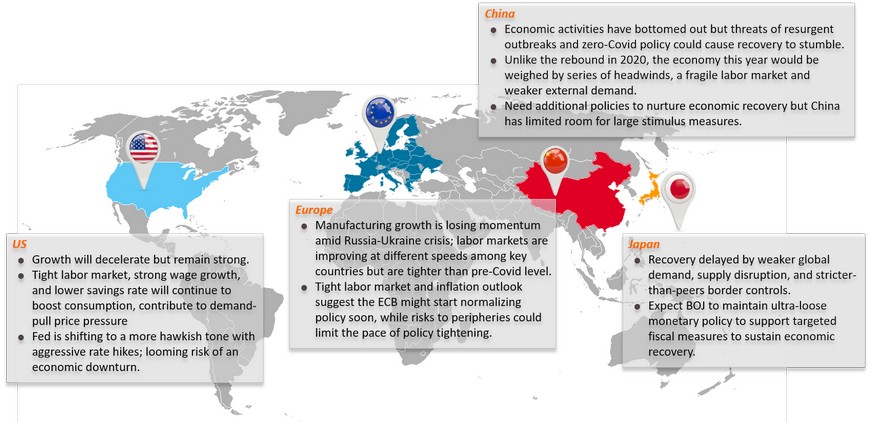

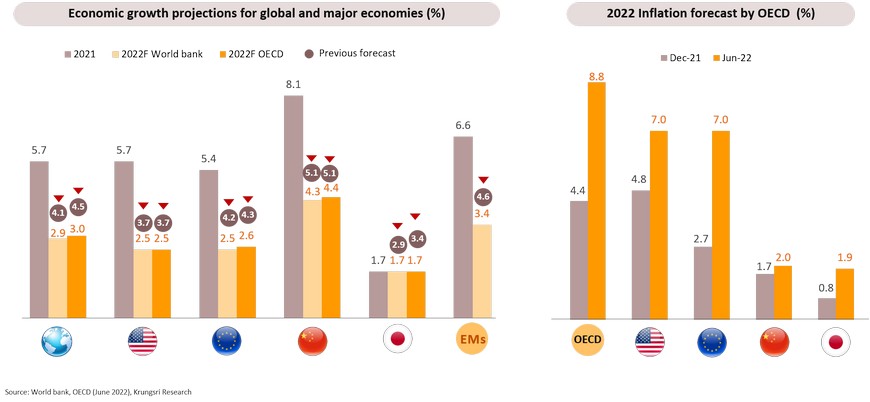

Global: Shifting into lower gear

World Bank sees higher stagflation risk amid sharp slowdown in growth; OECD blames slower recovery and higher inflationary pressures on Ukraine war

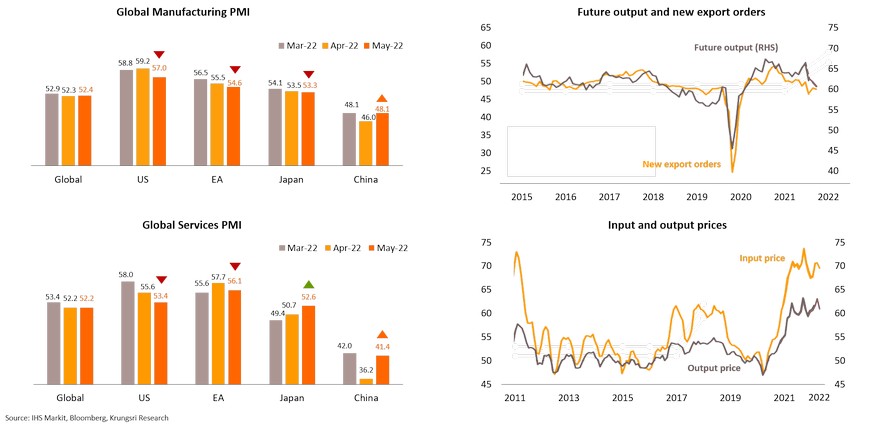

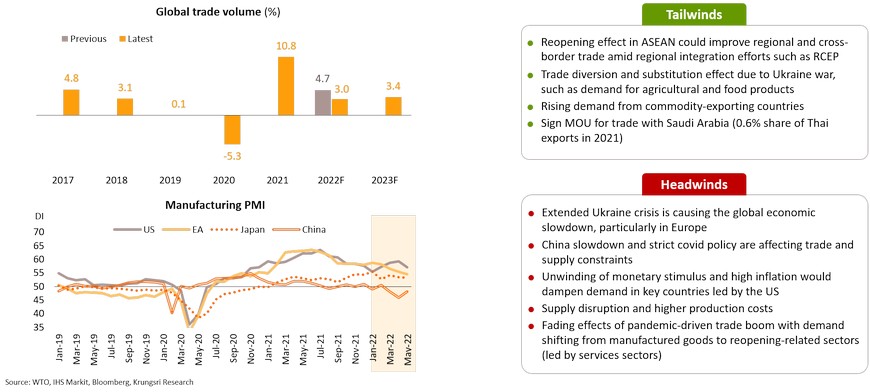

Signs of global economic slowdown with softer demand and weaker trade; high inflation will continue to dampen spending growth

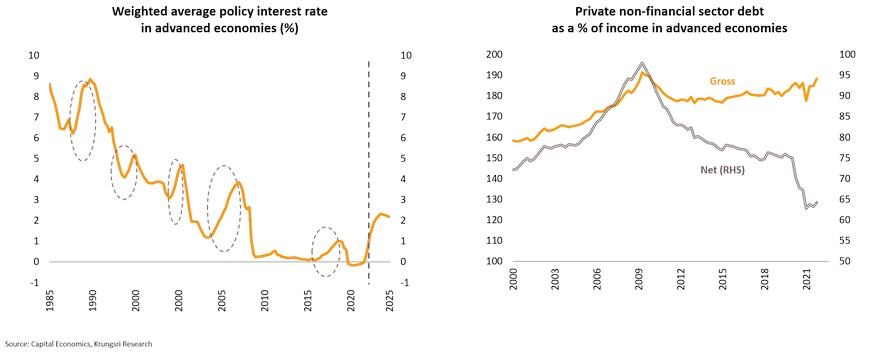

Aggressive policy tightening cycle could accelerate slowdown in global economic growth; large savings in advanced countries might help prevent a severe downturn

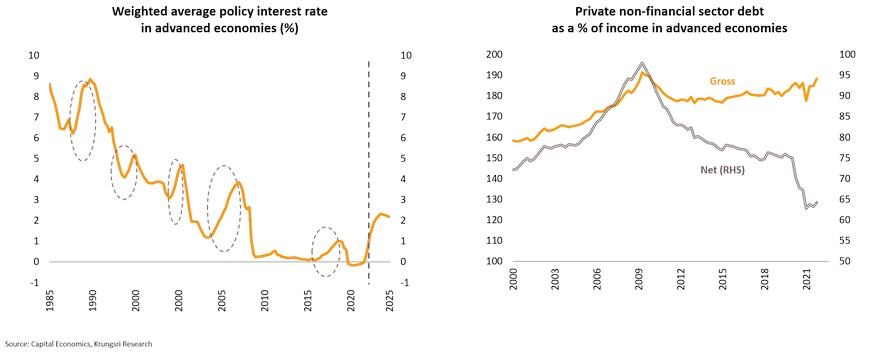

In an attempt to battle persistent inflation triggered by post-pandemic economic recovery, major countries are normalizing extraordinary monetary easing. Major central banks are expected to see the most aggressive policy tightening cycles in decades, which will slow down the global economy. Capital Economics projects the weighted average policy rate in major advanced economies will rise by 240bps within two years, sharper than the average for the past five tightening cycles. But there is one thing different from past cycles - interest rates will remain low. There has also been a build-up of savings by firms and households. Even though private non-financial sector debt as a share of income has risen to close to the level during the Global Financial Crisis (GFC); net of currency and deposit assets, the debt ratio has been low, which could be a cushion against economic shock or prevent a severe downturn.

US: Growth is slowing but remains high; tight labor market, strong wage growth, and lower savings rate continue to boost consumption, and exert demand-pull price pressure

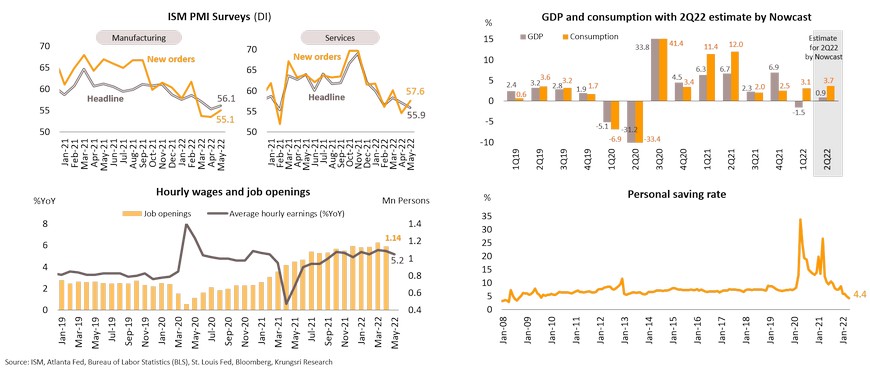

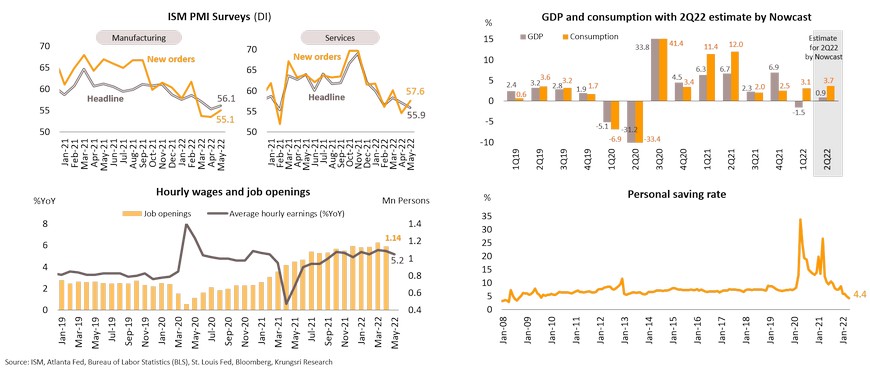

Economic growth is slowing but remains well above recession levels. While ISM Manufacturing and Services PMI data showed signs of stabilizing, they remain above-50. New orders sub-indices also reflect strong domestic demand. A running estimate of real GDP growth and components based on available economic data for the current measured quarter, called Nowcast, show that real GDP growth (seasonally adjusted annual rate) in 2Q22 might only reach 0.9% (data as of June 8) but Personal Consumption Expenditure in the same quarter could grow by 3.7%, stronger than pre-Covid level. Despite some easing in the hot labor market, job openings remain close to a record high in April and hourly earnings growth is high at 5.2% YoY in May, well beyond pre-Covid level. Non-farm payrolls are also better than market expectations, by 390,000 in May. Consumers have continued to spend as personal savings rate drop to a 14-year low of 4.4% in April. The tight labor market, high wage growth, and lower savings rate are boosting consumer spending, which could contribute to rising demand-pull inflationary pressure.

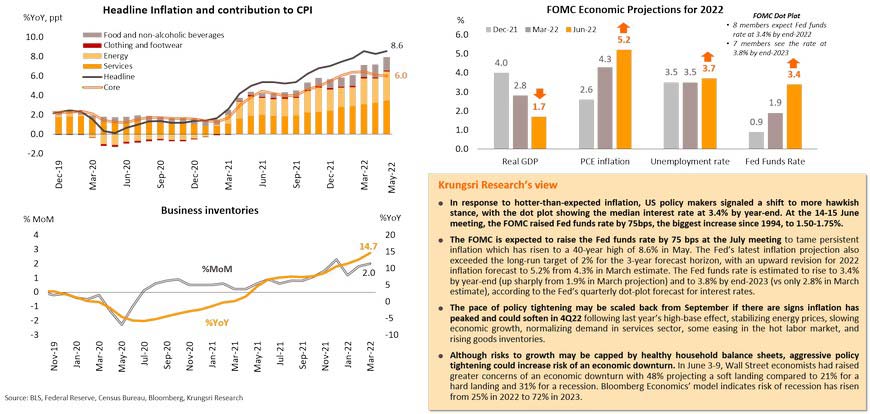

Amid more persistent inflation, Fed is shifting to more hawkish tone with aggressive rate hikes; looming risk of an economic downturn

Eurozone: Manufacturing growth is losing momentum amid Russia-Ukraine crisis; labor market improving at different speed complicates pace of policy normalization

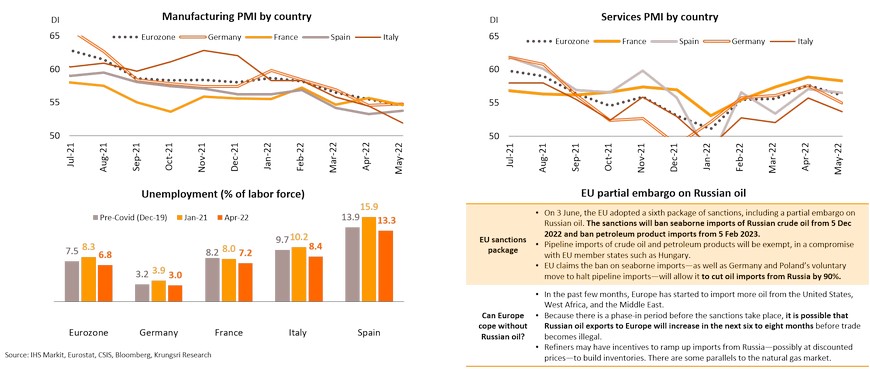

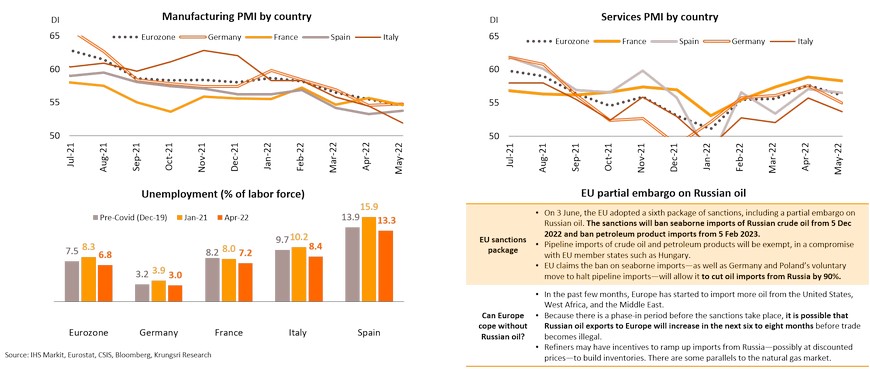

The extended Russia-Ukraine crisis, further sanctions and possible retaliation, suggest stronger downside risks to economic growth especially in Europe. Due to lingering supply shortages, elevated inflation and weaker demand amid the Ukraine war, China slowdown and economic uncertainty, Eurozone’s manufacturing growth is decelerating with Manufacturing PMI falling for the fourth consecutive month in May. Orders-to-inventory ratio has deteriorated, indicating slower output growth in the coming months. The weaker manufacturing sector has also been affected by a shift in demand from goods to services such as tourism and recreation. The services sector has rebounded from early this year but growth will plateau soon amid high inflation. Italy posted the weakest growth among key countries in both Manufacturing and Services sectors. Italy and Spain unemployment rates remain much higher than in other major economies but current unemployment rates in all key countries are below pre-Covid levels, suggesting less need for extraordinary monetary stimulus.

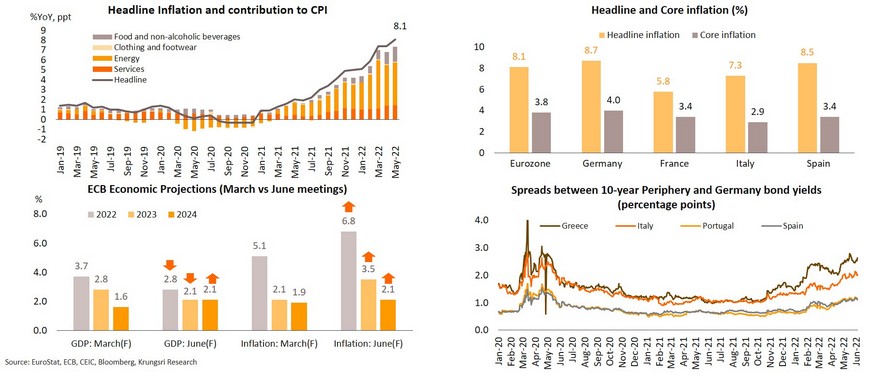

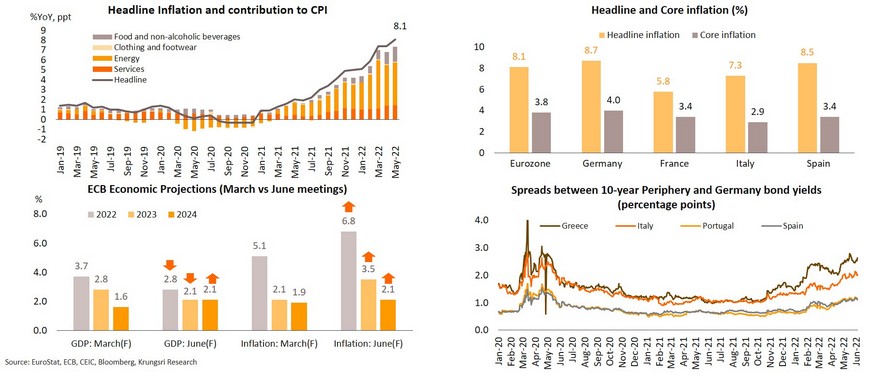

Tight labor market and inflation outlook suggest the ECB might start normalizing policy soon but risks to periphery bond markets could limit pace of monetary tightening

The tight labor market could lead to wage hikes and more upward pressure on headline inflation, which rose to a record high of 8.1% in May from 7.4% in April. The ECB recently raised inflation forecasts to 6.8% for 2022, 3.5% for 2023 and 2.1% for 2024, exceeding its 2% target for its projection horizon. Given the ECB’s stronger intention to maintain price stability, the central bank had on June 9 signaled to raise its main policy rates for the first time in more than a decade in July by 25 bps, and left open the possibility of a 50-bp hike in September. We expect a gradual move with a 25 bp hike in both September and October given lower core inflation and rising bond yields in peripheral markets. Spreads between 10-year Italian and German government bonds, a barometer of eurozone financial stress, have widened to the highest since May 2020 amid concerns over Italy’s public debt which remains high at 150% of GDP. At the emergency meeting on June 15, the ECB has pledged to act against resurgent fragmentation risks by deciding to apply flexibility in reinvesting redemptions coming due in the PEPP portfolio..

China: Economic activity has bottomed out but threats of resurgent outbreaks and extended zero-Covid policy could cause recovery to stumble

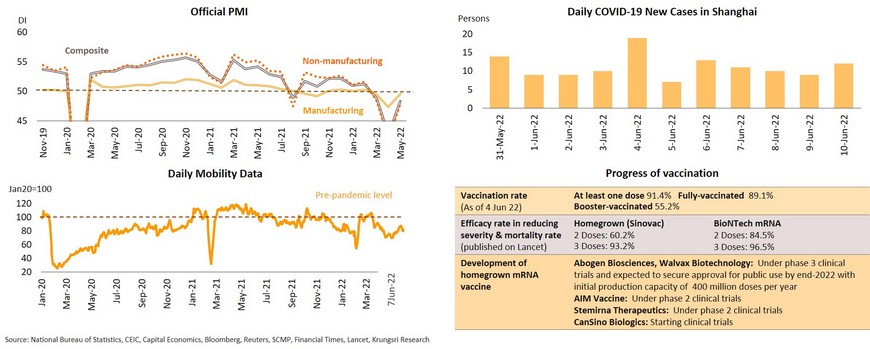

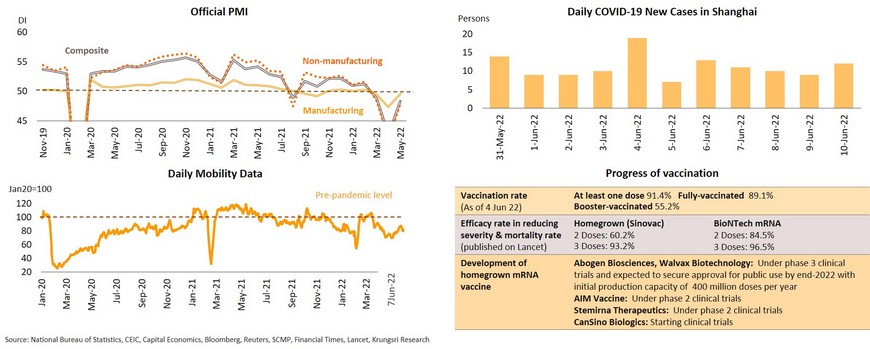

China’s economy has showed signs of improvement after nationwide outbreaks subsided. Though PMI indicators for May show economic activities are recovering gradually but Manufacturing and Non-Manufacturing PMI data remain in contraction territory. Moreover, the prompt reimposition of lockdown to curb a flareup in Shanghai in mid-June suggests the zero-Covid policy could delay economic recovery. Since lifting lockdown restrictions on 1 June, there has been a spike in new cases, which prompted authorities to reimpose lockdown in 7 of 16 districts. As Shanghai contributes 3.8% of GDP and is the financial services and manufacturing hub, the recurrent lockdowns will disrupt supply chains and discourage domestic spending. High-frequency data indicate overall economic activities have bottomed out but have not returned to pre-Covid levels. Looking ahead, lingering Covid-related factors could drag the economy intermittently. First, outbreaks driven by Omicron variant are not yet completely under control. Second, there is slow progress in dispensing booster shots, covering only 55.2% of China’s population. Also, fully-vaccinated citizens are still at risk from less-effective homegrown vaccines compared to mRNA. Third, risks from the extended zero-Covid policy would hurt economic activities going forward.

Unlike the rebound in 2020, the economy would be dampened by several headwinds, a fragile labor market and weaker external demand this year

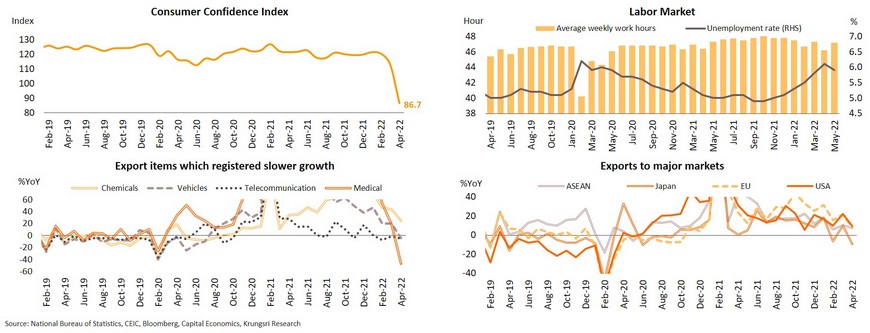

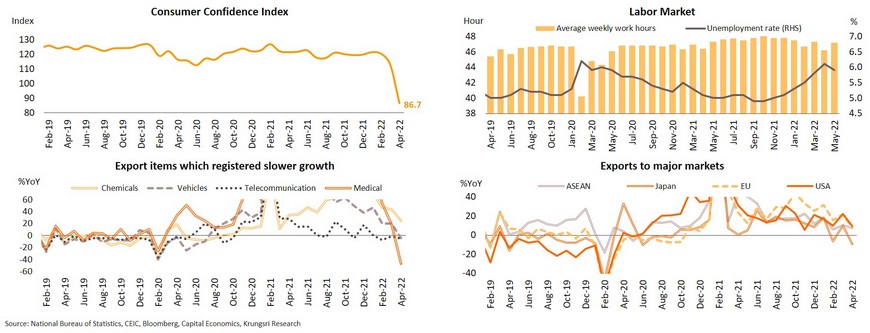

Compared to recovery after the first wave in 2020, China’s economy is likely to suffer from the longer impact of several outbreaks this year, aggravated by a series of headwinds, including regulatory crackdown, liquidity crunch in property sector, as well as external risks from Ukraine war and tightening policies abroad. Consumer confidence fell to a new low in April. Confidence could improve after lifting lockdown in some cities but recovery would be affected by a weak labor market. Unemployment rate remained high at 5.9% in May, far above pre-pandemic level in 2019. Moreover, exports which had cushioned the impact of a weaker domestic economy in 2020 might not be much help this time. Several export items which had benefited from the pandemic and work-at-home policy are seeing weaker demand, such as medical products, telecommunication, and vehicles. Exports to major markets have also dropped. In the next period, exports could also be threatened by the US's efforts to unite the Indo-Pacific Economic Framework (IPEF) that excludes China from a new trade bloc, while potential benefits from a review of import tariffs by President Trump’s administration may not be significant as some manufacturing facilities for those products have been relocated to other ASEAN countries. Despite anticipating a recovery following lockdown easing, the negative impact of a weak labor market, global economic slowdown, and rate hikes in major countries, coupled with fading gains from pandemic-related products and a shift in demand from goods to services could continue to pressure economic recovery in China.

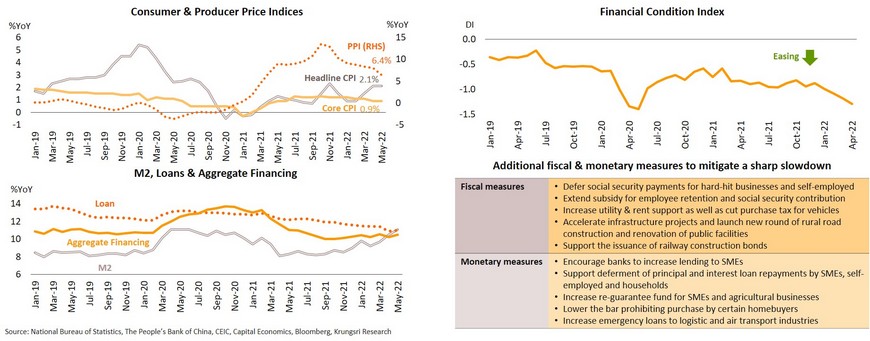

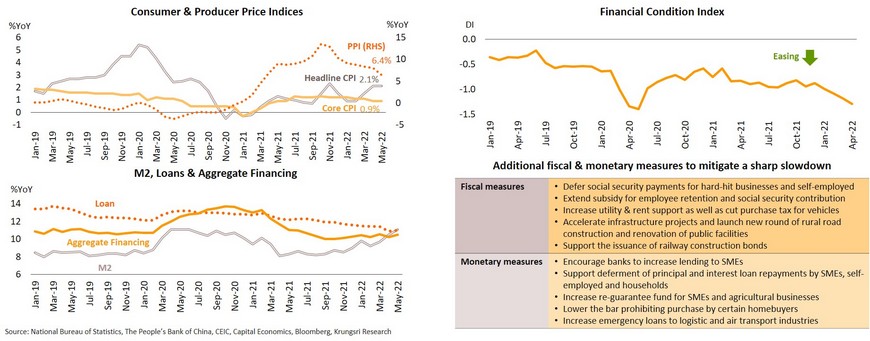

Need additional policies to nurture economic recovery but China has limited room for large stimulus measures

Low inflationary pressure compared to peers would allow China to continue to deploy accommodative fiscal and monetary measures. In May, headline inflation was steady at 2.1%, well below the target of 3% and in-line with unchanged core inflation. Producer price inflation also dropped to a year low. On May 20, the People’s Bank of China (PBOC) announced it would cut 5-year Loan Prime Rate (LPR) by 15 bps to 4.45%, the biggest reduction in 3 years. The PBOC also urged commercial banks to provide more credit, reflected by easing financial conditions and surging money supply (M2). Noticeably, the expansion in loans and aggregate financing have not accelerated because authorities remain cautious of speculation and excess leverage in the property sector. Recently, authorities have stepped up stimulus measures to ease the negative impact of latest outbreaks and lockdowns in key areas, particularly Shanghai and Beijing. On May 23, the State Council announced 33 support measures, worth CNY 2.1trn (1.7% of GDP), smaller than 2020’s stimulus package worth CNY 3.6trn (2.9% of GDP). Nonetheless, there is limited room for further monetary and fiscal measures to boost economic growth as (i) greater monetary easing would lead to more policy divergence with major countries, raising concerns over fund outflows, a weaker yuan, and higher inflation; (ii) greater policy easing could heighten risks in financial and real estate sectors; and (iii) 2022 target for fiscal deficit has been lowered to 2.8% of GDP from 3.6% in 2020 and 3.2% in 2021.

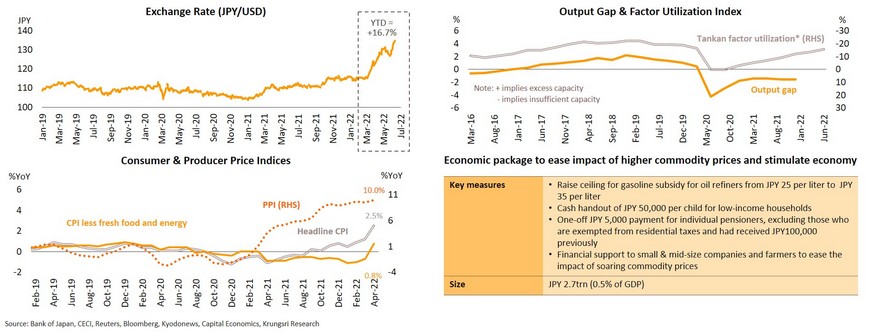

Japan: Recovery delayed by weaker global demand, supply disruption, and stricter-than-peers border controls

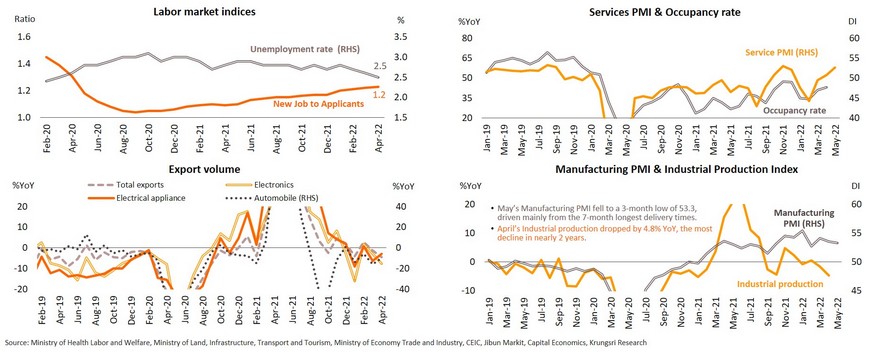

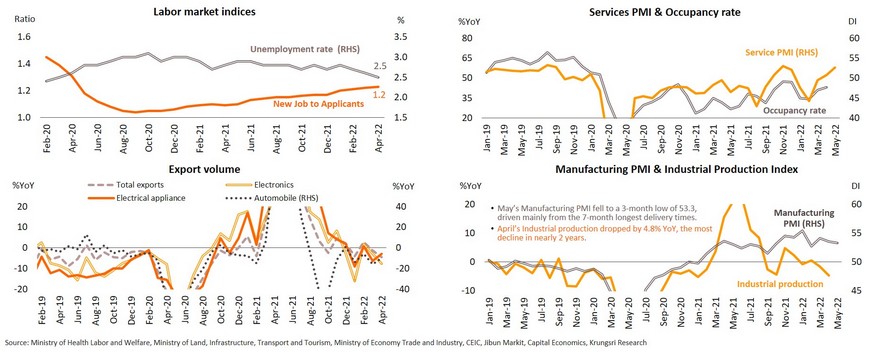

The Japan economy has been improving gradually mainly to the resumption of activities along with fewer Covid-19 cases and easing restrictions. The labor market has strengthened, reflected by over-2-year low unemployment rate and a 2-year high job-to-applicants ratio. The services sectors have also been improving with the relaxation of containment measures to revive retail, dining and tourism activities. This is reflected in 6-month high Services PMI for May. However, activities are still far below pre-pandemic levels, particularly hotel occupancy rate which was only 43.2% in April vs 62.6% average in 2019. Looking ahead, there are still several headwinds that could delay economic recovery, including (i) weakening external demand, reflected by the sharpest drop in export volume in 19 months as the Ukraine war and surging inflation dent demand abroad, (ii) supply disruption worsened by the Ukraine crisis and China’s strict zero-covid policy, though some of the constraints have eased since China relaxed restrictions in some areas, and (iii) Japan’s relatively stricter border controls to contain Covid cases; they reopened their borders to tourists from 10 June but only allowed guided tours and capped daily arrivals at 20,000, suggesting slow recovery in the tourism sector.

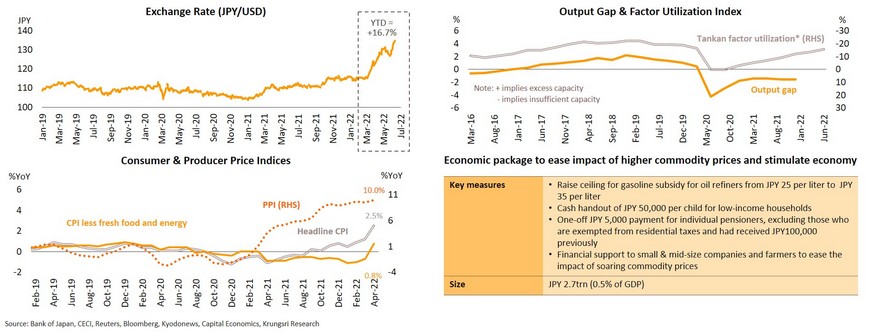

Expect BOJ to maintain ultra-loose monetary policy to support targeted fiscal measures to sustain economic recovery

There are several factors pressuring the Bank of Japan (BOJ). Policy divergence between Japan and the US has caused the Japanese yen to plunge to the weakest in 24 years against USD in mid-June. The BOJ governor said the share depreciation of the yen is undesirable and could hurt the economy. Headline inflation has risen to 2.5%, the highest since 2014. However, the BOJ is not expected to rush to unwind monetary stimulus for the following reasons. First, the economic recovery is still in the early stage and facing external headwinds. Second, the output gap is unlikely to turn positive soon. Output in 4Q21 was 1.5% below potential, in-line with below pre-covid Tankan factor utilization in 2Q22. Third, higher inflation has not been broad-based and mainly caused by a low base last April with a reduction in mobile phone fees. CPI excluding prices of fresh food and energy rose only 0.8%, implying weak demand-pull pressure. On the fiscal front, the parliament has passed a JPY 2.7trn extra budget (0.5% of GDP) for FY2022 on 31 May to launch an emergency economic package targeted at hard-hit businesses and vulnerable groups. Looking ahead, existing fiscal measures are likely inadequate as the latest supplementary budget is smaller than expected (draft total value was JPY 10trn) and much smaller than last year’s supplementary budget (5.9% of GDP), implying policy makers would need to align with monetary stimulus to support the further recovery of the Japanese economy.

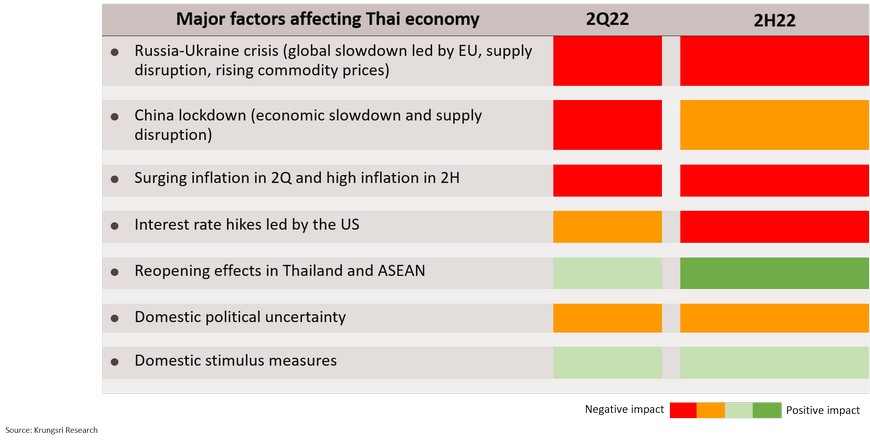

Thailand: Reopening tailwinds dampened by global headwinds and high inflation

- Key economic events in 2H22: The Russia-Ukraine crisis will continue to hurt global demand and supply. China will ease lockdown but weak growth in China would still weigh on global demand. Inflation would remain high and could still dampen spending. More importantly, the adverse impact of US rate hikes would be more visible in 2H22. The main positive factor would be reopening effect in Thailand and other southeast Asian countries. The government might consider additional stimulus measures but reducing government subsidies could push up inflation and consequently, hurt growth.

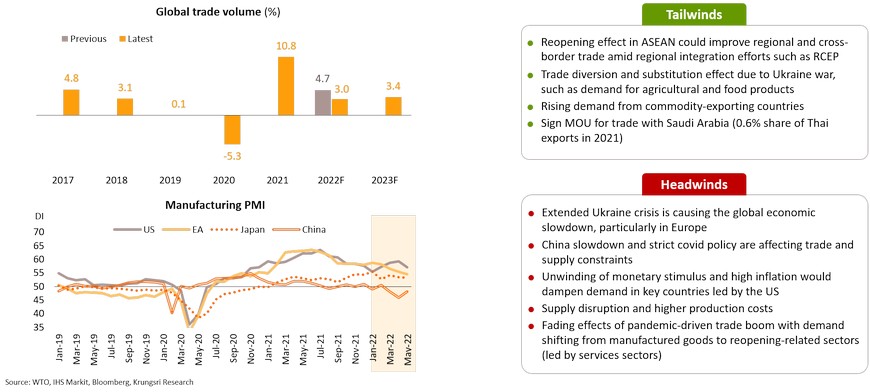

- Global economic slowdown and other headwinds could hurt Thai exports going forward despite reopening in ASEAN and trade diversion from Russia-Ukraine crisis.

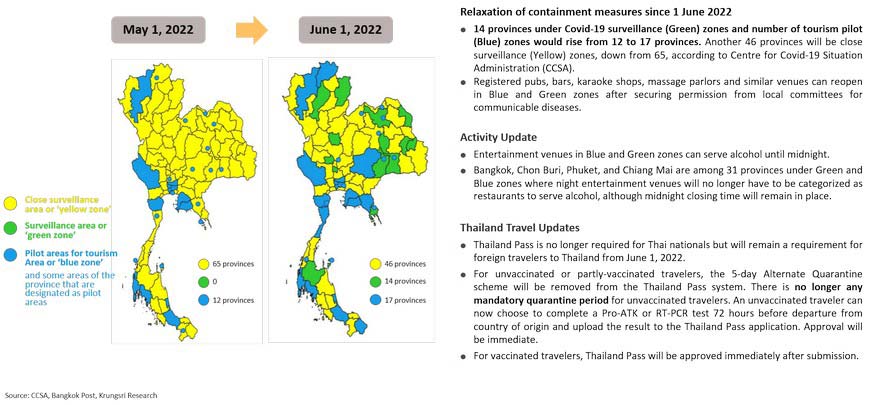

- Starting June 1, Thailand has relaxed nationwide covid controls, including quarantine-free entry to Thailand and easing restrictions on entertainment venues. Tourism sector is showing signs of stronger improvement after the decision to cease quarantine requirement. That could be an economic driver for 2H22.

- Private investment looks set to rise moderately amid the improving services sector and slowing manufacturing growth. Delays in mega-projects implies crowding-in effect of public investment will be smaller-than-expected and could cap overall investment growth.

- For private consumption, easing pandemic fears is a domestic tailwind but several headwinds and high inflation could dampen household spending. Rising farm income and improving employment could support consumption but growth would be moderate due to still-weak labor market and high household debt.

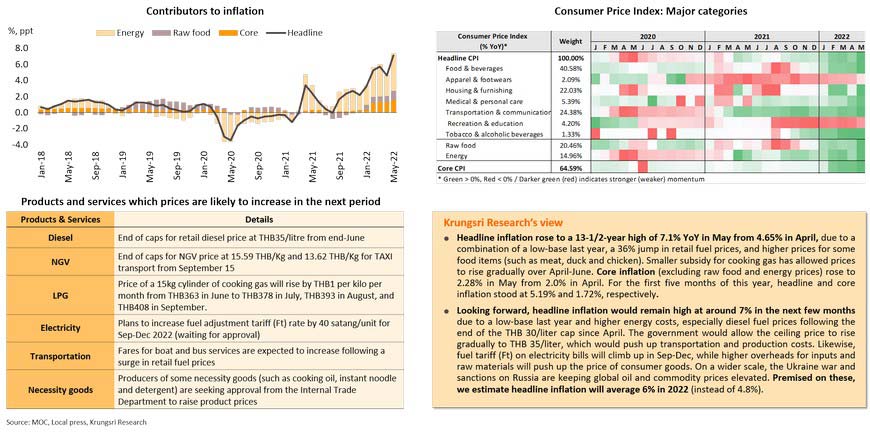

- Inflation rate would remain high at over 7% in the next few months. Full-year inflation is projected at 6%.

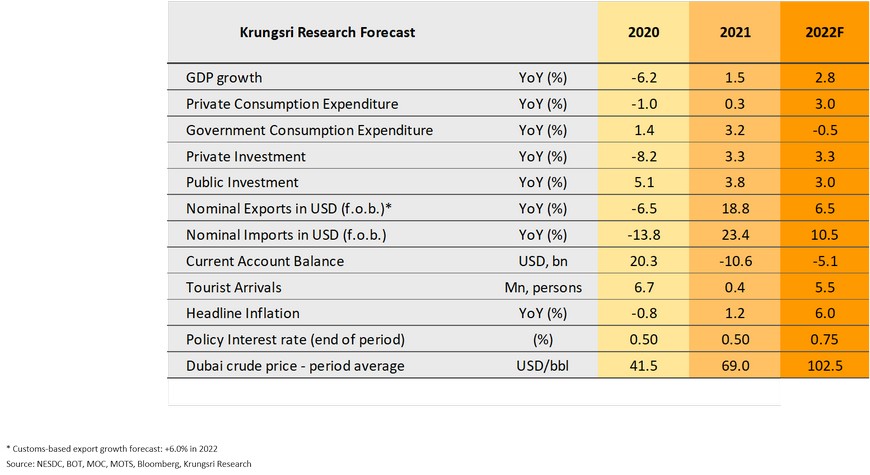

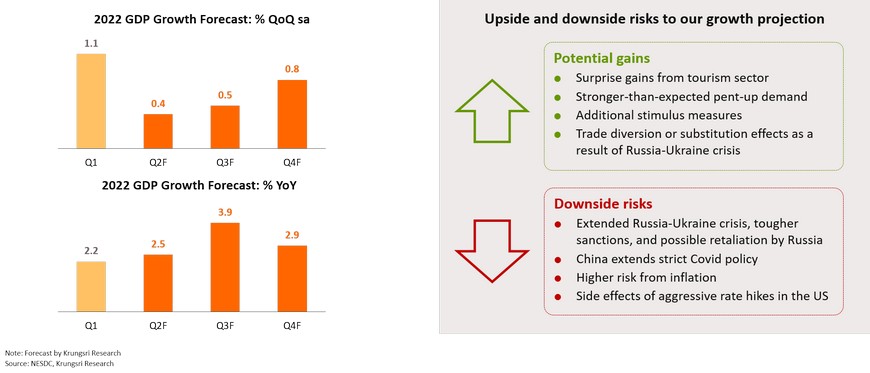

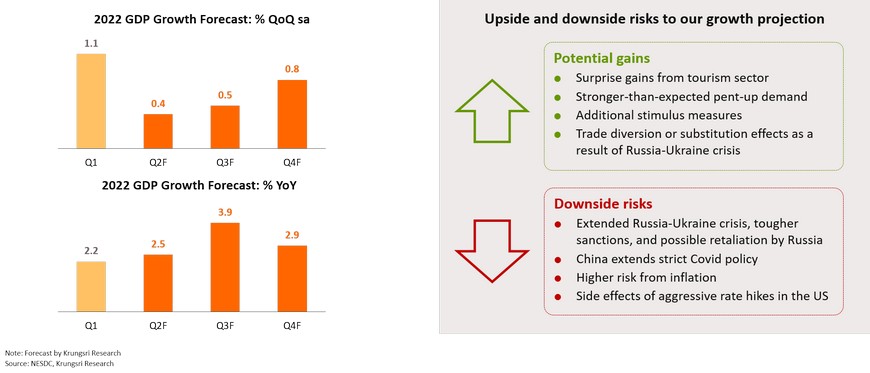

- We maintain 2022 GDP growth forecast at 2.8% amid the upside and downside risks. Economic growth would improve gradually from a low in 2Q22 to modest growth in 4Q22.

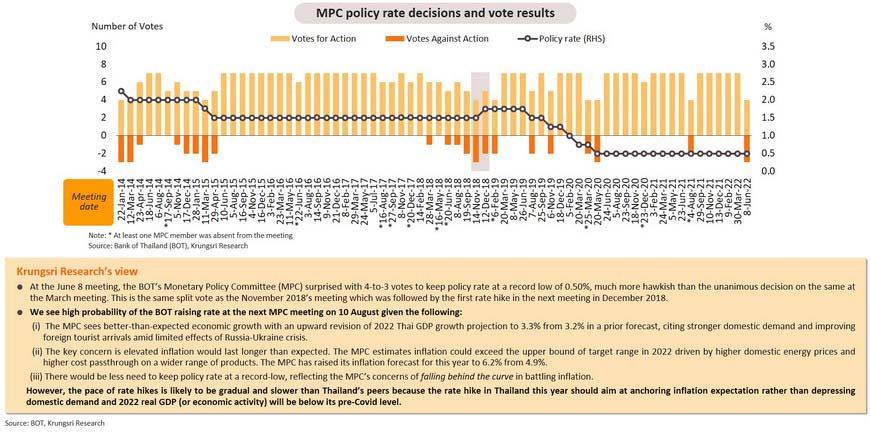

- Thailand’s first rate hike could start at the next MPC meeting on 10 August. However, the speed of rate hikes is likely to be gradual and will not outpace Thailand’s peers since real GDP this year will be below its pre-Covid level.

Krungsri Research Forecasts for 2022

Key factors in 2H22: Ukraine crisis would hurt demand and supply; China slowdown and high inflation remain headwinds; US rate hikes to see more visible impact

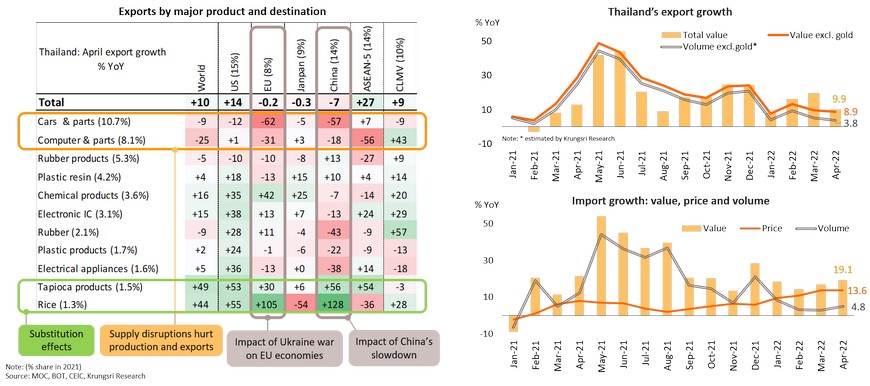

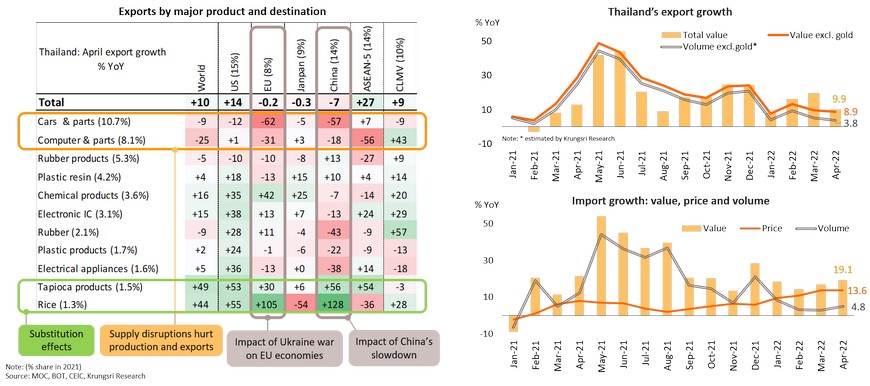

Export growth is decelerating and more diverse in terms of products and destinations

In April, merchandise exports reached USD23.5bn (+9.9%), down from a historic high of USD28.9bn in May (+19.5%). Excluding gold, export growth slowed to 8.9% from 9.5% in March. Expanding exports were driven by: (i) products that gained from rising energy and commodity prices (e.g., refined oil, chemicals, and plastic pellets); (ii) food and agricultural products given rising demand for restocking (e.g., rice, cassava products, and sugar); and (iii) products that rose along with demand for medical products (e.g. medical devices). There were strong exports to the US, the ASEAN-5, and the CLMV, but export sales to the EU, Japan and China shrank while exports to Russia contracted sharply. Although the export sector has been boosted by reopening in ASEAN nations, April shipments to China and Europe contracted for the first time in over a year as the lockdowns in major Chinese cities, the war in Ukraine, and the sanctions on Russia took their toll on global demand and supply chains.

Global economic slowdown and other headwinds could hurt Thai exports despite reopening in ASEAN and trade diversion from Russia-Ukraine crisis

We expect exports to remain under pressure for the rest of 2022 premised on softer global demand for manufactured goods, lingering supply disruption, and a slower global economy. Thai export growth could slow down from +13.7% average in the first four months of this year. We expect 2022 export value to grow by 6% based on MOC data (or 6.5% based on BOT data). The World Trade Organization (WTO) has trimmed its forecast for merchandise trade volume growth for 2022 to 3.0% from 4.7%, due to uncertainty over how Ukraine conflict will pan out. There have been recent signs of decelerating manufacturing output in core countries as a result of the global economic slowdown and supply disruption.

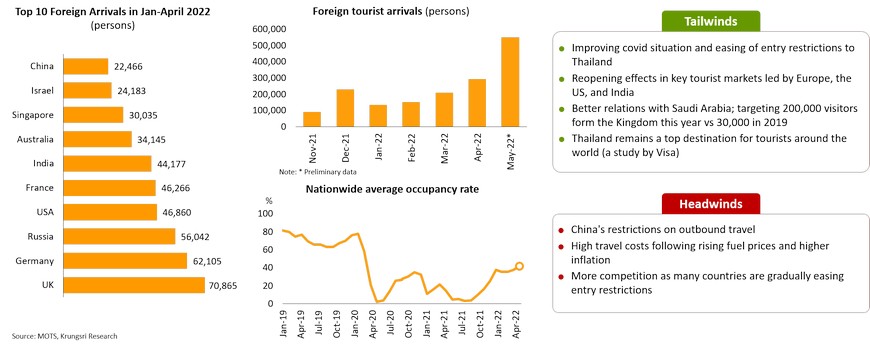

Reopening: Since June 1, Thailand has relaxed nationwide covid controls, including quarantine-free entry to Thailand and easing restrictions on entertainment venues

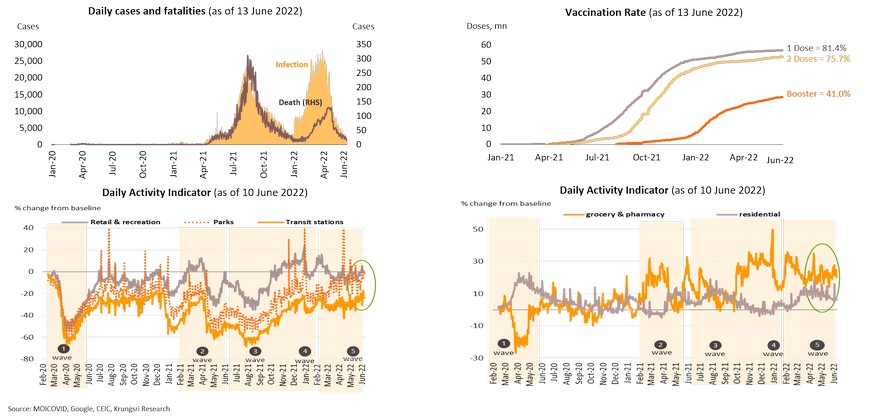

Daily covid cases continue to drop, allowing domestic economic activity to improve

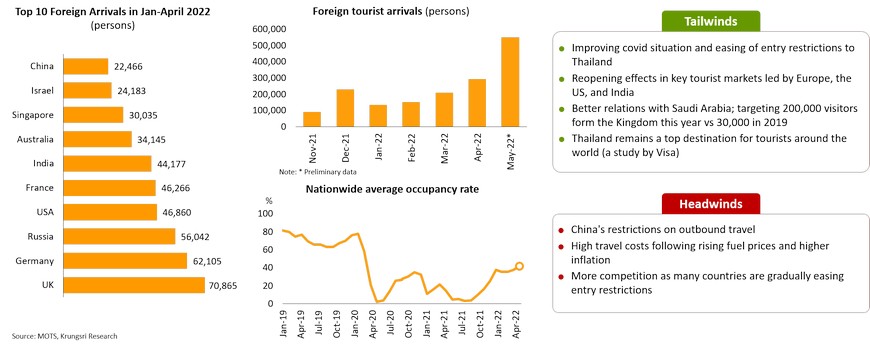

Tourism sector is likely to see stronger recovery since removing quarantine requirement on June 1, and could be an economic driver in 2H22

Since cancelling the Test & Go program on May 1, Thailand has received more than 500,000 foreign tourists or a daily average of 20,000, greater than 10,000 foreign tourist arrivals in April. Therefore, foreign tourist arrivals in the first 5 months of 2022 reached 1.35 mn. There were more tourists from the UK, Germany and Russia in January-April this year. Looking ahead, the tourism sector is showing more positive signs since the government relaxed travel restrictions and allowed quarantine-free entry to visitors from June 1. Registrations for Thailand Pass with health insurance (USD10,000) for foreign tourists may be canceled from July. These are expected to simplify regulations for foreign tourists. The Tourism Authority of Thailand expects foreign tourist arrivals to reach 500,000 monthly in 3Q22 and peak at 1 mn per month during high season in 4Q. For the whole year, Thailand expects to receive 7-10 mn foreign tourists and generate THB1.5 trn in tourism receipts. Krungsri Research views foreign tourist arrivals could surpass our forecast of 5.5 mn for this year.

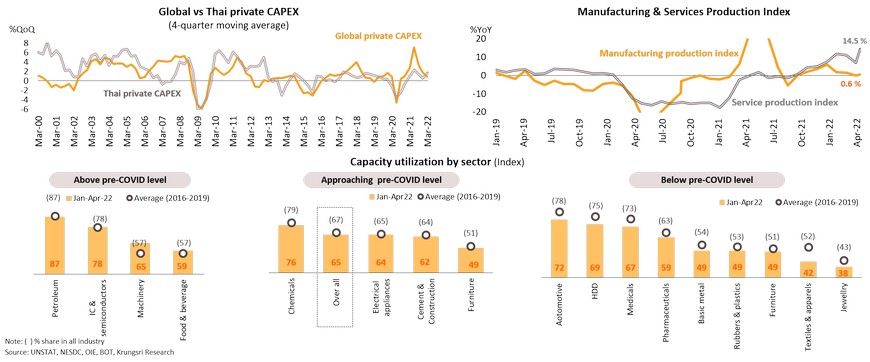

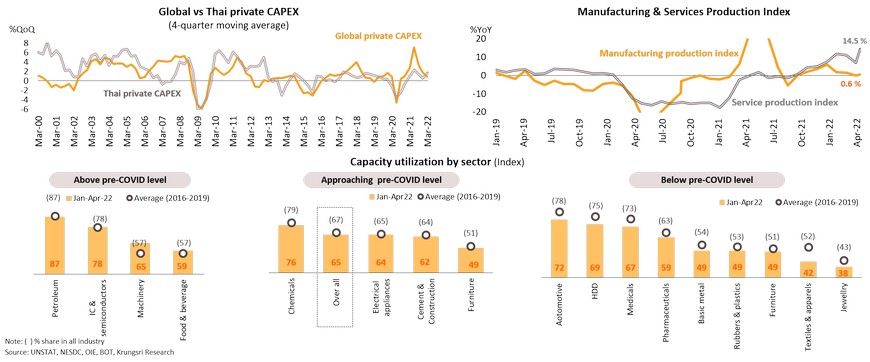

Private investment looks set to rise moderately amid improving services sector and slowing manufacturing growth; external risks are pressuring global investment cycle

Private investment is likely to expand moderately in 2H22, driven by the resumption of economic activities following the improving covid situation, despite a global downturn pressured by the Ukraine war and global supply disruption. In the services sectors, fewer omicron cases and reopening have helped to boost production growth to a historical high. On the other hand, manufacturing production is likely to experience sporadic growth in some sectors. Though national capacity utilization is below pre-pandemic level amid escalating external risks, some key industries are producing at above pre-pandemic levels, especially petroleum, IC & semiconductors, machinery and food & beverage. Production in some industries are approaching their pre-pandemic levels, including chemicals and electrical appliances. Expansion in the manufacturing sector would be concentrated in segments that benefit from commodity price hike and digital transformation.

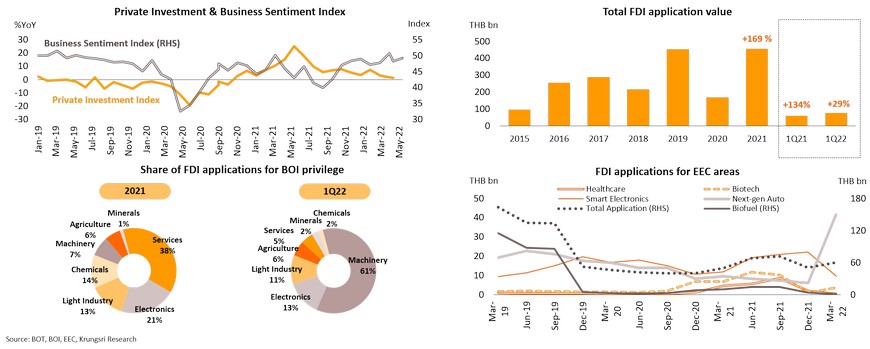

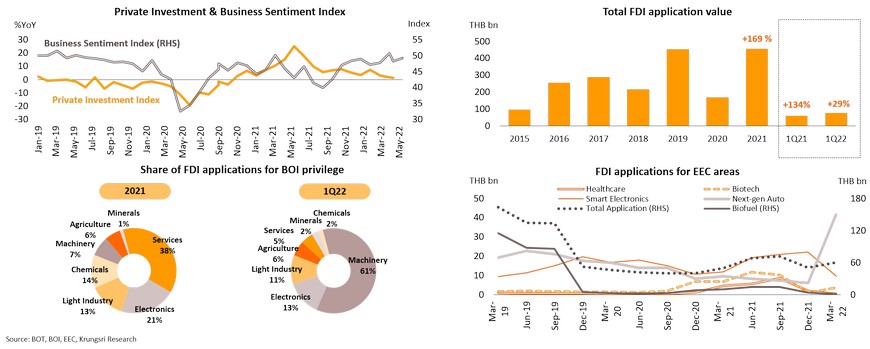

Rising inward FDI in some sectors could lift investment in the medium-term although negative factors could hurt confidence in the near-term

Business sentiment has been volatile this year due to several uncertainties, including the Ukraine crisis, China lockdowns, worsening supply disruption, as well as surging domestic inflation which has dampened purchasing power. In the longer term, investment will be driven by push inward FDI. In 1Q22, foreign direct investment rose 29.1% YoY, following 169% growth in 2021. Looking at FDI applications by category, the top three sectors in 2021 and 1Q22 industries that benefited from industrial transformation and reopening. In addition, sales and rental income in the industrial estate sector should improve by 31.7% in 1H22, especially those in the EEC area which remains a prime location. The value of applications for projects in the EEC area rose by 11.7% in 1Q22. Specifically, there was a surge in applications for projects in next-generation vehicles (mostly EV) and biotechnology to support a environment-friendly economy and health-conscious society. Expansion in the healthcare sector and transformation to a green economy would continue to encourage more investments in the long run.

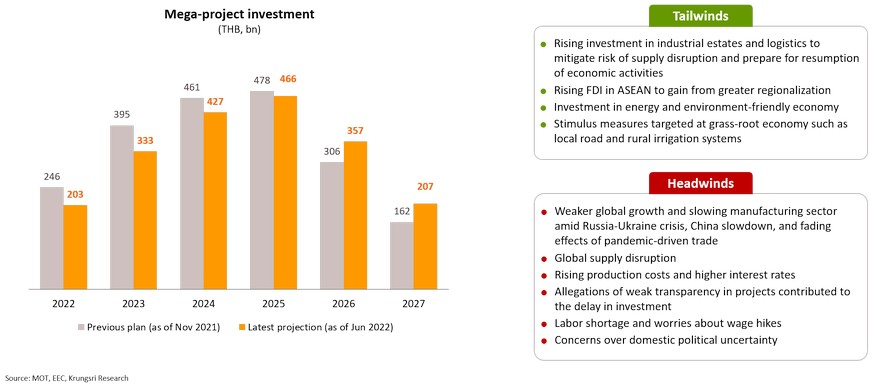

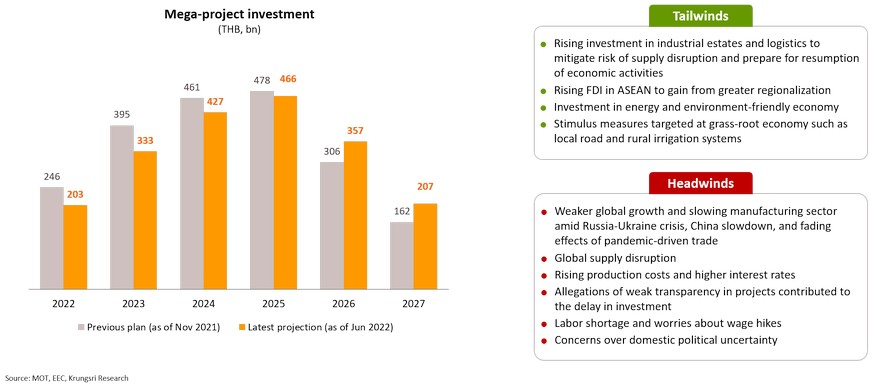

Delays in mega-projects imply crowding-in effect of public investment will be smaller-than-expected, capping overall investment growth

Given the need to reallocate the budget following large expenses to combat the outbreaks, coupled with legal disputes over transparency, several mega-projects have been delayed. In 2022, investment in infrastructure projects is expected to increase by 25%, albeit at a slower pace than the 51% estimated in November 2021, due to the postponement of the MRT West Orange Line and dual-track railways. The later-than-expected start of these projects would retard crowding-in effect of public investment.

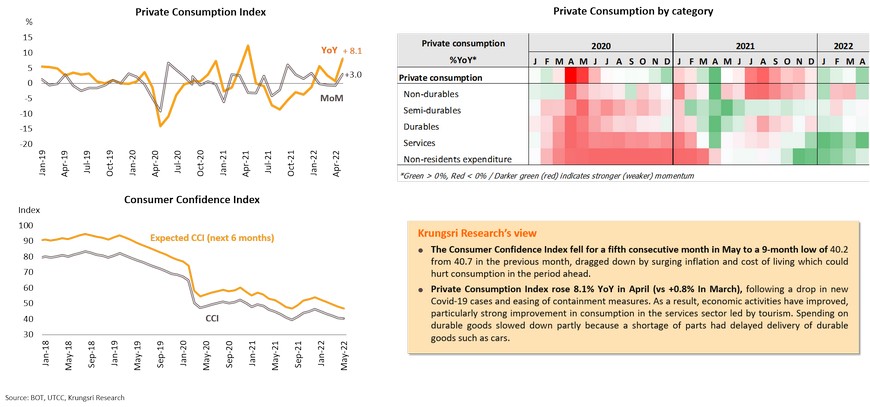

Private consumption: Easing pandemic fears is a domestic tailwind but several headwinds and high inflation could dampen household spending

Surging farm income and improving employment might support consumption, but growth would be moderate due to still-weak labor market and high household debt

Farm income has increased sharply following a jump in farm prices and farm output. Excess saving has surged from THB1,060bn at end-2021 to THB1,349 bn at end-April, accounting for almost 8.2% of GDP (vs 6.5% at end-2021). Although unemployment rate improved to 1.53% in 1Q22 from 1.6% in 4Q21, it is still higher than pre-Covid level of 1% in 2019. In addition, quasi-unemployment remains high at 3.78 million as several businesses have reduce work hours instead of employment. Household debt also rose to above 90% of GDP, which could limit consumer spending growth.

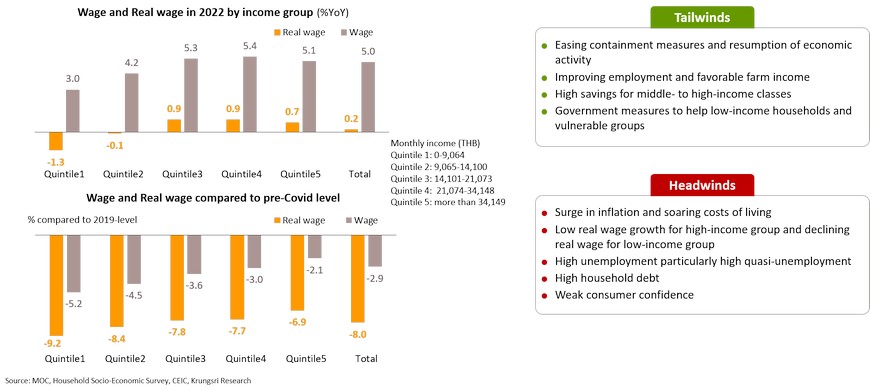

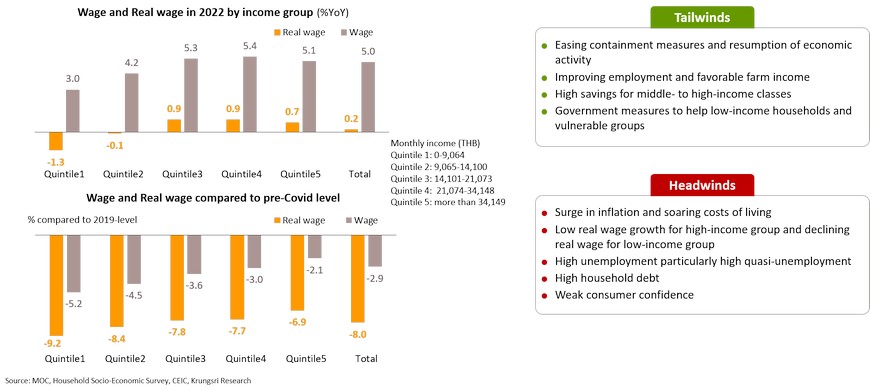

Higher income may not translate into greater consumption as surge in inflation hits real wages in both low- and high-income groups

Krungsri Research analyzed real wages (wage adjusted for inflation) across households to gauge their respective purchasing power on goods and services. They concluded real wage growth in all income groups is lower than nominal wage growth. Real wage in the lowest-income group could drop by 1.3% YoY compared to +0.7% in the highest-income group. Furthermore, real wage across households would remain below pre-Covid levels and that for the lowest-income group would be 9.2% below pre-Covid level. This implies weaker purchasing power especially in the poorer group, not only because of lower nominal income but also higher inflation and a different consumption basket.

Inflation to remain high at 7% in the next few months; full-year at c.6%

We maintain 2022 GDP growth forecast at 2.8% amid upside and downside risks; growth could improve gradually from lows in 2Q to modest growth in 4Q22

Our economic growth forecast is supported by potential upside from reopening and resumption of economic activity, including recovering tourism activities, pent-up demand, and additional stimulus measures. However, there are downside risks from the Russia-Ukraine crisis, China slowdown, and US Fed’s aggressive rate hikes. Given both upside and downside risks, we are keeping our GDP growth forecast for this year at 2.8%. Quarterly GDP growth is expected to improve from a low of 0.4% QoQ in 2Q22 to modest growth of 0.8% in 4Q22. On a year-on-year basis, last year’s low base (due to Delta-driven outbreaks) could boost 3Q22 GDP growth to close to 4% before normalizing at around 3% in 4Q22.

MPC: First rate hike possibly at next MPC meeting in August; pace likely to be gradual