Global: In a dilemma over inflation and growth

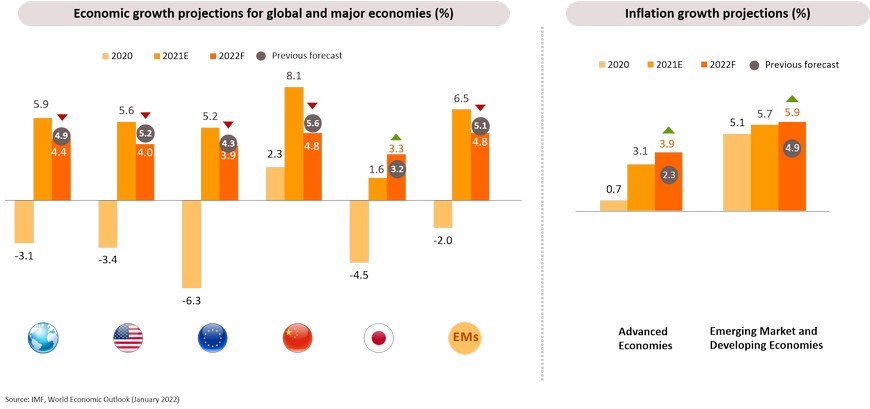

IMF trimmed 2022 global growth forecast because of rising caseloads and reimposition of restrictions, but raised inflation outlook due to higher energy prices and supply disruption

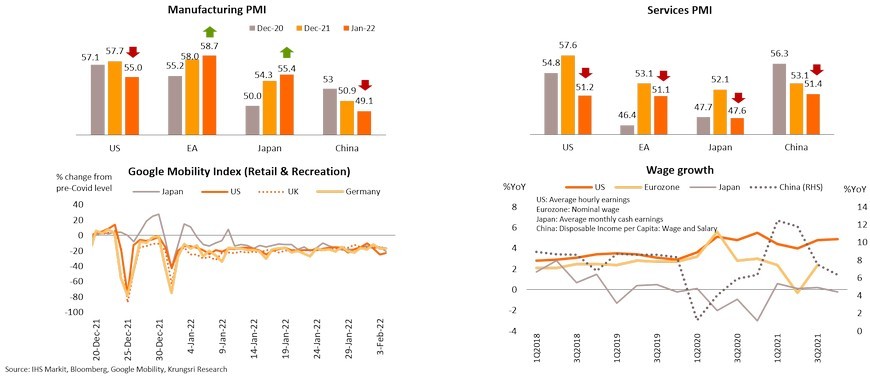

January global PMI data reflect services sector has been hit but could improve with easing restrictions; manufacturing remains resilient; rising wage would prompt policy tightening

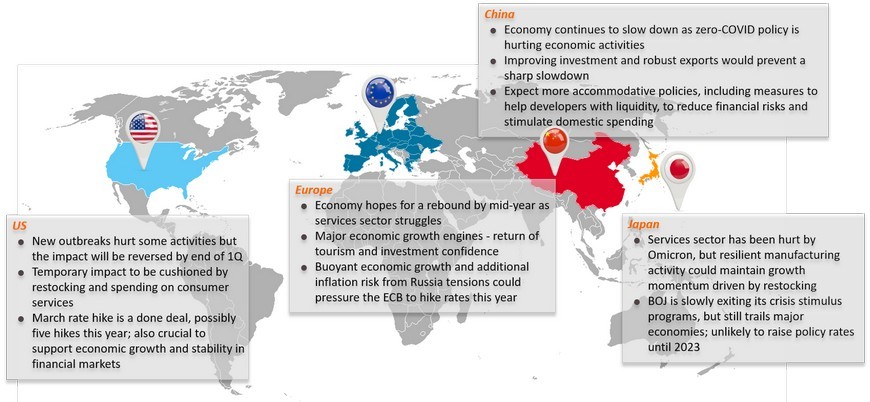

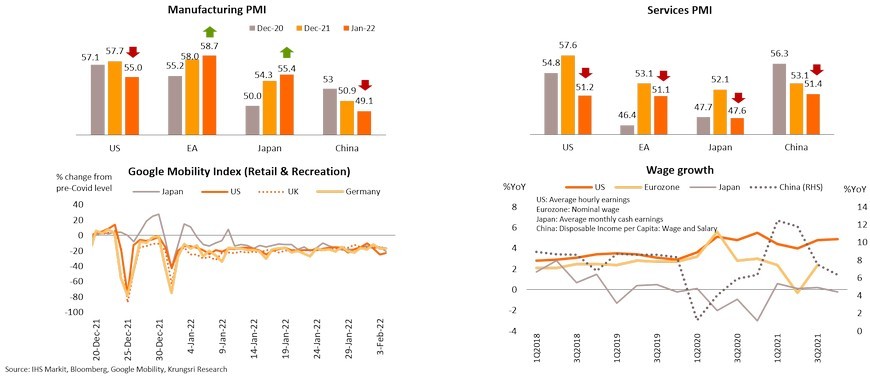

Following higher daily Covid-19 cases and tighter containment measures, global economic growth had slowed down with January Global Services Business Activity Index falling to an 18-month low. But the outlook remains positive with companies forecasting (on average) activity would improve one year from now. In manufacturing, US and China PMI data showed weaker growth but future output PMI has improved, suggesting the recent weakness is temporary. In addition, Euro area and Japan’s Manufacturing PMI had improved in January, suggesting resilience against the Omicron wave. Economic activity should improve as countries ease restrictions following fewer fatalities and higher vaccination rates. Economic recovery coupled with rising wages in several advanced countries are prompting their policy makers to tighten monetary policies to curb inflationary pressures.

US: New outbreaks hurt some activities but the impact will be reversed by end of 1Q

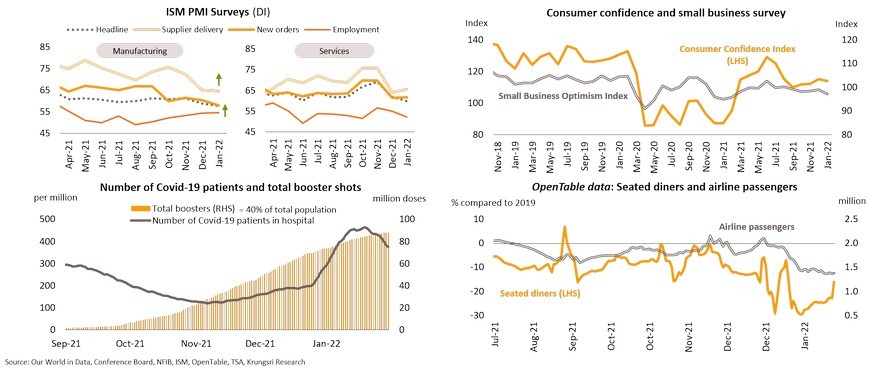

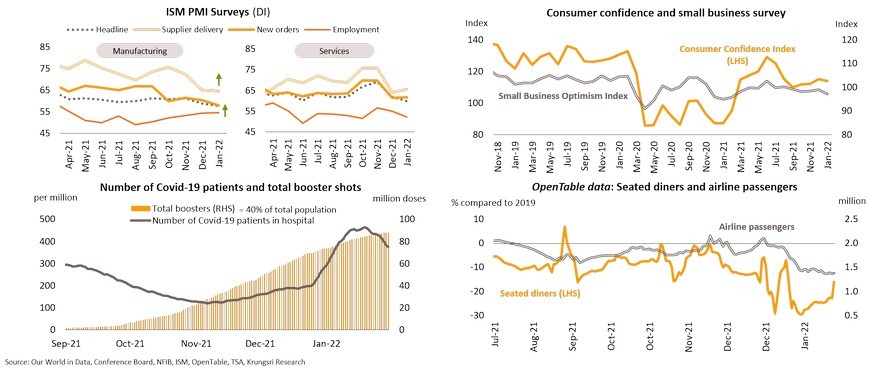

The surge in Omicron cases since late 2021 suggests there were limited outdoor activities in early-January. The latest outbreaks reveal a temporary impact on the US economy, in both manufacturing and services sectors. PMI data for those sectors edged down in January, reflecting the effects of temporary closure of factories and stores. The services sector saw a larger pullback in activities. The latest outbreaks have hurt consumer confidence in the first month of 2022 and small business sentiment has slid to an 11-month low. However, sub-indices for Manufacturing PMI showed improvements in supply delivery time and employment while all services sub-indices continued to improve. The latest outbreak is unlikely to restrain consumption for long. The number of seated diners have picked-up significantly since mid-January, suggesting people are adapting to pandemic conditions and restrictions. The number of airline passengers have dropped since the beginning of this year following busy travels during Christmas & New Year, but is higher than in the same period last year. In addition, the number of Covid-19 patients are falling as quickly as they had risen, in contrast to rising booster shots administered. Looking ahead, the improving Covid-19 situation will lift confidence and activity back to a steady growth path in late 1Q.

Temporary impact to be cushioned by restocking and spending on consumer services

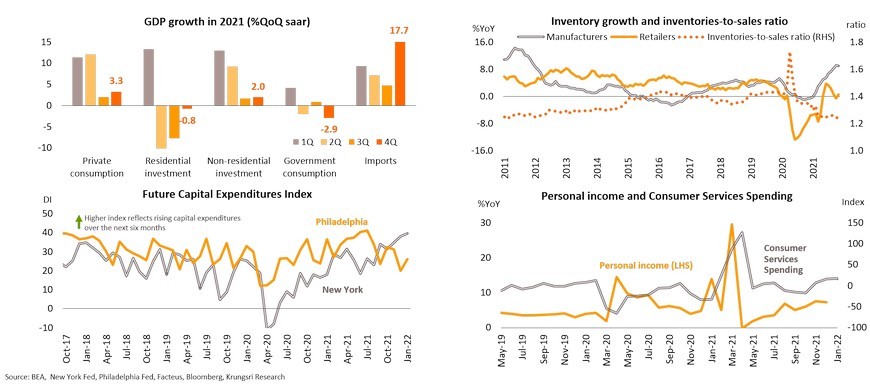

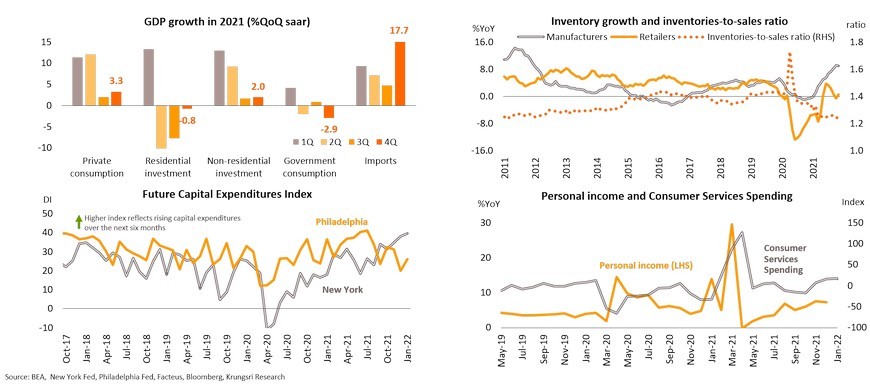

4Q21 GDP growth exceeded market expectations amid rising Omicron cases, led by private consumption and inventories. We expect demand-driven growth to contribute to rising inventories, investment and personal spending. Manufacturing inventory growth has hit a multi-year high as firms restocked materials to avoid supply constraints and respond to solid demand. Retail inventory has risen from pandemic-low, indicating businesses are preparing for more sales. Plus, the low inventory-to-sales ratio affirms better business performance as rising demand outpace supply growth. Businesses also reported higher capital expenditures over the next six months, which could support brighter investment prospects in 2H22. Personal income growth would decelerate in 2022 due to the expiry of child tax credit but adjustments to social security claims could help to ease the burden of household expenses later this year. Furthermore, consumer spending on services will continue to rise as the Consumer Services Spending Index has returned to pre-crisis level. All these developments would help to cushion the outbreak impacts and drive economic growth.

March rate hike is a done deal, possibly five hikes this year; also crucial to support economic growth and stability in financial markets

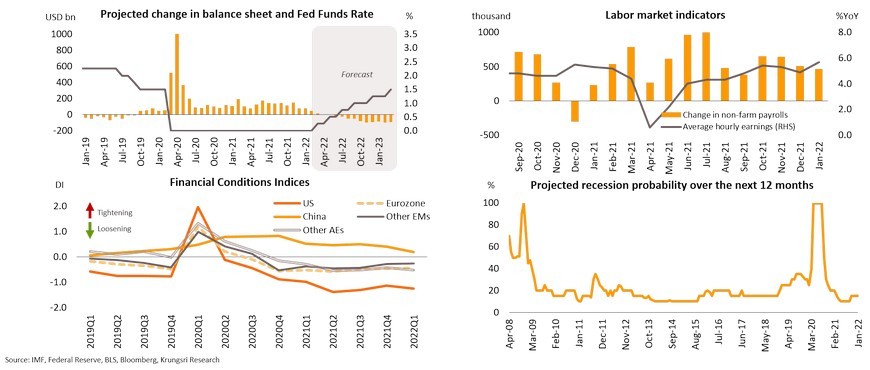

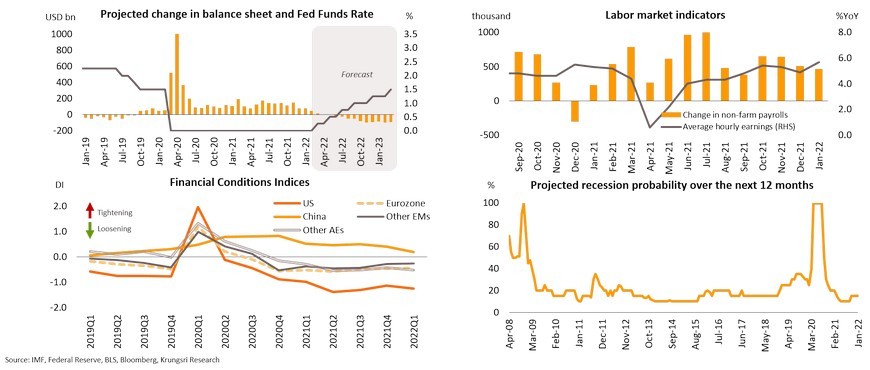

The Fed has ramped up tapering since late 4Q21 and opened the door to hike rates. We project five rate hikes this year given more persistent inflation, rapidly-rising wages, and a solid job market. The Fed might kick-off the rate hike cycle with a 25bps hike rather than 50 bps in March to prevent financial fears over a rapid liquidity contraction, followed by one each in May, July, September and December. The labor market remains strong despite the latest outbreak. Non-farm payroll showed a powerful gain by 467k in January and 4Q data had been revised up by more than double the initial forecast. Average hourly earnings jumped 5.7% YoY in January, the strongest growth since May 2020, adding inflationary pressure. If inflation remains at 5-6% in 1H22, the Fed might raise benchmark rates by a larger quantum this year. They might start to trim balance sheet or Quantitative Tightening (QT) in late-2Q. Despite the tightening cycle, the Fed will be cautious because they need to support domestic economic growth and stability in financial markets. Emerging and Asian markets would be hurt by their relatively tight financial conditions. The Fed’s aggressive rate hikes could reduce asset values worldwide but is unlikely to trigger another recession in the US because of massive liquidity injections in the previous year and probability of a recission is now only 15%.

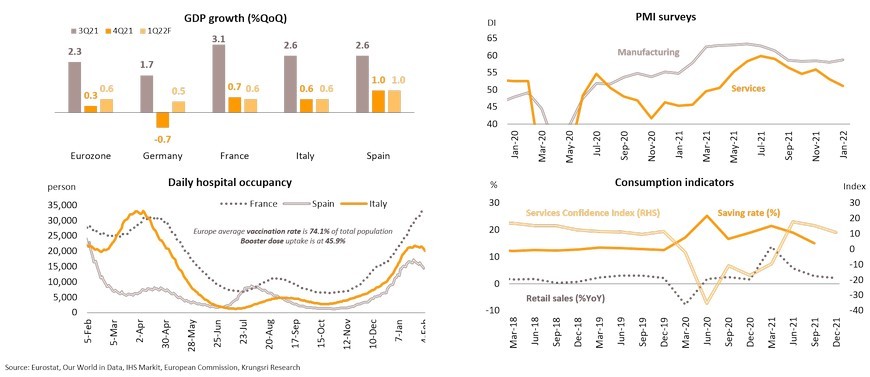

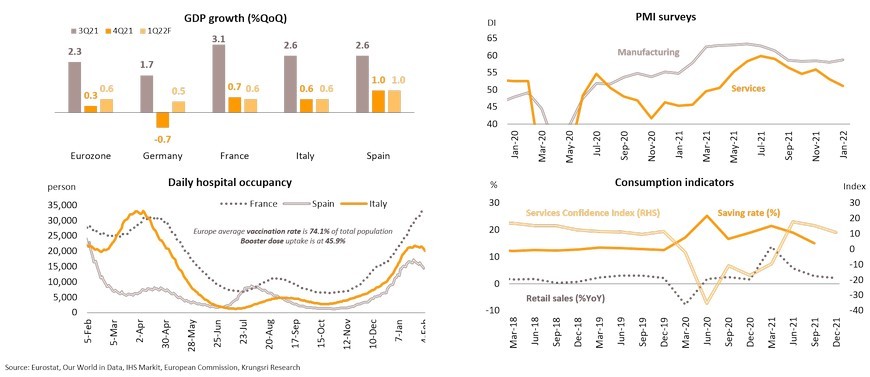

Europe: Economy hopes for a rebound by mid-year as services sector struggles

Eurozone economic growth slowed in 4Q21 due to softening reopening effects, supply disruptions and Omicron impact. Germany is the only major EU country which economy contracted due to its strong dependence on manufacturing and tight pandemic restrictions. With consumers staying home, services activities stuttered early this year. However, Manufacturing PMI hit a 5-month high in January as firms reported larger production, new orders and an improvement in supply problems. This prompted firms to upgrade growth expectations. Slowing daily Covid-19 cases and resilient demand could help to support growth ahead. Daily hospital occupancy rate has passed its peak in Spain and Italy. And recently, the WHO director said Europe would see a ‘plausible endgame’ to Covid-19 because fatality rate has started to plateau. Services Confidence Index and Retail Sales Index remain above pre-crisis levels, which savings rate is declining, reflecting rising spending since last year. These tailwinds could support a sustainable economic expansion in 1Q and take the bloc’s real GDP back to pre-pandemic level in 1H22, with the pace varying by country. We expect Eurozone to make a strong comeback in 2Q22 because Omicron symptoms mild, vaccination rate is rising, and governments have started to ease restrictions. Consumption will continue to improve.

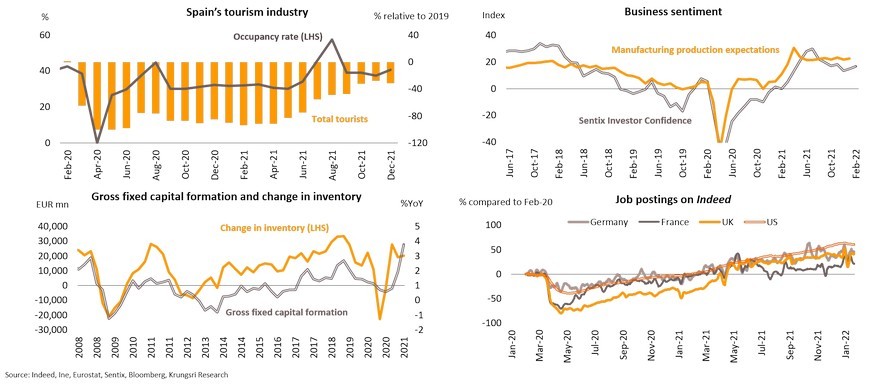

Major economic growth engines - return of tourism and investment confidence

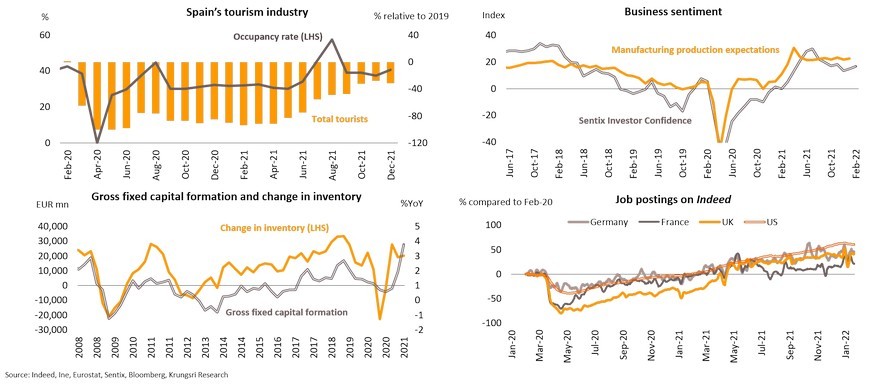

In addition to limited outbreak impacts and resilient consumption, there are several other positive elements to bolster growth, including a recovery in tourism activities, capital formation, and improving business conditions. Tourists are returning to Spain – tourist arrivals are now 30% below pre-pandemic level compared to almost 80%-below in mid-2021. Hotel occupancy rate has exceeded pre-Covid level. In manufacturing, production expectations remain high amid hopes of easing supply bottlenecks later this year. Eurozone investment prospects continue to improve. Gross fixed capital formation and inventory level has risen to a decade-high, suggesting business restocking and expectations of strong consumer demand. Sentix Investor Confidence rose to 16.6 in February from 14.9 in January, suggesting more investment ahead. Tourism and investment sectors would be crucial economic growth drivers this year. In addition, rising job postings allow workers to return to the labor market and earn more money to spend. However, Eurozone’s labor market is less tight than in the US, which also suggests a less-hawkish monetary policy.

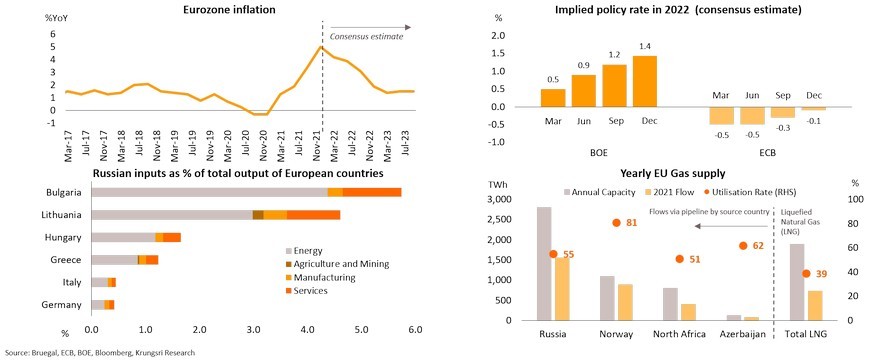

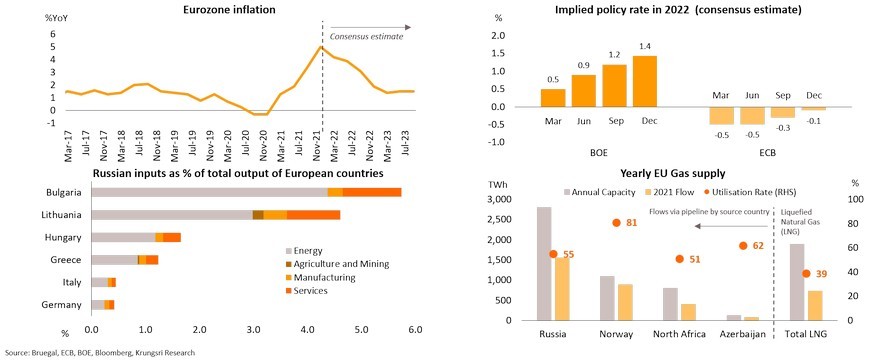

Buoyant economic growth and additional inflation risk from Russia tensions could pressure the ECB to hike interest rates this year

Strong inflation data in the first month of 2022 and better-than-expected economic growth could pressure the ECB to terminate all asset purchase schemes in 3Q and deliver two interest rates hikes in 4Q totaling 50 bps. We expect a shift in forward guidance to a more hawkish tone starting March, and the ECB might prudently follow the Fed and BOE to enter a tightening cycle. However, there is additional risk from Russia and West tensions. Output in several European countries, especially Eastern Europe, relies on Russian inputs, especially energy, primary commodities and basic manufactured products. If Russia imposes sanctions on Europe, the economy could be disrupted. The impact on general goods would be limited but its reliance on Russian energy (major share of input) could elevate risks. In 2021, Russia exported 1,700 TWh of natural gas to the EU, only half of the EU’s annual capacity to import natural gas. Even if the EU has large idle capacity, it would be difficult to increase gas supply due to higher imported prices and limited domestic production capacity. This implies measures to increase supply might not be enough, so it is crucial to manage demand by controlling consumption of households and factories. Halting Russian energy exports would increase cost of living, trigger higher inflation, and encourage a more aggressive ECB stance.

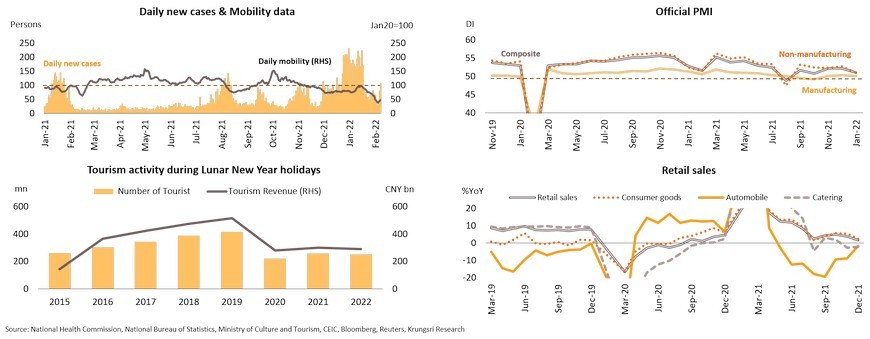

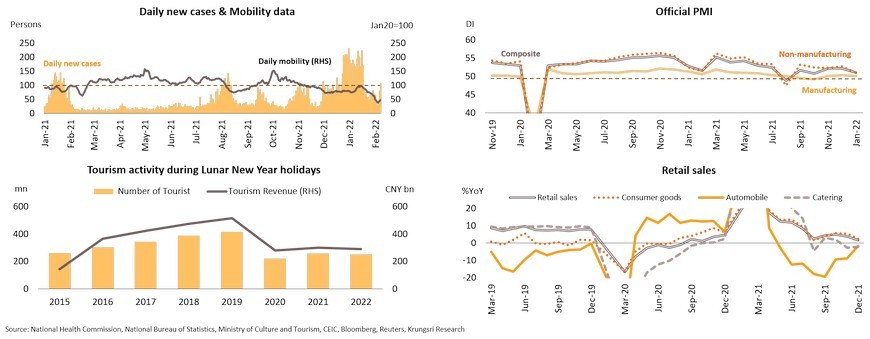

China: Continues to slow down as zero-COVID policy is hurting economic activities, especially domestic tourism and retail sales

Apart from the ongoing regulatory crackdown and liquidity crunch in the property sector, China’s strict zero-COVID policy during Chinese New Year and Winter Olympics will continue to slow down the nation’s economy. High-frequency data indicates economic activities are at the slowest since February 2021 during the 2nd wave of infections. Official January Non-manufacturing PMI recorded the weakest growth since August 2021. The tourism-related services sectors had been affected the most, with tourist receipts and domestic trips for the seven-day Lunar New Year holiday dropping from last year and still at about 50% below pre-pandemic levels. Moreover, retail sales suggest domestic consumption has been made worse by tighter restriction. Despite the drawbacks, China is expected to maintain the Zero-COVID policy because reports suggest the inactivated-virus vaccines (Sinovac and Sinopharm) that is widely used there might not be effective in preventing transmission of the Omicron variant. Meanwhile, progress in the development of homegrown mRNA vaccine (Fosun & BioNTech) is slower than in other major economies and has yet to be approved. This would discourage China from reopening to international tourists. The Ministry of Culture & Tourism said “China targeted 2023-2025 for recovery in international air travel”. The latest COVID outbreaks and following strict measures would present downside risks to economic growth going forward.

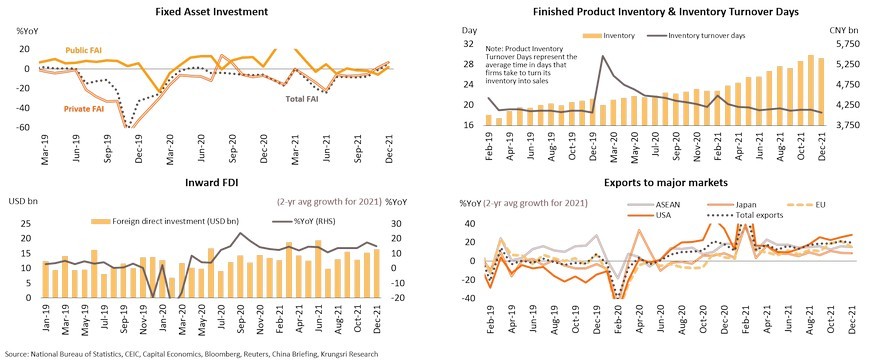

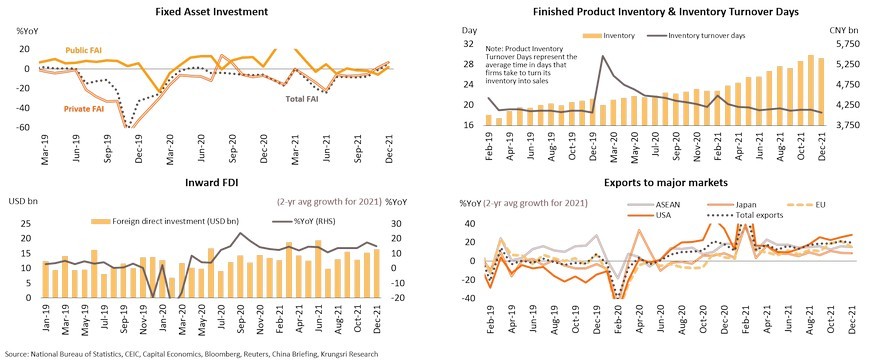

Improving investment and robust exports would prevent a sharp slowdown

Despite the economy being dragged by the zero-COVID policy, recovering investment and strong export growth would help to mitigate the impact. December fixed asset investment turned to expand for the first time in 18 months. Public investment rebounded with support from fiscal stimulus, led by infrastructure investment. At the beginning of 2022, the authorities announced they would kick-start new infrastructure projects worth CNY 3trn, 2.5 times more than last year. Private investment also improved, registering the strongest growth since September 2020. This is partly attributable to shorter Inventory Turnover Days which encourages businesses to restock and expand production. In addition, foreign direct investment (FDI) in December is the highest in 6 months, led by a jump in investment from countries along the Belt & Road Initiative (BRI) and Southeast Asia who benefit from the Regional Comprehensive Economic Partnership (RCEP) agreement that took effect on 1 January. On the external front, exports remain buoyant, marking the 15th straight month of double-digit growth as shipments to major destinations continued to rise. Although improving investment and strong exports can help to prevent a sharp slowdown, they are insufficient to offset the impact of weakening domestic consumption which contributes about half of China’s GDP.

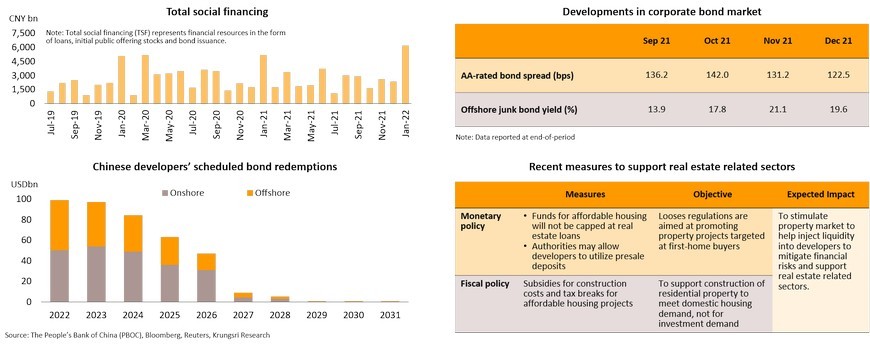

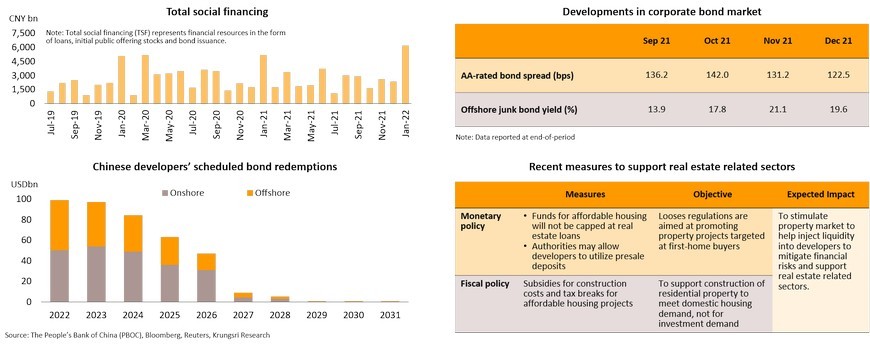

Expect more accommodative policies, including measures to help developers with liquidity, to reduce financial risks and stimulate domestic spending

Apart from easing measures, including a reduction in reserve requirement ratio (RRR) and cutting interest rates, the People’s Bank of China (PBOC) also urged banks to step up mortgage lending to home buyers. State-owned enterprises have been encouraged to raise cash for troubled developers by injecting funds as stakeholders. As a result, total outstanding total social financing had jumped to a record high of CNY 6.17trn in January, marking a 18.9% YoY expansion. That has eased financial distress, represented by an improvement in corporate bond spreads and yields. Nonetheless, there are lingering concerns about defaults by some developers. In 2022, they would have to redeem about USD 50bn in onshore bonds and USD 49bn in offshore bonds. Shimao, Kaisa and Logan recently reported they had defaulted in making interest payments. In response, authorities are stepping up stimulus measures to ease the liquidity crunch, including supplying credit and introducing fiscal incentives for affordable housing projects, and relaxing restrictions to allow developers to access cash tied up in presale deposits. The low-inflation environment, reflected by the easing of headline inflation to 1.5% in December, also allows authorities to employ more accommodative measures. We project China will conduct more monetary easing in the near future, including cutting rate and reducing reserve requirement ratio, to mitigate financial risks and support domestic demand.

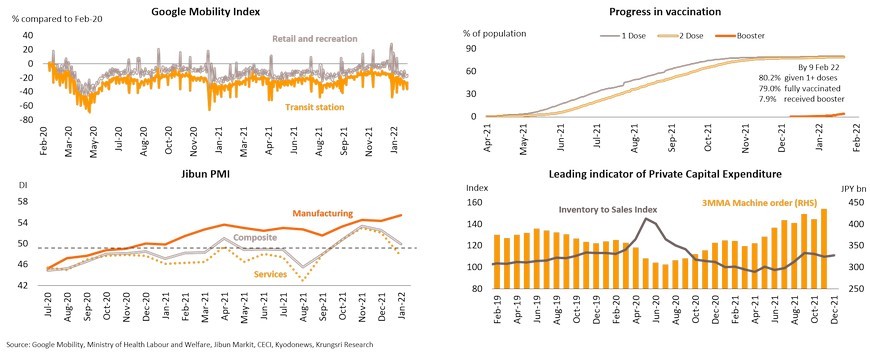

Japan: Services sector has been hurt by Omicron, but resilient manufacturing activity could maintain growth momentum driven by restocking

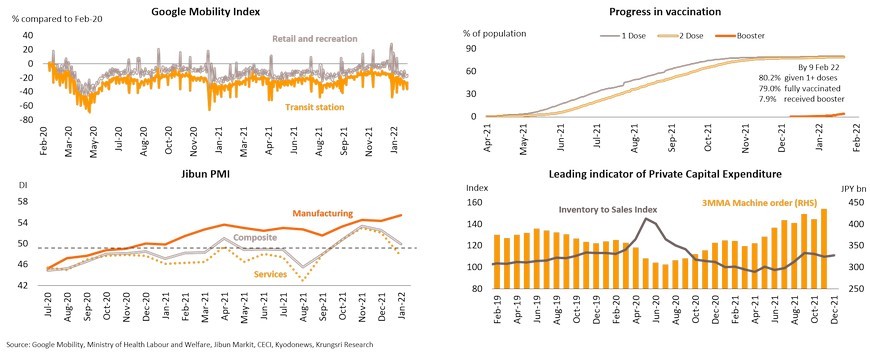

There is a hiccup in recovery due to weaker economic activities since Omicron emerged in January. Daily cases have hit a record high of over 100,000, which prompted the government to reimpose quasi-state of emergency in 35 prefectures which contribute 88.7% of national GDP. The Google Mobility Index has dropped more than during the Delta wave in August – September last year, because the highly-infectious Omicron variant has discouraged activities. In early-February, Japan missed its target to give booster shots to 15 million healthcare workers and the elderly (only 4.4% received booster shot). January Services PMI is at the lowest since August 2021. Nonetheless, the economic impact would be limited because of the following factors: (i) easing supply constraints and rising new export orders as reflected in the 8-year high Manufacturing PMI and record high exports in December with 17.5% YoY growth; and (ii) signs of an upturn in the investment cycle, reflected by stronger machinery orders (reached pre-pandemic levels) coupled with restocking of inventory in response to stronger demand. These positive factors should help to cushion the adverse effects of recent outbreaks and remain the growth driver going forward. Hence, recovery will not be derailed

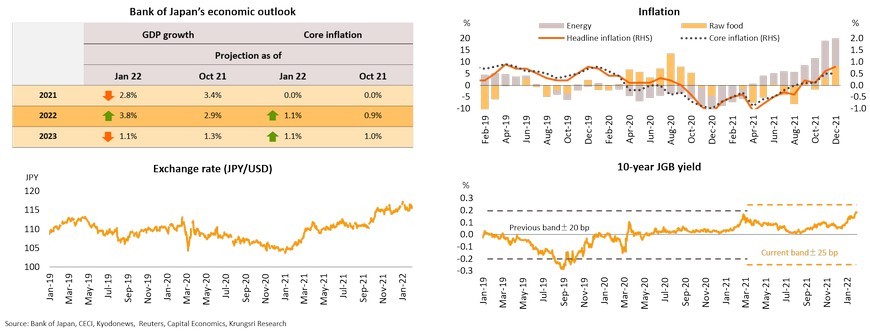

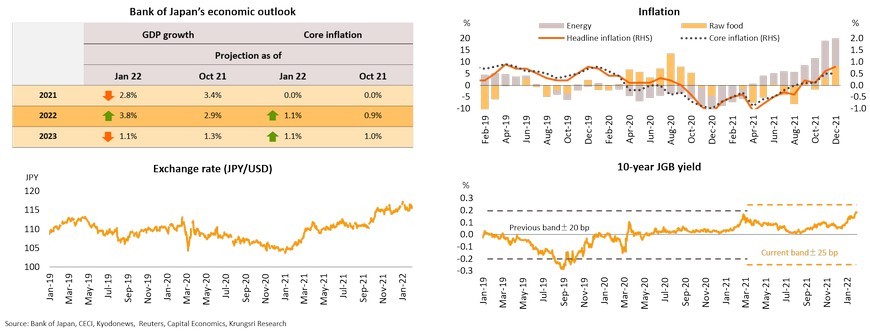

BOJ is slowly exiting its crisis stimulus programs, but still trails major economies; unlikely to raise policy rates until 2023

As the Japanese economy returns to its growth path and there is rising upside risk to inflation, the Bank of Japan (BOJ) has taken a small and cautious step to exit its crisis stimulus programs, supported by the following: First, the BOJ’s January outlook suggests risk of higher inflation and projection of stronger growth, as it had upgraded 2022 GDP growth projection to 3.8% (from 2.9%) and raised 2022 inflation forecast to 1.1% (from 0.9%). In fact, headline inflation had risen to 0.8% in December, the highest since December 2019. And, core inflation has risen for the 4th straight month, suggested rising inflationary pressure. Moreover, the weaker Japanese yen (JPY) would pressure inflation. Second, the BOJ plans to scale back purchases of corporate bonds, commercial papers and Japanese government bonds (JGB); that had pushed up 10-year JGB yield to close to its official ceiling of nearly 0.25%. Nonetheless, the BOJ is still committed to yield curve control (YCC) and would cap movements to within 0.25% of the upper limit. Hence, the BOJ will take small steps to exit crisis stimulus. BOJ governor Kuroda also signaled they would maintain an ultra-loose monetary policy, quoting “we are not thinking at all about raising interest rates or changing the current accommodative policy since the 2% inflation target will not be achievable anytime soon”, as reflected by the BOJ’s projection of only +1.1% core inflation in 2023, far below target. Hence, we expect the BOJ to maintain policy interest rates in 2022 and possibly in 2023.

Thailand: Uneven inflation burden across Thai households

-

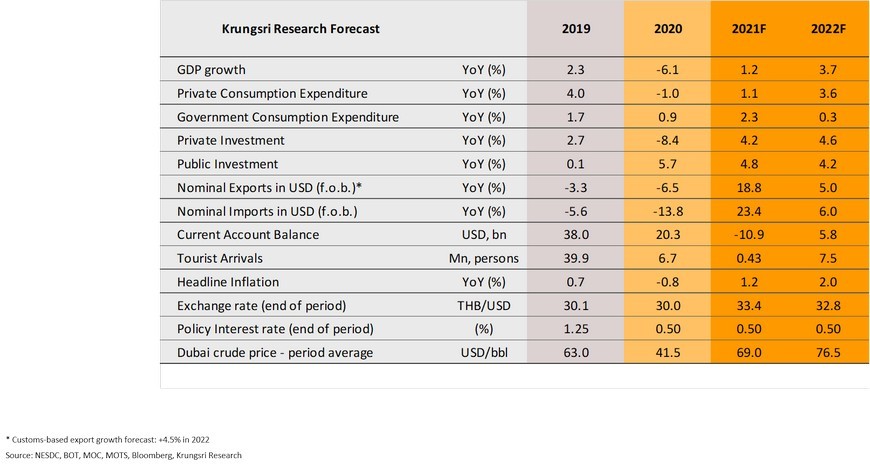

Omicron cases have slowed down since late-January. The Thai economy is slowly returning to the recovery path given easing restrictions, rising vaccination rate, and supportive fiscal and monetary policies. Krungsri Research is keeping 2022 GDP growth forecast at 3.7% but has revised up inflation forecast to 2.0%.

-

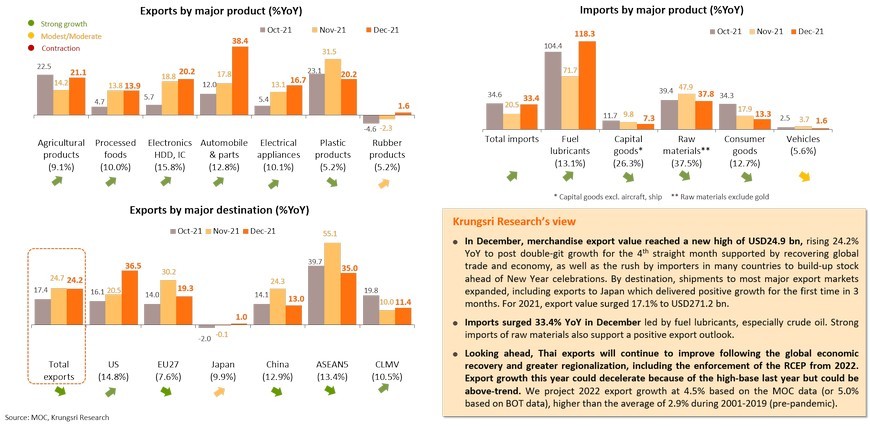

Export sector will be the main driver of the Thai economy, and encourage manufacturing activity and business investment. Inventories-to-sales ratio indicates stronger demand and signs of rising investment.

-

Tourism sector could pick up with the resumption of Test & Go program but would remain far below pre-Covid level.

-

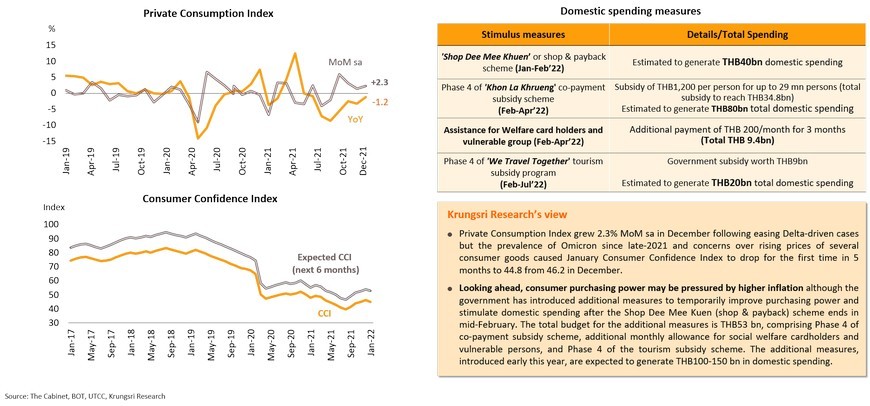

Domestic spending is improving but could see an uneven recovery amid rising inflation.

-

Higher-than-expected inflation has raised concerns over the impact on the Thai economy and household burden.

-

The inflation burden will be uneven across Thai households as low- to medium-income groups would experience higher inflation than the higher-income group because of a different consumption basket and rising food prices.

-

Real wage growth in the lowest-income group this year would be far below that in the highest-income group. That and higher debt burden would reduce their purchasing power and ability to repay debts. This implies policy makers should not raise interest rates this year as that would increase the burden on households and make the low-income group more vulnerable.

-

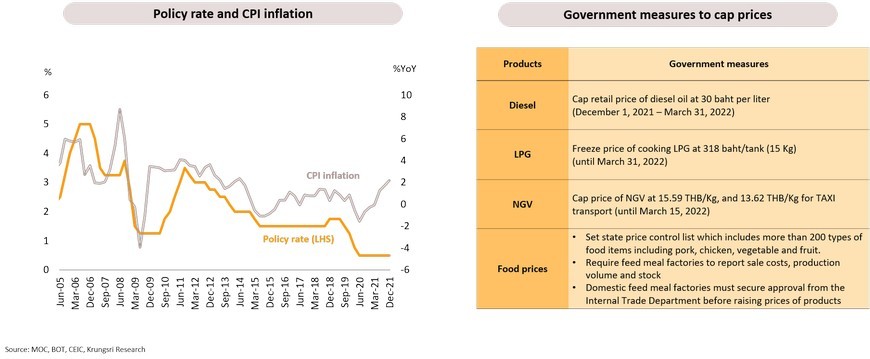

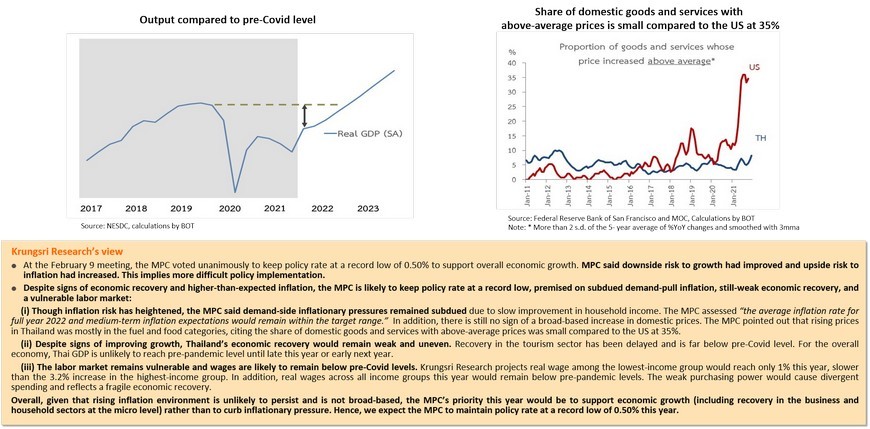

Despite signs of economic recovery and higher-than-expected inflation, the MPC is likely to keep policy rate at a record low this year, premised on subdued demand-pull inflation, still-weak economic recovery, and a vulnerable labor market.

Krungsri Research forecasts 2021-2022

Export sector is the main driver of economic growth; December export value reached a new high with broad-based expansion in products and markets

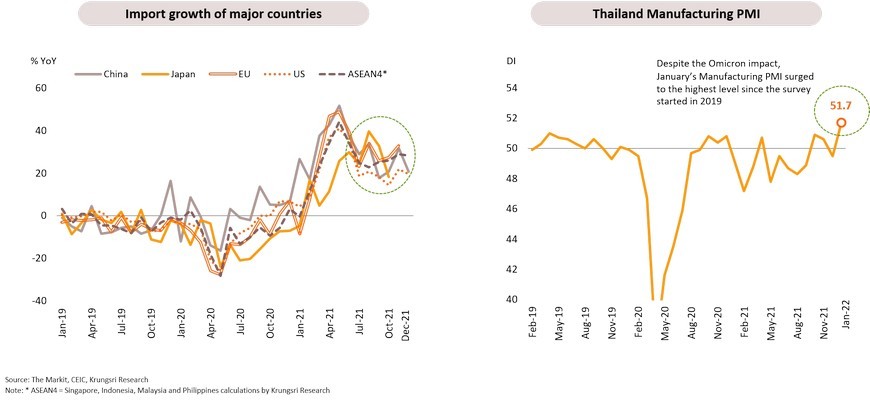

Rising demand from Thailand’s key trading partners would encourage export sector and manufacturing production; January Manufacturing PMI surged despite tighter restrictions

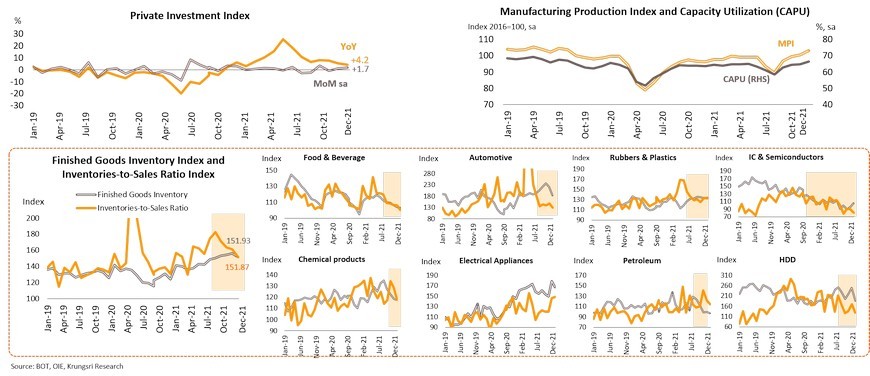

Private investment should improve further; stronger external and domestic demand would lead to business restocking

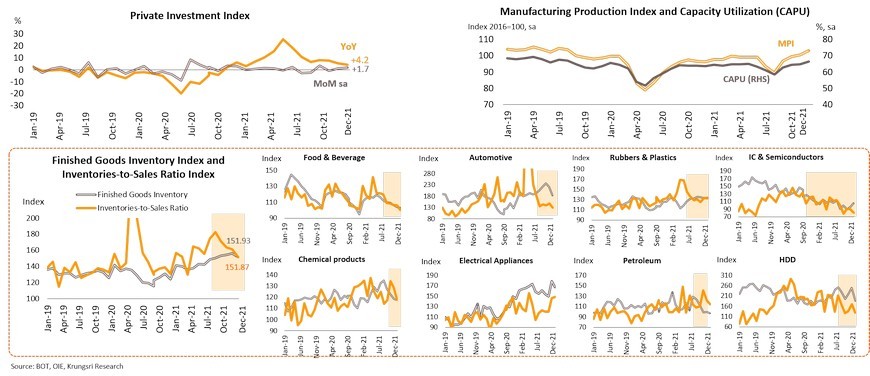

Private Investment Index (PII) expanded by 4.2% YoY (or 1.7% MoM sa) in December driven by stronger external demand and recovering domestic demand. Thai Manufacturing Production Index (MPI) and Capacity Utilization continued to recover to pre-pandemic levels in December. In addition, Inventory-to-Sales Ratio Index is falling, reflecting shipments (external and domestic demand) grew faster than inventories in most industries including food & beverage, automotive, IC & semiconductor, chemical products, petroleum and HDD. The recovering demand and low inventories would encourage businesses to increase production and investment in the foreseeable future.

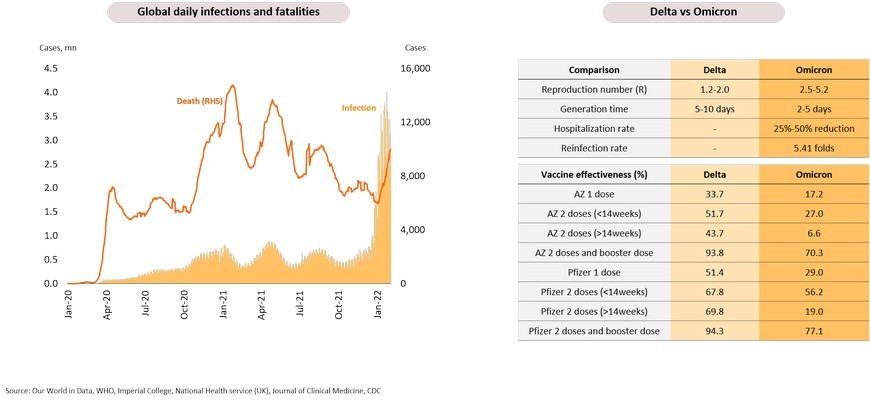

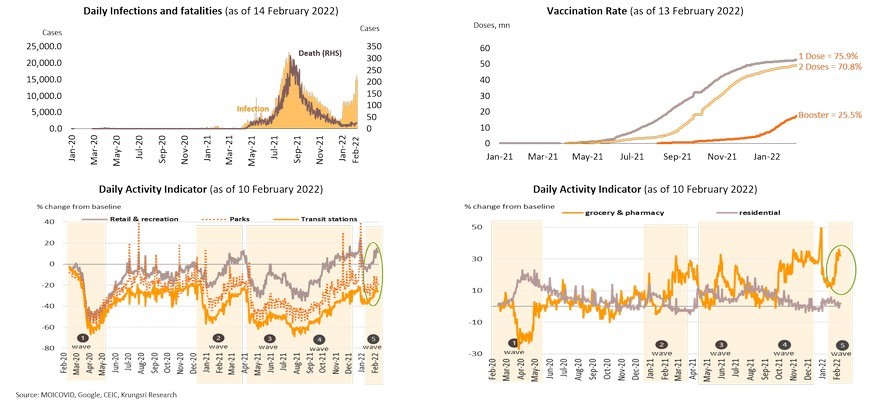

Omicron pushes daily cases to new highs worldwide

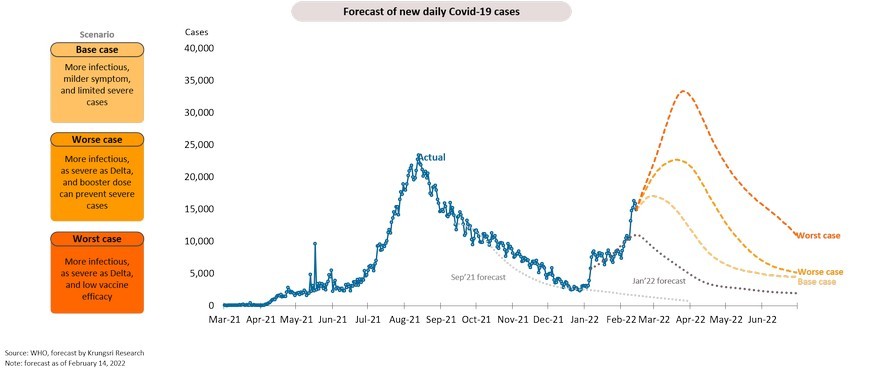

Daily Covid-19 cases in Thailand would reach 17,000 under base case and above 33,000 under worst- case scenario

Our base case assumes daily new detected cases would peak by the end of February at 17,000. Total cases in the first half of 2022 could reach 1.6 million. In the worst-case scenario, daily cases would reach 33,000.

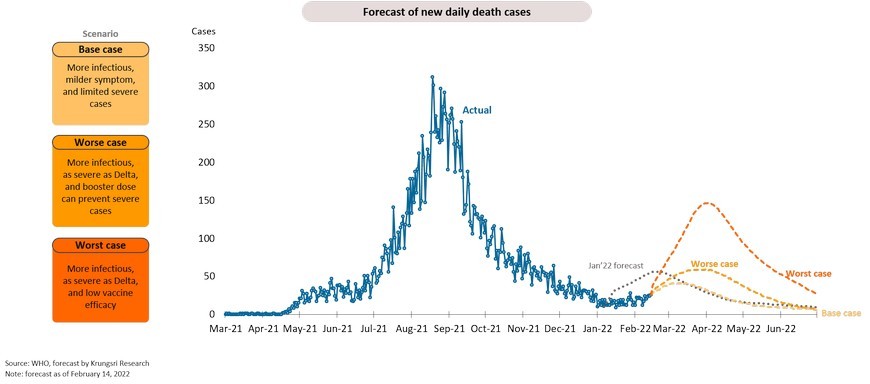

Daily fatalities would peak at 40 under base case and reach 150 under worst-case scenario

Our base case assumes fatality rate would be 0.2% with fatalities peaking at 40 a day by the second week of March. The low fatality rate and fewer severe cases would leave room for authorities to continue to ease Covid-19 containment measures. Under worst-case scenario, daily fatalities could reach 150 cases.

Easing restrictions amid low fatality rate and rising vaccination rate should support the tourism sector and domestic spending

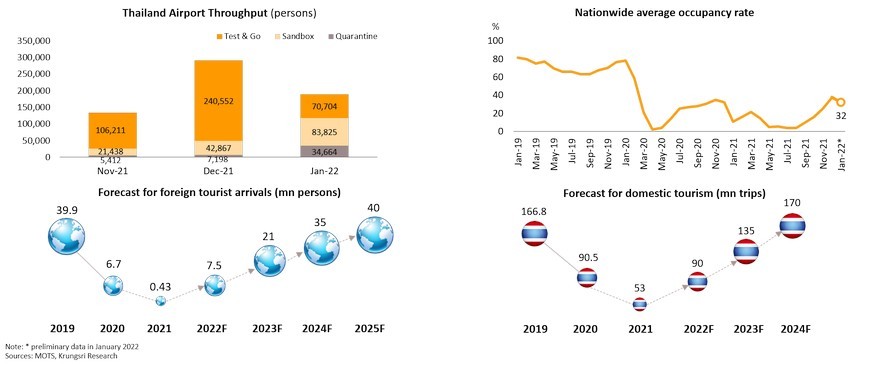

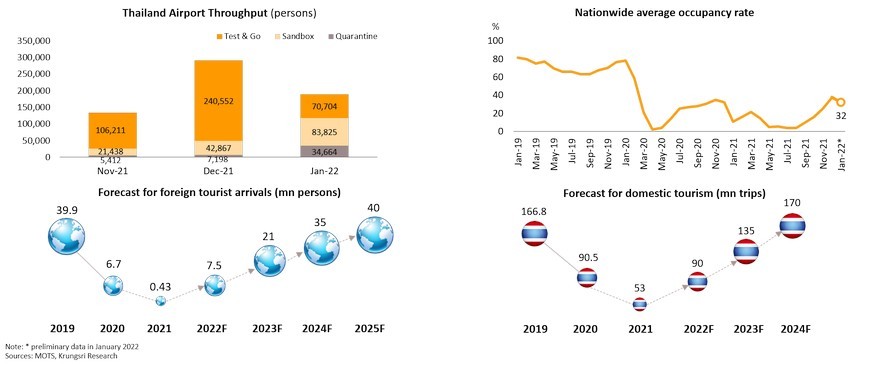

Tourism sector could recover amid resumption of Test & Go program and stimulus package but inbound tourism would remain weak given strict restrictions in home countries

- In January, 189,193 travelers entered Thailand via airports, down from 290,617 in December, following a surge in daily Covid-19 cases since late-2021 and the suspension of the Test & Go program during 4-31 January 2022. However, reports of mild Omicron symptoms and low fatality rate prompted the government to resume the Test & Go program on February 1. This could be a tailwind to attract foreign tourists. However, major countries, especially China, still have strict restrictions for inbound travelers, such as a long quarantine period. Therefore, foreign tourist arrivals in Thailand would increase at snail pace in 1H 2022.

- Domestic tourism slowed down in January and occupancy rate is expected to drop to 32% from 37% in December. However, we project domestic tourism would increase to 90 mn trips in 2022 (from 53 mn trips in 2021), supported by easing containment measures, mass vaccination program, and government incentives to boost domestic tourism, including Phase 4 of ‘We travel together’ program (THB9 bn budget, effective February-July 2022), ‘Tour Tiew Thai’ campaign (THB1 bn) which has been extended to May 2022 (originally scheduled to expire in February).

Domestic spending will improve driven by reopening and stimulus measures, but purchasing power may be pressured by higher inflation

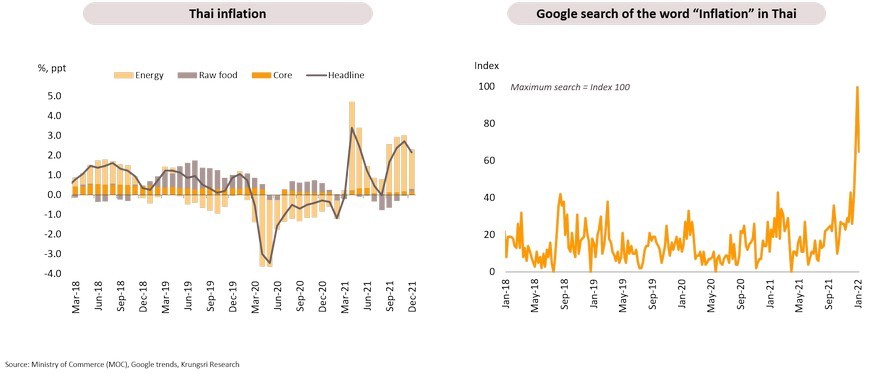

Headline inflation has exceeded 2% since late-2021, leading to rising social concerns over cost of living

Inflation rate has picked up since late-2021 as recovering global demand and supply constraints have driven oil and food prices to their highest in several years. Thai inflation had risen to 2% YoY in 4Q21, the surge mainly attributed to cost-push factors including rising prices of imported raw material and relatively high oil prices. Meanwhile in Thailand, there has been a surge in google search activity involving the word “inflation” in Thai (เงินเฟ้อ) to the highest level since 2008, reflecting greater inflation concerns.

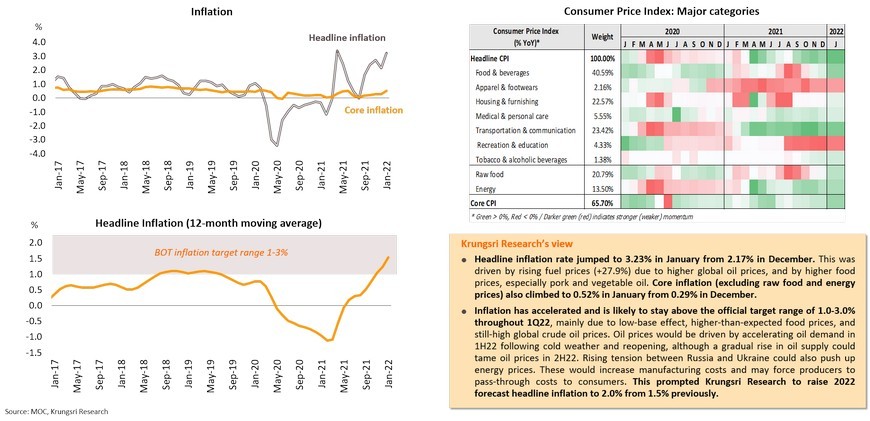

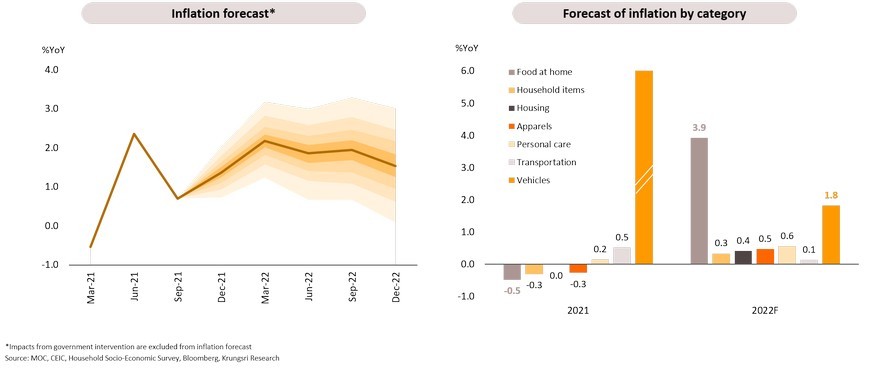

Krungsri Research raised 2022 inflation forecast to 2% mainly on higher-than-expected energy and food prices; monthly inflation could rise above BOT’s target in 1Q

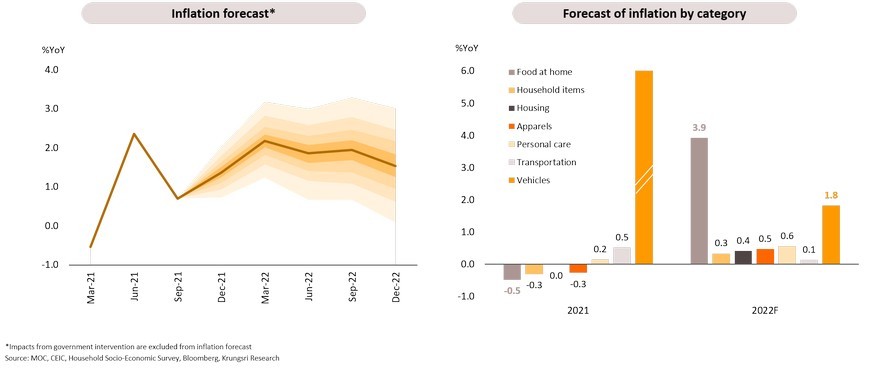

Major contributors to inflation this year would be prices of food-at-home and vehicles

Inflationary pressure in Thailand would increase in 2022, particularly in the first half of the year. Headline inflation could hit 4% in some months and would average 2% this year. Sub-indices of the Consumer Price Index (CPI) show the largest surge in inflation in food-at-home, vehicles, and personal care, respectively. These sectors are directly related to households’ daily activities, but the impacts might be different on each income group.

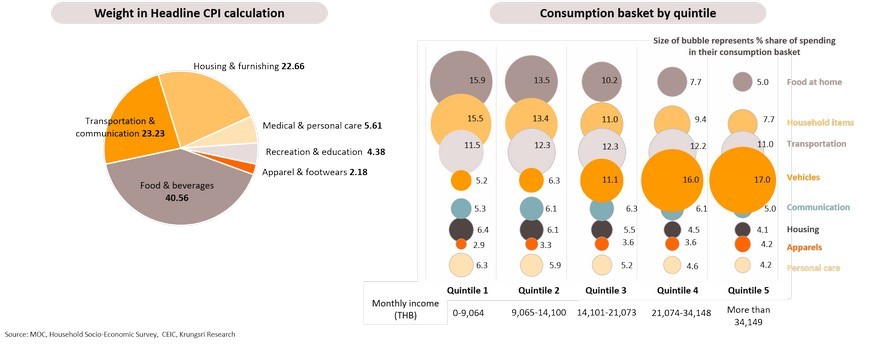

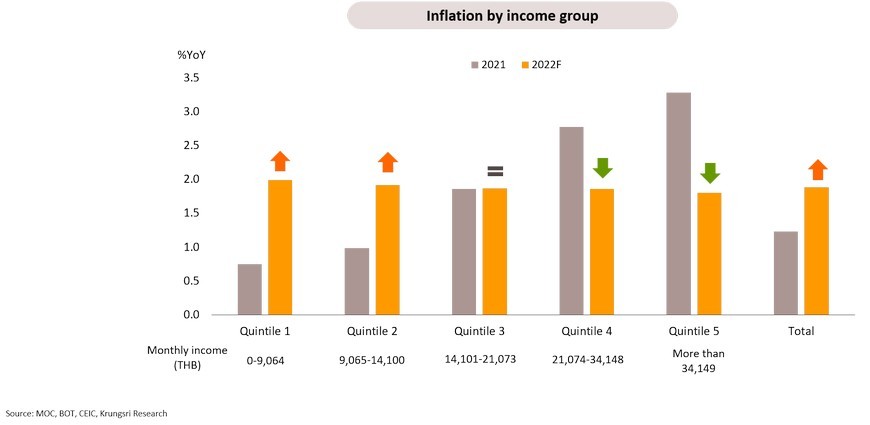

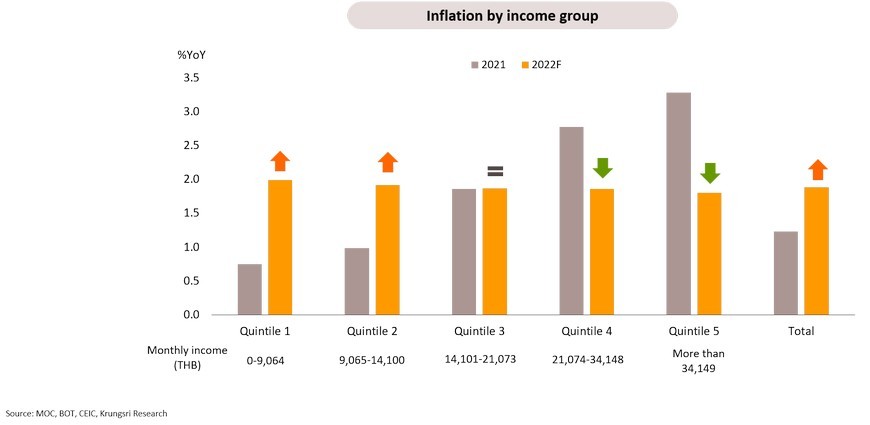

Different consumption baskets indicate uneven inflation burden across households; low-income group would be worst-hit by rising food prices

Even though headline inflation would remain within the Bank of Thailand’s target, households could face higher cost of living due to different weightings in their consumption baskets. To analyze consumption expenditure by category, we classified households into 5 quintiles based on income level. We found the largest expenditure category for the lowest-income group was food-at-home (15.9% of their total spending), followed by household items (15.5%) and transportation (11.5%). In contrast, the highest-income group’s spending was led by vehicles (17.0%) while spending on food-at-home was only 5.0% in their consumption basket. This suggests the low- to medium-income groups would be worst-hit by rising inflation this year, because of rising food prices.

Lower-income group would bear larger inflation burden this year, smaller for higher-income group

Based on the different consumption baskets, Krungsri Research forecasts inflation rate among the lowest income group (Quintile 1) would increase to 2.0% in 2022 from 0.7% in 2021 due to rising food price since late-2021. In contrast, inflation among the highest-income group (Quintile 5) could decline to 1.8% compared to 3.2% in 2021, as vehicle and oil prices might stabilize this year. Hence, households would face uneven inflation impact with the low-income group having to bear a larger inflation burden than the high-income group.

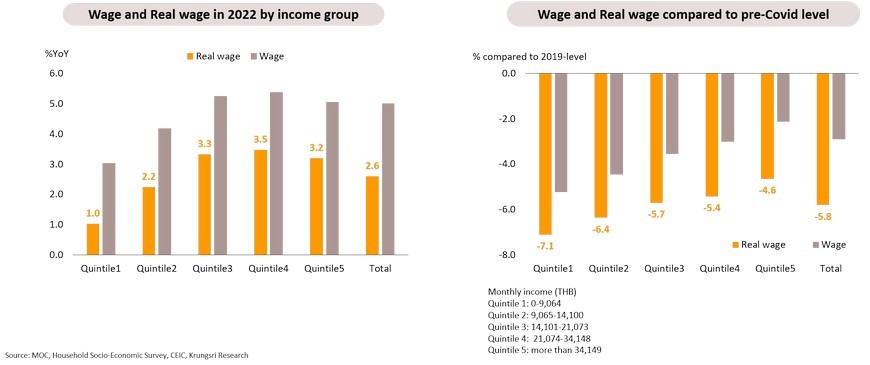

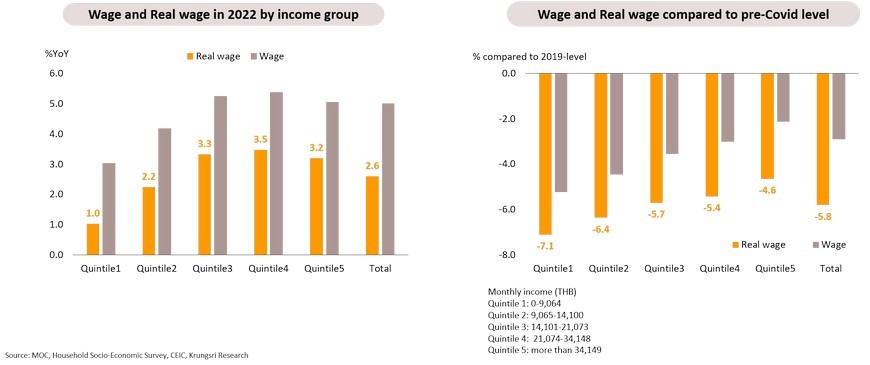

Real wage growth in the poorest group would be 3 times lower than in the wealthiest group; wages across income groups to stay below pre-crisis levels

Krungsri Research analyzed real wage (wage adjusted for inflation) across households to gauge their respective purchasing power for goods and services. The conclusion is that real wage growth in all income groups are lower than nominal wage growth. Real wage in the lowest-income group could rise by only 1% YoY compared to 3.2% in the highest-income group. Furthermore, real wage across households would remain lower than pre-Covid levels and that for the lowest-income group would be 7.1% below pre-Covid level. This implies weaker purchasing power especially in the poorer group, caused by not only lower nominal income but also higher inflation and a different consumption basket.

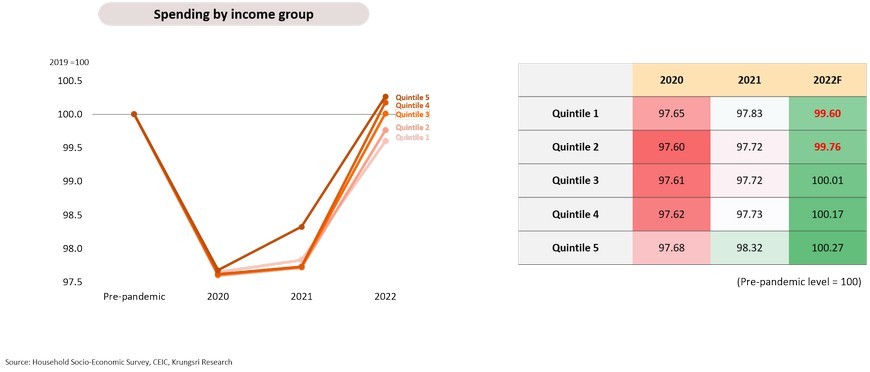

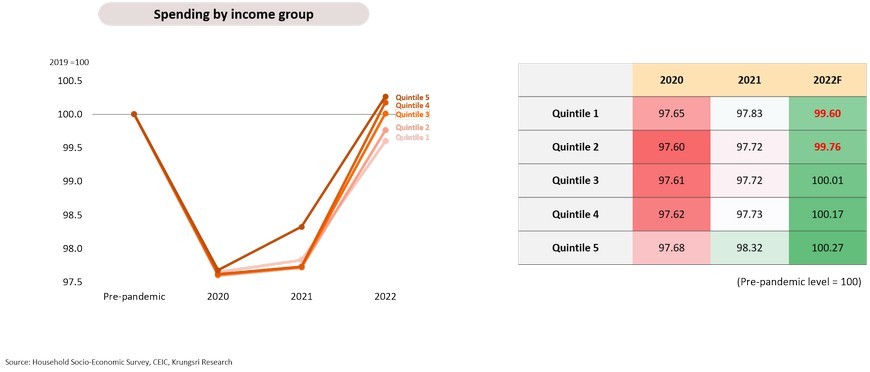

Uneven changes in purchasing power lead to divergent spending and reflect vulnerable economic recovery

Uneven wage recovery could lead to divergent recovery in consumption by each income group. Household spending is estimated to have dropped by 2.5% at the worst of the crisis. However, wealthier groups will recover faster. In 2022, spending by the top three wealthiest groups is expected to exceed pre-pandemic levels. Consumption by the poorest group would be 0.4% below pre-Covid level. Given that the majority of the Thai population is still struggling with low purchasing power, economic recovery could remain vulnerable.

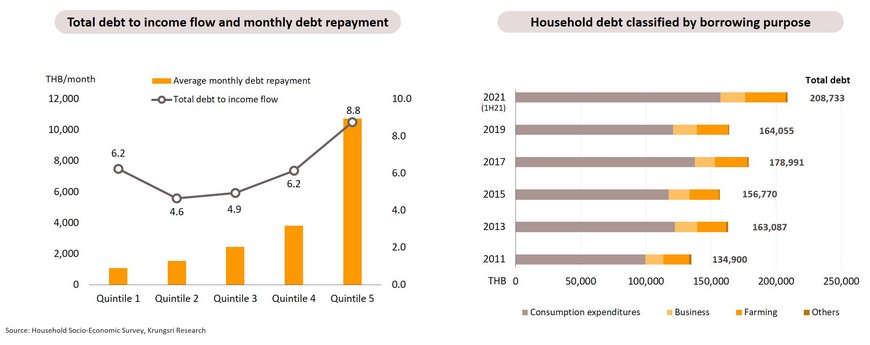

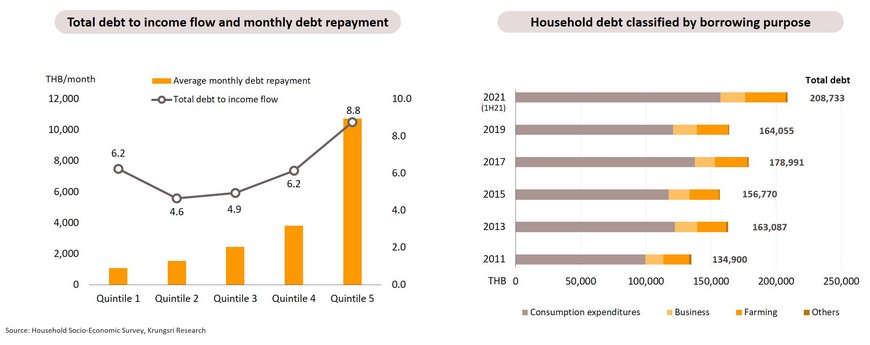

Still-low wages and higher debt level might increase burden on households to repay debt

Thailand’s average household debt (outstanding accounts) is about 6 times of total disposable income in 2017 (Debt Service Ratio: DSR). In the past few years, average household debt has risen rapidly to a new high of THB200k per household, largely driven by debt for consumption expenditures. This could elevate household risks as the Debt Service Ratio could rise further, as larger household debt would increase repayment burden on households. Coupled with miserable wages triggered by the pandemic, households would have weaker ability to repay debt which could lead to a spike in default risk.

Interest rate hikes would increase household expenditure, make the lowest-income group more vulnerable; price controls remain essential

Given a fragile economic recovery, a hike in policy interest rate to curb rising prices would be inappropriate. Higher interest rates could increase households’ borrowing costs, limit spending, and increase debt repayments, the last having the largest impact on households with large debts. These would make the lowest-income group more vulnerable. Hence, it remains essential for the government to control prices in the food and energy sectors to mitigate these impacts and help to reduce household expenses, especially for the poorest group.

Fragile economic recovery and low demand-pull inflation suggest the MPC would maintain policy rates at least until end-2022