-

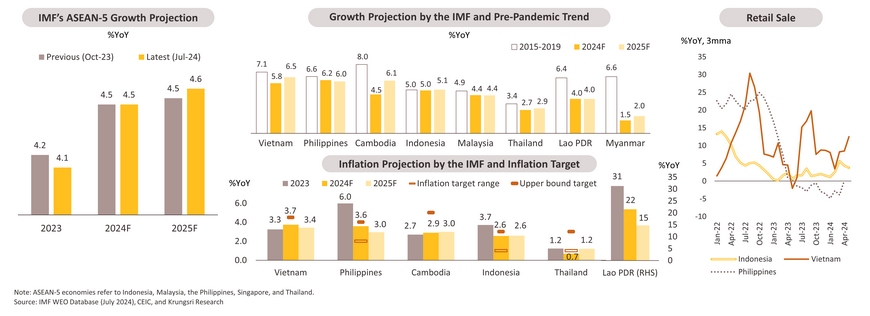

In line with the previous report, ASEAN growth is expected to accelerate from 4.1% in 2023 to 4.5% in 2024. In the first half of 2024, most ASEAN countries depicted a similar perspective of goods exports picking up, though varied economic fundamentals in each country have resulted in different export recovery pictures and impacts on growth. Among ASEAN countries, export-oriented economies like Vietnam and Cambodia have benefited the most in this regard. Domestic demand remains a key growth driver, driven by easing inflation and robust labor markets, although it has been somewhat constrained by high real interest rates. Rising exports have helped offset the impact of these higher rates on growth.

-

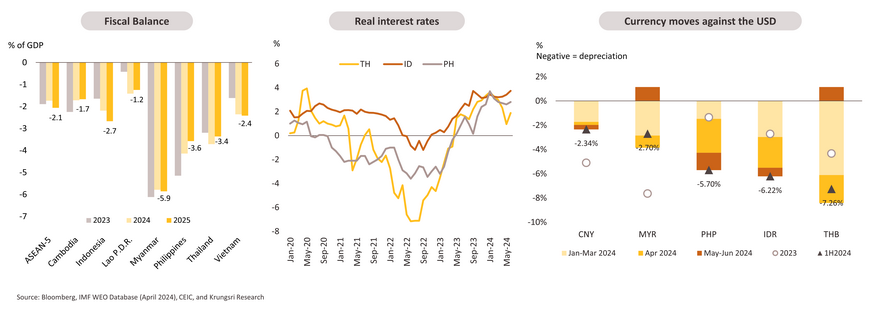

Monetary policy easing has been delayed from our previous expectations. Weakness in local currencies and capital outflows, driven by a possibly high-interest-rate environment from the Fed, have caused many central banks to hold back from cutting rates due to concerns over external conditions.

-

For the rest of 2024, a more broad-based growth recovery is expected as an improving trade cycle is likely to continue driving a more synchronized growth trajectory. With divergences in fiscal policies, domestic consumption will remain the key engine of growth. Growth in 2025 is projected to be solid at 4.6% as the current drivers are expected to maintain their momentum. In terms of monetary policy, uncertain external financial conditions could keep regional monetary policy stances neutral until late 2024 or early 2025. Regional central banks are likely to conduct policy easing with a more conservative approach. Indonesia and the Philippines will likely be the first in ASEAN to cut policy rates, given their high real interest rates.

-

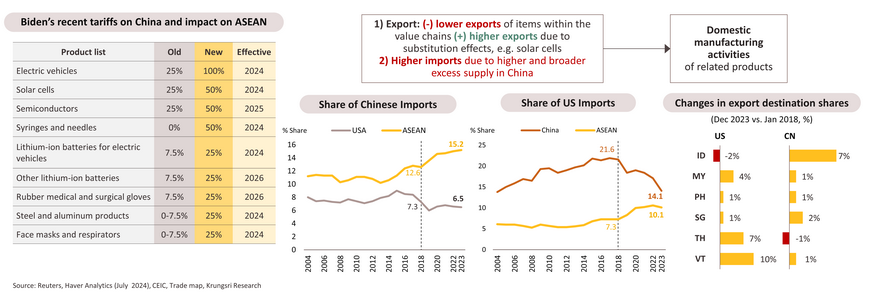

Significant headwinds ahead include trade tensions, which could directly reduce ASEAN exports, exacerbate China’s excess production capacities, and worsen external financial conditions and private confidence. This scenario would indirectly affect regional growth through reduced investment. On a positive note, the substitution effect on certain products could lead to an increase in exports to the US. This is evidenced by ASEAN benefiting from trade diversion and production base relocation since the trade tensions began in 2018.

-

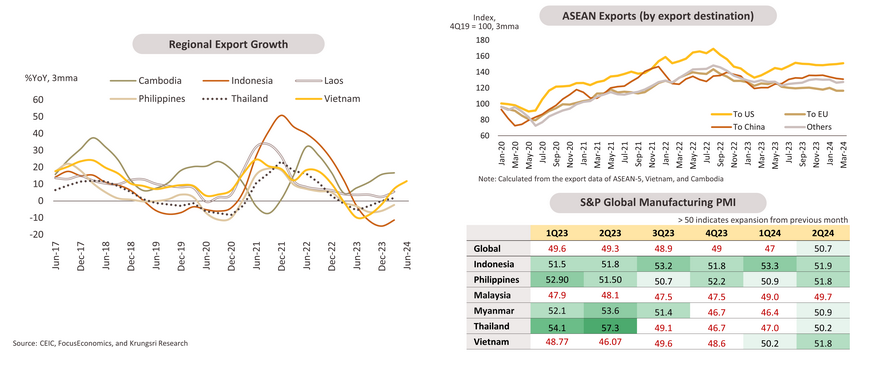

In 1H24, ASEAN exports showed a gradual bottoming, led by Vietnam and Cambodia with both garments and non-garments (particularly electronics) showing recovery. Despite a pullback in exports to EU since early 2023 and to China in 2024, resilient exports to the US have been observed. Improving manufactured goods exports have had a positive spillover effect on private investment, as reflected by the improvement of manufacturing PMI across ASEAN, particularly in Vietnam. However, domestic-demand-oriented economies like Indonesia and the Philippines have also maintained manufacturing PMI in the expansion zone, largely attributed to resilient domestic demand.

-

Going forward, goods exports should continue to modestly rebound given loosening supply chain conditions, a diminishing drag of tightened financial conditions, and a resilient, yet gradually slowing US economy. The IMF estimates that global trade volume will improve in 2024, growing by 3.1%, and in 2025, growing by 3.4%, up from 0.8% in 2023. However, trade tensions pose risks to this trade outlook (see more details on pages 6-7).

-

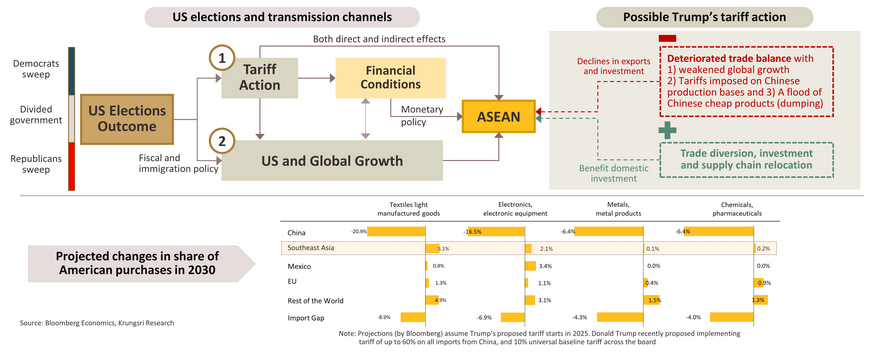

The key risk to regional exports and growth is a potential rise in trade tensions which relates to the US election results, scheduled in November 2024. Generally, the US election outcome will affect ASEAN growth through tariff actions and US economic performance, driven mostly by fiscal policies.

-

Further escalation of trade tensions and possible retaliatory measures would lead to i) a significant drop in trade flows and manufacturing activities in the US and China, leading to weakened global growth. Indirectly, it will affect investor confidence and capex.; ii) risk-off sentiment leading to tighter financial conditions (stronger USD, rising rates, and capital reversal); iii) new trade tensions between China and other countries are likely, following dumping.

-

For ASEAN, trade balances are expected to deteriorate due to the global growth slowdown, additional protectionist measures, and the influx of cheap Chinese products. However, there could be some benefits with trade diversion and supply chains being relocated to the region, which could benefit domestic investment in some related sectors.

-

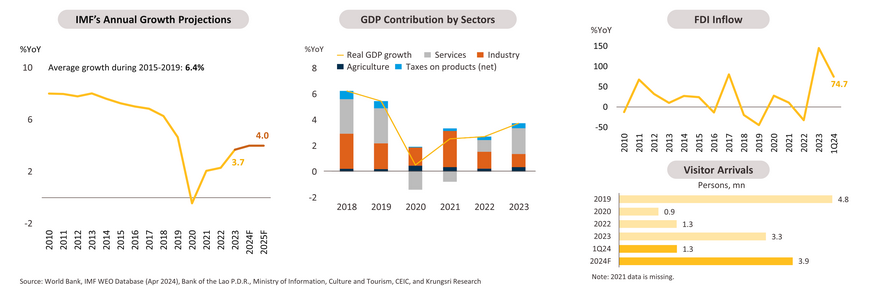

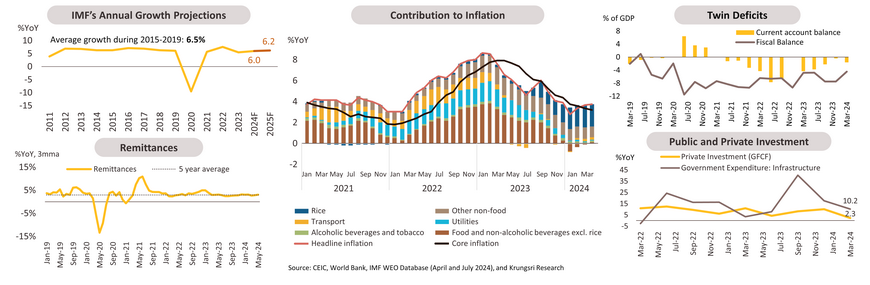

Laos’ economy is expected to gradually recover due to external drivers, with growth projected at 4% in 2024. These drivers include improved performance in services exports like tourism, logistics, and transport. In addition, foreign investment has increased significantly, mainly in the electricity and mining sectors.

-

Foreign visitor arrivals reached 1.3 million in 1Q24, up 36% YoY. The estimated number of 2024 total foreign tourists was revised down from that early this year (4.6 to 3.9 million visitors). To boost tourism in 2H24, the government extended visa exemptions (extending stay durations and including more countries) until the end of this year. In addition, the upcoming La Niña weather conditions may boost hydroelectric exports. Another major driver, foreign direct investment expanded significantly in 2023 and reached nearly 75% YoY in 1Q24.

-

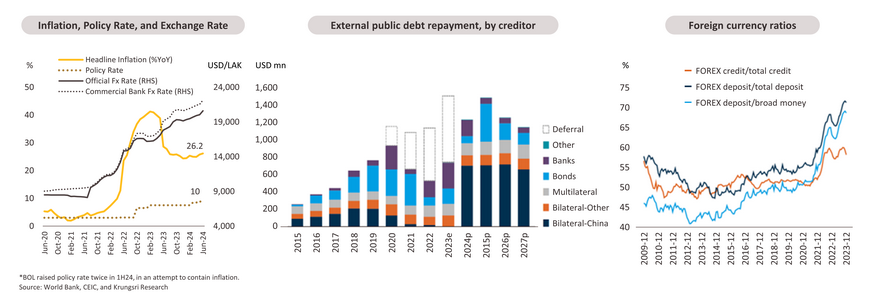

Domestic activities remained sluggish as private consumption stayed subdued, with rising inflation continuing to erode purchasing power. The high cost of living has exacerbated issues in labor migration and the manufacturing sector. Moreover, government spending is unable to provide support due to massive public debt, which has constrained fiscal space.

-

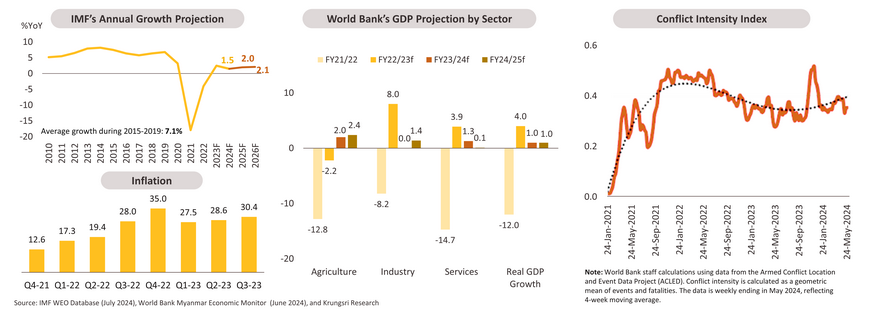

The IMF revised down growth for 2024 from 2.6% to 1.5%, largely due to escalating political conflicts. The dispersion in growth projections narrowed, given the World Bank’s estimate for GDP for FY2023 and FY2024 at 1%. The economic outlook remains very weak as persistently high inflation, mainly due to disruptions in trade and logistics, and currency depreciation, continue to pressure households. These factors have particularly large impacts on the service sector such as retail trade. In addition, shortages in labor, foreign currencies, and electricity will continue to downplay the manufacturing sector. Meanwhile, agricultural activity is expected to continue to expand. The impact of land border trade disruptions is expected to ease slightly as importers and exporters shift to alternative channels, while production in several major agricultural areas remains relatively unaffected by the conflict.

-

Foreign currency shortages continue as the spread between the official rate and the market rate stands at around 50%. According to the World Bank, the kyat has depreciated by about 20% since the end of 2023. As of June 2024, the exchange rate was around 4,500 kyat per dollar, while the official rate remains unchanged at 2,100 kyat per dollar.

-

Conflict intensity has trended upwards since January with armed clashes spreading from Northern Shan to other parts of the country including Rakhine and Kachin. The conflict has curtailed land border trade with Thailand, China, and India. Excluding natural gas, total land trade declined by about 38% in the six months to March 2024 compared to the previous six months.

-

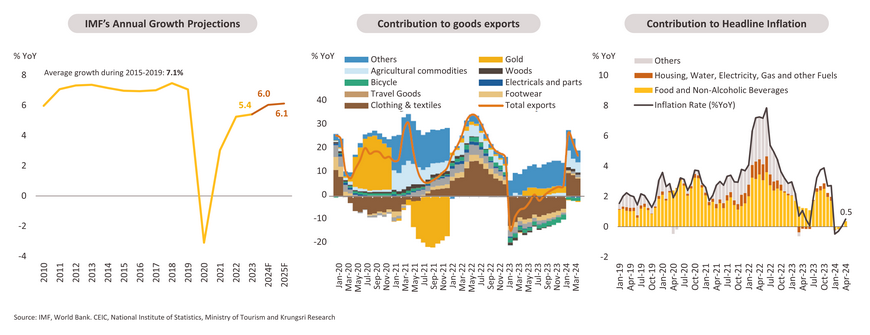

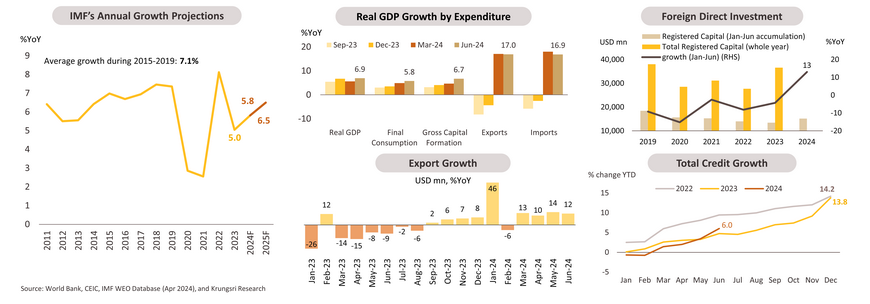

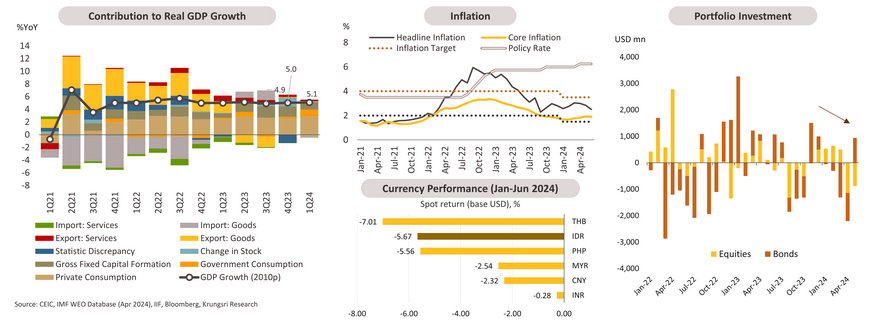

Growth will accelerate to 5.8% in 2024. Domestic demand is expected to expand following the accelerated disbursement of public investment projects and sustain private consumption, supported by ongoing fiscal stimulus measures including extended VAT cuts to 8% until the end of 2024 and a minimum wage increase of 6% nationwide.

-

Thanks to global electronics upturn and pick-up in external demand, particularly from the US, exports surged by 17% in 1H24, supported by key sectors like electronics and textiles. Improved exports have led to expansion in industrial production and enhanced business sentiment. Resilient private consumption and investment are reflected in the accelerated credit growth.

-

Foreign direct investment (FDI) inflows grew robustly at 13% in the 1H24, mostly to the manufacturing and processing industry, followed by the real estate sector. Despite the effectiveness of the global minimum tax rate (GMT) at the beginning of 2024, additional government incentives were introduced to compensate for the effect of GMT; thus, FDI inflows tend to expand in the medium term due to actively promoting investment opportunities abroad, competitive workforce, development of industrial park infrastructure, and administrative procedure reforms such as streamlining business registration and licensing, providing e-government services.

-

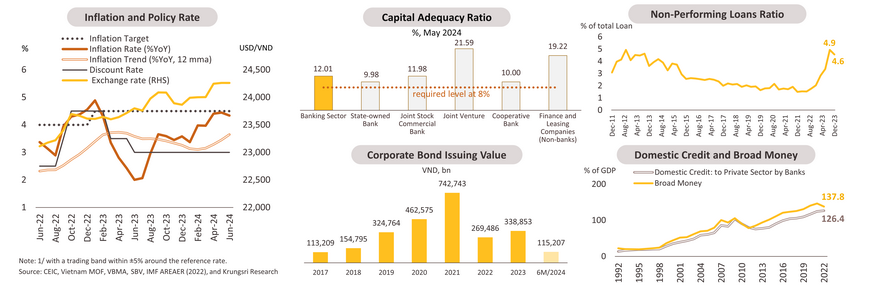

Inflation trended upward in 1H24, driven by rising global energy prices and VND depreciation. In 1H24, VND depreciated roughly 2% YoY against USD, a limited decline due to the SBV’s de facto crawl-like exchange rate arrangement1/. An increase in minimum wages on July 1, 2024, could add further price pressure in 2H24. Average inflation is expected to stay below the government's 4.5% target through 2024, assuming stable commodity prices. However, the policy rate is expected to remain unchanged at least through early 2025 to manage price pressures and mitigate negative effects from external financial conditions. The rate revision will also be based on the Fed’s rate cut decision.

-

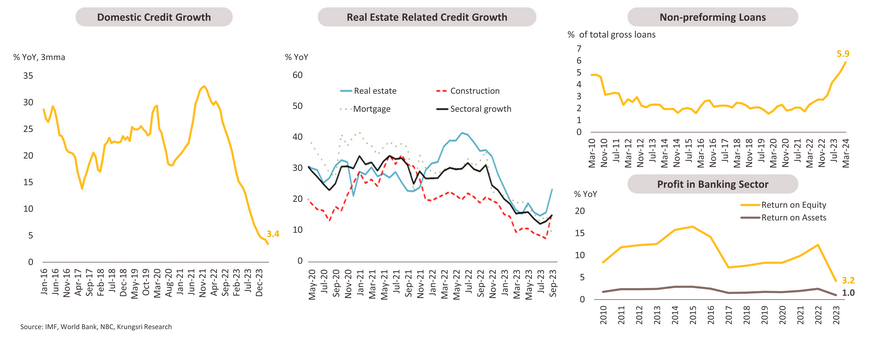

The real estate market is projected to gradually improve by late 2024 and into 2025, aided by FDI inflows to the sector, the easing of the corporate bond market freeze, and the upcoming Land Law, possibly effective in August 2024, which will clarify land pricing and introduce new land use regulations.

-

The banking sector is expected to be relatively resilient in 2024. Non-performing loans (NPLs), albeit remained high, are likely to decrease as borrowers' debt repayment capabilities improve, supported by stronger domestic activities, easy monetary conditions, and extended forbearance measures until the end of 2024. In addition, the Land Law is expected to lower the spillover risk of the bond market on the banking sector by alleviating difficulties faced by real estate developers such as streamlining legal procedures, improving land valuation, and enabling independent site clearance. The amended law will likely increase liquidity in the real estate sector and enable highly bond-leveraged developers to continue their projects, thereby enhancing their ability to repay debt and redeem bonds.

-

However, the financial sector faces persistent risks affecting bank asset quality, particularly from slow recovery in the corporate bond market and real estate sector. This could weigh on banks’ ability to expand credit and undermine financial stability.

-

Election-related spending mainly supported 1H24 growth, though post-election hangover may pose a drag in domestic demand over 2H24. Thus, flat growth is forecast at 5% for 2024. In the next couple of years, growth drivers may include more expansionary fiscal policy, increased investments in downstream and automotive (EV) industries, and construction in the new capital city, Nusantara.

-

Inflation this year will remain within the new BI’s target of 1.5-3.5% (down from the 2023 target of 2-4%). Upside risk is potential fuel subsidy cuts amid the increased need to free up fiscal space for a new government, particularly to fund incoming President Prabowo’s proposed free lunch program. The rollout of the program is expected to be gradual, aiming to limit the upside of inflationary pressures.

-

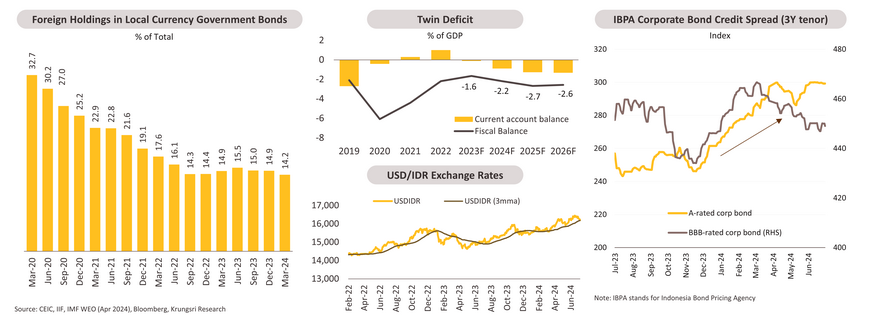

On the monetary policy front, a surprise April rate hike was likely a one-off, aimed at mitigating negative impacts from external conditions due to outflows of bonds and equities and poor IDR performance compared to peers. The watchpoint for BI to cut rates later this year depends on the US rates outlook and other factors that affect global financial conditions, including geopolitical factors and the US election outcome. We still expect BI to cut rates late this year due to elevated real interest rates, but the extent of the cut can be more conservative than previously expected.

-

Trade tensions: Indonesia announced measures to curb the flow of cheap imports from China. They are planning to impose tariffs up to 200% on a range of products including footwear, clothing, and textiles, aimed at protecting local MSMEs. We do not expect this move to disrupt the mutually beneficial aspects of bilateral ties between Indonesia and China, given that a continued flow of trade and investment is a necessary component of the government’s domestic economic agenda.

-

Fiscal stability: The future conduct of fiscal policy following the election in February this year is a key focus. The incoming administration's proposed free school meal program, estimated to cost 2% of GDP at full implementation by 2029, raises concerns about fiscal stability. This program could involve spending cuts in other areas, particularly energy subsidies. If the fiscal deficit widens, Indonesia’s reliance on foreign investor inflows is likely to resurface and the country will be more vulnerable to the external environment.

-

Recently, rising concerns about the country’s debt have led to capital outflows, higher yield premiums, and currency depreciation, raising refinancing costs for local companies. However, we currently expect that the new government will be pragmatic and adhere to the fiscal rules, including a fiscal deficit limit of 3% of GDP.