ASEAN: The economic activity is normalizing but recovery will remain uneven in 2022

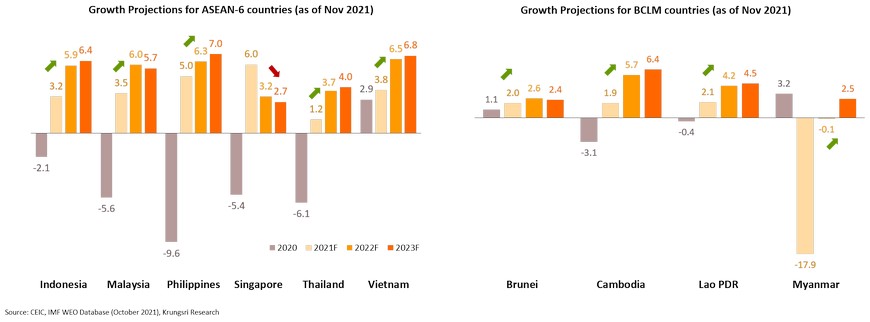

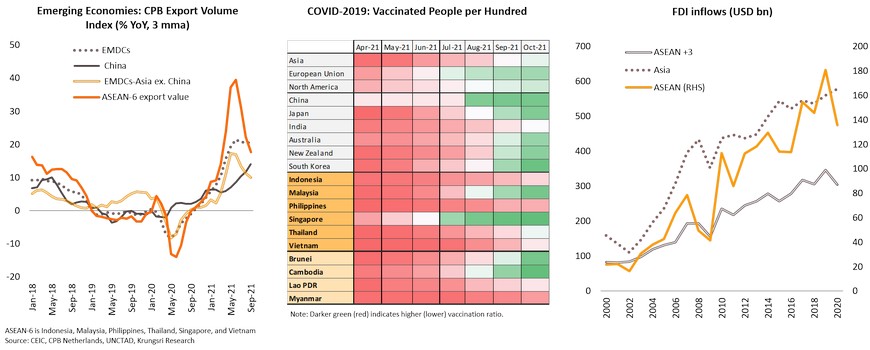

- ASEAN is gradually exiting the pandemic-induced economic slump and growth is expected to rebound in 2022, especially in Indonesia, the Philippines, and Vietnam. Given higher vaccination rates and reopening of economies at home and globally, household consumption, exports, policy support, and inward FDI would be the key growth drivers.

- However, the pace of recovery, and resilience, will be uneven across the region. It will hinge primarily on the efficacy of vaccines deployed, policy supports, and macroeconomic structure.

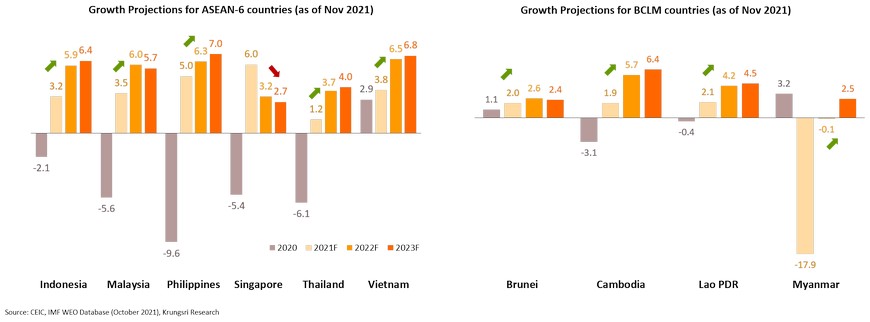

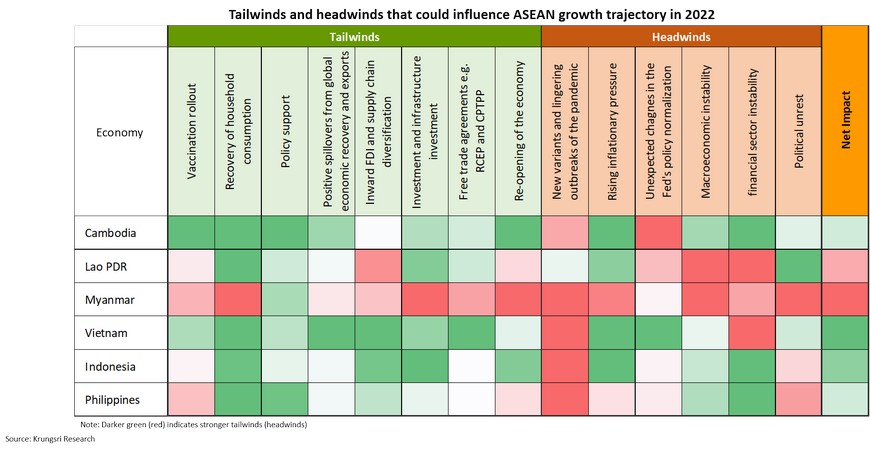

- Each country is facing different challenges. Common challenges are a slowdown in China threatening the region’s exports, and sooner-than-expected Fed tapering prompted by higher-than-expected inflationary pressure. However, given strong tailwinds on the horizon and better macro fundamentals, ASEAN nations should be able to weather the turbulence ahead. Myanmar is an exception as the ongoing political crisis will continue to weigh on the overall economy and the country will register a contraction in 2022.

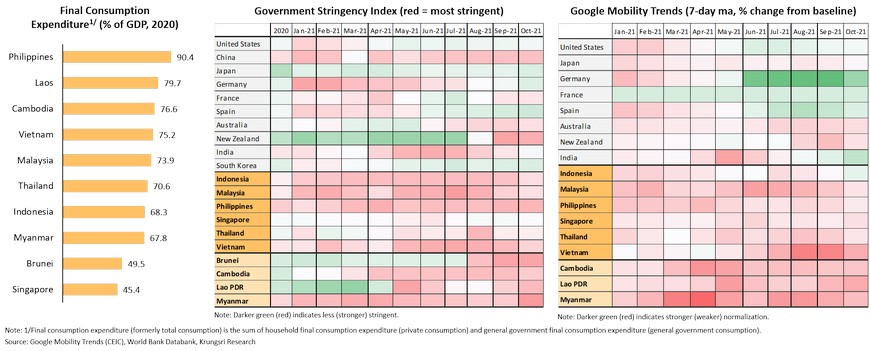

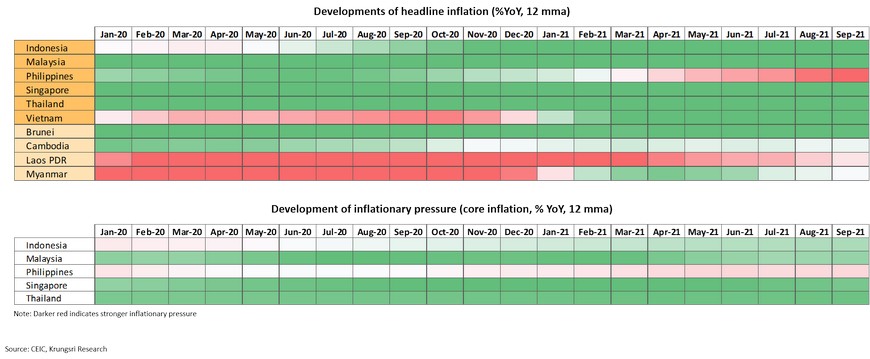

- Macroeconomic policy will remain accommodative in 2022 as inflationary pressure is expected to remain muted due to weak demand and slack in the labor market, as well as economic scars left by the pandemic. This would allow policymakers to focus on rejuvenating growth.

Multi-speed recovery in ASEAN region will continue into 2022 boosted by the normalization of domestic demand and external tailwinds

The growth outlook for ASEAN countries in 2022 is improving as they gradually exit the pandemic-induced economic slump. So far, the recovery trajectory has been driven by exports, policy supports, and private consumption, given higher vaccination rates and easing mobility restrictions by the government following fewer new cases. However, the pace of recovery remains uneven and weak across the region as a result of different policy choices to contain the pandemic impact, vaccine supplies, and economic fundamentals. The outlook for Myanmar remains negative due primarily to the ongoing political chaos. Looking ahead, with most countries adopting the living with COVID-19 approach, we expect the the economy to continue to reopen gradually and selectively, which will encourage the normalization of economic activity. Nevertheless, risks to the outlook are tilted to the downside and those on the top of our mind are (1) another global outbreak involving new virus variants, (2) pandemic-induced disruptions to global and regional supply chains, (3) economic slowdown in China, and (4) disruptions to global financial markets as a result of unexpected changes in monetary policy direction in major developed economies.

Resilience of the recovery will be determined by vaccine efficacy, a rebound in private consumption, policy supports, and FDI

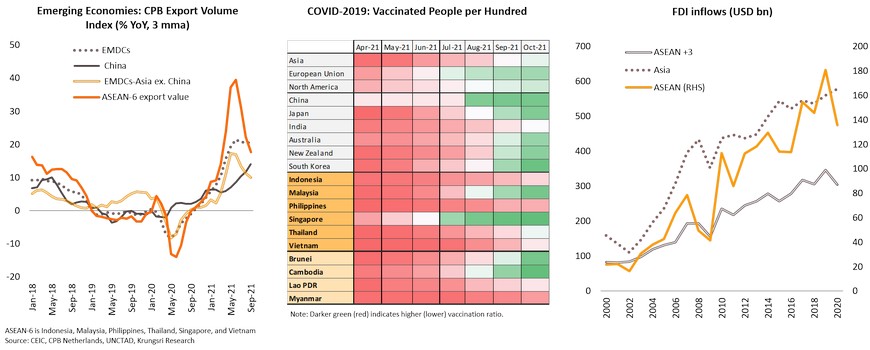

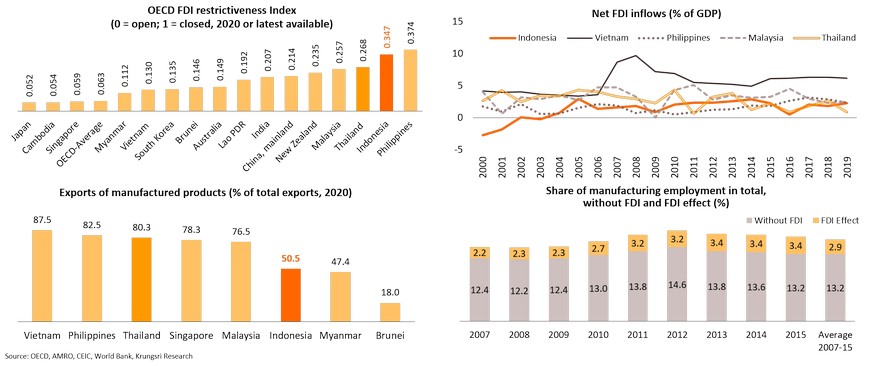

On the back of the global economic recovery which has so far fueled external demand for ASEAN exports, the resilience of the ongoing recovery in the 10-nation bloc will hinge on the efficacy of vaccines deployed, a pickup of domestic consumption, sufficient policy supports, and inward FDI to boost the export-oriented manufacturing sector. While there is a delay in vaccination rollout, the pace of inoculation is catching up with that in other regions. In addition, we are optimistic that FDI inflows to ASEAN will rebound supported by a cyclical pickup in global demand, supply chain diversification, structural reforms across the region, and regional trade agreements such as RCEP and CPTEPP.

Consumption should gradually rebound along with higher vaccination rates, and easing mobility restrictions and other containment measures

The gradual reopening of the economy and easing containment measures following the recent wave started in the beginning of 2H 2021 against a backdrop of faster vaccination rollout would support further normalization of private consumption in 2022. Consumption makes up the lion’s share of ASEAN members’ GDP, particularly the Philippines, Laos, Cambodia, and Vietnam, where the share of final consumption in GDP is more than 50%. Compared to AEs such as the US, Japan, and the EU, we expect a strong and resilient rebound in private consumption in ASEAN region in 2H 2022 when vaccination coverage reaches at least 80% of the population.

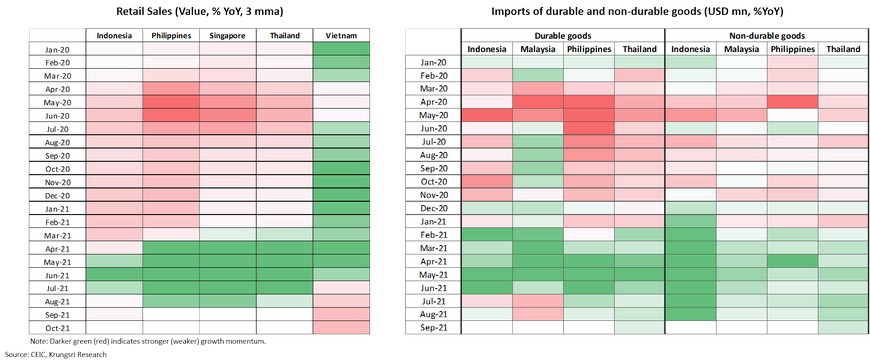

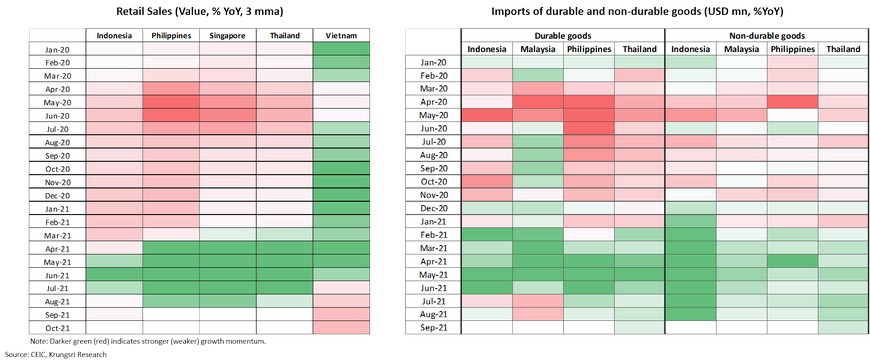

The rebound of retail sales and imports of consumer goods figures confirms the normalization of domestic consumption

The rebound of retail sales and imports of consumer goods - both durable and non-durables - over the past months suggest consumption is recovering. The pace should be more resilient as consumer confidence has turned positive across major ASEAN economies such as Indonesia, Thailand, Singapore and the Philippines, supported by rising vaccination rates, which will further drive consumption.

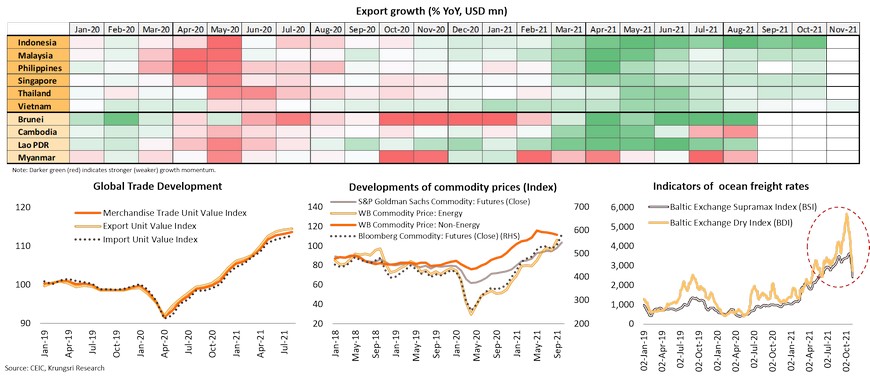

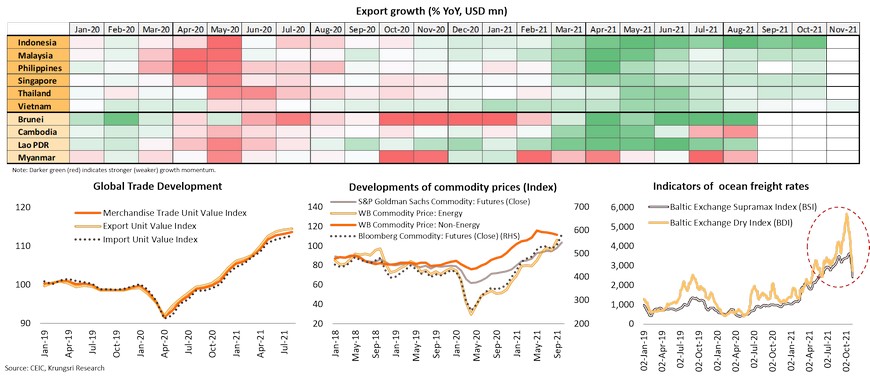

Exports remain a crucial tailwind to support ongoing normalization of economic activity in ASEAN

In 2022, ASEAN exports should continue to benefit from the global economic recovery. Following a slump in 2020, export growth has reversed to expand strongly, partly owing to a low base. Looking ahead, economic normalization in AEs, a pickup in global trade, and successful containment of the outbreak across the region, are expected to support export growth. Commodity exporters such as Indonesia and Malaysia should benefit from the recent surge in commodity prices. In addition, based on latest trends for freight rates, headwinds to exports, including soaring freight costs and shortage of container shipping capacity, are expected to be gradually resolved.

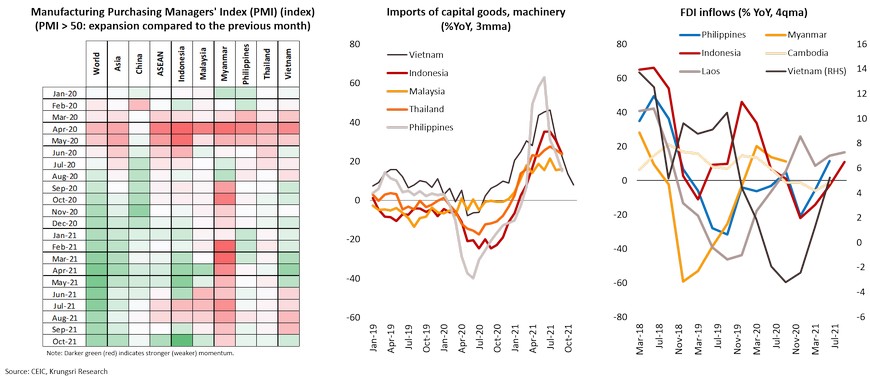

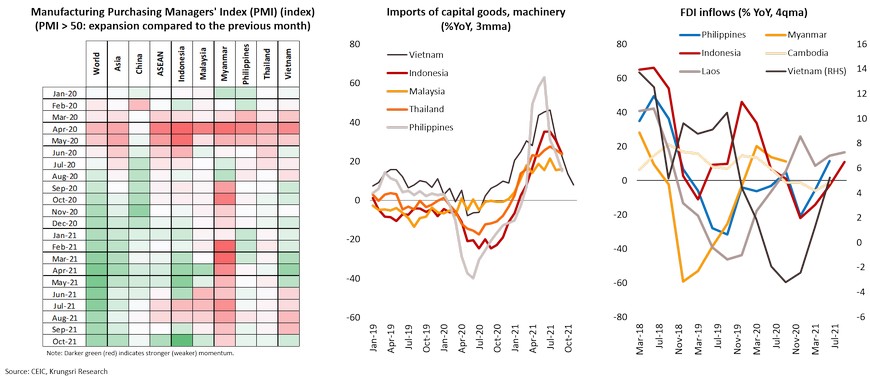

Inward FDI will rebound and continue to drive the export-oriented manufacturing sector and kick-start the next domestic investment cycle

Based on the latest PMI data, manufacturing activity appears to have normalized following the successful containments of the COVID-19 outbreak, particularly in Malaysia and Vietnam. In addition, other indicators such as imports of capital goods and inward FDI figures also point to a resumption of production. However, it remains challenging to achieve full normalization; for example, the pandemic has created labor shortage in Vietnam.

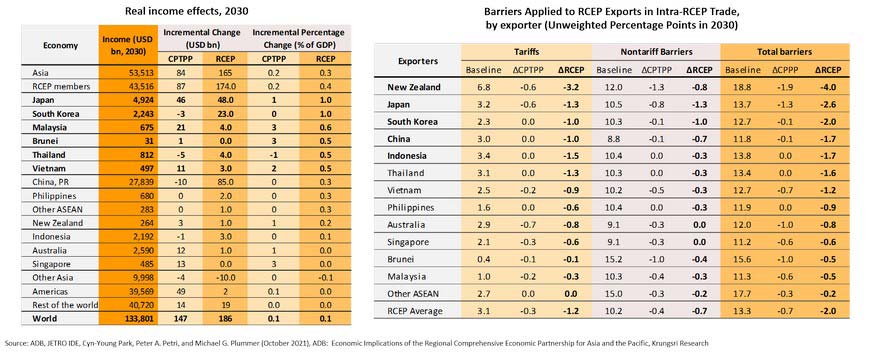

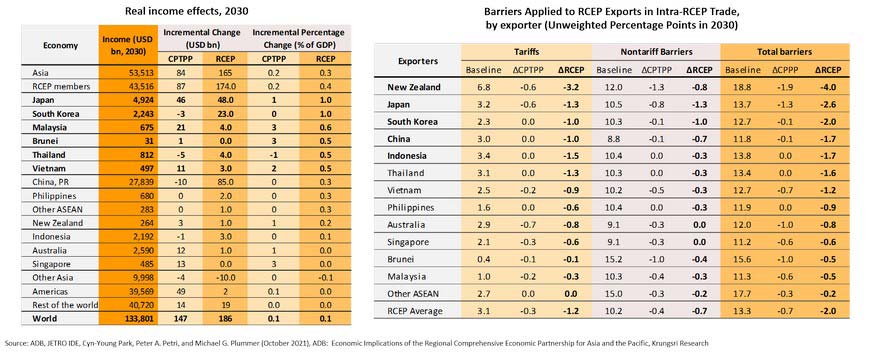

RCEP to be effective in January 2022 could be another tailwind for growth as it could be a key magnet to attract FDI and boost regional trade and investment

The effectiveness of the Regional Comprehensive Economic Partnership (RCEP), which will start in January 2022, would provide a significant boost to growth, trade, and investment for RCEP members that already ratified the trade pact. The pact targets to reduce tariffs on 90% of goods traded between the member countries within 10 years of implementation, by 2030. So, the agreement will lead to a substantial increase in real GDP in member countries like Japan, South Korea, and Malaysia as most tariff and non-tariff barriers will be eliminated over the next 10 years, according to a study by the ADB. In addition, with common rules of origin and lower trade barriers, this would deepen regional supply chain linkages as intra-regional trade in intermediate goods is expected to double in the periods ahead.

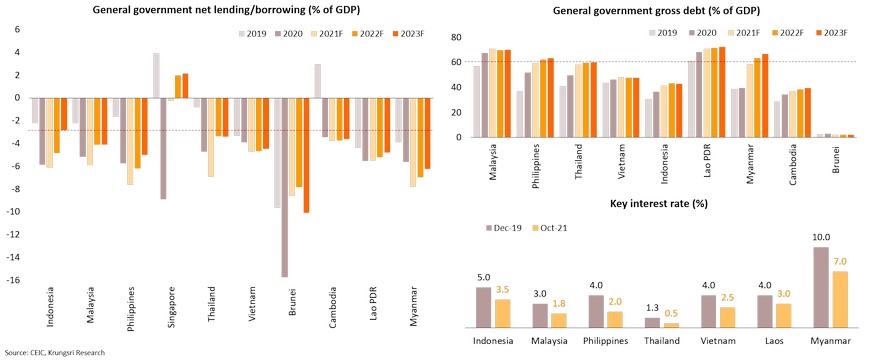

Macroeconomic policy will remain accommodative in 2022 to nurture ongoing recovery

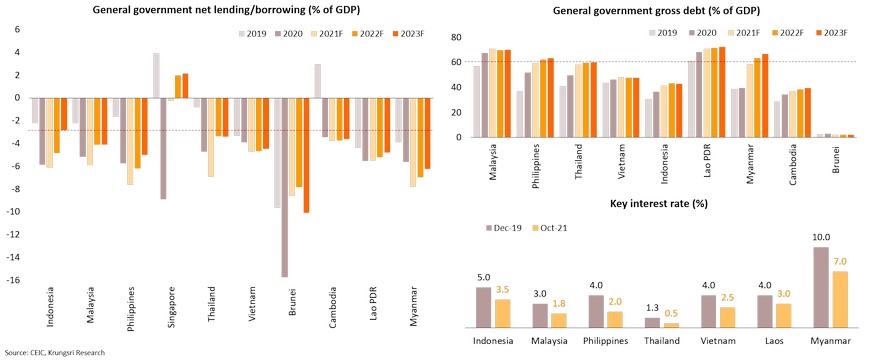

We expect macro policies to remain accommodative into 2022 as priorities of policymakers across ASEAN are to revive economic growth and exit the lingering pandemic-induced recession. Government budget deficit figures in 2022 will be exceptionally large in Indonesia, Malaysia, the Philippines, as well as in CLMV economies. And, where economic circumstances allow, we expect most central banks in the region to maintain an accommodative policy stance – low policy rates – to nurture the recovery into 2022 as the fiscal space is reaching its limits.

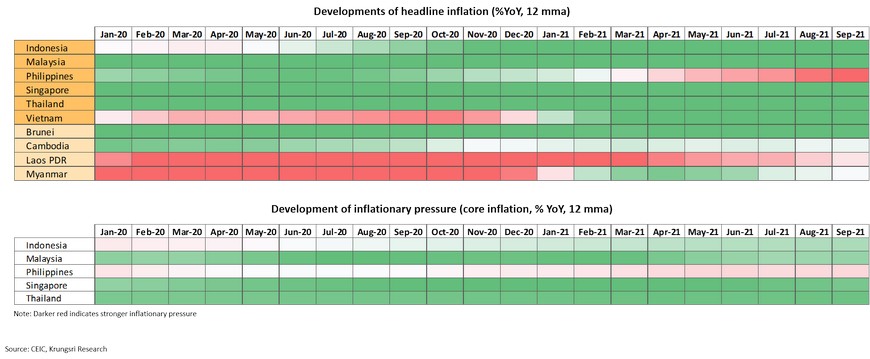

Muted inflationary pressure would allow ASEAN central banks to focus on steering monetary policy to reinvigorate growth

Weak inflationary pressures driven primarily by anemic domestic demand triggered by the pandemic and the slack in labor markets in most ASEAN economies, would allow most central banks in the region to keep interest rates low throughout 2022 as their priorities shift to supporting a sustainable recovery. In the Philippines, despite the recent uptick in headline inflation rate, it is transitory due to weak core inflation and headline inflation should revert to the central bank’s target of 2-4% in 2022.

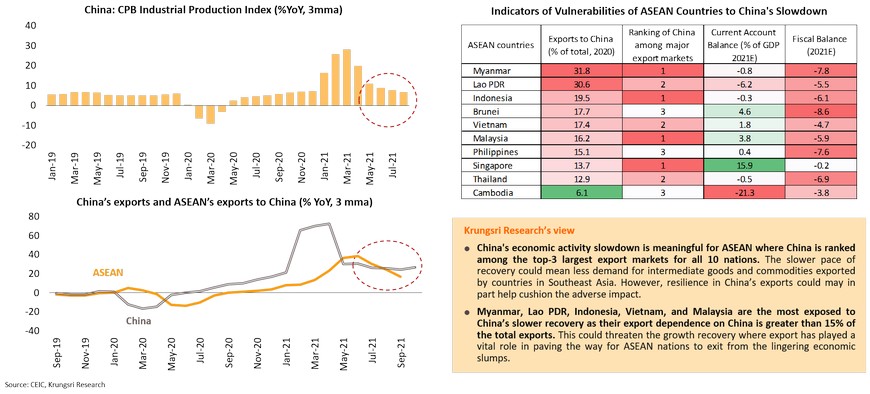

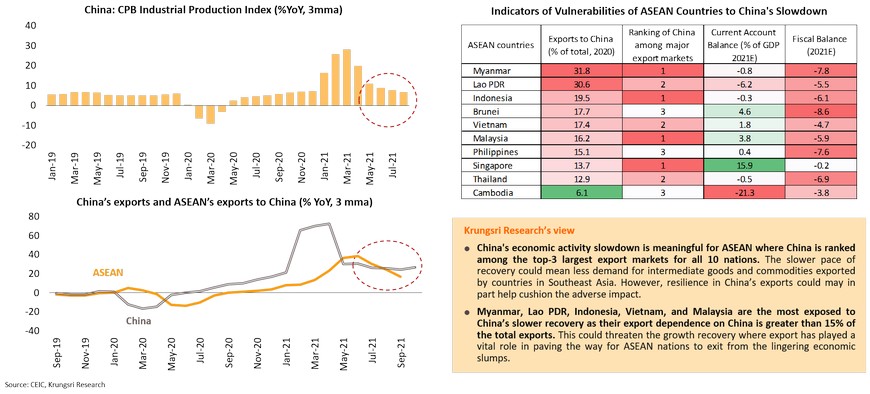

China’s slowdown could be a headwind for ASEAN exports

China’s economic activity slowdown triggered by a slump in the property market, disruptions to industrial production due to power shortages, and weak retail sales due to a zero-COVID policy to contain local outbreaks, could have repercussions for ASEAN exports. Particularly, this could have a large impact on exports of final and some intermediate products which account for a substantial share of total exports to China

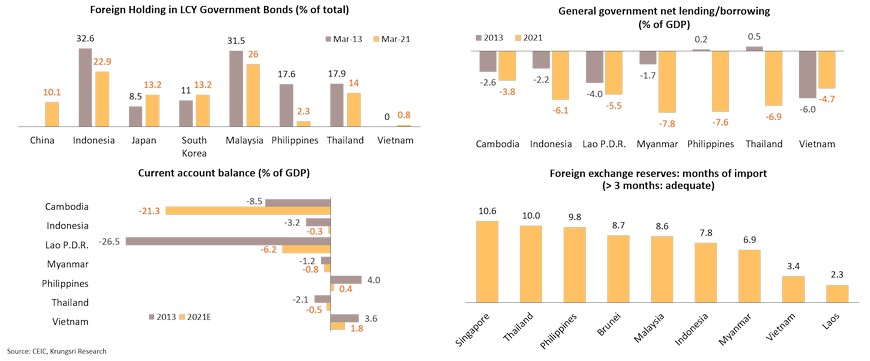

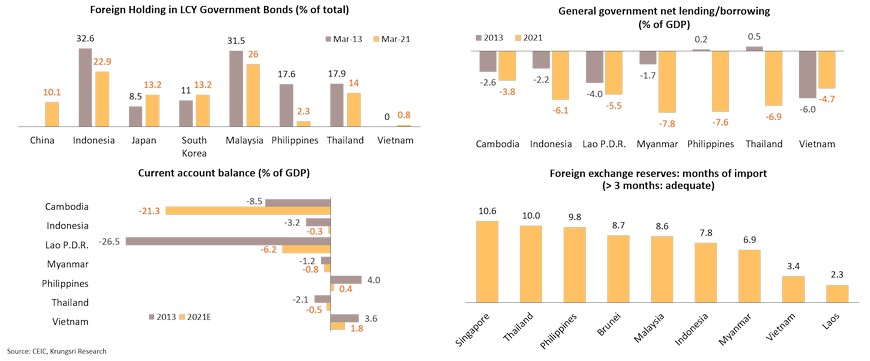

Policy normalization by US Fed poses challenges to ASEAN but the region is less vulnerable this time

The Federal Reserve is planning to normalize its policy with a forward guidance given the sustainable recovery. However, if there is any surprises in monetary policy tightening due to unexpected factors, including mounting inflationary pressure and higher inflation expectation, it could trigger sudden capital outflows and external disruption in some ASEAN countries including Malaysia and Indonesia where foreign holding of local currency government bonds is relatively high. However, ASEAN countries are now in a better position to weather disruptions and volatilities in the global financial markets given smaller share of foreign holding of local currency (LCY) government bonds, narrower current account deficits, and adequate foreign exchange reserves.

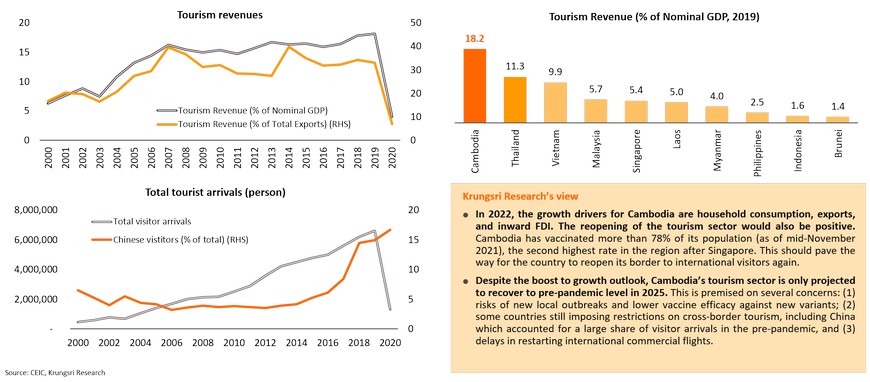

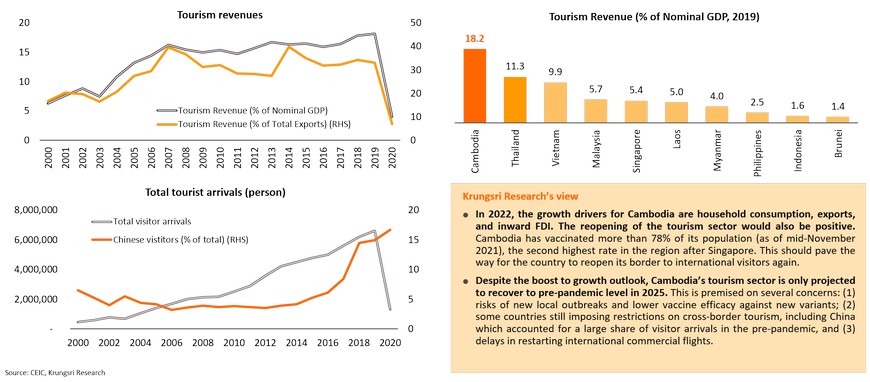

Cambodia: Making efforts to reopen tourism sector

The tourism sector has been one of the key GDP drivers in Cambodia, in addition to export of garments, construction, and FDI. Tourism revenue reached 18.2% of GDP in 2019, the highest among ASEAN peers. However, the pandemic has prompted restrictions on cross-border travel since 2020, which caused tourism revenues and visitor arrivals to drop. In mid-November, the government announced plans for quarantine-free entry for fully-vaccinated travelers to restore the country’s tourism sector and growth. This will be implemented sooner than the previous plan to start in early 2022.

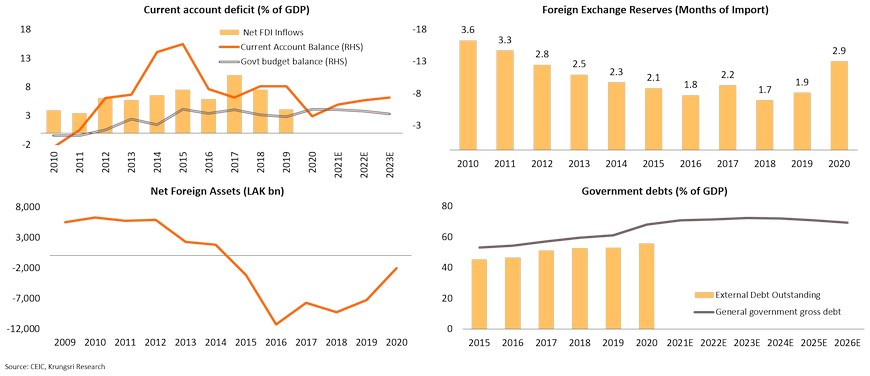

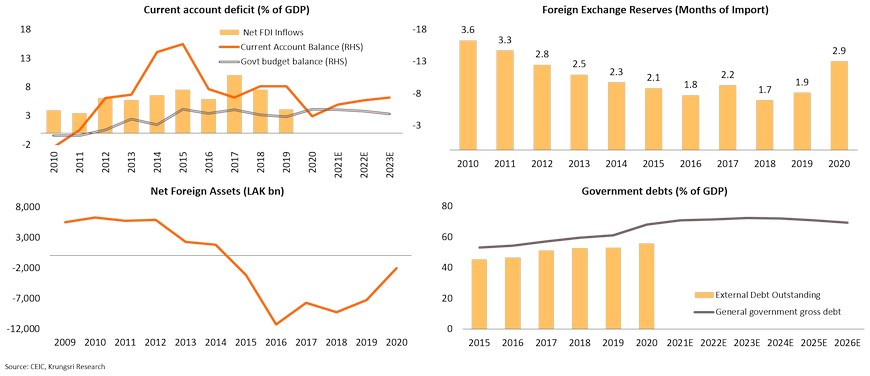

Lao PDR: Managing external instability and other headwinds to growth

Growth is expected to accelerate to 4.2% in 2022 supported by exports, inward FDI, a pickup in domestic demand, and positive spillover from the opening of the China-Lao railway link. However, there are still challenges and headwinds to growth in 2022. The country continues to face external instability as annual external debts to services remain high amid inadequate foreign exchange reserves and a weak currency. In addition, the government’s plan to pursue fiscal consolidation to reduce public debt to 64.5% by 2023 from more than 70% currently, could hinder growth. Coupled with a relatively low vaccination rate by regional standards (38% as of mid-November) and the recent surge in new cases, the reopening of the economy and cross-border tourism could be delayed.

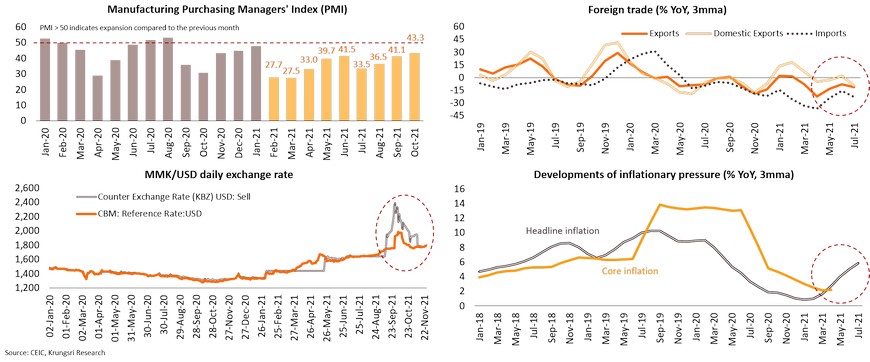

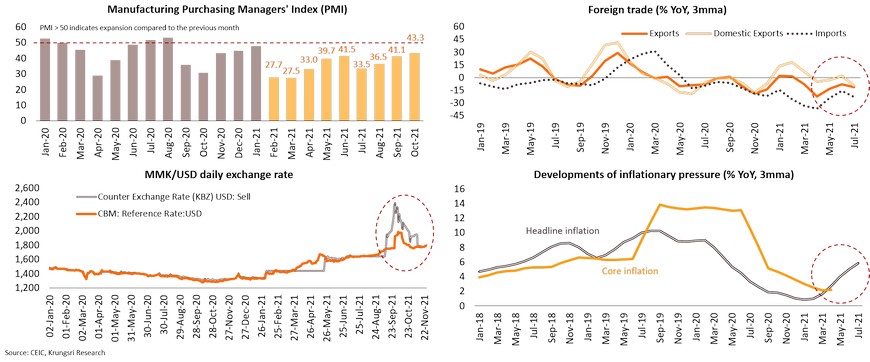

Myanmar: Another year of political-induced recession

Myanmar continues to face multiple headwinds to growth in 2022, including the after-effects of political unrest, sporadic COVID-19 outbreaks, and a weak economy. We expect growth to remain in negative territory, a contraction of 0.1% following a deep recession in 2021 (-18%), projected by the IMF. In addition to the adverse impact of the pandemic on the economy, the ongoing political crisis has hurt all economic sectors severely, especially the export-oriented manufacturing sector which is a key driver of income and source of employment for local workers, as well as export revenues. The persistent political unrest and uncertainties in the political scene there has hurt the business and investment climate there and will continue to discourage inward FDI. This would have adverse impact and large implications on the country’s macroeconomic stability and long-term economic growth.

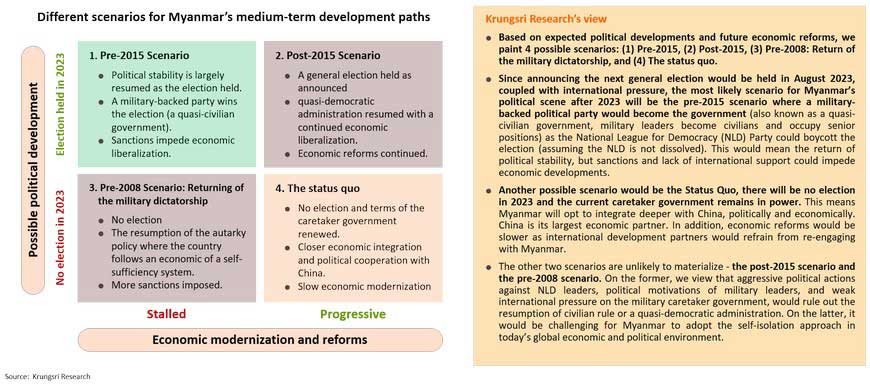

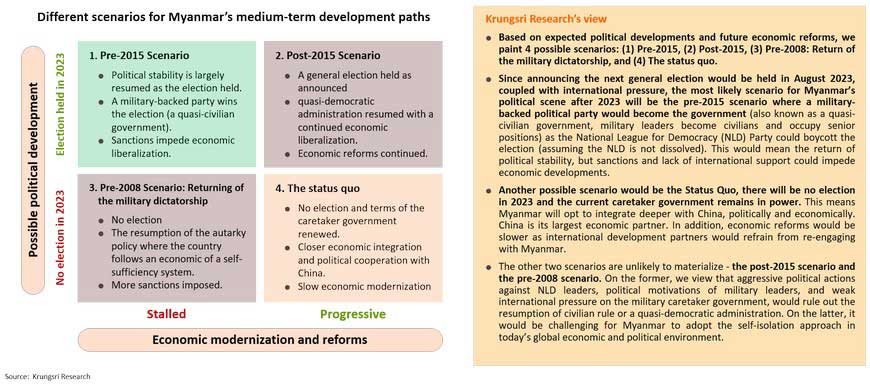

Political stability will hinge on political transition in 2023, as guided by the military leader

Political stability will be a key factor to ending the negative growth amid sporadic outbreaks. We expect political unrest to persist at least until 2023 when the next general election would be held, as announced by the caretaker government in August 2021. In the medium-term, political developments remain uncertain because of several issues in Myanmar. We paint possible scenarios based on expected political developments and future economic reforms.

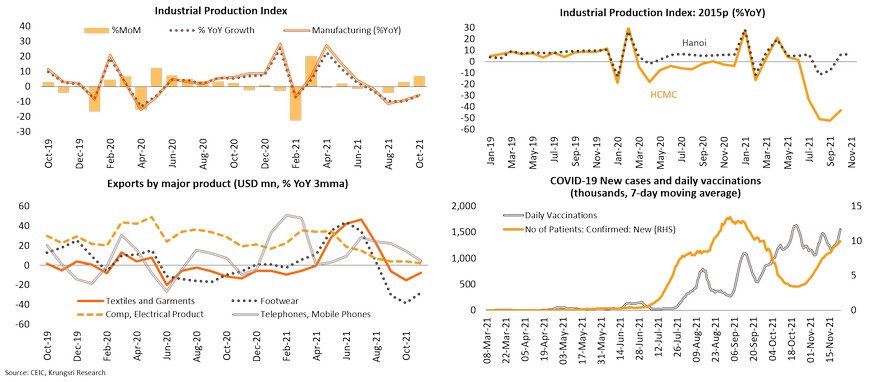

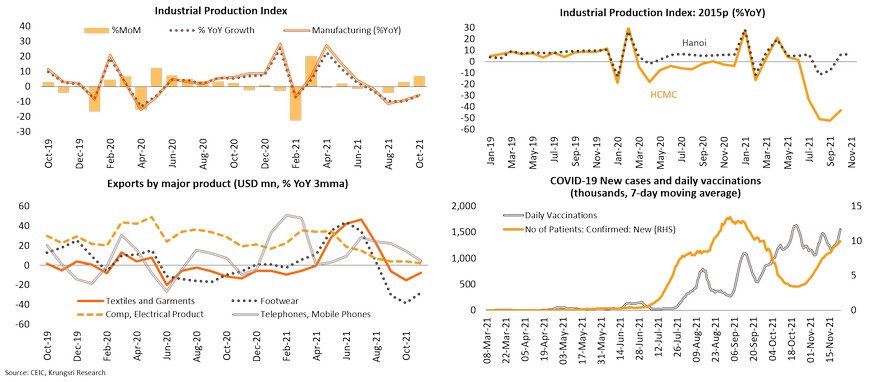

Vietnam: Rejuvenating the export-oriented manufacturing sector

The economy is expected to recover fully in 2022 and expand by 6.5% driven by exports and a rebound in domestic demand. However, in the near-term, given the gradual reopening of economic activity and easing of mobility restrictions, Vietnam is facing challenges in normalizing its export-oriented manufacturing sector due to the pandemic-induced supply chain disruptions and labor shortage following a 3-month full lockdown, especially in Ho Chi Minh City (HCMC) and nearby provinces. This has weighed on the country’s industrial production and exports. The extent of supply chain disruptions will hinge on vaccination rollout and measures to contain local outbreaks. At the current pace of deploying vaccines, only 35% of the population is fully-vaccinated (as of mid-November). This suggests industrial production would only fully recover in 2Q 2022.

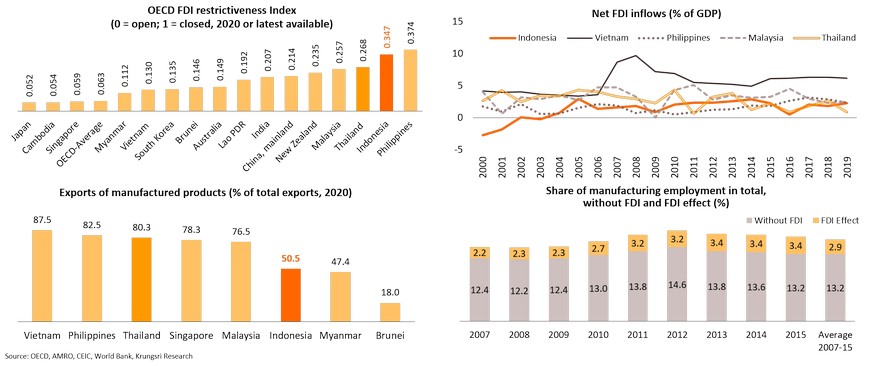

Indonesia: Implementing structural reforms to boost national competitiveness

Given the strong recovery in domestic demand and relatively high commodity prices boosting exports, we expect Indonesia’s economy to expand by 5.9% in 2022. To lift growth potential and ensure it is sustainable, policymakers guided by President Joko Widodo’s priorities are focusing on driving structural reforms. One of those is to implement the Omnibus Law on Job Creation endorsed by the parliament in October 2020 to promote competitiveness and a more conducive business environment for foreign investment, including simplifying the business licensing process and addressing labor market red tapes. By regional standards, Indonesia is not so open to FDI. Annual net FDI inflow is only around 2% of FDI, significantly lower than that of Vietnam. This could be the key reason behind a less-developed export-oriented manufacturing sector. According to the World Bank, positive spillovers from FDI significantly drive higher productivity in the the manufacturing sector and spur not only employment opportunities for the growing young population, but also industrialization.

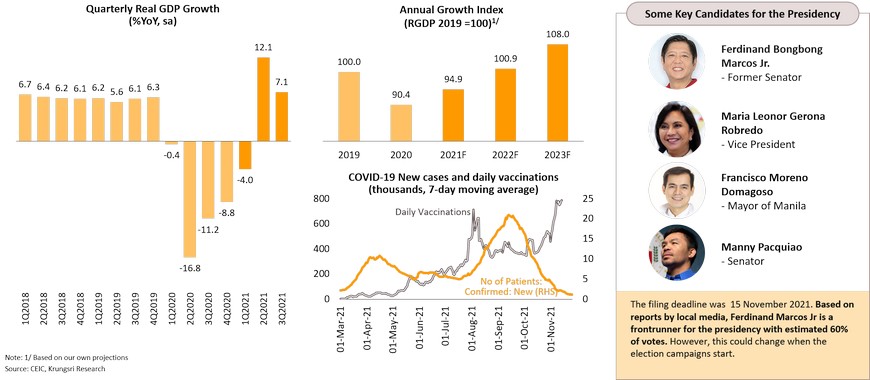

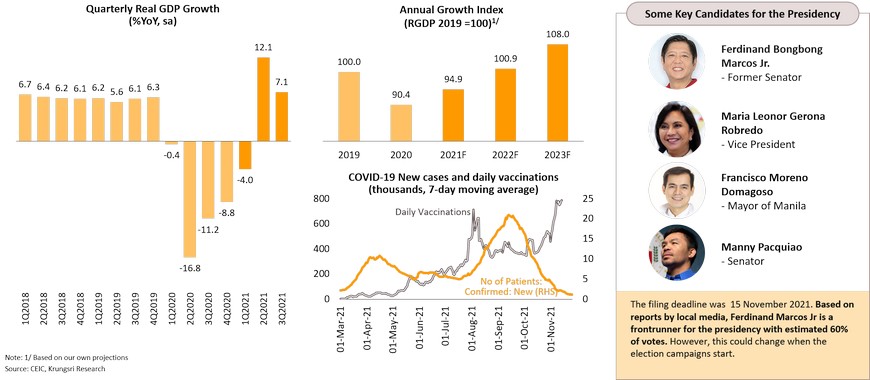

Philippines: A year of political transition

In 2022, the Philippines economy is expected to rebound strongly and expand by 6.3% (vs. the government target of 7.0% - 9.0%) boosted by domestic demand and exports, as well as tailwinds from the presidential election in May 2022. Against a backdrop of fewer daily cases and rising vaccination rate, the GDP level could surpass pre-pandemic levels in 2H 2022 following an extended pandemic-induced recession that started in 1Q 2020. On the political front, the country will hold a presidential election in May 2022. This will be another turning point for the country as the leader need to address several challenges, on both domestic and international fronts, including ensuring sustainable growth and introducing structural reforms, boosting the country’s competitiveness, and navigating the geopolitics in the South China Sea.

Key Takeaways: There will be a multi-speed recovery in ASEAN region in 2022; effective vaccine rollout would determine resilience and a sustainable path towards normalization