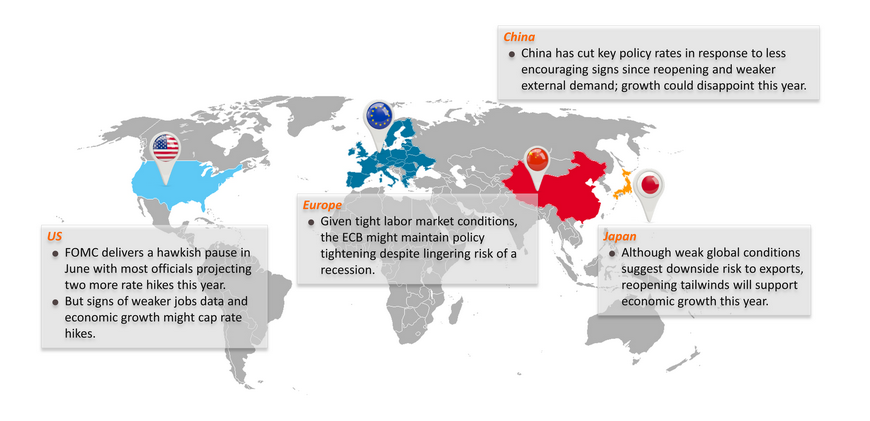

Global: Juggling inflation fears and recession risk

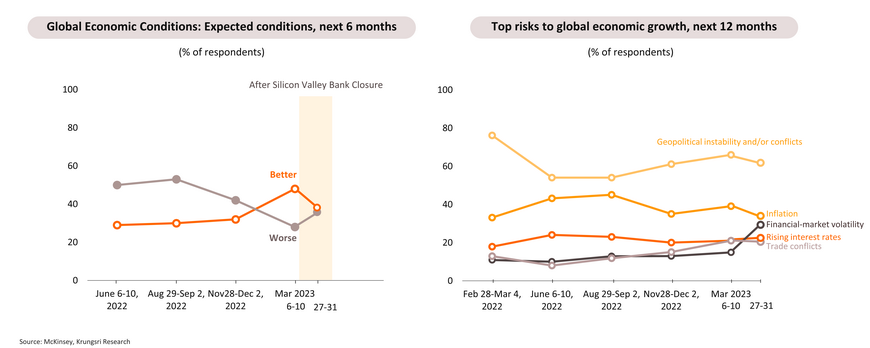

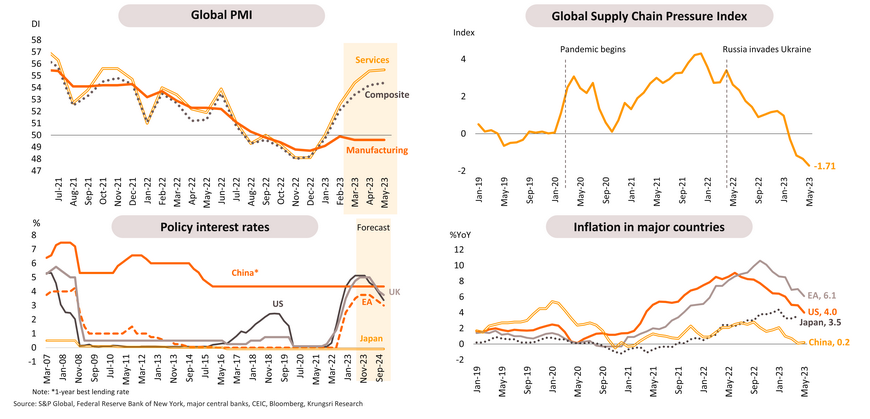

World Bank projects global growth will decelerate in 2023 despite China reopening and lower energy prices; revised down 2024 growth amid tight financial conditions

Global growth may not be sustainable given transitory pent-up demand and impending rate-hike impact; inflation remains high despite easing global supply chain pressures

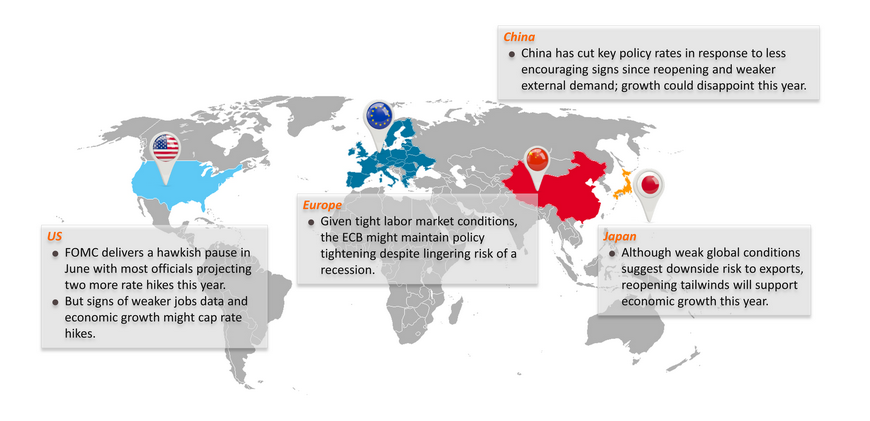

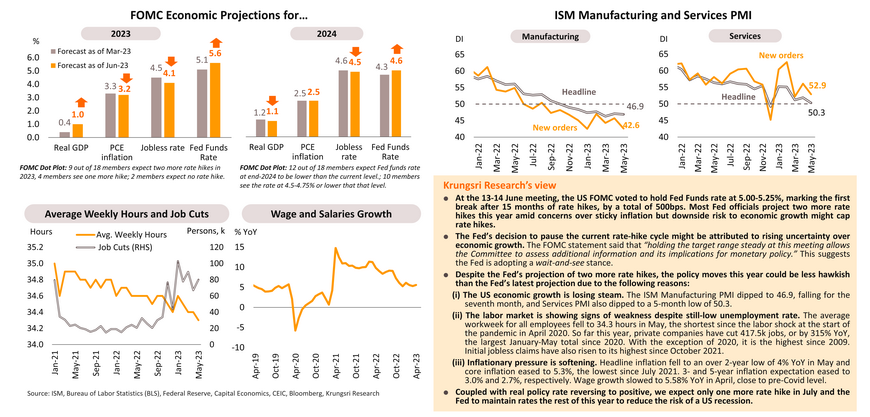

US: FOMC delivers a hawkish pause in June with most officials projecting two more rate hikes this year, but signs of weaker jobs data and economic growth might cap rate hikes

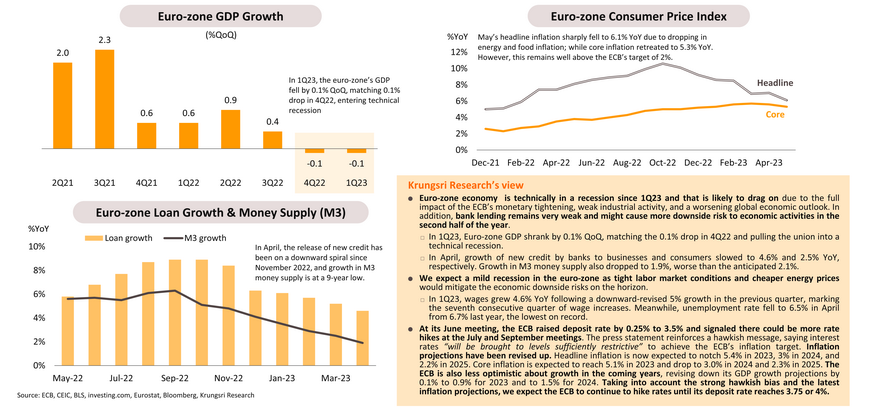

Euro-zone: Given tight labor market conditions, the ECB might maintain policy tightening despite lingering risk of a recession

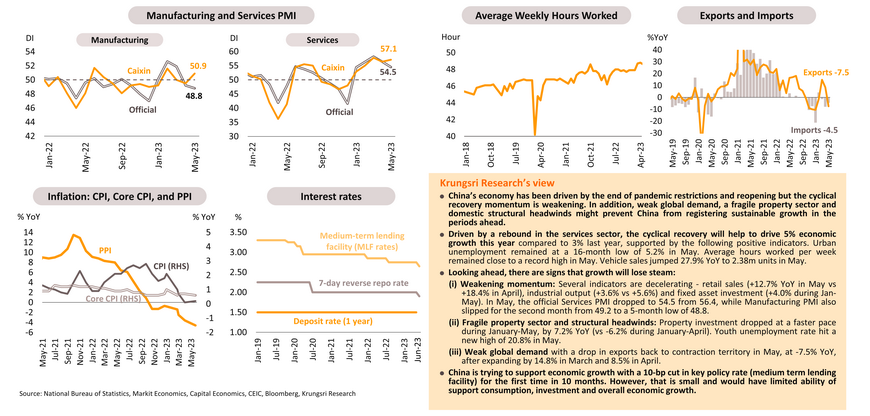

China cuts key policy rates in response to less encouraging signs since reopening and weaker external demand; growth could disappoint this year

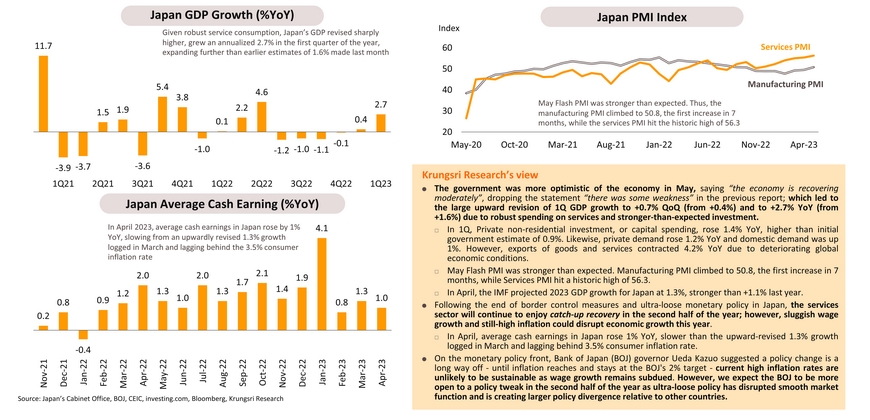

Japan: Although weak global conditions imply downside risk to exports, the reopening tailwinds will help support economic growth this year

Thailand: Awaiting clearer political direction in the country

-

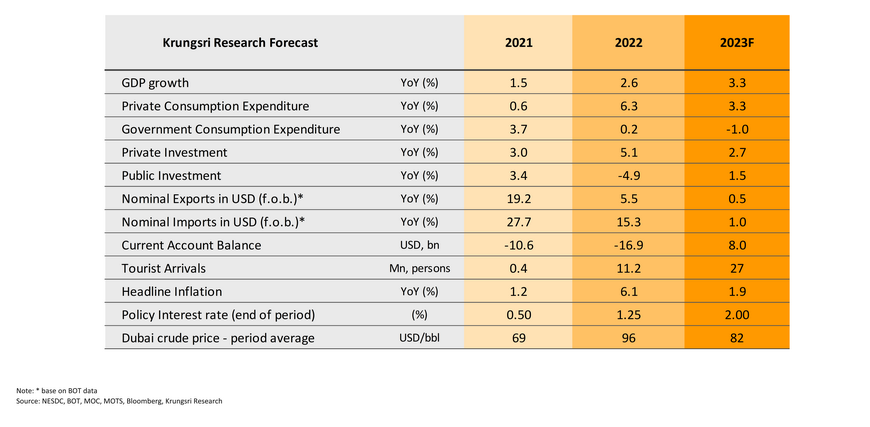

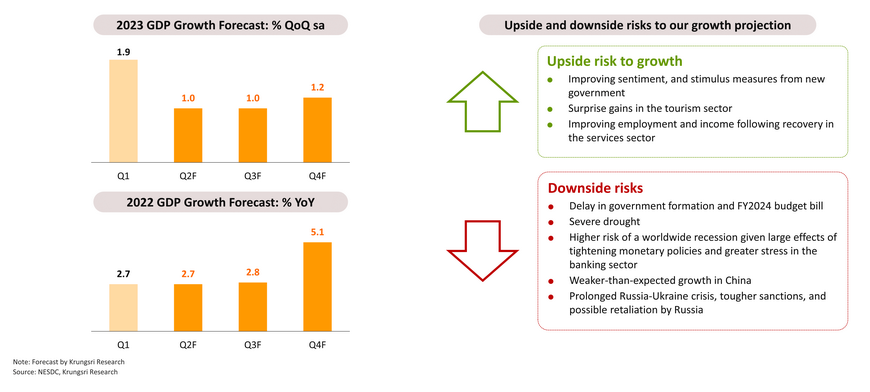

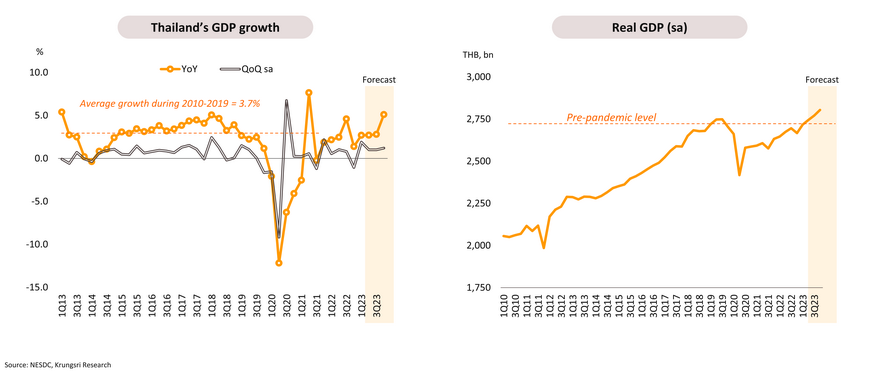

Krungsri Research is keeping 2023 GDP growth forecast at 3.3%. Economic growth is expected to be stable in Q2 and Q3 amid political uncertainty and rebound in Q4 driven by rising foreign tourist arrivals and the low base last year. The domestic political scene and new economic policies could determine upside and downside risks to growth outlook.

-

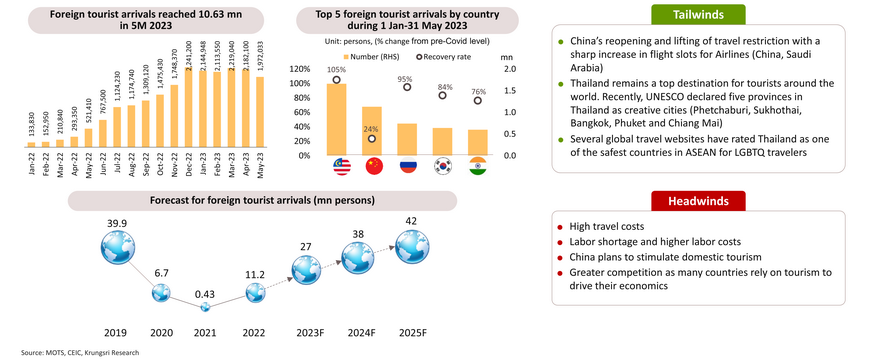

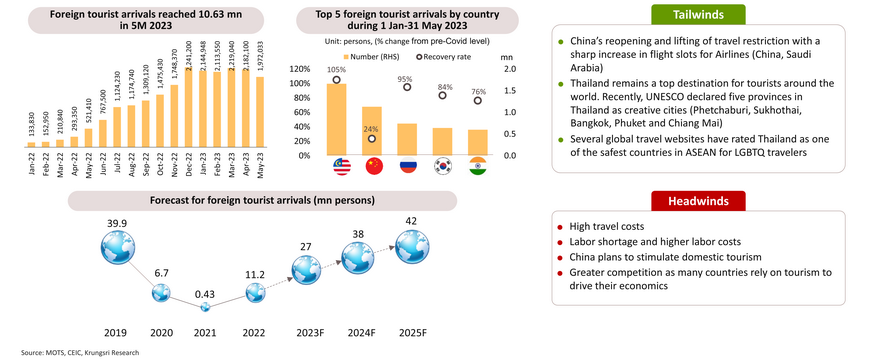

Tourism sector remains a key economic driver. Foreign tourist arrivals dropped below 2 mn persons for the first time in six months in May due to seasonal effect. We expect arrivals to rise to 14.5m in 2H23 from 12.5m in 1H23

-

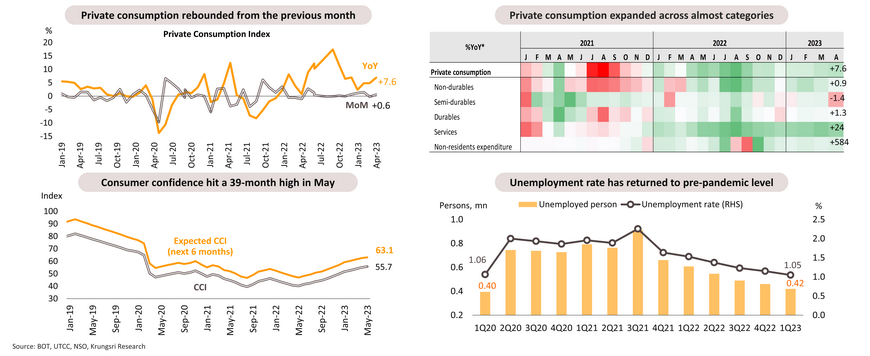

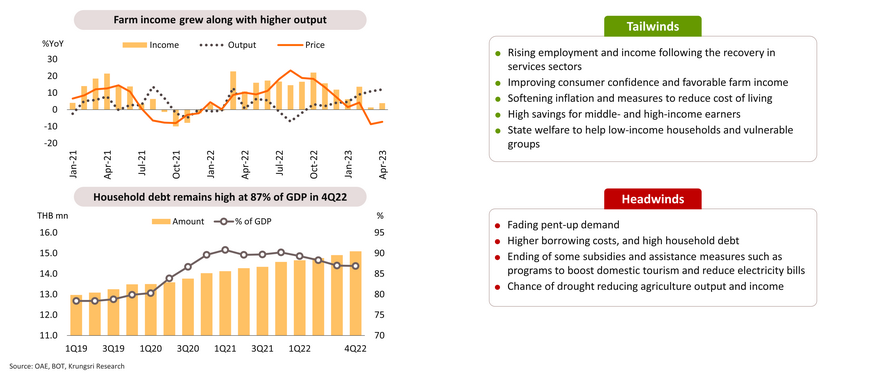

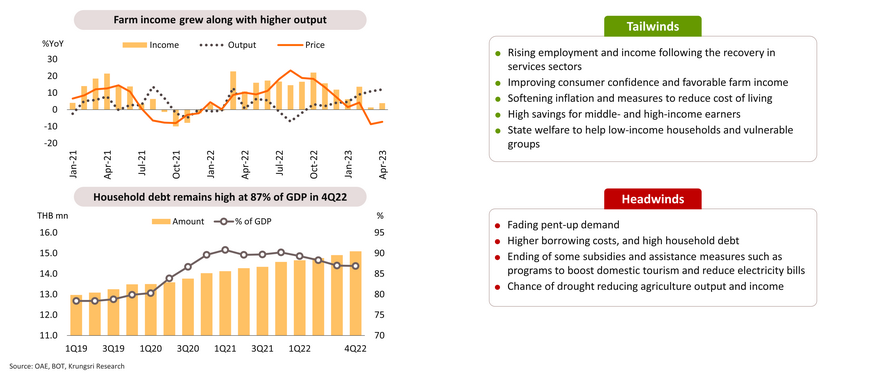

Private consumption would be the other key driver, led by improving tourism, unemployment rate returning to pre-Covid level, and improving consumer confidence. However, slower growth in farm income, higher interest rates, and high household debt could cap upside to domestic consumption.

-

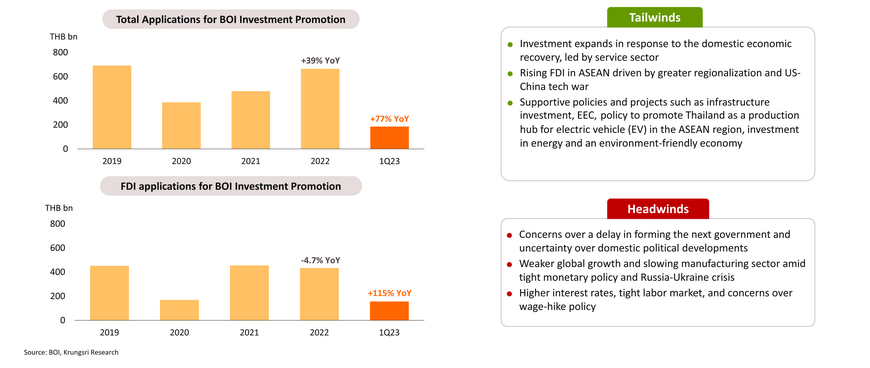

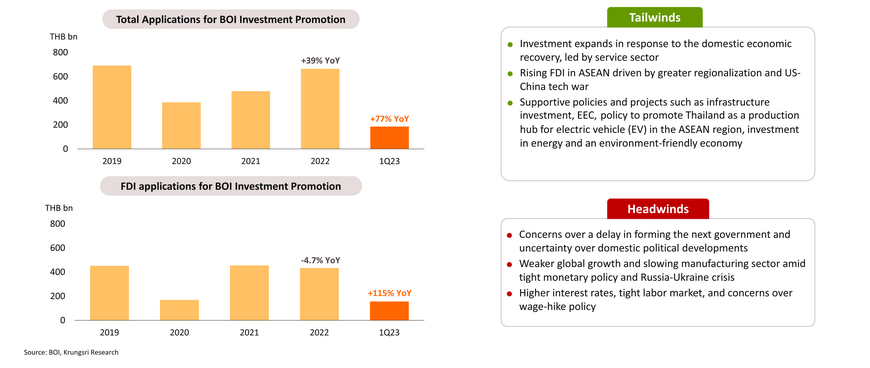

Private investment would be supported by improving domestic activity. However, sentiment might be hurt by slower manufacturing growth and political uncertainty. Although the BOI’s investment indicators are improving, a delay in forming the next government could hurt business sentiment

-

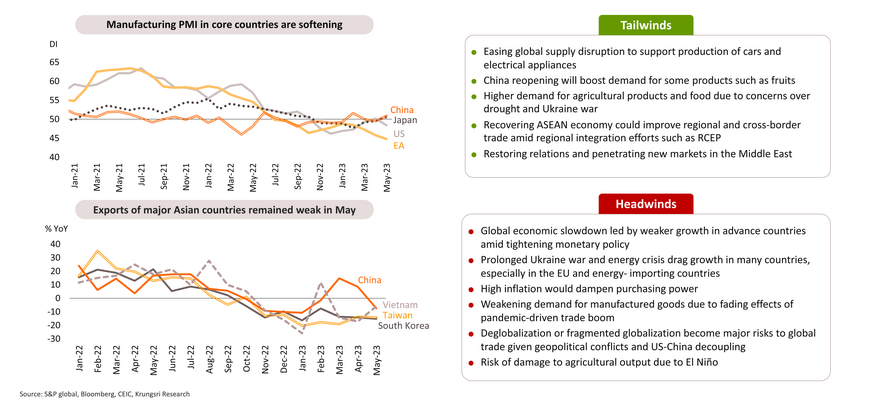

Exports are expected to see near-zero growth. China reopening and easing chip shortage would help to boost some sectors. Exports of most industrial products would remain weak following signs of a global economic slowdown.

-

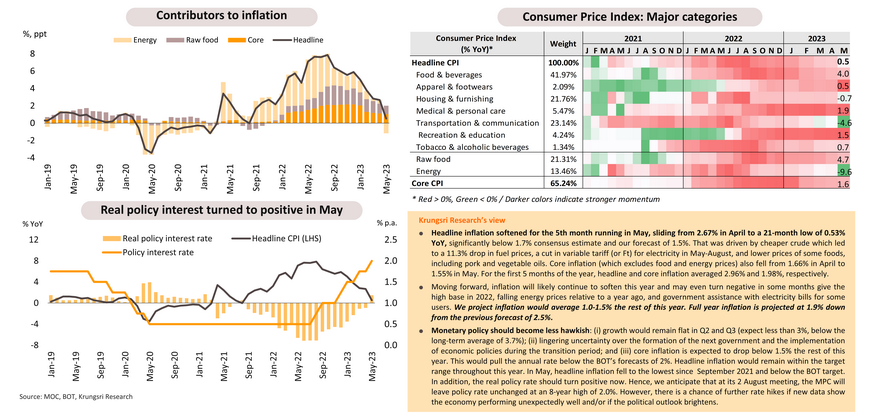

Inflation slipped to only 0.5% in May, below the BOT’s target range. Real interest rate is turning positive, reducing pressure to continue to tighten monetary policy.

-

Our analysis of new stimulus measures suggests the program to boost economic growth via the cash aid program -- THB10,000 digital wallet (or even half of it) – can substantially increase purchasing power but for only medium- and low-income households and for only a year. The welfare package to reduce wealth inequality and improve the wellbeing of Thai people will cost around THB650 bn per year. However, it is uncertain how they will obtain the budget for that and how long it would take. Policies to boost domestic spending might be a fiscal burden and raise public debt.

Krungsri Research Forecasts for 2023

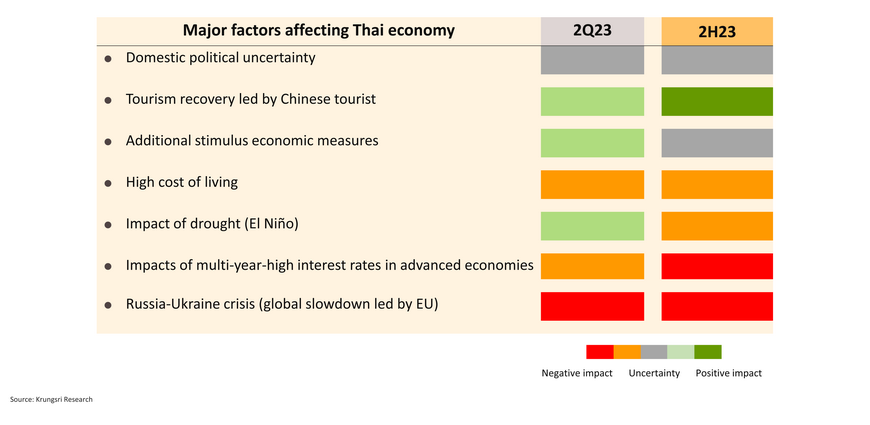

Key factors in 2H23: Growth would be driven mainly by tourism sector; domestic politics would affect investor sentiment

Tourism sector will remain a key driver although foreign tourist arrivals fell below 2 mn for the first time in 6 months due to seasonal effect; we expect arrivals to rise to 14.5m in 2H from 12.5m in 1H

The Tourism Authority of Thailand’s data show the country welcomed 1.97mn foreign tourists in May, down from 2.18 mn in April. In the first five months of this year, tourist arrivals reached 10.63mn or 63.6% of pre-Covid level (2019) and generated THB452 bn receipts (58% of pre-Covid level). Arrivals from Malaysia, Russia, South Korea and India reached 76-105% of pre-pandemic levels. Chinese tourists are returning slowly (23.5% of pre-Covid level). In the second half of this year, we expect more Chinese tourists following more slots for Chinese airlines, from 150 flights per week to more than 400 starting in September.

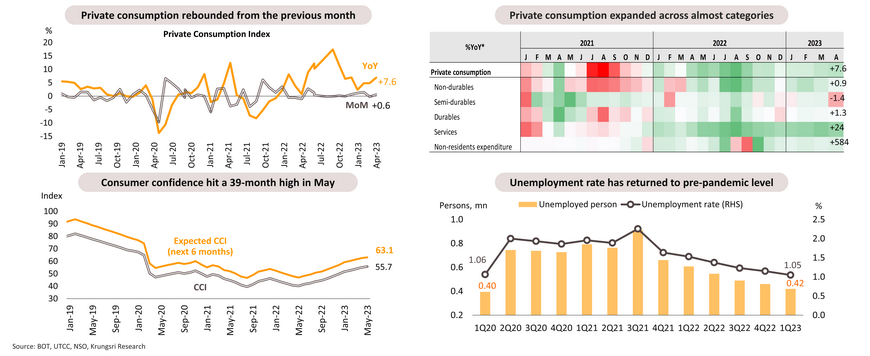

Private consumption: Mainly driven by improving tourism, unemployment rate returning to pre-Covid level, and improving consumer confidence

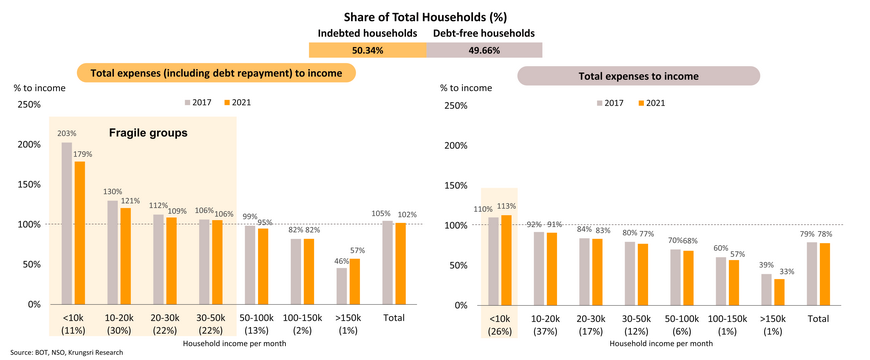

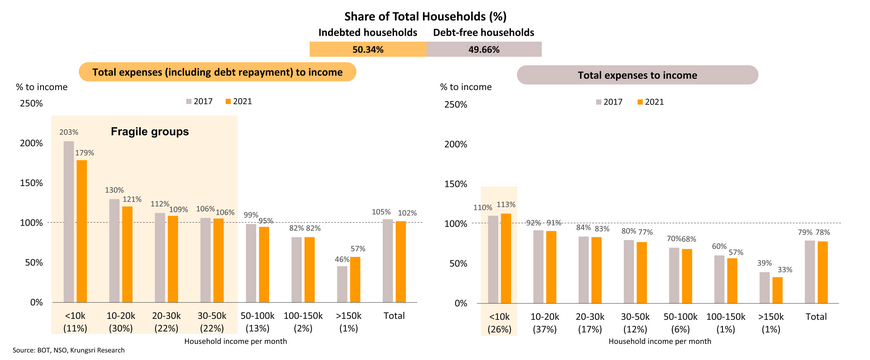

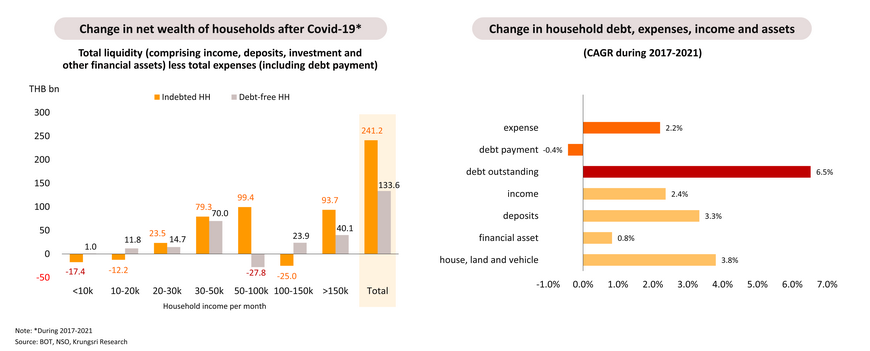

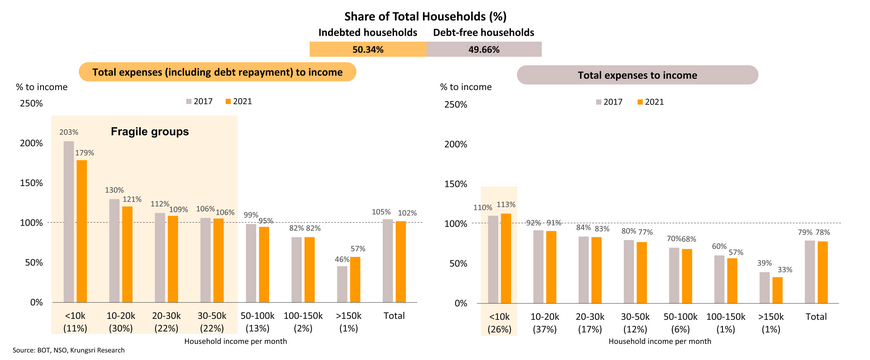

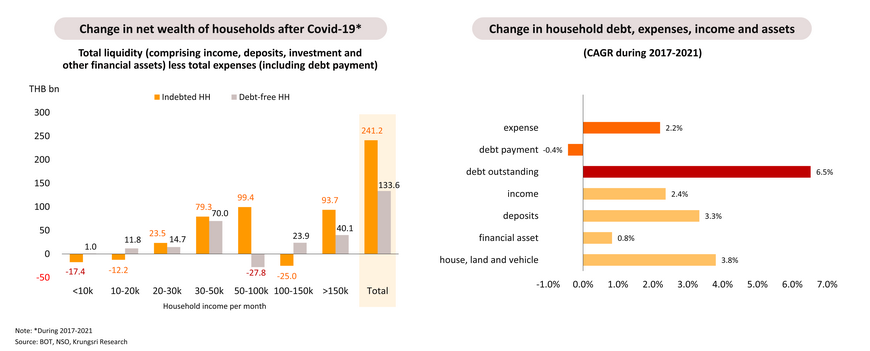

Private Consumption Index rose 7.6% YoY in April. There was improvement in many categories driven by recovering tourism activity, a growing services sector (which reduced unemployment rate to pre-pandemic level), improving confidence, and economic activity during the May general election. For the rest of the year, recovering tourism activity and easing inflationary pressure following lower fuel prices would boost consumption. However, household spending remains vulnerable, especially households which have debts and earn less than THB50,000 per month. Hence, recovery would be uneven between household segments amid fading pent-up demand.

Slower growth in farm income, higher interest rates, and high household debt could cap consumption growth

In the first four months of 2023, agricultural product prices fell 2.9% YoY but output increased by 8.9%, causing farm income to rise 6.9%. But looking ahead, farm income is likely to increase at a slower rate in line with the drop in agricultural product prices as well as risk of El Nino-induced drought reducing agricultural output. In addition, consumption has been pressured by high level of household debt which has reached almost 87% of GDP and increasing financial burden as interest rates are at an 8-year high. Vulnerable households might need additional support from the government.

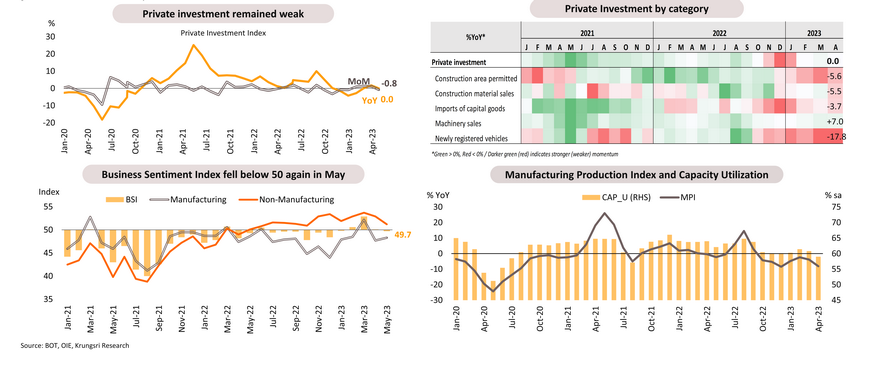

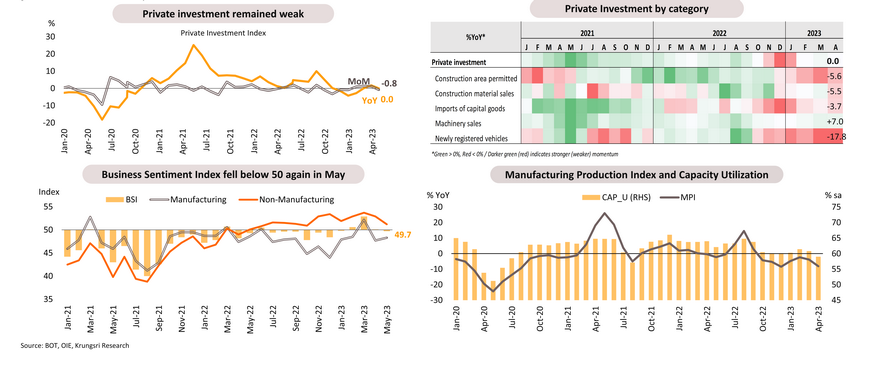

Private investment has been supported by improving domestic activity but sentiment is hurt by slower manufacturing activity and influenced by domestic political developments

Private Investment Index turned to contract 0.8% MoM and 0% YoY in April, led by a decline in new vehicle registrations and imports of capital goods. Likewise, the Manufacturing Production Index continued to drop for the seventh straight month, by 8.1% YoY. Capacity utilization rate fell to 59.0%, still below pre-pandemic level of 65.5%. The Business Sentiment Index (BSI) dipped below-50 again in May, as a result of a drop in non-manufacturing BSI, particularly hotel and restaurant sectors. This drop can be attributed to the start of the low season and the end of government tourism stimulus measures. Meanwhile, the Manufacturing BSI inched-up but remained in contraction territory (below-50). For the rest of this year, we expect private investment to remain stable as investors might delay investment decisions pending clarity on the formation of the next government and their economic policies.

BOI investment indicators improved in 1Q23 but delays in forming the next government could hurt sentiment

In 1Q23, the BOI received applications for investment incentives for 397 projects (+9% YoY) with a total investment value of THB185.73 bn (+77% YoY). Foreign direct investment applications rose by 10% to 211 projects valued at THB155.26 bn. (+115%), led by South Korea, Singapore, China, and Japan, as (i) the COVID-19 situation eased; and (ii) countries which are major sources of FDI have reopened their countries and might relocate production to mitigate risks from geopolitical conflicts. Applications were mostly for the electronics sector. 2Q and 3Q will be the transition period as investors wait for clarity on the the formation of the next government and well as their economic policies. Greater uncertainty could delay investments.

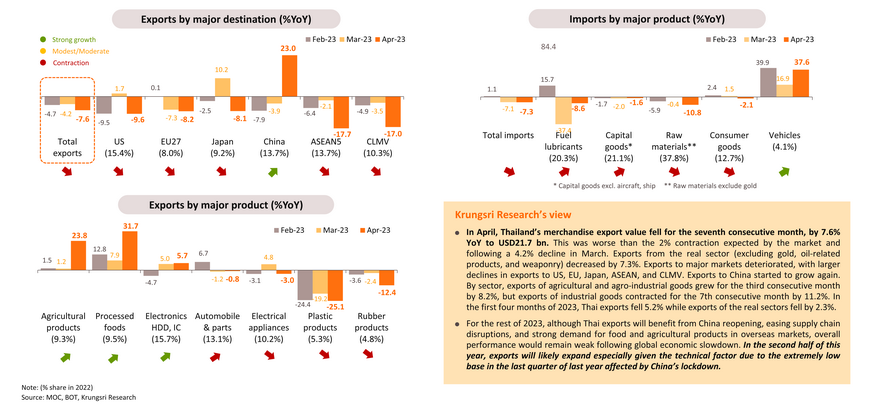

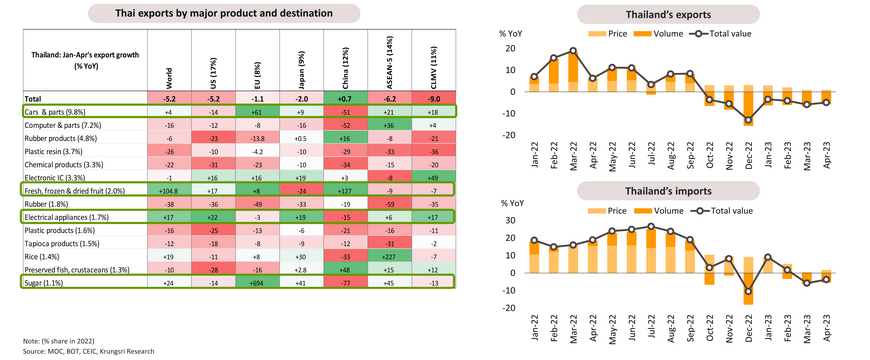

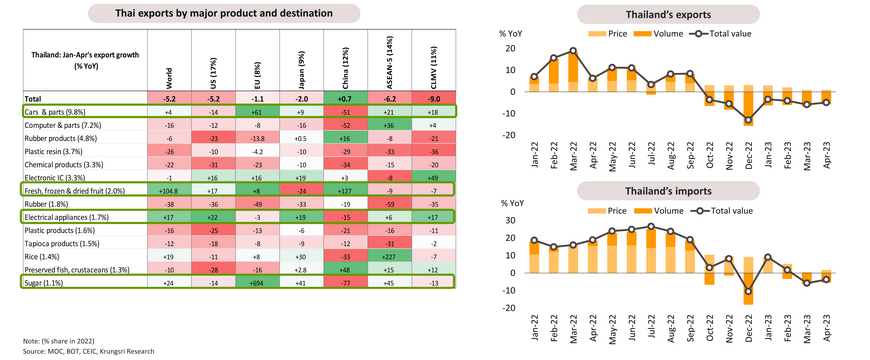

Exports: Total export value contracted more than expected in April though exports of agricultural products and processed foods expanded

Some sectors gained led by specific factors but most industrial products saw a drop in export volumes and prices

In the first four months of this year, Thai exports contracted 5.2% YoY led by a 7.1% decline in industrial products such as computers & parts and oil-related products, while agricultural and agro-industrial products experienced 3.7% growth driven by fresh, frozen & dried fruits, rice, and fresh & frozen chickens. China reopening and easing chip shortage helped to boost some sectors. Most industrial products registered weaker export volumes and prices. Exports from oil-related sectors remain weak.

Thailand's exports remain fragile given signs of weaker manufacturing activity in major countries and slower exports in key Asian countries

Headline inflation slipped to only 0.5% in May, below BOT’s target range of 1-3%; real policy rate is turning positive, reducing need for additional policy tightening

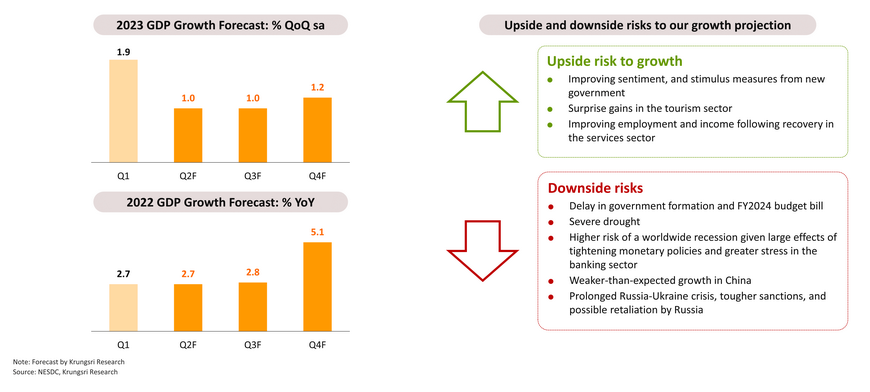

We maintain 2023 GDP growth forecast at 3.3% amid upside and downside risks; growth is expected to be stable in Q2 and Q3 amid political uncertainty

Our economic growth forecast is supported by recovering tourism activities and improving consumption. Growth is expected to stabilize in 2Q and 3Q to 2.7-2.8.% YoY and pick up in Q4 driven by rising foreign tourist arrivals and the low base effect last year. However, there is downside risk from domestic political uncertainty, China slowdown, and US Fed’s aggressive rate hikes.

Gauging Thailand’s economic recovery and assessing the impact of cash aid plans by major political parties

-

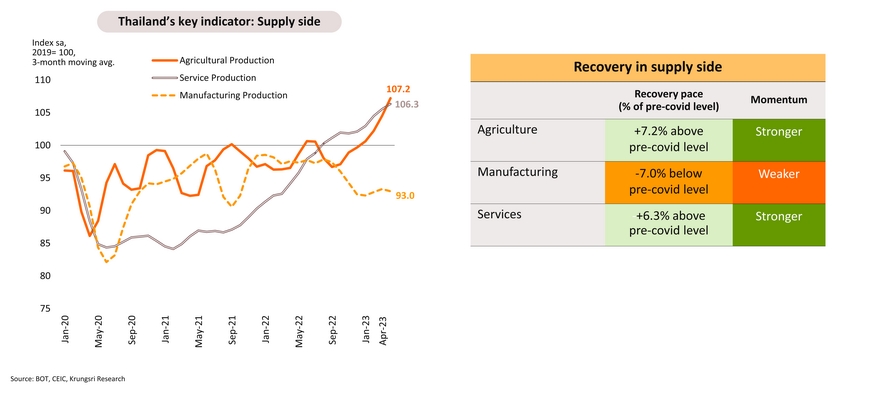

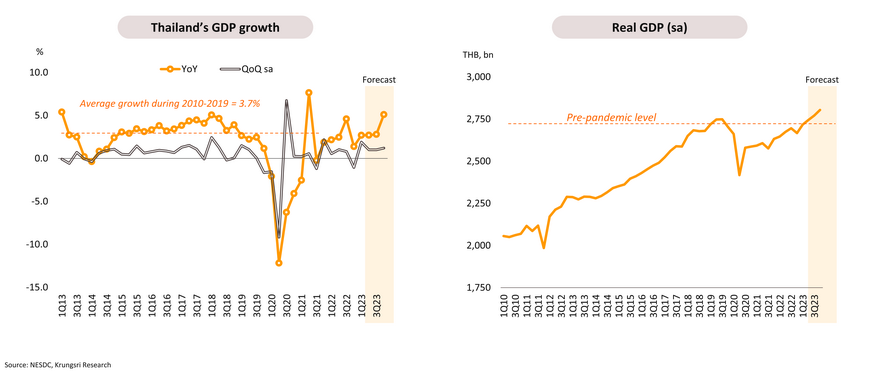

Thailand’s economic activity (reflected by GDP) returned to pre-Covid level in 1Q23. Growth is likely to stabilize in 2Q-3Q before improving in 4Q. On the demand side, the Thai economy has been driven by a strong recovery in tourism activity and rising domestic spending, despite weaker exports amid a slower global economy. On the supply side, agriculture and services sectors have exceeded pre-pandemic levels and continued to grow, while manufacturing output fell amid weak exports. There is lingering concerns over a K-shaped recovery.

-

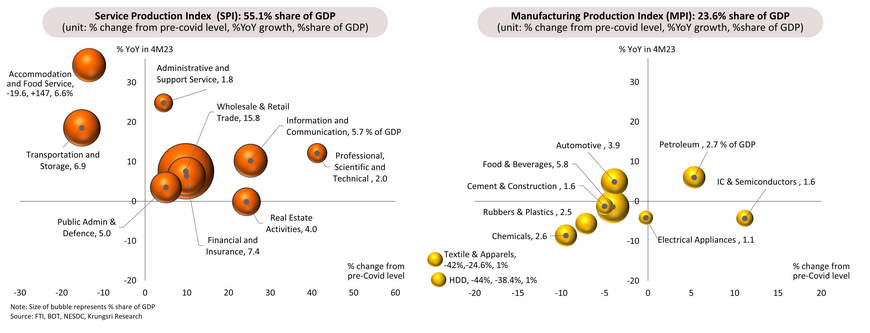

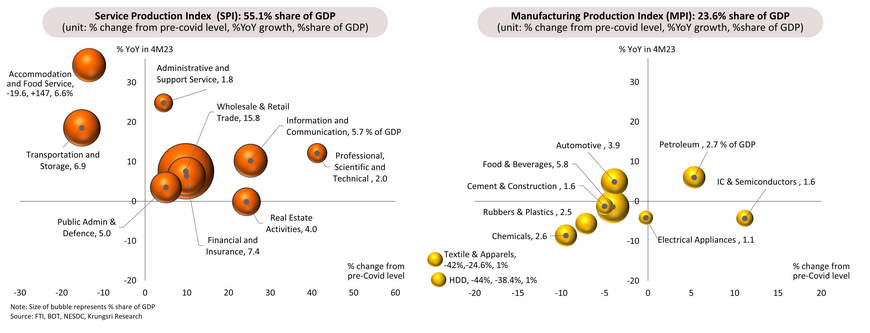

In the services sector, most categories have exceeded pre-Covid levels and been registering strong growth, including Information & Communication, Professional Scientific & Technical, Wholesale & Retail Trade, Financial & Insurance, Public Admin & Defense and Administrative & Support Service, accounting for a combined 37.6% of GDP. In the manufacturing sector, most industries remained weaker than pre-covid levels and registered negative growth, including Electrical Appliance, Food & Beverages, Cement & Construction, Rubber & Plastic, Chemicals, HDD, and Textile & Apparel, which account for a combined 15.5% of GDP.

-

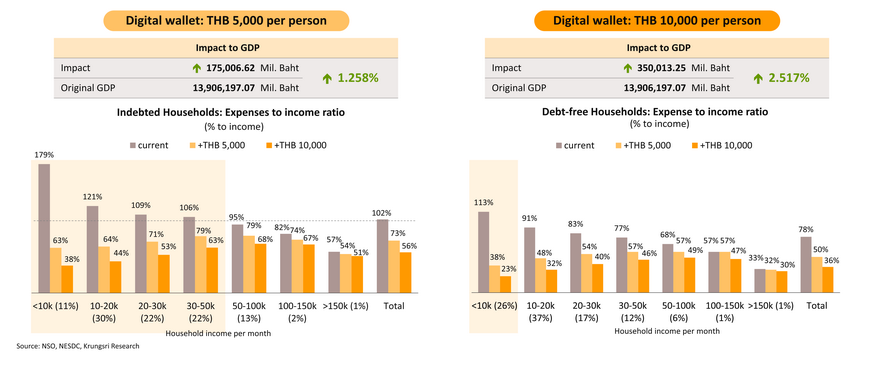

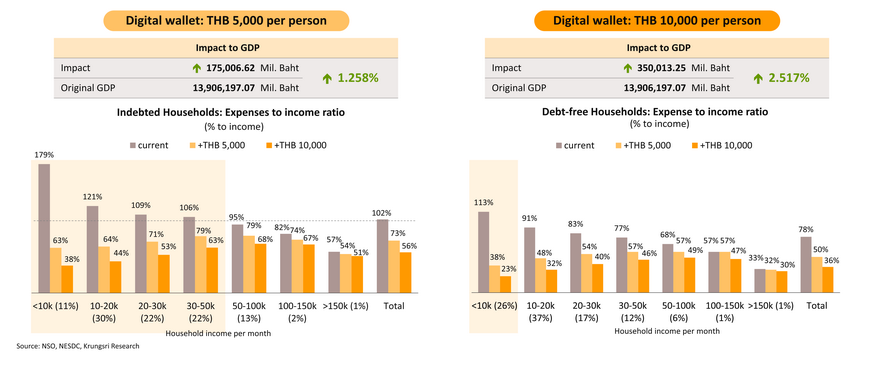

Measures to support economic growth via cash aid program such as THB10,000 digital wallet (or even half of it) can significantly increase purchasing power for low-income households and stimulate the economy, but for only a year.

-

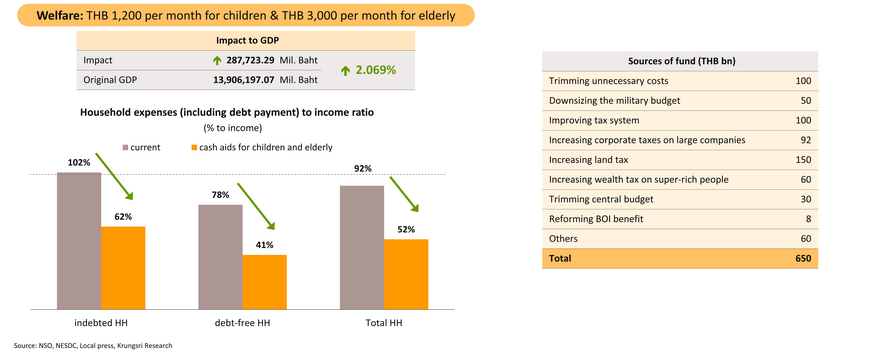

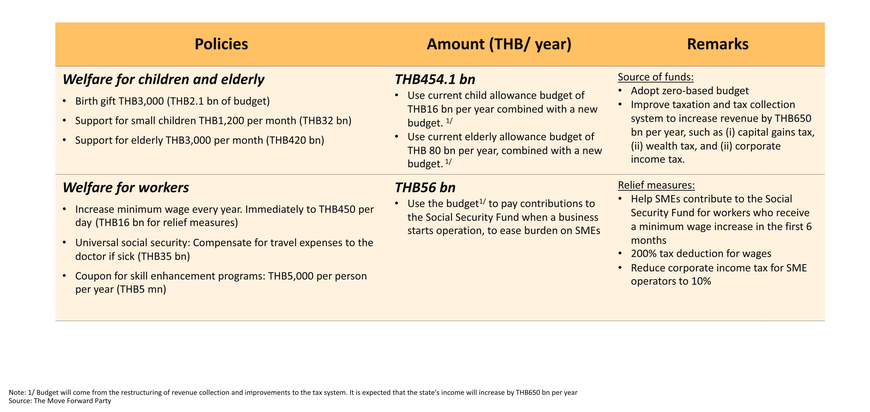

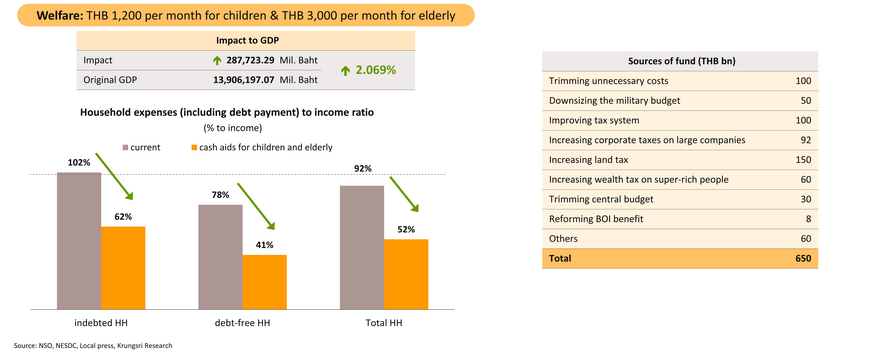

Welfare package to reduce wealth inequality and improve the wellbeing of Thai people will cost around THB650 bn. However, it is uncertain how they will obtain the budget for that and how long it would take.

-

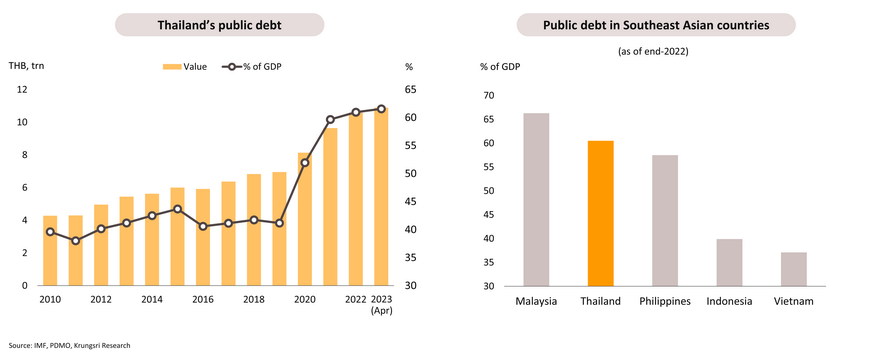

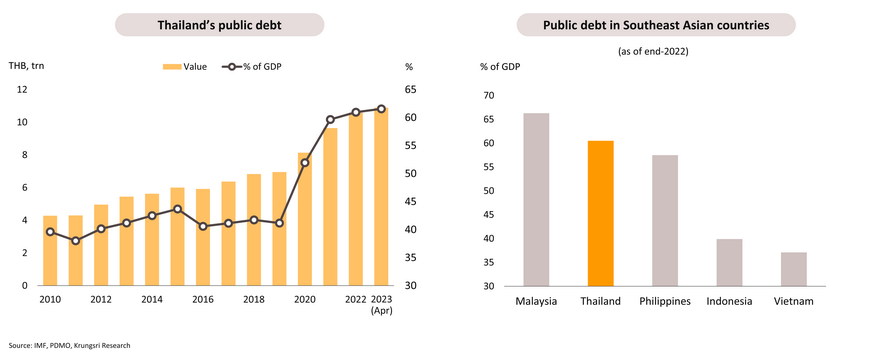

Policies to boost domestic spending might be a fiscal burden and raise public debt. If authorities borrow additional THB500 bn, public debt would increase from 61% of GDP currently to 64%, higher than that in other Southeast Asian countries.

Economic recovery: Economic activity (reflected by GDP) returned to pre-Covid level in 1Q23; growth is likely to stabilize in 2Q-3Q before improving in 4Q

The Thai economy expanded by 2.7% YoY in 1Q23, accelerating from 1.4% in 4Q22, driven by the recovering tourism sector and improving private consumption amid higher employment and rising farm income. Private investment rose at a slower pace in both construction sector and machinery equipment. Merchandise exports and public consumption continued to shrink in 1Q23. Looking ahead, economic growth is expected to stabilize in 2Q23 and 3Q23 amid political uncertainty but would register growth in 4Q23 premised on rising foreign tourist arrivals and the low-base last year.

Demand side: Economic growth driven by strong recovery in tourism and improving domestic spending, despite weaker exports amid the slower global economy

Supply side: Agriculture and services sectors have exceeded pre-COVID levels and continued to grow while manufacturing output fell amid weak exports; still in K-shaped recovery

Many service sectors continued to grow following recovering tourism activity and improving domestic consumption

Service Production Index (SPI) for the first four months of this year surged 13.1% YoY with tailwinds from reopening and relaxation of containment measures. Production in many service sectors have exceeded pre-pandemic levels with accelerating momentum, led by Information & Communication, Real Estate Activities and Wholesale & Retail Trade. Sectors that are still weaker than pre-covid levels but continue to improve include Accommodation & Food Service and Transportation & Storage, supported by stronger tourism activity and improving domestic activity post-pandemic.

Manufacturing production: Most sectors remained weak due to slower global demand

The Manufacturing Production Index (MPI) for the first four months of this year shrank 4.7% YoY. The sector which activities have exceeded pre-pandemic levels and continue to accelerate include petroleum amid ASEAN reopening and recovering tourism activity. Sectors which activity has exceeded pre-pandemic level but are registering steady momentum include IC & semiconductors amid easing chip shortage problem. Sectors which remain below pre-pandemic levels but are improving include electrical appliance and automotive due to easing global supply disruption. Sectors which remain below pre-pandemic levels with steady momentum include Food & Beverage and Cement & Construction given gradually improving domestic demand. Sectors which production remain weak and are still below pre-pandemic levels include Rubbers & Plastics, Textiles & Apparels, Chemicals and HDD as global demand has slowed down.

Recovery pace: Services sector registers stronger and broader-based recovery but manufacturing production remains fragile

-

For the services sector, most categories have recovered above pre-Covid levels and registered positive year-on-year growth, including Information & Communication (25% above pre-covid level, +10% YoY), Professional Scientific & Technical (41%, +12%), Wholesale & Retail Trade (10%, +8%), Financial and Insurance (10%, +6%), Public Admin & Defense (5%, +4%) and Administrative & Support Service (4%, +25%). Output of those categories accounted for a combined 37.6% of GDP. Manufacturing industry in this classification include petroleum (2.7% of GDP).

-

Manufacturing and services industries that have recovered above pre-Covid levels but registered negative growth included IC & Semiconductors (1.6% of GDP) and Real Estate Activities (4.0%).

-

Manufacturing and services industries that remained weaker than pre-pandemic levels but registered improving growth include Automotive (3.9% of GDP), Accommodation & Food Service (6.6%), Transportation & Storage (6.9%).

-

Manufacturing industries that remained weaker than pre-covid levels and registered negative growth include Electrical Appliance, Food & Beverages, Cement & Construction, Rubber & Plastic, Chemicals, HDD and Textile & Apparel. Output of those industries account for a combined 15.5% of GDP.

Economic policy: THB10,000 digital wallet (or half that) can significantly lift purchasing power for low-income households and stimulate the economy, but for only a year

The defeat of the Pheu Thai Party (PTP) in the 2023 election means it will not lead the coalition government and might not be able to implement its major campaign promises, such as “digital wallet”. We think the THB 10,000 in digital cash wallet proposal (for all Thais aged 16 and above) might be reduced or reallocated to the most fragile households (income less than expenses), especially those with monthly incomes below THB 50,000. We estimate the original THB 10,000 digital cash wallet proposal would boost Thai GDP by 2.52% within a year of it being implemented and significantly increase purchasing power for all households, particularly those with less than THB 50,000 monthly income. If the digital cash wallet is halved to THB 5,000, it would boost Thai GDP by 1.26% and would still be sufficient to rescue fragile households without creating an excessive fiscal burden for the Thai government.

Welfare package to minimize wealth inequality and improve wellbeing of Thai people will cost THB650bn but it remains uncertain where they would get the budget for that

By 2027, around 70% of the welfare budget (THB452bn out of THB650bn total budget) would be used to finance the focus groups - children, parents and senior citizens - in order to minimize wealth inequality, lift birth rate, and improve the wellbeing of Thai people from birth to death. We estimate the welfare package has increased household purchasing power and lifted Thai GDP by 2.07% per year since launch. However, the budget comes from funds saved by trimming costs such as downsizing the military budget and improving tax collection. Without borrowing, it could be difficult for the Move Forward Party to push forward the policies or any legislation.

State welfare policies would need a large budget and take time to implement

Policies to boost domestic spending could be a fiscal burden and raise public debt; if the government borrows additional THB500 bn, public debt would rise to 64% of GDP

The COVID-19 outbreak has had a significant impact on Thailand's fiscal position. At the end of April, public debt had reached 61.6% of the country's GDP, equivalent to THB10.9 trillion. Although the government has raised the public debt ceiling to 70% of GDP as a buffer for the new government to support crucial policies, there is still a noticeable gap in debt coverage. If the government borrows an additional THB500 bn, Thailand’s public debt will rise to 64% of GDP, higher than that of other Southeast Asian countries. Fitch Ratings has warned that this uncertainty and delays in forming the next government could interrupt disbursement of the annual budget. In addition, Thailand’s fiscal position has deteriorated markedly since the Covid-19 pandemic and if the next government is unable to regain control of government debt, it would drag Thailand’s credit profile.