Global: Timing of monetary policy transition

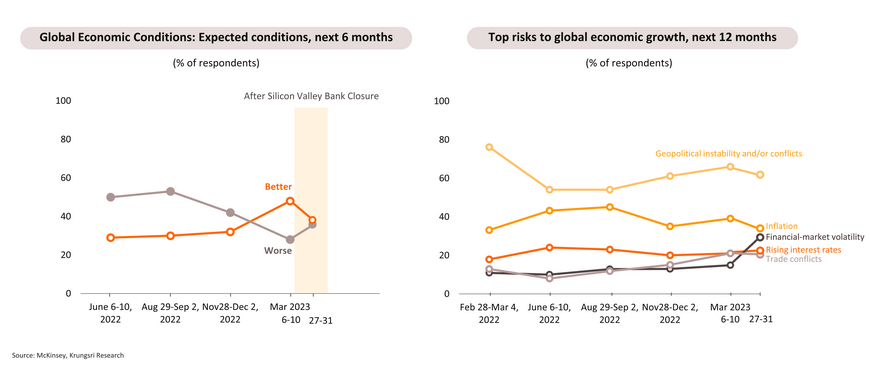

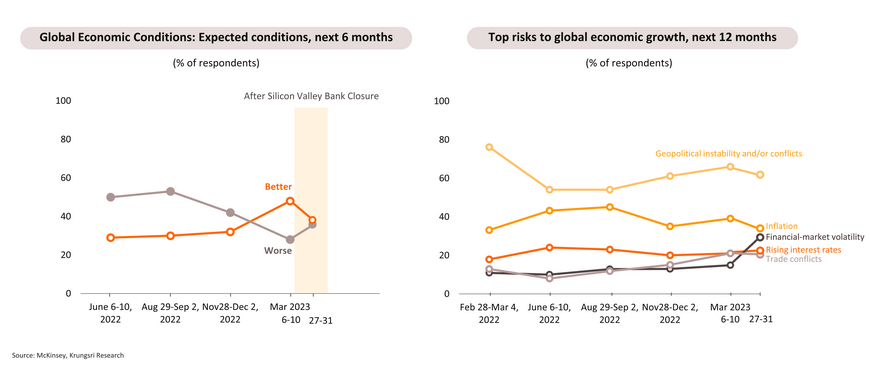

Sentiment towards global economic prospects is weaker than in early March; rising concerns about market volatility

In early March, respondents of a McKinsey survey on the global economy survey were more positive than in the past few quarters, with 45% expecting global conditions to improve in the months ahead and only 28% predicting conditions would worsen. But by the end of March, that optimism had tempered and there was rising concerns over increasing volatility in financial markets. Respondents were twice as likely (31%) to cite market volatility as a top global risk than in early-March (15%), and continued to cite inflation and geopolitical instability as the top threats to global growth.

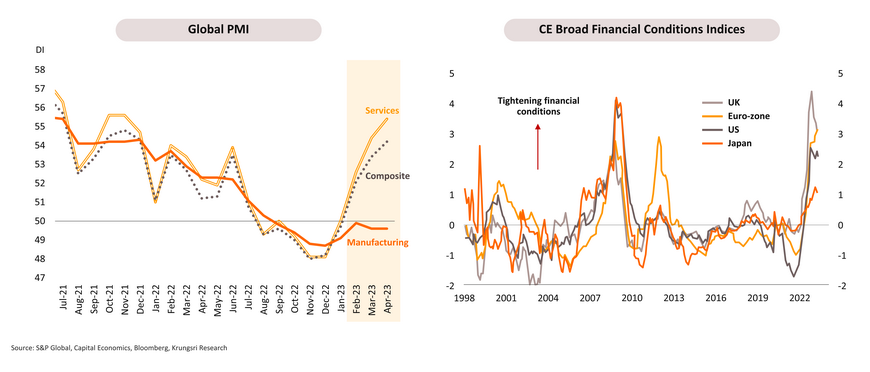

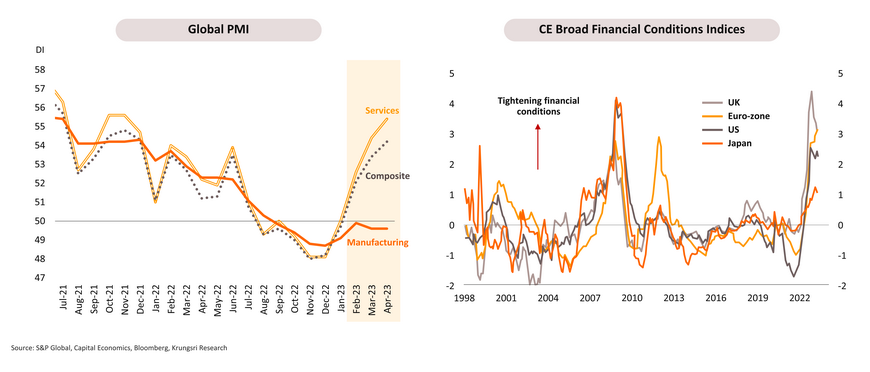

Diverging global demand trends as manufacturing activity continues to contract; global financial conditions are tighter than during the Global Financial Crisis

The global economy saw a divergence between manufacturing and services sectors. Manufacturing PMI remains in contraction zone, suggesting the current growth in manufacturing output might not be sustainable. If the services sector starts to run out of steam, the global expansion may be at risk of reversing its course. In addition, conditions for raising new financing are much tighter than before. Capital Economics (CE)’s Broad Financial Conditions Index (FCI) for developed market were close to their highest since the Global Financial Crisis (GFC) in April. Tightening financial conditions over the past 18 months has been mainly driven by a surge in borrowing costs (rather than normalization of stress measures such as spreads and banks’ appetite to lend).

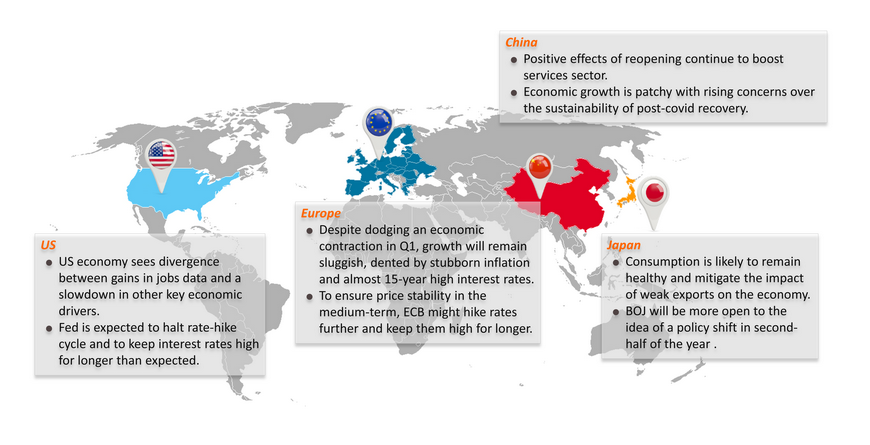

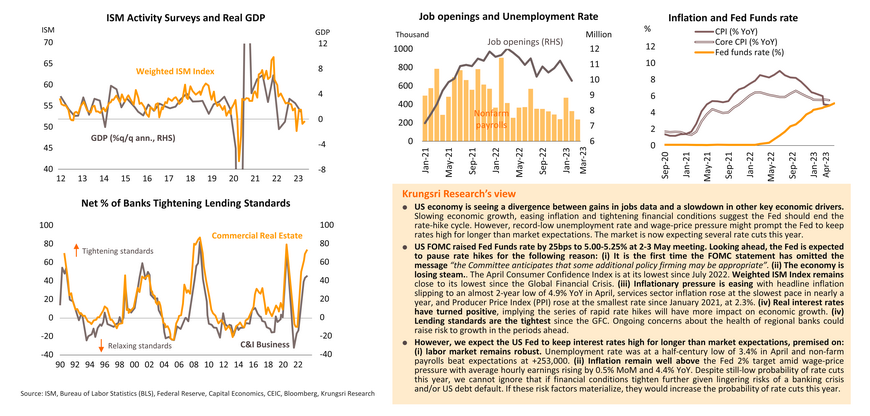

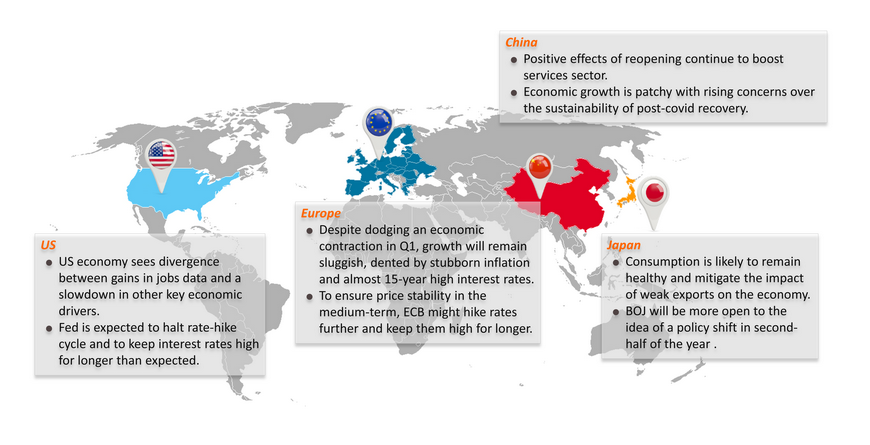

US: Divergence between robust jobs data and signs of weaker growth; Fed might halt rate-hike cycle and keep interest rates high for longer than market expectations

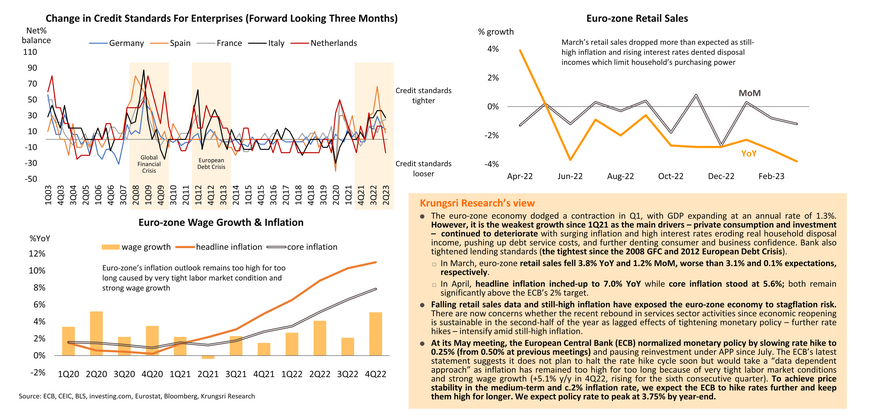

Euro-zone: Despite dodging an economic contraction in Q1, growth will remain sluggish, dented by stubborn inflation and almost 15-year high interest rates

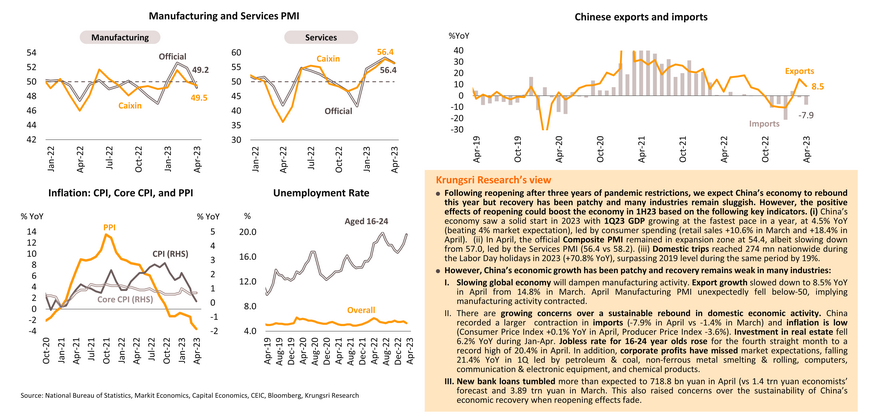

China: Positive effects of reopening continue to boost services sector; economic growth is patchy with rising concerns over the sustainability of post-covid recovery

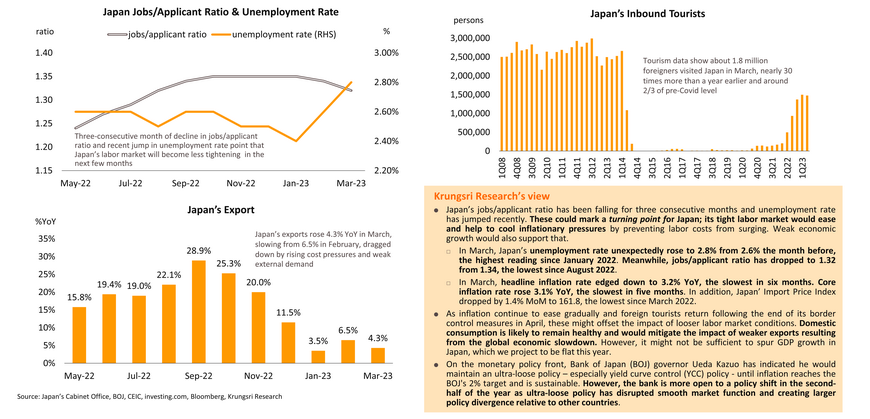

Japan: Inflation is close to peaking amid signs of less tight labor market; overall growth is expected to be flat this year

Thailand: Timing of political and policy transition

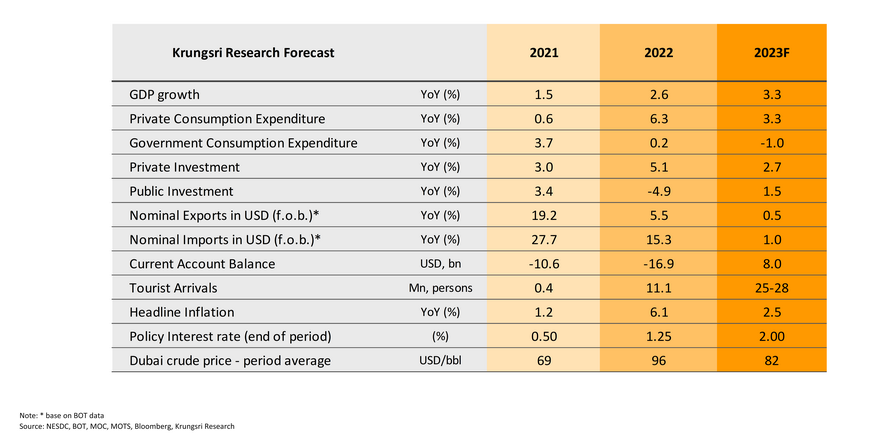

Krungsri Research Forecasts for 2023

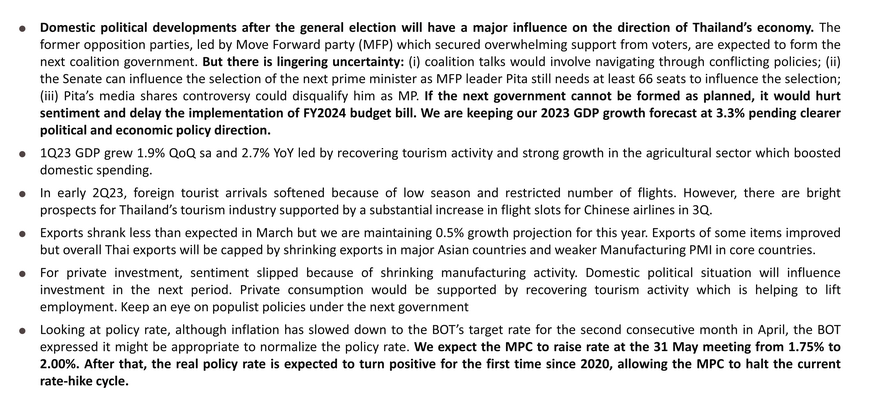

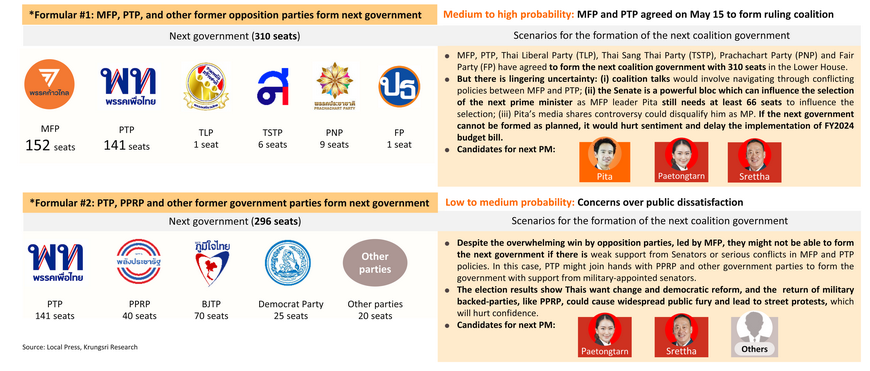

Thailand’s 2023 general election delivered political transition with a strong victory for opposition parties but there is uncertainty over coalition talks

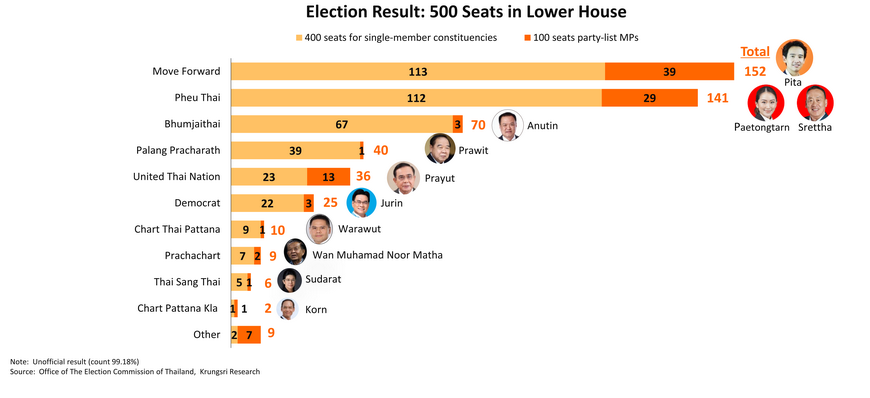

With over 99% of votes counted, the Move Forward Party has won the general election with 113 constituency MP seats and 39 part-list seats, outperforming expectations and polls. It also took 32 of 33 constituency seats in the capital, Bangkok. Move Forward will be the core party to form the next government. Addressing reporters on May 15, Move Forward leader Pita Limjaroenrat said he has reached out to four former opposition parties and one new party to form a coalition government with 310 combined seats in the Lower House, comprising Pheu Thai Party (141 seats), Prachachart Party (9), Thai Sang Thai Party (6), Thai Liberal Party (1) and Fair Party (1). However, coalition talks would take time and the road would be rocky ahead.

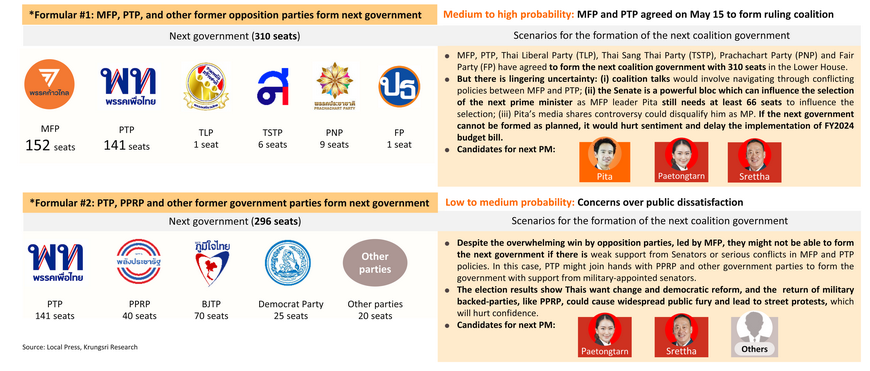

Move Forward and other former opposition parties agree to form next coalition government but the road ahead could be rocky

We summarize two scenarios for the next coalition government. With 99% of votes counted by May 15, Move Forward Party (MFP) and Pheu Thai Party (PTP) are the unofficial winners with 293 seats in the 500-seat Lower House; while Palang Pracharath Party (PPRP) and United Thai Nation Party (UNTP), the former government parties, won about 76 seats in total. However, there is lingering uncertainty over whether the pro-democratic parties would be able to form the next government because parliamentary rules require the 250 members of a military-appointed Senate to vote on the Prime Minister appointment.

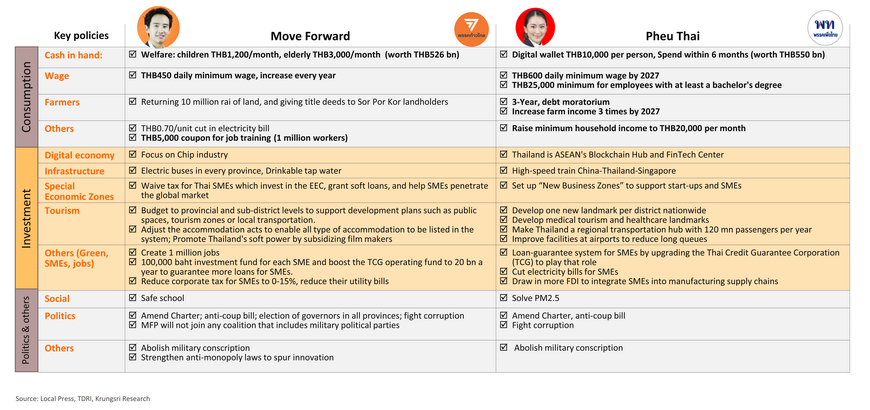

The two main political parties expected to form the next coalition government are focusing on boosting domestic spending, which could raise fiscal burden

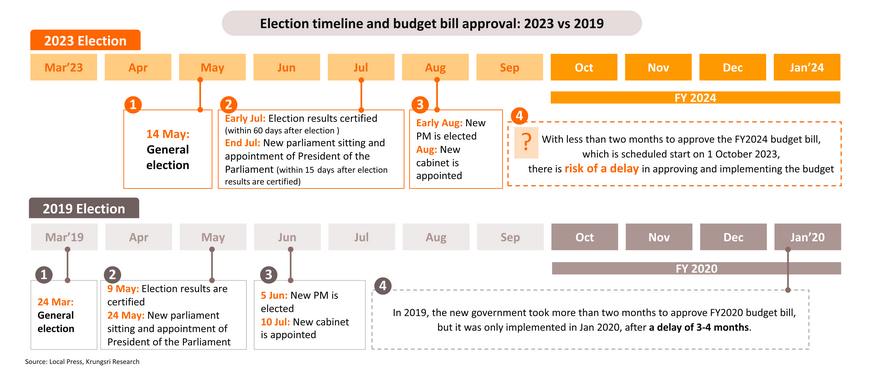

2023 General Election timeline: Next government expected to be formed by August, which means there could be delays in approving and implementing FY2024 budget bill

That is less than two months before the 2024 fiscal year (starting October 1, 2023). So, there is risk of a delay in approving and implementing the FY2024 budget bill. In the 2019 election, the government was formed in early July but the FY2020 budget bill (which should start on October 1, 2019) was delayed by 3-4 months and only approved in January 2020.

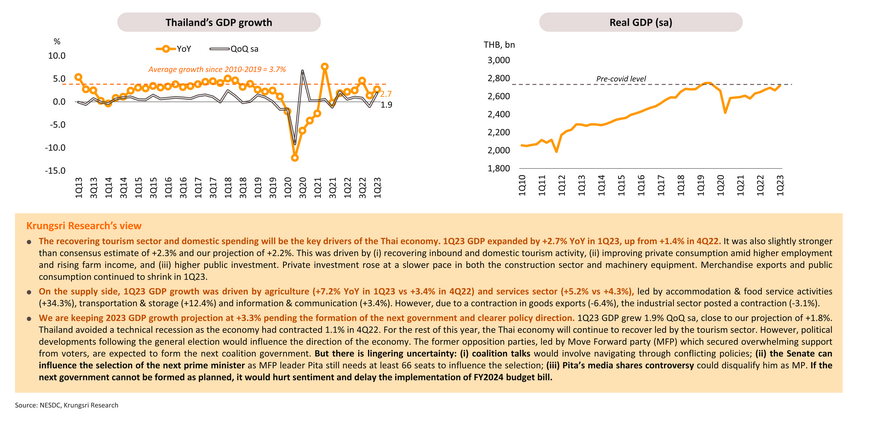

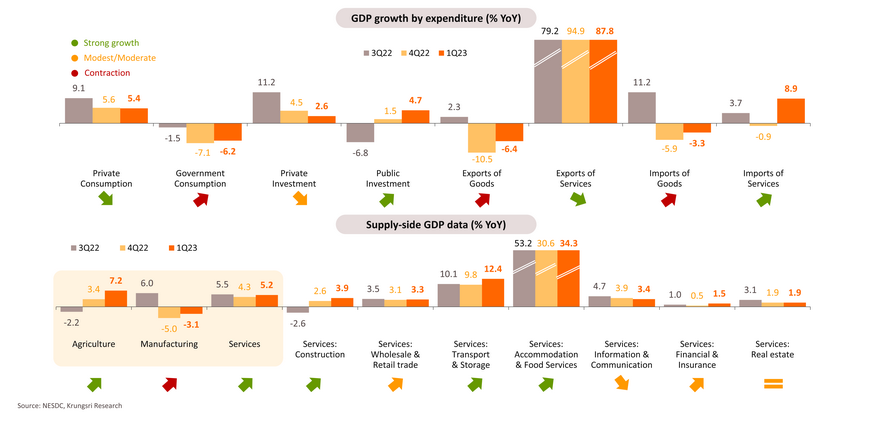

1Q23 GDP grew 1.9% QoQ sa and 2.7% YoY driven by recovering tourism activity and strong agricultural sector which boosted domestic spending

Strong recovery in tourism and private consumption supported 1Q GDP growth; agriculture and services sectors continued to expand but manufacturing shrank again amid weak exports

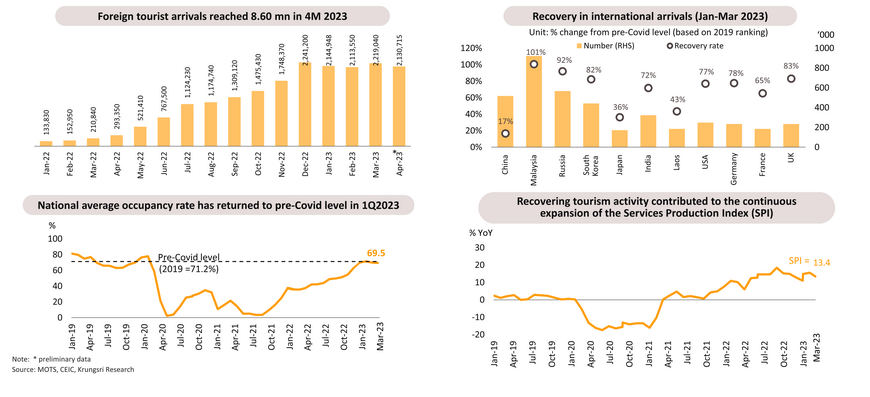

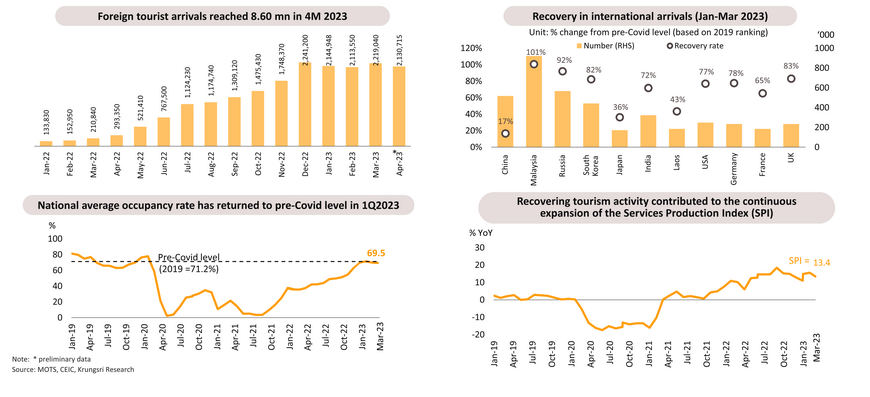

Tourism sector: Foreign tourist arrivals softened in early 2Q23 because of low season and restricted number of flights

Preliminary data from the Tourism Authority of Thailand show the country welcomed 2.13mn foreign tourists in April, down from 2.22 mn in March. In the first four months of this year, tourist arrivals reached 8.60mn or 61% of pre-Covid level (2019). They generated THB353 bn receipts (53% of pre-Covid level). In the first quarter of 2023, arrivals from Malaysia, Russia, South Korea, and the UK had reached 80-100% of pre-pandemic levels. Chinese tourists are returning slowly (preliminary TAT data shows 843,920 Chinese tourists visited Thailand in the first four months, or 21% of pre-Covid level) but that would rise in 2H23 as the Civil Aviation Authority of Thailand (CAAT) will increase flight slots for Chinese airlines from 152 weekly flights to 327 in June, 450 in July, and 452 in September.

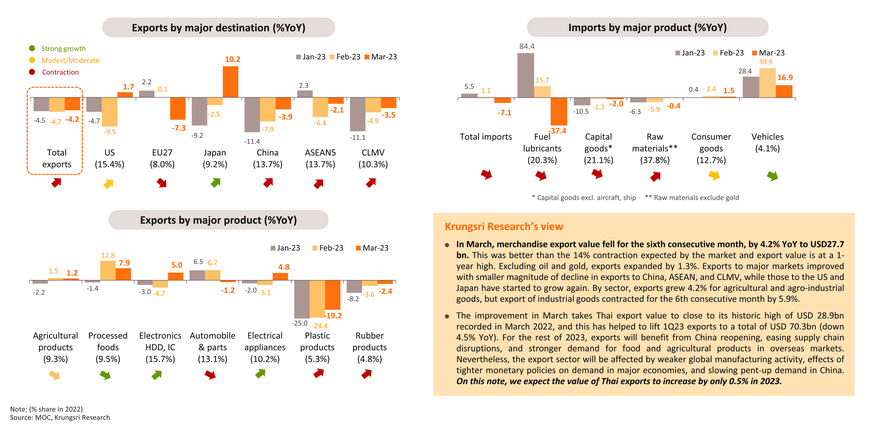

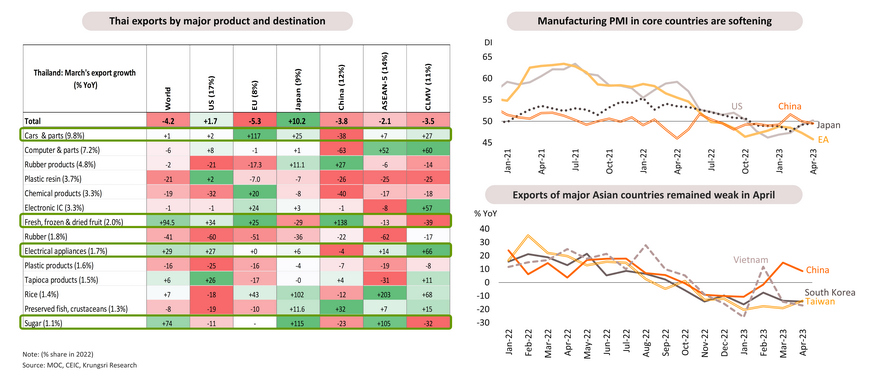

Exports shrank less than expected in March, we maintain 0.5% growth for this year

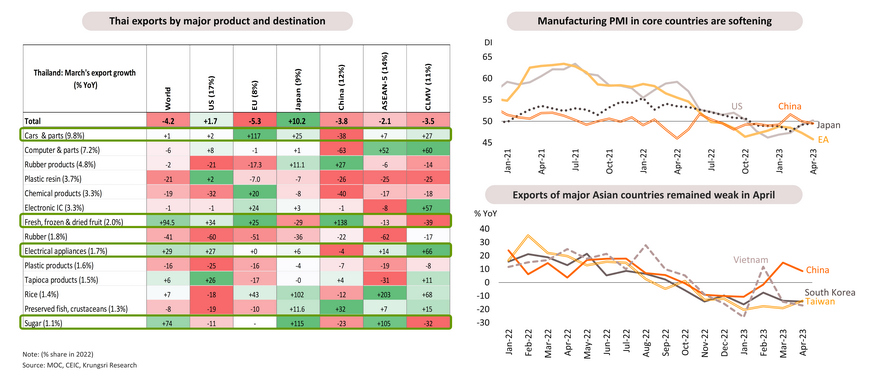

Export of some items improved but overall exports will be capped by shrinking exports in major Asian countries and weaker Manufacturing PMI in core countries

Easing global supply chain disruption and China’s reopening have helped to boost some the export of some products such as cars & parts, electrical appliances and fresh, frozen & dried fruit. Looking ahead, there are discouraging signs with major Asian countries registering shrinking exports and weakening Manufacturing PMI in core countries.

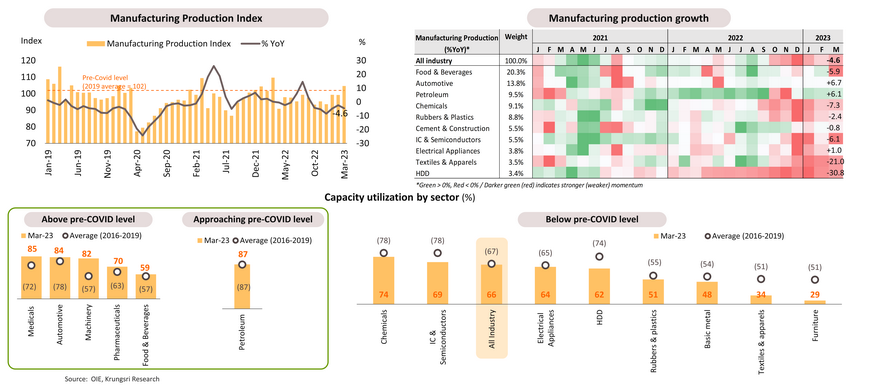

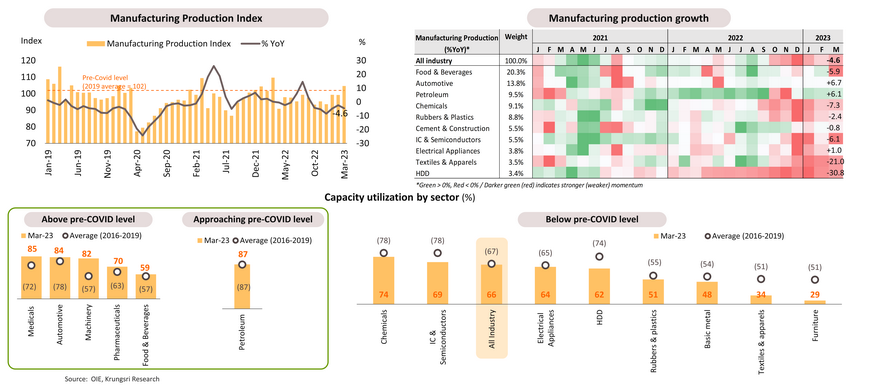

Manufacturing production was affected by weak export sector but got a boost from recovering domestic demand and tourism activity

The Manufacturing Production Index fell for the 6th straight month in March, by 4.6% YoY. Despite being hurt by weak exports, there are tailwinds from recovering tourism activity and expanding domestic demand; these helped to bolster some industries such as food & beverage, petroleum and automotive. Overall capacity utilization remained below pre-pandemic level but there are some industries which capacity utilization has returned to pre-COVID level. Looking ahead, Krungsri Research expects general election activities and recovering tourism activity to support manufacturing in some industries.

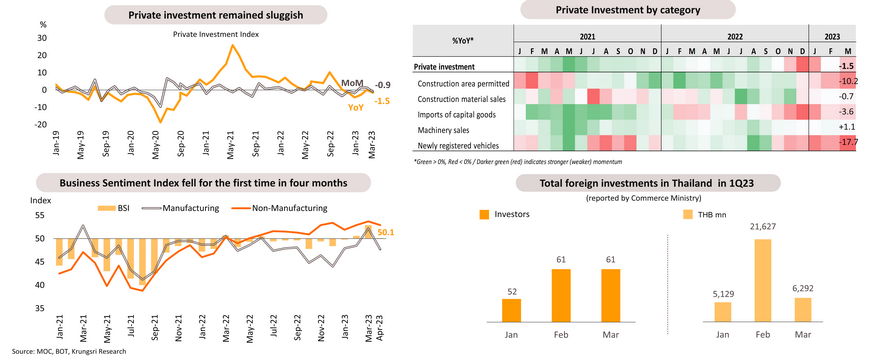

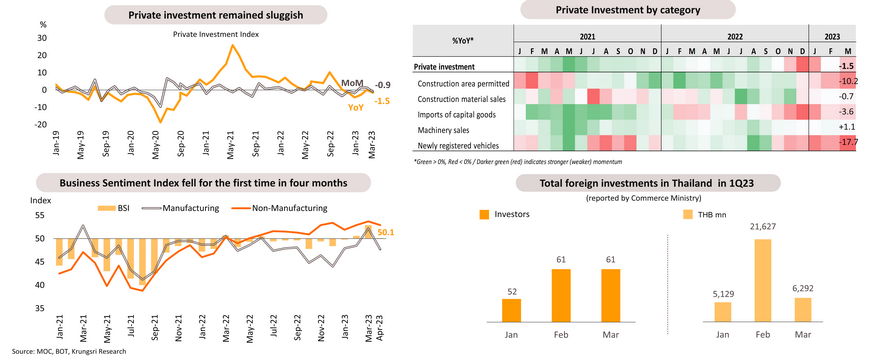

Private investment: Sentiment slipped because of shrinking manufacturing activity; domestic political situation will influence investment in the next period

Private Investment Index turned to contract 1.5% YoY and 0.9% MoM in March. Weaker business sentiment in the manufacturing sector pushed down business sentiment index to 50.1 in April from 52.9 in March, amid concerns exports would be hurt by slowdown in trading partners’ economies. Nonetheless, there are lingering tailwinds, as evidenced by the Ministry of Commerce’s report which revealed Thailand had approved 174 investment projects by overseas investors in 1Q23 (+19% YoY) with a combined value of THB 33,048mn (+25%), mainly from Japan, China and Singapore. The BOI announced that Changan Auto, China’s 4th biggest auto manufacturer, plans to establish an EV production facility in Thailand with an investment of THB 9,800mn. Looking ahead, the political situation and economic policy direction could have significant impact on business confidence and investment in the next period.

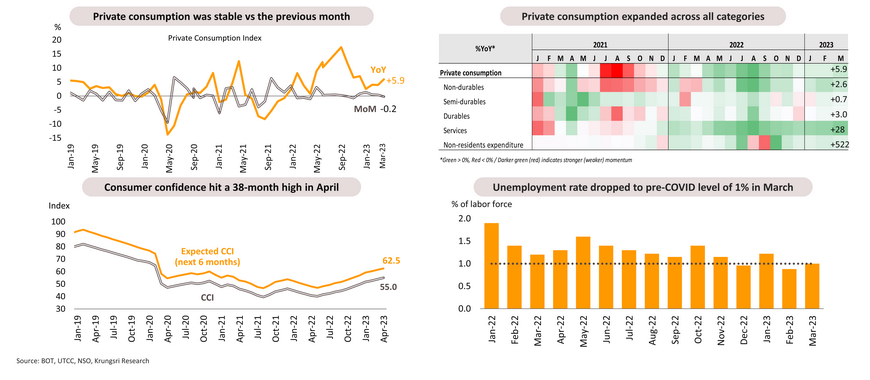

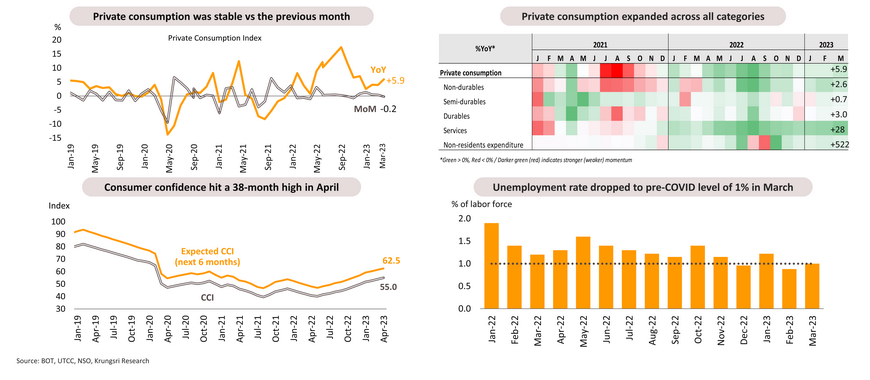

Private consumption was supported by recovering tourism activity, which helped to lift employment; keep an eye on populist policies under the next government

Private Consumption Index rose 5.9% YoY in March and there was improvement in all categories driven by recovering tourism activity, rising employment in the services sector which reduced unemployment rate to pre-pandemic level, improving confidence, and the May general election. In addition, stimulus measures under the next government are expected to boost consumer sentiment and domestic consumption. However, rising interest rates and high household debt might cap consumption growth.

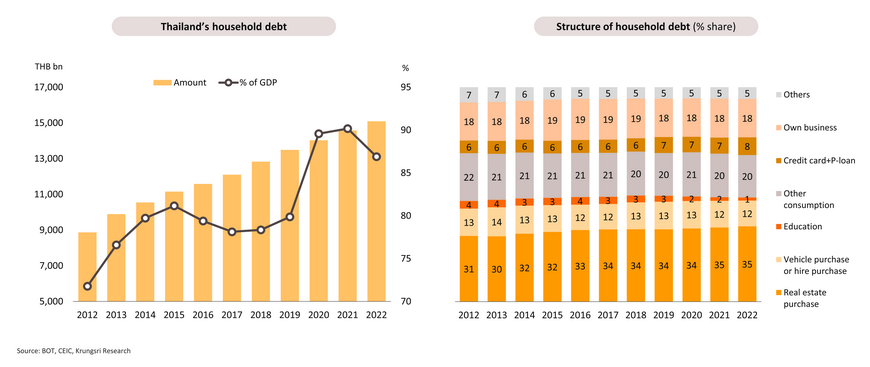

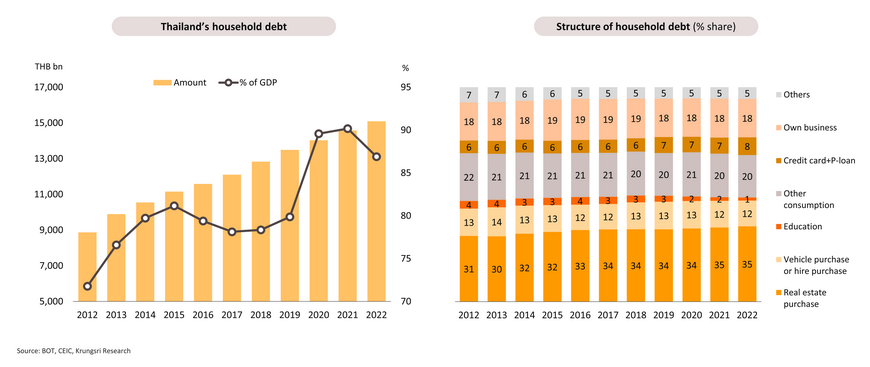

Household debt remains high at 87% of GDP and several household segments remain fragile

Household debt reached THB15.1 trn at end-2022, representing 86.9% of GDP (vs THB14.6 trn or 90.2% of GDP at end-2021). The ratio is higher than 79.9% pre-Covid level. Real estate loans account for 35% of total household debt, followed by loans for own business (18%), and hire purchase loans for vehicles (12%). The share of non-collateralized loans, especially credit card and personal loans has increased to 8.0% of total household debt in 2022 from 6-7% average over the past decade and registered 14% YoY growth in 4Q22. Overall household debt rose at a slower rate of 3.5% at end-2022 compared to +3.9% in 2021. We forecast household debt to GDP ratio will decrease gradually following the economic recovery in Thailand. However, some households with high debt levels are vulnerable to shocks.

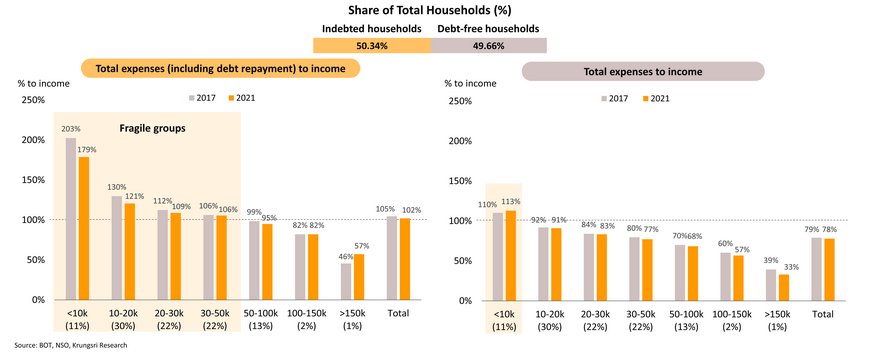

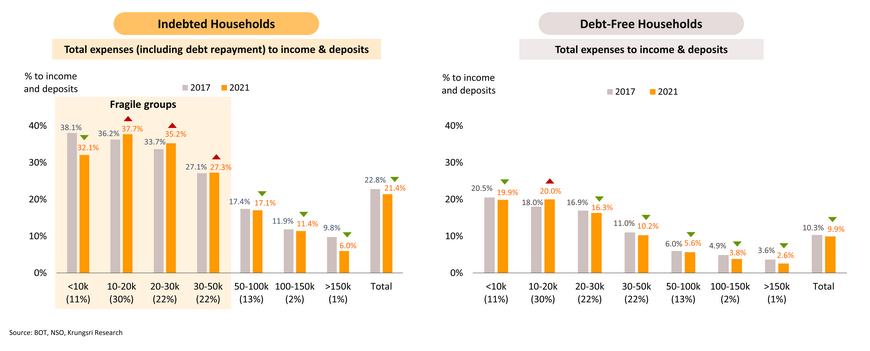

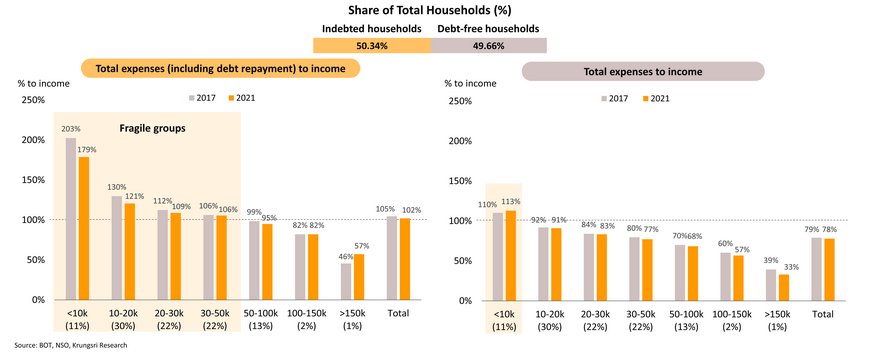

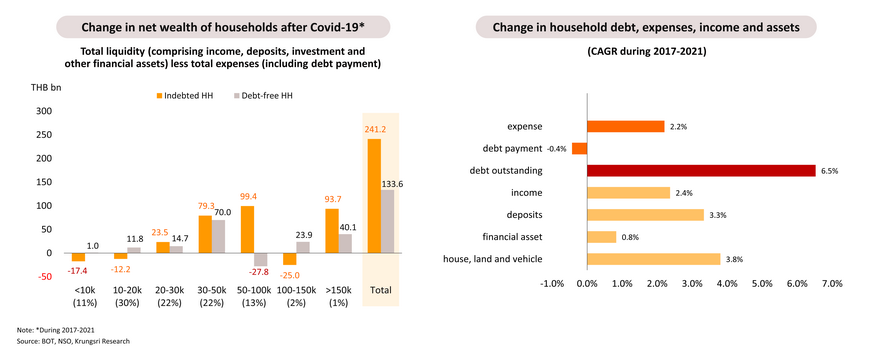

85% of indebted households and 11% of debt-free households have weak borrowing power, but other households have the ability to borrow more

We measured the borrowing capacity of several household groups in Thailand by looking at income, money deposits, expenses, and debt repayment. The result suggests indebted households with monthly income below THB50,000 and debt-free households with monthly income below THB10,000 have weak borrowing power as total expenses including debt repayments exceed their income. This group accounts for 85% of indebted households and 11% of debt-free households. However, households with high monthly income (more than THB50,000 for indebted households) and debt-free households (except those with monthly income below THB10,000) have room to borrow more.

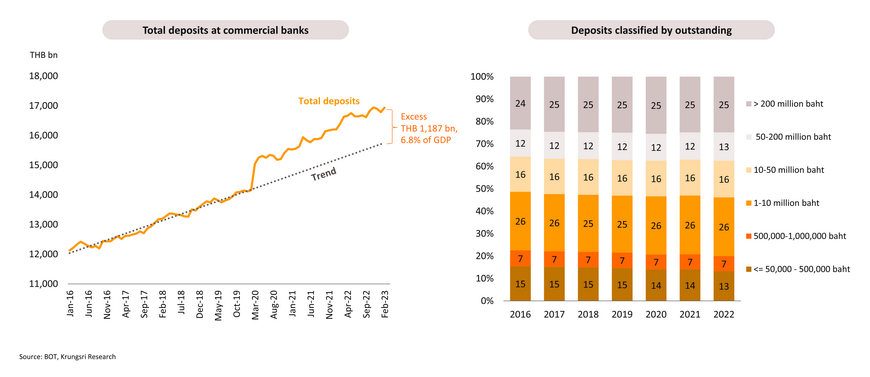

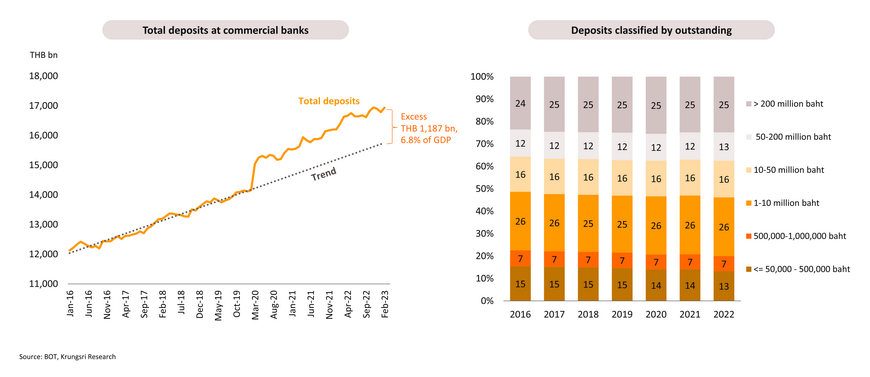

Since the pandemic, total bank deposits have expanded above trend by THB1.187 trn to account for 6.8% of GDP, which would support household consumption ahead

Total outstanding bank deposits stood at THB16.9 trn at end-2022, a 4.3% increase from the previous year and higher than THB 14.1 trn at the end of 2019 (pre-pandemic). Deposits with outstanding balance of 1-10 million baht accounted for the largest share at 26% of total bank deposits. At end-February, total deposits stood at THB16.94 trn and there was THB1.187 trn excess deposits. This excess deposits would help some household groups to maintain their spending power.

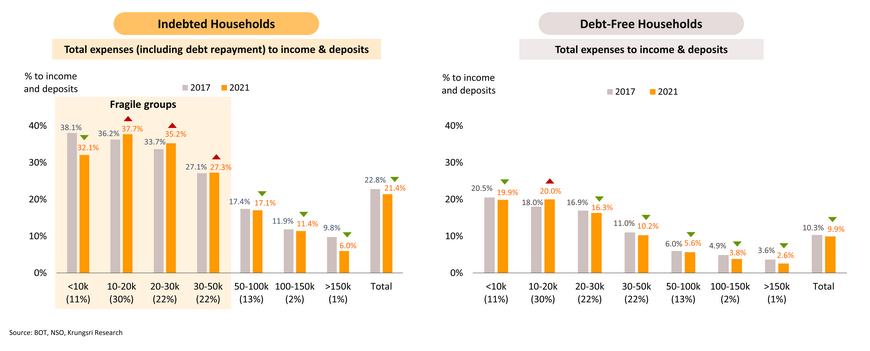

Including deposits, indebted households with income below THB50,000 still experience financial stress, suggesting limited ability to spend

To measure the spending capacity of households by their income level, we considered money deposits as the most liquid asset in addition to income. Looking at the ratio of total expenses (including debt repayment) to income and deposits, indebted households with monthly income below THB50,000 (85% of indebted households) are likely to experience financial stress due to relatively low liquidity. This group’s expenses account for up to 30% of income and deposits, implying they can spend and repay debts for only 3 years. And expenses have risen following the pandemic, which has pushed up the ratio of total expenses (including debt repayment) to income and deposits. Meanwhile, household groups with high monthly income (more than THB50,000 ) and all debt-free households are in healthier financial positions, with liquidity – income and deposits – remaining relatively high to to finance their expenses and debt repayments for more than 5 years. After the pandemic, most of these households also saw a drop in the ratio of total expenses to income and deposits, implying greater ability to spend.

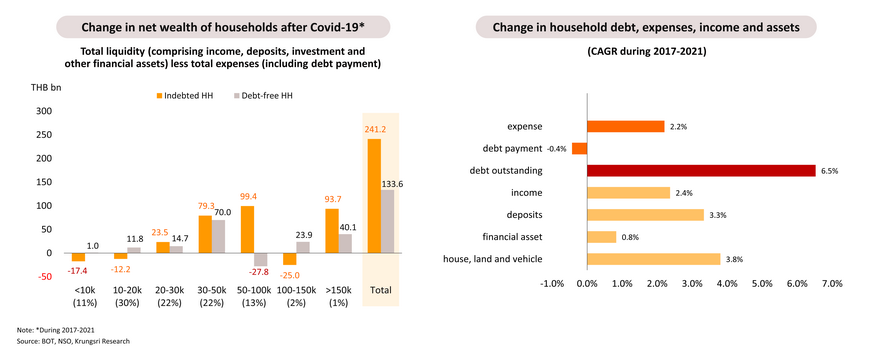

Higher net wealth post-pandemic (2.2% of GDP) have supported borrowing and spending capacity, particularly for high-income households

Looking deeper at households’ net wealth, by assessing their total liquidity (comprising income, deposits, investment and other financial assets) less total expenses (including debt repayments), we found most households - particularly the high-income group - are wealthier than before the pandemic. The net wealth of households in Thailand has risen by a total of THB375bn (accounting for 2.2% of GDP), suggesting greater room for borrowing and spending, especially the high-income group. But despite this, we remain cautious of the big increase in outstanding debt post-pandemic as that could increase their burden in the future.

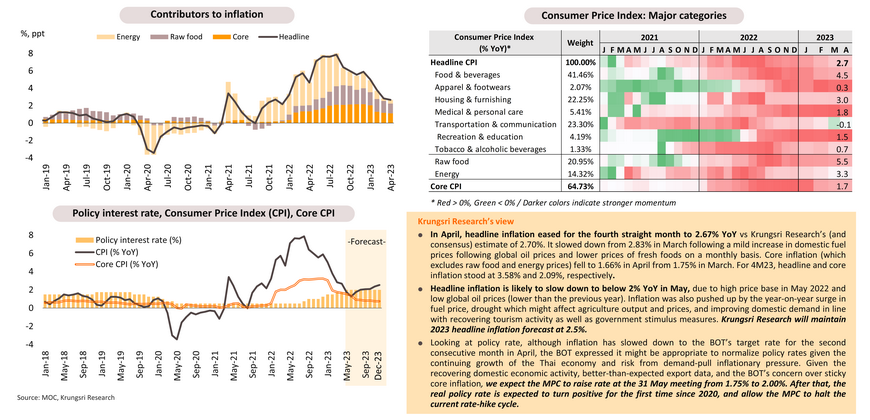

MPC might raise interest rate to 2% at the May meeting; after that, real interest rate is expected to turn positive