 4Q25, avoiding a technical recession and remaining consistent with our base-case forecast of 2.1% growth for 2025. However, GDP growth is expected to slow to just 1.3% YoY in the second half of the year, compared to 3.0% in the first half, as front-loaded exports fade and tariff impacts take hold.

Swift political transition, but new government lasts only 4 months before dissolution

Following the Royal endorsement of Anutin Charnvirakul, leader of the Bhumjaithai Party, as Thailand’s 32nd Prime Minister, domestic political tensions have eased somewhat, supporting continuity in economic policy implementation. Nevertheless, several key issues require close monitoring, as the political environment remains fragile. The current administration governs as a minority government with only 146 seats in the House of Representatives and a limited four-month timeframe after delivering its policy statement to parliament. These conditions underscore risks to political stability and highlight the challenges the government may face in advancing key national policies.

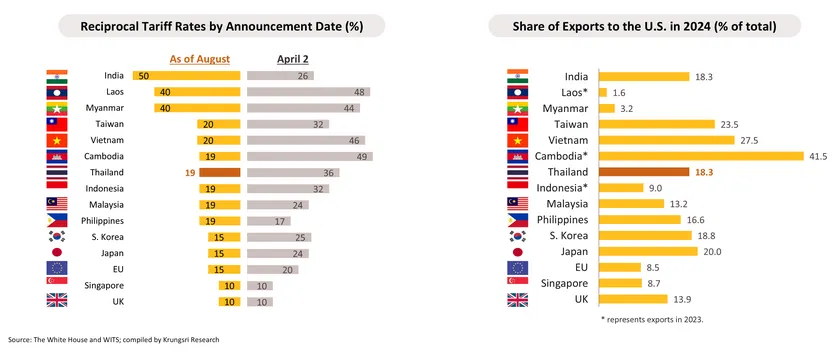

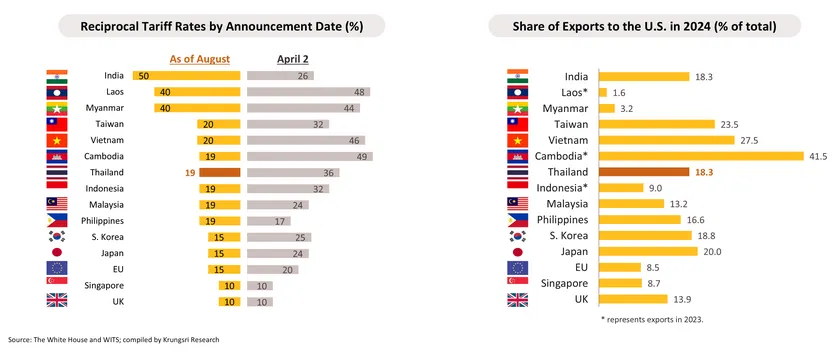

U.S. sets 19% tariff on Thailand, down from the threatened 36%, aligning with other ASEAN nations, but still higher than major countries

On July 31, 2025, the U.S. announced a 19% import tariff on Thai goods, significantly lower than the previously proposed 36% reciprocal tariff announced on April 2, bringing it roughly in line with rates imposed on several ASEAN countries, including Indonesia, the Philippines, Malaysia, and Cambodia. However, the rate remains higher than the 15% applied to South Korea, Japan, and the EU. Although the Trump administration has revised tariff rates downward from the average levels announced on April 2, the sectoral tariffs of 25-50% under Section 232 continue to apply to key products, such as automobiles, steel, aluminum, and copper, posing potential disruptions to global supply chains in the future.

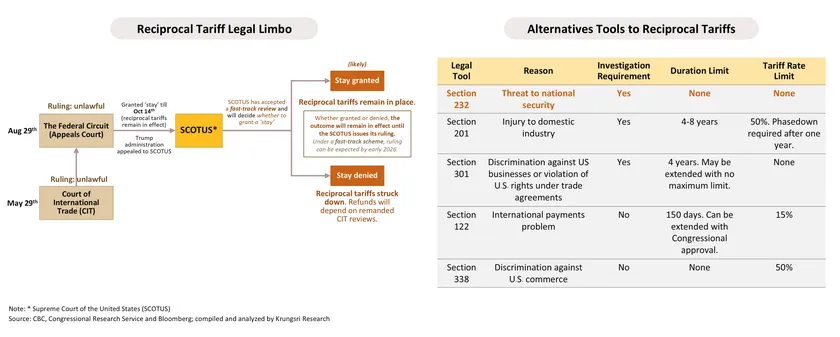

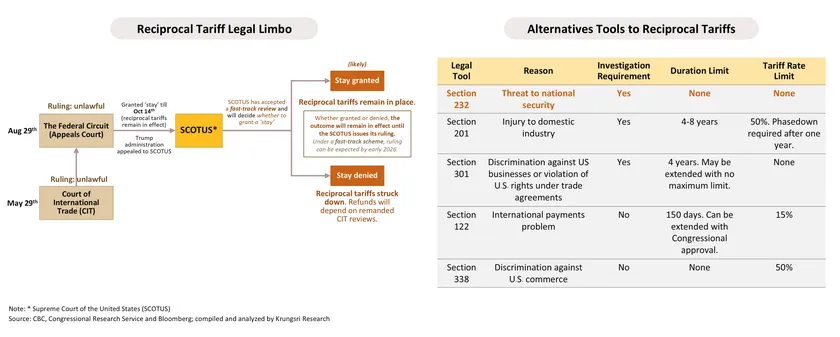

Reciprocal tariffs under IEEPA face legal dispute; even if struck down by U.S. courts, Trump administration can still resort to other tools

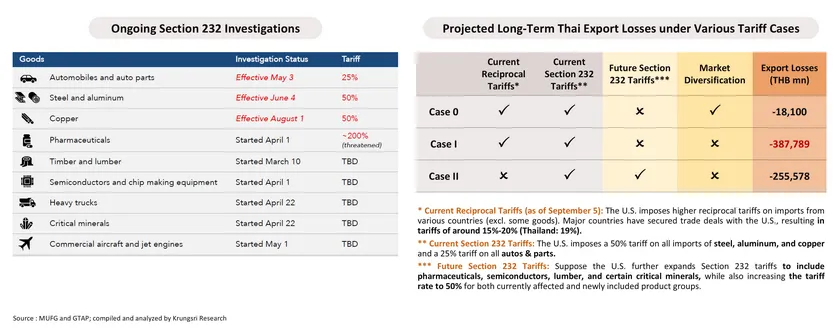

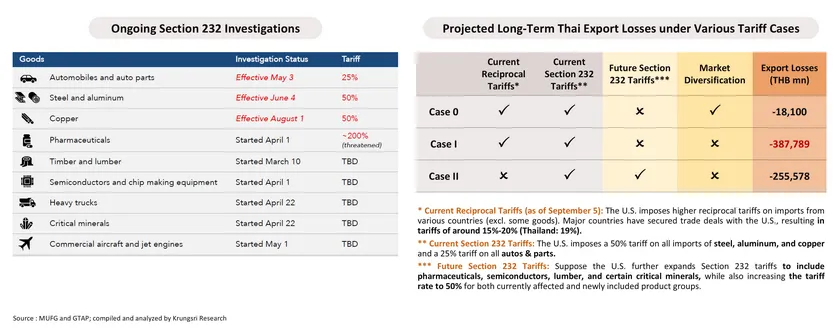

Reciprocal tariffs, imposed under the International Emergency Economic Powers Act (IEEPA), are under legal dispute. On August 29, the U.S. Federal Circuit upheld the Court of International Trade’s ruling that the Trump administration’s reciprocal tariffs were unconstitutional. Nonetheless, reciprocal tariffs remain temporarily in effect, with the Supreme Court granting a fast-track review starting in early November and a final ruling expected in early 2026. Even if struck down, the Trump administration can still resort to other tools, such as Sections 201, 301, and 232. Particularly, section 232 has already been implemented to impose industry-specific tariffs, currently 25% on autos and parts, and 50% on steel, aluminum, and copper, with potential expansion to other products. As such, U.S. tariff pressures are expected to persist in the near term.

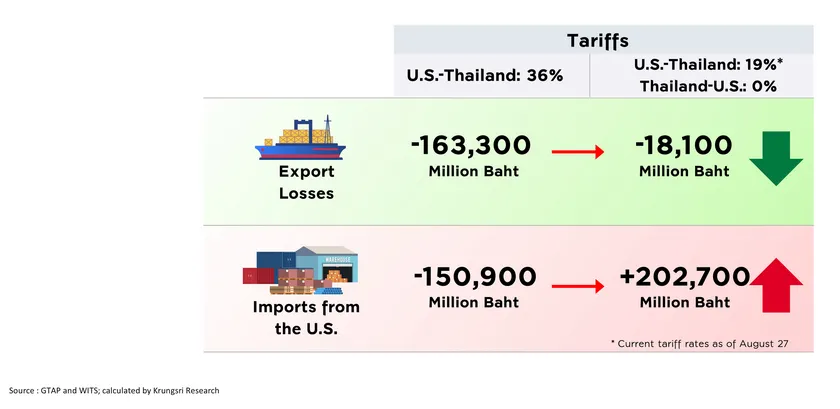

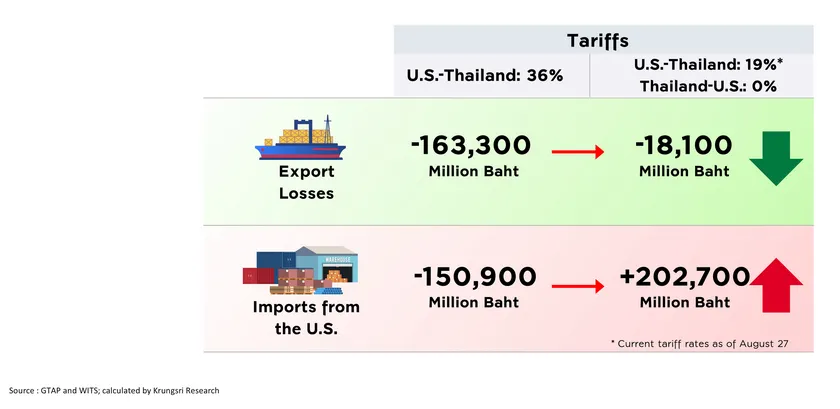

If Thailand offers 0% tariffs on all U.S. goods in exchange for the U.S. lowering its tariff to 19%, export losses could be reduced by 9 times, but imports from the U.S. may surge

The U.S.–Thailand tariff reduction from 36% to 19% is expected to significantly reduce long-term export losses, from THB -163.3 bn to THB -18.1 bn, a ninefold decrease. It is worth noting that the long-term effect may be less severe than the initial shock period, during which businesses may still struggle to shift their reliance on the U.S. market to other partners. Moreover, front-loaded exports are likely to fade in 2H25, following Thai export growth of 15% YoY in 1H25. The short-term impact, thus, could be higher but still less than the 36% scenario. However, the trade deal comes at a cost. Thailand has to offer zero tariffs on most U.S. goods, which could result in a 29% surge in imports from the U.S in the long term.

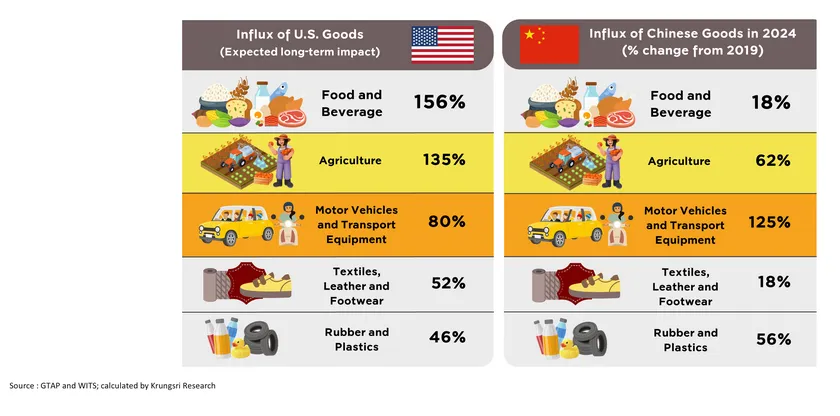

Surge in imports from U.S., induced by Thailand’s zero-tariff offer, could aggravate ongoing influx of Chinese goods, leading to “Twin Influx”

Granting zero tariffs to the U.S. is expected to lead to what we call the “twin influx,” which refers to the phenomenon of a simultaneous surge in imports from the U.S. alongside the ongoing influx of Chinese goods. The latter influx has continued to pressure the Thai economy in recent years, partly due to China’s excess supply and Trade War 1.0.

Agriculture and Motor Vehicle & Transport Equipment face major risks, as they are already heavily affected by the influx of Chinese goods. Imports from China in these sectors in 2024, compared with 2019, have grown substantially, while imports from the U.S., following the U.S.-Thailand trade deal, are expected to grow in the long term by 135% and 80%, respectively.

19% reciprocal tariff could still hurt Thai exports, and impact could even be more severe if Thailand fails to accelerate market diversification

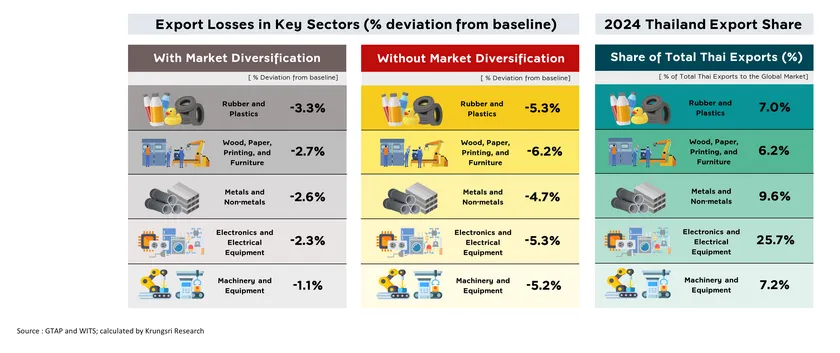

Despite the tariff reduction to 19% easing the overall impact, some key sectors could still face long-term damage, particularly Electronics and Electrical Equipment (-2.3%), Metal and Non-metals (-2.6%), and Rubber and Plastics (-3.3%), which account for a combined 42.3% of Thailand’s total exports in 2024.

In the worst-case scenario, where Thai businesses struggle to find alternative markets or government policies prove less effective in pushing for market diversification, the negative impacts could be more severe, such as Electronics and Electrical Equipment (2.3 times), Metal and Non-metals (1.8 times), and Rubber and Plastics (1.6 times). Moreover, sectors that might initially benefit in the long term from the substitution effect and investment relocation could instead see export losses, such as Motor Vehicles and Transport Equipment, Food and Beverages, and Chemicals and Pharmaceuticals.

This underscores the need to diversify partners, as U.S. trade policy is becoming increasingly unpredictable and subject to constant change.

Even without reciprocal tariffs, expanding Section 232 tariffs alone could inflict noticeable export losses on Thai exports, especially if Thailand struggle to find alternative markets

Regardless of whether the reciprocal tariffs are repealed, Thailand will continue to face the Section 232 tariffs that are already in effect, including 25% on autos and parts, and 50% on steel, aluminum, and copper. If the U.S. increases tariff rates and expands coverage to other key products such as semiconductors, pharmaceuticals, lumber, and critical minerals, the risks to Thai exports will increase further. Our model indicates that (i) with the reciprocal tariff set at 19%, the overall impact could be mitigated if businesses find alternative markets, but without such substitution the negative effect could intensify by as much as 21 times, equivalent to around THB -388 bn, and (ii) even without the reciprocal tariff, if the U.S. increase Section 232 tariffs to 50% and broadens product coverage, the impact would still be severe at approximately THB -256 bn.

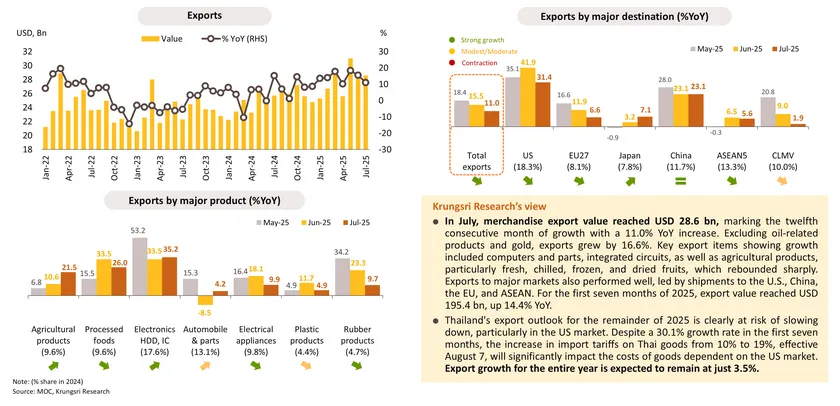

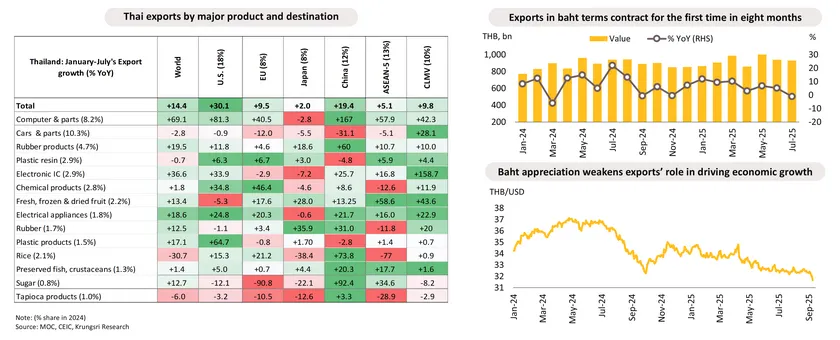

Thai exports set to slow sharply after 19% U.S. tariff takes effect in August; Full-year growth expected in single digits

Thailand’s export momentum faces headwinds from U.S. tariffs and stronger baht

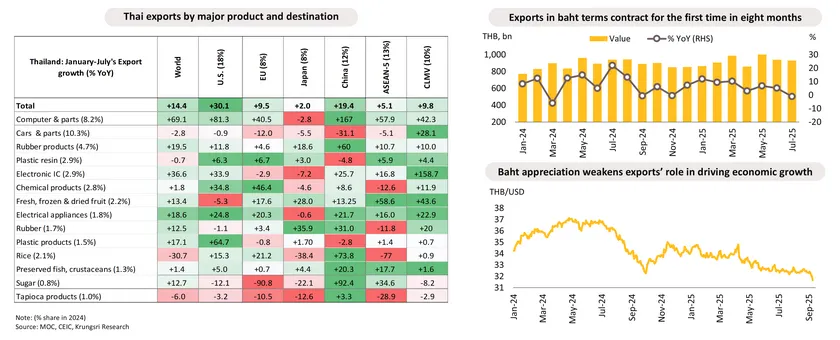

In the first seven months of 2025, Thai exports grew 14.4% YoY (Ministry of Commerce), led by industrial products (+18.5%, including computers and components, integrated circuits, and electrical appliances), agro-industrial products (+5.9%, such as pet food, fresh/chilled/frozen and processed chicken, and sugar), and agricultural products (+1.6%, including rubber and fresh, frozen, and dried fruits). Exports to the U.S. recorded particularly strong growth at 30.1%. However, looking ahead, the sector faces increasing challenges from U.S. tariff hikes and the continued appreciation of the baht, which weigh on export revenues in local currency and weaken price competitiveness against regional peers. In July, export values in baht terms contracted for the first time in eight months (-1.1% YoY), reflecting the weakening role of exports as a key driver of Thailand’s economy going forward.

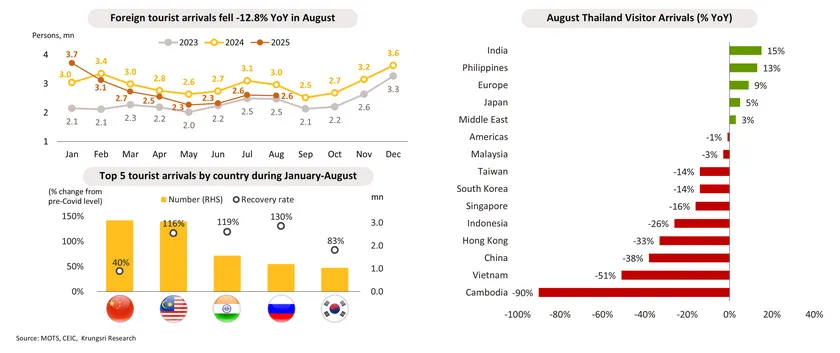

Tourism: Recovery still fragile, yet Q4 high season could lift arrivals

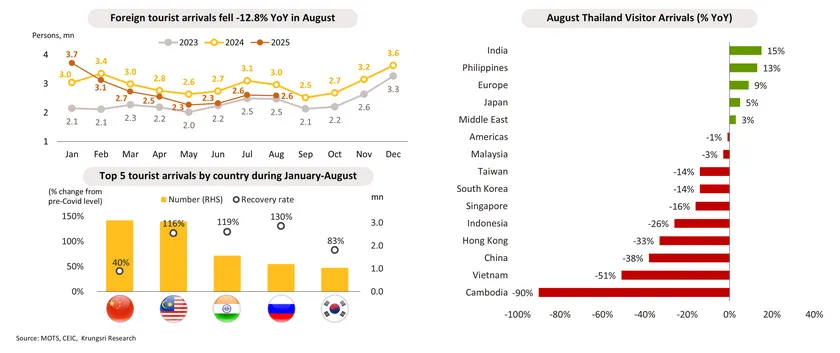

In August 2025, Thailand welcomed 2.58 mn foreign tourists, down from 2.61 mn in July and a decline of -12.8% YoY. Arrivals from China continued to contract sharply, falling by 33% YoY, while escalating border tensions with Cambodia led to a steep 90% drop in Cambodian visitors. In contrast, tourist arrivals from India and Europe recorded modest growth. During the first eight months of 2025, total foreign arrivals reached 21.88 mn (-7.2% YoY), generating THB 1.014 trn in revenue (-8.7%), underscoring persistent pressure on Thailand’s tourism sector. Nonetheless, the final quarter of the year is expected to benefit from seasonal factors, particularly the high season and China’s Golden Week holidays, which should help boost arrivals. In 2025, foreign tourist arrivals are projected at 34 mn.

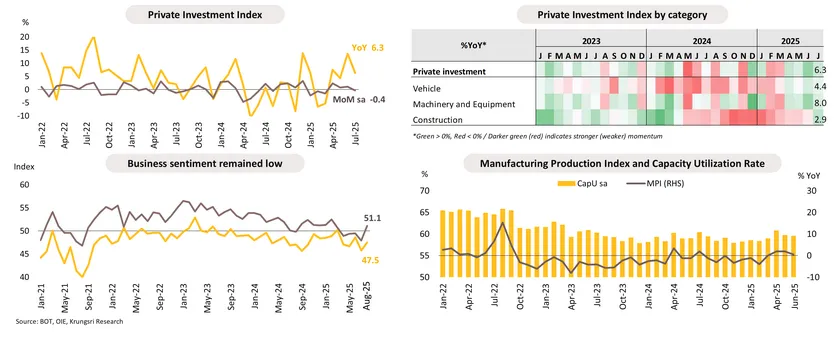

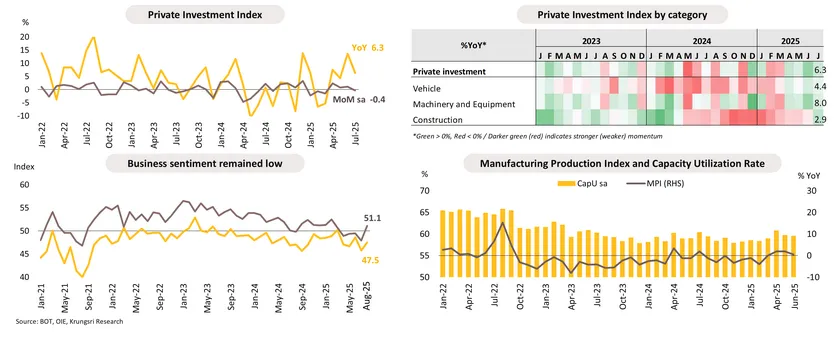

Private investment shows weak momentum, constrained by tariff concerns, sluggish industry, and slow tourism recovery

In July, the Private Investment Index (PII) expanded by 6.3% YoY but declined by -0.4% MoM after seasonal adjustment, reflecting pressures from contracting industrial production and persistently low-capacity utilization. Nevertheless, greater political clarity following the recent transition may ease concerns over political stability and support faster disbursement of funds under small-scale infrastructure projects worth THB 85 bn, which could help boost short-term investment activities. However, overall growth will remain constrained by several headwinds: (i) global economic uncertainty affecting demand for goods, (ii) the impact of U.S. trade tariffs, (iii) a slow recovery in the tourism sector, and (iv) weak business sentiment. These factors suggest that the recovery of private investment will remain limited going forward.

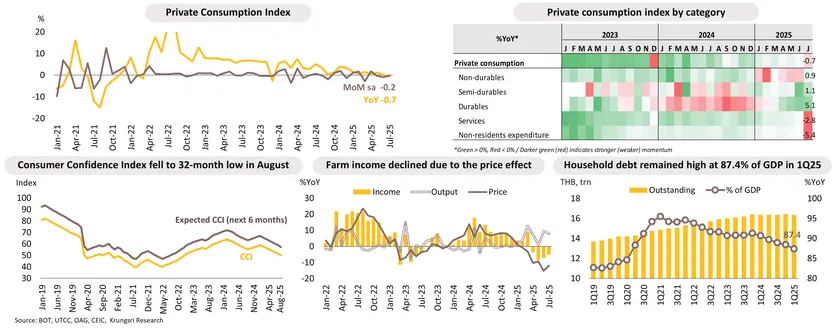

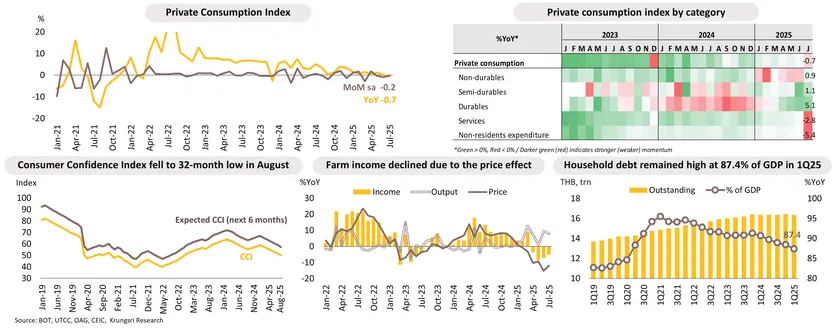

Private consumption falters amid service sector weakness and domestic headwinds; new government set to launch short-term stimulus in the final quarter

In July, the Private Consumption Index (PCI) contracted by -0.7% YoY, marking the first decline in 19 months. The drop was primarily driven by weaker spending in services, in line with the slowdown in tourism activities, while spending on consumer goods and durables expanded moderately. Looking ahead, private consumption is expected to face several headwinds, including (i) the impact of tariffs that could weigh on income and employment, (ii) lower farm incomes due to falling agricultural prices, (iii) high household debt, and (iv) fragile consumer confidence. Nevertheless, some supportive factors may come from domestic tourism stimulus measures and the possibility that the new government could reintroduce a stimulus program to boost short-term spending, such as the Half-half Co-Payment scheme.

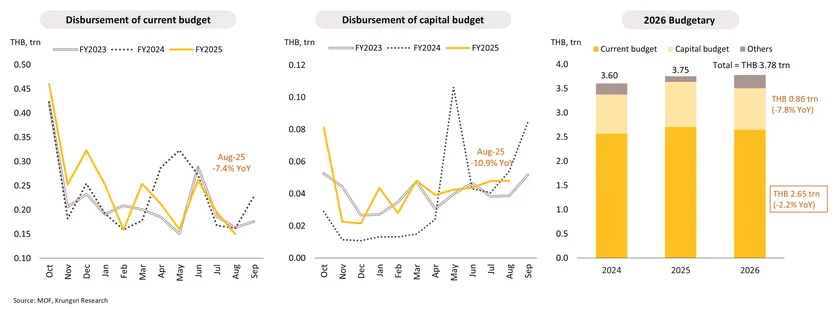

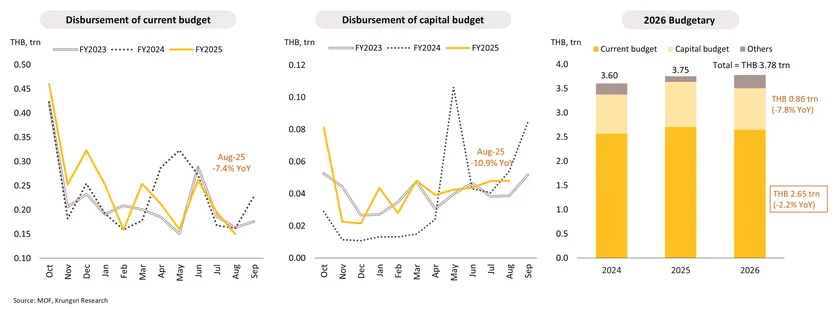

Public spending softens in August; policy execution and disbursement efficiency remain in focus amid political transition

In August, disbursements of current and capital expenditures contracted by -7.4% and -10.9% YoY, respectively, reflecting fiscal pressures and delays in certain projects. However, over the first eleven months of FY2025 (October 2024 – August 2025), current expenditure disbursement rose by 3.0% YoY to THB 2.68 trn, accounting for 96% of the annual allocation. Capital expenditure disbursement also increased significantly by 29.5% YoY to THB 0.47 trn, but it represented only 48% of the annual allocation target, highlighting persistent constraints in accelerating public investment projects. Although the political transition under the new government led by the Bhumjaithai Party is not expected to affect the enforcement of the FY2026 Budget Act, totaling THB 3.78 trn as scheduled, close attention will be needed on the efficiency of budget disbursement and the continuity of economic measures, which will play a critical role in supporting economic growth going forward.

Low inflation and weak growth open door for MPC to cut rates twice by 1Q26