Global Recovery: Going through a tougher phase

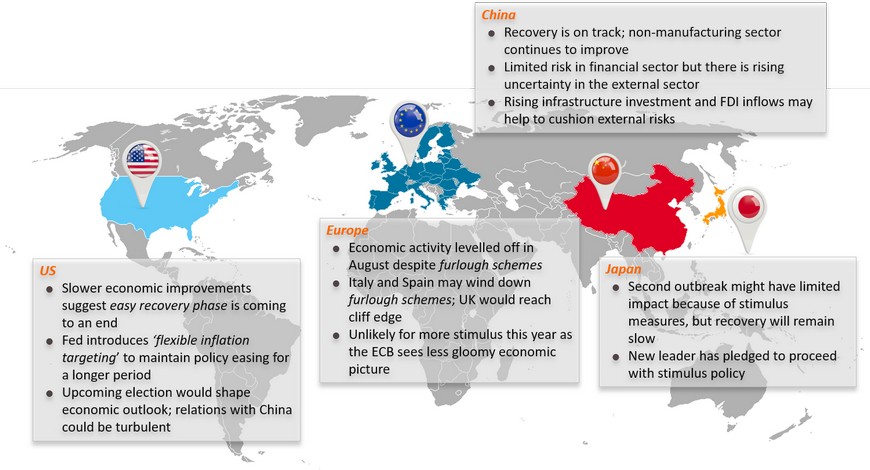

Economic recovery driven by reopening and pent-up demand to end soon; no signs trade is improving

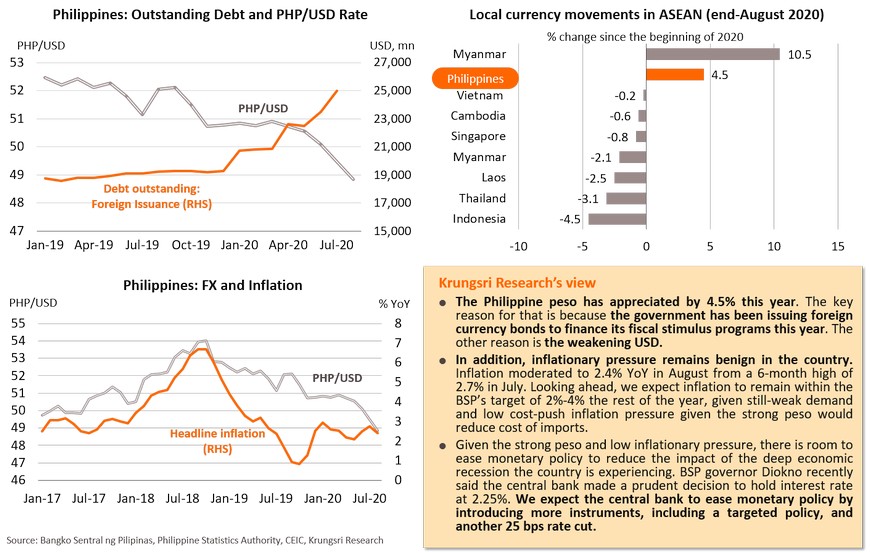

Composite PMI readings in major countries show manufacturing and services activities rebounded in May-June, largely driven by reopening of those business sectors and pent-up demand. However, since the beginning of the third quarter, Composite PMI readings have been improving at a slower pace in the US and China, leveled off in Japan, and edged down in Eurozone. This could mean the easy recovery phase would end soon and they would enter the tougher phase - to heal economic crisis scars such as high unemployment and weak purchasing power. And, although Composite PMI readings in most major countries have returned pre-crisis levels, their import data remain weak in the contraction zone. All these signs suggest the rebound in economic activities in major countries would only lift external demand slowly, which means global trade will remain sluggish ahead.

US: Slower improvements suggest easy recovery phase will end soon

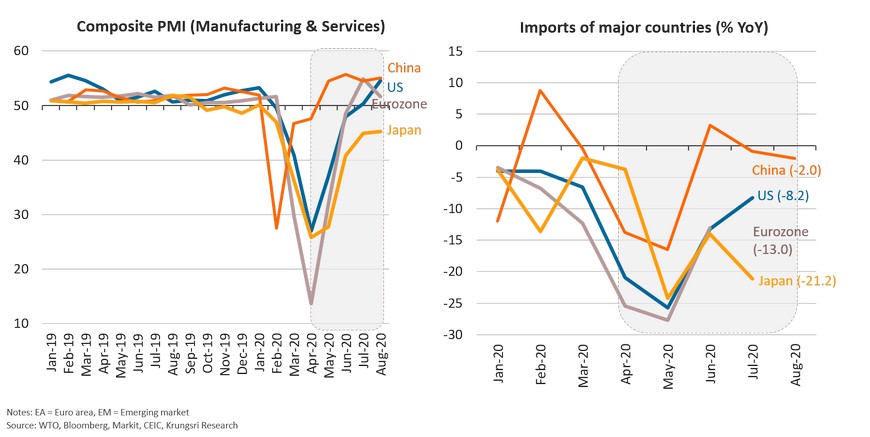

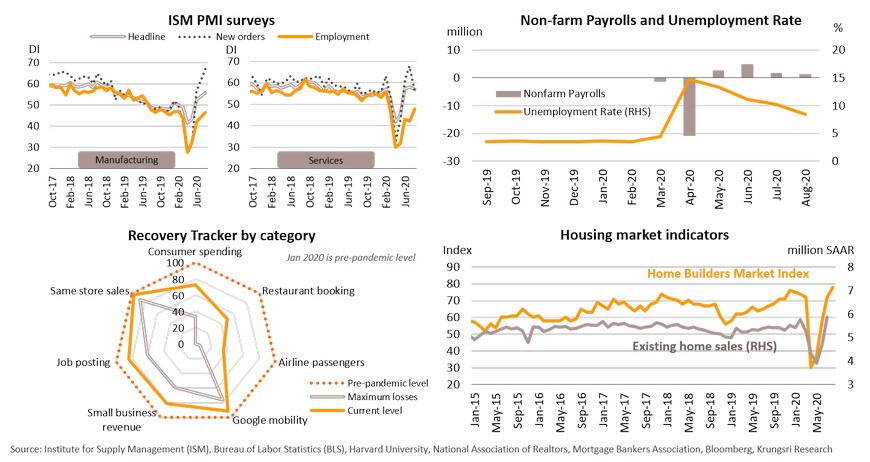

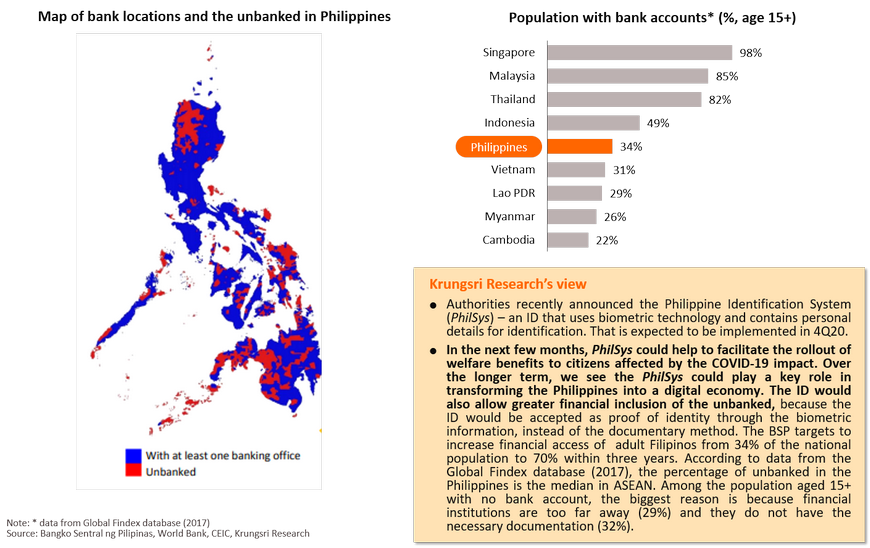

US Manufacturing PMI reading rose by 1.8 points in August and 1.6 in July, compared to the 9.5 jump in June. Services PMI, which accounts for 78% of the economy, fell from 58.1 in July to 56.9 in August. Employment sub-indices for both sectors remain far below pre-outbreak levels. Non-farm payrolls increased at a slower pace of 1.37 million jobs in August although unemployment rate fell to 8.4%. Labor market continues to recover but gains have slowed relative to recent months. The Recovery Tracker indicates ongoing recovery, but it is not broad-based. Consumer spending remains subdued and restaurant bookings are only half the pre-pandemic level. These reflect still-weak domestic demand, which would require additional support. Housing market is a bright spot for the economy. Home Builders Market Index rose to a record high of 78 in August, while existing home sales index rose to 1.496 in July as record-low interest rates spurred property purchases. However, overall economic activity is expanding at a slower pace, suggesting the next phase of recovery would be more challenging.

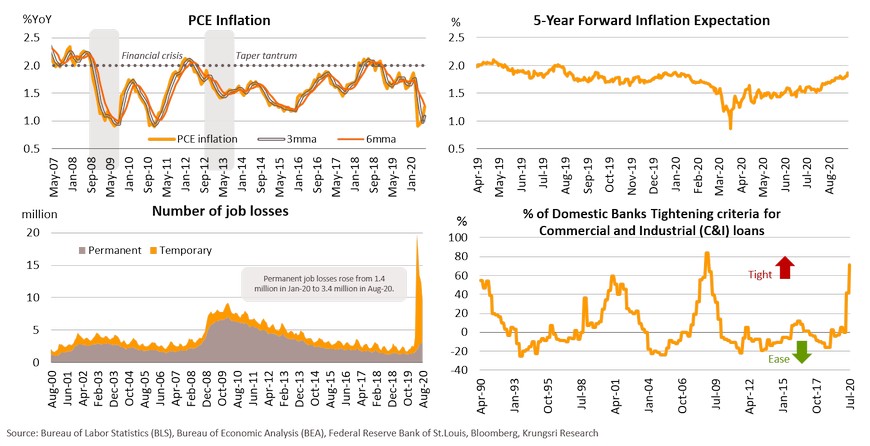

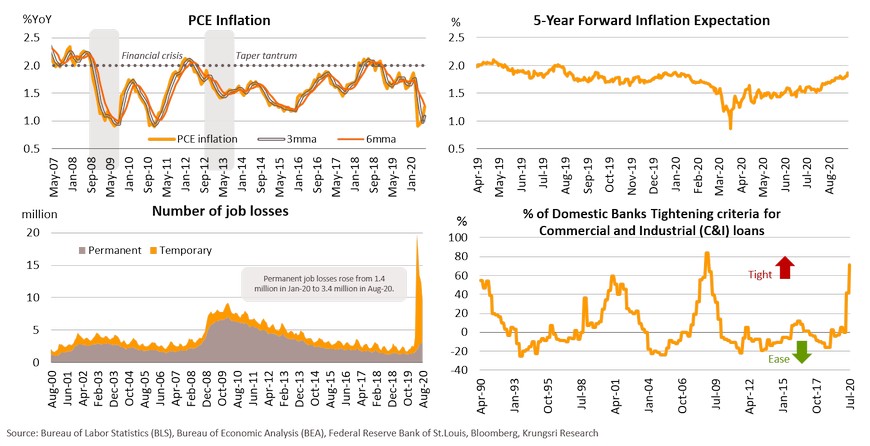

Fed introduces ‘flexible average inflation targeting’ to maintain policy easing for longer period

Fed chairman Powell’s said at the Jackson Hole symposium that the Fed has adopted a new monetary policy framework ‘flexible average inflation targeting’ which would allow inflation to run moderately above 2%. In response to this, the 5-year forward inflation expectation has risen to 1.91%, the highest since July 2019. The Fed also targeting a broad-base and inclusive goal, focusing on ‘shortfalls of employment’ rather than ‘deviation from maximum employment’. These suggest the Fed’s major concerns are the labor market and the real economy. The number of permanent job losses have risen to the highest since 2014. Temporary job losses have dropped, partly because of hiring by the government to conduct 2020 Census survey, but that would reverse when the survey ends. The net percentage of banks which have tightened criteria for commercial and industrial loans has risen from 41% in June to 72% in July, implying it would be more difficult for businesses to access credit. The latest liquidity concerns and policy tweak suggest the Fed would keep rock-bottom interest rates, implement unlimited QE, and maintain accommodative monetary policy beyond 2022.

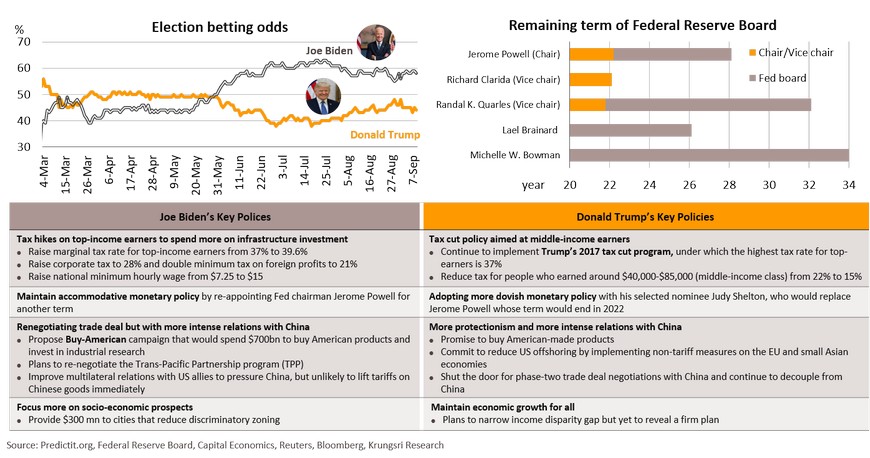

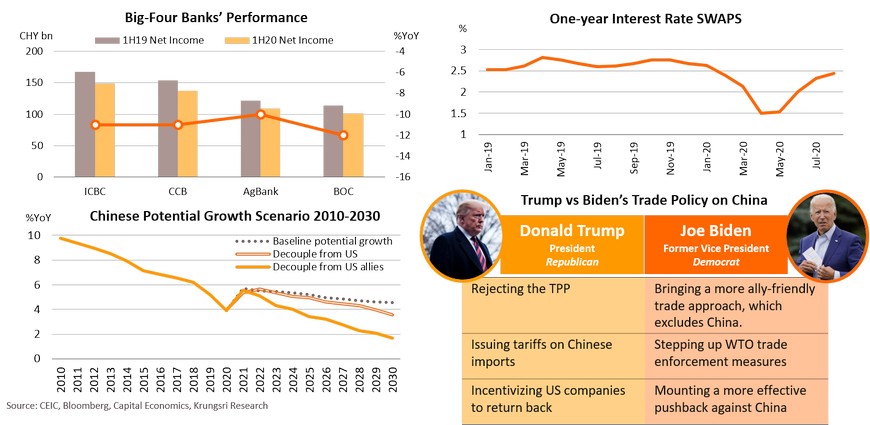

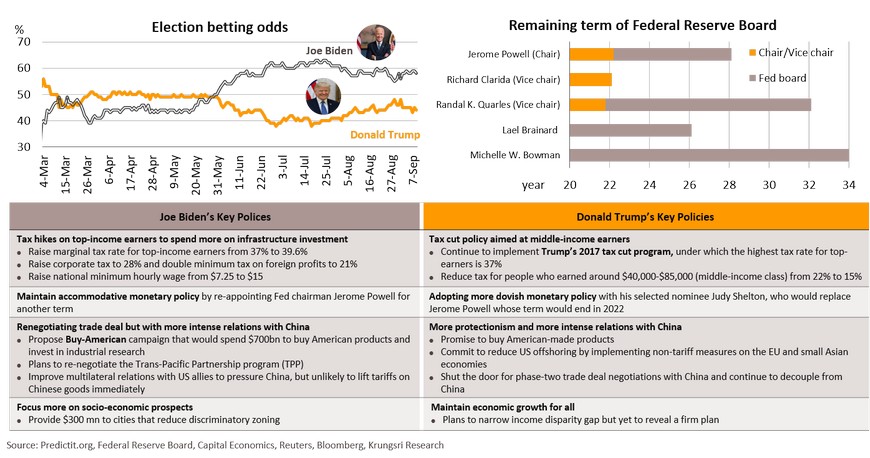

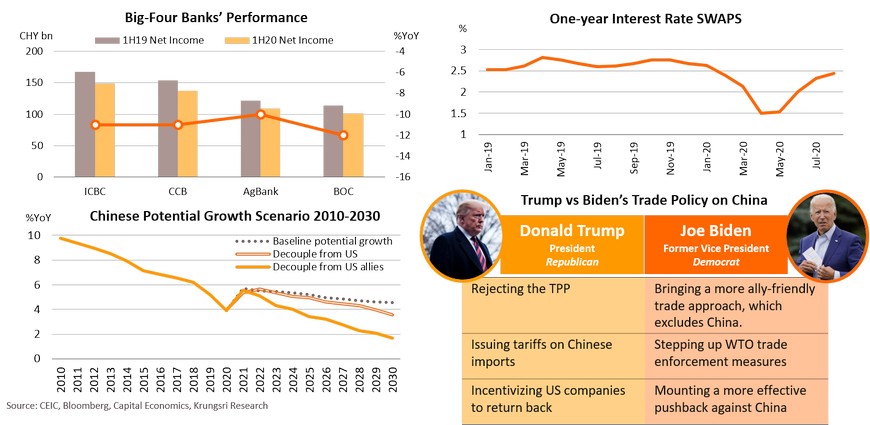

Upcoming election would shape economic outlook; relations with China could turn turbulent

The result of the US presidential election would have the same impact throughout the US economy, but different impact on the global economy. The US economic growth would still be supported by fiscal and monetary stimulus regardless who wins. Biden plans to raise tax on top-income earners to support USD4.5trn (22% of GDP) broad-base spending within a decade. Trump is proposing a deficit-financed tax cut during his second term. However, both of them would likely maintain an accommodative monetary policy to heal COVID-19 crisis scars. Premised on limited fiscal revenues and space, Trump would adopt a more dovish stance after Powell ends his term. Looking at trade policy, Biden’s victory could benefit global growth more as the US would rejoin TPP and participate in trade agreements. However, there will be rising tension with China regardless who wins. Trump’s is for a protectionist policy, which would threaten the growth of EU and small Asian economies. Trump also plans to gradually decouple relations with China in trade, technology and regulations. The latest poll shows Biden is leading Trump. We expect Biden to get more support because of his policy to reduce economic disparity in the US.

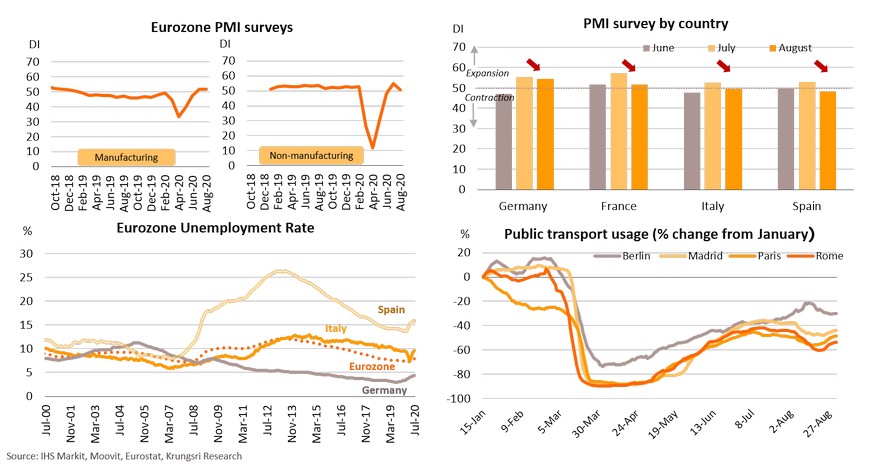

Europe: Economic activity levelled off in August despite furlough schemes

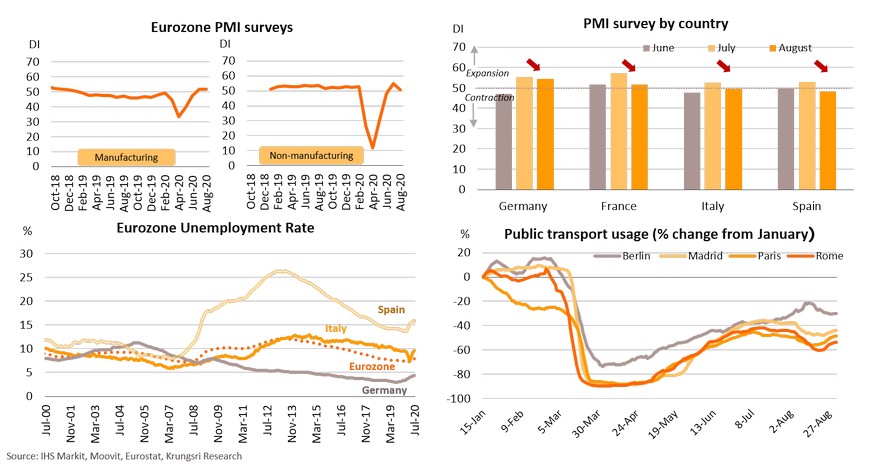

The economic recovery in Europe has been driven by reopening and pent-up demand, but that will end soon. Eurozone Manufacturing PMI edged down to 51.6 in August from 51.7 in July. Non-manufacturing PMI fell to 50.5 from 54.7, suggesting this rapid recovery pace is starting to stall. The recent rise in COVID-19 cases is also hitting the services sector again. Although PMI data for Germany and France remained in expansion zone in August, the readings have dropped by 0.9 and 5.7 points, respectively, after jumping by 8.3 and 5.6 in July. PMI data for Italy and Spain have also dropped to contraction territory, indicating their recovery is lagging behind the other major economies. Eurozone governments have attempted to support the labor market by subsidizing wages but unemployment in key countries rose in July, led by Spain (15.8%) and Italy (9.7%). Public transportation usage data also slowed down in late-August, led by Rome (-54% since January) and Paris (-49%). The current recovery phase could run out of steam soon.

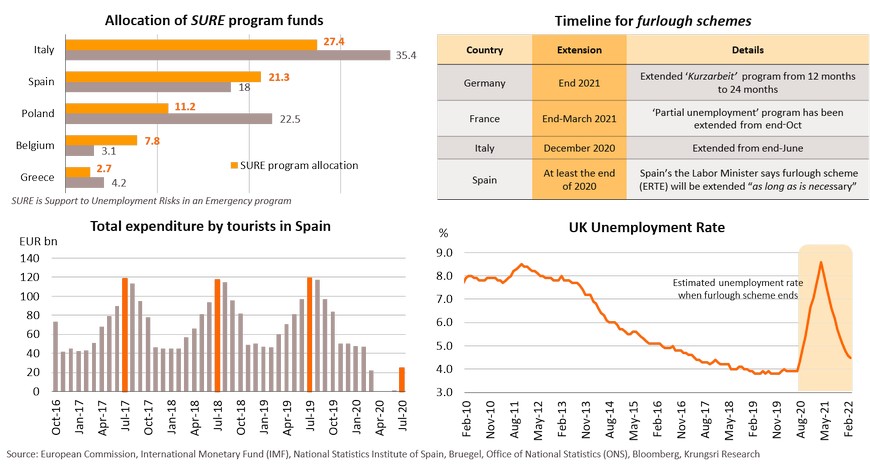

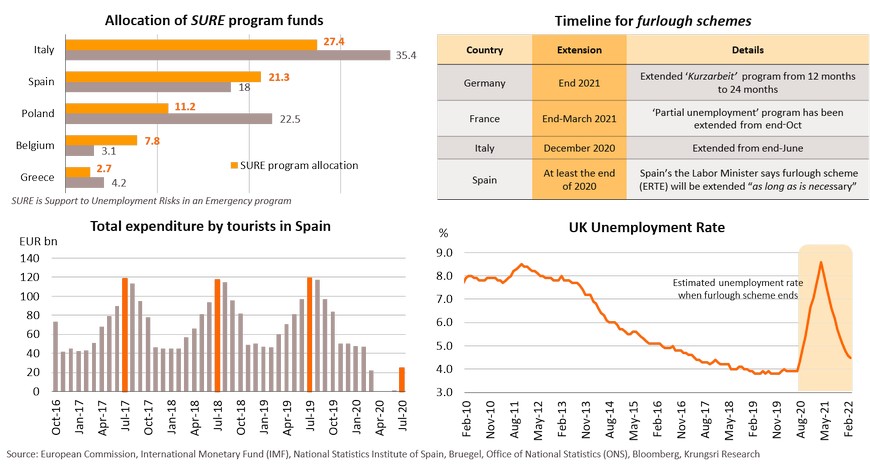

Spain and Italy may wind down furlough scheme; UK might reach the cliff’s edge soon

The European Commission has proposed to European Council to approve loans under the ‘SURE’ program which aims to support business and ‘short-time’ workers in 15 member states. Italy would receive the largest allocation of EUR27.4bn, but that would be smaller than its current employment support program. The government in each member state would also attempt to support the furlough scheme. Germany would keep the Kurzarbeit program until end-2021. Spain would receive EUR21.3bn allocation from the ‘SURE’ program, similar to the size of its current measures. However, the employment support measure in Spain would be reduced to cover only the hardest-hit sectors and the subsidy would be cut from 70% of prior earnings to 50% in the following months. This has created uncertainty over the outlook for Spain’s labor market. The UK government will not extend its program after 31 October, which could push the country to the cliff’s edge. Unemployment rate is expected to spike from 3.9% in July 2020 to a high of 8.5% by April 2021.

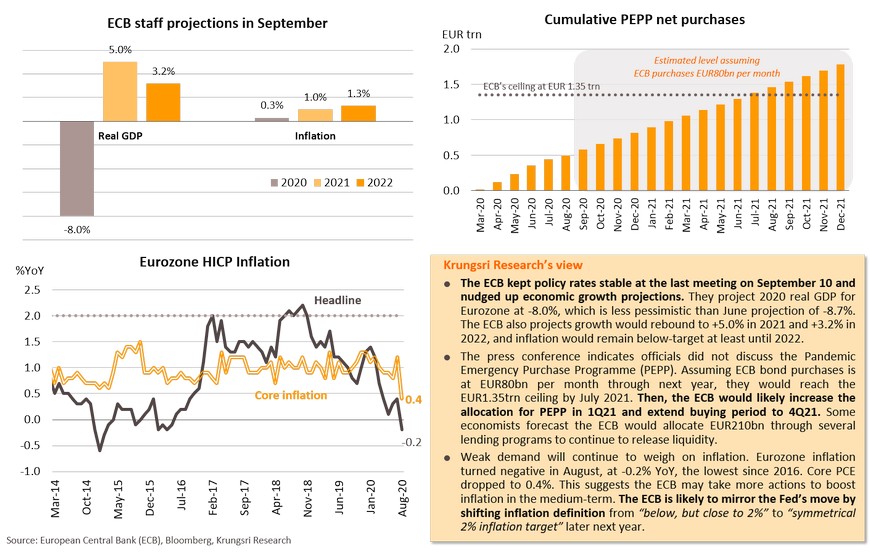

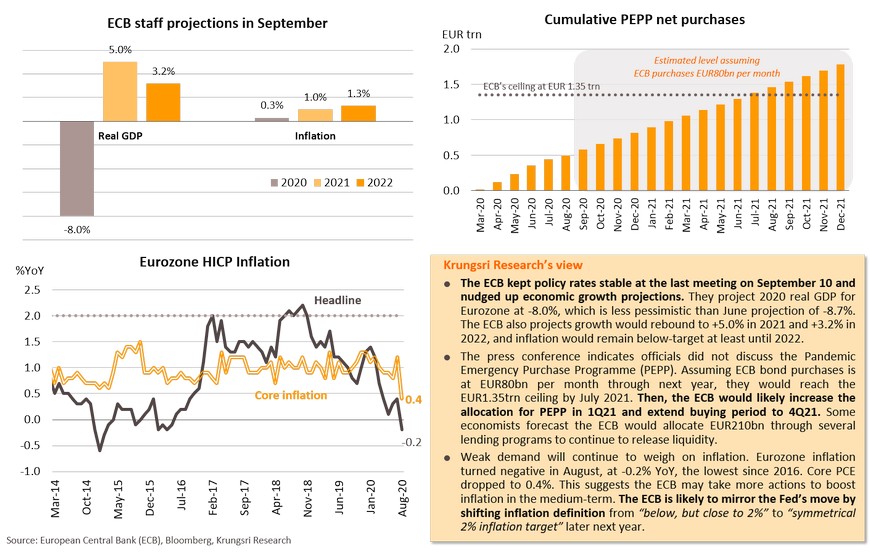

Eurozone is unlikely to introduce more stimulus this year given the ECB’s less gloomy economic picture

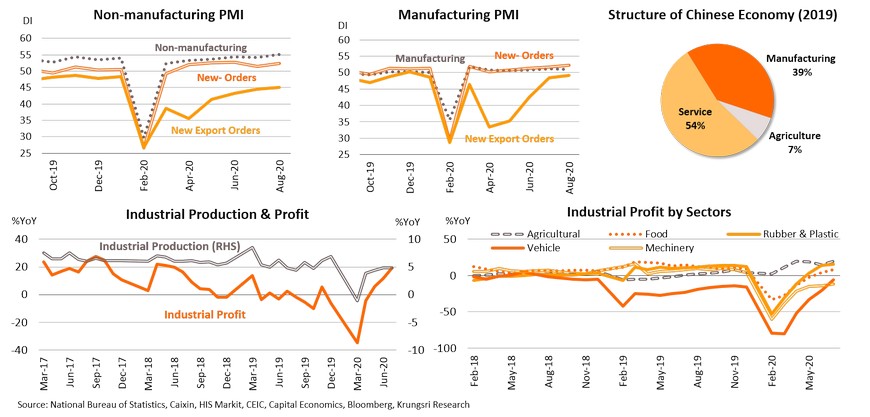

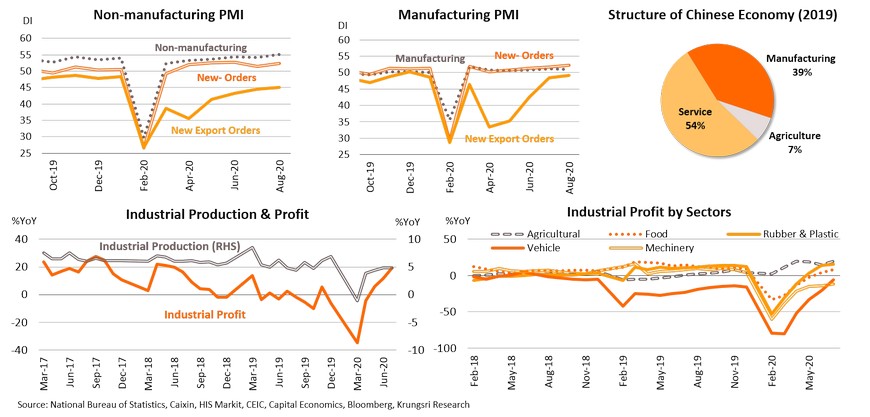

China: Recovery is on track; non-manufacturing sectors continue to improve

The ongoing recovery in the non-manufacturing sector is building momentum for further economic recovery. Official Non-Manufacturing PMI reading reached a 2-year high of 55.2 in August. Manufacturing PMI recorded 51.0, just 0.1 points drop from last month. The improvement in the Non-Manufacturing sector was mainly driven by the services and construction sectors, which PMI readings are at the highest since 2018. In fact, the services sector accounted for more than half of China’s economy. Looking at the PMI components, an improvement in new orders has been supporting the expansion in the manufacturing and non-manufacturing sectors. Meanwhile, new export orders has been improving gradually, albeit still below-50 (contraction mode). However, industrial production continued to expand for the fourth straight month in July. Industrial profits rose for the third month in a row, reaching 19.6% YoY in July. Moreover, profits have improved in most sectors, except for automobile and machinery which remained in negative territory. Looking forward, further improvements in economic activity will continue to drive recovery in the second half of the year.

Risk in financial sector could be limited but there is rising uncertainty in the external sector

China’s economic recovery could encounter some bumps ahead. In 1H20, the four big banks reported net income had dropped from past year and profits had contracted by 10-12% YoY. Nonetheless, Fitch is keeping its “stable” assessment for the Chinese banking sector because the PBOC has cut interest rates and is helping debtors by deferring loan repayment, which would reduce Chinese banks’ exposure to financial risks. Meanwhile, 1-year interest rate swaps have climbed to a 7-month high; this indicates rising stress, but it is still below pre-COVID level. On the external front, exports jumped 9.5% YoY in August, marking an improvement from July and the 3rd month of increase. However, there is rising uncertainty because the US presidential candidates could escalate tension. The extended conflict is a major threat to China’s economy. Based on Bloomberg estimates, potential growth is expected to fall to 3.5% by 2030 if the decoupling blocks the inflow of investment and technology transfer from the US to China, compared to 4.5% growth in the base case scenario. The situation would worsen if the allied countries join the US in decoupling from the Chinese economy; China’s potential growth would drop sharply to 1.6% by 2030.

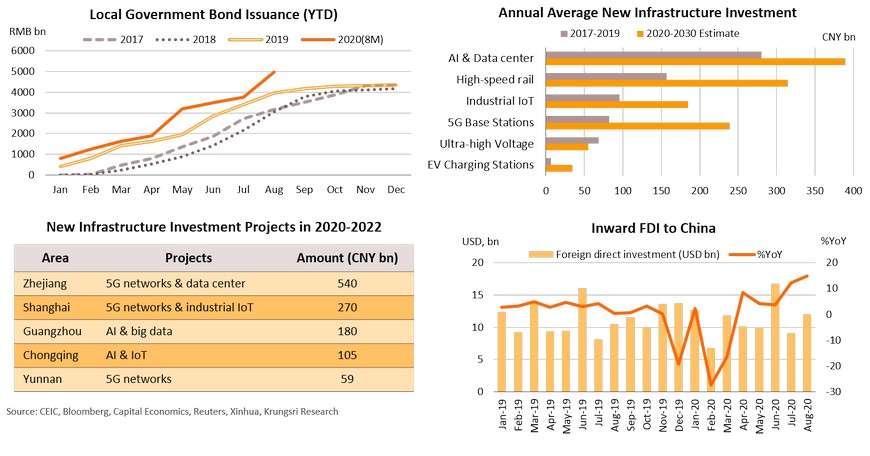

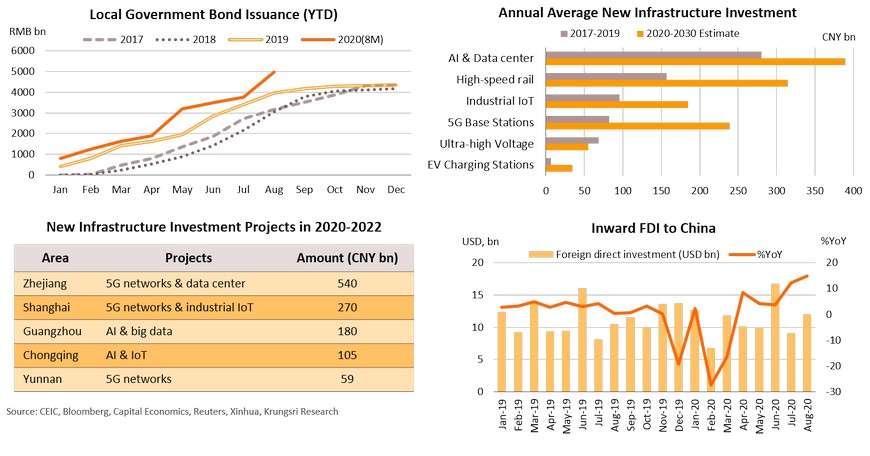

Rising infrastructure investment and FDI inflows might cushion some external risks

The ample liquidity supported by synchronized monetary and fiscal stimulus has continued to drive the recovery. In August, local government bond issuance surged by 25.1% YoY to shore up demand induced by infrastructure projects. The investment is primarily aimed at developing capabilities in cutting-edge technology across the country, especially 5G, artificial intelligence, big data, electric vehicle charging stations, and intra-city rail. In addition infrastructure investment, accelerating foreign direct investment would also support recovery ahead. August data show foreign direct investment surged 14.9%, the highest rate in 3 years. The growth in both infrastructure and foreign direct investment will help to mitigate external risks. This is aligned with the “Dual Circulation” policy to reduce dependency on global markets and strengthen technological self-reliance.

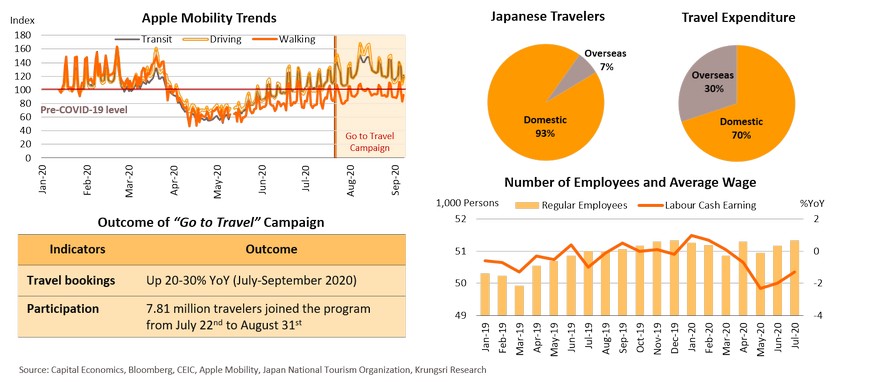

Japan: Second outbreak might have limited impact because of stimulus measures, but recovery will remain slow

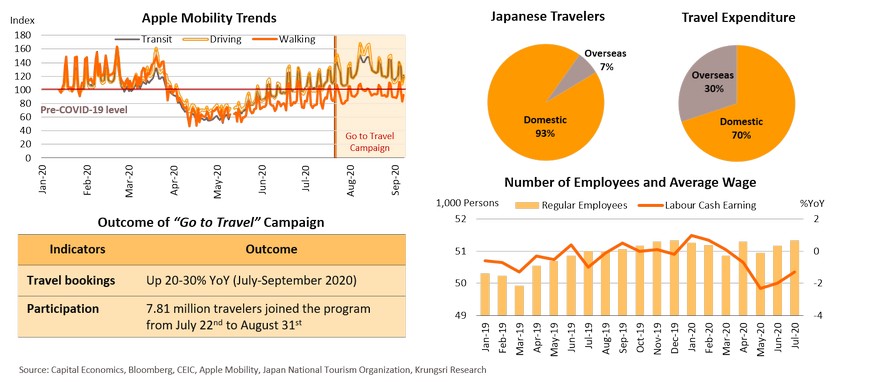

The second wave of infections might have limited impact on the Japanese economy, reflected in improving PMI readings and other indicators. In August, Jibun Manufacturing PMI rose to 47.2, the highest reading since February. Services PMI only edged down from 45.4 to 45.0. Public transportation and driving activities have exceeded pre-COVID levels. The stimulus programs could help to cushion risks from the second wave. One of Japan’s key stimulus measures is the “Go to Travel” program which ran from July 22nd to end-August. Domestic travel spending by Japan residents was twice greater than overseas travel expenditure. 7.8 million people took advantage of the “Go To Travel” campaign. The government will launch the “Go to Eat” campaign in September, which would offer (i) discount vouchers of up to 25% valid until end-March 2021, and (ii) point-based rewards which offer up to JPY500-1,000 for online reservations. There was also improvement in the labor market; the number of regular employees continued to increase in July, rising for the third consecutive month. Average monthly wage also rose, which would improve purchasing power in the next period. On external demand, exports remained weak in July (-18% YoY), but it is a smaller contraction for the second straight month. Despite weak external demand, the improving labor market and support from domestic stimulus measures are expected to help the Japanese economy to remain on its slow recovery path.

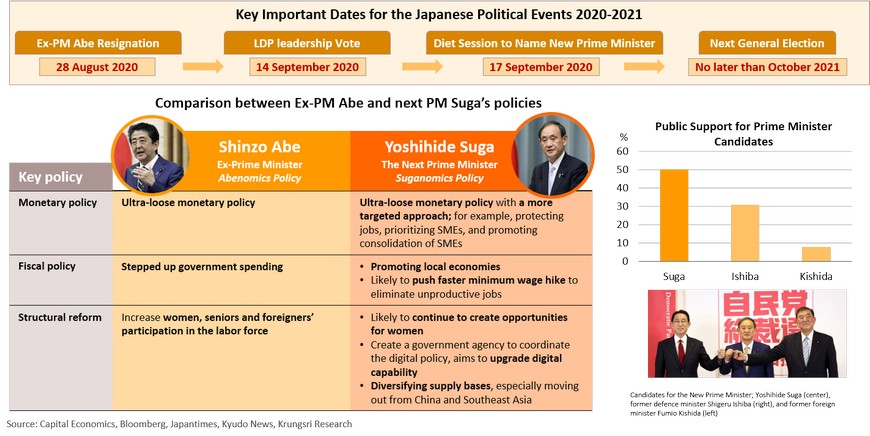

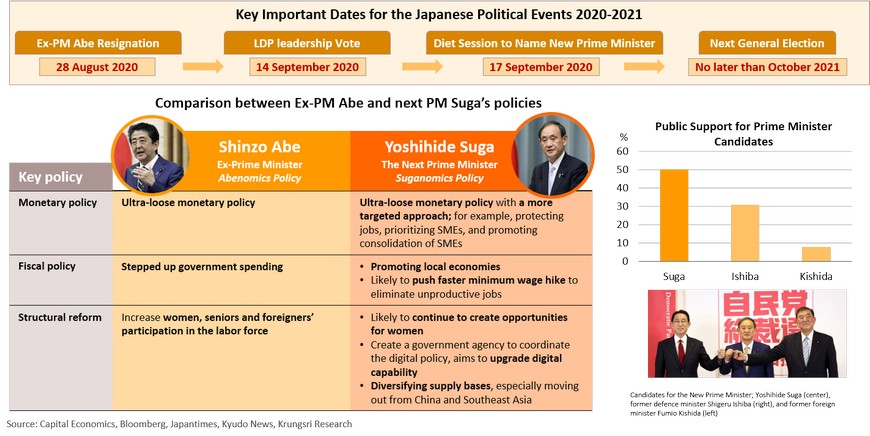

New leader pledges to proceed with stimulus policy

After winning votes to lead the Liberal Democrat Party (LDP), Yoshihide Suga will be the next Japanese prime minister. He would serve the remainder of Abe’s term, up to October 2021. Based on Kyodo news poll on September 2nd, Suga is more popular than the other two candidates. On policy issues, he is expected to (i) continue to pursue “Abenomics” to steer Japan out off the COVID-19 crisis, and (ii) conduct a bit more easing, reflecting more targeted ultra-loose monetary policy, fiscal stimulus to provide more support to local economies, and structural reform in the labor market. Suga vowed to strengthen the massive monetary easing, especially to help small businesses. He also promised to lift minimum wage and promote digitization. Looking forward, policies aimed at helping small businesses, and community and digital economies, would facilitate a more inclusive recovery and increase the effectiveness of policy implementation. However, there could be some bumps along the way, including a worsening pandemic situation, difficulty in implementing reforms, and inefficient policy administration.

Thailand: Confronting crisis scars and emerging risks

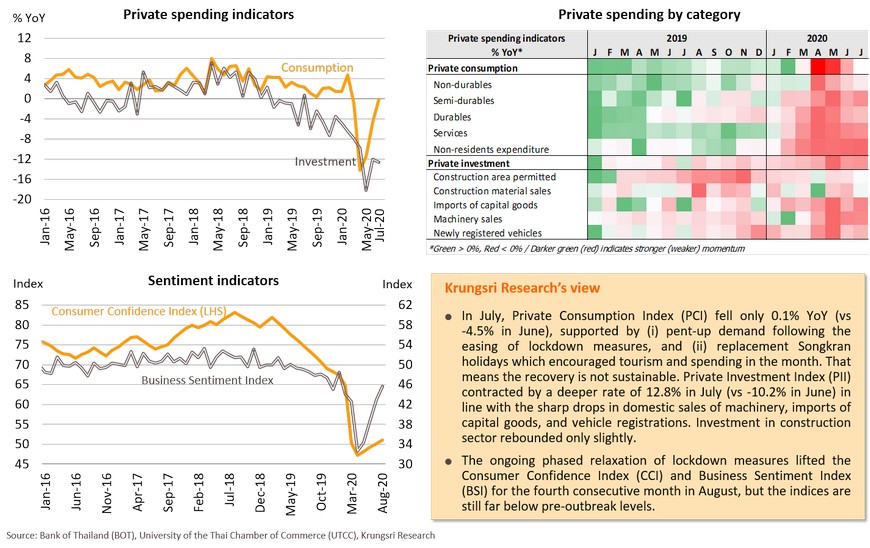

July consumption rebound is not sustainable; private investment marked deeper contracted

- Private Consumption Index (PCI) fell only 0.1% YoY in July, supported by (i) pent-up demand following the easing of lockdown measures and (ii) replacement Songkran holidays which encouraged tourism and spending in the month. This means the recovery is not sustainable. Private Investment Index (PII) contracted by a larger rate of 12.8% in July. Consumer Confidence Index (CCI) and Business Sentiment Index (BSI) rose for the fourth consecutive month in August, but the indices are still far below pre-outbreak levels.

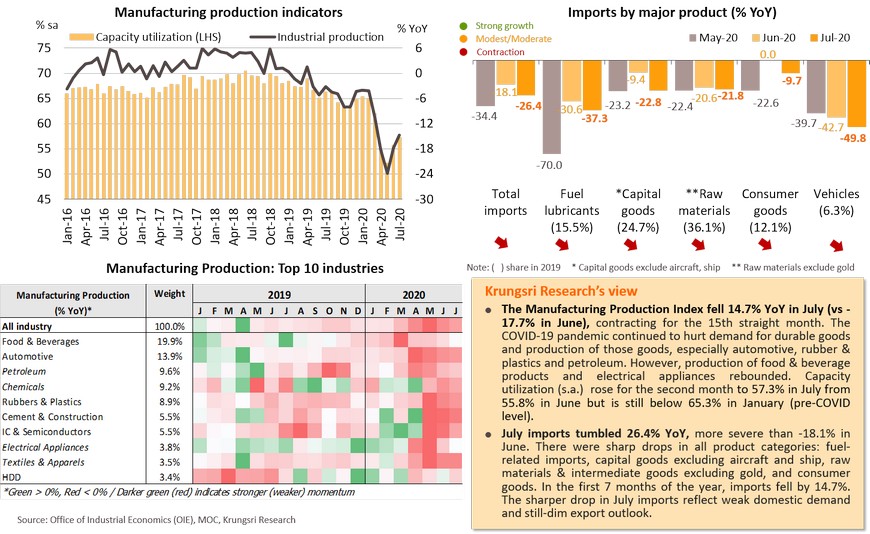

- Industrial production saw double-digit contraction, despite some improvement. The COVID-19 pandemic continued to hurt demand for durable goods and production of those goods, especially automotive, rubber & plastics and petroleum. However, production of food & beverage products and electrical appliances rebounded.

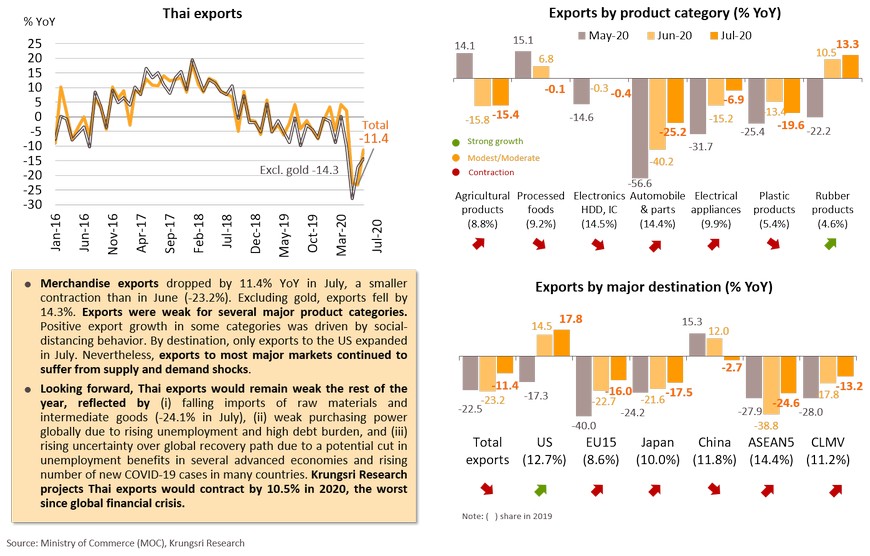

Thai exports continued to drop, but by a smaller magnitude. Plunging imports reflect weak demand and weak export outlook. Foreign tourist arrivals will remain near-zero the rest of this year. COVID-19 crisis could affect one-third of total formal workers.

- Merchandise exports fell 11.4% YoY in July. Excluding gold, exports declined by 14.3%. Imports also tumbled 26.4% in July vs -18.1% in June, reflecting weak domestic demand and still-dim export outlook. Thailand would benefit little from recovering imports in major countries, reinforcing our view of sluggish Thai exports ahead.

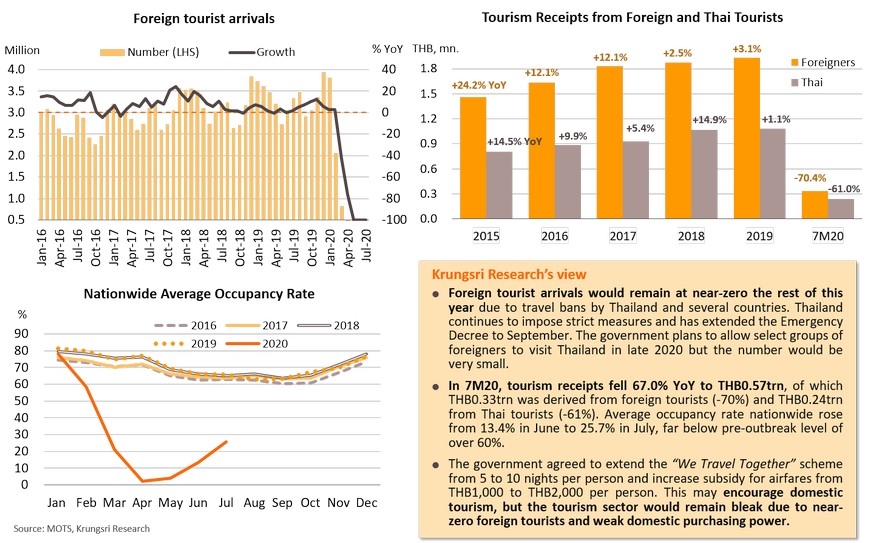

- The government agreed to extend the “We Travel Together” scheme. This would improve domestic tourism, but the outlook for the tourism sector remains bleak due to near-zero foreign tourists and weak purchasing power.

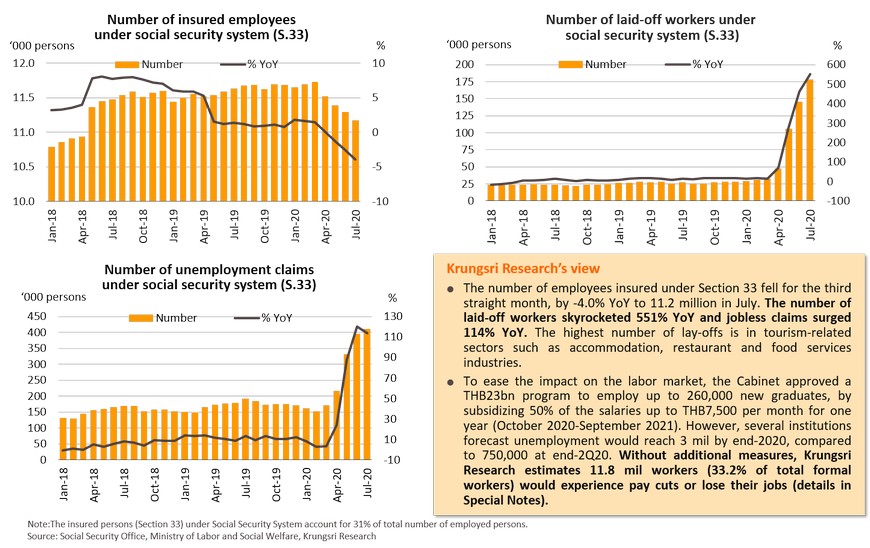

- COVID-19 crisis has left scars on the labor market. The number of workers laid-off is skyrocketing. Without additional stimulus measures, Krungsri Research estimates one-third of formal workers would experience pay cuts or lose their jobs (details in Special Notes section).

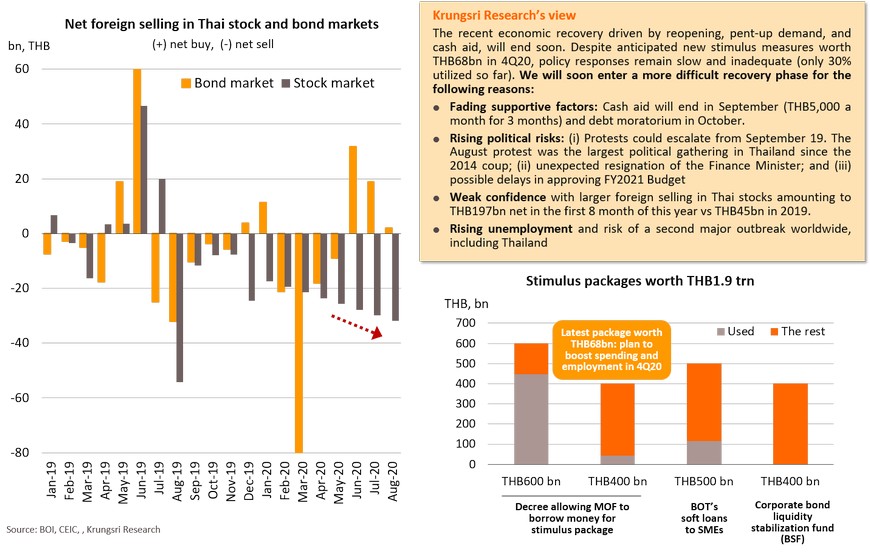

Economic policy responses remain slow. Large outflows reflect weak confidence. Emerging risks could retard recovery.

- Policy responses remain slow and inadequate. The easy recovery phase is ending, and the next will be much harder given (i) cash aid would end in September and debt moratorium in October; (ii) rising political risks with the possibility of more protests and delays in approving FY2021 Budget; (iii) weak confidence and larger foreign fund outflows; and (iv) rising unemployment and risk of a second major outbreak worldwide, including Thailand.

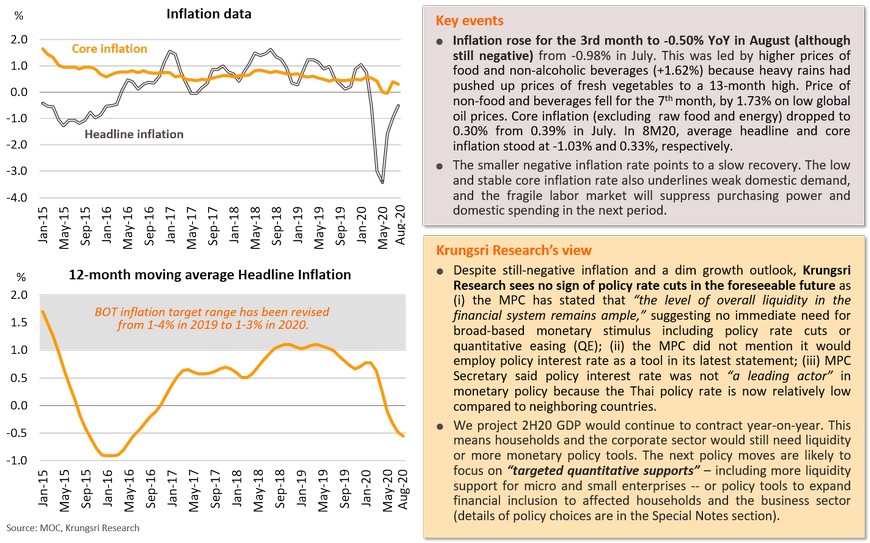

- Despite the dim growth outlook and still-negative inflation, Krungsri Research does not expect policy rate cuts in the foreseeable future. We project 2H20 GDP will continue to contract year-on-year. This means households and the corporate sector would still need liquidity or more monetary policy tools. The next policy moves are likely to focus on “targeted quantitative support”.

July consumption recovery is not sustainable; private investment continued to shrink

Industrial production improved but still booked double-digit contraction; raw material imports continued to drop

Thai exports still contracted in July despite improving since reopening; outlook remains weak

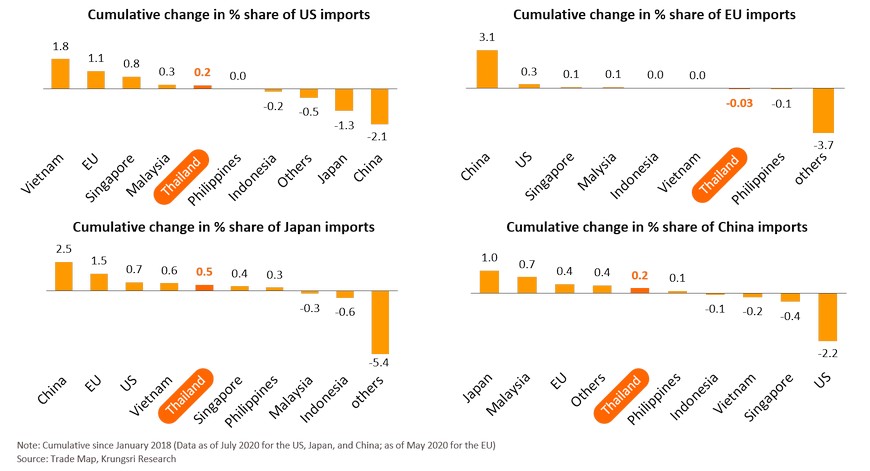

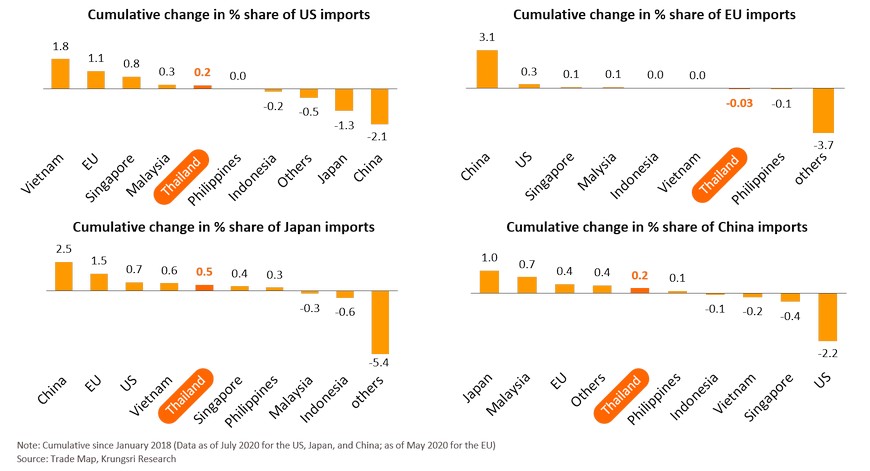

Thailand to benefit little from stronger imports at major countries, implying sluggish exports ahead

There have been signs of a recovery in economic activity in major countries, raising hopes for a rebound in international trade. Imports by the US, the EU, Japan, and China account for almost 60% of world imports. Vietnam would be the largest beneficiary of recovering US imports. Stronger imports in the EU and Japan should benefit China. Recovering Chinese imports could benefit Japan. Thailand would see relatively small gains from recovering imports in major countries, including Japan. However, Japan’s imports remain weak (-21.2% YoY in July). The recovery in EU imports would not benefit Thailand. This implies Thai exports would recover slower than other Asian countries, such as Vietnam, Singapore and Malaysia.

Despite stimulus, outlook for tourism sector remains bleak due to near-zero foreign tourists

Lay-offs surged again in July; Cabinet approves THB23bn job creation scheme for new graduates only

Economic policy response remains slow; outflows reflect weak confidence, emerging risks could retard recovery

Despite dim growth outlook and still-negative inflation, there is no signs of policy rate cuts in the near future

COVID-19 crisis: Choice of policy tools and the impact on businesses

- As the number of COVID-19 cases continue to rise, the global economy continues to suffer from social distancing and containment measures. The worst hit are tourism and related sectors. Thailand’s economy is projected to contract sharply in 2020 and would take more than three years to recover to pre-pandemic level. This will hit most industries and businesses through several channels in the near- and longer-term.

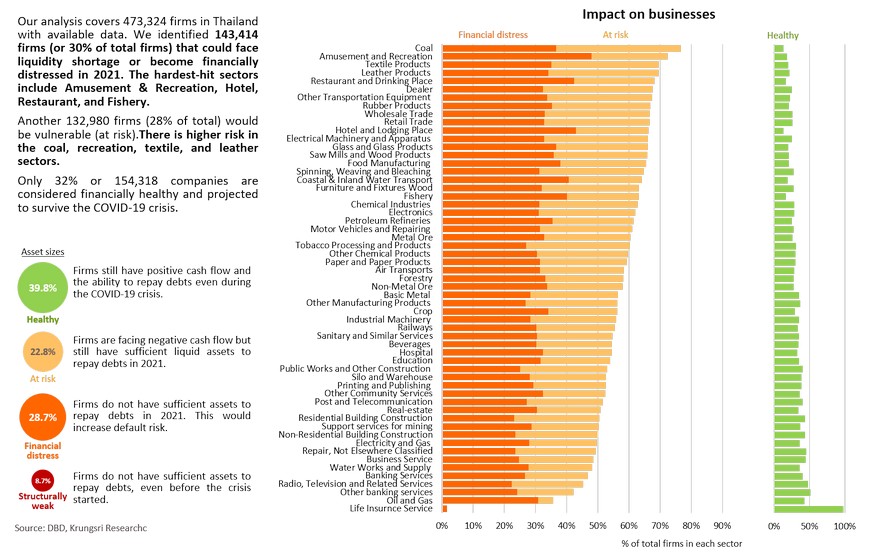

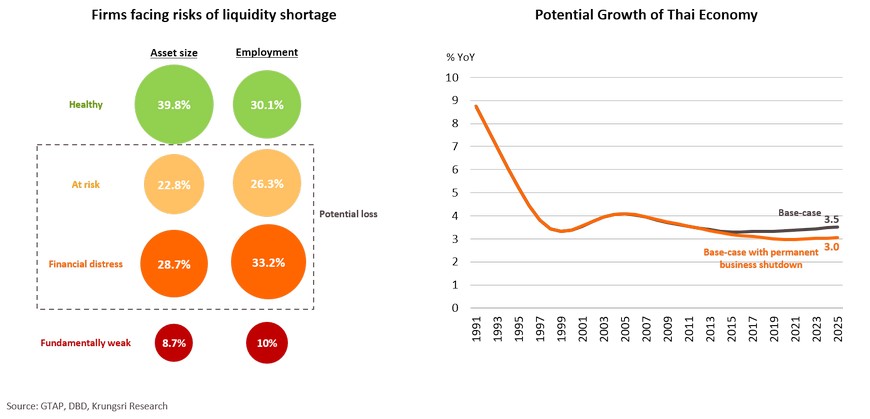

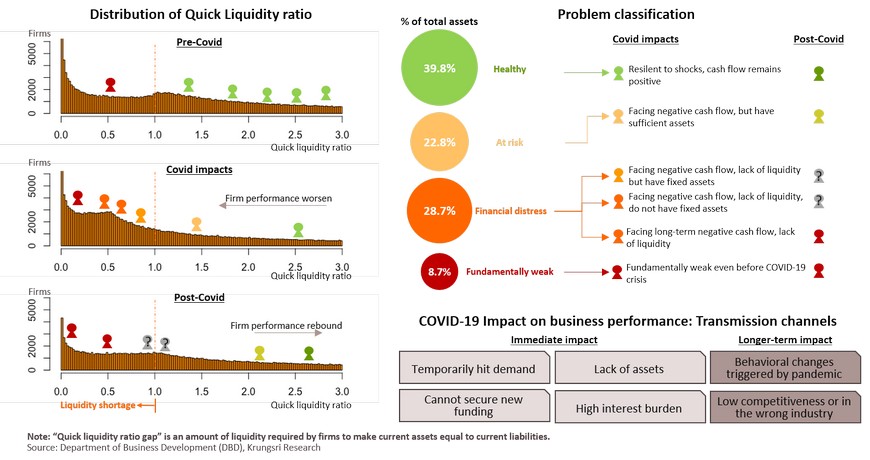

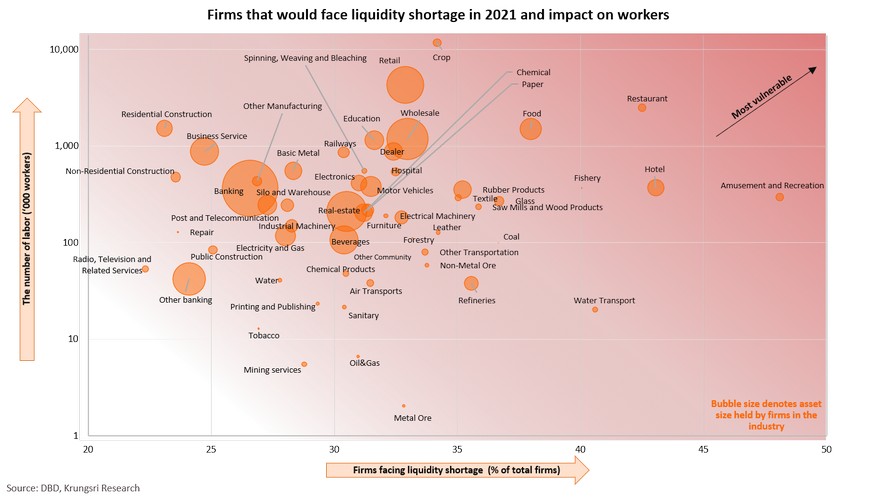

- Company-level data reveal that out of 473,324 companies in Thailand, 30.3% or 143,414 would experience tight liquidity in 2021. Most of the troubled firms would be small in size. Another 132,980 companies (28.1%) would be at risk of facing liquidity shortage. Only 32.6% or 154,318 companies are financially healthy.

- About 11.8 mil workers, or 33.2% of formal workers, are estimated experience a pay cut or lose their job. The includes 4 mil in the agriculture sector, 1.4 mil in retail trade, and 1 mil in the restaurant industry.

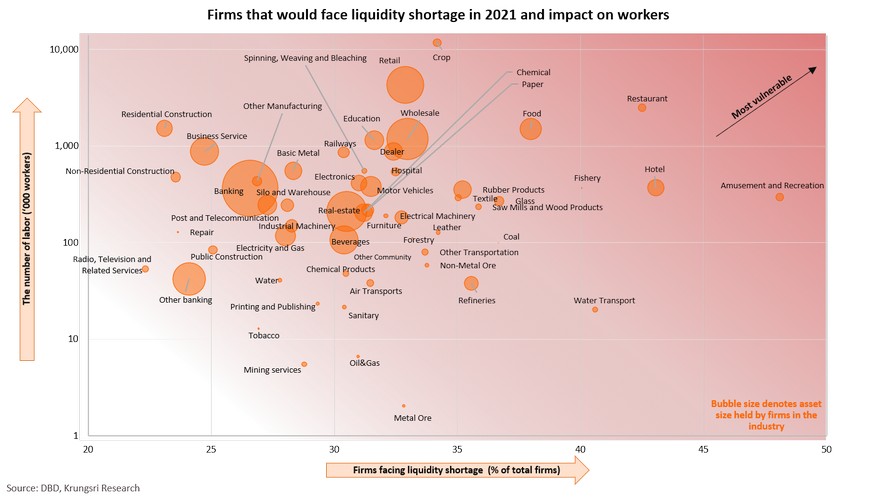

- The most troubled sectors - in terms of both number of companies and employment data – would be amusement & recreation, restaurant, hotel, crop farming and fishery. Krungsri Research estimate at least, THB2.3trn would be required to help businesses stay afloat in 2021.

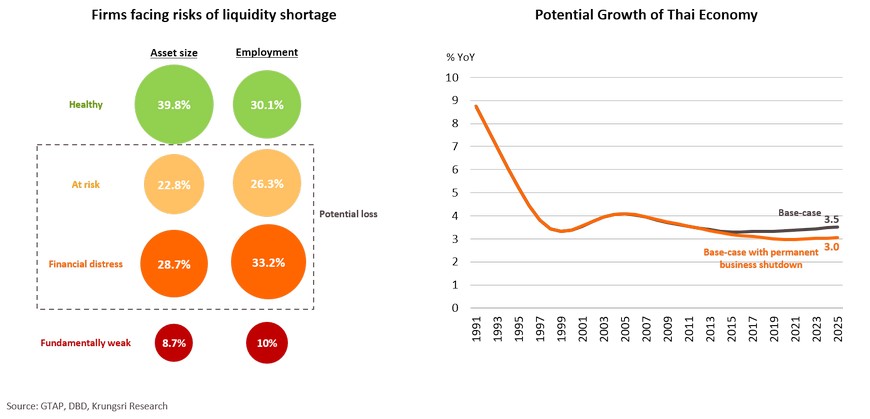

- Thailand’s potential (economic) growth would be wiped out by 0.5 percentage points (ppt) in the coming years triggered by business failures and declining labor productivity. Permanent business shutdowns would cause assets held by these firms to be under-utilized. That would trigger long-term unemployment, leading to lower labor productivity.

- To help businesses stay afloat, there is a need to identify the specific problems plaguing each business and/or sector, in order to develop targeted policy measures. Some companies would sustain permanent damage from the Covid-19 pandemic, but the impact would be temporary for the majority. Most Thai companies are finding it hard to secure additional liquidity to tide them through this difficult period. Hence, it is crucial for the measures to address liquidity issues. Each policy tool would benefit each company differently and each tool would have limited resources, so, it may be necessary to choose targeted measures.

- Economic policy responses, especially during this crisis, are important. They would not only prevent losses in the near-term but also help Thailand to stay on its long-term potential growth trajectory.

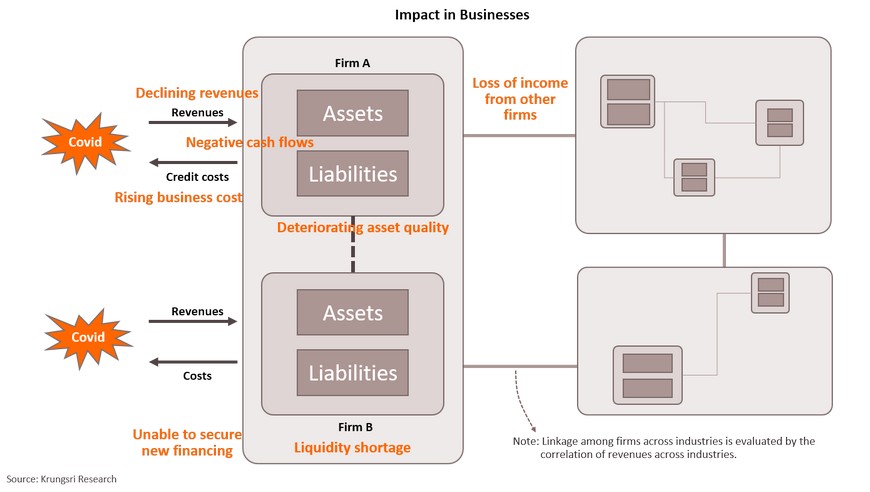

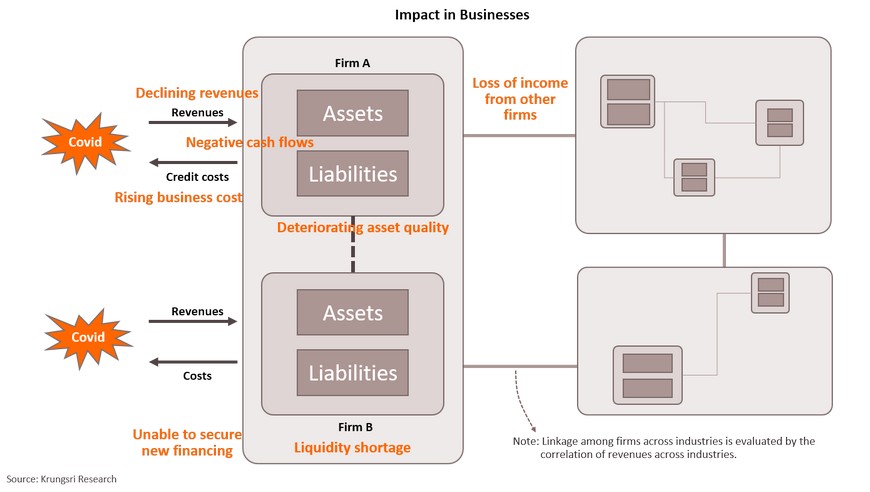

Business performance has been hit by supply and demand shocks; losses and linkage will create a vicious cycle

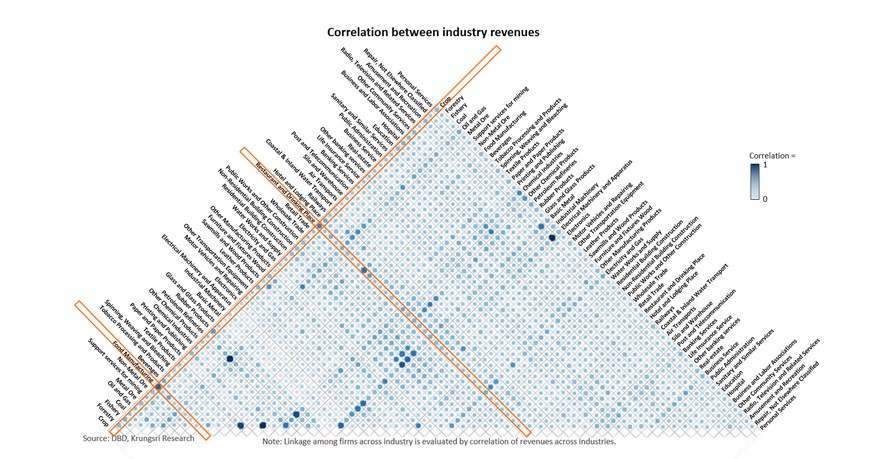

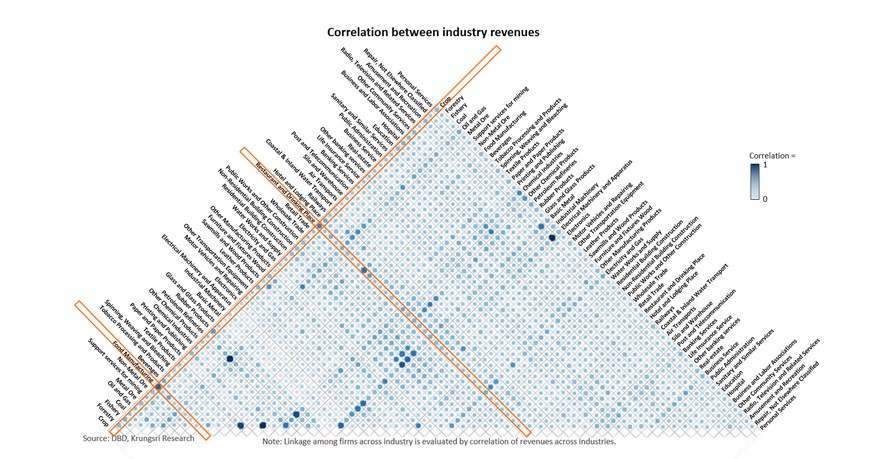

The pandemic has led to a worsening outlook for the overall economy because it is hurting business revenues and profitability. Asset quality has also deteriorated and businesses finding it increasingly difficult to secure new financing. These could lead to liquidity shortage and force businesses to shut down. This will compound the initial impact and create a vicious cycle of closures because of financial linkages among firms. Thus, our analysis and simulation model also capture the link between businesses across industries.

Businesses are linked within the same industry and also across industries

One business closure could hurt another’s revenues, which would in turn, lead to a rising number of businesses with insufficient liquidity to repay debts. For example, the closure of a restaurant would reduce revenues of food suppliers, and ultimately those in the related agriculture sector. This would increase risk of business closures in those industries and business sectors.

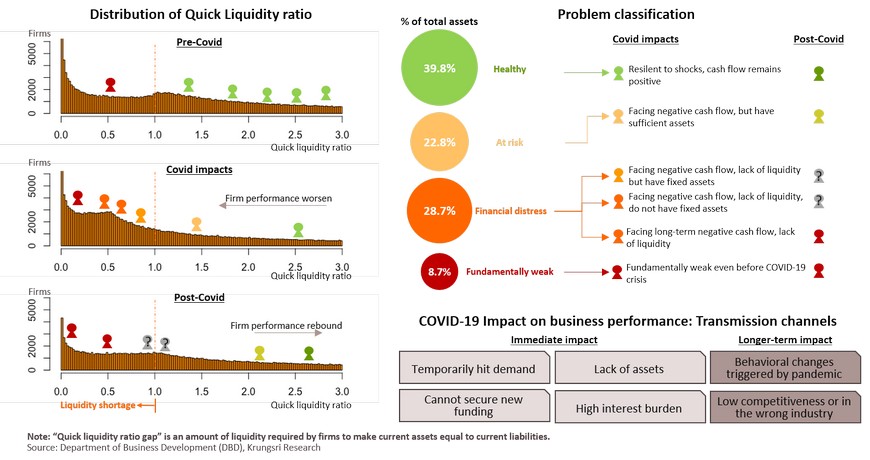

Liquidity problems differ among businesses; impact may be permanent on some but would be temporary on most

The COVID-19 pandemic has hurt business revenues and profits and the majority are experiencing liquidity shortage. Their financial health would only improve when the overall economy recovers. The pace of improvement would differ among businesses, and there would be a group that would shut down permanently. The latest available data suggest most Thai firms do not have sufficient assets to keep their business running, which means their cash flows are vulnerable to shocks. We identified six channels through which COVID-19 might hit businesses in the near future (see chart). Meanwhile, to keep business afloat through this crisis, the OECD has suggested several policy choices, including debt moratorium, offering direct loans to businesses, and easing regulations in the financial market.

Company-level data suggest 143,414 companies (30% of total) would face liquidity shortage

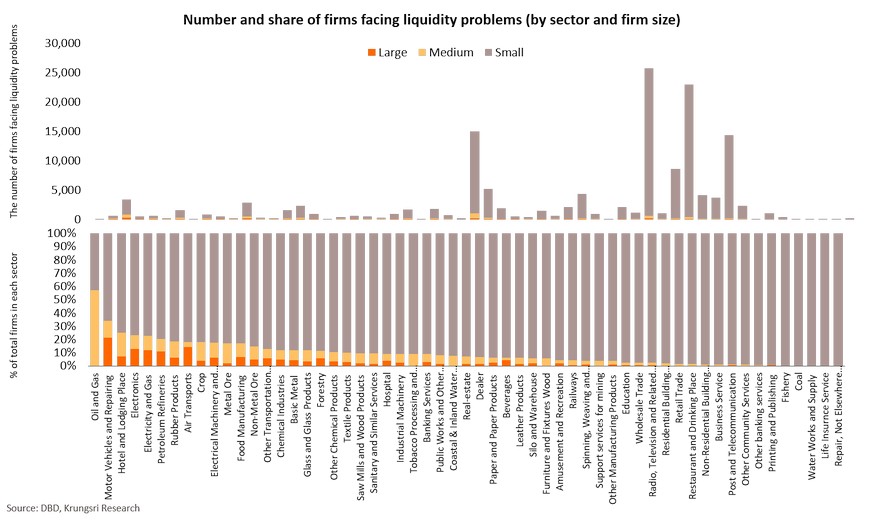

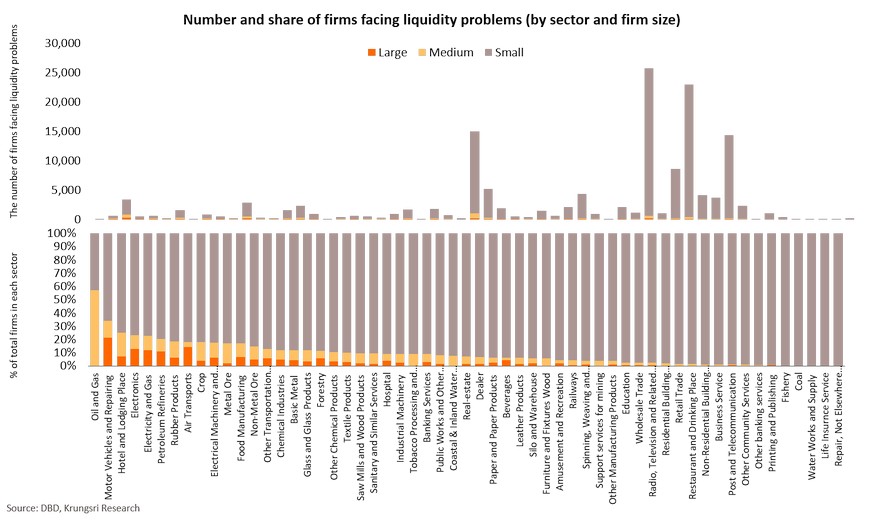

Those facing liquidity issues are relatively small firms

Our analysis suggests 143,403 firms might be unable to repay their debts. Of this, 136,152 (or 95%) are small-size firms. A large number of them are in wholesale and retail, business services, and real estate, in that order. Meanwhile, a large number in the oil & gas, motor vehicle, and hotel sectors are large- and medium-size firms.

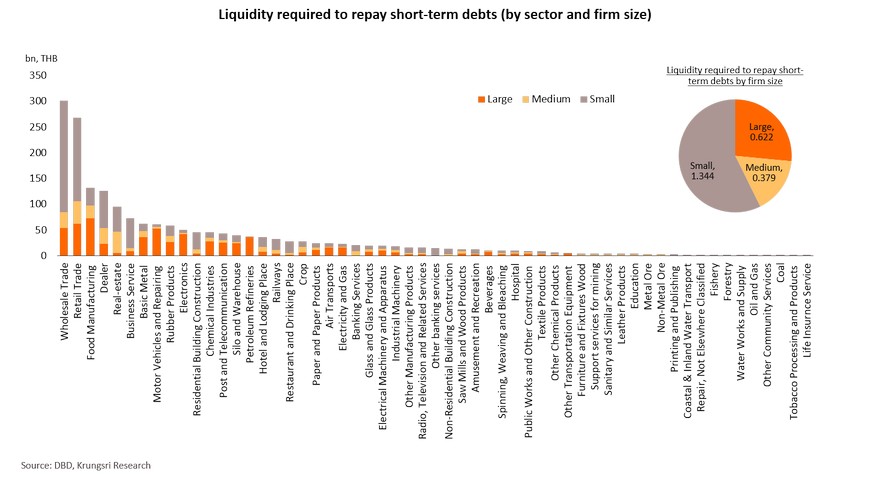

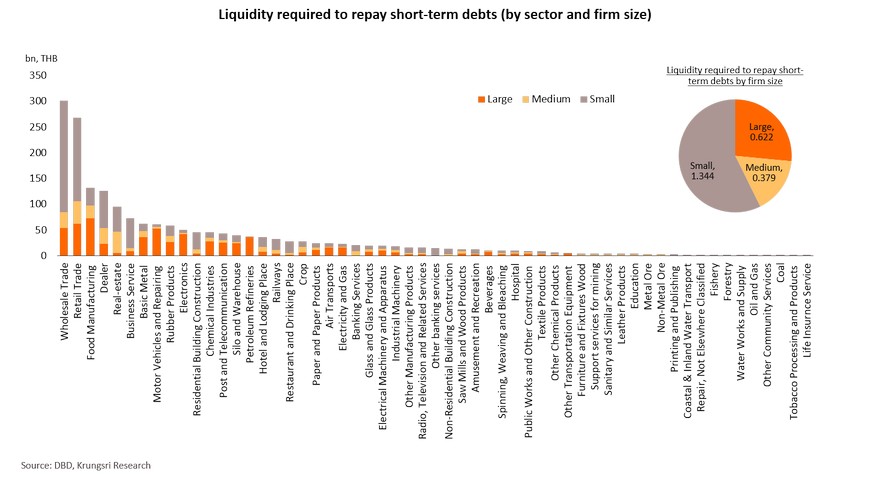

Business would need THB2.3 trillion to stay afloat in 2021

Krungsri Research estimates businesses would need THB2.3 trillion to repay debts. By industry, the wholesale and retail sectors would need a combined THB500 billion. Food manufacturers and dealers would require THB120 billion each. By size, large firms would need THB0.6 trillion and medium-size THB0.38 trillion. Small-size firms would need up to THB1.34 trillion.

11.8 million workers at risk of pay cuts or losing their jobs

Our analysis also suggests 11.8 million workers, or 33.2% of total formal workers, may see pay cuts or lose their jobs. That includes 4 million in agriculture, 1.4 million in retail trade, and 1 million in the restaurant industry. The most vulnerable sectors - in terms of both number of troubled firms and employment - are amusement & recreation, restaurant, hotel, crop farming, and fishery.

Business closures and lower labor productivity could shave 0.5ppt off Thailand’s potential growth trajectory

The European Commission and Federal Reserve believe the Spanish Influenza had short- and long-term impact on the economy. At that time, income fell by 6-9% and reduced potential economic growth by 0.6ppt. Today, of the 48.3 trillion baht worth of assets held by Thai firms, 28.7% (or 6.9 trillion baht) are held by firms facing financial distress, and another 22.8% is held by those identified as at-risk. These assets could become under-utilized soon if business activity drop. They would lay off employees, which would likely lead to permanent unemployment. This would hurt demand in the near-term and reduce labor productivity in the longer-term. Krungsri Research estimates business closures, under-utilized assets and lower labor productivity would shave 0.5 ppt of Thailand’s potential growth trajectory. There is a need to keep businesses afloat to prevent economic growth from sliding further in the long run. To assess the positive impact of policy responses, we simulated scenarios under five policy tools: interest rate cut, corporate income tax waiver, debt moratorium, easing credit conditions, and targeted direct loans to firms.

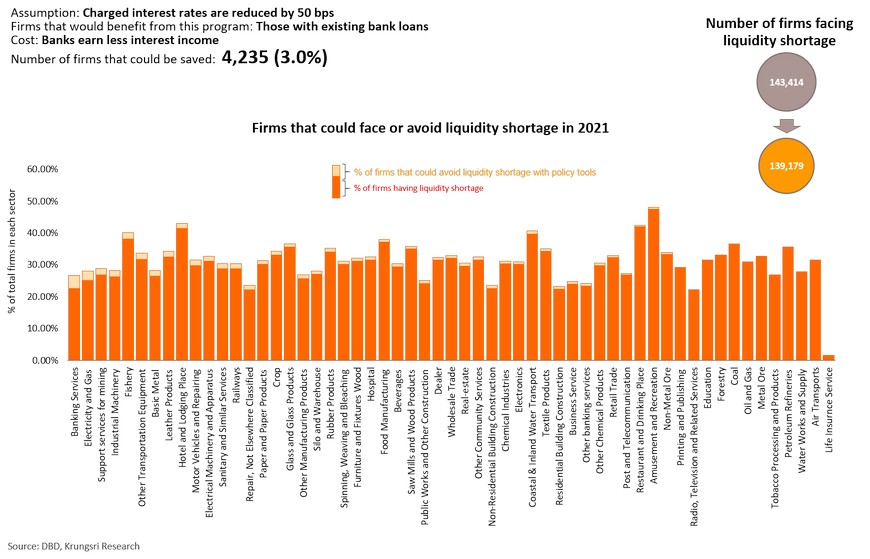

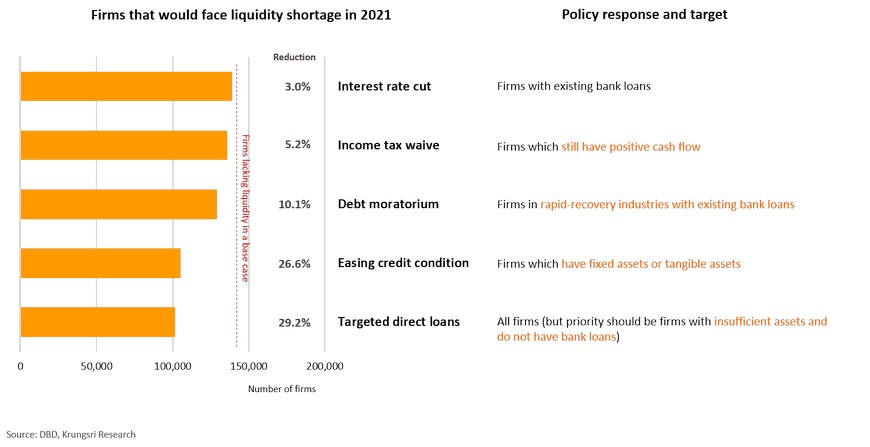

Policy choices: I. Interest rate cut would only help those with existing bank loans; limited positive impact

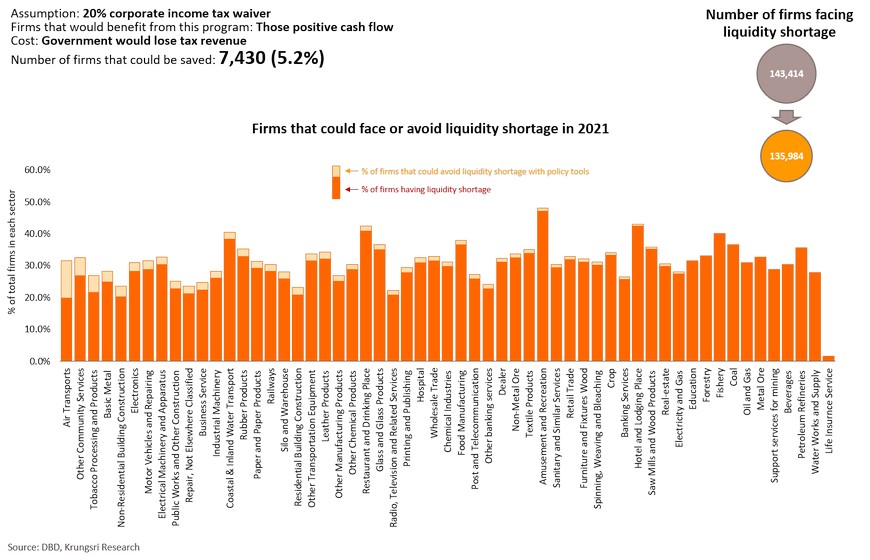

II. Corporate income tax waiver could prevent defaults only in firms with positive cash flow

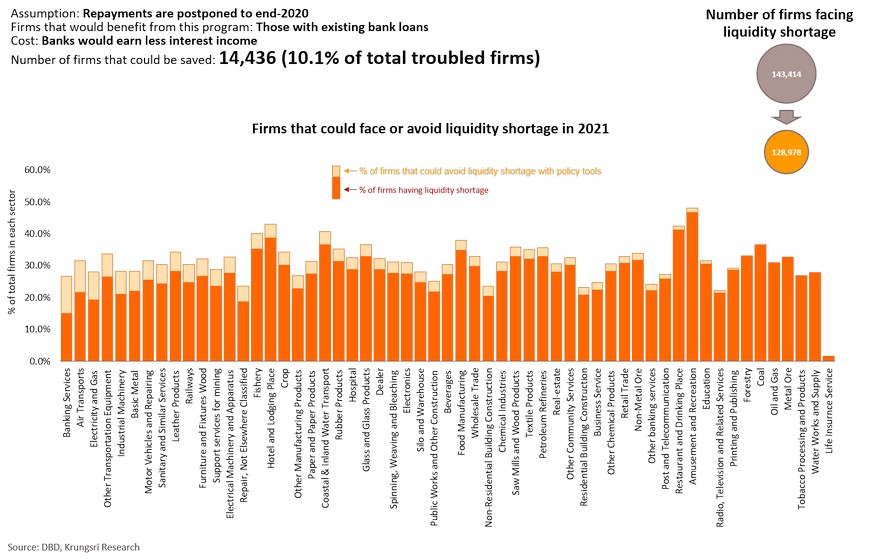

III. Debt moratorium will help those with existing bank loans, especially firms in rapid-recovery industries

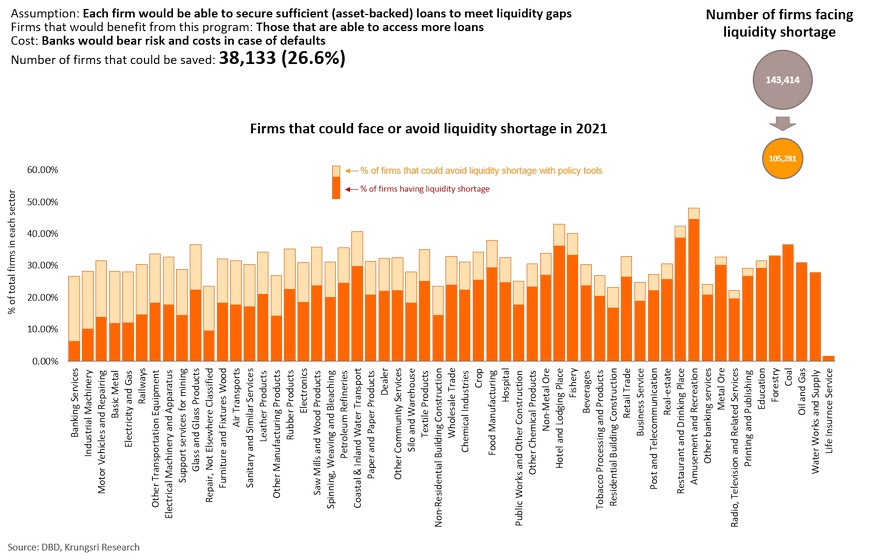

IV. Easing credit conditions in financial market would support normal market function

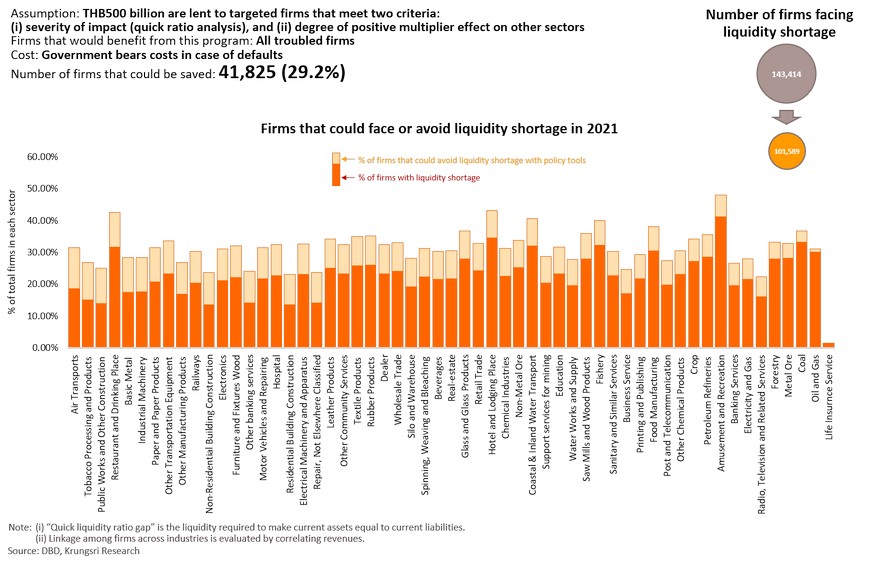

V. Direct loans targeted at severely-troubled firms would prevent more than 40,000 closures

Conclusion: Targeted loans and easing credit conditions would be best to keep businesses afloat

These two tools would help 29.2% and 26.6% of firms to avoid liquidity shortage in the next two years, respectively. Interest rate cuts would help only 3.0% of total firms. More importantly, each policy tool would benefit a different type of business. Debt moratorium and interest rate cuts would help those with existing bank loans. Corporate income tax waiver would only benefit firms with positive cash flow, while easing credit conditions would only help those with sufficient assets. Targeted direct loans would help all severely-troubled firms.

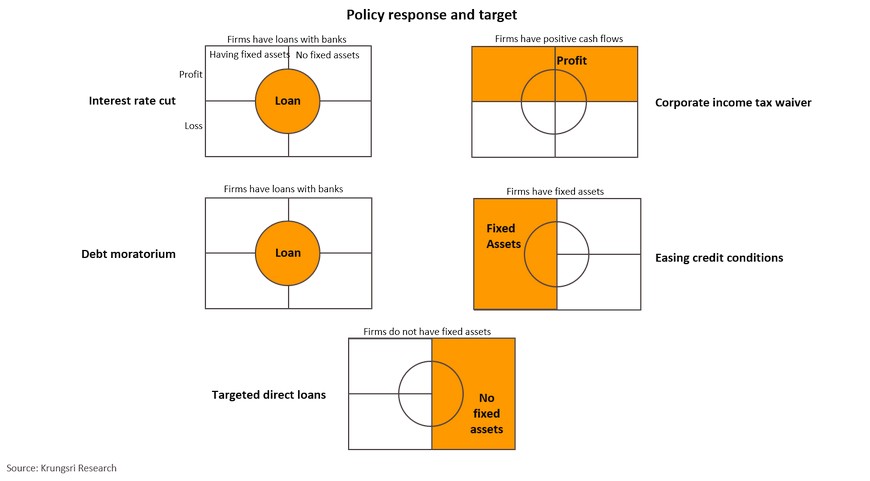

Policy choices should be determined by the problems

Each policy tools would benefit each business differently. Each tool would also have limited resources and there are limitations for each policy instrument. On this note, we opine policy tools should be determined by the targeted business. For example, if the targeted businesses have sufficient fixed assets, the solution would be easing credit conditions. For firms with little fixed assets and no bank loans, the appropriate tool would be targeted direct loans. Economic policy responses are important especially during a crisis. They would not only prevent business closures in the near-term but could keep the economy on its potential growth trajectory in the long term.

Regional Economic and Policy Developments in September

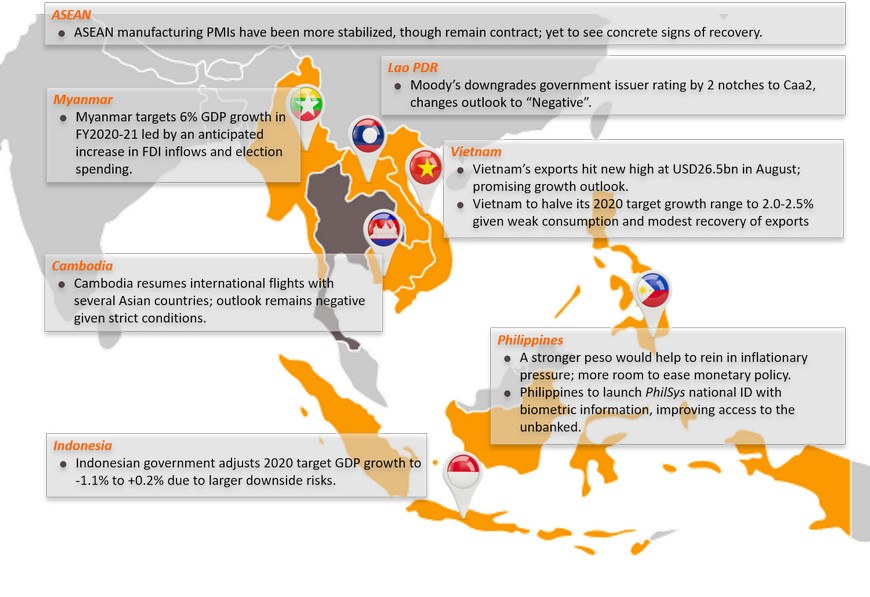

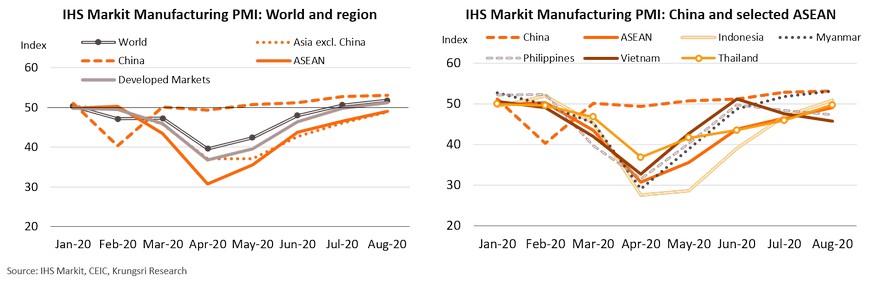

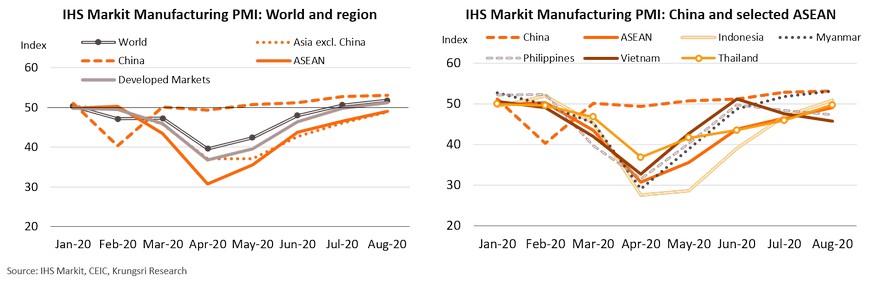

ASEAN manufacturing PMIs have been more stabilized, though remain contract; yet to see concrete signs of recovery

Krungsri Research’s view

- After a deep contraction in 2Q20, the ASEAN Manufacturing PMI, based on IHS Markit survey, has improved gradually to a 6-month high of 49.0 in August. The recovery is in line with that for overall Asia (excluding China) but still lags behind the global average.

- Myanmar and Indonesia are leading the improvement in the ASEAN index. This is supported by recovering business conditions in the manufacturing sector as the two countries continue to relax lockdown measures. Output and new orders also expanded at a faster rate. These led to a mild improvement in the job market. However, we project the recovery has been driven by pent-up demand and reopening in some countries, which could be temporary given still-fragile consumption.

- Countries which registered a drop in PMI readings are Vietnam and the Philippines, due to a resurgence of COVID-19 cases. However, Vietnam has better conditions to support a recovery because it has had better success in containing the outbreak; the number of new cases has dropped from a daily average of 50 in the last week of July to single-digit since late-August.

- Looking ahead, we see a mixed – and weak – recovery for the manufacturing sector across ASEAN. They would be dragged by (i) still-rising COVID-19 cases in the Philippines and Indonesia, and authorities in Vietnam has reinstated lockdown measures in some cities after a spike in new cases, (ii) weak external demand as global growth would remain sluggish, and (iii) high unemployment for an extended period, which would cap consumer spending for a longer period.

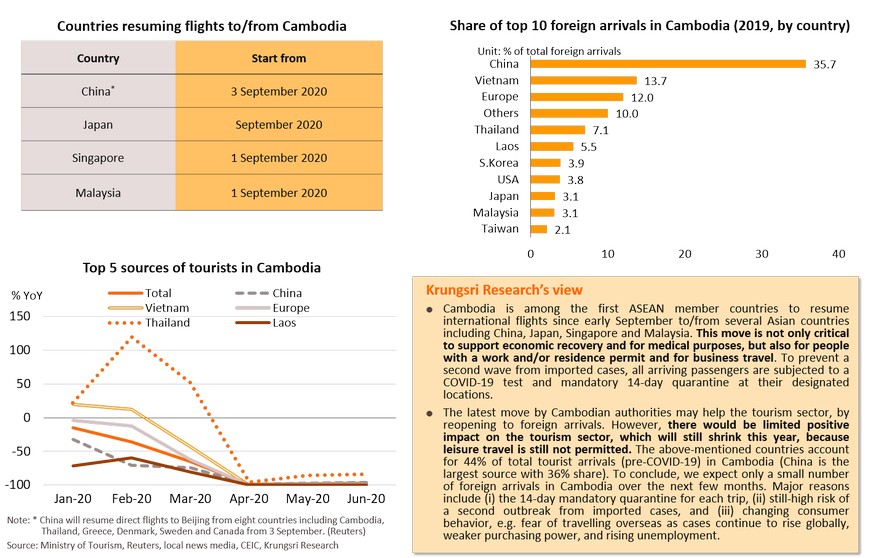

Cambodia resumes international flights with several Asian countries; outlook remains negative given strict conditions

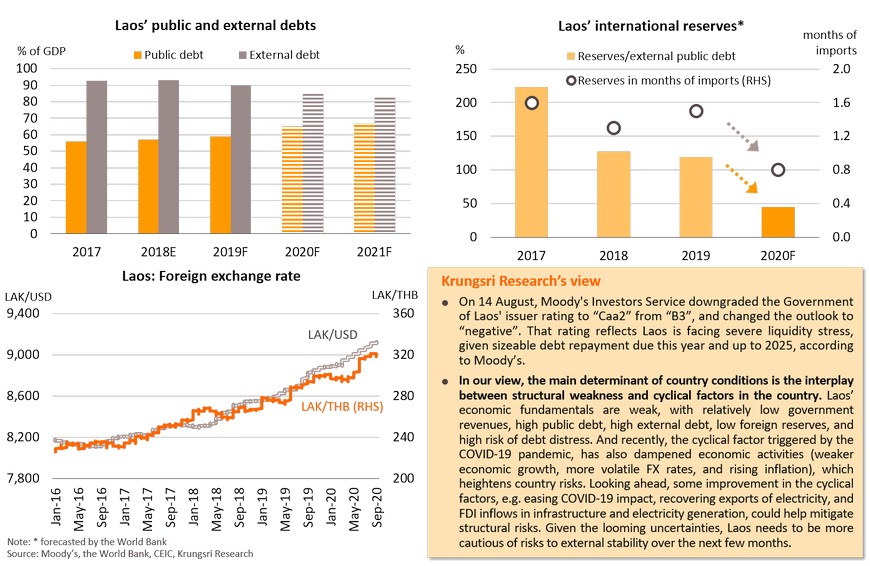

Lao PDR: Moody’s downgrades the government’s issuer rating 2 notches to Caa2, outlook changed to “Negative”

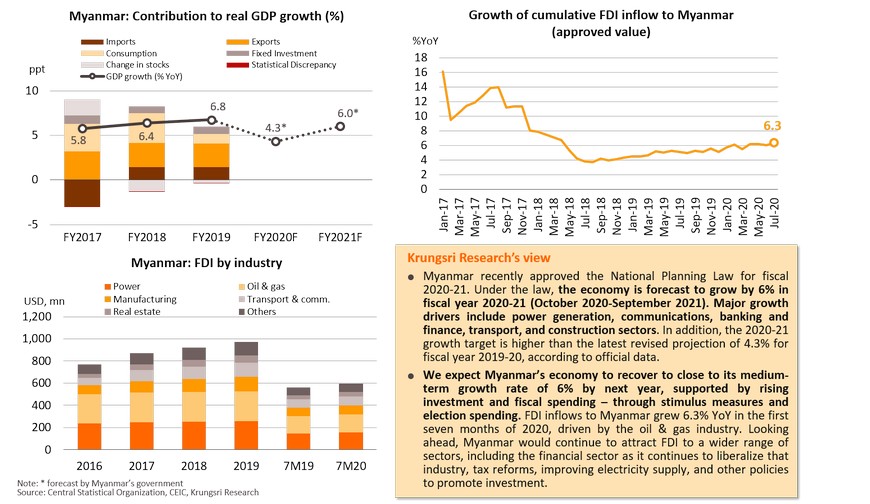

Myanmar targets 6% GDP growth in FY2020-21, led by an anticipated increase in FDI inflows and election spending

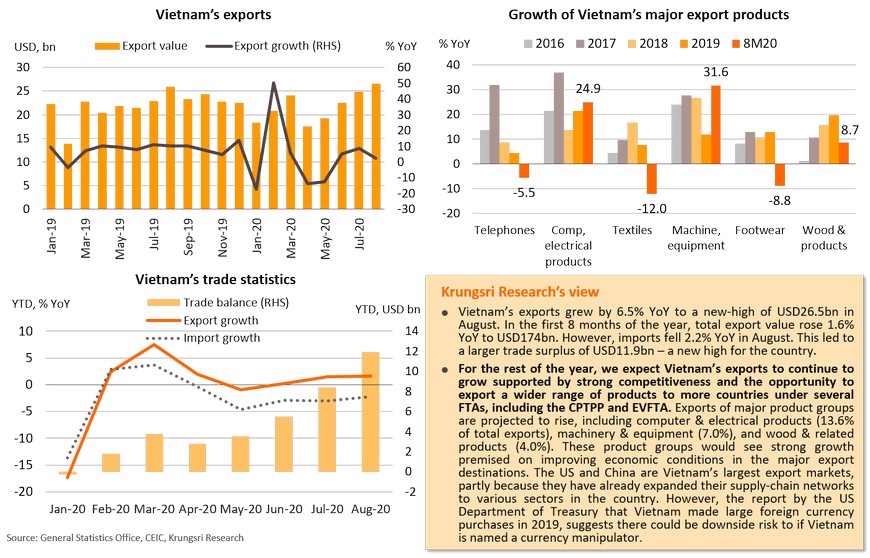

Vietnam’s exports hit new high at USD2a6.5bn in August; promising growth outlook

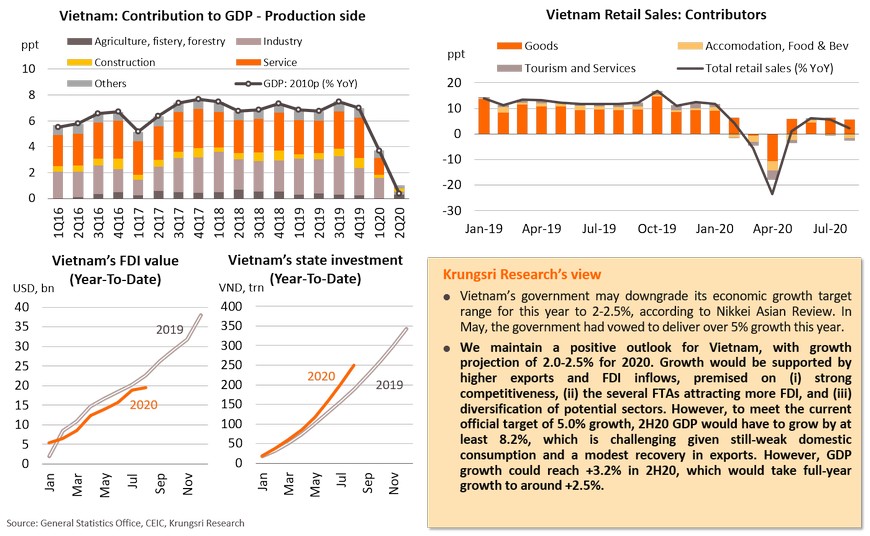

Vietnam may halve 2020 target growth range to 2.0-2.5% given weak consumption and modest recovery of exports

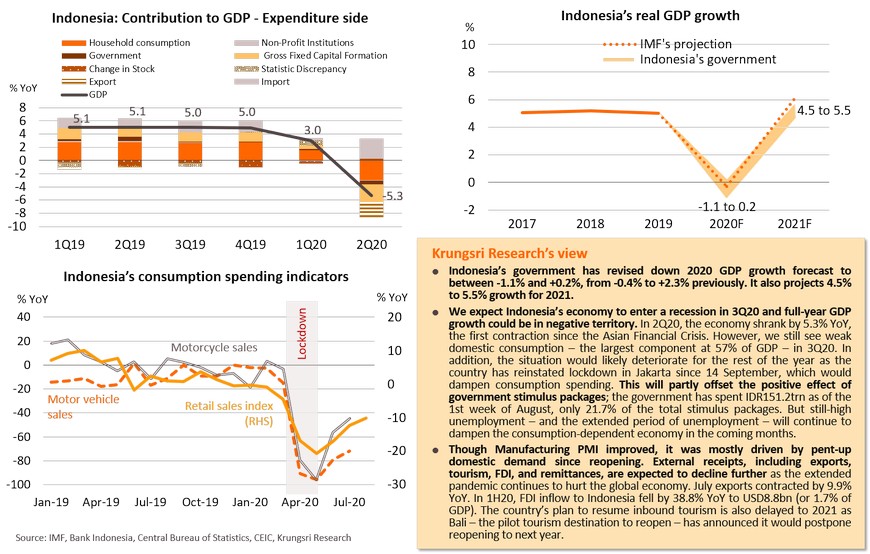

Indonesian government adjusts 2020 target GDP growth to -1.1% to +0.2% due to larger downside risks

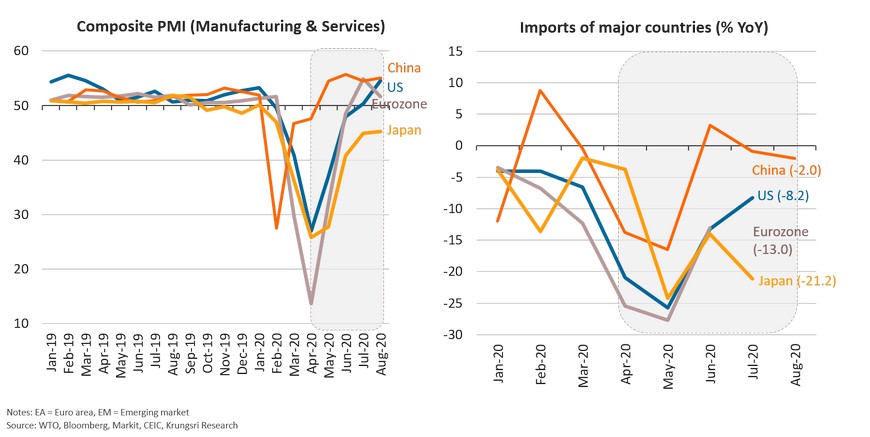

Philippines: Strong peso will tame inflationary pressure; more room to ease monetary policy

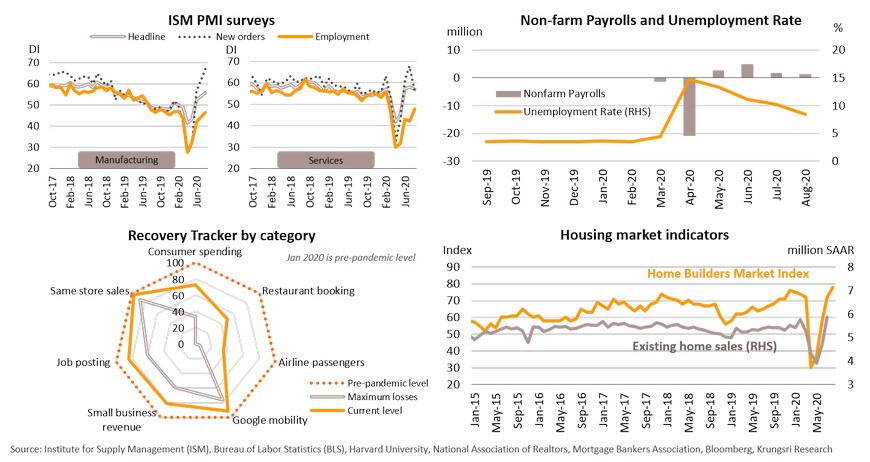

Philippines to launch PhilSys national ID with biometric information, improving access to the unbanked