EXECUTIVE SUMMARY

Credit card issuers can look forward to gradually improving conditions over 2025-2027 thanks to a forecast of 2.0-3.0% average annual increase in credit card spending through these years. Income will be lifted by an uptick in spending on domestic and international tourism by both mid- and upper-income earners and new entrants to the workforce, who will in the future comprise credit card issuers’ core customer base. The industry will also benefit from expansion into overseas markets and the release of financial products targeted at particular high-potential segments. However, growth will come under pressure from a number of headwinds. (i) Worsening geopolitical tensions and a deterioration in the international political environment are dragging on the domestic economy and undercutting growth in consumer spending power. (ii) Tourist arrivals may fall short of target numbers, most importantly within the Chinese segment, and this may then negatively impact spending on foreign-issued cards. (iii) Alternative financial products are gaining market share. In particular, ‘Buy Now, Pay Later’ (BNPL) schemes are evolving into a major threat to credit cards’ market share, especially among younger consumers. (iv) The 2026 increase in the minimum monthly payment from 8% to 10% of outstanding credit card balances will drag on consumer spending, most notably among low- and middle-income demographics. (v) Issuers are becoming more cautious about extending new credit. (vi) Fintech players are increasingly competing with credit card issuers for market share.

Krungsri Research view

Krungsri Research assesses the outlook for the credit card business by issuer as follows:

-

Non-bank issuers that are subsidiaries of a commercial bank: Credit card spending should grow at a faster rate for issuers in this group than for those in the general non-bank group since these players typically have a customer base that is tilted more towards middle- and upper-income earners, and for these individuals, spending power and creditworthiness remains solid. Spending should be heaviest on tourism, online shopping, and services connected to daily life. However, the need to maintain credit standards and to avoid a run-up in debt delinquencies means that issuers in this group are also tightening the release of new credit by slowing the issuing of new cards and restricting the credit available to high-risk customers. As such, both credit limits and the number of credit cards actively being used may fall.

-

General non-bank issuers: Issuers within this segment typically target low- and middle-income consumers, but due to the earlier increase in the cost of living and ongoing high levels of household indebtedness, these individuals are now much more careful about their finances and so their total spending on credit cards is thus likely to remain flat. Nevertheless, thanks to their ability to design new financial products and to mount effective, targeted promotional campaigns, these issuers should still be able to expand their customer base. Moreover, these companies also generally authorize lower credit limits than do bank-affiliated issuers and so they should be less exposed to the risk of a jump in debt delinquencies and non-performing loans.

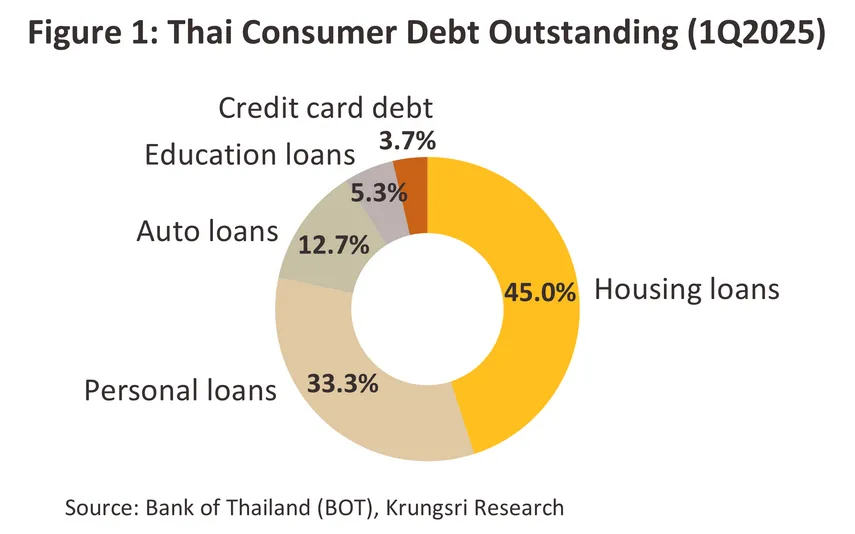

Overview

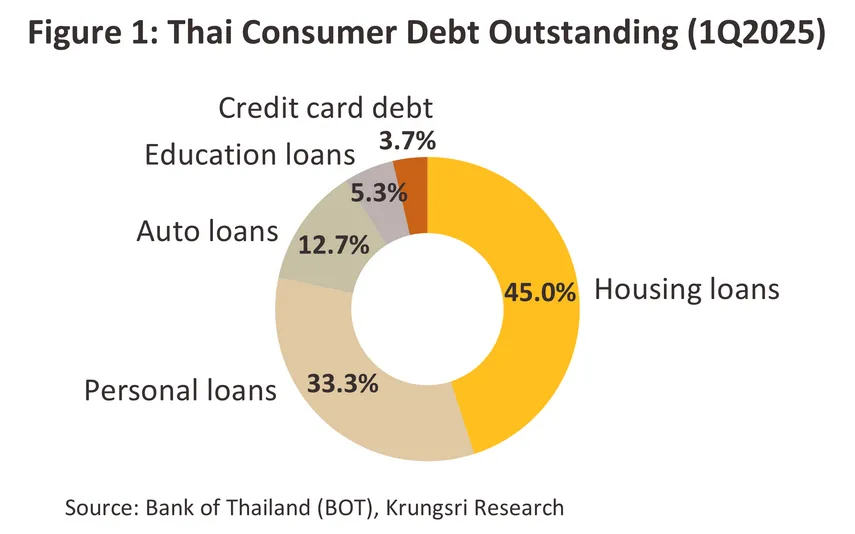

Credit card companies issue consumer credit to customers by authorizing the release of funds via credit cards up to a pre-approved limit, which then allows card holders to use their cards in place of cash when making purchases of goods or services, or when making cash advances to a value up to this pre-agreed limit. When purchases are made or money advanced on a credit card, the ensuing debt is a form of unsecured or non-collateralized loan that can then be paid off in installments, with the interest on this typically calculated from the day of purchase. Credit cards comprise a significant source of consumer debt, though in Thailand, they fall behind home, personal, auto and education loans in terms of their importance to the economy, and data from the first quarter of 2025 show that these accounted for 3.7% of total consumer loans of commercial banks (Figure 1).

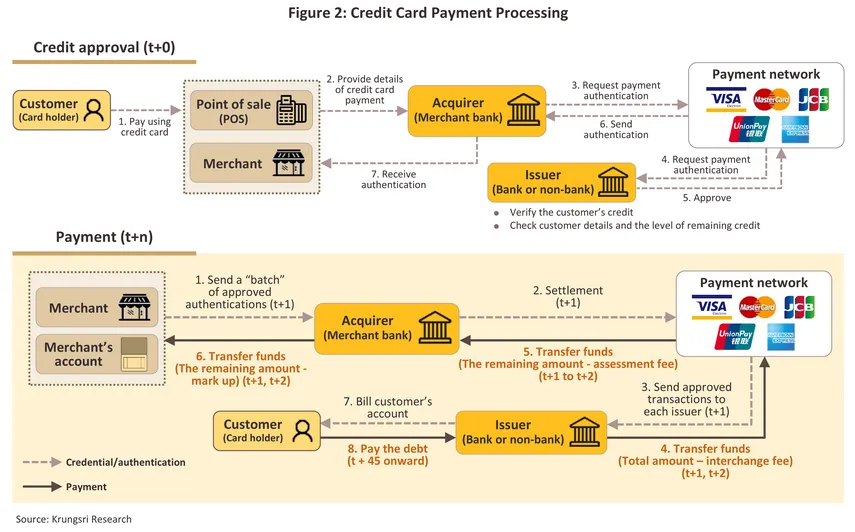

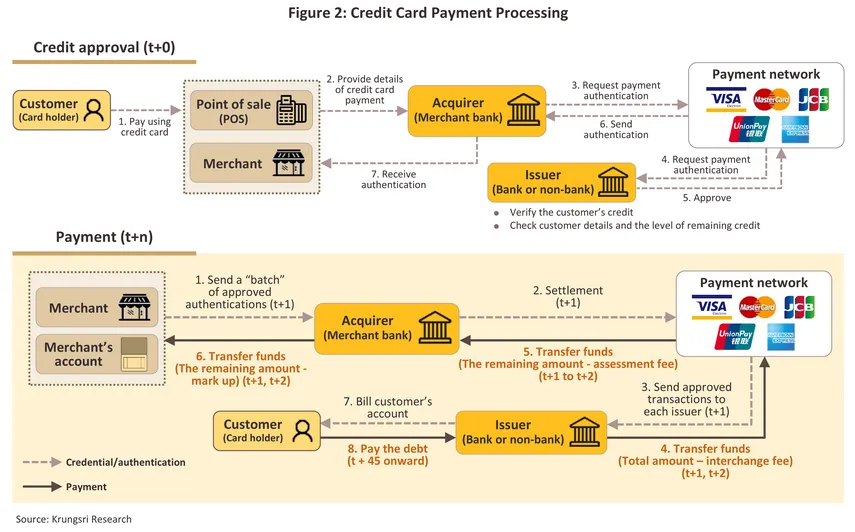

Each time a consumer purchases goods or services with a credit card, it will trigger several related-party transactions, from approving the release of credit to affecting the payment. Approving the release of credit typically happens instantaneously (t+0), and this makes the experience both convenient and seamless for consumers. Clearing and settlement between seller and the credit card company usually takes 1-2 days (t+n) and credit card holders will often have a 45-day period before interest is applied to this new debt (Figure 2).

The related parties connected through the transaction include the credit card holder, the issuing bank or business, the bank or business that receives the payment, the merchant to which the payment is made, and the payment network. Details are given below.

-

Card holders: Credit card holders may either pay off the entire balance on their card on or before the due date, or they may choose to pay off the outstanding balance in installments. For consumers, the benefits of using a credit card are: (i) it is convenient and reduces the need to carry excess cash; (ii) it provides access to credit, thus reducing the impact of fluctuations in personal liquidity and allowing consumers to spread out payments for purchases over a given period; and (iii) credit card issuers may offer additional incentives to encourage holders to use their cards to make purchases. The latter might include ‘cashback’ offers, points for purchases which can be exchanged for discounts/products, being billed for purchases in installments, benefits for making automatic monthly payments, and providing travel insurance.

-

Issuers: It is the issuer which, having already vetted card holders and set credit limits, authorizes or denies a payment request. Currently, there are several types of cards available, including: (i) general credit cards, which are part of general payment networks such as Visa, MasterCard, American Express, China Union Pay (CUP), and Japan Credit Bureau (JCB); (ii) co-branded cards, which involve banks or credit card companies issuing cards jointly with another company (Thai or foreign) so that card holders get additional benefits when using the card to make purchases from the co-brand company; (iii) affinity cards, which are issued jointly with non-profit making organizations, e.g. the cards issued by Krungthai for the Thai Flyer Association and the Thai Red Cross Society; and (iv) corporate cards, which are issued by organizations to pay for business expenses such as travel. They may also offer special discounts to organizations that partner with merchants. Examples include Krungsri Corporate Credit Card and KBank Corporate Executive Card.

-

Acquirers: Banks or other organizations that process transactions receive payment requests from businesses when there is a credit card transaction with a customer. When the payment is made, a charge will be imposed for the provision of this service, with the fee specified in the service contract. The fees levied by banks and processors for handling transactions vary, and providers may set a minimum charge for merchants. Banks and payment processors try to build networks of member merchants, with consideration given to the volume of transactions being made by a store or business and growth prospects. They will cooperate with retailers to offer different means of processing transactions, including: (i) electronic data capture (EDC), (ii) mobile point of sale (m-POS), (iii) one-time passwords (OTP), and (iv) automatic deduction from accounts.

-

Merchants: Accepting credit card payments offers several advantages for merchants, whether this is conducted through POS terminals or the internet. Credit card payments make shopping more convenient for customers, especially when purchasing high-value goods because customers do not have to carry large amounts of cash. It is also easier for businesses to manage electronic payments than cash payments, and card payment means retailers do not have to keep a supply of coins and small change. However, some smaller businesses may prefer not to accept credit card payments because they incur processing fees, and those merchants will not receive the full proceeds of the goods or services sold. Such merchants may specify a minimum amount for payments made by credit cards (e.g. THB500) or charge the fee to the customer by including an additional charge over the transaction.

-

Payment networks: When a merchant processes a credit card transaction, the relevant payment network will receive the request from the Thai business carrying out the transaction. These networks are based outside Thailand and are global in scope, receiving requests from around the world to make deductions in one account and balancing credit to another within the network. After the transaction information is received and evaluated, accounts will be debited and settled, and monies transferred to the relevant merchant in Thailand. The major players are Visa, MasterCard, American Express, China Union Pay (CUP) and Japan Credit Bureau (JCB). But the fact that the most important players are outside Thailand means fees for Thai transactions might be higher than they should be. Currently, local payment networks (called ‘local switching’) are capable of handling debit card transactions.1/

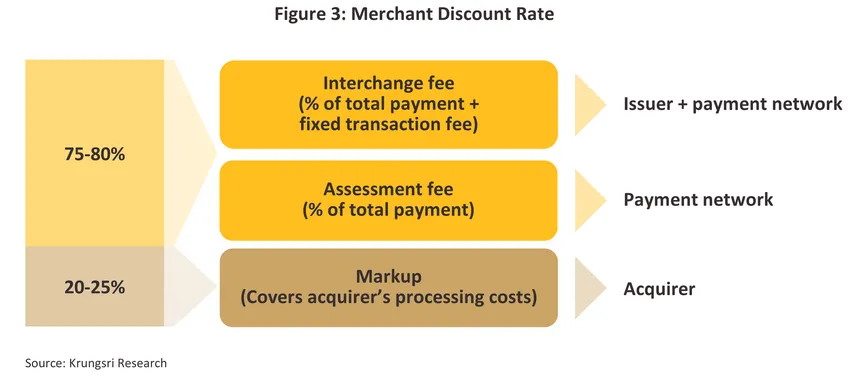

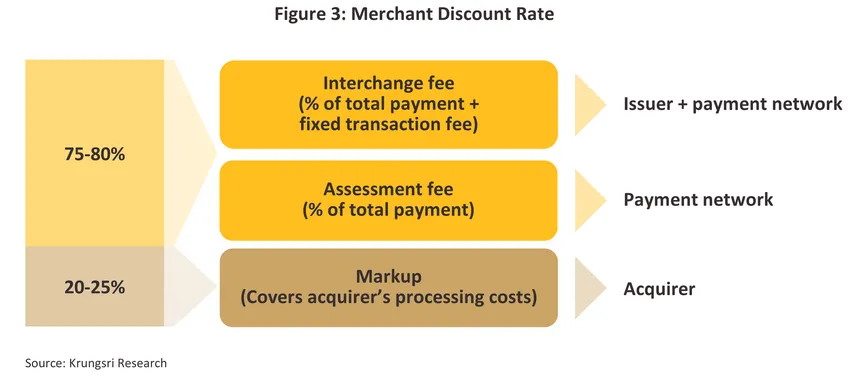

Usually a fee (or merchant discount rate) of 1.5-2.4% of the value of the transaction is imposed on Thai merchants for processing credit card payments; the exact amount will depend on the type of credit card used. This fee has several sub-components. (i) The interchange fee goes to the bank or organization that issued the card and covers the costs incurred for marketing, extending credit to card holders, processing payments by card holders, and covering and pursuing bad debts. (ii) The assessment fee is paid to the payment network, which acts as a middleman. (iii) The markup fee goes to the acquirer for its role and the costs incurred in managing and receiving the transfer of monies from the merchant that has taken the payment. On average, interchange and assessment fees will comprise 75-80% of the total fee paid by a merchant, with the markup fee accounting for the remaining 20-25% (Figure 3).

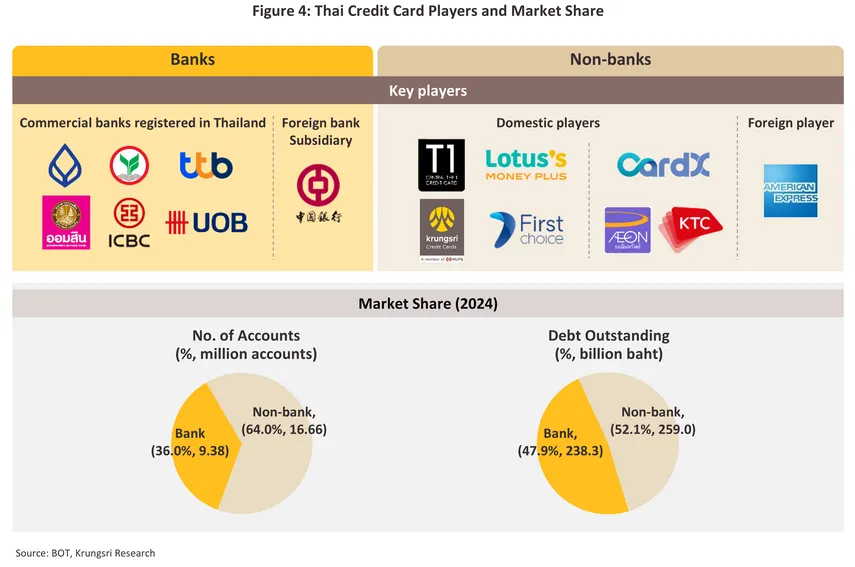

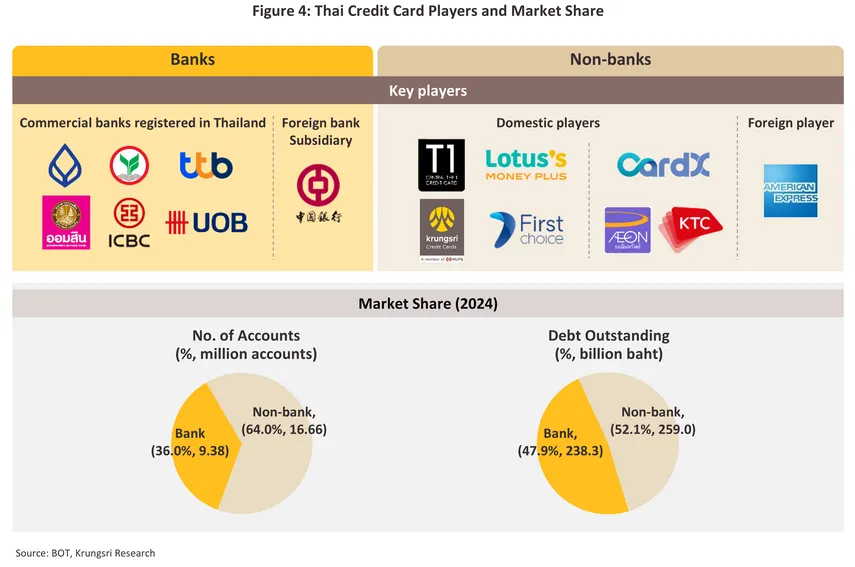

Credit card issuers currently operating in Thailand can be split into two groups. (i) Banks, both commercial banks and Specialized Financial Institutions (SFIs). These include commercial banks registered in the country; Bangkok Bank, Kasikorn Bank, TMBThanachart Bank, UOB (Thailand), and ICBC (Thailand), a foreign bank subsidiary; The Bank of China (Thailand), and SFIs; Government Savings Bank. (ii) Non-banks offering credit card services2/ such as two subsidiaries of Bank of Ayudhya Pcl. (Krungsri Ayudhaya Card Company Limited and Ayudhaya Capital Services Co., Ltd.); co-brands with Bank of Ayudhya Pcl. (General Card Services Ltd. and Lotus’s Money Services Ltd.), Card X Co., Ltd. (part of Siam Commercial Bank Pcl.), Krungthai Card Pcl. (part of Krungthai bank), AEON Thana Sinsap (Thailand) Plc. (AEON credit card); and American Express Thai Co., Ltd. (a foreign non-bank operating American Express credit card) (Figure 4).

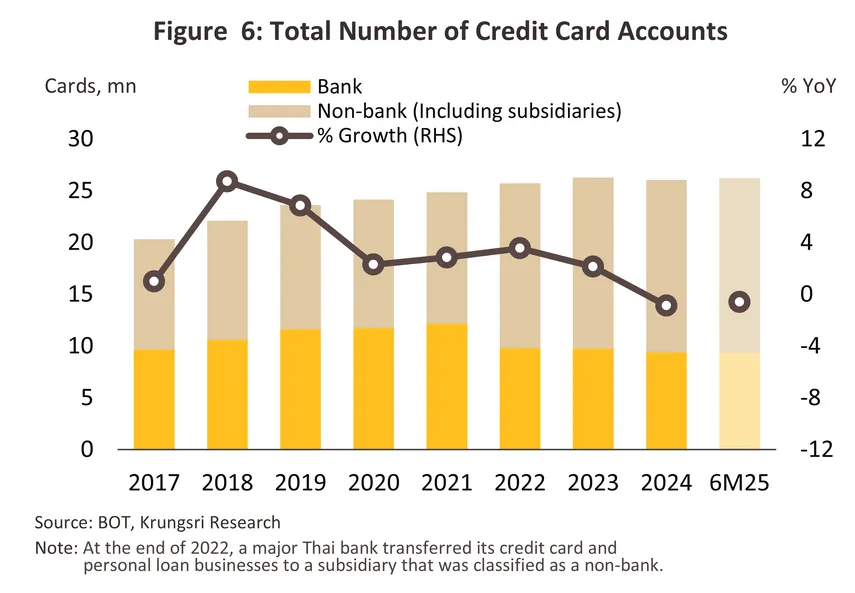

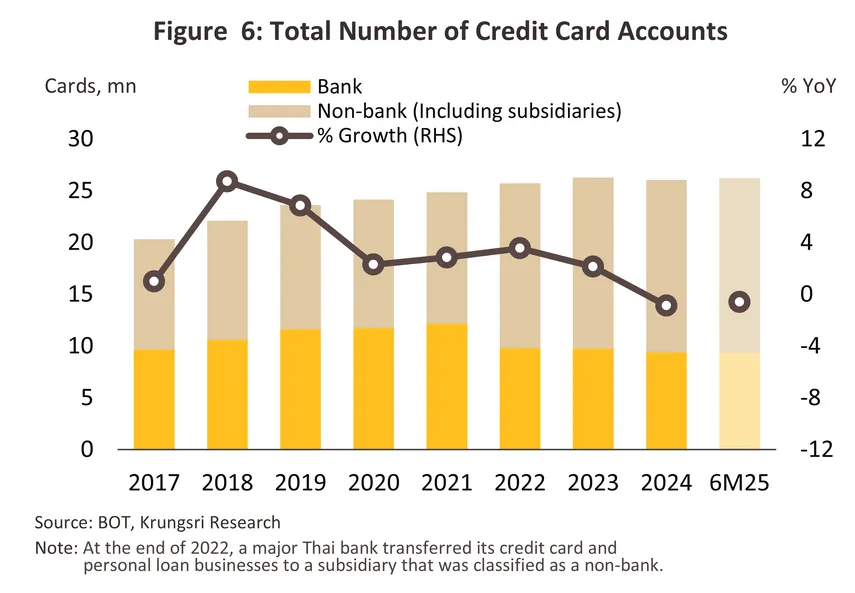

Competition within the credit card market is increasingly shifting in favor of the non-bank segment, and so measured by outstanding balances, as of 2024, non-bank issuers enjoyed a 52.1% market share, up from 50.5% a year earlier. This thus implies that bank issuers’ market share contracted from 49.5% to 47.9%. Looking at card issuance, the difference between the two segments becomes sharper, and with the number of credit cards issued by banks declining steadily, non-bank issuers now have an almost-two-thirds market share. Meanwhile, the number of cards in the Bank segment has continued to decline. This was mainly due to tighter credit card lending standards by commercial banks, particularly for low-income customers, in an effort to contain household debt. As a result, new card issuance slowed, while cancellations of inactive cards increased (Figure 4).

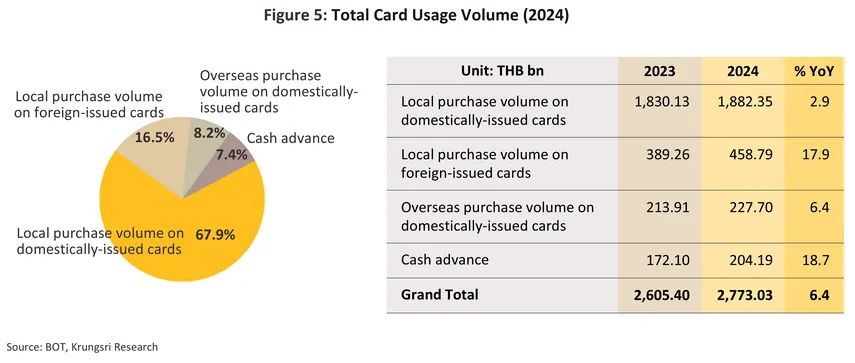

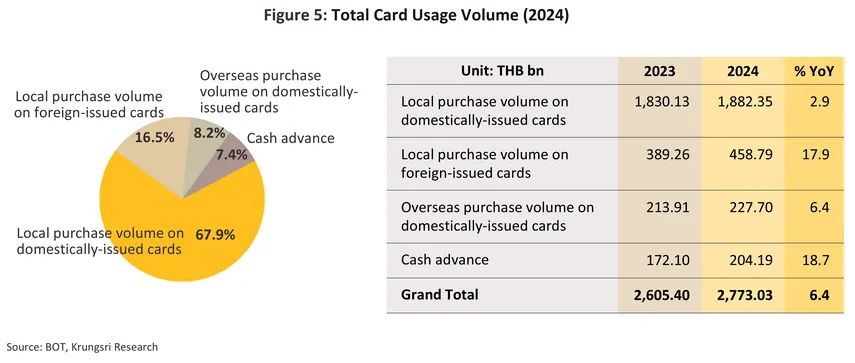

As of 2024, 67.9% of all domestic spending on credit cards was made via domestically issued cards, a rise of 2.9% from 2023. Spending made via foreign-issued credit cards jumped 17.9% to contribute a total of 16.5% of total transactions, while spending overseas made via Thai-issued credit cards climbed 6.4% to comprise 8.2% of the total. Finally, cash advances surged 18.7% to 7.4% of all credit card spending (Figure 5).

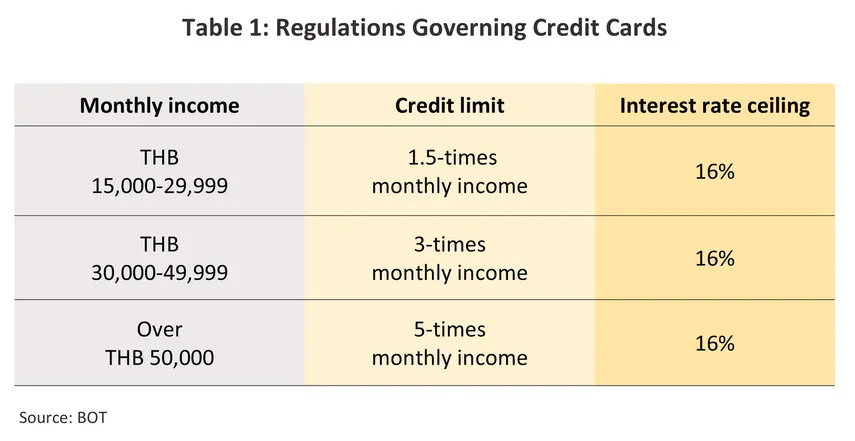

The Bank of Thailand is responsible for regulating the domestic credit card business, laying out similar rules for banks and non-banks regarding card issuance. To qualify, individuals should have a monthly income of not less than THB 15,000 or deposits in a bank account that average not less than THB 15,000 per month over at least 6 months. Credit limits are set according to the following regulations: (i) For individuals with an income below THB 30,000 per month, the credit limit is set at 1.5-times monthly income; (ii) for those with an income of THB 30,000-50,000 per month, the limit is set at 3-times monthly income; and (iii) for those on higher incomes, the limit rises to 5-times monthly income. The interest charged on outstanding balances, fees, penalties, and other charges is fixed at a maximum effective rate of 16% p.a. (Table 1), while for 2024-25, at least 8% of the outstanding balance must be paid each month.

Situation

Credit card spending continued to rise steadily through 2024, buoyed by the following factors.

1) Although it slowed from last year’s 6.9% expansion, private-sector consumption still grew by 4.4%, though this was especially dependent on middle- and upper-income consumers in major urban areas and key tourist destinations.

2) The tourism sector remained a key driver, supported by the continued recovery in foreign arrivals (35.54 million in 2024, or around 90% of the 2019 level). At the same time, domestic travelers sustained higher spending through credit cards, particularly on accommodation, dining, and air tickets for both domestic and international travel.

3) Although the rate of expansion has slackened, e-commerce sales are still growing and so as of 2024, the Thai market was worth THB 694 billion, up 9.5% from 2023’s THB 634 billion (which was itself a rise of 16.8% from a year earlier). Consumers are thus now very comfortable using credit cards to pay for these purchases, especially for electronics goods, fashion items, domestic electrical appliances, and beauty products.

4) Issuers remain proactive in deploying promotional campaigns. These include partnering with other businesses to offer special or differentiated promotions that target particular consumer groups (e.g., by joining with restaurants, hospitals, travel and tourism platforms, and shopping malls), offering reward points to be collected, and giving cashback credits in popular sales categories (e.g., tourism, health and beauty treatments, supermarkets and hypermarkets, and insurance). Players are also offering additional assistance in the form of a wide range of debt restructuring programs to customers who are struggling to make their payments.

Nevertheless, despite these tailwinds, the industry still faces a number of challenges. (i) At 87.4% of GDP as of Q1 2025, household debt remains high, the share of NPLs is rising, and worries over credit quality are worsening, and as such, credit card issuers are tightening the release of new credit and the approval of new cards, especially for customers in low- and middle-income groups. (ii) The adoption of responsible lending principles is encouraging commercial banks to rein in more aggressive growth plans and instead to focus on retaining current high-value customers while gradually shutting inactive accounts. (iii) Given the need to pay steep international fees, domestic credit card charges will likely remain high.

These factors combined to have the following effects on the market in 2024.

-

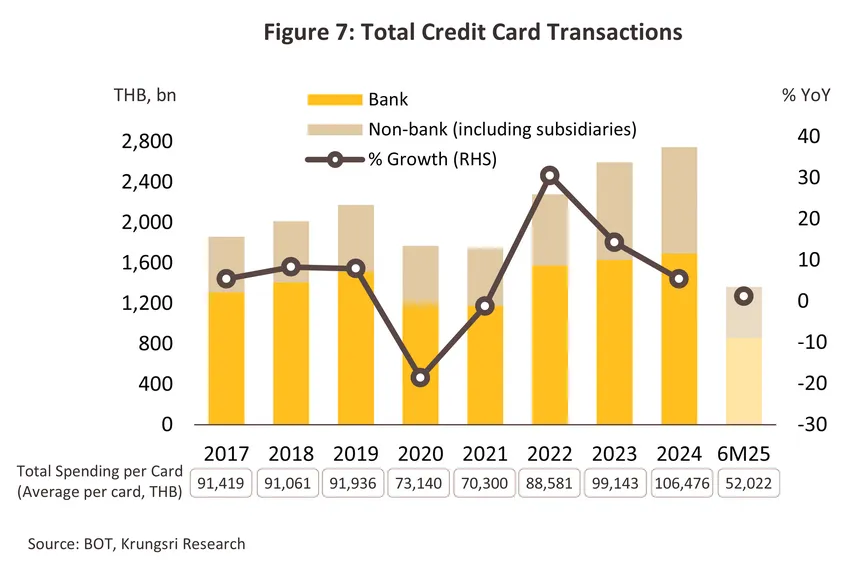

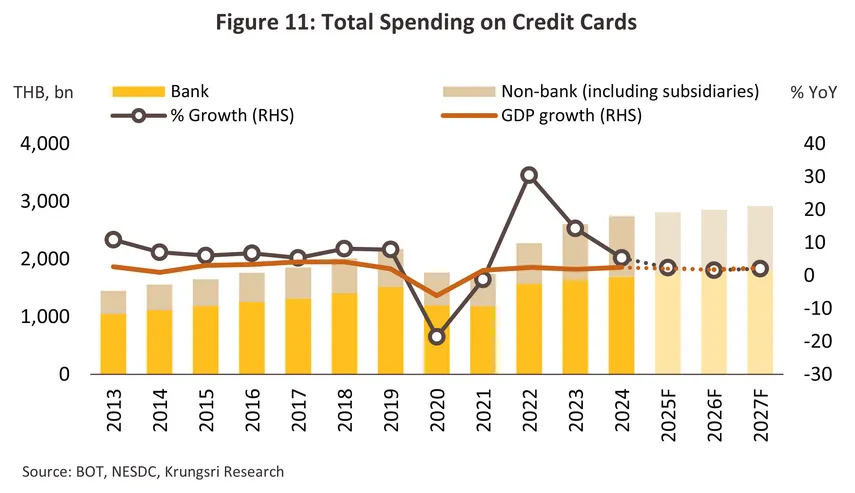

Total spending on credit cards expanded by 6.4% in the year, split between growth of 5.0% for those issued by commercial banks and 8.8% for non-bank credit cards. Spending on domestic purchases of goods and services rose 5.5%, lifted by government stimulus packages (e.g., the Easy E-Receipt program, which ran from 1 January to 15 February 2024, and the THB 10,000 payments to digital wallets made in September), while the start of visa-free travel for Thai visitors to China on 1 March 2024 helped to boost spending made overseas by 6.4%. Finally, although most credit card holders have a regular income, the run up in the cost of living and in household debt has added to demand for short-term liquidity and so the value of cash advances jumped 18.7% to bring this to 7.4% of all credit card transactions (up from 6.6% a year earlier). Over the year, total average spending per credit card thus increased to THB 106,476. This was the second year that spending was above the 2019 pre-pandemic average of THB 91,936, and this reflects the strength of growth in spending power in some consumer segments.

-

The number of credit cards in use dropped by -0.9% in the year, making 2024 the first year since 2019 that saw a decline in this metric. This drop off was caused by a number of factors including a decline in the number of consumers able to access new credit cards, the maturity of the market among those already approved for cards, the adoption of responsible lending principles by issuers and the resulting tightening of lending conditions, and the gradual closing of inactive accounts. Issuance by commercial banks therefore contracted -4.0%, and while the number of credit cards issued by non-banks rose 0.9%, this was the lowest rate of growth in 5 years.

-

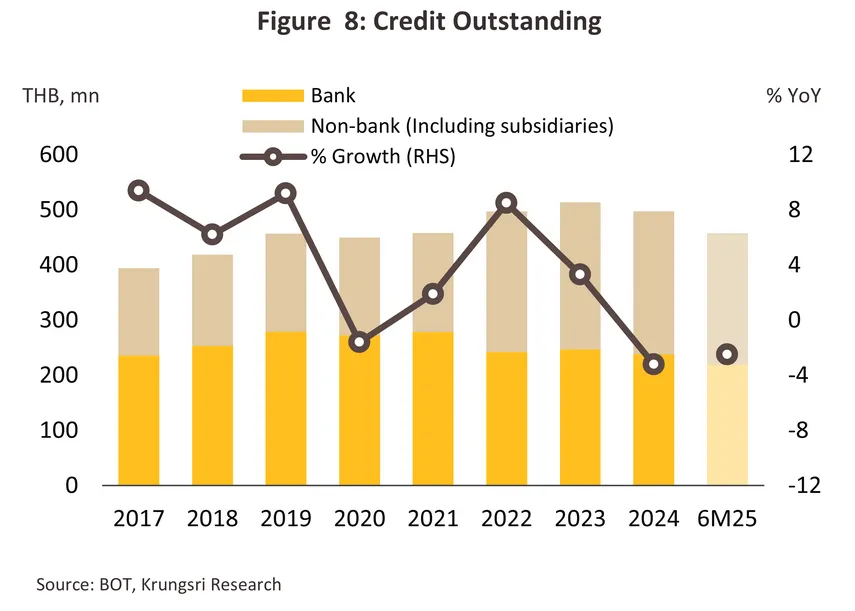

Outstanding balances also contracted in the year, falling -3.2% in total (Figure 8), though this was split between declines of -3.5% for accounts for bank-issued credit cards (47.9% of all outstanding balances) and -2.8% for those from non-banks (52.1% of the total). These falls are attributable to sluggish and uneven growth in the economy coupled with the persistently high cost of living. This has left some consumers, though especially those in a weaker financial position, struggling to make their repayments, and these individuals are therefore unable to take on more debt or to use their credit cards. In response, issuers have focused on maintaining the quality of the debt that is already on their books while also tightening approvals of new credit.

-

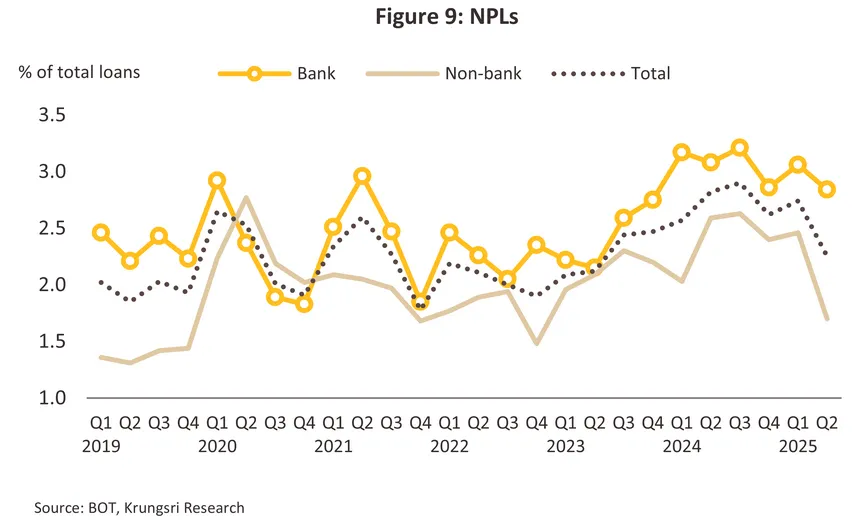

The share of non-performing loans (NPLs) to total outstanding balances edged up from 2.47% in 2023 to 2.62% in 2024. Again, the situation differed slightly between bank and non-bank issuers, with NPLs at respectively 2.86% and 2.40% of total balances (up from 2.75% and 2.20% at the end of 2023), though there are several factors behind this divergence. (i) Non-bank issuers typically set lower credit limits and this then helps to restrict systemic risk because although some cardholders will still default on their payments, their lower levels of indebtedness will help to limit impacts on the issuer’s overall finances. By contrast, banks have deeper pockets and a broader customer base, which allows them to be more expansive with their credit limits. However, as some market segments begin to be exposed to unfavorable economic conditions, the likelihood of their defaulting will rise and this will then mean that the share of NPLs on banks’ books will be higher than for non-banks. (ii) Banks and non-banks often take different approaches to dealing with bad debts. Thus, while the former generally give defaulters longer to clear their debts, this means that it will also take longer for these to be classified as NPLs and then to be written off. By contrast, non-banks are quicker to remove bad debts from their books and will typically do so as soon as they see the chance of successfully recovering the debt falling below a certain point. As such, NPLs tend to be higher for banks than for non-banks. (iii) Non-banks can adopt a more flexible approach to risk management and employ more aggressive debt recovery strategies. These companies can also change their policies and business practices more rapidly, and because this allows these players to adapt swiftly to evolving market conditions and changing consumer behaviors, non-banks can manage credit quality more effectively. More broadly, evidence of the continuing fragility of the market can be seen in the fact that the 2024 hike in minimum payments from 5% to 8% of the outstanding balance on an account helped to increase the share of accounts classified as NPLs for both bank and non-bank issuers.

However, to address these problems, the Bank of Thailand (BOT) has launched its ‘You fight, we help’ program which, via the ‘Pay direct and keep your assets’ scheme, consolidates home, auto and credit card debt. With the BOT’s assistance, this debt restructuring program waives interest on the outstanding debt for 3 years, and if the debtor complies with the conditions of the scheme throughout this period, the waiver will become permanent. This allows payments to be set directly against the loan principal, reducing the size of individual repayments and accelerating the pace at which debts are closed out. In addition, the BOT has also rolled out the ‘Pay-close-finish’ scheme to help alleviate problems with credit card NPLs (up to a maximum value of THB 5,000). This again provides for debt restructuring, though in this case by allowing debtors to make partial payments that accelerate the rate at which their debts are cleared.

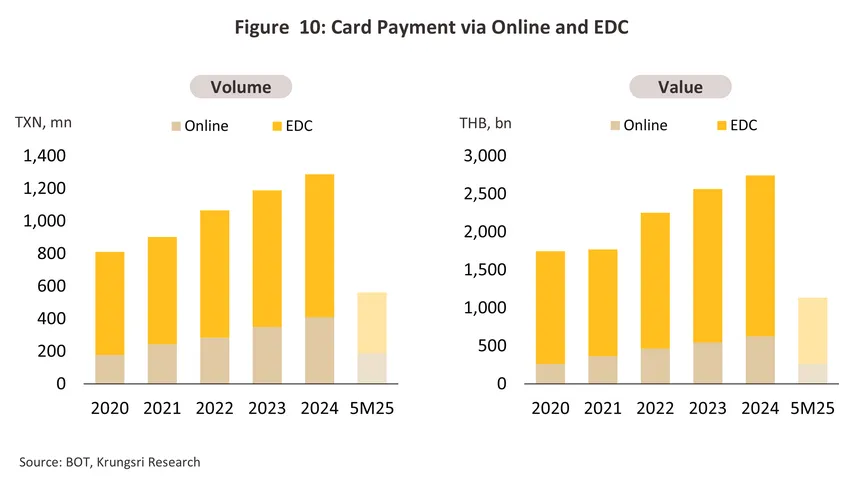

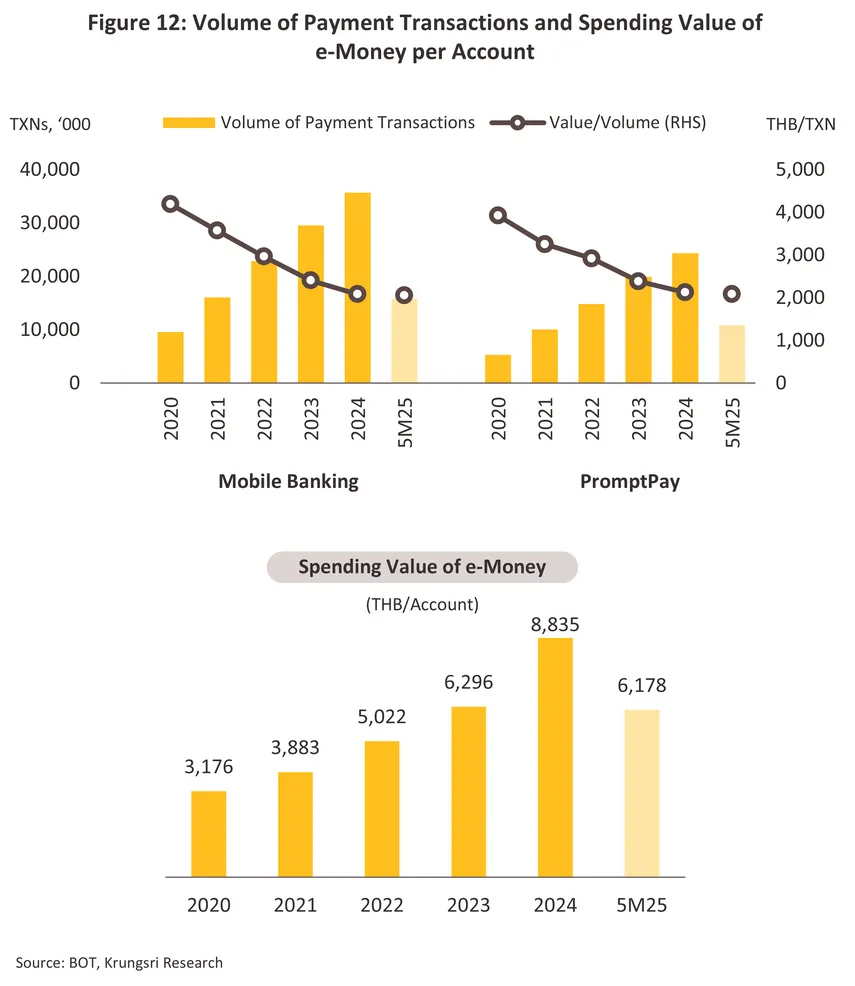

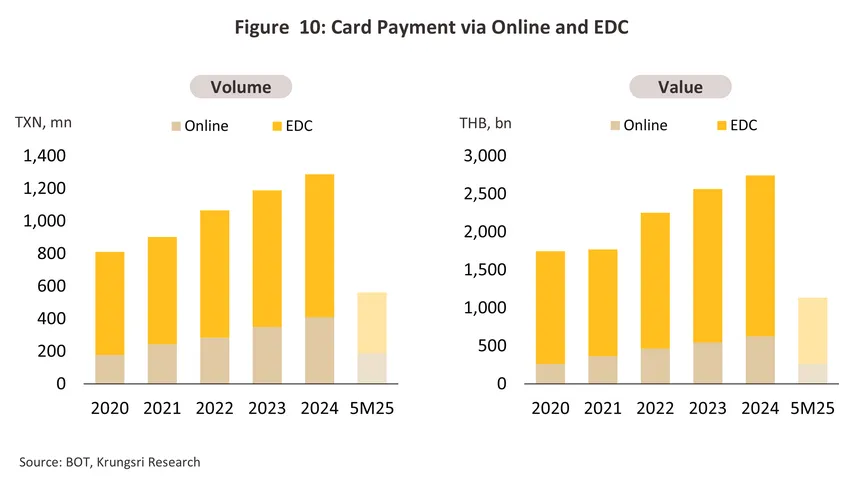

The ongoing spread of digital technologies is having a clear impact on preferred payment methods, and Thai consumers are increasingly moving away from cash payments and towards the use of credit cards and mobile phone payments, especially for purchases made online. Data from the Bank of Thailand thus show that the volume of online credit and debit spending jumped 17.1% in 2024, compared to growth of just 4.5% in spending made via electronic data capture (EDC) machines. As such, the division between online spending and spending made via EDC terminals shifted from a 30:70 split in 2023 to a ratio of 34:66 over the first 5 months of 2025. This is in line with research by Visa, which finds that relative to a year earlier, 46% of consumers in Southeast Asia have cut back on the amount of cash that they carry. Reductions were most pronounced in Vietnam (56%), Malaysia (49%) and Thailand (47%), with the most commonly cited reasons being a switch to the use of contactless payments, an increase in the number of establishments accepting digital payments, and worries over cash being lost or stolen. Moreover, more than 80% of Thai consumers also report not using cash for up to 9 days, and so consumers are looking increasingly ready to become cashless in 2028.

Outlook

Through the first half of 2025, credit card spending was adversely affected by the poor performance of the economy. The general business environment was impacted by risks associated with the increase in US tariffs and the fall off in the tourism sector, where worries about safety have fed a drop in arrivals, especially among Chinese visitors. These declines came despite government efforts to stimulate consumer spending, for example via the Easy E-Receipt program that ran from 16 January to 28 February 2025. Thus, total credit card spending edged up just 1.2% YoY in the period, split between an increase of 2.2% YoY for spending on bank-issued cards and a decline of -0.4% YoY for spending on non-bank credit cards. The total number of cards in use also contracted -0.6% YoY, though while the number of bank-issued cards fell -3.1% YoY, for non-banks, card numbers in fact inched up 0.8% YoY. Likewise, given worries over the impact of the rise in US tariffs on the Thai economy, the slowdown in the tourism sector, and ongoing problems with high levels of household debt, lenders have become more careful about issuing new credit and so total outstanding balances fell back -2.5% YoY in Q2. However, one bright spot emerged in the decline in NPLs, which fell from 2.62% of outstanding balances at the close of 2023 to 2.25% in 1H25. For banks, NPLs were almost unchanged, slipping from 2.86% of outstanding balances to 2.84%, but for non-bank issuers, NPLs plummeted from 2.40% to just 1.70% of total debts.

For all of 2025, the value of credit card transactions is forecast to strengthen by just 2.0-3.0%, which would represent a sharp slowdown from 2024’s 6.4% growth. This will come despite the introduction of the 2025 version of the domestic tourism-oriented ‘Half each’ program in the third quarter of the year and the positive impacts of this on spending on travel, restaurants and related services. The Bank of Thailand requirement that card holders pay off at least 8% of their outstanding balance each month has also been extended until the end of 2025. Although this will help to maintain overall stability within the financial system, this will come at the expense of weaker consumer spending power, especially at the middle- and lower-income groups, where consumers are already struggling under the weight of high levels of debt and the elevated cost of living. With both lenders and consumers anxious over the economic outlook, overall outstanding credit card loan growth is therefore forecast to slow from its 2024 level.

Through 2026 and 2027, credit card spending should rise, though only by some 1.5-2.5% annually. The market will benefit from the following.

-

Government policies will help to support domestic spending. These will include the Easy E-Receipt program, which allows consumers to offset online spending on goods and services against their taxes to a maximum of THB 50,000 annually. In addition to lifting domestic consumption, this will also help to get consumers more used to banking applications and online shopping, though the policy will especially affect middle- and upper-income consumers since these are more active in planning their taxes.

-

The tourism sector should continue to expand, and arrivals are now forecast to reach 38 million by 2027. Greater income to tourism and tourism-related businesses will lift labor markets and boost incomes, which in turn will tend to feed through into heavier spending on credit cards, especially for hotels, restaurants and travel.

-

Growth in transaction value will be driven by a combination of mid- and upper-income earners, whose spending power remains strong, and new entrants to the workforce, who in the future will comprise the market’s core demographic. In particular, growth in spending by the former group in second-tier/minor cities will be especially important since these individuals generally enjoy a stable income, prize value-for-money, and are interested in financial products that help them manage their money and plan for the future. Credit cards naturally fall into this group since these not only make paying for goods and services easier but also offer collectable points and cashback prizes for products that are a good match for individual lifestyles. At the same time, consumers who have recently entered the workforce (i.e., Gen Z) are also now drawing their first salary and these individuals often see credit cards as an essential part of the digital lifestyle. Moreover, younger consumers tend not to be overly worried about credit card debt since this is regarded as relatively small in scale and, because it is a type of revolving debt, as being more manageable than other debts.3/ Gen Z credit holders may therefore use these to pay for online purchases, meals, and entertainment services (e.g., concerts and short breaks).

-

A key strategy pursued by card issuers looking to expand their customer base will be the release of new products designed to meet the needs of individual target groups, including for example consumers interested in health and beauty products, travelers looking for specific benefits, and younger consumers who want to access sources of credit that offer more flexible repayment schedules. Players are also expected to expand into markets in Asia (e.g., Vietnam), where economies are growing strongly and the number of credit card holders is rising steadily. This will allow companies to hedge against risk, develop new income streams, and build their long-term competitiveness.

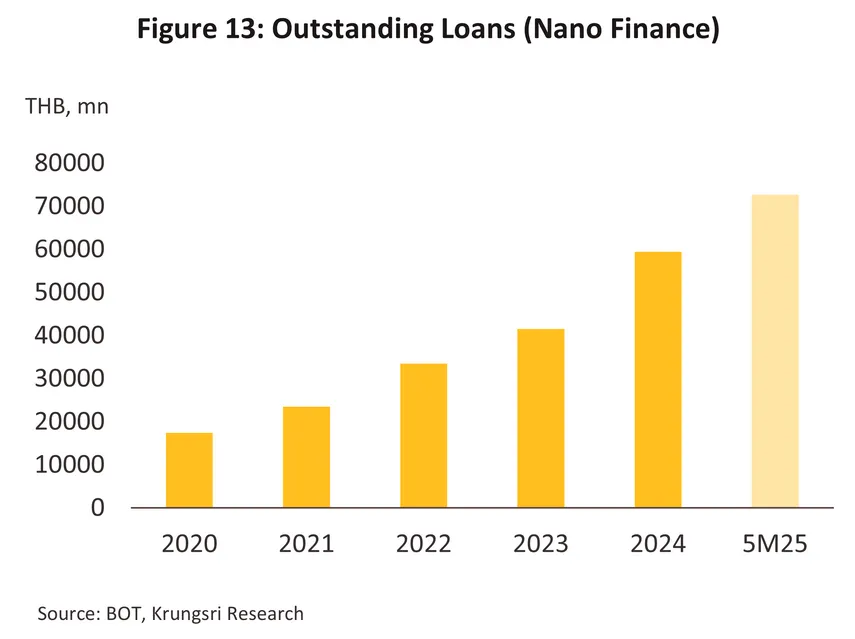

Despite this, the credit card industry will face a broad range of challenges. (i) Domestic purchasing power will grow only slowly as the economy struggles against the weight of rising barriers to trade, a deterioration in international relations, and a worsening geopolitical environment. Domestically, the high level of household debt will push consumers to be more careful about their spending, while long-standing problems with wealth inequality and job insecurity will also restrain growth in spending on credit cards. (ii) China’s economic difficulties, in particular sluggishness in the economy and only weak consumer sentiment, have been worsened by the imposition of draconian tariffs on imports of Chinese goods to the US, and because of this, Chinese arrivals to Thailand are now expected to undershoot earlier forecasts, cutting spending in the country by foreign visitors. (iii) Competition from alternative financial products is intensifying, especially from ‘Buy Now, Pay Later’ (BNPL) schemes. These are now a direct challenger to credit cards in younger demographics, where consumers favor rapid and flexible payment methods that do not rely on possession of a credit card. BNPL programs benefit from their simple and quick application and approval processes, and in many cases, shoppers do not even have to pay interest if they keep to the repayment schedule. These attractions have been enough to encourage some segments of the market to begin switching from credit cards to BNPL schemes, while BNPL providers are also expanding their customer base into online platforms and e-commerce sites, and so credit card issuers will need to respond swiftly to these threats. (iv) The Bank of Thailand, which has oversight of the industry, plans to increase the minimum monthly payment for credit cards from 8% of the outstanding balance to 10% in 2026, and as such, low- and middle-income consumers may face significant constraints on their ability to spend more heavily via credit cards. (v) Players are likely to extend their current cautious approach to the issuance of new credit, and so they will place a greater emphasis on limiting growth in bad debts than expanding overall credit levels. Where new customers are brought on, issuers will focus primarily on attracting more creditworthy individuals. To this end, companies will use AI-based technologies to screen applicants and to monitor spending, allowing them to accurately assess risk and to implement timely interventions as the need arises. (vi) Competition within the credit card market will intensify. This will come from non-bank or fintech service providers that do not operate branch networks and which therefore benefit from low-cost business structures (e.g., Line BK and TrueMoney). These are now taking market share from traditional credit card companies, especially in the provision of short-term, straightforward loans to retail customers (i.e., nano finance services). These companies also often use alternative credit scoring systems, which allows them to target demographics that are typically viewed by commercial banks as being too high risk while still maintaining control of their overall exposure to credit risk.

.webp.aspx)