ASEAN: Fate is swayed by the erratic forces of U.S. tariffs and China’s presence.

-

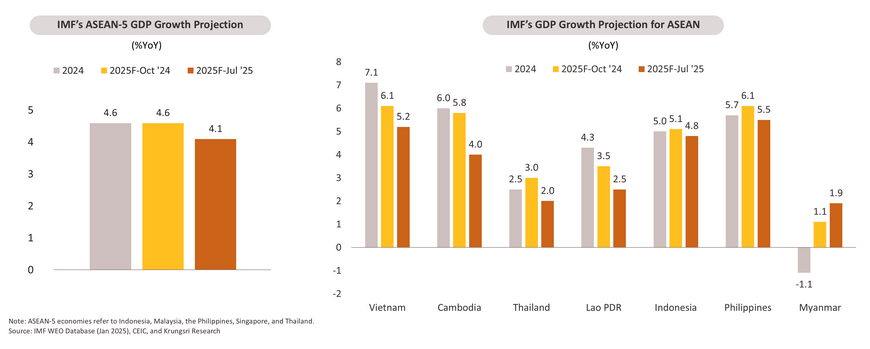

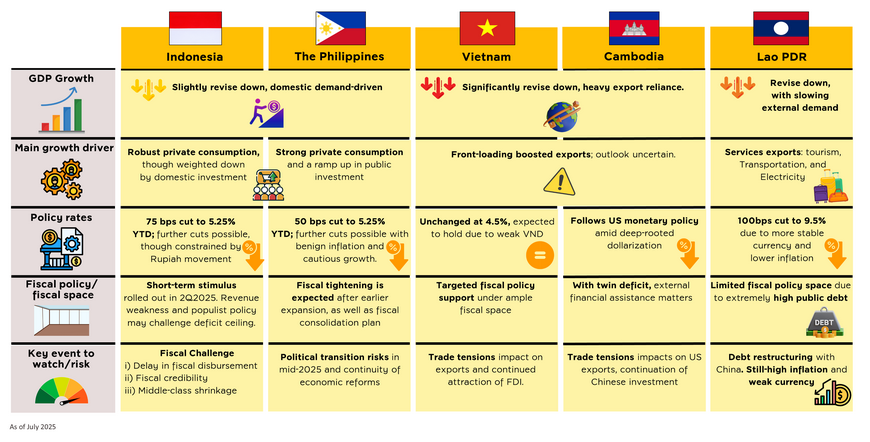

In 2025, ASEAN-5 growth was revised downward from 4.6% to 4.1%, due to weaker external demand, resulting from escalating trade tensions. The impact is most pronounced in trade-dependent economies such as Cambodia and Vietnam, while countries like Indonesia and the Philippines, which rely more on domestic demand, face milder slowdowns.

-

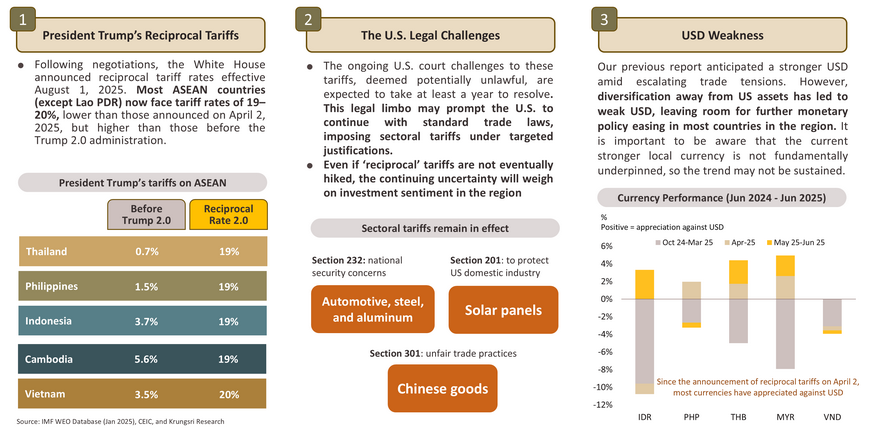

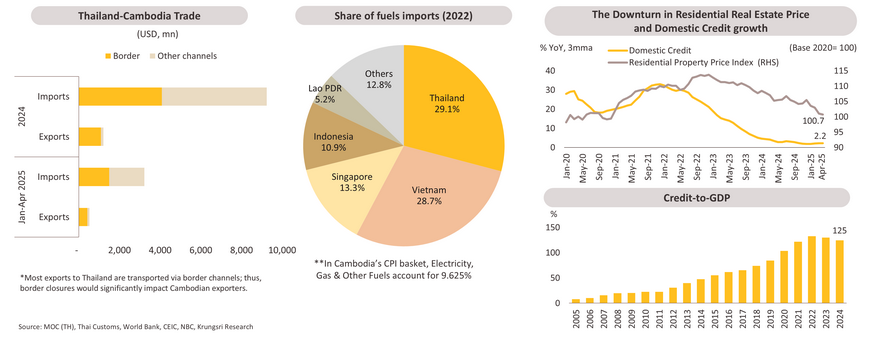

Since the last report, three major changes have emerged: first, President Trump’s higher-and-broader reciprocal tariffs, effective August 1, 2025. Amid ongoing legal challenges, the U.S. is likely to continue with sector-specific tariffs. Second, U.S. dollar weakness—driven by diversification away from U.S. assets amid escalating trade tensions—has created room for monetary policy easing. Third, the Thailand–Cambodia border conflict, which recently escalated in late July, has significantly affected both countries’ economic relations, security, bilateral trade, and investor sentiment. Both diplomatic and economic recovery is likely to take time.

-

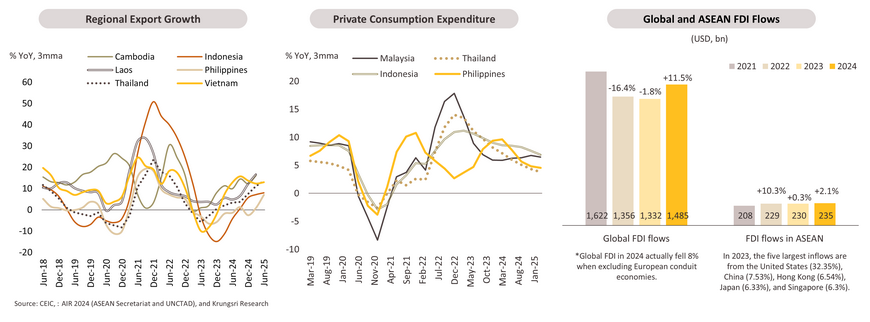

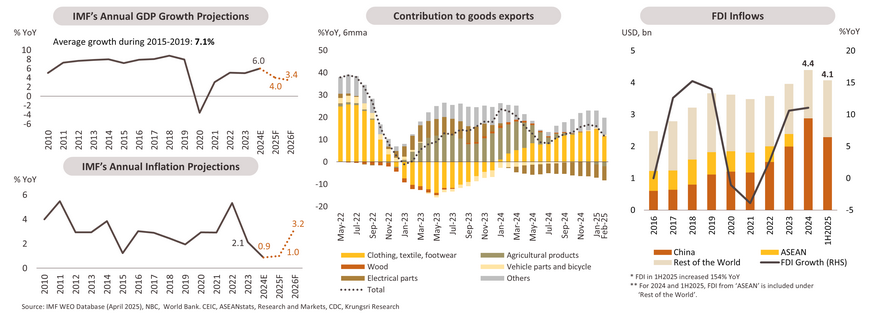

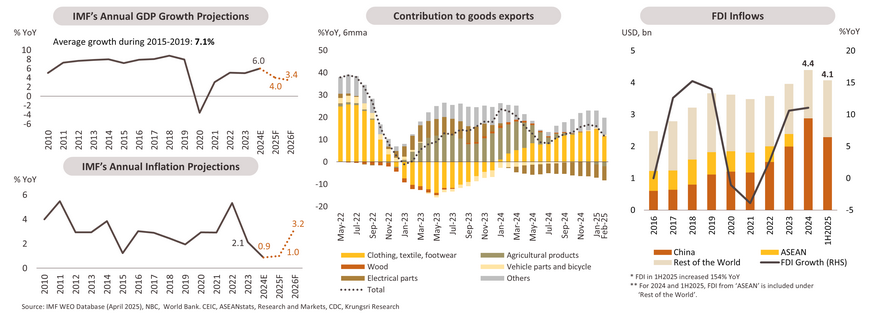

Major growth drivers in 1H25 included exports and private consumption. Export growth was previously boosted by front-running ahead of tariff implementation. However, momentum is expected to wane in the second half of 2025 due to a payback effect. Private consumption has moderated but remains relatively resilient, supported by easing inflation and lower policy rates. While private consumption is expected to remain a key driver of growth, the outlook remains uncertain due to evolving external risks, particularly trade policies that threaten domestic manufacturing and employment. Meanwhile, foreign direct investment, driven by ongoing supply chain diversification, remains the main engine of medium-term growth, though it also faces risks associated with continued U.S. trade policy uncertainty.

-

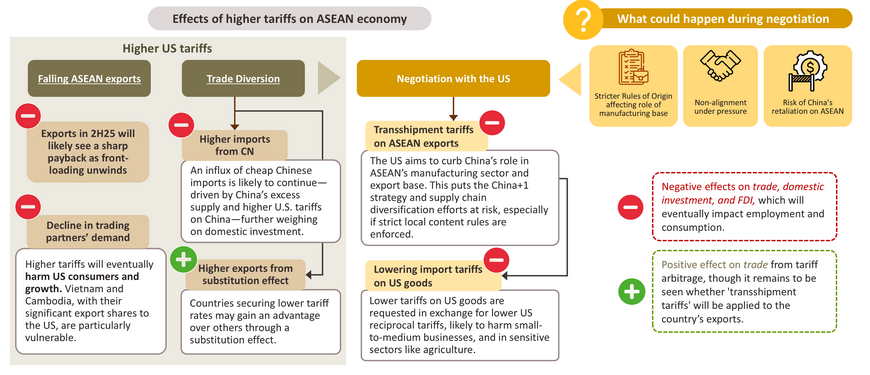

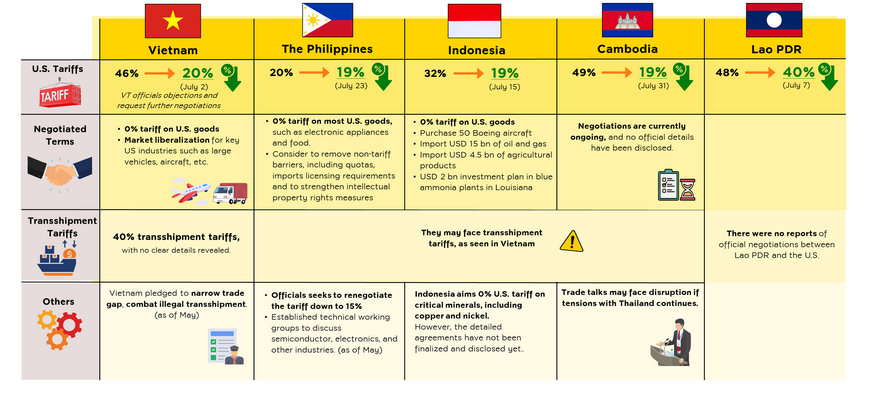

Downside risks loom large amid heightened uncertainty, as ASEAN economies face a delicate balancing act between maintaining U.S. market access and managing Chinese investment flows. This is compounded by potential U.S. transshipment tariffs—emerging from recent negotiations—aimed at curbing Chinese influence in the region. Furthermore, the impact of negotiated reductions in U.S. import tariffs on local SMEs and sensitive sectors such as agriculture will also be crucial to monitor. Last but not least, the Thailand–Cambodia border conflict could destabilize the subregion and weaken ASEAN cohesion if tensions persist.

-

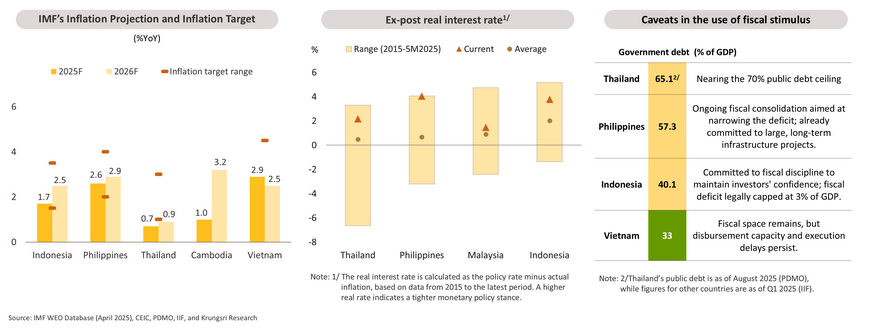

On the monetary policy front, higher slack in the economy, stronger disinflationary forces, and supportive external conditions all reinforce the case for further easing, particularly in countries like Indonesia and the Philippines, where fiscal constraints limit stimulus options.

ASEAN-5 growth revised down; tariff impacts vary across countries

-

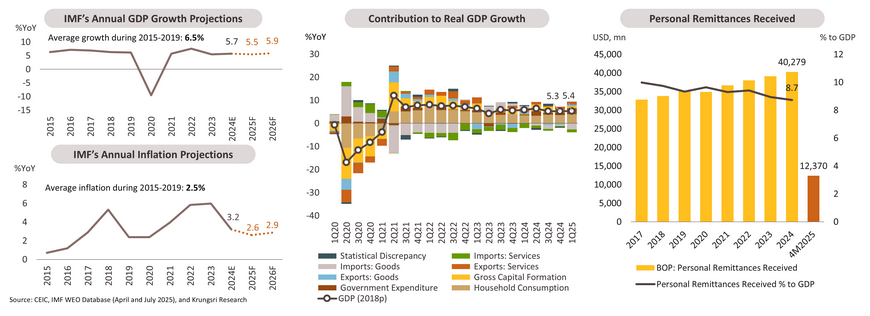

Previously, 2025 ASEAN-5 economic growth was expected to be steady at 4.6%. However, the IMF has revised this down to 4.1% in July 2025 as downside risks loom, including weaker demand from key trading partners and intensifying trade tensions—major challenges for the region’s trade-driven economies.

-

Within ASEAN, the overall picture reveals a broad-based downward revision. Countries like Cambodia, Vietnam, and Thailand, which are heavily reliant on trade, face the most significant downward revisions. On the other hand, economies driven more by domestic demand, like Indonesia and the Philippines, experience milder revisions.

Export boost expected to fade; moderated private consumption to drive growth

-

The massive front-running demand ahead of anticipated tariffs has artificially boosted the region’s export growth. However, a sharp payback is expected, with exports likely to slow in 2H25.

-

Private consumption moderated but remains relatively resilient, supported by easing inflation and lower policy rates. Key headwinds include weaker exports and shifting trade policy—ranging from settled U.S. export tariffs to potential cuts in import tariffs—which could weigh on manufacturing, jobs, and consumption, especially in export-dependent economies.

-

Another growth driver is FDI. Earlier optimism about manufacturing-related FDI was driven by supply chain diversification under the China+1 strategy, in response to trade tensions since 2017 and excess capacity in China. While this remains a key medium-term regional driver, it is not without risks (see p. 8)

What has changed since the beginning of 2025?

What to monitor next in trade tensions; negative effect is set to deepen either way.

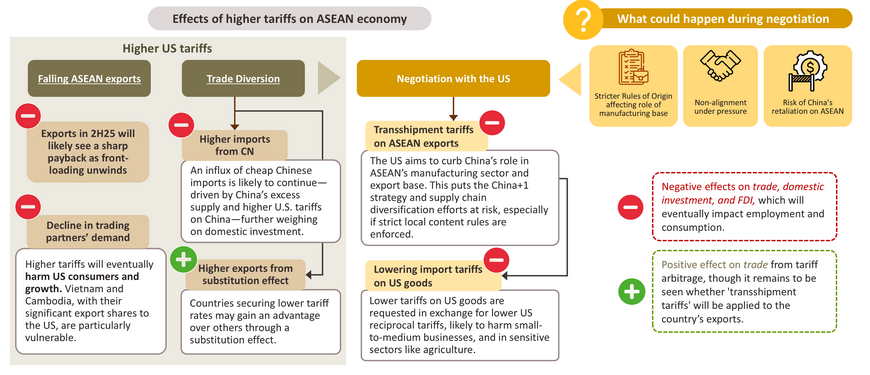

On the trade front, ASEAN countries are caught between weakening global demand and increasingly competitive Chinese supply. Given their export-driven growth models, many ASEAN economies have little choice but to continue negotiating with the U.S. However, aligning too closely with U.S. demands carries the risk of retaliation from China, potentially further undermining investment and economic development in the region.

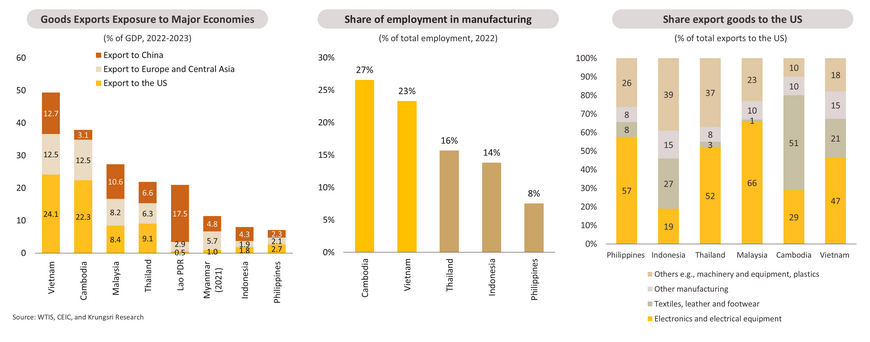

Vietnam and Cambodia have limited room to maneuver with high external exposure.

-

Amid rising risks of reciprocal, sectoral, and transshipment-related tariffs, trade-reliant countries like Vietnam and Cambodia will be hardest hit, given their high export exposure to the U.S. and heavy dependence on export-oriented manufacturing. In both countries, these sectors are predominantly labor-intensive, so a decline in exports could significantly affect employment and, in turn, domestic demand.

-

Regarding sectors, Vietnam’s electronics and Cambodia’s garment sectors are among the most affected. In addition, sectoral tariffs would directly impact Cambodia’s solar panel exports. Combined with ongoing uncertainty over reciprocal measures, this would weigh on trade, investment, and the broader economy.

The US makes the deal art; ASEAN struggles to make the deal work.

-

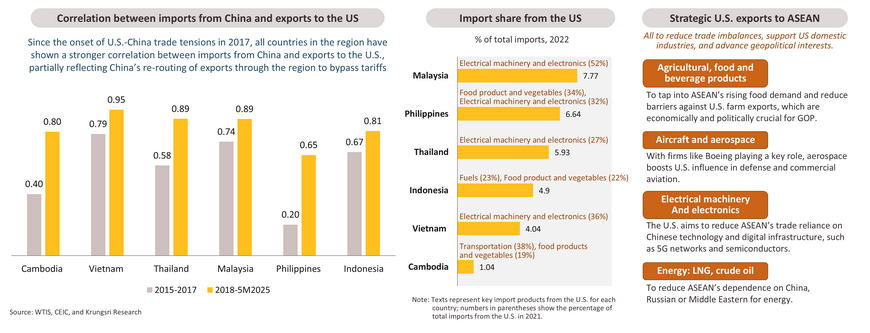

ASEAN now faces a growing challenge in balancing U.S. market access with Chinese investment flows, as the region has long relied on exports to the U.S. while depending heavily on Chinese intermediate goods, with limited local supply chain alternatives.

-

Potential negotiation outcomes could negatively impact the regional economy, affecting not only trade but also both foreign and domestic investment. These risks arise from issues such as transshipment and reduced tariffs on U.S. goods. A key challenge lies in the extent of local content required to avoid U.S.-imposed “transshipment tariffs,” which are aimed at curbing Chinese influence in ASEAN exports.

-

In addition, ASEAN’s offer to lower tariffs on U.S. goods in exchange for reciprocal U.S. tariff reductions could hurt small and medium-sized firms, which need more time to adjust, as well as other local producers in sensitive sectors such as agriculture and food and beverages.

Countries with policy cushions will be better positioned.

-

Heightened downside risks to growth have left the region grappling with economic slack. This, combined with intensifying disinflation—partly due to a potential influx of cheap Chinese goods—and weaker economic growth, underscores the need for further monetary easing and fiscal stimulus.

-

On the monetary policy front, pressures on growth, subdued inflation, more favorable external conditions (including improved fund flows and stronger local currencies), and the current high real interest rates suggest greater room for easing than earlier in the year.

-

Monetary policy will play a central role, especially in countries with limited fiscal space, such as Indonesia, constrained by its 3% deficit cap, and the Philippines, which is undergoing fiscal consolidation.

2025 ASEAN Economic Pulse

ASEAN-U.S. Tariff Negotiation Progress

Cambodia: Heavy reliance on external drivers leads to heightened growth risks.

-

Cambodia’s 2025 growth forecast was revised down from 5.8% to 4.0%, the largest downward revision in the region, due to the US tariffs and its high reliance on exports to the US. In 1H2025, growth remained relatively robust, mainly driven by front-loading goods exports, though it is expected to slow in 2H2025. Inflation eased to 1.59% in June 2025, after spiking to 4.8% in 1Q2025, mainly due to rising food prices. It is expected to moderate this year, assuming supply conditions remain stable.

-

FDI inflows, remittances, and partial tourism recovery in 1H25 supported the country’s balance of payment, lifting foreign reserves to USD 24.7 bn (7 months’ import cover). However, amid softening external demand and trade policy uncertainty, exports and FDI in labor-intensive manufacturing—particularly garments, travel goods, and footwear—are expected to slow, especially FDI from China, which has been dominant and currently accounts for 90% of apparel factories.

Border tensions and domestic credit stress present further risks.

-

The Cambodia-Thailand border tension may heighten short-term inflation and living costs, as border trade accounts for half of bilateral trade, and the fuel import ban covers one-third of Cambodia’s supply. Although Cambodian authorities have affirmed their ability to secure new fuel sources, their prior heavy reliance on Thai imports may still lead to shortages and upside inflation risks. Prolonged tensions could further undermine investor confidence.

-

The banking sector faces rising risks from high private debt and deteriorating asset quality, with NPLs reaching 7% by end-2024. Slowing credit growth (32.5% in 2021 to 2.2% in April 2025) and falling real estate prices are tightening credit conditions, constraining investment and consumption (negative wealth effect), and risking financial stability and overall growth.

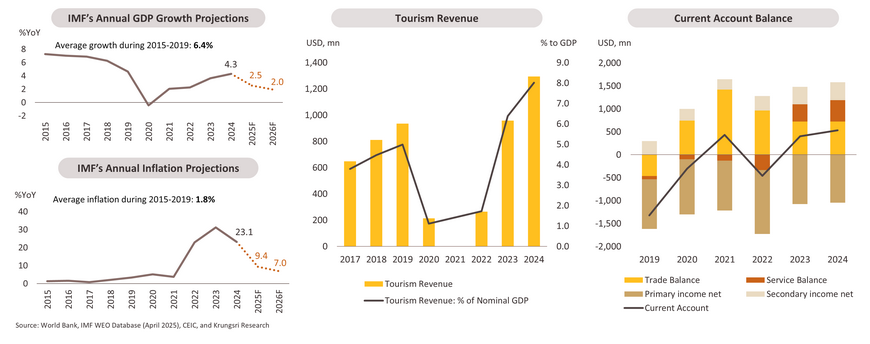

Lao PDR: Service sector remains the key growth engine amid weak domestic economy

-

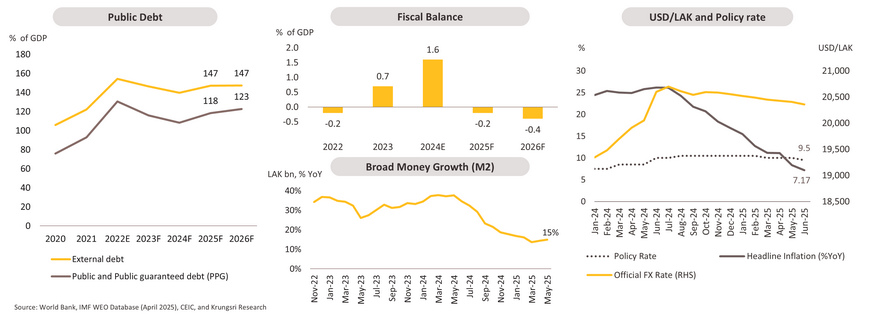

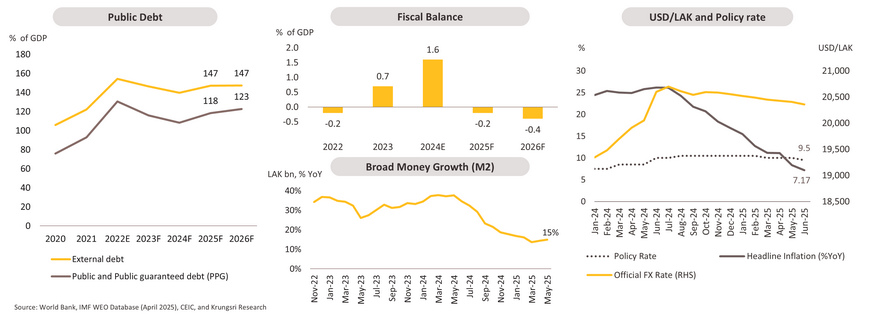

In April, the IMF revised down Lao PDR’s growth for 2025 to 2.5% from 3.5% in its October projection. The slowdown reflects weakening external demand and global trade policy uncertainties, weighing the country’s growth outlook to be lower than the pre-covid levels. Service sectors (tourism and transport services) continue to be the main growth drivers. Service balance also shows promising growth, mainly driven by tourism.

-

Domestically, eroded household purchasing power, high production costs, and tight monetary conditions continue to constrain domestic economic activity, particularly over the past five years. Although the inflation rate has declined to single digit since May 2025, due to a more stable Lao Kip, the cost of living remains persistently high.

Ongoing vulnerability limits policy space and keeps the local currency structurally weak

-

Public external debt remains sustainably high, exposing Lao’s external stability to vulnerability. Nonetheless, the foreign exchange reserves by the end of 2024 reached USD 2.1 bn, at around 2.5 months of imports of goods and services and only 1.6 months of imports (excluding short-term liabilities).

-

A recorded fiscal surplus in 2024 was driven by the tax policy reforms and improved tax administration. However, high debt service costs have absorbed much of the fiscal gains, limiting space for further fiscal stimulus.

-

While the local currency has stabilized following the implementation of tight monetary policy—including exchange rate controls and repatriation mandates—it is expected to remain structurally fragile due to high external debt obligations. Regarding domestic demand, despite the reduction in the short-term loan interest rate from 10.0% to 9.5% in June 2025, demand remains constrained by overall tight monetary conditions, as reflected in the slowdown of broad money growth.

Myanmar: Deeper contraction from earthquake; recovery expected in late 2025.

-

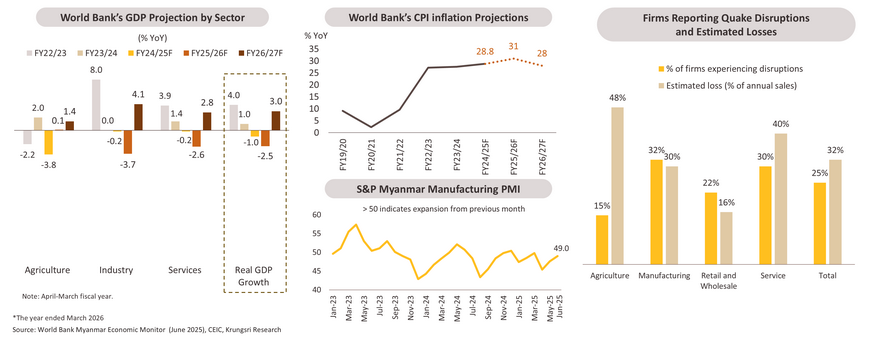

Myanmar’s economy is projected to contract by -2.5% in FY2025/26*, revised downward from earlier estimates primarily due to the severe impact of the 7.7-magnitude earthquake in March 2025. As a result, the manufacturing PMI remains in the contraction zone, amid factory closures, raw material shortages, and power outages undermining production. However, activity is expected to partially recover in 2H2025, supported by reconstruction efforts. Additional pressure comes from monsoon flooding, with the agriculture sector already having contracted by -3.8% in FY2024/25.

-

According to World Bank price surveys, Inflation has accelerated to 34.1% YoY in April 2025, driven by supply chain disruptions—earthquake, conflict-related supply issues, and import restrictions. Food inflation remained high at 29.5% while non-food inflation spiked to 36.4%, further straining household consumption.

The unresolved political situation hinders economic recovery.

-

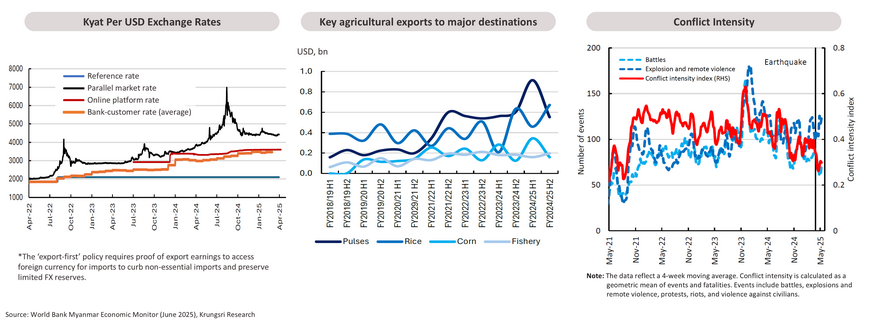

The kyat has stabilized in parallel markets since October 2024 after a period of sharp depreciation, though a wide gap remains due to foreign currency shortages. Despite reduced central bank interventions, stability has been supported by tight import controls, the ‘export-first’ policy*, and crackdowns on informal forex trading. A decline in imports and higher agricultural exports, due to subdued domestic demand and domestic logistics disruptions, have contributed to the country’s trade surplus, easing pressure on the currency.

-

Regarding the political situation, armed conflict intensified and spread in 2025, disrupting production and logistics, thereby adding economic uncertainty. The military plans elections by early 2026 after repeated emergency extensions, with only its proxy and allied parties contesting nationwide while opposition parties remain excluded.

Vietnam: Front-running exports sooth growth concerns—for now.

-

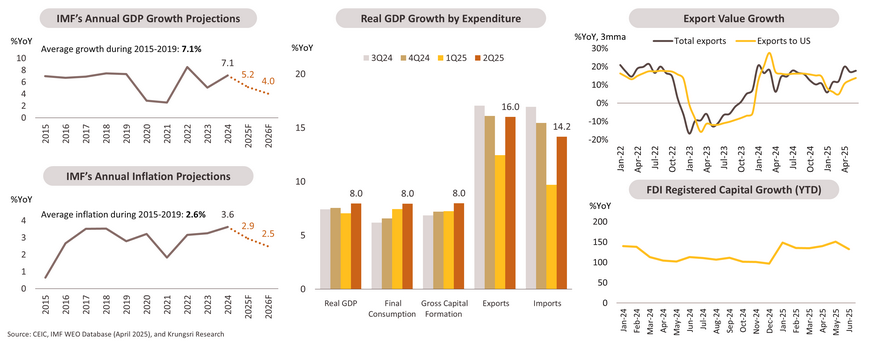

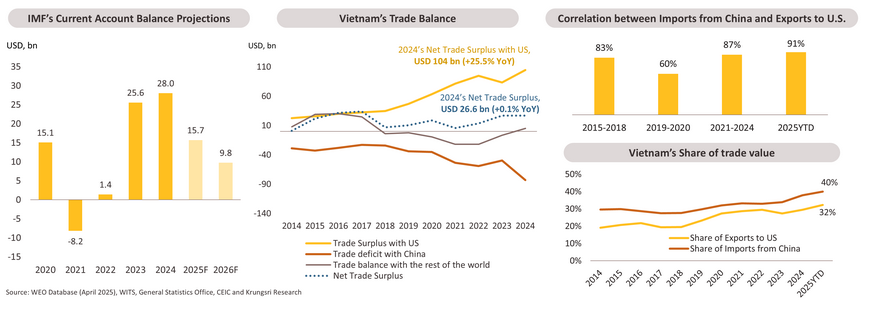

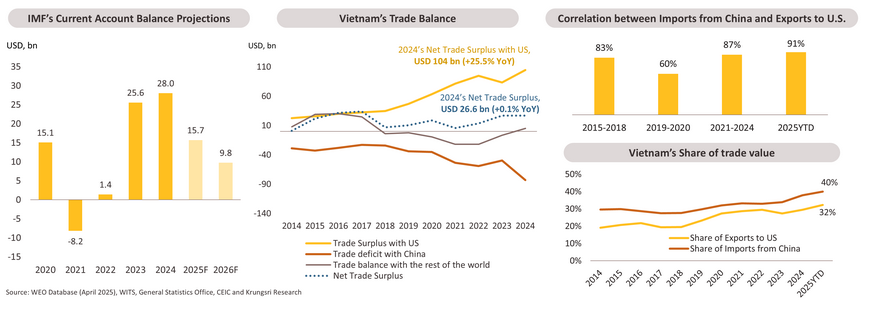

In 2024, Vietnam’s economy grew by 7.1%, outpacing other ASEAN economies, driven by front-loaded exports and resilient domestic demand. While the IMF has revised Vietnam’s 2025 GDP growth projection down to 5.2% (from 6.1%), the 2Q25 GDP outturn came in resilient at 7.96%. This was driven by front-running exports and broad-based domestic growth, partly supported by government stimulus measures, particularly the extended VAT rate cut through end-2026, and lower inflation, which helped improve purchasing power. At the same time, the government has been making progress in attracting export-led FDI through investment incentives and facilitation, further boosting the manufacturing sector and employment.

-

The key question going forward is how this momentum can be sustained under an export-led growth model amid the U.S. export-related policy uncertainties.

Escalating trade tensions pressure Vietnam’s high-external-reliance economy.

-

With total goods exports exceeding 80% of GDP, Vietnam is exposed to higher downside risks from weakened global demand amid unfavorable trade policies. Vietnam’s 1H2025 exports, particularly to the U.S., rose significantly from frontloading to avoid higher tariff rates. Hence, its recent growth may not sustain throughout the year.

-

On July 2, 2025, the U.S. announced that Vietnam’s imports to the U.S. are subject to a 20% tariff, effective from August 1. On the other hand, transshipments face a 40% rate and would therefore result in stricter Rule of Origin implementation. The high correlation between imports from China and exports to the U.S. underscores Vietnam’s role as a key China+1 manufacturing hub—something the U.S. aims to rebalance. As a result, the current account surplus is expected to narrow due to a smaller anticipated trade surplus.

-

However, there are still uncertainties in such measures until the official trade agreement with the U.S. is launched, depending on various factors, including the U.S. legal process, other countries’ agreement, as well as the trade diversification strategy towards other key economies.

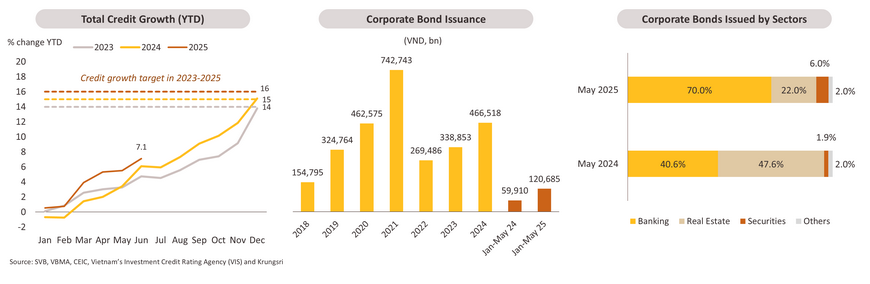

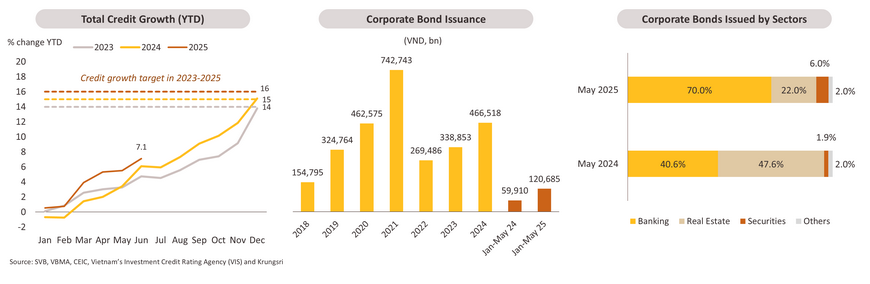

Banks ordered to support economy as property sector risks linger.

-

1H2025 credit growth reached 7.1%, exceeding the growth in 2023 and 2024, and approaching the country’s target of 16% for 2025. The government has mandated the SBV to assign a credit growth target for commercial banks. Key programs raising the credit growth include 1) Credit package of VND 100 trillion for agriculture, forestry, and fishery sectors (accounting for 6% of total outstanding credit, as of April 2025) and 2) Housing loans with preferential rates for young borrowers aged under 35.

-

Vietnam’s property market remains an issue to watch. Although corporate bond issuance in the first five months of 2025 rose significantly compared to the same period last year, bank bonds dominated the corporate bond market—accounting for nearly 70% of total issuances YTD—while the real estate sector made up only around 22%. The increase in bank bond issuance is largely aimed at supporting the government’s credit growth target and strengthening medium- to long-term capital structures

-

The subdued bond issuance from the real estate sector may signal ongoing liquidity constraints. Real estate bonds valued around VND 80 trillion maturing in 2H2025 (accounting for more than 50% of the total value of maturing bonds in 2H25) should be closely monitored, given potential rollover risks. This situation could have broader implications for the corporate bond market, particularly if liquidity challenges intensify. Companies facing upcoming bond maturities may undertake early bond buybacks as a strategy to manage refinancing risks.

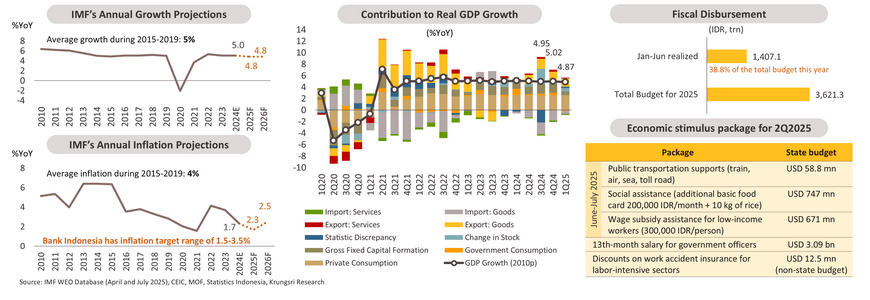

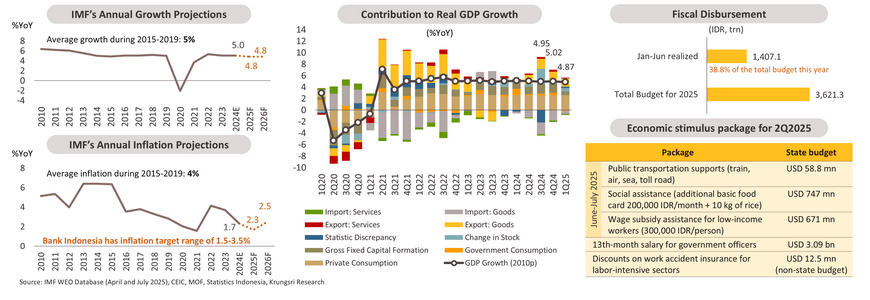

Indonesia: Growth softens but remains resilient, driven by private consumption.

-

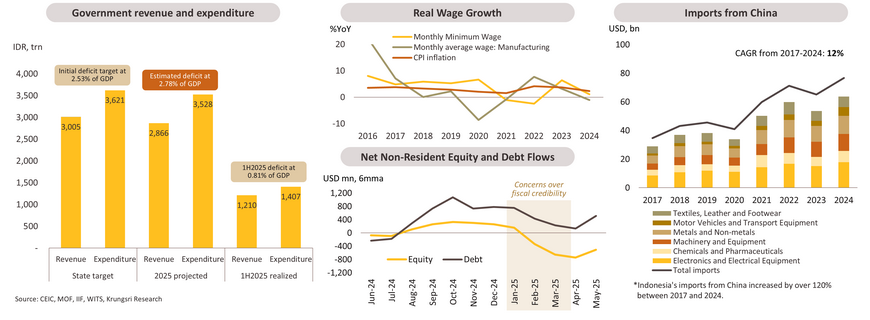

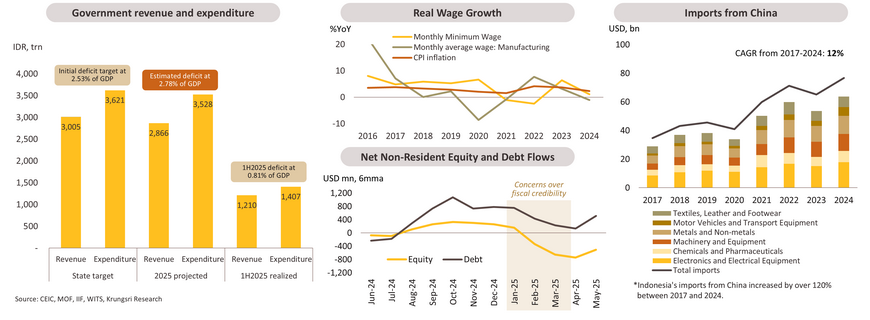

The IMF has revised its 2025 growth forecast down from 5.1% to 4.8%, the smallest downward revision in the region, reflecting low trade exposure. So far, private consumption remains robust, supported by easing inflation and lower interest rates. However, overall economic growth has been weighed down by weak public and private investment, as fiscal disbursement was delayed following a presidential directive in 2025 to cut the budget for fiscal efficiency, thereby dampening business sentiment. Meanwhile, goods exports grew steadily in 1Q25, supported by non-oil & gas shipments, despite lower oil prices.

-

Monetary policy has eased as Bank Indonesia (BI) cut policy rate by a total of 75 bps so far in 2025 to 5.25%, alongside liquidity injections to support domestic demand and credit growth after the rupiah stabilized following its intervention. Further rate cuts are expected in 2H2025 as BI sees softer growth, though the pace and timing will depend on currency stability.

-

The government sought to boost consumer purchasing power in mid-2025 by launching an additional stimulus package and extending electricity and fuel subsidies to shield vulnerable households from rising global prices. However, given the small size of the package (0.1% of GDP), its impact on the real economy is likely to be limited.

Fiscal stability risks and middle-class shrinkage may weigh on domestic demand.

-

Fiscal stability has emerged as a key concern. Indonesia’s weak revenue collection (-9% YoY over 1H2025) and expansive stimulus measures have pushed its 2025 budget deficit to near the 3% legal cap. In addition, private consumption faces headwinds as the share of middle-class households continues to decline. Labor-intensive industries are seeing factory closures due to rising competition from low-cost Chinese manufacturers, while ongoing trade tensions have led to increased layoffs.

-

To support long-term investment, the government launched Danantara Sovereign Wealth Fund in February 2025 with USD 20 bn in capital, consolidating major SOEs. However, the fund faces scrutiny over transparency, oversight gaps, and fiscal risks as SOE dividends now bypass the state budget.

-

Indonesia’s reliance on external financing makes fiscal credibility crucial. Concerns over the fiscal deficit cap and the Danatara SWF have weighed on investor sentiment, triggering capital outflows early this year. While flows have stabilized thanks to BI’s intervention and a shift away from dollar assets since April, the reallocation of the budget from public infrastructure investment to short-term stimulus may weigh on medium-term growth.

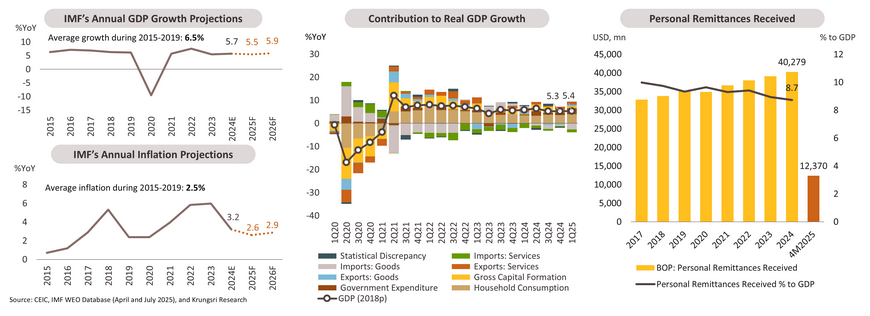

Philippines: Maintain steady growth with strong domestic consumption

-

In 2024, the Philippines’ economy grew by 5.7%, supported by strong domestic demand and services exports. In 1Q2025, growth registered at 5.4%, mainly driven by increased government spending, particularly in public infrastructure investment, while household consumption remained a growth driver.

-

Economic growth for full-year 2025 is projected to remain steady at 5.5%. Domestic consumption will continue to be a key growth pillar, supported by stable remittance inflows, rising purchasing power with softening inflation, and a resilient labor market. The unemployment rate in May 2025 stood at 3.9%, remaining below the average of 5.2% since 2021. The service sectors, especially tourism and business process outsourcing, are also expected to be major growth drivers.

-

However, 2025 GDP growth has been revised down from an earlier forecast of 6.1%, partly due to external headwinds. Although goods exports account for only 17% of GDP, the imposition of 20% U.S. import tariffs, particularly affecting electronics, could weigh on export performance, as the U.S. market represents around 13% of total electronics exports.

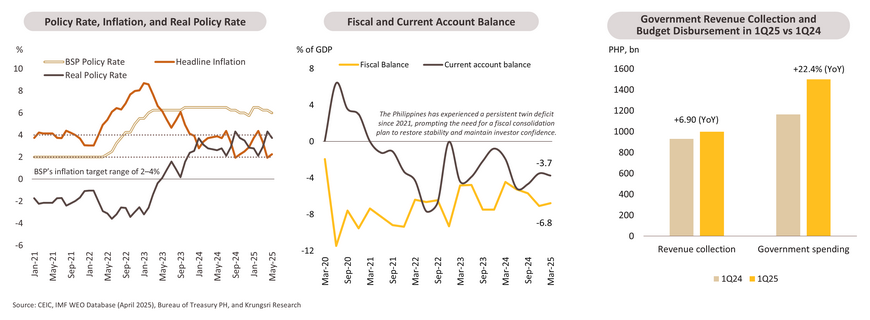

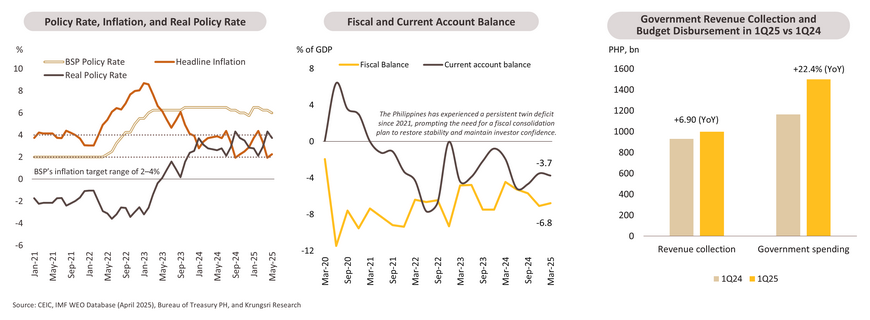

Loosening monetary policy to support the economy, while fiscal policy space is limited

- The Bangko Sentral ng Pilipinas (BSP) imposed expansionary monetary policy after Peso has been stabilized and inflation rate remains in targeting range of 2-4%. The easing cycle is expected to continue, encouraging consumption and private investment as main growth engines amid external headwinds.

- As of March 2025, the fiscal deficit rose significantly to 6.8% of GDP as budget disbursement outpaced revenue collection ahead of the mid-term election. With such a large deficit, fiscal tightening is expected in the remainder of the year to achieve the 2025 deficit target of 5.5% of GDP. In addition, the government’s fiscal consolidation plan aimed at narrowing the deficit to 4.3% of GDP by 2028 is expected to constrain public spending and public investment over the medium term. However, the consolidation effort may face delays due to weaker-than-expected revenues and elevated expenditure pressures at present.

- Political risk has been de-escalated after Sara Duterte’s impeachment was dismissed by the Senate. The case was sent back to the House of Representatives to clarify whether its process had been lawful. It is expected that the case will be delayed until the next Senate session, beginning in July 2025.

With strength from within and support from new partnerships, ASEAN can move more freely—freed from US-China strings.

-

Cyclical outlook: Over the short term, growth in ASEAN-5 increasingly depends on domestic demand, as external headwinds and tariff uncertainties continue to weigh on exports and investor confidence. Private consumption will be a key driver, but risks remain, particularly around trade policies that could affect manufacturing and employment.

-

Medium-term prospects: Foreign direct investment (FDI) continues to flow into the region, supported by ASEAN’s broader regional attractiveness amid ongoing supply chain diversification. However, uncertainty around U.S. trade policy, including potential transshipment tariffs, and sector-specific measures, poses significant risks. Amid ongoing external uncertainties, internal matters have become increasingly critical, both within individual ASEAN countries and across the region as a whole.

-

To move more freely from the strings attached, ASEAN must strengthen internal unity and diversify its partnerships. Prioritizing cohesion is essential to enhancing ASEAN’s collective bargaining power on the global stage. By fostering mutually beneficial relationships with new partners, the region can build greater strategic autonomy. Notably, significant progress has been made in upgrading trade agreements with the European Union. While tangible outcomes may take time to materialize, this remains a promising step toward reducing overdependence and empowering ASEAN to shape its own fate.