ASEAN: Amid fading global support and rising local challenges, core strengths are the bridge over troubled waters toward the path ahead.

-

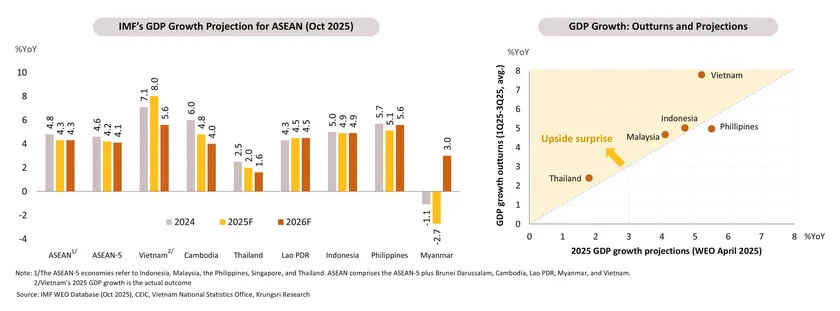

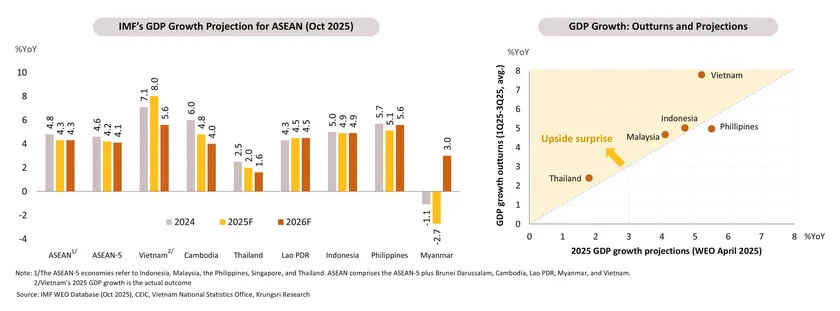

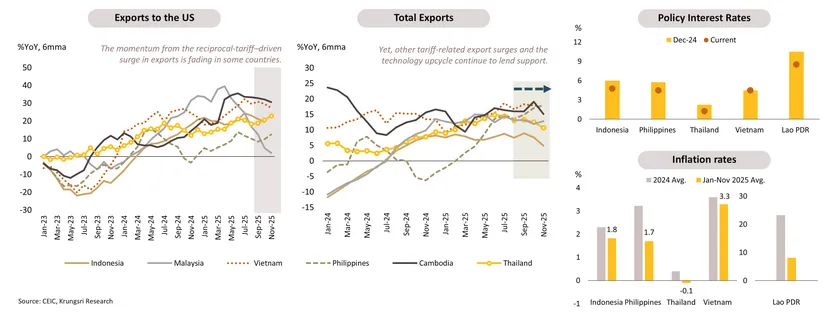

In 2025, ASEAN-5 economies are projected to grow at 4.2%. Growth has been propelled by two main forces: (i) robust export performance, driven by shipments amid tariff-related uncertainties and global technology upcycle; and (ii) resilient domestic demand supported by earlier fiscal stimulus, progressive monetary easing, and lower inflation that has supported private consumption.

-

In 2026, growth is projected to remain steady at 4.2%, with domestic demand remaining the key engine as goods export momentum is expected to fade. Cyclical supports include earlier and further monetary easing, tamed inflation, steadily growing tourism, and tech-driven tailwinds, while challenges arise from export payback effects, pressure on domestic manufacturers, and political uncertainties. Structurally, demographic advantages and deeper regional integration support FDI as a medium-term growth driver, but high debt, rising trade protectionism, and widespread scams in some countries continue to weigh on economies and may also affect the regional investment climate.

-

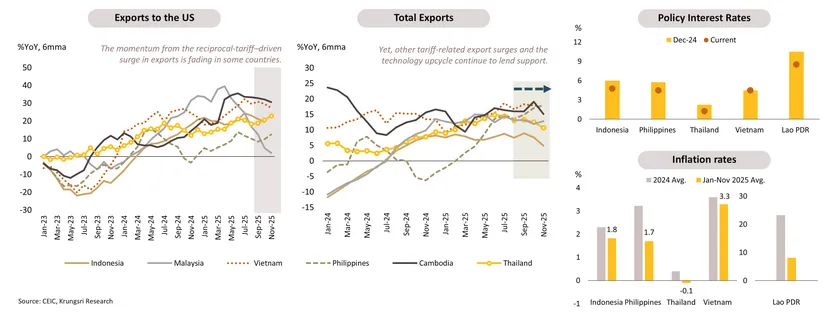

On the monetary policy front, Indonesia (BI) and the Philippines (BSP) are expected to continue monetary easing into 2026, supported by softer inflation and the need to support domestic demand. In contrast, Vietnam (SBV) is likely to keep rates on hold, balancing growth concerns against a weak VND. Meanwhile, Lao PDR (BoL) may still ease modestly, supported by a declining inflation trajectory, though the scope is limited by unsustainably high external public debt.

-

Key issues to watch in 2026 include: (i) export performance, particularly whether the technology upcycle can sustain growth amid fading front-loaded shipments and developments in U.S. reciprocal, sectoral, and potential transshipment tariffs; (ii) sub-regional conflicts, notably any escalation of the Thailand–Cambodia border conflict and the potential broader spillovers if it becomes prolonged; and (iii) country-specific issues, including the economic impact of scam-related sanctions in Cambodia and Myanmar, as well as political uncertainties in some countries, which could weigh on private-sector confidence.

-

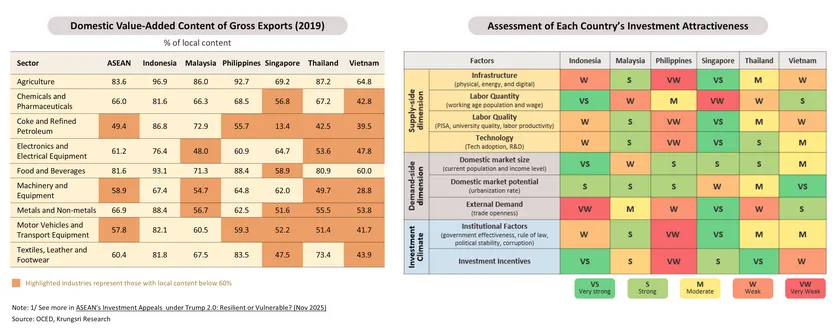

Over the medium term, FDI will remain the region’s growth engine, though rising U.S. tariffs and potentially stricter local content rules could challenge ASEAN’s cost competitiveness. Beyond costs, quality factors, such as infrastructure, skilled labor, and supply-chain depth, will play a crucial role in strengthening resilience against trade and investment uncertainties.

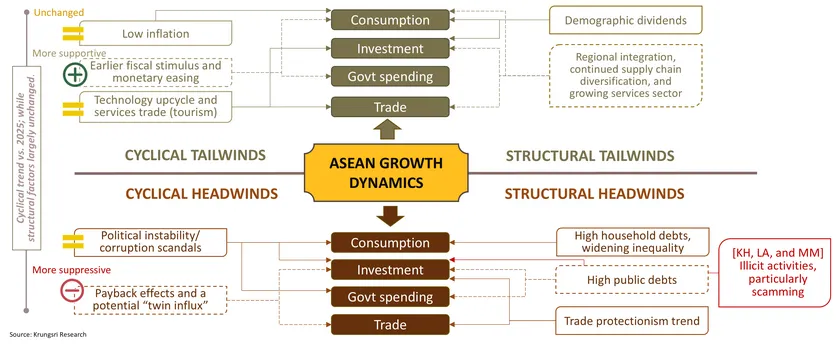

Cyclical and structural forces continue to shape ASEAN’s growth path.

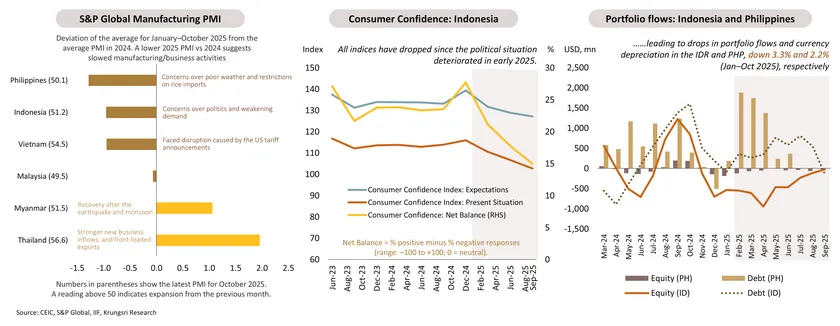

Both cyclical and structural forces shape ASEAN’s outlook. Cyclical headwinds stem from tariff-related payback effects, the risks of a surge in imports from both the US (following the trade deal) and China—the so-called “twin influx”—as well as political instability.

Cyclical tailwinds include earlier policy stimulus, lower inflation, a sustained tourism rebound, and the ongoing technology upcycle.

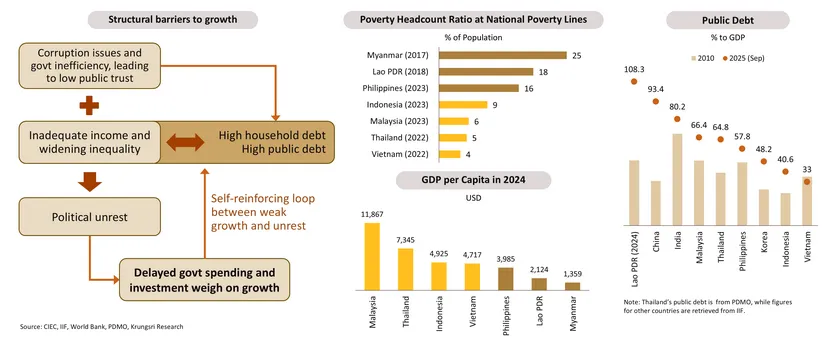

On the structural side, headwinds come from high household and public debt, while tailwinds include demographic dividends, deeper regional integration, ongoing supply chain diversification, and growth potential in the service sectors, particularly digital services.

ASEAN’s 2026 growth remains steady despite various challenges.

- ASEAN-5 growth is projected at 4.2% in 2026, steady compared with 4.2% in 2025, supported by the technology upcycle, which partly helps sustain export momentum, alongside earlier fiscal and monetary stimulus. Lower inflation will also maintain domestic activity. Compared with the IMF’s growth projection in April, real GDP outturns through 3Q25 have been stronger than expected with lower-than-assumed US reciprocal tariffs and a stronger export ramp-up.

- By country, the earlier upside surprises in GDP growth among export-oriented economies are expected to moderate, as these economies experience a payback effect following the earlier front-loading of exports. In contrast, domestically driven economies such as Indonesia and the Philippines are expected to stay relatively resilient, though momentum remains clouded by the ongoing political situation. Other economies, including Cambodia, Myanmar, and Lao PDR, are influenced by idiosyncratic factors, which will be discussed in the country-specific sections.

Tariff-driven growth gains taper; domestic demand stays the cyclical anchor.

-

In 2025, ASEAN growth is supported by two major factors: robust exports, relatively firm domestic demand driven by earlier fiscal stimulus and monetary easing, and lower inflation. Looking ahead, goods export momentum is expected to fade, while domestic demand will remain the key driver, supported by lower inflation and continued monetary easing into 2026, especially in Indonesia and the Philippines. The services exports, particularly growing tourism, will also help sustain growth.

-

Export strength so far has been driven by front-loaded shipments to the US ahead of the U.S. reciprocal tariffs implemented in August 2025. Even after the tariffs took effect, exports remained resilient but uneven, concentrated in semiconductors and electronics, reflecting the ongoing technology upcycle and precautionary shipments amid tariff-related uncertainties (transshipment and sector-specific tariffs). However, tariff-driven export gains are likely to fade, whereas regional demand and the AI investment boom (assuming it is not a bubble) will continue to support exports.

Cyclical headwinds arise from tariffs and country-specific pressures.

-

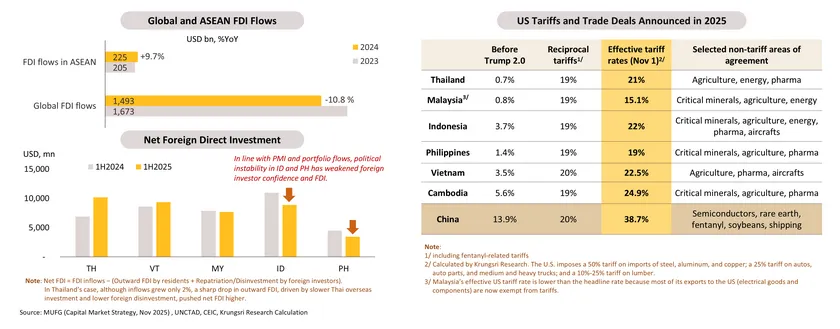

Potential cyclical drags arise from tariff-related issues and country-specific factors. On tariffs, the bilateral deal with the US on reciprocal tariffs could trigger higher imports in sensitive sectors such as agriculture and food & beverages, compounding the ongoing influx of Chinese goods. Rising competition could further weigh on domestic manufacturers and investment.

-

On country-specific factors, persistent political uncertainty remains a regional challenge, dampening confidence and delaying policy execution. In the Philippines, corruption scandals have disrupted public spending and investment, as reflected in the sharp GDP slowdown in 3Q25. In Indonesia, earlier protests, concerns over fiscal stability, and central bank independence have constrained budget allocations and weakened investor sentiment.

Structural pressures persist amid socio-economic bottlenecks

Structural challenges continue to exert cyclical pressures, creating a self-reinforcing loop that constrains ASEAN’s growth potential. In countries with higher financial access, such as Thailand, elevated household debt remains a key drag on domestic activity. In contrast, economies with low financial inclusion—as seen recently in Indonesia and the Philippines—face persistent institutional weaknesses and rising inequalities, often fueling political unrest. Except for Vietnam, most countries in the region also face high public debt or limited fiscal space. Unless these structural bottlenecks are addressed, they will continue to reinforce social and economic vulnerabilities, constraining growth across the region.

Even as tariffs dominate the headlines, FDI remains a structural support

- FDI remains a key medium-term growth driver for ASEAN. Despite the global slowdown in 2024, inflows rose 10%, led by strategic manufacturing such as semiconductors and EV components, underscoring ASEAN’s structural strengths—large domestic markets, competitive labor costs, lower effective tariffs than China’s, and improving infrastructure—under the “China+1” strategy.

- Currently, tariffs remain a pivotal factor shaping investment decisions. After several rounds of negotiations, ASEAN countries have maintained similar tariff levels, limiting potential gains from tariff arbitrage. However, with higher US tariffs on ASEAN (reciprocal, sectoral, and potential transshipment tariffs), the region’s cost advantage could erode, while ongoing trade policy uncertainty presents additional risks to long-term investment planning.

Ultimately, quality factors remain ASEAN’s key engine of growth

-

ASEAN’s investment appeal faces challenges from evolving trade policies: higher U.S. tariffs, potential U.S. transshipment tariffs, and stricter local content requirements, which could weigh on supply chain diversification and cost-competitiveness, especially in manufacturing sectors.

-

Our analysis of ASEAN’s investment attractiveness1/ shows that the region’s competitive advantages extend beyond cost factors. Quality factors, including infrastructure and logistics readiness, skilled labor, and deep supply chain integration, are critical, as they create sticky investment relationships that are resilient to trade policy volatility. While trade policies under Trump 2.0 will create headwinds, their impact will vary across ASEAN, with countries that continuously strengthen these qualitative factors best positioned to sustain their investment edge.

Cambodia: External headwinds weigh on outlook despite near-term resilience.

-

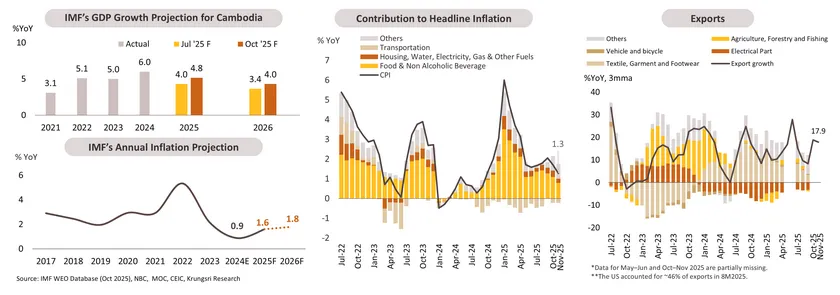

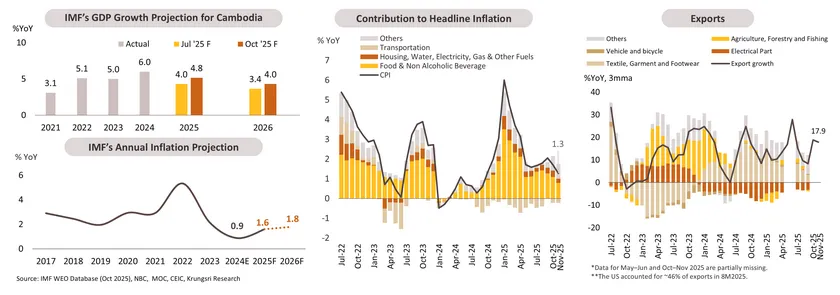

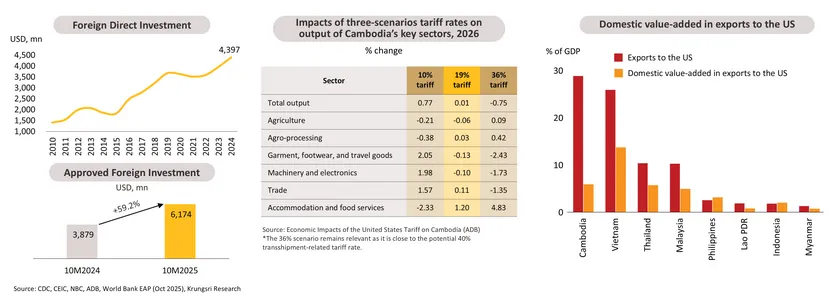

The IMF revised Cambodia’s 2025 GDP growth forecast up to 4.8% in October from 4.0%, despite external headwinds from U.S. trade tensions and border disputes with Thailand. The upward revision reflects stronger-than-expected exports (+15.2% in 10M2025), led by textiles, footwear, and agricultural products, as well as strong FDI inflows.

-

In 2026, GDP growth is expected to moderate to 4.0%, mainly driven by export payback effects. In addition, declining tourism revenues and weaker remittances—due to border tensions with Thailand—may soften household consumption. On the positive side, relatively contained inflation should help ease pressure on consumers. FDI is expected to remain a supportive engine, though inflows may become more cautious due to uncertain global trade policies and deteriorating investor sentiment following recent scamming issues and border conflicts with Thailand.

-

Inflation recently eased after the food-price volatility spike in early 2025. Although the Thailand–Cambodia border closure initially raised concerns of a price surge, inflationary pressure moderated, as Thai exporters rerouted shipments, and Chinese goods continued to flood into Cambodia. Fuel costs also remained stable as imports shifted to Singapore, where oil inflows rising 157% YoY in Jul–Oct 2025.

FDI should remain a key driver, though caution lingers.

-

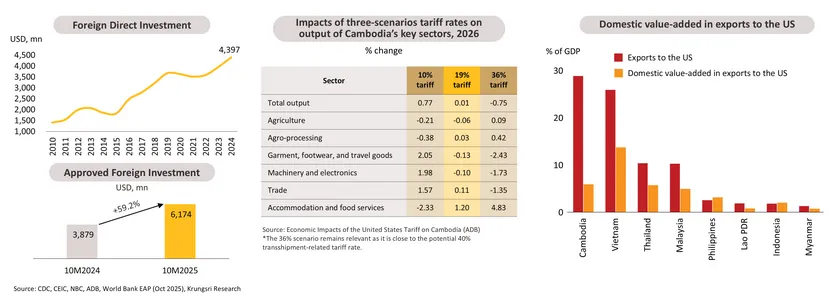

FDI remains a resilient external growth driver. Approved FDI rose 59% YoY in 10M2025, with China accounting for over half of the total. Most capital continued to flow into the industry sector, while notable approvals include the USD 1.2 billion Funan Techo Canal. Despite strong near-term inflows, prospects face rising downside risks, with uncertain trade policies, border conflicts, and scamming issues weighing on investor sentiment.

-

Regarding trade policy, the ADB notes that the 19% US tariff on Cambodian goods will have only a minimal impact on Cambodia’s exports and manufacturing activities, given that the rate is comparable to that of regional peers. However, potential transshipment tariffs remain a key risk for both FDI and exports, particularly for garments and electronic assembly, where domestic value-added is low, but export exposure to the US is high.

-

The trade deal with the US to lower tariffs not only eases trade barriers for US goods but also includes renewed defense cooperation, reflecting US efforts to counterbalance China’s growing influence in Cambodia.

Scam sanctions and the border dispute are key risks to the economy and stability.

-

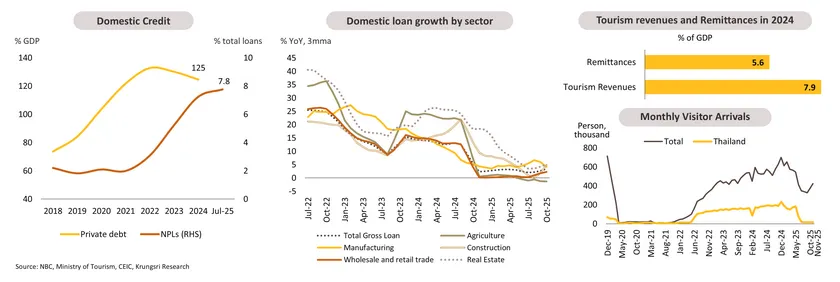

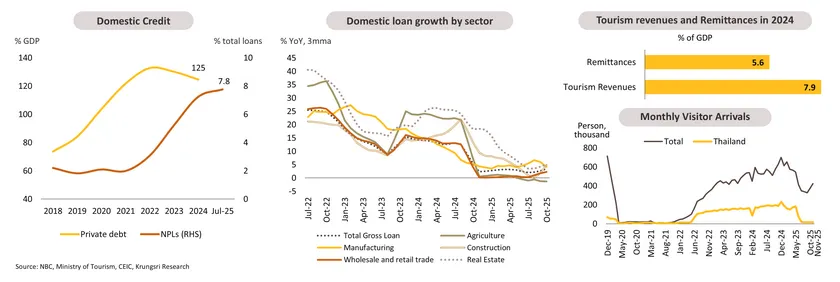

Domestic financial sector stability remains fragile. Credit growth has decelerated to a historic low as (i) banks have tightened lending standards; (ii) broad-based demand has stayed weak; and (iii) NPLs have risen to a record high of 7.8% at end-July 2025 due to overextended pre-pandemic lending to tourism and real estate. Continued weakness in housing and real estate markets has raised risks for developers and could further amplify credit stress, although capital buffers remain adequate.

-

Recent scam-related sanctions by the US and the UK have not only dampened investor sentiment but also compounded financial stability risks. The seizure of digital assets linked to a major conglomerate with banking ties sparked bank-run concerns, highlighting fragile public confidence. Tighter correspondent banking requirements and enhanced compliance checks could add pressure on the banking sector.

-

Besides the scamming issues, another key challenge for the economy and overall stability is the ongoing border dispute with Thailand, which shows no sign of near-term resolution and has major impacts on several fronts. Cross-border trade has collapsed, monthly visitor arrivals have fallen nearly -40% YoY since July 2025, and nearly one million Cambodian workers have returned from Thailand, leading to a collapse in remittance inflows (which account for 4–6% of GDP). These developments have pressured household incomes and overall domestic activity, even feeding back into the cycle of stagnant credit growth.

Lao PDR: Outlook cyclically improves, with external demand supporting growth.

-

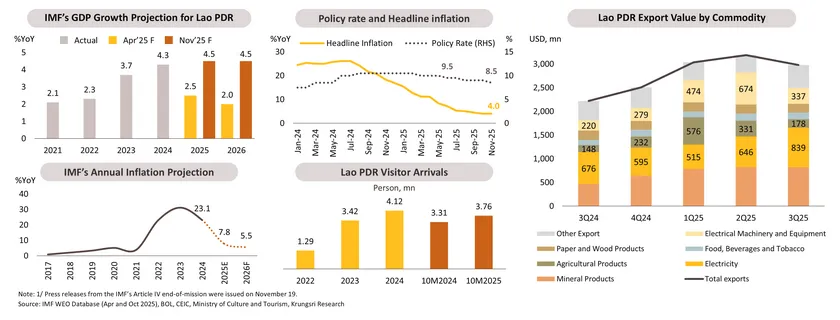

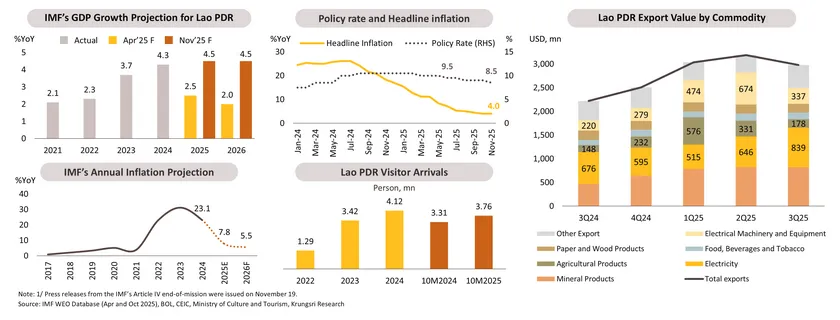

The IMF revised up the GDP growth to 4.5% in 2025-20261/, mainly driven by robust external demand. Exports accelerated in 1H25 with electricity and mineral products remaining key exports. In addition, exports of electrical equipment and agricultural products, particularly to China, surged due to robust Chinese demand and better logistics through the Lao-China high-speed train. However, exports had decelerated in 3Q25 as reciprocal tariffs started to take effect. Tourism is another important external driver, where tourist arrivals in 10M2025 rose by 13% YoY.

-

Regarding internal drivers, easing inflation and policy rate cuts have eased pressure on domestic activities, albeit offering only limited support. This is because countercyclical fiscal policy (the VAT rate increase) and persistently high living costs continue to keep domestic demand structurally weak and less self-resilient compared with ASEAN peers. Thus, in 2026, external drivers and expected fiscal support, despite the consolidation plan, would nurture cyclical growth.

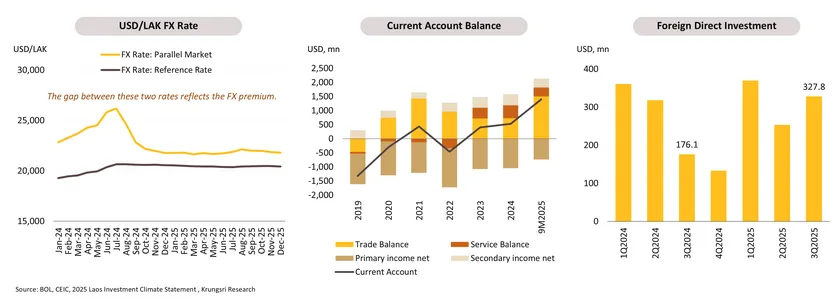

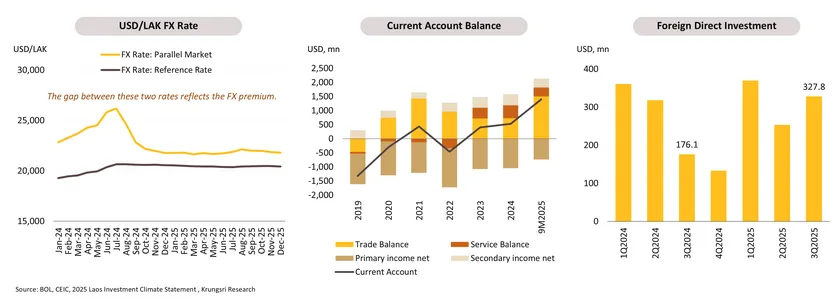

External tailwinds and policy supports help stabilize the currency.

-

LAK stability has improved significantly, with the average YTD FX premium in 2025 falling to 6.8% from 17.4% a year earlier. This indicates easing foreign-currency shortages, and driven by a stronger current account, rising FDI inflows, and continued policy support. The current account posted a solid trade and services surplus. Rising FDI has also boosted foreign-currency inflows, with total 9M2025 FDI increasing 11.1% YoY, mainly in mining, infrastructure, construction, and hydropower projects.

-

Policy support has further reinforced FX stability through i) capital-flow measures, including continued enforcement of strict repatriation requirements; ii) an improved fiscal position (see next page); and iii) still-tight monetary conditions.

-

Given Laos’ vulnerability to high external debt, FX control measures are expected to remain in place to support LAK stability. If depreciation pressures stay contained, there may be room for further policy rate cuts. However, the room for easing monetary policy is likely limited by expected fiscal support measures and the ongoing revival in economic activity.

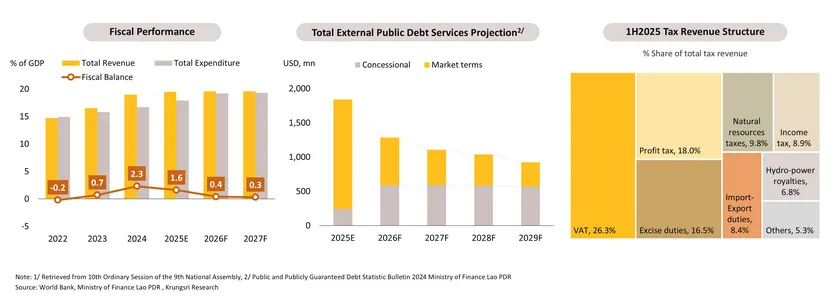

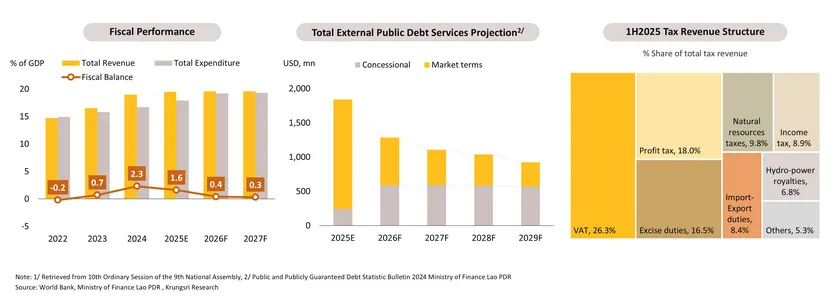

Fiscal and financial stability partly improved but remains structurally fragile.

- An improved fiscal position has also helped stabilize the currency by raising government revenue, both tax and non-tax. With tax revenue accounting for 87% of the total revenue, the VAT rate increase to 10% and fuel excise tax were the key sources of tax revenue in 1H2025. Stronger fiscal condition is expected to allow a more expansionary fiscal stance in 2026, focusing on the prioritized policies, including infrastructure, social protection, and human capital development to support the economy.

- Beyond currency stabilization, total public and publicly guaranteed (PPG) debt has declined— representing a significant development for financial stability. Lao officials announced on Nov 10 that the government has successfully lowered PPG debt to about 88% of GDP, down from 112% in 20221/, following ongoing debt-service negotiations, loan restructuring, and restrictions on ineffective new loans. Public debt service is forecasted to continue decreasing throughout 2025–2029.

- While policy efforts to stabilize the currency and improve fiscal policy show commitment to addressing financial instability, high external dependence, elevated debt, and limited loan restructuring transparency still leave the country vulnerable to external shocks.

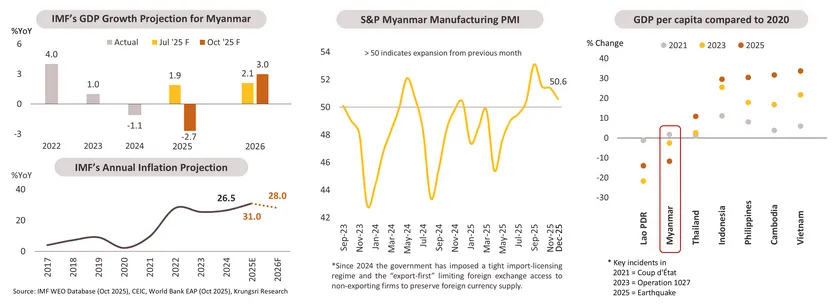

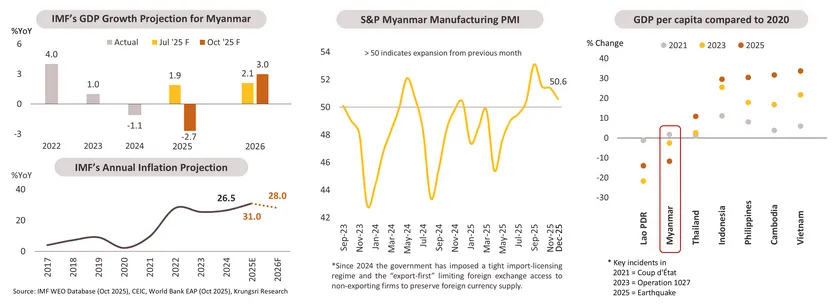

Myanmar: Internal conflicts remain the core drag on outlook.

-

The IMF sharply revised down Myanmar’s 2025 GDP growth down to -2.7% in October as ongoing conflict and the March 2025 earthquake continue to disrupt logistics, infrastructure, and production. Transport bottlenecks and shortages of materials and labor are constraining manufacturing and agricultural distribution. As a result, exports are unlikely to meaningfully support growth despite government efforts under the “export-first policy.”

-

In 2026, GDP growth is expected to rebound to 3.0%, post-earthquake reconstruction supporting industrial and services activities. This is partly reflected in forward-looking manufacturing PMI readings, which continue to stay above 50, but input shortages and ongoing political instability will keep the recovery modest and uneven.

-

Inflation is expected to remain extremely high, with the IMF projecting 31% in 2025 and 28% in 2026, further eroding households’ real purchasing power.

-

Internal conflicts remain a structural drag on the economy, as supply chain disruptions from the 2021 coup, escalating ethnic armed conflict, and the recent earthquake—combined with sanctions and tighter trade policies*—have raised input costs, pushed up living expenses, and driven GDP per capita below pre-coup levels.

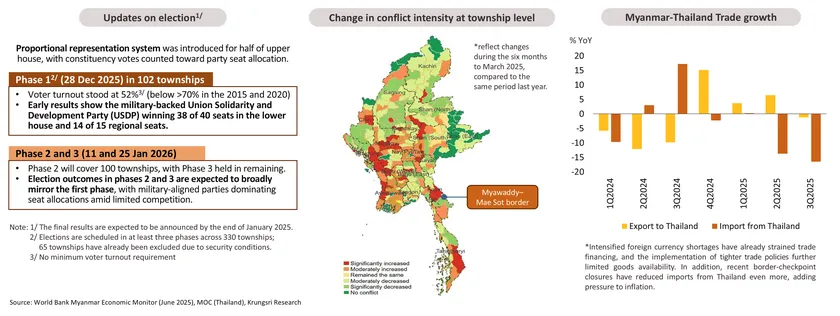

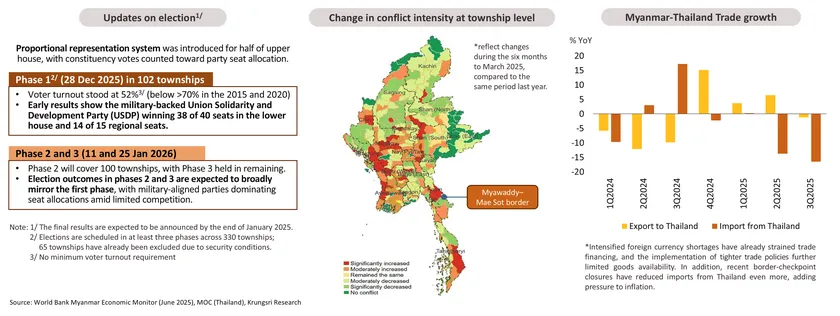

Despite election, political conflict may continue to disrupt trade and business activity.

-

Even if the military completes the planned election phases, the status quo of conflict is likely to persist. External pressures, such as weak trade and investment flows and ongoing FX constraints, are unlikely to ease, as international acceptance of the new government will remain difficult given concerns over fairness and inclusivity. The UN has explicitly described the planned vote as a “charade,” reinforcing the view that political legitimacy will not be restored.

-

As ethnic armed conflict is expected to continue, particularly in contested border townships where fighting escalated before the vote, the collapse in cross-border trade, disrupted domestic logistics, and limited market access are unlikely to be resolved. Moreover, the closure of the Myawaddy–Mae Sot border crossing—Myanmar’s highest-value import channel from Thailand—under the junta’s crackdown on illegal trade financing for ethnic armed groups has further strained supply chains, adding upward pressure on inflation.

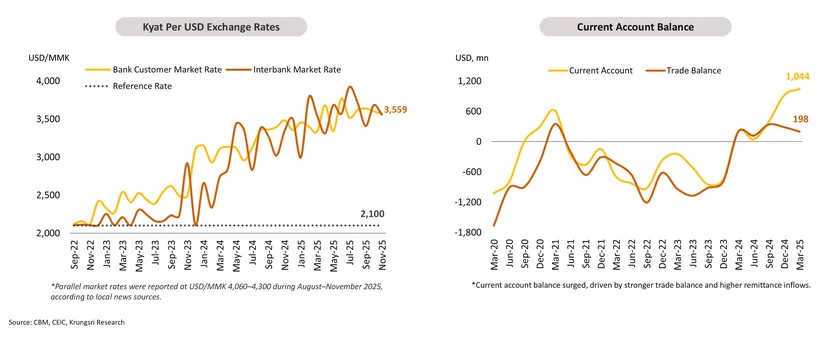

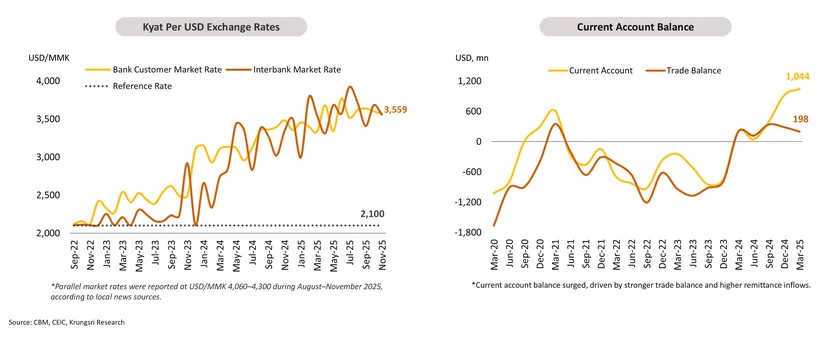

Kyat strength is unsustainable despite intervention and tighter FX control.

-

The recent appreciation of the kyat reflects heavy central bank intervention and stricter import-related FX controls, rather than genuine market strength. Under the export-first policy—which requires proof of export earnings to access foreign currency for imports—foreign currency access is effectively limited to exporters, leaving importers facing severe shortages of inputs and finished goods. This makes the kyat appear stronger than the underlying fundamentals and has resulted in significant operational and financial disruptions for businesses engaging with Myanmar.

-

Such restrictive policies and frequent market interventions are likely to continue in the near term, but they will worsen foreign currency shortages, elevate inflation, and deepen market inefficiencies. The widening gap between official and market rates is likely to expand further. As a result, these policies cannot deliver sustainable kyat stability. Instead, they will further deter foreign direct investment and complicate trade financing, constraining Myanmar’s economic recovery and stability.

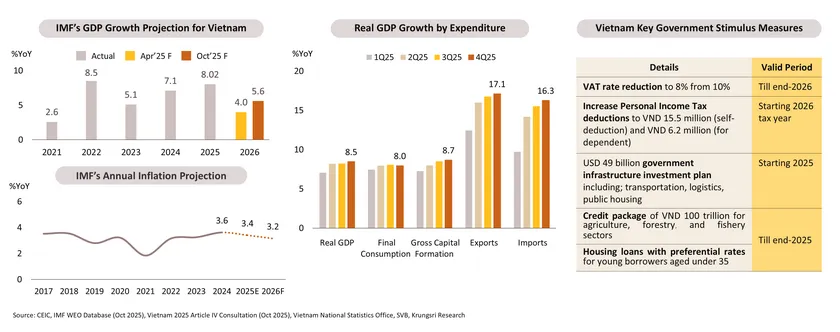

Vietnam: maintains strong economic growth, but risks of export payback loom.

-

Vietnam’s 2025 GDP growth came in at 8.0%, well above the IMF’s October forecast of 6.5%, making it the fastest-growing economy in the region. A higher-than-expected GDP outturn, driven by robust export growth of 17.1%. Domestic demand has also been a key driver of growth. Private consumption has been supported by contained inflation and government stimulus measures, while public investment in infrastructure has also promoted private investment.

-

In 2026, GDP is expected to grow by 5.6%. Export growth is likely to slow as the ramp-up phase fades, amid the implementation of reciprocal and sector-specific tariffs and rising uncertainties related to transshipment (see p.8). Even if external demand weakens, domestic demand will continue to support growth, underpinned by existing positive factors and, on the structural front, a growing middle class and sustained FDI inflows.

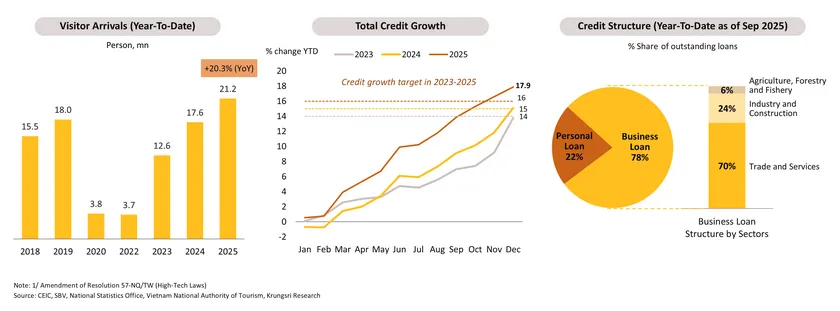

Robust domestic activity underscores Vietnam’s resilient growth.

-

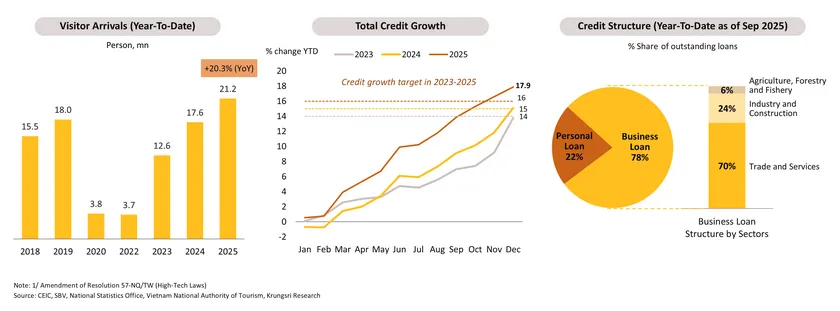

Besides internal drivers, strong domestic consumption is also supported by surging tourism. Visitor arrivals in 2025 rose 20.3% YoY, surpassed pre-COVID levels. Continuous growth in tourism has helped boost tourism-related retail sales, reinforcing domestic activity. In 2026, tourism is expected to continue expanding.

-

Another driver of domestic activity is strong private investment, reflected in 2025 credit growth at 17.9%, exceeding the initial target at 16%. As of September 2025, credit is concentrated in manufacturing and business activities, accounting for 78% of total outstanding loans across trade and services, industry, and construction. This expansion is supported by public investment and government measures to revive the real estate sector. Solid FDI inflows further reinforce private investment (see next page). Despite tariff-related uncertainties for exports, the government aims to raise local content through incentives for high-tech firms with over 30% domestic equity and core technology transfer1/ that will be effective from July 1, 2026, alongside a USD 50 billion infrastructure plan to strengthen the investment climate.

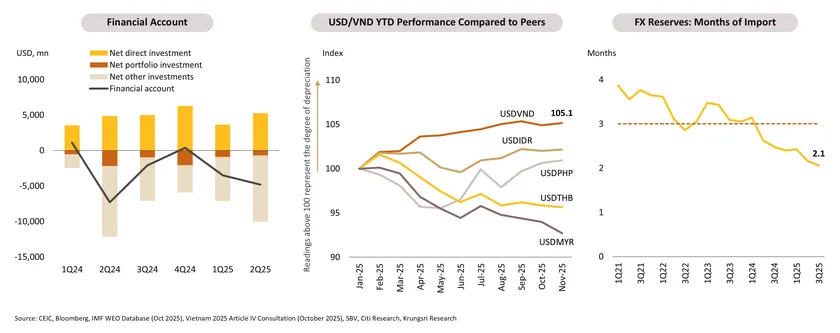

Despite growing FDI and a trade surplus, financial outflows have weakened VND.

-

Vietnam’s financial stability issue is now concentrated in the external sector, with the VND down around -5% (Jan-Nov 25), the weakest currency in the region. Solid net FDI and trade inflows were offset by continuous financial outflows, particularly external debt repayment, leading to depleting FX reserves and depreciation of VND. Currently, FX reserves cover only 2.1 months of imports as of Q32025, limiting the room for policy easing.

-

The domestic financial sector remains broadly stable, though risks persist. While banks’ NPLs have edged down from its peak of 5.9% in September 2023 to 5.3% in March 2025, the Vietnamese banking sector’s CAR is the lowest in the region, though still above the 8% requirement. Also, uncertainties in the corporate bond market remain high, particularly in real estate. The IMF estimates scheduled maturities of real estate bonds at USD 4.9 billion in 2026, up from around 4.6 billion in 2025.

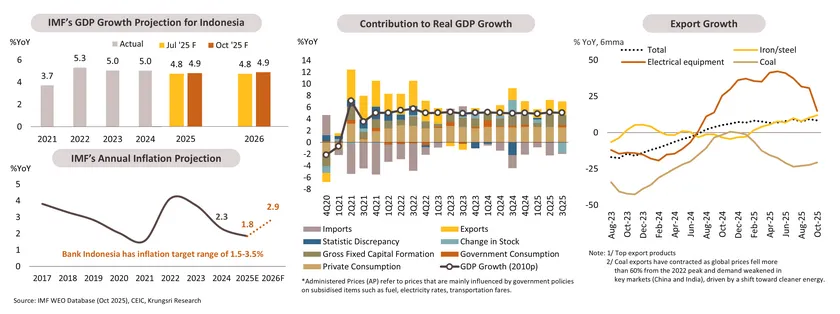

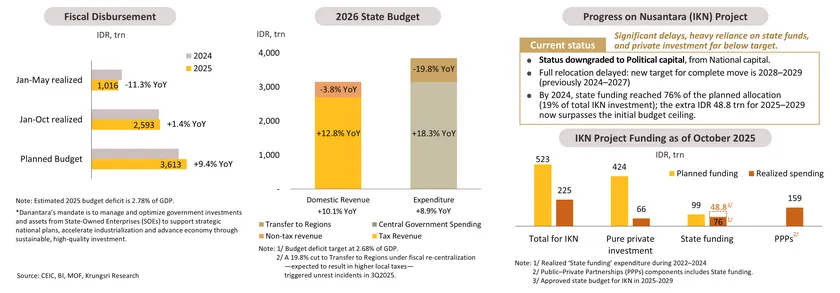

Indonesia: Resilient domestic demand; policy execution is a risk.

-

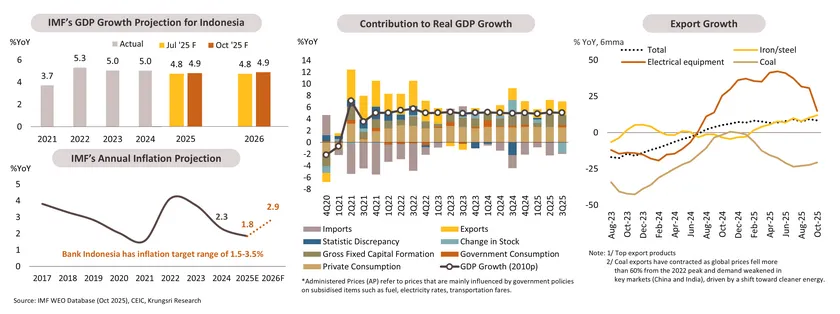

The IMF maintained Indonesia’s 2025 GDP growth forecast at 5.0%, supported by firm domestic demand. Although private confidence softened due to the social unrest in September, stimulus packages targeting household spending and low-income support helped shore up consumption. Meanwhile, exports performed better than expected, albeit unevenly, driven by base metals and electrical components amid the U.S. sector-specific tariff uncertainties.

-

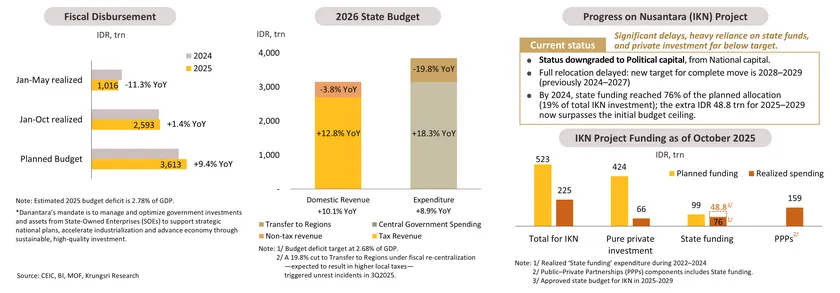

In 2026, GDP growth is expected to hold steady at 5.1%, supported by countercyclical fiscal and monetary policies that help sustain domestic demand, particularly through a 9% increase in approved 2026 state expenditure. Also, looser monetary conditions are expected to feed through to the real economy and support private investment, especially in construction and real estate. However, poor fiscal execution of social programs remains a risk.

-

Inflation will edge up in 2026, driven mainly by volatile food prices and administered prices* adjustments, though it is expected to remain well anchored within the target. Thus, coupled with risks of weaker confidence and policy execution delays, we expect Bank Indonesia (BI) to deliver additional monetary easing.

Government credibility is key to restoring confidence and investment.

-

Concerns over government efficiency and credibility have intensified since President Prabowo took office, especially amid scrutiny of fiscal decisions and questions over central bank independence following Sri Mulyani’s removal. These issues have weighed on both domestic and foreign investor confidence.

-

Domestically, political unrest since early 2025—sparked by backlash over welfare budget cuts and increased lawmaker allowances—has delayed public spending and heightened concerns about policy execution, contributing to a cautious investment environment. This was reflected in soft public investment growth in 1Q2025 before activity recovered in 2Q–3Q2025. Looking ahead, the government’s signals of greater investment through Danantara sovereign wealth fund* should also help crowd in private investment.

-

On the FDI front, the Nusantara (IKN) project remains particularly vulnerable, given that it is intended to be financed by the private sector for around 80% of total costs. Persistent doubts over policy stability and governance undermine foreign investor confidence and risk leaving the megaproject underfunded. With delays already stemming from limited foreign participation, the government may need to inject additional fiscal resources to keep the project on track, potentially straining fiscal space and yielding suboptimal economic outcomes.

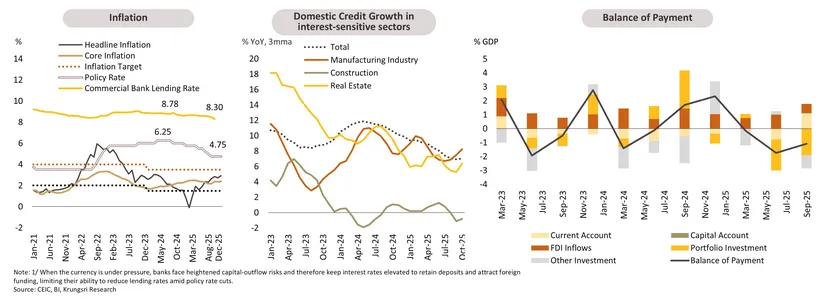

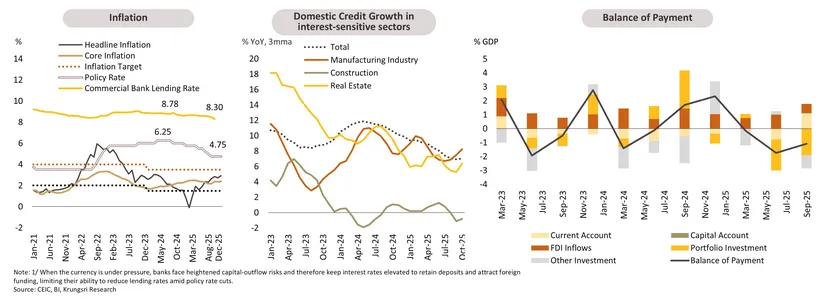

Easing cycle to continue, with concerns on effectiveness and external stability.

-

The policy rate stands at 4.75% in November 2025 after Bank Indonesia (BI) cut a cumulative 150 bps since September 2025. The easing cycle is expected to continue gradually in 2026, with sufficient room for further reductions supported by within-target inflation. However, rising concerns over government credibility and political stability, along with questions about BI’s independence and the trajectory of Fed rate cuts, could constrain the pace and extent of monetary easing. The rupiah has depreciated nearly 4% YTD in 2025 (see p.21), as unrest and weakened confidence have triggered foreign portfolio outflows and increased FX volatility, highlighting concerns over BI’s external stability mandate.

-

The transmission of looser monetary policy to domestic activities has been deficient. Despite aggressive policy rate cuts, lending rates remain elevated as commercial banks have passed through only a small portion of the rate cuts. Banks remain cautious about lowering loan rates due to FX pressures1/. This has weighed on the already-weak credit demand, particularly in interest-sensitive sectors. Going forward, hopes rest on improved monetary transmission to support private investment, while fiscal stimulus—alongside a ramp-up in public spending—is expected to stimulate consumption.

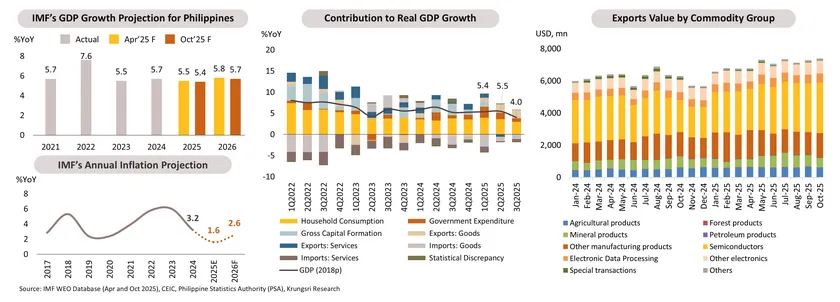

Philippines: internal headwinds challenge the country’s resilient growth

-

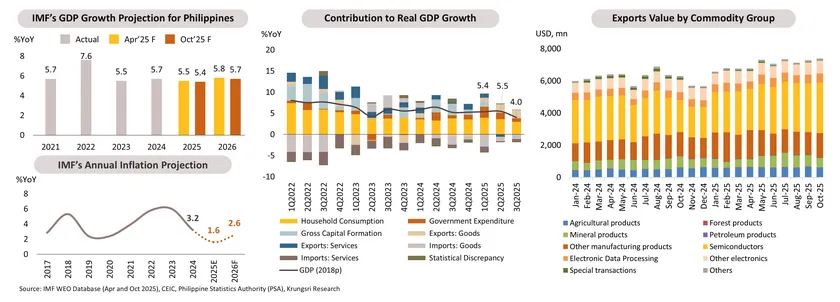

The IMF maintained the Philippines’ 2025 GDP growth forecast at 5.1%, supported by modest private consumption and strong export performance. The ramp-up in exports amid U.S. tariff uncertainties (both reciprocal and sectoral) has been uneven, driven largely by semiconductors, with total export value during 10M2025 rising 11.6% YoY. However, investment—both public and private—has weakened, as the flood-control corruption scandal has delayed government spending, subsequently dampening private investment since 3Q2025. This is reflected in the 3Q GDP outturn, which slowed to just 4%, a development that could challenge the 5.4% growth projection for this year and beyond.

-

In 2026, the Philippine economy is expected to grow by 5.6%, supported by stronger consumption amid eased financial conditions and robust remittances, alongside private investment in government-targeted industries such as renewable energy and semiconductors, with semiconductors remaining a key export sector amid ongoing global supply shortages and sustained demand. While weakness in public spending related to tighter corruption controls will weigh on domestic activity, monetary easing passthrough should help partially alleviate the pressure.

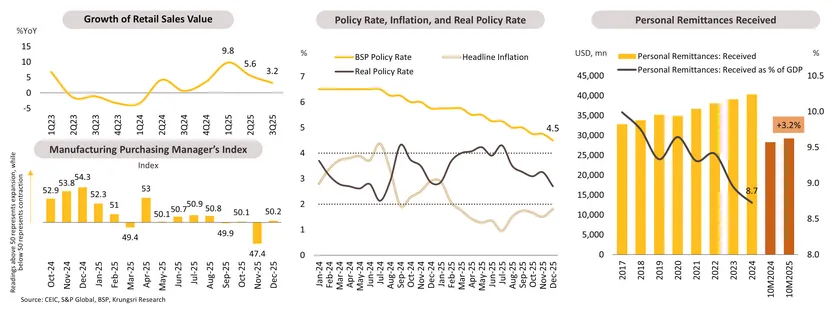

Weak domestic activity, though cushioned by healthy remittances received.

- As the major drivers of growth, domestic activities face significant hurdles, including corruption scandals and natural disasters. These challenges have affected public spending, weakened investor confidence, and dampened household consumption.

- On the private demand side, retail sales have softened continuously since 2Q2025, reflecting subdued household spending. Weaker demand, coupled with slow public works and slowing FDI, has put pressure on private investment. After contraction of Manufacturing Purchasing Managers’ Index (PMI) at 47.4 in November (the lowest level since mid-2021), the PMI increased to 50.2 in December 2025- a slight improvement of production side.

- While major concerns remain concentrated in public and private investment, household consumption could be supported by still-growing remittances, which increased by 3.2% in 10M2025, and by anticipated pass-through of monetary easing on the economy.

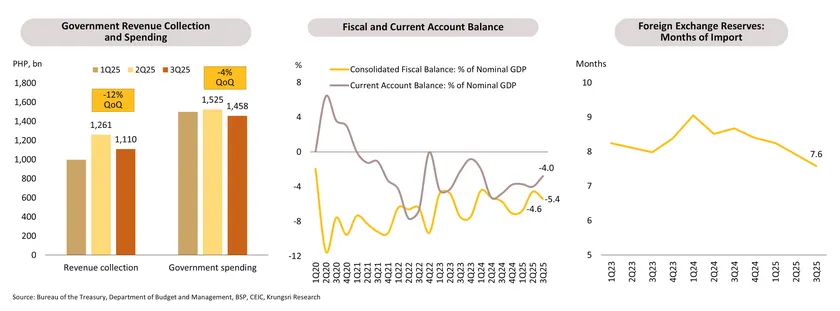

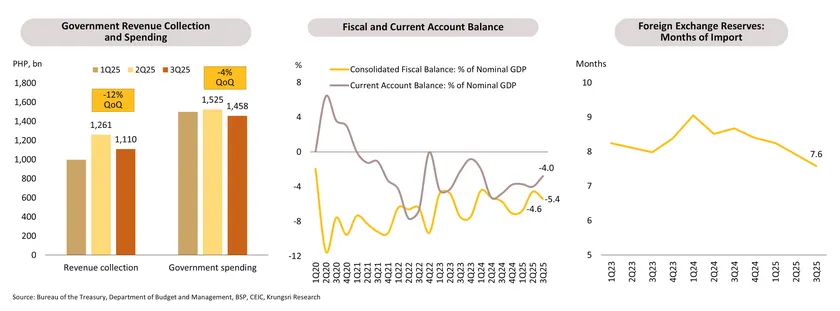

Political instability raises concerns over currency and funding costs.

- The country’s fiscal space is limited. Revenue collection and government spending were sluggish in 3Q2025. In addition, there are more challenges in next year’s budget spending, attributed to three key factors; i) Flood-control corruption investigations may disrupt budget disbursement, ii) Budget reallocation, diverting from the president Marcos Jr. flagship infrastructure initiative “Build Better More” to accommodate the disasters loss and economic stimulus, and iii) Ongoing fiscal consolidation plan to reduce the deficit to 4.3% of GDP by 2028 from an expected at 5.5% in 2025, restricting fiscal space.

- Twin deficits persist, with the fiscal and current account deficits expected to remain at 5.5% (under the fiscal consolidation plan) and 3.3% of GDP (BSP forecast) in 2025, respectively. This reflects the need for continued external financing. While foreign reserves are currently ample (covering 7.6 months of imports), capital outflows have been observed in 2025. If political instability intensifies next year, it could continue to put pressure on the local currency and government funding costs.