Introduction

Ongoing technological progress, changing lifestyles and values, and a rapidly evolving business environment have together triggered significant global shifts in the financial system and in broader trends in consumer behavior. This is especially true for the younger generation, Generation Z or Gen Z,1/ which has grown up in the shadow of the digital revolution. These individuals are now entering the workforce and as their spending power strengthens, their outlook, preferences and financial behavior will be of growing importance. Clearly, understanding the needs and expectations of the new generation will help to underpin the successful development of products and services targeting younger consumers. Through this, enterprises will be able to deepen and strengthen their relationship with this consumer group, which will play an increasingly central role in the market in the years to come.

To better understand this emerging segment, Krungsri Research has conducted a survey of individuals aged 18-30 that focuses in particular on this group’s attitudes towards their finances, their financial behavior, and their expectations and needs with regard to financial products and services. It is hoped that this will provide insights that will then help the financial sector to better engage in strategic planning and to develop innovative new products that are a tighter fit with the needs of modern consumers.

.

Survey results

Respondents’ demographic profile

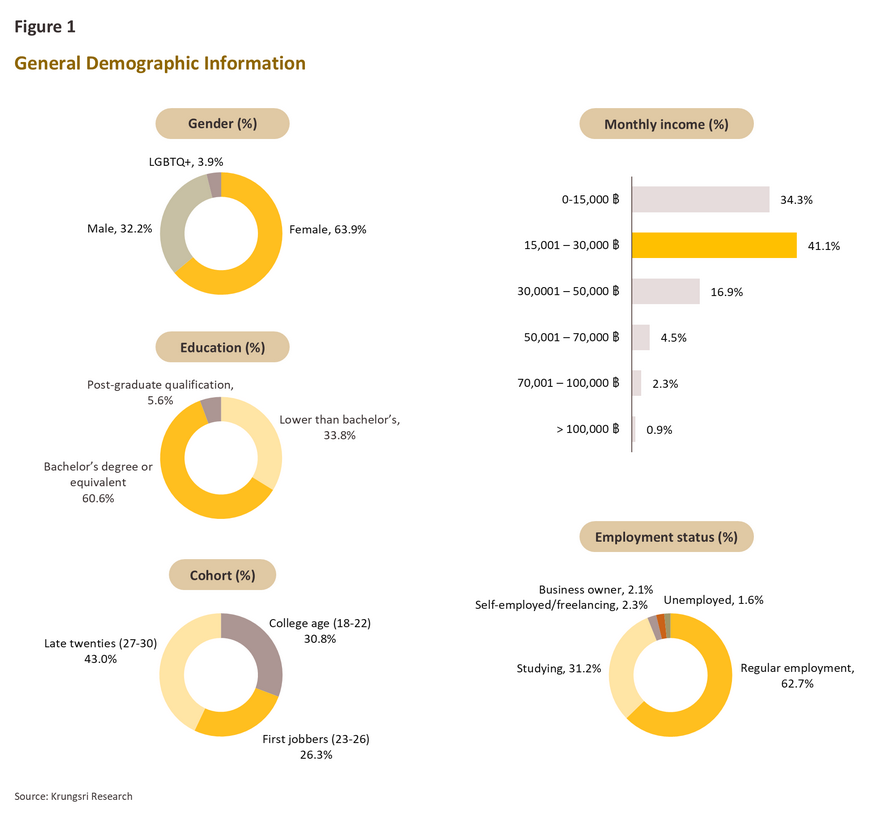

Krungsri Research conducted a survey on the behaviors and attitudes of Thai consumers aged between 18 and 30 — commonly referred to as “Gen Z” — during February to March 2025 via online platforms. The survey received responses from a total of 426 Gen Z participants.

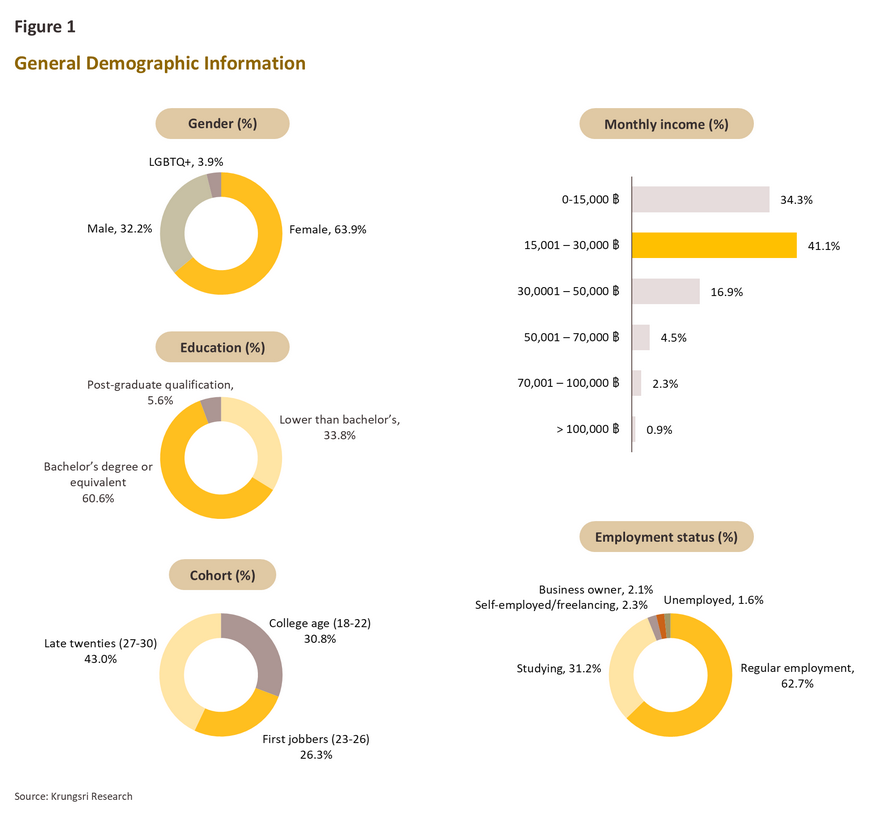

By age, the largest group of respondents, or 43% of the total, were those in their late twenties (27-30 years old). These were followed by college-age individuals (18-22 years old), which comprised 31% of responses, and then those just entering the workforce or first jobbers (23-26 years old), which made up the remaining 26%. 63% of respondents were in regular employment, and 61% had completed a bachelor’s degree or equivalent. Approximately two-thirds were women, and over 9 in 10 respondents reported earning less than 50,000 baht, with the largest group (41%) earning between THB 15,000 and 30,000 per month.

Income, expenditure and indebtedness

Earnings and Income Creation

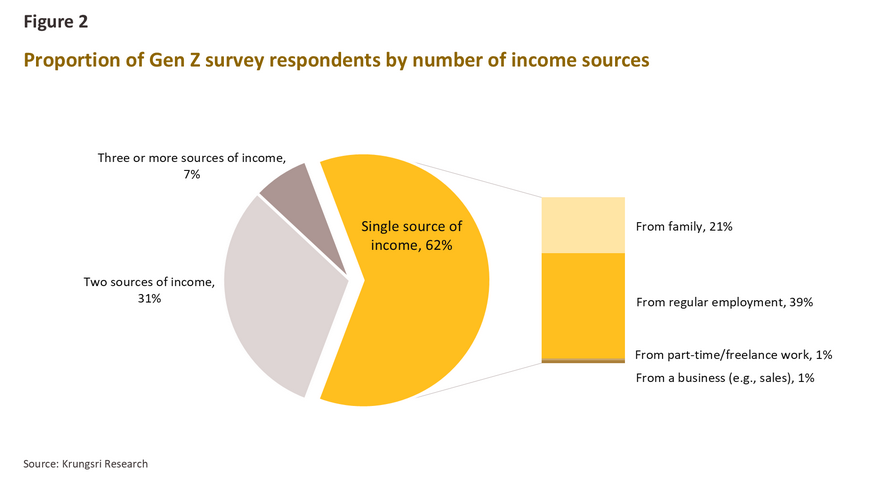

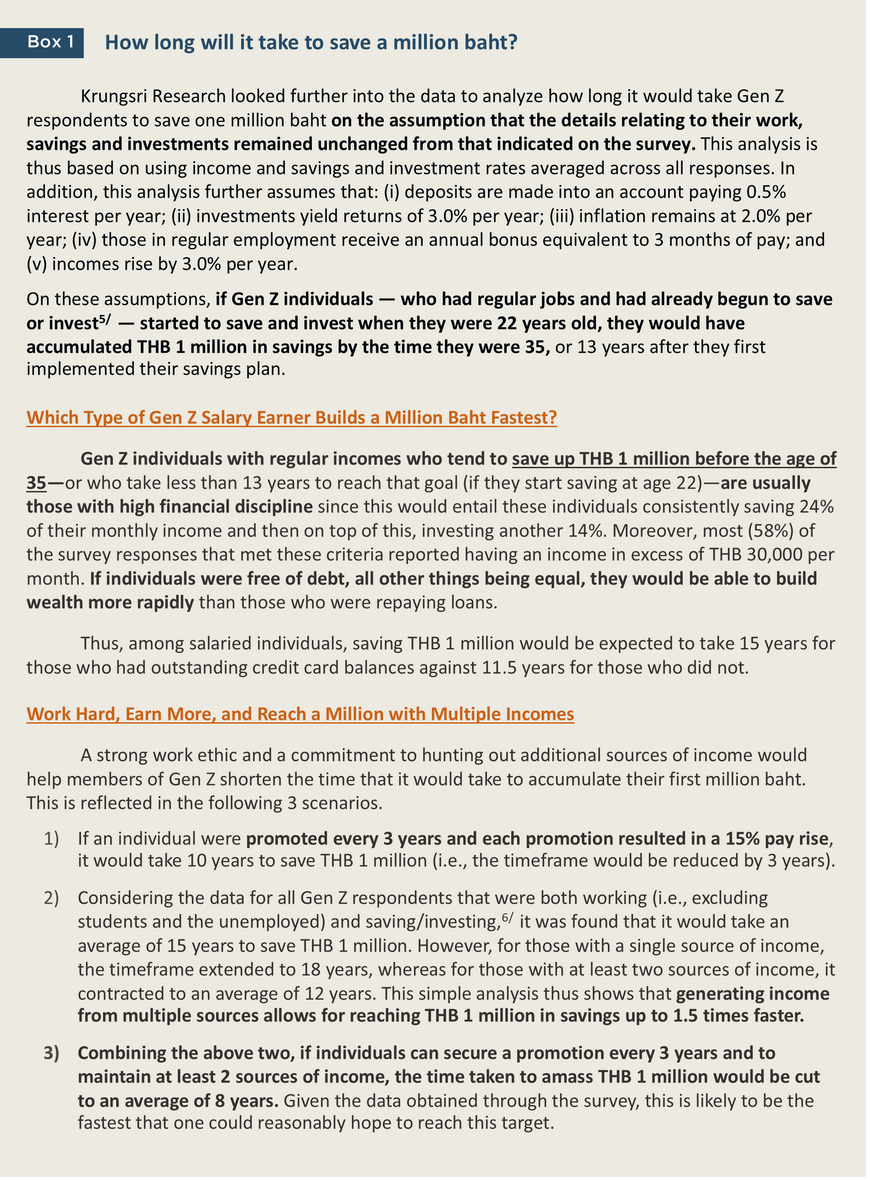

Around 6 in 10 respondents reported receiving income from a single source. Of these, 63% were in regular employment, 34% received an income from their family, and 3% were self-employed or freelancers. Some 4 in 10 thus had access to two or more sources of income. Across all respondents, income averaged THB 26,755 per month, though this showed strong age-based differentiation. Thus, among college-age respondents, monthly income averaged THB 15,935, rising to THB 25,826 for those first jobbers and THB 35,068 for those in their late 20s. Overall, Gen Z respondents reflected on their current financial situation by saying that their income is "moderate," requiring them to spend frugally.

Individuals reporting that they had at least two different sources of income (38% of the total) had an average age of 25. The most commonly given reasons for seeking multiple sources of income were respondents’ worries over the possibility of losing their job, an insecure working environment, and the risk of being laid off. 60% of those with two sources of income were in regular employment, while 28% were students. Additional income typically came from investments and part-time or freelance work.

Moreover, 7% of respondents had at least 3 sources of income, though these individuals reported being motivated by their deeper financial concerns relative to those who received only a single income. These worries included their indebtedness, the high cost of living, their income being insufficient to meet their outgoings, the risk of becoming unemployed, concerns about their ability to support their family, or a lack of funds to cover emergencies or retirement.

Managing personal finances

After being paid, the majority of Gen Z individuals reported prioritizing settling their bills, while allocating funds to investments was generally relegated to the end of the queue. Female respondents typically ‘saved first, spent later’ having paid their bills, but men and LGBTQ+ respondents were more likely to spend on day-to-day expenses before allocating money to savings and then to investments. Across all genders and age groups, investing was thus typically awarded the lowest priority.

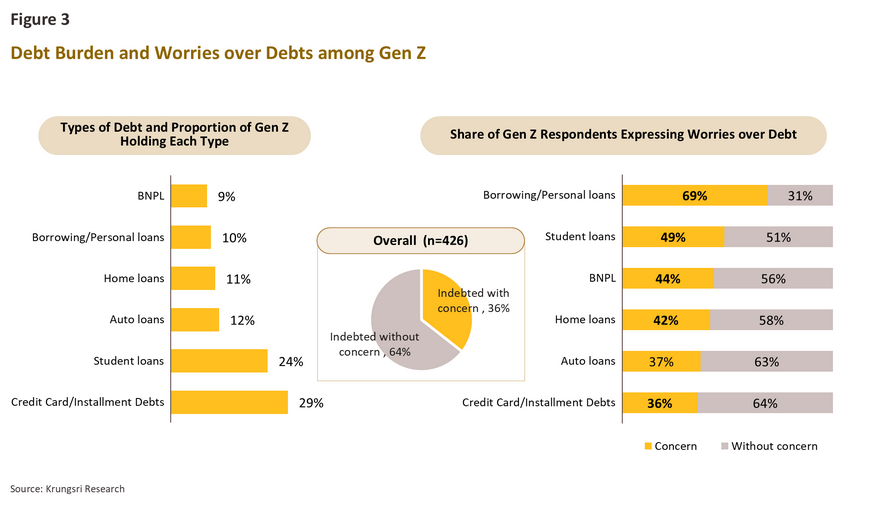

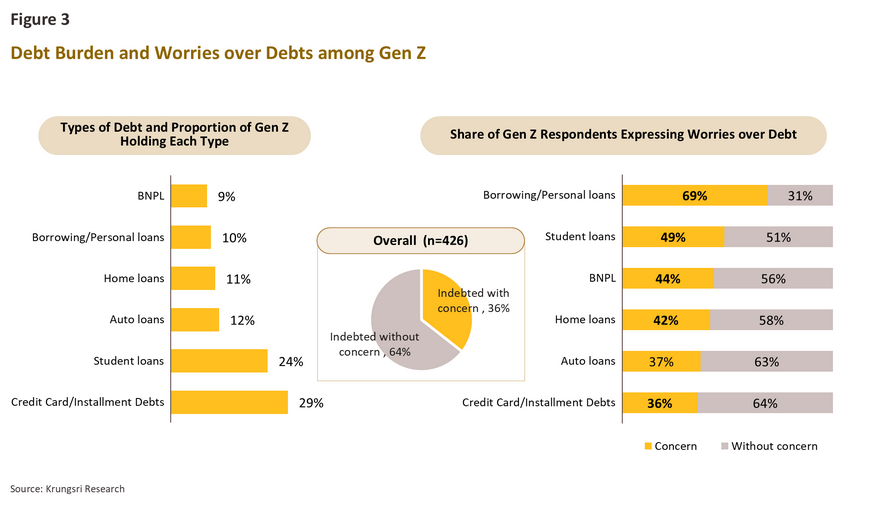

Around 6 in 10 respondents carried some kind of debt. Half of these individuals owed money in the form of outstanding credit card balances or installment plans, though this was highest among those earning THB 15,000-70,000 per month, of whom 44% had this kind of debt. Debt in the form of borrowing/personal loans and buy now pay later (BNPL) schemes were reported only among those earning less than THB 50,000 per month, and overall, around 1 in 10 respondents owed money on borrowing/personal loans and BNPL plans. Auto and home loans were also reported, though these could be loans taken out either by that individual or by a member of their family, with the respondent then taking on a share of this themselves. In addition, around a quarter of the survey respondents had outstanding student loans.

64% of indebted respondents reported being unworried about their debts, though this may be because these were relatively minor or because they were in the form of rolling debt (i.e., when payments are made and new debts are then accrued, such as with a credit card). In-depth analysis of the data shows that those who favor spending on current consumption are 1.7-times more likely to have at least 2 different types of debt compared to those who are more focused on saving for the future. 47% of respondents agreed that ‘spending was more fun than saving’, while 27% thought that ‘saving first brings peace of mind’. 26% were neutral between the two.

Financial worries

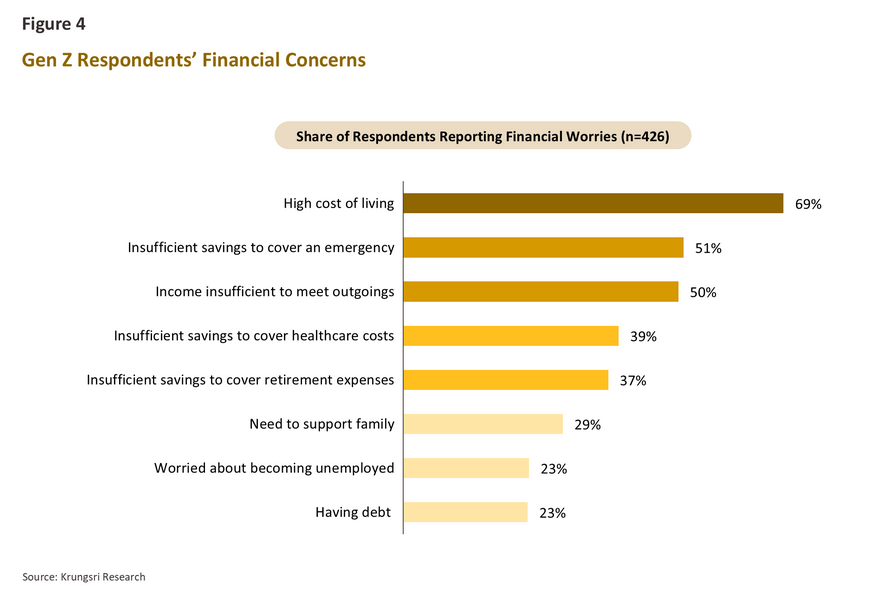

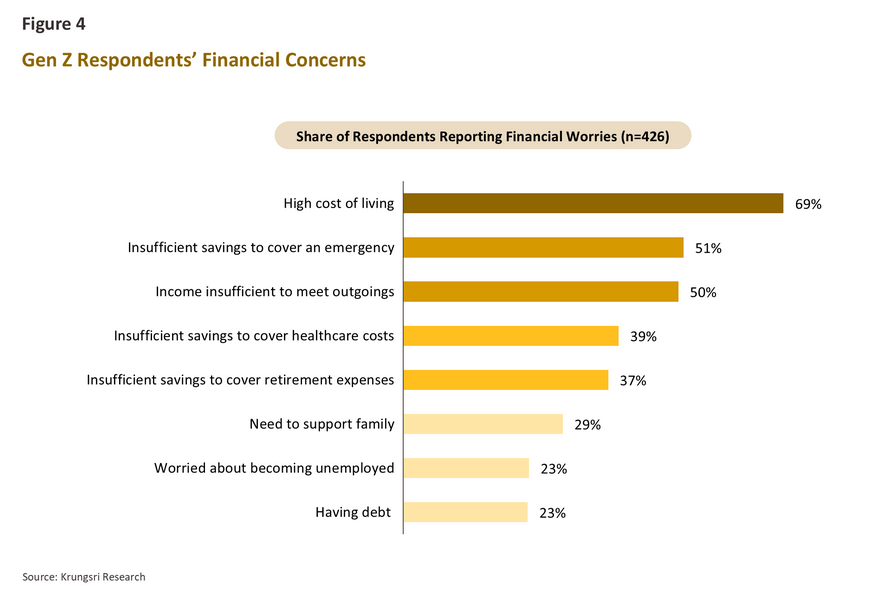

Nevertheless, worries over finances were widespread. Concerns over the cost of living were most common, with 69% of respondents counting this as one of their worries. Perhaps unsurprisingly, this became more common as incomes shrunk, and so while 45% of those earning over THB 50,000 per month reported this as a concern, this jumped to 70% among those earning less than this. Around half of individuals surveyed also said that they were either worried that they had insufficient funds to cover an emergency or that their income was insufficient to meet their outgoings, while 23% reported being concerned about all three of these.

Fears over the possible financial impacts of healthcare costs and worries over not having sufficient funds to pay for their retirement were also among the five financial concerns most commonly reported by respondents, with around half of those in their late 20s (27-30 years old) worried about funding their retirement. By contrast, only 6% of respondents had no financial worries.

Saving and Investment Behaviors

Gen Z is focused on saving and investing

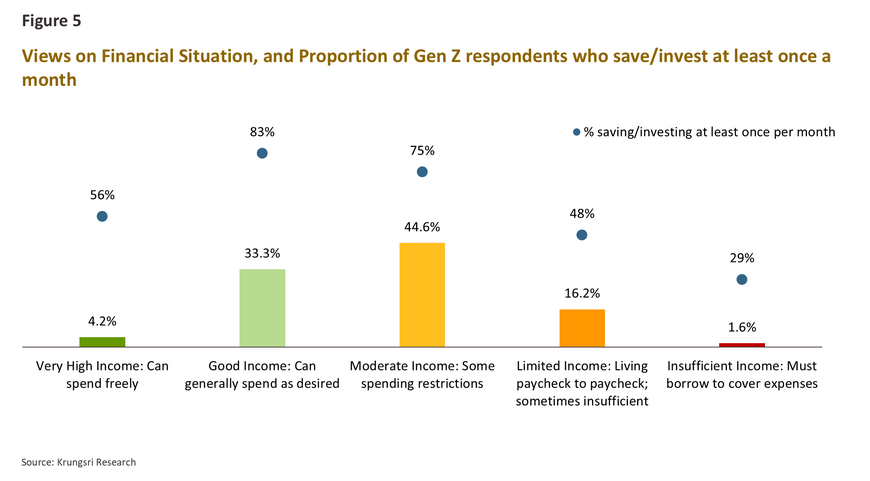

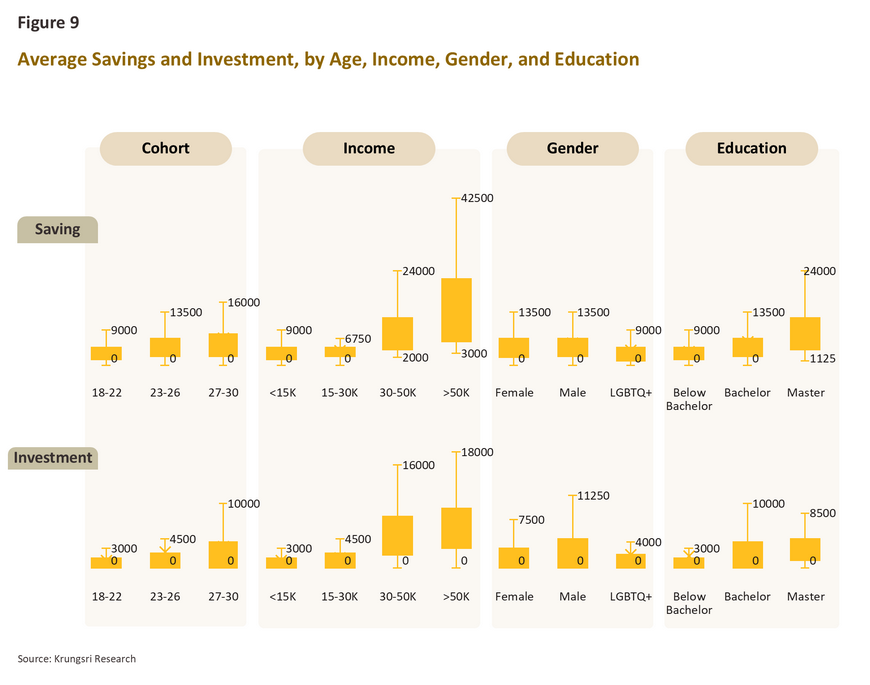

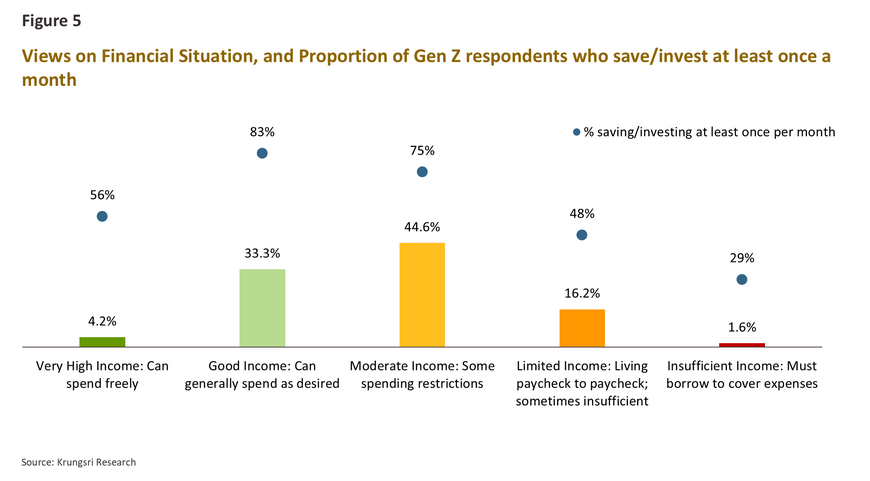

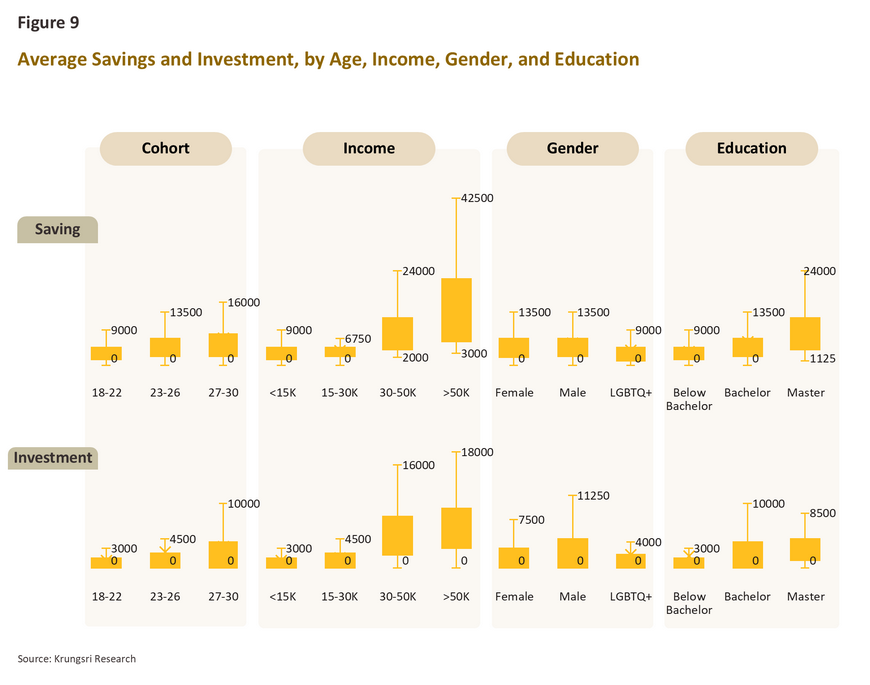

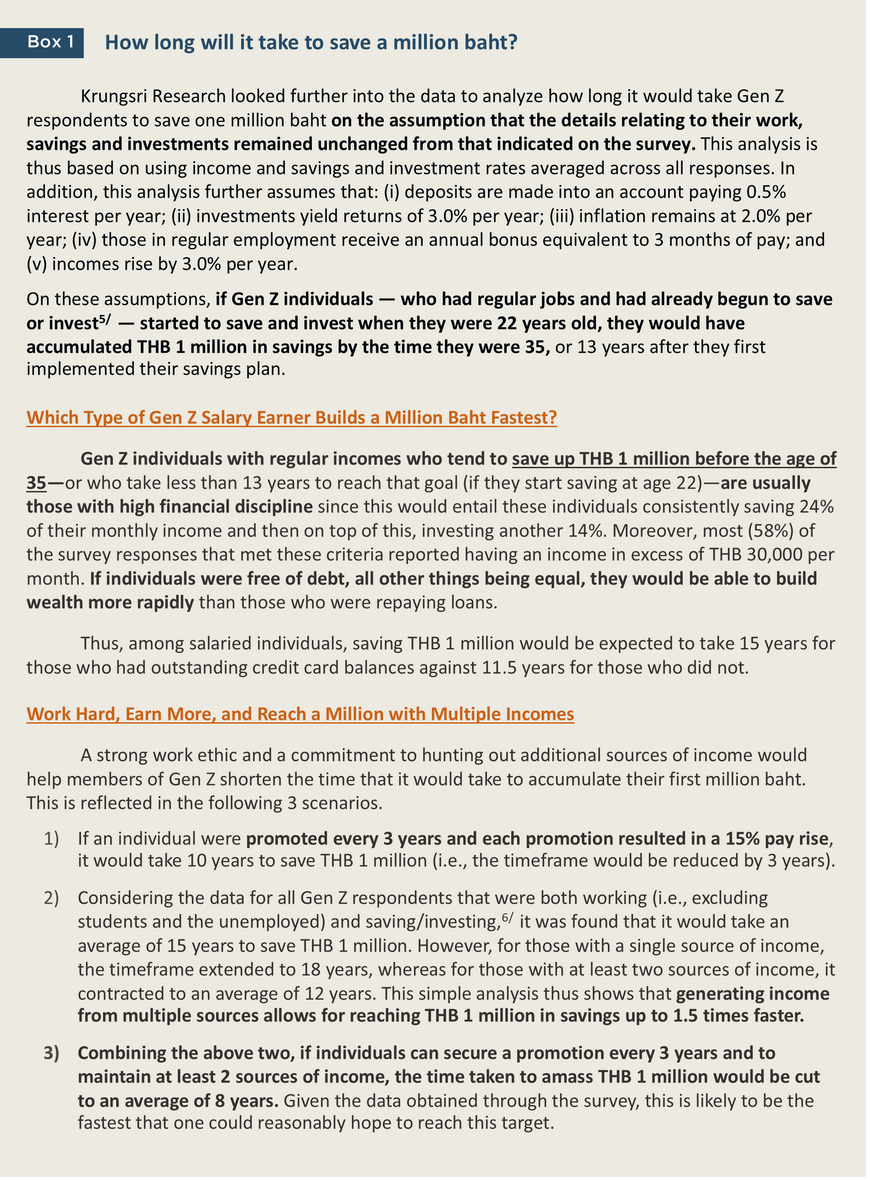

Approximately 7 in 10 individuals responding to the survey reported saving or investing every month, though the amount of money that is invested or saved generally increases with age, income and level of education. On average, respondents saved 19% of their monthly income, with investments accounting for a further 8% of this.2/ However, the proportion of savings and investments to income rises as these activities are undertaken more often, meaning, among those who save or invest only once per month, savings account for 20% of income, while for those who do so more often, the savings rate rises to 23%. Nevertheless, for those investing and saving once per month or more often, the share of income devoted to investments remains at around 9% regardless of how often they do this.

All respondents earning at least THB 30,000 per month reported saving or investing for the future, though the frequency with which individuals did so varied. Regardless of their gender, all respondents prioritized saving and investing via savings accounts, fixed deposit accounts, cash, bonds, stocks, and mutual funds. These were followed in importance by buying gold, though this was preferred by women. LGBTQ+ individuals favored bonds, stocks and mutual funds at a level that was similar to men. Relative to others, men also preferred building savings and investments through hoarding cash, buying collectibles or valuable items, and investing in digital assets and cryptocurrencies.

Two-thirds of respondents save for unexpected events

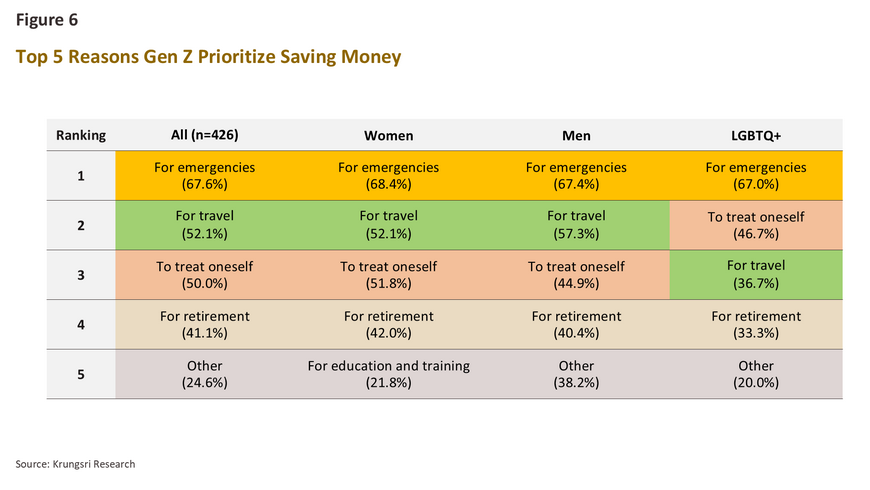

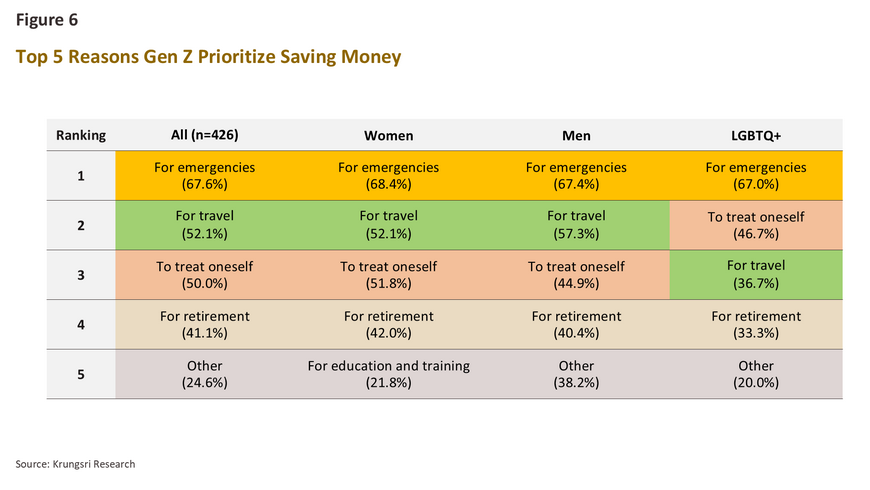

Respondents were most likely to save for emergencies, with this followed in importance by saving for travel and to treat oneself. These thus came ahead of saving for retirement, though this could be for the simple reason that Gen Z individuals do not see their retirement as a pressing issue and so this is less important than other demands on their finances. It is also noteworthy that women place a higher importance on saving to pay for their education and training, and that unlike other groups, this was in women’s top 5 reasons for saving.

Retirement Worries Drive Higher Savings Rates

Although all respondents prioritized saving for emergencies, those saving less than THB 5,000 per month (69% of respondents) also valued putting money aside for travel and to treat themselves. By contrast, the 31% of respondents saving more than THB 5,000 per month also emphasized the need to get their finances in shape for their retirement, and the share of those doing so increased as total savings rose. Thus, among those putting aside less than THB 5,000 monthly, 32% reported saving for their retirement. However, for those that saves 5,001–10,000 baht per month has about 58% of its members saving for retirement. Meanwhile, those who save 10,001–15,000 baht and more than 15,000 baht per month have higher proportions of retirement savers, at 62% and 74% respectively. It is thus the case that among Gen Z consumers, a greater propensity to save tends to indicate a greater concern with having sufficient funds for one’s retirement. In addition, 41% of those saving more than THB 15,000 per month also intended to use their savings to fund a business venture.

Gen Z investors favor bonds, stocks and mutual funds

About 6 in 10 survey respondents invest a share of their income, though overall levels of investment rise with age, income and level of education. On average, men also invest significantly more than other groups, averaging THB 3,115 per month, compared to THB 2,000-2,200 per month for women and LGBTQ+ individuals.

13% of those responding to the survey reported investing more than THB 5,000 per month, and around two-thirds of these ‘heavy investors’ allocate funds to bonds, stocks and mutual funds. 26% of those in this group also favor purchasing endowment insurance. This differs from those saving less than THB 5,000 per month, who typically prefer investing via the Bank for Agriculture and Agricultural Cooperatives and Government Savings Bank lotteries.

Views on personal finances

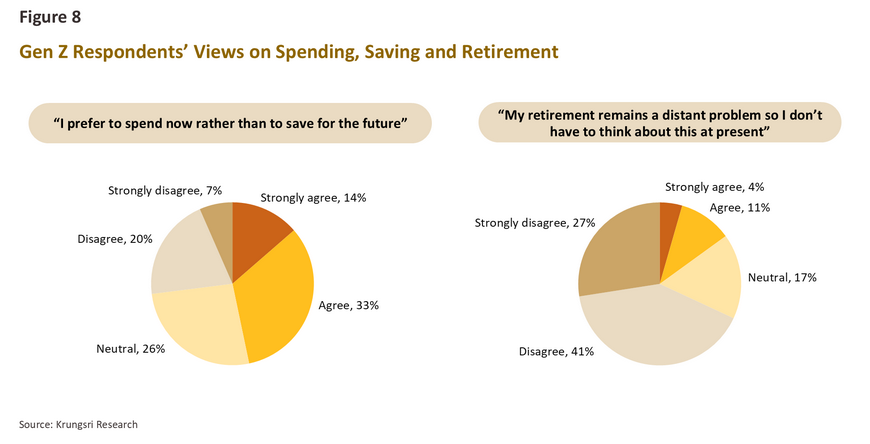

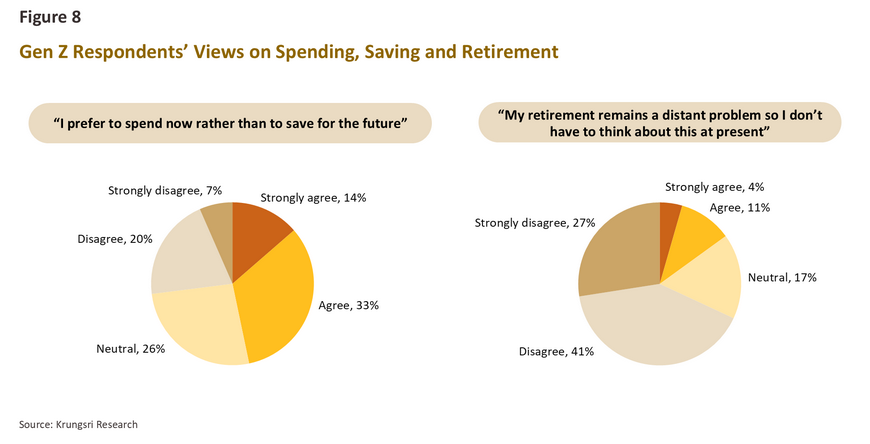

Spending on current consumption vs. saving and investing for the future

As stated above, almost half of respondents agreed that ‘spending was more fun than saving’, but in-depth statistical analysis shows that these Gen Z individuals were 1.7-times more likely to live paycheck to paycheck or to be unable to meet their expenses compared to those who believed that ‘saving first brings peace of mind.’ Savings rates mirrored these differences, with those who favored immediate consumption saving and investing respectively 18% and 8% of monthly income, compared to rates of 21% and 10% for those who were more focused on the future.

However, this analysis obscures variations that emerge when more fine-grained differences in age and education are considered, since as these rise, individuals are typically more careful about their spending. Thus, working-age respondents were 2.2-times more likely than those of college age to see retirement as a factor to consider when thinking about their savings, and only 25% of those with a master’s degree or higher favored short-term consumption over long-term saving and investment. This compares with 48% of those who finished their education with at most a bachelor’s degree.

It is noteworthy that among LGBTQ+ respondents, 60% favored consumption over saving, with this dropping to respectively 48% and 45% among men and women,3/ with LGBTQ+ individuals planning to save less than other groups in all areas with the exception of saving to treat oneself. By contrast, for those who expressed a preference for saving relative to consuming, setting funds aside to pay for future travel or to treat oneself was relatively dispreferred. Compared to those focused on present consumption, these individuals were also 4-times more likely to see retirement as an issue to be considered when making savings plans.

Almost 7 in 10 respondents reported feeling that planning for retirement was important, with the proportion rising with age and income. 33% of these individuals had thus begun to invest in bonds, stocks and mutual funds (compared to just 9% of those who were not thinking about their retirement), while 14% had begun to purchase endowment insurance (against 4% for those not yet interested in planning for their retirement). The share of individuals concerned with this rose to 75% among those with regular jobs and 63% for those who were self-employed or working as freelancers.

Even though the interest rates paid on savings have averaged less than 0.5% over the past two decades (most of the life of Gen Z savers), 88% of respondents agreed that to accelerate opportunities to build wealth, it was important to start saving early in one’s career.4/ Compared to individuals who did not share this view, these respondents were 2.2-times more likely to save more than 20% of their income.

Around 8 in 10 male respondents invested having accepted the risk of losses, a proportion that was higher than for LGBTQ+ individuals and for women (for whom this was around 7 in 10). As might be expected, those with a higher appetite for risk also tended to invest a higher proportion of their earnings, this rising to 13% of monthly income against an average of 8% for all survey respondents

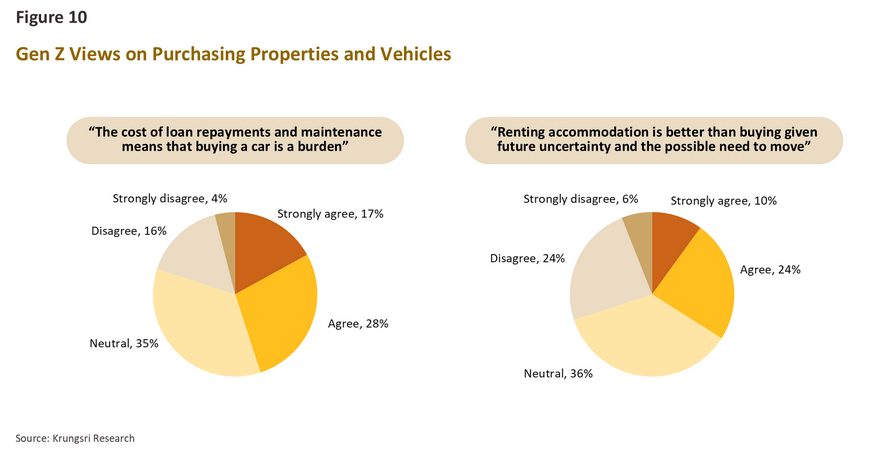

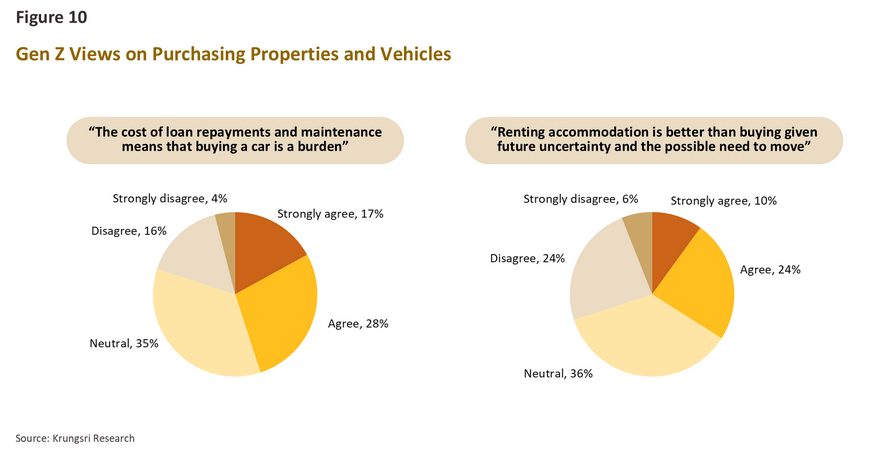

Paying for properties and vehicles is a burden

Although members of Gen Z are old enough to drive, 45% of respondents viewed incurring the debts entailed when buying a vehicle as a burden, though 29% of these individuals were currently paying off an auto loan. 20% of survey respondents did not share this view and so did not see this as a burden, while 35% were neutral on the issue. Analysis showed that gender was not a statistically significant factor influencing these views.

Interestingly, Gen Z respondents were more likely to view buying a vehicle as a burden as their age and income increased, and so by implication, younger, poorer respondents tended to view taking on auto loans more positively. This could be because rather than covering all the associated expenses themselves, these individuals are more likely to receive financial assistance from their family, whether that comes in the form of money for the downpayment, loan repayments, or services and maintenance. This is particularly so for students and those in work but earning less than THB 30,000 per month.

On the question of home ownership and whether it is better to rent than to buy given future uncertainty and the possible need to move, opinions were roughly equally divided, with 34% agreeing that renting was preferable to buying, 30% preferring buying to renting, and 36% not expressing a view or indifferent on the choice. However, women were 2.6-times more likely than men to see buying as better than renting.

Nevertheless, 86% of those submitting survey responses hoped to avoid carrying major debts or of being indebted through to their retirement. This view was shared by two-thirds of those paying off home loans, but while 76% of men also felt like this, this rose to 88% for women, a difference that was statistically significant. LGBTQ+ responses fell in the middle of these at 80%. Overall, while willingness to take on major debt appeared to rise with income, analysis showed that this trend was not statistically significant.

Does “rich” mean successful?

Although many or perhaps most people hope to get rich, only 45% of respondents agreed with the statement ‘to be rich is to be successful, so I want to get rich as quickly as possible’, compared to 21% who disagreed with this and 34% who were indifferent or who did not express an opinion. Moreover, as age increased, the proportion of individuals disagreeing with this proposition also rose, and so while half of college-age respondents agreed, this fell to 40% for those in their late 20s. This may be explained by people altering their understanding of what it means to be successful as their life experiences accumulate. It is also worth noting that while 46% of men and 45% of women were in agreement with this statement, this fell to 33% among LGBTQ+ respondents, which may indicate that these individuals see other things as being more important such as work responsibilities or personal relationships.3/

At 44%, those earning THB 30,001-50,000 per month were most likely to agree that success was determined by wealth or income. Among this group, the most pressing concern was the rising cost of living and the need to earn enough to cover these expenses. However, this fell to just 24% among individuals earning more than THB 50,000 per month, who were also most likely to be worried about having enough money to cover their retirement.

In summary, individuals responding to the survey were largely aware of the importance of putting a financial plan in place at a young age. Respondents hoped to begin saving as soon as possible in order to allow wealth to accumulate (88%), they did not want to take on major debts or to be indebted through to their retirement (86%), they acknowledged the risks entailed in investing (71%), and they saw their retirement as being a pressing issue that needed to be planned for (69%). Gen Z respondents reported allocating money to savings and investments made in traditional assets such as savings accounts, government savings bonds, deposits in cooperative or saving and loan associations, gold, bonds, stocks, mutual funds, and real estate, as well as in non-traditional assets, such as endowment insurance, digital assets and cryptocurrencies, or collectibles, such as watches, Buddhist amulets, brand-name goods, and collectable art-toys.

Krungsri Research view

This survey has shown that despite stereotypes that Thai Gen Z consumers are concerned primarily with shopping and spending, this cohort in fact displays financial behaviors and opinions that indicate a much more complex ability to engage in financial planning. In particular, five key traits emerge from an analysis of the survey data.

1. Long-term financial planning and saving for emergencies: Gen Z continues to see the importance of stability, security and long-term financial planning. This could be a result of having lived through the Covid-19 pandemic and thus of experiencing the impacts of a sudden economic disruption on their own lives and those of their families and those around them. Given this, it is perhaps understandable that a desire to save for a future emergency is the most important consideration motivating the savings behavior of Gen Z respondents. However, equally important is saving for retirement, and although members of Gen Z are still young, many are planning for this. In particular, half of those in their late twenties (27-30 years old) are already worried that they may not have enough money to pay for their retirement. This is in line with prior analysis of Thais’ saving patterns carried out by Krungsri Research7/ that shows that on average, members of Gen Z begin to save when they are 26 with the aim of retiring when they are 53. This is earlier than was typical for older generations, though this may be because individuals growing up in the digital age have from their youth been exposed to a much more extensive financial education, and an almost unlimited wealth of information remains just a keystroke away.

2. Consumption mixed with saving: The stereotypical view of Gen Z as reckless spenders who do not save has been shown to be a poor reflection of reality. Although it is true that Gen Z respondents to this survey saved for travel and to treat themselves, all those earning more than THB 30,000 per month also saved or invested with a view to their future financial security. Given that as of 2024, household expenditure averaged THB 22,282 per month across Thailand,8/ it seems reasonable to conclude that Gen Z are perfectly capable of saving once their income exceeds their expenses, and so although social media often portrays Gen Z as being guided by slogans such as ‘live life to the fullest’ or ‘you only live once’, this does not appear to apply to the majority in this survey.

3. Value security when saving but accept risk when investing: The survey results show that 80% of survey respondents kept their savings in bank accounts, while 26% preferred buying bonds, stocks, and mutual funds. However, consistent with good risk-management strategies, most Gen Z respondents were also careful to distinguish between funds allocated to savings and those assigned to their investments, with 7 in 10 prepared to accept some degree of risk with regard to the latter.

4. Happy to take on smaller debts but wary of larger ones: The survey results indicate that Gen Z typically prefers to avoid long-term debt that might drag on into retirement, and so only around a third of respondents expressed a desire to buy their home, and almost half also saw car ownership as a burden. This reflects that many individuals in this age group do not wish to saddle themselves with sizeable debts that will take an extended period to clear. Factors that might further influence these behaviors include, for example, increasing opportunities to work abroad, and for younger Thai consumers, the wider range of work choices and experiences that are available may dissuade some individuals from becoming heavily indebted. Nevertheless, most Gen Z individuals who already had debt did not generally feel concerned about being in debt. This may be due to two key factors: their overall debt burden was relatively low, or the debt was of a rolling or revolving nature (e.g., credit card debt), which can be managed without causing significant pressure.

5. Building financial security by opening up new income streams: Increasing volatility in labor markets and the general rise in economic uncertainty that has been experienced over the past two decades may have undermined Gen Z’s overall sense of security and fueled worries over their work, and thus of potentially becoming unemployed. Moreover, the need to manage a broadening range of debt-types may also be pushing Gen Z consumers to look for additional income. As such, two-fifths of respondents were generating an income from more than one source, though having grown up within the digital world, members of this generation are well placed to exploit new financial opportunities that have recently opened up. Younger individuals are thus now able to leverage the potential afforded by new technology to generate part- or full-time incomes, take advantage of possibilities for freelancing and self-employment, and invest and generate returns from this. By diversifying their sources of income in this way, Gen Z is reducing risk related to uncertainty in labor markets and in the economy more broadly.

Overall, while Gen Z may differ from other generations with regard to their values, lifestyles, and ways of expressing themselves, their views on personal finances and their financial behavior are much more consistent with older generations. In the details there are differences, and Gen Z may be happier speculating on, for example, cryptocurrencies and contemporary collectibles, but overall, this survey shows that the young generation remains focused on preparing for the future just as much as previous generations and is therefore committed to saving and to long-term financial planning.

Moreover, one consequence of the deep social and technological transformations that have upended the world over the past few decades has been the amplification of the apparent differences between younger and older generations, which has then made it appear as if there is an uncrossable chasm between the two. Reacting to this, many older individuals have adopted a strikingly negative view of Gen Z, but it is wise to remember that the old criticizing the young is hardly a new phenomenon, and that all those muttering ‘kids these days’ were themselves once the kids being talked about.

Ultimately, the wheel of change will continue to turn and first Gen Z and then subsequently other generations will occupy the central position driving the economy and society at large, and so stakeholders, especially businesses that are targeting Gen Z consumers, should work to better understand the technological context within which this cohort has grown up and the unique challenges that it now faces. Going forward, as older generations that were themselves once at the center of national progress pass the baton to those who come next, fostering mutual understanding, bridging the generation gap, and avoiding outdated or unjust judgements will be key to driving forward collaborative and constructive social and economic development — just as previous generations once served as key driving forces.

References

Krungsri Research. (2025, เมษายน 10). Saving Behavior Survey: ไขรหัสพฤติกรรมการออมของผู้บริโภคไทย. Krungsri. Retrieved from https://www.krungsri.com/th/research/research-intelligence/Thai-Saving-2025

สำนักงานสถิติแห่งชาติ. (2024). การสำรวจภาวะเศรษฐกิจและสังคมของครัวเรือน พ.ศ. 2567.สำนักงานสถิติแห่งชาติ. Retrieved from https://www.nso.go.th/nsoweb/storage/survey_detail/2025/20250321102834_82027.pdf

1/ For the purposes of this paper, Gen Z is defined as those born between 1995 and 2007. These individuals are thus between 18 and 30.

2/ When combining the average saving rate (19%) and average investment rate (8%), it is found that the total share of saving plus investment of monthly income among Gen Z respondents is 27%, which is a figure close to the results of a previous survey on Thai Saving Behaviors conducted by Krungsri Research (https://www.krungsri.com/th/research/research-intelligence/Thai-Saving-2025) showing that Gen Z individuals who saved/invested regularly allocated 23% of their income to this.

3/ These differences are not statistically significant.

4/ Starting to save when young or at the start of a career helps to accelerate wealth creation through the combination of time and compound interest.

5/ 255 responses met these criteria.

6/ 274 respondents met these criteria. However, the calculation of salaries excluded the earlier assumption of an annual 3-month bonus since in addition to salaried individuals, this also included freelancers and the self-employed.

7/ Saving Behavior Survey: Decoding the Saving Habits of Thai Consumers https://www.krungsri.com/en/research/research-intelligence/Thai-Saving-2025

8/ From the National Statistical Office’s 2024 Socio-Economic Survey. For more details please see https://www.nso.go.th/nsoweb/storage/survey_detail/2025/20250321102834_82027.pdf