Development of Solar Power System Installations in Thailand

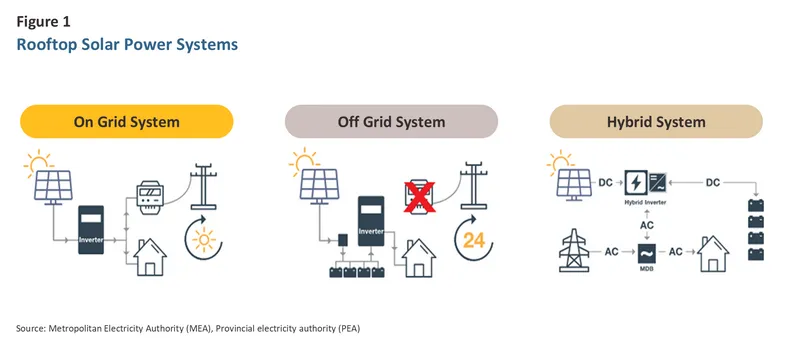

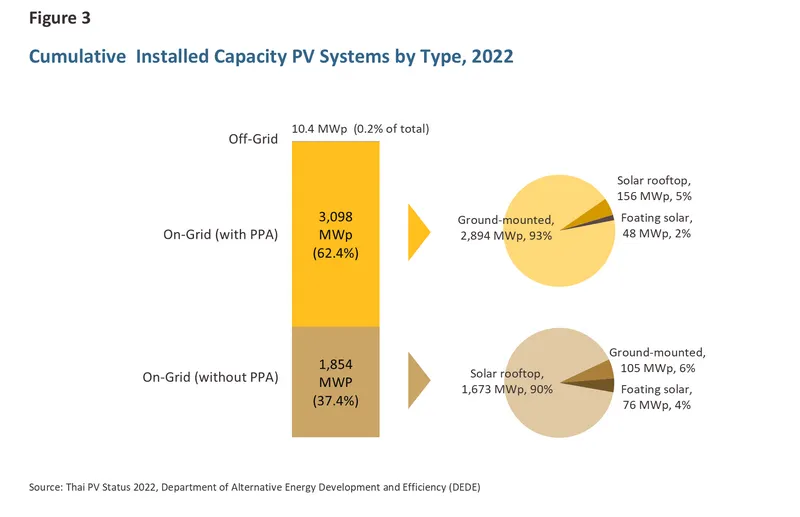

Thai solar PV installations take three forms.

-

Ground-mounted solar installations or solar farms: These fall under ground-mounted PV purchase power agreements, including those run by government agencies and agricultural cooperatives.

-

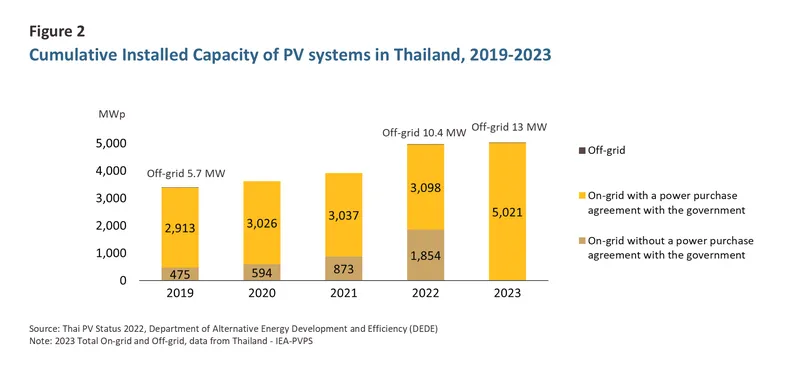

Rooftop solar: Rooftop PV systems initially gained traction in 2013, when purchase power agreements for these were first rolled out, though these saw a surge in uptake over 2019-2022, when domestic household installations began to rise. On 17 December, 2024, the cabinet agreed to liberalize the rules for rooftop solar installations, and so these are no longer classified as industrial facilities and households are no longer required to seek a permit authorizing their installation. Deregulating the industry should now help to promote an increase in the use of clean-energy across the economy, including greater use of off-grid systems.

-

Floating solar: An example of this can be seen in the 1.8 MW system operated by Total Energies ENEOS1/ in collaboration with S. Kitjai Enterprises in Khon Kaen Province. This is sited on a reservoir operated by the company and uses over 3,000 separate solar panels to generate 2,650 MWh of electricity annually. This is enough clean energy to cut CO2 emissions by 1,125 tonnes, or the equivalent of planting 16,800 trees. Likewise, the Electrical Generating Authority of Thailand (EGAT) also operates a floating solar hybrid installation in the Sirindhorn reservoir in Ubon Ratchathani. This produces 45 MW of output, providing clean energy that reduces CO2 emissions by 47,000 tonnes annually. Production from this site began on 31 October, 20212/.

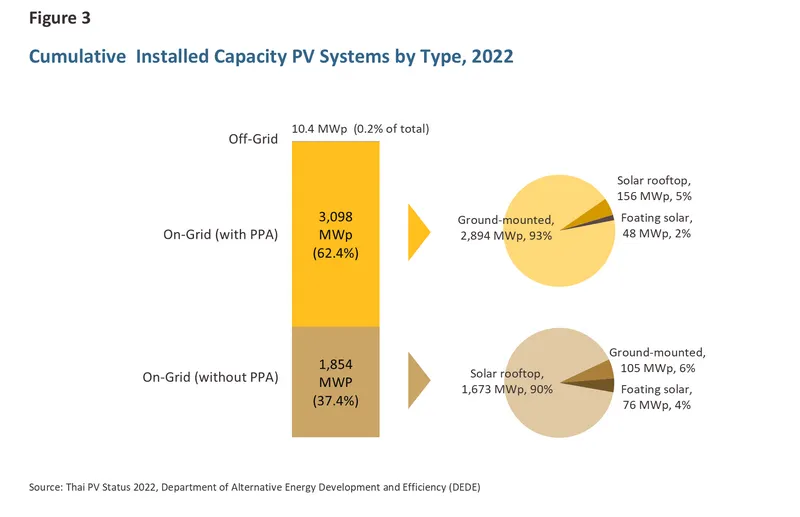

The majority of domestic solar installations are grid-connected systems operating under purchase power agreements (PPAs). Almost all of these are for ground-mounted solar farms, which account for a full 93% of grid-connected solar capacity. By contrast, rooftop and floating solar installations represent respectively just 5% and 2% of grid-connected supply. By contrast, grid-connected systems without government-approved power purchase agreements (PPAs) are typically operated for self-consumption – i.e., electricity is produced and consumed by the same entity. In some cases, electricity may also be distributed directly to customers, in which case the generator is classified as an independent power supplier (IPS). More than 90% of IPS capacity is accounted for by rooftop solar installations (Figure 3). The latter is in fact becoming increasingly popular at home and abroad, especially among industrial and commercial users looking to cut both power bills and CO2 emissions.

Current Status and Installation Trends of Rooftop Solar in the Business and Residential Sectors

Impacts on Thai manufacturers of US tariffs on imported solar cells

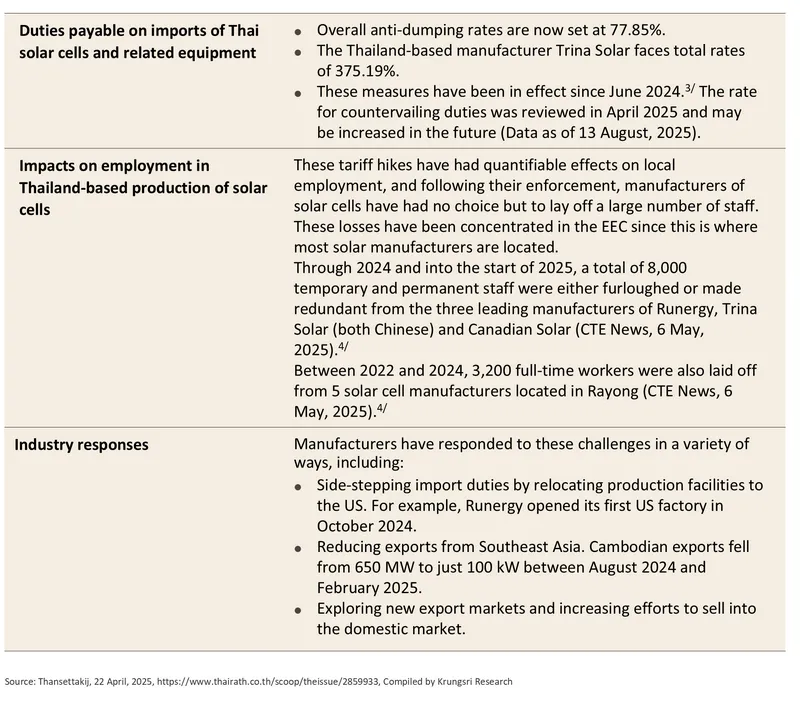

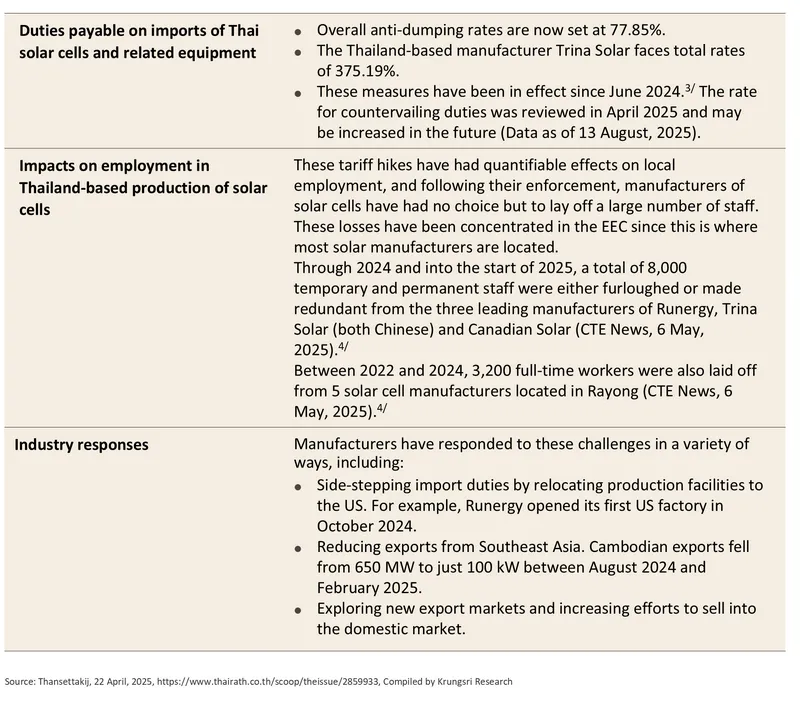

The domestic solar industry, which had previously relied heavily on exports to the US market, has been significantly impacted by the announcement of steep increases in import duties on solar cells from Southeast Asia.

These hikes came in April 2025, when the US Department of Commerce announced new final rates for duties payable on solar cells and solar modules from Cambodia, Malaysia, Vietnam and Thailand. This has had severe consequences for the domestic solar industry, as shown below.

Opportunities for the Thai rooftop solar industry: Although these changes have clearly had a negative impact on exports, this situation has also created new opportunities within the domestic market for rooftop solar installations. This can be attributed to the following factors:

-

A change in the sales focus: Manufacturers that had previously relied on exports have been forced to pay closer attention to the domestic market.

-

Competitive pricing: To stimulate the domestic market, manufacturers may offer more competitively priced goods.

-

The promotion of innovation: Competing in the Thai market may lead to the development of products and services that are a closer match to domestic needs.

-

The development of domestic supply chains: This is an opportunity to develop a fully-fledged domestic solar supply chain.

Given this context, the recent increase in US tariffs – while posing a challenge for the Thai solar industry – should also be considered an opportunity that may catalyze growth in the domestic market for rooftop solar. If such growth materializes, it could help offset losses in export markets.

Factors driving stronger investment in rooftop solar installations

Rooftop solar offers a way for businesses to build long-term sustainable value, firstly by reducing spending on electricity and secondly by burnishing a company’s public image and better aligning corporate growth with environmental and social responsibility. Government support for the industry comes in the form of the feed-in tariff (FiT), which reflects the current true cost of electricity, and the adjusted buy-back rate for surplus power generated from residential systems (currently set at THB 2.20/unit). These measures have helped to shorten the payback period for PV installations. Other important factors that are also helping to stimulate demand include the following.

-

Rising electricity costs: Average per unit retail electricity prices climbed from THB 3.61 in 2021 to THB 4.57 in 2023 before falling back to THB 4.18 in 2024, and although the government has pledged to cap prices at THB 4 per unit through 2025, they remain high relative to the recent past. This has had significant impacts on businesses since electricity typically comprises a sizeable fraction of manufacturing costs (typically 10-30% of the total for factories) and operating overheads (often 15-20% of these for department stores or shopping centers). Installing rooftop solar offers a way of avoiding these pressures, which may in fact be worse than initially appear since prices can not only track upwards but can do so in a volatile fashion. The appeal of solar installations is being amplified by falling costs and ongoing progress with technology, which is then adding to the options available on the market and broadening the customer base. These shifts are naturally accelerating the adoption of PV systems among both residential and commercial users.

-

Falling costs for solar cells: Prices for solar cells suitable for use in residential environments fell from THB 16/watt peak (Wp) in 2019-2020 to THB 10.5/Wp in 2023, while the cost of installed residential systems inched down from an average of THB 40/Wp to THB 39/Wp over the same period. For commercial and industrial users, prices for installed solar systems have dropped from THB 27.5/Wp in 2020 to around THB 20-25/Wp in 2023-2024 (Thai PV Status 2022, DEDE). These declines will help to stimulate additional demand.

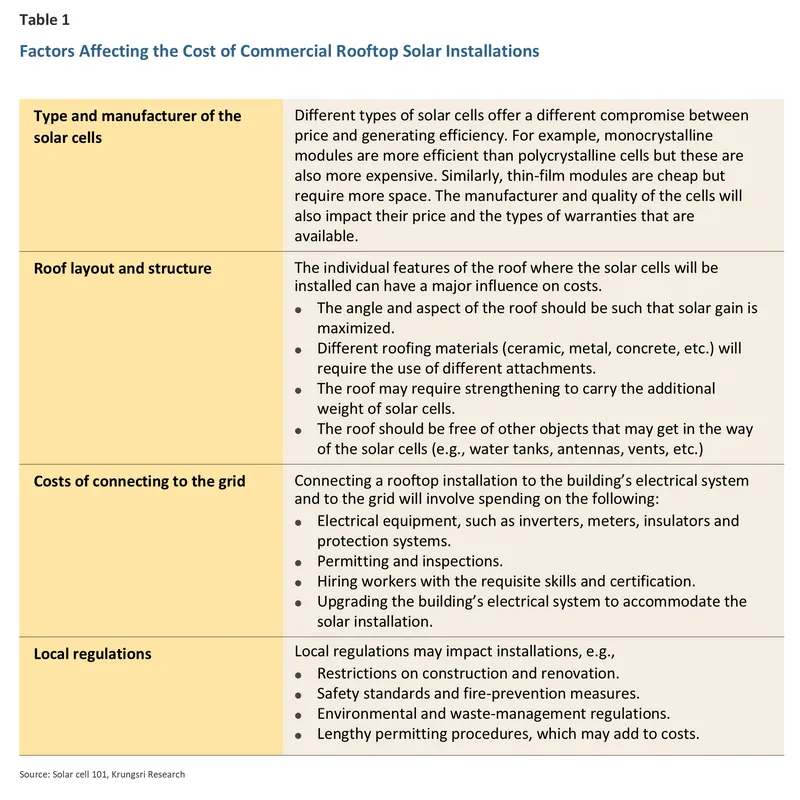

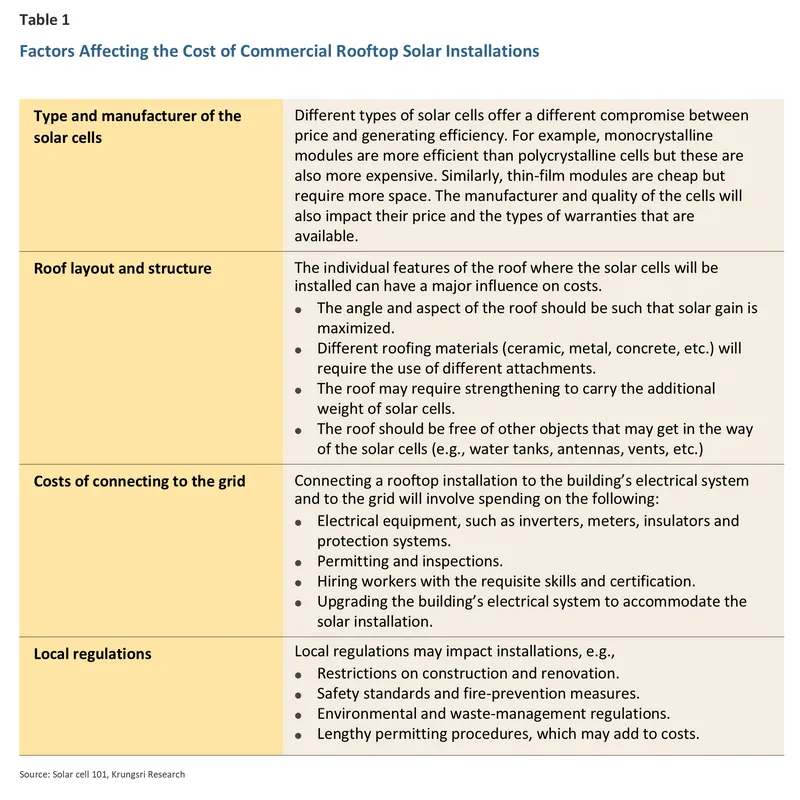

Additional factors affecting the cost of commercial solar panel installations

In addition, other factors may influence the cost of installing commercial rooftop PV systems, including the type and manufacturer of the solar cells, the layout and structure of the roof, the cost of connecting to the grid, and relevant local regulations (Table 1).

A comprehensive analysis of these factors will enable businesses to accurately assess actual costs, plan investments efficiently, and select appropriate contractors and suppliers—ultimately ensuring the most cost-effective return on investment.

Assessment of Business Benefits from Rooftop Solar Installations in Thailand

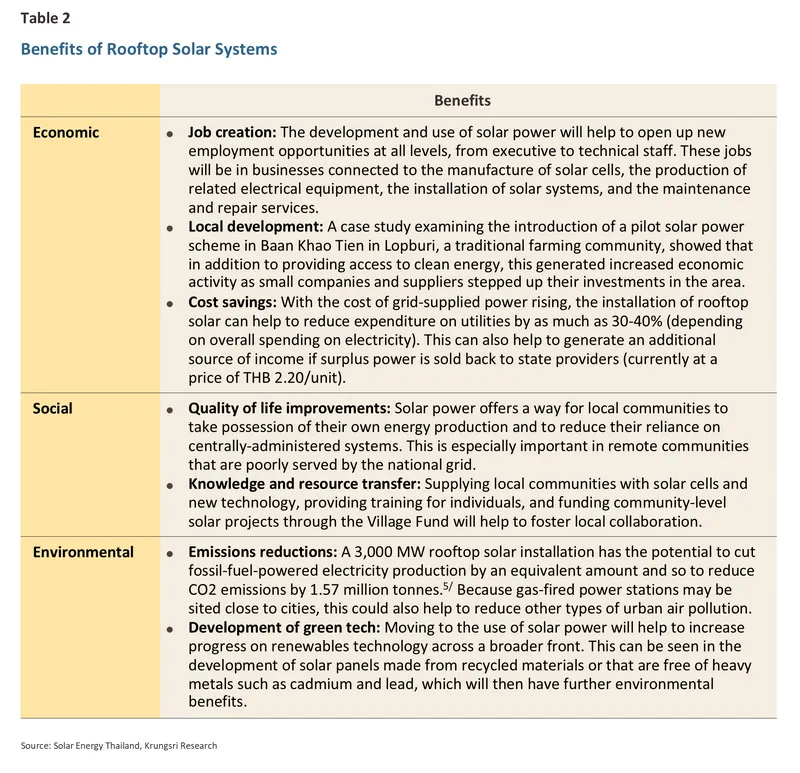

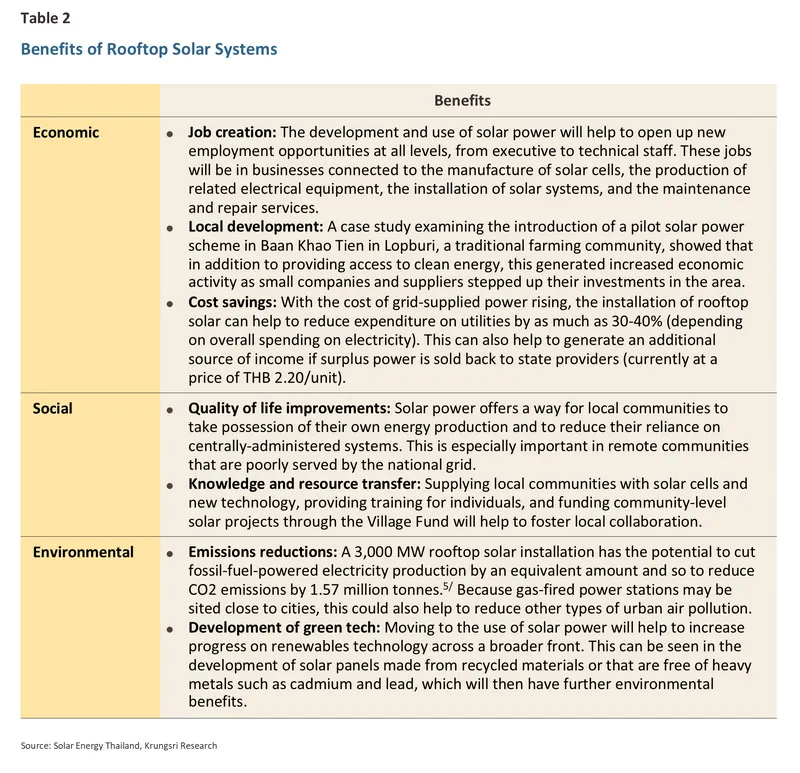

Economic, social and environmental benefits

This analysis shows that installing a rooftop PV system may generate three distinct types of benefit: clear economic returns, quantifiable environmental impacts, and sustainable social development. Moreover, these benefits are interconnected and mutually supporting since lower costs will help to improve quality of life issues, while imposing a lighter environmental footprint can help to raise long-term sustainable growth. And although the upfront costs may be high, the threefold benefits that are generated will accumulate and expand through the 25-30-year lifespan of the installation (Table 2). Installing rooftop solar systems thus makes for an attractive and compelling long-term investment.

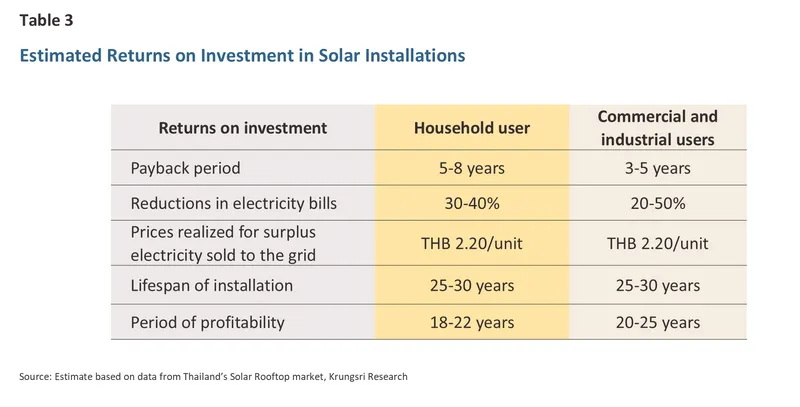

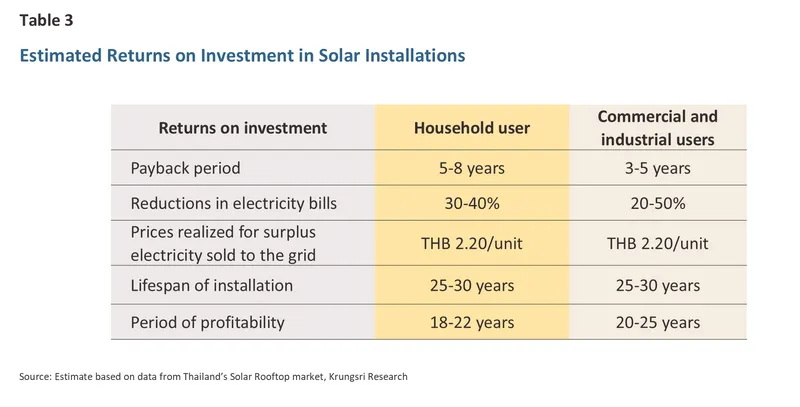

Cost-benefit analysis

Any decision to install a rooftop solar system should include an analysis of the costs and likely returns,6/ and in particular, by estimating savings resulting from reduced purchases from the grid and any additional income generated from sales of surplus electricity, annual returns can be forecast. Thus, if a 10-kW rooftop installation costs THB 500,000 to install and if this then results in annual reductions in electricity bills of THB 75,000-100,000 (or 15-20% of the total cost), this will give a payback period of 5-8 years, though businesses or buildings that experience peak consumption during the day will enjoy the greatest benefits. Further details are given below.

Household users: Rooftop solar installations are most suitable for households that are currently spending in excess of THB 3,000 per month on electricity since at this level, the savings will pay for the upfront costs. In these cases, a 3-10 kW installation costing between THB 170,000 and THB 430,000 will be most appropriate. This will provide household users with sufficient electricity to meet their needs and allow for excess to be sold back into the grid without straining household finances.

Industrial and commercial users: Businesses typically see peak demand for electricity during the day and because this coincides with the maximum output from solar cells, they make better candidates for solar installations than domestic users. This also allows businesses to use solar-generated power instantly without relying on battery storage. For many businesses, installations of at least 100 kW (costing some THB 3.3 million) will be most suitable since at this size, companies can exploit economies of scale to reduce per-unit costs. For many businesses, the typical payback period will therefore run to 3-5 years compared to 5-8 years for households.

Business Sectors Well-Suited for Rooftop Solar Investment in Thailand

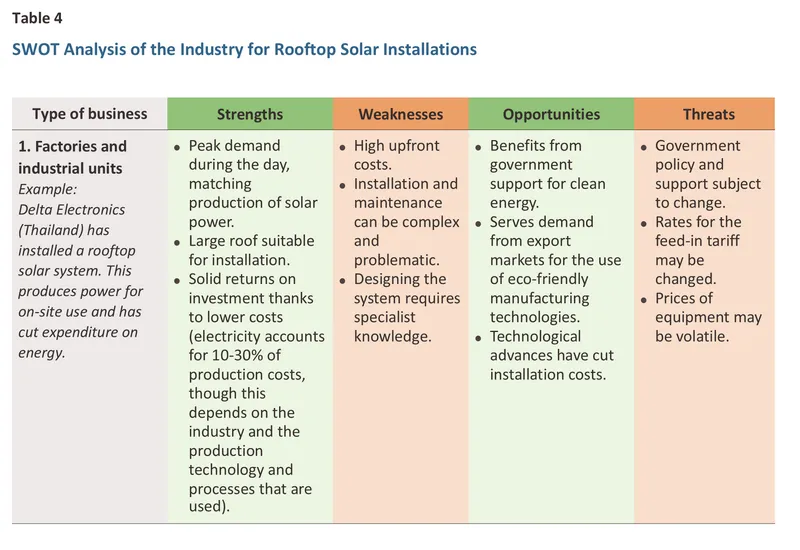

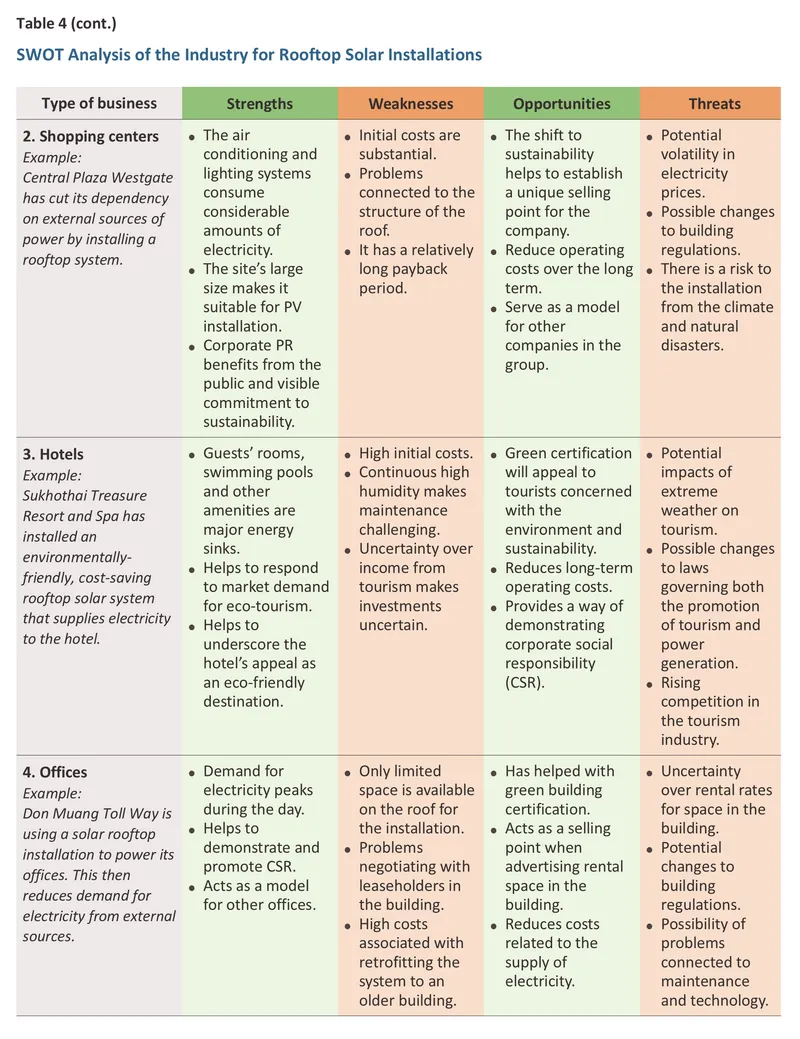

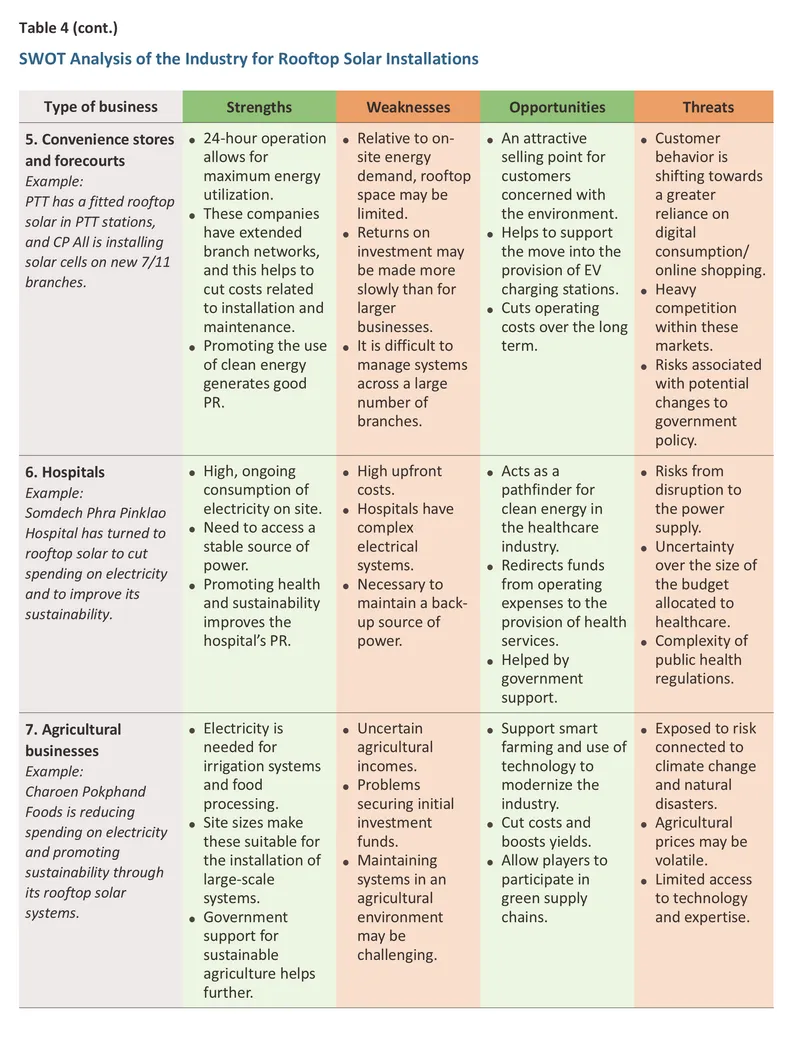

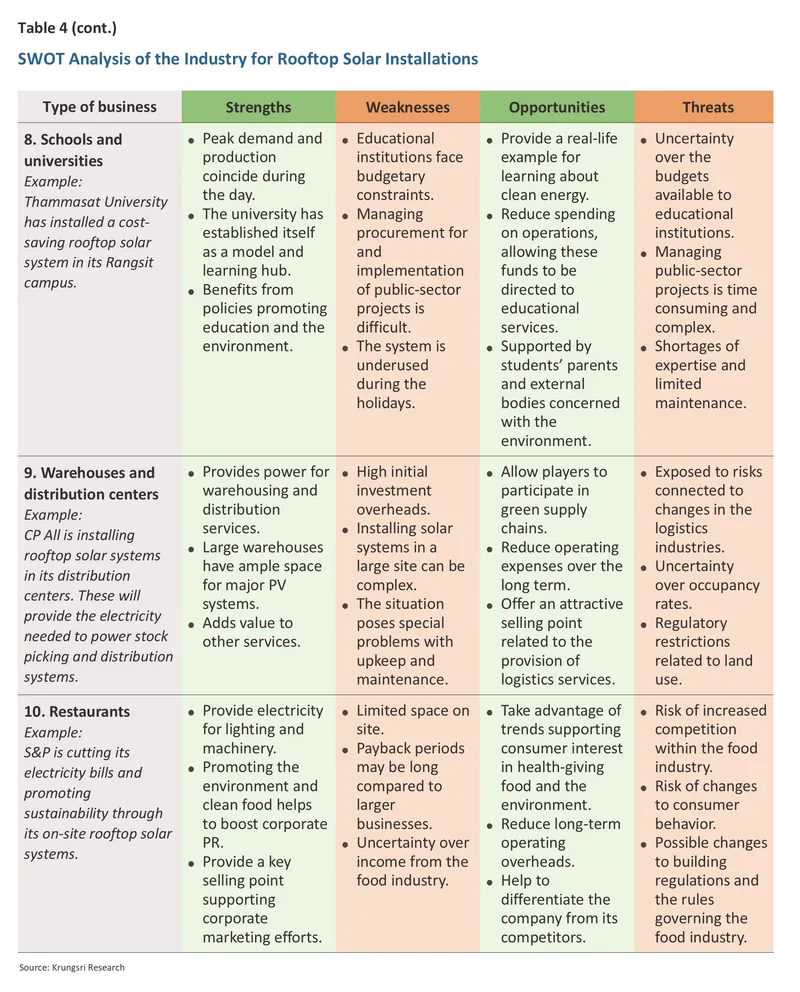

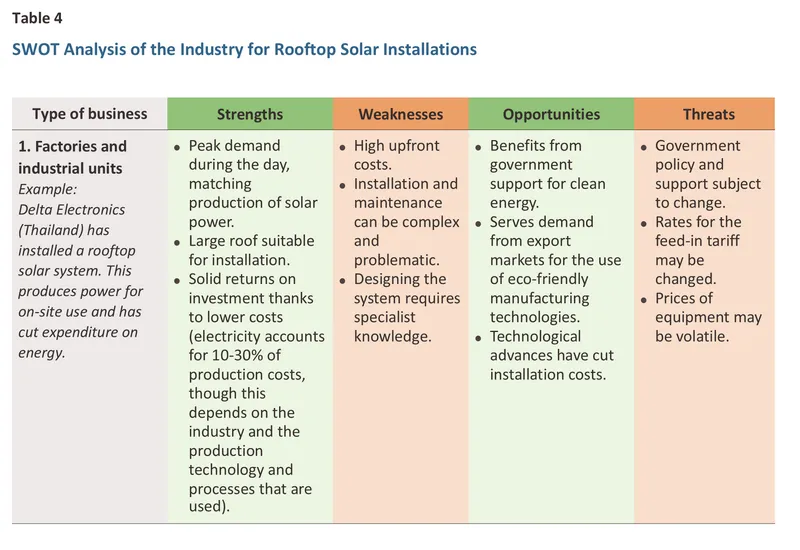

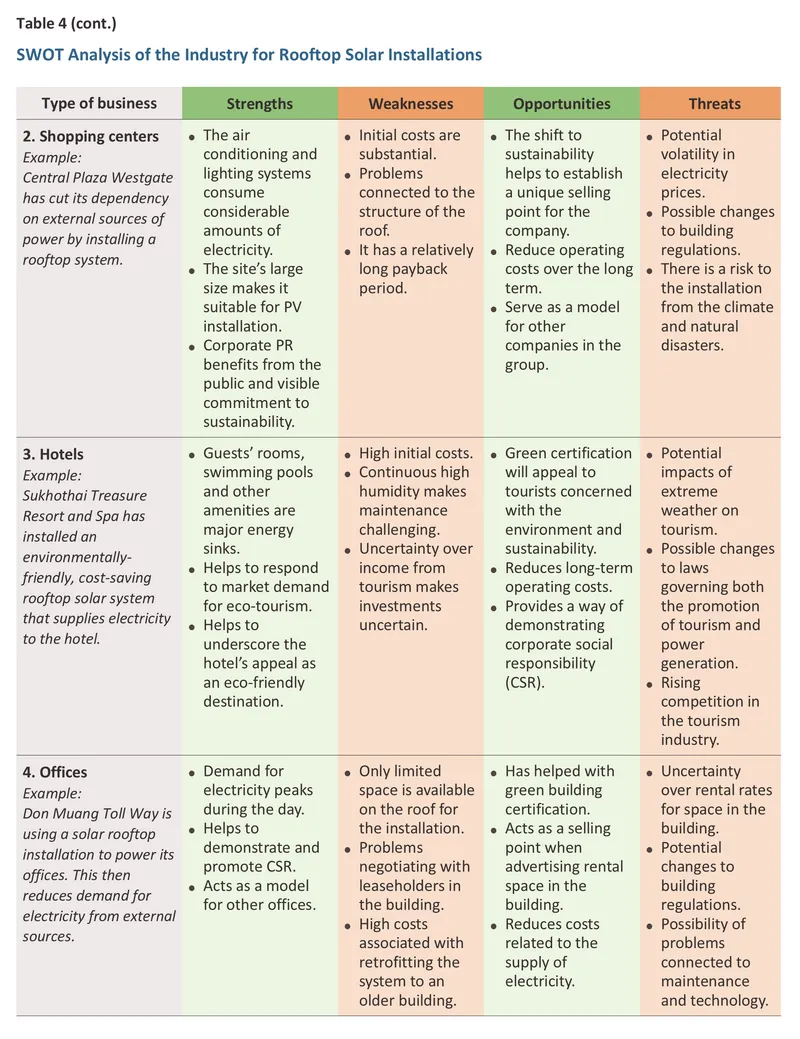

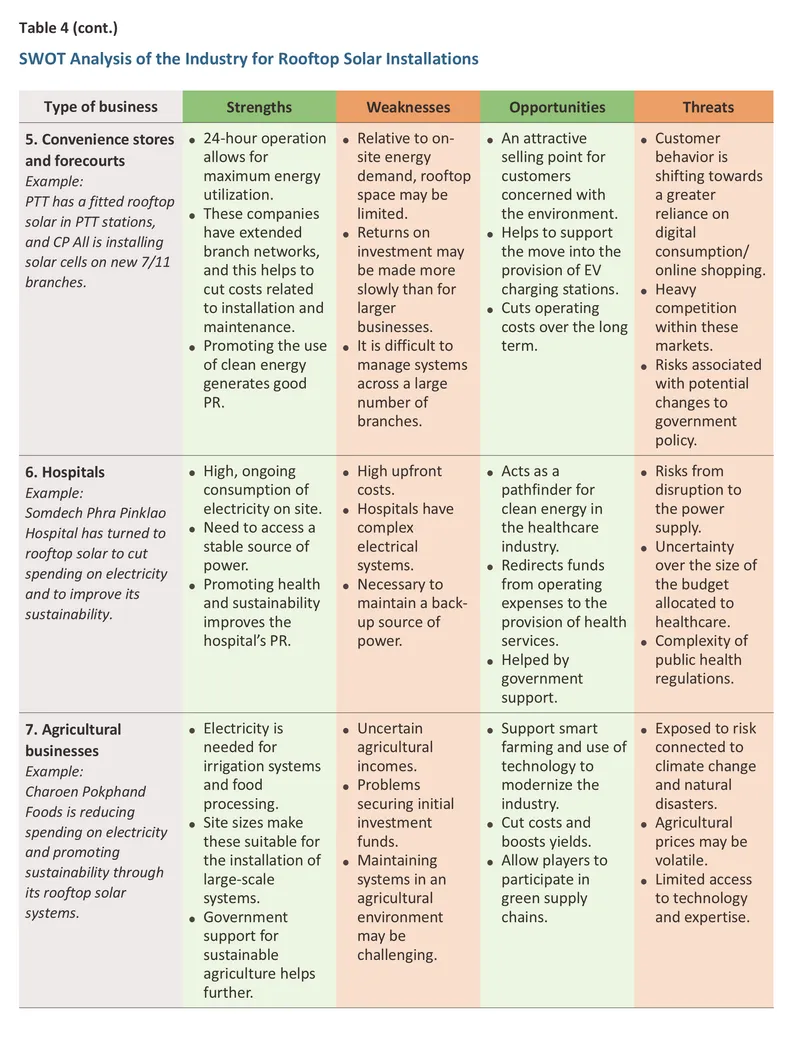

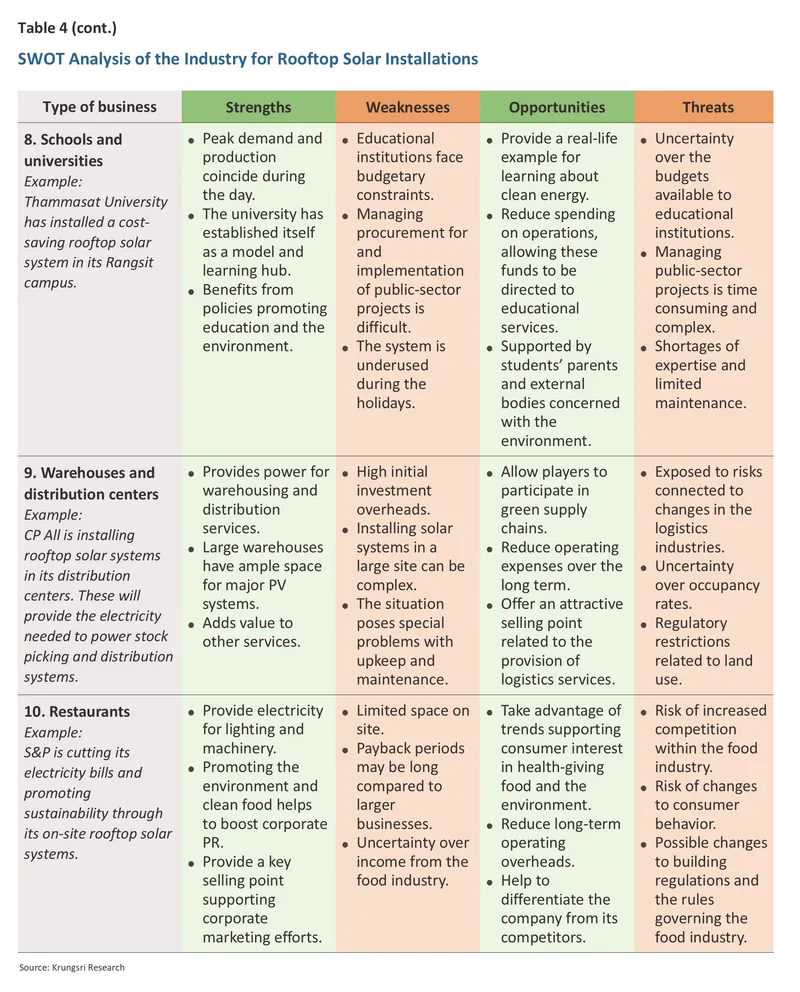

Given the cost-benefit analysis outlined above, investing in rooftop solar offers potentially high rewards for companies, most clearly in terms of cutting long-term expenditure on electricity while simultaneously moving business activities towards a more sustainable social and environmental footing, in line with the increasingly popular ESG framework. The best candidates for PV installation will be businesses that use the most power during the day, that have access to sufficient space to accommodate solar installation, and for which electricity costs currently represent a significant share of overall production or operating overheads. A sectoral SWOT analysis of these issues shows that across the economy, many businesses would benefit from investing in their own solar facilities, though the exact nature and extent of these benefits varies from one industry to the next. However, external factors including the regulatory framework and government support for the industry remain key challenges and ongoing improvements in these areas will be necessary if broad-based demand for solar installations is to be maintained.

Table 4 makes clear that industrial companies, including those operating in manufacturing, heavy industry, and petrochemicals are among the most suitable for rooftop solar installations since these typically see heavy and ongoing demand for electricity. However, upfront costs may be significant, especially for businesses that operate through the night because in this case, switching to solar power would also require the installation of energy storage facilities, most obviously batteries.

Within the service sector (e.g., hotels, shopping centers, office buildings, etc.), rooftop solar offers a way for businesses to make their commitment to sustainability and to the ESG standards visible. Following this path will therefore not only help with the practical matter of cutting energy bills but will also help players develop unique selling points and build credibility in the eyes of customers who are concerned with environmental issues.

For agricultural operations, rooftop solar installations remain something of a rarity and their use in greenhouses and livestock operations is limited. Nevertheless, PV systems have the potential to provide farmers with a stable and low-cost source of energy, while at the macro level, they will have a significant role to play in shifting the industry to the adoption of smart farming, for example by supplying the power needed for automating irrigation, controlling temperature and moisture in greenhouses, and providing ongoing monitoring of the environment.

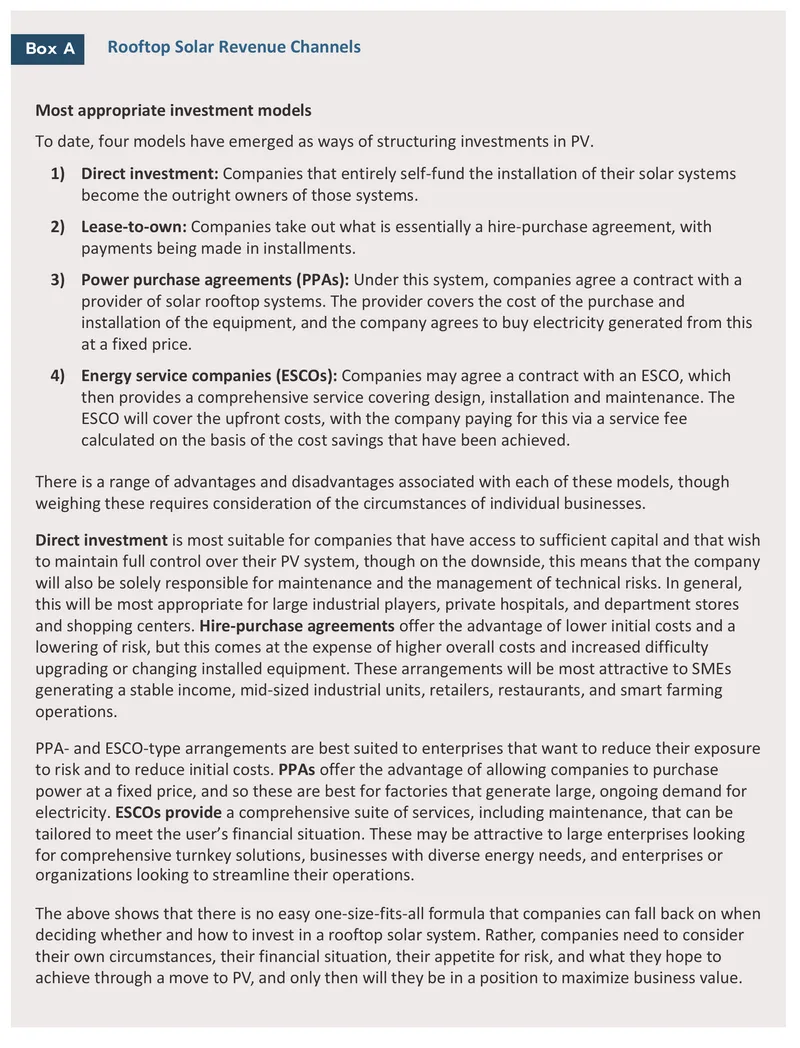

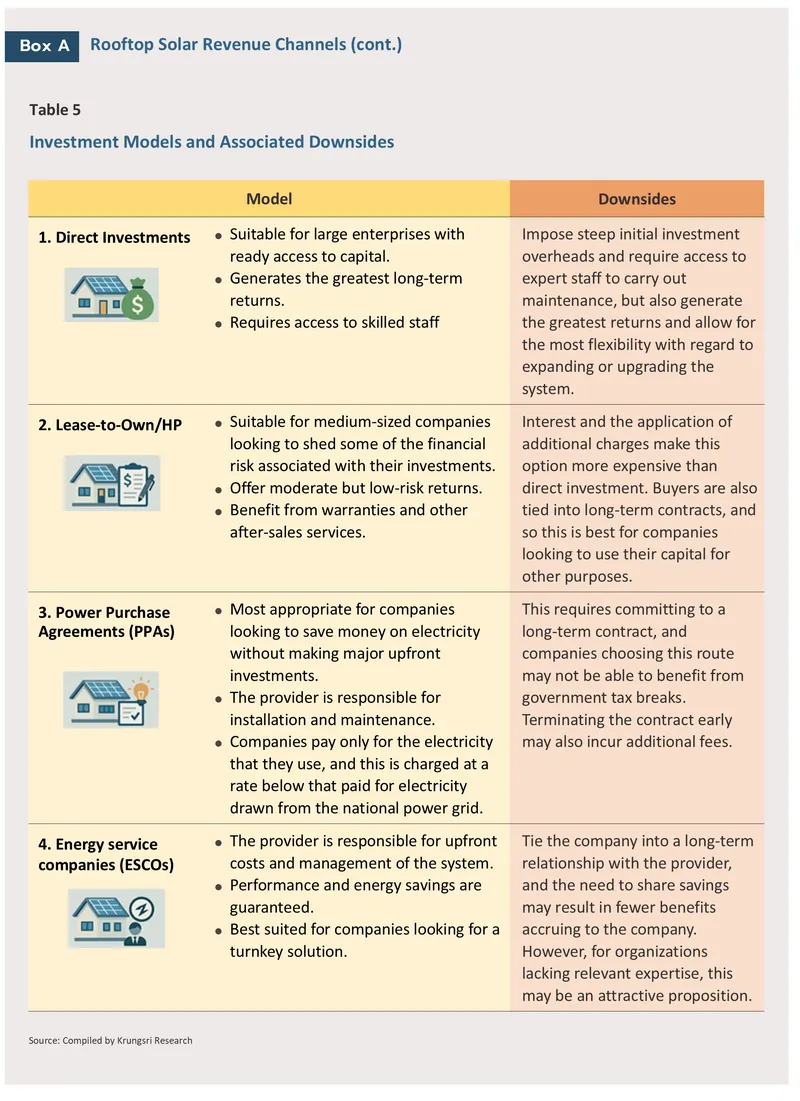

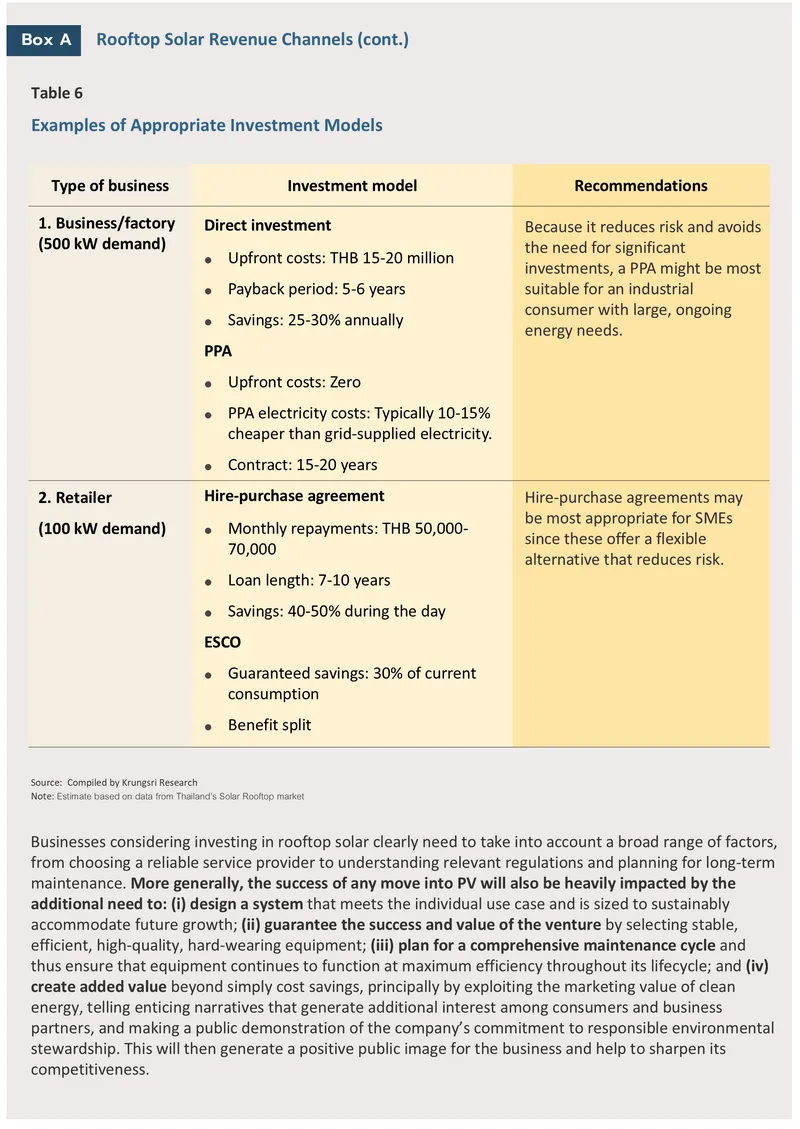

Overall, the clearest advantage of rooftop solar to emerge across all industries is its potential to save money. This is most pronounced for businesses that see peak demand during the day (most factories, shopping centers and especially offices) since this is also when solar cells are most productive. In many industries, the ability to demonstrate a commitment to sustainability may also be an important way of clearly differentiating a company from its competitors. By contrast, the most prominent obstacle to greater uptake is the potentially major upfront investment overheads that moving to solar power may entail, though this is likely to be especially problematic for capital-poor SMEs. Further problems may come from difficulties accessing the specialist skills needed for installation and maintenance, and uncertainty over government policy, which may impact returns over the long term. Going forward, the benefits of government promotion of clean energy are clear for all sections of the economy, while consumer demand for eco-friendly goods and services will steadily track upwards. Beyond this, progress with technology will continue to bring costs down and raise generating efficiencies, and this will add to the opportunities available to business, strengthening the case for adoption and pushing companies to maximize the long-term benefits that these systems offer (for details see Box A).

The Financial Sector’s Role in Facilitating Solar Rooftop Uptake

Given its role directing investment flows, the financial sector has a significant part to play in determining how the market for rooftop solar systems develops.

1) Green financial products will be key to unlocking the market. Leading players in the domestic financial system have already developed a range of such products, including the following:

-

Clean energy loans: For borrowers, these generally have the benefit of offering interest rates that are 1-2% below market rates and flexible repayment terms of up to 15-20 years. Eligibility is based on the cash flow generated by cost savings associated with the installation of the clean energy system. Examples of these loans include the SCB Solar Loan (restricted to financing solar installations), the Government Savings Bank’s Green Energy Loan, for which all clean energy projects are eligible, and an offering from ICBC Leasing in cooperation with Huawei Digital Power, which offers loans at rates as low as 2.99% annually for purchases of solar cells (source: company data).

-

ESG loans: By offering interest rate discounts that are tied to progress on environmental goals and potentially offering bonuses for environmental accountability and transparency, these align enterprise financing with sustainability. Examples of products currently on the market include Krungsri’s ‘Home for Cash Loan for Rooftop Solar Installation’, Bangkok Bank’s ‘Bualuang Phoon Phon Green Loan’, Krungthai Bank’s ‘ESG Loan’ and Kasikornbank and SCG’s ‘Solar Home Loan’ (source: company data).

-

Green credit cards: These are targeted at retail customers who spend on environmental products and services, and these are becoming more popular for commercial banks looking more closely at ESG issues and carbon neutrality. Typically, cardholders spending on clean energy, for example by purchasing solar cells, inverters, or batteries, will benefit from discounts or enrollment in special 0%-interest schemes that run over 6-24 months. Examples of these that are available in Thailand include the SCB Green Ecosystem, which partners with distributors of solar cells and the Krungthai-Go Green, which supports energy-saving equipment and certain solar rooftop installations.

2) Infrastructure mutual funds play an important role in securing funding for large-scale rooftop solar installations in industrial and commercial settings (e.g., for factories, department stores and state projects) when capital is being raised from retail investors rather than being drawn from internal funds. Returns on these investments are generated through the sale of electricity. Examples include power station infrastructure mutual funds such as those offered by PRIME BCPG and GUNKUL, which have previously used this model to raise funding for solar farms and are now expanding these mutual funds to include rooftop solar projects.

Emerging Business Opportunities and Government Policies Supporting the Rooftop Solar Market

Growth in the market for rooftop solar installations will help to create and develop new businesses across an interconnected and mutually supportive ecosystem, from manufacturing through installation and management to maintenance, and as part of this, a range of new opportunities will open up. This will include the following.

-

Installation and maintenance: Demand for skilled staff to install and maintain PV systems—especially those with relevant certifications—will continue to rise, as will long-term contracts for the provision of maintenance services, which may generate a stable income for as long as 20-25 years. Performance warranties that guarantee that rooftop solar equipment will continue to provide a minimum level of generating efficiency across its lifespan (typically 80-90% of its original performance out of the box) will be an important way of building confidence in these products and in convincing companies that the expected returns will indeed be generated.

-

Software and power management systems: All rooftop solar systems require software to manage the power that they generate and so as organizations adopt the ESG standards in greater numbers, demand for these services will grow. Moreover, large enterprises are increasingly required to report their carbon footprint and their sustainability measures, and this will add further to demand. This will encompass products such as platforms that allow users to track electricity production in real time around the clock, AI systems that will predict and adjust energy production to best match this to daily weather conditions, apps that monitor energy usage and that help users analyze costs and calculate returns on these investments in real time, and data-management systems that support ESG compliance.

-

Energy storage solutions: The falling cost and rising efficiency of batteries is boosting demand, with government support for the adoption of clean energy and the development of smart grids providing additional tailwinds to the market. Demand for back-up power supplies from domestic and commercial users is also being built. Areas of particular interest that can look forward to high rates of growth include the development of batteries that are suitable for Thailand’s climate, comprehensive energy management services, integration with smart grids, and emergency solutions.

-

Energy consultants: Because knowledge and understanding of rooftop PV systems remains relatively scarce, demand for consultancy services is set to grow. In particular, potential users will need help and advice on the costs and benefits associated with rooftop solar installation, the design of a suitable system, and sources of funding. Moreover, in some areas, permitting may also be complicated, and this will add further to demand for consultants.

-

Community solar projects and renting space for PV systems: Some business models involve renting roof space from building owners, who receive monthly payments. These models include community solar projects, peer-to-peer energy-sharing, and the use of crowdfunding platforms to raise capital for small-scale initiatives. Since individuals seeking affordable clean energy often lack access to either a suitable roof for solar installation or the financial resources to self-fund such systems, these projects are expected to continuing growing. Meanwhile, the government is developing the regulatory framework needed to manage peer-to-peer energy generation and sharing, which is likely to create greater opportunities for group funding in the future.

As shown above, growth in the market for rooftop solar installations will create new business opportunities across a broad front, though changes in these areas will be especially energized by the recent hike in US tariffs on imports of Thai solar cells and the resulting need by manufacturers to focus more intently on the domestic market. Importantly, the government has a major role to play in this area and several policy tools are available that can help sustain growth.

-

Financial support measures: Pro-industry measures will involve addressing tax issues, including cutting taxes for rooftop solar installers, zero-rating duties on imports of solar equipment, and removing size-related restrictions on transformer capacity to promote the installation of solar rooftops in the household and business sectors; and facilitating access to finance by establishing clean energy funds or supporting low-interest loans to help businesses secure funding more easily, developing a diverse range of green financial products, supporting low-interest loans through guarantees or subsidies, and establishing a national clean energy development fund.

-

Infrastructure development: This will include making concrete progress on rolling out net metering, thus allowing individuals to sell surplus electricity back into the grid, though mechanisms for calculating pricing for this will need to be transparent. The development of rooftop solar power networks should also be accelerated.

-

Knowledge diffusion and technology transfer: In this area, governments can help the market mature by setting up training facilities that meet international standards and that produce fully certified engineers, promoting research projects that marry expertise from universities and the private sector, creating cooperative networks to develop curricula that meet the needs of the market, encouraging technology transfer from overseas companies, and funding research and development of related technology (e.g., batteries and high-performance solar cells).

-

Reforming regulatory mechanisms: This might include introducing digital technology to streamline permitting processes, establishing clear quality and safety standards, developing fair and transparent net metering mechanisms, and ensuring that policy implementation is consistent across different government agencies.

Nevertheless, despite its clear growth potential, the market for rooftop solar faces three major challenges.

-

Technical challenges: Uncertainty over the weather and climate is a major obstacle, particularly the prolonged rainy season, which may lead to reduced electricity generation efficiency. Retrofitting solar systems to old buildings may also be problematic, as may designing installations that are appropriate for different types of structures. In addition, it is essential that problems with a lack of skilled staff and an absence of standards that are consistent with international benchmarks are addressed immediately.

-

Regulatory challenges: A lack of clarity over the permitting process remains a major drag on installations, while a lack of policy consistency also hinders long-term planning. Beyond this, net metering regulations are still complex, their details are unclear, and the work of different government agencies remains uncoordinated and potentially contradictory. This all then continues to undermine investor confidence.

-

Market challenges: The costs associated with investment in rooftop solar systems remain volatile and uncertain due to the impacts of the US tariffs and the ongoing trade war. At the same time, both domestic and international competition is tending to intensify, and building confidence in the quality of Thai goods and services is a challenge that will take time and effort to overcome.

In conclusion, while rooftop solar installations enable individual businesses to reduce their energy overheads, at a broader scale, this market supports the development of a new industry in which sustainability is a core concern. This, in turn, will help drive the adoption of clean energy across the economy and embed environmental awareness more deeply within the country. These efforts will be further amplified by the impact of punitive import duties and the broader trade war on the solar industry. Success in developing this nascent industry will be partly determined by the cooperation of government agencies, private sector organizations, and the general public. By working together, stakeholders will be able to lay solid and secure foundations for sustainable growth, positioning the country to adapt effectively to changes in global markets.

References

Arizton Advisory & Intelligence (2024). Global Solar Panels Market: Global Outlook and Forecast 2024-2029.

CTE News, 6 May 2025. Solar Panel Industry in Thailand at Risk Due to US Tariffs, https://ctenews.com/solar-panel-industry-in-thailand-at-risk-due-to-us-tariffs?utm_source=chatgpt.com

Department of Alternative Energy Development and Efficiency, Ministry of Energy. Report on the status of solar power generation in Thailand 2022.

Department of Alternative Energy Development and Efficiency, Ministry of Energy. National Survey Report of PV Power Applications in Thailand 2021.

Mordor Intelligence. Solar Energy In Thailand Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030)

MDPI Journal. Performance and Economic Evaluation of Solar Rooftop Systems in Different Regions of Thailand.

Reccessary news, May 2025. Thailand’s rooftop solar market surges with falling costs, regulatory reforms.

Roofing Contractor Magazine. Solar and Roofing: Current Trends and Looking Ahead.

Solar power in Thailand (March 1, 2024)- The potential and development trend.

Solar Fund, Sirindhorn International Institute of Technology, Thammasat University, Health Policy Foundation and Greenpeace Thailand. Solar Rooftop Revolution : A Green and Just Recovery for Thailand 2021-2023.

Thaipbs. Policy watch, 19 November 2024. Government pushes “solar” but lacks support mechanisms.

Thansettakij. 22 April 2025. US imposes 375% tariff on Thai solar panels to curb Chinese investment.

The Straits Times, 24 May 2025. Solar squeeze: US tariffs threaten panel production and jobs in Thailand, https://www.straitstimes.com/asia/se-asia/solar-squeeze-us-tariffs-threaten-panel-production-and-jobs-in-thailand?utm_source=chatgpt.com