Global: Economy stands on the cusp of change

Beneath uneven global growth, manufacturing worldwide falters with weak outlook and rising tariff pressures.

U.S.: Growth outlook deteriorates as tariff pressures mount; stagnant services and slowing job gains may prompt Fed to shift focus from inflation to growth support

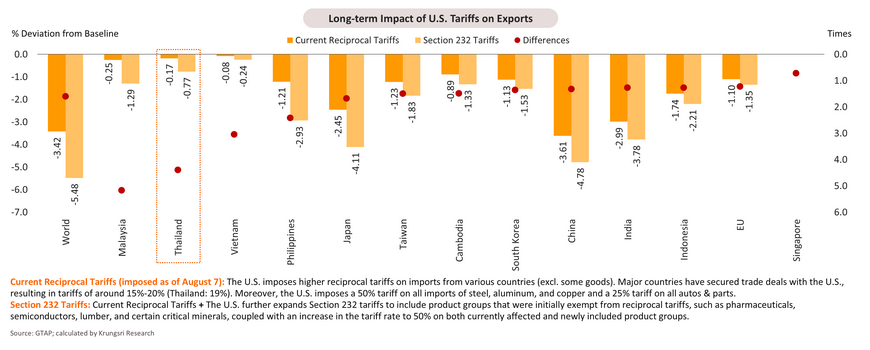

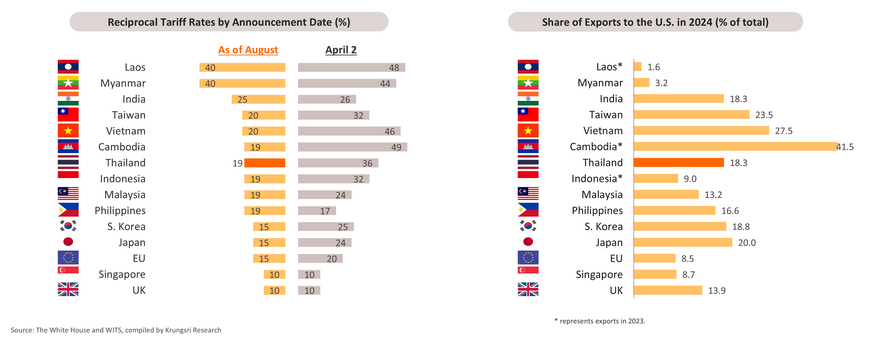

U.S. raises tariffs on most countries from previous 10% starting August 7; higher rates expected to increase U.S. production costs and living expenses, while sector-specific, transshipment tariffs, and 0% tariffs on U.S. goods could impact many economies

Despite easing export losses from tariff reduction to 19%, risks from Twin Influx, coupled with potential Section 232 and transshipment tariffs, could weigh on Thailand’s economy

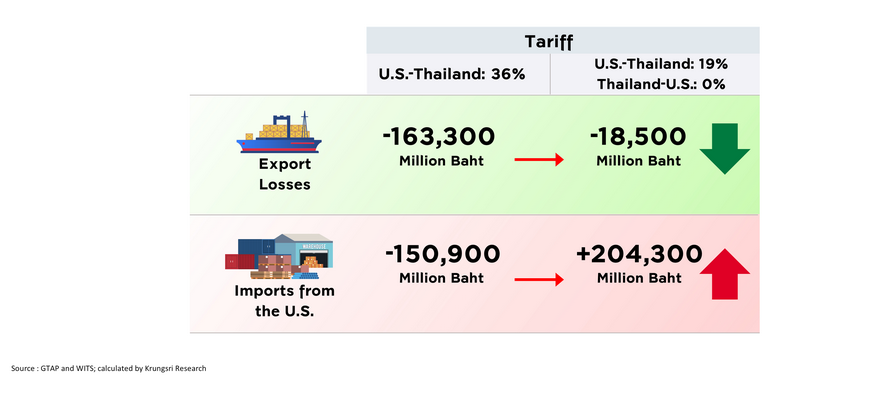

The U.S.–Thailand tariff reduction from 36% to 19% is expected to significantly reduce long-term export losses, from THB -163.3 billion to THB -18.5 billion, a ninefold decrease. However, the trade deal comes at a cost. Offering zero tariffs on most U.S. goods could lead to “Twin Influx”, a phenomenon of a simultaneous influx of U.S. goods coupled with the ongoing influx of Chinese goods. Moreover, if the U.S. proceeds to expand both the product coverage and tariff scale under Section 232 (e.g., from 25% to 50%), Thailand’s export losses could worsen by 4.4 times, the second-highest increase in ASEAN. Together, the Section 232 tariffs and potential transshipment tariffs of 40% could compound pressures on Thailand’s fragile economy, which is already struggling with weak domestic demand, political uncertainty, influx of goods, and border tensions.

Eurozone: EU-US trade deal offers mixed outlook despite lower-than-threatened tariffs; sluggish growth and competitiveness risks point to further rate cuts this year

Japan: Despite trade deal relief and resilient services, low growth outlook persists amid upcoming tariff impacts and political uncertainty, pointing to no rate hike this year

China: Economy shows signs of weakness, while trade war could weigh more on growth despite extended trade truce; effectiveness of new measures is a key

Thailand: A Fragile Economy on the Borderline

-

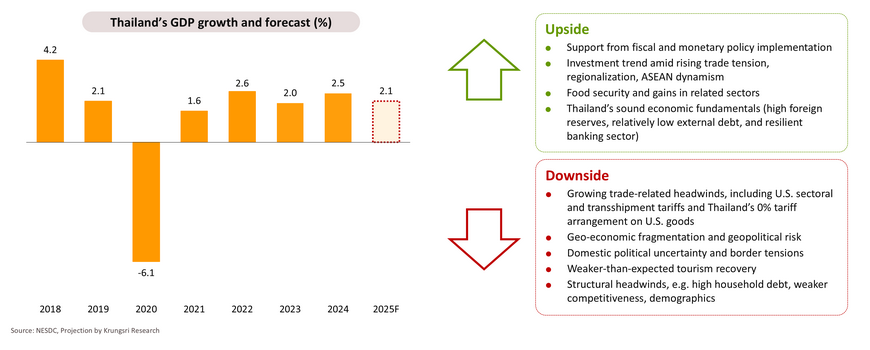

Thailand’s GDP grew at a slower pace of 2.8% in 2Q25, supported by temporary tailwinds. Mounting headwinds are expected to significantly dampen economic momentum in 2H25. The NESDC has revised up its 2025 GDP growth forecast to 2.0%, close to Krungsri Research’s current 2.1% estimate (new forecast to be released early September).

-

U.S. sets 19% tariff on Thailand, down from threatened rate of 36%, bringing it in line with other ASEAN nations—but sectoral tariff risks remain. Thailand offering a 0% tariff on all U.S. goods in exchange for the U.S. lowering its tariff to 19% could reduce export losses by 9 times, but imports from the U.S. may surge.

-

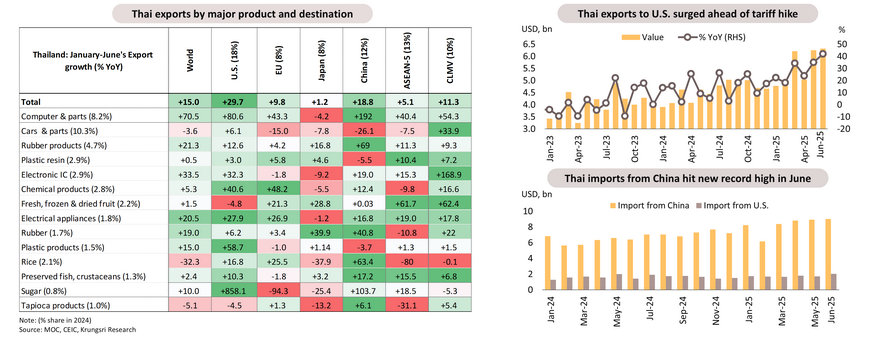

In 1H25, Thai exports surged 15% YoY, but the materialized tariff impact would significantly drag 2H25 performance, bringing the full-year growth forecast to just 3.5%. Due to a hike in U.S. tariffs to 19%, exports to the U.S. may slow sharply in 2H25, compared with nearly 30% growth in 1H25.

-

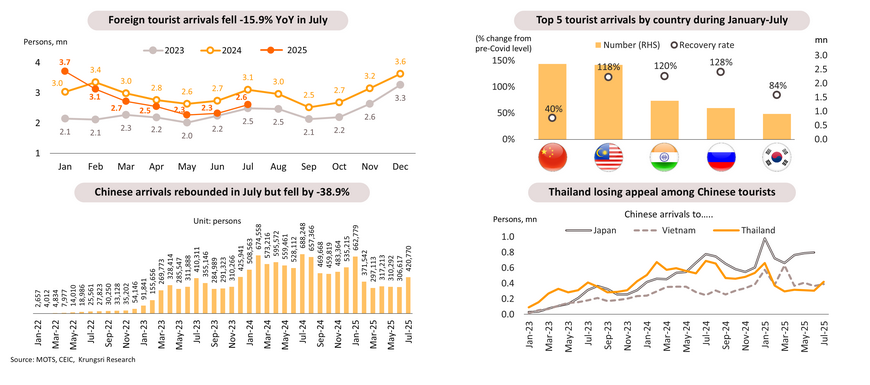

Foreign tourist arrivals declined 6.4% YoY during January–July. 2025 full-year arrivals expected to drop to 34 million—the first decline since 2020.

-

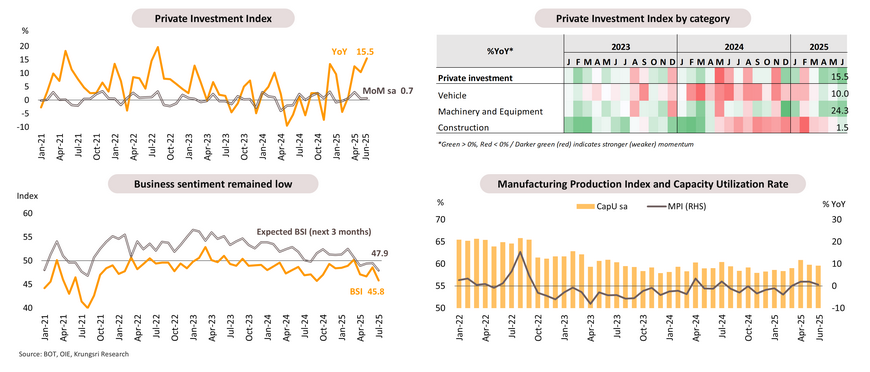

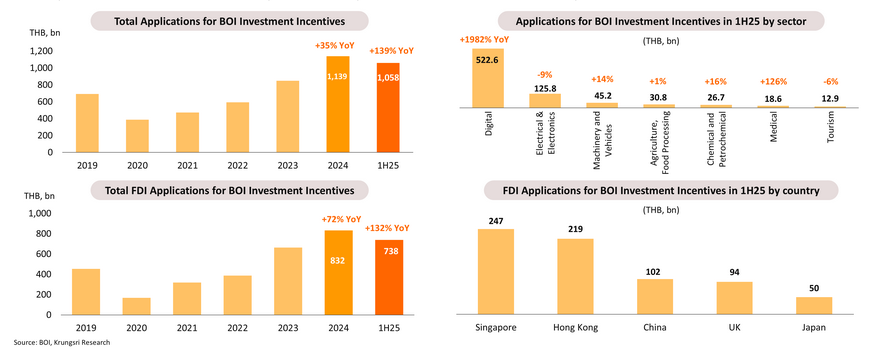

Private investment remains vulnerable to pressures from both domestic and external factors, though investment promotion applications soared 139% YoY in 1H25.

-

Private consumption continues to weaken on falling confidence, declining farm income, and structural challenges.

-

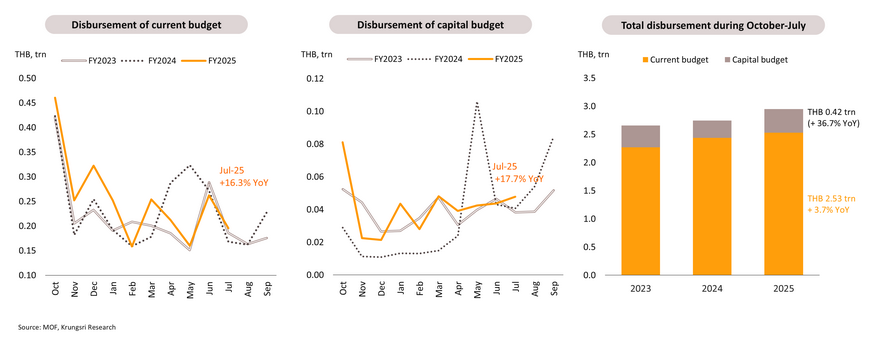

Public spending is likely to stay on track following the House’s approval of the FY2026 budget bill, though political uncertainty may affect key policy actions.

-

Inflation posted a negative rate for the fourth consecutive month in July and is expected to remain negative in 3Q25, pulling the full-year forecast down to just 0.2%.

-

MPC is shifting focus to growth concerns and may deliver 1–2 rate cuts by early 2026 amid persistent downside risks.

Krungsri Research Forecasts for 2025

2Q25 GDP growth decelerated to 2.8% YoY from 3.2% in 1Q25, driven by front-loaded exports and ongoing public spending, while private consumption and tourism weakened

2H25 growth to slow markedly amid fading front-loaded external demand, rising U.S. tariffs, and mounting domestic headwinds. 2025 growth expected at 2.1%.

Thailand’s GDP grew 3.0% YoY in 1H25, broadly in line with our projection of 2.9%. We projected 2025 economic growth at 2.1%. In our view, while upside risks exist, particularly from fiscal and monetary policy implementation, downside risks remain significant. These include domestic political uncertainty, unresolved border tensions, and growing trade-related headwinds. In particular, concerns center on the potential impact of newly imposed reciprocal tariffs, uncertainty surrounding Thailand’s 0% tariff arrangement on U.S. goods, and the risk of further expansion in U.S. sectoral tariffs. Collectively, these factors could weigh on external demand, undermine investor confidence, and constrain overall economic momentum. As such, Krungsri Research is revising our 2025 GDP forecast, scheduled to be released in September.

U.S. sets 19% tariff on Thailand, down from threatened rate of 36%, bringing it in line with other ASEAN nations—but sectoral tariff risks remain

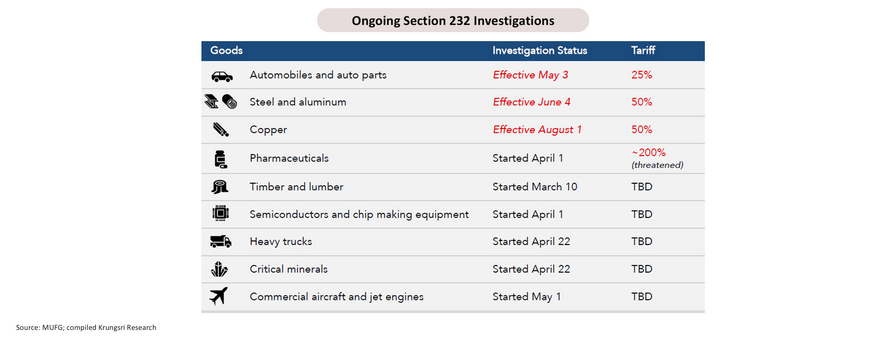

On July 31, 2025, the U.S. announced a 19% import tariff on Thai goods, significantly lower than the previously proposed 36% reciprocal tariff on April 2, bringing it roughly in line with rates imposed on several ASEAN countries, including Indonesia, the Philippines, Malaysia, and Cambodia. However, the rate remains higher than those applied to countries such as South Korea, Japan, and the EU, which face tariffs of 15%. Although the Trump administration has revised tariff rates downward from the average levels announced on April 2, the sectoral tariffs of 25–50% under Section 232 will still apply to key products, such as automobiles, steel, aluminum, and copper, posing potential disruptions to global supply chains in the near future.

Thailand offering 0% tariff on all U.S. goods in exchange for the U.S. lowering its tariff to 19% could reduce export losses by 9 times, but imports from the U.S. may surge

The U.S.–Thailand tariff reduction from 36% to 19% is expected to significantly reduce long-term export losses, from THB -163.3 bn to THB -18.5 bn, a ninefold decrease. It is worth noting that the long-term effect may be less severe than the initial shock period, during which businesses may still struggle to shift their reliance on the U.S. market to other partners. Moreover, front-loaded exports are likely to fade in 2H25, following 15% YoY in 1H25. The short-term impact, thus, could be higher but still less than the 36% scenario. However, the trade deal comes at a cost. Thailand has to offer zero tariffs on most U.S. goods, which could result in a 29.3% surge in imports from the U.S in the long term.

19% reciprocal tariff could still hurt Thai exports; the vulnerable sectors are mostly those with certain degree of reliance on the U.S. market

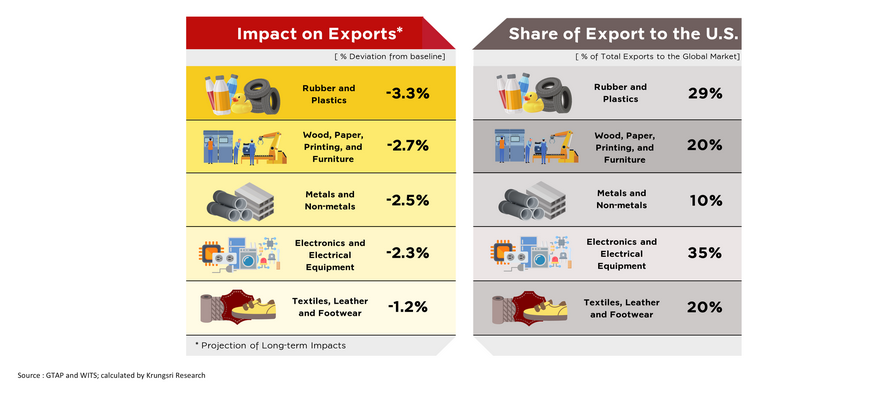

Despite the tariff reduction to 19% easing the overall impact, some sectors, mostly reliant on the U.S., could still be hurt in the long term, especially Rubber and Plastics (export losses: -3.3%, share of exports to the U.S.: 29%), Wood, Paper, Printing, and Furniture (-2.7%, 20%), Electronics and Electrical Equipment (-2.3%, 35%), and Textiles, Leather, and Footwear (-1.2%, 20%). This underscores the need to diversify trading partners, as U.S. trade policy is becoming increasingly unpredictable and subject to constant change.

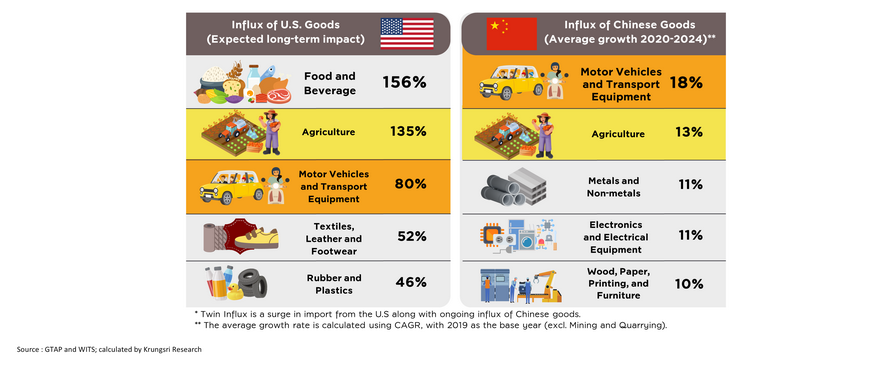

Surge in imports from U.S. induced by Thailand’s zero-tariff offer could aggravate ongoing influx of Chinese goods, leading to “Twin Influx”

Granting zero tariffs to the U.S. is expected to lead to what we call the “twin influx,” which refers to the phenomenon of a simultaneous surge in imports from the U.S. alongside the ongoing influx of Chinese goods. The latter influx has continued to pressure the Thai economy in recent years, partly due to China’s excess supply and the trade war 1.0. Agriculture and Motor Vehicle and Transport Equipment face the greatest risk, as they are already affected by the influx of Chinese goods. Post-COVID import growth from China in such sectors has been substantial, while imports from the U.S., as a result of the recent U.S.-Thailand trade deal, are expected to grow in the long run by 135% and 80%, respectively.

Moreover, signs of relief might be short-lived if the U.S. proceeds to expand both product coverage and tariff scale under Section 232

Currently, import tariffs imposed by the U.S. since the beginning of this year can be divided into two main categories. The first is the reciprocal tariff, which applies broadly to all categories. Although some goods are exempted from the reciprocal tariff, they are still subject to tariffs imposed under Section 232, which target specific product groups. Tariffs under Section 232 that are in effect include autos and auto parts (25%), steel and aluminum (50%), and copper (50%). With or without the reciprocal tariff, expanding product coverage and tariff rates (e.g., from 25% to 50%) under section 232 would significantly pose risks for Thai exporters, especially Electronics and Electrical Equipment. It is important to note that this sector account for 25.7% of total Thai exports in 2024, with its exports to the U.S. representing 34.6% of total Thai exports in such a sector. Together, section 232 tariffs, the twin influx, and potential transshipment tariffs of 40% could compound on Thailand’s fragile economy, which is already struggling with weak domestic demand, political uncertainty, and border tensions.

Exports surged 15% in 1H25, but materialized tariff impact would significantly drag 2H25 performance, bringing full-year growth forecast to just 3.5%

Due to a hike in U.S. tariffs to 19%, Thai exports to the U.S. may slow sharply in 2H25, compared with nearly 30% growth in 1H25

In the first half of 2025, Thai exports grew by 15.0% YoY (based on MOC data), led by industrial products, which expanded by 19.3% (including computers & components, electronic integrated circuits, and electrical appliances), and agro-industrial products which expanded by 7.2% (such as pet food, fresh, chilled, frozen, and processed chicken, and sugar). However, exports of agricultural products decreased by -1.3%, led by rice and tapioca products. Notably, exports to the U.S. surged by 29.7%, led by computers & parts, plastic products, chemical products, and electronic integrated circuits. In June, imports from China continued to hit record highs of USD9 bn. Going forward, key factors include potential risks from U.S. transshipment tariffs and the impact of Thailand’s reduction of import tariffs on many U.S. items to 0%, which could affect production costs and the competitiveness of domestic producers.

Tourism: Foreign tourist arrivals declined -6.4% YoY during January–July; 2025 full-year arrivals expected to drop to 34 million—the first decline since 2020

In July 2025, Thailand welcomed 2.61 mn foreign tourists, an increase from June but still down by 15.9% YoY. For the first seven months of 2025, total foreign tourist arrivals stood at 19.3 mn, (-6.4% YoY), generating THB 895 bn in revenue (-4.2%). The decline was largely driven by a sharp drop in Chinese visitors, down -34.9% YoY to just 2.69 million—equivalent to only 40% of pre-COVID-19 levels in 2019. The slower recovery of Chinese tourists was attributed to concerns over travel safety in Thailand and intensifying competition. For 2025, foreign tourist arrivals are projected to fall for the first time since 2020 to 34 mn, from 35.5 mn in 2024.

Private investment remains vulnerable to pressures from both domestic and external factors

In June, the Private Investment Index increased by 15.5% YoY, driven mainly by last year’s low base and improving growth in manufacturing production. However, private investment for the rest of the year could be supported by the THB 85 bn infrastructure development program, but overall growth will remain under pressure from: (i) weak sentiment amid concerns over domestic political stability and tensions between Thailand and Cambodia; (ii) the slower-than-expected recovery in tourism; and (iii) uncertainty over U.S. trade policy.

Investment promotion applications soared 139% YoY in 1H25 amid domestic political uncertainty

In the first half of this year, the Board of Investment (BOI) received applications for investment incentives with a total investment value of THB1,058 bn (+139% YoY). The three industries with the highest investments were Digital, Electrical & Electronics, and Machinery & Vehicle. Foreign direct investment (FDI) applications for BOI incentives valued at THB738 bn (+132%), led by Singapore, Hong Kong, and China. Meanwhile, the BOI has approved with a total investment value of THB 904 bn (+90%). The investment value of promoted certificates, which are closely linked to actual investment, totaled THB 653 bn (+49%). This is a promising sign for domestic investment in key industrial sectors over the next 1–2 years. However, downside risks remain from political uncertainty, which could undermine confidence and delay investment decisions.

Private consumption continues to weaken due to falling confidence, declining farm income, and structural challenges

In June, the Private Consumption Index (PCI) rose slightly by 0.6% YoY, dampened by a slowdown in service spending, particularly in hotels and restaurants, and a contraction in non-durable goods consumption. Looking ahead, domestic tourism stimulus may lift consumption in the remainder of the year, but several challenges persist. These include: (i) potential tariff impacts on income and employment; (ii) declining farm income due to lower agricultural prices; (iii) high household debt; and (iv) weak consumer confidence, further weighed down by domestic political uncertainty.

Public spending is likely to stay on track following the House’s approval of the FY2026 budget bill, though political uncertainty may affect key policy actions

Preliminary data from the Ministry of Finance shows that in July, disbursement of the current budget rose by 16.3% YoY, while capital budget disbursement increased by 17.7%. For the first ten months of FY2025 (October 2024 to July 2025), current budget disbursement grew by 3.7% YoY to THB 2.53 trillion, accounting for 91% of the annual allocation. Capital budget disbursement rose by 36.7% YoY to THB 0.42 trn, but represented only 43% of the full-year target. Meanwhile, the draft FY2026 budget bill, with a total expenditure of THB 3.78 trillion (+0.8%), has passed its second and third readings in parliament and is expected to take effect on schedule. However, political uncertainty remains a significant risk that could affect the implementation and effectiveness of economic policies in the period ahead.

Inflation posted a negative rate for the 4th consecutive month in July and expected to remain negative in 3Q25, pulling the full-year forecast down to just 0.2%

MPC is shifting focus to growth concerns and may deliver 1–2 rate cuts by early 2026 amid persistent downside risks

Key factors in 2H25: Deeper tariff impact, political uncertainty, and slow tourism recovery heighten risk of a negative feedback loop despite policy supports