Executive summary

As of 2023, more than 20% of the Thai population was aged 60 or over, thus qualifying the country as an ‘aged society’. Unfortunately, the elderly face a wide range of challenges, in particular: (i) insecure and insufficient income as a result of not working or doing so but receiving insufficient wages, or a lack of savings or a pension; and (ii) increased outgoings due to higher medical, housing and care costs. The impacts of these problems are being felt by individuals, families, and society at large, but more positively, the aged society will also open up new opportunities for businesses in areas as diverse as healthcare, real estate, food, lifestyles, electronics and digital technologies, and finance. Players in these industries that are able to respond to changing demographic conditions and that can bring new and appropriate products and services to market will therefore be able both to expand their businesses and to alleviate many of the problems currently impacting Thai seniors.

From an ‘aging’ to an ‘aged’ society: Thailand is getting old before it gets rich

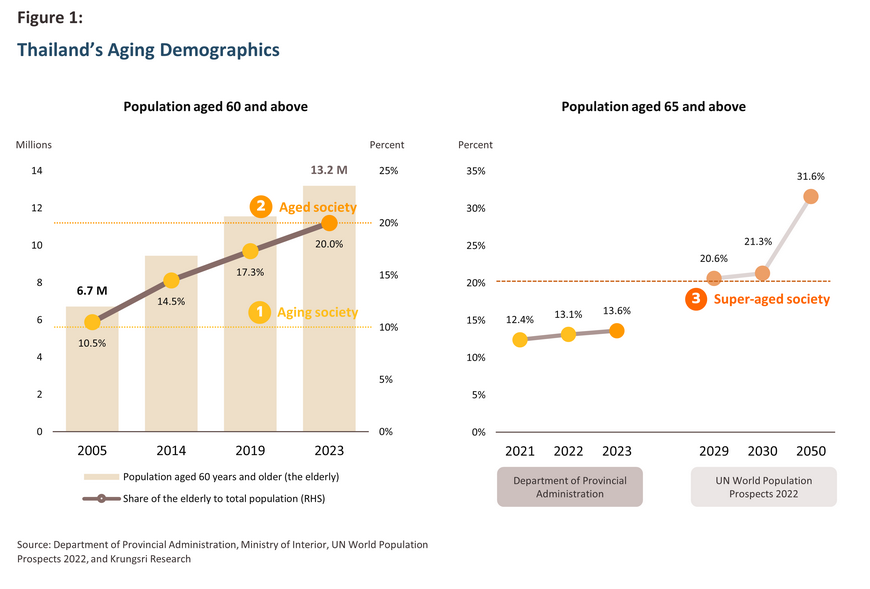

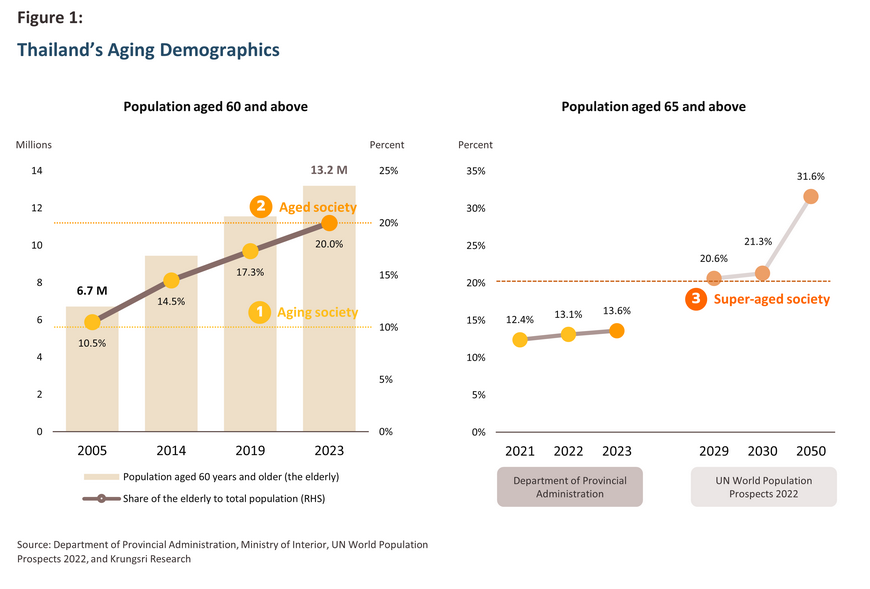

It has long been observed that Thailand is aging rapidly, and as long ago as 2005, Thailand became an ‘aging society’1/, that is, at least 10% of the population was 60 or older. However, in 2023, Thailand reached another demographic milestone when the share of over-60s reached 20% of the population, or 13.2 million people, qualifying it as an ‘aged society’2/. It therefore took less than 20 years for the share of the elderly in the population to double and for the country to go from an aging to an aged society, a rate that is significantly faster than that recorded in many other countries, including Singapore and China (25 years), the United Kingdom (45 years), and the United States (69 years)3/. Moreover, in 2023, 13.6% of the Thai population was 65 or over, and the United Nations4/ expected this proportion to grow to more than 20% by 2029, which would then qualify Thailand as a super-aged society. This is the most aged of the UN’s demographic categories, and once Thailand reaches this stage, it will join countries including Japan, Germany, Italy, and France, but while these are all wealthy developed economies and that are thus ‘old but rich’, Thailand is at risk of becoming ‘old before it is rich’.

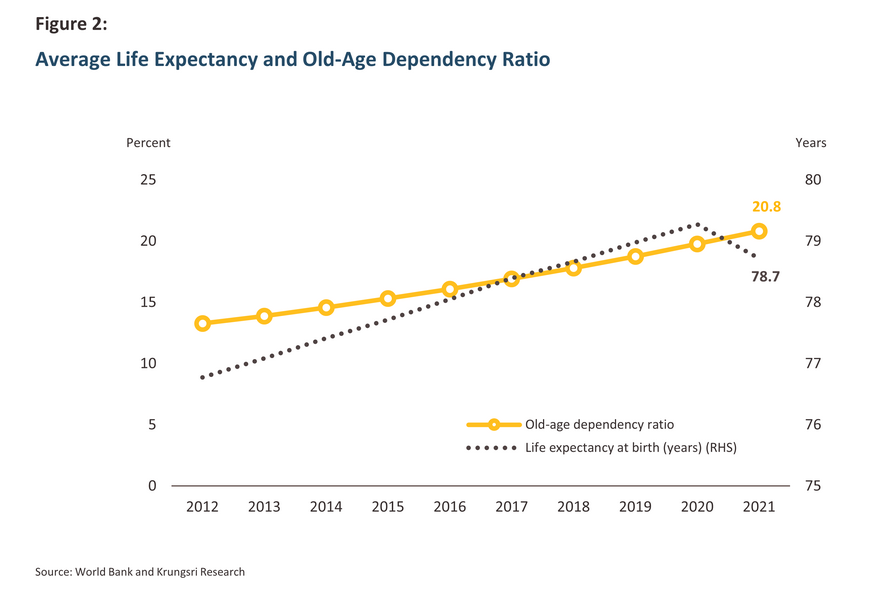

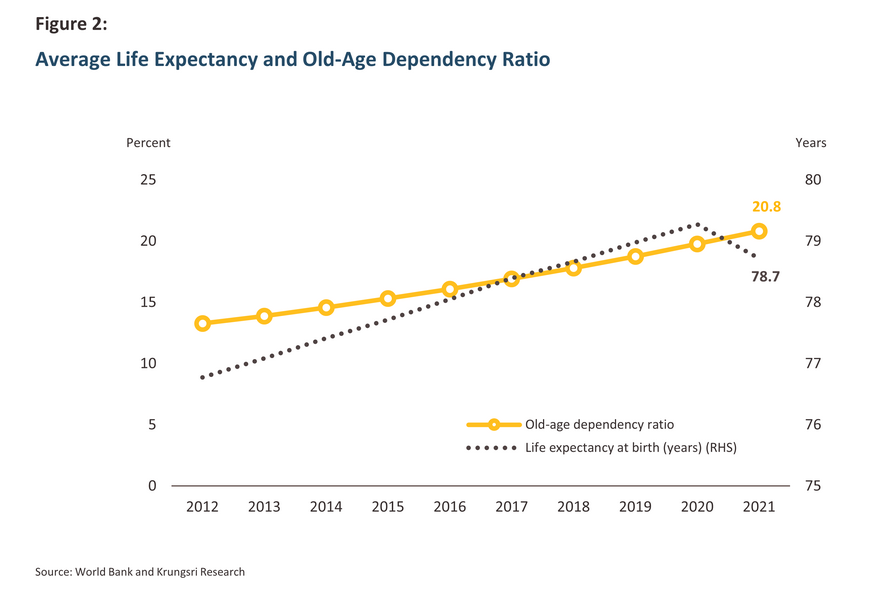

A number of demographic indicators point to Thailand’s changing circumstances. The country’s median age5/ is currently 41, significantly older than the ASEAN average of 296/, and although it dipped slightly during the COVID-19 pandemic, life expectancy is steadily tracking upwards and as of 2021, this stood at 78.7. In the same year, deaths also outnumbered births for the first time since records began. The rising share of the population classed as elderly, lengthening life expectancy, and the falling birth rate are all steadily adding to the challenges faced by the country, though most evident among these at present is the shrinking workforce and the falling labor force participation rate, which declined to 68.7% in 20237/, down from more than 70% a decade earlier. This is then increasing the old-age dependency ratio8/ and so in 2021, every 100 working-age Thais had to support 21 over-60s, up from 13 in 2015 (Figure 2), and this ratio will continue to rise as time goes by.

Clearly, the aging of Thai society has the potential to place very considerable demands on the country, and balancing the need to grow the economy with a declining workforce while still providing for the needs of the elderly will be no easy task. Nevertheless, the transition to an aged society is also moving the economy’s center of gravity towards this demographic, and so this group will become an increasingly important market for many industries. This paper thus examines the particular challenges faced by the elderly before looking at the business opportunities that will result from this shift and the potential of these to address the needs of Thailand’s increasingly elderly population.

Challenges faced by the elderly in Thailand

The elderly often have to manage various pain points that span the core areas of day-to-day life, namely income, work, savings, health, and accommodation. The most important of these challenges are described below.

Over half of the elderly are primarily dependent on others for their income, and nearly half face uncertainty over whether this will be sufficient to meet their needs.

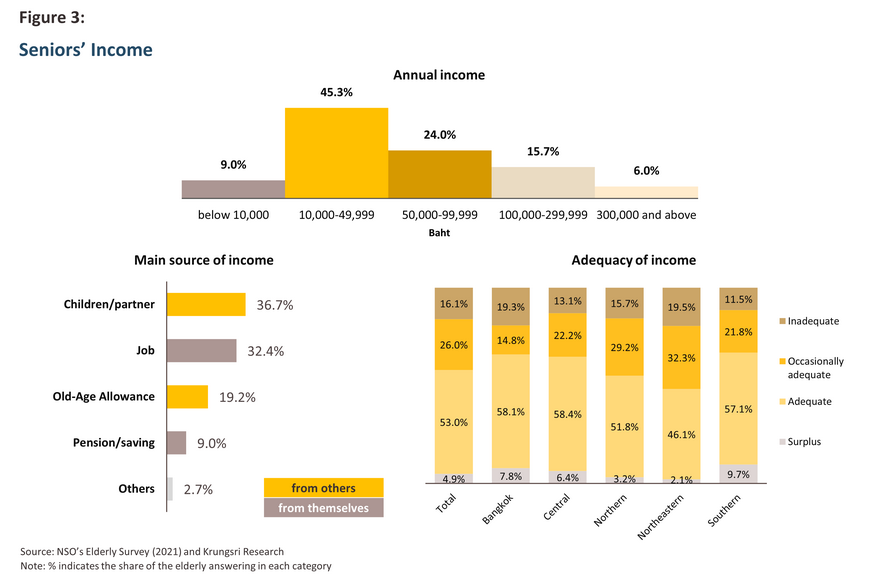

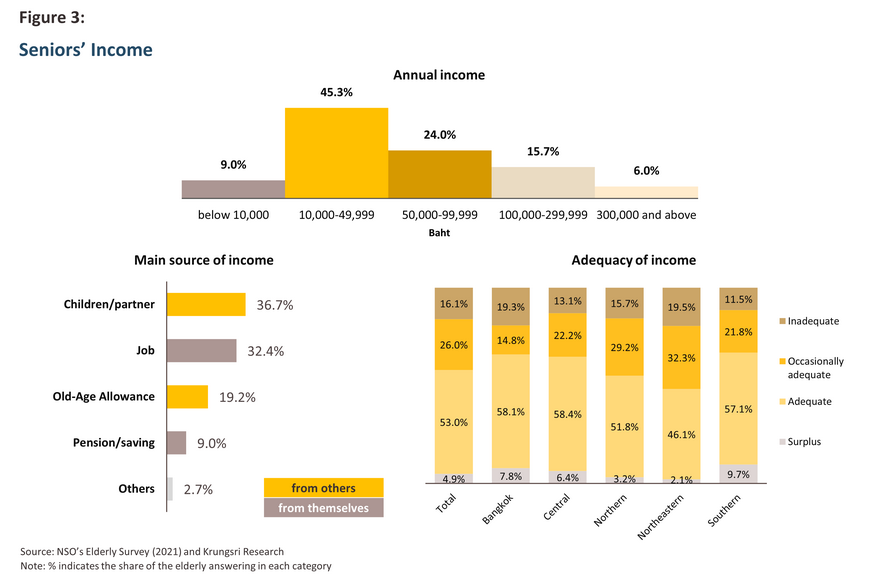

Income is a major determinant of quality of life for the elderly, but a 2021 survey carried out by the National Statistical Office of Thailand9/ revealed that incomes for the seniors averaged just THB 87,136 annually, or THB 7,261/month. This works out as THB 242 per day, or less than the national minimum wage10/. 56% of survey respondents also reported that they were primarily dependent on others for their income, typically either a partner or other family members, with this followed in importance by the state pension. By contrast, only 32% reported that work was their primary source of income. This dependence on others may be one reason why more than 40% of respondents encountered with uncertainty about their income, that is, they said either that their income was definitely insufficient to meet their needs or that it was periodically so. This was particularly common in the northeast of Thailand, where the proportion rose to 52%, while nationally, the proportion of over-60s who had sufficient income to meet their needs and to save came to less than 5% of the total. Besides, more than 40% of those who did have savings had less than THB 50,000, and so for the majority of the elderly, their savings are too small to provide their main source of income. Almost half of elderly respondents further reported that they or members of their family had debts11/.

Most elderly individuals do not work, either because of personal issues or due to difficulties finding suitable positions, and among those who do have a job, pay is often low.

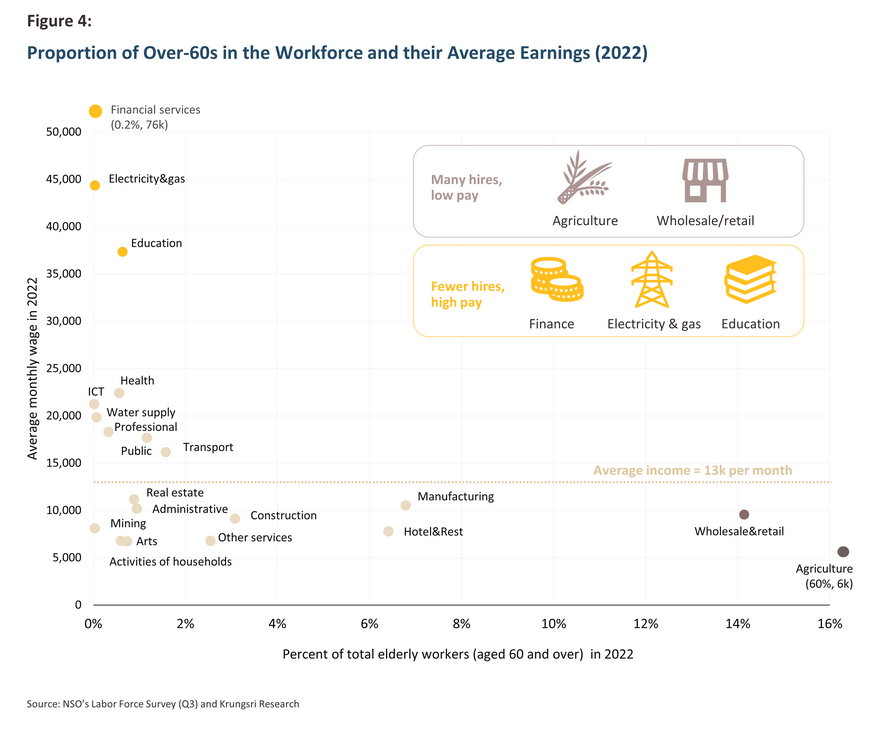

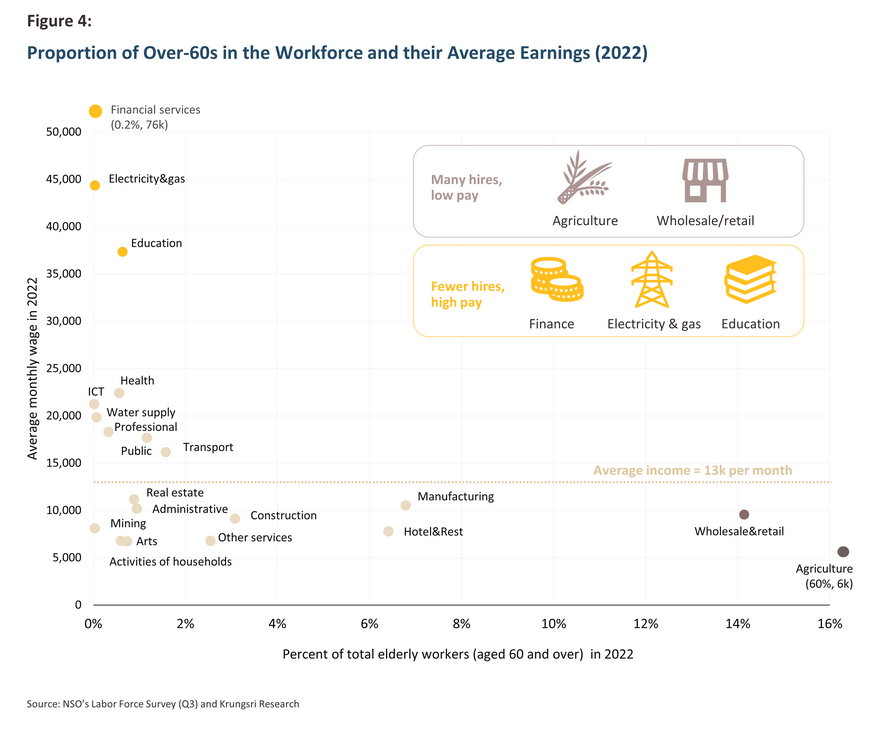

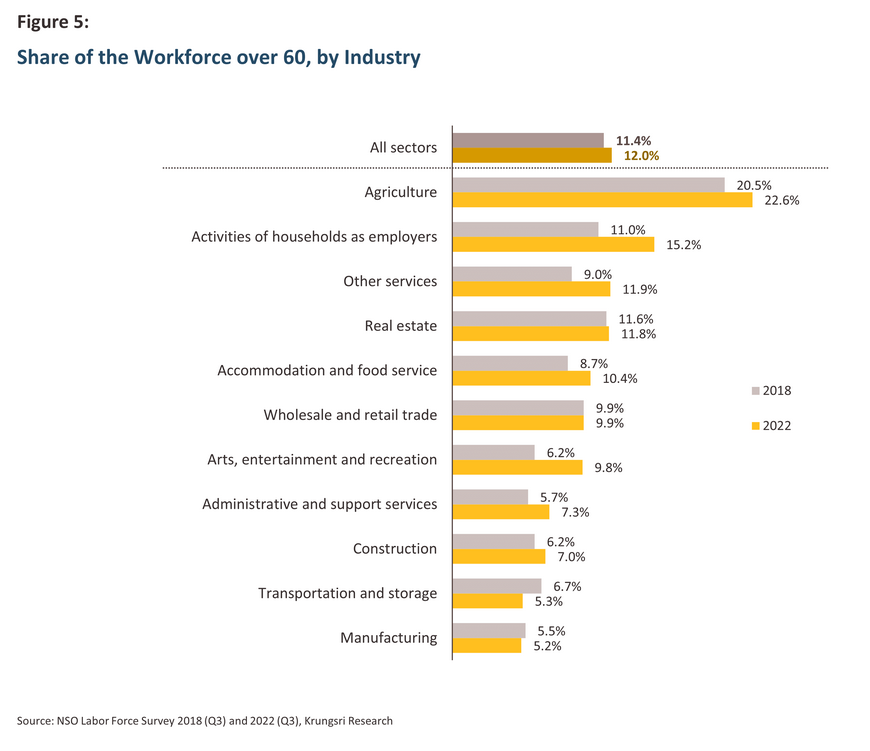

With around a third of the elderly dependent on wages or salaries as their main source of income, it is normal to then ask what kinds of work the elderly tend to do and whether their income from this is sufficient to meet their needs. The answers to these questions are provided by a survey carried out in 2022, which reveals that of the 4.7 million over-60s still working, 2.8 million (or 60%) worked in the agricultural sector, and indeed the elderly account for almost a quarter of the 12.4 million people working in agriculture nationally. However, although this is an important source of jobs, pay is low, and average earnings for the elderly in the farming industry are just THB 6,279 per month. Agriculture is followed in importance by the retail and wholesale industry, which employs 0.67 million elderly workers (14% of the elderly workforce) on an average of THB 9,560 per month. These two industries are thus major employers but minor payers (Figure 4), unlike the finance, gas and electricity, and education industries, which employ only relatively low numbers of the elderly but who are well compensated, making these minor employers but major payers. Plus, in these latter industries, pay for the over-60s is typically higher than it is for 45-59-year-olds, indicating that experience is highly valued in these parts of the economy.

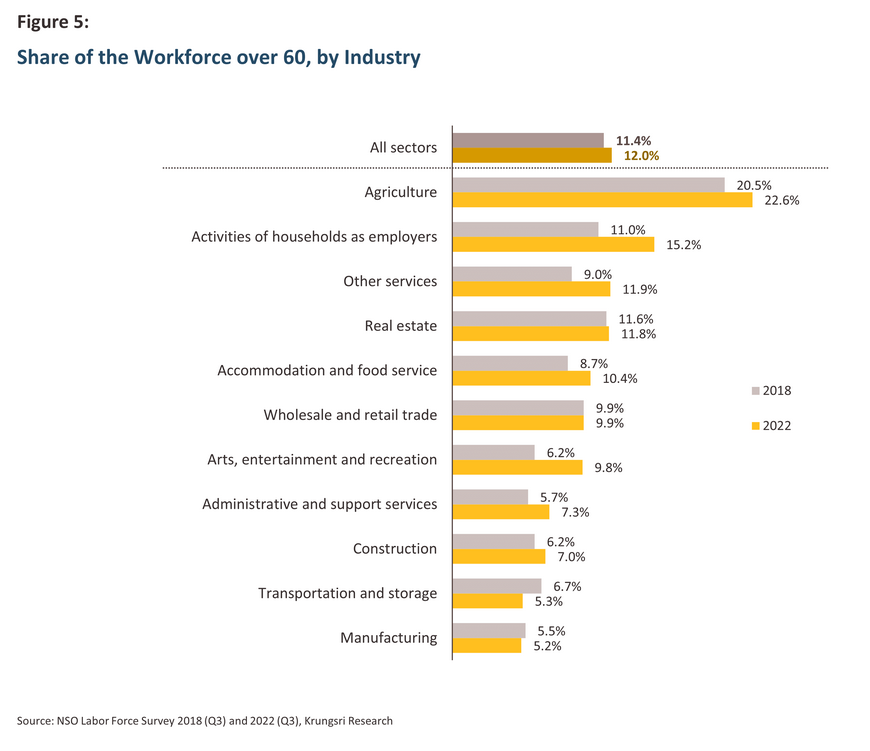

Between 2018 and 2022, the share of the elderly in employment rose slightly (Figure 5). This increase was most concentrated in agriculture, household businesses, hotels and restaurants, the arts and entertainments, and other parts of the service economy such as spas, beauty salons, and laundry services. These are, however, labor-intensive industries that exhibit low levels of productivity and so elderly employees in these sectors earn an average of less than THB 8,000 per month. At the same time, the share of the elderly in less labor-intensive industries such as manufacturing, mining, transport, and information and communications technology (ICT) is much lower. These industries are also better suited for automation, which then further undercuts demand from these for elderly workers. This is most pronounced in ICT, where the 45-59-year-old age cohort outnumbers the over-60s 42-fold, vastly more than the economy-wide average of a 3-fold difference, and where pay for these two groups differs by a factor of 2 against the average of 1.5. Overall, average wages for 45-59-year-olds come to almost THB 20,000 per month, compared to THB 13,000 for the elderly.

Elderly workers are thus typically employed in low-paying industries, and this is in line with the findings of a 2022 survey12/ that showed that 55% of elderly employees reported low pay was the most important work-related issue that they faced. This was followed in importance by problems with working conditions, including the work environment, employee responsibilities, job security, working hours, benefits, and time off.

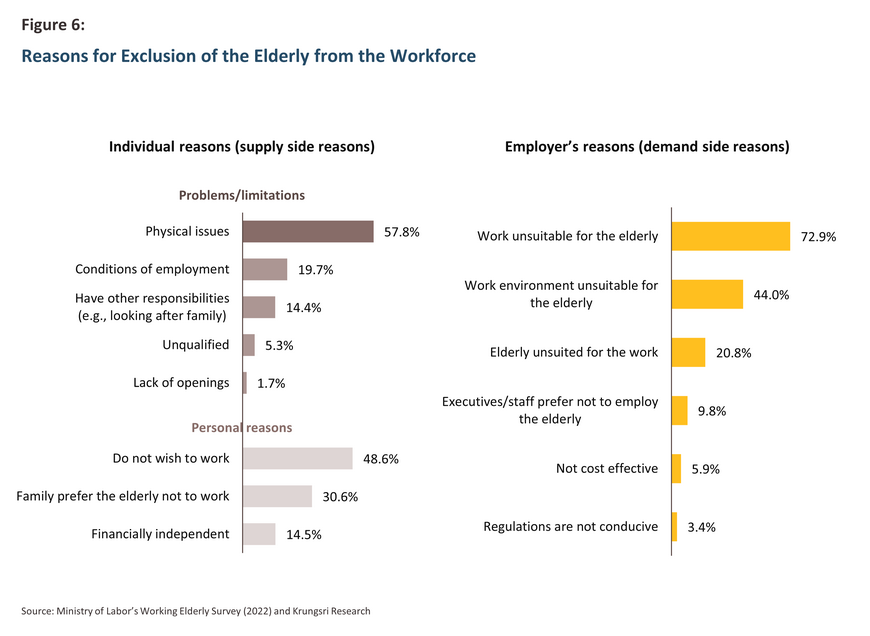

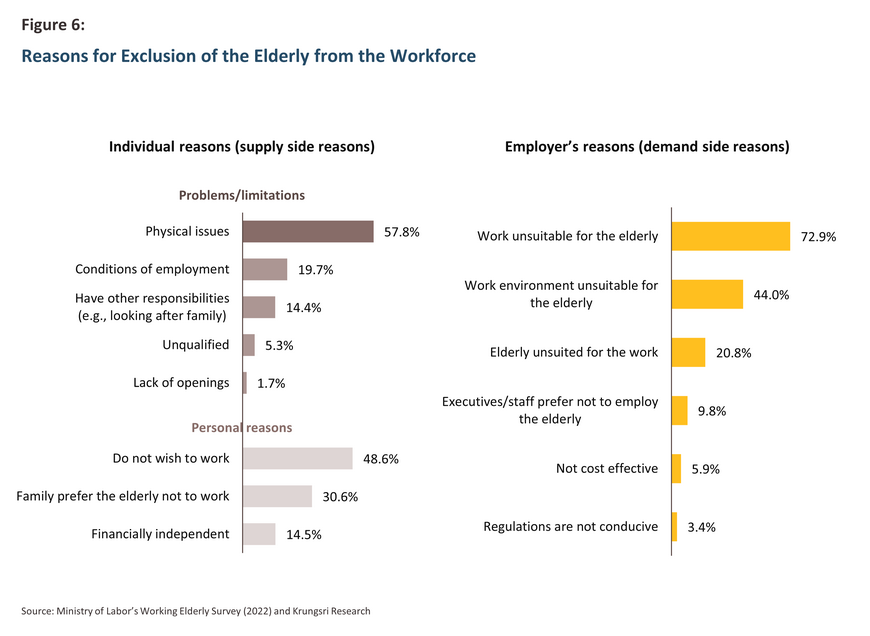

In addition to those working for low wages, many of those not employed at all are likely to be in a precarious situation. There may be many reasons why someone is not working, though these can be divided into those connected to the attitudes or actions of potential employers and those relating to the individual. The results of a Ministry of Labour survey into the factors behind non-participation in the labor force13/ are shown in Figure 6.

-

On the supply side, the most commonly cited reason for elderly individuals to be excluded from the labor market was physical problems or their health. This was followed in importance by failing to meet the age requirements of the job, having home responsibilities or needing to look after family members, a lack of skills, and a lack of suitable jobs. In addition, some elderly individuals chose not to work because they do not need to or because they want to enjoy their retirement.

-

On the demand side, the most common reason for employers not to hire elderly staff was their unsuitability for the work, followed by the unsuitability of the workplace for elderly staff, older workers low productivity, executives’ preference for younger staff, and regulations that make this difficult.

- Savings and government welfare schemes

Many of those of retirement age do not have a pension or savings, and if they do, this may not be sufficient to meet their expenses.

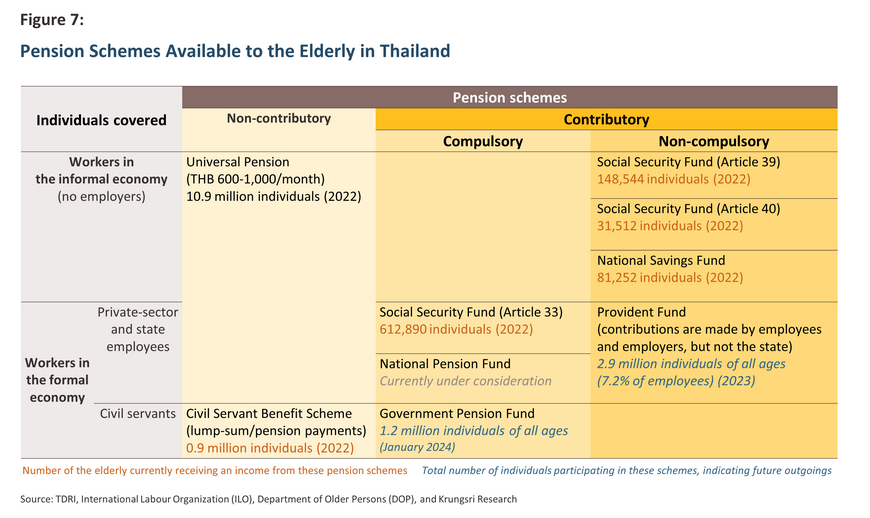

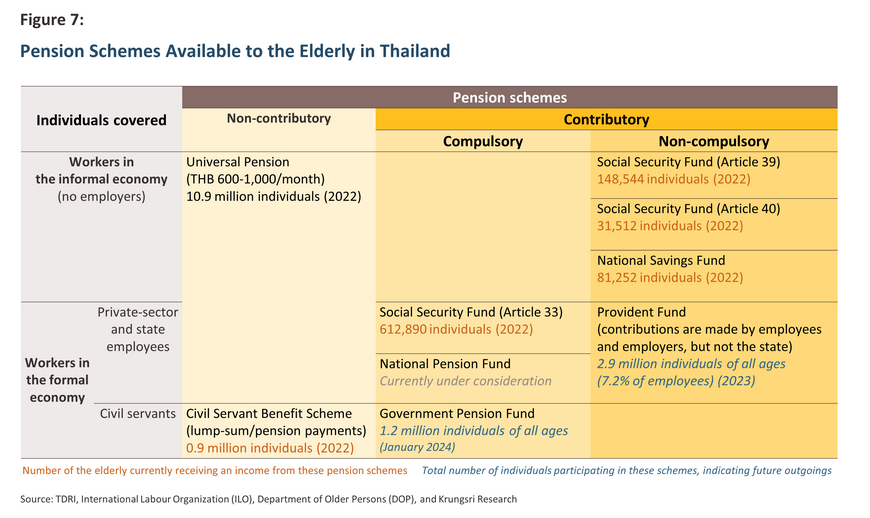

In addition to their wages or salary, the elderly may also draw an income from government welfare schemes or pensions. These can be divided into two categories according to how contributions are collected while individuals are still in employment (Figure 7).

-

Non-contributory schemes include the universal pension paid to all over-60s, and as of 2022, around 10.9 million individuals were eligible for this, though some 0.85 million civil servants are excluded since they have access to a separate pension scheme.

-

Contributory schemes may be divided into two sub-categories. (i) Compulsory schemes include Article 33 of the Social Security Fund, which covers employees in the formal economy, and the Government Pension Fund, which supplements post-retirement savings for civil servants. (ii) Voluntary schemes include pensions provided for under Article 39 and Article 40 of the Social Security Fund, which cover the self-employed, and the National Savings Fund, which has been set up for workers in informal employment not-covered by pension funds to which the state or an employer makes contributions14/. Around 0.87 million people are covered by the three schemes of the Social Security Funds and the National Savings Fund.

9.3 million over-60s are therefore not covered by contributory state pension schemes (the Social Security Fund, the National Savings Fund, or the Government Pension Fund), and of these, 2.6 million are dependent on the THB 600-1,000 per month payments made under the universal pension scheme15/. Such a low income places these individuals significantly below the poverty line of THB 3,000 per month, and indeed, more than twice as many seniors are dependent on the universal pension than draw an income from a lump-sum payment, pension, savings, or other assets.

One important reason why many individuals lack sufficient savings to pay for their retirement is the absence of a compulsory savings scheme for workers in the informal economy (e.g., farmers, sellers, and other self-employed workers). Instead, these individuals are only covered by voluntary schemes (articles 39 and 40 of the Social Security Fund and the National Savings Fund), which remain less popular among informal workers than they should. As such, 21 million workers, or 51.2% of the working age population16/, remained outside the scope of the social security system as of 2023, and so because they were not enrolled in a compulsory pension scheme, half of all workers are now at risk of not having access to a pension.

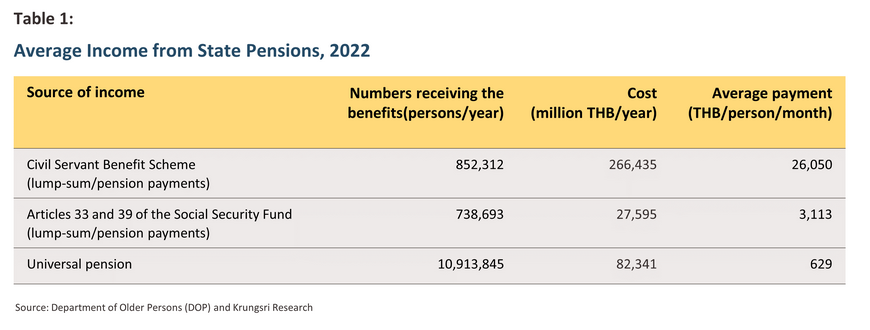

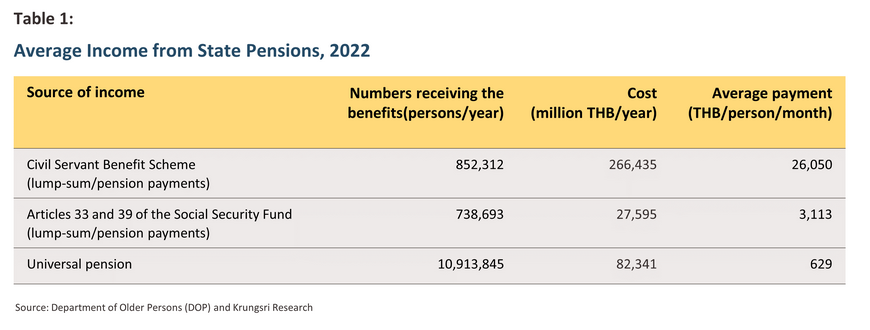

In addition to problems relating to exclusion from the pensions system, a further problem is the low level of payments made to those who are covered by the various state pensions since at present, only the civil service pension is sufficient to cover living costs (currently, this averages THB 26,000/month). By contrast, those relying on payments from the other funds will receive an income that is less than the minimum wage. For example, monthly payments made under articles 33 and 39 of the Social Security Fund to those over 60 average THB 3,000, and adding the maximum payment made under the universal pension brings this up to no more than THB 4,000 per month, a level that may be above the poverty line but which is insufficient to guarantee a decent quality of life.

Workers enrolled into the formal pension system are thus at risk of facing poverty in retirement. In 2023, 12 million individuals were covered by Article 33 of the Social Security Fund, and so these will be eligible for monthly THB 3,000 payments but only a quarter, or 3 million workers, have also been enrolled in a provident fund. The latter are voluntary pension schemes to which employees contribute, with additional payments then coming from employers, and so these provide a source of income for retirees in addition to any state pensions already being paid. Nevertheless, in 2023, only 22,821 workplaces, or less than 5% of the total, had set up provident funds for their staff, and the current absence of a compulsory pension or provident fund drawing contributions from employers and employees in the formal system is one factor driving interest in the development of the National Pension Fund; the draft bill on this is currently being considered by the Office of the Council of State17/.

A final important issue is the sustainability of the Thai pension system, and with the country contending with a growing elderly population and a shrinking workforce, it is possible that current pension arrangements will in the future face a funding crisis. Thailand is not alone in encountering these problems, and countries around the world are dealing with a similar set of challenges, but Thailand ranks 43 out of the 47 countries covered in the Mercer and CFA 2023 Global Pension Index18/. This reflects the pressing need for reform and development of the national pension system, in particular with regard to extending coverage to all parts of society, increasing contributions, and raising the level of payments.

Expenditure on healthcare rises with age, placing additional burdens on both household and national budgets.

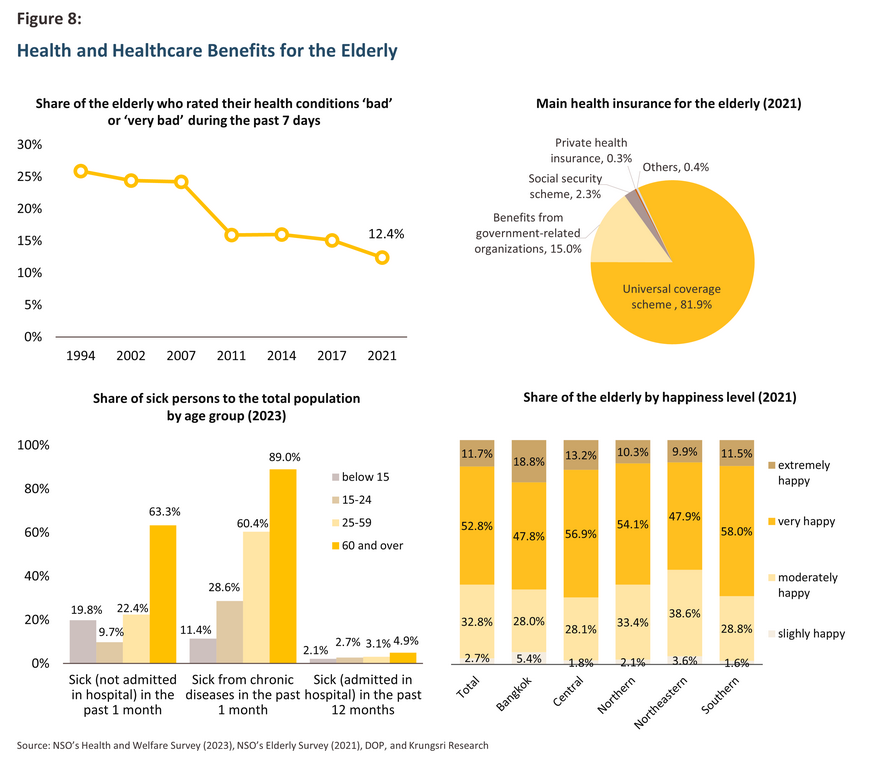

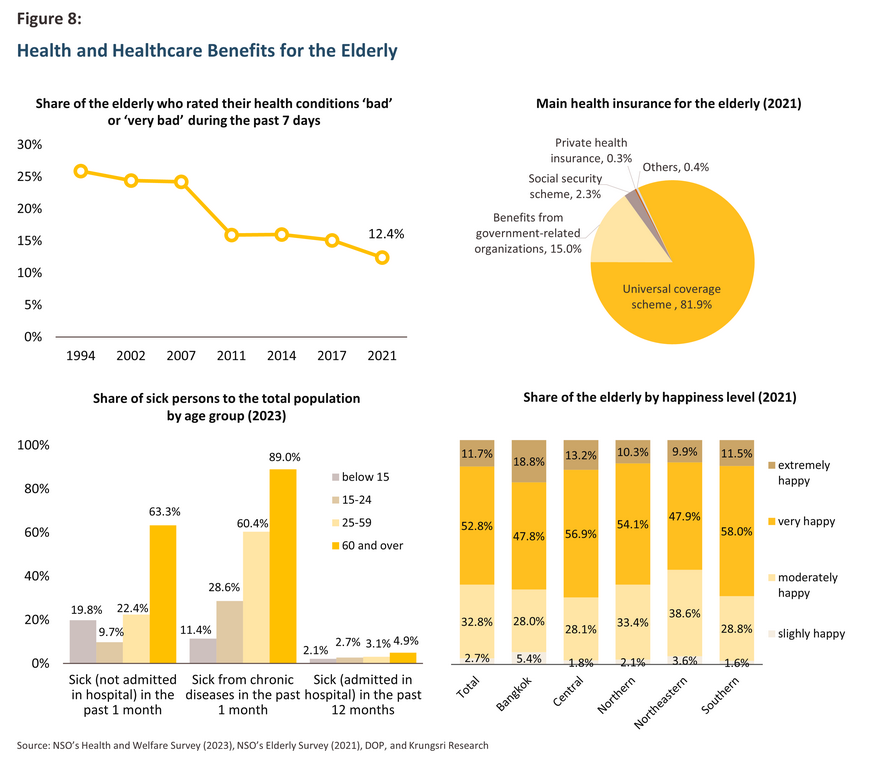

The majority of the elderly are self-reliant and are able to continue to contribute to society, with just 1.8% and 1.3% housebound and bedbound, respectively. Moreover, the health of the over-60s is tending to improve, and this is reflected in surveys of self-rated health that show that the share of the elderly reporting that their health was bad or very bad fell to just 12.4% in 2021, down by more than half from 20 years earlier (Figure 8).

Nevertheless, although the elderly are getting healthier, they clearly suffer from greater levels of ill health than younger cohorts. Thus, a survey shows that 63% of respondents reported that they had been affected by ill-health that was insufficiently severe to warrant hospital treatment in the month prior to the survey, and almost 90% of these cases were related to chronic or pre-existing conditions. A further 5% had also required hospitalization in the previous year. Falls are a particular problem for the elderly, and 6.4% of the over-60s had had a fall in the 6 months prior to the survey. The results of questions on mental health were more positive, and more than half of the elderly reported being happy, although the 2021 survey showed that responses were most diverse in Bangkok and residents in the capital showed the greatest gap between the numbers reporting themselves as extremely happy and extremely unhappy. This reflects surveys of income and the adequacy of this (Figure 3), and it is reasonable to assume that among the elderly, life satisfaction is at least partly correlated with post-retirement income.

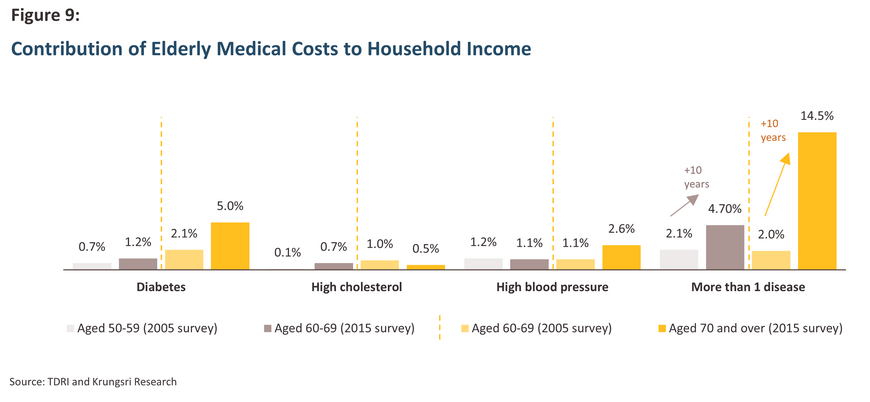

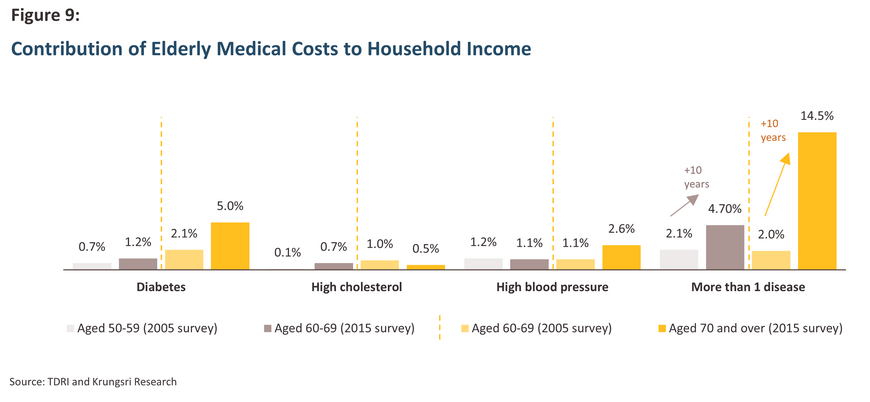

Meeting rising healthcare costs for the elderly is a significant challenge for both households and the country at large. Data from Japan show that spending on healthcare increases sharply after 50 and then continues to rise as individuals pass through subsequent age cohorts19/. Research carried out by the TDRI also shows that in Thailand, the cost of treating elderly individuals with diabetes doubles for every 10 years that they age, though for those with more than a single chronic condition, treatment becomes even more expensive. In line with this, medical costs account for around 2% of household expenditure for those aged 60-69 but this then rises more than 7-fold to 14.5% for those aged 70 and over20/ (Figure 9).

The 2021 survey of the elderly shows that 81.9% relied on the universal health coverage scheme (the gold card), 15% exercised their right to access healthcare for ex-civil servants and employees of state enterprises, and just 0.3% had private health insurance. In 2022, more than 10 million elderly patients sought treatment covered by the gold card, and at an average rate of 6.3 outpatient treatments each per year, this was almost twice the 3.5 average for the system as a whole. Treatments were most often related to non-communicable diseases (NCDs), such as hypertension and diabetes, and taking into account patient numbers and the frequency of visits to healthcare facilities, treatments for the elderly represent around a third of all demand placed on the public healthcare system21/.

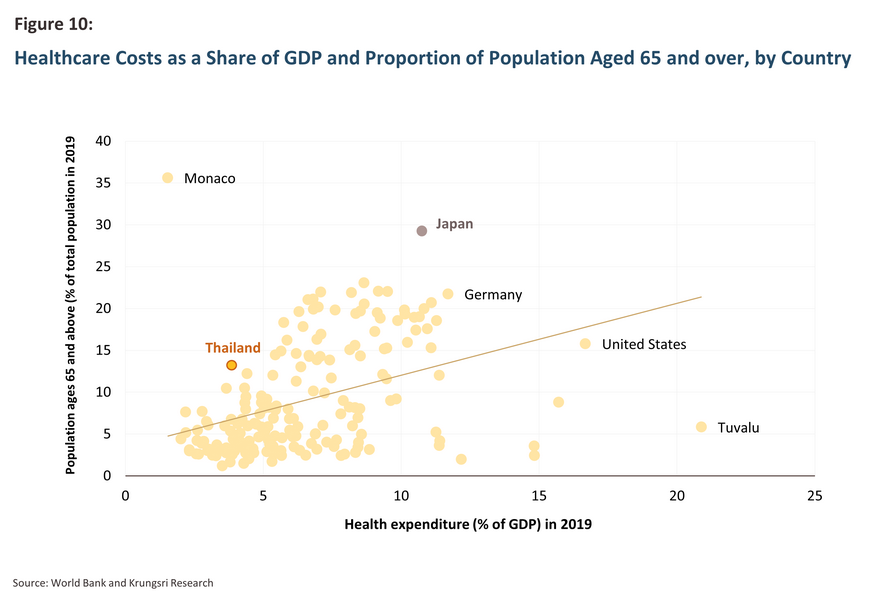

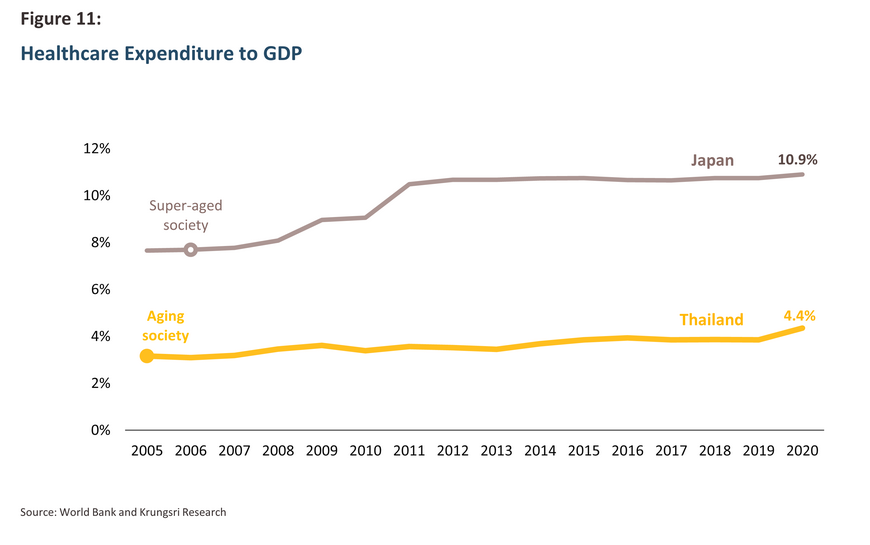

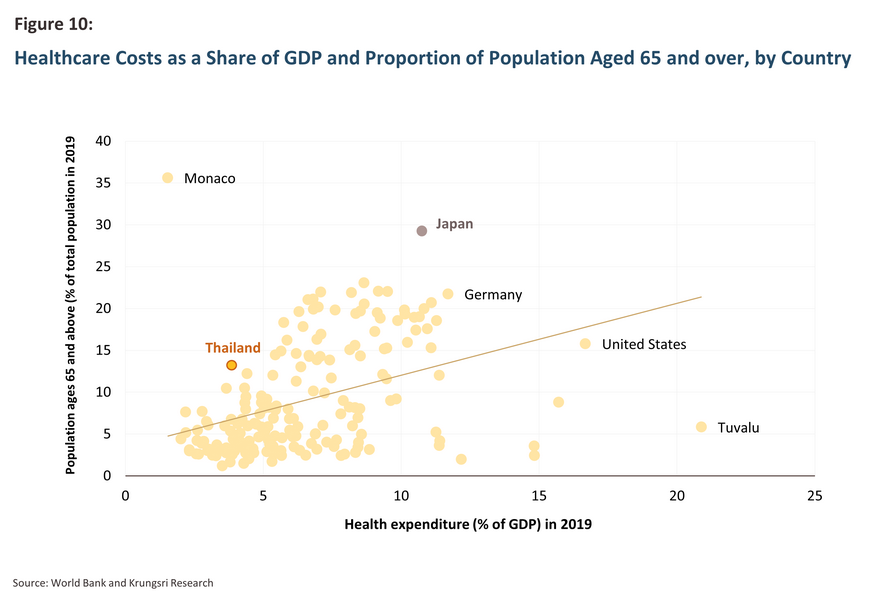

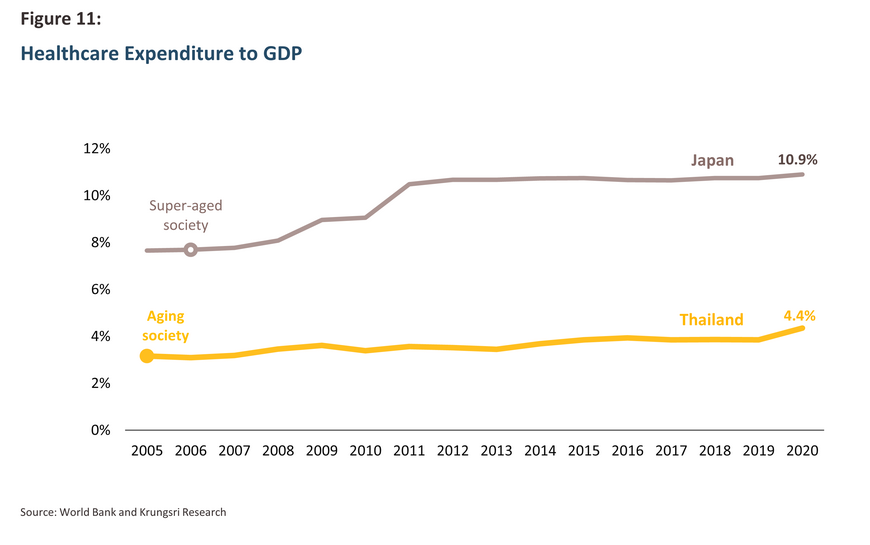

The aging of society will naturally add to public health expenditures, a process that has already been witnessed in other countries around the world. Figure 10 shows that spending on healthcare as a share of GDP is the highest in the world in the US, Germany, and Japan, though in these nations, more than 15% of the population is over 65 and so elevated spending on healthcare is likely related to short- and long-term healthcare costs and the need to develop related medical technology22/. In Thailand, healthcare accounted for just 4.4% of GDP in 2020, but although this is somewhat low compared to both the share of the elderly in the general population and the level of spending seen in other countries, this is nevertheless trending upwards. The World Bank thus estimates that combined spending on public healthcare and the state’s various pension commitments will swallow 11.5% of Thai GDP by 206023/. Moreover, Japan’s experience shows that the rate at which expenditure increases will itself accelerate sharply once the country becomes a super-aged society, and there, in the 15 years after Japan crossed this demographic boundary, the share of GDP going to healthcare jumped from 7.7% in 2006 to 10.9% in 2020 (Figure 11).

Older individuals are increasingly living alone, though at present, the supply of accommodation for the elderly is focused disproportionately on mid- to upper-income earners.

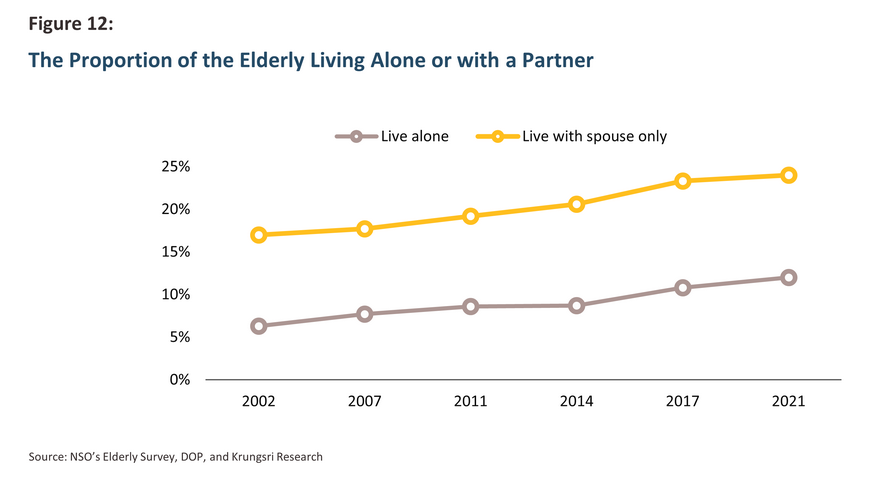

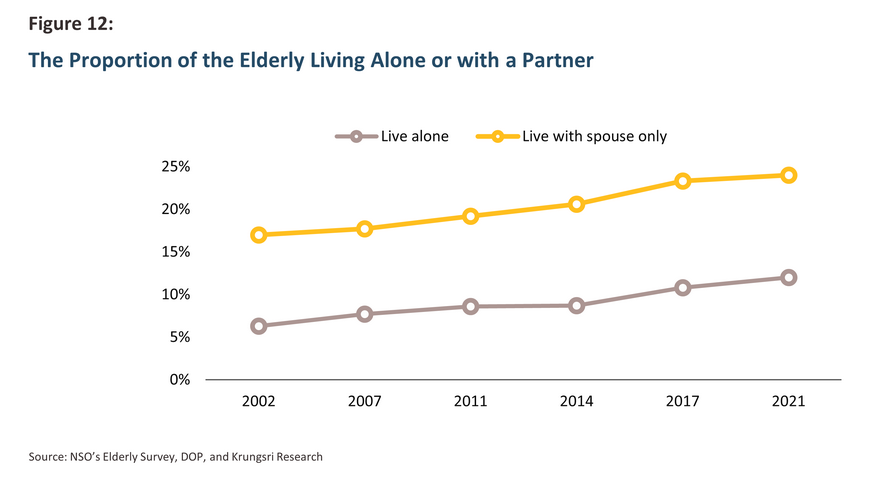

In Thailand, most over-60s live with a partner, family members, or other individuals, but the proportion living alone is increasing steadily, having risen from 6.3% in 2002 to 12% (or 1.6 million people) in 2021 (Figure 12). Likewise, the number living with just a partner has also increased, and 2.8 million retirees were in this situation in 202124/.

Typically, retirees in good health and with no special needs stay in their current accommodation (i.e., they ‘age in place’). However, they might move into an independent living facility, i.e., apartments or houses that have a shared common area where residents can meet and socialize. Those with more comprehensive needs have the option of moving into a residential care home or an assisted living community, where residents still live somewhat independently but help is available when needed. Finally, those who are no longer able to manage normal day-to-day activities can take advantage of nursing homes, where 24-hour care is on hand. Naturally, the costs entailed in staying in different types of accommodation increase in step with the facilities and level of help that is available.

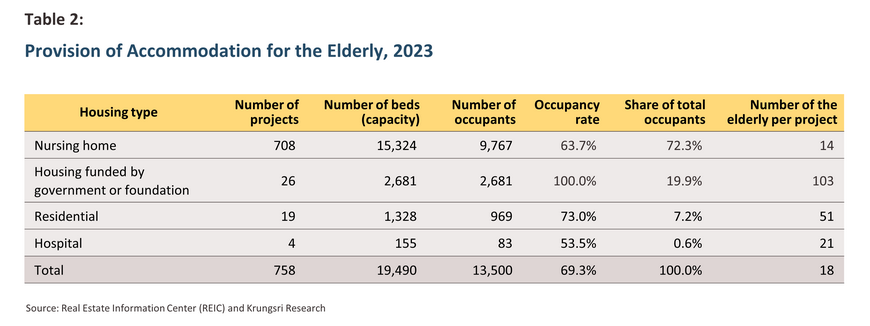

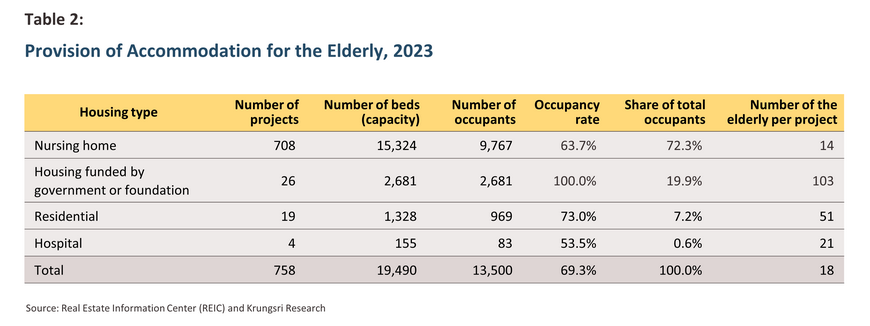

Unfortunately, the current supply of accommodation for the elderly is insufficient to meet demand and those facilities that are available are targeted at middle- to upper-income residents. A 2023 survey by the Real Estate Information Center at the Government Housing Bank25/ revealed that there were only 19,490 places available to over-60s who did not wish or who were unable to live in their current accommodation. This is sufficient to house just 1.2% of the elderly living alone and who might need more assistance. Moreover, most projects are suitable only for those with an upper-mid or higher level of wealth, and more than 60% of supply was in the Bangkok Metropolitan Region.

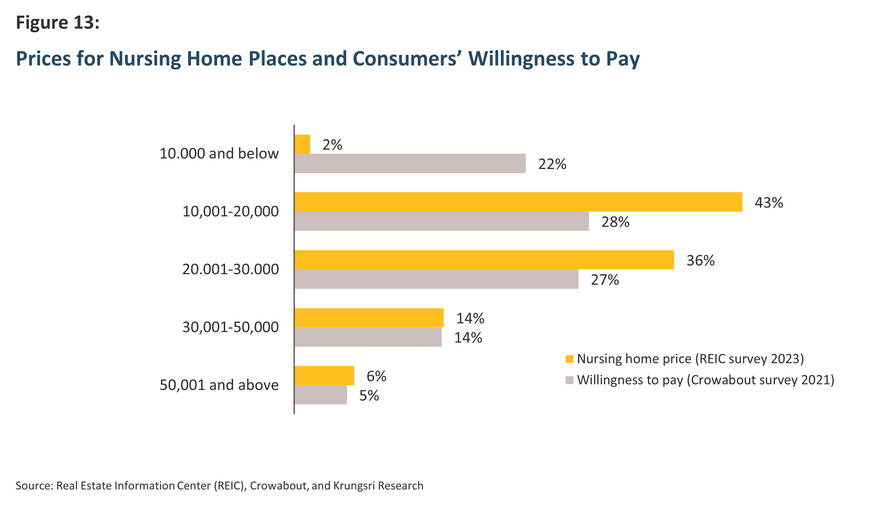

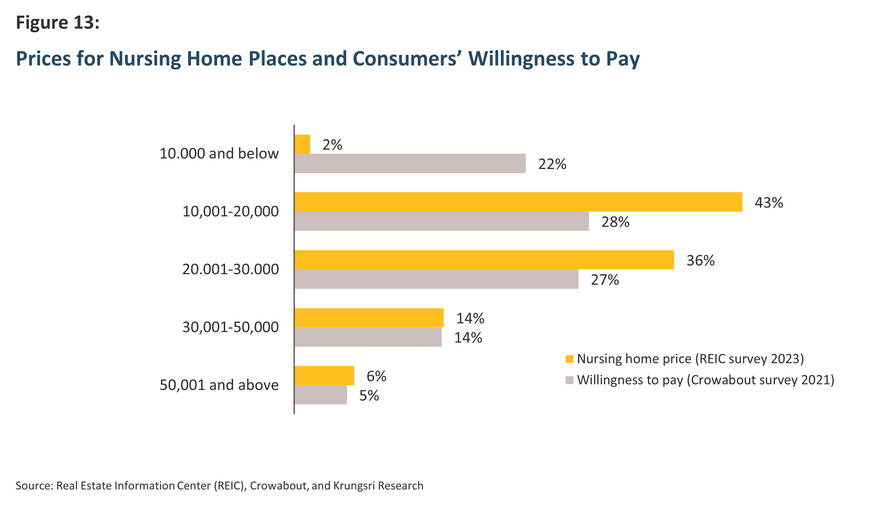

This supply was most abundant in the nursing home segment, but the disparity between the cost of these and residents’ ability to pay meant that occupancy rates averaged just 63.7%. Thus, over 80% of nursing home spaces were priced at THB 10,001-30,000 per month, and just 1.5% cost less than THB 10,000. However, this pricing structure fails to reflect consumers’ willingness to pay, since the survey shows that 22% of respondents did not want to pay more than THB 10,000 per month26/. Nevertheless, for the THB 30,000 and over segment, supply and demand were more closely aligned (Figure 13).

By contrast, occupancy rates are at 100% for accommodation for the elderly funded by the state or from charitable sources, and these projects have an average occupancy of 103 individuals each. Demand for spaces in these is high since this is generally free or carries only reduced fees, and this has also led to there being an undersupply of these. For residential projects for the elderly (e.g., the Thai Red Cross Society’s Sawangkhanivas, Bussayaniwes and Wellness City projects) occupancy rates also average 73% since some of these receive funding from the state and this helps to make their prices more attractive. However, there is a significant overall shortage of accommodation suitable for low-income retirees, and the REIC survey shows that for some government-supported accommodation, there can be as many as 2,500-3,000 people on the waiting list at any one time. Given that there are just 2,700 spaces in housing projects for the elderly funded by the government or charitable donations, capacity clearly falls far short of demand.

Access to and knowledge about technology and financial services is improving among the elderly, though this still lags behind that of other age cohorts.

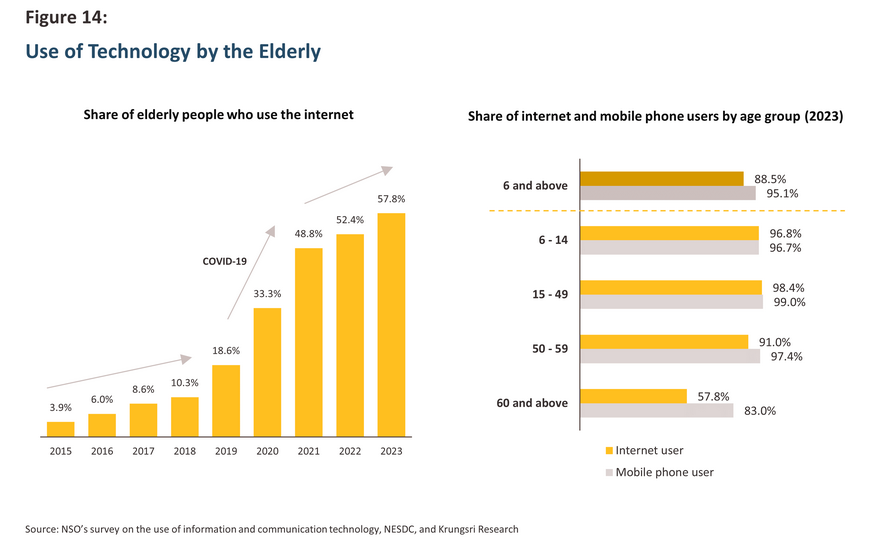

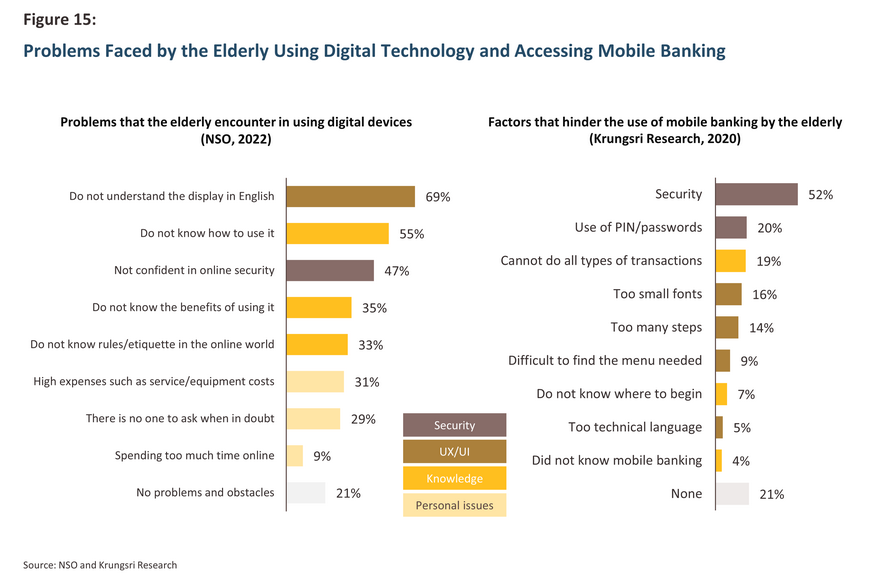

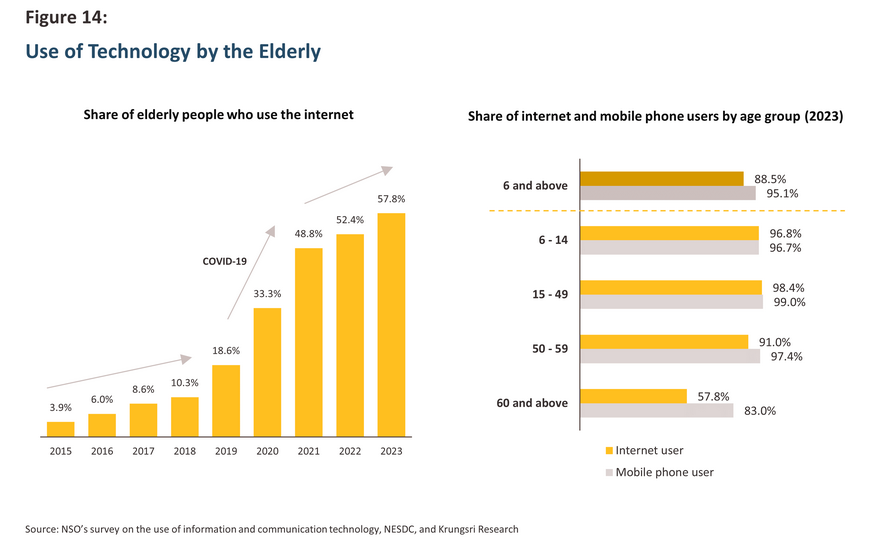

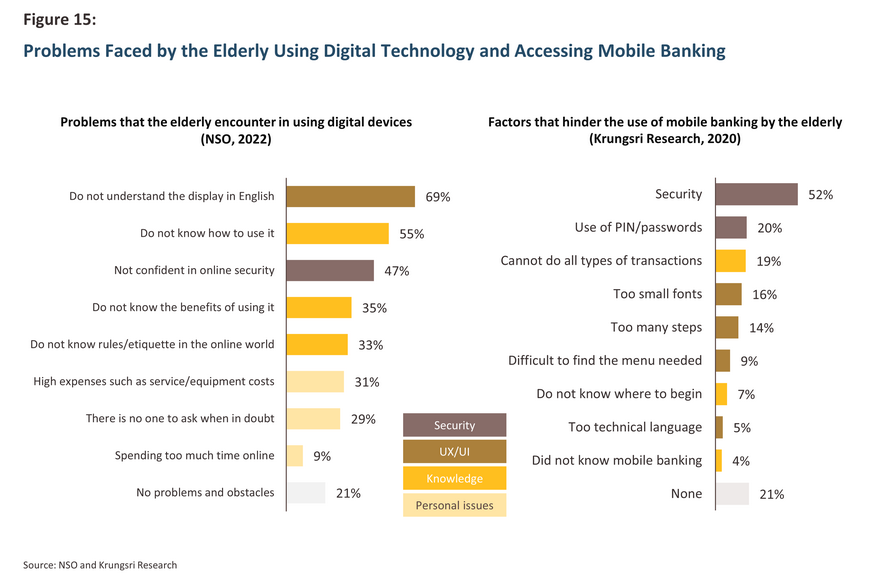

Access to the internet by the elderly is increasing, with the process having gained a significant boost from the COVID-19 pandemic, and a 2023 survey by the National Statistical Office of Thailand shows that almost 60% of over-60s are internet users (Figure 14), though among 60-69-year-olds, this rises to over 70%. The most common reason for not using the internet, cited by more than a quarter of respondents, was a lack of sufficient skill or knowledge, followed by a lack of desire or need. 83% of elderly respondents used a mobile phone, and although most had a smartphone, 80% reported experiencing problems using digital devices. The three most common pain points cited by retirees were not understanding the English used in the device (69% of users), not knowing how to use their device generally (55%), and worries over cybersecurity (47%)27/. Thus, as shown in Figure 15, technology-related knowledge and skills remain a significant problem for the elderly.

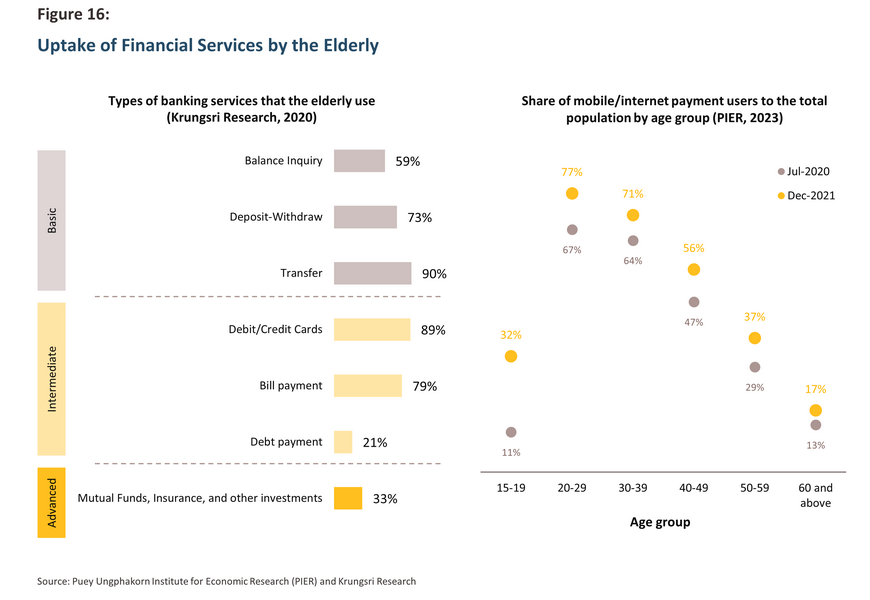

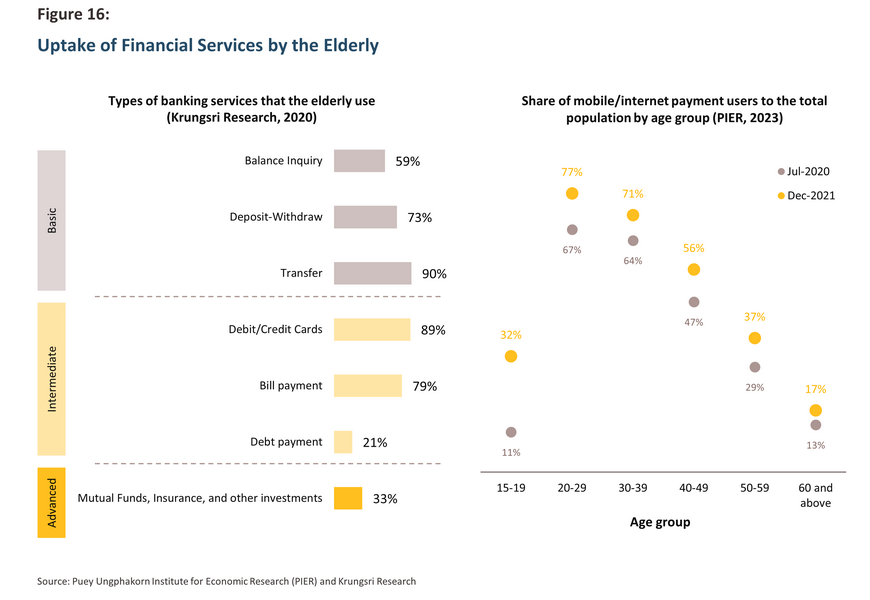

The elderly are also the most unserved demographic with regard to financial services (i.e., deposits, transfers, and payments). This is principally a result of a lack of knowledge and weak finances28/, although these problems are compounded by poor technology skills, and the result of this is that the elderly have lower rates of access to digital financial services than do all other age cohorts. It is therefore not surprising to note that analysis of the frequency of use of e-payment services29/ shows that retirees make use of these less often than other demographics; as of the end of 2021, just 17% of over-60s used mobile and internet payment systems, partly because compared to other cohorts, COVID-19 delivered a much weaker boost to uptake of these (Figure 16). In addition, the elderly make less frequent use of e-payment systems, and fewer than half of all 50-59-year-olds use these.

It can therefore be seen that the major blocks on access to online financial services stem from problems with digital and financial literacy.

-

Digital literacy: The prior survey by Krungsri Research published in 202030/ shows that the most important obstacles preventing the elderly using mobile banking services more often are fears over online safety (the security of the banking system, the risk of being defrauded, and worries over the use of passwords), followed by issues related to user experience (UX) and the user interface (UI), or what can jointly be referred to as UX/UI. These include matters such as the size of the type used on an app, the number of steps involved in carrying out a transaction or its complexity, and the language that is used (Figure 16). These problems are also faced by seniors when using digital devices.

-

Financial literacy: A survey carried out in 2022 by the Bank of Thailand on the population’s financial literacy31/ revealed that although this had improved since 2020 among those aged 57 and over, it was on average still weaker than among younger individuals. This was most pronounced in the area of financial knowledge, for example, the time value of money and how to calculate interest, and this is likely one reason why most elderly bank customers take advantage of only more basic services, such as making deposits, withdrawals, and transfers, checking account balances, using debit and credit card services, and paying service fees. By contrast, uptake by the elderly of more complicated services related to investments and insurance is sparse. Nevertheless, scores for financial behavior (e.g., budgeting for expenses and comparing information before making purchases) were not substantially different to other cohorts.

Golden opportunities in the silver economy

It is undeniable that the steady aging of Thai society is amplifying the problems described above, but alongside the deepening challenges faced by the country, the growth in the elderly demographic is generating its own economic opportunities in the form of the ‘silver economy’. Meeting the evolving needs of the ‘silver generation’ will therefore open up new markets, the most important of which are describe below.

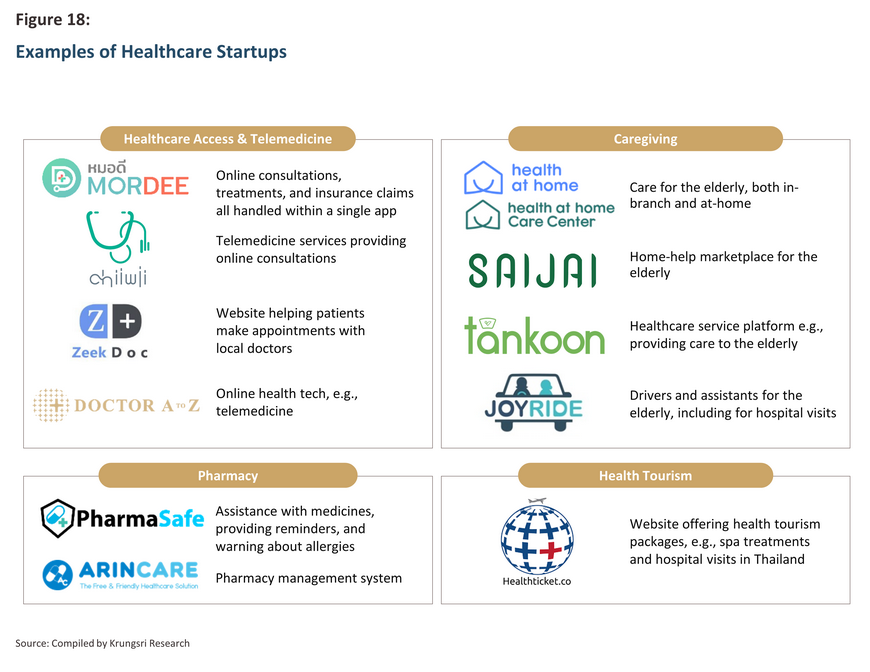

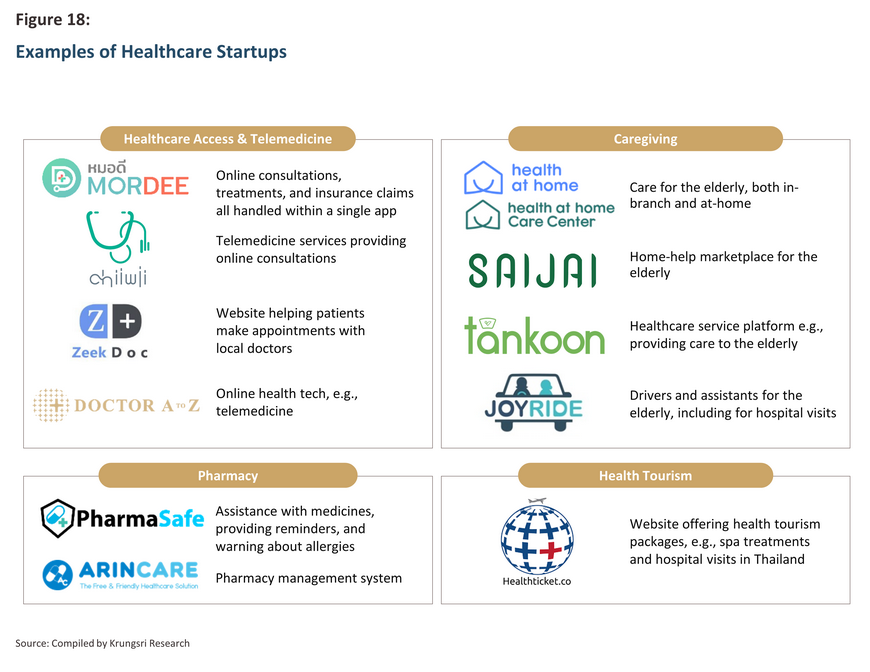

Unsurprisingly, demand for health-related goods and services is predicted to rise as the population ages, and so businesses in this sector will be presented with significant opportunities to meet expanding demand for healthcare from growth in the silver generation. In particular, these changes will affect demand for services delivered through hospitals and healthcare centers, especially for businesses targeting higher-income retirees and their families. Within the broader industry, preventive medicine and wellness-based healthcare, which put a much greater weight on preventing ill-health rather than curing it, will gain ground, while players will make increased use of medical technology that helps meet demand from the elderly and/or makes service provision easier (Figure 18).

-

Health tech is making it easier for the elderly to access healthcare services via websites and apps, examples of which include MorDee, Chiiwii and ZeekDoc. Individuals are also increasingly able to seek advice from doctors remotely through these platforms (i.e., through telemedicine services).

-

Caregiving services will be in high demand as greater numbers of the elderly look for assistance. In 2021, 0.26 million over-60s needed help completing daily activities but because finding home-help is difficult, these had nobody to assist with this. To meet this gap in the market and to provide on-demand services, platforms such as Health at Home, SAIJAI, and Tankoon have been developed, while JoyRide also provides transportation services that specifically target the needs of elderly individuals visiting doctors.

-

Health tourism will become increasingly popular for the elderly in both the domestic and international markets. One company that has already spotted these openings in the market is Healthticket, a website that offers packages for spas, health-checks, and hospital stays.

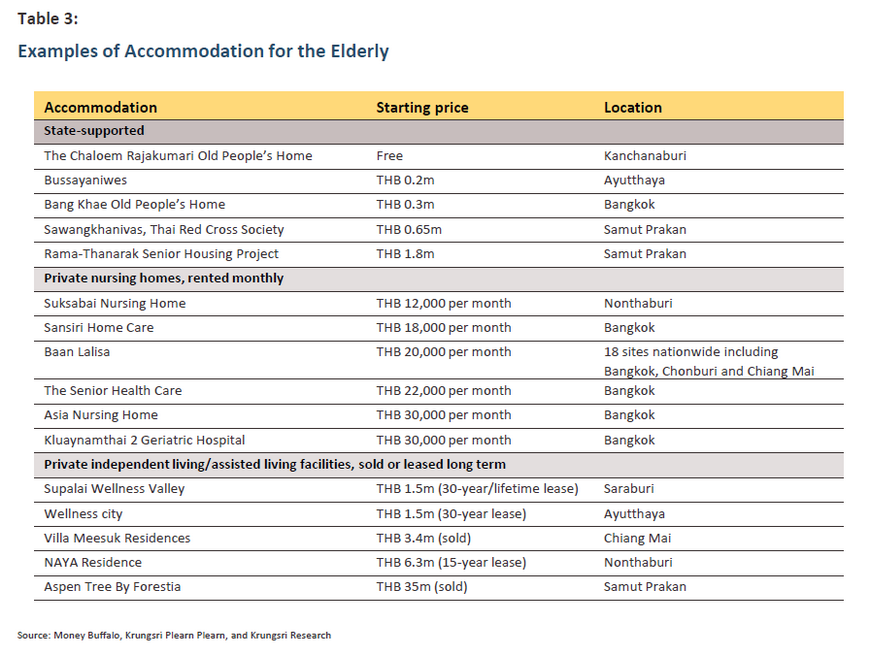

The current supply of accommodation for the elderly is both inadequate and overly focused on wealthier individuals, and so there is considerable room for expansion in this market. With occupancy rates at 100% and huge waiting lists for free or cheap government- and charity-backed accommodation, unmet demand is especially strong from low- and mid-income retirees. Potential demand for accommodation for elderly individuals who need assistance in an appropriate social and physical environment is thus significant, and this will only expand as the silver generation grows.

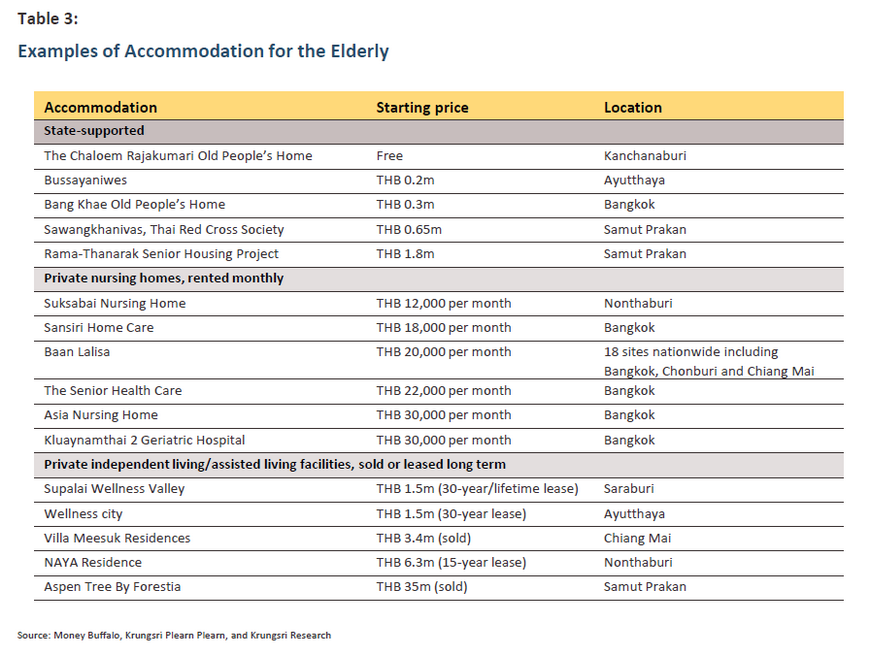

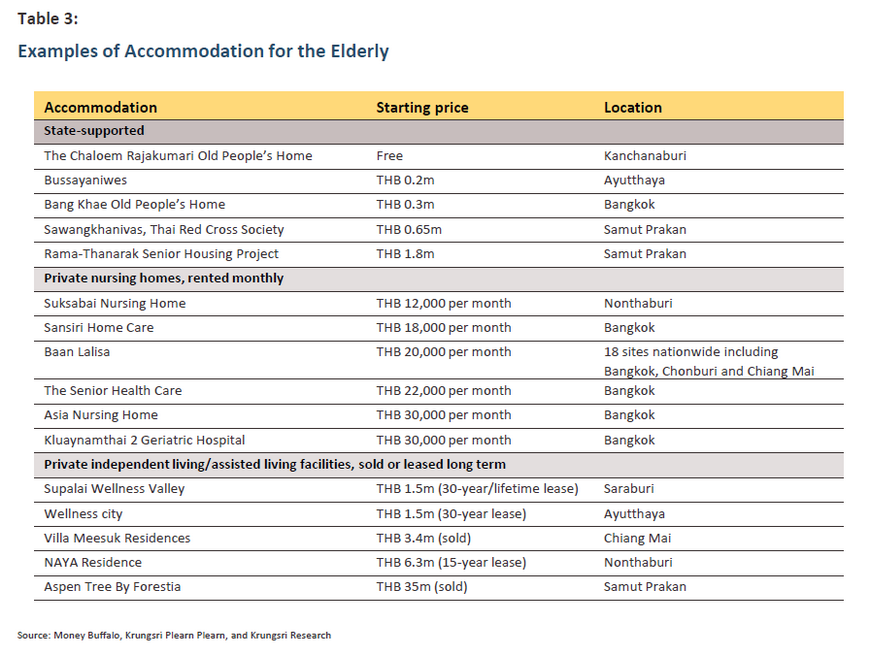

The market for accommodation for the elderly is growing, and a large number of players now compete for market share (Table 3). The most commonly found types of accommodation can be divided into the following two classes.

- Nursing homes typically provide 24-hour expert care, and so these target mid- and upper-income retirees in short-term recovery or who need specialized facilities. Accommodation for these units is paid for monthly, with charges typically in the range of THB 10,000-30,000, and examples include Baan Lalisa, Sansiri Home Care and Asia Nursing Home. However, because the supply of nursing homes has expanded significantly while prices remain above the level that can be borne by most of the market, occupancy rates are generally lower than for other types of old-age accommodation. Nevertheless, future growth in the number of the elderly living alone and in need of assistance will mean that if providers are able to diversify their offerings and to supply this at a range of price points, they will be able to build market share.

- Houses or condominiums may be specially designed for permanent occupation by the elderly, and then either sold or rented on long-term or life-long leases. This market is thus targeted at wealthier individuals who are still capable of living independently but who may need particular facilities or who would like to have access to a community of similar individuals. Prices for these units generally start at THB 1.5 million, with examples offered by Supalai Wellness Valley, Wellness city, Villa Meesuk Residences, and NAYA Residence.

Moreover, because supply is currently tilted overwhelmingly in favor of locations in the Bangkok Metropolitan Region and the main provinces, opportunities exist to meet demand for accommodation for the elderly in a more diverse range of sites. These facilities are being developed with the goal of improving elders’ quality of life and encouraging socialization either within the same age cohort or across different cohorts, and this is then changing perceptions of these facilities and boosting the market. At the same time, developments that aim to meet demand from those who prefer to ‘age in place’ are improving their designs by using fittings specifically designed for the elderly, for example by equipping bedrooms with adjustable beds, installing grab rails in bathrooms, and using non-slip tiles, and features such as these will become standard in developments targeting the silver market.

Around one-third of spending by Thai households is on food32/ and this supports a sizeable domestic food and beverage industry. Within this, as the share of the population over 60 grows to constitute a significant segment of the market (at 20% of the population), sales to the elderly will likewise expand, and Deloitte therefore expects that at 27% of the total by 203033/, the food and beverage industry will be the single largest component of the silver economy.

The importance of diet increases with age, and so the elderly are more likely to purchase healthier foods and food supplements such as milk, rice, and edible bird’s nests, while at the same time, older shoppers tend to cut back on unhealthier products or foods that can contribute to or worsen chronic conditions, for example, non-dairy creamer, eggs, MSG, and instant noodles34/. Research by The 1 Insight also shows that elderly high-income consumers generally favor buying imported fruit juices, organic vegetables, and natural yoghurt35/. Product groups that will tend to see growth opportunities as society ages will therefore include the following.

-

Aging-friendly foods: These are easy to chew, swallow and digest, and have a high nutrient content and low levels of sodium, sugar and fat. Examples of food products designed for the elderly are CPRAM’s (part of the CP group) ‘Creator’ range of easy to eat and digest meals (e.g., clear soup with tofu and minced pork, and rice soup with seabass) and the Singaporean ‘GentleFoods’, minced and pureed foods designed for those who have difficulty swallowing.

-

Functional foods: These have a high nutritional content and help to protect against the risk of disease or conditions related to aging, for example by reducing blood sugar and cholesterol levels, and improving the immune system. Examples include essence of chicken products that have added herbal ingredients (e.g., caterpillar fungus, ginseng, and ginkgo), high protein products that help prevent muscle wastage, and nutraceuticals that assist with cholesterol reduction programs36/.

Beyond its nutritional properties, when thinking about food products for the elderly, consideration also needs to be given to their taste, aroma, and tactile qualities since changes to these can help to overcome problems with the weakening of appetite that many elderly individuals experience. In addition, packaging needs to effectively communicate the product’s benefits in an easy-to-understand format, likely by using images and colors that are in accordance with the principles of universal design.

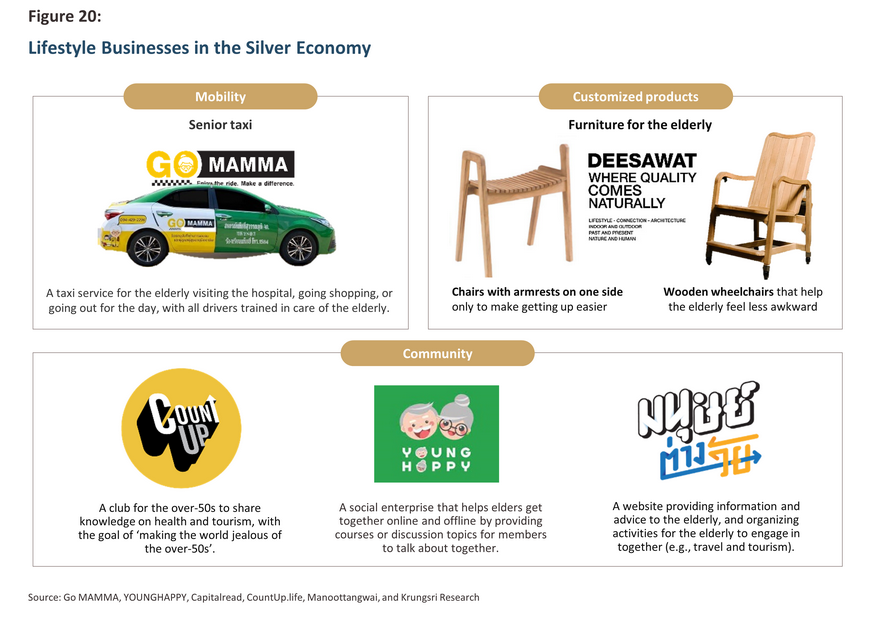

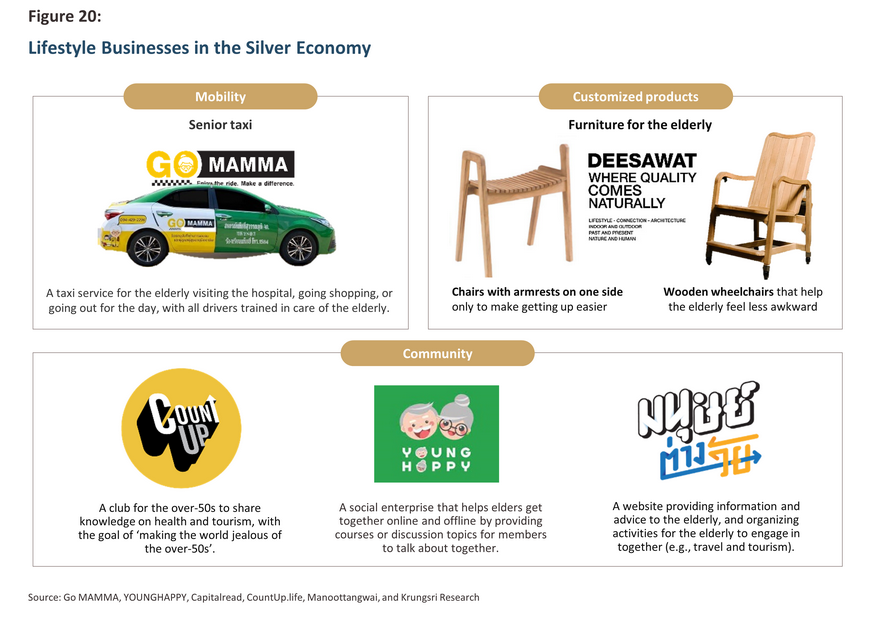

In the near future, the over-60s will comprise a significant consumer group, and manufacturers of fashion and beauty products that are able to meet the particular needs of the elderly will be presented with sizable new market opportunities. Research by The 1 Insight shows that high-income retirees are happy to spend money on lifestyle products that provide health benefits, for example orthopedic shoes and beds, on cosmetics and anti-aging skincare, and on other products that provide health benefits or otherwise make them happy. Given this, opportunities abound for products and services that are designed to address the problems routinely encountered by the elderly in their day-to-day life, examples of which cover areas as wide as chairs with armrests on one side only (so that getting in and out is easier) and taxi services for seniors staffed by drivers who have received basic training in care of the elderly (thereby giving passengers greater confidence in the quality of the service on offer).

Because retirees have much more free time than other adults, it is important that they find activities to engage in, which in addition to being pleasurable in itself also helps to avoid feelings of loneliness. Businesses that are connected to home-based activities favored by the elderly (e.g., home decorations, pet care, gardening, and communications and entertainment) will therefore benefit from the growth of the silver economy, as will those linked to activities undertaken outside the home (e.g., travel and tourism) or community activities. At present, many businesses are focused on creating communities for elders based on the sharing of information, knowledge and experiences, or on undertaking activities together, and by fostering and maintaining social connections through these, retirees are able to enjoy a higher quality of life (Figure 20).

- The electronics and digital industries

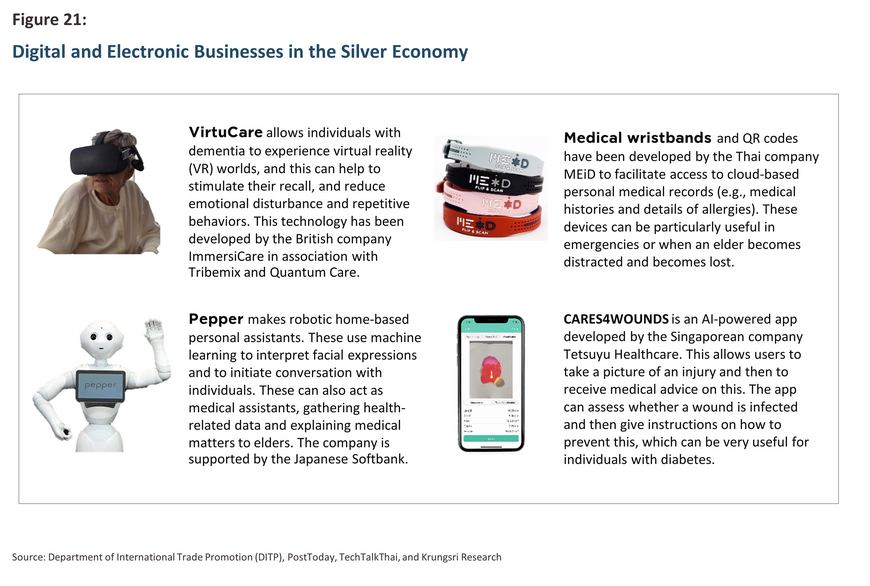

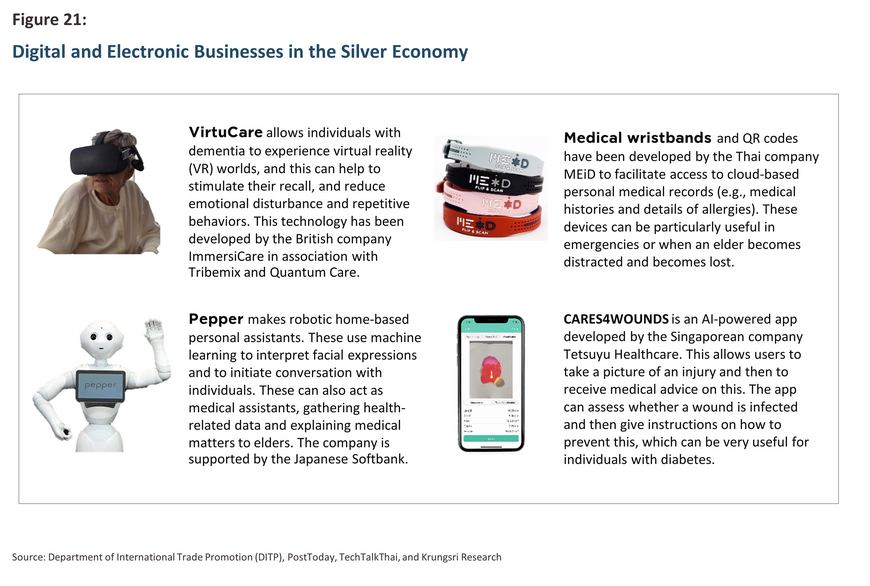

Rapid progress in technology has led to the development of devices that provide considerable assistance to the elderly, and these now help retirees to function more independently and to track their health more carefully. Examples of these include improved hearing aids, smart walking sticks, electric massage chairs, robotic personal assistants, and digital devices that allow users to monitor health indicators such as blood pressure and oxygen levels. Smart watches also help to provide continuous tracking of the wearer’s health, collecting data and warning of any potential problems. Demand for devices such as these will naturally strengthen in the future.

In addition, the market for goods and services for use with individuals who require specialized therapy or who need care for particular conditions will continue to broaden. For example, virtual reality (VR) headsets can be used to create virtual environments for individuals with dementia, and this can help to stimulate a patient’s memory and reduce repetitive behaviors. Wristbands and QR codes can link to cloud-based datastores and so act as virtual health records, and these can be especially useful for elders with memory loss or who are at risk of wandering. For those with paralysis, smart electric wheelchairs can be controlled using only the eyes, while AI-enabled apps can be used to assess injuries and to give guidance on how best to treat these, and this can be especially useful for individuals with diabetes.

Because many Thai over-60s experience difficulties with managing their finances and accessing financial services, the emergence of the silver economy will bring with it an enormous range of new opportunities for the finance industry. Financial institutions should therefore design and promote new financial products targeting this market, for example high-yielding deposit accounts with flexible terms, and occupational and business loans. In addition, the elderly are at much greater risk than the general population of experiencing health problems, but most individuals continue to rely on treatment options provided under the gold card. There is thus space to develop the market for products that help elders access better healthcare, from prevention and screening through to treatment, examples of which include health insurance, medical loans, and credit cards that provide rewards for health-related spending.

Financial products designed specifically to meet the needs of the elderly fall into the four categories of deposit facilities, loans, insurance, and debit and credit cards. Details of these are given below.

1) Savings accounts for the elderly: These would be aimed at the over-55s or the over-60s and could include both regular and tax-free fixed-term deposits, with small initial deposits and high levels of interest (see Table 4 for examples). Many banks also offer high-interest deposit accounts to general savers, thus including the elderly, that tie the interest that is paid to restrictions on when deposits may be withdrawn.

2) Loans for the elderly: On the one hand, there is significant potential for growth in this market, but on the other, successfully exploiting these possibilities poses a challenge for banks since lending to the elderly carries with it higher levels of risk with regard to borrowers’ income and life expectancy. Loans are thus best restricted to those for retired civil servants and business owners, who are likely to be better able to meet loan repayment schedules. However, other loans are also available to all age groups, including the elderly, and these can be divided into the following (see Table 5).

-

Loans for retired civil servants: Many financial institutions offer loans to retired civil servants that are secured against the right to a lump-sum payment paid to their next of kin37/. The maximum loan available is capped at the amount due to the next of kin, with the term limited to no more than 30 years and the combined age of the borrower and the repayment term no greater than 90 years. Payments may be deducted monthly from pension payments.

-

Occupational and business loans: These are typically short-term loans issued to MSMEs or entrepreneurs starting up in business. Although these are not targeted specifically at the elderly, they may help older individuals generate income. Borrowers should usually be no more than 70 years old.

-

Home loans: Older borrowers can apply for long-term loans to buy, renovate, or repair their house, or alternatively, they may refinance it. Generally, banks specify that the borrower’s age plus the term of the loan should not exceed 70-75 years, with the longest payment term set at 30-40 years.

-

Reverse mortgages are a way of allowing home owners to release the equity that they have built up in their home38/. Borrowers aged 60-80 are able to use property that they own as collateral against a loan from the bank, with this paid either monthly or as a lump sum. This thus helps to turn a house into a source of income while the owner is still living in it since it is only on their death, or at the end of a fixed period of time, that the loan becomes due. At this point, if the original owner or their heirs do not clear the loan, ownership of the property will be transferred to the bank. Given the increase in the number of elderly individuals who are childless or living alone, reverse mortgages are likely to become increasingly popular, but lenders may face challenges from home owners’ heirs, while they will also need to bridge the lengthy gap between making the loan and being repaid for this

3) Insurance products for the elderly: As the elderly demographic expands, opportunities will increase for insurance companies to develop products that address the needs of retirees, especially with regard to health and finance. The ages covered by life insurance have generally increased so that those aged 50-75 are now able to buy insurance that is valid until they are 80-90 years old, or in some cases for life. It is also possible for the elderly to take out health insurance, though the premiums will rise with age and individual risk, while insurance can also be bought to cover individual conditions, such as Alzheimer’s or strokes. For those who are not yet old but who wish to prepare for this and to ensure that their finances are in order when they retire, it is possible to start paying into an annuity from the age of 20 or 25. These schemes will start to pay out from 55 onwards and these payments will continue until the individual is at least 85, though this may be until they are 99. When arranging an annuity, plans can be chosen according to the regularity, duration, and amount of the payments that will be made39/. (See Figure 22 for examples of insurance products for the elderly).

4) Credit/debit cards: Credit and debit cards for the elderly can take two forms: cards that are issued only to older consumers, so for example, these might specify that applicants must have a minimum age of 4040/, and cards that are issued to all adults, including older consumers, so for example those that are issued to holders aged 20-7041/ or 18-8042/. In addition, some issuers also run promotions that aim to encourage spending by the elderly. These thus offer rewards for spending made in old people’s care centers or hospitals43/, those paying for healthcare for seniors may get cashback payments44/, or account holders may be given coupons that can be used in payment for health screening services45/. Since older individuals typically spend more heavily on healthcare, these kinds of promotions can help card issuers preserve their user base while also attracting new customers.

In addition to the products described above, demand will continue to strengthen for financial services that help individuals prepare for their retirement, such as retirement mutual funds46/, financial planning and advice, and estate management services. However, successfully exploiting these opportunities will depend on providers of financial services designing a diverse range of products that meet demand within different market segments and that are a close match for individual circumstances (e.g., income, health and post-retirement lifestyle). More important than this, though, will be designing and delivering products in a way that takes into account the needs of the elderly and their possibly weaker financial literacy and less fluent tech skills.

Krungsri Research view: The aged society is both a policy problem to be pondered and a business opportunity to be pursued

The aging of society is one of a number of global megatrends affecting Thailand, and the country is rapidly moving through the various stages of this process. Thus, Thailand officially became an aged society in 2023, and it will not be long until it transitions to a super-aged society, but although this will create a range of economic and social challenges, it will also generate new markets, and so in the view of Krungsri Research, this is both a policy problem to be pondered and a business opportunity to be pursued.

Principal policy challenges

The elderly face the twin problems of insufficient income and rising expenses, and this has the potential to have significant negative effects on day-to-day quality of life. Policymakers should thus focus their efforts on ensuring that retirees: (i) have a stable and adequate source of income; and (ii) face lower expenses, though not such that this impacts their quality of life.

Income: In Thailand, the majority of over-60s are dependent on external sources of income, whether that is the state or members of their family, and this may be inadequate to meet expenses. The elderly should thus be encouraged to seek other sources of income, either from work or savings.

-

Raising employment rates among the elderly: At present, labor force participation rates for the elderly run to just 37.6%, almost half of the average across the population, and so those who want to work should be helped to do so through measures such as raising the retirement age from 55 or 60 to 65 or over, as in Japan and Europe47/. To ensure that their skills match the needs of employers, training should be provided for older individuals and seniors should be actively matched with suitable job openings, while providing adequate compensation for the elderly is also crucial since inadequate pay is the problem most commonly reported by older workers48/. The government could further tilt labor markets in favor of elderly employees by putting in place tax incentives for their employers49/ and by providing funding for older entrepreneurs50/. Many of these measures are in fact already in place, but current policies need to be reviewed and revised, and implementation should be tightened beyond the merely voluntary.

-

Encouraging greater saving for retirement: A large share of the workforce retires with no or inadequate pensions or savings, though this is a particular problem for those in the informal economy and who are outside the scope of compulsory saving schemes. These individuals should thus be encouraged to join voluntary savings programs, such as those provided by the National Savings Fund or articles 39 and 40 of the Social Security Fund. Likewise, workers in formal employment should be provided with additional savings options beyond the mandatory social security system. Provident funds would be the most appropriate form for this to take, and awareness of the importance of these should be raised among both employers and employees. Beyond this, knowledge and training in financial planning should be provided to individuals while they are still working since financial health plays as important a part as physical health in securing post-retirement quality of life.

Expenses: As with everyone else, the elderly face core expenses related to food, clothing, accommodation, and medical care, though for older individuals, the latter is likely to increase sharply as they age. However, many retirees have difficulty accessing appropriate healthcare and accommodation, and so the authorities should tackle these problems by undertaking the following.

-

Encourage personal healthcare and promote choice: Healthcare costs increase with age, though at a much sharper rate if an individual has multiple chronic conditions, and so to cut costs for the individual, their family, and society at large while also building the foundations for a healthier old age, members of the public should be encouraged to engage in preventative healthcare. In addition, the elderly should be able to exercise a greater degree of choice over their healthcare, for example by taking out private insurance to supplement the options provided for by the state Universal Health Coverage. This would then help elderly individuals gain easier access to treatment and reduce the financial burden placed on the public purse.

-

Support the development of old-people’s accommodation for low-income earners: Accommodation for less wealthy individuals is in short supply since the market is much more heavily focused on higher-income retirees. The supply of nursing homes and old-people’s homes at the cheaper end of the market is therefore very limited and so to help those with lower incomes who are unable to age in place, the government should encourage greater provision of the latter.

In addition to helping Thai elders enjoy a better post-retirement quality of life, the authorities should simultaneously move to foster the development of the silver economy by promoting the development of the relevant parts of the medical, healthcare, tech, food, real estate, and consumer product markets.

Opportunities in the silver economy

A wide swathe of the economy will benefit from the aging of society and the growth in the silver economy. Clearly, the market for healthcare services will expand as average ages rise, while in the real estate sector, demand for assisted living facilities and for properties designed to meet the challenges faced by the elderly will also strengthen. Similarly, sales of food, lifestyle products, electronics and digital services will benefit from these demographic changes and the emergence of elders as a major consumer group that is in the market for a diverse range of goods and services. Overall growth in the silver economy will further benefit from the following.

-

The market is diverse and encompasses individuals with a wide range of purchasing power. (i) High-spending elders are typically knowledgeable and experienced, and are happy to spend on convenience items, beauty products, and entertainment. (ii) The remainder may have weaker purchasing power but they are much more numerous and these thus comprise a significant underserved market, especially in the areas of accommodation, health, and finance.

-

The diversity of sub-groups covered by ‘the elderly’ will support vigorous growth in business opportunities. The general cohort can be divided into: (i) the pre-retired, or those preparing to retire who are aged 50-59 and who typically have higher incomes and display greater use of technology than retirees; (ii) the young old (‘yold’), aged 60-69; and (iii) the late old (‘lold’), aged 70 and above51/. In addition, the elderly can be classified according to their health into the active, the housebound, and the bedbound, and these various groups and their subdivisions comprise a very varied market for goods and services. Beyond the over-60s, the ‘sandwich generation’, that is, individuals responsible for looking after both their parents and children, are also responsible for purchasing decisions relating to goods and services for the elderly.

-

The market is expansive and the level of competition is relatively relaxed. Business expansion will benefit from growth in the domestic market, which comprises both Thai elderly and non-Thais wishing to spend their retirement in the country, and in exports, since the trends described above are being repeated worldwide. Competition for the elderly demographic is also less intense than it is for working-age individuals, and in the future, the size of the former will approach that of the latter.

Most importantly, players looking to exploit opportunities in the silver economy will need to clearly understand the ways in which behaviors, demand, and consumer pain points differ in different market segments, and then supply these with the most appropriate products and services. Moreover, rates of technology uptake are rising among older consumers and in addition to increasingly shopping online, these are engaging more with social media, especially Facebook and Youtube52/. The latter platforms will therefore play an important role in advertising and marketing plans directed at seniors.

Social impacts of the banking and finance industry

Within these broader changes to the economy, the banking industry has the opportunity to develop new financial products that address some of the challenges generated by the transition to an aged society. These should have the following characteristics.

-

Banks should help the elderly access financial products that support an improved quality of life. These could include savings accounts or loans that help elders undertake new types of work that generate additional income, add to savings, and increase their ability to spend on areas that become important later in life, such as healthcare, adapting homes to age in place, or paying for specialist care.

-

Banks need to ensure that new products aimed at this silver market are designed and delivered appropriately, and that they address elders’ core needs, in particular their physical health, their tech skills, and their financial literacy. For example, mobile banking apps need to be designed with large buttons and typefaces, they should use mostly Thai, online procedures should be streamlined and simple, and these apps should put safety concerns front and center.

Finally, by acknowledging and adapting to the emergence of the elderly as a core part of the market, the banking industry will have an expanded role to play in improving elders’ access to financial services, improving seniors’ quality of life, and supporting the development of the silver economy. By doing so and by playing an active part in this aspect of social development, banks will underscore their commitment to environmental, social and governance (ESG) principles.

References

Deloitte. (2019). The Silver Avalanche Are you prepared?”. Retrieved from https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/strategy/sea-so-monitor-deloitte-the-silver-avalanche.pdf

Department of Older Persons. (2023). “Report on the situation of the Thai elderly in 2022”. Retrieved from https://www.dop.go.th/th/ebook/010

Glinskaya, E., T. Walker, and T. Wanniarachchi. (2021). “Caring for Thailand’s Aging Population”. World Bank. Retrieved from https://documents1.worldbank.org/curated/en/249641622725700707/pdf/Labor-Markets-and-Social-Policy-in-a-Rapidly-Transforming-Caring-for-Thailand-s-Aging-Population.pdf

International Labour Organization. (2022). “Social Protection Diagnostic Review: Review of the pension system in Thailand”. Retrieved from ilo.org/wcmsp5/groups/public/---asia/---ro-bangkok/documents/publication/wcms_836733.pdf

Mercer and CFA Institute. (2023). “Mercer CFA Institute Global Pension Index 2023”. Retrieved from https://www.mercer.com/assets/global/en/shared-assets/global/attachments/pdf-2023-mercer-cfa-global-pension-index-full-report-11-09-2023.pdf

National Statistical Office. (2023). “The 2023 Health and Welfare Survey”. Retrieved from https://www.nso.go.th/nsoweb/storage/survey_detail/2023/20230929131046_99194.pdf

Siddhartha Sanghi. (2022). “Can Population Aging Explain Rising Healthcare Spending Across Countries?”. Retrieved from https://research.stlouisfed.org/publications/economic-synopses/2022/06/30/can-population-aging-explain-rising-healthcare-spending-across-countries

TDRI. (2023). “How does an aging society affect the social, economic, health, and medical expenses of Thai households?”. Retrieved from https://tdri.or.th/wp-content/uploads/2023/06/wb202.pdf

World Health Organization. (2020). “How will population ageing affect health expenditure trends in Japan”. Retrieved from https://extranet.who.int/kobe_centre/sites/default/files/How%20will%20population%20ageing%20affect%20health%20expenditure%20trends%20in%20Japan.pdf

1/ The UN classifies aging countries into 3 levels: (i) If 10% of the population is over 60 or 7% over 65, the country is classified as an ‘aging society’; (ii) if 20% of the population is over 60 or 14% over 65, it is an ‘aged society’; and (iii) when 20% of the population is over 65, the country becomes a ‘super-aged society’.

2/ Department of Older Persons (DOP), https://www.dop.go.th/th/statistics_page?cat=1&id=1

3/ Bangkok Post, https://www.bangkokpost.com/business/general/2643057/thailands-silver-economy-trends-and-opportunities

4/ UN World Population Prospects 2022

5/ If the population were lined up in order of age, the median age would be the age of the individual exactly in the middle.

6/ Bangkok Post, https://www.bangkokpost.com/opinion/opinion/2504556/old-poor-and-unemployable

7/ National Statistical Office (NSO)’s Labor Force Survey (2023Q3),

8/ The old-age dependency ratio is the proportion of the population of working age (15-59) relative to the population aged 60 or over.

9/ NSO’s Elderly Survey (2021), https://www.nso.go.th/nsoweb/storage/survey_detail/2023/20230731135832_95369.pdf

10/ As of March 2024, the minimum wage has been set at THB 330-370/day (Ministry of Labour, https://www.mol.go.th/อัตราค่าจ้างขั้นต่ำ)

11/ The National Credit Bureau reported that among those aged 50 and over, overall indebtedness had increased in 2022 relative to the 2019 pre-COVID total. This was largely due to additional debts related to farming activities and loans for motorcycles (Thansettakij, https://www.thansettakij.com/business/economy/578569).

12/ NSO’s Working Elderly Survey (2022), https://www.nso.go.th/nsoweb/storage/survey_detail/2023/20230505101915_73227.pdf

13/ Ministry of Labor’s Working Elderly Survey (2022),http://nlrc.mol.go.th/imagesAll/2022426853528_(Final%20Report)%20โครงการศึกษารูปแบบการทำงาน%20การจ้างง.pdf

14/ The National Savings Fund is a voluntarily funded contributory pension scheme that helps to provide income to retirees who have worked in the informal sector. The fund is open to self-employed Thais aged 15-60 who work as farmers, sellers or independent workers, or who are members of the public. These individuals should not be covered by a Social Security Fund pension, the Government Pension Fund, a provident fund, or any other pension scheme to which the state or an employer makes contributions. Individual contributions can be made to a maximum of THB 30,000 per year, and these will be matched by state contributions of up to THB 1,800 per year. Payments will then be made to an individual once s/he is 60 years old (National Savings Fund, https://www.nsf.or.th/sites/default/files/กองทุนการออมแห่งชาติ%20%28กอช.%29%2031.03.2566.pdf).

15/ NSO’s Elderly Survey (2021)

16/ NSO’s Informal Worker Survey (2023),

17/ The National Pension Fund has been proposed as a provident/pension fund drawing compulsory contributions from all 15-60-year-old workers in the formal economy not making contributions to another provident fund. This would include workers in the private sector, temporary employees, and employees of the state and state enterprises. Contributions would be required from both employers and employees of at least 3% of earnings up to a maximum of THB 60,000 per month, with the minimum contribution increasing to a maximum of 10% within 10 years. On retirement aged 60, those making contributions would then be able to draw on these. The act establishing the National Pension Fund was drafted by the Ministry of Finance and approved by the cabinet in 2021, and this is now under consideration by the Office of the Council of State (Fiscal Policy Office, https://www.fpo.go.th/main/Important-economic-policy/7776.aspx)

18/ The Mercer and CFA Institute Global Pension Index 2023 evaluates national pension provision in the three areas of adequacy, sustainability, and integrity. The Index awarded Thailand a grade D, the worst grade available, though countries gaining a similarly mark included the Philippines, India, Turkey, and Argentina. Malaysia, South Korea, and Japan were awarded a C+, while Singapore achieved a B+ (Mercer, https://www.mercer.com/assets/global/en/shared-assets/global/attachments/pdf-2023-mercer-cfa-global-pension-index-full-report-11-09-2023.pdf)

19/ World Health Organization (2020). “How will population ageing affect health expenditure trends in Japan”.

20/ TDRI. (2023). “How does an aging society affect the social, economic, health, and medical expenses of Thai households?”. Retrieved fromhttps://tdri.or.th/wp-content/uploads/2023/06/wb202.pdf

21/ National Health Security Office (NHSO), https://www.hfocus.org/content/2023/10/28769

22/ Siddhartha Sanghi. (2022). “Can Population Aging Explain Rising Healthcare Spending Across Countries?”. retrieved from https://research.stlouisfed.org/publications/economic-synopses/2022/06/30/can-population-aging-explain-rising-healthcare-spending-across-countries

23/ Glinskaya, E., T. Walker, and T. Wanniarachchi. (2021). “Caring for Thailand’s Aging Population”. World Bank.

24/ NSO’s Elderly Survey (2021)

25/ Real Estate Information Center (REIC), https://www.reic.or.th/Activities/PressRelease/199

26/ From data on the price of accommodation that the survey respondents (the elderly or their family) are prepared to pay, Crowdabout (2021), https://crowdabout.io/blog/senior-market-nursing-home/

27/ NSO’s survey on the use of ICT, https://www.nso.go.th/nsoweb/storage/survey_detail/2023/20230929102632_92912.pdf

28/ Bank of Thailand and NSO’s Financial Inclusion Survey (2022), https://www.bot.or.th/th/research-and-publications/articles-and-publications/articles/article-2024mar19.html

29/ From analysis of data on use of e-payment services between July 2020 to December 2021 (18 months) from the 5 largest banks and covering 80% of all transactions nationally, by Thiti Tosborvorn et al (Puey Ungphakorn Institute for Economic Research (PIER), https://www.pier.or.th/abridged/2023/05/)

30/ For more details, please see: https://www.krungsri.com/th/research/research-intelligence/ri-elders-20

31/ Bank of Thailand and NSO’s Financial Literacy Survey (2022),

32/ NSO’s Household Socio-Economic Survey (2023),

33/ Deloitte, https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/strategy/sea-so-monitor-deloitte-the-silver-avalanche.pdf

34/ Bangkok Bank SME, https://www.bangkokbanksme.com/en/silver-economy-marketing-elderly

35/ The 1 Insight, https://workpointtoday.com/the-1-silver-spenders/

36/ Nutraceuticals are foods or food supplements that have medical properties and that provide health benefits. These may help to prevent against or to cure diseases and to slow the aging process, https://www.foodnetworksolution.com/wiki/word/1006/nutraceutical-โภชนเภสัช

37/ The government makes payments to civil servants’ next of kin. These are calculated at 30-times their monthly pension plus any living allowance less any payments made to date and can be used as collateral against loans https://www.excise.go.th/cs/groups/public/documents/document/mjaw/mdc0/~edisp/webportal16200074801.pdf

38/ Specialized financial institutions (the Government Savings Bank and the Government Housing Bank) have been piloting reverse mortgages since 2018-2019. Currently, these offer reverse mortgages with a maximum value of THB 10 million, with a term of no more than 25 years and the combined age of the borrower and loan term not more than 85 years (https://www.gsb.or.th/personals/reverse-mortgage/ and https://www.ghbank.co.th/product-detail/reverse-mortgage-loan)

39/ The Stock Exchange of Thailand, https://www.set.or.th/th/education-research/education/happymoney/knowledge/article/89-tsi-do-retirement-planning-with-annuity-insurance

40/ KTC Senior Platinum Mastercard https://www.ktc.co.th/credit-card/generic/ktc-senior-platinum-mastercard

41/ GSB Prestige Credit Card, https://www.gsb.or.th/personals/prestige-credit-card/#section4

42/ Krungthai Happy Life Debit Card, https://krungthai.com/th/personal/cards/debit-card/550

43/ Holders of KTC credit cards who spend at least THB 30,000 will receive free adult diapers. https://www.ktc.co.th/promotion/hospital/hospital/nursing-home

44/ Holders of Krungsri credit cards aged 60 or over who use their card to pay for hospital treatments will receive cashback payments of up to THB 6,000, https://www.krungsricard.com/th/promotion/Hospital-Elderly-Jan23

45/ Coupons that can be used to pay for Cogmate Brain Health Test Kits are available to Krungsri credit card holders, https://www.krungsricard.com/th/Promotion/Cogmate

46/ Retirement mutual funds help to facilitate long-term saving. These can be drawn on once an individual is 55 or over, provided that at least 5 years of payments have been made. During the period of saving, no dividends or other payments are made, but contributions can be set against tax up to a total of THB 500,000, including other retirement-related savings and to a total of 30% of assessable income (https://www.krungsri.com/th/krungsri-the-coach/life/retirement/well-earned-retirement-with-rmf)

47/ Data from the Hello Work employment center in Tokyo, Japan, https://asia.nikkei.com/Spotlight/Work/Japan-retirement-trends-job-seeking-seniors-double-in-10-years

48/ The Ministry of Labour has issued guidelines on employing over-60s. These request that wages should be at least THB 45/hour, but this is voluntary, not compulsory, https://www.mol.go.th/wp-content/uploads/sites/2/2019/03/prakaasphuusuungaayu.pdf

49/ Since 2016, the Ministry of Finance has allowed companies employing staff over 60 years old to set their wages or salary against tax at double the actual rate, https://area3.labour.go.th/attachments/article/46/dg290.pdf

50/ The Department of Older Persons provides interest-free occupational loans to the over-60s to a maximum value of THB 30,000 per person, or to a maximum of THB 100,000 for groups of 5 or more. These are repaid in installments over a period of 3 years, https://olderfund.dop.go.th/บริการให้กู้ยืมเงินทุน/

51/ Creative Talk, https://creativetalkconference.com/the-trend-of-the-silver-economy-the-blue-ocean-business-of-the-future/#:~:text=ธุรกิจ%20Silver%20Economy%20คือเทรน,ในอนาคตอันใกล้นี้

52/ A survey of media consumption carried out by PHD Datalab shows that in Thailand, the elderly prefer to use Facebook, followed in order by television, Youtube, and streaming platforms, https://www.warc.com/newsandopinion/opinion/apac-2024-outlook-understanding-thailands-fast-growing-silver-generation-social-media-adopters/en-gb/6419