ผลิตภัณฑ์

สมัคร

ผลิตภัณฑ์

บริการ

หน้าหลัก

สินเชื่อ

บริหารเงินสด

การค้าระหว่างประเทศ

โกลบอลมาร์เก็ตส์

ธุรกิจหลักทรัพย์

ดิจิทัลโซลูชั่น

บริการอื่นๆ

ลูกค้าบุคคล

ลูกค้าบุคคล

บัตร

ผลิตภัณฑ์

บัตรกรุงศรีเดบิตชิปการ์ด

บัตรเครดิตในเครือกรุงศรี คอนซูมเมอร์

บัตรเครดิตนักศึกษา

บัตรของขวัญกรุงศรี

Krungsri Boarding Card

แนะนำ

บัตรกรุงศรี เดบิต จัดให้ D

รวมค่าธรรมเนียม บัตรกรุงศรี เดบิต

ลงทะเบียนเพื่อซื้อของออนไลน์ผ่านบัตรกรุงศรีเดบิต

โปรโมชันบัตรเดบิต

โปรโมชัน Krungsri Boarding Card

สมัคร

สมัครบัตรเครดิต กรุงศรี

ลูกค้าบุคคล

ลูกค้าบุคคล

บริการ

LINE Krungsri Simple

ลูกค้าธุรกิจ

ลูกค้าธุรกิจ

โกลบอลมาร์เก็ตส์

บริการ

โกลบอลมาร์เก็ตส์

บริหารความเสี่ยง

อัตราแลกเปลี่ยนเงินตรา

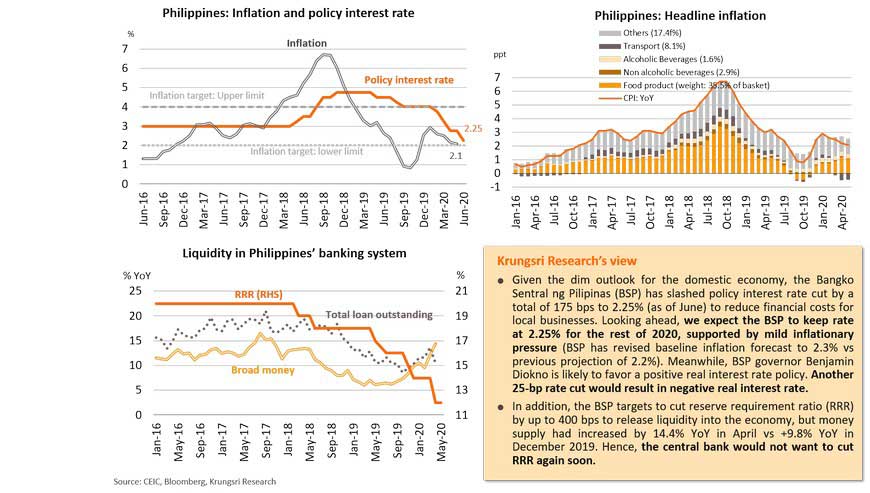

Market Commentary

Digital Channel

แนะนำ

FX@Krungsri

ลูกค้าธุรกิจ

ลูกค้าธุรกิจ

ลูกค้าธุรกิจ