Global: From pandemic to endemic, but with rising threats

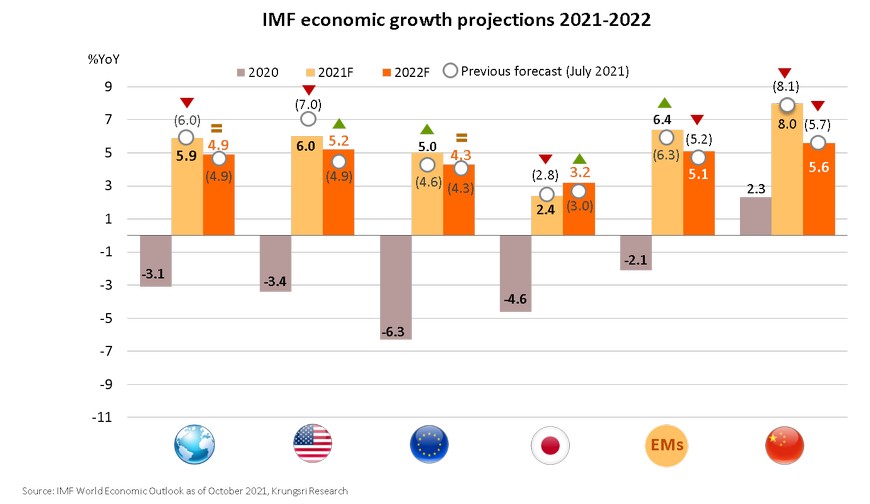

IMF sees major countries struggling with supply bottlenecks; pandemic dynamics dampen recovery in developing economies; headline growth revision capped by gains in commodity-exporting countries

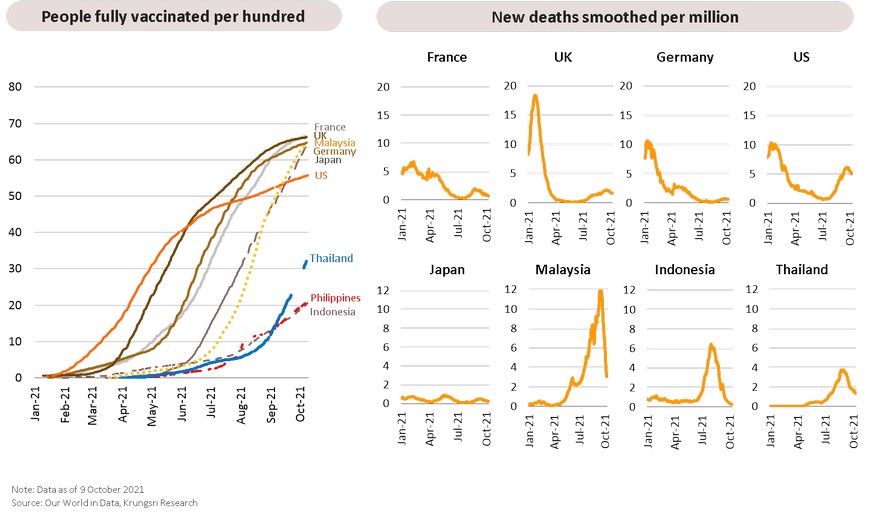

Vaccination progress raises hopes of transition from pandemic to endemic

Improving COVID-19 situation a tailwind but supply disruption and rising price pressures threaten the global economy

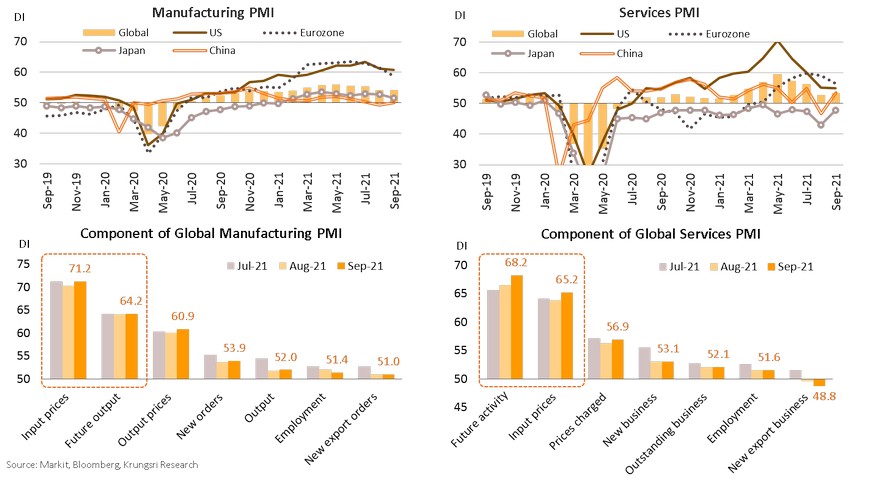

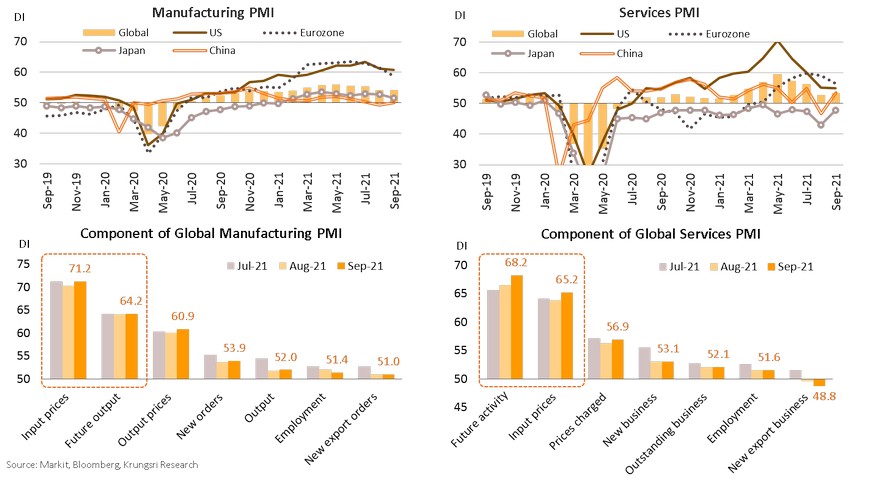

Global Manufacturing PMI was stable at 54.1 in September, matching August’s 6-month low, with rising concern over price pressures and supply disruption. Most key countries saw slower manufacturing growth except China where manufacturing activity picked up because of fewer daily cases and easing restrictions. Global Services PMI rose to 53.4 in September, led by a rebound in activities in China and Japan given the improving COVID-19 situation. Overall, despite threats to growth and inflation, global Manufacturing and Services PMI data remained well above pre-pandemic levels of 50.1 and 51.9 in December 2019, respectively.

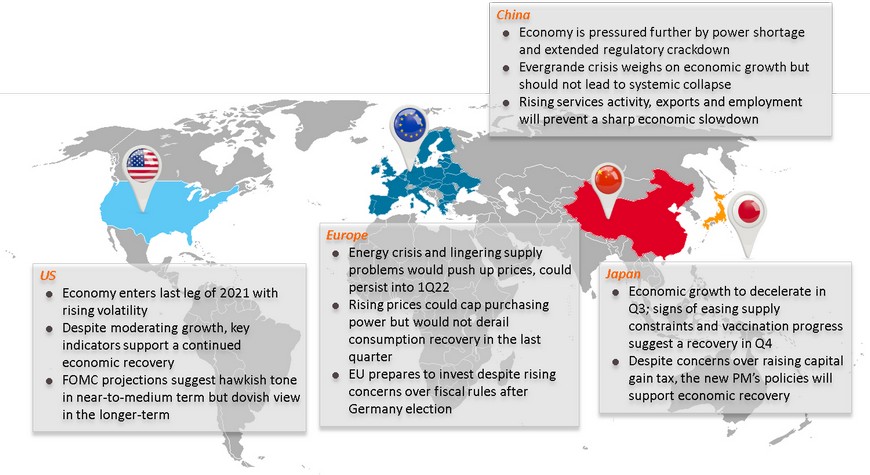

US: Economy enters last leg of 2021 with rising volatility

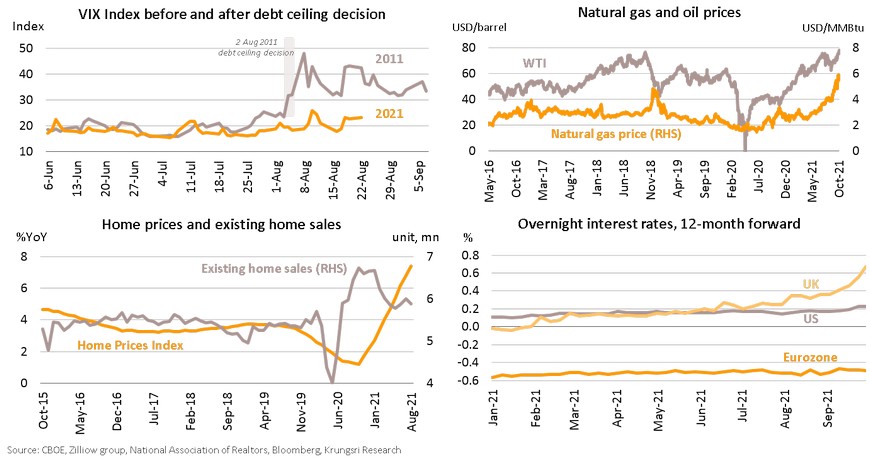

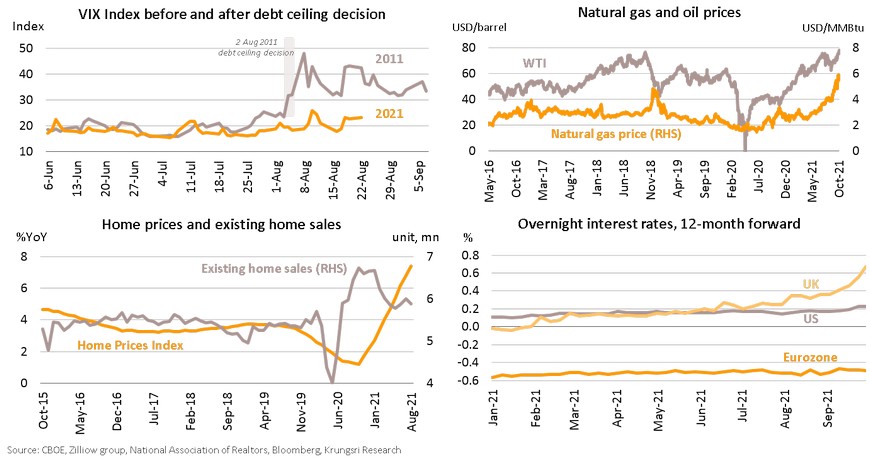

Concerns over temporary lifting of debt limit, rising energy prices, an overheating housing market, and the beginning of policy normalization, would increase volatility and risks in financial markets in the final quarter of 2021. These could threaten economic growth and fuel fear of rising cost of living. The House approved to raise debt limit to USD28.9trn, pushing off risk of default at least until early-December. However, historical data show that although the debt ceiling is lifted or suspended, markets remain volatile for about a least a month before easing. US natural gas price has jumped 140% this year while oil price has risen to its highest since 2014, partly due to escalating demand since reopening. Surging natural gas and oil prices have increased inflationary pressures and inflation rate could exceed policymakers’ expectations and push up production costs. The overheating housing market is fueled by rising home prices and solid demand. Demand continues to exceed supply because of low mortgage rates and fewer people working at the office. However, record-high prices have eroded consumers’ affordability. Moreover, increasing overnight interest rates of major central banks suggest the start of policy normalization later this year. This would affect bond yields, currency movements and capital flows. Looking ahead, volatility could dampen economic growth in 4Q21 and early-2022.

Despite moderating growth, key indicators support a continued economic recovery

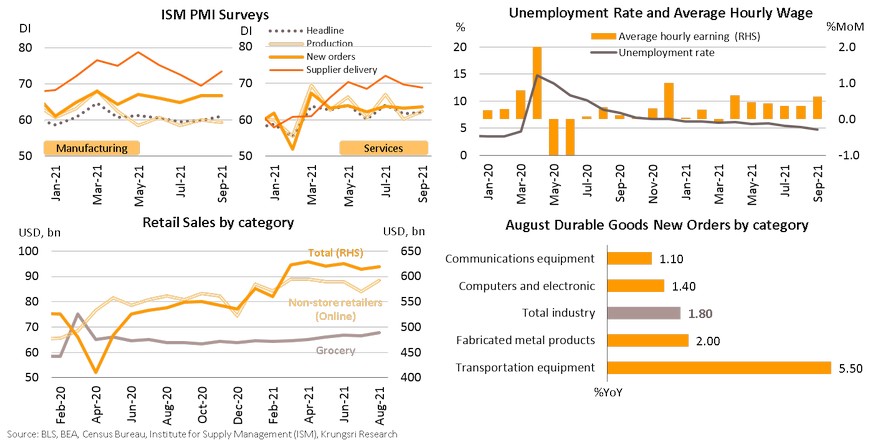

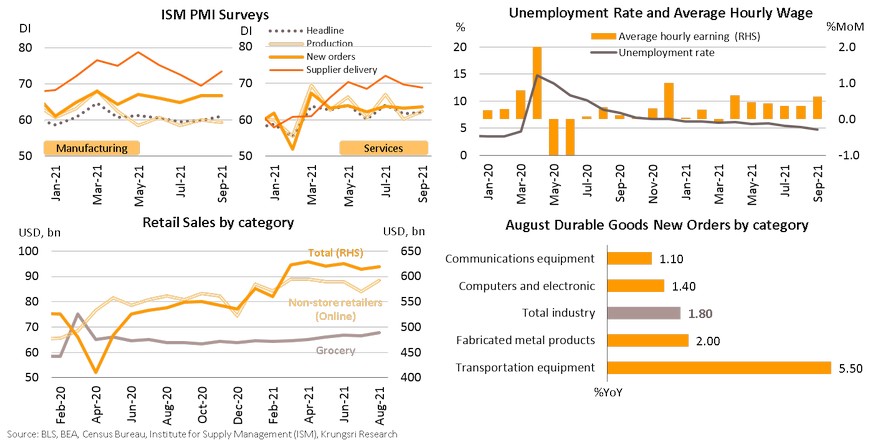

Despite visible delivery problems and weaker-than-expected job data, the economy continued to expand in September, suggesting the delta-variant only had a temporary impact on demand. Services sector PMI inched-up to 61.9 and Manufacturing PMI to 61.1 despite supply bottlenecks. The mild rise in non-farm payrolls reflect hiring problem. However, unemployment rate is at its lowest since Feb 2020, at 4.8%. The expiry of unemployment benefits and school reopening should improve hiring in the coming months. Moreover, average wage has risen more-than-expected at 0.6% MoM, suggesting consumption will continue to pick up. Hence, despite higher prices, rising wages and a rebound in online & grocery shopping activities could boost retail sales in 4Q21. Retailers are stocking-up for the holiday season, including retailers of home decoration and food supplies. Other businesses also signaled improvements and preparation for new investment. Orders for cars, appliances and computers had risen in August; improving durable goods new orders would support GDP growth in 2H21 and could lift manufacturing capacity. These would support a continued economic recovery in the next period.

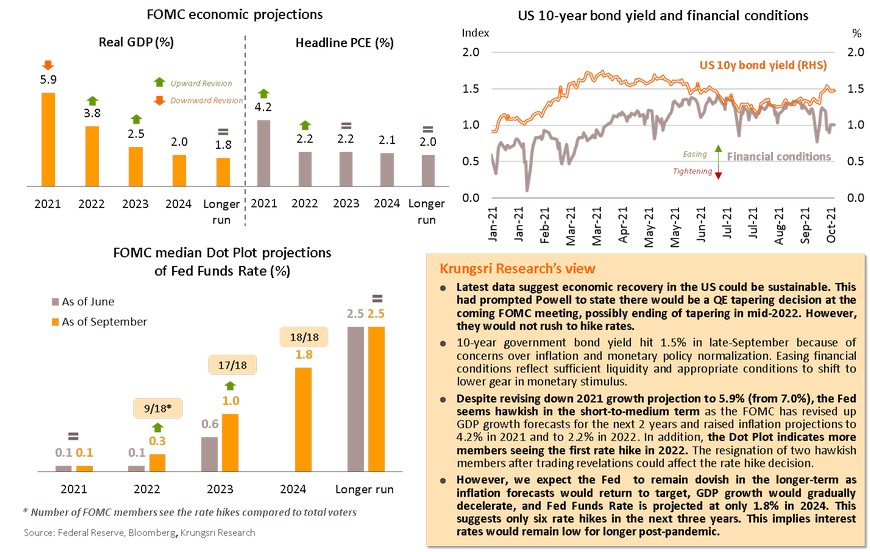

FOMC projections suggest hawkish tone in short-to- medium term but dovish view in the longer-term

EU: Energy crisis and lingering supply problems would push up prices, could persist into 1Q22

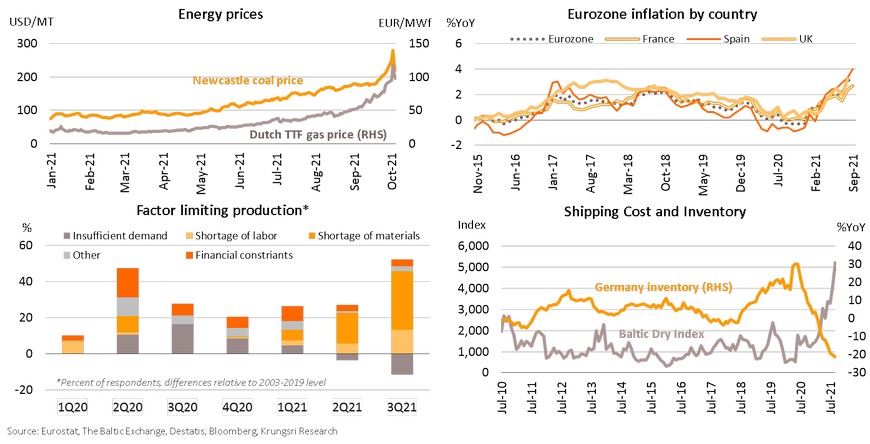

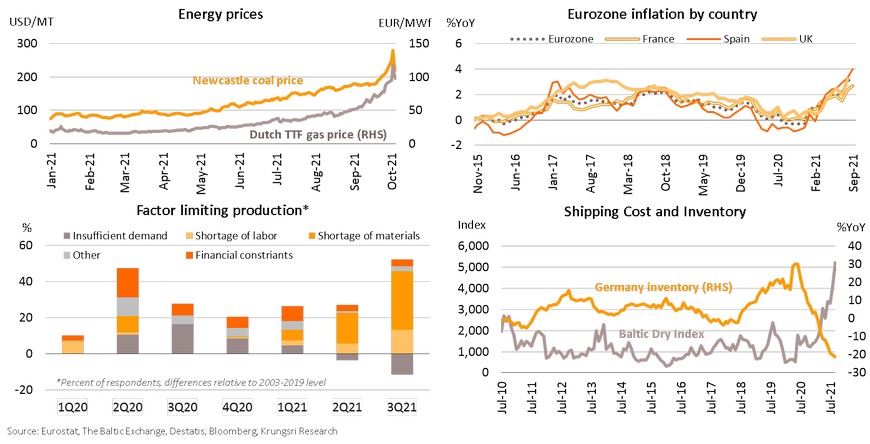

Energy prices in Europe have surged because of several factors, including economic reopening, seasonally-higher winter demand, limited delivery from Russia, and low energy inventories. The benchmark price for natural gas, Dutch TTF, has risen more than 400% since January. Higher energy prices have pushed up electricity bills and overall inflation. Eurozone inflation spiked to 3.4% in September, especially in the UK which depends on gas energy. Given higher inflation in the UK, the market expects the BOE to hike interest rates by 1Q22. The European Commission is trying to resolve the problem by creating a strategic gas reserve and excluding gas price from electricity bills. These would help to sustain long-term energy supply and temporarily relieve the burden on consumers starting November. Supply shortage and higher transportation costs also add to inflationary pressures. Manufacturers have reported shortage of raw materials as the biggest factor limiting production, followed by labor shortage. Soaring shipping costs and congestion at ports would delay deliveries and reduce inventories for the holiday season. Looking ahead, higher power consumption after reopening, coupled with existing supply problems, could lead to prices remaining high next year before easing by mid-2022.

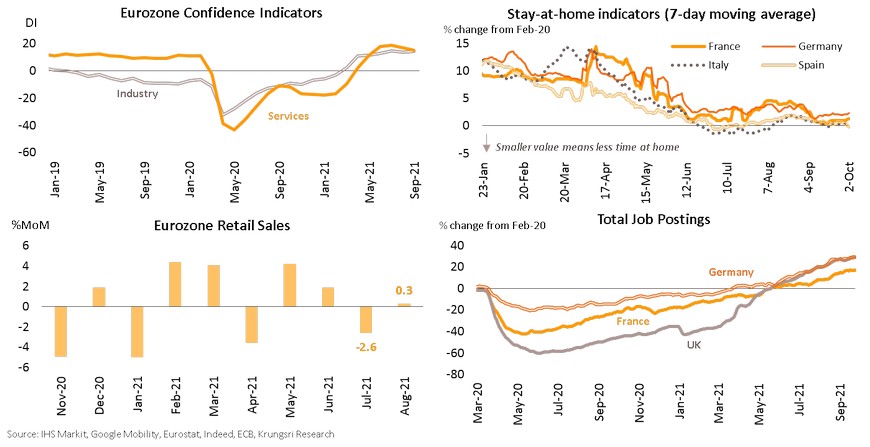

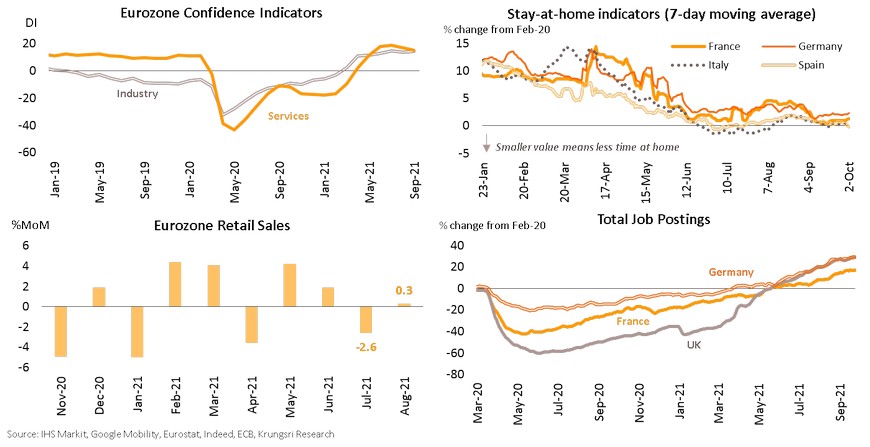

Rising prices could cap purchasing power but would not derail consumption recovery in the last quarter

Energy shortage and supply bottlenecks would prompt the ECB to revise up inflation forecasts for 2021 and 2022 at its December meeting, while the ongoing economic recovery suggests the ECB will continue to reduce PEPP purchases in 4Q. Rising energy prices might cap purchasing power but would not derail consumption recovery in 4Q21. Consumer Confidence has improved along with fewer daily Covid-19 cases and a larger fully-vaccinated population. Both Manufacturing and Services confidence indices are above pre-crisis levels. High-frequency data indicate people are spending less time at home since schools reopened and workers returned to offices, implying higher eating out and travel activities. Retail sales rose moderately by 0.3% MoM in August and could rise again in the final quarter due to holiday shopping. The improving labor market would also support consumer spending. Job postings have exceeded pre-pandemic levels, particularly in Germany and the UK, reflecting strong demand for labor and more people returning to works after the furlough programs expired. Hence, we project consumption would continue to improve in 4Q21 despite waning reopening effects. Furthermore, the government might want to support longer-term economic growth through infrastructure investment.

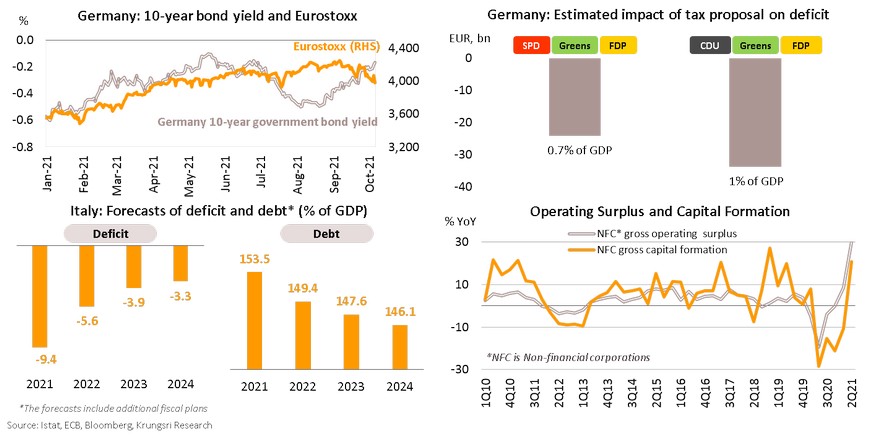

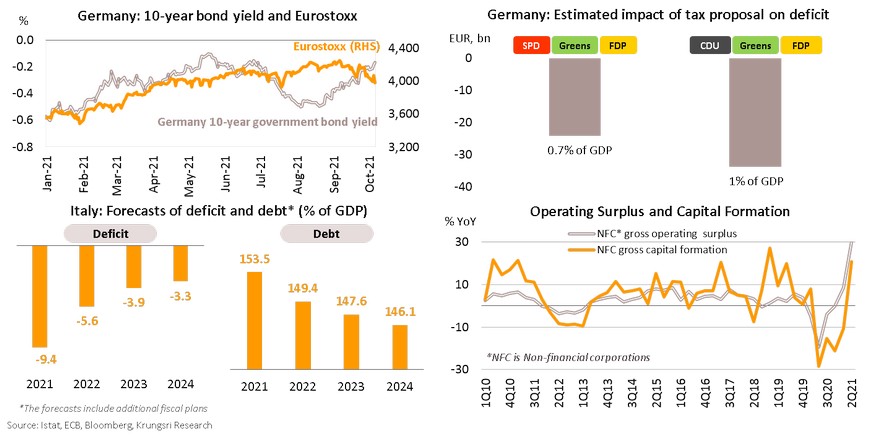

EU preparing for investment despite rising concerns over fiscal rules after Germany election

Germany’s preliminary election results show the SPD won more seats than the CDU, and the Greens and FDP are critical to secure a majority in the parliament. The setting up of a coalition government might only be finalized in late-December. A SPD-Greens-FDP coalition would be less favorable for the market than other coalitions, because they promote higher taxation and stricter environmental rules for businesses. However, higher taxes could cause small deficit. A CDU-Greens-FDP coalition which promises corporates tax cuts would be more market-friendly and push up equity prices. Regardless of the coalition results, the new government would consider the reinstated fiscal rules in 2023, pertaining to capping budget deficit at 3% and public debt at 60% of GDP. In contrast, Italy and France need to make the Covid-19 era budget flexibility to remain. Forecasts of Italy’s annual budget suggests it is unlikely to meet the 3%-deficit rule by 2024, which means Europe would fight over fiscal stance again. But despite regulatory concerns, the European governments would likely increase investment spending to support a sustainable recovery as they believe that would help to address the debt and deficit problems. Moreover, rising capital formation suggests companies will continue to invest and prepare to restore production when the pandemic ends.

China: Economy is pressured further by power shortage and extended regulatory crackdown

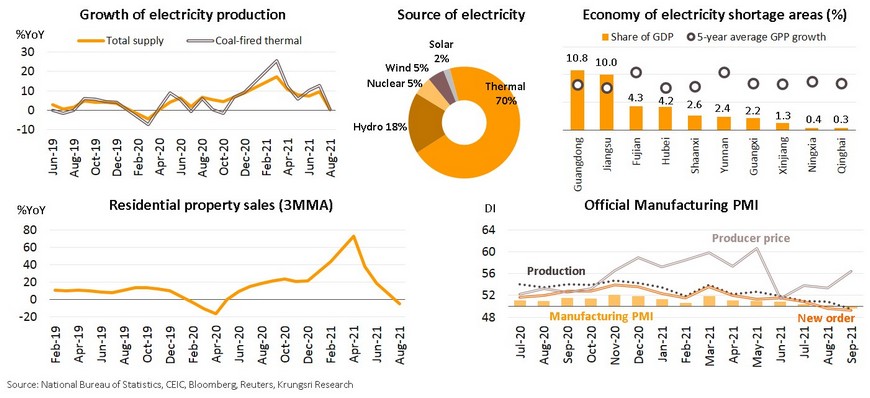

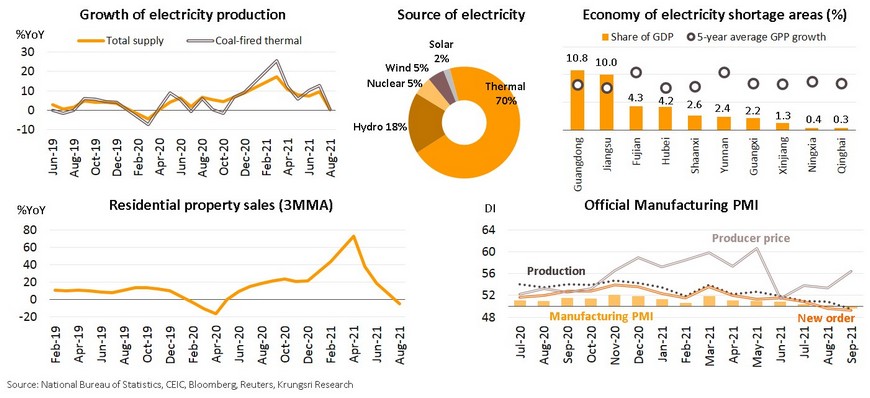

There is rising risk to China’s economic growth, especially with the recent electricity crunch. The main reason for the power shortage is low coal supply following regulations to reduce greenhouse gas emission, while demand for thermal coal spiked because of the recovering economy. Growth of coal-fired thermal power output (accounting for 70% of electricity supply) has decelerated to an 8-month low. The energy crunch could worsen supply constraints in the fastest-growing production areas, especially in 10 provinces that contribute 38.5% of GDP. The adverse impact of the outage is broad and could worsen the supply chain disruption. Moreover, measures to reduce speculation on the property sector have caused residential property sales to contract for the first time in 16 months. Given stronger pressure on production, the official Manufacturing PMI marked 49.6 in September, slipping into recessionary territory for the first time since February 2020. Noticeably, the producer price sub-index is at its highest since May 2021, partly driven by rising commodity and energy prices. Looking ahead, electricity shortage could dampen manufacturing output and exports if not resolved soon. In response, authorities have allowed coal mines to increase production to full capacity and waived quotas. Meanwhile, the government plans to raise the ceiling on electricity tariffs to incentivize power plants to supply more energy. However, this could push up manufacturing costs and affect global supply chains because China is the world’s main production base, implying higher risks to growth and inflation in the global economy.

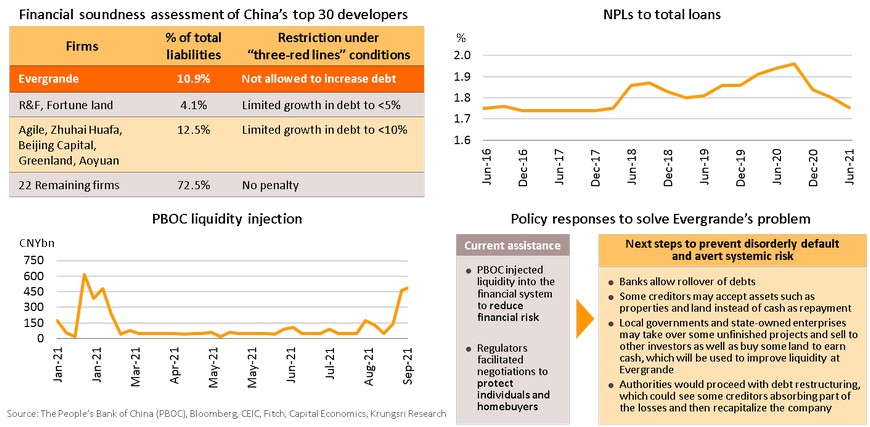

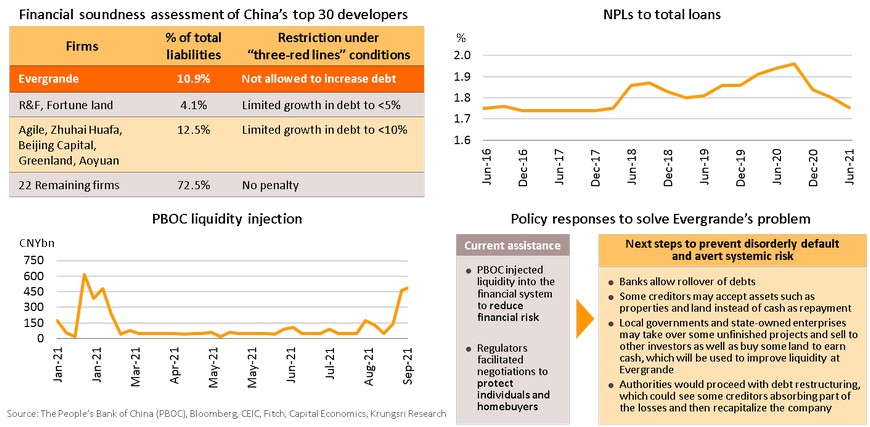

Evergrande crisis weighs on economic growth but should not lead to systemic collapse

China’s second largest real estate developer Evergrande has been struggling with tight liquidity, which could hurt investor sentiment, asset prices, real estate sector, and China’s economic growth. Evergrande has sizable liabilities amounting to CNY1.97trn (USD306 bn) or about 2% of China’s GDP. The major concerns include interest payments worth CNY2.1 bn (USD331 mn) on USD and local bonds, due in September-October. Evergrande’s default risk would push up financial cost in the property sector, which raised concerns over the contagion effects (real estate and construction sectors account for a combined 14.5% of GDP). However, the central bank has injected net CNY960 bn into the financial system during 22 Sep - 9 Oct, the largest since January. Authorities also encouraged negotiation to ensure individual investors and homebuyers are protected. In our view, Evergrande’s problems should not lead to a systemic collapse because (i) Evergrande holds physical assets which can be converted to cash (unlike Lehman which held financial assets); (ii) performance of most real estate developers and banks remain sound; and (iii) there were prompt policy responses to reduce financial risks and curb the impact on individuals and home buyers, all of which should prevent a chain reaction across the economic and financial system.

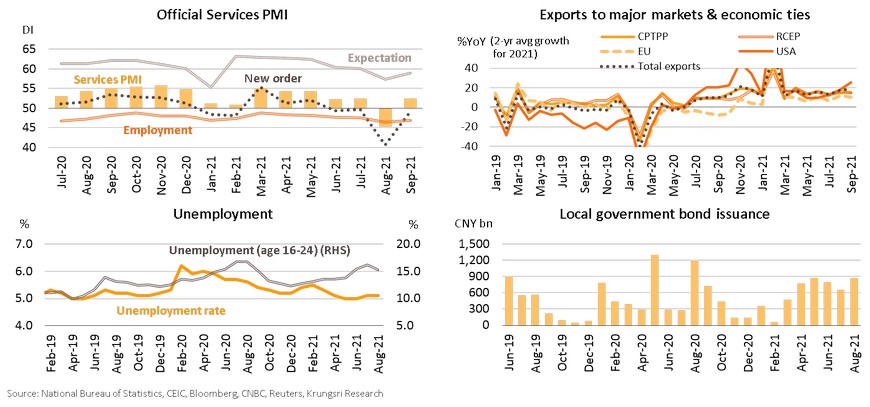

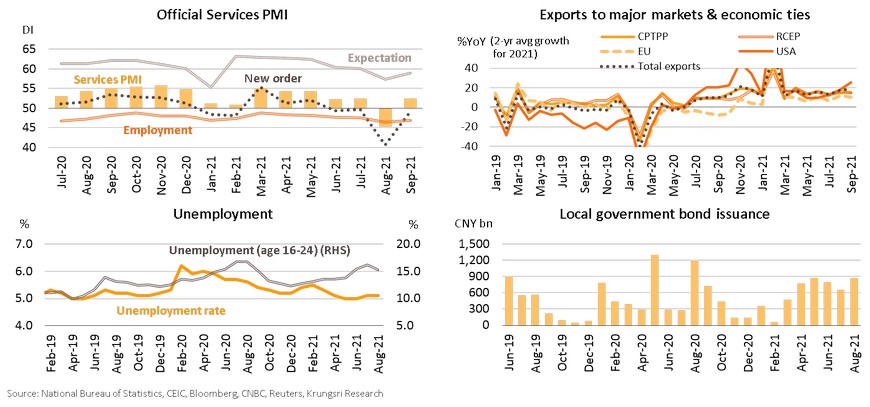

Rising services activity, exports and employment will prevent a sharp economic slowdown

Despite escalating risks, some key economic sectors are recovering. The relaxation of containment measures pushed up the Services PMI in September as new orders, employment, and business outlook picked up. On the external front, exports remain resilient despite congestion along a global marine transportation route and shortage of container shipping capacity. Export growth accelerated to 18.7% YoY in September, marking the 16th straight month of expansion, led by shipments to the US, EU and RCEP that all registered double-digit growth. Looking at the CPTPP (Comprehensive and Progressive Agreement of Trans-Pacific Partnership) which China has recently applied to join, exports to those areas showed favorable growth of 15.1%. As this transpacific agreement contributes 29.7% of global trade, it would help China to diversify export destinations and improve access to North and Latin America markets. The rebound in services activity and continued expansion in exports will boost employment. Unemployment rate remains well below pre-pandemic level, while that for workers aged 16-24 years old has started to improve. In addition, the government has boosted economic activity through public investment. In August, authorities ramped up infrastructure spending by raising local government bond issuance to a year’s high of CNY 897.7bn. Looking forward, improving services activities, strong exports, an improving labor market, and rising infrastructure investment, would soften the impact of supply disruption, power shortage, and regulatory crackdown. We expect authorities to maintain targeted accommodative fiscal and monetary measures to support further expansion in the real sector of the Chinese economy.

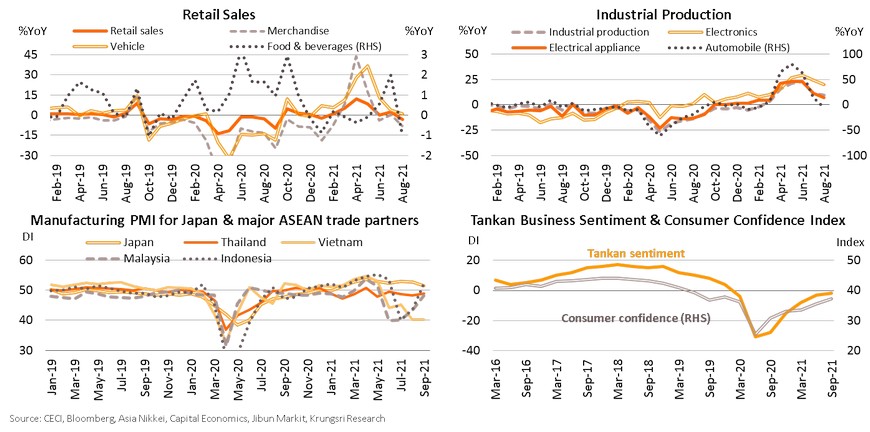

Japan: Economic growth to decelerate in Q3; signs of easing supply constraints and vaccination progress suggest a recovery in Q4

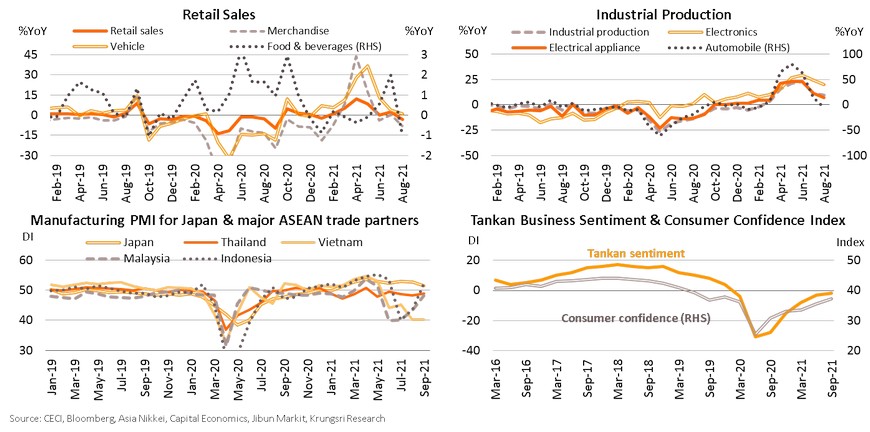

Recovery in Japan continues to be dragged by both domestic demand and supply side. In August, due to rising daily COVID-19 cases and harsher restrictions, retail sales fell for the first time since February. Meanwhile, due to ripple effects of the temporary factory shutdowns after the Delta-variant outbreak tore through Southeast Asia suppliers, Japan’s industrial production growth slowed down for the second consecutive month in August. Automobile production fell after 5 months of expansion, because ASEAN region is the hub for Japanese auto makers. In September, Manufacturing PMI slipped to 51.5, its lowest in 7 months. However, the overall economy is projected to strengthen given the following: (i) Southeast Asia’s manufacturing output has rebounded in September after lockdown easing; (ii) improving COVID-19 situation in Japan as daily cases are at a 2-month low of fewer than 3,000 in September and the government has lifted state (and quasi-state) of emergency effective 30 September; and (iii) progress in vaccine rollout (65.6% of the population has been fully-vaccinated). Recently, there are signs of improving business and consumer sentiment. The Tankan Manufacturing Sentiment Index in Q3 (survey conducted in September) reached a 3-year high, while September’s Consumer Confidence Index has risen to its strongest since February 2020. Domestic consumption and investment should pick up. Looking ahead, Japan’s economy would start to improve from late Q3 despite still lagging behind other major economies.

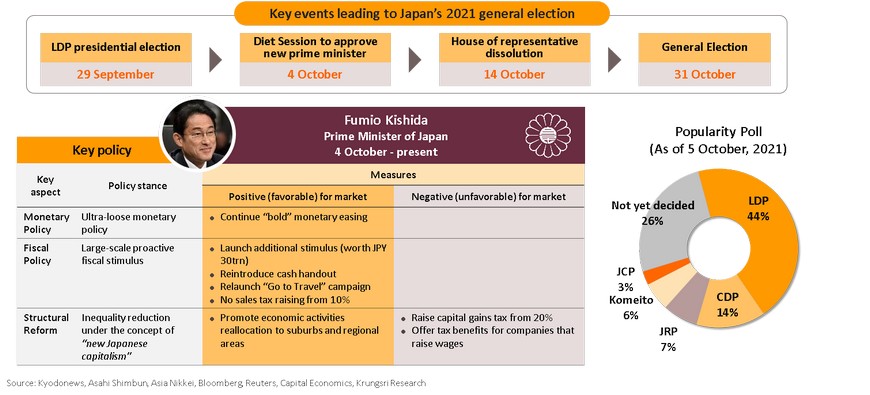

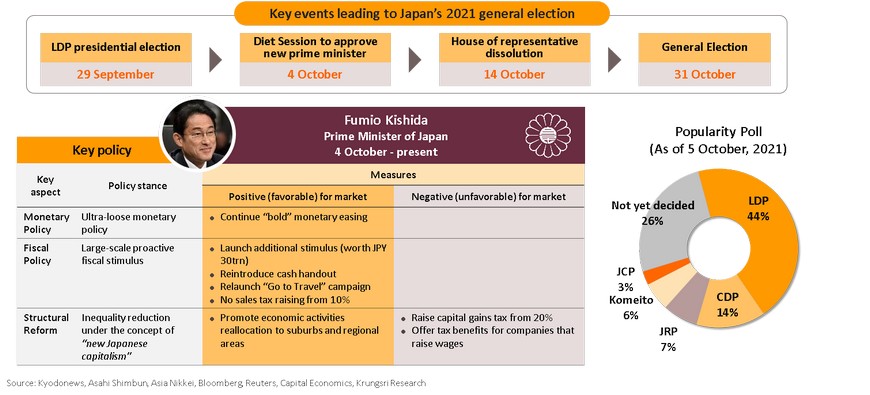

Despite concerns over raising capital gain tax, the new PM’s policies will support economic recovery

After edging out Taro Kono in a run-off race in the Liberal Democratic Party (LDP) presidential election, Fumio Kishida became Japan’s prime minister. He will lead the LDP in the general election scheduled for 31 October. The Kyodonews polls show 44% of respondents intended to vote for LDP, suggesting the LDP is likely to win. Nonetheless, Kishida has relatively weaker support than the ex-prime minister Suga when he took office. Kishida received only 49% approval rating while his predecessor got 62%. This was partly due to market concerns over some policies. He proposed the “new capitalism” concept to reduce income disparity by raising capital gains tax and supporting wage hikes. However, Kishida recently clarified that he will prioritize economic growth over income reallocation. He will adopt Abenomics - the economic framework that include monetary easing, fiscal stimulus and structural reforms. Specifically, Kishida wants to implement a JPY30trn supplementary spending budget (6% of GDP) to restore the economic recovery trajectory. Overall, despite recent market concerns, Kishida’s policy would be net beneficial for Japan’s economy due to (i) his plans to balance a “bold” monetary easing and “tens of trillions yen” additional stimulus, and (ii) a continuity of policy in terms of vaccination and economic revitalization.

Thailand: Ambiguous outlook amid reopening

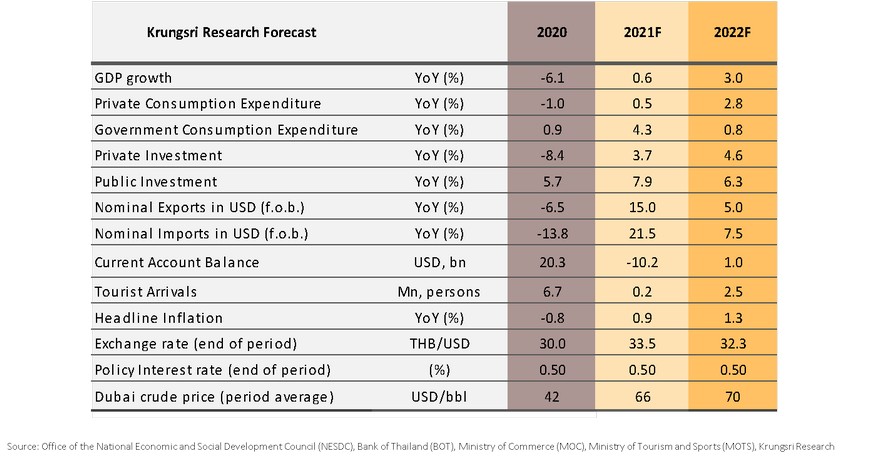

Despite a reopening on 1 November, we expect Thai economic activity at year-end would still be 6% below pre-COVID level.

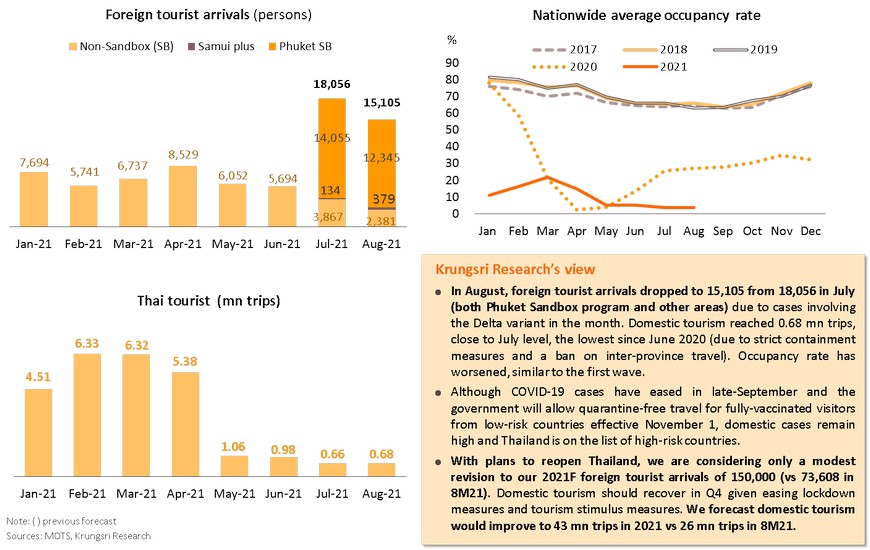

- Global daily COVID-19 cases and fatalities have dropped after the 3rd-wave peaked. This was driven by mass vaccination programs, although achieving optimal vaccination rates remain challenging. In Thailand, the vaccination rate is close to 50% and continues to rise. Daily new cases has fallen substantially since mid-August and Thailand has eased lockdown restrictions since September to prevent further economic losses. We expect lockdown measures to remain stringent the rest of this year though the population is adapting to the new normal.

- While most domestic economic activities have resumed, the tourism sector remains far below pre-pandemic level. The government has introduced quarantine-free travel for vaccinated visitors from low-risk countries effective 1 November. But with Thailand still designated high-risk country and strict travel policies, particularly in China and the US, and the EU, there would be limited upside from the reopening.

- The economic impact of COVID-19 will last throughout this year. We expect overall economic activities to reach 94% of pre-pandemic level by end-2021.

Export sector should be key growth driver. Latest flooding is a headwind but would have limited impact.

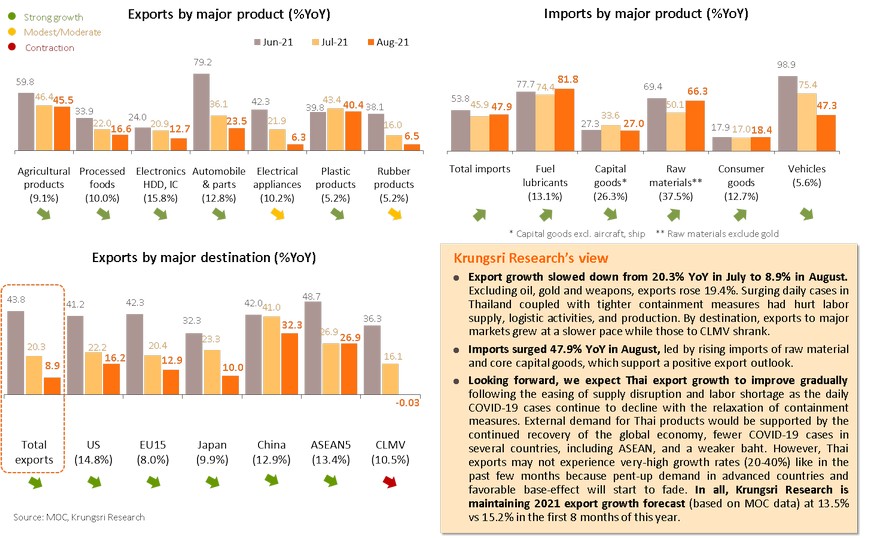

- Export growth is likely to rebound amid easing labor shortage problem and rising demand after easing lockdown measures in September. Export value remained above pre-pandemic level in August driven by rising volume rather than prices.

- Latest flooding is a headwind but the impact would be smaller than that experienced in 2011.

- Consumer and business sentiment indices for most components have rebounded but remain very low.

- Government measures, mostly cash aid, would support consumer spending in the short term.

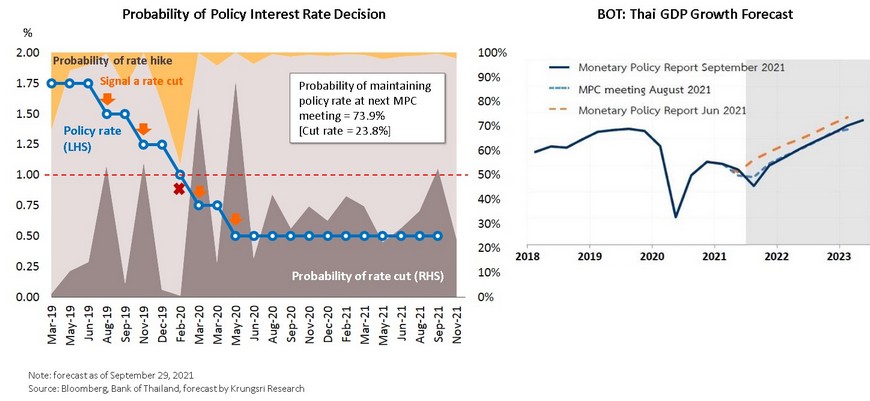

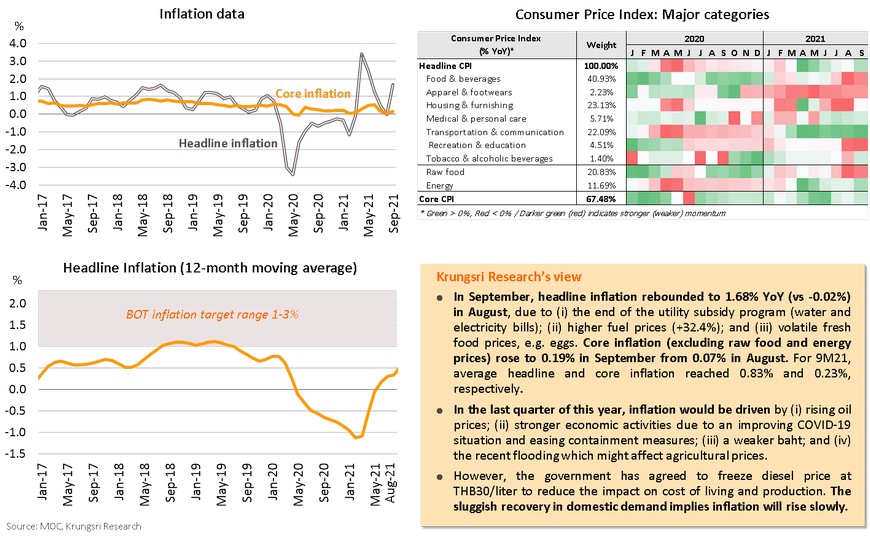

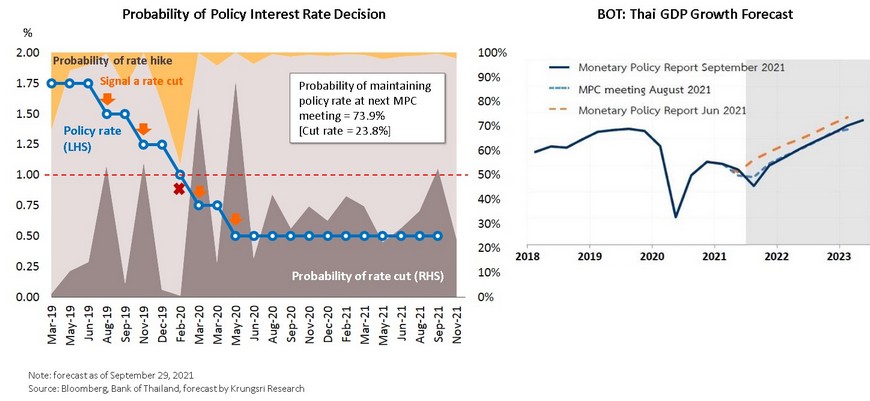

MPC likely to hold rate this year and next year.

- Krungsri Research maintains that the MPC would keep policy rate unchanged this and next year as (i) Thailand’s recovery remains fragile and dotted with economic scars, and (ii) authorities are leaning towards targeted measures rather than a policy rate cut. Although rising inflation could prompt several central banks to raise policy rates next year, Thailand is unlikely to raise rate in 2022 because of low inflationary pressure. The BOT projects core inflation at only 0.2% in 2021 and 0.3% in 2022.

Thailand Economic Outlook 2021-2022

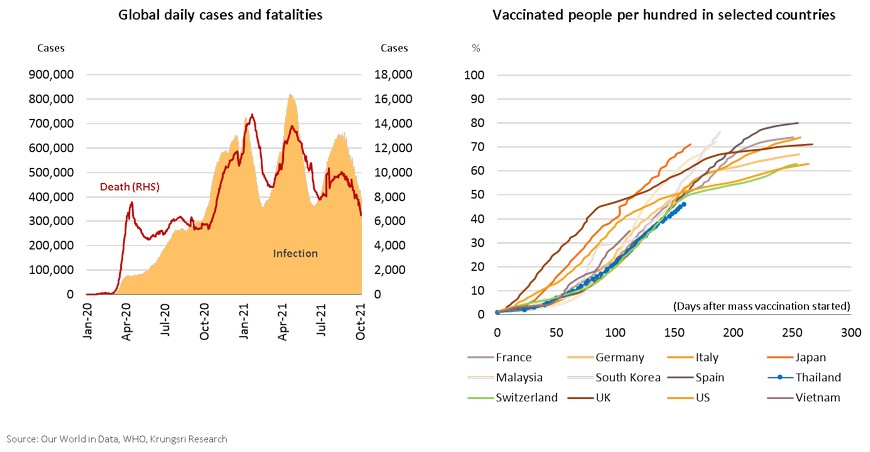

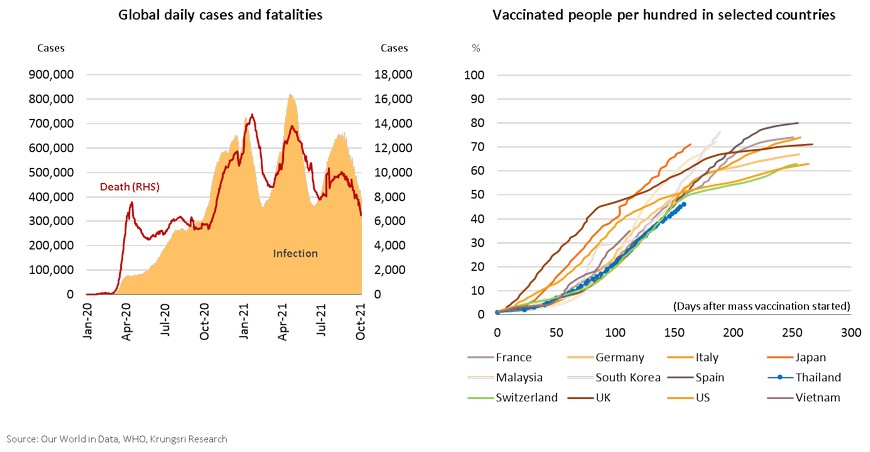

Global daily cases and fatalities have dropped thanks to mass vaccination although vaccination rate remains low

Global daily cases have dropped from the third wave peak of over 0.6 million to 0.4 million. This is a result of mass vaccination, especially in advanced economies. Over 60% of the population in the US, UK, Germany, France, and Japan have received at least one dose of vaccine. Mass vaccination has helped to reduce critical cases and fatalities in recent months. However, the pace of vaccination is slowing down, which is making it challenging to achieve herd immunity. For example, the US took less than 150 days to vaccinate half of its population but took more than 100 days to cover an additional 15%. It is the same patterns worldwide. In addition, vaccine distribution remains uneven, with only 8% of Africans vaccinated. India and Indonesia have achieved only 50% vaccination rate. Thailand would face similar challenges in the coming months in attempts to achieve herd immunity.

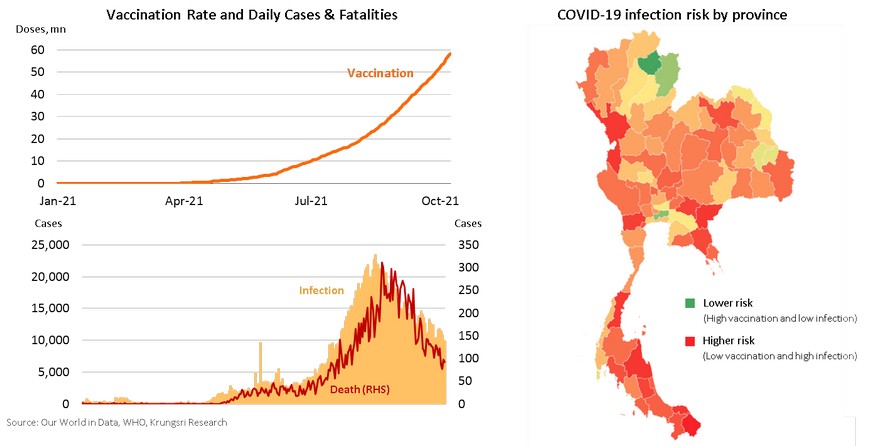

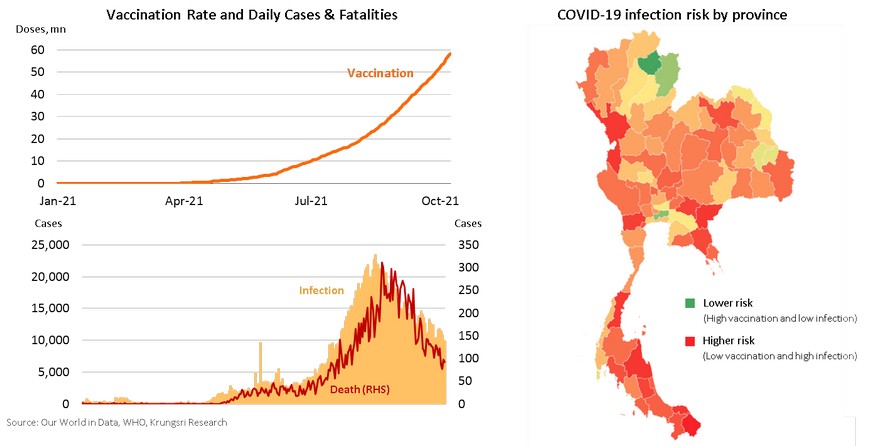

Thailand vaccination rate is almost 50% and daily cases have fallen since mid-August; many provinces still vulnerable to COVID-19 risks

Vaccination rate in Thailand has reached 49% (including 1- and 2-dose), which is among the key reasons that daily cases in Thailand have been dropping. Currently, 21.2 million or 30% are fully-vaccinated and 14.2 million have received one dose. Thailand has dispensed 60 million doses of COVID-19 vaccines. However, the pace of vaccination has slowed down worldwide, including in Thailand, and it would require a strong push to achieve above-80% vaccination rate. Krungsri Research expects Thailand to continue to dispense nearly 0.5 million vaccines a day up to end-2021, which means 90.3 million doses dispensed by end-2021. This implies 37.3 million persons are expected to have fully-vaccinated [51.3% of Thai population] and a total of 54.0 million would receive at least one dose [74.3%] by year-end. Based on latest dynamics, at least 85% of the population would receive at least one dose by the second quarter of 2022. Currently, mass vaccination programs are concentrated in large provinces including BMR (100% of Bangkok residents have been vaccinated), Phuket (79%), and Chonburi (69%). Meanwhile, 35 provinces have a vaccination rate of less than 35% of their population. That leaves many provinces vulnerable to COVID-19 risks, especially Tak, Sakaew, and provinces in the South.

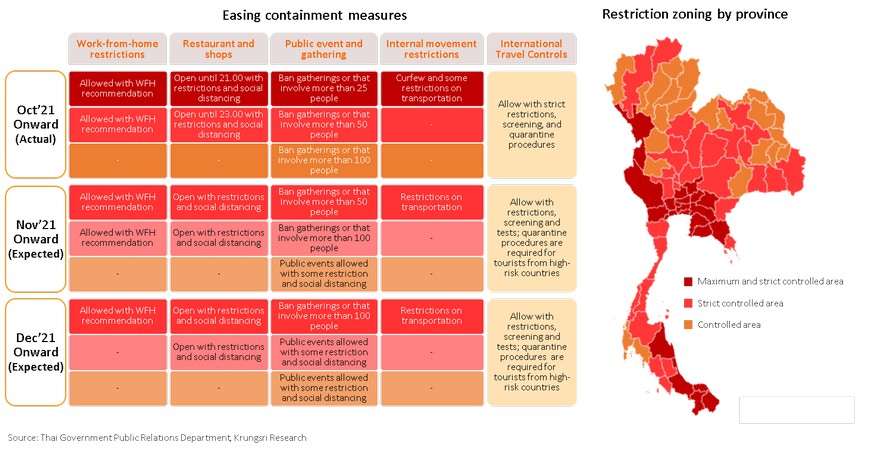

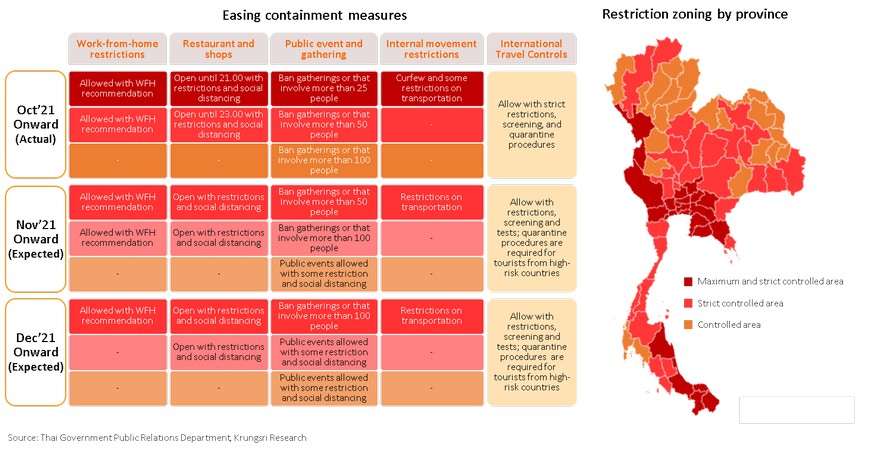

Easing containment measures since September to prevent further economic losses; measures should be relaxed cautiously

Falling number of daily cases and fatalities in the past few weeks have prompted the Thai government to ease containment measures. Dine-in is allowed and they have relaxed restrictions on internal movement subject to social distancing and other containment measures. The relaxation of measures would help to restart economic activities and reduce further economic losses. However, that could also increase risk of another spike in daily cases. Krungsri Research expects the government to continue to ease measures cautiously the rest of this year (see table below). In addition, there is still a need for containment measures, including clear communication, wearing a mask, a track & trace system, and the mass vaccination program.

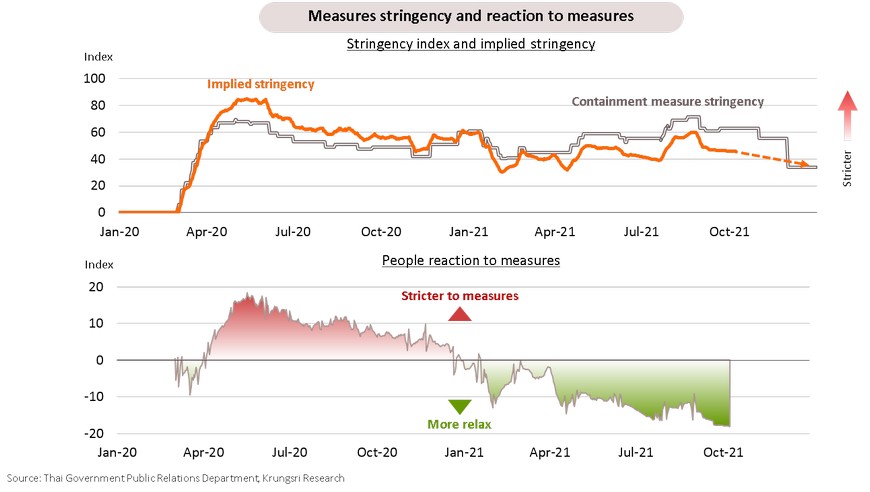

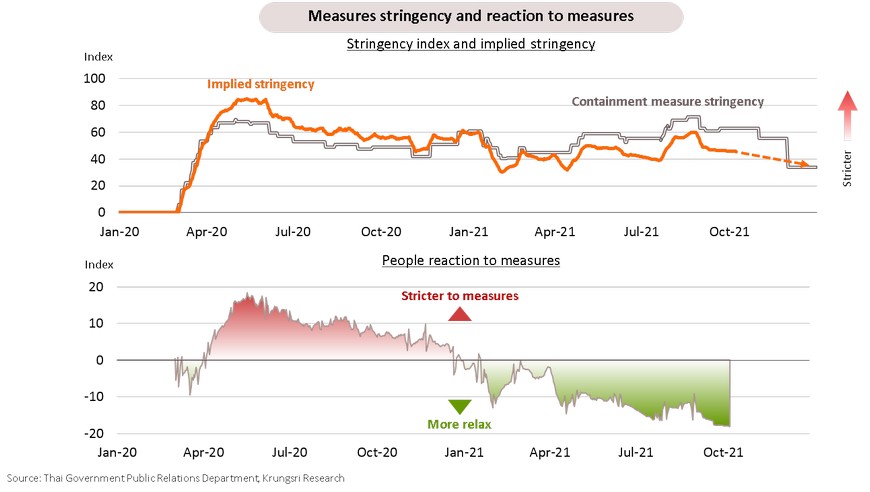

Still-stringent containment measures throughout the year but the public is adapting to the new normal

Although the government has relaxed some restrictions, such as allowing restaurants and shops to reopen since early-September, containment measures remain stringent (reflected by the Stringency Index by the University of Oxford). However, we choose to track the “implied stringency index” based on our infection model, which indicates actual stringency level. It reveals that people react differently to restrictions each time. More importantly, there was a strong fear of COVID-19 in 2020 but those fears have eased with time. The difference between the Stringency Index and Implied Stringency Index is that the former comprises measures that would hurt the economy, but the latter reduces social mobility to contain an outbreak. Closing these gaps would make containment measures more efficient. To effectively contain the outbreak requires a firm easing timeline and timely communication to the public. Krungsri Research projects stringency would drop gradually. It is expected to stay at around 55.5 by end-2021 compared to 71.43 at the peak of the COVID-19 crisis.

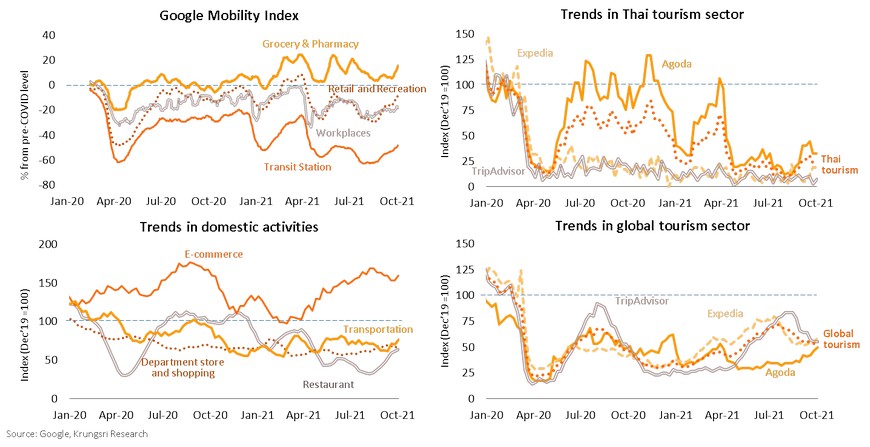

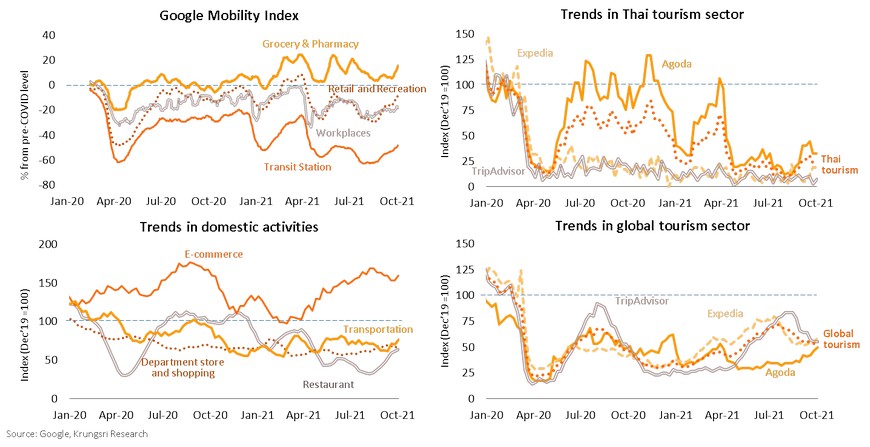

Economic activities have resumed in Thailand but tourism sector remains far from pre-pandemic level

High-frequency data suggest economic activities have resumed since mid-August. Google Mobility Index shows activities in grocery and pharmacy sectors has surpassed pre-pandemic levels. Activities in retail, recreation and workplaces are close to pre-pandemic levels. However, mobility data at transit stations is nowhere near pre-COVID level. In addition, we tracked Google trends to reflect economic activities. E-commerce performed well last year and during the lockdown in July-August. Activities in Transportation and Department Store & Shopping are bottoming-out. Restaurants, one of the hardest-hit sectors, has recovered considerably but is still far from pre-COVID level. For the tourism sector, we tracked trends on Agoda, TripAdvisor and Expedia to gauge travel demand; they suggest global tourism sector is recovering faster than in Thailand, because of vaccination progress and continued recovery in the US and Europe. October data shows activities in Thailand’s tourism sector is only 25% of pre-COVID level.

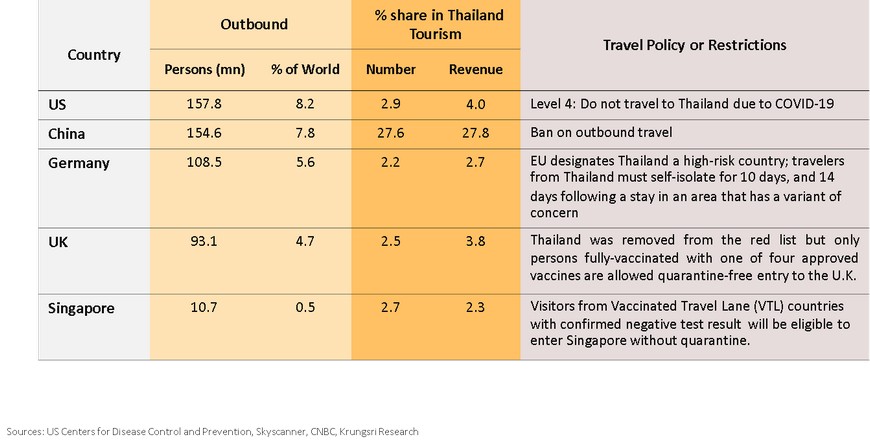

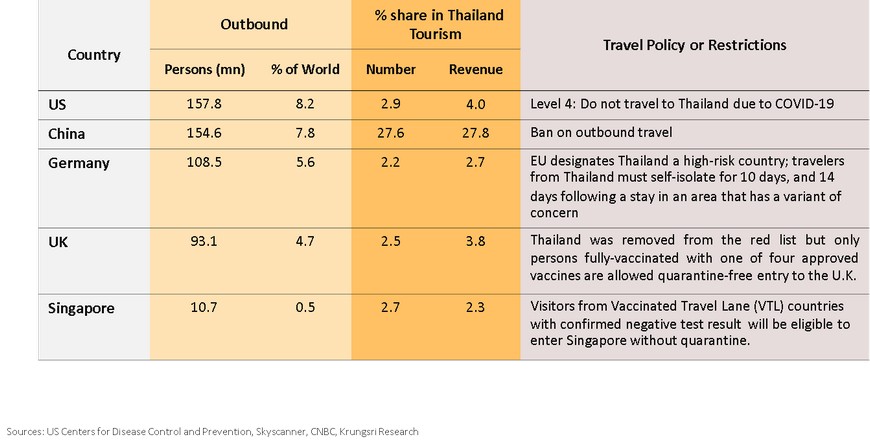

Despite a reopening on 1 November, strict travel policies in departure countries still hinder Thailand’s tourism recovery

In 2019, there were 1,980 mn outbound travelers. The US and China accounted for the largest number of outbound travelers (about 8% share each). In Thailand, Chinese tourists are account for a major share of tourism receipts and arrivals (account for 28% share each). Thailand recently announced it would reopen the country from 1 November and allow quarantine-free entry for fully-vaccinated visitors from low-risk countries (such as the US, the UK, Germany, China and Singapore) with some requirements such as RT-PCR tests in their home country and in Thailand. However, visitors are subject to departure countries’ measures or policies, especially in China which still does not allow outbound travel. Hence, the reopening may be a tailwind for inbound tourism in Thailand but there would be limited gains due to strict travel policies, particularly in China and the US, and the EU.

Thailand remains a high-risk country for travelers, so reopening gains may be limited

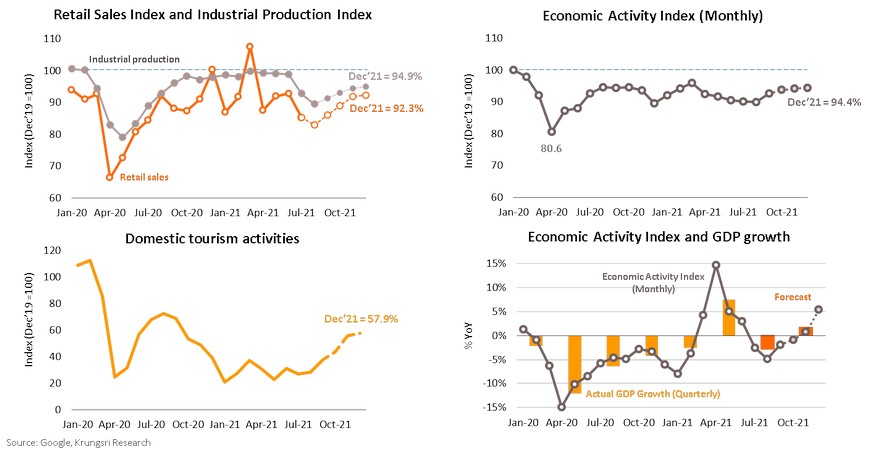

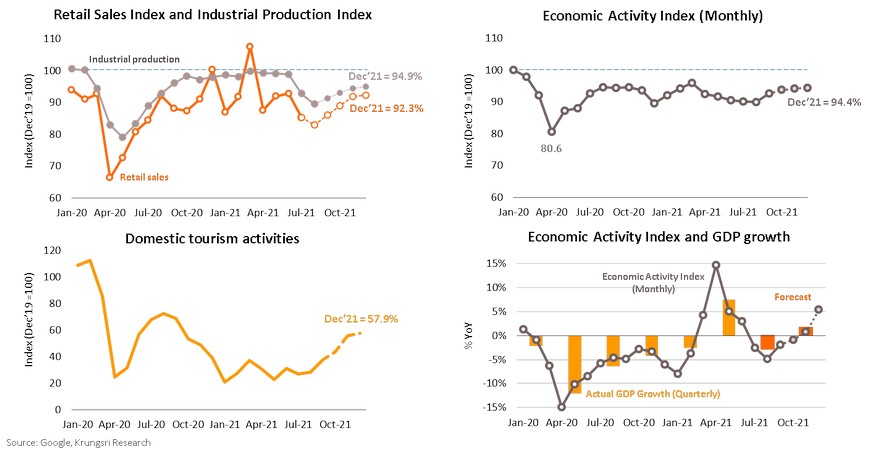

Lingering economic impact until year-end; economic activities would still be 6% below pre-pandemic level

In the coming month, domestic retail sales and industrial production index are expected to recover stronger than foreign tourist arrivals. Hence, we estimate overall economic activities would still be less than pre-pandemic level. Krungsri Research uses high-frequency data, including measures of stringency, implied stringency, Google Mobility Index, and Google search trends, to reflect economic activities and predict the direction of retail sales, industrial production, and tourism activities. We also computed the Economic Activity Index to represent Thai domestic economic activities. They suggest that by year-end, industrial production and retail sales would return to 94.9% and 92.3% of pre-pandemic levels, respectively. Domestic tourism activity would be only 57.9% of pre-COVID level with inbound tourism still well below pre-pandemic level. In sum, overall economic activity, reflected by the Economic Activity Index, would reach 94.4% of pre-COVID level.

Exports likely to rebound amid easing labor shortage and rising demand as pandemic impact fades

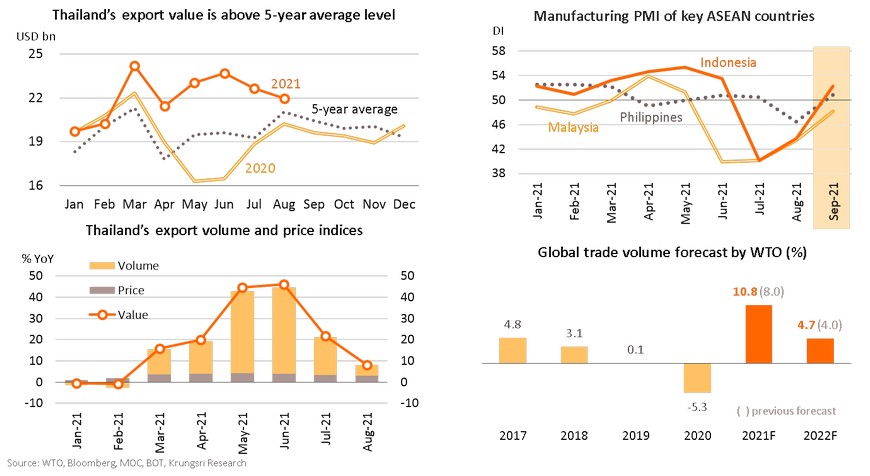

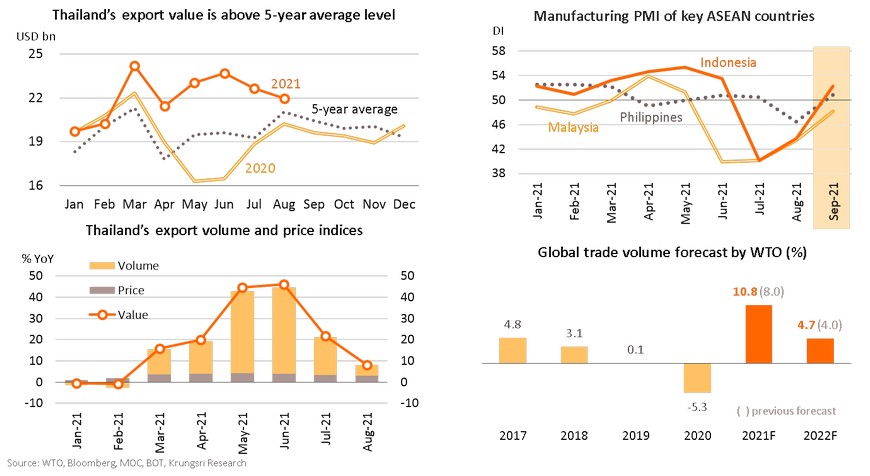

Despite a slowdown, Thai export value remains above pre-pandemic level, driven by rising volume rather than prices

Even though Thailand’s export value fell to USD22.0bn in August from USD22.7bn in July, it remained well above the last 5-years’ August average of USD21.0bn. And, the main export growth driver this year is higher export volume rather than price hikes, suggesting a positive outlook for Thai products. Looking ahead, Thai exports should rebound, premised on positive trends in Manufacturing PMI data for key ASEAN countries, particularly Malaysia, Indonesia, and the Philippines, as the COVID-19 impact on their supply chains fades. The World Trade Organization (WTO) also recently revised up its growth forecast for world trade volume for 2021 to 10.8% (from 8.0% previous forecast) and for 2022 to 4.7% (from 4.0%), which would support economic growth of export-dependent nations, including Thailand.

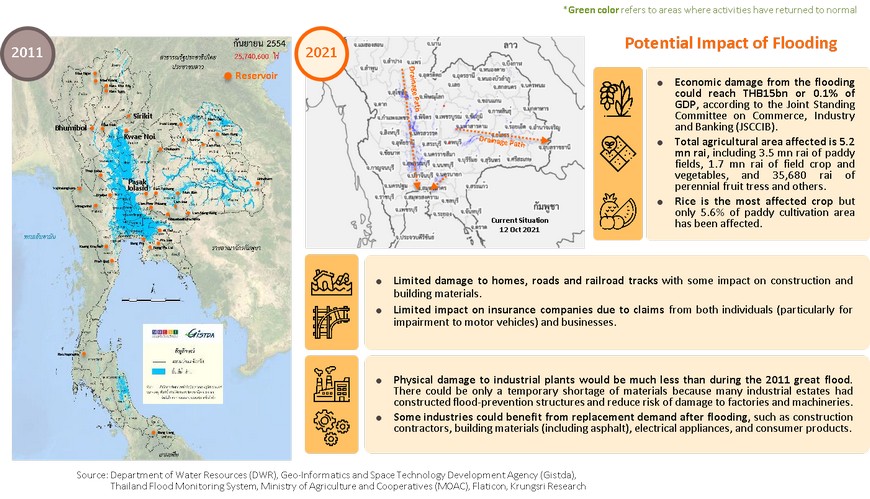

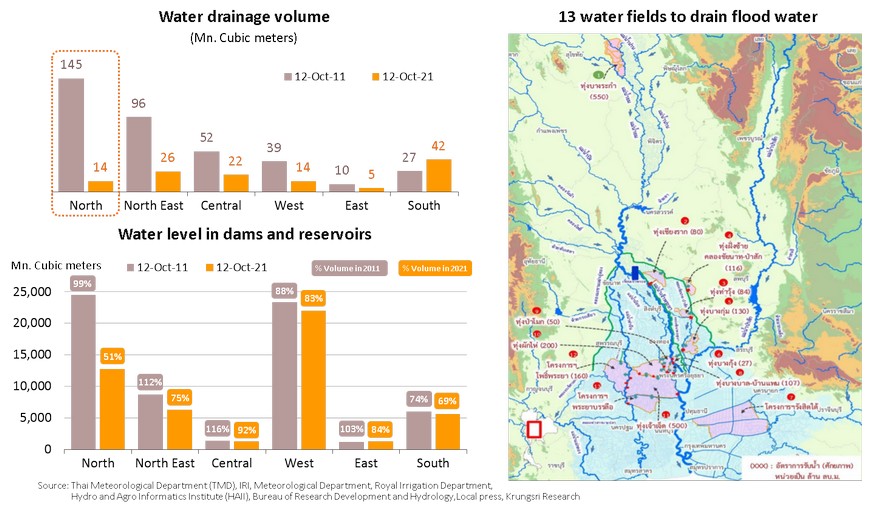

Latest flooding a headwind but has smaller impact than in 2011

Many provinces in Thailand experienced heavy rains and have been affected by floods. However, the total area affected this year is smaller than during the severe flooding in 2011 and economic activities in several provinces have since recovered. 43 provinces have been affected, classified by region and drainage path, as follows:

- From the north and central regions to the Gulf of Thailand, namely Maehongson, Chiang Mai, Chiang Rai*, Tak*, Nan, Phrae*, Phayao, Lampang*, Lamphun*, Sukhothai, Phitsanulok, Phichit, Kamphaeng Phet, Nakhonsawan, Phetchabun, Uthai Thani*, Chainat, Lop Buri, Sing Buri, Ang Thong, Suphan Buri, Ayutthaya, Kanchanaburi, Ratchaburi, Saraburi, and Bangkok.

- From the northeast region to the Mekong River, namely Loei, Chaiyaphum, Khon Kaen, Buriram, Nakhon Ratchasima, Roi Et, Surin, Yasothon, Sisaket, Nong Bua Lam Phu, Amnat Charoen, Kalasin, and Ubon Ratchathani.

- Eastern region: Prachinburi, Sa Kaeo, Rayong and Chanthaburi*

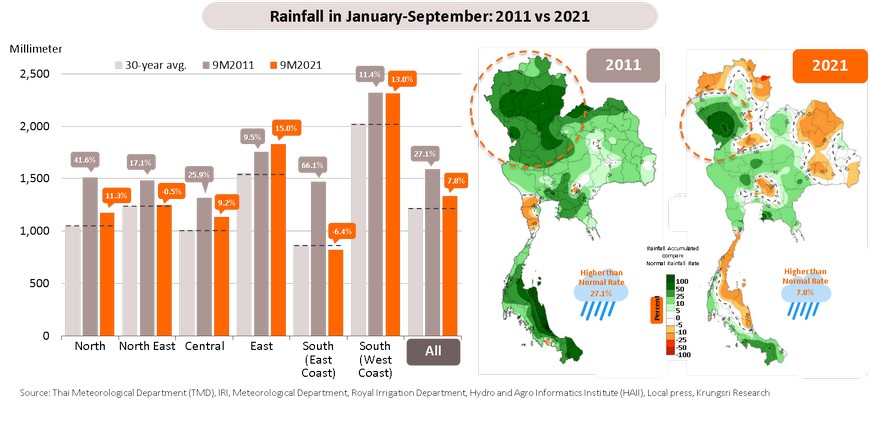

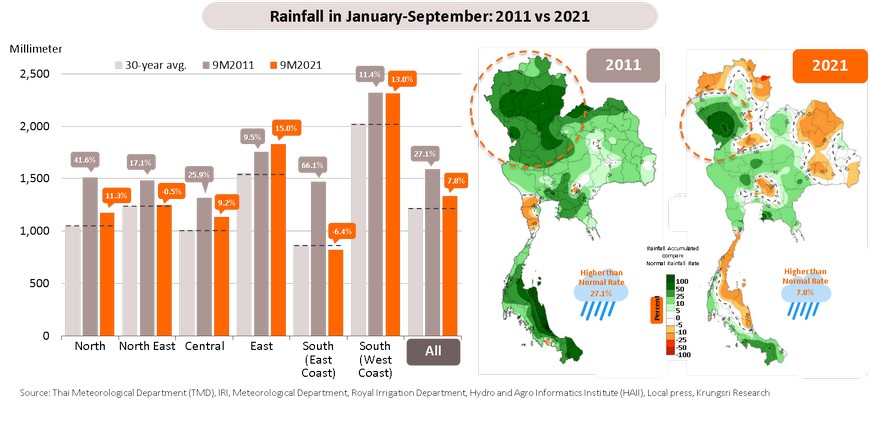

Heavy rains in mostly flood-prone regions but this year’s rainfall is estimated to be less than during the 2011 flooding

- 2021 rainfall is estimated to be lower than that in 2011. Rainfall in the first 9 months of this year is 7.8% higher than average but rainfall in the same period in 2011 was 27.1% higher than average. This year, there was only heavy rainfall in some parts of the country but in 2011, it affected the entire country.

- In 2011, there had been heavy rains (both above and below the major dams) since the beginning of the rainy season, which led to many dams and reservoirs overflowing. This year, many areas had little rainfall or had faced drought from late-May to June. This implies water levels at major dams are under control this year.

- In 2011, Thailand experienced 5 major storms during the rainy season, namely "Haima“, "Nock Ten“, “Haitang”, "Nesad" and "Nalkae". This year, Thailand has experienced only one - Depression "Dian Mu“. Authorities expect two more storms in October.

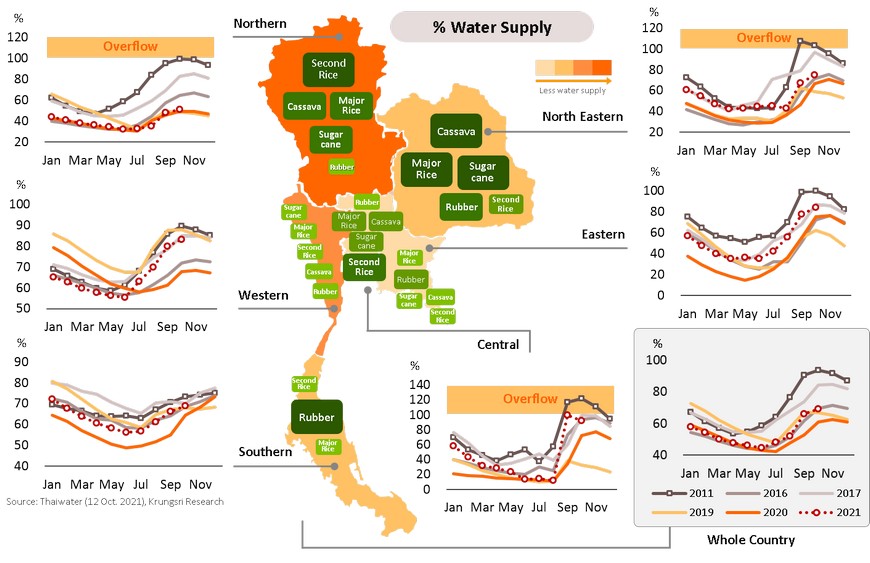

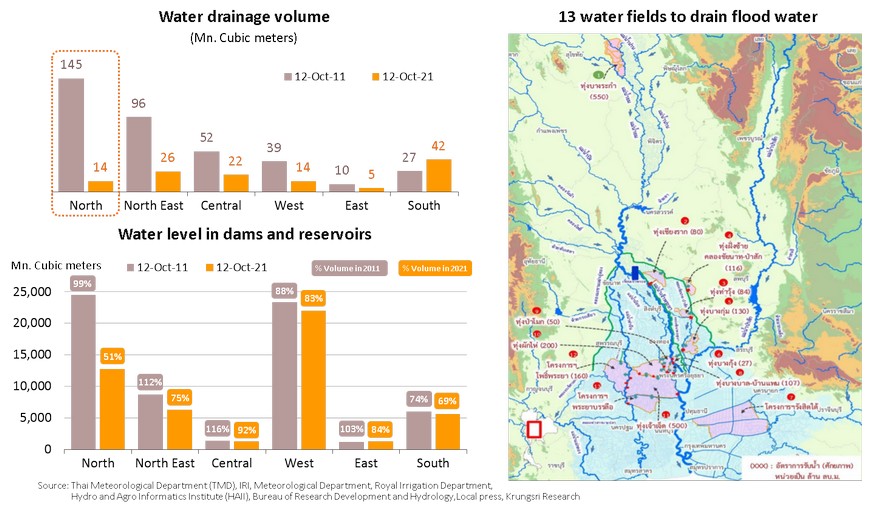

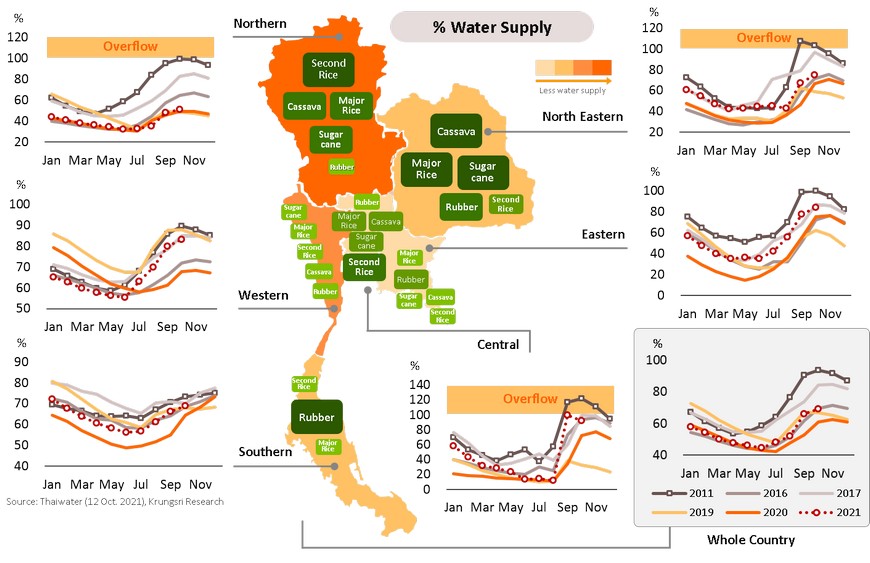

Water levels at major dams are under control; but there is risk from unexpected storms and heavy rains falling below the dams

There is higher risk of flooding if (i) storms are stronger than expected in Thailand; (ii) heavy rains fall continuously below the major dams; and (iii) water level in the Chao Phraya River increases with a surge in sea level. The key indicator is water outflows from the Chao Phraya dam, which was 2,520 cubic meters per second (as of 12 October 2021). The critical level is 3,500-4,500 cubic meters per second, which was seen during the 2011 great flood.

Improving water management has reduced risk of severe flooding

There is less risk of severe flooding in Thailand than in 2011 for the following reasons: (i) higher water storage capacity at major dams; (ii) preparation of 13 water fields in the central region to drain 1,787 mn cubic meters of water, and there is 1,089 mn cubic meters remaining capacity; (iii) plans to drain water to the western region via rivers; (iv) ability to drain water of the northeastern region into the Mekong River. Water level at Khong Chiam District, Ubon Ratchathani is at 34.7 meters vs a record high of 46.0 meters; and (v) industrial estates have constructed floodwalls and flood-protection systems to reduce risk of damage to factories and production.

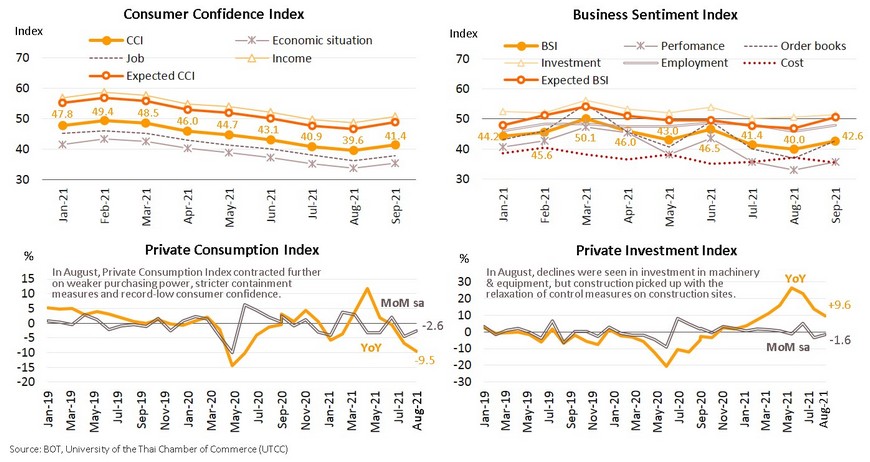

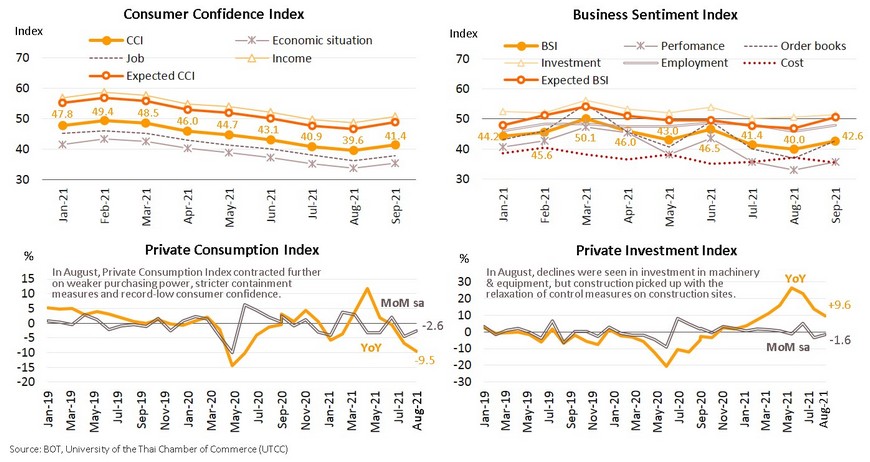

Confidence indices for most components have improved but recovery could remain weak

In September, the Consumer Confidence Index (CCI) rose for the first time in 7 months given the improving COVID-19 situation, easing containment measures, and rising vaccination rate. The CCI improved to 41.4 from a historic low of 39.6 in August, with improvements in most components. Likewise, the Business Sentiment Index (BSI) rose for the first time in 3 months, climbing from 40.0 in August to 42.6 in September. There were improvements in all components except business costs due to higher prices of oil and steel. Expected BSI for the next 3 months also improved from 46.8 to 50.7, moving into expansion territory (above-50) for the fist time in 5 months. But despite improving consumer and business sentiment, the confidence indices remain far below pre-pandemic levels (in December 2019, CCI was at 68.3 and BSI at 45.1). Hence, recovery will be slow and uneven because of economic scars creased by the pandemic, uncertainty over political issues, and flood impact.

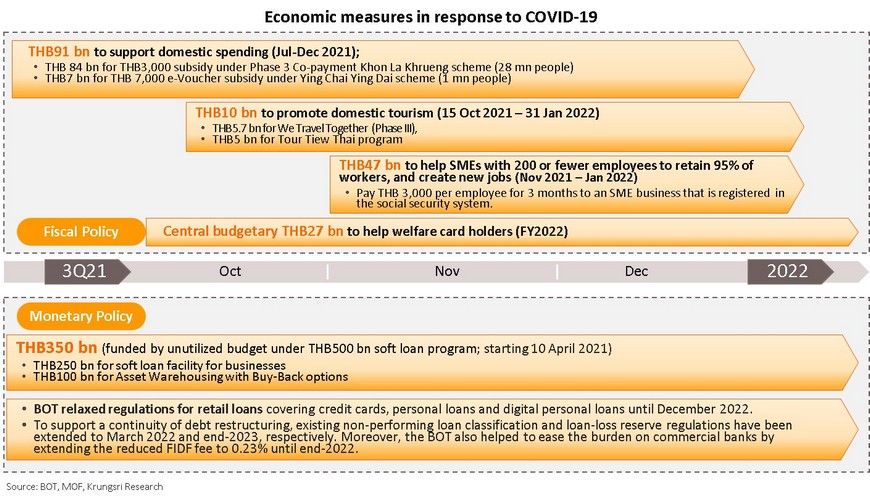

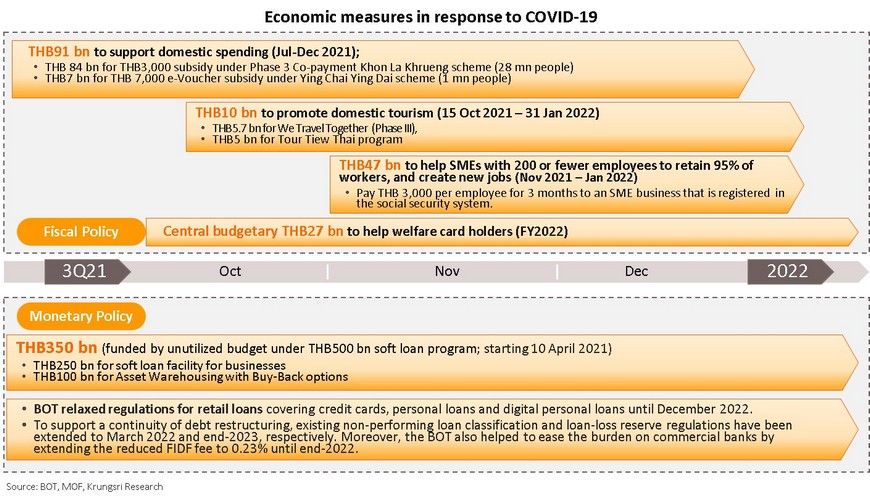

Government measures, mostly cash aid, would support consumer spending in the short term

Latest government measures would support domestic spending and overall growth the rest of this year and in early 2022. The important measures in 4Q21 comprise (i) cash aid to support consumer spending and domestic tourism, and (ii) measures to help SMEs to retain employees. The extension of the public ceiling from 60% to 70% of GDP would pave way for the government to launch additional economic stimulus measures in the period ahead.

End of relief measures, fuel price hikes, and flooding are temporarily driving inflation

MPC likely to hold policy rate this year and next year

At the next MPC meeting on 10 November, our model based on the MPC voting results suggests only 23.8% probability of a rate cut and strong 73.9% probability the MPC would hold rates. Krungsri Research maintains that the MPC would keep policy rate unchanged for the following reasons: (i) despite the BOT’s less pessimistic outlook, Thailand still needs an accommodative monetary policy because recovery remains fragile with economic scars such as high debt burden and a weak labor market; (ii) authorities are leaning towards targeted measures rather than a policy rate cut; and (iii) although rising inflation might prompt several central banks to raise policy rates next year, Thailand is unlikely to raise rate in 2022 because demand-pull inflationary pressure remain low. The BOT projects core inflation at only 0.2% in 2021 and 0.3% in 2022. In addition, economic activity or Thai GDP growth is unlikely to exceed pre-pandemic levels until 2023. In all, we expect the MPC to hold policy rate at a record low of 0.50% this year and next year.