Global: Growing threats to recovery progress

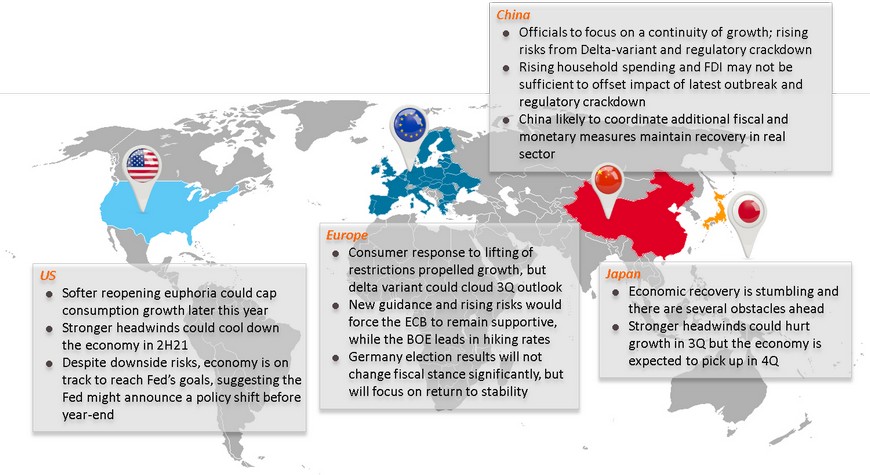

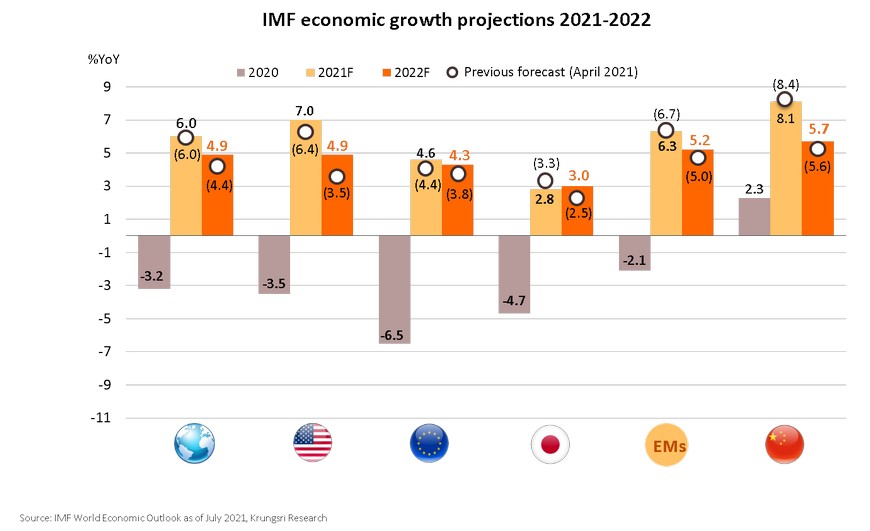

Global economic prospects are diverse with normalization in advanced economies and worsening pandemic dynamics in EMs

Downside risk to growth triggered by Delta variant and slow vaccine rollouts in EMs and developing countries

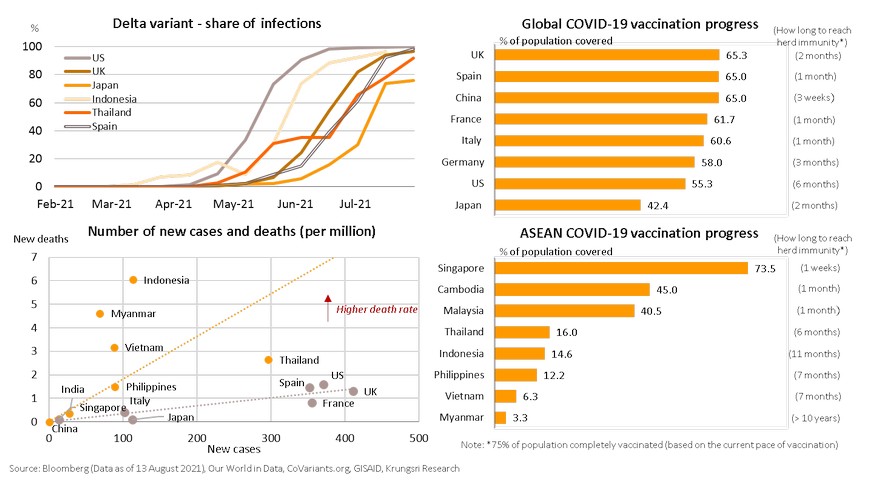

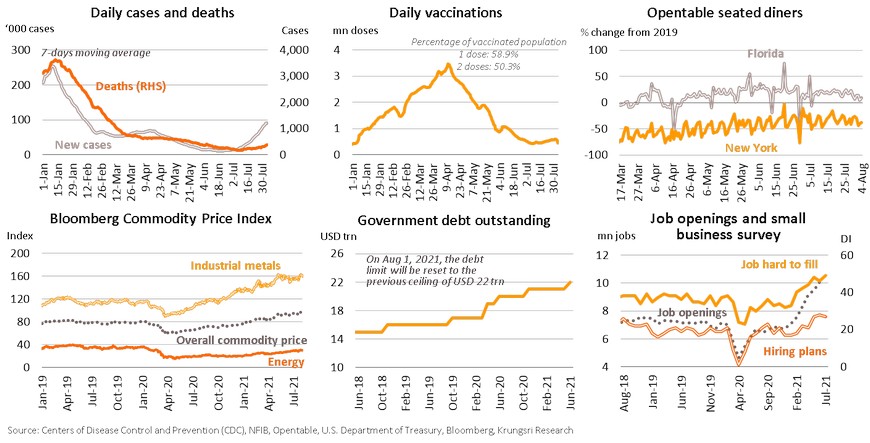

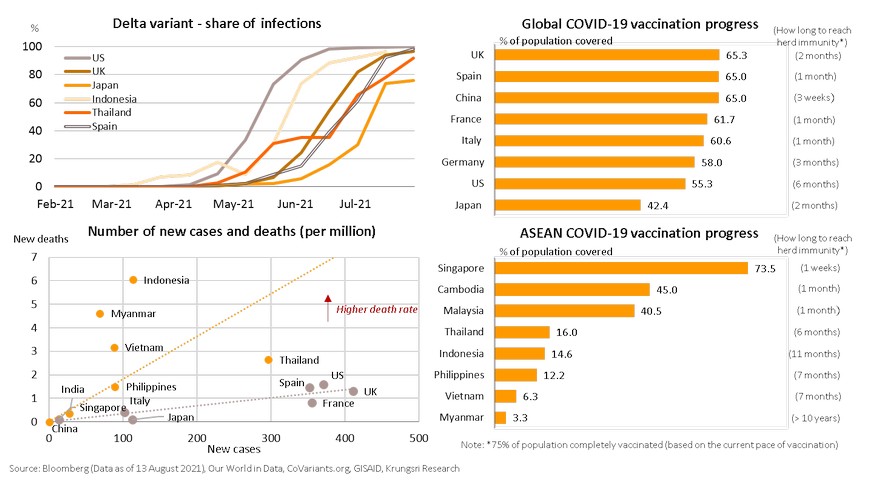

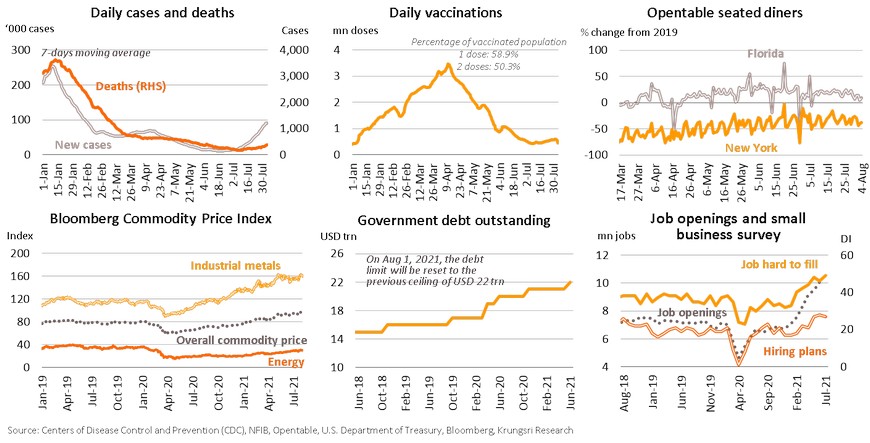

The Delta variant has been the dominant strain in latest cases worldwide. The latest outbreak has dimmed recovery prospects in many countries, especially in Emerging Markets (EMs) and developing countries. Despite a higher number of cases in developed countries, the fatalities are much lower than in many countries, particularly in Southeast Asia which economic activities have been severely hurt by the latest outbreaks and lockdown measures. Mass vaccination programs in advanced countries seem to be successful in curbing risks but rising public caution could slow progress of economic recovery. Looking ahead, there is still a lot of uncertainty over the Delta strain and it is increasingly becoming a major threat to global growth.

US: Softer reopening euphoria could cap consumption growth later this year

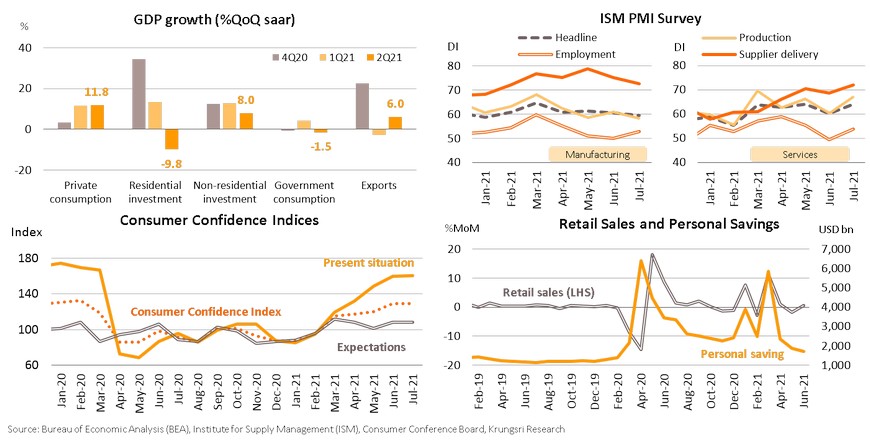

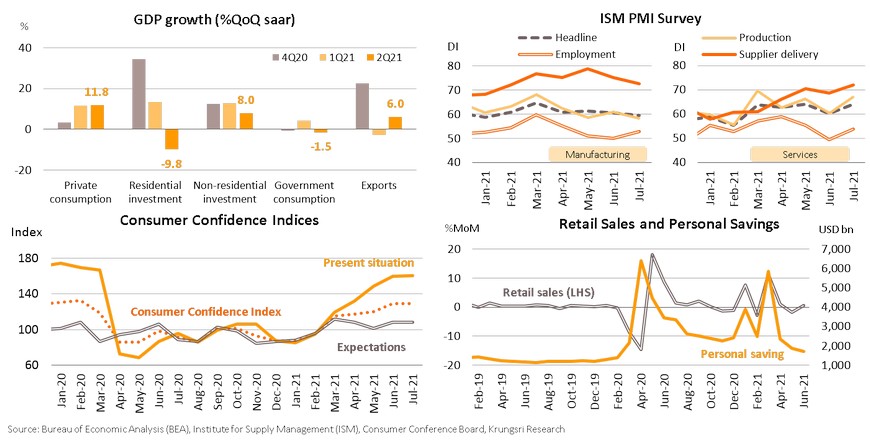

The US economy expanded by 6.5% QoQ saar in 2Q21, far below consensus expectation. Consumer spending was the major driver, reflected by surging demand after reopening, especially in the services sector supported by government stimulus. Services PMI reached a new high of 64.1 in July, suggesting the economy has yet to be affected by the rising number of delta variant cases in early 3Q. In contrast, manufacturing continued to expand but at a slower pace than the previous month. Supplier delivery time remained above 70 for both sectors, suggesting a longer delivery time and ongoing supply disruptions. Consumer Confidence Index was little changed in July at 129.1 as consumers remained optimistic about personal finance, jobs and the economy. Although activities seem to be unaffected by the delta variant, there are indicators reflecting the reopening euphoria is softening. The drop in personal savings imply consumers had spent in 1H, and the strong pent-up demand would fade gradually. Moreover, consumers reported arising concerns about inflationary pressure, which could limit their consumption. The increasing COVID-19 threats, slower pent-up demand, and expiry of unemployment benefits, could weaken consumption growth to single-digit in 2H but economic recovery would remain on a favorable path the rest of the year.

Stronger headwinds could cool down the economy in 2H21

The US economy is facing both health and economic headwinds. The rapid spread of the delta variant has pushed up new cases to around 100k a day, but average fatality rate remains far below that in last winter. Unfortunately, the slowing pace of vaccination could accelerate transmission nationwide. The resurgence of new cases could hamper progress towards a full-fledged recovery in the services sector. Stalled number of outdoor diners suggest consumer demand for bar and restaurant services is slowing, but the impact would be more visible in late-August. On the supply side, shortages and logistic bottlenecks remain major issues and will continue to push up commodity prices and increase inflation concerns. These rising risks are unlikely to induce more stimulus from the government because of the debt ceiling problem after the debt suspension order expired in July. The Treasury has applied special measures to tackle short-term borrowing limit by halting new bond issuances and new investment in health and pension funds. We suspect the impact would be temporary as the government could increase or suspend the ceiling by November this year. There is still a labor shortage as small businesses reported bigger hiring plans but found it hard to fill the jobs. However, the record-high job openings is a sign of ongoing economic recovery. The current headwinds had stopped the economy from rapid acceleration in 1H21 but an expansion in overall activities suggests the economy will continue to recover in the foreseeable future.

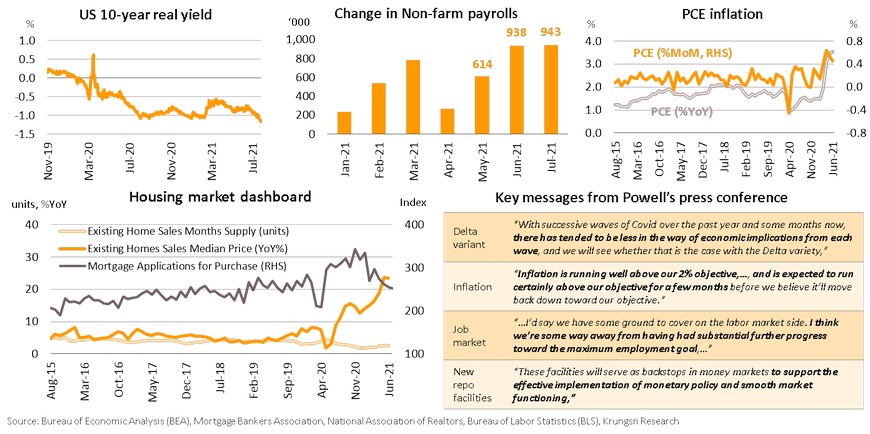

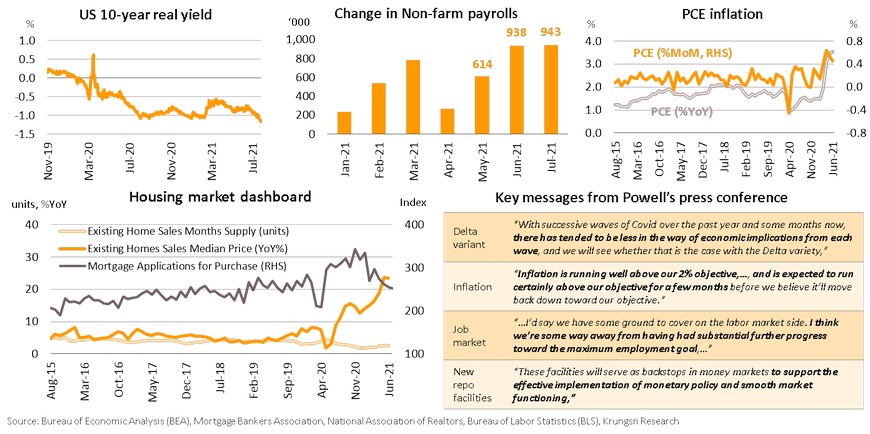

Despite increasing risks, economy is on track to reach Fed’s goals, suggesting policy shift announcement possibly by year-end

The Fed would be less likely to signal a hawkish stance at the Jackson Hole symposium as the delta variant is clouding outlook, but the announcement of a policy shift could be seen by year-end. Rising uncertainties have dragged US 10-year real yield to a new low in August. Statement from the July meeting suggests the FOMC is less concerned than investors over the latest outbreak and still wants to assess whether the economy has met the bar for substantial progress. The economy is on track to meet the Fed’s criteria. July Non-farm payrolls rose at the fastest pace in nearly a year by 943k, while unemployment rate has dipped to 5.4%. Assuming monthly payrolls increase by 600k, unemployment could drop below 5% by 4Q21. This would be close to the Fed’s projection of 4.5% this year and move closer to pre-crisis level. PCE inflation remains elevated, indicating more persistent inflation. Inflation would be allowed to exceed 3.5% in 2H21 but the full-year average would remain in line with the Fed’s forecast and higher than the medium-term target. Housing demand fell slightly from last year but remained higher than historical average, while home supply continues to decline. This could push up home prices further in 3Q21, implying the market would not cool down soon. On this note, we expect the impact of current headwinds to be outweighed by progress in the labor market and broader inflation, which would encourage the Fed to consider reducing bond purchases. There could be a clear decision on the tapering in the last quarter of this year.

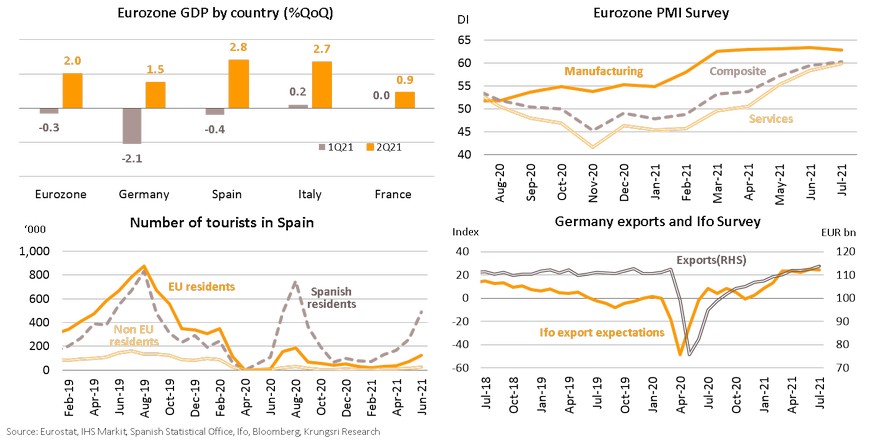

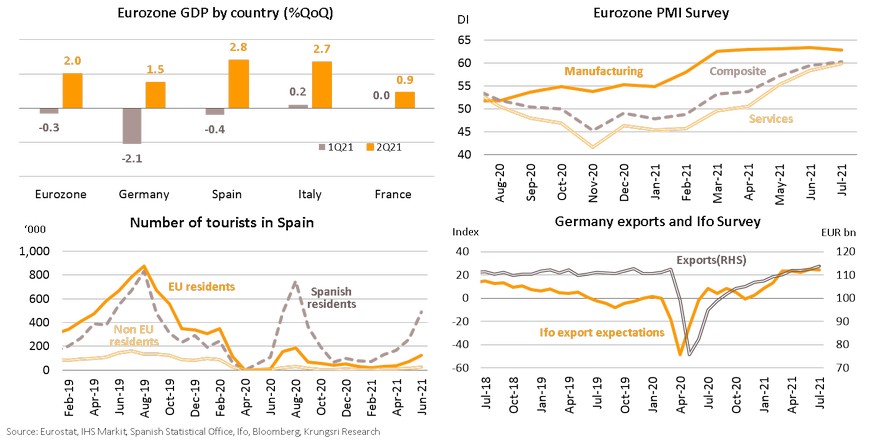

EU: Consumer response to lifting of restrictions propelled growth, but delta variant could cloud 3Q outlook

Eurozone economy expanded by 2% QoQ in 2Q21, surpassing expectations, especially countries in southern Europe, led by strong consumer demand after lifting of social restrictions. The reopening of leisure, hospitality and non-essential retail sectors also supported the strong recovery in consumption. Services activity indicator rose to 59.8 in July from 58.3 in June, as looser restrictions boosted services but fears of another wave hit consumer confidence. The delta variant could dampen recovery in the tourism sector. Latest tourist data in Spain indicate the residents are the major engine. In contrast, foreign tourist arrivals remained at 80% below pre-crisis level, suggesting the recovery would take longer. Manufacturing activity indicator slid to 62.8 in July as supply shortages and longer delivery time hampered industry performance. However, rising overseas demand could support Germany’s exports. Exports increased by 1.3% MoM in June and has finally returned to pre-pandemic levels despite risks of microchips shortage. Export expectations remain higher than 2019-level, reflecting a steady recovery in the bloc’s largest economy. Looking ahead, the eurozone remains on the road to a firm recovery but the delta strain is likely to cap economic growth.

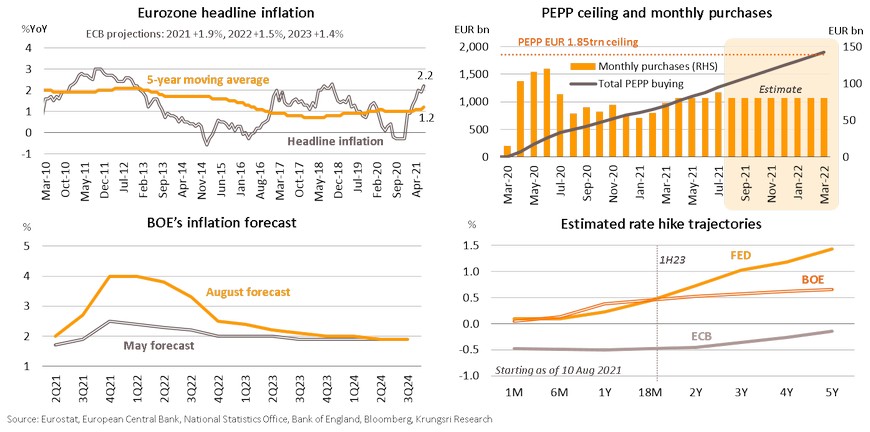

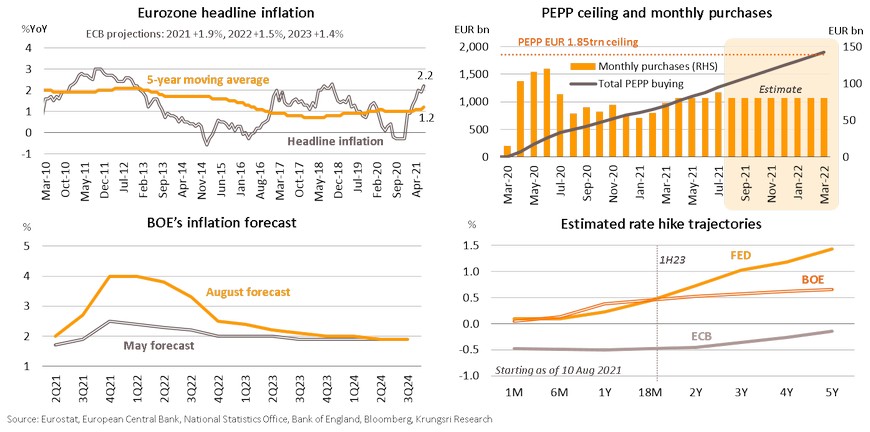

New guidance and rising risks force the ECB to remain supportive while the BOE leads in hiking rates

The ECB has announced adjustments on its forward guidance to boost inflation. They stated interest rates would remain at present or lower levels until inflation is forecast to hit or slightly surpass 2%. According to the ECB’s current projections, inflation rate would remain below 2% at least until 2023, implying they would not hike rates over the next 2 years. To reach the new inflation target and prevent the economy from stumbling due to the delta variant risks, the ECB’s commitment to purchase bonds “at a significantly higher pace” than 1Q21, would be extended to the end of the year instead of September. The purchases could hit the PEPP ceiling in 1Q22 and could prompt the ECB to ramp up its Asset Purchase Program in 2Q22. The UK is running a different show. After full reopening since July 19, rising demand and labor shortage are threatening inflation. The BOE’s August projections show inflation could peak in 4Q21 at 4% before dropping to 2% in 2023. Fears of inflation spike could pressure the BOE to lead a curve of raising rates before the Fed, and taper QE as well. They plan to taper when the benchmark interest rate hits 0.5%, which could happen in 1H23, and to sell assets when the rate hits 1%. The latest outbreak and inflation concerns would be the main challenges and would influence the ECB’s and BOE’s policy decisions for the rest of the year.

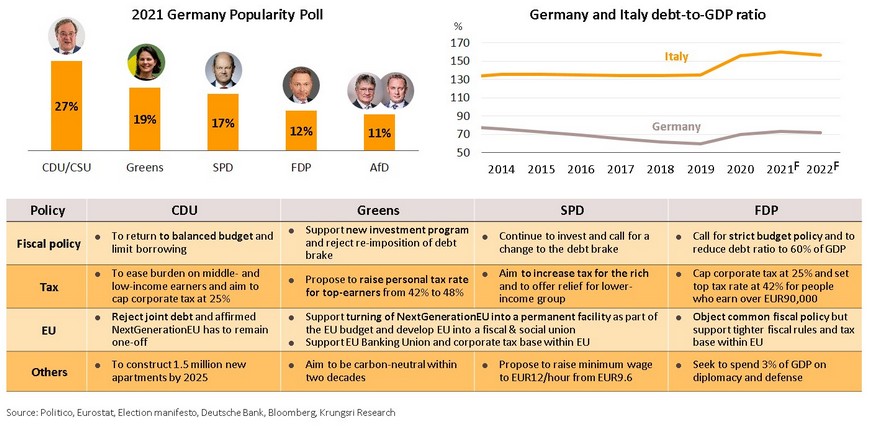

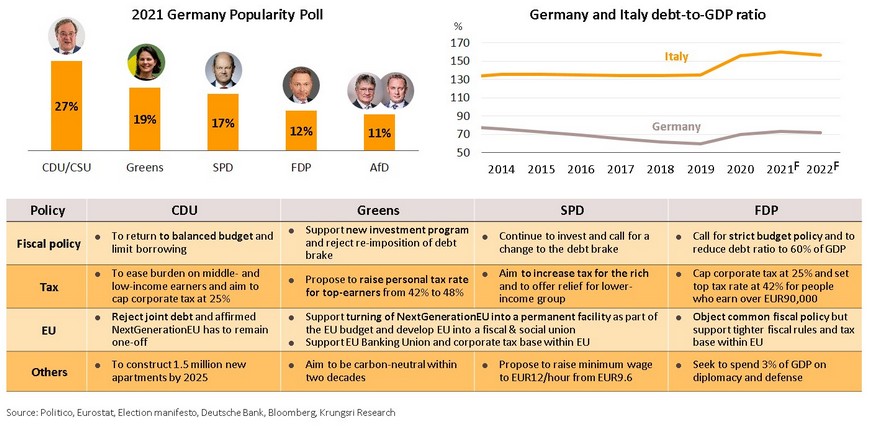

Germany election results will not change fiscal stance significantly, but will focus on return to stability

Germany will hold federal elections on September 26. That will mark the beginning of the post-Merkel era and the return to fiscal stability post-pandemic. Latest polls suggest a small drop in votes for Christian Democratic Union (CDU) because of the recent flooding, but they remain the frontrunner. The next government is likely to bear the task of driving economic recovery and reform post-crisis. There seems to be broad expectations of more investment and fiscal stimulus, but the CDU and FDP might return to a balanced budget and debt limit. This would also affect future EU policy as Germany might reject the common fiscal rules, joint debt and setting of NextGenerationEU in the permanent facility, implying limited assistance to other countries and less policy coordination to mitigate future economic shocks. On domestic policies, all parties aim to reduce burden for middle- and low-income earners; the CDU and FDP have promised not to increase taxes while the Greens and the SPD have proposed to introduce a wealth tax. They all encourage the creation of new companies and want to reduce red tapes to promote growth and compete with China. They would also prioritize climate change issues and to improve standard of living. To conclude, regardless of who wins the election, there will not be a major shift in fiscal policies and there will be greater focus on economic stability.

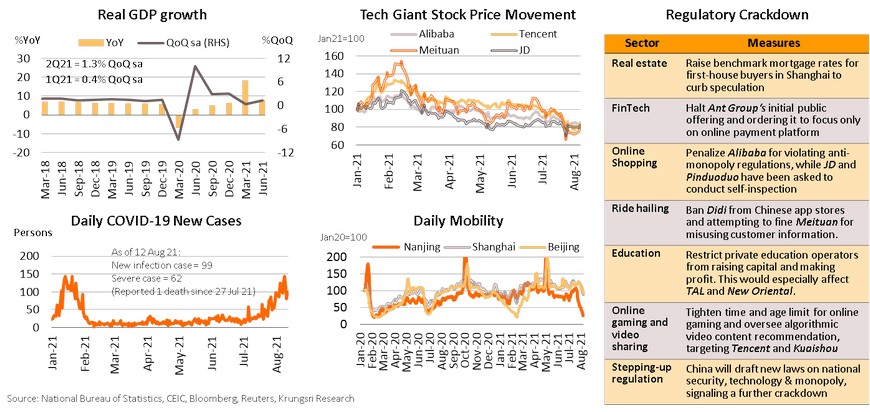

China: Officials to focus on a continuity of growth; rising risks from Delta-variant and regulatory crackdown

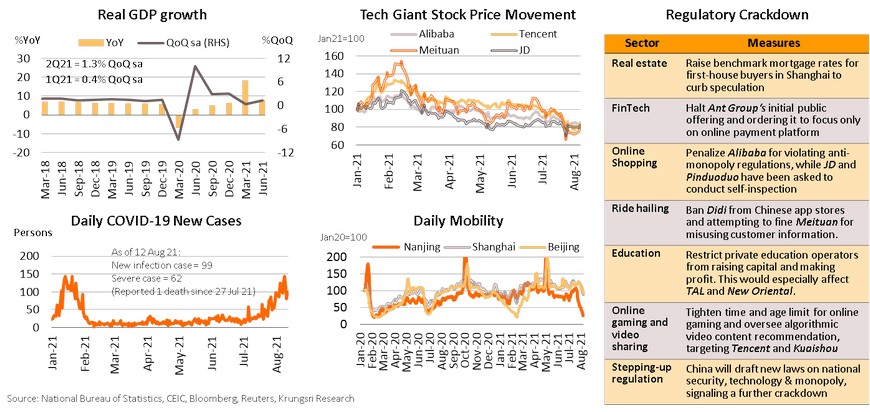

China’s economy grew at a slower pace in 2Q21, with GDP growth decelerating to 7.9% YoY from 18.3% in 1Q21. And there is rising uncertainty over China’s growth trajectory partly due to the government’s decision to focus on sustaining growth instead of targeting high GDP growth. Chinese authorities have unveiled a series of regulations to curb speculation, promote fair competition, and reduce inequality. However, the clampdown has encouraged greater sell-off in the equity market and generated negative side-effects on economic activities. The recent, severe flooding in Henan has also created uncertainty, though the impact of this disaster would be limited as economic activities had resumed quickly after the floodwaters receded. However, the economy is also being threatened by a resurge in COVID-19 cases dominated by the Delta-variant, starting from Nanjing where contributes 1.4% of national GDP. Authorities have imposed stricter measures and banned travel in Nanjing. Recently, Zhejiang’s Ningbo-Zhoushan port, the second largest Chinese port, had been forced to halt operations temporarily to contain the outbreak. The impact is estimated to be worse than the disruption at Shenzhen’s Yantian port. Hence, China’s economy is facing several threats, including (i) rising daily cases dominated by the Delta-variant, and ensuing restrictions, including temporary port disclosure, (ii) regulatory crackdown, and (iii) natural disasters.

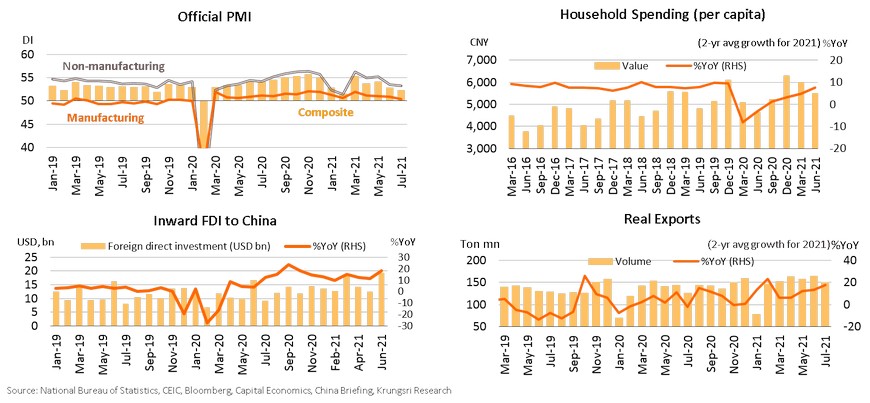

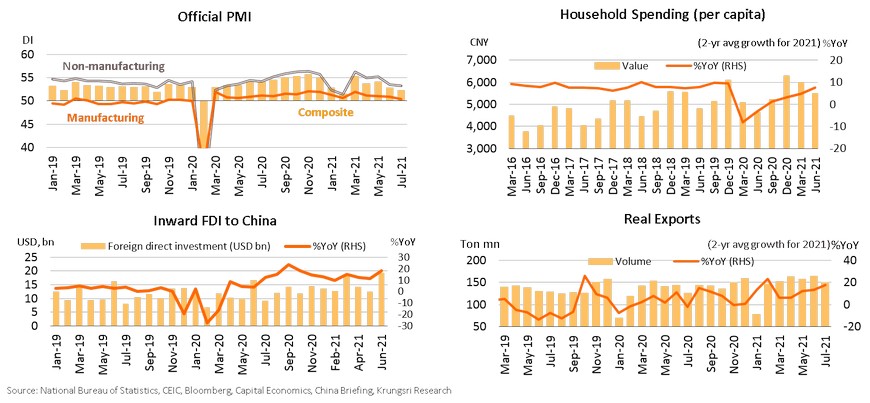

Rising household spending and FDI may not be sufficient to offset impact of latest outbreak and regulatory crackdown

Supply-side indicators are showing signs of slowing down. July Official Composite PMI signaled a slower growth trajectory. Non-Manufacturing PMI slipped to a 5-month low of 53.3, and Manufacturing PMI fell to 50.4, its lowest since the pandemic started in February 2020. Nonetheless, there are positive signs in the demand side. 2Q21 per-capita household spending grew 7.6% YoY, staying well above pre-pandemic level at CNY5,493. This is in line with the 10.3% expansion in per-capita income, which reflects an improving labor market; June unemployment is at a 2-year low. Meanwhile, inward foreign direct investment (FDI) has surged to USD19.3bn, the highest since December 2016. Looking at external demand, real export growth hit a 5-month high in July, improving for 8 straight months despite the Delta-driven outbreaks in some markets and supply constraints. However, the recent port closures have exacerbated bottlenecks in international shipping and container shortages; delays in shipment would hurt China’s exports. The congestion at ports is expected to last more than 2 months. The recovery in household spending, FDI, and exports, would help to ease the negative impact of temporary factors, but they will not be sufficient to offset the negative impact of looming threats to China’s growth.

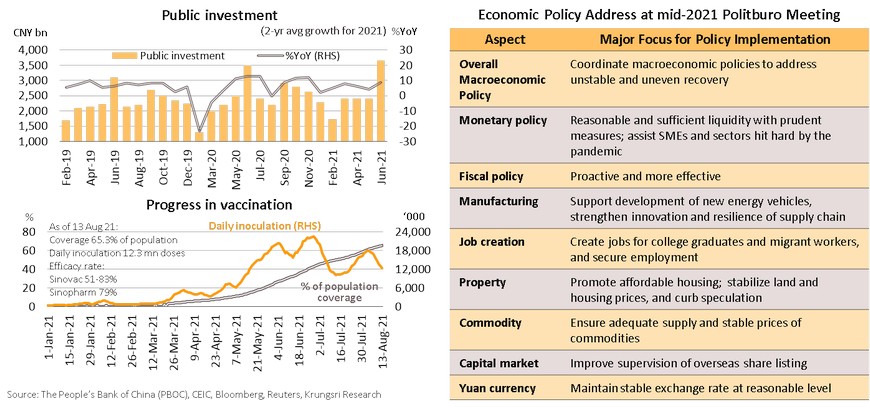

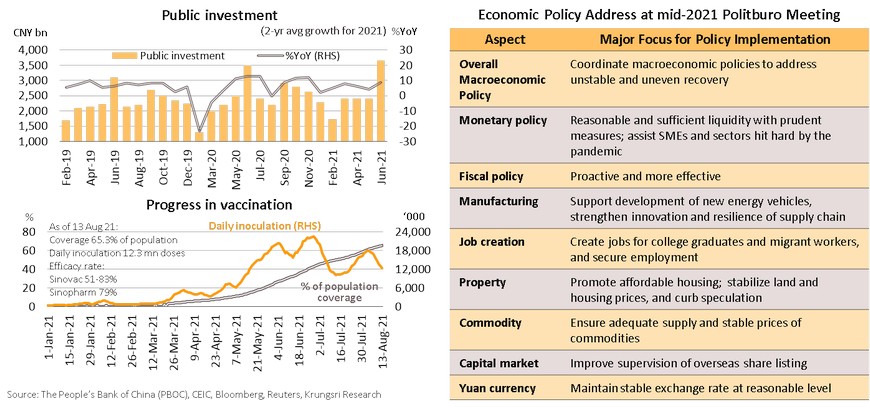

China likely to coordinate additional fiscal and monetary measures to maintain recovery in real sector

To address the larger-than-expected slowdown in the real economy and several threats, authorities have ramped up stimulus measures. In June, spending on public investment reached a new high after rising for 10 straight months. China has fully-vaccinated 63.1% of its population by relying only on homegrown vaccines from Sinovac Biotech and Sinopharm. However, there are lingering doubts about the efficacy of those vaccines against the Delta variant. In addition to stepping-up public investment, the Politburo has announced a comprehensive economic policy guideline to further cushion a sharp slowdown at its mid-year meeting in July. It vowed to provide “more proactive and effective” fiscal measures, as well as a “reasonable and sufficient liquidity with prudent measures”, especially for SMEs and businesses that have been severely hurt by the outbreak. Recently, the People’s Bank of China (PBOC) affirmed it would maintain an accommodative monetary stance and pledged to make them forward-looking and more effective. For the rest of the year, the fiscal and monetary measures are expected to focus on (i) expediting government spending through public investment, (ii) providing liquidity, possibly by reducing reserve requirement ratio (RRR), and (iii) introducing additional measures to help SMEs. These should help to prevent a sharp slowdown in the economy and maintain recovery in the real sector. Meanwhile, prudent measures would remain in place, suggesting Chinese authorities will not accelerate economic growth.

Japan: Economic recovery is stumbling and there are several obstacles ahead

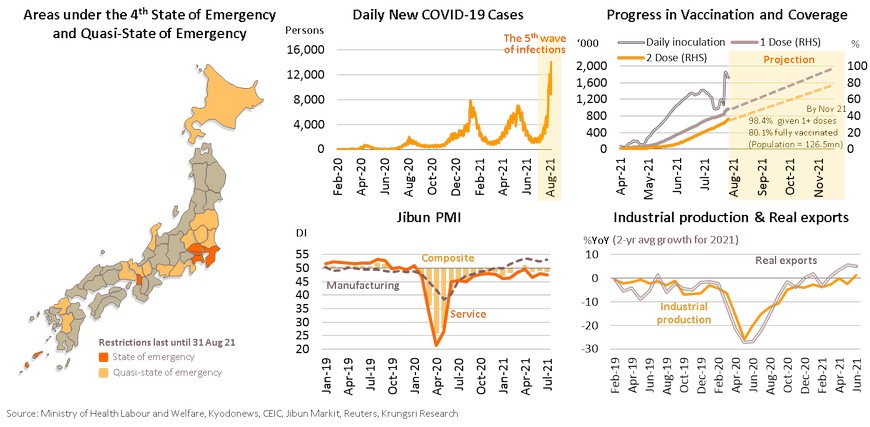

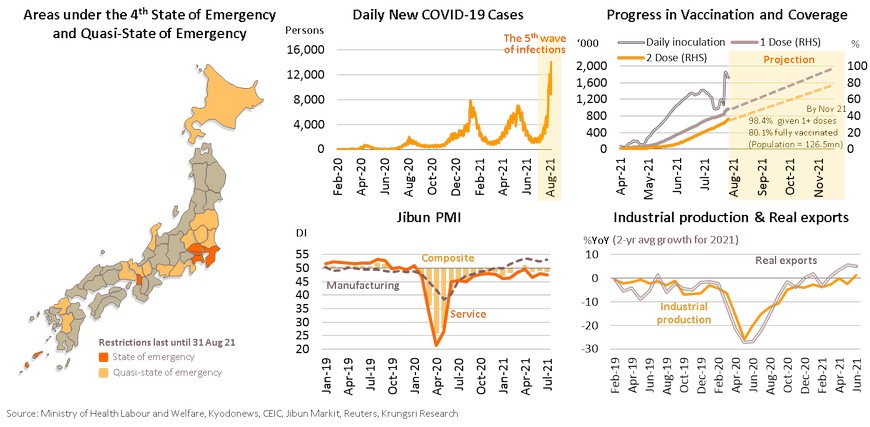

The latest outbreak (5th wave) that started in July has worsened, partly attributable to the Delta-variant. The government has tightened restrictions by extending the state of emergency (the 4th since last year) to 6 prefectures, including Tokyo and Osaka, and reimposing quasi-state of emergency over 13 prefectures. These prefectures contribute around 75% of national GDP. The national tally has hit new high of over 15,000 per day. Meanwhile, the vaccination program has hit a snag because of delays in vaccine shipments. As at early August, only 36.2% of the population has been fully vaccinated. At the current vaccination pace, Japan will only be able to fully vaccinate 80% of the population by November. These have had severe consequences on the economy. The Jibun Service PMI for July is weaker than in June, falling for 18 straight months alongside a decline in new orders. The impact on the manufacturing sector was less severe because of strong adoption of robotics and automation. In addition, rising exports also helped to push up Manufacturing PMI. Though the manufacturing sector is improving, economic recovery could experience a hiccup because of several obstacles: (i) risk of more stringent measures if daily cases continue to rise, (ii) delays in achieving enough fully vaccinated population, and (iii) later-than-expected implementation of additional government measures.

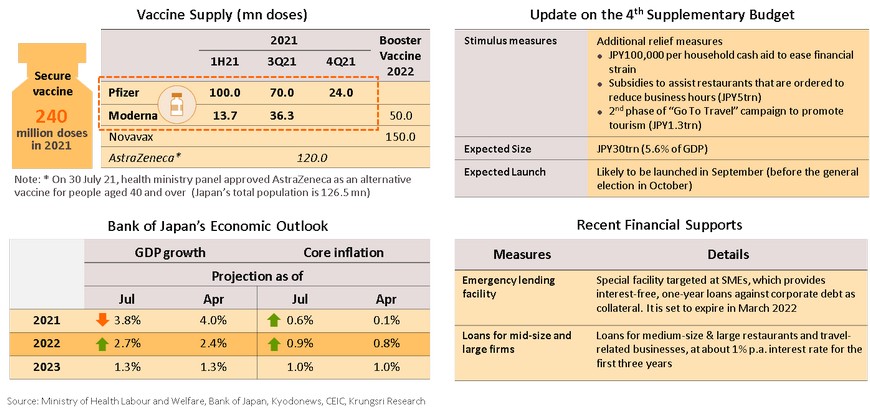

Stronger headwinds could hurt growth in 3Q but the economy is expected to pick up in 4Q

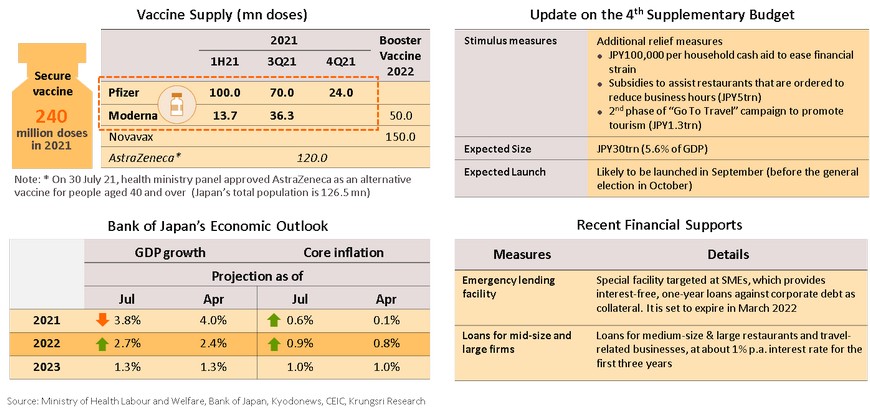

Japan’s mass vaccination program has been interrupted partly due to vaccine shortage. Pfizer has delivered less than the 100m doses promised in 1H21 and Japan has urged the manufacturer to expedite shipment of the balance. In addition, the 4th supplementary budget has been delayed. This additional government measures were expected to be launched by July. And the Japanese economy is still struggling to contain the Delta-variant cases. This has prompted the Bank of Japan (BOJ) to trim its GDP growth projection to +3.8% for 2021. However, in addition to record-low interest rates and quantitative easing, the BOJ has also provided other financial supports, especially interest-free loans for SMEs and low-interest rate funding targeted at businesses in the services sector, which would help ease the pandemic impact in 3Q21. On the 4th supplementary budget, it is likely to be implemented before the general election which would be held before the current term of the House of Representatives expires on 21 October 2021. Hence, we expect disbursements under the additional fiscal measures to start in late-3Q or early-4Q. Looking ahead, the Delta variant would have more severe impact in 3Q21 than expected, but the economy should return to the recovery path in 4Q21 supported by additional government measures and progress in vaccination.

Thailand: COVID-19 risks could spill over to supply side

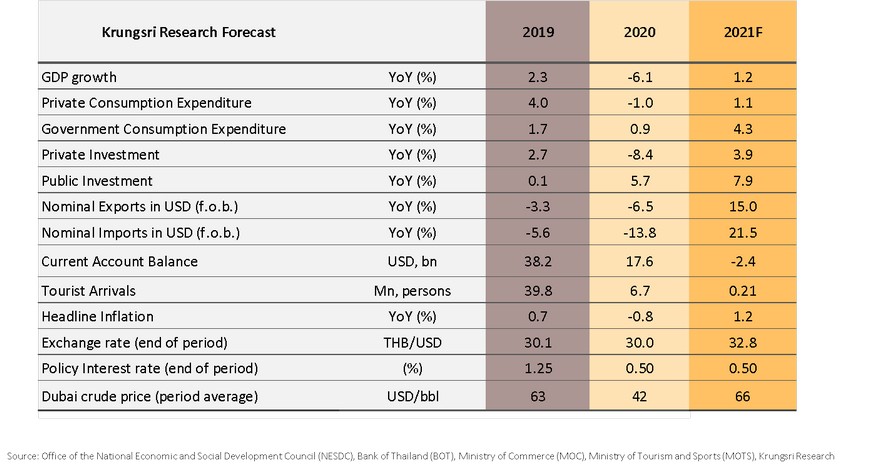

Third wave is more severe than expected and daily cases are likely to peak in September; despite upbeat 2Q21 GDP data, we may downgrade 2021F GDP growth unless there are substantial policy supports later this year

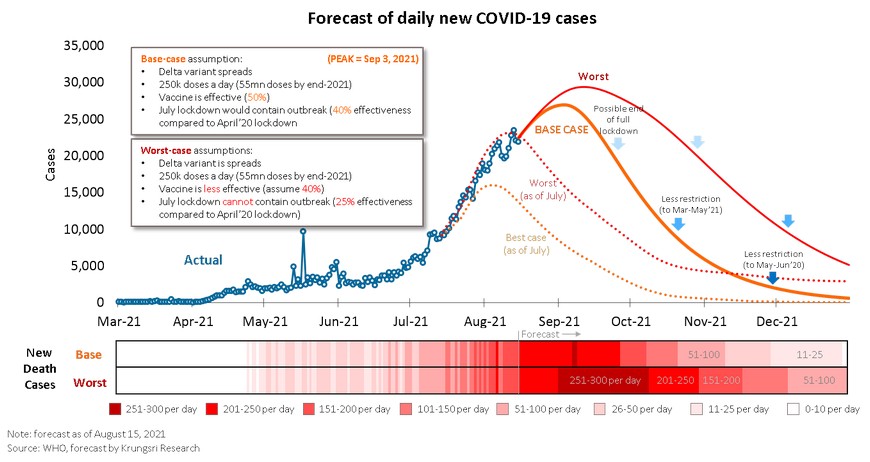

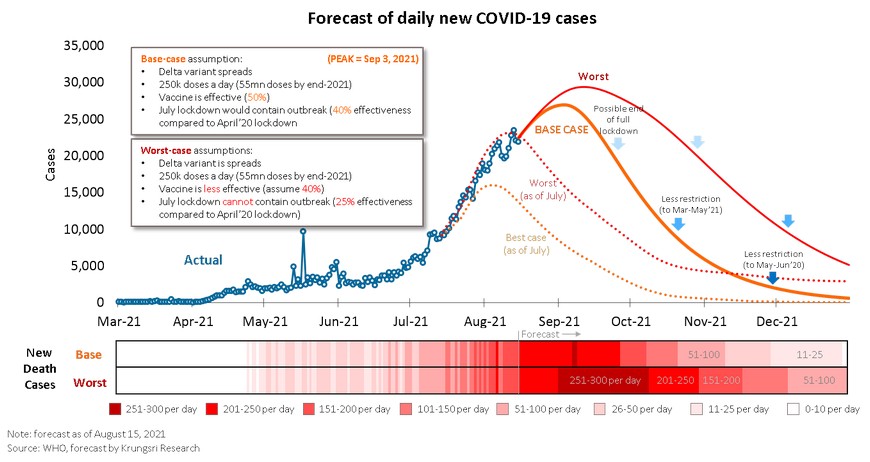

- The number of COVID-19 cases could be much higher than our previous forecast. In our base case, we assumed daily cases would peak at around 26,000 cases in early-September, and daily fatalities would peak in the second week of September. On this note, we expect authorities to relax (full) lockdown in late-September. Mass vaccination, vaccine efficacy, and effectiveness of lockdown measures are considered critical variables in determining how quickly domestic outbreaks can be contained. At worst, daily cases would remain high the rest of the year due to low effectiveness of lockdown measures and vaccines.

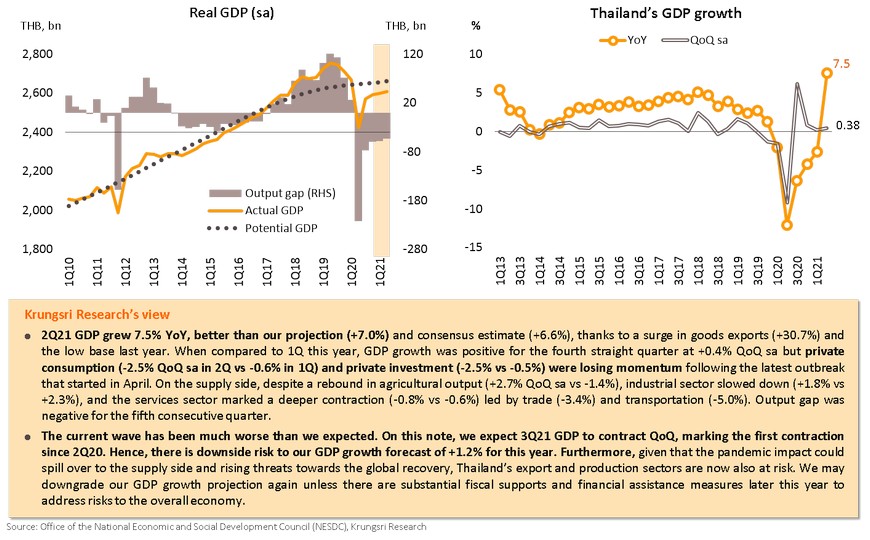

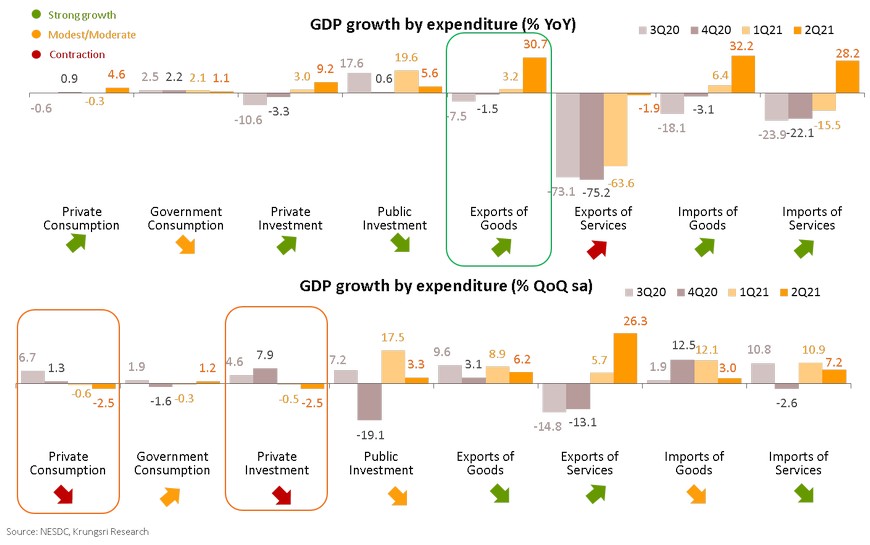

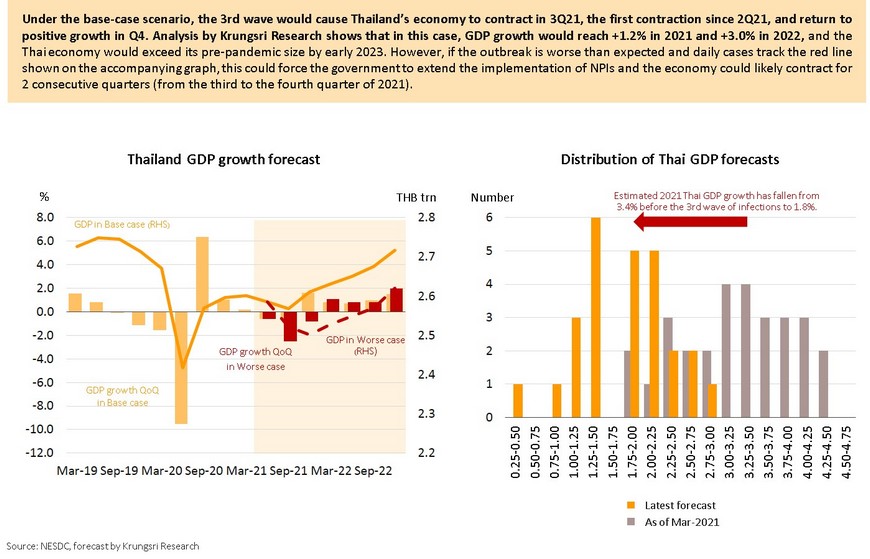

- 2Q21 GDP growth was stronger than expected, at +7.5% YoY thanks to a surge in goods exports, higher public spending, and the low base last year. When compared to 1Q this year, even though GDP growth remained positive for the fourth straight quarter at +0.4% QoQ sa, private consumption (-2.5% QoQ sa) and private investment (-2.5%) are losing momentum following the latest domestic outbreak that started in April. 3Q21 GDP is expected to contract QoQ, marking the first contraction since 2Q20.

- We anticipate the more-severe-than-expected outbreak will hurt supply-side variables and threaten the progress of global recovery. Hence, we may downgrade 2021 GDP growth projection (+1.2% currently) again unless there are substantial fiscal support and financial assistance measures later this year to mitigate downside risk to the overall economy.

Services sector continues to weaken; labor shock and global risk could impede growth in manufacturing sector and exports; gains in agriculture sector offers limited windfall for overall economy.

- Services sector has continued to be hit by the worsening outbreak; Phuket Sandbox program may be in hot water.

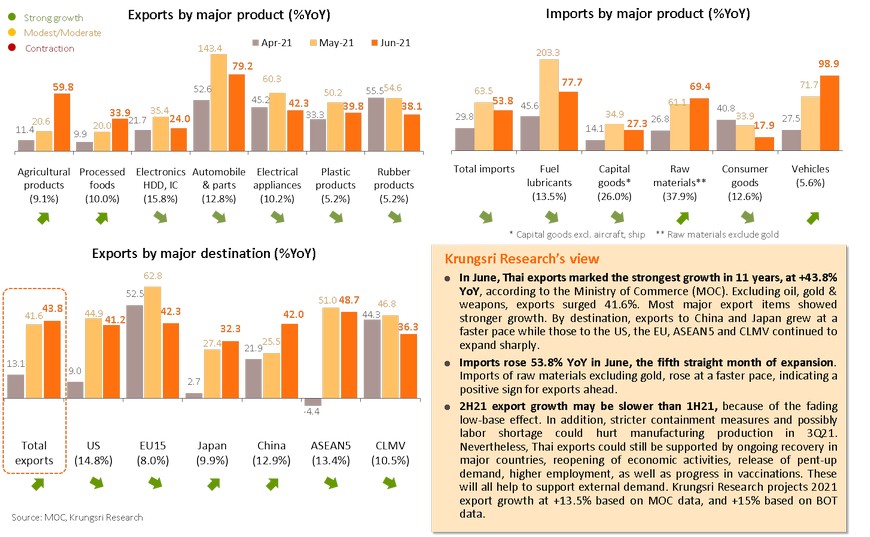

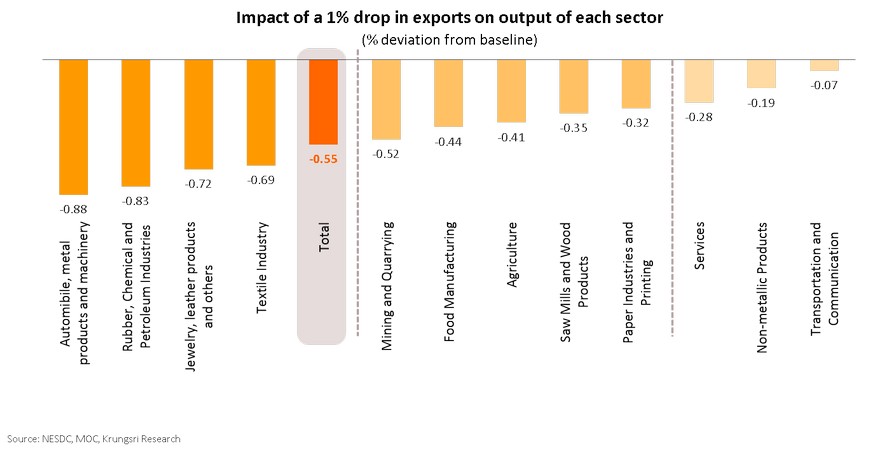

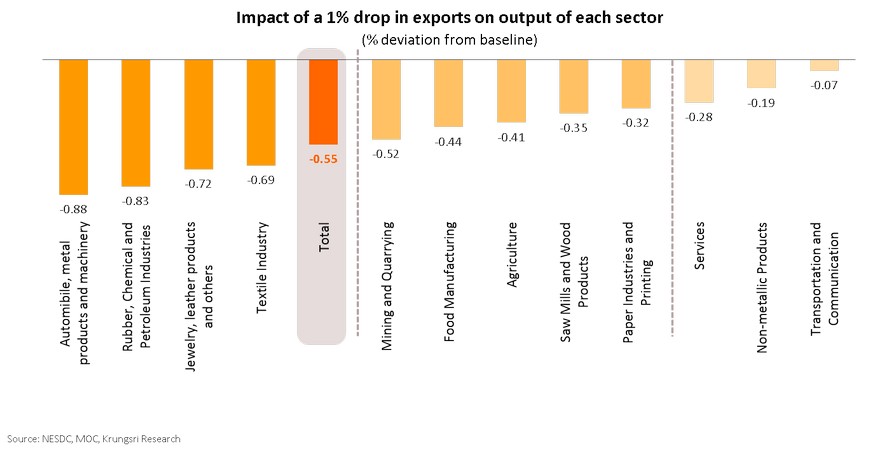

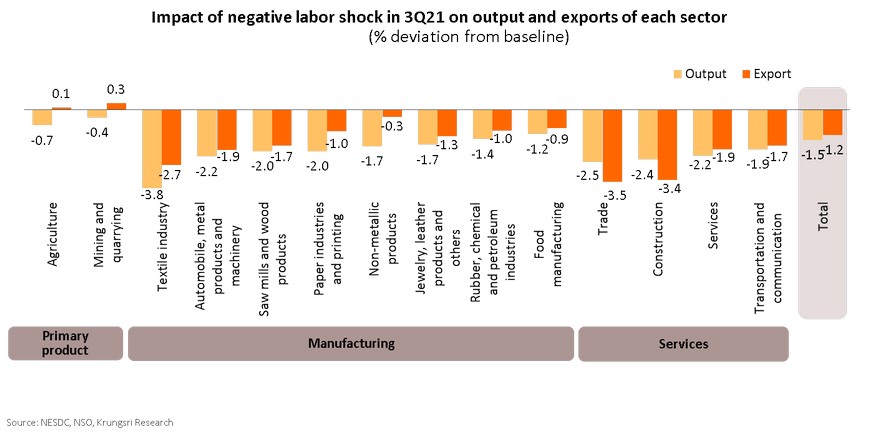

- Manufacturing sector may be threatened by the domestic outbreak. There is risk to exports although export growth reached an 11-year high in June. Amid higher global risks, a 1% drop in exports could drag national output by 0.55%, led by automobiles, rubber and jewelry. And, assuming a labor shock in 3Q21, exports and output could shrink by 1.2% and 1.5%, respectively.

- Agricultural sector would benefit from reopening in many countries, high commodity prices, favorable climate, and supportive policies. However, gains in the agricultural sector would offer limited windfall for the overall economy because this sector accounts for less than 10% of GDP.

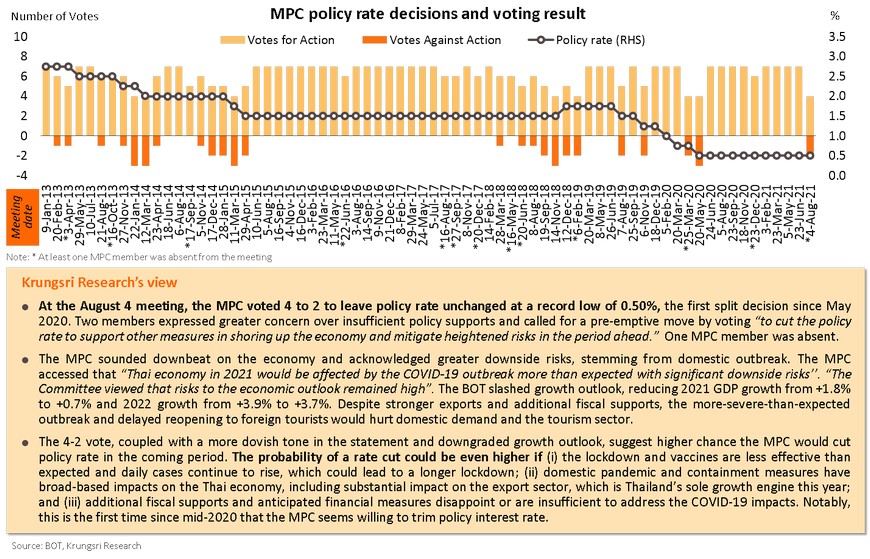

MPC willing to ease policy rate if prospects turn pessimistic

- The split vote at the latest MPC meeting, coupled with a more dovish tone in the statement and the move to downgrade growth forecasts, suggest they may cut rates in coming period. There is higher probability of a rate cut if (i) daily cases continue to rise, leading to a longer lockdown; (ii) domestic outbreak has broad-base impact on the Thai economy, especially a substantial impact on the export sector; and (iii) additional fiscal supports and financial measures disappoint or are insufficient to address the COVID-19 impacts.

Thailand Economic Outlook 2021

Third wave of COVID-19 in Thailand is more severe than expected; daily cases likely to peak in September

The number of COVID-19 cases could be much higher than our previous forecast, with the Delta variant being dominant in the last few months. In our base case, we assumed daily cases would peak at around 26,000 cases in early-September and gradually decline after, and daily fatalities would peak in the second week of September. So, we might expect authorities to relax (full) lockdown in late-September. In addition, strict non-pharmaceutical interventions (NPIs) would remain throughout the year. We assumed an average of 250k doses would be dispensed each day with 50% vaccine efficacy against the Delta variant. Mass vaccination, vaccine efficacy, and effectiveness of lockdown measures are considered critical variables in determining how quickly domestic outbreaks can be contained. At worst, even if Thailand dispenses 55mn doses of vaccines by end-2021, daily cases would remain high the rest of the year due to low effectiveness of lockdown measures and vaccines. In this case, the (full) lockdown could be seen until November.

Despite upbeat 2Q GDP data, there is downside risk to our 2021F GDP growth unless there are substantial policy supports

Low base and surge in exports drove YoY growth in 2Q GDP, but COVID-19 has started to hurt consumption and investment

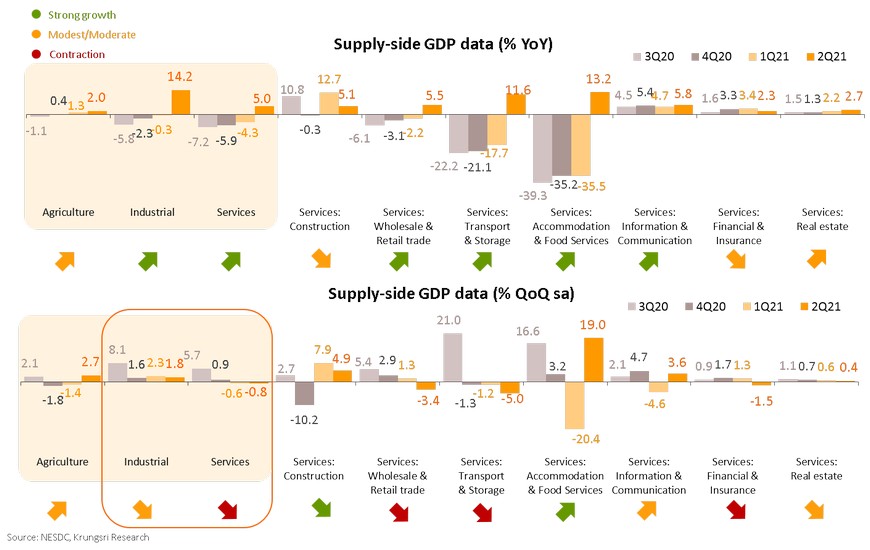

On the supply side, agriculture output grew but industrial sector slowed down and services sectors saw deeper contraction

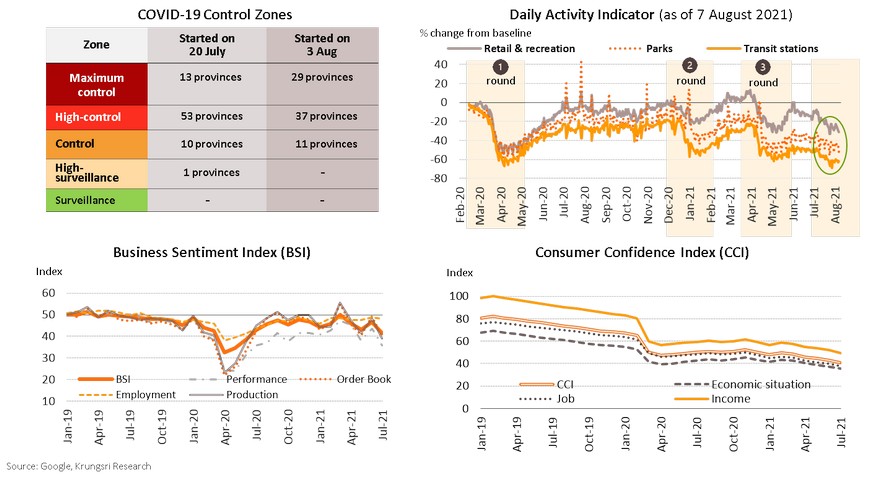

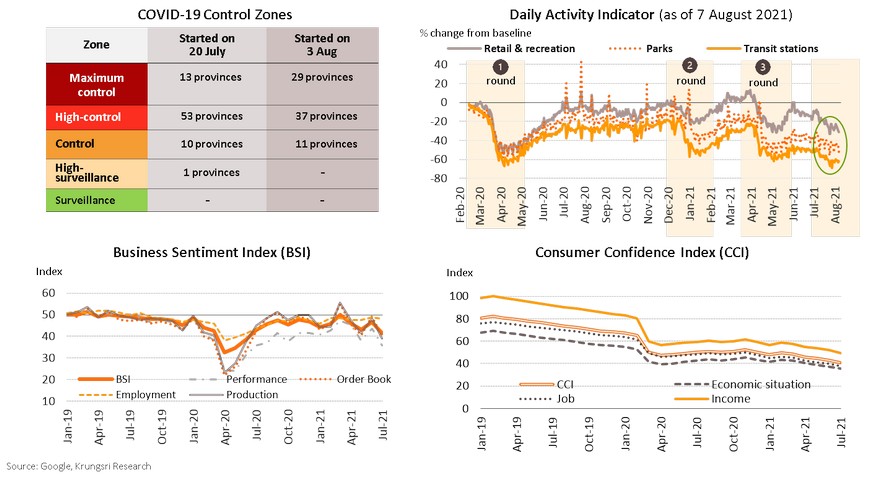

Extending lockdown to cover 29 provinces will hurt economic activity in 3Q21

In early August, the government extended strict lockdown measures to cover 29 provinces that are on the critical (red zone) list. The government will review the situation again on August 18. If daily cases continue to rise, they will extend the restrictions to end-August. Google Mobility Index indicated activity has been sluggish this quarter, and indicators for some activities have plummeted to lows close to that seen during the first wave in April 2020. The recent surge in daily cases nationwide has also raised concerns among consumers and investors, which as hurt consumer confidence and investor sentiment substantially.

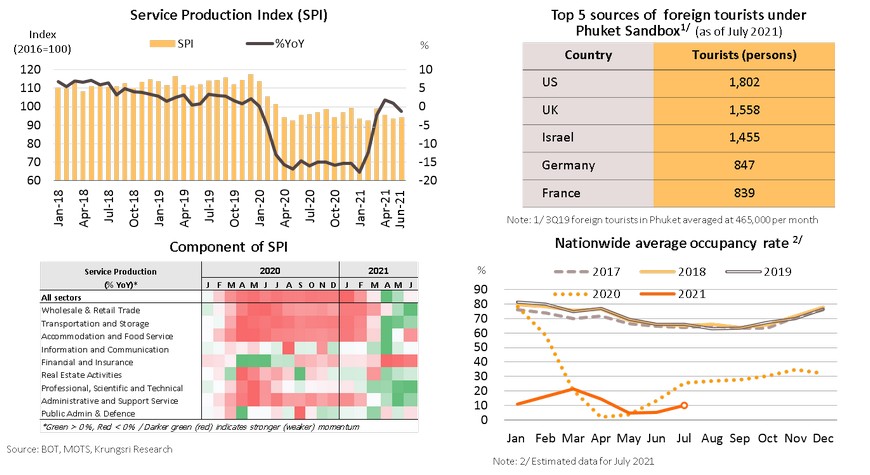

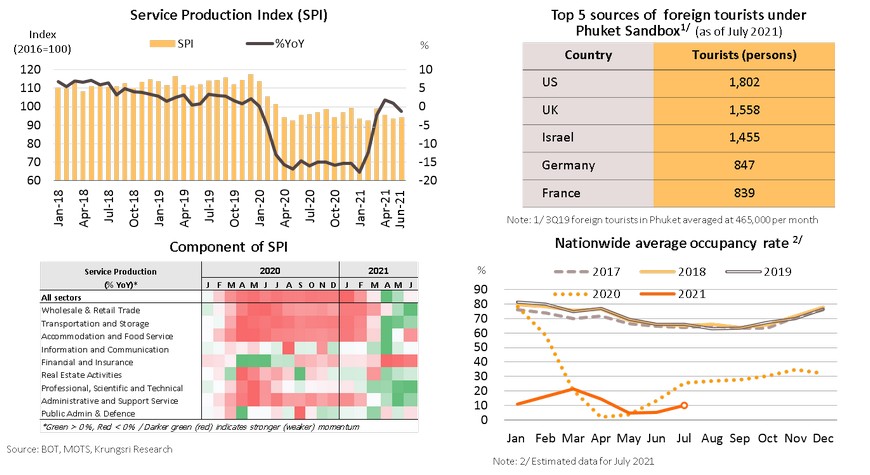

Services sector weakens as daily cases rise; Phuket Sandbox program may be in hot water

The services sector has slowed down. The Service Production Index (SPI) has started to contract for the first time in 3 months, marking -1.4% YoY in June, following a drop in demand for accommodation and food services. The ferocious Delta variant has prompted the government to tighten measures and restrict high-risk activities, especially in dark-red zones. Under the Phuket Sandbox program, the number of fully-vaccinated foreign tourists who entered Thailand without being subject to quarantine reached 14,055 in July. They generated THB829mn in tourism receipts. The 5 largest groups of tourists came from the US, the UK, Israel, Germany and France. However, daily cases has surged to more than 20,000 in August, so we expect fewer foreign tourist arrivals than the government’s target of 40,000 for August (preliminary data show 4,600 foreign tourists in 1-9 August). Since 9 August, the US has downgraded Travel Advisory for Thailand to level 4, which is the most severe COVID-19 warning (it means “Do not travel”), and the EU had removed Thailand from the COVID-19 safe list in mid-July.

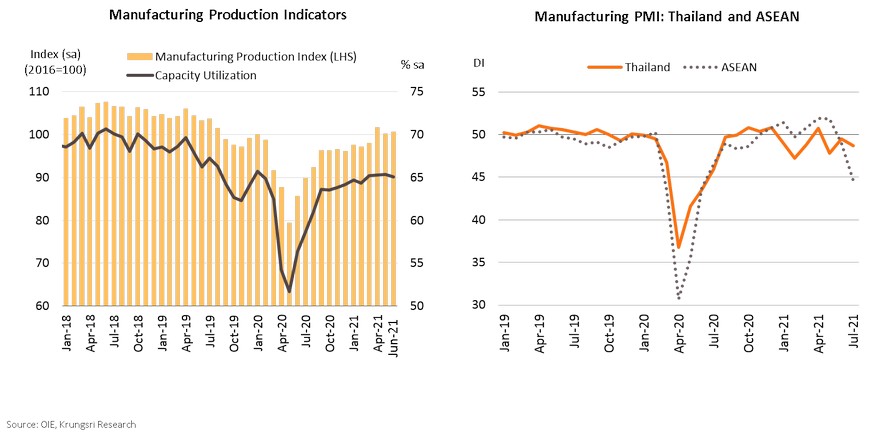

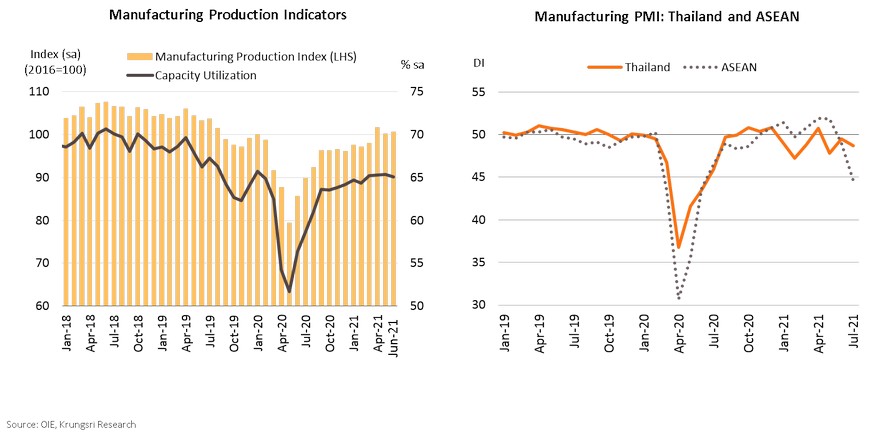

Manufacturing sector would be hit by latest outbreak, and threaten exports which is Thailand’s sole growth engine

Domestic demand has been hurt by the latest outbreak but manufacturing production grew 9.4% YoY in 1H21 led by strong export growth following the global economic recovery. But in 2H21, the Delta variant has been dominant in cases involving the industrial sector. The more severe outbreak has pushed down the ASEAN Manufacturing PMI to a 13-month low in July. Thailand, one of the 7 countries covered by the survey, has experienced a contraction in its manufacturing sector. According to Thailand’s Ministry of Industry, from 1 April to 29 July, there were outbreaks in 518 factories involving 36,861 persons in 49 provinces. Most of the hardest-hit sectors were labor-intensive industries, including food, electronics, textiles, metals and plastics. If the government fails to contain the outbreak in these industries soon, it will hurt manufacturing output. This could then hurt the export sector, which had been projected to be the major driver of the Thai economy the rest of this year.

Export growth is at risk, despite reaching an 11-year high in June

Amid higher global risk, a 1% drop in exports would drag output by 0.55%, led by automobile, rubber, jewelry

There are growing threats to the global economic recovery triggered by the Delta variant. Our sensitivity analysis involving the Input-Output table shows the direct and indirect effects of a 1% drop in exports (from baseline) would drag total output by -0.55%. Industries that would hurt the most would be automobile, metal products & machinery (-0.88%), rubber, chemical and petroleum industries (-0.83%), jewelry, leather products & others (-0.72%), and textile (-0.69%). There would be moderate impact on mining & quarrying (-0.52%), food manufacturing (-0.44%), agriculture (-0.41%), sawmills & wood products (-0.35%), and paper industries & printing (-0.32%). The mildest impact would be in services (-0.28%), cement & non-metallic products (-0.19%) and transportation & communication (-0.07%).

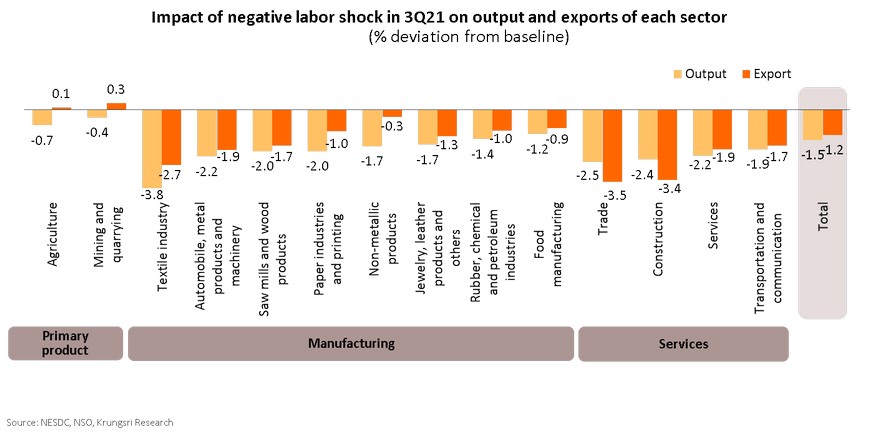

Assuming negative labor shock in 3Q21, exports and output could drop by 1.2% and 1.5%, respectively

Assuming a negative labor shock in 3Q21 triggered by spillover effects of the severe outbreak and tight containment measures, our analysis of industry linkages and economic impact via the Input-Output table shows that the country’s exports and output would shrink by 1.2% and 1.5% from baseline, led by manufacturing and services sectors. Industries that would see the largest drop in output would be textile (-3.8%), trade (-2.5%), construction (-2.4%), automobile, metal products & machinery (-2.2%), services (-2.2%), and transportation & communication (-1.9%). Industries that would see the largest drops in exports would be textile (-2.7%), automobile, metal products & machinery (-1.9%), sawmills & wood products (-1.7%), jewelry, leather products & others (-1.3%), and rubber, chemical & petroleum (-1.0%).

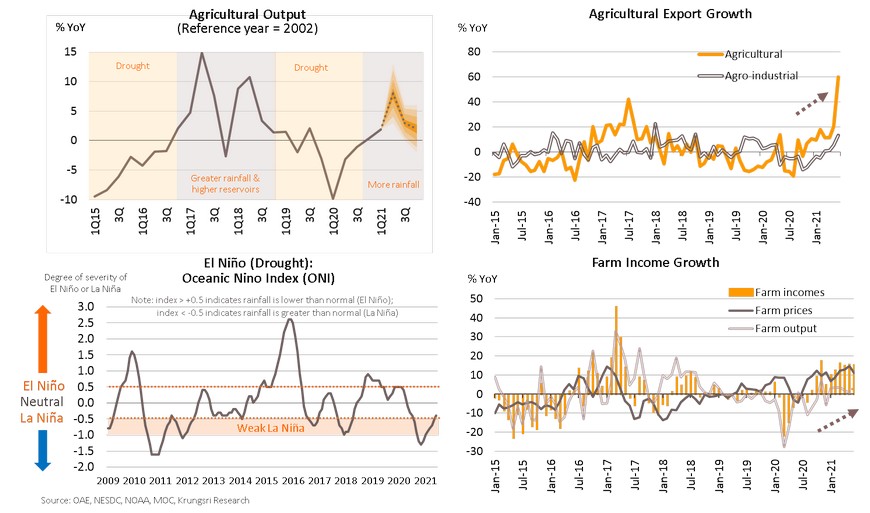

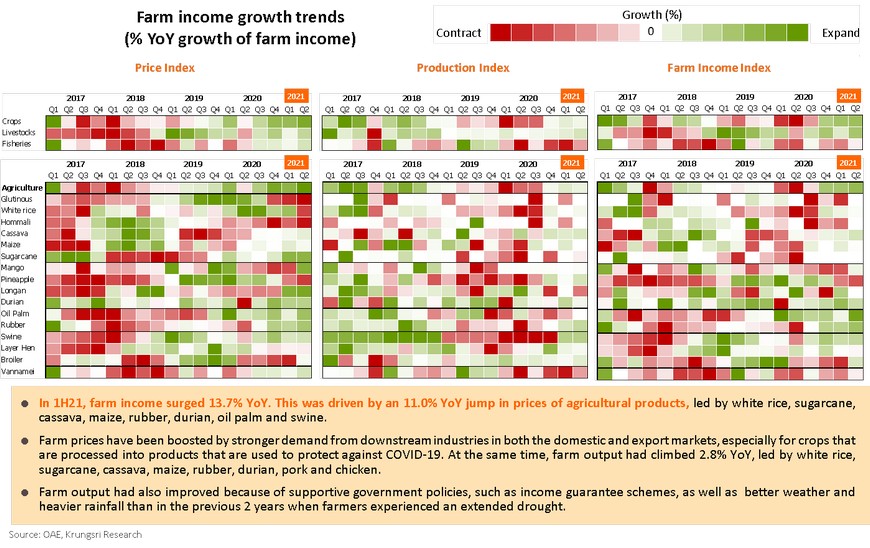

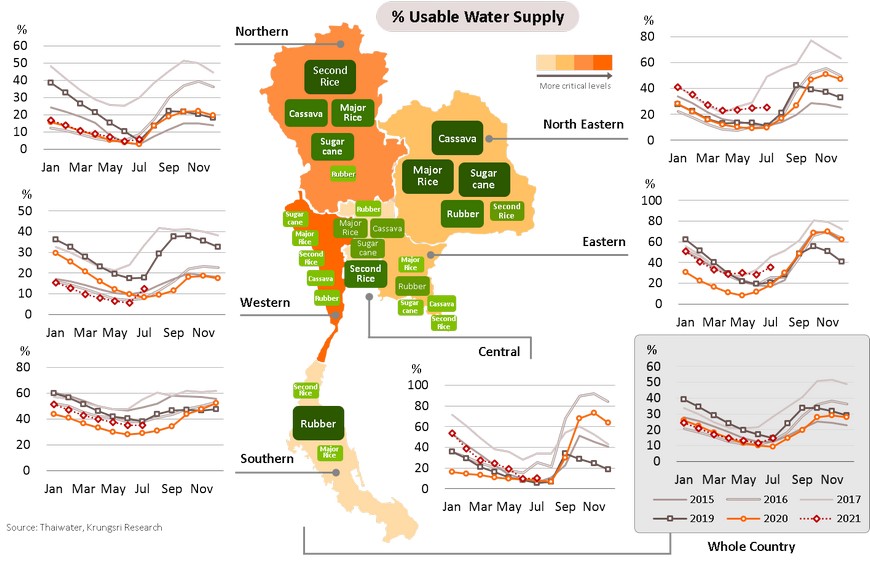

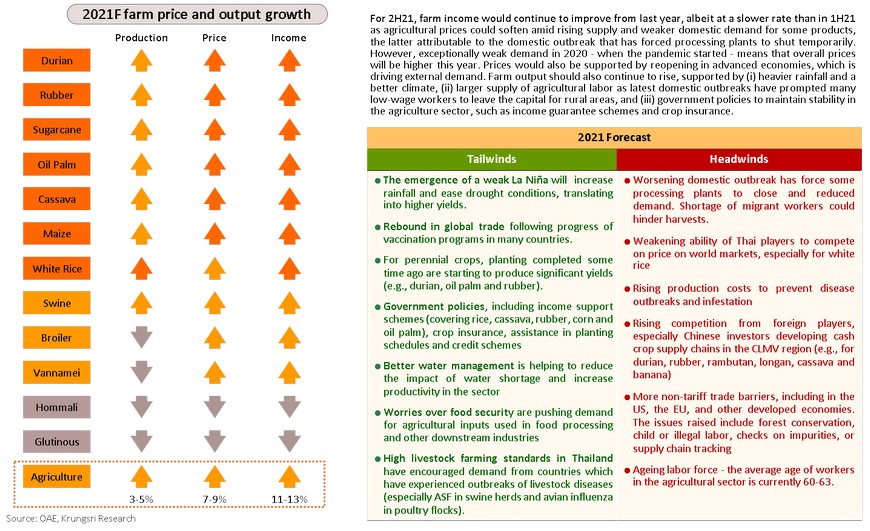

Agriculture will benefit from recovering demand and reopening in several countries, favorable climate, and supportive policies

Crop and livestock farmers are reaping higher income with the surge in commodity prices and larger output

Water level is improving; La Niña should increase average rainfall by 5-10% to close to 2016-2017 level

Despite a slowdown in prices, farm income will remain high in 2H led by rubber, sugarcane, oil palm, durian, cassava

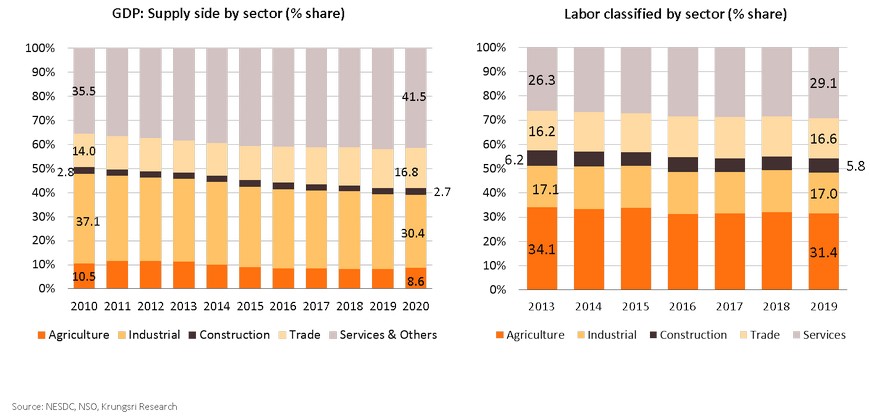

Agriculture to offer limited windfall; services sector will be severely hurt; manufacturing sector is at risk

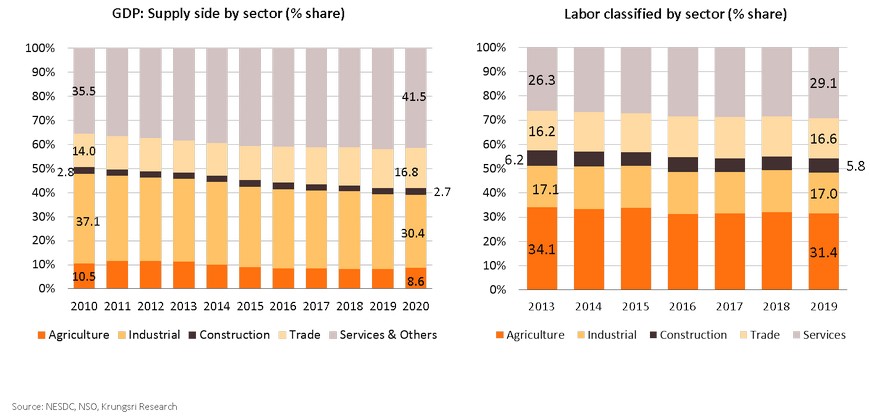

Gains in the agricultural sector this year would offer limited windfall to the overall economy. This is because agriculture accounted for only 8.4% of national GDP but employed 31.4% to total labor in the country. The COVID-19 impact on the services, trade and construction sectors would drag the Thai economy as the combined output is up to 61% of national GDP and they employ 51.1% of total labor. For the industrial sector (30.4% of GDP, 17% of total labor), gains from exports this year should reduce the impact of weaker domestic demand. However, exports and manufacturing production are facing rising threats to global economic recovery and are also at risk of labor shortage if the domestic COVID-19 situation worsens.

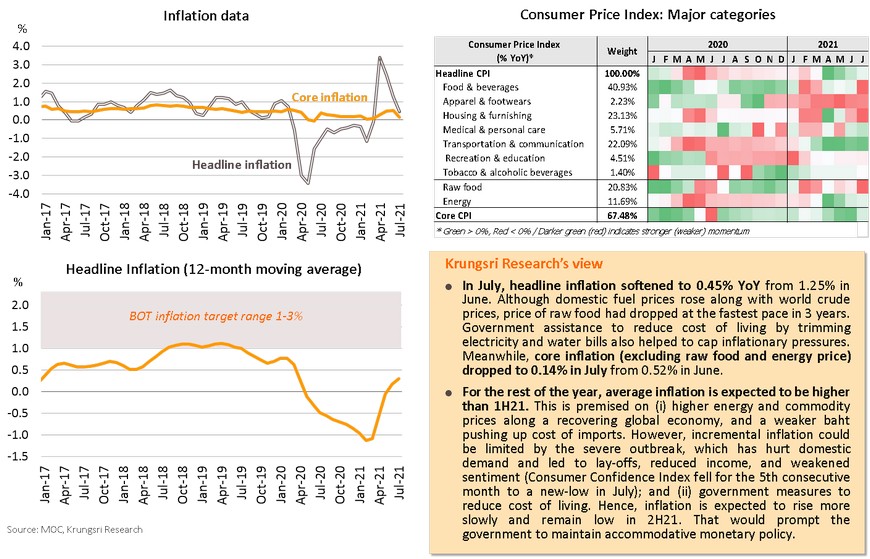

Inflation would be capped by weaker domestic demand and government relief measures

MPC willing to ease policy rate if conditions worsen

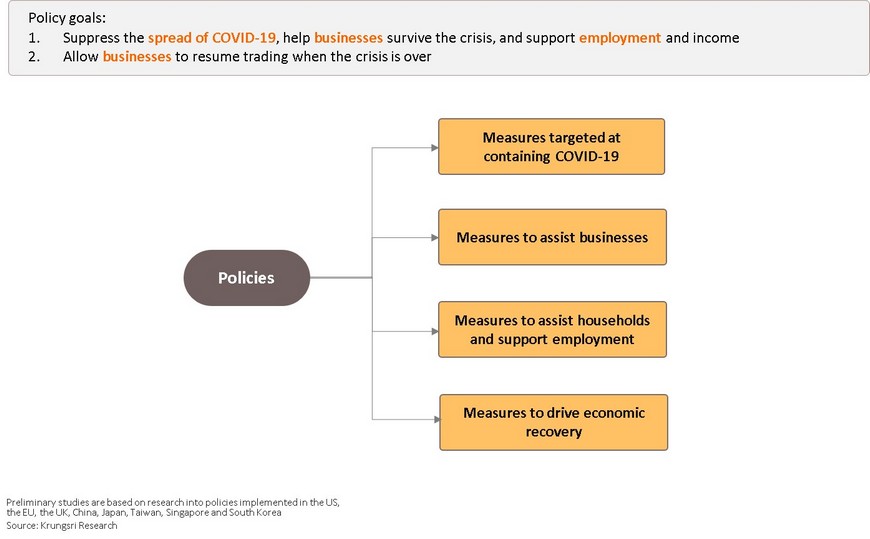

Lessons for Thailand: Global responses to the COVID-19 crisis

- The emergence of the Delta variant and smaller-than-expected effectiveness of lockdowns and vaccinations have led to Thailand experiencing a more severe 3rd wave that has lasted longer-then expected. Indeed, daily cases are now in line with Krungsri Research’s worst-case forecast. Consequently, non-pharmaceutical interventions (NPIs) could remain in place up to the end of this year, and economic and recovery prospects have taken a turn for the worse. As of August, the average forecast for 2021 economic growth by 31 research organizations has been slashed to +1.8% from +3.4% forecast in March.

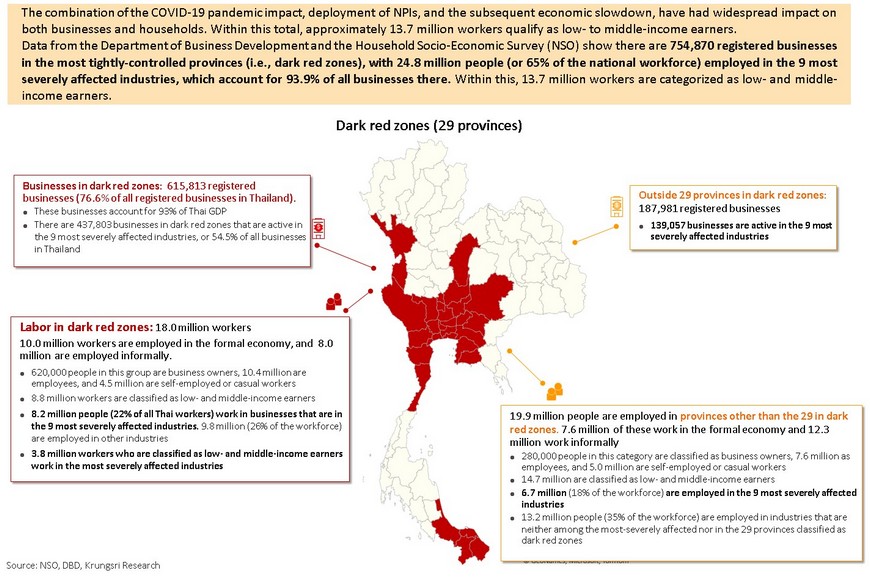

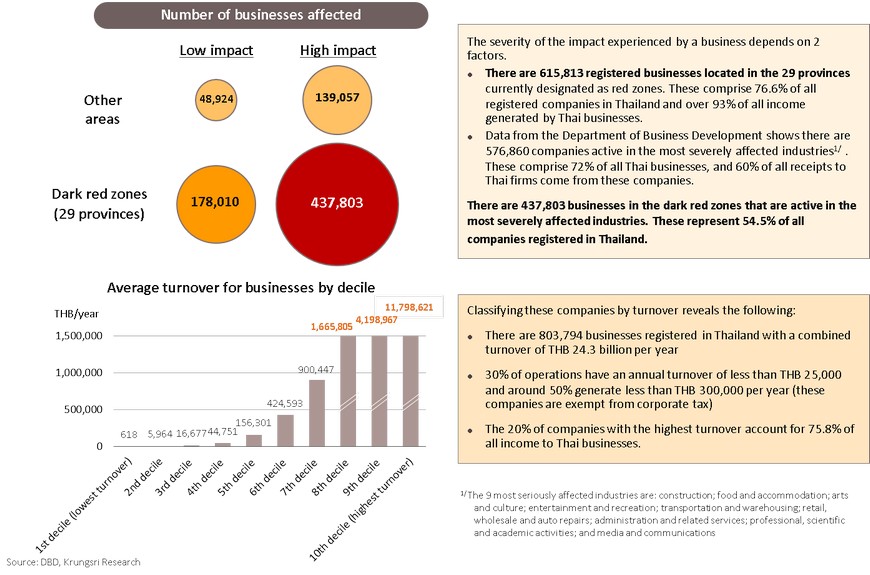

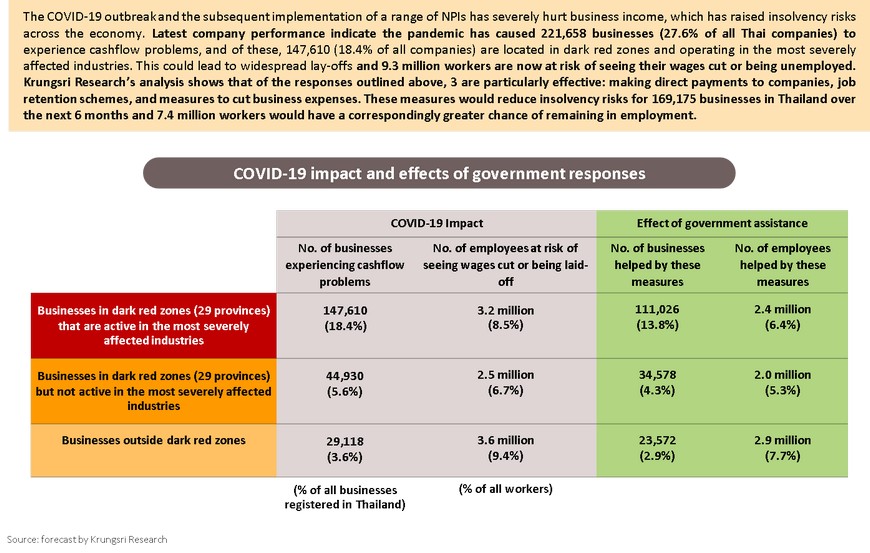

- The slowdown in the Thai economy is having widespread impact on both businesses and households. Data from the Department of Business Development and the Household Socio-Economic Survey (NSO) show there are 754,870 registered businesses in the most tightly-controlled provinces (i.e., dark red zones), with 24.8 million people (or 65% of the national workforce) employed in the 9 most severely affected industries, which account for 93.9% of all businesses there. Within this, 13.7 million workers are categorized as low- and middle-income earners.

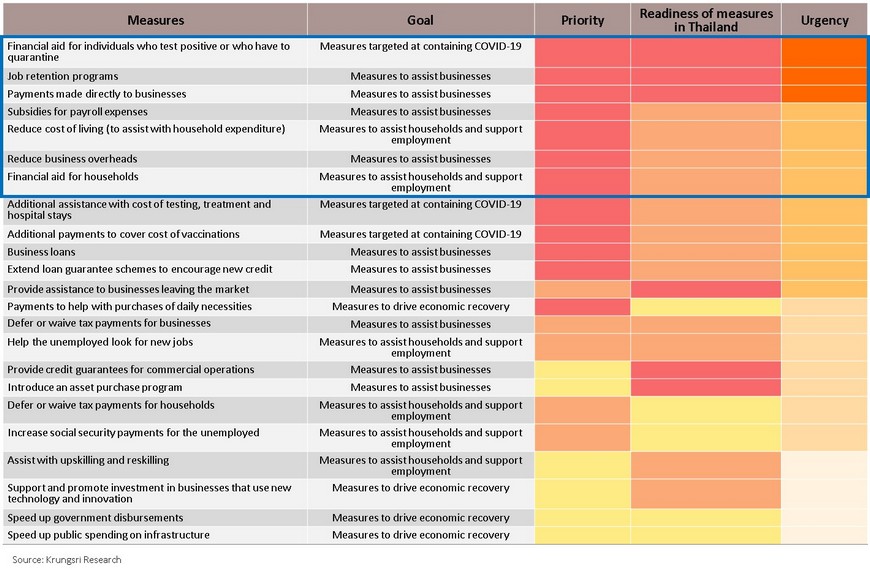

- Given the intense drawn-out nature of the COVID-19 pandemic and its broad impacts on the population, it is necessary for authorities to implement measures that will contain the virus and support both businesses and households through the crisis. Krungsri Research compared several countries’ policy responses to the pandemic and concludes that the 6 most effective policies have been: cash aid for individuals who test positive and/or those who need to be quarantined; introducing job retention schemes; direct payments to businesses; subsidize cost of living; cutting business overheads; and direct payments for households. Unfortunately, current policies remain inadequate to address the current situation in Thailand.

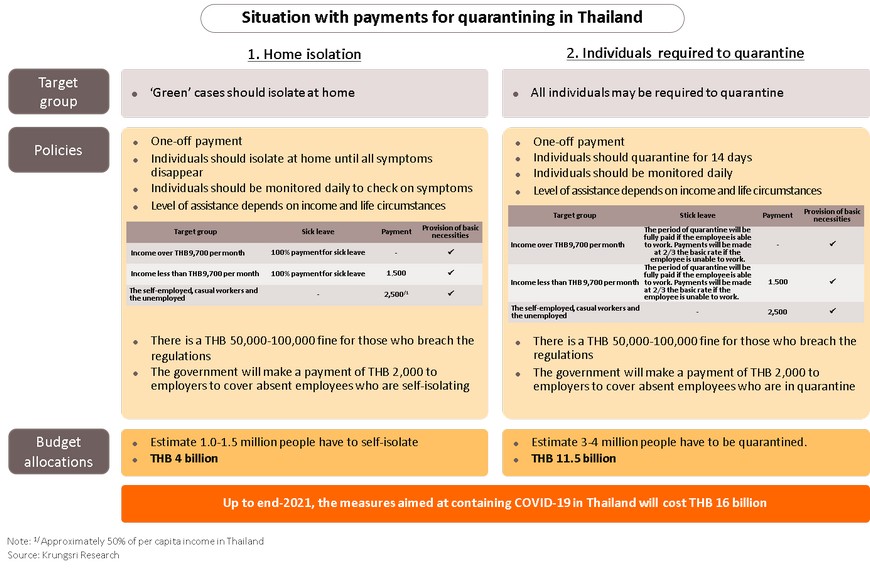

- Cash aid for individuals who test positive and/or those who need to be quarantined: This would incentivize or compel individuals who are at risk of spreading the virus to quarantine at home.

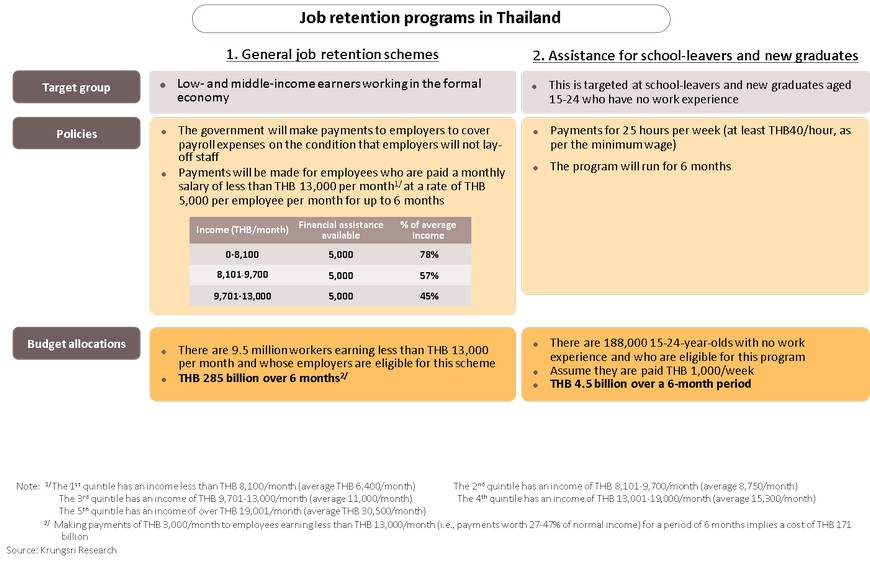

- Introducing job retention schemes: This involves the government making payments to employees via their employer (essentially, a temporary subsidy of payroll expenses) with the goal of reducing business overheads and preventing a wave of layoffs. This policy is most effective when targeted at low-income earners

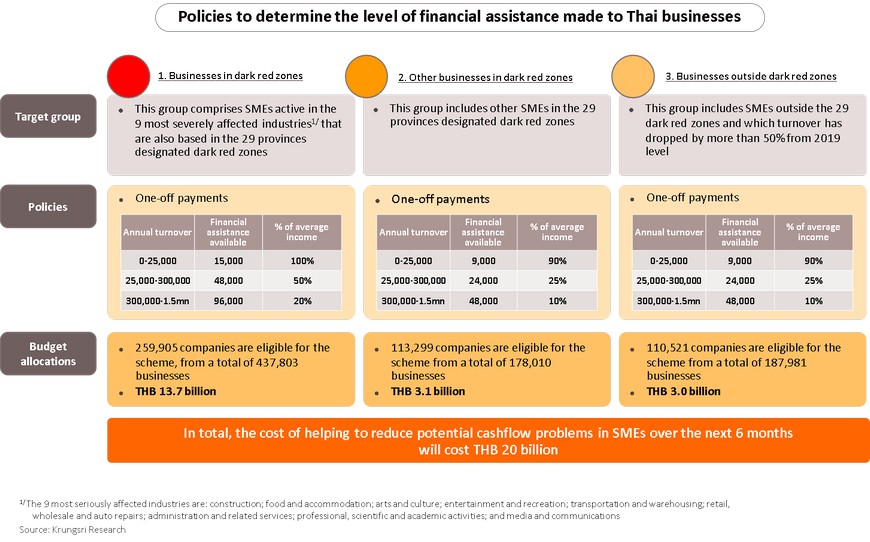

- Making direct payments to businesses: This entails making one-off payments to businesses with the goal of increasing company liquidity. The scale of payments to each business sector will depend on how severely that are or would be affected by the crisis.

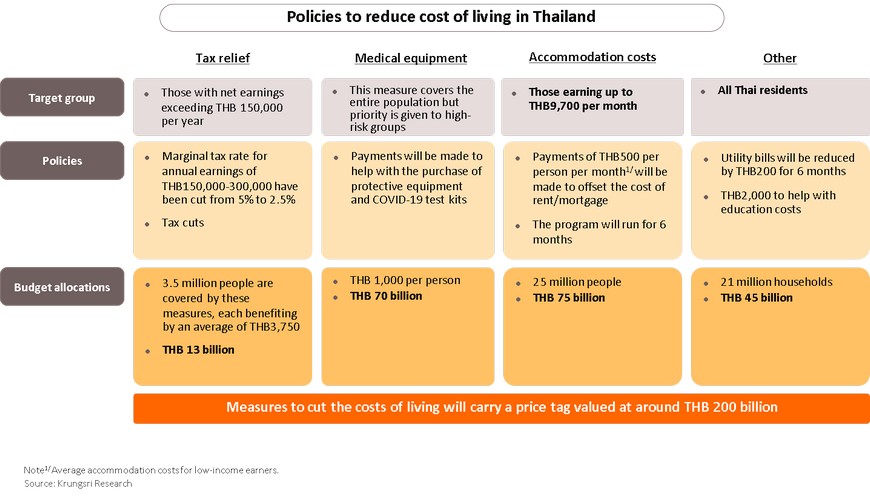

- Subsidize cost of living: This involves tax cuts, subsidies for buying products used to prevent the virus from spreading, accommodation costs, and spending on other necessities such as utilities, food, and education.

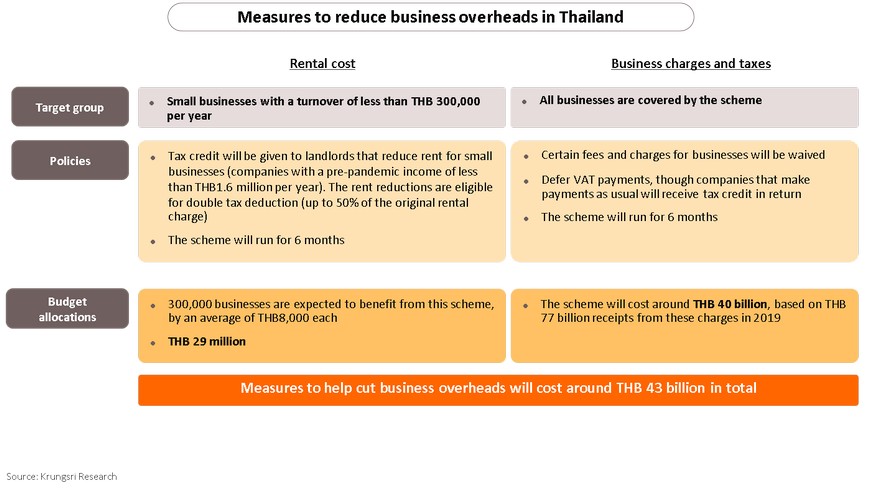

- Cutting business overheads: This includes reducing business expenses such as rent and tax and related payments.

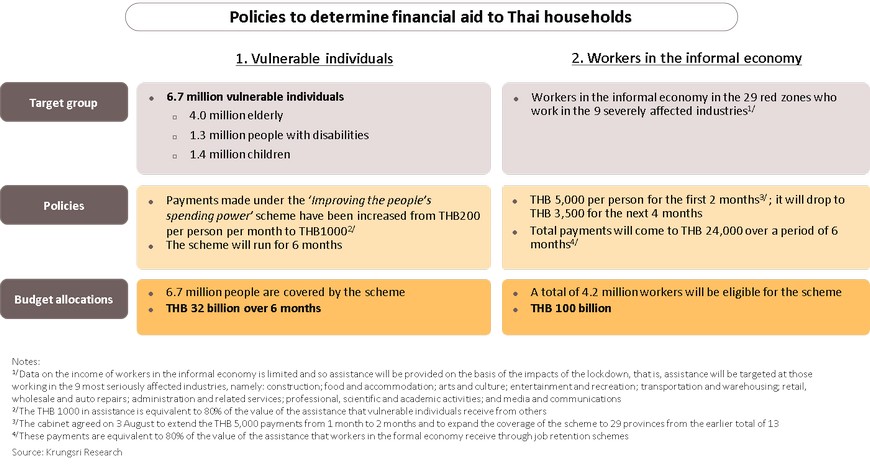

- Direct payments for households: These target selected groups who have difficulty accessing other sources of assistance, such as vulnerable individuals and those working in the informal economy.

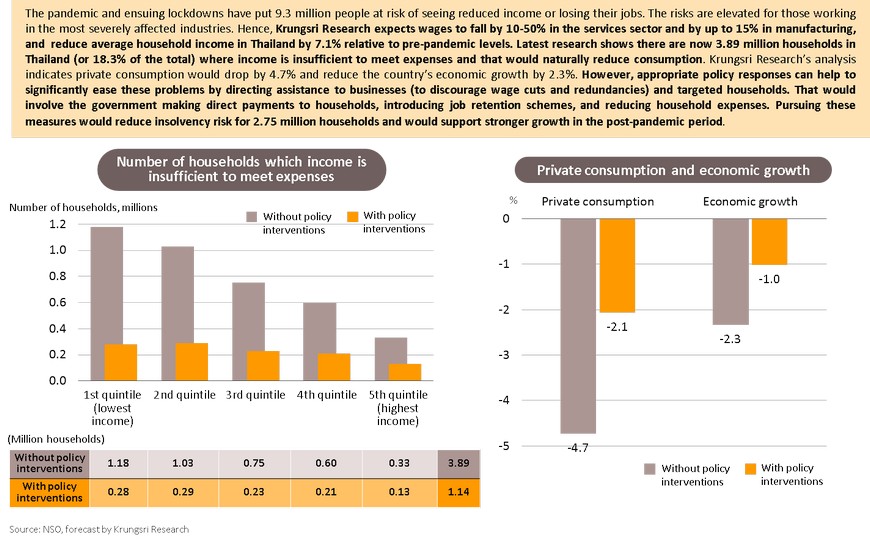

- The implementation of these measures would help to alleviate both the short- and long-term impacts of COVID-19 on the economy, by reducing the risk of 169,175 companies being forced to cease operations over the next 6 months (from 221,658 currently exposed). These policies would also help to keep 7.4 million workers employed (from 9.3 million that are at risk of seeing their income reduced or being laid-off), which would in turn, reduce risk of bankruptcy faced by 2.75 million households (from 3.89 million affected households).

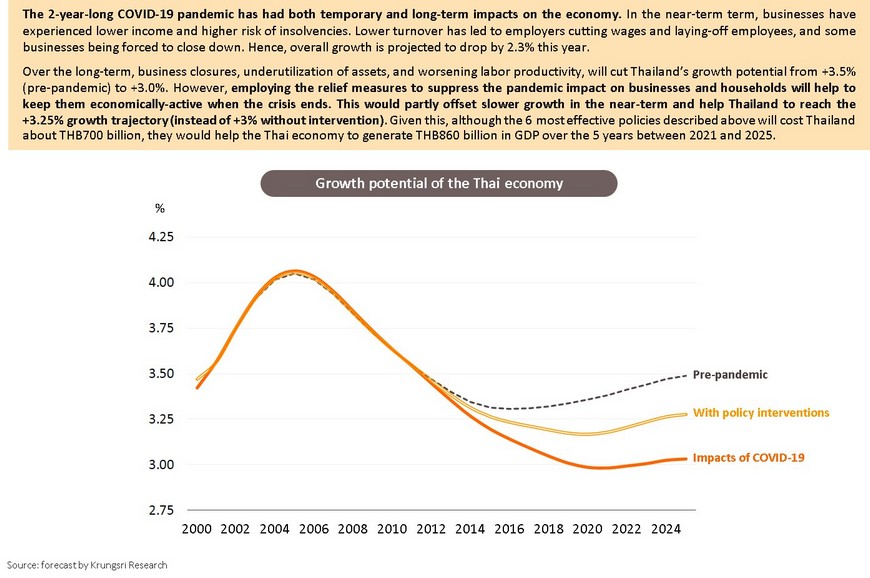

- Over the long-term, the COVID-19 outbreak would cut Thailand’s growth potential from +3.5% pre-pandemic level to +3.0%, attributable to business closures, asset impairment, and a drop in workforce productivity. However, implementing the 6 measures identified in this paper would help to lift Thailand’s growth potential back to +3.25%.

- Pursuing these policy recommendations would cost the country about THB700 billion over the next 6 months, but it would be more than compensated by the ensuing spending to boost growth. Krungsri Research estimates the measures would help the Thai economy to generate THB860 billion in GDP over 5 years from 2021 to 2025.

Pandemic impact on Thailand’s economy

Pandemic impact

Government policies that aim to reduce the pandemic impact on households and businesses

Urgency of measures

Payments for quarantine

Payments made directly to businesses

Financial assistance provided to businesses

Job retention programs

Policies to determine financial aid for Thai households

Policies to reduce cost of living

Reduce business overheads

Pandemic impact on businesses and effects of subsequent government assistance

COVID-19 impact on households and effects of government responses

Long-term impacts