Introduction

Ethereum is a blockchain-based technology that manages and stores data in a manner similar to the better-known Bitcoin, but which has its own native coin1/ called Ether, or ETH, a type of cryptocurrency that may be used to pay for services and transaction fees. Ethereum also differs from Bitcoin by providing users with additional programming capabilities that may be coded to execute automatically once certain conditions are met. The possibilities offered by these ‘smart contracts’ are one factor underpinning interest in Ethereum and driving efforts to extend its capabilities and improve the efficiency of its operations. Most recently, this has led to ‘the Merge’, an event that has marked a major change in how the Ethereum blockchain operates.

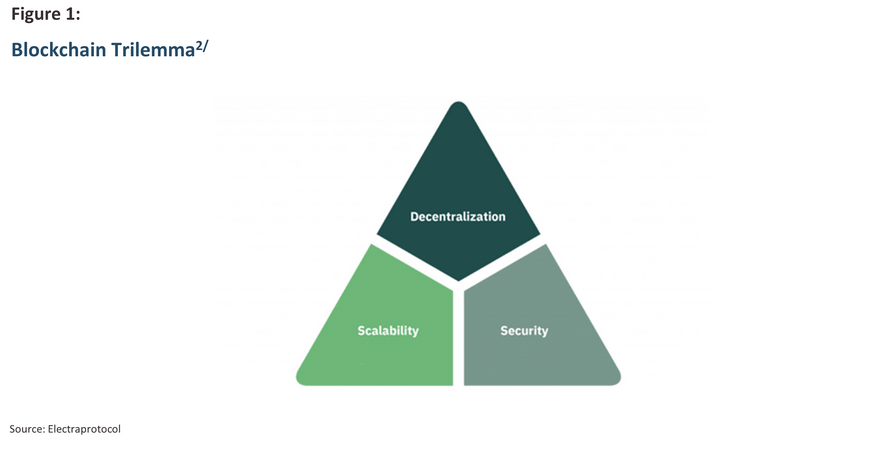

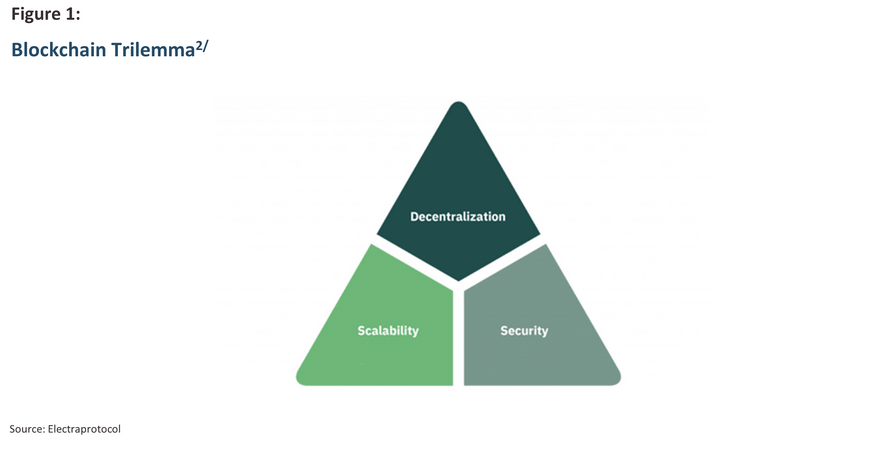

Blockchain Trilemma

Within the realm of digital assets, blockchain technology should be developed to optimize all 3 of these characteristics simultaneously within a blockchain network, which include:

- Decentralization: The ability to operate in the absence of middlemen and other types of intermediations, i.e., eliminating the need for a central authority.

- Security: The ability of the system to deter threats and maintain cybersecurity. A secure blockchain ensures the integrity of transactions and the confidentiality of sensitive information.

- Scalability: The ability of a blockchain network to handle a growing number of transactions and users without compromising its performance.

However, investors and blockchain gurus alike agree that at least up to the present day, it has been impossible to fully satisfy all three requirements simultaneously, the challenge that has been named the ‘blockchain trilemma’.

Given the current shape of the digital asset landscape, most blockchain networks meet at most only two of these three requirements. Improving one aspect often comes at the cost of another. Although Ethereum was both secure and decentralized3/ , it had previously failed to meet the requirement for scalability. However, this weakness has been addressed by the Merge of Ethereum, which has formed part of the move to upgrade the network’s capabilities and to ensure that the blockchain trilemma is resolved by achieving the perfect balance between scalability, security, and decentralization.

What is The Merge of Ethereum

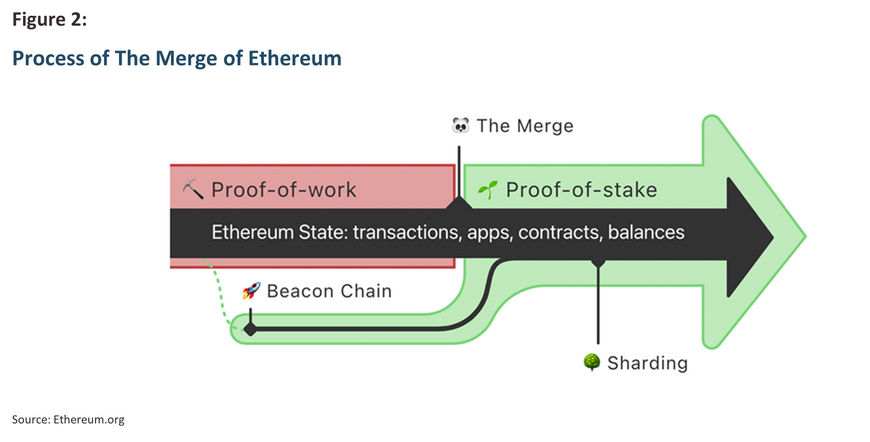

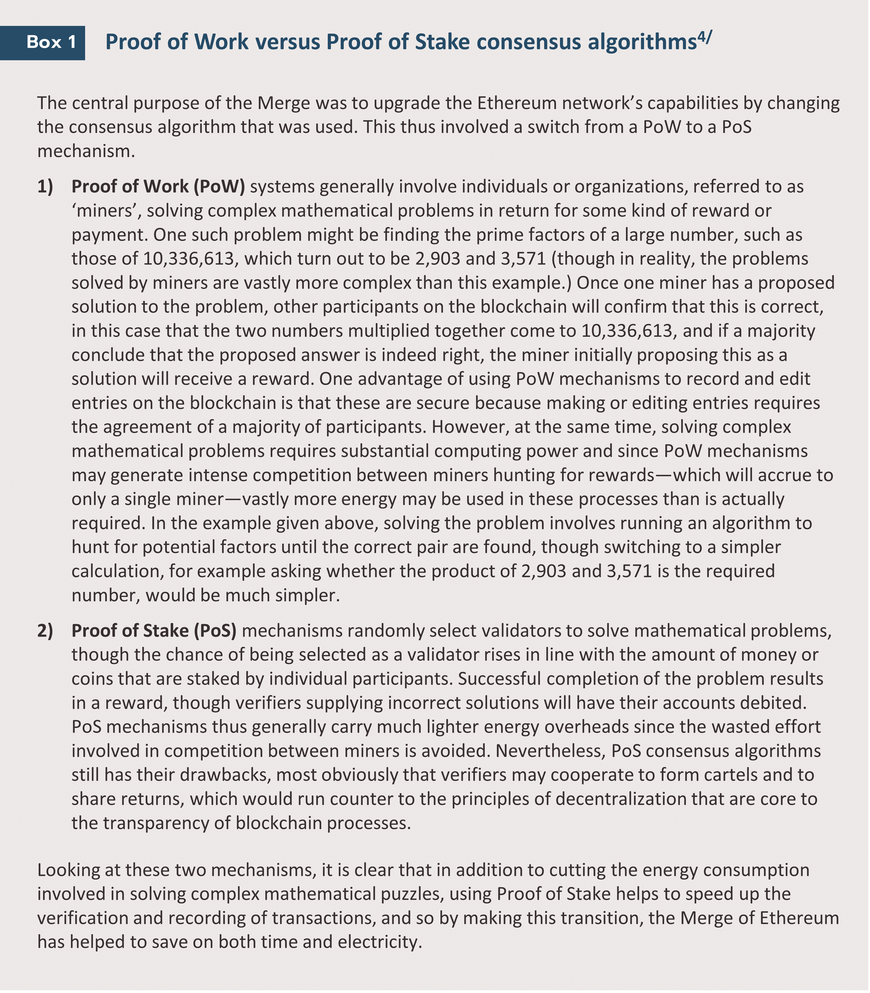

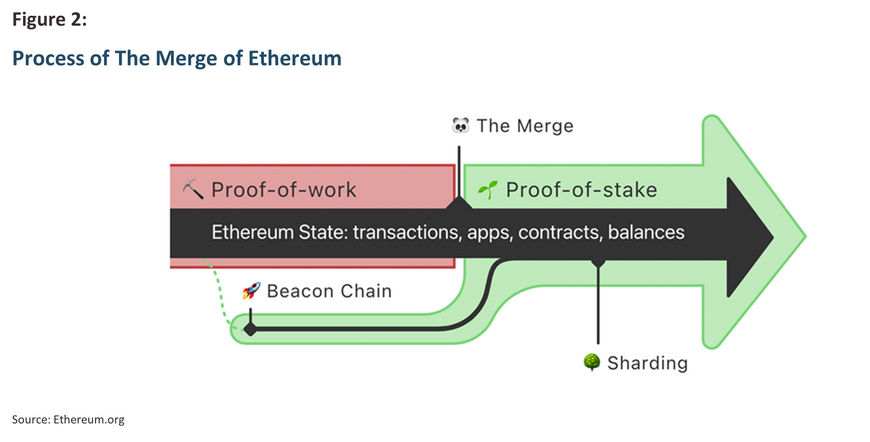

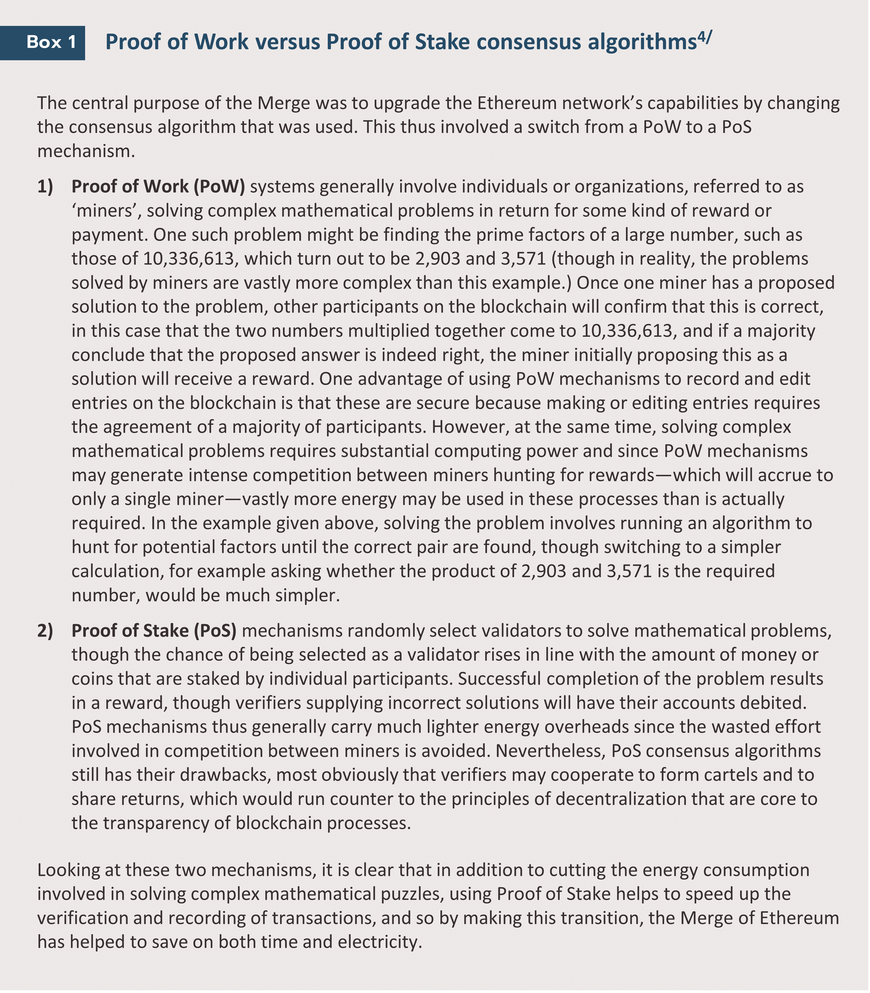

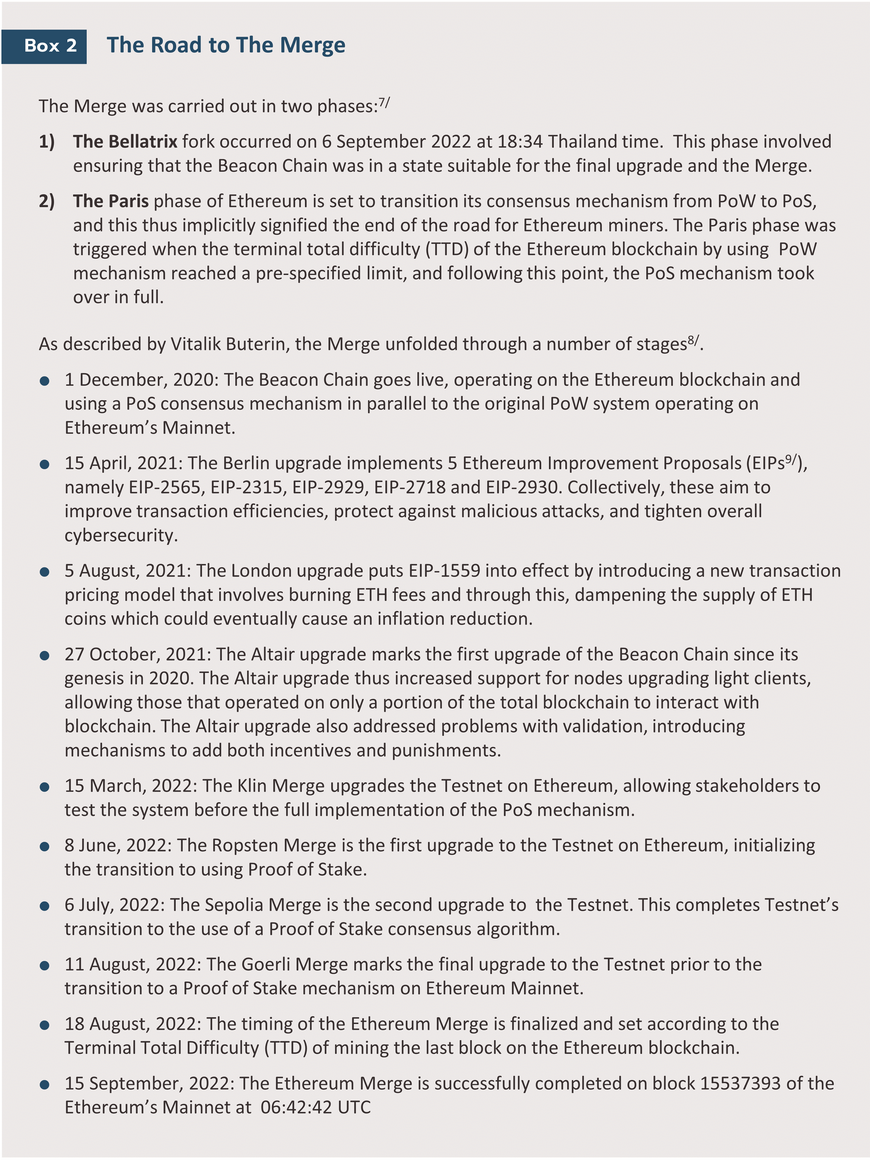

Prior to the Merge, to verify transactions and to record data, account balances, and smart contracts coded and operating on it, the Ethereum Mainnet (i.e., the live Ethereum blockchain deployed for daily use) was based on a Proof of Work (PoW) consensus algorithm. However, the use of a PoW mechanism carries with it significant problems with regard to scalability, and so to overcome these difficulties, a decision was made to switch to a Proof of Stake (PoS) algorithm instead. The transition from a PoW to a PoS consensus algorithm occurred in two major phases: (i) the creation of a separate yet parallel network alongside the Mainnet called ‘the Beacon Chain’ that uses the PoS mechanism; and (ii) the process of merging the Beacon Chain with the existing Mainnet, also known as 'The Merge'.

The Beacon Chain was developed as a separate layer of the Ethereum blockchain. In the initial phase of the switch to the PoS consensus algorithm, the Beacon Chain operated in parallel with the Mainnet, allowing developers to test the system and to deal with problems as and when they arose, without this impacting the functionality of the existing Ethereum network itself. Once it was clear that the Beacon Chain was operating as designed and that use of the PoS mechanism would not generate problems for users on the Ethereum blockchain, it was then possible to integrate the two layers.

The Ethereum Mainnet and the Beacon Chain have been successfully integrated—this is The Merge of Ethereum—and so the Ethereum blockchain now fully operates on a PoS rather than a PoW consensus mechanism.

Following the success of the Merge, the Ethereum network is now looking at implementing a new method of storing data called sharding, which may be used on blockchains. Under this system, the network is split into separate smaller self-managing units called shards, which in the Ethereum network can be connected using the Beacon Chain, with the goal that 64 shard chains will operate simultaneously. The result of this will be to allow the Ethereum network as a whole to process up to 100,000 transactions per second (TPS), significantly cutting processing time and costs and dramatically extending the network’s scalability.

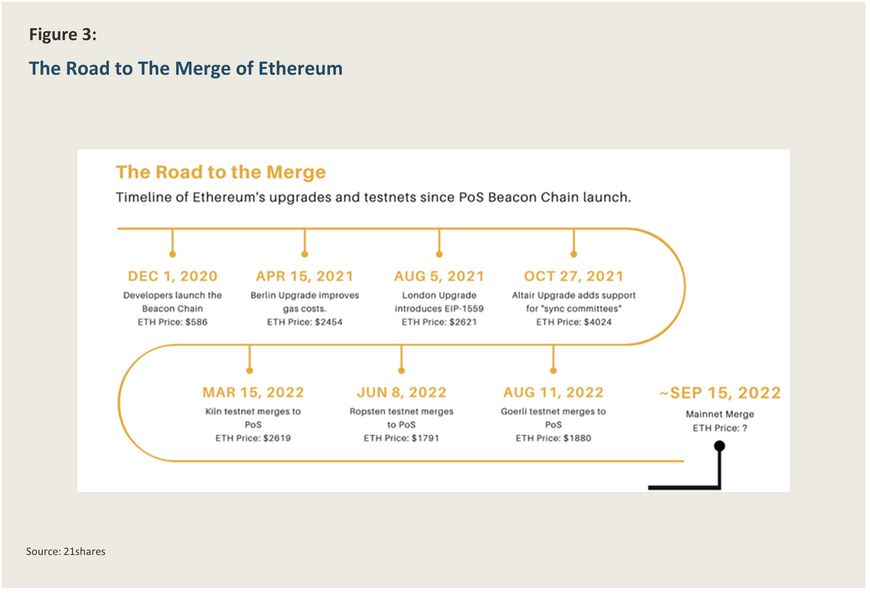

Vitalik Buterin, the Russian programmer behind ETH and the Ethereum blockchain, spoke about how Ethereum might solve the blockchain trilemma at Ethereum 2022 (EthCC), an annual conference devoted to its namesake technology that in 2022 was held in Paris between 19 and 22 July . At the conference, Buterin outlined the details of how upgrades to the Ethereum network would enable it to meet all three of the main requirements for a comprehensive blockchain solution. At that point, the Merge was more than 90% complete, with just some work on Testnet remaining to be completed5/. It was later announced that as of 20:42 Thailand time on 15 September 2022, the Merge of Ethereum had been successfully completed.

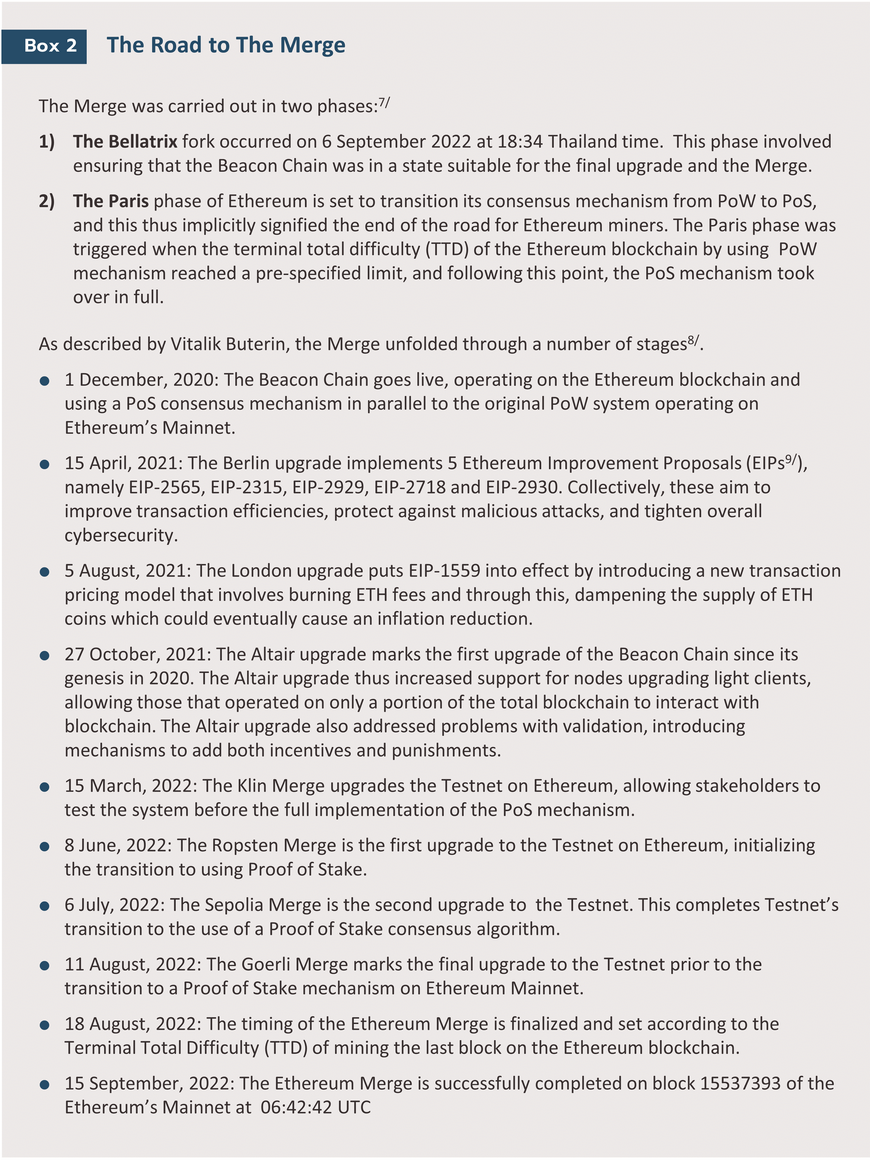

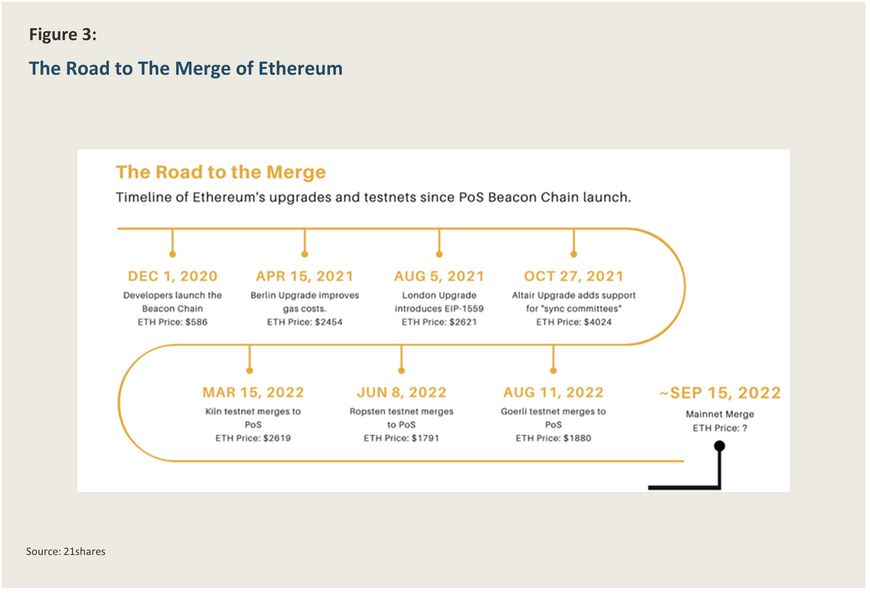

Bringing The Merge to completion

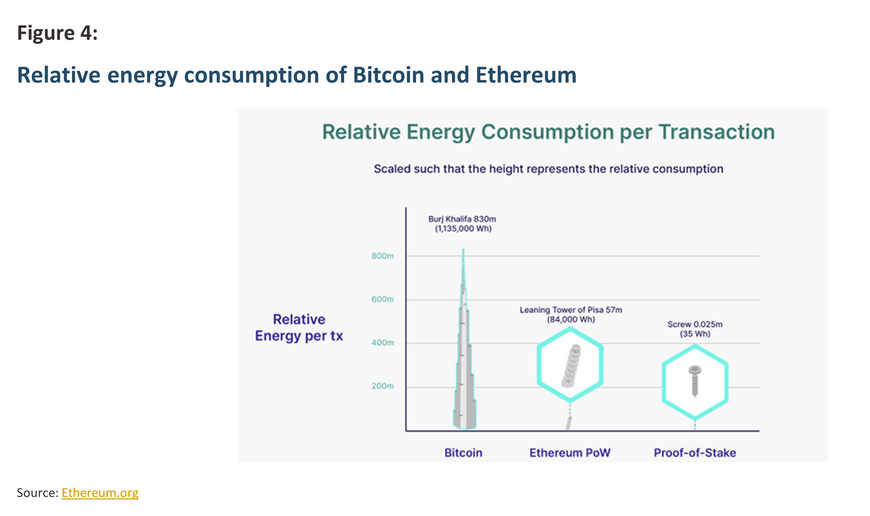

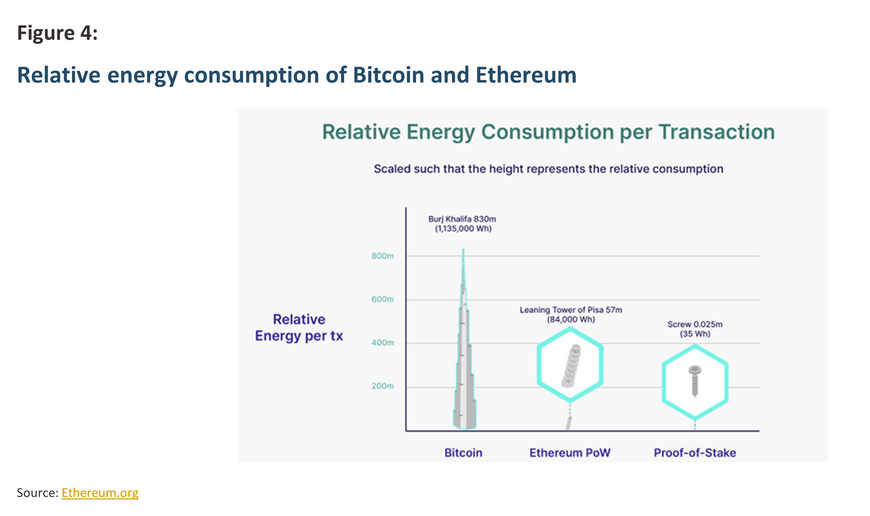

In the recent past, one criticism leveled at cryptocurrencies has been their voracious energy consumption, a situation that many believed was only likely to worsen in the future. In particular, the demands placed on power supplies by the cryptocurrency industry escalated sharply over 2018-2022, and estimates place the industry’s total global power consumption at 120-240 TWh annually. This is a significant amount of electricity, and in addition to being in excess of the total national demand of major economies such as Argentina and Australia, cryptocurrencies are estimated to account for 0.4-0.9% of global energy demand.10/ Alongside other blockchains, Ethereum was guilty of profligate energy consumption, and prior to the Merge, the Ethereum blockchain is estimated to have used 46.31-93.98 TWh of electricity annually,11/ an astounding amount that resulted in a carbon footprint12/ of 11,016,000 tonnes of carbon dioxide equivalent (CO2e).13/

Problems with some blockchains’ excessive energy consumption originate in the use of the PoW consensus algorithm. This contributes somewhere close to 100 TWh annually to global energy demand, a figure that is itself comparable to the entire annual electricity consumption of Colombia or the Czech Republic, and so this was a major driver of the desire to transition the Ethereum network to the PoS mechanism. The total electricity demands generated by using PoS systems to verify transactions come to just 0.0026 TWh per year, or something like 0.01% of the PoW total (i.e., this represents a 99.99% energy saving). In terms of estimated overall consumption, the Merge should thus result in the Ethereum blockchain going from using as much electricity as a mid-sized economy to using as much as a small US town containing around 2,100 households.14/ The collapse in energy usage associated with the PoS systems stems from the fact that rather than being selected through a race to the first correct answer, the system employs a semi-random selection process to find Validator,15/ who adheres to the blockchain regulations to verify transactions. As a result, there is only one validator per block.

As described above, the Merge was undertaken with the aim of increasing Ethereum’s scalability and of reducing the congestion on the network that was being generated using the PoW mechanism. The upgrade has also had the twin results of helping to bring Ethereum closer to meeting the three desired characteristics of the ideal blockchain, and of increasing the network’s security. The latter is due to the transition to the PoS algorithm and the requirement that transaction validators stake 32 ETH16/ of collateral in exchange for the right to be considered as a validator. Participants are therefore incentivized to be much more careful about validating transactions correctly and accurately since otherwise, they run the risk of forfeiting their stake. At the same time, it is now easier to compete for a position as a validator since these are chosen randomly, rather than by solving hugely complex mathematical problems; in the latter situation, race conditions mean that PoW validators, or miners, are forced to make considerable upfront investment in high-end and quickly outdated machinery as they try to gain an edge over the competition, and this then functions as a significant barrier to entry. The net effect of these changes should therefore be to make it easier to become a validator, and with a deeper pool of validators available, the process will become more decentralized.

Despite these positives, the Merge carried with it fears of possible risks to the Ethereum blockchain. (i) The transition from the PoW to PoS mechanism was a major change to the way in which the network operates and although this was thoroughly tested in advance, there was still a risk that the upgrade would result in an interruption to Ethereum services or the departure of some users. (ii) These changes should have the effect of increasing overall security but carrying out such a major overhaul of the network’s technological plumbing opened up the possibility that security holes might be created, which could then be exploited by threat actors. (iii) Some worried that swapping over the consensus algorithm might impact the price of ETH, and given the volatility of cryptocurrency prices, it also was possible that this could affect prices for other coins built on the Ethereum blockchain.

However, in the roughly 10 months between the completion of The Merge of Ethereum in mid-September 2022 and the present, these fears have not come to pass. Thus, there have been no interruptions to the operation of the Ethereum network and no security flaws have come to light that have resulted from the Merge. Rather, security has been improved. Moreover, those who hold ETH can participate as validators in the blockchain. As regards prices for ETH, these have fluctuated over the intervening period, but this has been as a result of market mechanisms, not as a consequence of the upgrade, and these have not had a noticeable impact on the prices of other cryptocurrencies.

The next stage of Ethereum’s development

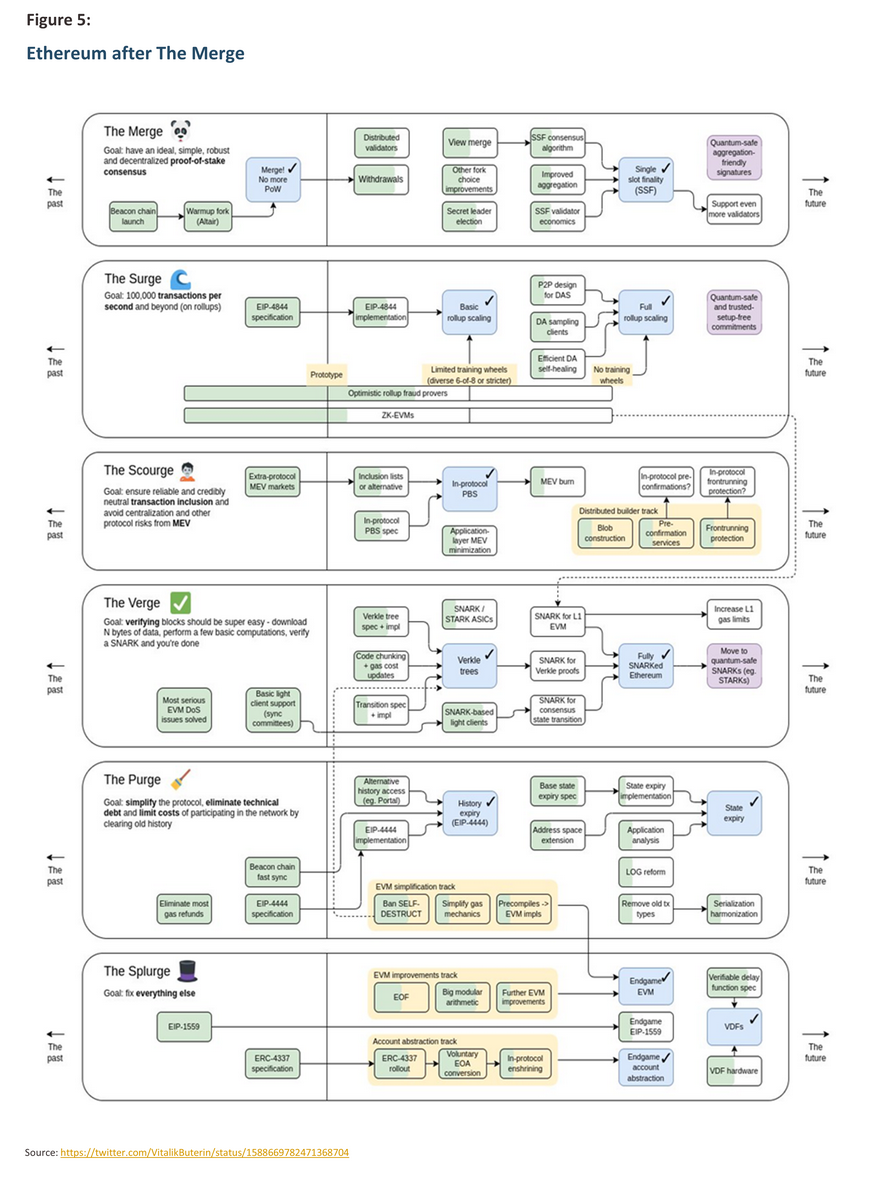

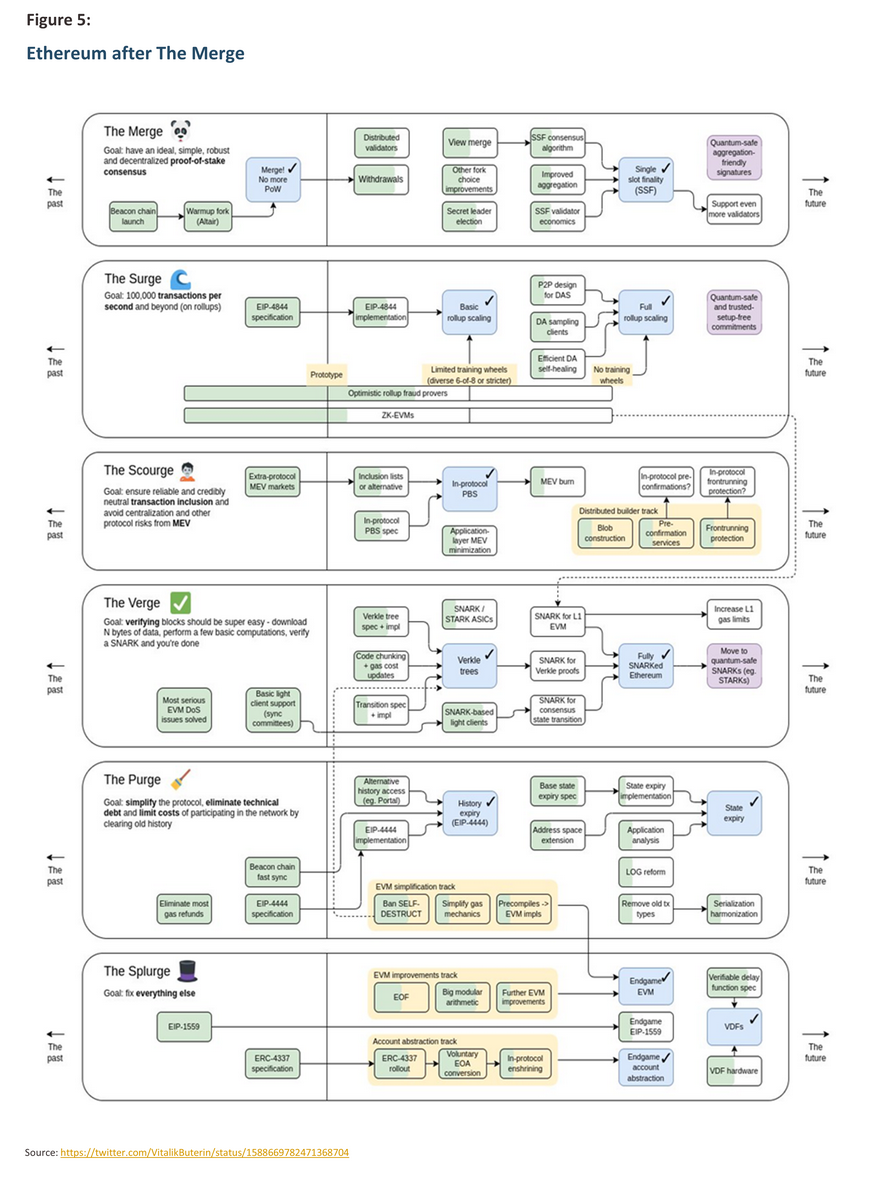

As described by Vitalik Buterin, The Merge of Ethereum was just one stage in the ongoing development of the Ethereum blockchain, and to continue extending the capabilities of the network, a series of further upgrades have now been scheduled.

- The Surge: This will increase the processing capabilities of the Ethereum blockchain. In general, the blockchain is limited to recording only around 15-20 transactions per second (TPS), but the upgrades that will be implemented during the Surge should vastly expand this, taking the cap to 100,000 TPS. The Surge is planned for the second half of 2023.

- The Scourge: This upgrade aims to ensure the reliability and trustworthiness of the network, partly by ensuring that platform users are protected against unwanted kinds of MEV17/ extraction.

- The Verge: This upgrade will increase the network’s efficiency by optimizing storage on Ethereum through replacing ‘Merkle trees’ with the use of ‘Verkle trees’18/ in the verification process. By reducing the quantity of data that each node needs to store and process, overheads should be cut by as much as 85%.

- The Purge: The removal of unnecessary data marks a pivotal phase for Ethereum, accomplished through the implementation of EIP-4444: Bound Historical Data in Execution Clients. This proposal seeks to assist in purging redundant blockchain data, resulting in reduced computational workload and shorter data transfer times.

- The Splurge: The final upgrade of the currently envisaged round of Ethereum will implement two EIPs: (i) to reduce the volume of ETH in circulation, EIP-1559 specifies mechanisms for burning ETH when this is generated from transaction fees; and (ii) EIP-4337: Account Abstraction will increase the network’s flexibility and efficiency by using Verified Delay Functions (VDFs), which will then accelerate the verification of large transactions when these are processed on the network faster.

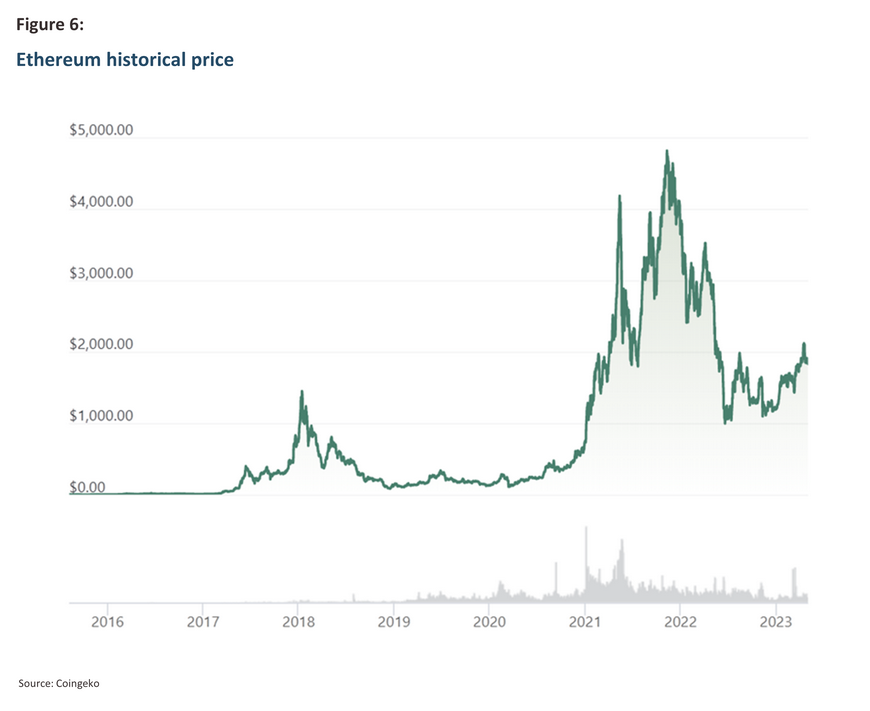

Market reactions to The Merge of Ethereum

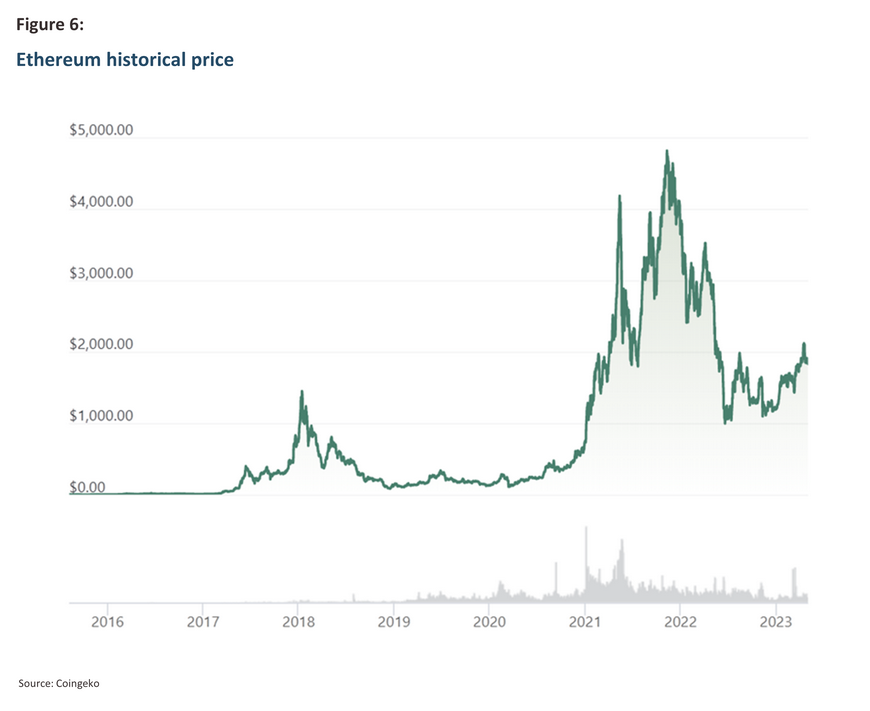

The Merge was one of the most significant events to occur in the crypto space in 2022, following its successful completion, prices for ETH failed to rise, despite predictions from many investors that this would be the case. Rather, prices immediately dipped and then stabilized. This short-term decline was partly driven by rumors and misunderstandings surrounding the upgrade, with many believing that the Merge would result in the formation of a new blockchain, ‘Ethereum 2.0’, and a newly minted coin to go along with this, ‘ETH2’, though as has been shown above, neither of these claims were true. In addition, the Merge coincided with the latest ‘crypto winter’ and significant turbulence in the crypto world. Among the most important causes of the latter was the collapse of the FTX19/ cryptocurrency trading platform, which prior to its being declared bankrupt was after Binance the world’s second largest crypto exchange. The value of ETH was thus impacted by the FTX scandal, losing over 30% of its value overnight; on 8 November 2022, ETH traded at USD 1,574.80 but only a day later, its value had slumped to USD 1,083.29.20/ The market for ETH then remained choppy through 2022, closing out the year at around USD 1,300.

In addition to troubles originating from these market-driven price swings, the regulatory authorities have also begun to take a closer interest in ETH and its exact legal status. Gary Gensler, Chair of the US Securities and Exchange Commission (SEC) stated that following the merge and the 2022 transition from the PoW to the PoS consensus mechanism and the introduction of staking, it was possible that ETH could henceforth best be regarded as a security, and in that case, it would come under the purview of the US SEC. In assessing the case for this, the SEC applied the ‘Howey Test’. For ETH, this required considering whether holders of the coin expected to earn profits from a common enterprise, or in other words, the test assessed whether holding ETH was a type of profit-seeking investment. The result of the SEC’s assessment was that holders of ETH did indeed buy ETH exactly because they expected to earn a profit from doing so, and as such, ETH could be regarded as a type of security.21/ However, at around the same time, on 13 December, 2022,22/ the United States Commodity Futures Trading Commission (US CFTC) issued its indictment of Sam Bankman-Fried, the ex-CEO of FTX, and in this, the CFTC clearly regarded ETH as a commodity, much like Bitcoin and other cryptocurrencies. This conflict over the status of ETH and whether it should be classified as a security or a commodity then generated considerable uncertainty in the investor community since if it is the former, ETH will be regulated by the SEC, whereas if it is the latter, it will be regulated by the CFTC. Following the disagreement between the regulatory authorities, the waters were perhaps muddied further by comments made in May 2023 by Dan Berkovitz, ex-general counsel for the Securities and Exchange Commission, on the Unchained podcast, where Berkovitz stated that it is possible that from a legal perspective, ETH could fall within the scope of both the SEC and the CFTC.23/

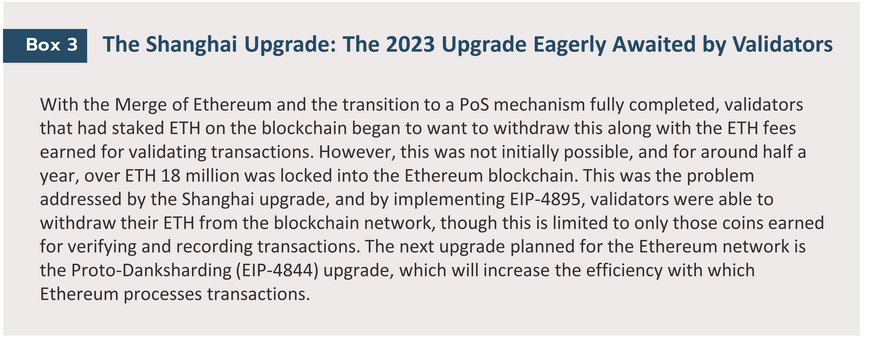

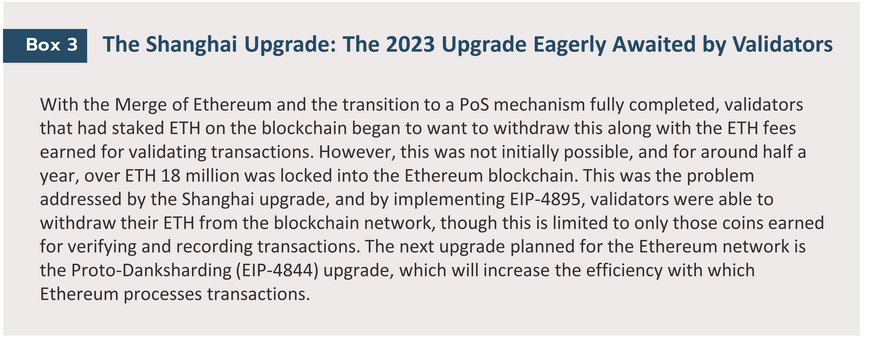

Following this period of volatility, demand for ETH benefited from a number of factors, including the decision by Google to offer blockchain node hosting,24/ for which Ethereum was the first blockchain to be chosen. Vitalik Buterin also announced that following the Merge, the next upgrade to be made to the Ethereum network would be the Scourge,25/ which would help to address problems with validators claiming additional fees for adding transactions to the blockchain. The Shanghai upgrade,26/ which was implemented at the start of April 2023, also allows validators to withdraw ETH that has been staked on the blockchain. These have then helped to improve perceptions of the Ethereum network and as such, prices for ETH have rallied; in the wake of the successful Shanghai upgrade, ETH prices broke through the USD 2,000 barrier for the first time in 8 months.

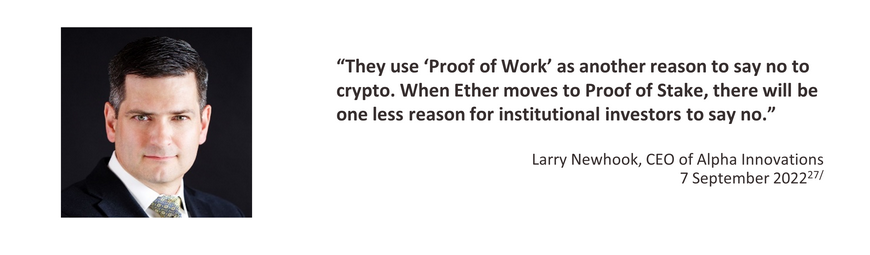

Investors and commentators are agreed that by expanding its transaction handling capabilities, beefing up its security, and slashing its energy overheads, the Merge has had major benefits for the Ethereum network and added to interest in the possibilities on offer.

Krungsri Research view: The Merge of Ethereum

Within the crypto world, the Merge was a major event on the 2022 calendar, and across the space, the success of the upgrade was closely tracked. This intense interest stemmed from the expectation that the Merge would achieve the difficult task of shifting the Ethereum blockchain into the sweet spot at the center of the blockchain trilemma, and by reducing problems with scalability, Ethereum would much better balance this with the other demands of security and decentralization.

From the point of view of the banking and finance industry, this upgrade to Ethereum’s capabilities brings with it significant benefits but also implies major impacts, too. With regard to the former, the Ethereum blockchain is already capable of supporting decentralized applications (DApps) and smart contracts, and combined with the network’s trustworthiness and decentralization, these offer an easy and convenient solution for processing a wide range of financial transactions. Moreover, because the smart contracts that are built on the Ethereum blockchain self-execute when specified conditions are met, this adds to efficiencies and reduces the risk that contracts can or will be amended after having been agreed.

In addition, the very sharp cuts in electricity consumption that the Merge has enabled will serve to provoke greater interest from investors attracted by the promise of digital assets and who are focused on the development of Environment, Social, and Governance (ESG) goals. Within the blockchain universe, the Ethereum network is thus establishing itself as a leader in the field and is the choice for a ‘green blockchain’ for those interested in this area, and by occupying this position, the network will appeal to investors looking to push forward with the development of the industry and the generation of benefits for stakeholders. More generally, blockchain technologies are finding an ever-growing range of applications across the economy, including in the real estate sector, where their use is allowing for asset tokenization and for simpler document storage and exchange; the arts and entertainments industry, where blockchains can be used to encode artists’ rights, prevent copyright violations and ensure that payments are made directly to originating artists; and the health industry, where blockchains may be used to securely store patient records, easing bottlenecks created when individuals are seen in a number of different hospitals or clinics. Ultimately, blockchain technologies may be used to simplify and streamline work processes, and through this, reduce operating overheads. And with the introduction of PoS mechanisms on the Ethereum blockchain, this is now becoming an environmentally friendly option, too.

In terms of impacts, the basic structure and limitations of blockchains needs to be kept in mind. For example, because data stored on blockchains is largely immutable, care must be taken that this is correct when it is written into a block, and there is always a risk that a mistake may be made when, for example, keys, which function like account numbers, or the value of a transaction is recorded. Another problem connected to upgrades is that although those made to the Ethereum blockchain improve its efficiency, because it is a distributed system, carrying out a successful upgrade is more technologically challenging than for a centralized system. Another feature of distributed systems is that verification and confirmation of transactions takes longer, and if network supervision is inadequate, this gap opens up a window of opportunity that may be exploited by malicious players looking to gain unauthorized access to the blockchain. In addition, the automatic execution of smart contracts may be negatively impacted by weaknesses or bugs in the underlying program, and poorly designed software will naturally tend to generate problems and security holes in the contracts that they deploy.

Nevertheless, despite the fact that the financial and banking industry has embraced blockchain technology more than other industries, with a usage rate as high as 29.7%28/ and being one of the leading adopters of the technology, real-world blockchain applications have to date been somewhat limited. It may thus be the case that what is needed is more applied research on how best to harness the undoubted potential that blockchain technology offers. For example, industry can play to blockchain’s strengths by developing applications that use the technology to verify and track information related to products and documentation, or in areas connected to supply chain tracking and traceability. However, it is also clear that this technology is not best suited for use in every corner of the economy, and in some industries, adoption may be limited by persistent worries over blockchain’s weaknesses and the risks inherent in its use, as well as by a lack of clarity over its business value and how, in individual use cases, blockchain provides benefits in excess of better-established technologies. Moving against these trends, though, the Japanese financial giant Mitsubishi UFJ Financial Group (MUFG) has announced that it is in the process of developing its ‘Progmat’ platform.29/ One of the most notable features of Progmat is the development of a stablecoin pegged to the Japanese yen, known as ‘Progmat Coin’. MUFG envisions that this coin could be widely adopted in the future, and to this end, Progmat Coin will facilitate the issuance of bank-backed stablecoins in Japan on leading blockchain networks, with Ethereum, Polygon, Avalanche and Cosmos being the initial choices. Future developments penciled in for the project include building in the interoperability required to support cross-chain lending and swaps.30/ Overall, the latest round of upgrades to the Ethereum network can perhaps best be viewed as a process of infrastructure development undertaken to raise the network’s abilities and potential, and through this, pave the way for the future rollout of a much more varied range of applications.

In the case of Thailand, it may take some time before corporations fully understand and embrace the implications of these new technologies compared to older alternatives, as well as how to best utilize blockchains and smart contracts to create business value for their specific use cases. Nonetheless, moving in this direction and incorporating blockchain technology into business processes will be a crucial stride toward enhancing the growth potential of individual businesses and sharpening national competitiveness.

References

21shares (Sep 2022) “The Ethereum Merge, Arguably The Most Significant Event in Crypto History”. Retrieved March 28,2023 from https://21shares.com/research/ethereum-merge-primer

Bitkub (Aug 2022) “รู้จัก The Merge การรวมร่างที่น่าตื่นเต้นที่สุดในประวัติศาสตร์ Ethereum”. Retrieved March 23,2023 from https://www.bitkub.com/th/blog/ethereum-the-merge-db43450d5c1b

Coindcx (Apr 2023) “Ethereum Shanghai Upgrade Explained: Staking, Withdrawals & Everything in Between!”. Retrieved April 18,2023 from https://coindcx.com/blog/cryptocurrency/ethereum-shanghai-upgrade/

CoinDesk (Aug 2022) “What is the Ethereum Merge”. Retrieved March 14,2023 from

https://www.coindesk.com/learn/what-is-the-merge-and-why-has-it-taken-so-long/

Cointelegraph (Oct 2022) “The Merge brings down Ethereum’s network power consumption by over 99.9%”. Retrieved March 29,2023 from https://cointelegraph.com/news/the-merge-brings-down-ethereum-s-network-power-consumption-by-over-99-9

efinanceThai (Sep 2022) “สรุปประเด็นต้องรู้เกี่ยวกับ The Merge การอัปเกรดครั้งใหญ่ของ Ethereum” Retrieved March 16,2023 from https://www.efinancethai.com/LastestNews/LatestNewsMain.aspx?ref=C&id=SWdGZThmT1JLSFk9

Ethereum.org “The Merge” Retrieved March 10,2023 from https://ethereum.org/en/roadmap/merge/

Finnomena (Jun 2022) “The Merge คืออะไรและส่งผลกระทบอย่างไรบ้าง?”. Retrieved March 15,2023 from https://www.finnomena.com/zipmex/the-merge/

Investopedia (March 2023) “What Is the Ethereum Shanghai Upgrade?”. Retrieved March 21,2023 from https://www.investopedia.com/what-is-the-ethereum-shanghai-upgrade-7099021

Icommunity (Feb 2023) “Do you really need blockchain” Retrieved July 6,2023 from

https://icommunity.io/en/do-you-really-need-blockchain/

SCB10X (Jan 2023) “รู้จัก The Merge กับการอัปเดตครั้งสำคัญเพื่อรากฐานอนาคตของ Blockchain”. Retrieved March 25,2023 from https://www.scb10x.com/blog/the-merge-future-blockchain

Techsauce (Sep 2022) “The Merge การอัปเกรดครั้งใหญ่ของ Ethereum คืออะไร ทำไมถึงน่าจับตา?”. Retrieved March 20,2023 from https://techsauce.co/tech-and-biz/what-is-ethereum-the-merge

The ascent (March 2022) “Here's What the Ethereum Merge Means for Investors”. Retrieved March 17,2023 from https://www.fool.com/the-ascent/cryptocurrency/articles/heres-what-the-ethereum-merge-means-for-investors/

Theblock (March 2023) “Ethereum to begin final dress rehearsal today for Shapella upgrade”. Retrieved April 6,2023 from https://www.theblock.co/post/219793/ethereum-to-begin-final-dress-rehearsal-today-for-shapella-upgrade?utm_source=cryptopanic&utm_medium=rss

Theblock (Sep 2022) “The Merge: Everything you need to know about Ethereum's big upgrade”. Retrieved March 29,2023 from https://www.theblock.co/post/166708/the-merge-everything-you-need-to-know-about-ethereums-big-upgrade

Zipmex (Sep 2022) “การอัปเดต The Merge สำเร็จแล้ว พร้อมต้อนรับกลไก PoS บน Ethereum”. Retrieved March 20,2023 from https://zipmex.com/th/learn/what-is-the-merge/

1/ A "Native coin" refers to the cryptocurrency that is used within a specific and dedicated blockchain system.

For example, Bitcoin, which is the oldest and most well-known cryptocurrency, is considered the Native coin

of the Bitcoin blockchain. Similarly, Ether (ETH) is the Native coin of the Ethereum blockchain.

2/ https://academy.binance.com/en/articles/what-is-the-blockchain-trilemm

3/ https://academy.shrimpy.io/post/what-is-the-blockchain-trilemma

4/ For more details, please see our paper “Banking and blockchain technology”

5/ https://cryptopotato.com/the-merge-testing-is-90-complete-says-ethereums-vitalik-buterin/

6/ https://twitter.com/VitalikButerin/status/1570306185391378434

7/ https://www.outlookindia.com/business/ethereum-gets-into-the-merge-with-bellatrix-upgrade-today-news-221317

8/ https://www.etfstream.com/articles/ethereum-merge-arguably-the-most-significant-event-in-crypto-history

9/ Ethereum Improvement Proposals (EIP) are plans that outline technical features or new processes that will occur within Ethereum. These proposals are meant to inform investors or individuals following the blockchain about upcoming changes

10/ https://www.whitehouse.gov/ostp/news-updates/พ.ศ.2565/09/08/fact-sheet-climate-and-energy-implications-of-crypto-assets-in-the-united-states/

11/ https://cointelegraph.com/news/the-merge-brings-down-ethereum-s-network-power-consumption-by-over-99-9

12/ The carbon footprint is the net total of greenhouse gas emissions and removals attributable to a goods or service across its product lifecycle, or to an individual or organization. The carbon footprint is typically measured in tonnes of carbon dioxide equivalent (CO2e).

13/ https://ethereum.org/en/energy-consumption/

14/ https://content.ftserussell.com/sites/default/files/education_proof_of_stake_paper_v6_0.pdf

15/ A validator is a participant selected through a Proof-of-Stake mechanism to verify a transaction that has occurred on the Ethereum blockchain. Generally, the greater the pool of validators, the more secure the blockchain.

16/ The process for staking ETH to operate as a validator is stipulated by the regulations put in place by the Ethereum blockchain. These state that validators need to deposit at least 32 ETH as collateral, though many prospective validators will not be able to reach such a high bar. The Ethereum network thus allows validators with insufficient ETH to share their resources in so-called pooled staking, thereby allowing smaller participants to vie for the right to validate and verify transactions alongside bigger players.

17/ MEV or the Maximal Extractable Value, is similar to transaction fees as it is a cost borne by users that transact on public blockchains. It is the maximum returns available to a validator when verifying and processing a transaction. MEV refers to the additional revenue that blockchain validators can earn by including, excluding, or reordering transactions before finalizing them. This leads platform users to pay higher fees to validators when their transactions are verified and recorded on the blockchain.

18/ A Merkle tree is a type of data structure that forms a fundamental part of blockchain technology. Data stored in Merkle trees has a tree-like branching structure. This makes accessing the data easier and improves the efficiency with which blockchain data may be inspected and verified. Subsequently, Merkle trees have evolved into Verkle trees, which have the advantage of greater efficiency and of being able to process larger quantities of data.

19/ https://capital.com/what-did-bankman-fried-ftx-and-alameda-do-wrong

20/ https://blinkrilo.weebly.com/blog/ethereum-will-drop-consumption-by

21/ https://www.wsj.com/articles/ethers-new-staking-model-could-draw-sec-attention-11663266224

22/ https://www.courtlistener.com/?q=commodities%20id%3A219985730&type=r&order_by=score%20desc

23/ https://cointelegraph.com/news/eth-can-be-security-and-commodity-says-former-cftc-commissioner

24/ https://cloud.google.com/blog/products/infrastructure-modernization/introducing-blockchain-node-engine

25/ https://twitter.com/VitalikButerin/status/1588669782471368704

26/ https://www.coindesk.com/tech/พ.ศ.2565/11/24/ethereum-developers-agree-on-what-could-be-included-in-the-next-upgrade-but-not-when/

27/ https://qz.com/esg-investors-arent-all-sold-on-ethereums-merge-1849504484

28/ https://www.simplifyconsulting.co.uk/blockchain-in-wealth/

29/ As of 1 June 2023, the Japanese government has prohibited the issuance of stablecoins by organizations other than licensed banks, registered money transfer agents and trust companies in Japan.

30/ https://cointelegraph.com/news/mufg-to-facilitate-japanese-bank-backed-stablecoins-via-progmat-coin-platform