Global: The storm has passed, but the danger has not

Renewed lockdowns could hurt global economic growth at the beginning of this year

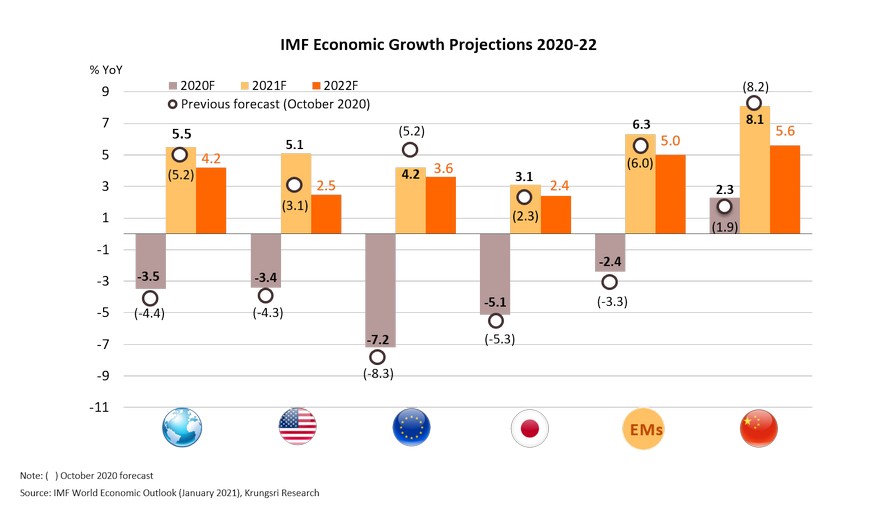

IMF raised 2020 and 2021 global growth forecasts on the back of additional policy supports and vaccine approvals

Approvals for several vaccines and the launch of mass vaccination programs have raised hopes the pandemic would end soon. Latest economic data suggest stronger-than-projected momentum in 2H20. Although COVID-19 cases continue to rise, economic activity seems to be adapting to subdued contact-intensive activity. Moreover, additional measures announced at end-2020 in major countries should provide further support to the global economy. These developments indicate a stronger starting point for 2021–22 global outlook, according to the IMF.

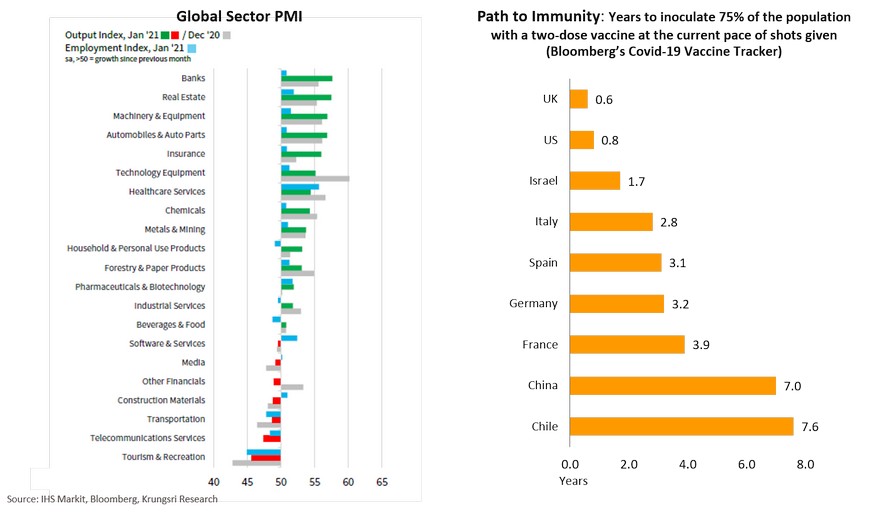

Global recovery remains uneven; it would take a long time to return to normal

Latest Global Sector PMI data suggest recovery remains uneven across sectors. Despite a pick-up in financial services activity and rising manufacturing, output in other sectors continue to be hurt by the pandemic, led by tourism & recreation. This is due partly to behavioral changes triggered by pandemic fears. Although many countries have started mass vaccination programs, it could take 3-7 years for life to return to normal based on the latest vaccination progress, according to Bloomberg’s COVID-19 Vaccine Tracker.

US: Economy gains momentum, raising hopes for a stronger recovery ahead

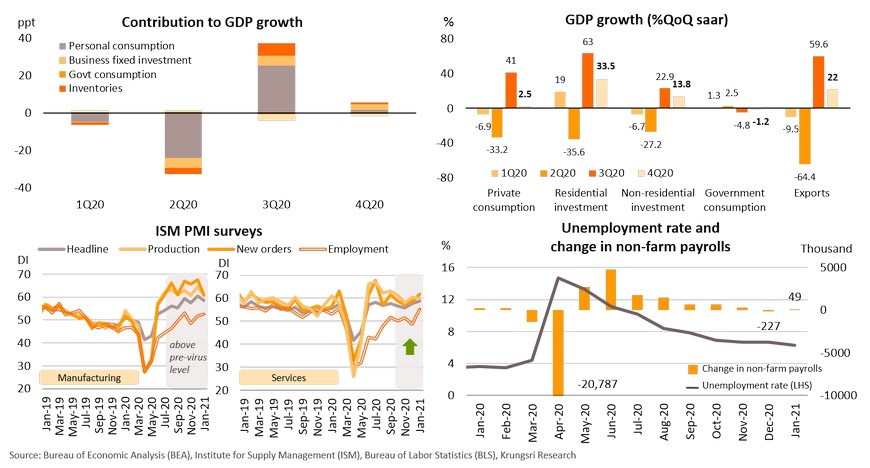

The US economy expanded 4% QoQ saar in 4Q20, but contracted by 3.5% for full-year 2020. The expansion in the final quarter was led by investment in both residential (+33.5%) and non-residential sectors (+13.8%). Private consumption, the biggest contributor to the economy, booked a moderate rebound at +2.5%. 4Q20 real GDP remained 2.5% below pre-pandemic level. However, the vaccine rollout and optimism towards large fiscal stimulus induced a more upbeat outlook, prompting the IMF to revise up 2021 US GDP growth forecast to 5.1% from 3.1% in the previous forecast. Services sector signaled a gradual improvement despite the resurgence of COVID-19, led by employment (55.2 in January vs 48.7 in December). Manufacturing PMI remained solid. Non-farm payrolls turned to increase by 49k jobs and unemployment rate dropped to 6.3%, reflecting the return to work and resumption of economic activities. The positive momentum would raise hopes for a stronger recovery ahead.

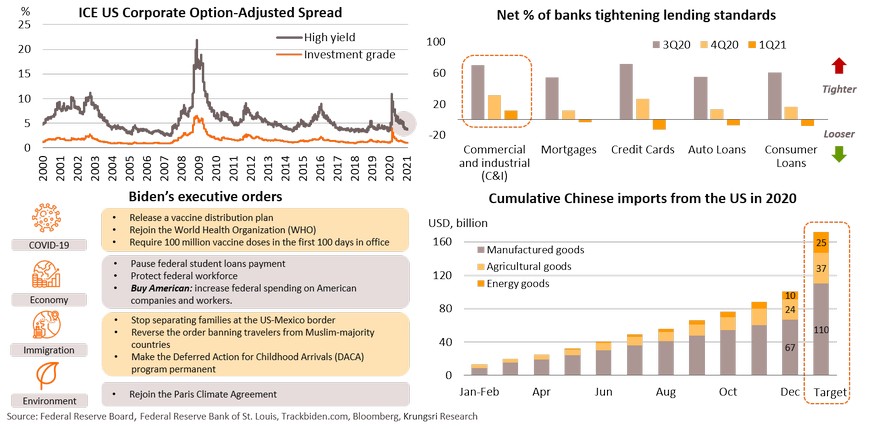

FOMC advocates monetary support along with fiscal aid to strengthen recovery; Biden to dismantle Trump’s policies

Although the outlook is improving, the FOMC kept monetary policy unchanged, citing the economy is still far from full recovery, and support fiscal aid to offset the pandemic damage. Corporate spread for high-yield bonds has dropped to 3.7%, below pre-pandemic level, raising fears of a Taper Tantrum. However, we believe the Fed would not exit from massive support this year, and would apply forward guidance to anchor inflation and interest rate expectations. Moreover, tightening C&I credit standards suggest the Fed will keep a dovish stance. The looser monetary policy and USD1.9trn stimulus package should support recovery this year. Since his inauguration, Biden has signed several executive orders to address the pandemic, rejoin the Paris agreement, increase spending on American companies, and reversed Trump’s immigration policies. On China relations, the US government is committed to address abusive, unfair and illegal practices suggesting the former trade deal would remain in place. This could prompt China to accelerate purchase of American products in 2021 before Biden’s administration reviews current policies, as China has bought only 58% of US products under phase-one trade deal last year.

Rebound in US economy masks uneven recovery

Europe: Slow economic activity and vaccine rollout could cap economic recovery

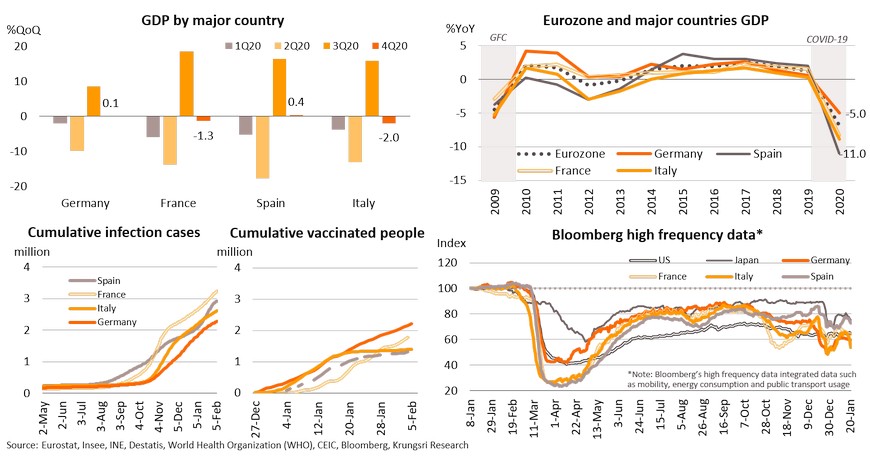

Renewed COVID-19 restrictions in Eurozone in 4Q20 had caused France and Italy’s GDP to fall by 1.3% and 2% QoQ respectively. By contrast, Spain’s economy expanded by 0.4% in the last quarter of 2020 driven by an increase in household consumption and fewer restrictions than elsewhere. Germany, the biggest economy in the bloc, reported 0.1% GDP growth driven by goods exports and investment. For full-year 2020 GDP, Germany saw the smallest contraction of 5%, while Spain’s economy shrank by 11%, worse than during the Global Financial Crisis. Although the choatic and slow vaccination has raised the risks for curbing virus, Germany and France have since accelerated vaccinations and would create herd immunity faster than Italy and Spain. High frequency data show economic activity had weakened again in late-January but remained above levels during the initial outbreak last year, suggesting more businesses are adjusting to the restrictions. Looking forward, the economic recovery trajectory would depend heavily on progress in the bloc’s vaccination programs and when they can effectively exit from lockdown.

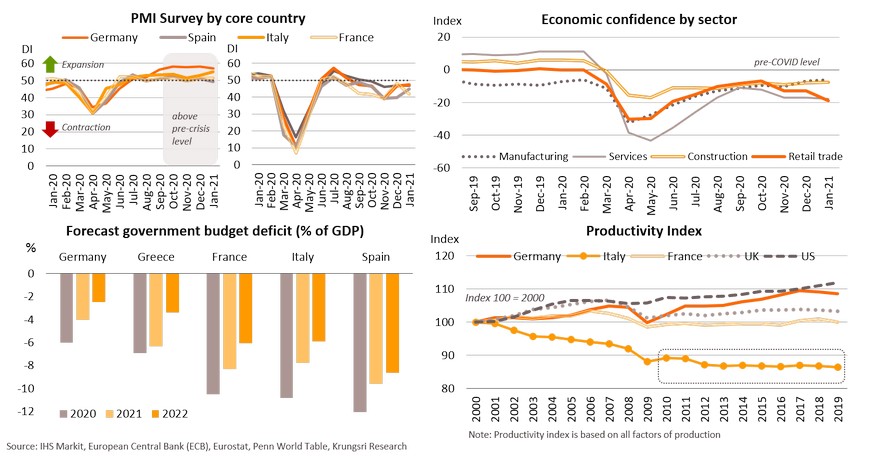

Uneven recovery across sectors and countries; Italy is facing several headwinds

The recovery in the Manufacturing sector is gaining pace, leaving the Services sector trailing further behind. Services PMI remains below-50 in the big four economies due to tighter restrictions. Meanwhile, the industrial sector has continued to expand, led by Germany and Italy where Manufacturing PMI data are above pre-crisis levels. Economic confidence data also reflect sluggish services and retail trade sectors, which remained weaker than the manufacturing sector and far below pre-pandemic levels. There is also uneven recovery among countries in the bloc. Italy is facing several headwinds that could derail recovery, including (i) limited room for fiscal support due to high debt level (160% of GDP) and large budget deficit (about 8% this year), (ii) relatively low productivity, which means Italy needs more structural reforms, and (iii) possible delay in plan to utilize the EU Recovery Fund which is equivalent to 12% of GDP. These could make it challenging for the Mario Draghi-led government to seek solutions to address the crisis and help Italy’s recovery to catch up with the rest of the EU.

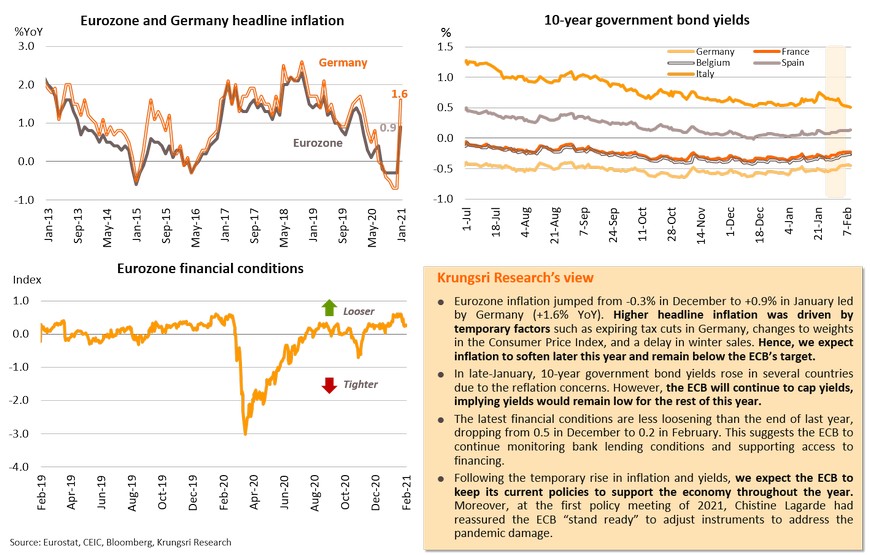

Temporary rise in inflation and yields insufficient to push the ECB to review monetary supports

China: Latest outbreak slows services sector but will not derail recovery trajectory

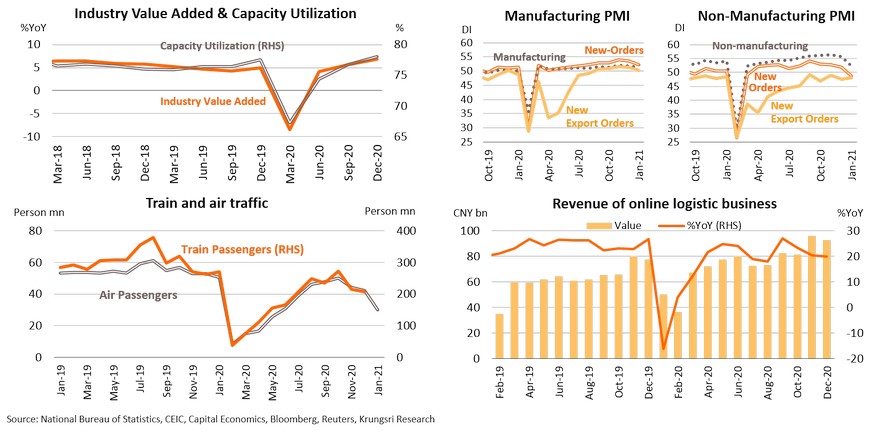

China’s economy will continue to recover through 2021 as economic activities have been improving since last year and the latest outbreak is expected to have only temporary impact. In December 2020, industrial capacity utilization and value-add in the industrial sector reached 3-year highs. In January, both Manufacturing and Non-Manufacturing PMI data remained in expansion mode for the ninth consecutive month. Manufacturing sub-indices for new export orders and new orders also stayed above-50, indicating production will continue to expand in the coming period. Although travel restrictions and partial lockdown could affect the services sector in the beginning of this year, these might support manufacturing because companies might continue to operate instead of normally shutting down for 1-2 weeks during the Lunar New Year break. Online logistic businesses would also continue to operate during the seasonal holidays. These activities could mitigate the impact from the latest outbreak. Daily COVID-19 cases have dropped significantly and there have been no local transmission for the first time in two months. The government has also eased restrictions. These would support economic activities in the next period.

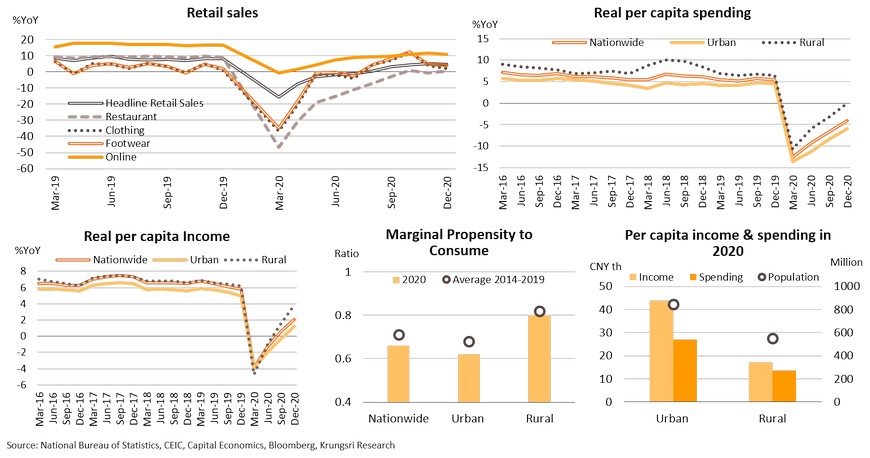

Urban residents still spending cautiously, slowing down the recovery in domestic consumption

While the supply-side economy continues to strengthen and seems resilient to the resurgence in COVID-19 infections, household consumption is lagging. Retail sales growth is below pre-pandemic rate, especially for non-essential products. One explanation would be uneven recovery; the pandemic has affected urban individuals more than rural residents. Real spending per capita in urban areas is weaker than that in rural areas. Real per capita income of urban residents is also recovering slower than the rural population. Moreover, urban individuals are less elastic to a change in income, as reflected in lower Marginal Propensity to Consume (MPC). Hence, urban spending, which accounts for about three-quarters of total household spending, would take longer to return to pre-pandemic level, although income and spending continue to improve.

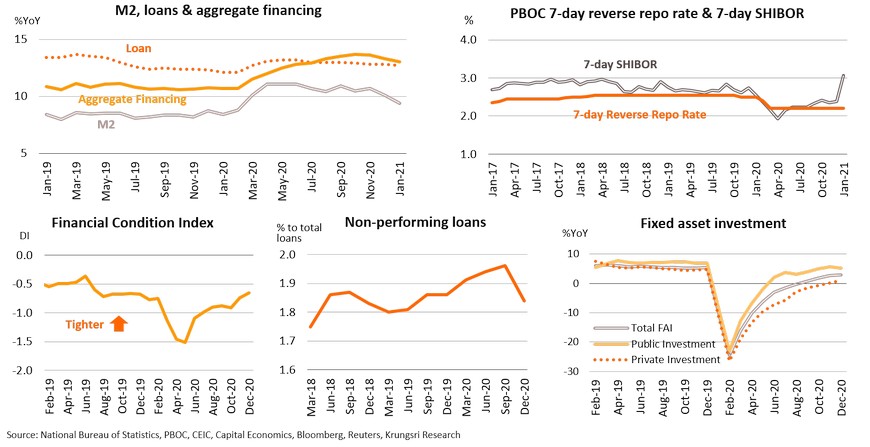

To support recovery of domestic demand, PBOC will maintain accommodative policy with prudent measures

The delayed recovery of household consumption suggests the People’s Bank of China (PBOC) should keep its accommodative policy stance. We expect the central bank to employ prudent and targeted measures to reduce risks. In January, bank loan growth decelerated slightly while M2 and Aggregate Financing slowed down, reflecting the central bank’s efforts to deleverage and limit excessive speculation. Also, the 7-day SHIBOR has risen to its highest since 2015. Financial conditions have been tightening and are near pre-pandemic level. Nevertheless, the monitoring of credit quality would likely be directed at risky or speculative activities. Also, the recent implementation of targeted measures might be able to contain financial risks, reflected by the drop in non-performing loans. Looking ahead, the PBOC is unlikely to raise policy interest rates until there are clear signs private consumption and private investment growth are returning to pre-pandemic levels.

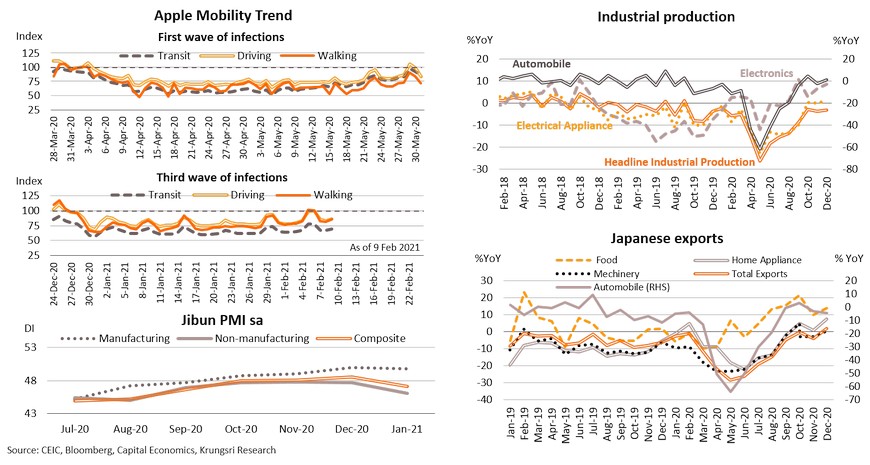

Japan: Improving exports and manufacturing sector could ease latest COVID-19 impact

The government has extended the state of emergency by a month, but less stringent measures than before should ease the impact on economic activities. Latest mobility data indicate commuting has returned to normal faster than after the first outbreak last year, but the latest restrictions still hurt January PMI data, especially Services PMI which is at a 5-month low. However, several other economic indicators continued to improve: (i) Manufacturing PMI only slipped slightly; (ii) Industrial Production is improving and key industries are operating at above pre-pandemic levels; (iii) exports rose for the first time in two years; and (iv) daily domestic COVID-19 cases have been falling from a high of 7,863 cases on January 8 to less then 2,000 recently. In addition, there are fewer areas subject to restrictions. When Japan lifts the state of emergency and exits from lockdown, the continued recovery of exports and manufacturing sectors, as well as a pick-up in the services sector, would drive the economy in the next period.

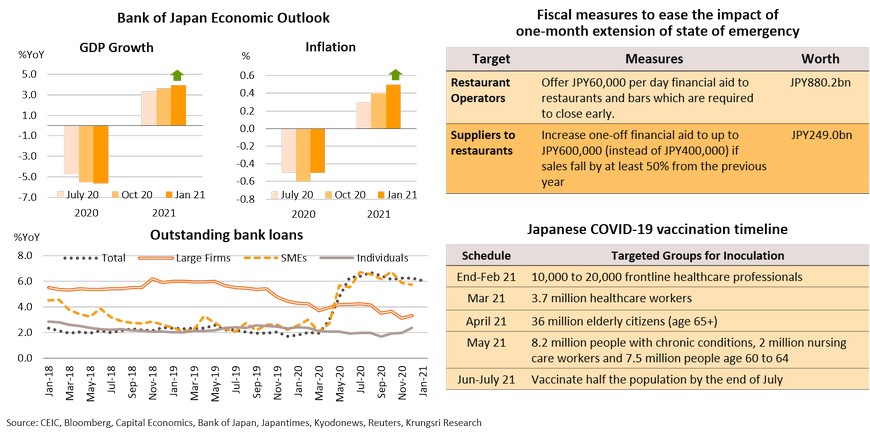

Fiscal and monetary measures and vaccination program to support economic recovery

The huge monetary and fiscal measures introduced since the pandemic seem sufficient to ease the impact and support the overall economy. In January, the Bank of Japan (BOJ) upgraded its economic growth forecasts for 2021 from +3.6% to +3.9%, citing positive momentum and the unprecedented stimulus packages. The BOJ continues to keep a very-loose monetary policy by controlling the yield curve, employing unlimited asset purchases, and offering interest-free lending facilities. In January, bank loan growth exceeded 6% for the 8th straight month, led by lending to SMEs. Also, the BOJ would likely keep negative interest rate until 2023. Meanwhile, the government has launched a series of supplementary budgets to ease the pandemic impact and boost domestic spending. Recently, the government decided to disburse JPY1.2trn from FY2020 reserve funds to increase subsidies for hard-hit restaurant operators and their suppliers. In addition, Japan will start its vaccination program at end-February. The government now plans to inoculate half its population by end-July (instead of June). Therefore, the current monetary and fiscal stimulus, and the vaccination program, should help keep the economic recovery on track.

Thailand: COVID-19 impact and uneven recovery; what will happen if the pandemic does not end soon?

- Our latest estimates suggest daily COVID-19 cases could peak in early February, with lower uncertainty. The latest outbreak is having a relatively smaller impact than last year, because more business sectors are allowed to operate and the lockdown measure are less severe. However, foreign tourist arrivals will remain weak until there is mass vaccination.

- The latest partial lockdown will continue to hurt the hospitality sector and overall demand. Despite a recovery in overall economy this year, the pandemic would have different impact on business sectors.

- In the household sector, there would be uneven recovery in household income among the different income classes, provinces, skill levels, and asset sizes. Wages in the hospitality sector will remain below pre-pandemic levels. Low-income group in major provinces and most of the middle-income group would see substantially smaller incomes. Households with a smaller buffer and low-skilled workers are likely to be hurt worst.

- We expect total household expenditure to rebound moderately this year. Spending on housing, tourism & recreation and vehicles accounts for the largest proportion of spending among the high-income group, so that could recover in the coming period. However, total expenditure would be lower than pre-pandemic levels.

- Export sector will be a key driver of the Thai economy, given positive momentum in latest data. Rising external demand should support a recovery in industrial production and capacity utilization. Investment would benefit from growing exports and infrastructure projects, although the latest outbreak had hurt sentiment early this year.

- If the pandemic does not end soon, the inequality will widen. Sector performance would become more divergent. Unskilled labor will be hit more severely than skilled labor. Also, the low-income group in major provinces would see larger income inequality. This will lead to a more uneven recovery of the Thai economy. However, allowing the movement of resources - capital, raw materials, and labor - across sectors and locations would help to mitigate the COVID-19 impact and accelerate economic recovery.

Thailand Economic Outlook 2021

Our re-estimates still suggest daily COVID-19 cases could peak in early February, but with lower uncertainty

Latest outbreak will have less severe impact on economic activities than last year

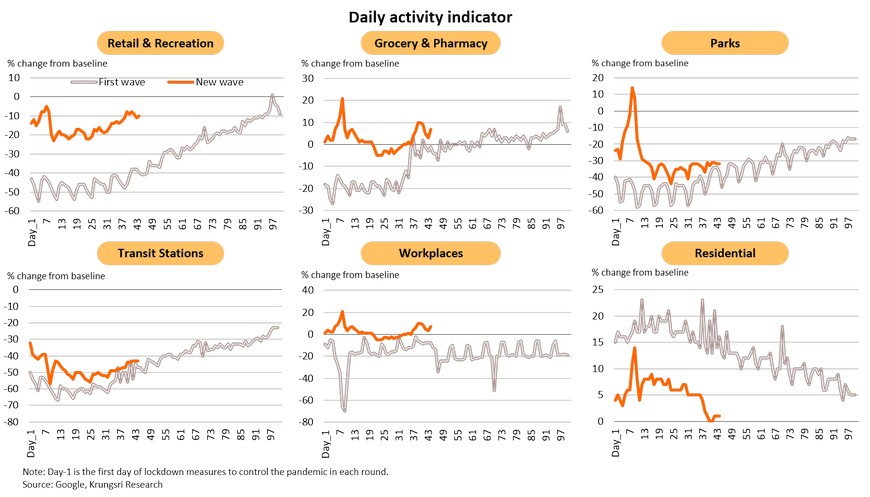

According to Google Community Mobility Reports (as of 5 February 2021) for six categories, following the latest lockdown measures, economic activity was better than during the initial outbreak and strict lockdown last year. Due to more relaxed and targeted measures, faster relaxation of measures, and quick relief measures to boost spending, the latest outbreak should have less severe impact on the economy than last year.

Foreign tourist arrivals will remain weak until there is mass vaccination

The latest partial lockdown will continue to hurt the hospitality sector and overall demand

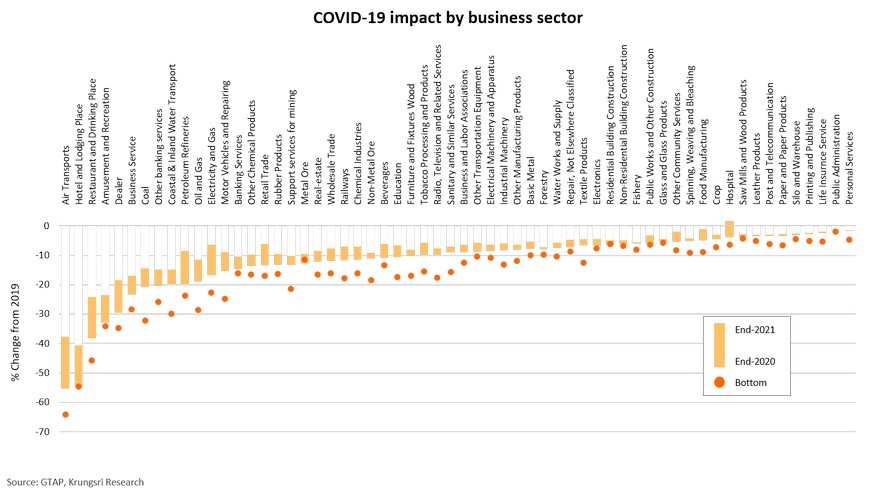

The hardest-hit sectors would be air transportation, hotel & lodging places, and restaurants, followed by recreation, car dealers, and business services. They would be hit not only by the weak tourism sector and supply disruption (both domestic and international), but also the negative income effect.

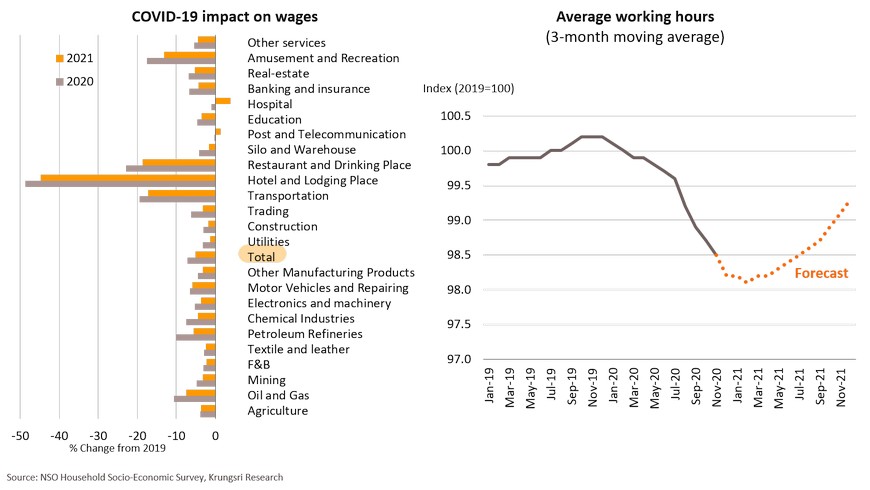

Lost revenues translated to lower wages and working hours, which will reduce household income

Despite a mild improvement this year, wages and working hours would remain below 2019 (pre-COVID) levels. Wages in the hospitality sector (including hotel, restaurant, transportation and recreation) would drop substantially. Average working hours have also dropped since the COVID-19 outbreak in early 2020 and is unlikely to improve significantly in 2021.

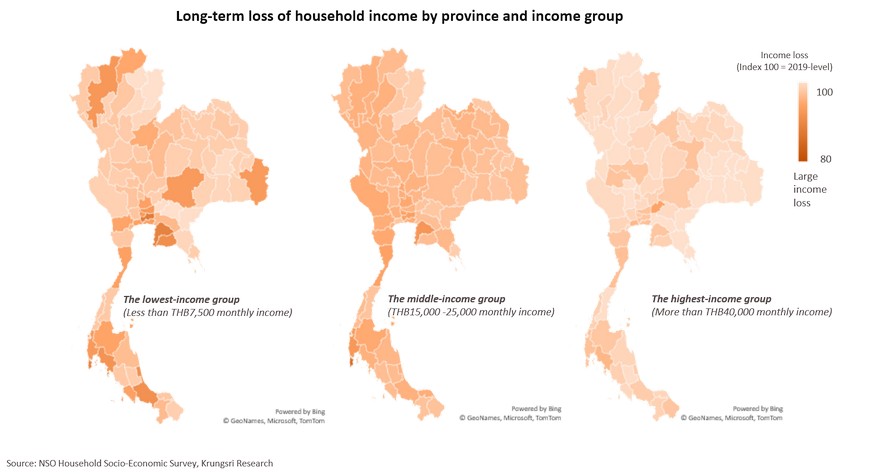

Low-income group in major provinces and middle-income earners will see a sharp drop in household income

The impact on the labor market is transmitted through lower household income and spending. Average income in 2021 is estimated to drop by 7% from pre-crisis level in 2019, but the income losses will be uneven among the different income group. The high-income group would be least affected (-6.6%). Average income for the working class would drop by 7.6%. And, the low-income group could see the largest drop in income, especially in major provinces such as Chonburi (-12.7%), Bangkok (-12.3%), Phuket (-12.2%), Chiang Mai (-9.8%) and Krabi (-9.4%). The pandemic has highlighted the level of income-inequality in Thailand which would lead to uneven recovery among the high- and low-income groups.

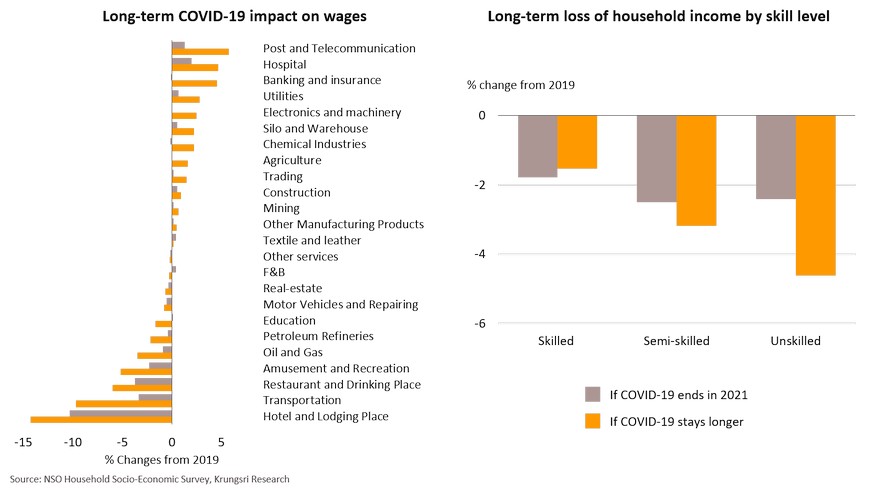

Households with smaller buffers and low-skilled workers will be more severely hit

The COVID-19 impact is felt across all industries and income groups, including the high-income group. With international borders likely to remain closed for much of 2021, entrepreneurs and labors in the services sector would continue to be affected. The ability to weather this crisis would depend on their asset size. Households with less assets (smaller buffer) would be hurt more severely and could easily fall into poverty. Meanwhile, households with low-skilled workers would see an 8.3% to 8.6% fall in earnings compared to a 6.1% drop in households with skilled-workers.

Household spending on all items will rebound moderately in 2021 but remain below pre-pandemic levels

In 2021, we expect total household expenditure to rebound moderately given several government support measures, but it would remain 2.5% below pre-pandemic level. Spending on housing, tourism & recreation, and vehicles, saw the largest declines in 2020. These account for the largest proportion of the spending by the high-income group, so that could recover in the coming period with improving purchasing power. However, the latest outbreak has created more uncertainty in the economy and business environment, so there is an element of risk to the anticipated recovery in spending on these items. Consumption would be suppressed until the majority of the population has been vaccinated, which would then allow economic activities return to normal.

Export sector will be key driver of the Thai economy; latest data show positive momentum

Rising external demand should support a recovery in industrial production and capacity utilization

Investment would benefit from exports and infrastructure projects although latest outbreak hurt sentiment in 1Q

MPC likely to hold rates this year; BOT says uneven recovery requires targeted measures, in line with our view

What happens if the COVID-19 pandemic does not end soon?

Current vaccine development and inoculation plans suggest the pandemic might only end in late 2021

Vaccines from Pfizer, Moderna and AstraZeneca have been approved for public use, but the rest are mostly still in late-stage trials. Some countries have started vaccination programs in December last year. The US and the EU would probably be able to inoculate more than 70% of their population this year. China also plans to vaccinate about half of its citizens in 2021. In Thailand, about 50% of the population could receive a vaccine this year. However, deliveries and efficacy remain doubtful. The global and domestic vaccine uncertainties means international border restrictions could remain in place for most of this year. This means Thai economy would have traverse another bumpy road to recovery this year. Additionally, that might send global and Thai economies into the unwanted scenario of an “extended COVID-19 pandemic”.

What happens if COVID-19 does not end soon?

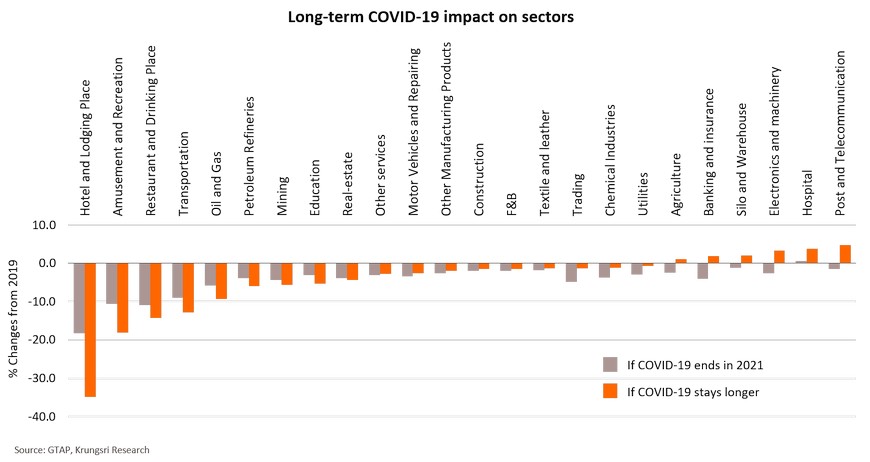

Economies will see a structural shift to meet new equilibrium if COVID-19 becomes seasonal

Hospitality industries, including hotel, restaurant, recreation, and transportation, would remain the hard-hit sectors as cross-border travel would continue t be restricted. Oil & gas and refinery sectors would be hit by lower demand for transportation. The education (face-to-face) sector would also weaken. At the other end of the spectrum, hospitals would benefit from higher expenditure on healthcare. Meanwhile, telecommunication, electronics and banking sectors could accelerate digitalization and adoption of technology. If COVID-19 becomes a seasonal epidemic, that could lead to relocation of resources and labor from hard-hit sectors to fast-growing sectors. That would make is easier to identify winners and losers.

An extended pandemic will leave permanent scars on wages, and would hurt unskilled labor

An extended pandemic would hurt labor productivity, which would reduce wages for unskilled labor. In this scenario, we expect wages for unskilled labors to drop by 4.6% from pre-crisis level, compared to -2.4% if the pandemic ends in 2021. There would be no impact on skilled labor. As shown, an extended pandemic would widen income inequality among different labor and income segments.

An extended pandemic could encourage labor movement between sectors as well as regions

The high-income group will be resilient to further shocks and their income will return to near pre-crisis level. Overall, the middle- and low-income groups in major provinces would remain the hardest-hit. An extended pandemic could force the low-income group to relocate to rural areas, which would worsen income inequality in Thailand. That could slow down economic recovery in the coming years.

Allowing movement of resources across sectors could reduce COVID-19 impact and speed up recovery

Several industries will perform better if resources are allowed to move freely across sectors. Although hotel & lodging places, recreation, and restaurant industries will continue to underperform, total industry output would increase by 0.19% if cost of resource movement drops by 10%. This would boost average wage by 0.24% and support economic recovery in coming years.

Regional Economic and Policy Developments in February

ASEAN’s FDI inflows fell by 31% in 2020 but the region remains attractive, led by Vietnam and Indonesia

Cambodia to sign FTA with South Korea by mid-2021; this would diversify sources of FDI inflows and exports

Lao PDR sets 4% annual growth target for 2021-2025; external stability will remain a major challenge

Myanmar military declares one-year state of emergency, creating concerns over investments and trade

Vietnam targets 6.5%-7.0% annual GDP growth over 2021-25; this would encourage further reforms and privatization

Indonesia’s 2020 GDP falls 2.1%; recovery will continue given supportive policies and progress in vaccination

Philippines 2020 growth is the worst in ASEAN; recovery will be slow given weak demand and limited stimulus