Introduction

What are specialty chemicals?

Specialty chemicals are chemical products designed to meet the specific needs of targeted downstream users, typically to enhance their industrial processes or products. In contrast, commodity chemicals are standardized products produced in large quantities to meet a more generalized demand.

The market for specialty chemicals can be categorized by the types of products available and their applications in downstream industries.

-

Specialty polymers: These include high-performance thermoplastics, specialty films, engineering thermoplastics, and water-soluble polymers. These materials are used in end-user industries such as construction, cosmetics, auto assembly, medical devices, and electronics to enhance product quality and performance.

-

Electronics chemicals: These are used in the production of parts and products in the electronics industry, including printed circuit boards, semiconductors, and display devices.

-

Construction chemicals: This category includes concrete admixtures, waterproofing chemicals, protective coatings, asphalt additives, adhesives, and sealants.

The specialty chemical value chain

Overview of the industry value chain

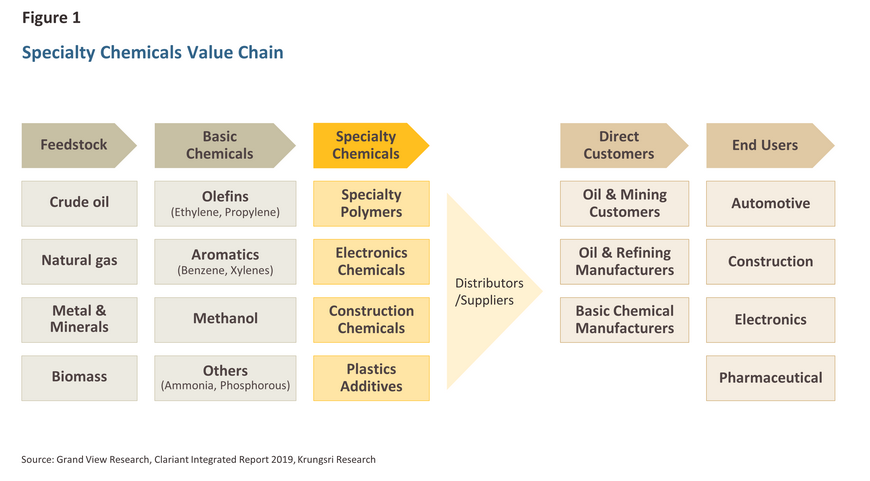

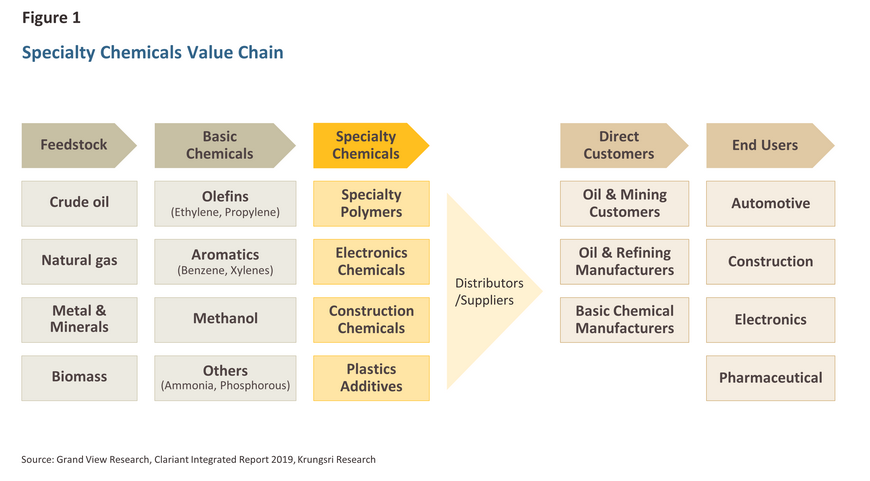

The production of specialty chemicals is primarily driven by a focus on customer needs, requiring players across the value chain to demonstrate creativity and innovation in responding to rapidly evolving demand. Globally, the specialty chemical value chain consists of: (i) feedstock suppliers; (ii) specialty chemical manufacturers; (iii) direct customers; and (iv) end-users.

Manufacturers of specialty chemicals utilize a wide range of feedstocks derived from crude oil, metals and minerals, natural gas, and biomass. Major suppliers of these feedstocks to global markets include Saudi Aramco, Royal Dutch Shell, China National Petroleum Corporation, BP, and Exxon Mobil (Figure 1). The industry transforms these inputs into specialty chemical products such as construction chemicals, agrochemicals, food additives, and cosmetics products. Companies such as Solvay, Evonik Industries AG, and Clariant then sell these products through suppliers and distributors to their customers. These customers include oil companies and refiners that use enhanced oil recovery chemicals to improve extraction rates.

At the end of the specialty chemical value chain are the globally significant end-users in Asia, Europe, and North America. Among them is the Saudi Arabian chemicals manufacturer SABIC, which uses specialty chemicals to produce high-performance thermoplastic polyetherimide (PEI). PEI is notable for its strength and rigidity at high temperatures and its rapid heat dissipation, which enhances energy efficiency. These advantages have led to PEI's widespread application in diverse areas such as electronics, automotive engineering, and medical devices.

Feedstock trends

Manufacturers of specialty chemicals, similar to their counterparts in the commodity chemicals market, are increasingly exposed to risk due to feedstock price volatility. These prices are influenced by fluctuations in the global price of crude oil, the primary input in chemical supply chains. Additionally, the supply of feedstocks has been disrupted by periodic production facility shutdowns. During the COVID-19 pandemic, sluggish demand from downstream consumers, including the construction and auto assembly industries, negatively impacted demand for products such as specialty polymers and construction chemicals.

However, if these manufacturers can expand their customer base, they may mitigate risks and offset the effects of weak demand from end-users. Investing in large-scale facilities can generate additional economies of scale, and strategically locating these facilities near raw materials can reduce transportation costs and enhance the producer’s competitive advantage.

In recent years, specialty chemicals manufacturers operating in global markets have increased their competitiveness by scaling up investments, with a notable focus on the Middle East. For instance, in Saudi Arabia, the chemicals industry represents 35% of all national investments. Similarly, China’s Sinopec Corp has been investing in refineries and petrochemical production facilities abroad, using these investments to both expand internationally and secure access to feedstocks and other inputs. Additionally, companies are enhancing their competitive edge by securing supplies through long-term procurement contracts or by pursuing backward integration to extend their operations upstream.

Trends in the manufacturing of specialty chemicals

To better meet customer demand for products with specific characteristics, specialty chemicals are typically produced using batch processing. Unlike the mass production of commodity-grade chemicals, this method requires more frequent changes to feedstocks, equipment, and operating conditions. However, batch processing is less capital-intensive, consumes less energy, and results in lower CO2 emissions.

The business environment has significantly evolved in recent years as major commodity-grade manufacturers have sought to mitigate risk by diversifying into the specialty chemicals market. For example, Thai IRPC PCL has set a target to increase the share of income from specialty chemicals from 33% of its polymer sales in 2023 to 38% in 2024 and 50% in 2025. Additionally, many companies are actively pursuing mergers and acquisitions to establish new entities focused solely on the specialty chemicals market, aiming to better meet consumer demand.

Recent developments, the current situation and the outlook

Overall market growth

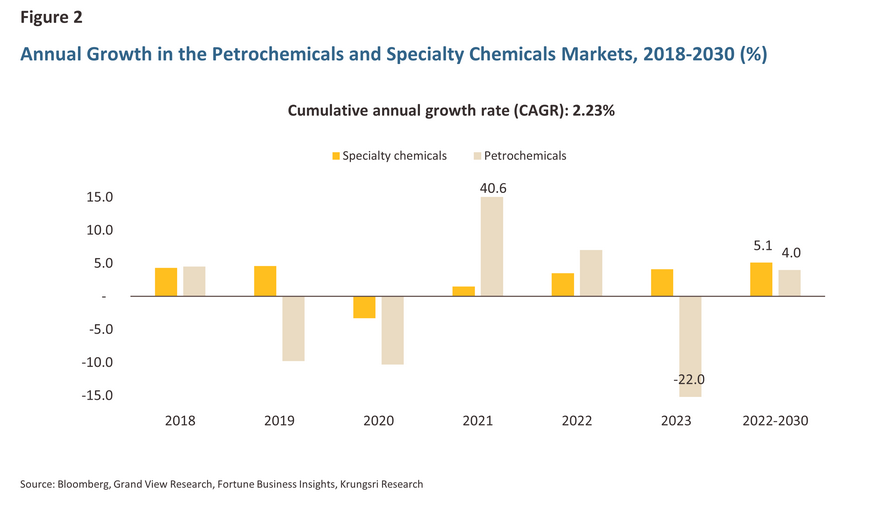

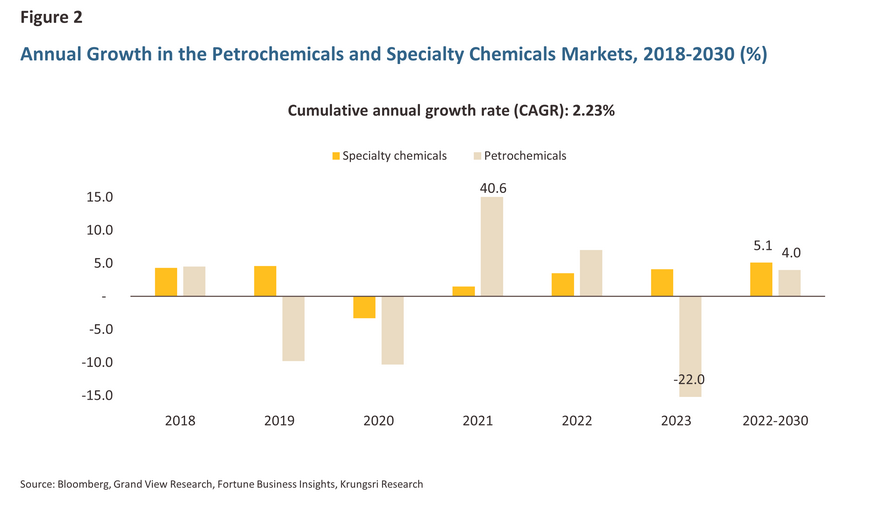

Prior to the COVID-19 pandemic, the global market for specialty chemicals experienced strong demand from downstream industries, including automotive, electronics, construction, pharmaceuticals, food additives, and oil refining. As a result, global sales increased by 4.6% in 2019, even as the petrochemicals sector faced a -9.8% contraction. The onset of the pandemic in 2020 led to a global economic recession. While petrochemical sales fell by -10.3% worldwide, the specialty chemicals market contracted by only -3.3%. Sales then rebounded in 2022, growing by 3.5% as infection rates eased and downstream demand resumed.

The market for specialty chemicals is projected to grow at a compound annual rate of 5.1% from 2022 to 2030, which is more favorable compared to the 4.0% annual average growth forecast for the petrochemicals industry (Figure 2).

Market segment analysis

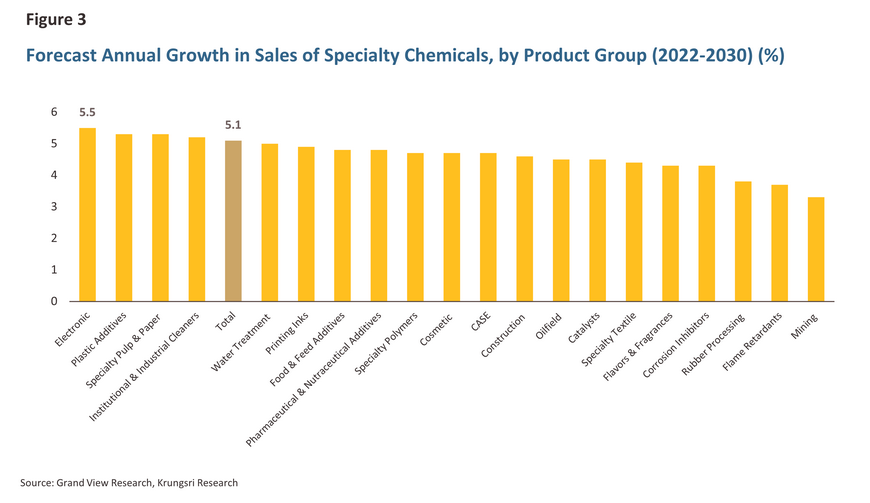

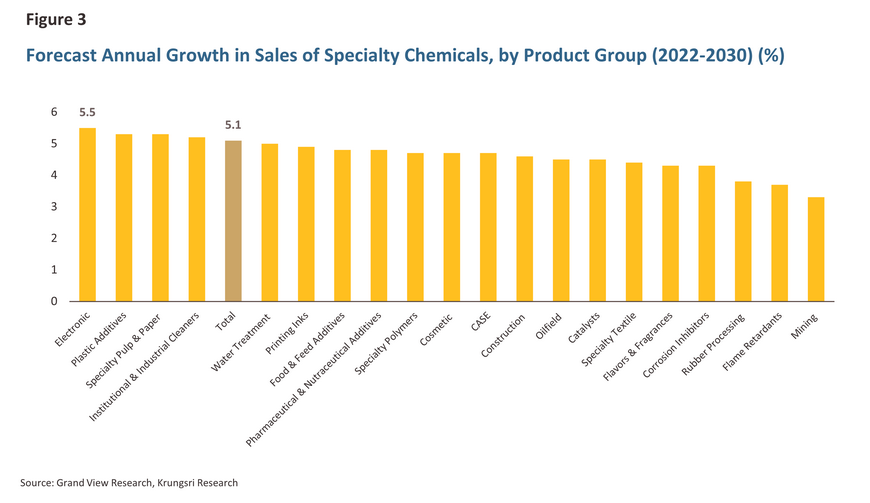

A comparison of the various specialty chemicals segments shows that the market for electronics chemicals is expected to experience the strongest growth between 2022 and 2030, at a rate of 5.5% per year. Global demand for electronics goods is projected to rise steadily (Figure 3). Cisco estimates that in 2020, 127 Internet of Things (IoT) devices were brought online every second, and the number of IoT devices is expected to reach approximately 75 billion by 2025. Consequently, demand for smartphones and integrated circuits will continue to accelerate, boosting the production of the specialty chemicals required by the electronics industry.

Strong growth in the electronics and automotive industries will also boost demand for other specialty products. These chemicals can be used to produce lighter, more wear-resistant parts, benefiting manufacturers of specialty polymers, coatings, adhesives, sealants, elastomers (CASE products), and plastic additives. Annual sales for these products are expected to rise by 4.7%, 4.7%, and 5.3%, respectively.

Regional and country analysis

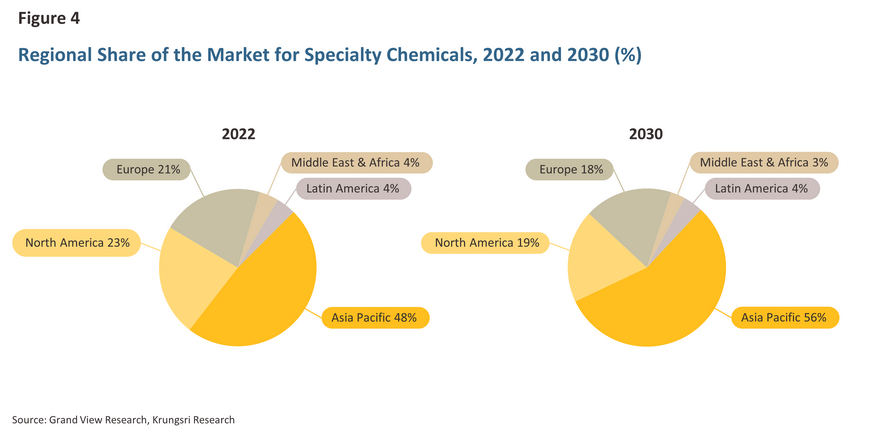

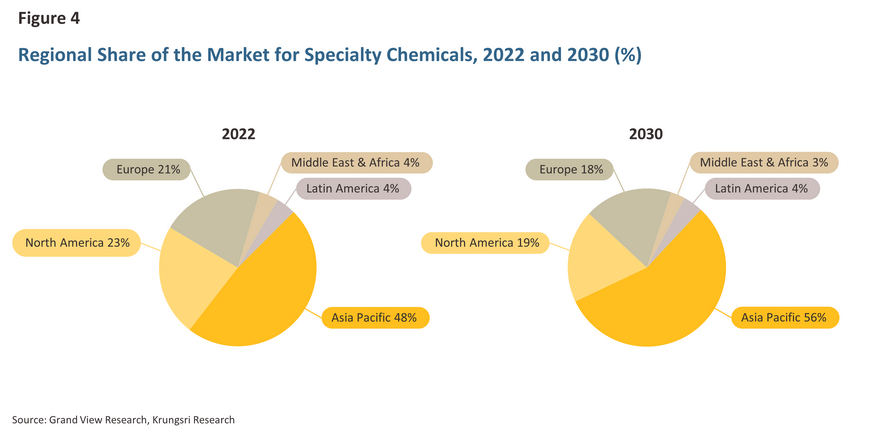

Globally, the Asia-Pacific region has the highest concentration of specialty chemicals manufacturing capacity. As of 2022, the region accounted for 48% of the global output of these products by value. Following the Asia-Pacific region, North America and Europe contributed 23% and 21% of industry income, respectively. This disparity is expected to widen further, with the Asia-Pacific region projected to enjoy annual growth of 6.9% from 2022 to 2030, compared to just 2.9% and 2.7% for North America and Europe. By 2030, these three regions are anticipated to control 56%, 19%, and 18% of the market, respectively (Figure 4). This strong divergence in outcomes and the greater relative strength of specialty chemicals production in the Asia-Pacific region can be attributed to the rapid pace of industrialization there. The IMF forecasts annual GDP growth of 3.9%, 6.5%, and 5.0% for China, India, and Indonesia, respectively, over 2024-2028, compared to an average growth rate of just 1.3% for the G7 economies (the Group of Seven, an association of seven highly developed economies). This significant difference in economic growth will support much stronger demand for specialty chemicals in the Asia-Pacific region than in the West.

Examining individual countries within the Asia-Pacific region reveals that the market is dominated by China and India, which are expected to experience annual growth rates of 7.4% and 6.8%, respectively, from 2022 to 2030. By 2030, these two countries alone will account for two-thirds of the total value of the Asia-Pacific market. China and India, with their long-standing expertise in using medicines and food to treat illness, are poised to become market leaders in the production of pharmaceutical and nutraceutical additives. The market for these additives in China and India is forecast to grow by 8.0% and 7.4%, respectively, over the period 2022-2030. Additionally, Chinese production of electronics chemicals is projected to expand by 6.7% annually, driven by strength in the semiconductor market, which Marketline predicts will grow by 6.7% per year from 2024 to 2028. This growth rate is significantly higher than the forecast growth of 5% and 3% in India and Singapore, respectively. In India, ongoing economic expansion and substantial government spending on infrastructure will boost demand from downstream industries such as construction, automotive engineering, and manufacturing in general. This increased demand will lead to stronger sales of construction chemicals, plastic additives, electronics chemicals, and rubber processing products.

Opportunities and market drivers

The market for specialty chemicals will be boosted by tailwinds on both the demand and supply sides. On the demand side, growth in downstream industries will naturally support increased demand for specialty chemicals. On the supply side, increased spending on research and development will help manufacturers better meet the ever-changing needs of their buyers.

Demand: Growth will be driven by downstream industries

Increased demand for specialty adhesives and sealants: Downstream manufacturers are transitioning from traditional materials like steel and other metals to a greater reliance on plastics. This shift is driving a move from mechanical fasteners to adhesives and sealants. For instance, in automotive and aeronautical engineering, the increasing use of plastics, composites, and non-ferrous materials is naturally boosting the demand for adhesives and sealants. These products offer additional advantages over traditional materials, including reduced vibration and lower weight. Consequently, this segment is experiencing significant growth, and producers are benefiting from the ability to charge a premium for specialty adhesives and sealants compared to standard products, further enhancing their revenue.

Rising demand for water-soluble polymers: The market for water and wastewater treatment is strengthening due to the expanding global population, which drives demand for water-soluble polymers. This trend is expected to continue in the near term, particularly in developing and newly industrialized countries such as India and China. Governments in these regions are increasingly focused on environmental issues and wastewater management. For instance, the Chinese government plans to invest USD 50 billion in 2025 to manage wastewater from heavily polluting industries, including textiles, printing, iron and steel processing, oil and natural gas extraction, coal mining, and pharmaceuticals.

Supply: Investment in R&D will be the main driver of expansion

Manufacturers of specialty chemicals are addressing the demand for safe and sustainable products from electronics and consumer goods producers by increasing their investment in R&D and product innovation. A notable example is Apple, which has implemented strict requirements for the components used in its products. As a result, specialty chemical manufacturers are developing higher-performing products that are both cost-effective and safe. Market changes are also influenced by external factors, such as rising oil prices, increased demand for environmentally friendly products, the tightening supply of non-renewable resources, and the growing global population. These factors collectively drive the need for specialty chemicals and polymers derived from biomass. In response, industry players are boosting their R&D expenditures.

Challenges facing the industry

The commoditization of the specialty chemicals market

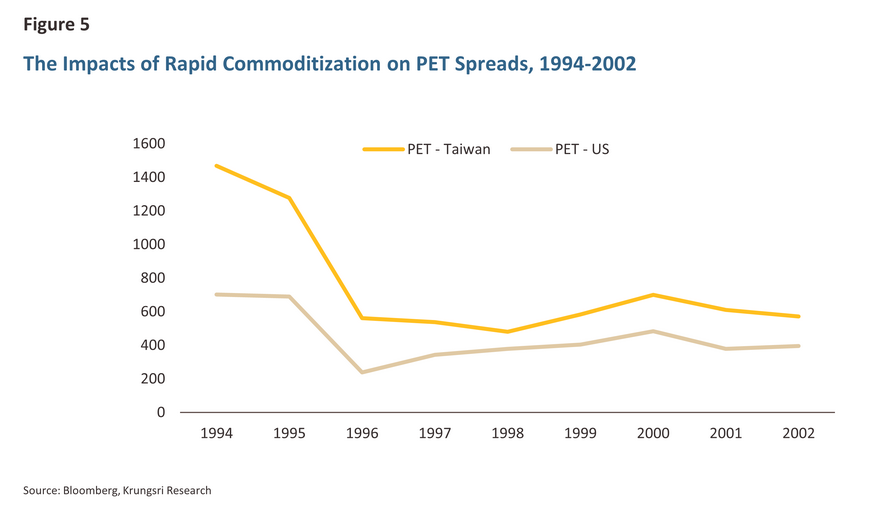

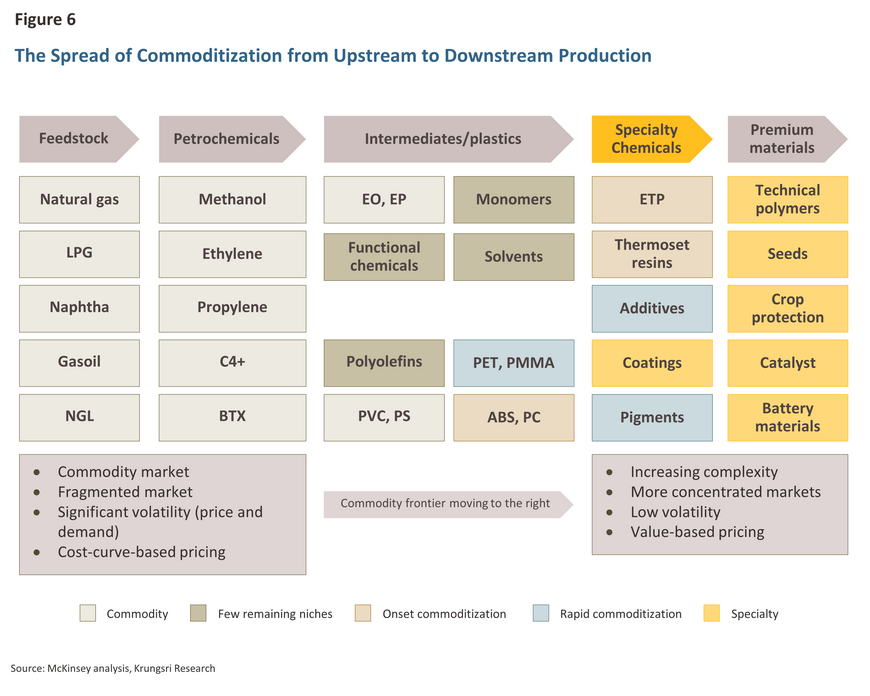

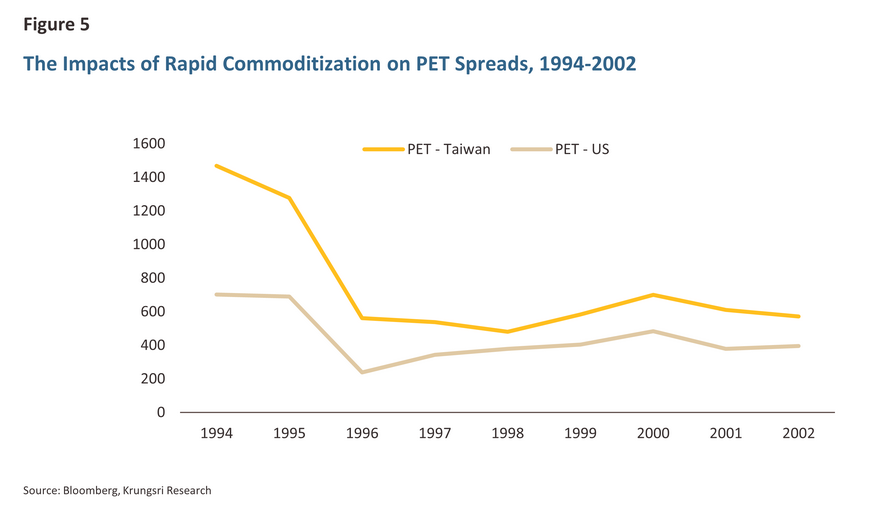

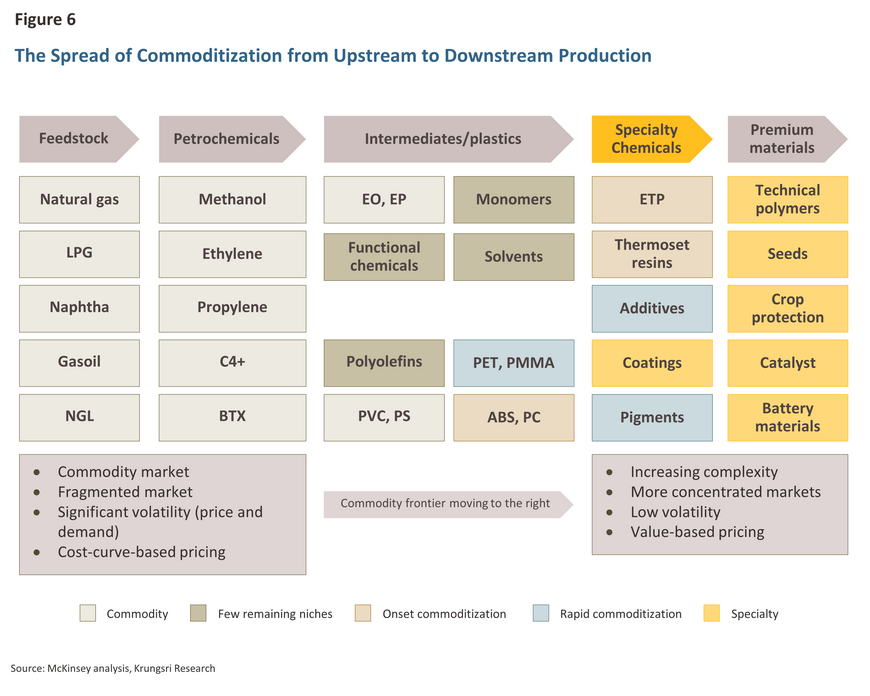

The commoditization process occurs when products that are initially highly differentiated and command a premium price become low-cost goods with minimal or no differentiation. This shift has been observed in the specialty chemicals industry; for example, polyethylene terephthalate (PET) transitioned from a specialty to a commodity chemical due to the rapid dissemination of production technologies. As a result, PET production capacity expanded quickly, leading to market saturation and oversupply. In response, manufacturers have had to revise their business strategies, shifting from a focus on adding value for customers to competing on price. This price competition has led to squeezed profit margins (Figure 5). Similar patterns of commoditization have affected other chemical products in the industry, resulting in price declines (Figure 6).

For players in the specialty chemicals market, a significant concern is the increasing entry of new companies, particularly in China, India, and the Middle East. This influx is accelerating the commoditization process and the rate at which capacity is being added to the supply side of the market. To maintain their position as market leaders, specialty chemical manufacturers will need to intensify their efforts to create value for their customers. This will require a strong focus on investing in R&D and technical innovation.

Over the past two to three decades, the pace of technical innovation in the specialty chemicals sector has slowed. This has made it more challenging to introduce new products that are significantly differentiated from existing ones and that provide customers with a clear way to enhance their own outputs. Established products have already achieved widespread commercial use in downstream industries, and the increased knowledge of industrial buyers and users of specialty chemicals has strengthened their bargaining power. As a result, new products find it harder to penetrate these markets.

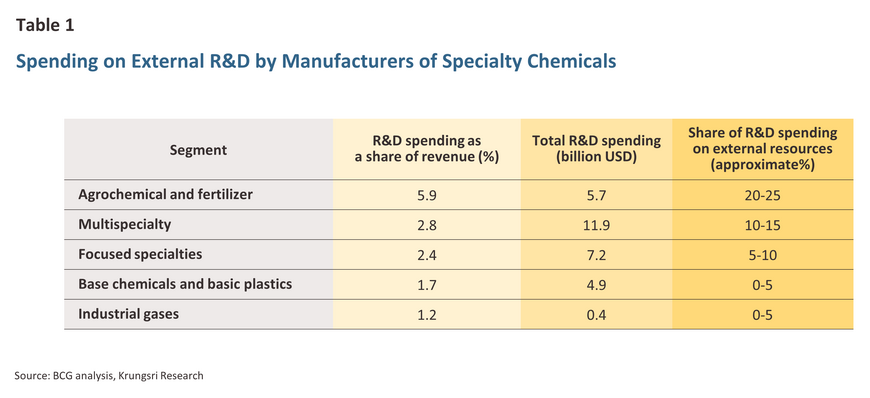

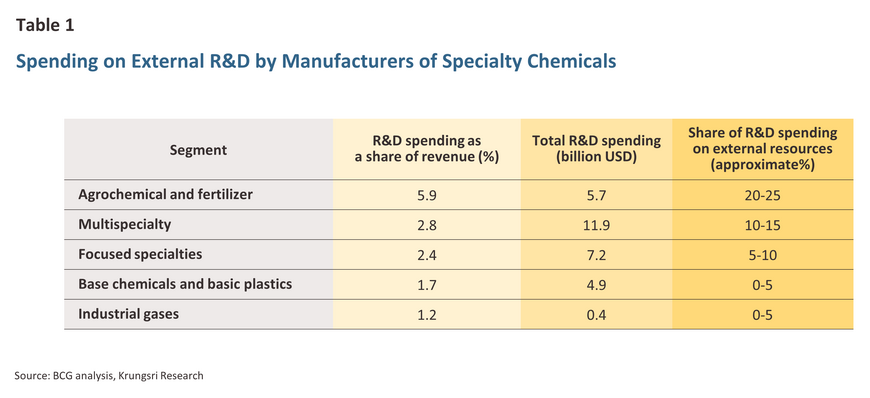

Nevertheless, manufacturers are now beginning to leverage advances in artificial intelligence (AI) to enhance their manufacturing processes. AI is being used to support R&D, accelerating progress and improving the standards of new product development. Unlike in the past, companies are increasingly collaborating with customers, academia, and startups on R&D projects. This approach allows them to extend their knowledge and expertise beyond their internal capabilities and incorporate external sources of innovation. This trend is most notable in the agrochemicals and fertilizer segments, where over 20% of R&D spending is directed towards external collaborations (Table 1). By embracing and expanding these practices, specialty chemicals manufacturers can revitalize the industry’s research and innovation efforts.

Volatility in raw material costs and the overall industry price structure

Crude oil is a vital input for producing specialty chemicals. However, before it can be used as a feedstock, crude oil must first be processed into various hydrocarbon products. Given the central role of oil products in specialty chemicals manufacturing, fluctuations in global crude oil prices inevitably affect profitability across the industry.

The price structures for specialty and commodity chemicals differ significantly, leading to varying impacts of production cost changes on profits. Typically, commodity products use a cost-based pricing model, meaning price increases are driven by changes in production costs. In contrast, specialty products are priced based on the value they provide to downstream consumers, following a value-based pricing model. As a result, manufacturers' ability to raise prices for specialty chemicals depends on the additional value their products deliver, rather than changes in crude oil or other input costs. This means that, compared to companies in the commodity market, specialty chemicals manufacturers have less flexibility in adjusting to fluctuations in production costs.

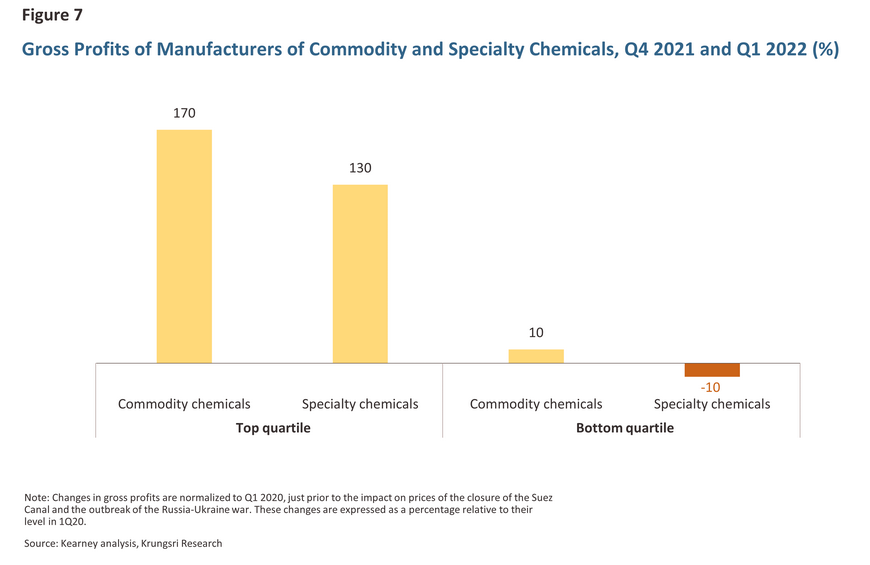

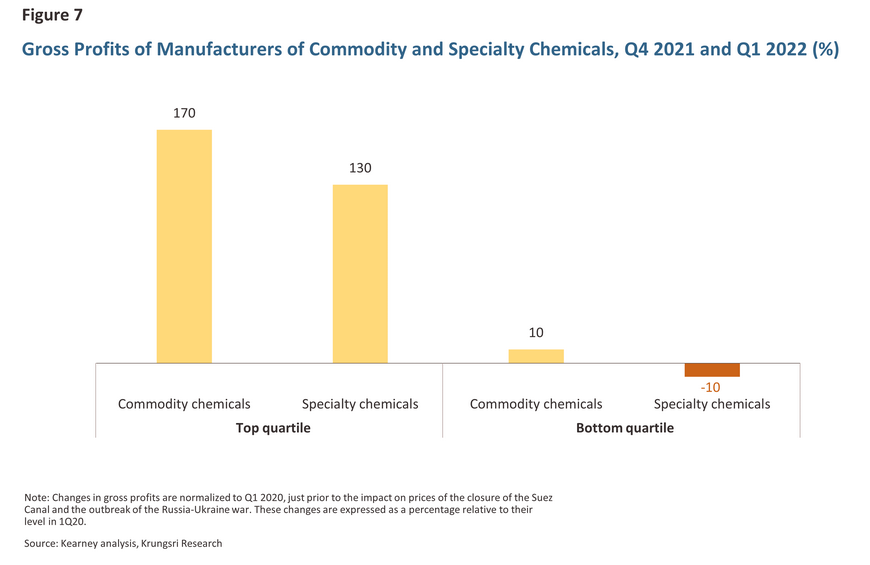

The Russian invasion of Ukraine in February 2022 underscored the differing impacts of cost-based and value-based pricing models. The war and the resulting spike in prices of most chemical feedstocks in Q1 of 2022 negatively affected manufacturers' profits. However, with rising oil prices, the macroeconomic environment favored players using cost-based pricing. Consequently, gross profits for commodity chemical manufacturers increased by 170% and 10% for the top and bottom quartiles, respectively, compared to Q4 of 2021. In contrast, specialty chemical manufacturers saw a 130% increase in profits for the top quartile but a -10% contraction for the bottom quartile (Figure 7). Going forward, ongoing geopolitical tensions and other shocks are likely to persist, keeping crude markets both volatile and bullish. As a result, players in the specialty chemicals market can expect their profits to remain under pressure.

More stringent environmental regulations

Consumers are increasingly concerned about the environmental impacts of the chemicals industry. In response, companies are improving their manufacturing processes and minimizing the release and impact of by-products resulting from chemical production and consumption.

Pressure from governments is also impacting the industry, as both domestic and international state-backed environmental agencies tighten regulations. These include the US Environmental Protection Agency (EPA) and the EU's Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations, which aim to protect humans and the environment from the side effects of chemical manufacture and use. Specifically, the inclusion of volatile organic compounds (VOCs) in specialty chemicals is strictly regulated, particularly in specialty paints, coatings, adhesives, and sealants. These regulations aim to reduce the health and environmental impacts caused by the evaporation of VOCs and the resulting air and water pollution.

On the positive side, these regulations will create new opportunities for the manufacture of sustainable chemicals. However, adapting to the new regulatory environment without passing on the additional costs to consumers through higher prices could be problematic. To complicate matters further, companies must also navigate the challenges posed by intensifying competition and the volatile and escalating cost of feedstocks.

The challenges faced by players can best be understood through Porter’s 5-force framework.

Specialty chemicals as drivers of sustainability

Semiconductor chemicals

The growing awareness of climate change dangers is driving countries worldwide to decarbonize their economies and aim for net zero emissions. One key technology in this effort is the increasing use of power semiconductors, which manage energy consumption across various applications, including electronics, electrical appliances, AI systems, data centers, and even national grids. Advances in power semiconductor technology now allow for the replacement of traditional silicon with silicon carbide (SiC) and gallium nitride (GaN), enhancing efficiency and reducing overall energy consumption. For instance, semiconductor manufacturer Infineon estimates that data centers using GaN-based power supply units achieve 10% energy savings compared to those relying on older silicon-based chips.

However, switching between different types of power semiconductors is not straightforward, as producing the newer chips involves distinct manufacturing processes. Specialty chemicals are a crucial input for these processes, and advancements are needed in adapting and developing the products required for the new generation of chips. Companies that can successfully innovate in this area will not only enhance their profitability and reduce the risk of commoditization but also contribute to the sustainability of downstream industrial consumers.

Agricultural specialty chemicals

The growing global population combined with decreasing access to fertile arable land is significantly affecting food production. Over the past two decades, the amount of arable land per capita has declined by -18.2%, from 0.22 hectares per person in 2001 to 0.18 hectares in 2021. As the world’s population continues to rise, finding ways to improve agricultural yields has become crucial.

In response, many companies in the specialty chemicals market are developing new agrochemicals designed to enhance yields, including fertilizers and pesticides. These innovations aim to increase agricultural output, meet growing demand, and address food security challenges.

However, excessive use of agricultural chemicals can cause long-term environmental damage, an issue that is increasingly concerning consumers. In response, companies are also focusing on developing sustainable agrochemical solutions. For instance, in 2022, the European manufacturer BASF launched its new insecticide, Exponus, in India. This product aims to provide more effective pest control while minimizing environmental impacts.

New opportunities and challenges for Thai manufacturers of specialty chemicals

According to 6Wresearch, Thailand’s specialty chemicals market was valued at approximately USD 545 million (THB 17 billion) in 2020. Growth in this sector is projected to exceed the overall GDP expansion over the next 3-5 years. Domestic players are thus presented with a significant opportunity to boost sales, especially those producing goods that support high-growth downstream industries such as automotive engineering, packaging, and construction. Notable product categories poised for strong performance include industrial coatings resins and additives, engineering plastics, and hydrogenated styrenic block co-polymers. These products have yet to be heavily commoditized, unlike acrylonitrile-butadiene-styrene (ABS) and polyvinyl chloride (PVC), whose production has become widespread. Additionally, Grand View Research forecasts that the specialty chemicals market in the Asia-Pacific region will grow at an annual rate of 6.9% from 2022 to 2030, with China’s market expanding at an even faster rate of 7.4% per year. By 2030, China is expected to account for over half of all specialty chemical sales in the Asia-Pacific region, presenting a substantial growth opportunity for Thai manufacturers.

However, China is among several countries pursuing self-sufficiency in various sectors, including chemicals production. The goal is to reduce imports and become a net exporter in these areas. To achieve this, the Chinese Ministry of Industry and Information Technology is implementing policies designed to enhance the country's competitiveness in specialty chemicals and establish China as a leading global supplier. Despite this, China currently faces a deficit in specialty chemicals and, as of 2018, had to import over half of its supply. However, increased emphasis on self-sufficiency is expected to expand Chinese production capacity, which could lead to a global supply glut and heighten the risk of commoditization for products produced by Thai manufacturers.

Krungsri Research view

The specialty chemicals market is poised to experience significant growth over the next 5-10 years, driven by increasing demand from downstream industries, particularly automotive, electronics, and construction. Companies active in these areas will tend to increase their consumption of inputs that require the use of specialty chemicals, further bolstering market growth. Additionally, the growing emphasis on sustainability will provide further impetus for the market.

However, players will face several challenges, including the anticipated acceleration in the commoditization of chemical products, volatile and rising prices for crude and other inputs, and increasingly stringent regulations. These factors are likely to exert downward pressure on profits in the future.

Faced with the evolving business environment, Thai companies in the specialty chemicals market should consider increasing investments in high-growth potential areas, such as agricultural chemicals and advanced semiconductor materials, as described above. By focusing on these growth-oriented product lines, companies can rebalance their portfolios and enhance opportunities for profit expansion. At the same time, investing in downstream industries—such as customer support services and formulation customization—will help align products more closely with consumer needs. These strategies leverage specialized expertise and strengthen client relationships, which can raise barriers to entry and mitigate the risk of further commoditization.

References

6Wresearch (2022) Thailand Specialty Chemicals Market (2024-2030) Outlook. Retrieved June 14, 2024 from https://www.6wresearch.com/industry-report/thailand-specialty-chemicals-market-outlook

BCG (2022) The State of Change in Chemical Innovation. Retrieved June 25, 2024 from https://www.bcg.com/publications/2022/state-of-change-in-chemical-innovation

Elsevier (2024) Key chemicals industry trends in 2024. Retrieved June 22, 2024 from https://www.elsevier.com/industry/4-key-chemicals-industry-trends

Forbes: Business development council (2023) The Future Of Renewable Energy Is Built On Semiconductors. Retrieved June 2, 2024 from https://www.forbes.com/sites/forbesbusinessdevelopmentcouncil/2023/09/08/the-future-of-renewable-energy-is-built-on-semiconductors/

Grand View Research (2022) Specialty chemicals: Market estimates and trend analysis. Retrieved May 15, 2024 from EMIS Next Market Intelligence & Strategic Planning

International Monetary Fund: IMF (2024) World economic outlook databases. Retrieved July 15, 2024 from https://www.imf.org/en/Publications/SPROLLS/world-economic-outlook-databases#sort=%40imfdate%20descending

International Trade Administration, Department of Commerce, United States of America (2023) China – country commercial guide: Environmental technology. Retrieved July 10, 2024 from https://www.trade.gov/country-commercial-guides/china-environmental-technology

Kearney (2022) How inflation is reshaping margins for commodity and specialty chemicals. Retrieved June 24, 2024 from https://www.kearney.com/industry/chemicals/article/-/insights/how-inflation-is-reshaping-margins-for-commodity-and-specialty-chemicals

Marketline (2024) China – semiconductors – market overview. Retrieved July 12, 2024 from EMIS Next Market Intelligence & Strategic Planning

Mckinsey & Company (2016) Commoditization in chemicals: Time for a marketing and sales response. Retrieved June 10, 2024 from https://www.mckinsey.com/industries/chemicals/our-insights/commoditization-in-chemicals-time-for-a-marketing-and-sales-response

Technavio (2023) Global specialty chemicals market 2023-2027. Retrieved May 20, 2024 from EMIS Next Market Intelligence & Strategic Planning

ศูนย์ข่าวพลังงาน (Energy news center) ‘IRPC เร่งปรับพอร์ตธุรกิจ ตั้งเป้าผลิตภัณฑ์ชนิดพิเศษสูงถึง 50% ภายในปี 2568’. Retrieved May 30, 24 from https://www.energynewscenter.com/irpc-%E0%B9%80%E0%B8%A3%E0%B9%88%E0%B8%87%E0%B8%9B%E0%B8%A3%E0%B8%B1%E0%B8%9A%E0%B8%9E%E0%B8%AD%E0%B8%A3%E0%B9%8C%E0%B8%95%E0%B8%98%E0%B8%B8%E0%B8%A3%E0%B8%81%E0%B8%B4%E0%B8%88-%E0%B8%95%E0%B8%B1/