ASEAN: Multi-speed recovery to pre-pandemic levels

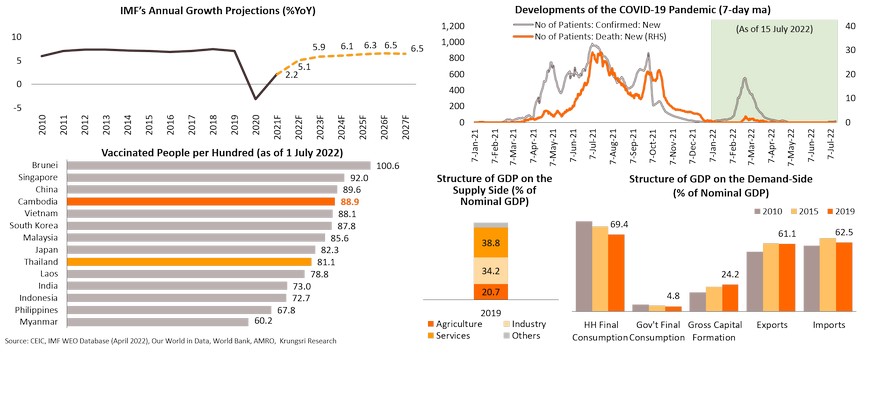

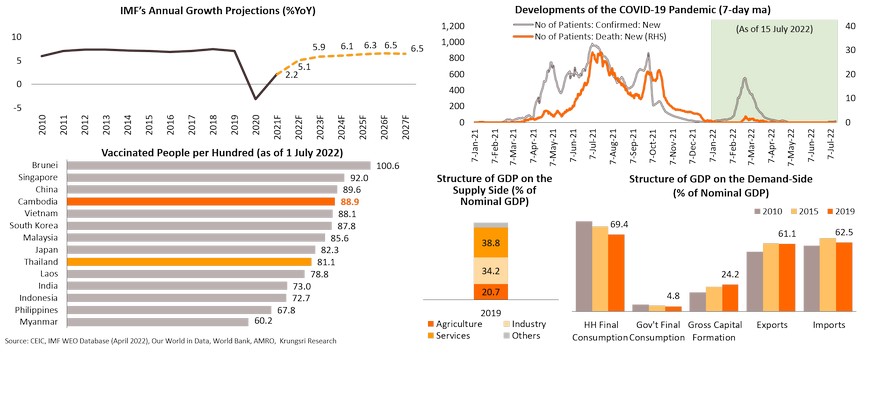

- ASEAN is exiting the pandemic-induced economic slump and each country in the region is recovering at a different pace. We maintain our view that growth will rebound strongly in 2022 led by the Philippines, Vietnam, and Indonesia. With high vaccination coverage and easing mobility restrictions, growth will be underpinned by the re-opening of economies at home and globally, domestic demand, exports, the resumption of cross-border tourism, and inward FDI.

- Economic resilience, macroeconomic fundamentals, and policy supports will determine the pace of recovery in each country.

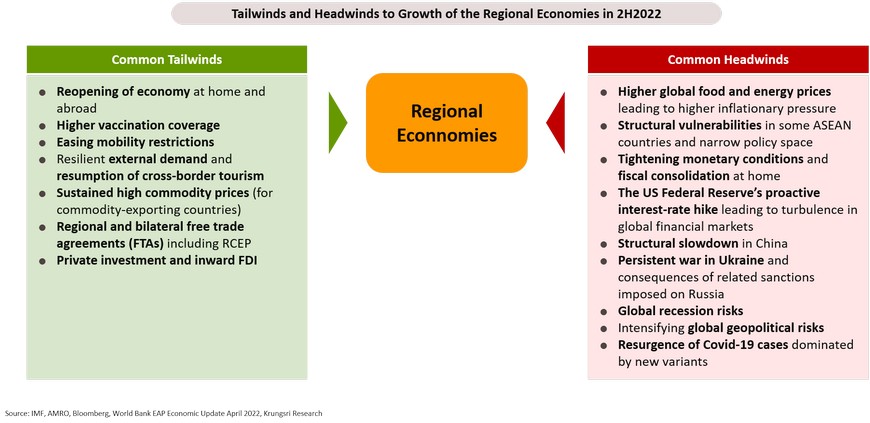

- However, the near-term growth outlook is tilted to the downside amid an uneven recovery across the region. Despite tailwinds, there are stronger internal and external headwinds. Internally, inflationary pressure is building up and forcing some countries to normalize monetary policy faster-than-expected. On the external front, external demand could be dampened by a structural slowdown in China, global recession concerns, and a cyclical slowdown in the US. The longer-than-expected war in Ukraine and sanctions imposed on Russia have triggered oil price shocks and elevated prices of commodities, leading to worsening terms of trade for commodity-importing countries. The larger-than-expected policy-rate hike by the US Federal Reserve could trigger sudden capital outflows and worsen external sector stability as well as exchange rate volatility for ASEAN currencies.

- Lao PDR and Myanmar will experience the largest exposure to those headwinds and external shocks among countries in the region.

Economic recovery will remain uneven across ASEAN in 2H2022 amid stronger external headwinds and greater uncertainties

In 2H2022, economic recovery will remain uneven across the region. Growth will rebound strongly in the Philippines, Vietnam, and Indonesia where the reopening of the domestic economy and easing restrictions facilitated by higher vaccination rates as well as successful pandemic containment measures have invigorated domestic demand, especially household consumption. In addition, external demand should remain supportive of growth, particularly in commodity-and-food-exporting countries such as Indonesia, Cambodia, and Lao PDR, due to sustained high commodity prices and trade diversion. Despite showing signs of stabilizing, Myanmar is expected to slowly exit the pandemic-induced recession. Regionally, however, the near-term outlook is surrounded by downside risks and uncertainties. Key risks are (1) rising inflation and higher energy prices, (2) repercussions from Russia’s invasion of Ukraine, (3) financial tightening in the US., and (4) a structural slowdown in China, as well as (5) the resurgence of Covid-19 cases dominated by new variants.

Despite tailwinds, near-term outlook for ASEAN economies is clouded by stronger external headwinds

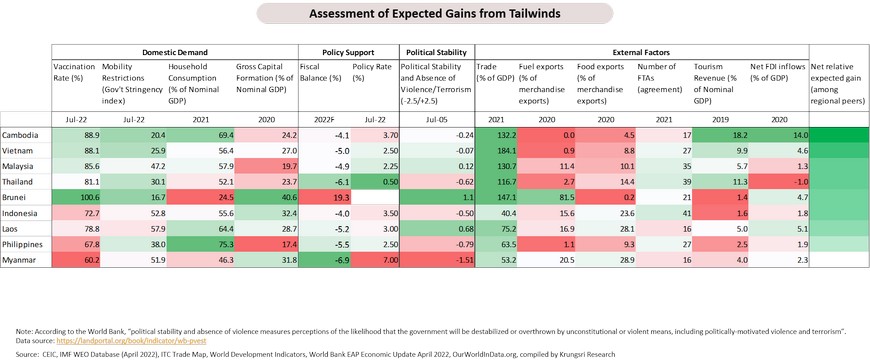

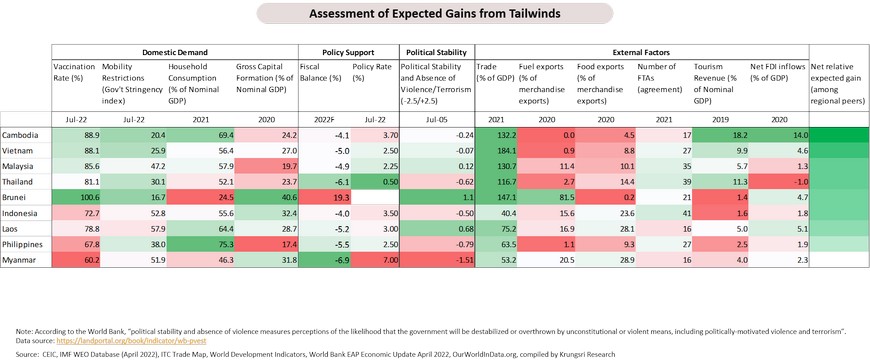

Cambodia and Vietnam are the largest beneficiaries if tailwinds become stronger

Based on our simple assessment of parameters in four dimensions - domestic demand, policy supports, political stability, and external factors - among peers, Cambodia, Vietnam, Malaysia and Indonesia would be the top gainers if tailwinds strengthen.

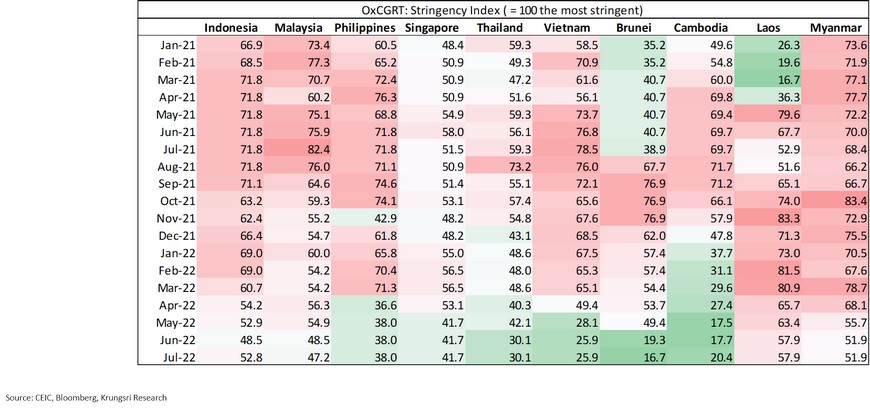

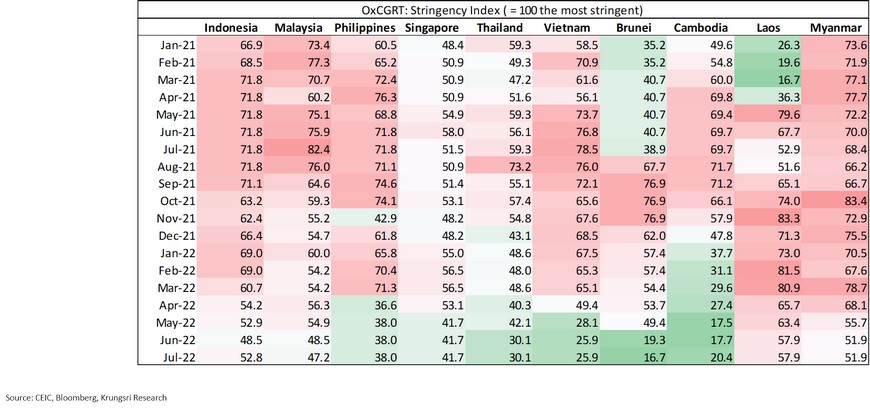

Easing pandemic restrictions and full reopening of domestic economies continue to support recovery in the region

Higher vaccination rates are helping to bring the pandemic under control. Coupled with the adoption of living with COVID strategies, related restrictions and containment measures - reflected by the Stringency Index - have eased, particularly in Indonesia, the Philippines, Vietnam, Cambodia, Laos and Thailand. This will help domestic demand to improve but recovery will be uneven across the region. Albeit fading, the boost from reopening will continue to support domestic demand, particularly private consumption which is the main growth driver for this region. However, higher food and fuel prices, as well as tighter monetary conditions, could cap growth where the economic recovery is just starting to take shape.

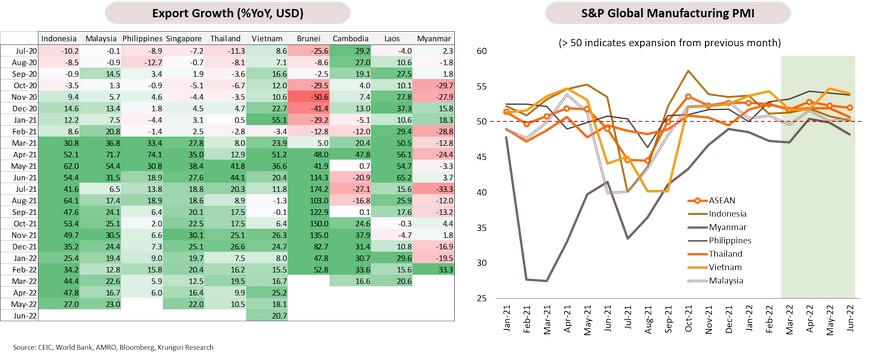

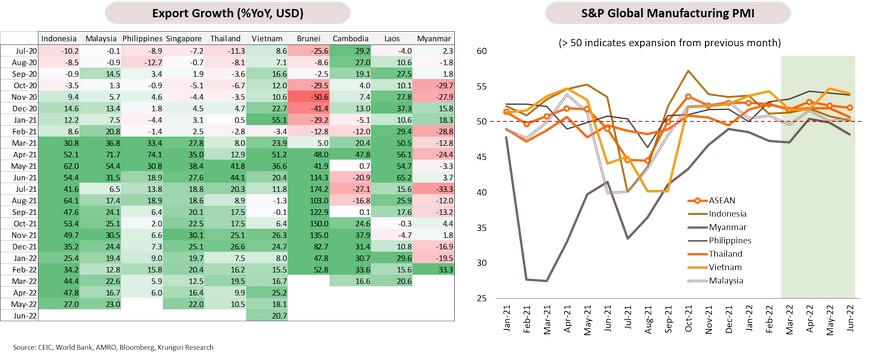

External demand and high commodity prices should continue to drive exports

Export-dependent economies in the region should continue to benefit from external demand, especially net commodity exporters such as Indonesia and Laos due to sustained high prices and

a degree of trade diversion despite the dim global economic outlook. Latest Manufacturing PMI data also suggest there could be a boost in 2H 2022 from export-oriented manufacturing sectors, tailwinds from further reopening, and recent easing of the COVID-19 lockdowns in China. Myanmar is an exception as the country continues to face internal challenges. Looking ahead, the export growth trajectory is surrounded by downside risks including global recession concerns, slower-than-expected growth in China, and the prolonged conflict between Russia and Ukraine intensifying geopolitical risks and dampening global business sentiments.

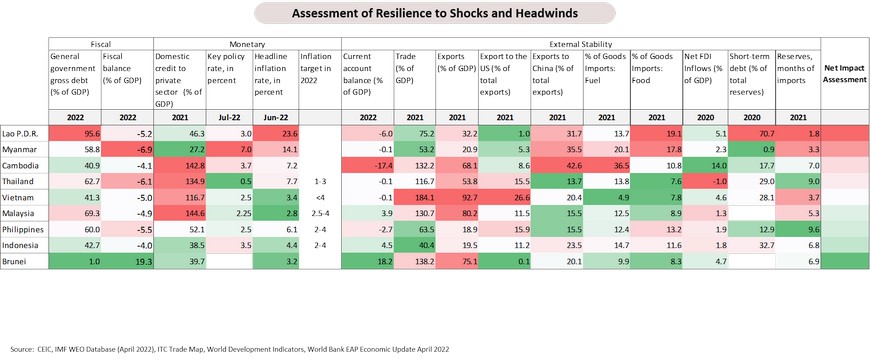

Exposures to external headwinds are different depending on economic fundamentals, policy maneuver, and policy space in each country

Against a backdrop of different macroeconomic fundamentals, the top policy priorities for this region in the last two years have been to weather the COVID-19 shock and easing its repercussions. Despite the uneven recovery, all the countries are exiting the pandemic-induced recession. But on one hand, containing the shock has left some legacy issues including higher public debts and narrow fiscal space. On the other hand, there are emerging new risks and challenges. In the near-term, there are five key headwinds for the region: global recession risks, Fed’s proactive policy hike and turbulence in the global financial market, slower-than-expected growth in China, the protracted war in Ukraine and spillover effects of sanctions on Russia, and the resurgence of Covid-19 cases and other unforeseen shocks. These headwinds will weigh on growth, inflationary pressure, currency, and capital flows in each country in the region through different channels, mostly influenced by their exposure and resilience to these shocks.

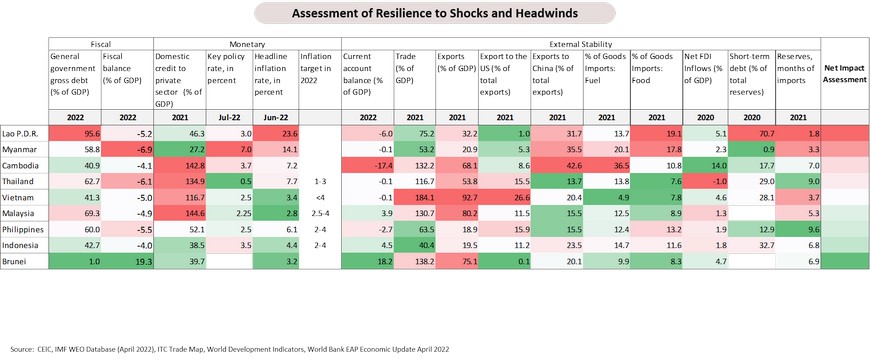

Lao PDR, Myanmar, and Cambodia are more vulnerable to external shocks if risks and anticipated headwinds materialize

Based on the assessment of parameters in the three dimensions - fiscal, monetary, and external stability - Lao PDR, Myanmar, and Cambodia would be the most exposed to external shocks and headwinds. This is partly due to their structural characteristics including high debts, large external imbalances, and low foreign exchange reserves. The ability to weather these headwinds depends primarily on their policy responses, policy space, and macroeconomic fundamentals.

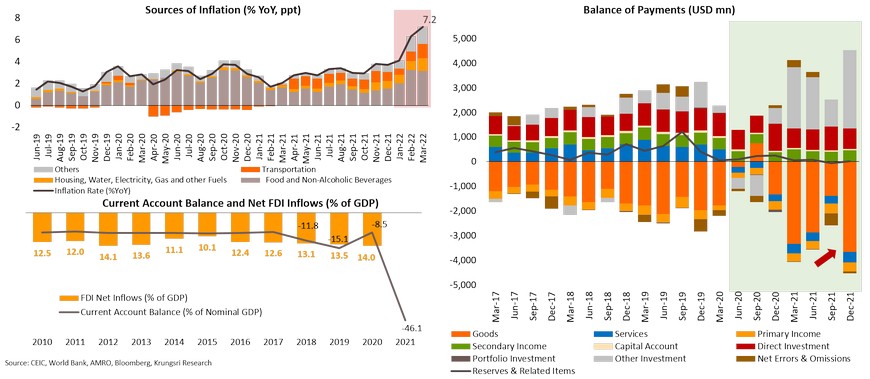

Cambodia: Economy is recovering, growth is projected to reach 5.1% in 2022

In 2022, the economy is expected to grow by 5.1% driven by the recovery in domestic activity, exports of goods, FDI inflows, and reopening of cross-border tourism on the back of living with COVID strategy as well as high vaccination rate. The latter has helped to contain the pandemic. Cambodia has the second highest ratio of vaccinated population per hundred compared to ASEAN peers. Fewer mobility restrictions and containment measures will continue to allow domestic consumption (70% of national GDP pre-COVID) to normalize and a recovery in the tourism sector (18% of national GDP pre-COVID). However, the near-term growth outlook for Cambodia is tilted to the downside. Risks to growth are growing at home and abroad, including the resurgence of Covid-19 cases, rising inflation driven by higher energy and food prices hampering household consumption, slower growth in China, and global recession concerns. These could reduce external demand for the country’s exports.

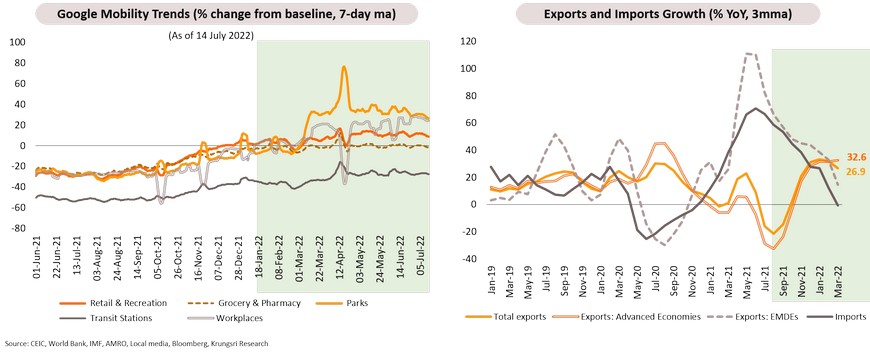

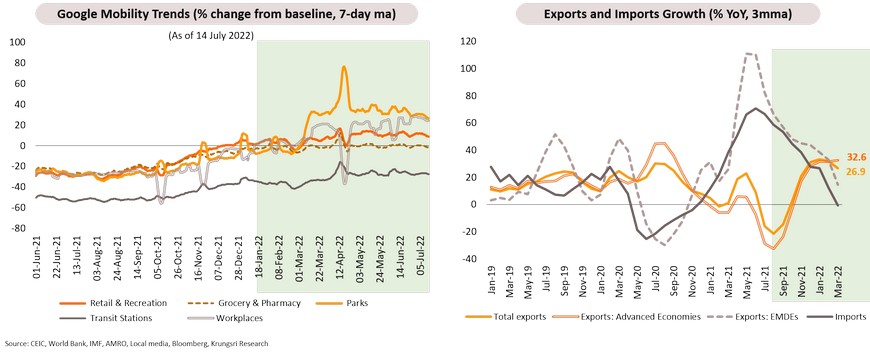

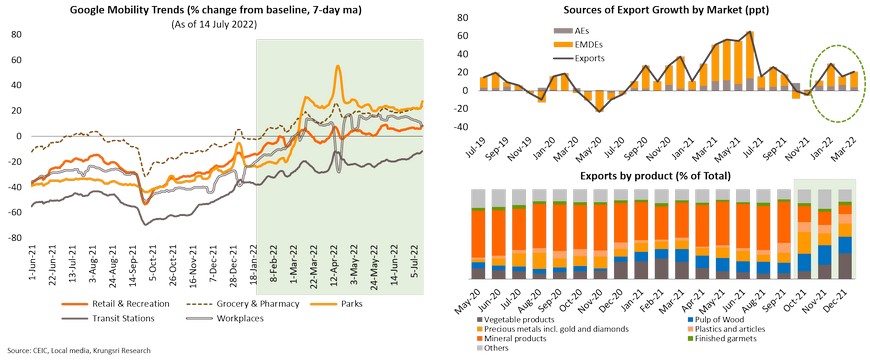

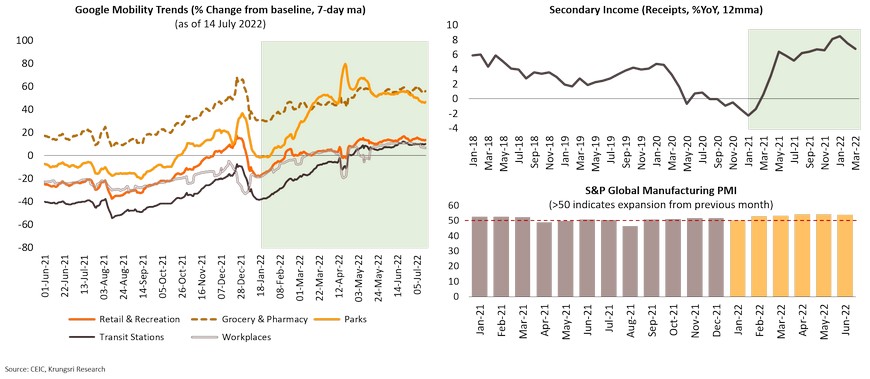

Living with COVID strategy has allowed economic activity to return to near normal in all sectors

Latest Google Mobility Data trends suggest domestic economic activity has recovered surpassing the past pre-pandemic levels and will continue to recover strongly the rest of 2022. This will support a sustainable recovery in Cambodia. On the external front, since 2H2021, external demand for Cambodia’s exports has grown strongly driven by pent-up consumer demand in the major export markets such as the US and the EU. Cambodia has also enjoyed the benefits of bilateral and regional free trade agreements, including the China-Cambodia Free Trade Agreement and Regional Comprehensive Economic Partnership (RCEP). However, due to growing concerns about a global recession driven by a cyclical slowdown in the US (Cambodia’s largest export market) and slower growth in China, it remains unclear if this strong export momentum is sustainable.

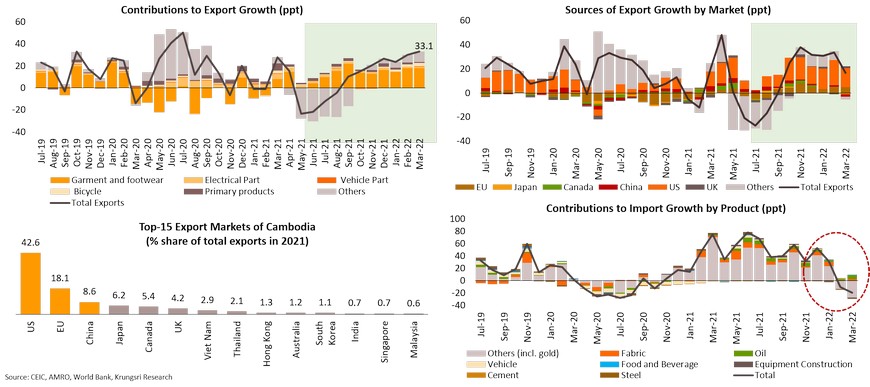

External demand has been a key driver of the post-pandemic recovery

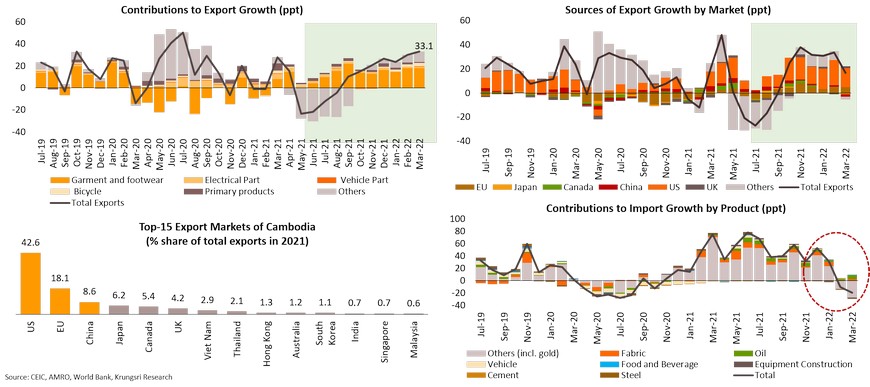

Given its high dependence on international trade, Cambodia’s goods trade reached 132.2% of national GDP in 2021. Hence, the rebound in external demand has been a key driver of the post-pandemic recovery in Cambodia. Exports surged 33.1% YoY in March. Exports of traditional items such as garment and footwear products, bicycles, and electrical parts, have benefited from the recent boom in international trade. Robust demand in the US and the EU, which collectively account for over 60% of national exports in 2021, has driven the recovery in the country’s exports. However, slower import data recently could signal weak export momentum in the periods ahead.

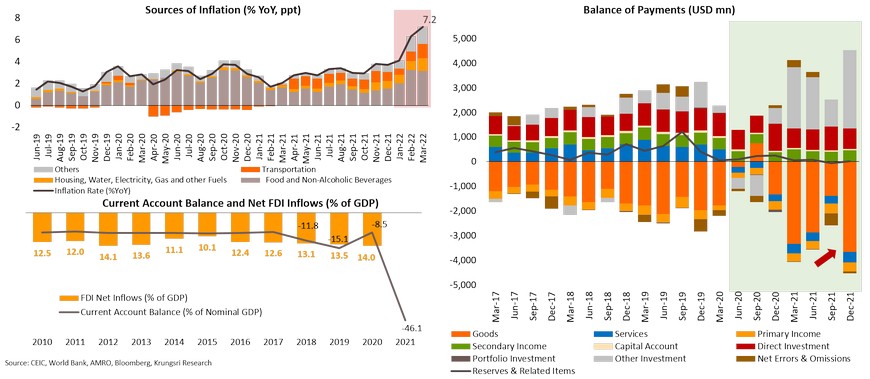

Surge in global energy and commodity prices is threatening price stability and widening external imbalances

Like most countries, price stability in Cambodia is being pressured by rising global energy and food prices. According to the National Bank of Cambodia (NBC), inflation has risen sharply to 7.2% YoY in March driven by a surge in food and energy prices. If this trend continues, it will dampen household consumption and economic recovery momentum. In addition, as Cambodia relies significantly on imported fuel, about 36.5% of imports in 2021, the highest ratio among regional peers, oil price shocks and higher food prices will widen Cambodia’s already large external imbalances.

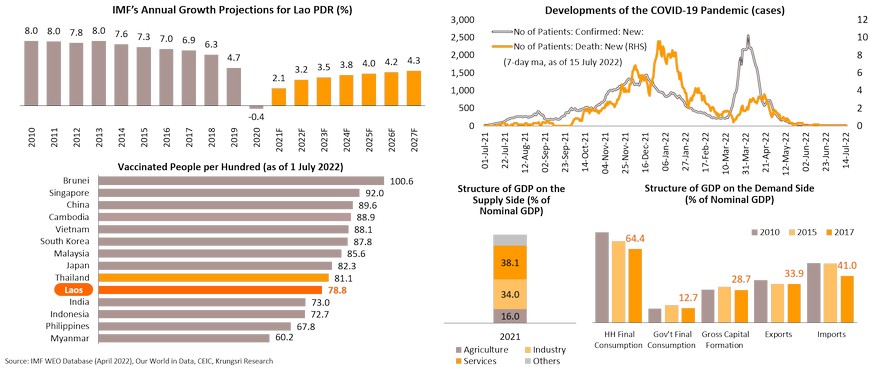

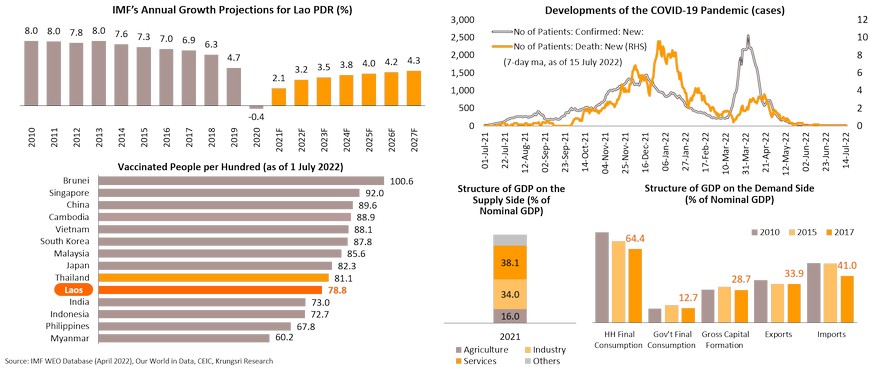

Lao PDR: Growth to recover gradually to 3.2% in 2022 amid downside risks

GDP growth could exceed 3.0% in 2022, while the IMF’s latest projection is 3.2%. However, the near-term outlook is surrounded by risks and challenges. A gradual reopening of economic activity at home and abroad, as well as the resumption of international tourism should continue to support normalization in all sectors in the country, especially the services sector. But currently, against the backdrop of vulnerable macroeconomic conditions, including high public and external debts and thin foreign exchange reserves, the country has been facing several domestic headwinds, including skyrocketing inflation, fuel shortage, and currency depreciation. There are also external headwinds, including economic conditions in key export markets and spillover effects of Russia’s invasion of Ukraine. In addition, the resurgence of COVID-19 cases remains a key risk although it appears to be contained by higher vaccination rates.

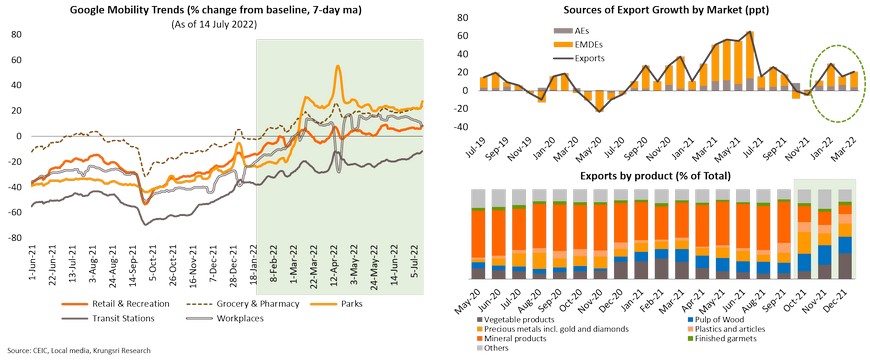

Post-pandemic reopening and external demand should support recovery

Latest mobility data suggest economic activity in Lao PDR, especially retail & recreation activities, has recovered past pre-pandemic levels, in line with other countries in the region. In 2H2022, resumption of economic activities within the country and abroad should continue to support recovery of the Lao economy, which depends heavily on the services sector. On the external front, economic recovery in key export markets, including China, Thailand, and Vietnam, should boost the country’s exports. Laos reportedly earned more than USD870mn from the export of agricultural products in 1H2022. In addition, with the China-Laos Railway Link in operation, the reopening of cross-border tourism in this region should support the recovery of the tourism sector in Lao PDR. Tourism sector revenues contributed about 5% of GDP in 2019.

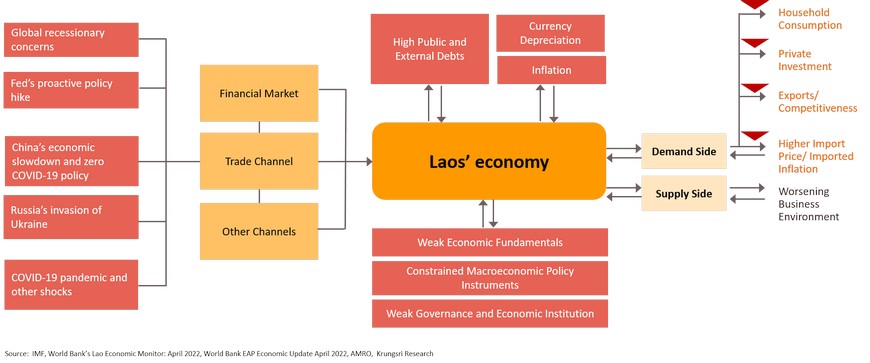

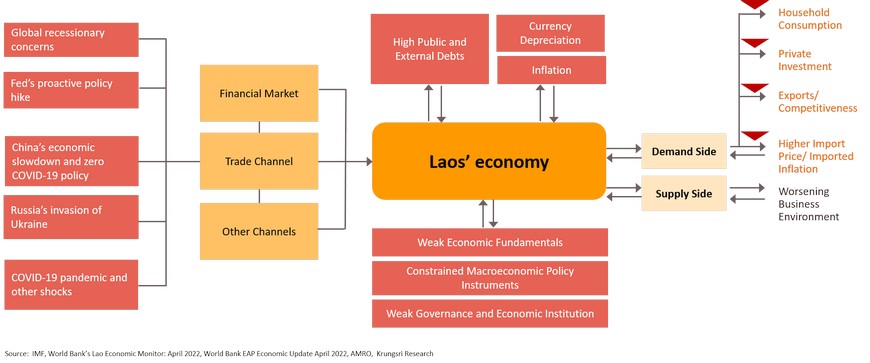

External headwinds coupled with weak economic fundamentals will worsen macroeconomic stability and increase risk of an economic crisis

Our simple assessment suggests that among regional peers, Lao PDR would be the most exposed to external shocks in 2H2022. This is due primarily to the country’s persistent weak macroeconomic fundamentals, high debt service burden, limited financing options, and low foreign reserves. Since the country depends significantly on food and fuel imports (13.7% and 19.1% of good imports in 2021, respectively), higher global energy and food prices is pressuring the country’s already weak external position. On 14 June, Moody’s Investors Service downgraded Laos’s credit rating by a notch to Caa3, deeper into junk territory, citing weak governance, high external debt burden, and thin foreign exchange reserves.

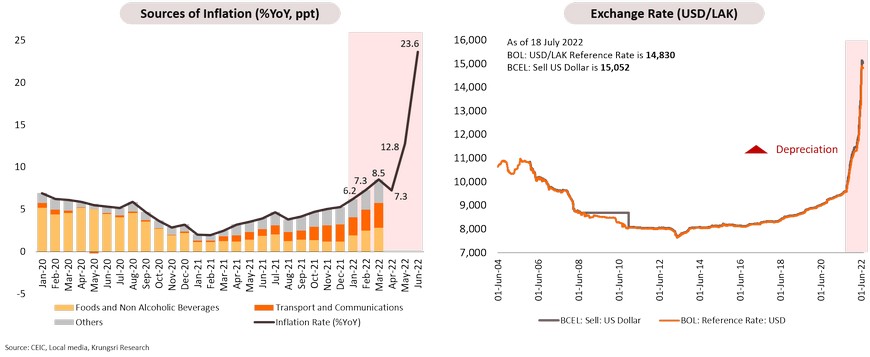

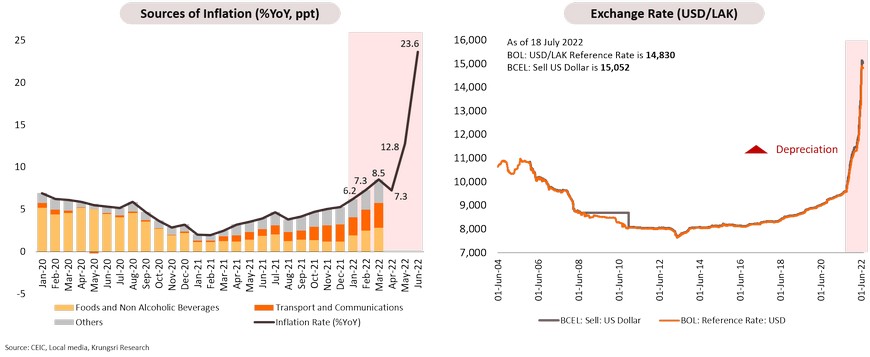

Efforts to maintain macroeconomic stability are constrained by limited policy space and tools

Rising global energy and food prices are fueling inflation in Lao PDR through imported inflation as the local currency has depreciated substantially since Q4 2021. According to reports by Lao Statistics Bureau, inflation reached a 22-year high of 23.6% YoY in June. The Lao kip has continued to weaken against the USD and THB; since the beginning of 2022, it has depreciated 34.2% against the USD. The government and the central bank have vowed to do more to ensure sufficient forex supply for the import of essential goods and to strictly control forex transactions through more restrictive regulations. However, given that the economy is high dollarized, we project the kip will continue to depreciate due to thin foreign exchange reserves, sustained high energy prices, and insufficient foreign exchange inflows through formal channels.

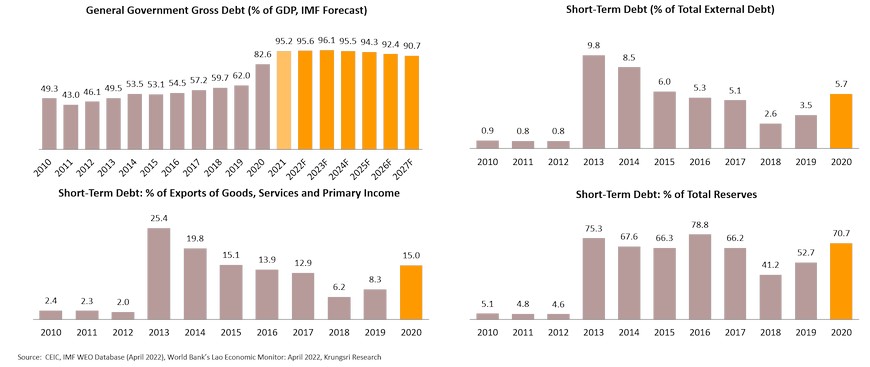

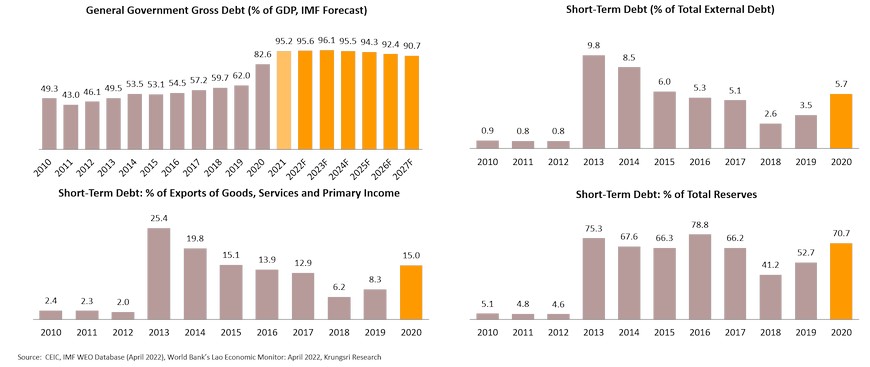

High debt obligations, limited financing options, and low foreign currency reserves create liquidity and solvency risks for the country

Based on the World Bank’s latest assessment in April, since 2019, Lao PDR’s public debt has surged to a level that could jeopardize its macroeconomic stability, reflected by different warning indicators. Total public and publicly-guaranteed (PPG) debt reached USD14.5bn or 88% of GDP in 2021 from 68% (or USD12.5bn) in 2019. Based on IMF data, general government gross debt could reach 95.6% of GDP in 2022. And, according to the World Bank, if the currency swap arrangement is classified as public debt, the PPG stock would rise to about 90% of GDP in 2021. In terms of structure, most PPG debts are external debt.

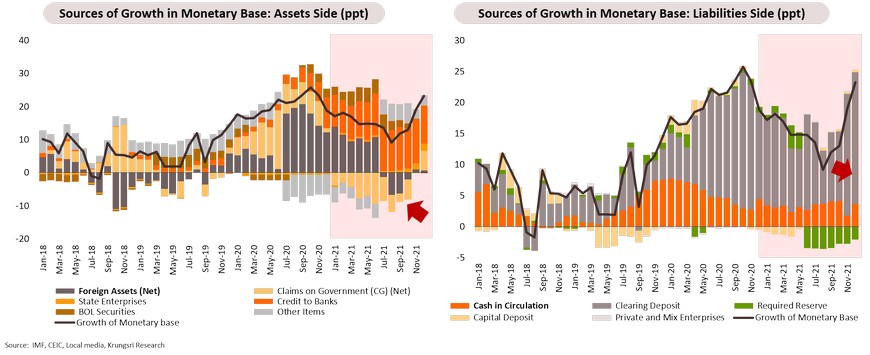

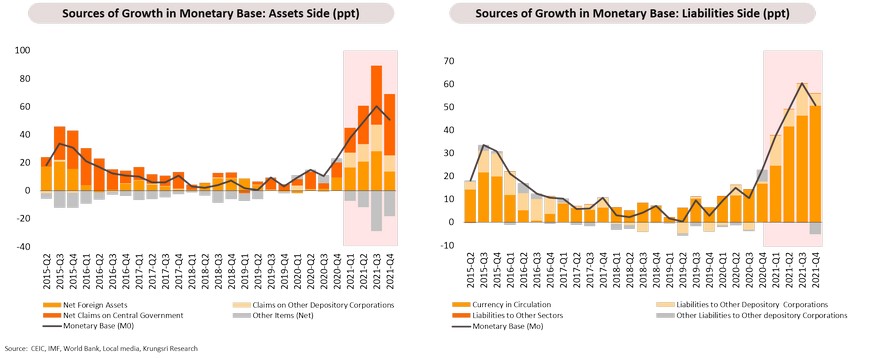

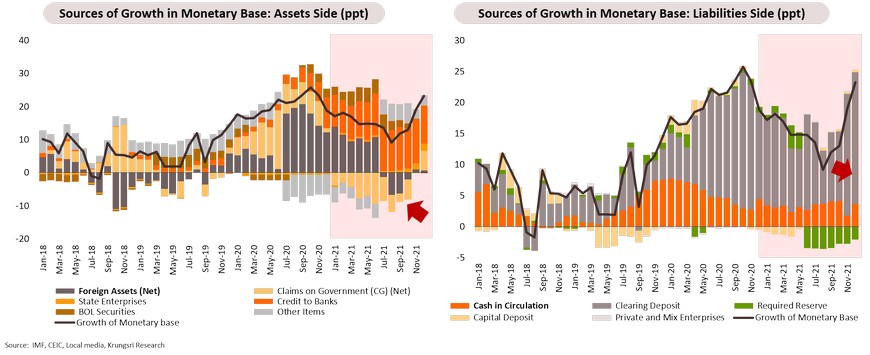

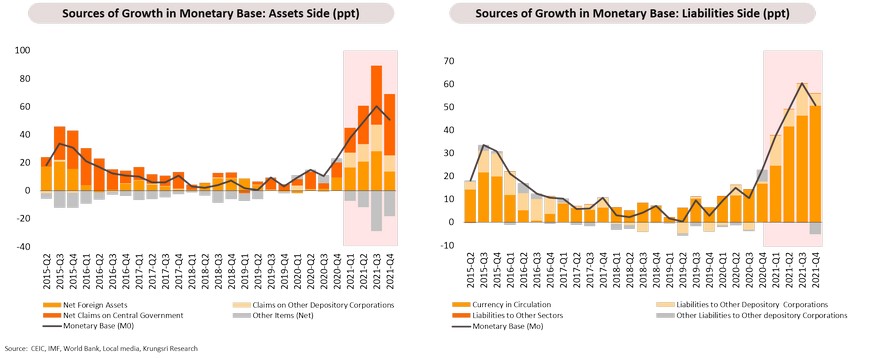

Foreign exchange reserves have been secondary growth driver of the monetary base

Based on the central bank’s data, net foreign assets (equivalent to foreign exchange reserves) has tumbled along with the rapid depreciation of the Lao kip. The central bank, which has a monopoly of the local currency, has tried to stimulate the economy by injecting more money into the economy by giving higher credit to banks. However, this has not increased currency in circulation and is instead reflected in higher clearing deposits for banks. The accumulation of clearing deposits by banks normally reflects malfunction in the interbank and money markets. As a result, the latest move by the Bank of Laos PDR (BoL) in issuing LAK 5-trillion savings bonds in early June to individuals and legal entities residing in the country, to absorb LAK liquidity, might not help to address inflation at its root cause. A key evidence reported by the survey is that the country is running out of foreign reserves, which means higher probability of a balance of payments (BoP) crisis in the coming periods.

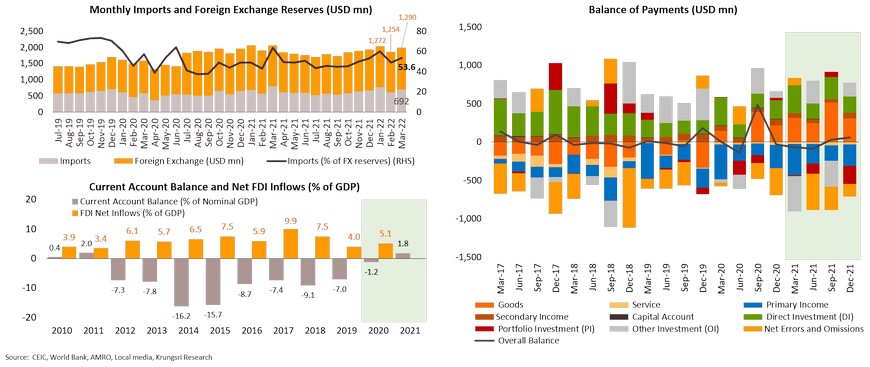

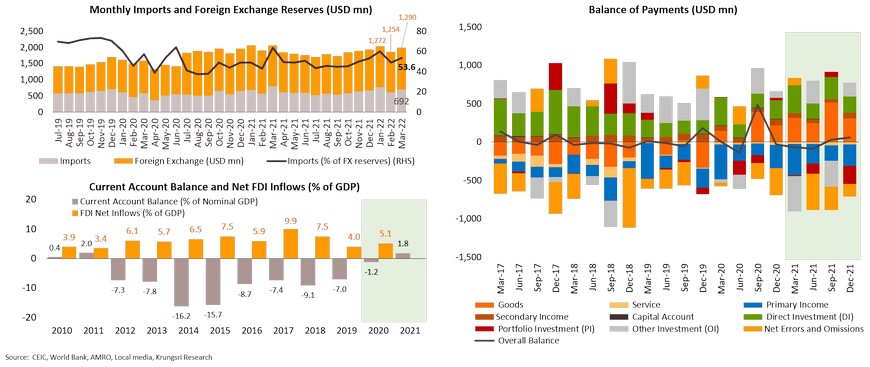

External stability is extremely vulnerable to external shocks due to persistent low foreign exchange reserves, despite a large trade surplus and resilient FDI inflows

Despite a sizeable trade surplus and FDI inflows in 2H2021, foreign exchange buffers have been persistently and dangerously low by international standards, exposing the country to external shocks including the recent surge in global oil and commodity prices. Based on official statistics, gross reserves reached only USD1.2bn, covering only 1.86 months of imports of goods and services (monthly imports account for about 54% of gross reserves as of March 2022). This development is reflected in the rapid depreciation of the Lao kip. Looking ahead, sustained high fuel and food prices could weigh on Lao PDR’s current account balance.

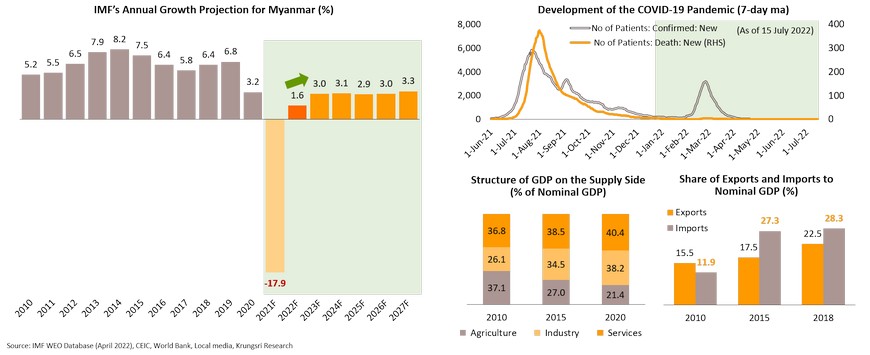

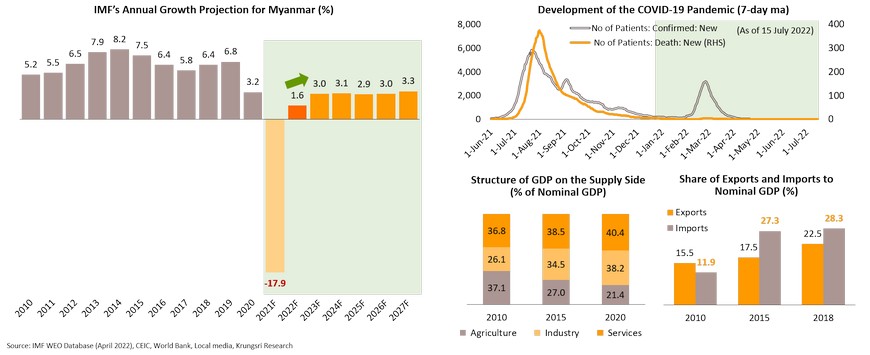

Myanmar: Economic activity should continue to normalize; lingering political conflicts and external headwinds to weigh on near-term outlook

In 2022, Myanmar’s economy is expected to expand by 1.6% following a sharp 18% contraction in 2021. Near-term economic outlook remains dim, depending on political developments and external factors. Fewer COVID-19 cases and deaths, coupled with higher vaccination rate, have facilitated greater mobility and the resumption of domestic economic activities in all sectors. Despite economic activities stabilizing, there are still internal and external risks, as well as challenges. Internal challenges include higher input prices, recurring electricity outages, escalating political conflict, and trade and forex restrictions, as well as adequacy of foreign exchange reserves. External challenges are higher global energy prices and uncertainties in the global financial markets, as well as slower growth in China, its largest trading partner.

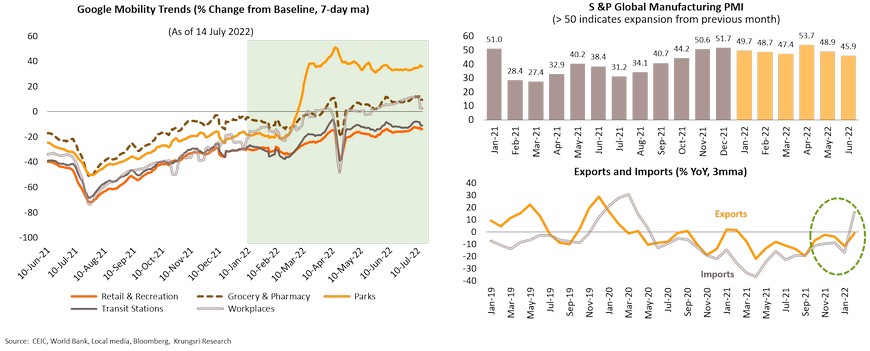

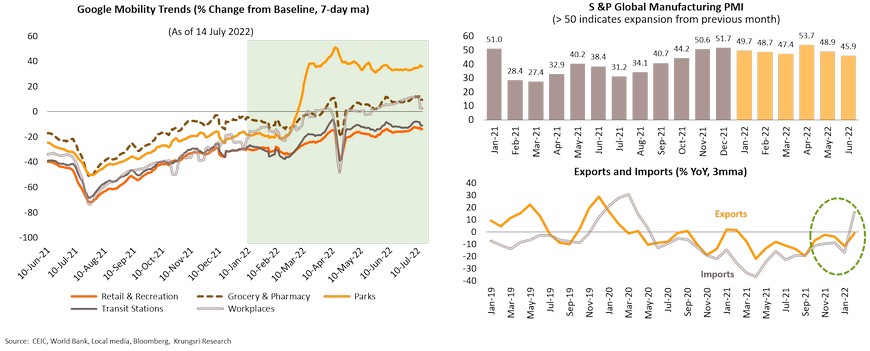

Latest mobility data and other indicators suggest gradual normalization of economic activity; however, this will depend on pandemic situation and political developments

The latest wave of Covid-19 cases is believed to have peaked. Coupled with higher vaccination rate, economic activity in Myanmar has been recovering gradually toward its pre-pandemic level. However, due to political conflicts and domestic fuel shortage, some mobility trends remain weak, particularly transport and retail activities. This suggests a slow recovery of the services sector which accounts for more than 40% of GDP in 2020. There is some improvement in the manufacturing sector, but activity remains weak with Manufacturing PMI lingering at below-50. There are signs of a recovery in international trade activity, particularly exports of agricultural products, but the recent introduction of trade and foreign exchange restrictions, including requiring all FX deposits to be converted into local currency (introduced in April 2022), a ban on car imports (introduced in June 2022), and the over-valued official exchange rate, could cap recovery.

Macroeconomic stability remains weak, might be worsened by mounting external headwinds

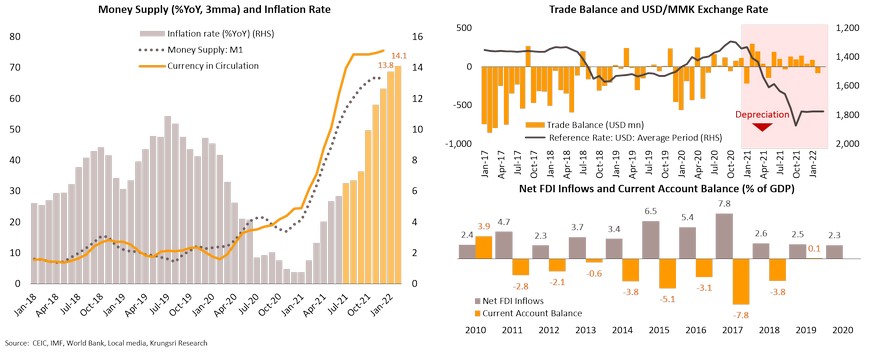

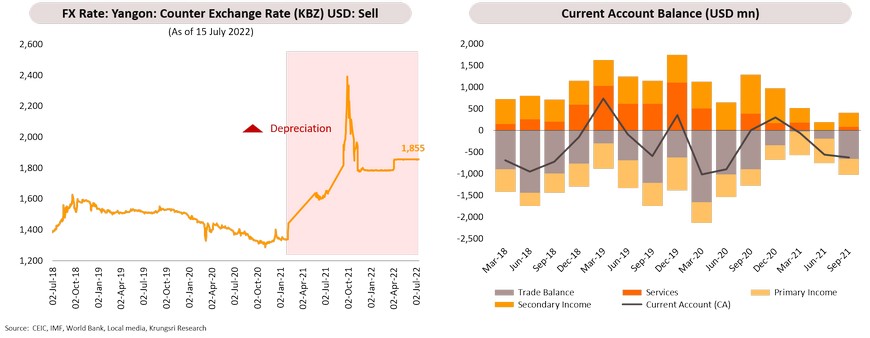

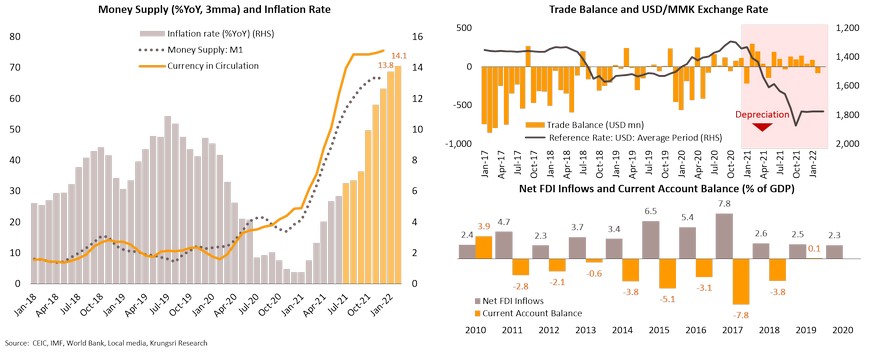

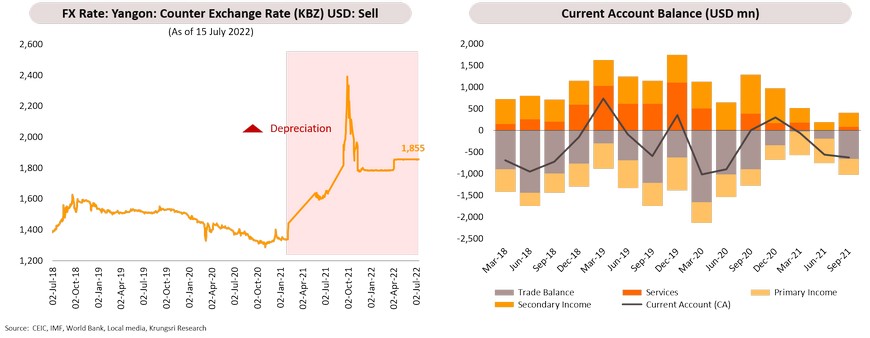

Maintaining macroeconomic stability is crucial for Myanmar in the near term. On price stability, inflation has surged since Q2 2021 to 14.1% YoY in February this year, according to latest available data. The inflation dynamics have been driven by both internal and external factors. Debt monetization by the central bank leading to higher volume of currency in circulation is among the key internal drivers of inflation. Among external factors, imported inflation triggered by a weaker MMK and oil price shocks are the major drivers. Looking ahead, the oil price shocks will widen the country’s current account balance, while there will not be new large FDI inflows at least until there is a sign of political stability after the next general election, which is tentatively scheduled to be held in the second half of 2023. This would in turn put downward pressure on the official exchange rate which is currently fixed by the central bank at 1,850MMK/USD.

Debt monetization has caused monetary base and currency in circulation to surge

Latest central bank data suggest the Central Bank of Myanmar (CBM) has recently supported the economy by extending credit to the government and deposit-taking institutions, reflected by sources of monetary base (M0) on the asset side. Debt monetization by the CBM has translated into a surge in currency in circulation on the liabilities side of the survey. And based on pat experience, a sharp increase in money in circulation normally leads to higher inflation. Looking ahead, due to constraints in revenue collection and weak economic conditions in Myanmar, we expect the CBM to conduct more debt monetization activity.

Exchange rate seems to have stabilized but fundamentals suggest MMK is over-valued

The USD/MMK exchange rate has been under downward pressure since the February 2021 coup. It depreciated sharply in September 2021 but seems to be stable recently following intervention by the CBM. Since Q4 2021, the CBM has fixed the official exchange rate at 1,850 MMK/USD. However, dual exchange rates - official and unofficial - have emerged and the gap is widening. This reflects a shortage of USD in the country. The CBM adopted trade and forex restrictions to curb the MMK depreciation and to preserve USD liquidity but there are increasing signs of USD shortage. In April 2022, the CBM had ordered all foreign currencies received by residents and businesses formed or registered in the country to be converted into kyat within one working day at the central bank's official rate of 1,850 MMK/USD. Subsequently, the Central Bank announced some exceptions to this rule. Looking ahead, Myanmar’s current account balance and the USD/MMK exchange rate are expected to be under pressure in anticipation of large shortfall in FDI inflows, oil price shocks, and higher food prices as the country imports a large volume of food and fuel. Looking ahead, we maintain our view that the authorities would introduce more restrictions on foreign exchange transactions including capital control measures as the USD liquidity is drying up.

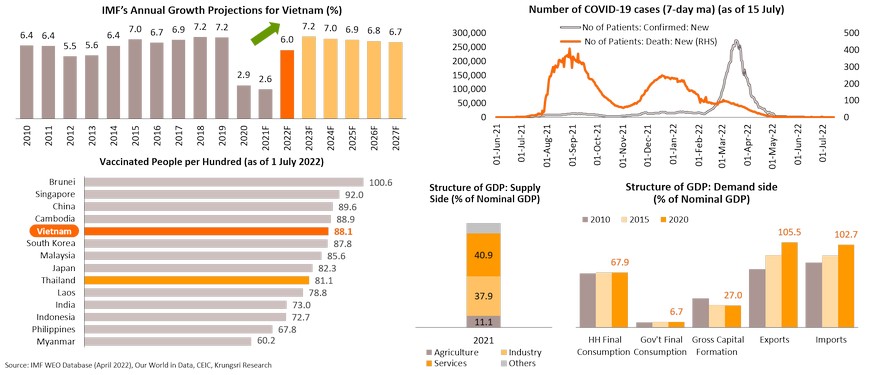

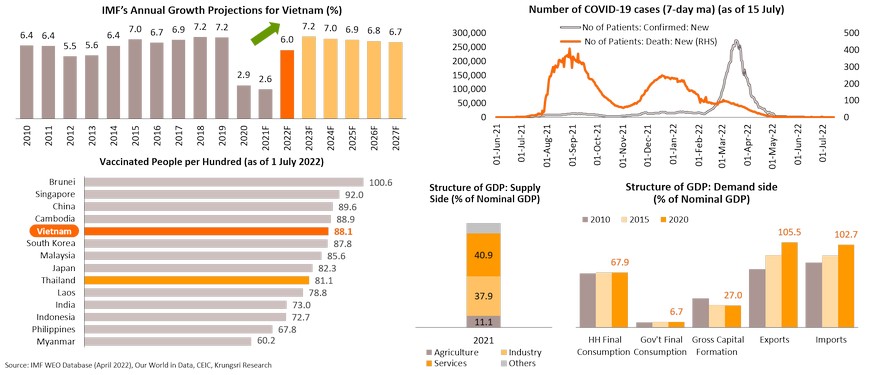

Vietnam: Strong recovery underway, estimate economic growth at +6% in 2022

The IMF projects Vietnam’s economy will grow by 6% in 2022. However, we estimate growth could reach 6.5% this year supported by the stronger-than-expected recovery in domestic demand as well as resilient exports. Vietnam is among the pioneers in the region to adopt living with COVID strategy. Coupled with high vaccination rate, this has facilitated the reopening of the domestic economy, especially the services sector which accounted for over 40% of GDP in 2021. The resumption of international tourism will also boost growth in 2H2022. In addition, FDI inflows to the export-oriented manufacturing sector are expected to be resilient. However, there is mounting headwind to growth, including (1) higher inflationary pressures driven by food and energy prices, (2) global recession risks, (3) structural slowdown in China, and (3) related sanctions and repercussions of the war in Ukraine.

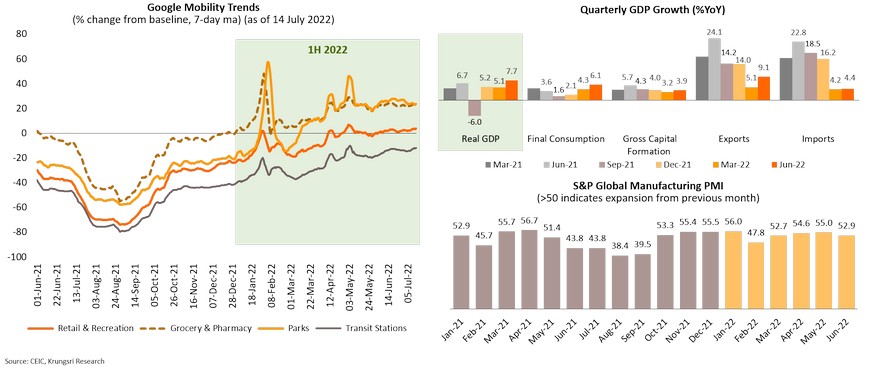

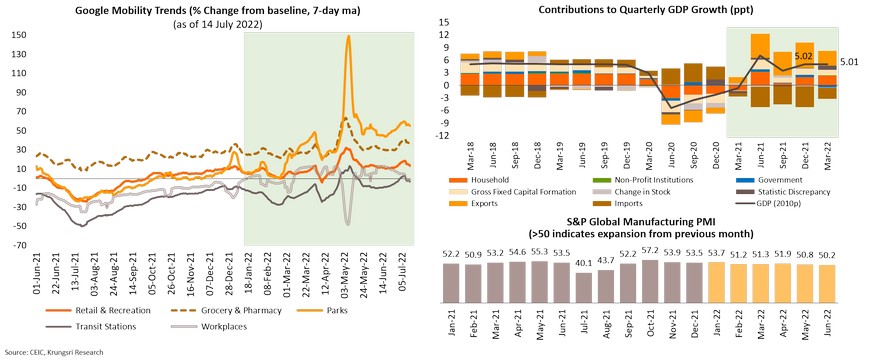

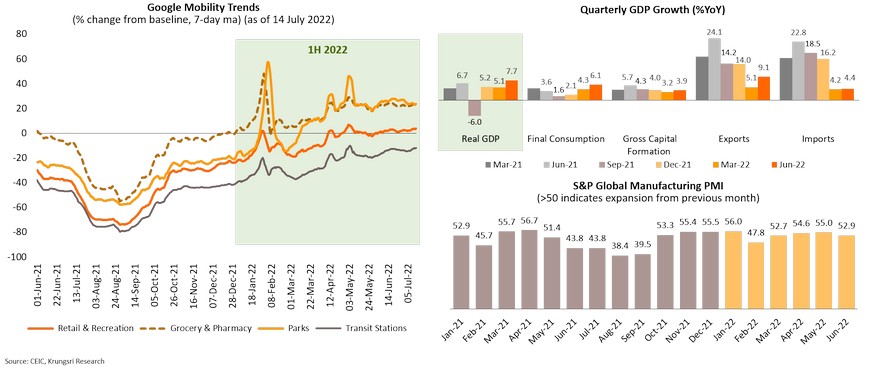

High-frequency data confirm a recovery; Q2 2022 GDP grew 7.7% YoY

Google Mobility Trends suggest most economic activities in Vietnam have returned to pre-pandemic levels, particularly transport and retail activities. Like other countries in the region, this suggests a fuller recovery of the services sector which accounted for almost 41% of GDP in 2021. This is in-line with Q2 data, with growth accelerating from 5.0% in Q1 to 7.7% in Q2 driven mainly by the reopening of the domestic economy as well as strong export demand. On the manufacturing front, activity has continued to expand strongly, as reflected by Manufacturing PMI data which exceeded-50 in 1H2022.

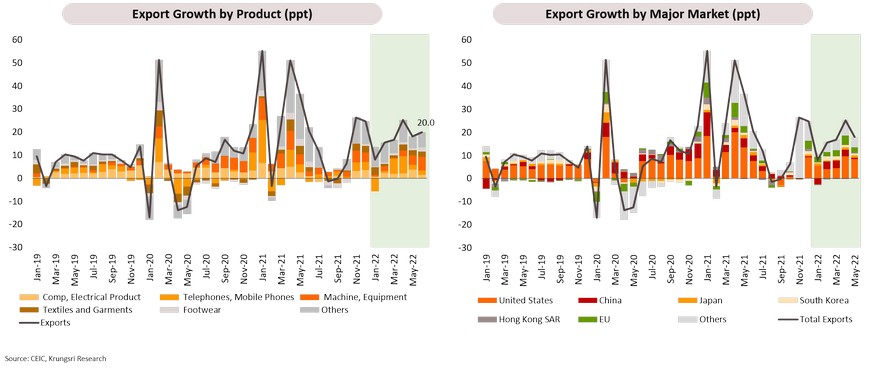

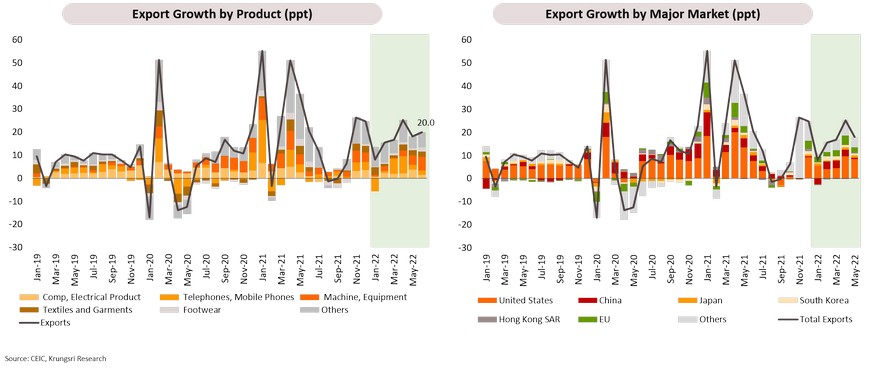

Exports should remain a key growth driver in 2H2022 amid fears of a global recession

There is still strong external demand for Vietnam’s key exports including electronics, telephones, machine, garments and footwear, and we expect the momentum to continue into 2H2022. This will be driven primarily by ongoing supply diversification efforts by major MNCs, by relocating manufacturing activity to Vietnam. In terms of export markets, Vietnam will continue to enjoy trade privileges and the benefits of free trade agreements (FTAs) to support market access to major markets including the US, the EU, China, and Japan. However, there are lingering downside risks to export growth in the near term, including global recession risks and a shift in consumer spending from goods back to services as the global economy continues to recover.

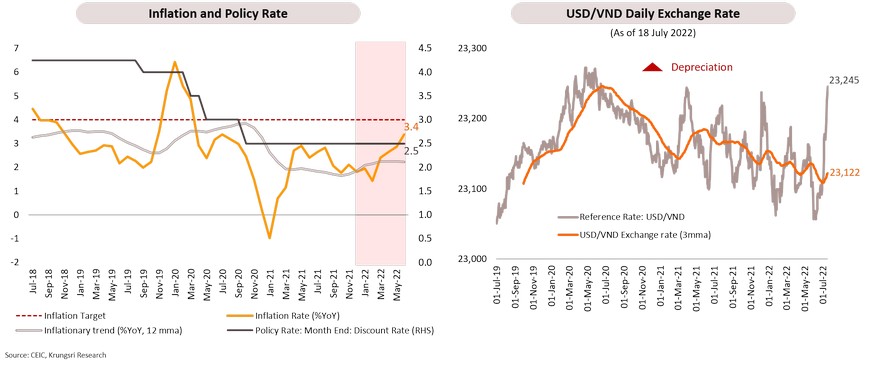

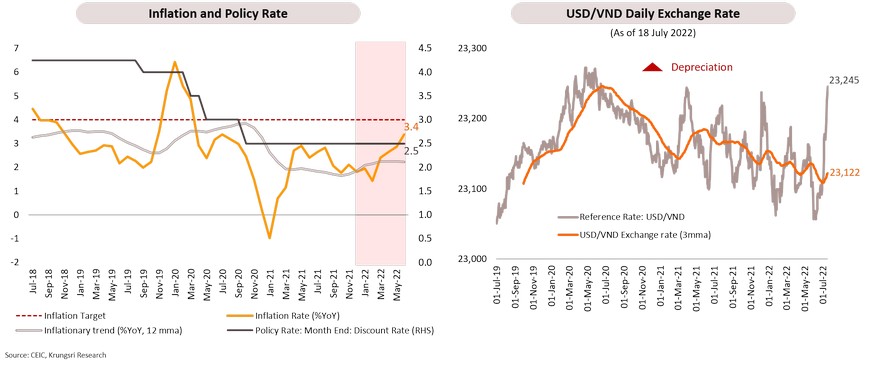

Macroeconomic stability remains benign, but external headwinds, including repercussions of Russia-Ukraine war, will add upward pressure on inflation

There is rising pressure on price stability in Vietnam due primarily to the surge in global energy and food prices, like in other countries. Inflation rose to 3.4% YoY in June, and we expect inflationary pressure to persist in 2H2022 driven by both demand and supply factors. Domestic demand has rebounded strongly and the spillover effects of the war in Ukraine, particularly oil price shocks, will linger for awhile. To maintain price stability and contain inflation expectations, we expect the State Bank of Vietnam (SBV) to gradually raise policy rate in 3Q2022. We also expect the VND to be stable supported by Vietnam’s favorable external position and the SBV’s occasional intervention.

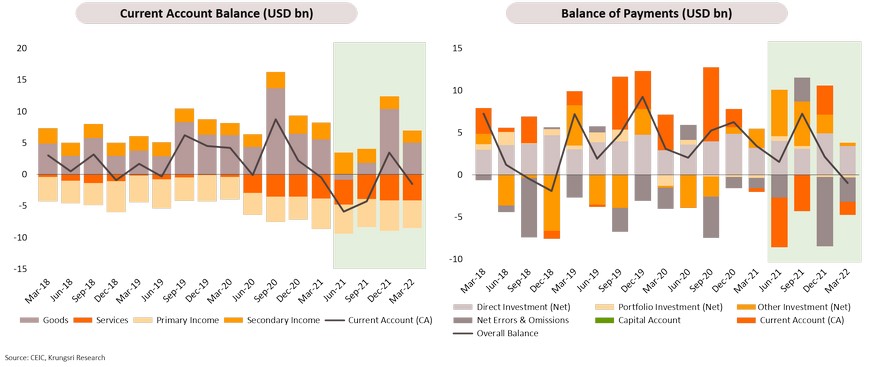

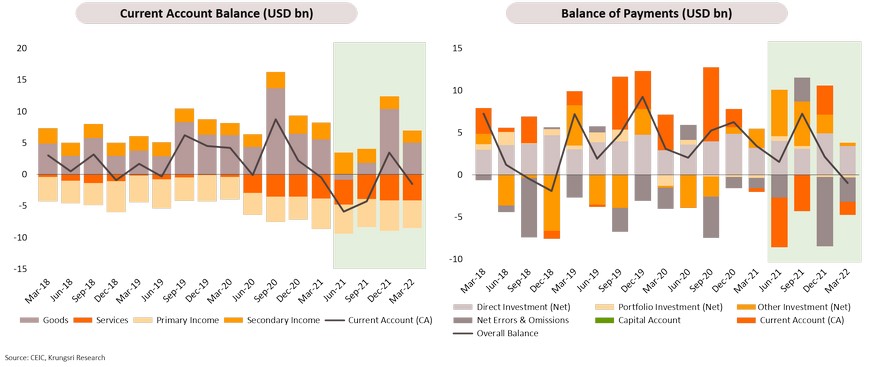

External position is relatively resilient to weather shocks and turbulence in the global financial market

With the gradual reopening of cross-border tourism at home and globally, trade in services, together with an expected surplus in trade in goods, should turn the current account balance to positive territory. Looking ahead, a current account surplus and sustained FDI inflows should support a stable exchange rate and Vietnam’s overall external position. Hence, we expect the VND to be relatively stable against the USD in the near-term.

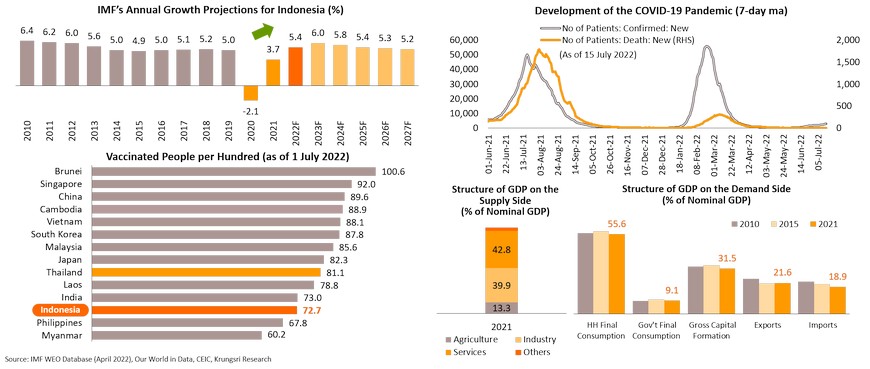

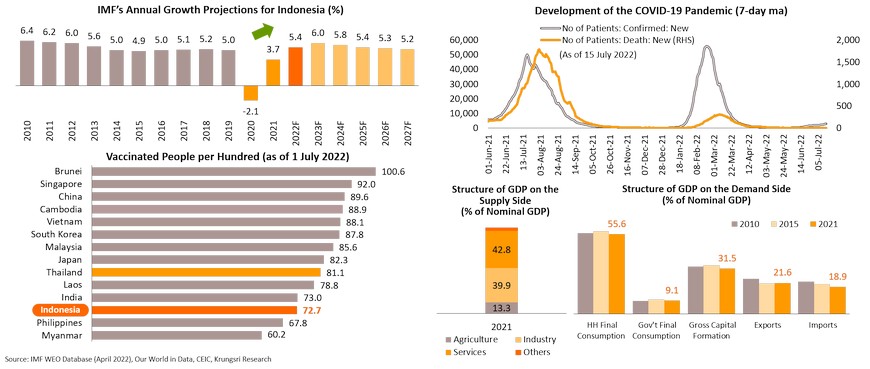

Indonesia: Resilient recovery in domestic demand and commodity export boom to drive economic growth above 5% in 2022

The IMF projects Indonesia’s economy would grow by 5.4% in 2022. However, we see upside risks to the country’s growth trajectory in 2H2022. In addition to the strong recovery in domestic demand, particularly household consumption and private investment, Indonesia will continue to benefit from a surge in global commodity prices and substitution effect triggered by trade diversion. Reopening to international tourism will also boost growth. However, the near-term growth outlook is clouded by mounting external headwinds, including the Fed’s proactive rate hike, structural slowdown in China, a resurgence of COVID-19 cases, and higher food and energy prices.

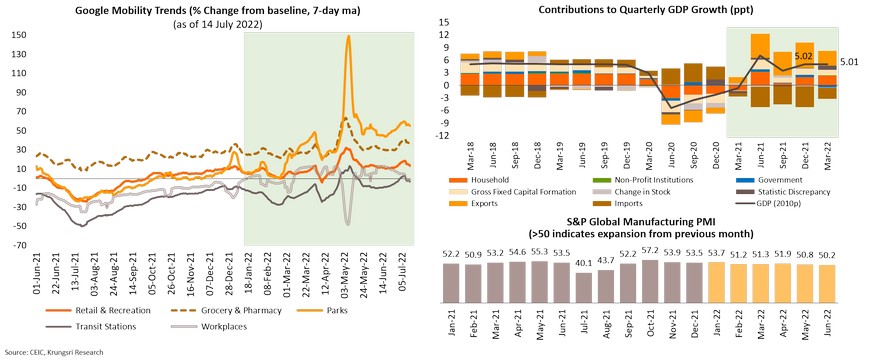

Domestic demand has recovered strongly driven by firm improvements in both household consumption and private investment

Latest Google Mobility Trends suggest most economic activities in Indonesia have recovered past pre-pandemic levels. This should support a strong recovery in domestic demand in 2H2022. The pace of recovery is also reflected in 1Q2022 GDP growth data; the economy continued to expand for a second consecutive quarter in 1Q 2022, by 5%, driven by commodity exports and a rebound in domestic demand with easing COVID restrictions. On the manufacturing front, activity has continued to expand strongly, reflected by above-50 Manufacturing PMI in 1H2022.

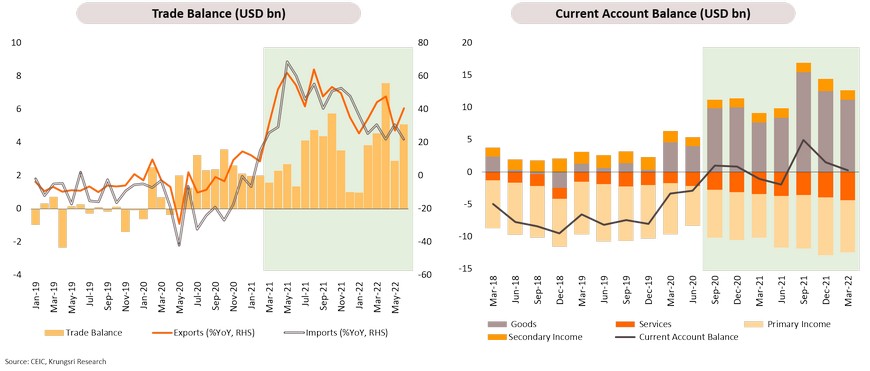

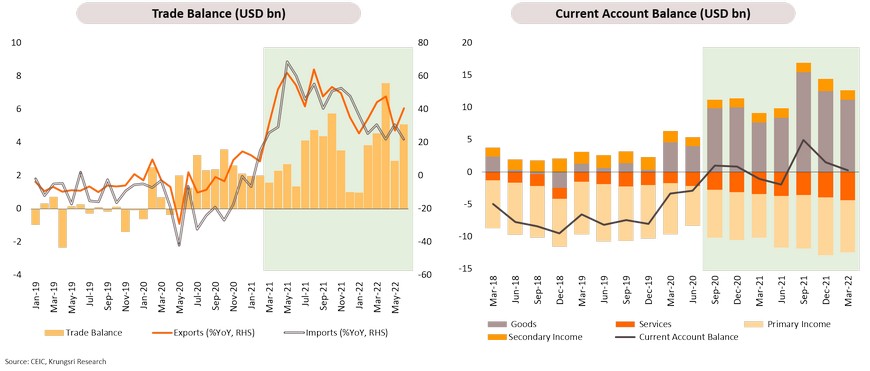

Surge in commodity prices has resulted in a large trade surplus and an improved current account position

Indonesia is a resource-rich nations which has enjoyed favorable conditions in the world commodity market in the past two years. Its exports, particularly oil & gas, palm oil, and mining products including coal and copper, have increased substantially, leading to a surge in exports and trade surplus. For example, the country registered larger-than-expected trade surplus of USD4.5bn in March – the largest since October 2021. Commodity prices have been sustainably high as a result of the Russia-Ukraine war. A sustained surplus of trade in goods has led the country’s current account balance to positive territory. This will provide a cushion for Indonesia’s external stability and the exchange rate.

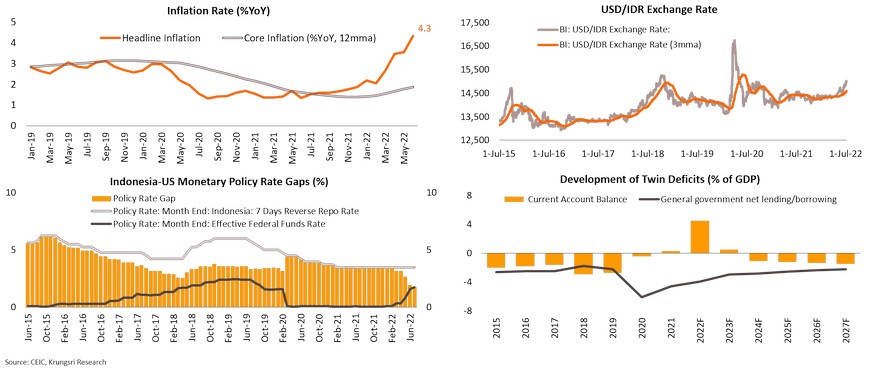

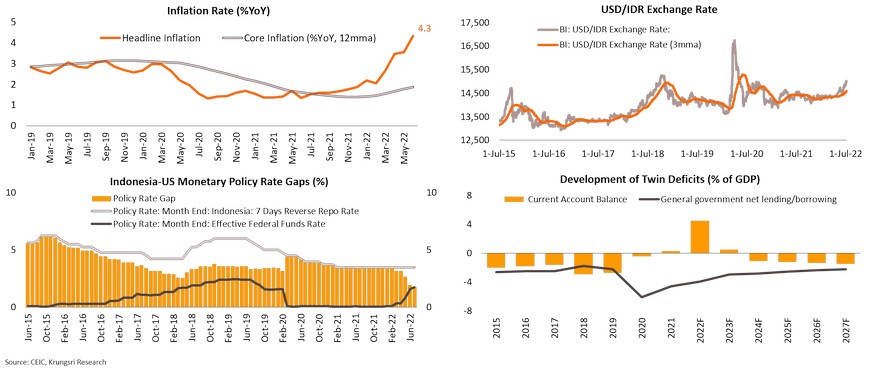

Rising fuel and food prices add upward pressure on inflation; Fed’s proactive rate hike could weigh on IDR stability and capital outflows

Inflationary pressure is building up in Indonesia, like elsewhere in the region. Inflation rose to 4.3% YoY in June, breaching the upper bound of the 2-4% inflation target for the first time in five years. Rising inflation has been driven by higher energy, food and housing prices. Core inflation has also been trending up, reflecting underlying pressure on inflation. This, coupled with the Fed’s aggressive rate hike and a stable IDR, might prompt BI to raise policy rate at the September meeting to maintain optimal policy rate gap with the US Fed rates.

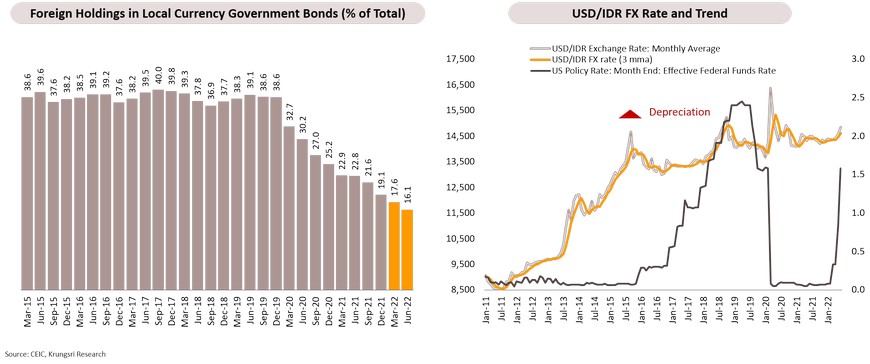

Bank Indonesia (BI) might start tightening cycle in 3Q2022; pace of rate hike will depend on external stability and the Fed’s actions

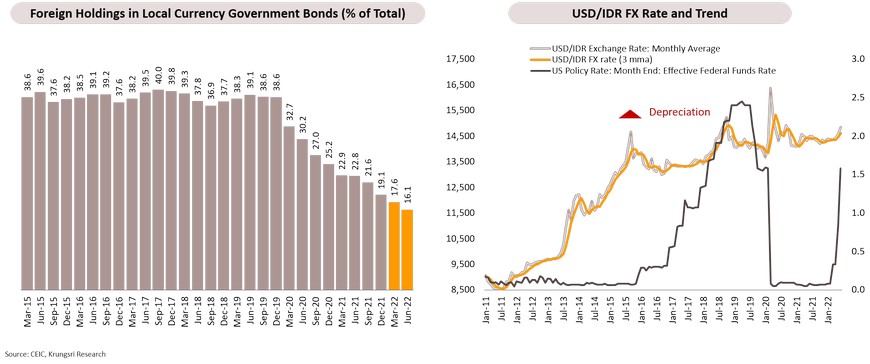

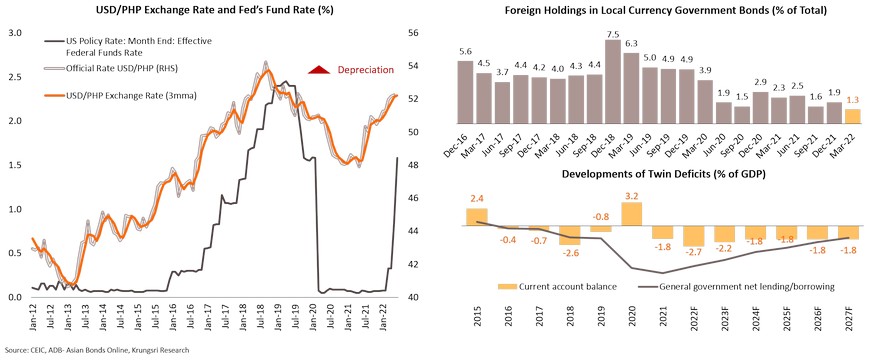

Over the past few years, Indonesia’s relatively high dependence on the international capital market (reflected by the high ratio of foreign holding in local currency government bonds )makes it vulnerable to disruptions in capital flows and global financial conditions. The ratio peaked at 40% in 2017 and has gradually dropped to 16.1% in June 2022. However, it remain relatively sizeable among regional peers and therefore, makes Indonesia vulnerable to a weaker exchange rate. However, a current account surplus could support the value of the local currency against the backdrop of risk-off mode in global financial markets triggered by aggressive tightening by the US Fed. This could support BI to gradually normalize its monetary policy.

Philippines: Reopening at home and abroad to support strong economic recovery

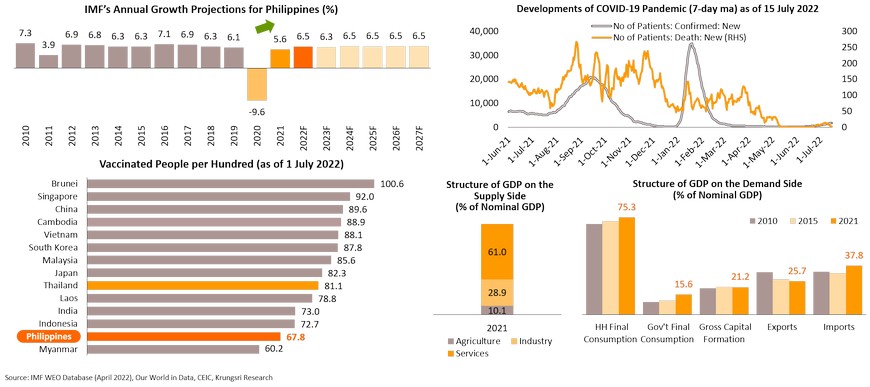

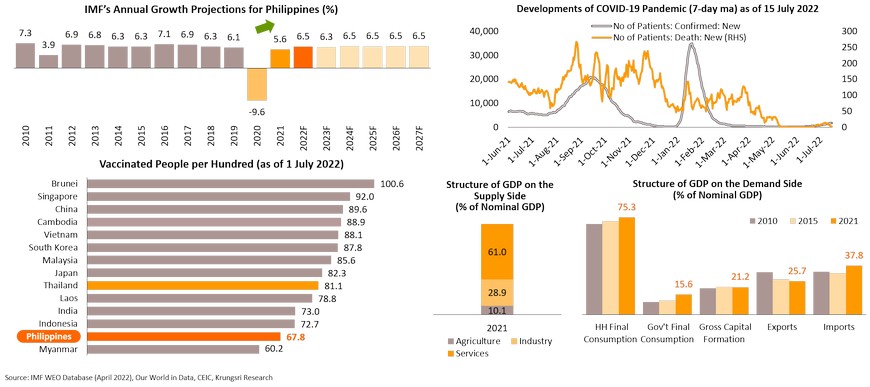

The IMF projects the Philippines’ economy would expand by 6.5% in 2022 driven by the reopening of the domestic economy and strong external demand. Despite a relatively low vaccination rate compared to its neighbors, the COVID-19 pandemic seems to be largely contained and would facilitate full normalization of economic activities in all sectors, especially private consumption. In early July, the government trimmed 2022 growth forecast to a range of 6.5-7.5% from 7.0-8.0%, citing rising inflation, government’s fiscal consolidation, and a dim global economic outlook.

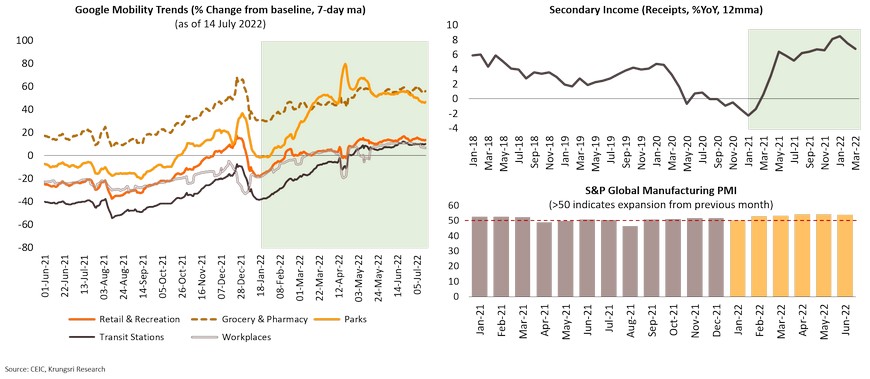

Economic activity has fully recovered, surpassing pre-pandemic levels

The near-term outlook for the economy is relatively optimistic. This is affirmed by a strong recovery in mobility data. The reopening of the economy has led to full normalization of activities across all sectors. Overseas remittances, which accounts for almost 10% of GDP, have been recovering in tandem with the resumption of economic activities abroad. This will support domestic consumption the rest of year. On the industry front, in the first half of 2022, the MPI continued to rise, reflecting strong manufacturing activity which boosted the country’s exports.

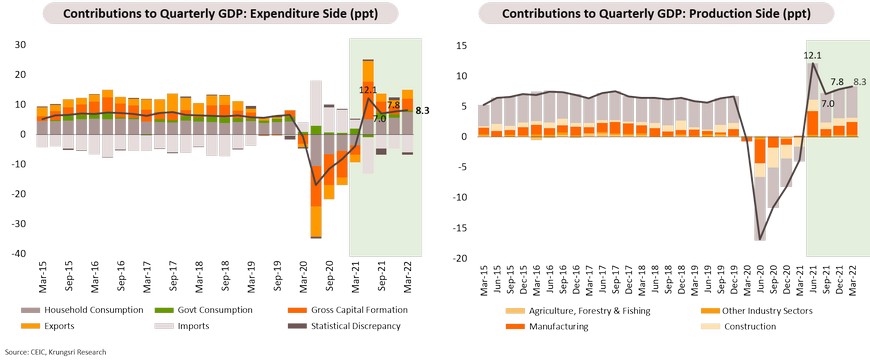

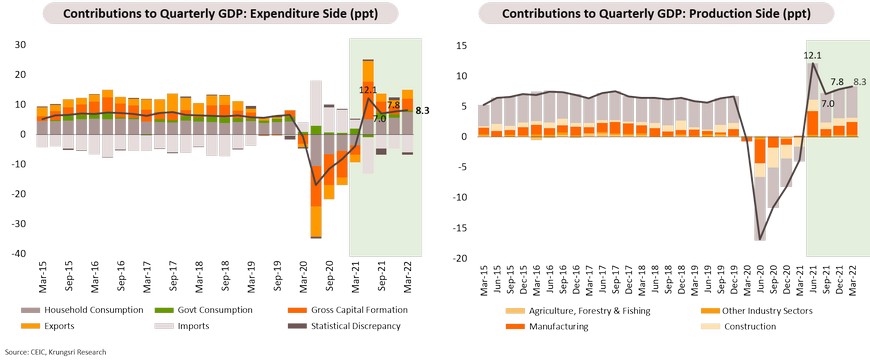

Household consumption and service sector have recovered strongly due to the reopening at home and abroad

In Q1 2022, Philippines’s GDP grew 8.3% YoY, the highest in the region following 5.6% growth for full-year 2021. The reopening of the economy and easing mobility restrictions drove the strong expansion in household consumption and investment, by 10.1% YoY (7.5% YoY in Q4 2021), and 20% YoY (vs. 14.2% YoY in Q4 2021). External demand also supported growth. Activity in the industry and services sectors has also recovered strongly. However, higher food and energy prices, rising borrowing costs at home, slower growth in China, and recession risks in the US, will weigh on the near-term outlook. The US and China are the two largest export markets for the Philippines at 31.4% share of total exports in 2021.

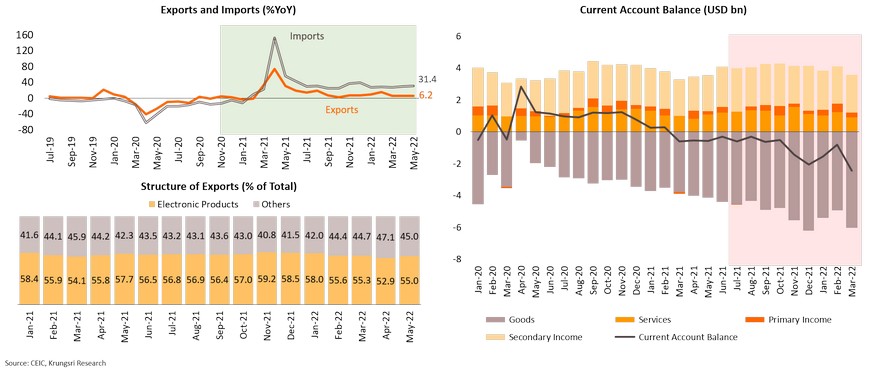

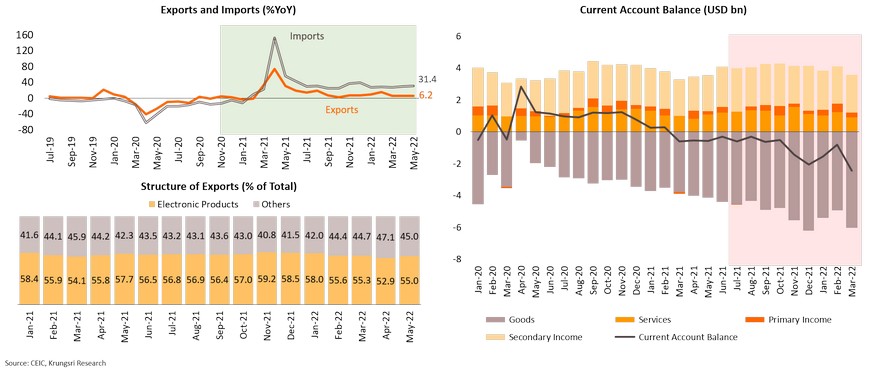

External demand could be weakened by worsening global outlook; strong rebound in economic activity at home is widening external imbalances

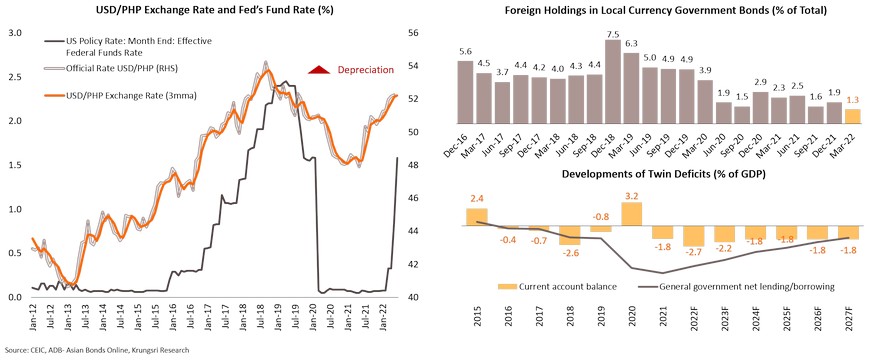

Philippines’ international trade activity has recovered supported by global economic normalization over the past year. The country experienced the recent boom cycle in global goods trade, reflected by a surge in exports. However, looking ahead, we view that external imbalance will widen driven by strong import demand with the reopening of domestic economic activity, rising imports of capital goods for infrastructure investment, and elevated global commodity prices. This will widen the current account deficit and assert fundamental downward pressure on the currency.

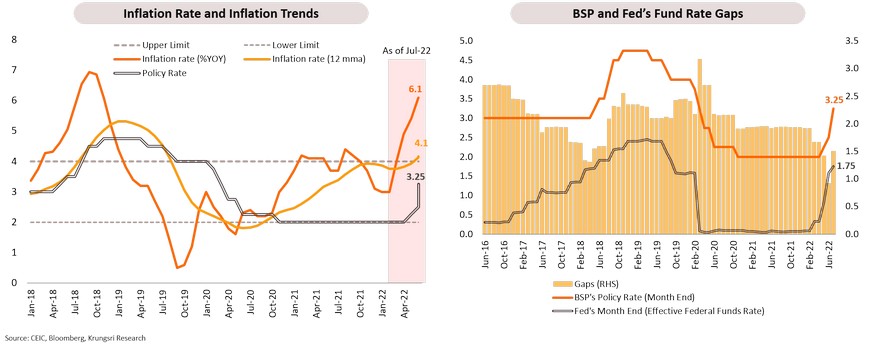

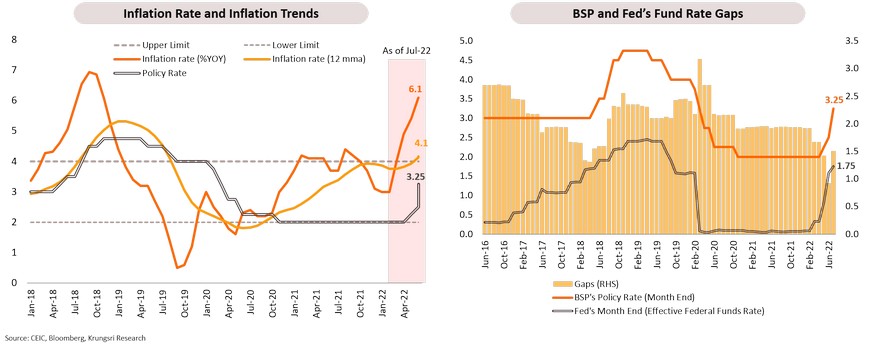

Rising inflation and the Fed’s aggressive rate hikes have prompted the BSP to start its tightening cycle

The Bangko Sentral ng Pilipinas (BSP) – the Philippines’ Central Bank – has delivered two quarter-point increases to take key rate to 2.5% to curb inflation expectations and the second-round effects of wage-price spiral, as well as to keep the currency stable. And on 14 July 2022, the BSP surprisingly raised its key interest rates by 75 basis points and hinted further rate hikes are on the table. Like elsewhere in the region, the Fed’s hawkish stance is pressuring the country’s external stability and exchange rate stability. According to a Bloomberg report, the new BSP governor has said “the Bank is prepared to be more aggressive in raising its policy rate, compared to its initial gradualist stance,”. We expect the BSP to raise policy rate by a total of at least 100 basis points this year, as inflation has surged in June to its highest since late-2018. The BSP wants to contain inflation expectations as domestic demand has rebounded strongly past pre-pandemic levels and wants to maintain an appropriate policy rate gap with Fed rates to keep the exchange rate stable.

Exchange rate will be under pressure in 2H2022 given the Fed’s proactive rate hikes and widening current account deficit

The USD/PHP exchange rate could depreciate in the near-term. The post-pandemic recovery remains strong, particularly household consumption, so import demand in the Philippines would rise and pressure the current account balance. In addition, despite low foreign holdings in local currency government bonds, the Federal Reserve’s proactive interest-rate hikes to contain inflation at home is widening the interest rate gap with the Philippines, which could trigger disruptive capital outflows. These two key factors would put downward pressure on the exchange rate. Subsequently, a weaker currency would add to concerns about imported inflation in an economy like the Philippines which depends significantly on food and fuel imports (13.2% and 12.4% of goods imports in 2021, respectively).

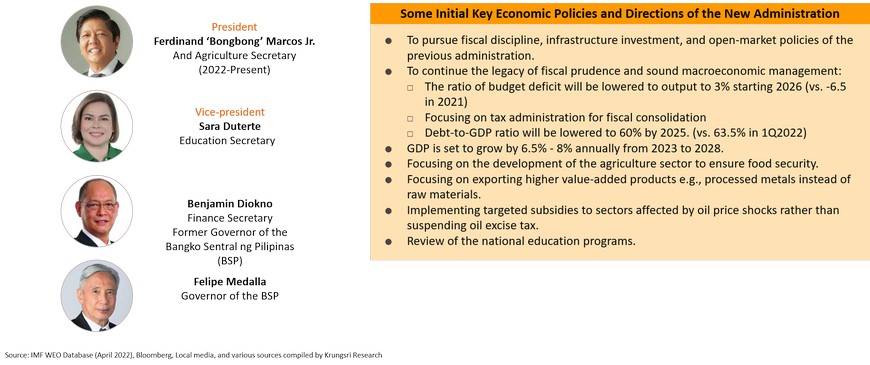

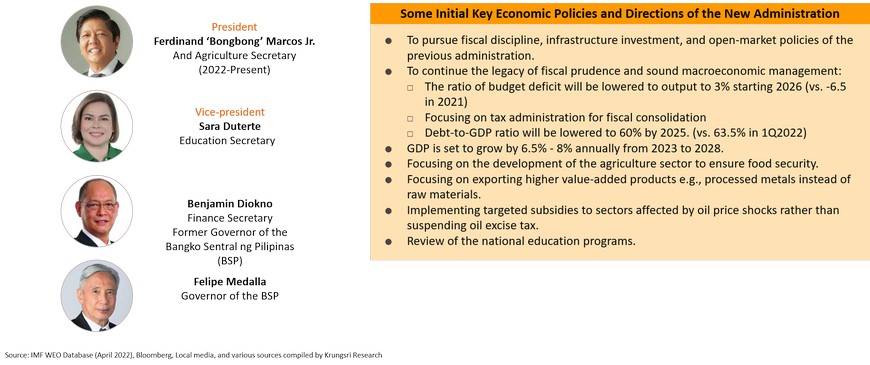

New administration is expected to maintain sound macroeconomic management and key structural reforms

President Ferdinand Marcos Jr. had a landslide victory in the general election on 9 May 2022, after promising unity and measures to spur the post-COVID economy. Under the 6-year term, President Marcos’s economic team comprises competent policymakers from the previous administration, including Finance Secretary Benjamin Diokno, former BSP Governor, and Governor Mr. Felipe Medalla, a member of the monetary board at the BSP. This means Marcos Jr.’s administration will maintain sound macroeconomic management and fiscal prudence. However, it might be challenging to deliver a robust recovery in the near-term because of rising inflation, and high government debt limiting fiscal space to support growth and to boost economic potential.