ASEAN: Growth will soften in 2023/24, domestic landscape pivotal amid uncertainties

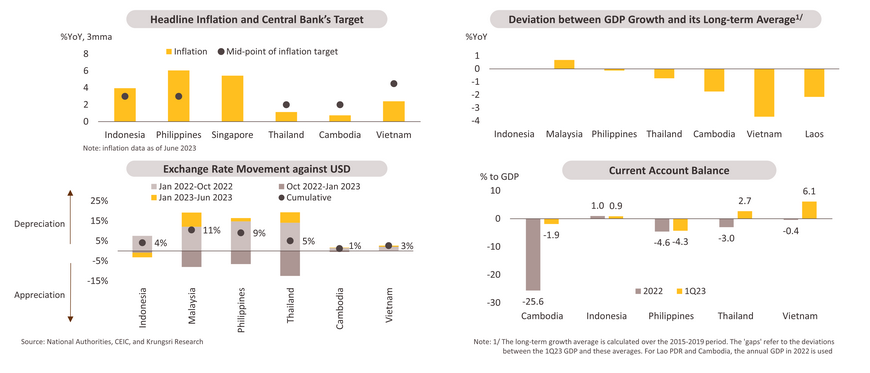

Cyclical Outlook: Economy will continue to recover but at a slower pace, and inflation will return to central banks’ comfort zones

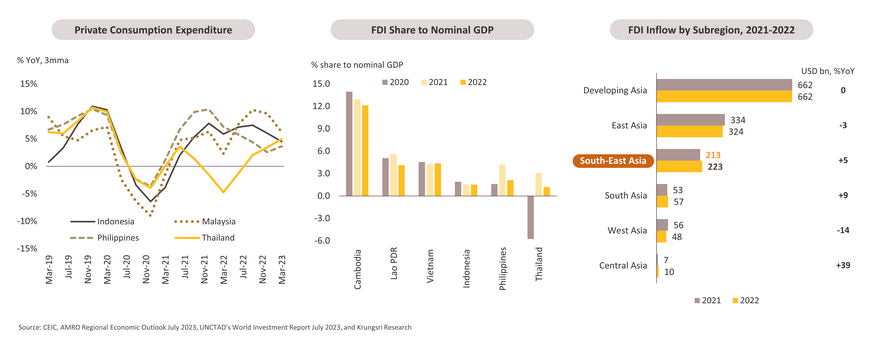

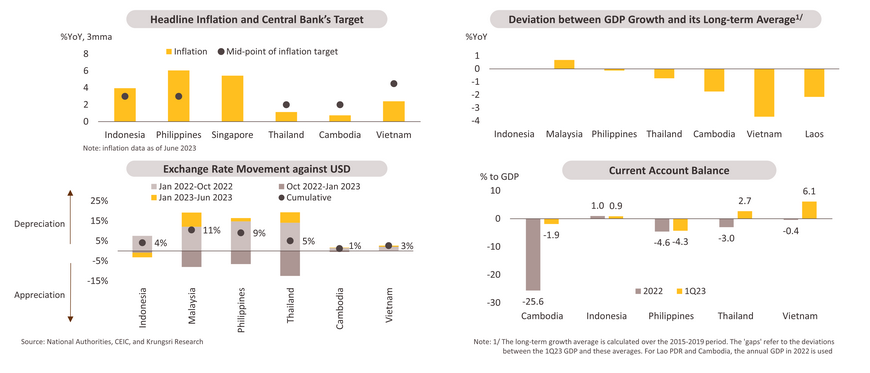

- In 2023, ASEAN economy will continue to recover but at a slower pace than last year because of weaker external demand for export goods. The economy will continue to expand in 2H 2023 and into 2024, driven by resilient domestic demand, strong job markets, improving contribution from the service sector, and likely an end to the current rate hike cycle. Headline inflation has moderated and is heading towards the central banks’ targets, thanks to lower commodity prices, easing supply chain disruption, and tight monetary policies. Most central banks in ASEAN have paused rate hikes and will likely stay that way. Besides, disinflation in most countries would open to door for rate cuts, if necessary.

- Vietnam, the Philippines, Indonesia, and Cambodia are projected to be the fastest growing economies in the region.

2023 regional growth projected to dip to 4.6% amid slowing exports

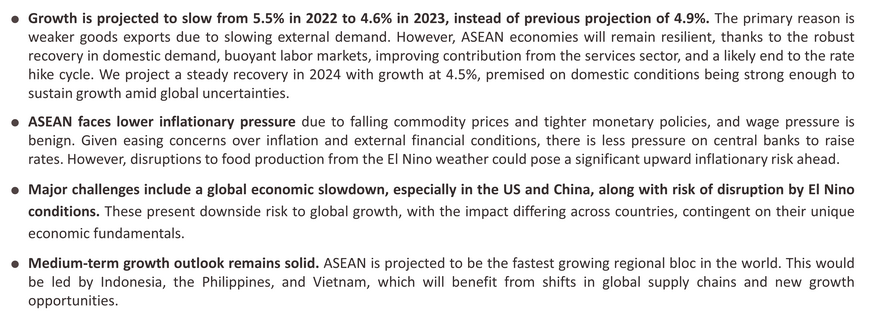

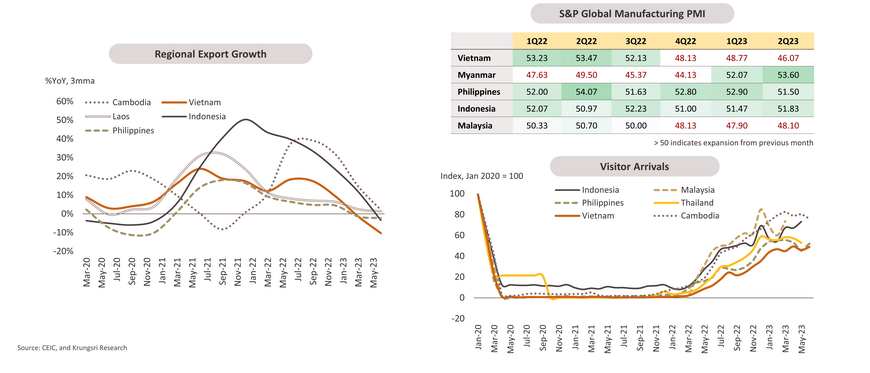

In 1H23, exports decelerated as global demand for manufactured goods slowed. However, the regional economy expanded, driven by recovering domestic demand and tourism activity. Weaker global demand was reflected in slower industrial activity, especially in manufacturing exports-heavy countries like Vietnam and Malaysia. The contraction in their respective PMI readings suggested the same. Conversely, the indicators were strong in the Philippines and Indonesia, largely attributed to their strong reliance on domestic demand. Weak global demand has depressed goods exports, but service exports – especially tourism - is recovering rapidly and should partly offset the slowdown in goods exports

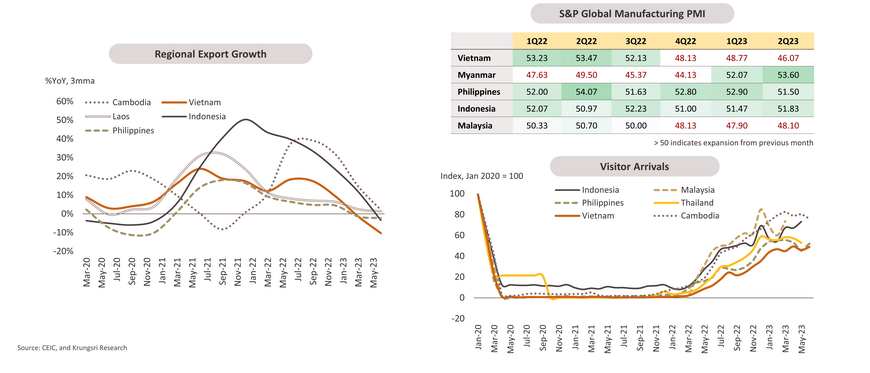

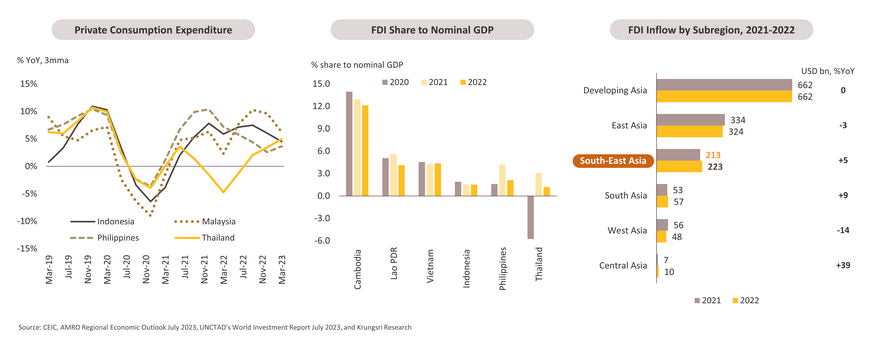

Tailwinds: Growth drivers include relatively strong domestic demand and resilient FDI inflows in most countries

Growth in ASEAN is being supported by resilient domestic demand with a steady recovery in the labor market and easing inflation. FDI slowed down recently because of cyclical factors but remains resilient despite weaker global growth and financial headwinds. According to UNCTAD’s World Investment Report 2023, FDI inflows to the region increased by 5% YoY to USD 223bn in 2022, the strongest on record. There are challenges posed by trade protectionism and slower Western economies. However, several trade agreements, including the Regional Comprehensive Economic Partnership (RCEP), are expected to create robust platforms to expand trade and investment in the region. As the focus shifts away from China, ASEAN nations will remain attractive destinations for FDI inflows.

Central banks are likely to pause rate hikes given easing inflation and improving external conditions

- Most economies in ASEAN are seeing lower inflation, mainly due to stable commodity prices, easing supply chain bottlenecks, and tighter monetary policies.

- External conditions have improved. ASEAN currencies experienced a sharp depreciation last year amid tightening global financial conditions. They have appreciated since 4Q22 but saw mild weakness again recently. Current account balances have also improved thanks to easing commodity prices, except for commodity-exporter Indonesia. Receding inflation and external pressures have prompted central banks in the region to become less hawkish by pausing rate hikes. In order to balance financial stability with growth and inflation, we expect central banks in the region to hold policy rates for the rest of the year (except for Lao PDR and Myanmar). Vietnam, nonetheless, is ahead in the business cycle and has started to cut its policy rates.

Headwinds: External factors such as global economic slowdown and El Niño effects could drag ASEAN economies, primarily through trade channels

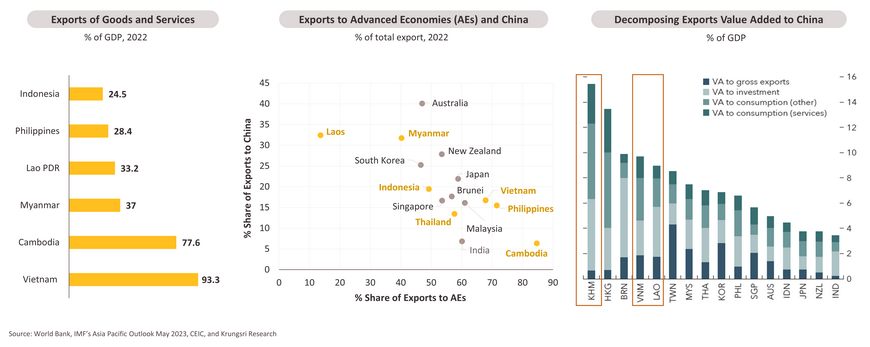

- Manufacturing- and export-dependent countries will feel the brunt of the slowdown. The impact of these headwinds will differ across countries based on their respective exposure to exports. Those which have significant trade ties with the US and China will be most vulnerable in a global economic downturn. On this note, Vietnam and Cambodia would be most vulnerable.

- Spillover effects of China’s structural slowdown will differ based on exposure to demand for consumption, investment, and degree of integration in global value chains (GVCs) through China. Looking at value-added exports, Cambodia, Vietnam, and Lao PDR could be the worst hit by slowing growth in China.

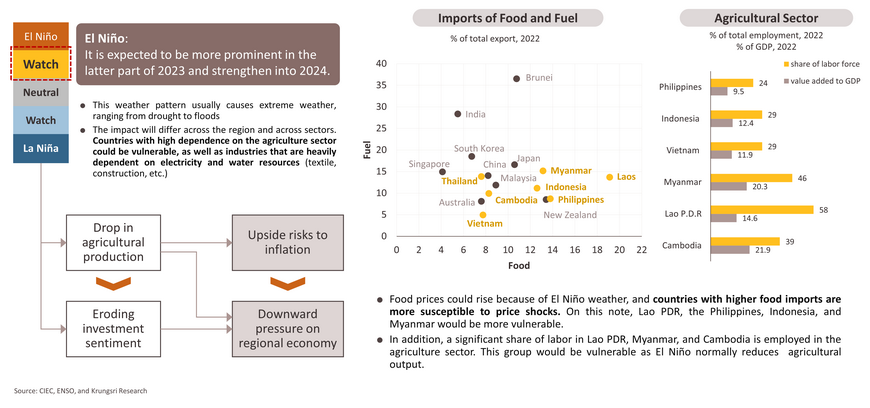

El Niño threatens regional economic growth. Lao PDR, the Philippines, Indonesia, Myanmar, and Cambodia would be relatively more vulnerable.

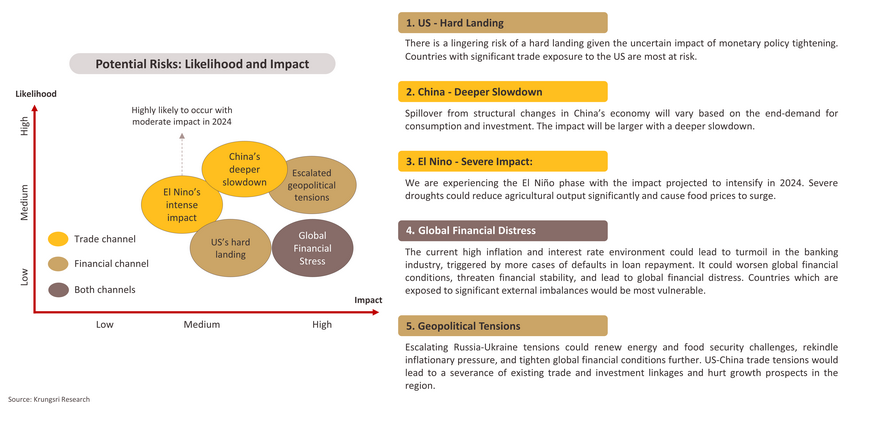

Lingering downside risks are still present amid stronger headwinds, global financial distress, and geopolitical tensions

External financial stability: countries with large external financing needs are vulnerable amid volatile global financial conditions.

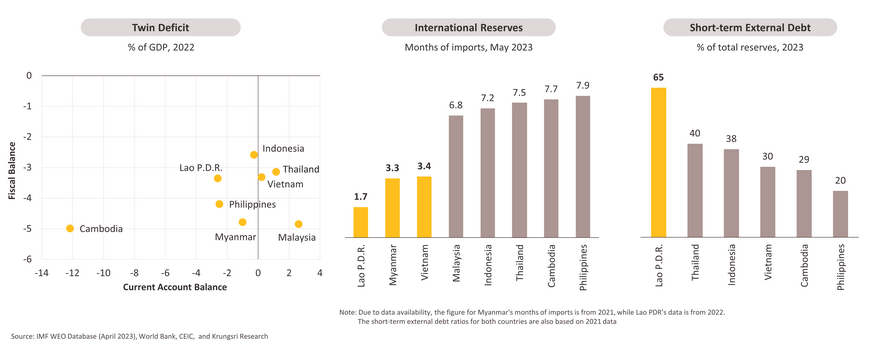

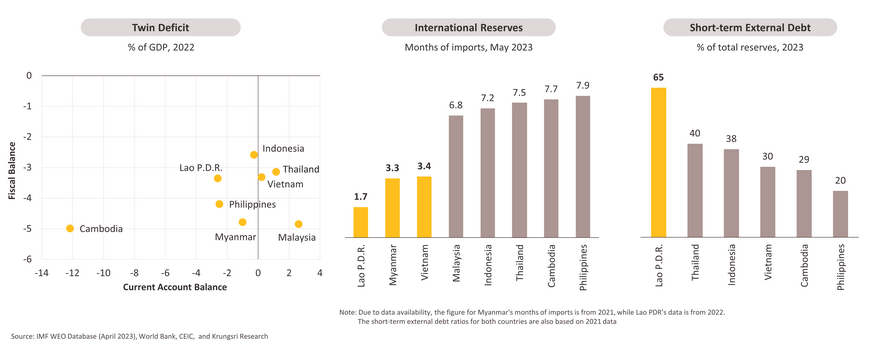

In a global financial distress scenario, the USD will appreciate and funding and borrowing costs would rise. This could be disruptive for countries running twin deficits and with large external financing needs, as they would be pressured by higher repayments for USD-denominated debts and would find it difficult to rollover debt due to surging borrowing costs.

Countries with significant external imbalances, including twin deficits, high short-term debts, and low foreign exchange reserves, would not have the ability to absorb external shocks in financial conditions. Lao PDR has high risk of experiencing debt distress, followed by Cambodia and Myanmar.

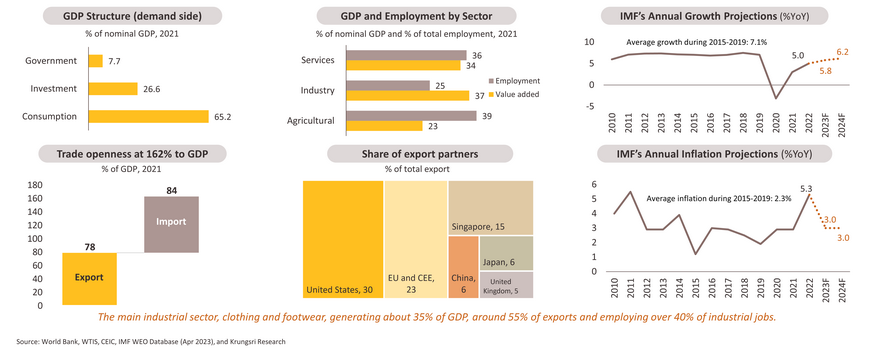

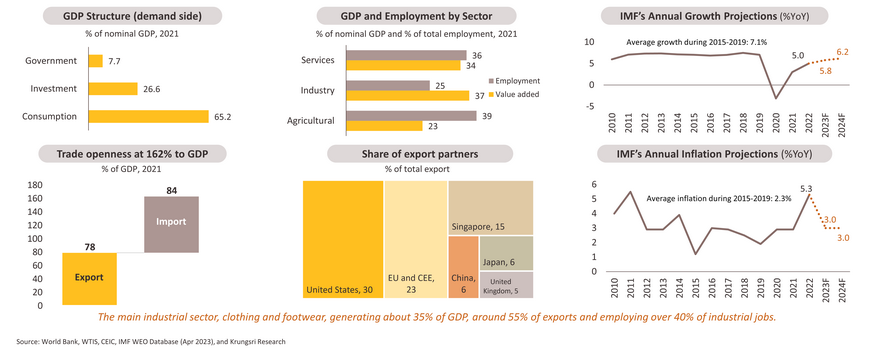

Cambodia: Economy is recovering firmly with growth drivers rotating from manufacturing sector to services sector

In 1H23, Cambodia's recovery was hampered by falling goods exports due to weaker external demand, especially from the US and Europe, which accounted for more than half of its total exports. Cambodia's economy is projected to grow by 5.8% in 2023 and remains strong in 2024, primarily driven by tourism and robust household consumption, which would help to cushion the impact of weak global demand. According to IMF projections, growth and inflation trajectories have returned to their pre-pandemic levels. However, despite some improvements, financial stability remains fragile due to high credit growth that is concentrated in specific sectors.

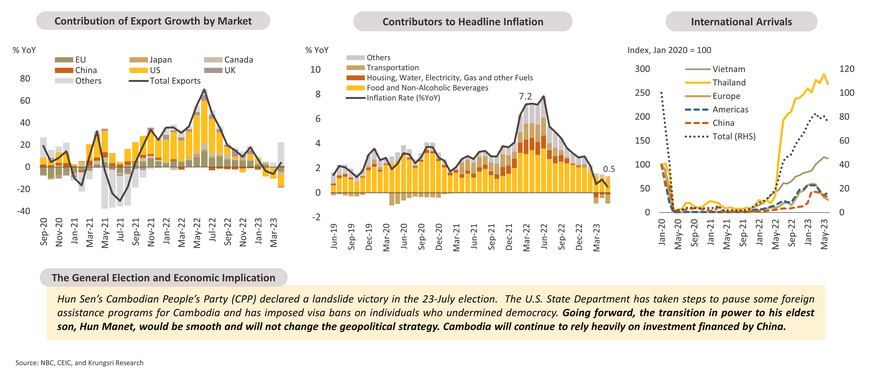

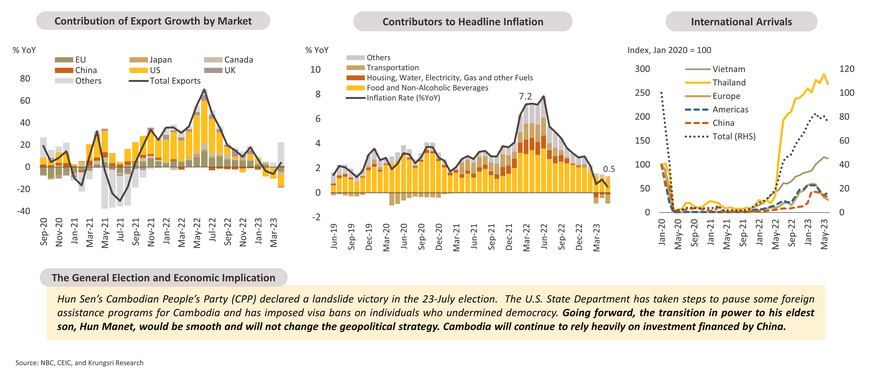

Recovery fueled by tourism while goods exports acting as a drag

Export surged in 2022 led by textiles and related products. However, waning demand from US and Europe accounted for 70% of the drop in goods exports (peak to trough, June 2022-April 2023) in 2023. Economic recovery is now underpinned by a strong rebound in the service sector, driven by the return of foreign tourists and pent-up domestic demand that is also being fueled by cooling inflation, the latter easing pressure on real income. Visitor arrivals have recovered to 80% of the pre-pandemic level, providing an impetus for a services sector recovery.

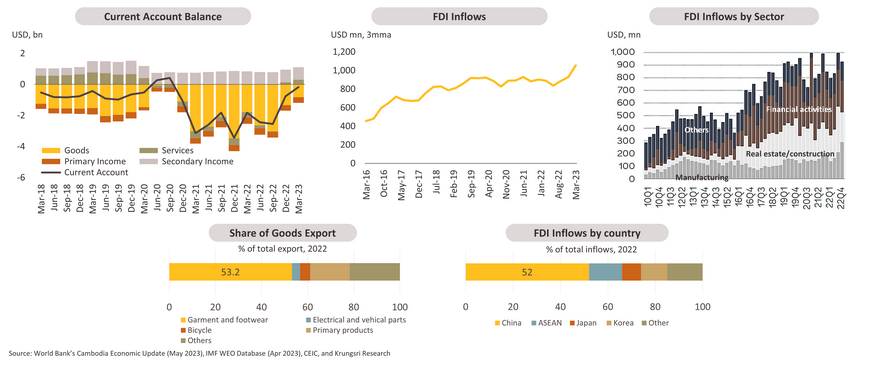

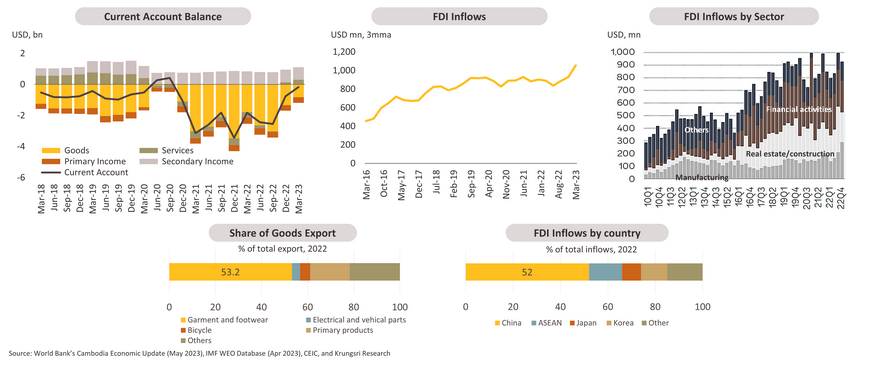

Despite improved external stability, a lack of diversification leaves country vulnerable to external headwinds

The IMF forecasts Cambodia’s current account deficit will narrow from 27% of GDP in 2022 to 12% in 2023, thanks to the recovering services sector and falling commodity prices. FDI inflows to Cambodia have surged over the past decade and remain resilient even through the pandemic. Half the FDI inflows is from China and is concentrated in the accommodation, construction, real estate and financial sectors. Low diversification on both good exports and FDI would make country vulnerable to external shocks.

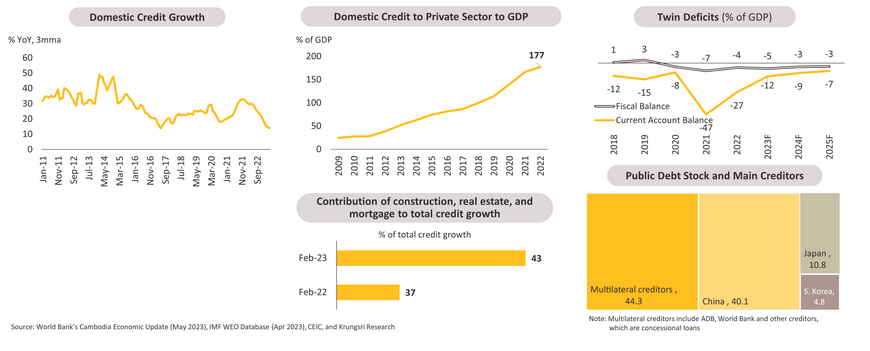

Domestic credit is concentrated in the construction sector, which poses a key risk to domestic financial stability.

- Credit growth slowed significantly to 14% YoY in May, in response to higher borrowing costs caused by a surge in global interest rates. However, the credit-to-GDP ratio continued to rise to 177% in 2022 as domestic credit continued to outpace nominal GDP. According to the World Bank, a larger share of domestic credit concentrated in the construction and real estate sectors suggest greater speculation activity in real estate. Highly-leveraged sectors remain vulnerable amid rising funding costs.

- Twin deficits will persist despite an improving fiscal balance and current account balance. Continued capital inflows and concessional financing will largely cover external financing needs. With 44.2% of public debt denominated in USD, the projected global financial distress could exacerbate concerns over repayment and currency mismatch.

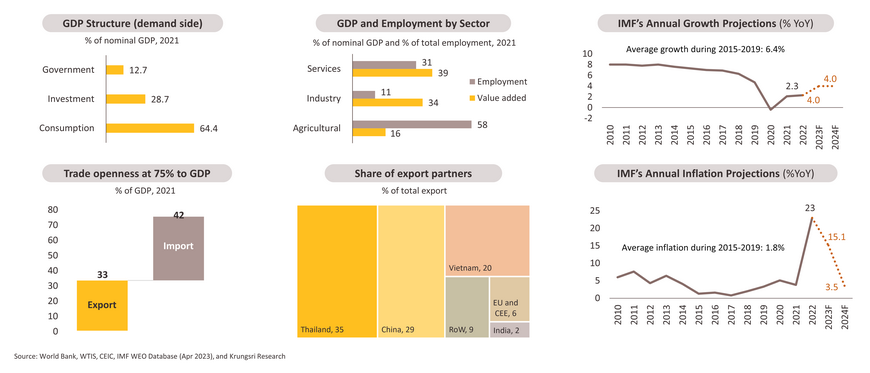

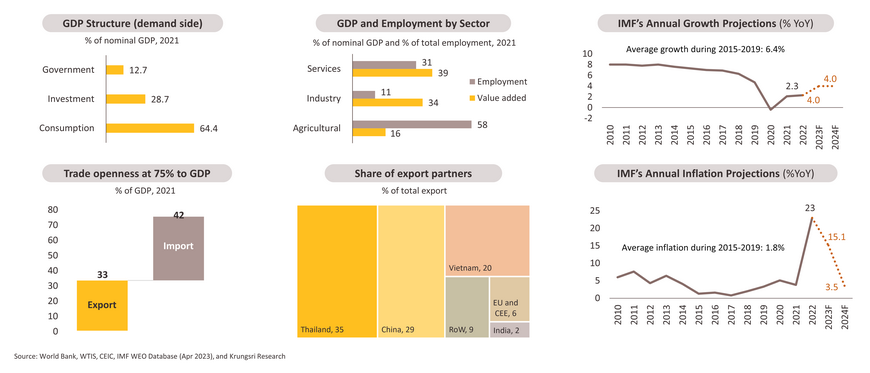

Lao PDR: Growth to pick up in the near-term amid persistently high inflation

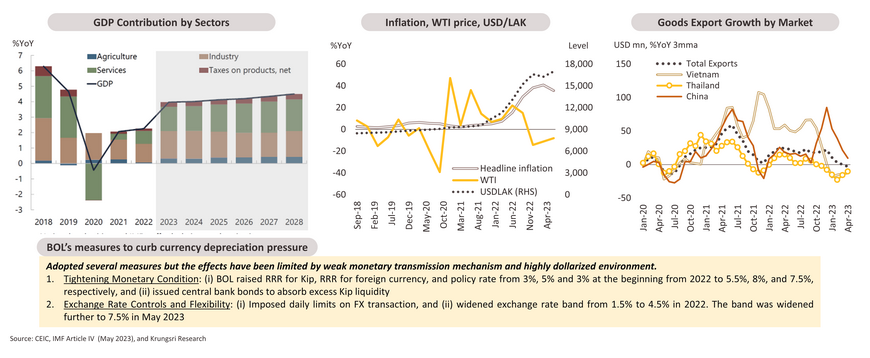

Economic growth in Lao PDR is projected to accelerate to 4.0% in 2023, from 2.3% in the previous year, provided there is sustainable momentum in the service sector. Falling commodity prices are driving down inflation, but inflation remains exceptionally high because of the weak currency. This will continue to erode real income. BOL’s measures to curb currency depreciation pressure have been limited by a poor monetary operation framework and a largely dollarized environment. Over the medium-term, growth is expected to remain below the pre-COVID level, hovering at 4.0% compared to the pre-pandemic average of 6.4%, because of structural vulnerabilities.

Cyclical outlook appears positive as the service sector sees a post-pandemic rebound

- Growth is anticipated to pick up in the near term driven by the service sector, notably logistics and tourism. This uptick is in response to the reopening, which (i) has led to a resurgence of tourists, especially from China and Thailand, and (ii) ensures the uninterrupted operation of the Laos-China railway. The trade account is anticipated to show positive trends. Additionally, the domestic economy could benefit from FDI inflows, especially in hydropower and renewable energy projects. However, persistently high inflation threatens to erode real household income and could undermine domestic demand

- Total goods exports have slowed, contributed mostly by weaker export to China. Exports to Thailand and Vietnam are picking up in line with relatively resilient domestic demand in those two markets, despite the recent slowdown in Vietnam.

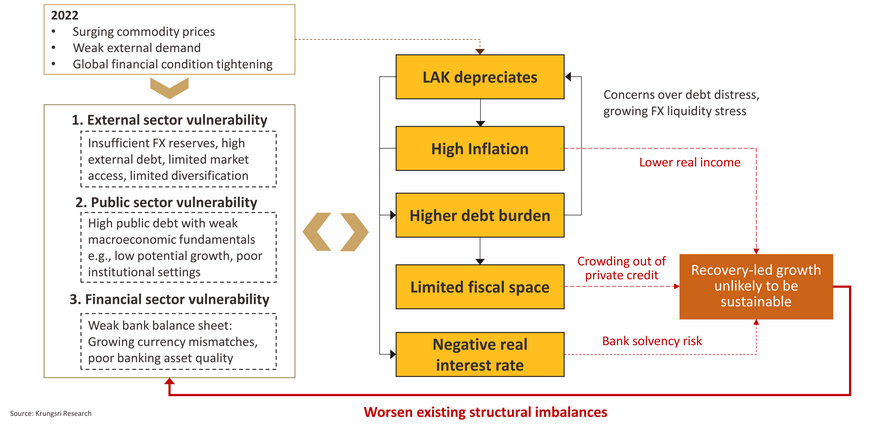

Persistent structural vulnerabilities …

Vulnerabilities in public, external, and financial sectors will dampen recovery and cap medium-term growth at below pre-covid level.

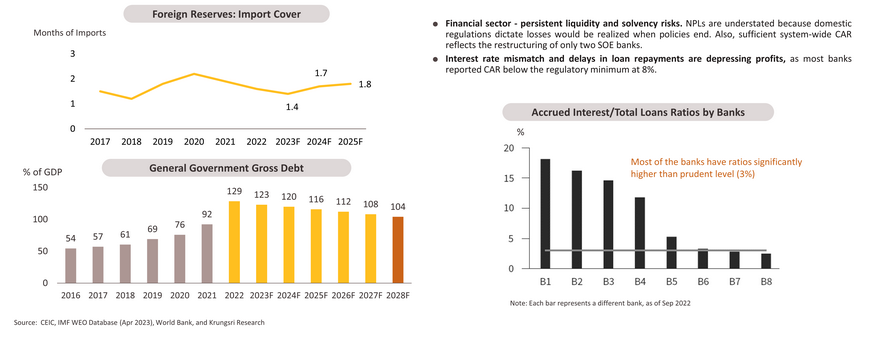

- External vulnerability remain pronounced. Despite an improving current account led by the recovery in its services account balance, overall international investments have deteriorated. Coupled with substantial external debt repayment, this situation had exerted considerable pressure on its foreign reserves and currency due to heightened foreign exchange demand. Consequently, foreign reserves dropped to USD 1.1 bn in 2022, covering less than 2 months of imports. Moreover, external debt service is estimated to exceed its foreign reserves at USD 1.3 bn per year over 2023-26. High debt obligation will continue to pressure external stability and limit the BOL’s ability to withstand external shocks.

- Public sector remains vulnerable with exceptionally-high total public debt. The IMF estimates it will remain above 100% of GDP for the next 7 years.

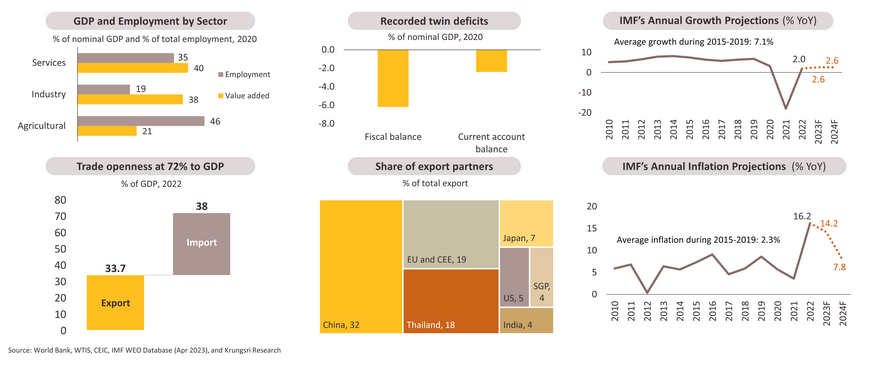

Myanmar: Visible signs of stability with low base, but headwinds will prevent a full recovery.

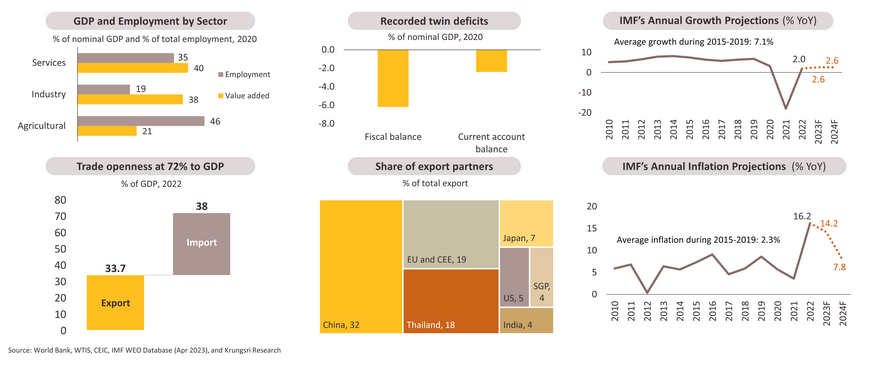

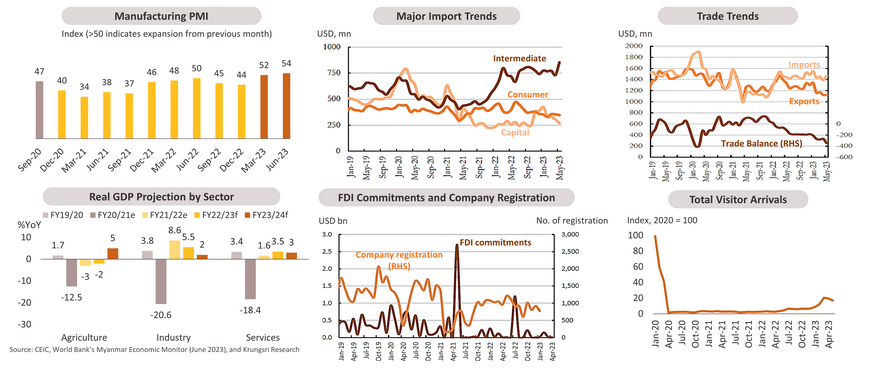

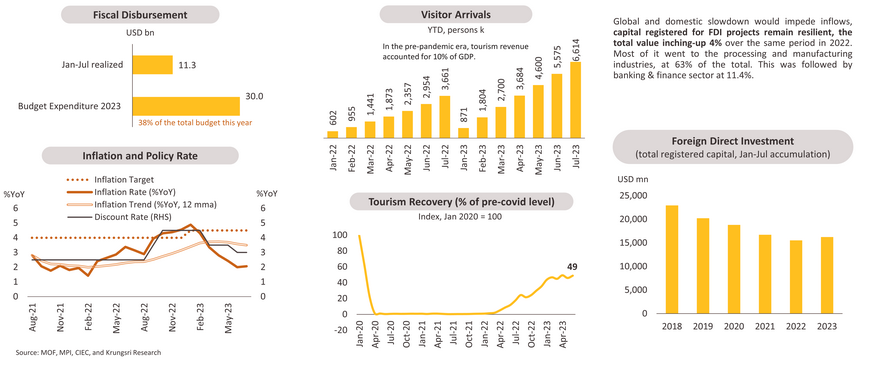

The IMF has revised down 2023 economic growth forecast from 3.3% to 2.6%, citing the slower-than-expected manufacturing sector. Despite improving economic activities, several external and internal headwinds will prevent a full recovery of consumption and investment and cap its growth trajectory at well below the pre-covid level. Exports will be pressured by waning external demand. Inflation has eased in food and fuel prices but remains disturbingly high and will continue to erode household purchasing power. Lingering political and policy uncertainties and the unfavorable business environment would worsen the business and investment climate in the country. Medium-term growth is expected to reach 2.8% p.a. compared to the pre-COVID level of 7.0%.

Fragile recovery is visible in a tough business climate.

- We expect moderately stronger growth in the industrial and service sectors, but the agriculture sector will continue to contract. After a long period of contraction, Manufacturing PMI data have exceeded-50 since the beginning of the year, albeit from a low base. The recovery in investment will be sustainable but would be capped by an unfavorable business environment. Businesses are finding it difficult to source the inputs they need to operate. The weak investment sentiment is reflected in capital imports which are at half of pre-pandemic levels and in negligible FDI commitments.

- Looking at trade data, international tourist arrivals have been rising but remain insignificant at well below pre-pandemic and pre-coup levels. Furthermore, goods exports would be pressured by weak external demand, an overvalued currency, and foreign conversion restrictions.

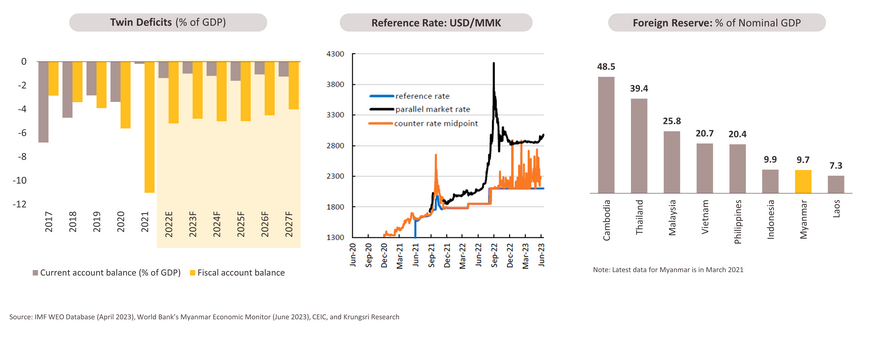

Macroeconomic stability continues to waver

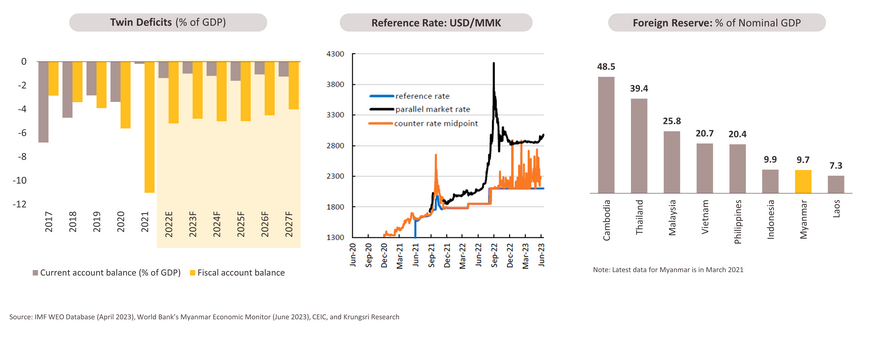

- Persistent twin deficits. The current account deficit is expected to widen further due to an expanding trade deficit. There is insufficient FDI to meet financing needs as MNCs have been exiting the country due to an unfavorable investment climate. Against this backdrop, foreign exchange reserves is now insufficient, covering only about 3 months of imports (2021), and reserves could slip further going forward.

- The official exchange rate is unchanged (capped at 2,100) but the MMK has weakened by 25-30% in the black market, suggesting a shortage of foreign exchange supply. The Central Bank of Myanmar (CBM) has adopted a moderately tight monetary policy. It raised required reserve ratio by 50 bps to 3.5% in April and there are still several foreign exchange restrictions in place. The use of the yuan and baht has been mandated. The CBM is negotiating with its Indian counterpart to establish a rupee-kyat payment and settlement mechanism. The deteriorating external position remains a risk as it could worsen the USD liquidity shortage and prompt authorities to impose even stricter regulations and restrictions.

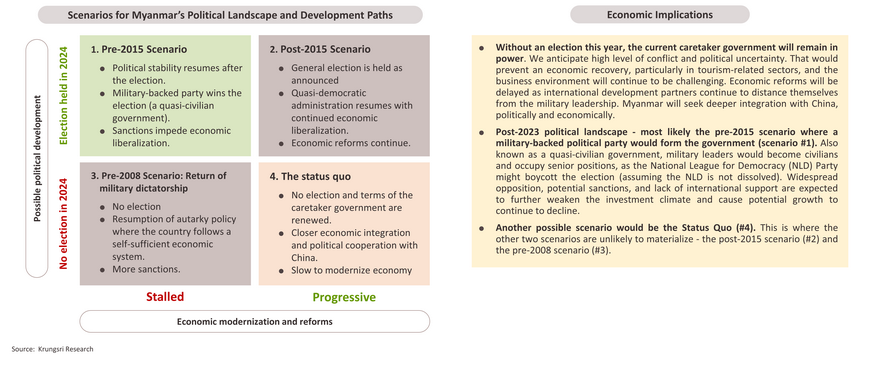

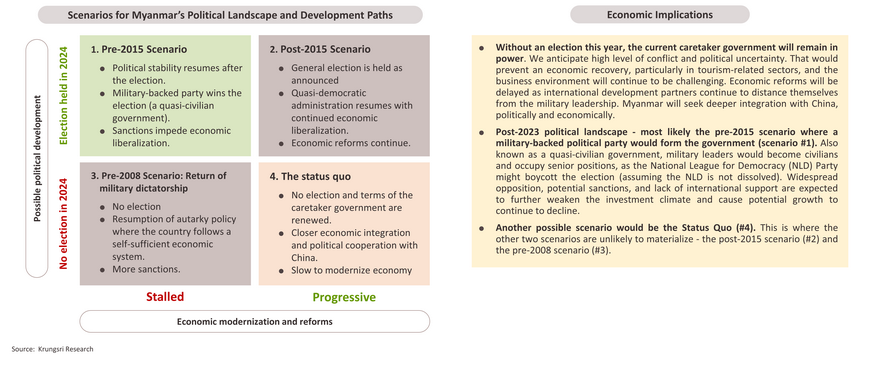

Despite the deferred 2023 general election, we still expect a smooth political transition in 2024 albeit the ongoing violence. The military is likely to retain control.

The government has canceled the general election that was scheduled to be held in August this year, citing ongoing violence. The government also extended the state of emergency by 6 months. We view that the election is unlikely to happen this year due to slow progress in collecting national census data, although the authorities claimed the process would be completed by October. Even if the general election is held next year, the military-backed Union Solidarity and Development Party (USDP) is poised to win given the military leaders’ intent to maintain their hold on power.

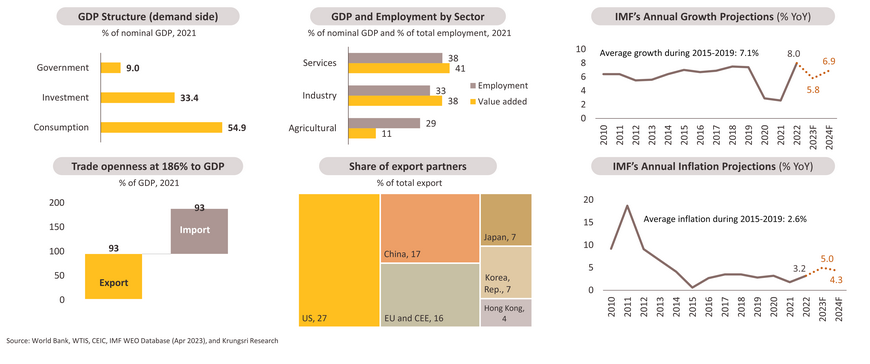

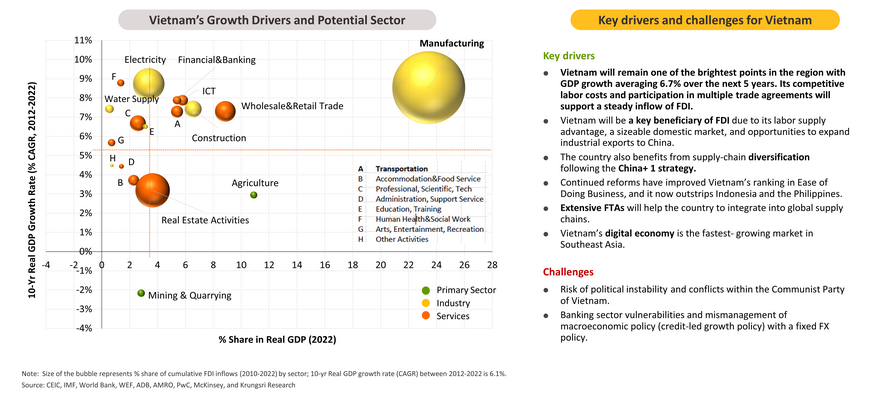

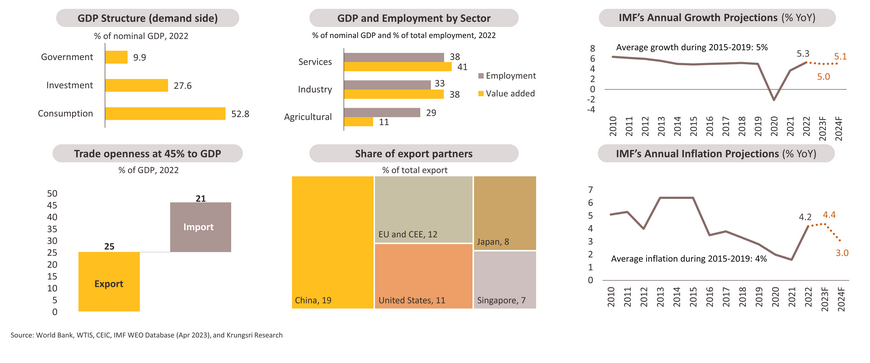

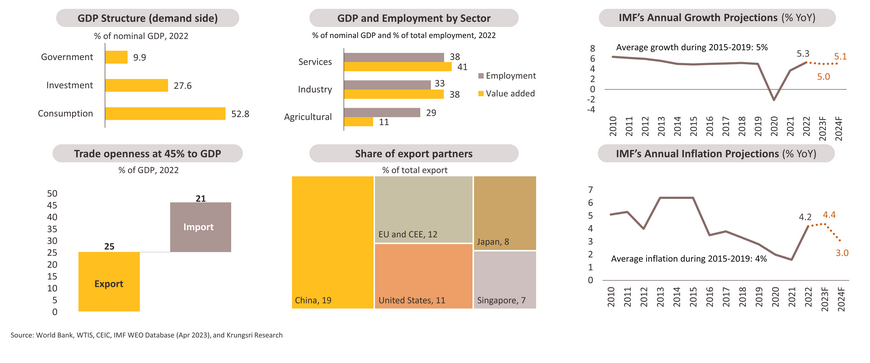

Vietnam: Domestic and external headwinds will constrain cyclical growth, but we still project robust medium-term growth.

- Growth momentum will moderate in 2023 to 5.8% from 8% in 2022, reflecting slowing global growth and concerns over domestic financial vulnerabilities. Public investment will be the key driver of economic growth in the coming years. The country will also benefit from revived tourism and related services since China’s reopening. Key risks remain deep-seated financial sector vulnerabilities.

- Over the medium term, Vietnam is expected to be one of the fastest growing economies in the region (expected growth to average 6.7% p.a. in the next 5 years) as its increasingly important role in global value chains (GVCs) would continue to attract robust FDI inflows.

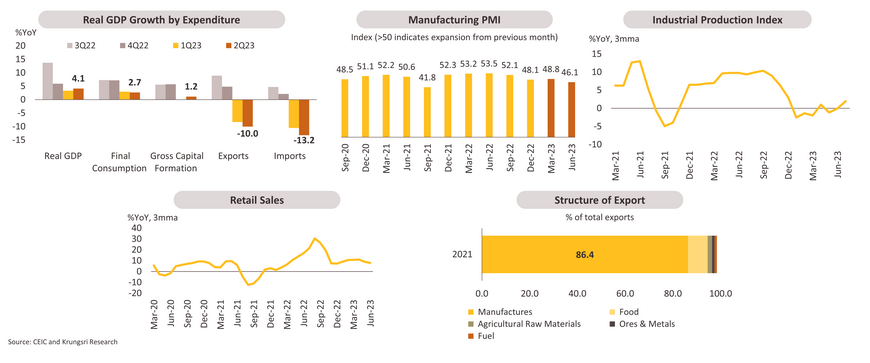

Major dampeners are weak exports and industrial production

- In 1H23, growth decelerated from 8.0% in 2022 to 3.7%, reflecting the global economic slowdown and cautious consumer and investor sentiment against the backdrop of domestic financial vulnerabilities and tighter domestic financial conditions last year. Weaker domestic activities are reflected in retail sales, which fell from last year's levels.

- External weakness is weighing heavily on manufacturing, especially since the country’s exports are dominated by manufacturing products that are highly sensitive to an economic slowdown. Manufacturing PMI data has been below 50 since late 2022, indicating a contraction in export-driven manufacturing. This trend is also evident by the Industrial Production Index which has decelerated from the previous year.

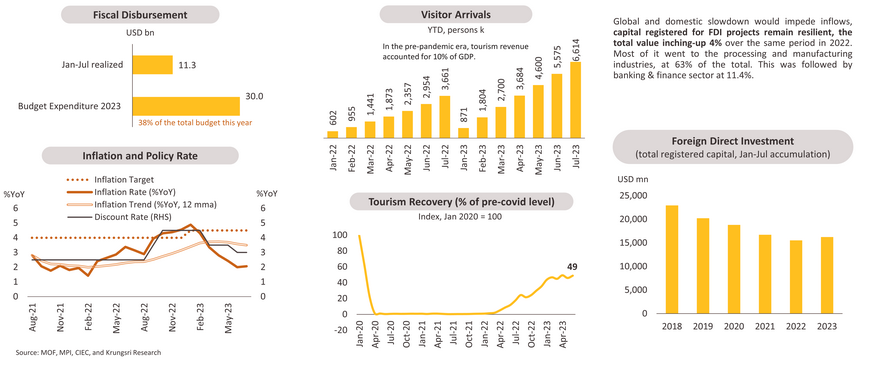

Looking ahead, domestic conditions are crucial to sustain growth

Next year, public investment and the recovering tourism sector will be the key growth drivers. Government spending will generate a substantial multiplier effect. As of July, only 40% of the total budget has been disbursed, indicating room to accelerate spending. Additionally, the resumption of international tourism will boost growth with a substantial increase in visitor arrivals this year. On monetary policy, the SBV has cut discount rate by a total of 150 bps since February to address slowing external demand and deteriorating domestic activities. With the combination of more relaxed financial conditions and higher government expenditure, we expect support for domestic activities and a relief in the credit crunch in the property sector.

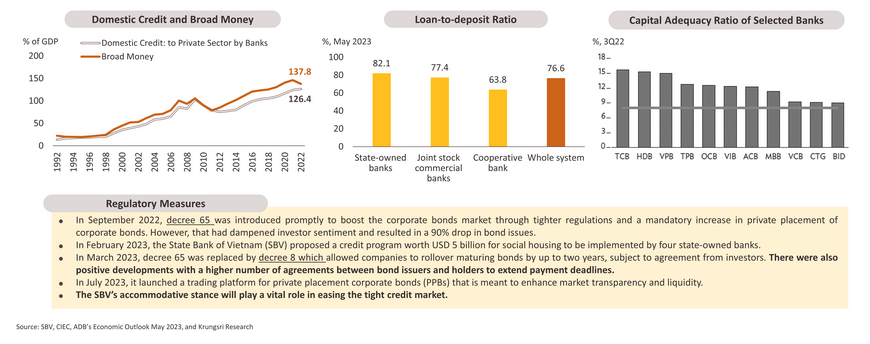

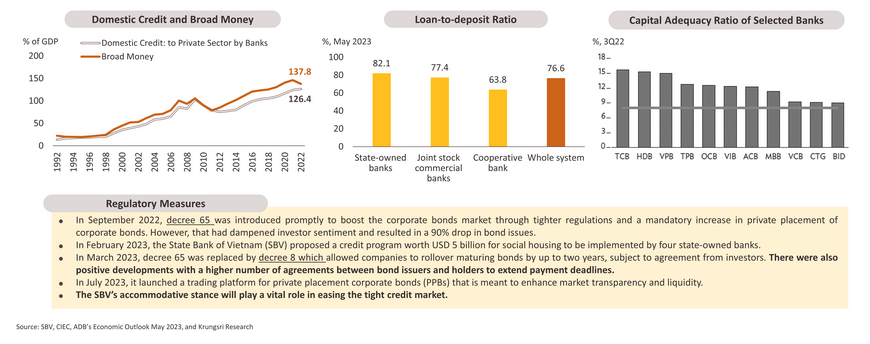

Lingering vulnerabilities in property and banking sectors remain, but refinancing risk is smaller with the combined efforts of policymakers.

Currently, Vietnam has exceptionally high level of outstanding domestic credit, with bank borrowings to the private sector at 126% of GDP. The primary concern is the over-leveraged property and banking sectors. There is lingering refinancing risk in the property sector as tough economic conditions have made it challenging for companies, especially developer, to meet bond obligations. However, the banking sector’s capital adequacy ratio (CAR) is well above the required level, and loan-to-deposit ratio remains below the 85% threshold. These would insulate the sector from systemic risks arising from the real estate sector. Coordinated responses by policymakers and banks are essential to reduce refinancing risk, ease liquidity constraints, restore credit flow, and ensure stability in the real estate and banking sector.

Over the medium-term, Vietnam will climb the global value chain via FTAs and attracting FDI with structural reforms and infrastructure development projects

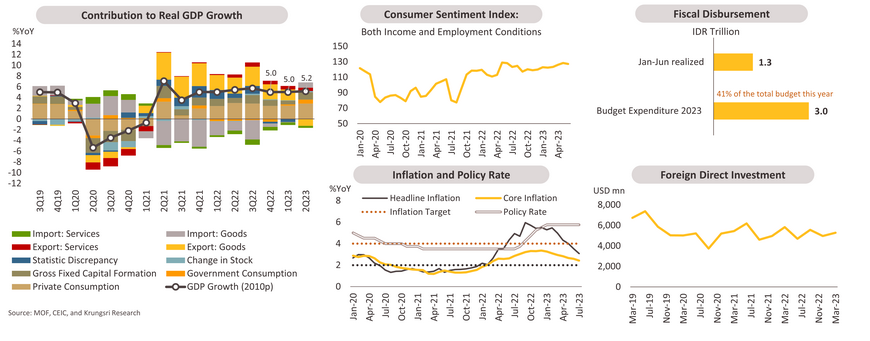

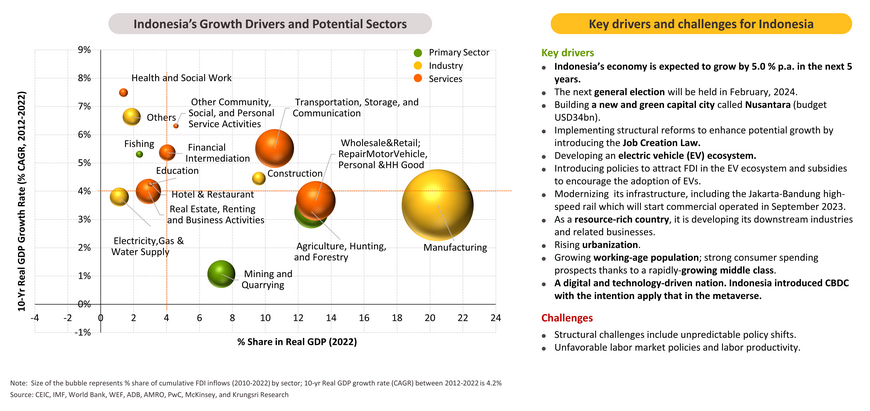

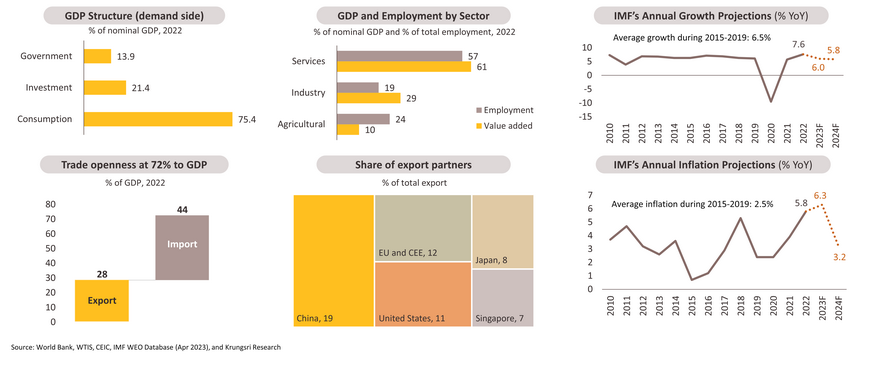

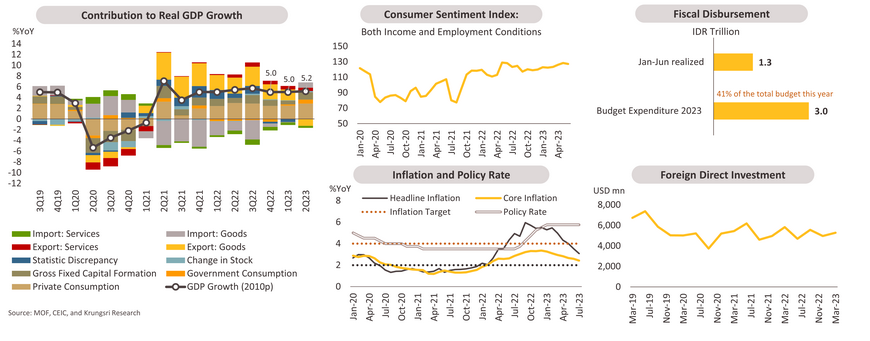

Indonesia: Solid growth ahead with resilient domestic demand

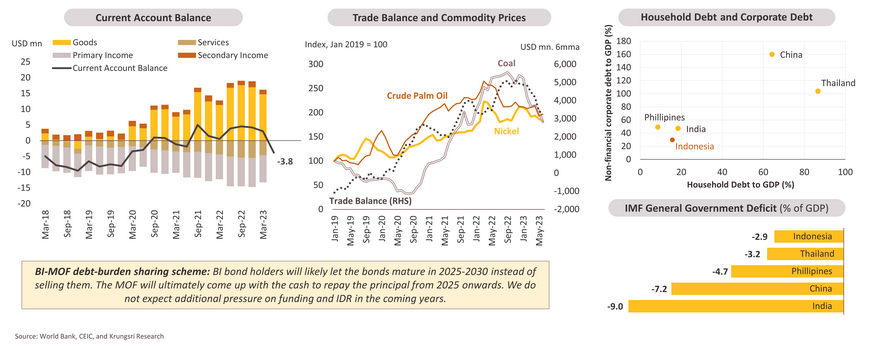

- Indonesia’s exports tumbled in 1H23 mainly due to the large drop in commodity prices. Given its domestic-oriented economy, growth will slow but remain solid at 5.0% in 2023-2024, from 5.3% in 2022, as Indonesia is less vulnerable to a global slowdown. Private investment remains strong amid the diversification of supply chains by MNCs and structural reforms initiated by the government. The election next year should spur the economy with extra spending by the government and for campaign activities.

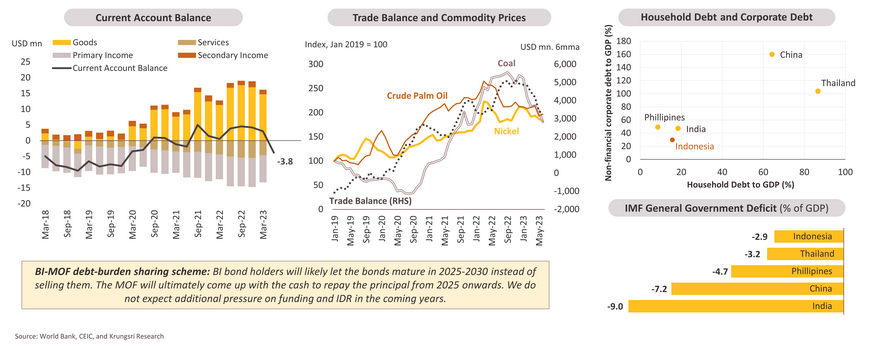

- Resilient macroeconomic stability. Inflation has eased rapidly and returned to the BI’s 2-4% target. While the reversal in commodity prices means reduced support from terms of trade, the current account is expected to register a mild deficit as commodity prices are still above pre-covid levels. El Nino risk is also on the radar; Indonesia’s agriculture sector was badly affected by severe El Nino conditions in 2015-2016. However, the impact is predicted to be weak-to-moderate this year.

Growth would soften but resilient domestic conditions would offset part of the impact of external headwinds

- Net export strength is not sustainable as Indonesia’s key commodity exports continue to drop. However, private consumption remains resilient as firm consumer sentiment and easing inflation should also lift consumer purchasing power. There is continued investment in the downstream commodity sector, especially the nickel supply chain. FDI inflows remain resilient due to the region's rich resources, and reforms have made it attractive to invest in the manufacturing of stainless steel and battery material.

- On the fiscal front, there is ample room to accelerate fiscal spending prior to the general election in February 2024 (only 41% of its 2023 budget has been disbursed) and hasten progress in the Nusantara Capital City (IKN) project. Furthermore, preliminary guidance for 2024 budget signals higher spending, especially in infrastructure. However, private investment might need to wait until 2024 to see stronger recovery, following greater clarity on the policy environment post-election. With inflation returning to target range, the BI’s next move would be to cut rates if domestic recovery stays relatively subdued and there is still disinflation. The Fed’s extended rate pause is a pre-requisite for the cut.

Prudent macroeconomic policies will improve the country’s stability

- Indonesia’s current account position has peaked. The cyclical deterioration in terms of trade, coupled with recovering domestic demand, will narrow its goods surplus. Notably, the decline in prices of Indonesia’s key commodity exports - coal, crude palm oil, and nickel which comprised 20%, 9.3%, and 2.4% of total exports in 2022, respectively - has been more pronounced since the beginning of 2023. Its current account balance is expected to mark a mild deficit as prices remain relatively high compared to pre-pandemic levels, which is unlikely to create funding risks.

- On the domestic front, healthy private sector balance sheets mean that there is ample room for corporates and households to leverage up and support the ongoing domestic demand recovery. Additionally, prudent public finance policies, reflected by its lowest fiscal deficit among peers, ensure sufficient room to introduce fiscal stimulus if needed.

In the medium-term, Indonesia wants to integrate its manufacturing sector into global supply chains through structural reforms and infrastructure modernization

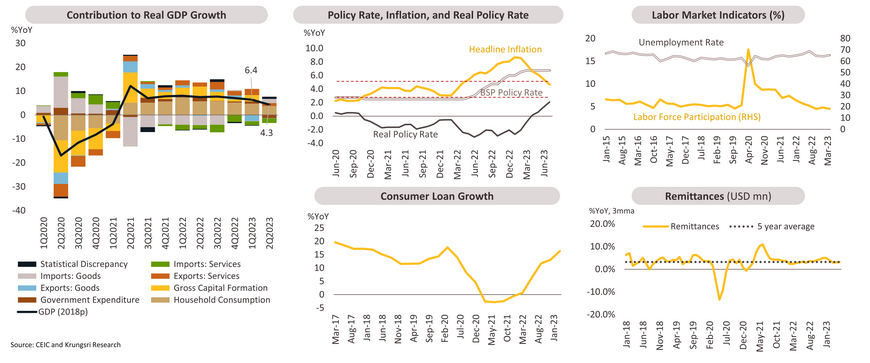

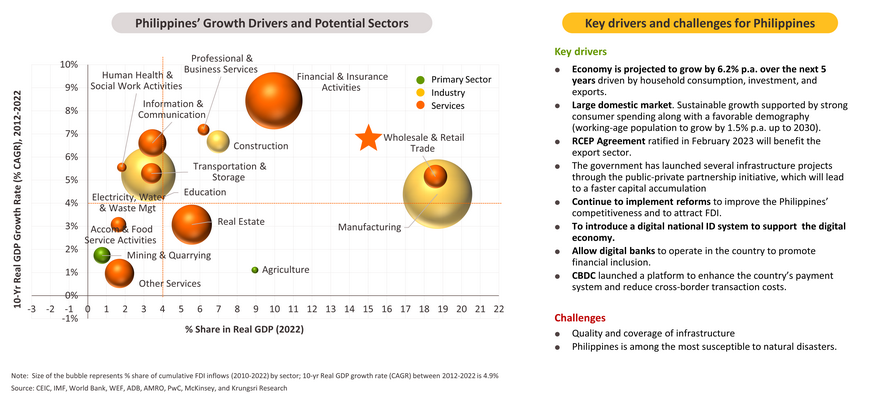

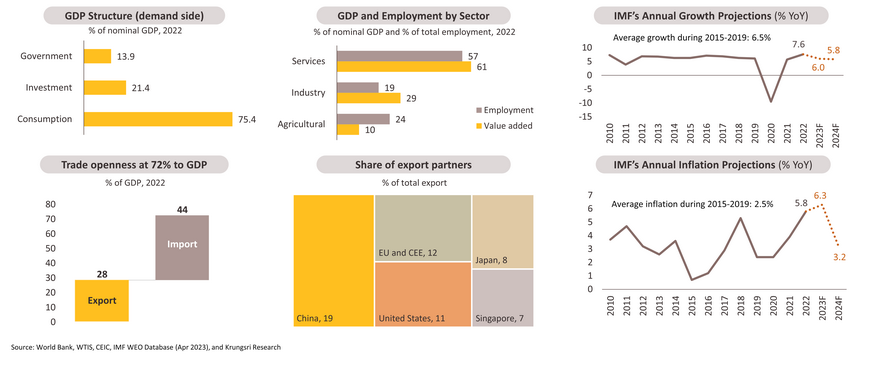

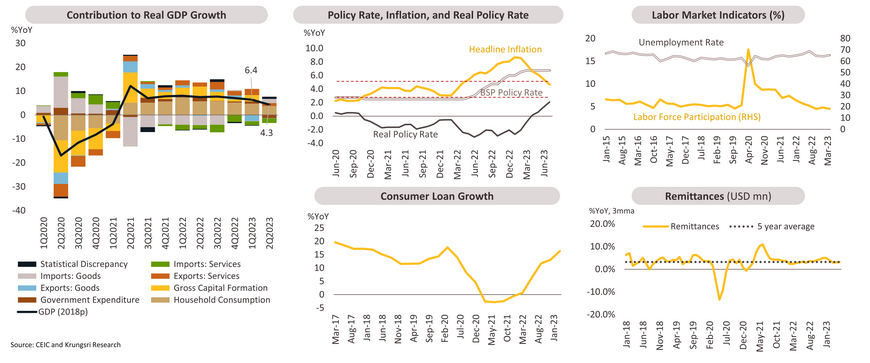

Philippines: Widespread slowdown, hope anchored in domestic consumption

In 1H23, economic growth came in at 5.4% as elevated real rates weighed on the economy. The IMF predicts growth will moderate to 6.0%in 2023 from 7.6% in 2022, in line with the pre-pandemic average. However, given the weaker and more broad-based slowdown in 2Q data, the full-year 2023 growth forecast might be revised down. The silver lining is easing inflation, thanks to fading second-round effect of high food and fuel prices. June headline CPI print at 5% was the lowest in a year and close to the central bank’s target of 2-4%. Going forward, major challenges include rising funding costs, maturing pent-up demand, fiscal consolidation, and lackluster private investment and exports. Private consumption is expected to slow but at a milder pace than other components, thanks to stable remittances and solid employment.

Post-pandemic recovery has matured, rising real rates could hamper economic activity

Growth has started to slow across the board, reflecting a mature post-pandemic recovery and the impact of rising interest rates. Real rates have turned positive and continued to rise as inflation recedes and policy rates rise. Looking ahead, with final consumption making up almost 80% of the country’s nominal GDP, key growth drivers in 2023 and early next year would remain domestic demand. Manufacturing PMI remains above 50, the labor market is solid, credit growth is resilient, and remittances are stable (accounting for 10% of GDP), suggesting relatively strong consumption momentum. However, positive real rates will pressure consumer credit growth and domestic activity. Higher borrowing costs and uncertain demand prospects could dampen investment activity in the near term. Furthermore, the central bank’s fiscal consolidation plan will not support growth.

Over the medium-term, pursuing reforms and infrastructure overhaul to ensure strong growth amid structural challenges