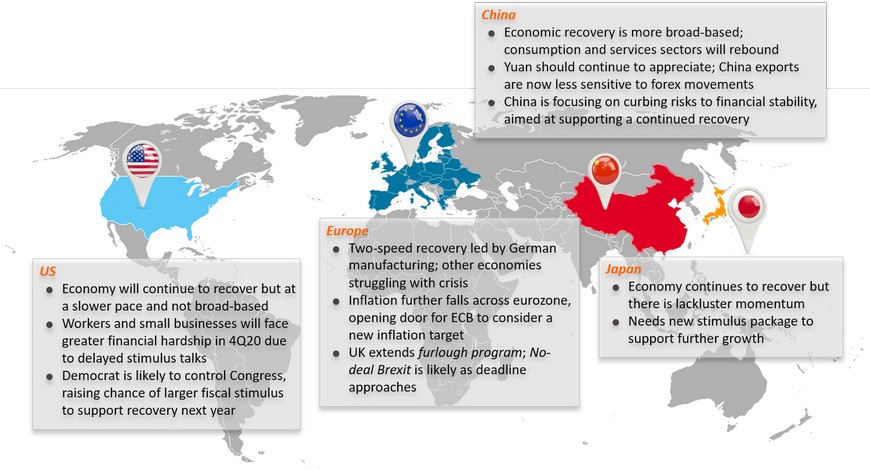

Global: Fragile and fragmented rebound

China and US lead global recovery; Eurozone activity lose momentum; Japan rebounds at a slow pace

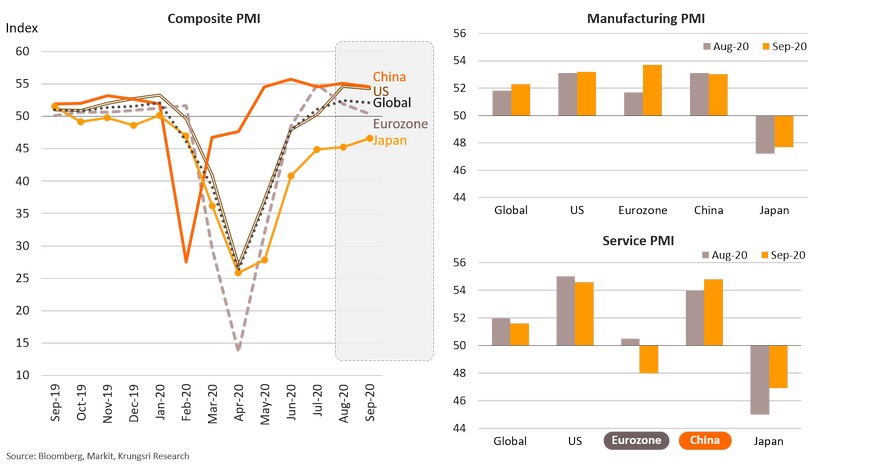

Global overall economic activity, indicated by the Composite PMI, was stable in September led by growth in China and the US. Despite a rebound in the manufacturing sector, overall activity in Eurozone tumbled for the second consecutive month dragged by the services sector due to restrictions following a resurgence in COVID-19 cases. In Japan, Manufacturing and Services PMI data continued to rise but remain below 50.0, indicating a further contraction in economic activity.

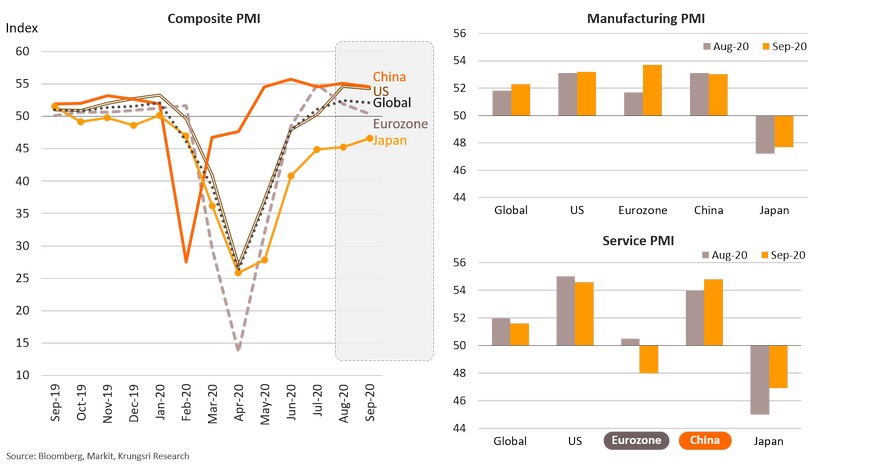

US: Economy continues to recover but at slower pace and is not broad-based

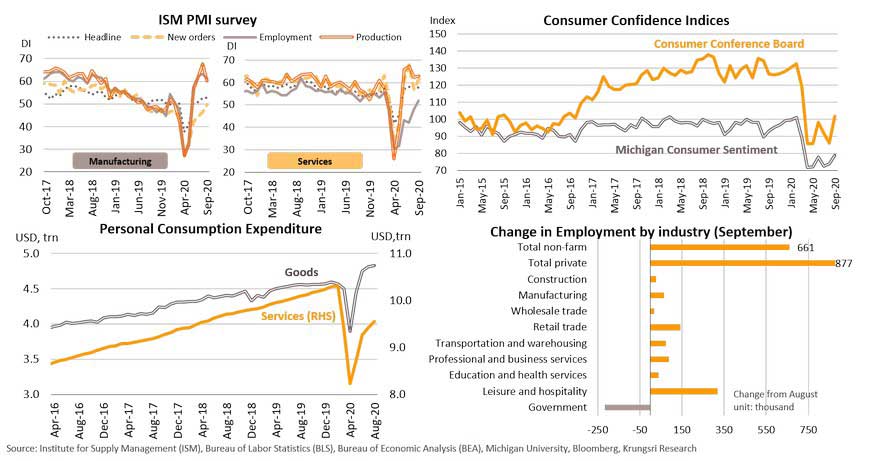

US economy continues to recover but it is not broad-based. Manufacturing PMI fell to 55.4 in September from 56.0 in August, as new orders declined. Services PMI inched-up 0.9 point to 57.8 in September, suggesting the first expansion in employment sub-index since the pandemic. Consumer Confidence Index surged 15.5 points to 101.8 in September supported by rising sentiment among the wealthier group, as unemployment among the lower-income group remained high. Personal Consumption Expenditure (PCE) on goods has rebounded to above pre-pandemic level since June. In contrast, Services PCE lagged and remained below pre-outbreak level, suggesting a long road to recovery. Total private payrolls rose by 877k with non-farm payrolls rising by 661k jobs in September, slower than a 1.489 mn increase in August, due to a reduction in government hiring as pandemic restrictions encouraged online learning. This suggests the next phase of recovery will shift to lower gear.

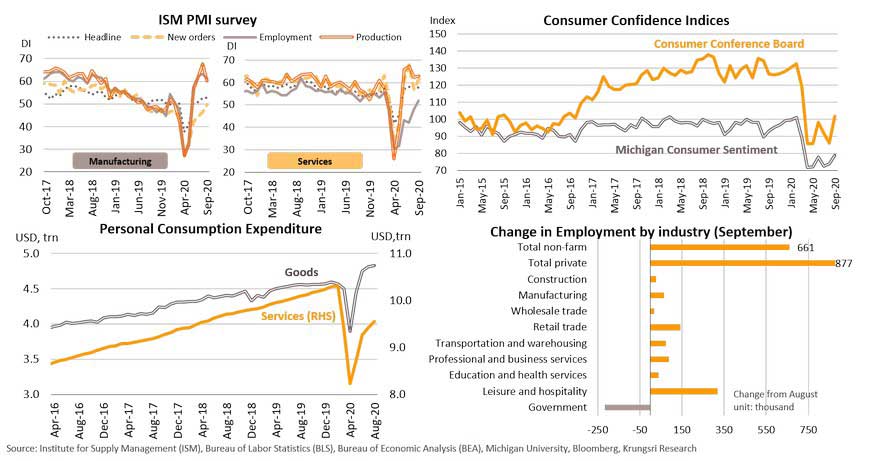

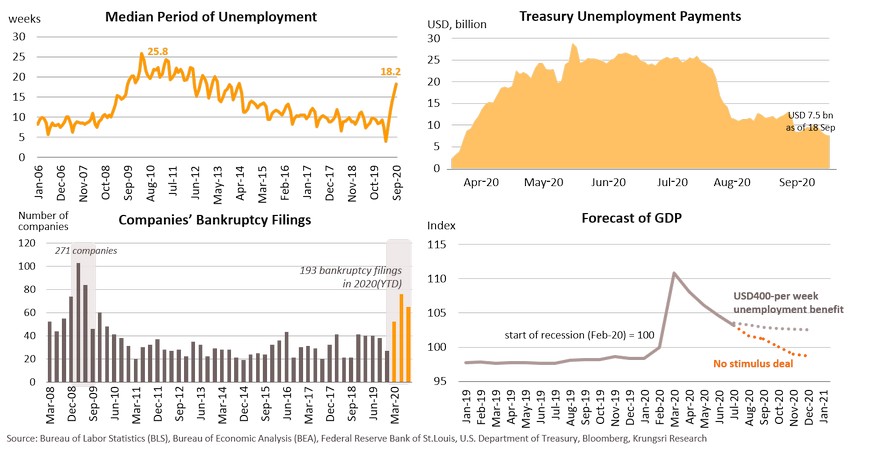

Workers and small businesses will face greater financial hardship in 4Q20 due to delayed stimulus talks

Delays in the fiscal stimulus package continue to hurt workers and small businesses. A government survey shows the median period of unemployment has risen to 18.2 weeks, the highest since 2010. Payments of jobless benefits has dropped to USD7.5 bn as at 18 September, reflecting treasury is running out of funds to support those who have lost jobs. In the business sector, 193 companies have filed for bankruptcy in the first nine months of 2020. This is 64% higher than in the same period last year, reflecting a tough business environment. The deadlock between White House and Democrat over a new stimulus package means there is no fresh relief for struggling businesses and the unemployed. Fed Chair Jerome Powell warned the delay would jeopardize the recovery trajectory. Without fresh stimulus, 4Q20 GDP growth would be 5 percentage points below the estimated growth in the USD400-per week unemployment benefits scenario.

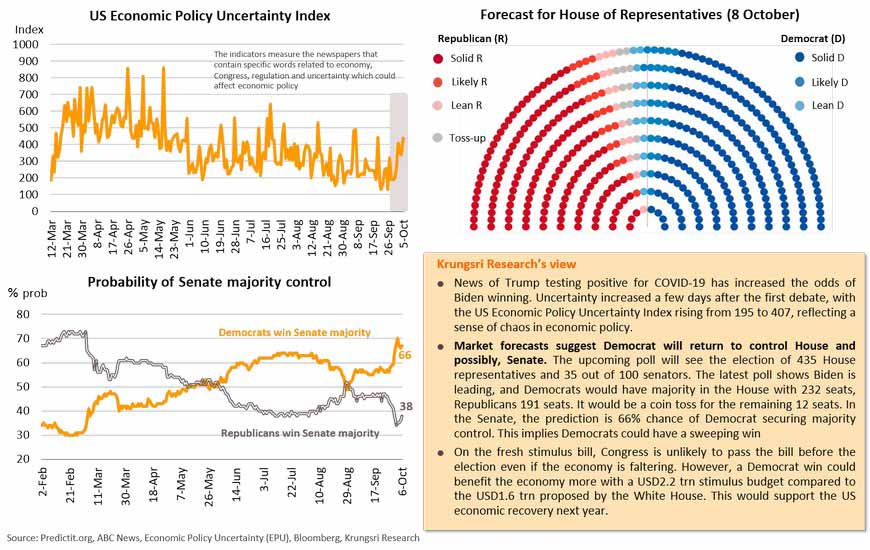

Democrat is likely to control Congress, raising chance of a larger fiscal stimulus to support recovery next year

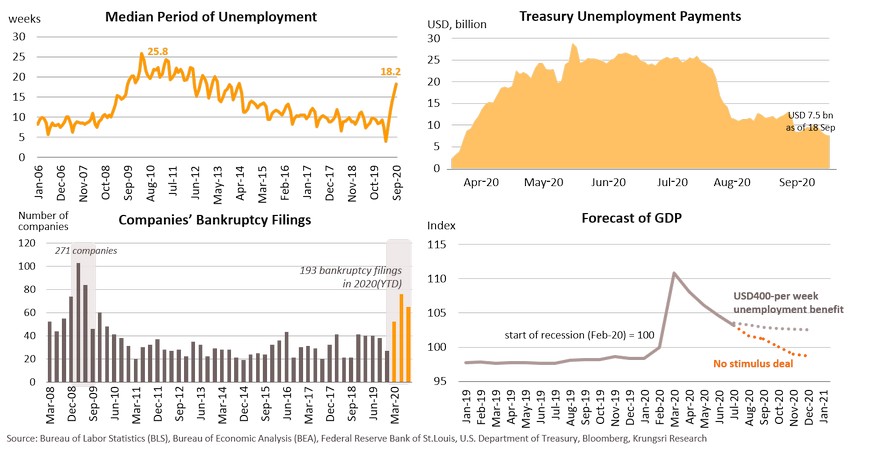

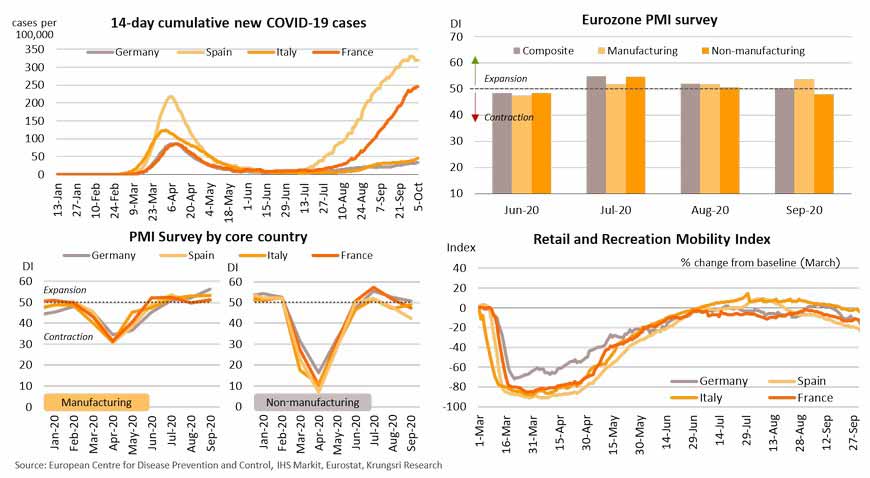

Europe: Two-speed recovery led by German manufacturing; other economies struggling with crisis

The number of news COVID-19 cases continue to surge in Spain and France, exceeding highs in March and April. This has forced those countries to reimpose restrictions. The Eurozone is seeing a two-speed recovery. Manufacturing PMI rose to 53.7 in September led by a solid rebound in Germany. However, the Composite PMI edged down to 50.1 in September from 51.9 in August as Non-Manufacturing PMI slipped to 48.0, suggesting a return to contraction territory. By country, Germany’s Non-Manufacturing PMI edged down to 50.6 in September while Spain booked the largest drop to 42.4 from 47.7 in the previous month. The rest of this region continues to see a fragile recovery, especially Spain where the retail and recreation mobility index has fallen sharply since mid-August to below those of other major countries.

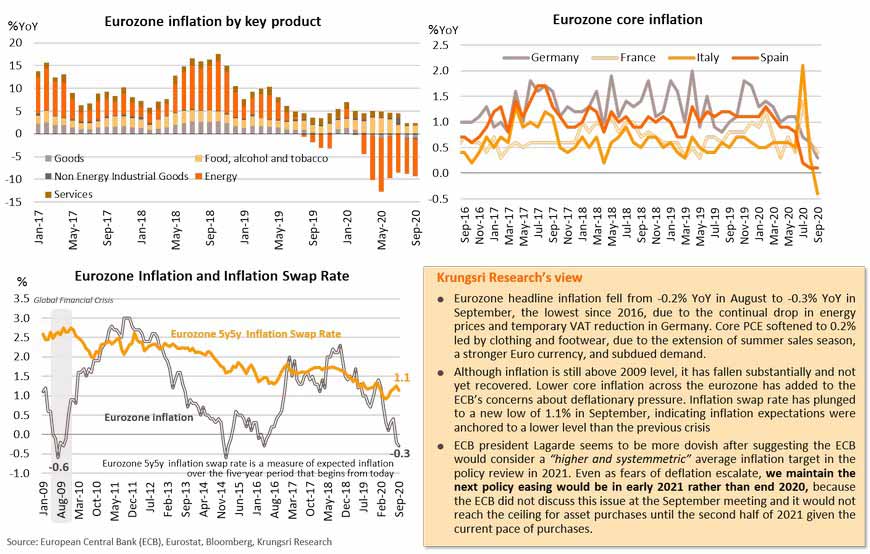

Inflation further falls across eurozone, opening door for ECB to consider a new inflation target

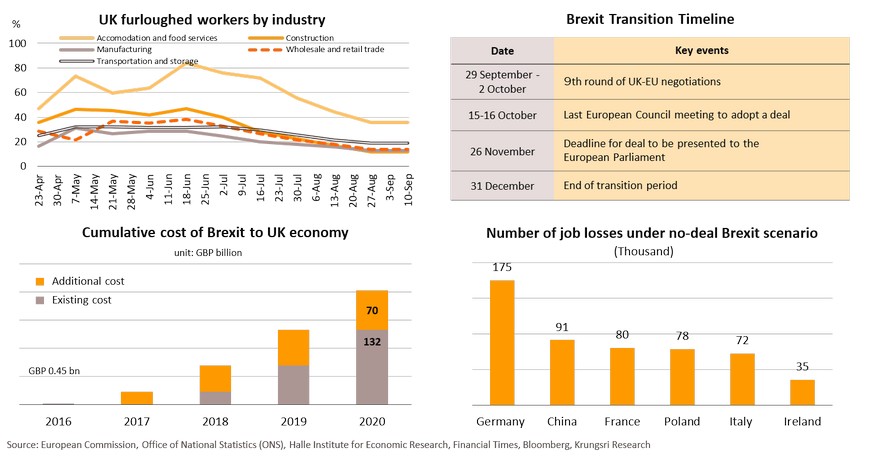

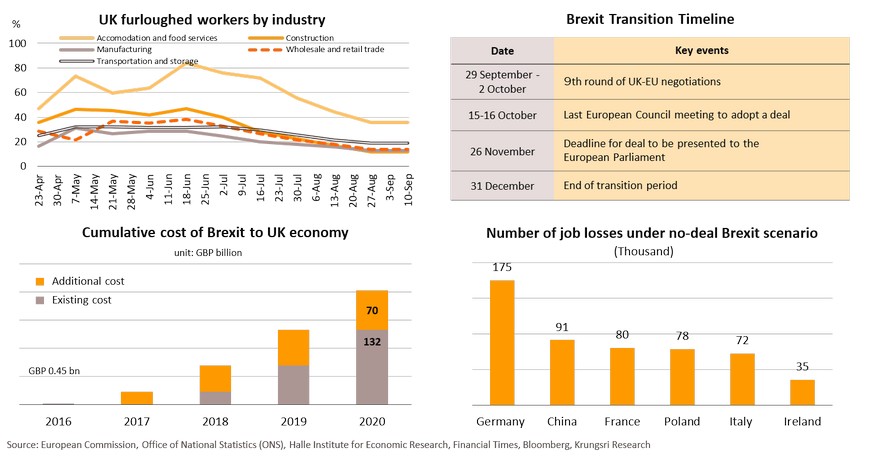

UK extends furlough program; No-deal Brexit is likely as deadline approaches

More than 5 million people (17.7% of UK workforce) are under the furlough program, most in the accommodation and food services industries. The government has extended the program (originally supposed to expire October this year) to April 2021 under the Winter Economic Plan. However, the UK is facing other issues. The Brexit deadline is approaching and there is rising risk of a No-deal Brexit. Johnson has set the deadline for an agreement for 15 October but the latest Internal Market Bill is threatening EU trade talks, and both parties might have to accept the risk of not having a trade agreement. This could send the UK into a tougher period. Brexit had cost the UK GBP132bn (6% of GDP) since 2016 and would cost another GBP70 bn in 2020 (3.2% of GDP). A No-deal Brexit would also hit other economies, especially in the EU. It could lead to over 700k job losses in EU companies, particularly major exporters to the UK. Germany would be the hardest hit, losing 175k jobs, followed by China (91k), France (80k) and Poland (78k).

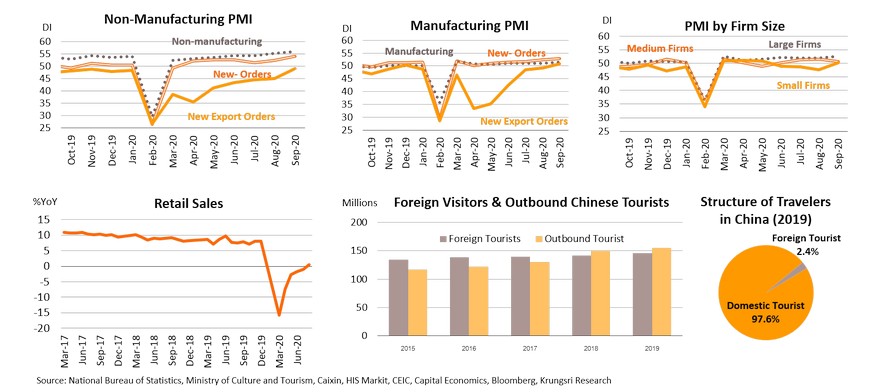

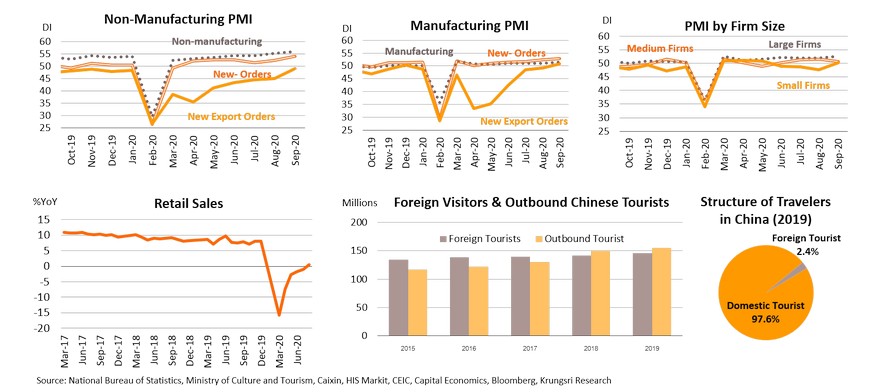

China: Economic recovery is more broad-based; consumption and services sectors will rebound

September Manufacturing PMI rose to a 6-month high of 51.5, while Non-Manufacturing PMI jumped to a 6-year high of 55.9. Recovery is gaining strength with the new export orders component of the Manufacturing PMI rising above 50.0 for the first time in 8 months. Recovery is also more broad-based as PMI data by firm size are all showing expansion, especially for small firms which rose to 50.1. More importantly, retail sales turned positive in August, for the first time since the COVID-19 outbreak, suggesting household spending is picking up. And, China’s tourism industry has recovered during the 8-day Golden Week holiday. Although the number of domestic tourists were below last year’s level, it reached 637 million travelers and generated CNY467bn receipts compared to 115 million travelers and CNY47.6bn receipts during the 5-day Labor Day holiday in May. In fact, domestic tourists in China accounted 97% of total tourists, while foreign visitors accounted for only 3%. Moreover, Chinese tourists who had plans to travel abroad will switch to domestic destinations, which would lift domestic spending and the services sector. Looking forward, the stronger recovery in the services sector and continued expansion in the manufacturing sector would support overall economic growth in the periods ahead.

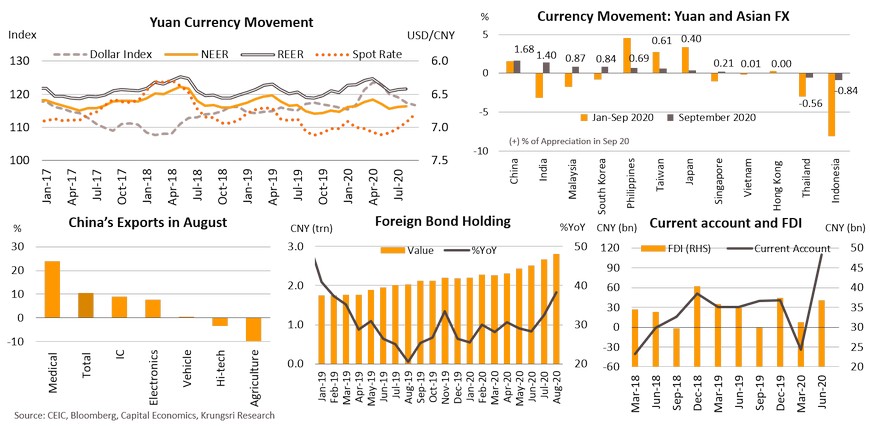

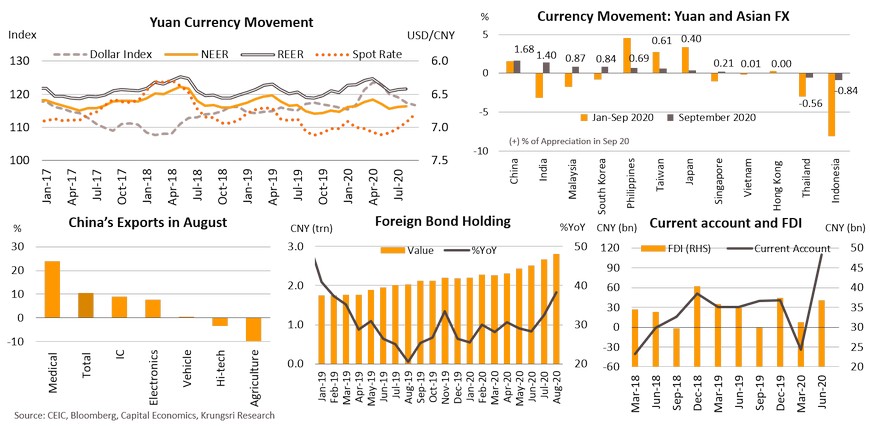

Yuan to appreciate further; China exports are now less sensitive to foreign exchange movements

In September, the Yuan appreciated 1.68% against the US dollar to 6.81, the strongest in 16 months. This is the highest appreciation among peers. Looking ahead, the Yuan should continue to appreciate because the stronger economic recovery would attract foreign funds into China through bonds and foreign direct investment. The Yuan would be driven by a continued surplus in the country’s current account balance, policy to promote the Yuan as an international currency, a weaker US dollar, and strong possibility of a Democrat winning the US Presidential election. It should not have large impact on Chinese exports because several of its key export products are necessities and inelastic to changes in foreign exchange rates, such as medical products and IC which are in-demand in the COVID-19 era and work-from-home and social distancing policies. Despite the stronger Yuan, August exports grew 10.5% YoY led by medical product (+24%). The appreciating yuan will also strengthen its role in “dual circulation” because it would benefit imported-content infrastructure investment, which will be one of China’s major growth drivers.

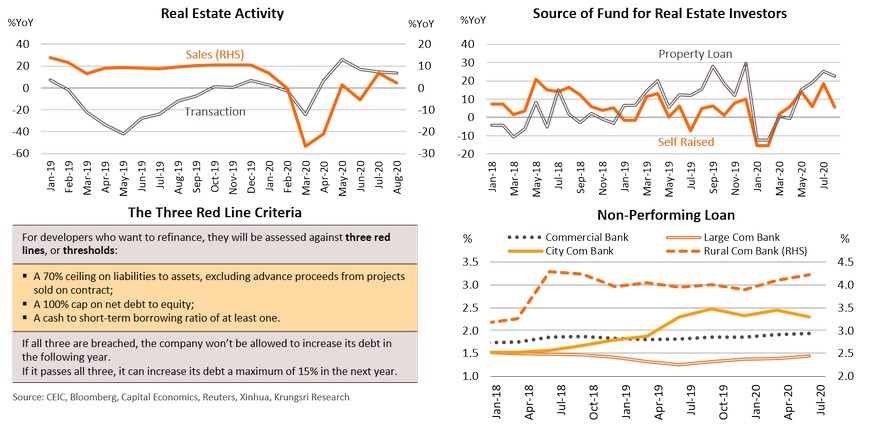

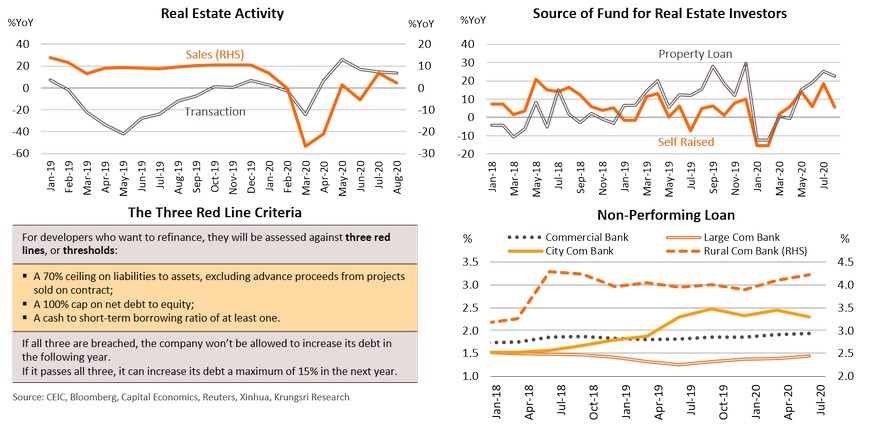

China is focusing on curbing risks to financial stability to support a continued recovery

Chinese authorities are focusing more on some sectors to prevent bubbles and financial instability, although these measures could sacrifice accelerating higher growth. Since the COVID-19 outbreak in China – which had hit the nation hard - the central bank (PBOC) has injected liquidity and cut interest rates, which led to lower mortgage rates. As a result, property sales and transactions picked up rapidly and led to excessive demand and higher leverage for developers. To pre-empt risks, the PBOC and Ministry of Housing announced they were drafting the “Three Red Lines” regulation, where real estate developers who want to refinance will be required to pass financial soundness assessment. This regulation will be launched on 1st January 2021, but its announcement has caused property loans to drop and slowed down real estate activity, which could reduce bubble risk. And, there were also signs of rising non-performing loans, especially at city commercial and rural commercial banks. Therefore, the PBOC encourages small and local banks to merge and strengthen their capital buffer. These measures would reduce risk of insolvency & default and support financial stability. This could rein in growth in some risk sectors but the overall economy would continue to expand in the next period.

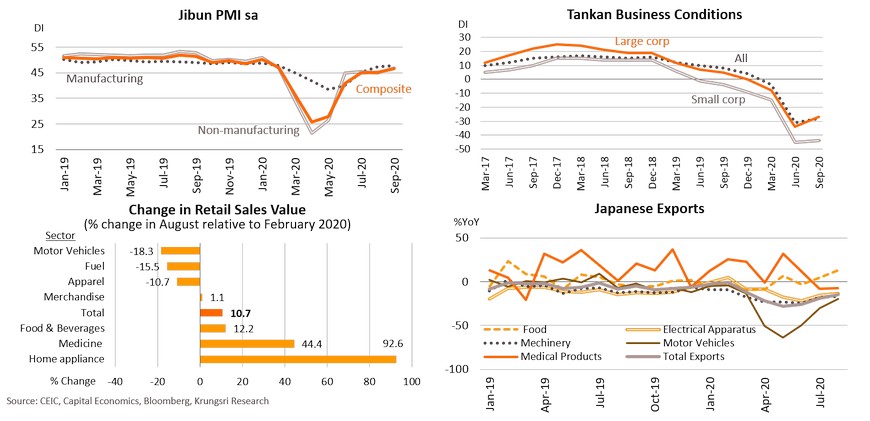

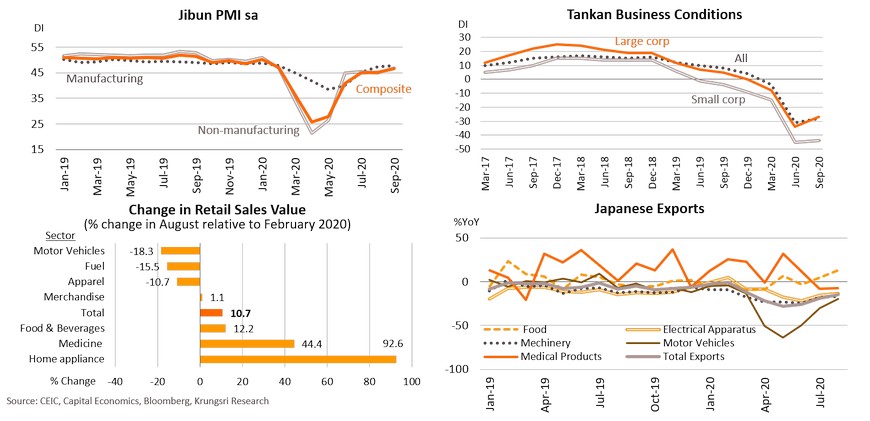

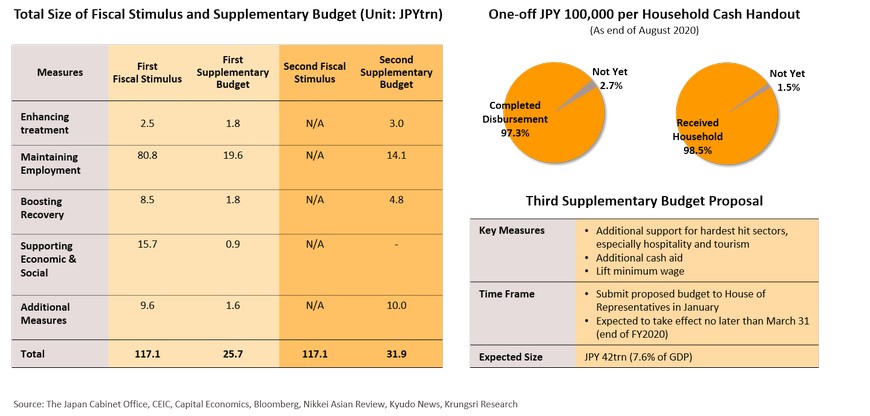

Japan: Economy continues to recover gradually but lackluster momentum

The overall economy is slowly recovering. September Jibun PMI has been improving, reflected by an increase in Manufacturing PMI to a 7-month high of 46.6 and Non-Manufacturing PMI to an 8-month high. But several economic indicators remained sluggish. The Tankan Business Condition indices for large and small manufacturers picked up in 3Q20 but remained in negative territory and below pre-pandemic levels. Retail sales continued to improve in August, albeit still in contraction territory. Sale of vehicles, fuel and apparel dropped sharply, while sale of food & beverage, medicine and household appliances picked up. Based on a household survey in August, people saved 44% of their income instead of spending, the highest saving rate since 1992, indicating consumers are still cautious. On the external front, exports dropped by 12.1% YoY in August, the 13th straight month of decline. Major export items continued to suffer from weak global trade, particularly vehicle (-19.4%), machinery (-16.8) and electrical appliances (-13.6%). Subdued demand in both domestic and external sectors imply the Japanese economy remains weak and needs additional stimulus measures to support the recovery process in the next period.

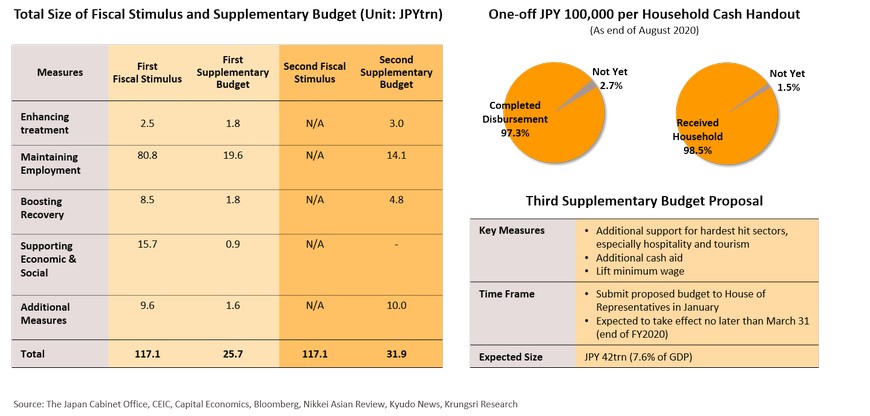

Needs new stimulus package to support further growth

The Japanese government has introduced two fiscal stimulus package since the COVID-19 pandemic, but overall economic activities remain weak, especially demand. This suggests a need for fresh fiscal supports to boost recovery. Most of the fiscal stimulus supports have been in the form of transfers to firms and households to maintain employment and business operations. At the end of August, the government revealed that 98.5% of households had received the JPY 100,000 cash aid, implying direct support to boost household spending would end soon. However, vulnerable households may still need assistance. Recently, Suga’s cabinet started to work on the third supplementary budget for the new stimulus package, which is expected to be compiled as early as in November 2020 and then be submitted to the House of Representatives before January 2021. The third package is expected to mostly support the services sector and include additional cash aid. The new stimulus package would help to boost domestic spending, but it remains unclear if it can generate sufficient multiplier effect to sustain overall economic growth going forward.

Thailand: Still-sluggish recovery

Foreign tourist arrivals near-zero for the 5th consecutive month in August. Exports (excluding gold) saw double-digit contraction. Long-stay tourist visa will have minimal impact. Private consumption shrank after end of long holiday in July.

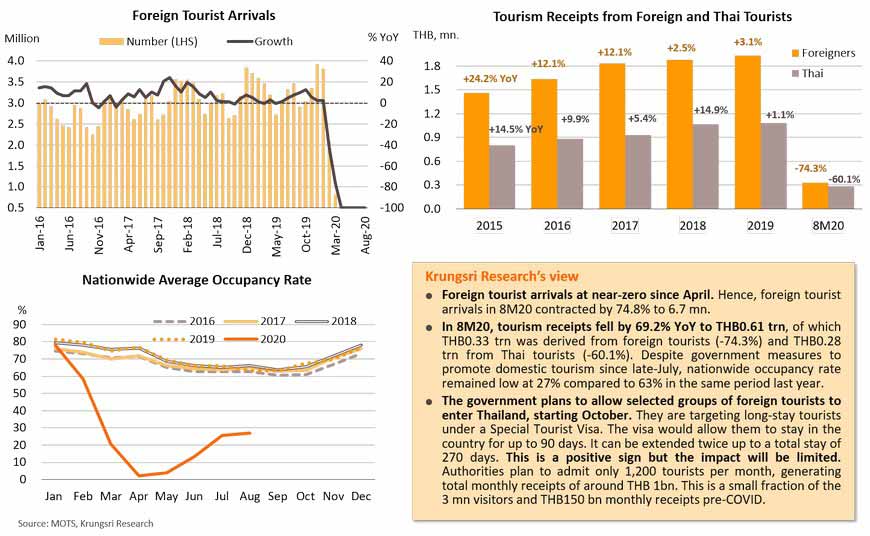

- There were near-zero foreign tourist arrivals in August. The government is allowing a selected group of foreign tourists to enter Thailand starting October. This is a positive sign but the impact will be limited. The authorities plan to admit only 1,200 tourists per month that is expected to generate about THB1bn receipts monthly; this is a small fraction of the 3mn visitors and THB150 bn monthly income pre-COVID.

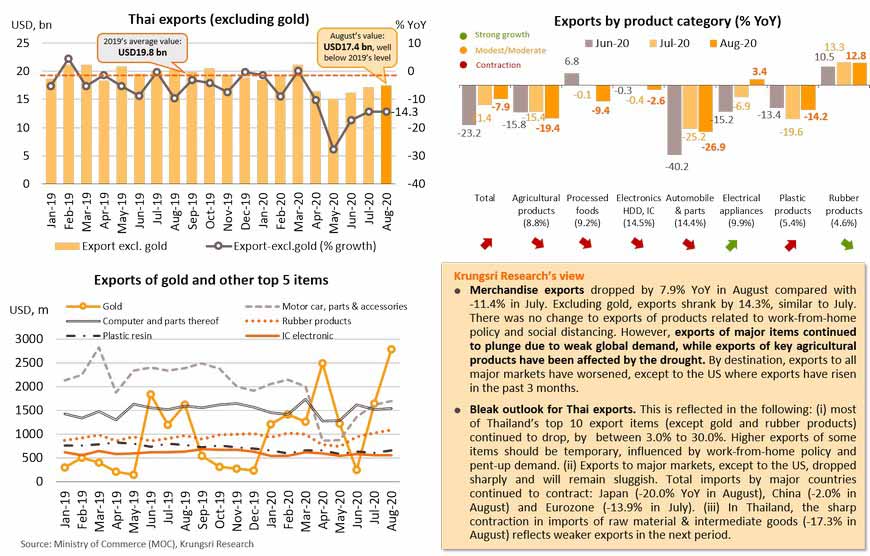

- Merchandise exports fell by 7.9% YoY in August compared with -11.4% in July. Excluding gold, exports fell by 14.3% (same as July).

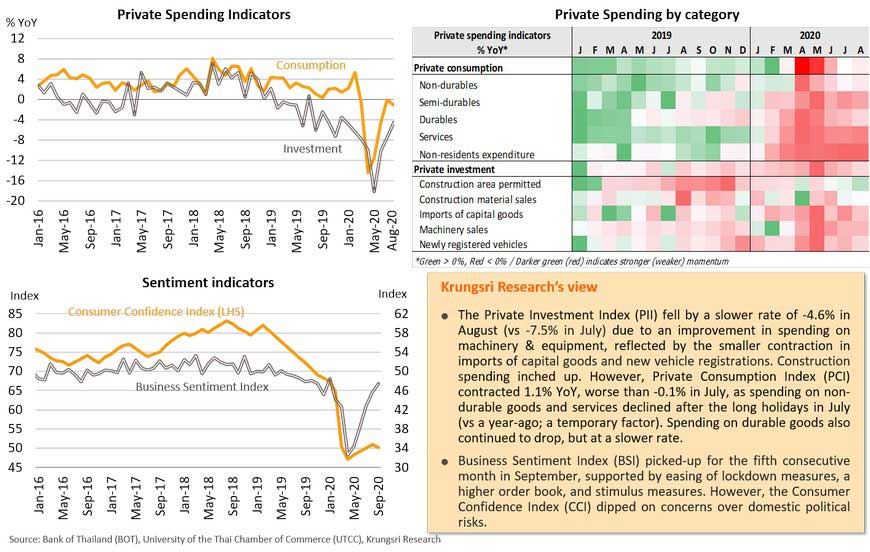

- Private Consumption Index (PCI) contracted 1.1% YoY, worse than -0.1% in July, as spending on non-durable goods and services declined after the long holidays in July. Private Investment Index (PII) fell by a slower rate of -4.6% in August (vs -7.5% in July). In September, Business Sentiment Index (BSI) rose for the fifth consecutive month following easing lockdown measures, but the Consumer Confidence Index (CCI) dipped on concerns over domestic political risks.

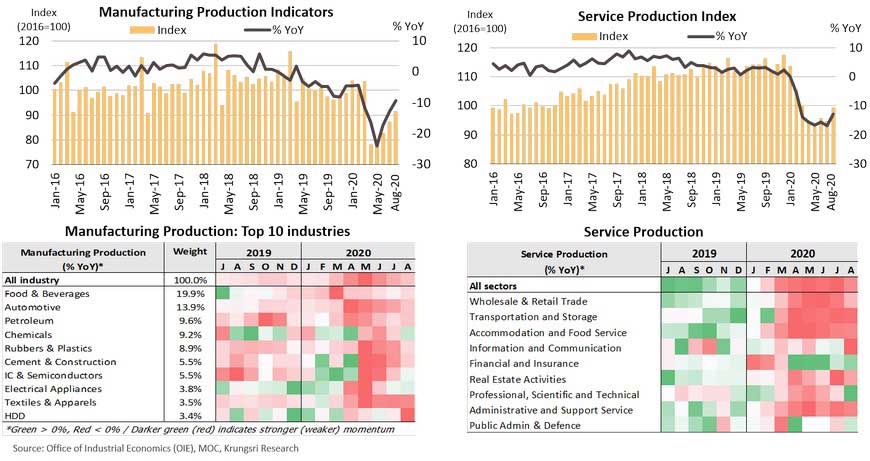

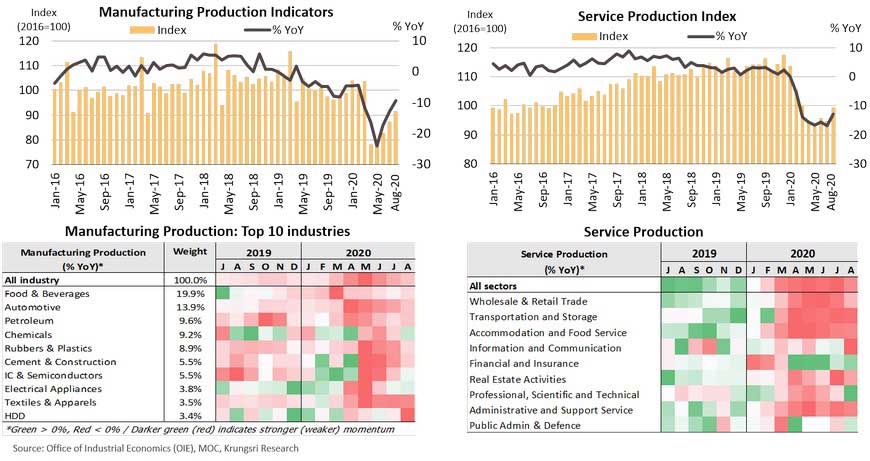

Manufacturing production continued to improve but concentrated in some sectors. Services sector recovery is slow with contraction in most sectors. Despite improving economic activity, labor market showed signs of weakening.

- The Manufacturing Production Index (MPI) dropped by 9.4% YoY in August, improving from -12.7% in July. However, this is the 16th straight month of contraction amid the prolonged impact on external and domestic demands. The Service Production Index (SPI) continued to recover slowly and remains far below pre-pandemic level, posting double-digit contraction for the 6th straight month at -12.9% YoY in August (vs -16.9% in July).

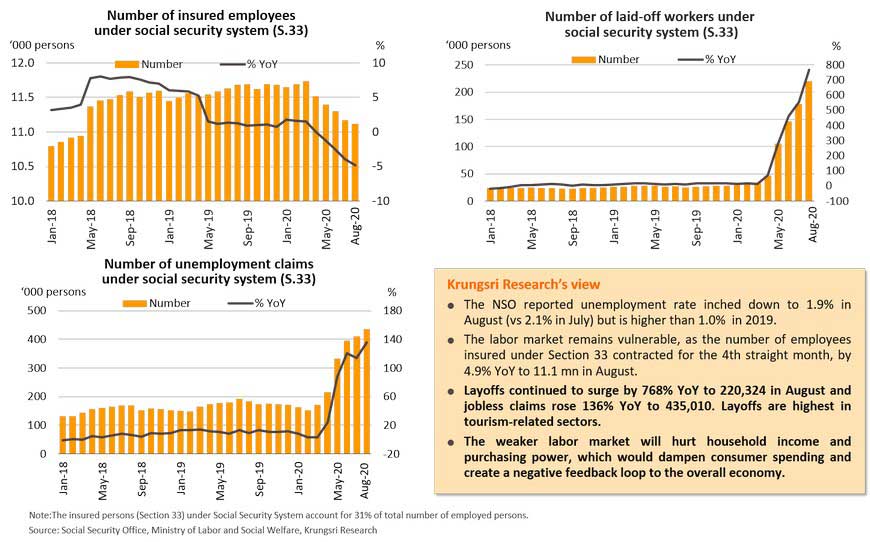

- Despite a rebound in economic activity, the labor market weakened. Layoffs and jobless claims continued to surge in August.

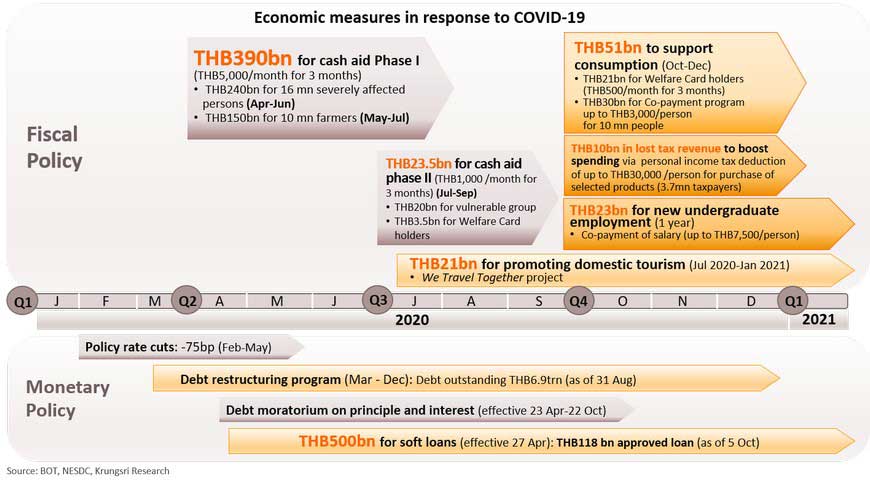

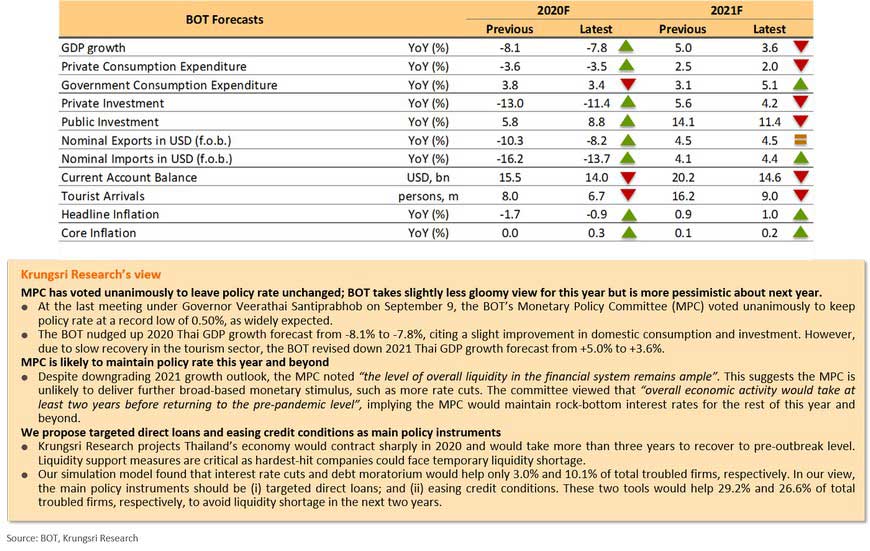

Economic relief package for 4Q20 is much smaller than recent schemes. MPC has a more pessimistic outlook for next year; likely to maintain policy rate this year and beyond.

- In 4Q20, the government approved economic stimulus measures worth less than THB100bn compared to more than THB400bn in 2Q-3Q. Hence, the positive effects would be limited and risks would increase after the debt moratorium scheme ends on October 22.

- The BOT has downgraded 2021 GDP growth forecast but the MPC noted “the level of overall liquidity in the financial system remains ample”, suggesting the MPC is unlikely to deliver more broad-based monetary stimulus such as rate cuts. The committee view that the “overall economic activity would take at least two years before returning to the pre-pandemic level”, implying the MPC would maintain rock-bottom interest rates in the foreseeable future.

Foreign tourist arrivals at near-zero again in August; long-stay visa will have minimal impact

Exports posted less negative growth but excluding gold, they contracted at double-digit rate

Smaller drop in private investment in August; consumption shrank after end of long holidays in July

Manufacturing production improved but concentrated in some sub-sectors; services sector remained weak

The Manufacturing Production Index (MPI) fell by 9.4% YoY in August, improving from -12.7% in July, led by a rebound in the production of electrical appliances, IC semiconductor and chemical products. However, this is the 16th straight month of contraction, led by lower production of cars and hard disk drives, because of the COVID-19 impact on external and domestic demand. The Service Production Index (SPI) recovered at a slow pace and is still far from pre-pandemic level, posting double-digit contraction for the 6th straight month at -12.9% YoY in August (vs -16.9% in July). Specifically, there was a sharp contraction in tourism-related businesses such as accommodation, food services, transportation, and storage due to the ban on international flights and entry of foreign tourists for the 5th consecutive month.

Despite recovering economic activity, labor market weakens as layoffs increase

Cash aid has dropped sharply; 4Q20 stimulus package is much less than recent schemes

In 4Q20, the government approved several measures to support the Thailand’s economic recovery: (i) THB51 bn cash aid to boost domestic consumption. Payments will be made through State Welfare Cards and Co-payment scheme (G-Wallet)’; (ii) tax deduction for the purchase of selected products, which is estimated to reduce government tax revenue by THB10 bn; and (iii) THB23 bn program to support new graduate employment. However, the cash aid budget (more than THB400 bn) will be exhausted soon as layoffs continue to rise. The less than THB100bn stimulus package for 4Q20 is much smaller than in 2Q-3Q20. Therefore, there would be limited positive effects on the economy and risks would increase after the debt moratorium scheme ends on October 22.

MPC has more pessimistic outlook for 2021; may maintain policy rate in the foreseeable future

Measuring the COVID-19 impact on the labor market and household sector

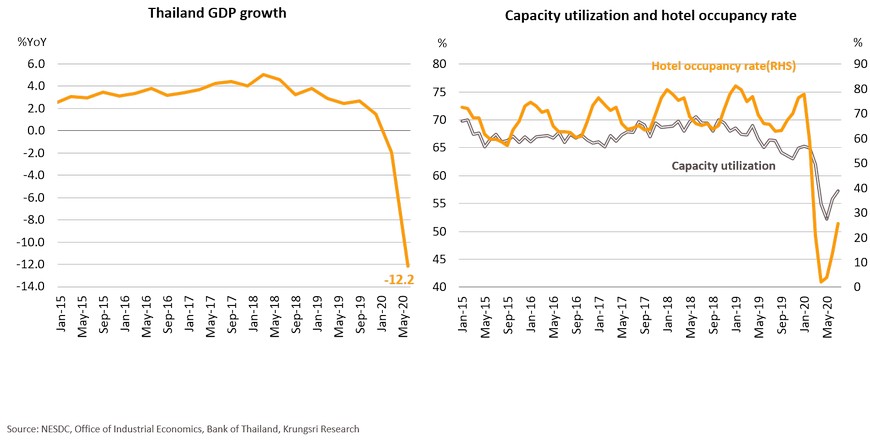

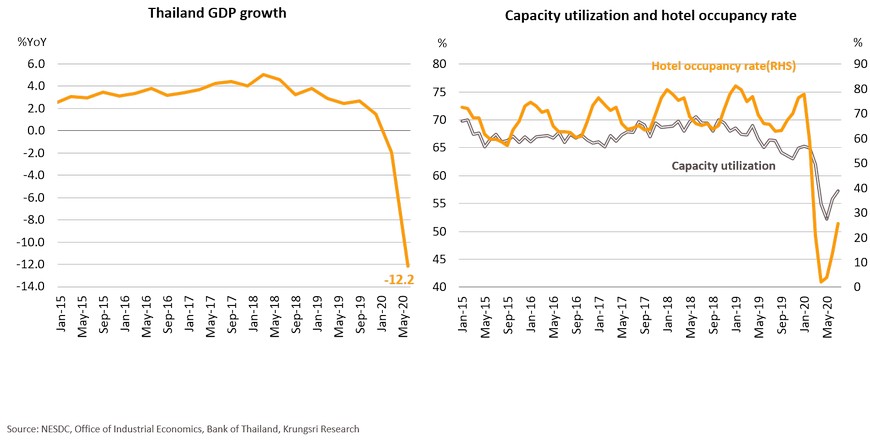

- At the height of the COVID-19 pandemic, the Thai economy posted the worst contraction in 22 years at -12.2% YoY in 2Q02. The crisis also had severe impact on the labor market, which transmitted down to household income and spending.

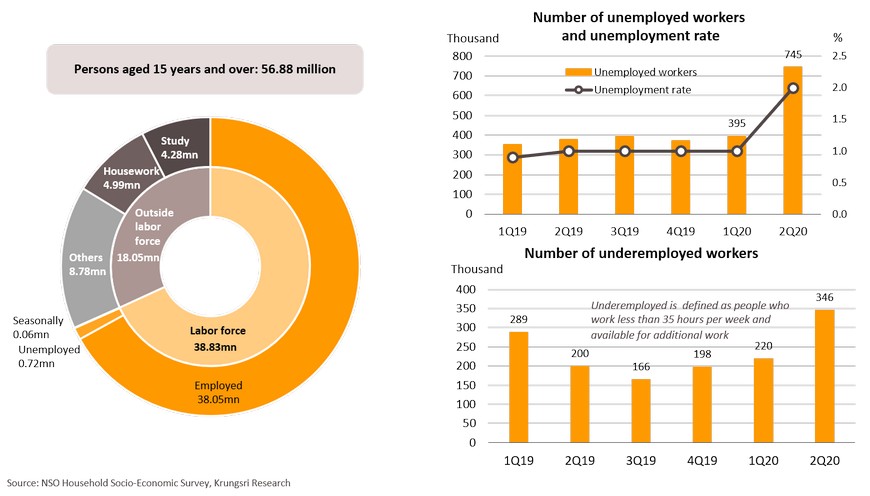

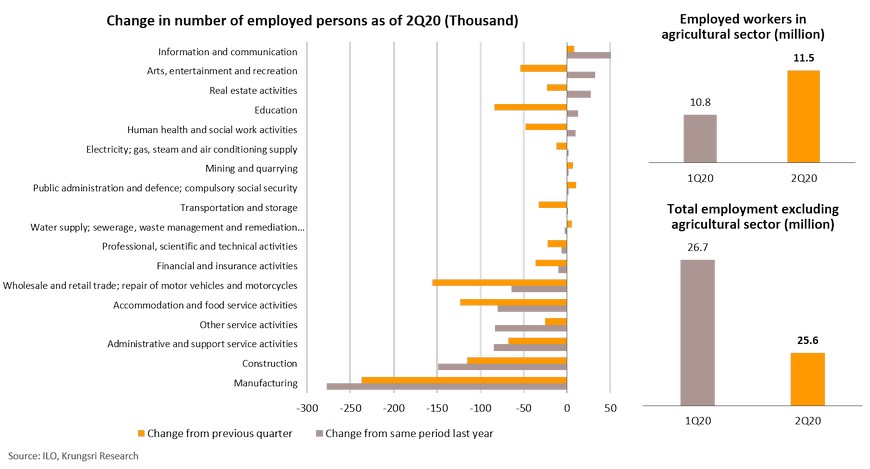

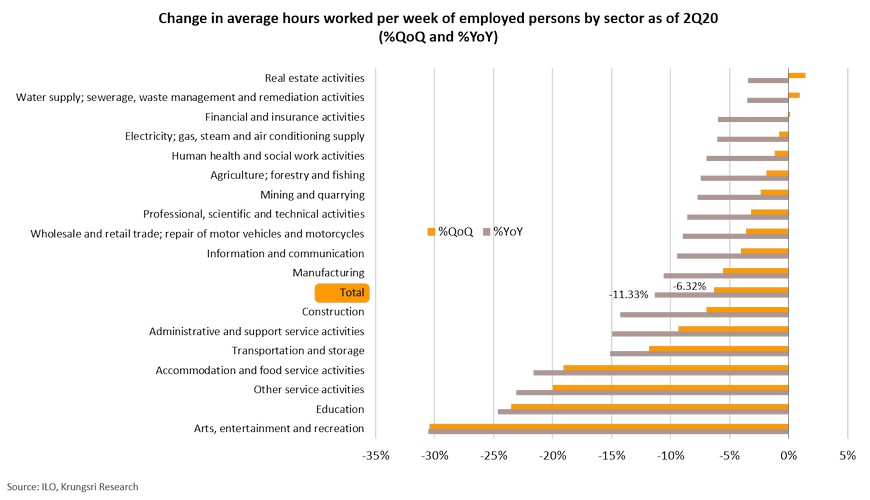

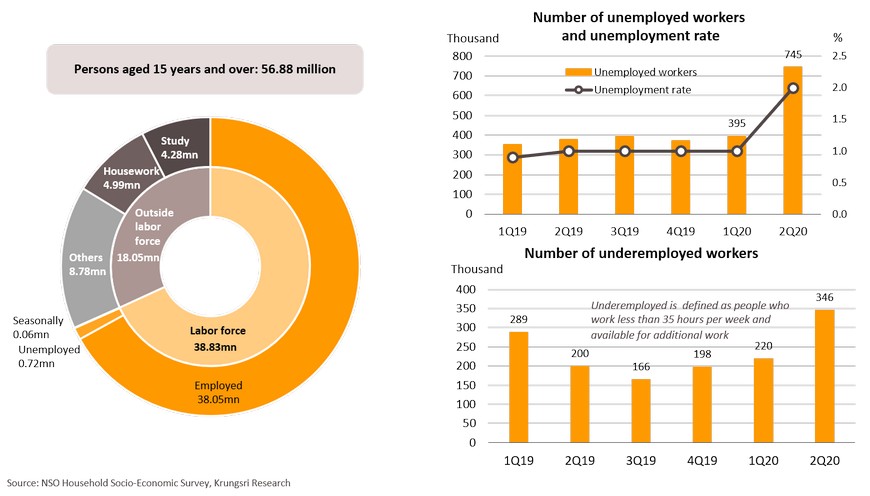

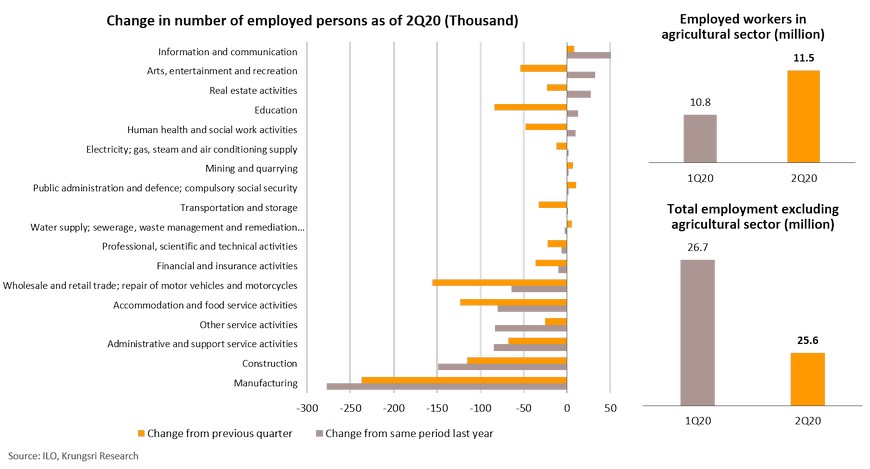

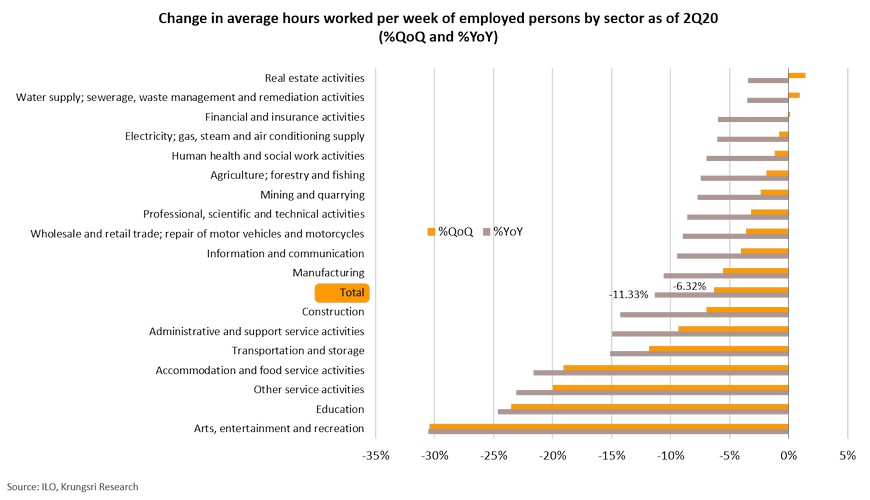

- Unemployment surged to 745k in 2Q20 from 395k in 1Q20. Underemployment also rose to 346k from 220k. By sector, the largest drop in employment was recorded in the manufacturing sector, followed by construction and other services. The pandemic forced more than 700k to return to the agricultural sector in 2Q20. It also reduced total hours worked by 6.3% in 2Q20, equivalent to the loss of 2.7mn full-time jobs. The largest declines in average hours worked were in services-related sectors (ranging from -20% to -30% QoQ in 2Q20).

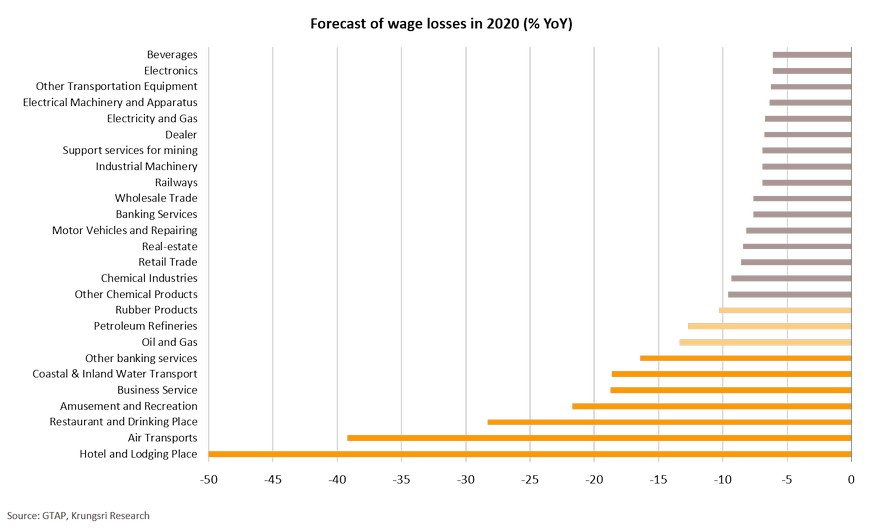

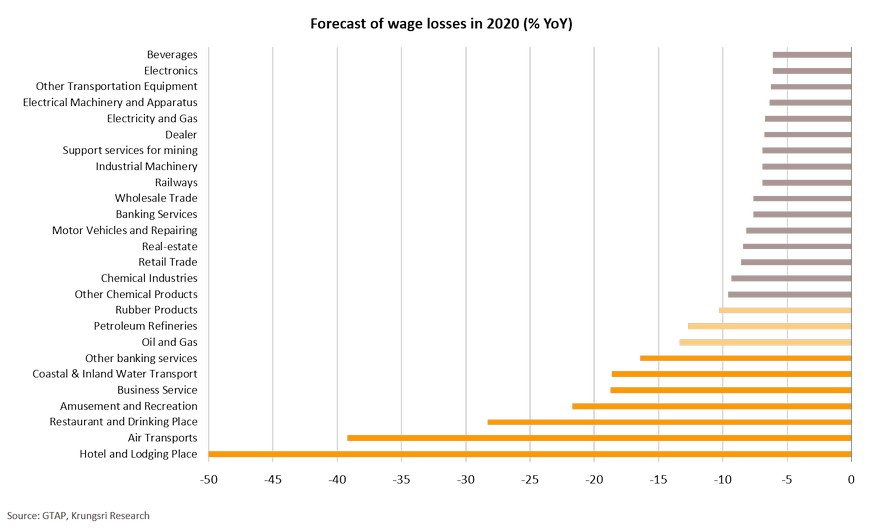

- Looking ahead, Krungsri Research expects workers in services-related sectors to experience the largest pay cut of 20-50% in 2020, led by hotel & lodging, air transportation, food & beverage, and amusement & recreation. Those in business services and oil & gas could see 10-20% pay cut, while those retail & wholesale trade, banking services, electronics, and beverage would see 5-10% pay cut.

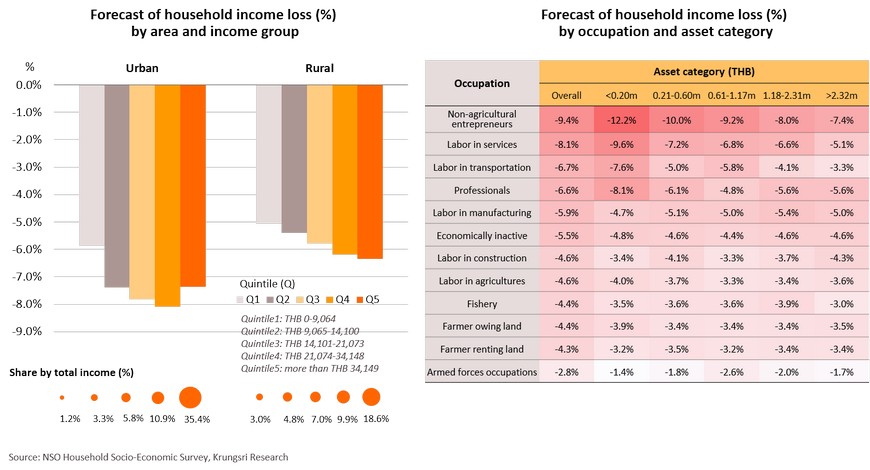

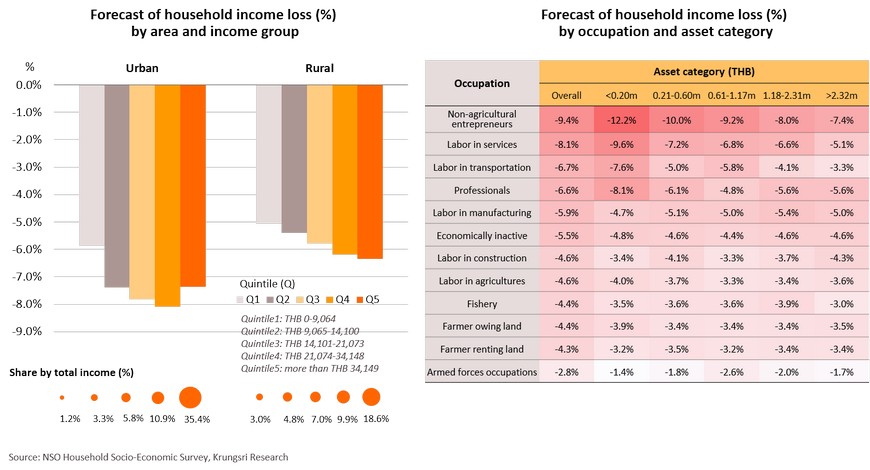

- As a result, total household income is projected to drop by 6.9% in 2020, comprising 7.5% in urban areas and 6.0% in rural areas. Middle-class households in urban areas would see a larger drop in income than other groups. By occupation and asset size, households with smaller asset size are likely to face larger income losses, led by non-agricultural entrepreneurs, labor in services sectors, and labor in transportation.

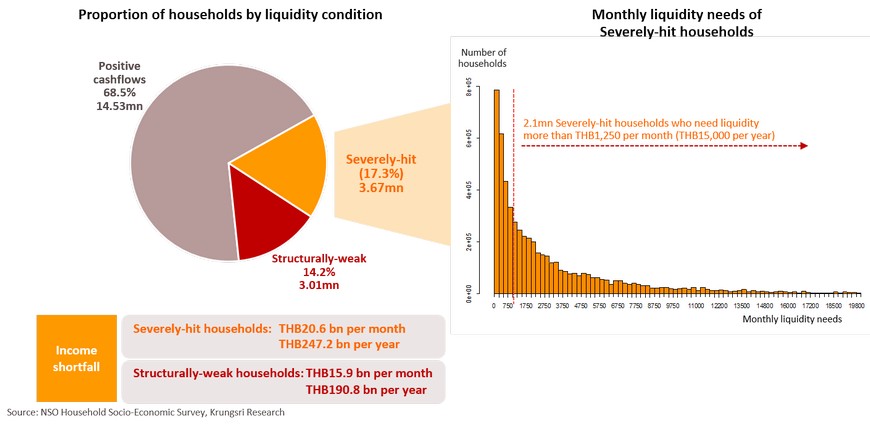

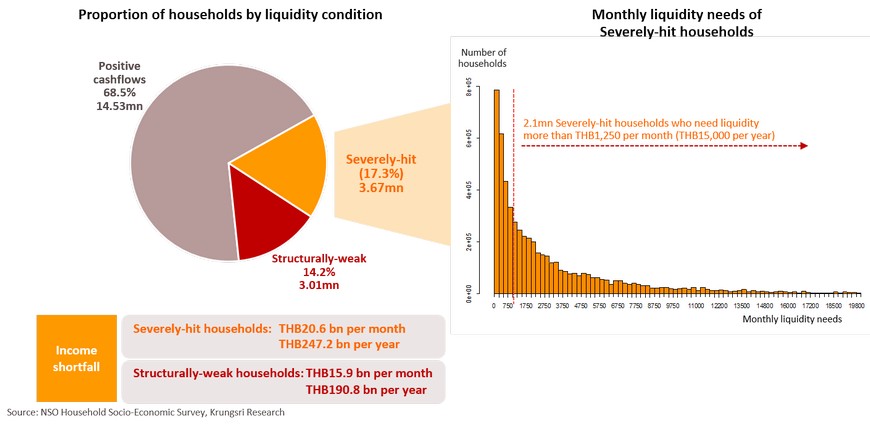

- COVID-19 has had different impact on household liquidity. We classified households into 3 groups, comprising those with Positive cash flow, Severely-hit (by COVID-19 impact), and Structurally-weak (pre-pandemic). Structurally-weak households (3.01mn, 14.2% of total households) and Severely-hit households (3.67mn, 17.3%) are facing negative cash flows. This suggests rising risks of a drop in household consumption and default on debts. This means the government stimulus programs are insufficient to support household income and consumer spending in these two groups.

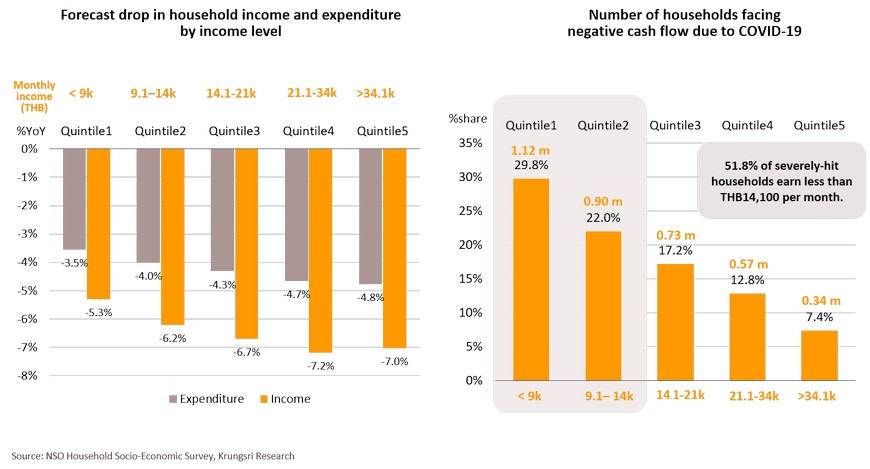

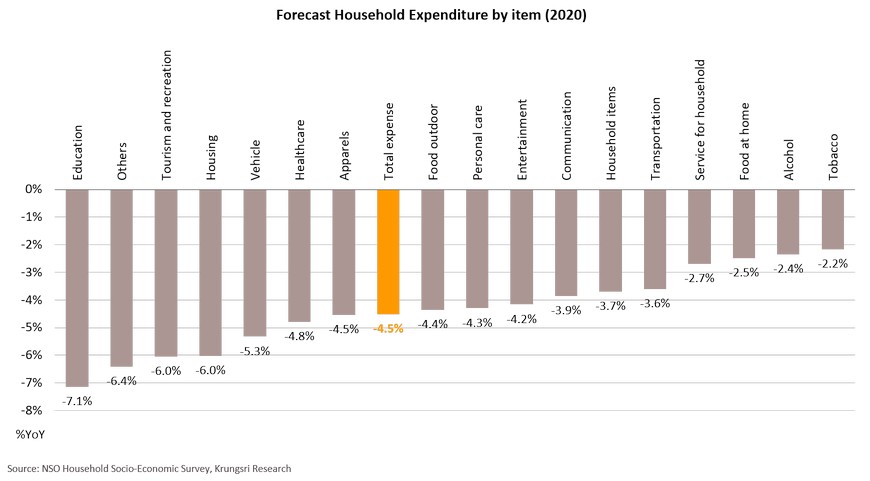

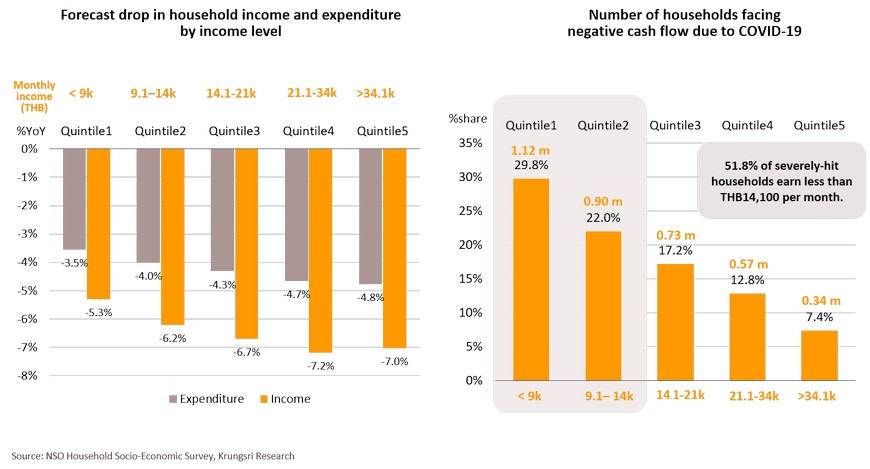

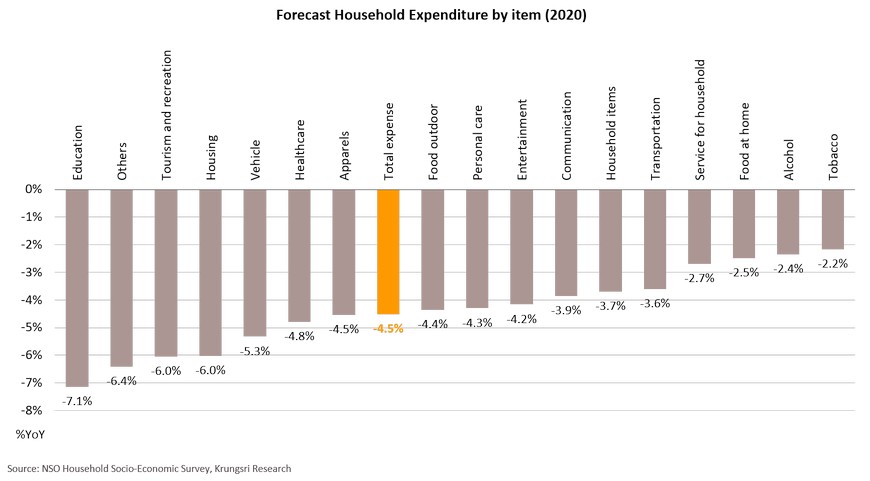

- We expect total household expenditure to drop by 4.5% in 2020, led by lower spending on education, tourism & recreation, and housing. Hence, the tourism sector would suffer from a drop in spending by residents as well as the absence of foreign tourists.

COVID-19 crisis caused Thai economy to post the worst contraction in 22 years

Thailand has been successful in controlling the domestic outbreak. However, the economy has been severely hit by the lockdown as well as travel restrictions. This led to the near-collapse of the tourism industry and negative income effect. Thai GDP contracted by 12.2% YoY in 2Q20, the largest contraction since the Asian Financial Crisis. The pandemic adversely affected both the manufacturing and services sectors. Capacity utilization in the industrial sector is 15% below pre-pandemic level and hotel occupancy rate is 50% below pre-crisis level. The pandemic has affected the Thai economy severely, particularly the labor market, and that will continue to dampen household income and consumer spending.

Unemployed jumped to 745k in 2Q20 from 395k in 1Q20; underemployment rose to 346k

The Labor Force Survey (August 2020) revealed there were 56.88 million people aged 15 years and over, of which 38.83 million were in the labor force (98% were employed, 1.9% were unemployed, and 0.2% were seasonally inactive labor force). 18.05 million were not in the labor force (27.6% were housework, 23.7% were students, and 48.6% 'others'). The number of unemployed surged to 745k in 2Q20 from 395k in 1Q20 (+89% QoQ). The number of underemployed rose to 346k in 2Q20 from 220k in 1Q20, which means more people are working fewer hours.

Pandemic forced 700k workers to return to the agricultural sector in 2Q20

As the crisis continues, companies have been forced to lay off staff to reduce payroll costs. Industries that registering the largest drops in employment during 2Q19-2Q20 were manufacturing and construction, where total employment fell by 426k, followed by ‘other services’ sectors. This reveals the effects of factory closures and the impact on vulnerable groups such as casual workers in the construction sector. However, the agricultural sector recorded the largest increase in employment, suggesting some of those who lost jobs had been absorbed by the sector. Excluding the agricultural sector, total employment fell by 1.1 million persons in 2Q20.

A drop in total hours worked in 2Q20 is equivalent to loss of 2.7mn full-time jobs, led by services-related sectors

In 2Q20, total number of hours worked in Thailand declined by 6.3% from the first quarter of the year. This is equivalent to the loss of 2.7 million full-time jobs (assuming 40-hour work week). The sectors that registered the largest drops vs 1Q20 were art, entertainment & recreation (-30.4%), education (-23.5%), other services (-20.0%), and accommodation & food (-19.1%), followed by other services-related sectors. These illustrate the severe impact on the services sector and manufacturing (-5.5% hours worked).

Krungsri Research estimates wages in services sector would drop by 18%-50% in 2020

We project Thai GDP would contract by 10.3% this year. Tourism-related sectors would register the largest drop in wages of 18%-50% this year. Hotel and lodging industry would see a 50% wage reduction, followed by Air transportation (-39.2%) and restaurant & beverage (-28.3%). Manufacturing sector would register the smallest wage loss.

Middle-income households in urban areas and less wealthy households to see larger income loss

Total household income is expected to decline by 6.9% in 2020, including -7.5% in urban areas and -6.0% in rural areas. Middle-income households will experience larger income losses than other groups, especially in urban areas. There is income inequality in Thailand, with high-income households in urban areas (fifth quintile) accounting for 35.4% of total income, and the lowest income group accounting for only 1.2%. By occupation and asset level, households with smaller asset level would suffer the largest income losses, led by non-agricultural entrepreneurs, labor in the services sector, and labor in transportation.

Low-income households are most vulnerable

The pandemic has reduced household income across all segments, from the poorest to the richest. However, it has had the largest impact on the lower-income group because they have relatively low savings to tide them over if they lose their job or there is a pay cut. Our analysis revealed 3.67 million households have been severely hurt by the pandemic and have negative cash flow; more than half the households in this group earn less than THB14,100 per month.

31% of households will suffer from negative cash flow, 17% is severely impacted by the pandemic

The pandemic has had different impact on household liquidity. We classified households into 3 groups, comprising those with Positive cash flow (income exceed expenses), Severely-hit (expenses exceed income due to the pandemic), and Structurally weak (expenses had exceeded income even before the pandemic). Apart from 3.01mn Structurally-weak households (14.2% of total households), 3.67mn Severely-hit households (17.3% total households) would also face liquidity problems. These two groups would face income shortfall of at least THB438bn per year. This would hurt consumption and could increase risk of default. Without government support, total household expenditure would drop by 8% this year. However, the government is offering THB5,000 per month cash aid for 3 months (total THB15,000) to 15mn persons, at a total budget of THB240 bn. But when this aid ended in September, 2.1mn Severely-hit households and the Structurally-weak households would face income shortfall again. This implies current measures are insufficient to support household income and consumer spending in the periods ahead.

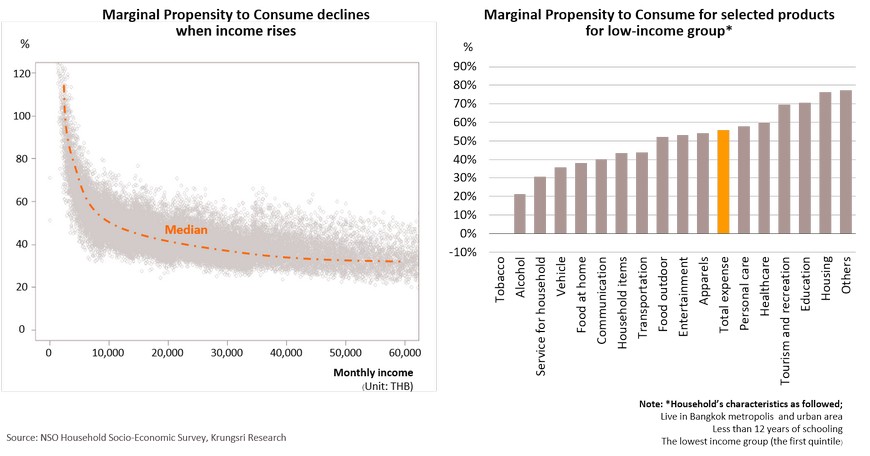

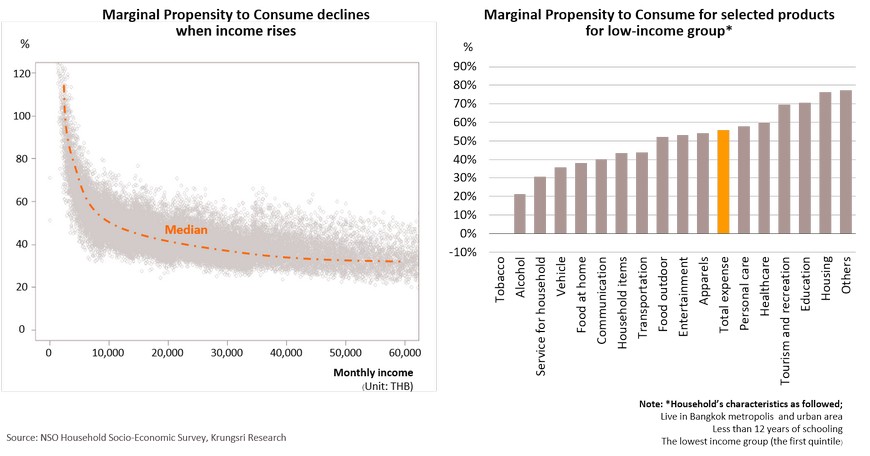

Marginal Propensity to Consumer drops when income rises

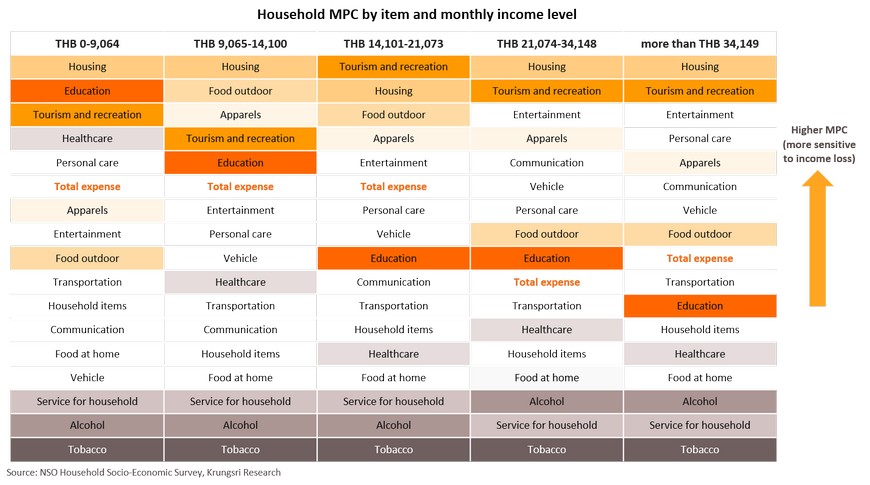

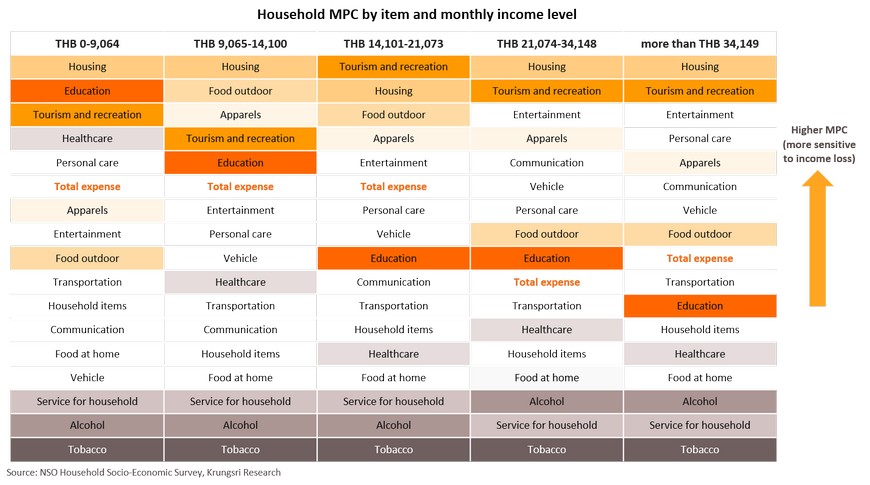

The Marginal Propensity to Consume (MPC) is the extra consumer spending arising from an increase in income. The MPC is influenced by 2 key factors - income level and type of goods/services. In Thailand, the majority of households are low income which MPC is much higher than for wealthier households. The lower-income group would tighten their belts more than wealthy households when their income drop, meaning they are more sensitive to changes in income levels. The MPC can also be influenced by the type of product or services. For the low-income group, spending on housing, education and tourism is highly sensitive to income changes. Spending on alcohol is less-sensitive, suggesting they are less likely to drink less alcohol if their income drop. In contrast, the MPC for tobacco is negative, implying households would consume more tobacco when their income drop.

Total household expenditure would drop by 4.5% in 2020; education and tourism are highly sensitive to income loss

Total household expenditure would drop by 4.5% YoY this year, assuming the aforementioned wage losses. The largest drops would be seen in education, tourism & recreation and housing sectors, which are highly sensitive to income loss. The smallest drops would be in alcohol and tobacco, suggesting households tend to continue consuming these items even if income drop.

Households are sensitive to housing and tourism spending; tourism hit by travel bans and income losses

Expenses on housing and tourism & recreation are most sensitive to income changes in all income groups. This implies the tourism sector would be hit by travel restrictions, and indirectly, by income losses. Households would likely cut spending on tourism more than other expenditures when their income drop. For low- to middle-income households, they are more to expenditures on food, outdoor and apparels when their income change. The poorest households are more sensitive to education spending, suggesting they would forgo education when income drop.

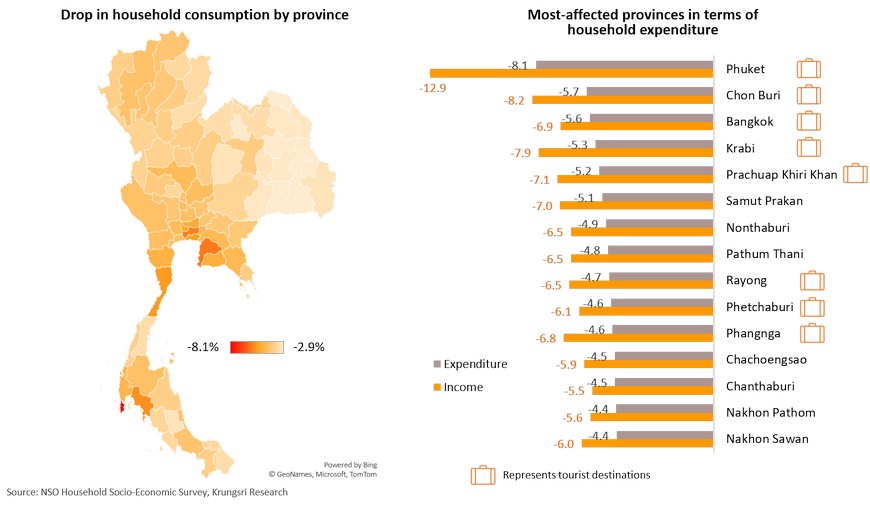

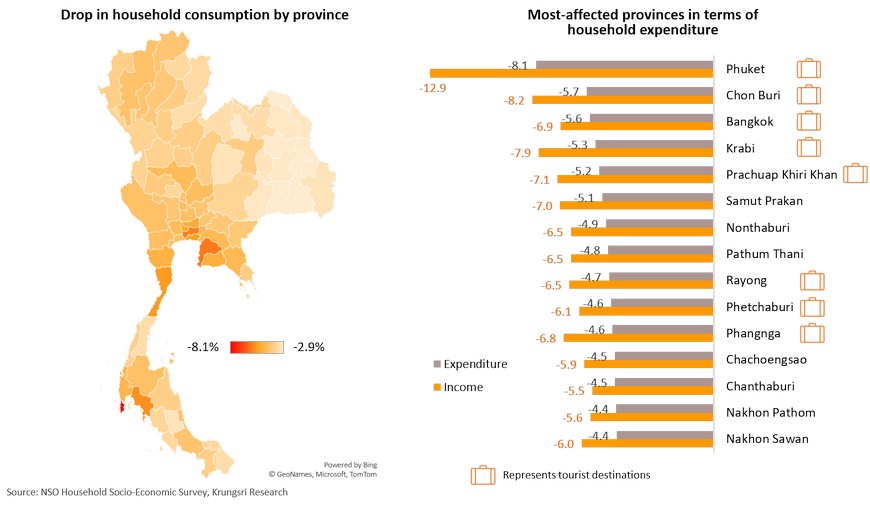

Household spending dropped the most in tourism-dependent provinces

This is led by Phuket, followed by Chon Buri, Bangkok, Krabi and Prachuap Khiri Khan. For other provinces, Bangkok Metropolis Region (BMR) showed the largest drop in household expenditure led by Samut Prakan, Nonthaburi and Pathum Thani because of income losses in the manufacturing and services sectors. Northeastern Thailand registered the smallest decline in consumption because the economy there is driven by the agriculture.

Regional Economic and Policy Developments in October

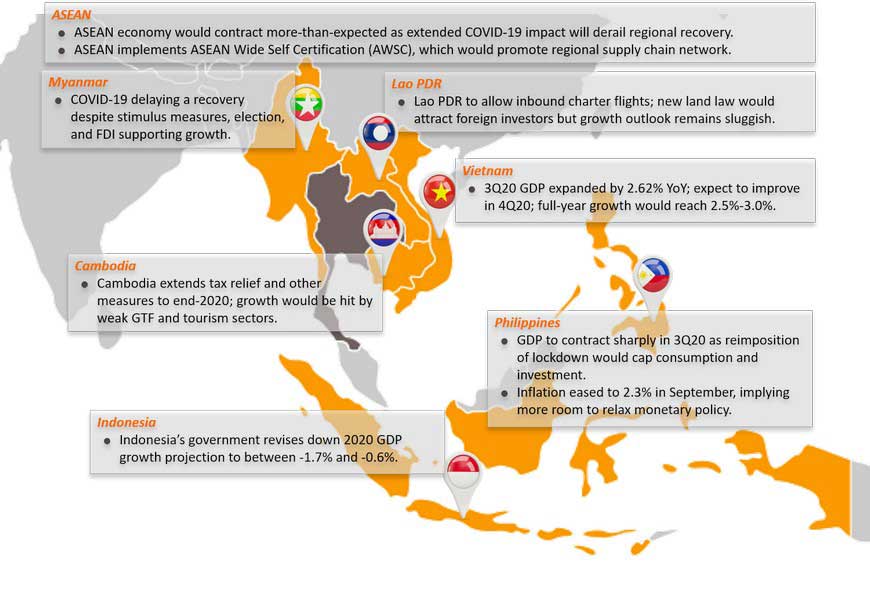

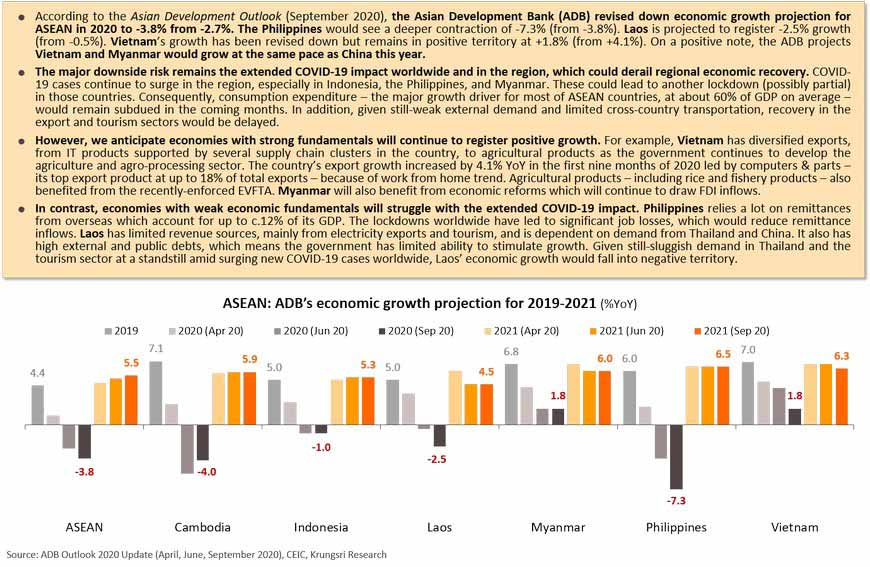

ASEAN economy would contract more-than-expected as extended COVID-19 impact will derail regional recovery

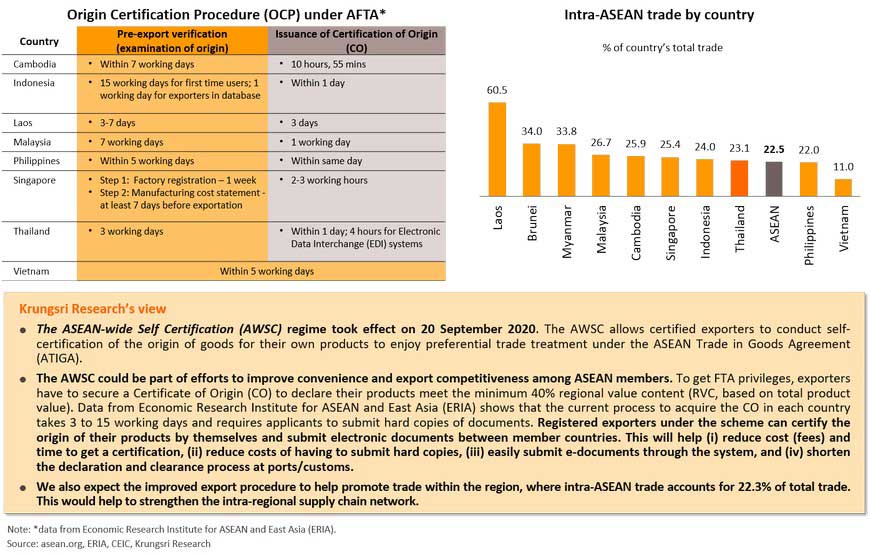

ASEAN implements ASEAN Wide Self Certification (AWSC) to promote regional supply chain network

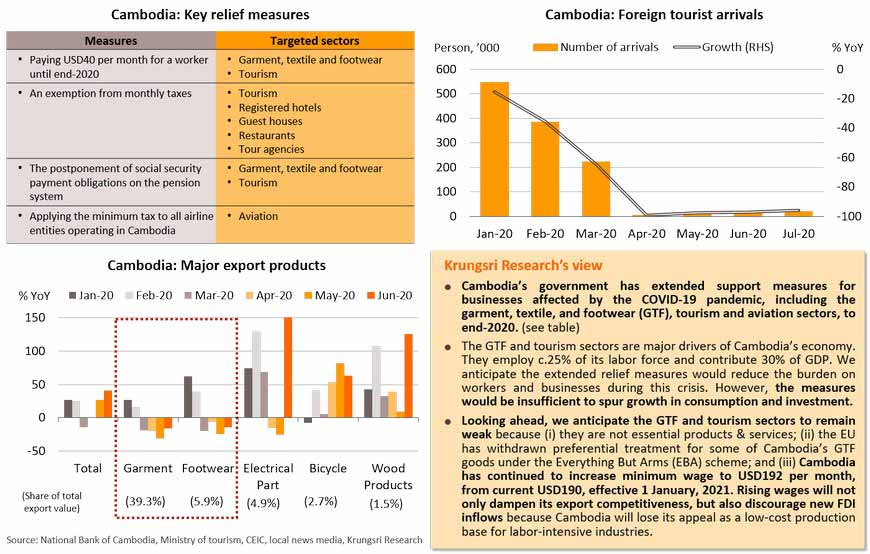

Cambodia extends tax relief and other measures to end-2020; growth would be dragged by GTF and tourism sectors

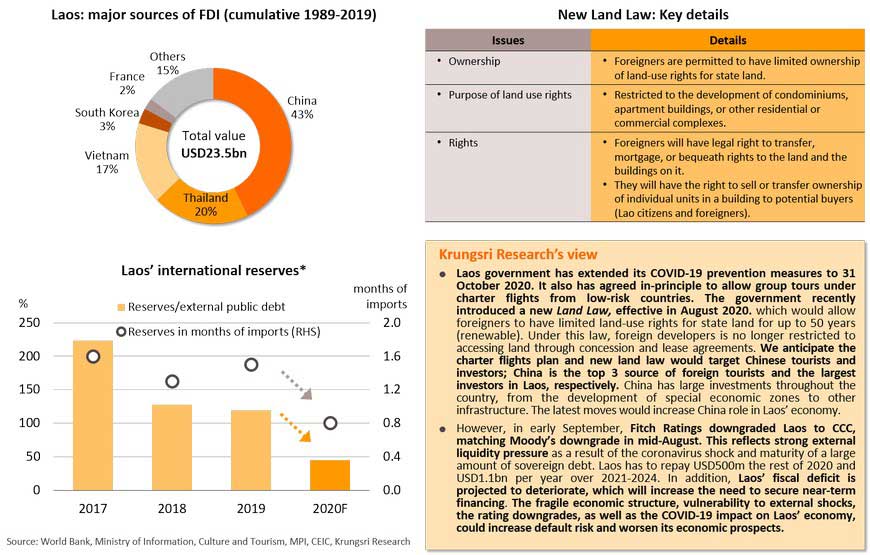

Lao PDR to allow inbound charter flights; new land law to attract foreign investors but growth will remain sluggish

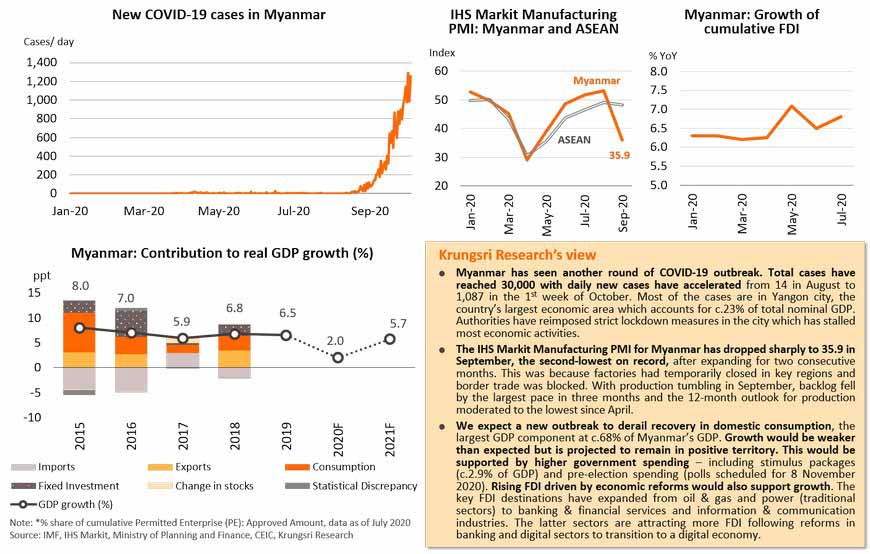

Myanmar: COVID-19 to delay recovery despite support from stimulus measures, election, and FDI

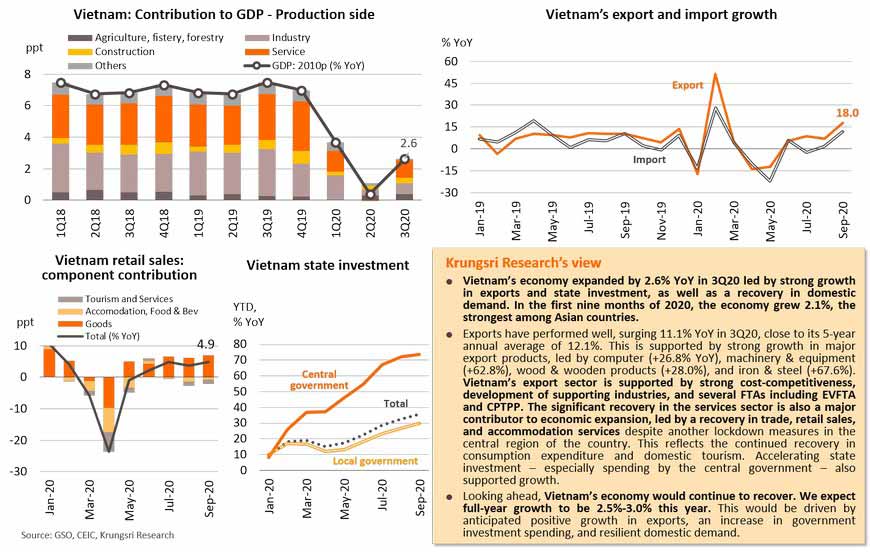

Vietnam’s GDP expanded by 2.62% YoY in 3Q20, to improve in 4Q20; full-year growth would reach 2.5%-3.0%

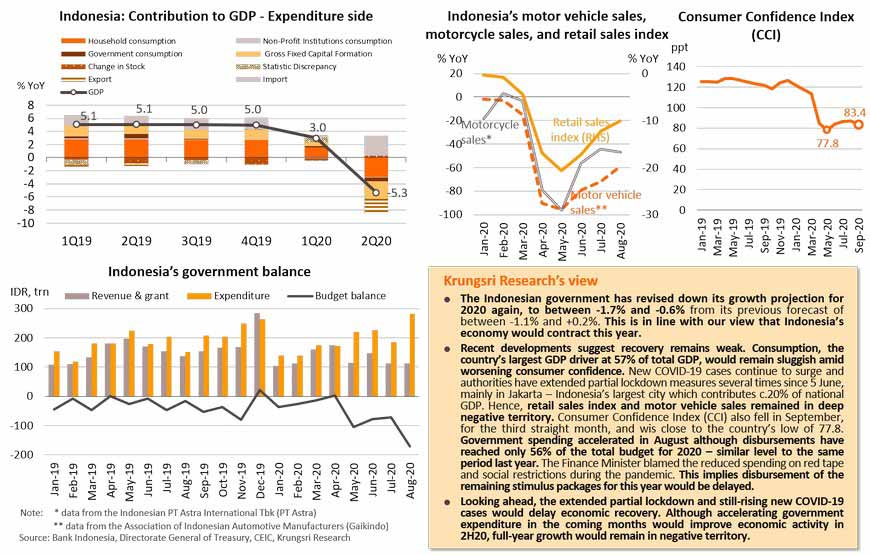

Indonesia’s government slash 2020 GDP growth projection to between -1.7% and -0.6%

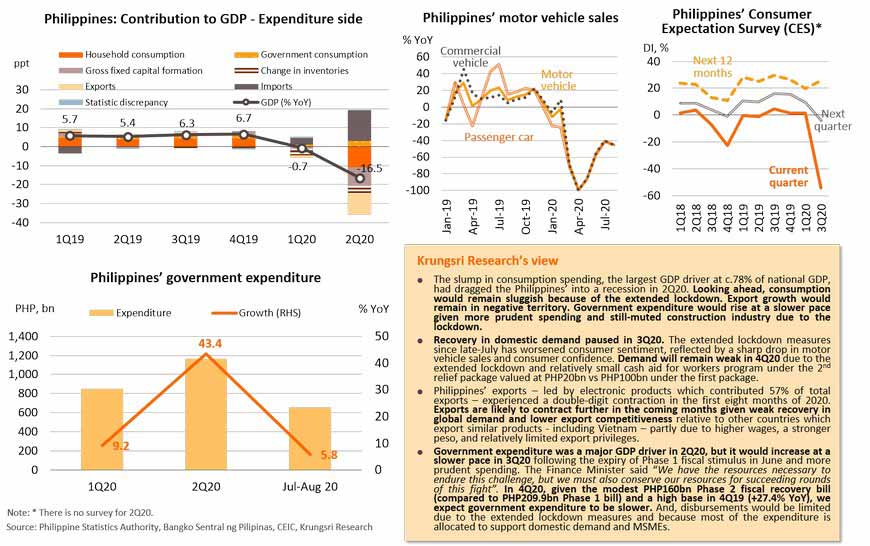

Philippines’ GDP to contract sharply in 3Q20 as another lockdown caps consumption and investment

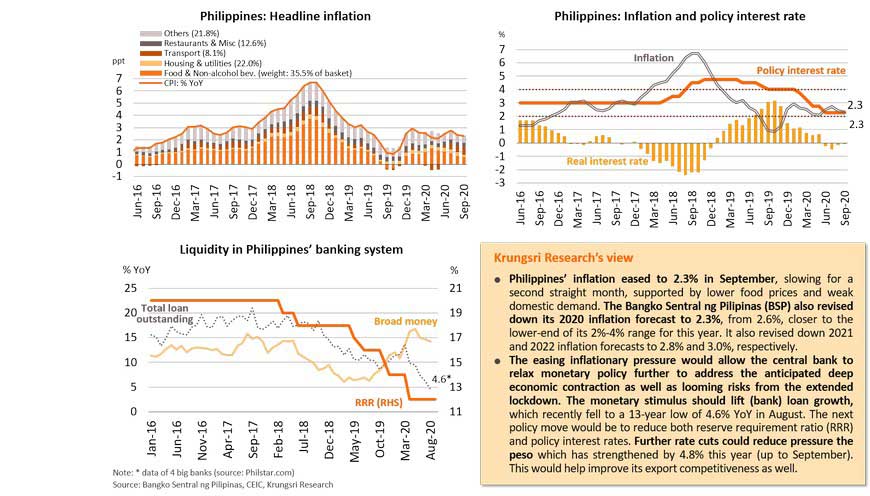

Philippines’ inflation eased to 2.3% in September, implying more room for further easing of monetary policy