Global: Great expectations

Global growth still supported by resilient manufacturing; services sector shows signs of imminent recovery

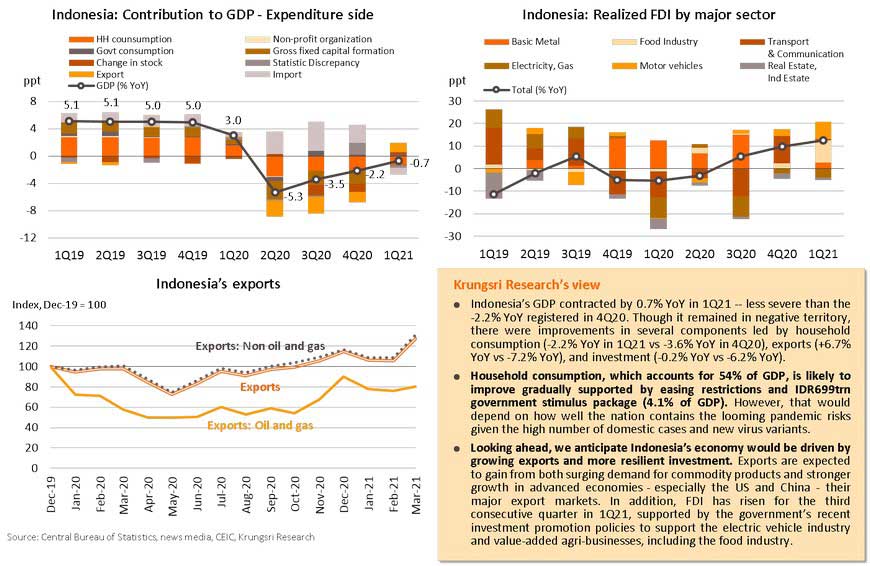

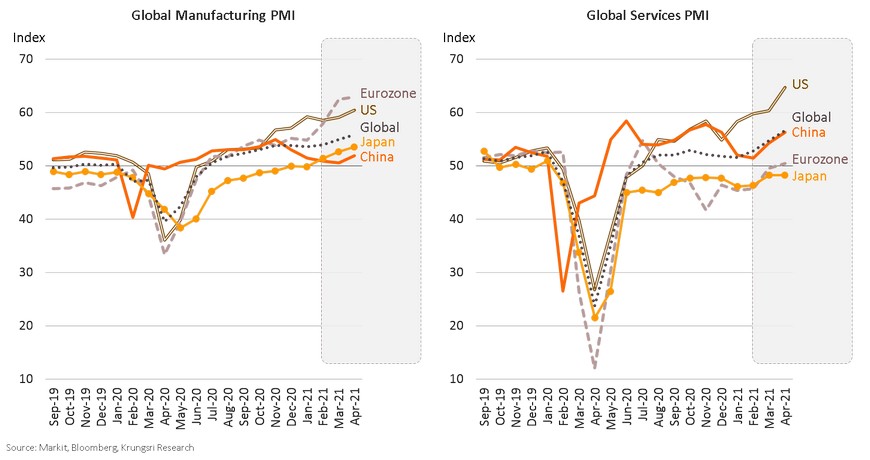

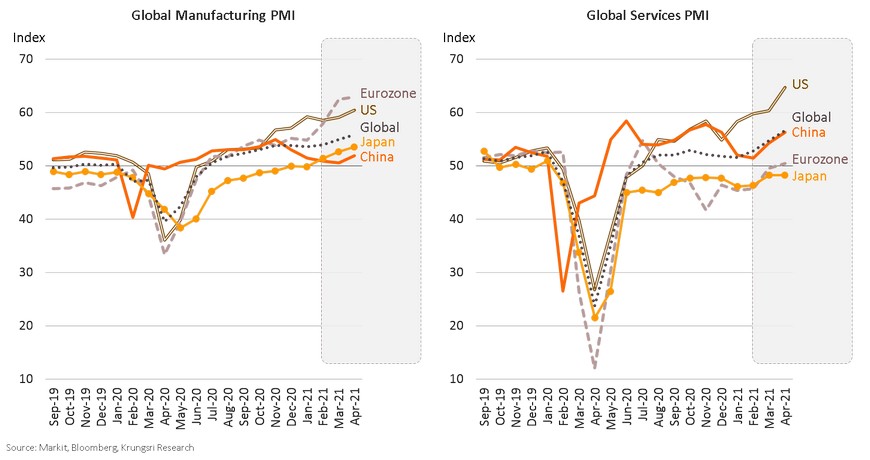

The gradual relaxation of COVID-19 containment measures in key countries is supporting an upturn in manufacturing activity and an early recovery in the services sector. In early 2Q21, Global Manufacturing PMI rose to its highest reading since April 2010, driven by firmer demand, supply shortage, and job creation. The major countries simultaneously experienced a rise in Manufacturing PMI data. April Global Services PMI also rose to the highest level since July 2007, led by stronger activity in the US, Eurozone, and China.

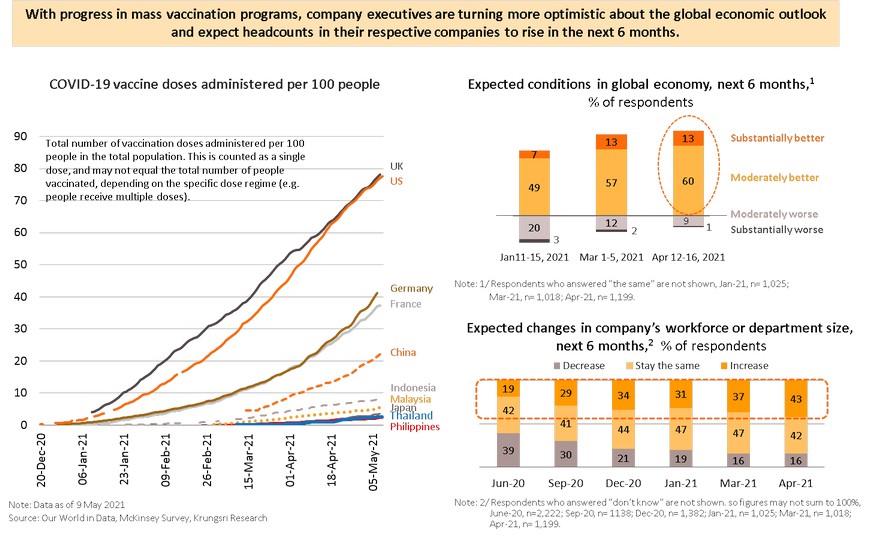

Pandemic remains a major risk but prospects over global growth and hiring are brightening with progress in mass vaccination

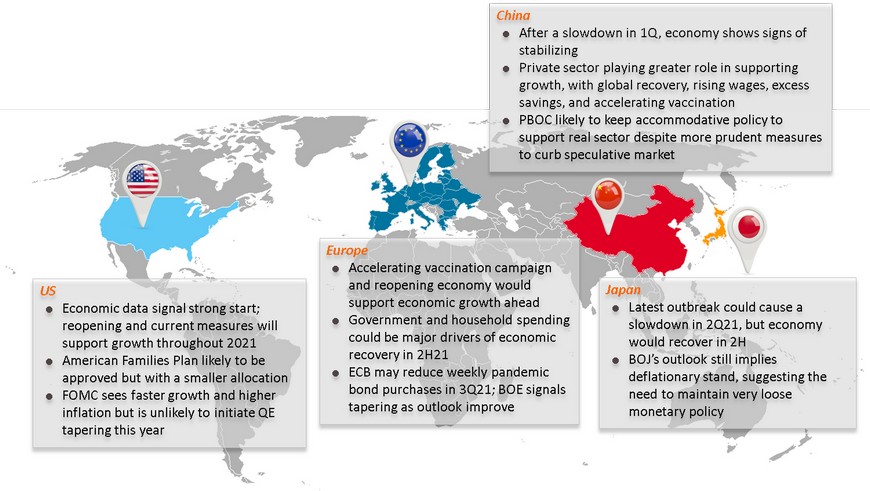

US: Economic data signal strong start; reopening and current measures will support growth throughout 2021

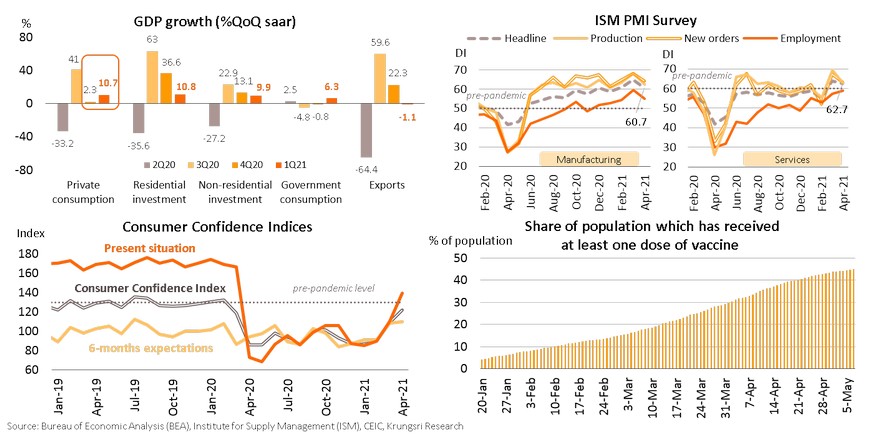

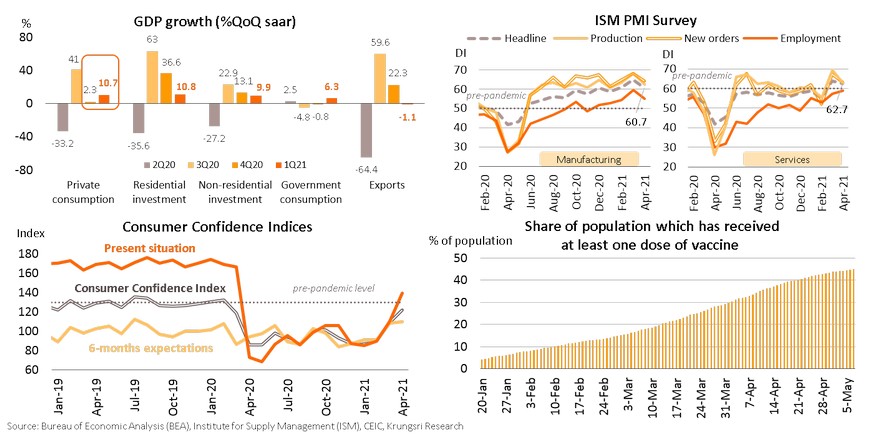

The US economy is off to a strong start. GDP expanded by 6.4% QoQ saar in 1Q21 led by personal consumption, domestic investment, and government spending. Latest data show the economy continued to gain momentum. Despite a blip, April Manufacturing and Services PMI data remained well above pre-crisis levels. Consumer Confidence Index soared to a 4-month high of 121.7 in April, while the expectations index ticked-up on economy reopening hopes and faster jobs growth. Looking ahead, economic growth will accelerate in 2Q21 and remain robust in 2H driven by pent-up demand after lifting restrictions and reopening the services sector. In addition, government responses - such as aid for the unemployed - would continue at least through 3Q21, while the new spending plan on jobs and childcare totaling USD4.1trn could see moderate progress and lift sentiment ahead. The vaccination program is progressing well, with more than 40% of the population having received at least one dose of vaccine. The Biden administration is targeting for 70% of American adults to receive at least one dose by July 4, suggesting the US could reach herd immunity soon. Existing measures and positive developments would lift consumption and investment, and pave the way for solid growth the rest of the year.

American Families Plan likely to be approved but with a smaller allocation

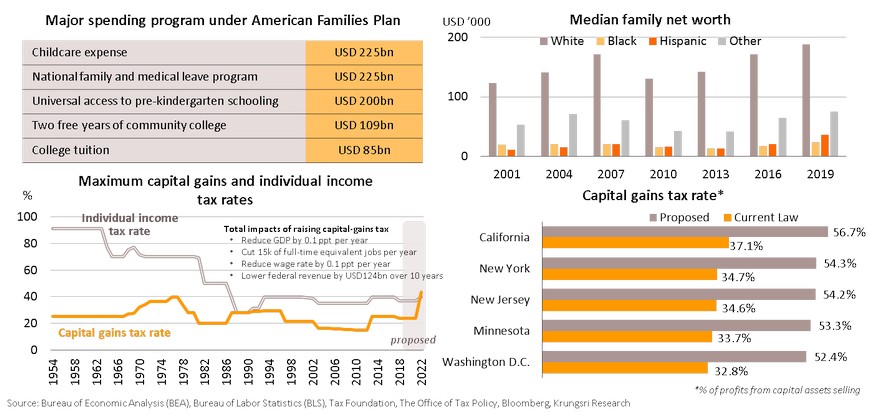

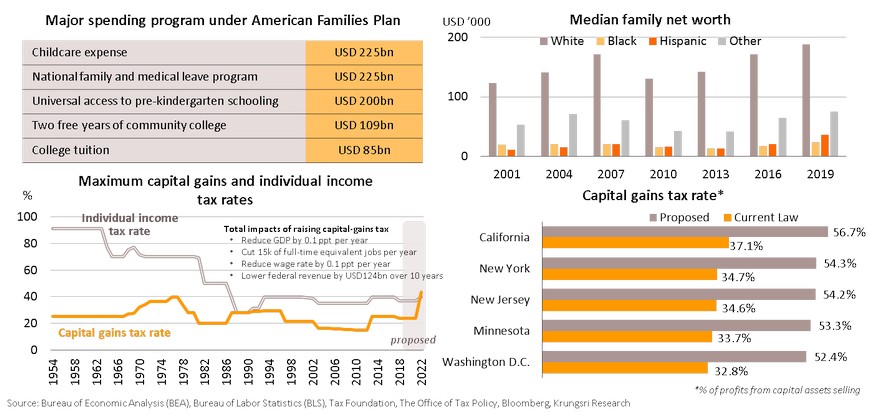

Apart from existing COVID-19 relief measures worth USD1.9trn and the proposed USD2.25trn infrastructure plan, the government has also proposed the USD1.8trn American Families Plan to provide tuition-free college and pre-school, childcare subsidies, and paid family and healthcare for over a decade. The tuition would reduce the yawning wealth gap between black and white Americans by improving educational opportunities and increasing employing rate in the black community. To fund the program, Biden has proposed to increase individual tax rate for top earners to 39.6% from 37%, and raise capital-gains tax rate to 39.6% from 20% for those earning more than USD1mn a year. Including state taxes and Obamacare tax, that would increase the combined tax rate to over 50% in California, D.C. and New York. The higher capital-gains tax could be implemented in 2022, the quickest period to pass the Families plan. It would hurt the economy by reducing GDP by 0.1 ppt per year and trimming federal revenue by USD124bn (0.6% of GDP) over 10 years. However, the package is meant to improve social equality rather than contribution to real economic growth, unlike the American Job Plan. Then, we suspected the package could be passed as a separate bill with a smaller budget than proposed under regular process rather than under the budget reconciliation. The government could apply the reconciliation process on the American Job Plan instead.

FOMC sees faster growth and higher inflation but is unlikely to initiate QE tapering this year

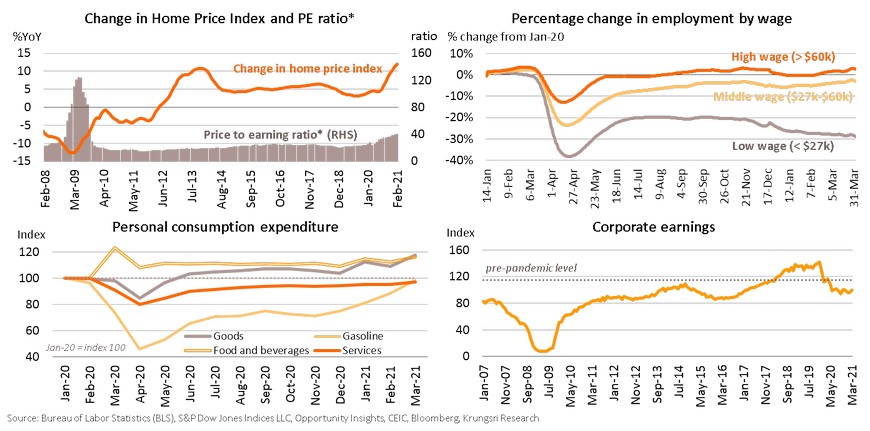

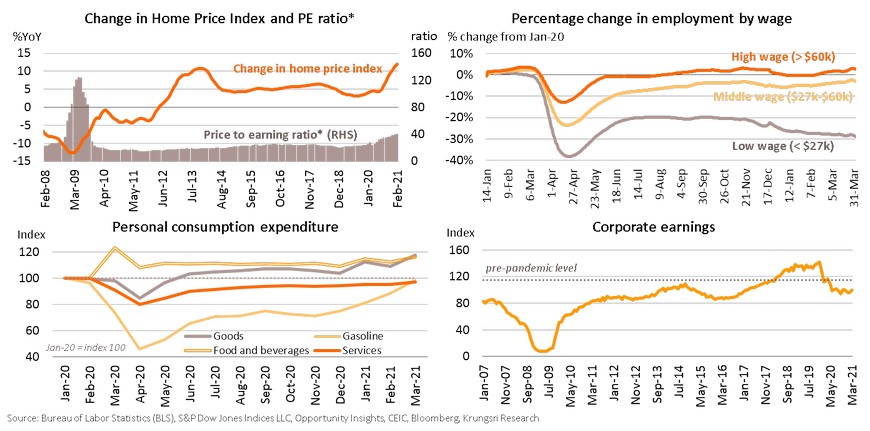

FOMC held interest rates and bond purchase volume at the latest policy meeting. At the press conference, Powell said the members have yet to discuss QE tapering but see faster growth and higher inflation. Despite stellar growth, the Fed could start discussions in 4Q21 and tapering could happen in 1H22, when the services sector has fully reopened and unemployment rate falls to below 4.5%, close to pre-crisis level. The financial and housing markets are showing sign of overheating. The National House Price Index rose 12% in February, the biggest jump since 2006, while price to earning ratio has surged to 40 from 22 in the same period last year. However, the Fed would also consider performance of the real sector. Latest employment data indicate an uneven recovery as employment within the low-income group remains 29% below pre-pandemic level. Consumption in the services sector is still below pre-crisis level. In addition, corporate earnings remain 20% below 2019-level, indicating still-weak business revenues. The uneven economic recovery suggests the Fed needs to make a careful decision on tapering and wait until the data show substantial and sustainable progress. But when the tapering begins, the Fed might start with mortgage-back securities, followed by the Treasury, to control risks in targeted sectors.

Europe: Accelerating vaccination campaign and reopening economy would support economic growth ahead

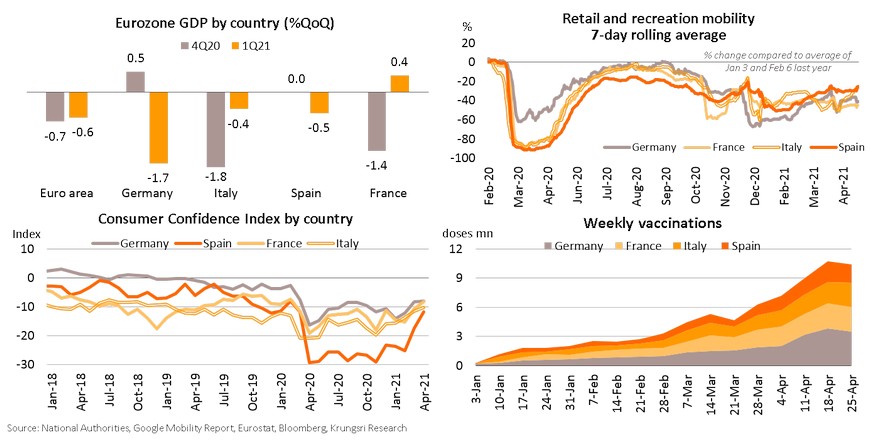

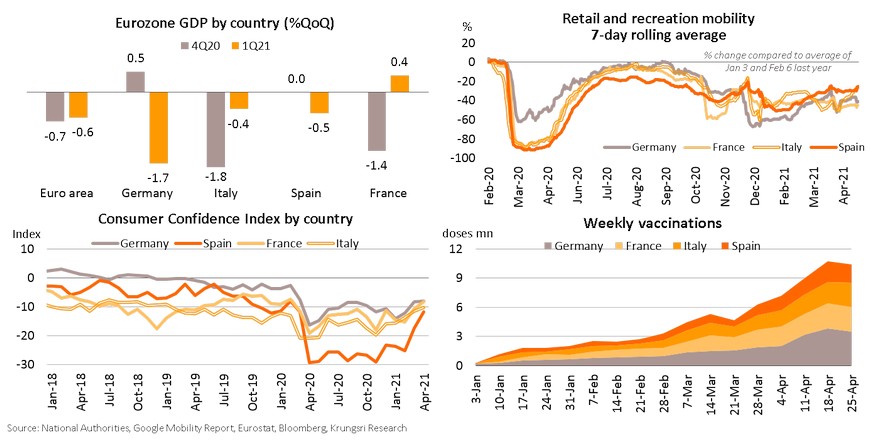

Nationwide lockdowns in 1Q21 took the eurozone economy into a double-dip recession, with GDP contracting by 0.6% QoQ. Germany registered the largest contraction among major countries at -1.7%, while France’s economy unexpectedly expanded by 0.4% due to better household consumption and construction sector. The rising COVID-19 cases in April would have only a mild impact on business in 2Q21 because most businesses have adapted to the restrictions. Looking ahead, the economy could improve in 2H21 driven by the reopening of the services sector, coupled with investments under the Recovery & Resilience Facility. Retail and recreation mobility data show a pick-up in activities in Italy and Spain as restaurants were allowed to serve diners from late-April. Consumer confidence data also showed broad-based improvements but remained below pre-crisis level. The region’s vaccination program is accelerating with weekly vaccinations at around 2.6 mn in each country in late April, compared to 1 mn in March. In addition, vaccine supply would rise to 400 mn doses in 2Q21 from 100 mn doses at the beginning of the year. The accelerating vaccination program would pave the way to lift COVID-19 restrictions in the coming months and support healthier growth ahead.

Government and household spending could be major driver of economic recovery in 2H21

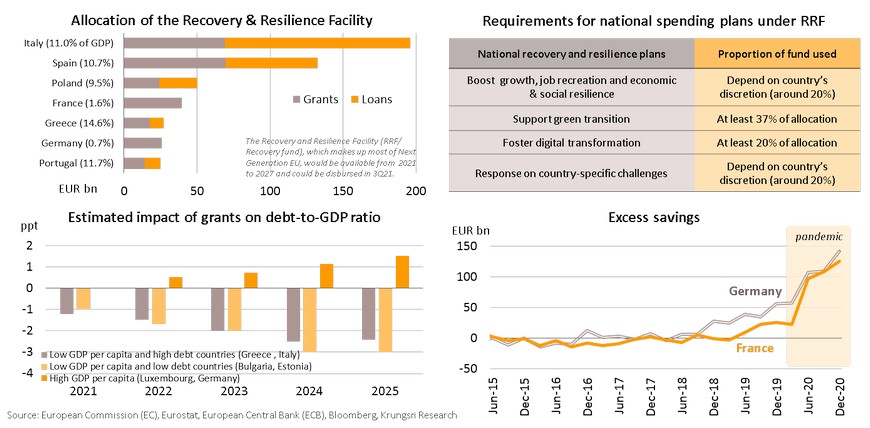

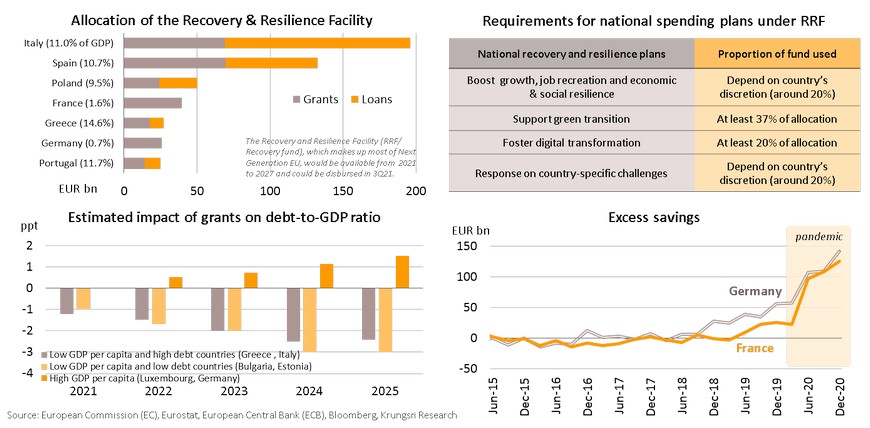

The Recovery & Resilience Facility worth EUR750bn will be available over the next six years and should be a major stimulus for the economy in 2H21. The allocation will support green & digital transformation efforts, improve social resilience, and mitigate the economic impacts. The positive impact on GDP would be more visible in southern eurozone such as Greece, Italy and Spain, due to the larger size of packages relative to GDP. The European Commission estimates countries which receive larger grants would borrow less from financial markets, leading to smaller debt burden, and debt-to-GDP ratio in Greece and Italy would drop by 2.5ppt in 2024. However, we are concerned over debt and spending, including (i) existing high debt level triggered by COVID-19 stimulus programs, (ii) fiscal regulation limiting debt level to 60% of GDP could return by 2023, and (iii) cost of debt could increase if the PEPP purchases are reduced. Looking ahead, the private sector needs to play a greater role in driving economic growth once countries ease containment measures. To boost Eurozone’s GDP growth by 1.5 ppt, they would need to utilize EUR170bn of excess savings, which is possible given current savings in Germany and France. The combined stimulus and private spending should push economic recovery to catch up with that in other developed countries.

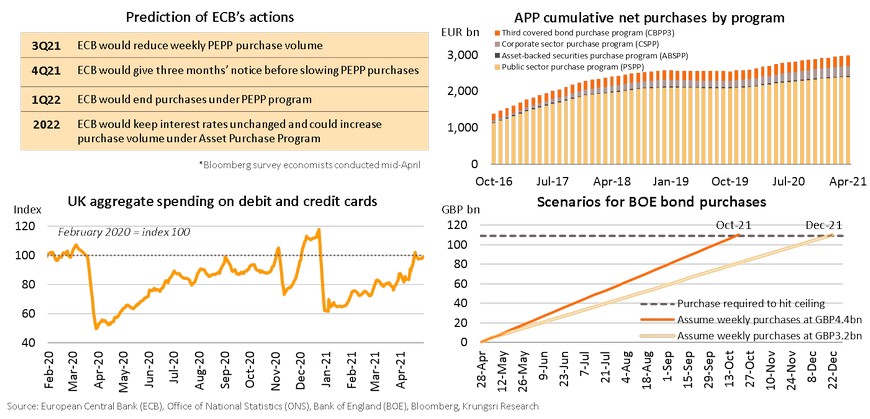

ECB may reduce weekly pandemic bond purchases in 3Q21; BOE signals tapering as outlook improve

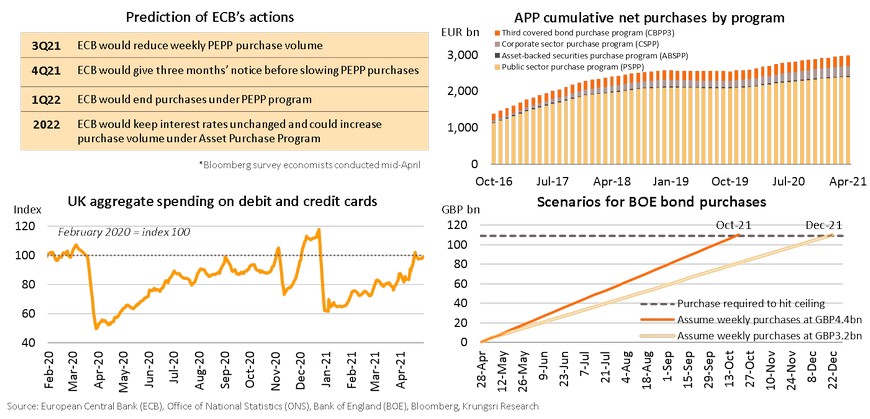

The ECB held interest rates and pandemic bond purchase volume at the latest meetings, but some members have hinted at reducing bond purchase volume possibly starting June. The ECB would continue to increase weekly bond purchases in 2Q21 due to the rising yields and lingering COVID-19 impact. But in 3Q21, accelerating vaccination pace and reopening of the services sector could support economic recovery and prompt the ECB to consider reducing weekly bond purchase volume. Looking ahead, they would be unlikely to extend the PEPP program as it would reach the ceiling by March-May next year, but the reinvestments would continue. After that, the ECB could use the older Asset Purchase Program to support an accommodative monetary policy and bolster recovery, along with TLTROs and forward guidance. The targeted APP monthly purchase volume might be doubled from EUR20bn since 2019 to at least EUR40bn in 2022. In the UK, aggregate credit & debit card spending has risen to close to pre-pandemic level and they could achieve herd immunity by the end of this year. Then, the central bank decided to reduce the pace of weekly bond buying to GBP3.2bn from GBP4.4bn, starting in May this year. Moreover, they could signal tapering its QE program in mid-year meeting as the economy is set to improve. This implies the progress of vaccination programs and substantial economic developments could be the major factors prompting central banks to shift to lower gear.

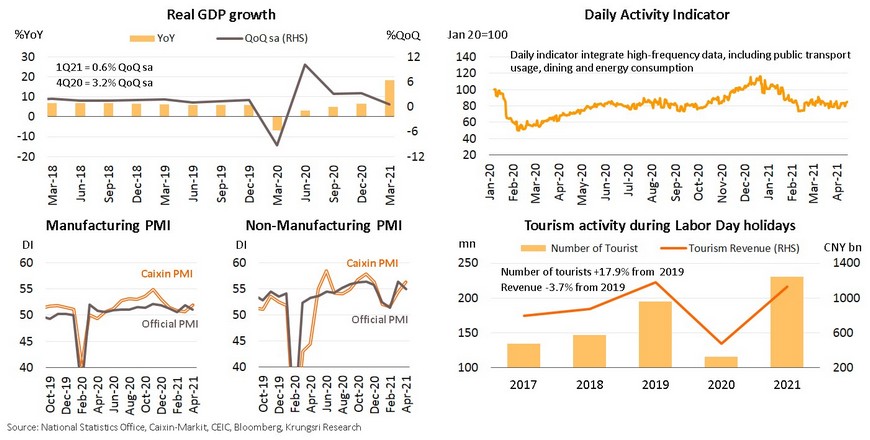

China: After a slowdown in 1Q, economy shows signs of stabilizing

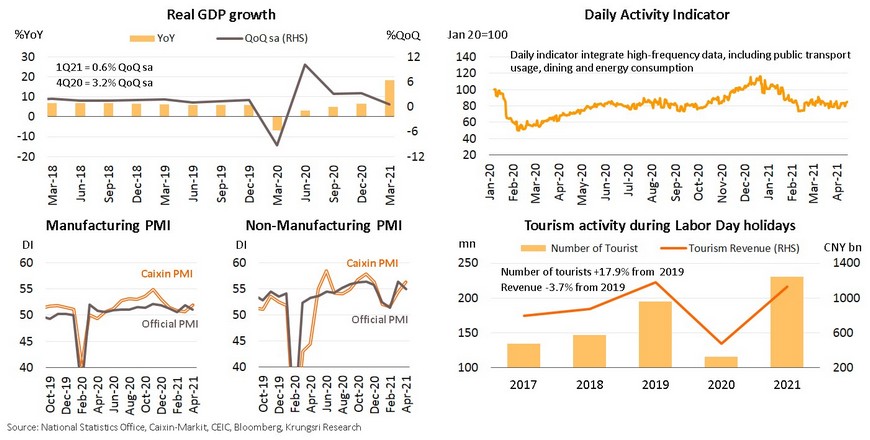

China’s economy slowed down in 1Q21 largely due to temporary factors, including the resurgence of COVID-19, Lunar New Year holidays, and a shortage of container shipping capacity. However, latest high-frequency data indicate economic activities are stabilizing. Official April PMI data remained in expansion territory (above-50), despite slowing down slightly. Caixin PMI data also improved for both Manufacturing and Non-manufacturing sectors, reflecting recovery in the SME sector because the Caixin survey is focused on small- and medium-size businesses. In addition, tourism-related services sectors also rebounded, reflected by recovering activities during the Labor Day holiday (1-5 May 2021) when the number of tourists surpassed pre-pandemic levels in 2019. These positive factors signal continued improvement in economic activity with a broader-base recovery that includes small businesses.

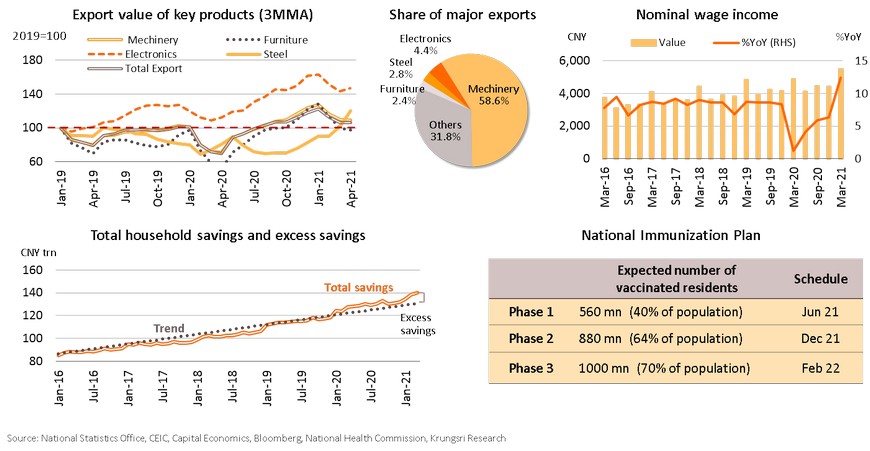

Private sector playing greater role in supporting growth, with global recovery, rising wages, excess savings, and accelerating vaccination

The economy is likely to expand at a steady pace this year. Amid the cyclical recovery of the global economy, China’s major export items are expanding and remain above pre-pandemic levels in 2019. And, rising wages and income would gradually increase household purchasing power. Likewise, household excess savings has reached CNY 9.4trn or 9.3% of GDP in 1Q21, implying large room to increase consumption in the next period. The accelerating mass vaccination program would also support further improvements in services-related activities in 2H21 and allow China to reopen to international travelers next year. They target to inoculate 70% of the population to achieve herd immunity before Winter Olympics in February 2022. Looking forward, China will continue to recover, driven by a gradual rebound in domestic demand and exports, and reopening effects.

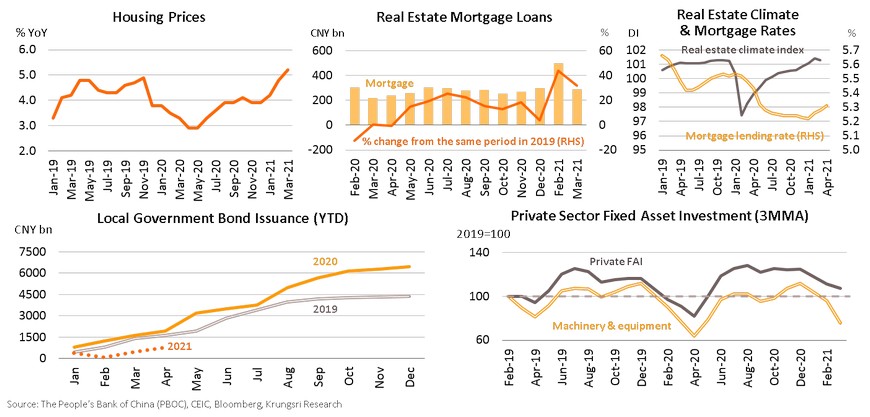

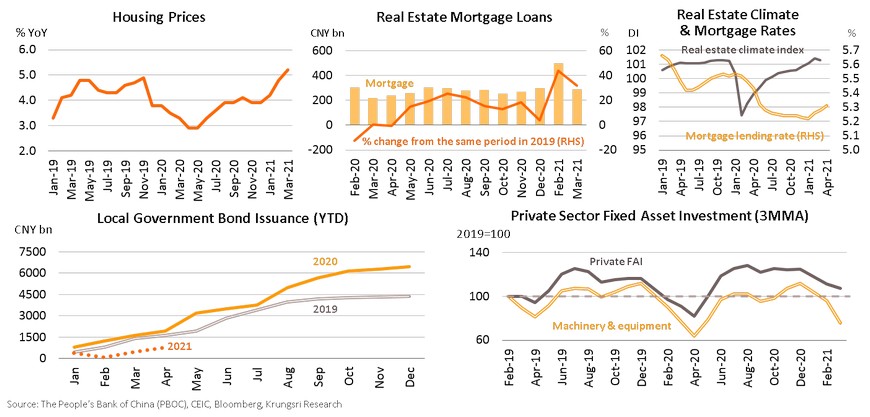

PBOC likely to keep accommodative policy to support real sector despite more prudent measures to curb speculative market

There are signs of a boom in China's housing market, with a continued increase in house prices and acceleration in real estate mortgage. That has prompted The People’s Bank of China (PBOC) to supervise lending to some segments, reflected in higher mortgage lending rates. The PBOC had requested cooperation from major lenders in March to “keep loan growth stable and reasonable” the rest of this year, aiming to deleverage excessive credit. However, the accommodative monetary policy is still necessary to sustain recovery in the real sector, due to the following: (i) The government is playing a smaller role in stimulating public investment, indicated by slower local government bond issuances compared to last year. (ii) Private investment has not recovered well enough, with the average 1Q21 growth of only 1.7% over the past two years. Recently, private investment had slowed down compared to pre-pandemic levels, with investment in machinery & equipment still below 2019 levels, before the pandemic. Looking ahead, amid curbs in speculative activity and slower public investment, we expect the PBOC to continue to implement monetary supports to strengthen growth of the private sector, while still adopting prudent measures to address risks in selected sectors.

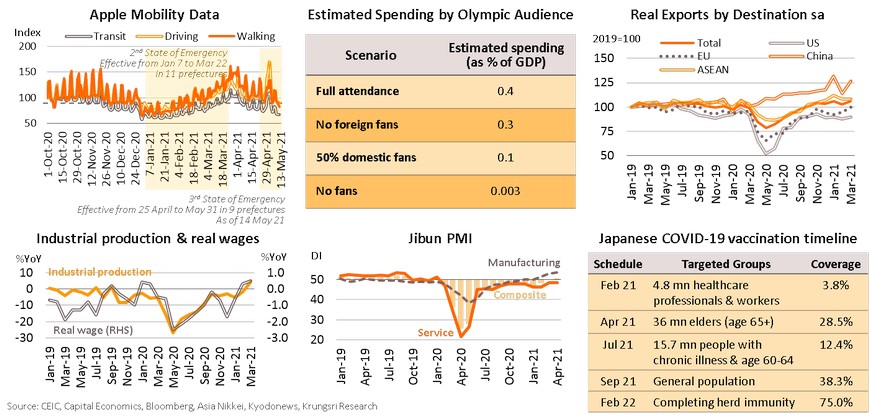

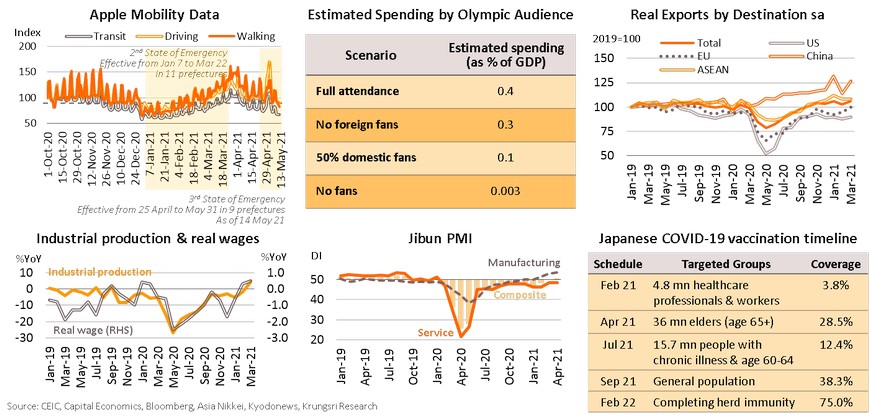

Japan: Latest outbreak could cause a slowdown in 2Q21, but economy would recover in 2H

The fourth wave could slow down domestic economic activities, as reflected by Apple mobility data. But the impact would be less severe than before as the recent state of emergency covers fewer areas and travel was allowed during the Golden Week festival (29 April to 5 May). The latest outbreak could prompt authorities to ban spectators at the Olympic Games, which could cause economic losses amounting to 0.4% of GDP. However, the economy would recover and improve in 2H21 supported by the following: (i) recent JPY 500bn additional stimulus to ease the impact of the outbreak on the services sector; (ii) improving exports with value exceeding pre-pandemic levels and reaching its highest since March 2018;. (iii) signs of recovery in the manufacturing sector as Manufacturing PMI hit a 3-year high in April and Tankan Sentiment Index is at its highest since Feb 2019; (iv) the labor market continues to recover with real wages rising for the second consecutive month in March; and (v) the national vaccination program is expected to accelerate in 2H21 to inoculate 75% of residents above 16 years of age by February 2022. These factors would support a gradual recovery that would be more visible in 2H21.

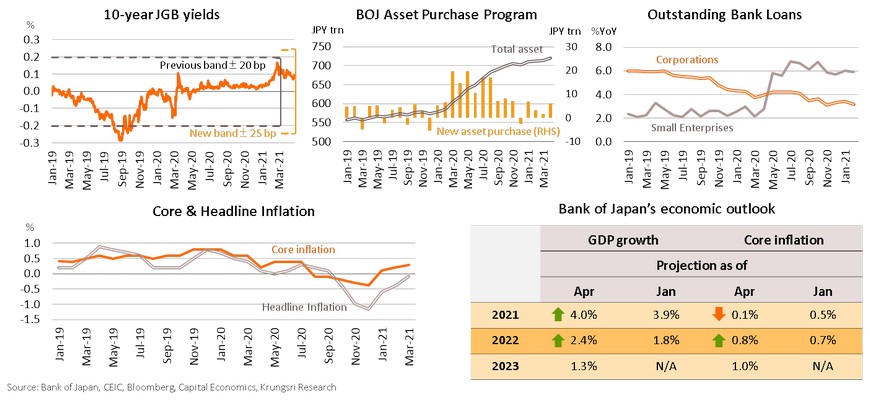

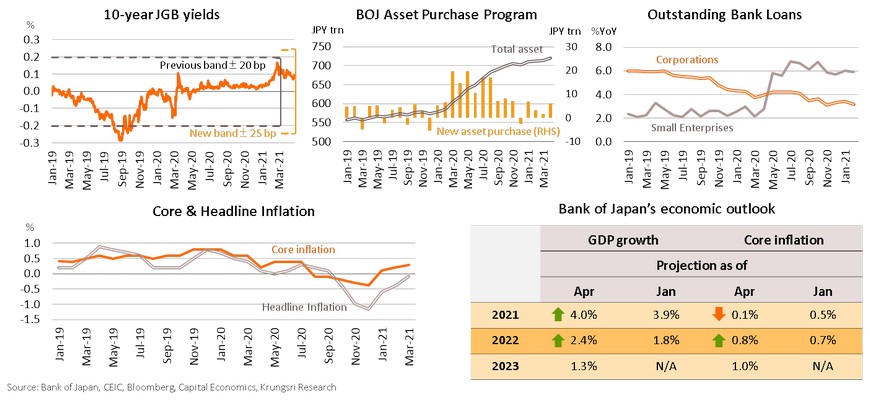

BOJ’s latest outlook still implies deflationary stand, suggesting the need to maintain very loose monetary policy

The Bank of Japan (BOJ) recently tweaked monetary policy in response to gradual improvements in the Japanese economy but that has not affected financial conditions. (i) 10-year JGB yield is still within the BOJ’s previous tolerance band (±20 bp), (ii) BOJ will continue with asset purchases and extend balance sheet, and (iii) still-growing bank loans, especially for hard-hit small businesses. These data suggest the BOJ is likely to maintain an accommodative policy stance. Looking at growth prospects, the BOJ has upgraded GDP growth projection to +4.0% for 2021 and +2.4% for 2022. However, the projections do not include the impact of the fourth wave which could slow domestic economic activities and reduce gains from the Olympic Games. In addition, the BOJ projected GDP growth would slow to only +1.3% in 2023. Looking at inflation, the latest projections imply a “deflationary mindset” until 2023, since (i) the BOJ has cut its forecast for core inflation this year to just 0.1%, while March core inflation was 0.3%, and (ii) core inflation is projected at 1% in 2023, far below the 2% inflation target. Therefore, the BOJ would likely maintain a very-loose monetary policy, by keeping the negative interest rate policy and implementing quantitative and qualitative monetary easing (QQE) with yield curve control (YCC) longer than other major countries, to sustain economic recovery.

Thailand: Recovery stumbles, not crumble

1Q21 GDP hit by second wave but contracted less than anticipated. Economic recovery stumbles as third wave has lasted longer than we expected.

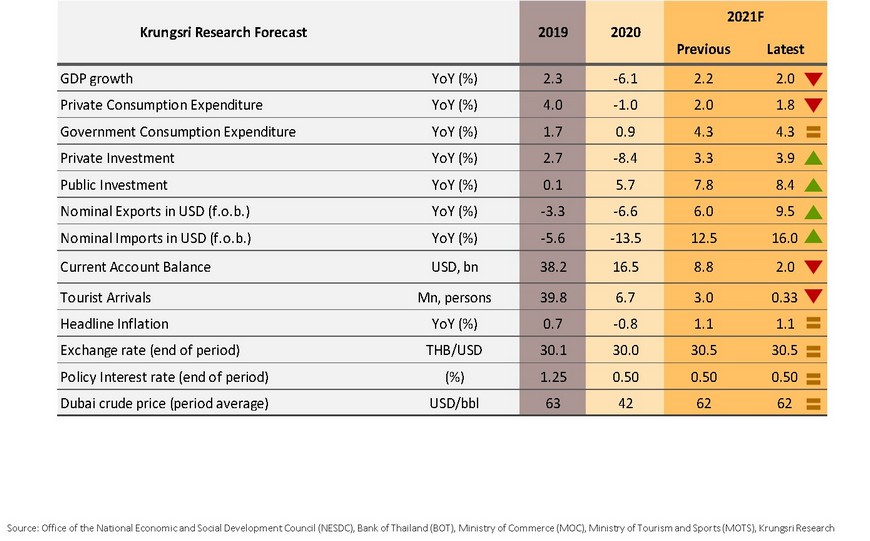

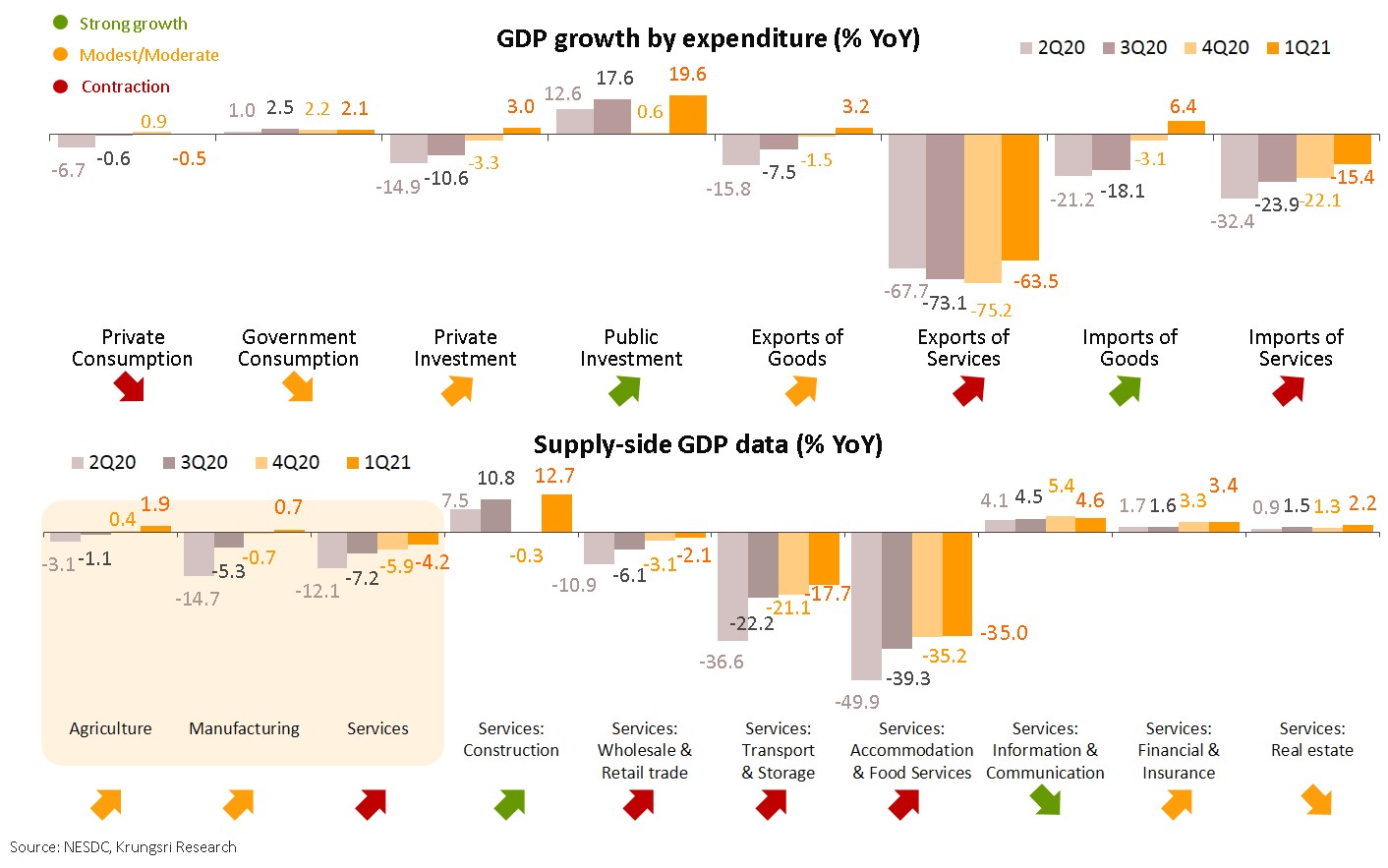

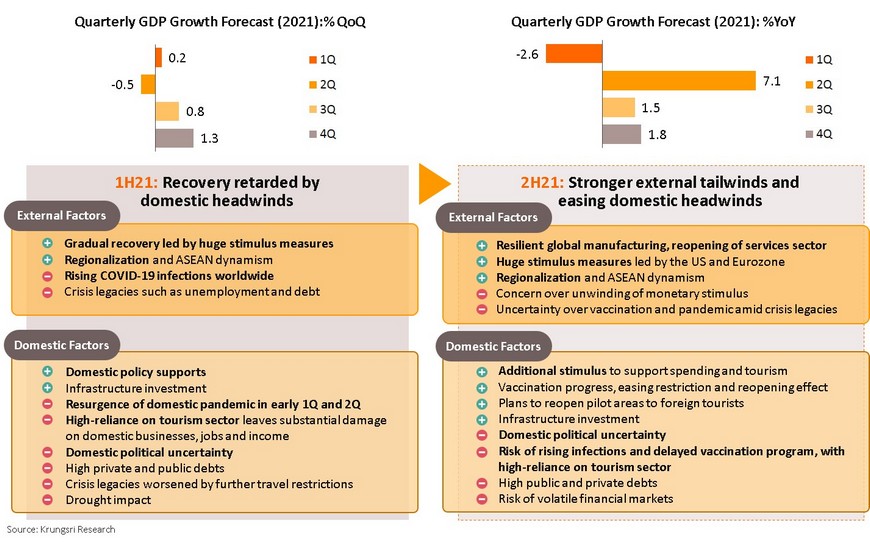

- During the second wave, Thai GDP contracted for the fifth consecutive quarter in 1Q21 (-2.6% YoY vs -4.2% in 4Q20). But that was less severe than we expected, supported by recovering exports and investment, as well as stimulus measures. Sequential growth was positive for the third straight quarter.

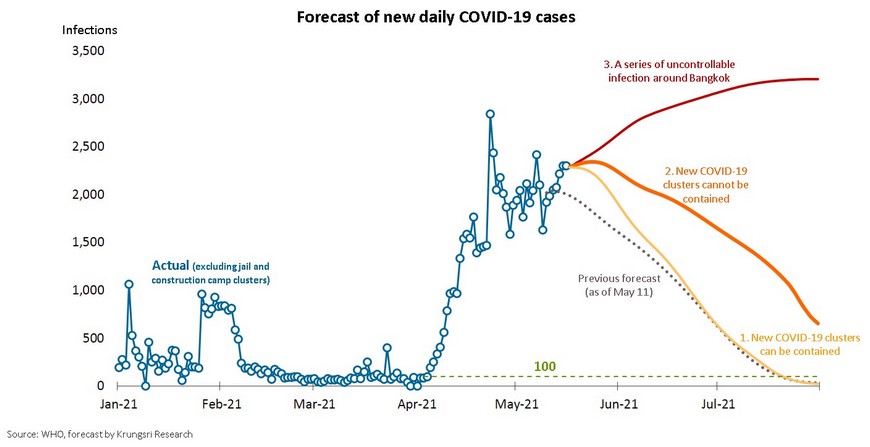

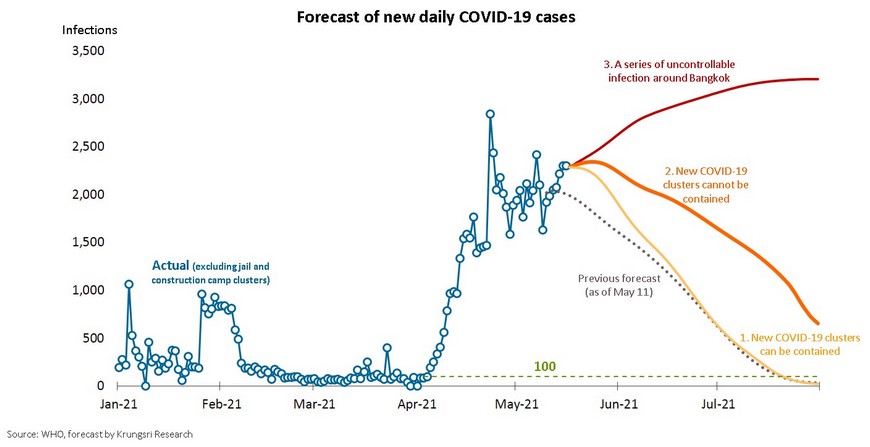

- New COVID-19 clusters and still-high number of new cases will escalate pandemic risk in Thailand, especially in the BMR area. Our model (as of May 17) suggests new daily cases would drop below-100 in late-July to late-August (instead of early-July). That means the economy could contract again in 2Q.

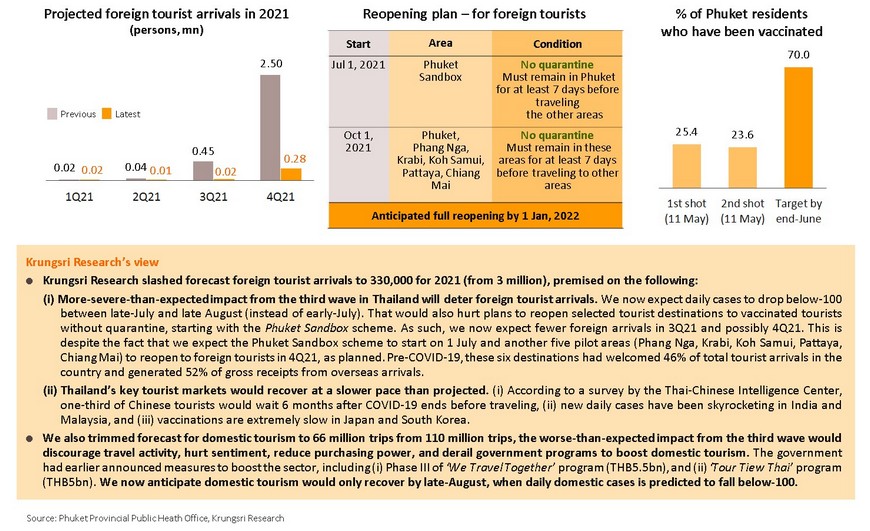

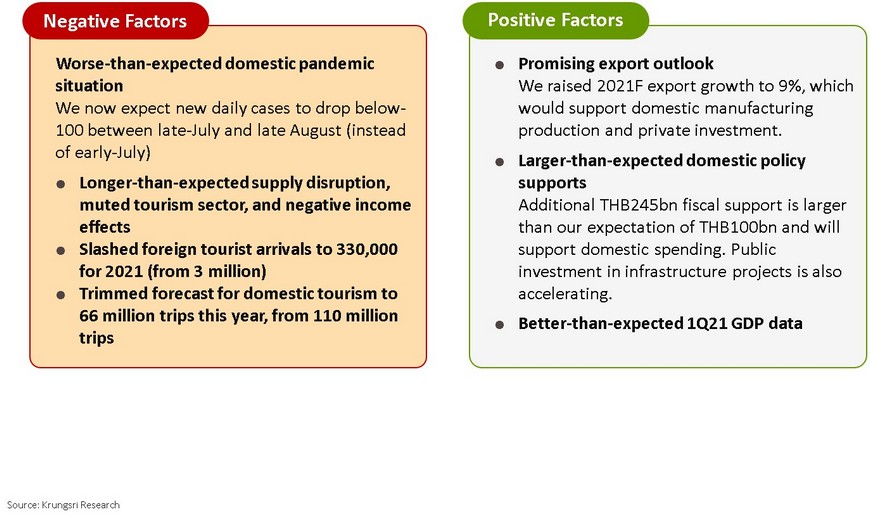

Trimmed 2021F GDP to 2.0% from 2.2%. We slashed 2021F tourist arrivals to 330,000. Promising exports, domestic policy supports, and better-than-expected 1Q GDP data would limit downside to our growth outlook.

- Krungsri Research slashed 2021F foreign tourist arrivals to 330,000 from 3 million, premised on (i) the third wave in Thailand having a more severe impact than expected and discouraging arrivals; and (i) Thailand’s major tourist source markets recovering at slower-than-expected pace. However, the larger-than-expected government stimulus packages would support consumer spending and domestic tourism after easing restrictions. Export sector remains a key growth driver. We upgraded 2021F export growth to 9%.

- We trimmed 2021F GDP growth to +2.0% from +2.2%. The economy would improve in 2H21 on the back of the global economic recovery, worldwide vaccination programs, possible relaxation of containment measures, and gradual reopening of the services sector. Nonetheless, there is downside risk from hiccups in vaccination programs and the sporadic resurgence of outbreaks.

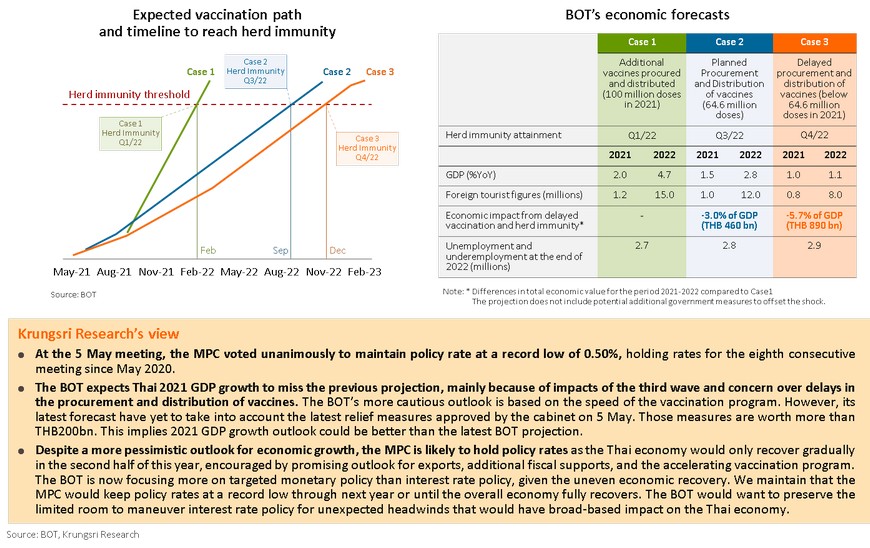

Despite a more cautious outlook, MPC is likely to hold policy rates through to next year

- The MPC is unlikely to cut policy rates as the Thai economy would see a gradual recovery in the second half of this year. The BOT is now focusing more on targeted monetary policy than interest rate policy, given the uneven economic recovery. We maintain that the MPC would keep policy rates at record lows through next year or until the overall economy fully recovers.

Thailand Economic Outlook 2021

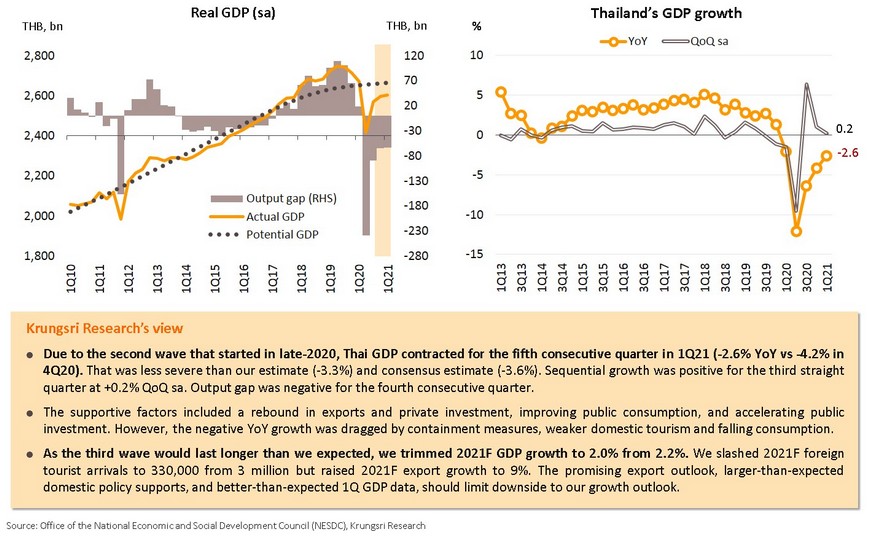

Second wave hit 1Q21 GDP but QoQ growth was positive, better than our and market expectations

Consumption and tourism-related sectors hurt by COVID-19 but stimulus and external tailwinds limited losses

Third wave is more severe than expected

New COVID-19 clusters and still-high number of new cases would escalate pandemic risk in Thailand, especially in the BMR area. Our model (as of May 17) suggests three scenarios. Our base case assumes new daily cases would drop below-100 between late-July and late-August (instead of early-July). In the first scenario, new clusters including jail and construction camps would be contained (Yellow line). Like our previous projection, the number of new daily cases would peak in May before falling below-100 in late-July. Total number of cases up to end-July would be around 176,000. In the second scenario, new clusters cannot be contained (Orange line). The number of new daily cases would peak in late-May but drop slower than expected. Thus, the number new daily cases would drop below-100 in late-August. Total number of cases up to end-July would reach 230,000. In the third and worst-case scenario, a series of uncontrollable clusters would emerge around Bangkok (Red line). The number of new daily cases would rise in the next few months. The cumulative number of positive cases up to end-July would reach 320,000.

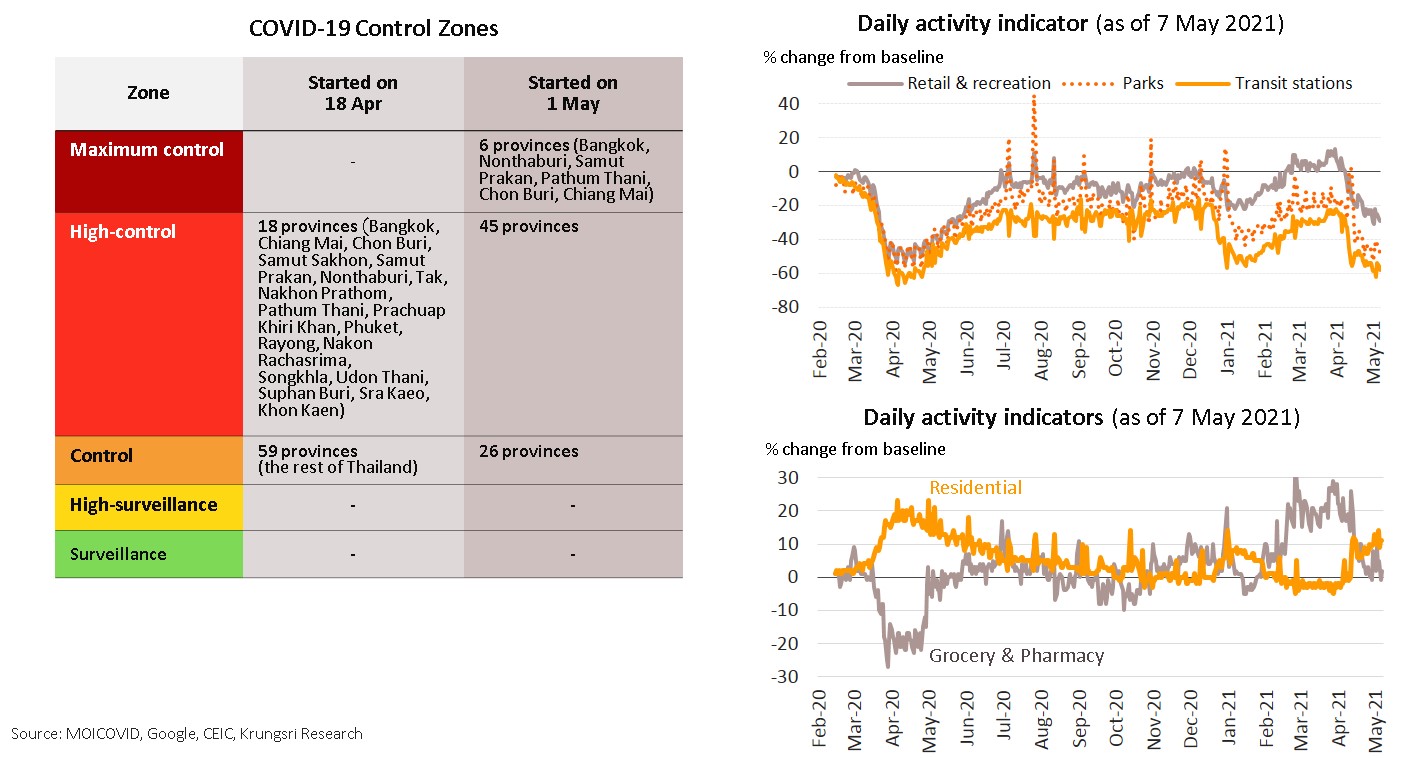

2Q economic activity lashed by stricter and longer containment measures

Since 1 May, the government has tightened restrictions in 6 provinces where new daily cases had exceeded 100 in the preceding 7 days, designating these ‘dark red zones (maximum & strict control)’. Another 45 provinces were designated ‘red zones (high control)’ and the remaining 26 provinces are ‘orange zones (control)’. The government also extended quarantine period for inbound travelers back to 14 days after planning to reduce it to 7-10 days earlier. They also sought public and private sector cooperation to step up work-from-home measures. Economic activities will be disrupted in May and possibly June, especially in the ‘dark red zones’ where the 6 provinces contribute about 50% of Thai GDP.

We now estimate tourist arrivals at 330,000 this year to reflect the worsening of domestic pandemic situation and risk of reopening being delayed

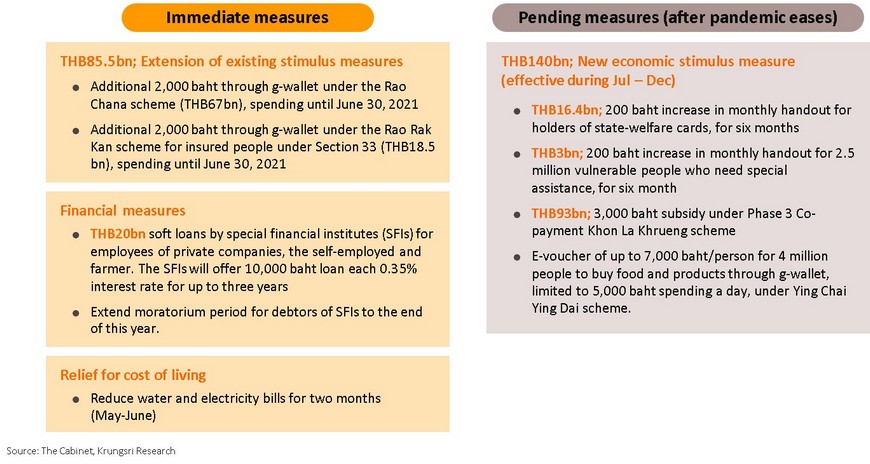

Additional THB245bn fiscal support is larger than expected and will support domestic spending

The government approved a new relief package amid the third wave. The package is divided into two stages: (i) Stage 1 - immediate measures worth THB105.5bn that includes aid under existing stimulus program (such as Rao Chana for selected groups of Thai citizens and Rao Rakkan for insured persons under Section 33), soft loan measure, and reducing water and electricity bills; and (ii) Stage 2 – measures worth THB140bn effective after the pandemic eases (starting July) which include lifting purchasing power of low-income earners and to boost spending by medium- and high-income earners. The new relief package is larger than our estimate of THB100bn, and should support consumer spending and domestic tourism after easing containment measures.

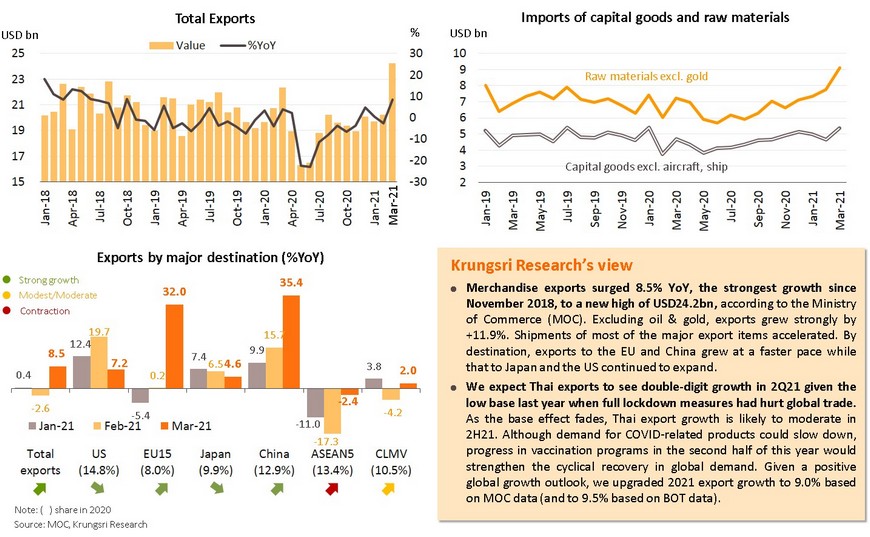

Exports could see double-digit growth in 2Q21; upgraded full-year growth to 9%

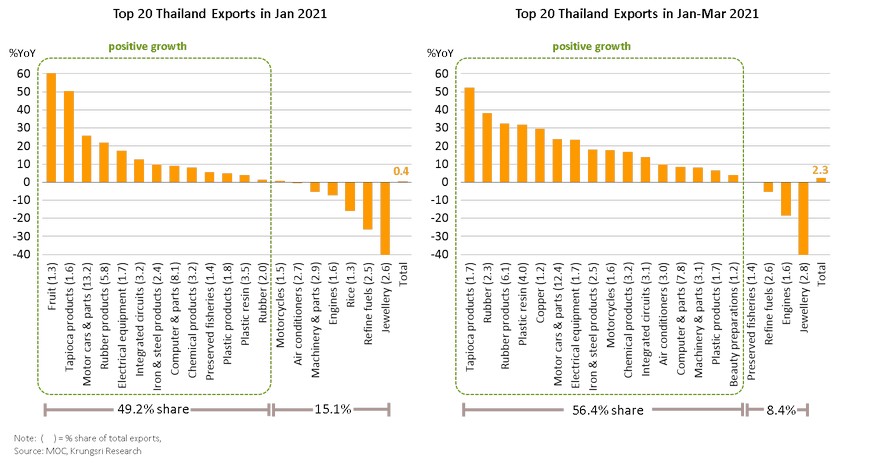

By sector, exports show more broad-based recovery

In the first quarter of this year (January-March), 16 of the top 20 export items showed positive growth. The combined share of these items accounted for 56% of total exports, larger than 49% in January. This suggests a more broad-based recovery in exports.

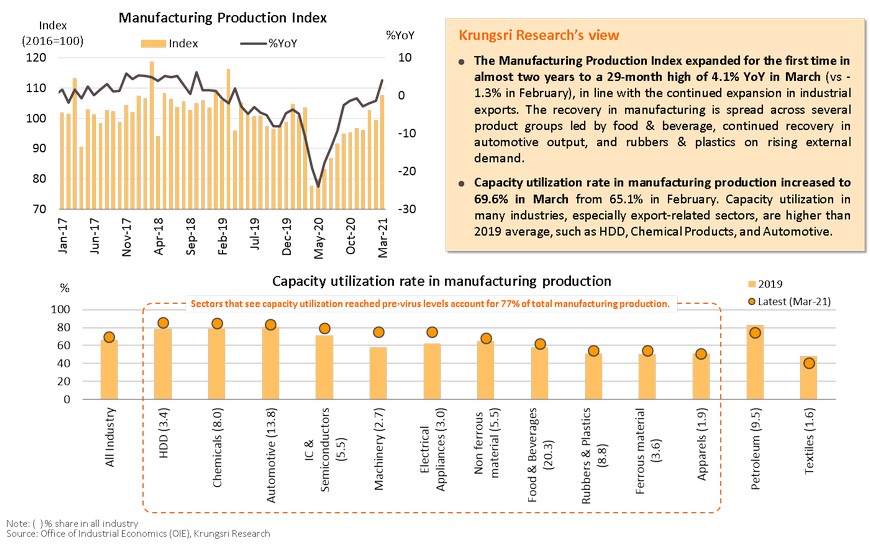

External demand is supporting manufacturing growth; capacity utilization in key industries close to 2019 level

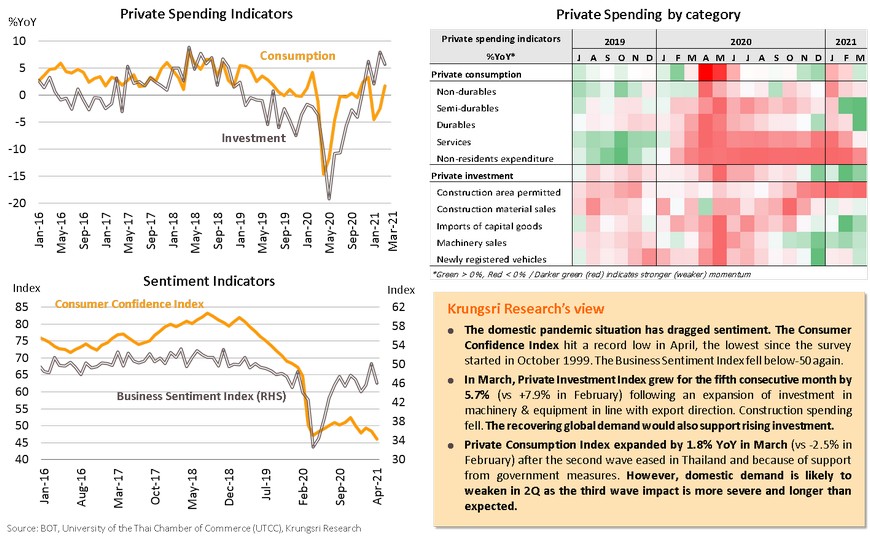

Private investment improved along with exports, but pandemic dragged consumer confidence and domestic demand

Faster vaccination program would lift sentiment and facilitate gradual reopening, supporting growth in 2H21

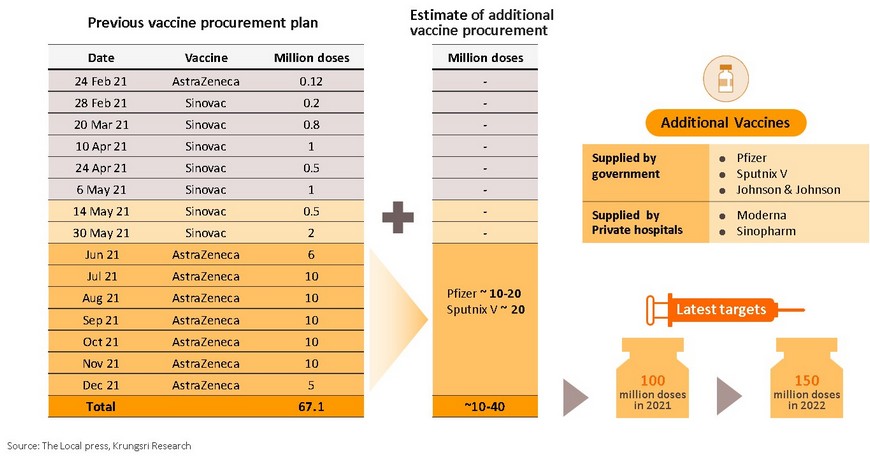

The government has stepped up Thailand’s vaccination program. They had earlier planned to dispense 63 million doses this year (or 50% of the population). Now, they are targeting 100 million doses this year, which would inoculate 50 million people or 70% of the population. They are aiming for herd community with the plan to dispense 10-15 million doses per month. Currently, they have secured 67 million doses and would need to purchase another 33 million doses to meet target. Details for the procurement and distribution of the additional vaccines are pending. On 12 May, the National Vaccine Committee (NVC) had approved plans to procure up to 150 million doses of vaccines by 2022 and expected to provide the first dose to as many residents as possible in 2021.

Thai economy in 2H21: Gains from a cyclical rebound in global economy and unwinding of domestic headwinds

Trimmed 2021F GDP growth to 2.0% from 2.2%; third wave impact limited by more policy supports and export windfalls

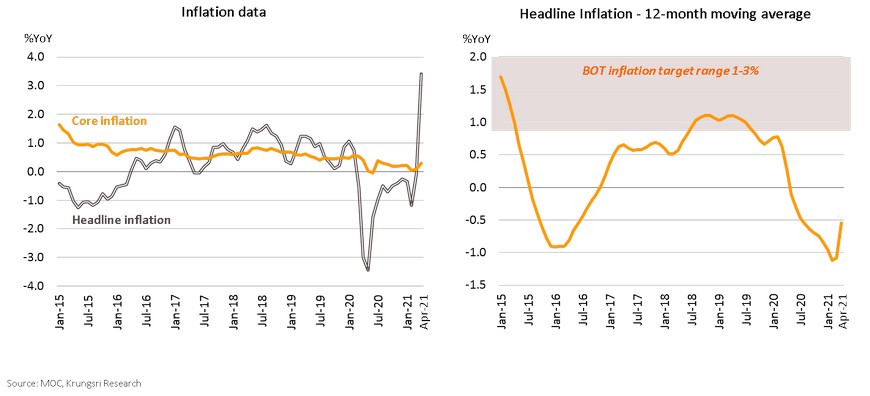

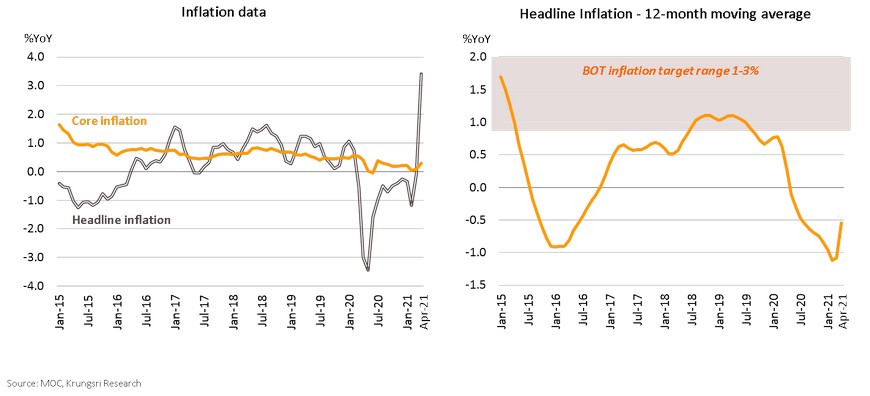

Inflation has been accelerating in 2Q due to temporary factors, could slow down markedly from 3Q

April headline inflation turned positive for the first time in 14 months and hit the highest level since January 2013, at 3.41% YoY (vs -0.08% in March). The increase was triggered by the end of relief for water & electricity bills and a 38.3% hike in fuel prices (compared to low base in 2020). In addition, prices of fresh vegetables & fruits also rose in line with lower output due to unfavorable weather. Core inflation (excluding volatile raw food and energy components) rose 0.30% in April (vs 0.90% in March) driven by government stimulus measures. For 4M21, average headline and core inflation came in at 0.43% and 0.16%, respectively. Looking ahead, the third wave impact would urge the government to launch measures to reduce water & electricity bills for consumers for 2 months (May-June). Hence, inflation could ease in April and slow down markedly from 3Q onwards given fading temporary factors.

MPC holds rates with more cautious outlook; we expect policy rates to be maintained through next year

Regional Economic and Policy Developments in May

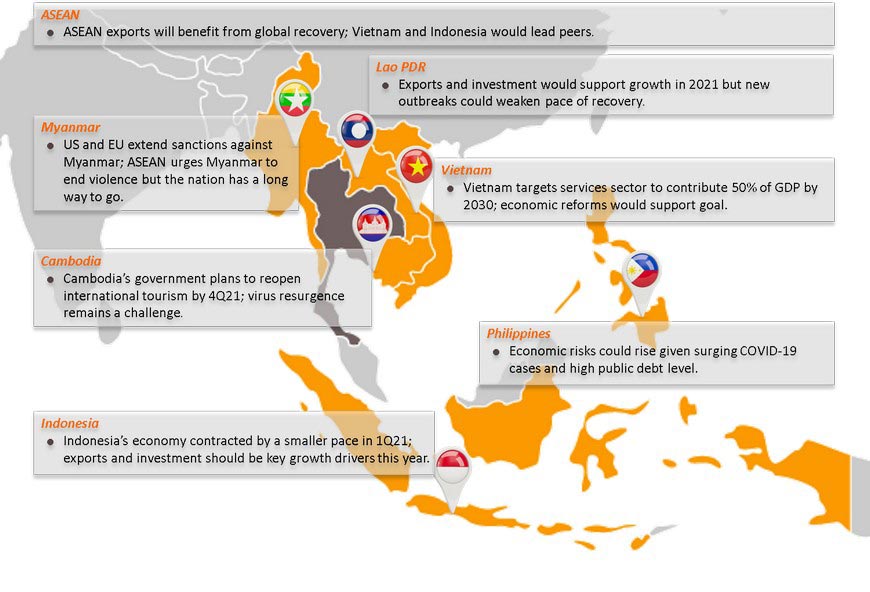

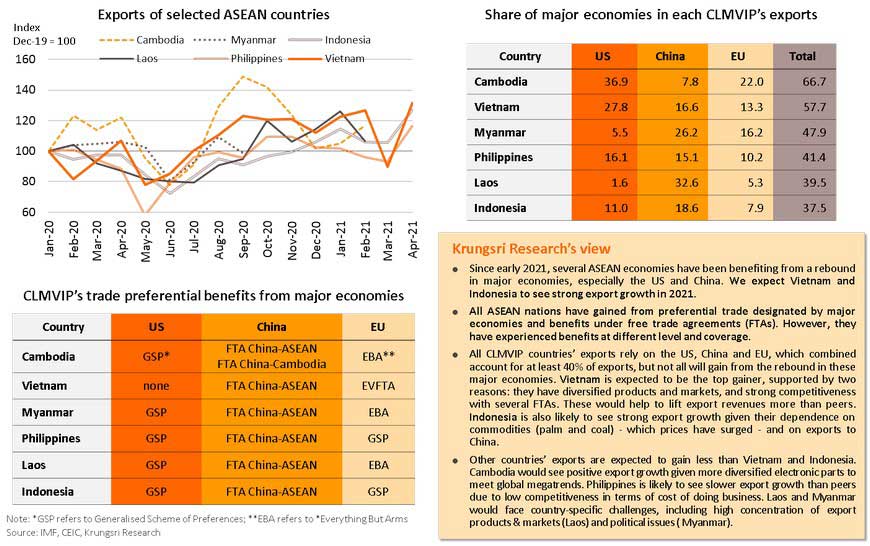

ASEAN exports will benefit from global recovery; Vietnam and Indonesia would lead peers

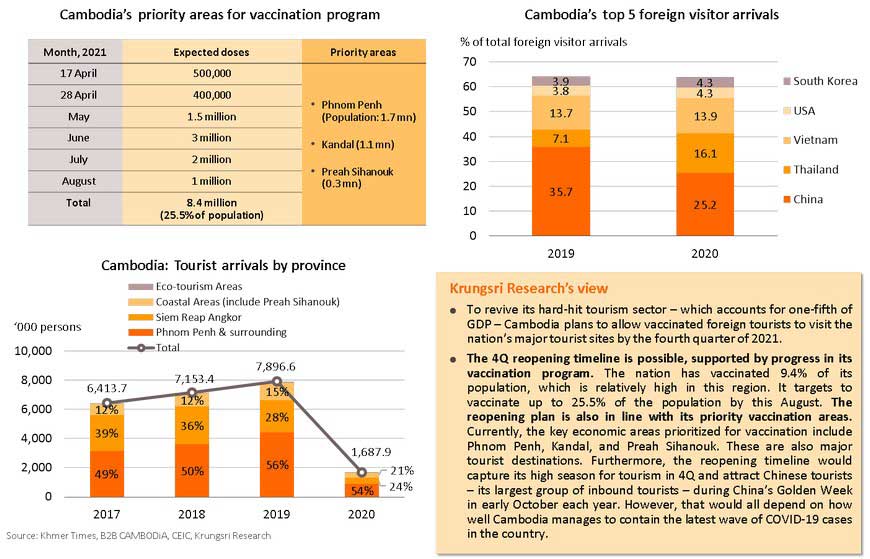

Cambodia’s government plans to reopen international tourism by 4Q21; virus resurgence remains a challenge

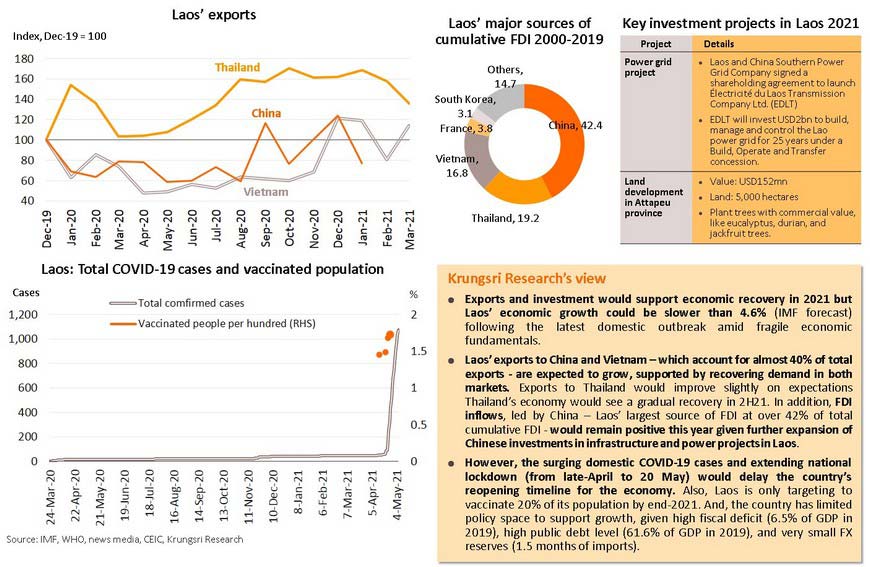

Lao PDR: Exports and investment would support growth in 2021 but new outbreaks could weaken pace of recovery

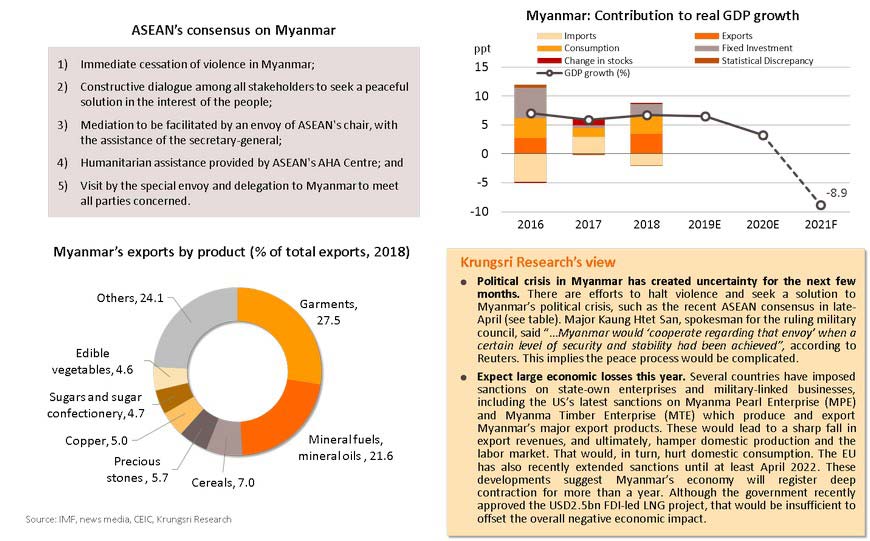

Myanmar: US and EU extend sanctions; ASEAN urges Myanmar end violence but it still has a long way to go

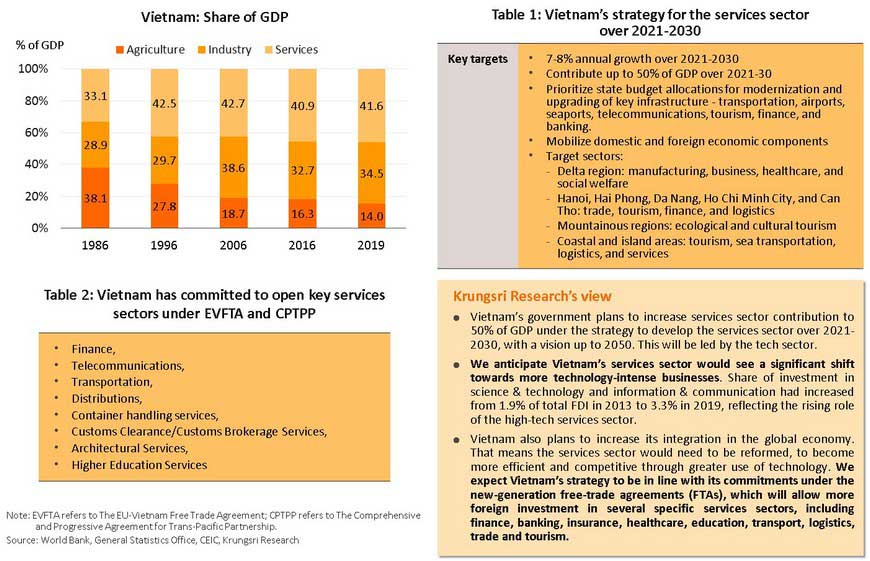

Vietnam targets services sector to contribute 50% of GDP by 2030; economic reforms would support goal

Indonesia’s economy contracts by slower pace in 1Q21; exports and investment should be key growth drivers

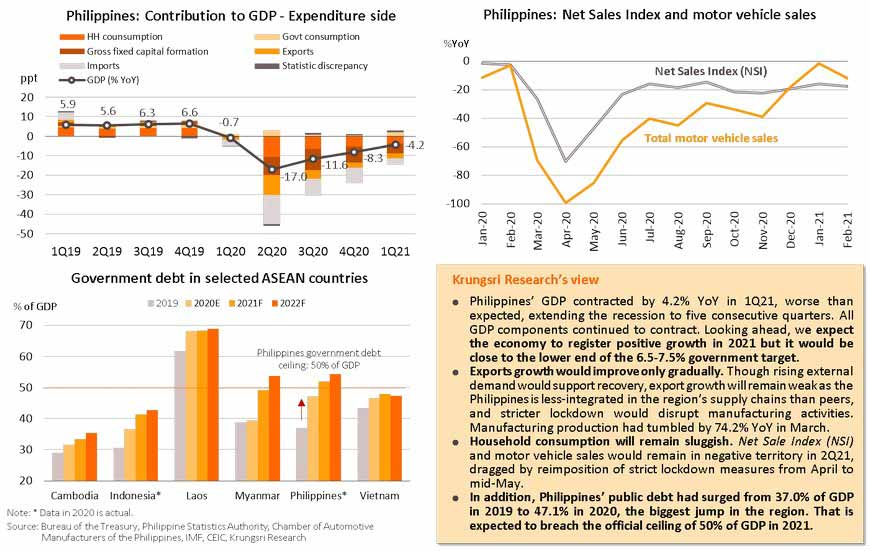

Philippines: Higher economic risks given surging COVID-19 cases and high public debt level

.jpg.aspx)