Executive Summary

Indonesia's financial landscape is rapidly being reshaped by the digitalization trend, entering the era of digital finance. This digital finance wave, mainly driven by digital payments, is now moving towards other innovative digital financial services. This transformation is impacting both the economy and the financial system. Economically, it holds promising potential to address the country’s financial constraints and to unleash economic potential by bridging financing gaps. Financially, it enhances efficiency and innovation within the financial system. In addition, the transformation presents promising business opportunities, especially in untapped market segments. However, challenges persist in this journey. Low financial literacy levels, inadequate internet infrastructure in remote areas, and the complexities of diverse populations, all require ongoing efforts from stakeholders.

Introduction

Financial digitalization is the key to unlocking growth potential by bridging financial gaps.

Indonesia is the world's fourth most populous country and the largest economy in Southeast Asia. The economy has been growing steadily, with GDP growth averaging 5 percent per year over the past decade. Indonesia has several strengths, including a large population, a growing middle class, and a favorable investment climate. In addition, Indonesia's abundant natural resources have attracted foreign investment. Despite the economic progress made, Indonesia’s economic productivity has been capped by low financial inclusion, and a large financing gap in the micro-, small-, and medium-sized enterprise (MSME) sector, a vital component of the economy. A lack of access to formal banking services has capped their ability to access capital, limiting their growth potential.

The digital technology wave in the financial sector, further accelerated by the surge in online transactions during the COVID-19 pandemic, has propelled Indonesia's financial landscape into the era of financial digitalization. This transformation has significant implications for both the financial sector and the economy. In the financial sector, digital innovation has led to the emergence of digital banking and Fintech companies, as well as a wide range of innovative financial services, including digital payments, peer-to-peer (P2P) lending or digital lending, wealth management (Wealthtech), and insurance (Insurtech). Although there has been an increase in financial service accessibility for the Indonesian population, there are still considerable gaps in financial access. The government agencies in Indonesia are particularly hopeful that the shift towards digital finance will address and overcome these structural limitations, unlocking the economic potential of the country.

This article will address the following key questions: how is digitalization in finance evolving in Indonesia’s financial landscape? What are the implications for the economy and the financial sector? What are the challenges and business opportunities?

Developments of Indonesia’s financial landscape with a focus on financial digitalization

Indonesia’s financial landscape transforms through digital transformation, fueled by demand for digital services and supportive regulations.

Aligned with global trends, consumer behavior, and business practices in Indonesia have undergone significant changes, primarily driven by the digital wave. Consumers have increasingly shifted towards conducting transactions through online platforms for greater convenience. This transformation has been further accelerated by the impact of the COVID-19 pandemic, coupled with supportive factors within the country. A large population of unbanked individuals, the surge in smartphone usage and internet penetration, and regulations promoting financial digitalization have paved the way for the emergence of online banking solutions, digital banks, and Fintech platforms. These factors have contributed to a significant transformation in Indonesia’s financial landscape. The developments can be viewed from three perspectives: financial institutions, the types of financial services, and regulations.

- From the perspective of financial institutions

The synergy of traditional and digital banks with Fintech entities is redefining Indonesia's financial sector, blurring the lines between established and emerging players.

Development can be observed in both licensed-bank entities and nonbank entities. For licensed bank entities, the evolution of banking is heading towards digital banking, both in the form of digital services of traditional banks and fully digital banks. Firstly, traditional incumbent financial institutions are adopting new technologies to remain competitive with the evolving demands of clients, thus incorporating online and mobile banking features to accommodate transactions. Secondly, the emergence of digital banks involves offering financial services that are easily accessible and cost-effective through various electronic channels. These digital banks may either be an expansion of traditional financial institutions or be newly established digital entities, often associated with Fintech players. Operating with only a few physical branches, or sometimes none, these digital banks are sometimes referred to as Neobanks, virtual banks, or branchless banks. With Indonesia's diverse landscape and a significant number of unbanked and underbanked populations, digital banks present a solution to bridge the financial accessibility gap across the islands without the reliance on brick-and-mortar establishments.

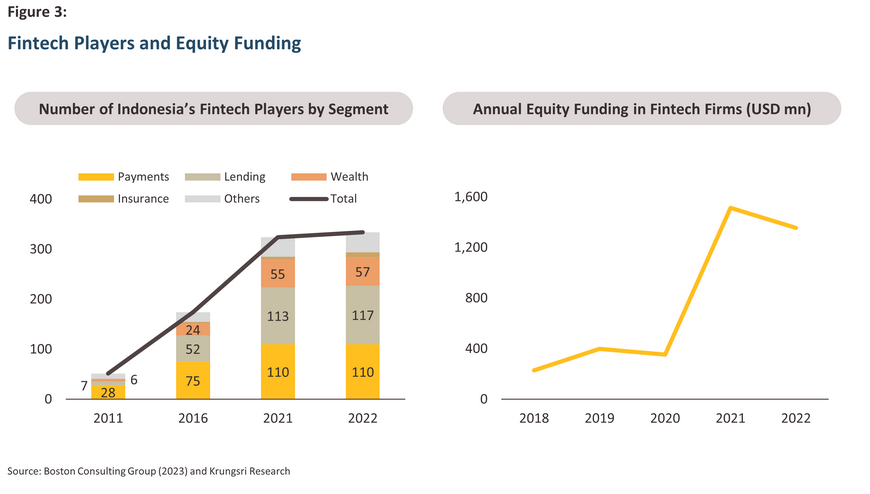

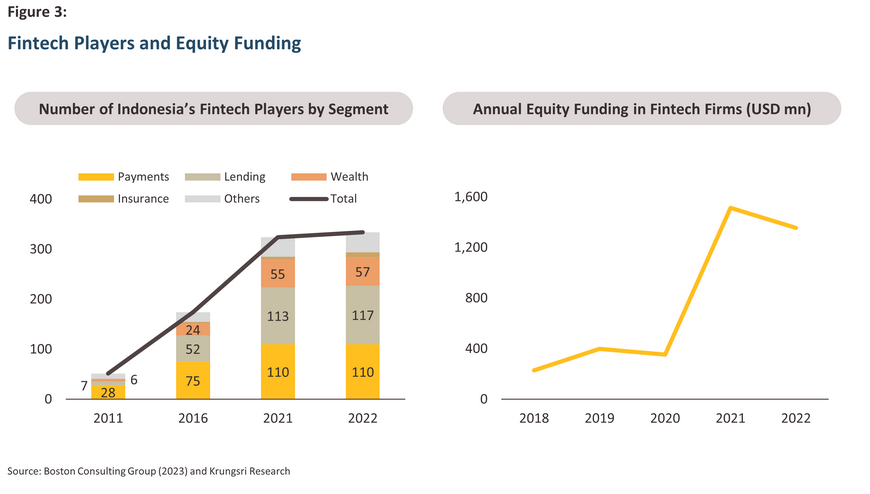

For nonbank entities, a major development is that technology-oriented companies and Fintech startups are entering the financial services space to leverage technology for enhancing or innovating financial services. They usually offer specialized financial products or services, e.g., digital wallets, P2P lending platforms, Wealthtech, and Insurtech. The number of Fintech players in Indonesia rapidly surged from around 50 in 2011 to over 330 by 2022. Key Fintech entities providing financial services and products include OVO, Akulaku, Xendit, and Ajaib.

Banks and nonbanks often focus on different market segments, but they can overlap. Licensed banks compete in segments of mid-sized businesses and upper-middle-income individuals. Meanwhile, nonbank platforms typically focus on the lower tier of the income pyramid, providing services to the bottom unbanked sector; lower-income individuals and MSME businesses. However, soon after the Fintech lenders successfully grew in providing services in those segments, digital banks are trying to replicate and compete with nonbanks in the MSME segment.

Furthermore, the boundaries between these two entities are being blurred with recent strategic acquisitions for mutual benefits. Banks are increasingly collaborating with and investing in Fintech companies, as they look for new distribution channels to connect to MSMEs and accelerate their digital transformation. On the other hand, Fintech lending platforms are looking to collaborate and partner with traditional financial institutions to gain access to a larger capital base to cater to the demand of borrowers.

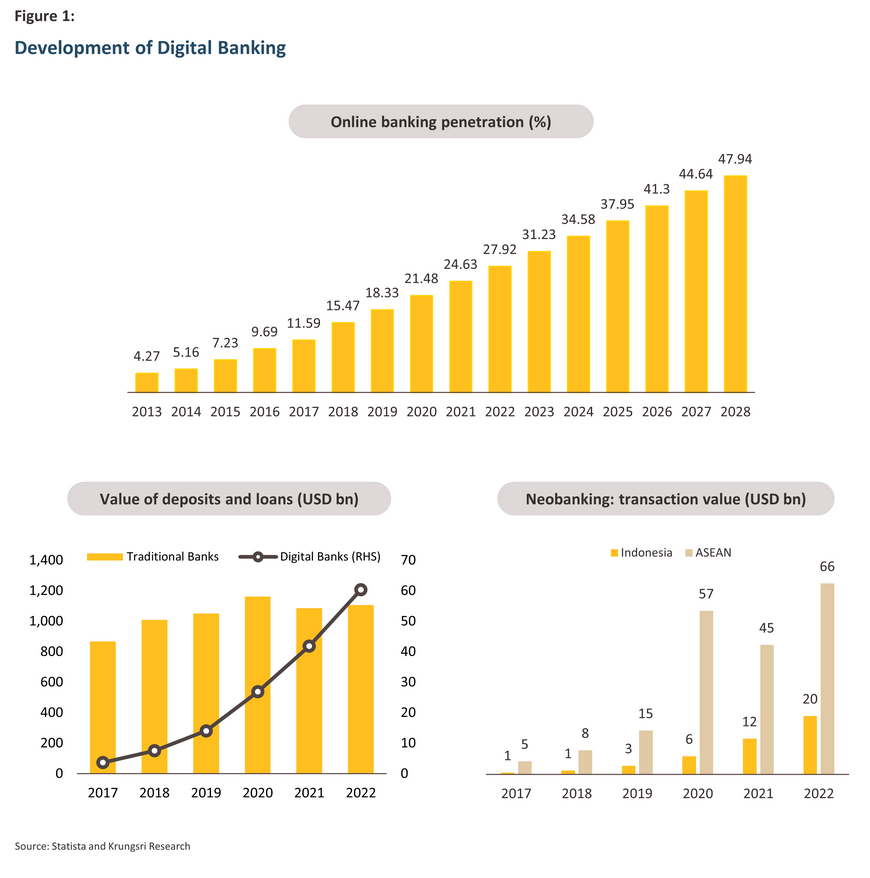

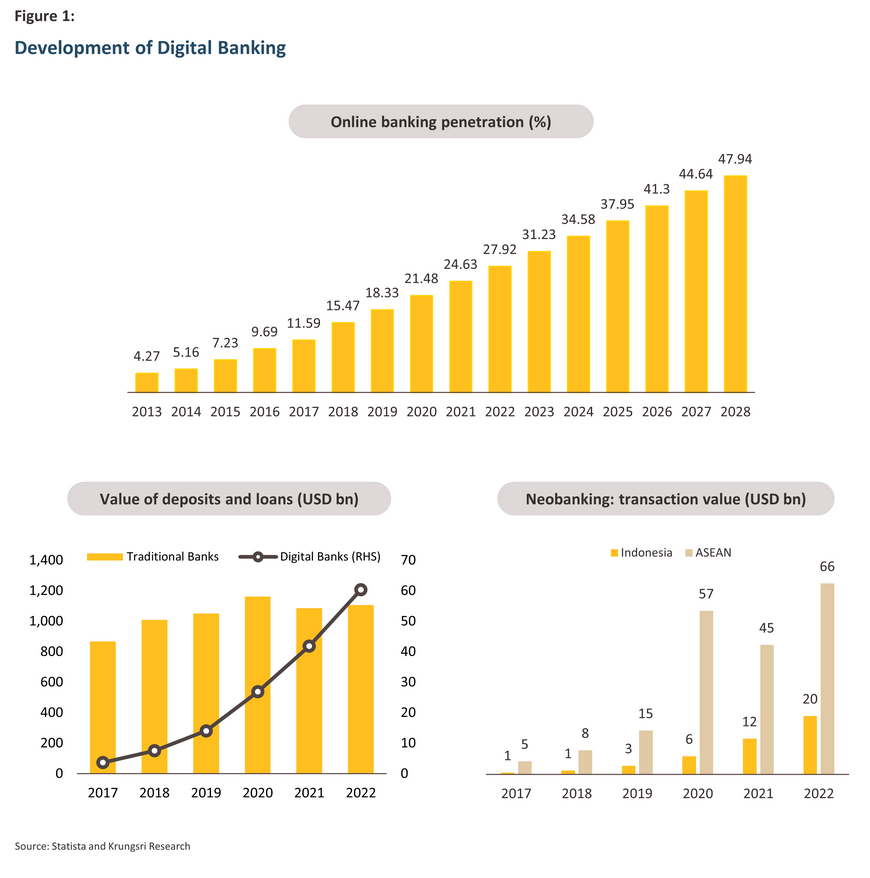

The rapid development of digital banking in Indonesia is seen in Figure 1, which shows that online banking penetration increased from 4 percent in 2013 to approximately 28 percent in 2022. From 2018 to 2022, the values of deposits and loans in digital banks grew at a CAGR of 78 percent. However, when compared to traditional banks in terms of deposits and loans, the shares held by digital banks remain negligible. In a regional comparison, the transaction value of Neobanks in Indonesia reached USD 20 billion, accounting for almost 30 percent of the total value in ASEAN in 2022.

- From the perspective of financial products and services

Indonesia's digital financial landscape is shifting towards broader services besides payments.

Digital financial innovation in Indonesia, concentrated in digital payments services, has expanded rapidly in recent years, especially with the introduction of the Quick Response Code Indonesian Standard (QRIS) in 2019. This national standard for QR code payments allows merchants to accept various digital payment methods. Additionally, the pandemic has accelerated the process, caused a surge in the use of digital payment and transfer services, and helped to reduce dependency on cash exchanges.

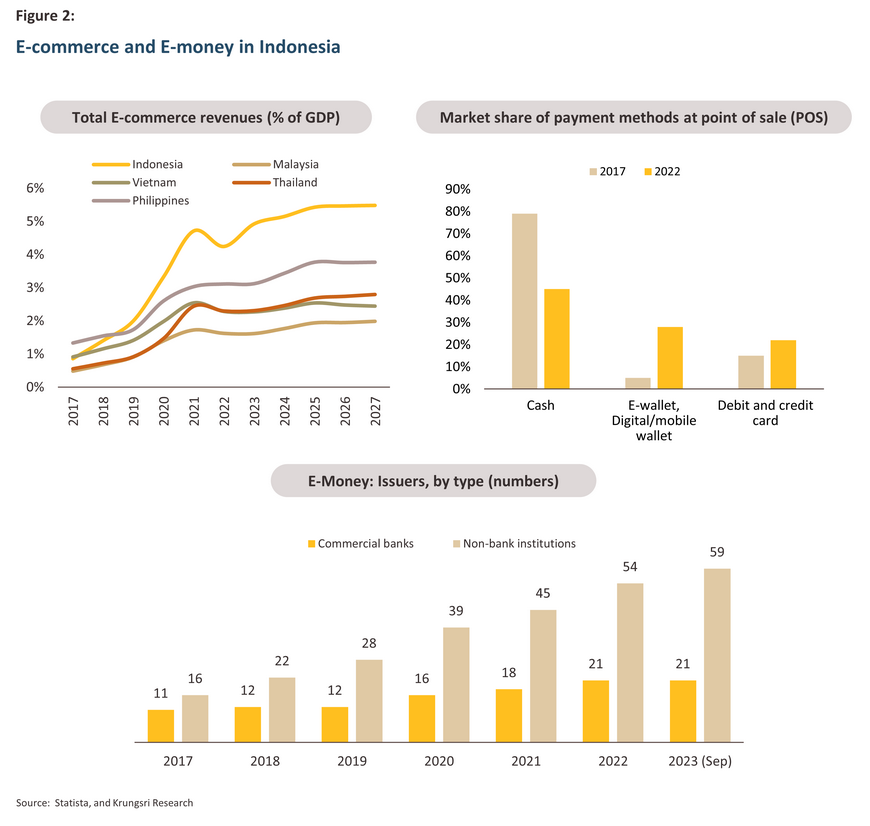

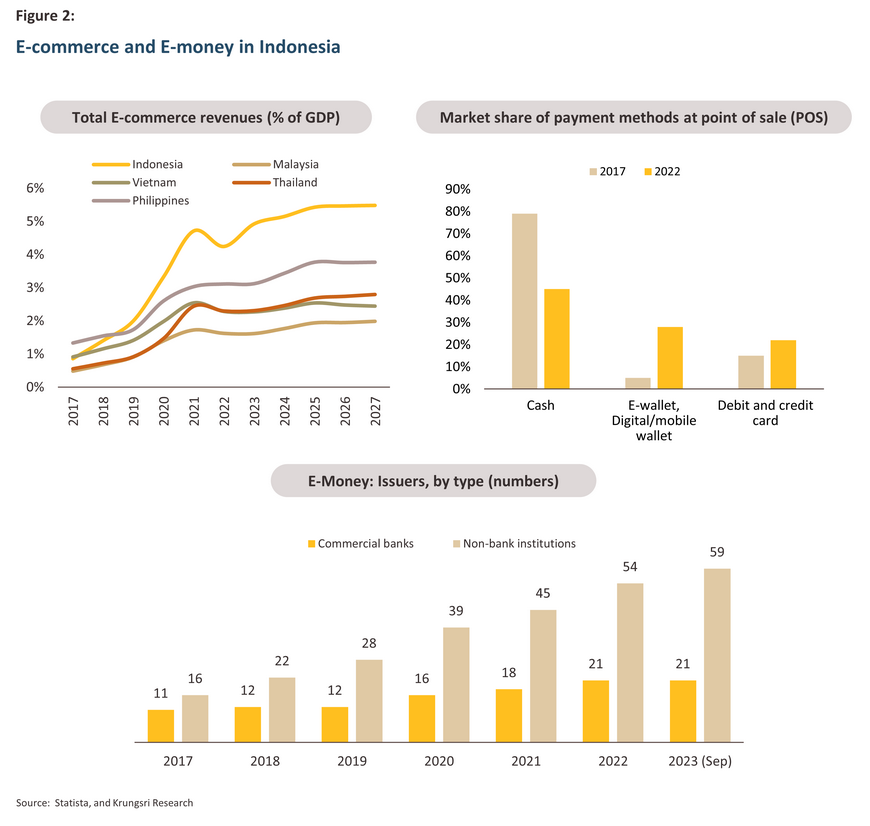

The rapid surge in the adoption of digital payments is in turn supporting the rapid growth in e-commerce. Currently, Indonesia is the largest market for e-commerce in ASEAN, with the share of e-commerce revenue around 4 percent of GDP in 2022, growing from 1 percent in 2017. For payment methods, the market share of e-wallets and digital wallets surged from 5 percent in 2017 to 28 percent in 2022, while cash usage halved to around 40 percent in 2022. This is because e-commerce is an active market for e-money issuers. It is also worth noting that the number of nonbank e-money issuers is significantly larger than traditional banks (Figure 2). This is the presence of a few key dominant domestic nonbank players in Indonesia’s digital payments market—Gopay, OVO, and LinkAja—which are the most widely used e-money services.

However, digitized financial products are evolving beyond payments and are increasingly offering more sophisticated products and services. Looking closely into nonbank players, the number of nonbank entities (Fintech players) was initially driven by the payment segment; however, it has been relatively stable over the last two years. Digital lending and Wealthtechs now represent emerging driving forces, with several new entrants operating in these segments. Furthermore, Investor sentiment continues to be notably positive for Indonesia’s Fintech sector. In 2021, Fintech equity funding surged to USD 1.5 billion from USD 200 million in 2018. Although a large share of this investment was channeled to payment and lending segments, 2021 marked a standout year for Wealthtech participants, attracting over USD 500 million in funding (Figure 3).

- From the perspective of regulations

To address financial inclusion gaps, OJK and BI drive digital financial innovations.

Indonesia's regulations have played a significant role in accelerating digital transformation in the financial sector, with two primary responsible authorities. Firstly, Bank Indonesia (BI) oversees traditional banks and products related to digital payments. BI aims to enhance the reach of banking and financial services, especially in regions with traditionally low banking penetration, by ensuring that digital payment systems are accessible and reliable. Secondly, the Financial Services Authority (OJK) governs small-scale banks, Fintech companies, and products associated with digital banking. Indonesia is among the few countries with a regulatory body dedicated solely to accelerating digital transformation in the financial services sector, and the development of the financial services sector ecosystem.

Given that accelerating digitalization is part of the development roadmap by the OJK, and to facilitate the digitalization in financial sector, the new rules in 2021 allow near-full foreign ownership of digital banks (foreign shareholders can own up to 99 percent of the bank) and quicker permit process to spur growth in the country’s emerging digital financial industry. These include SeaBank (formerly Bank Kesejahteraan Ekonomi), acquired by Singapore’s Sea Group; Bank Jago, now 22 percent owned by Indonesia’s largest tech company, GoTo, which boasts Google and Tencent among its investors. Indonesian financial technology startup Akulaku, with investors including Alibaba affiliate Ant Group, is moving to become Bank Neo Commerce’s controlling shareholder.

Key drivers for the digital finance adoption

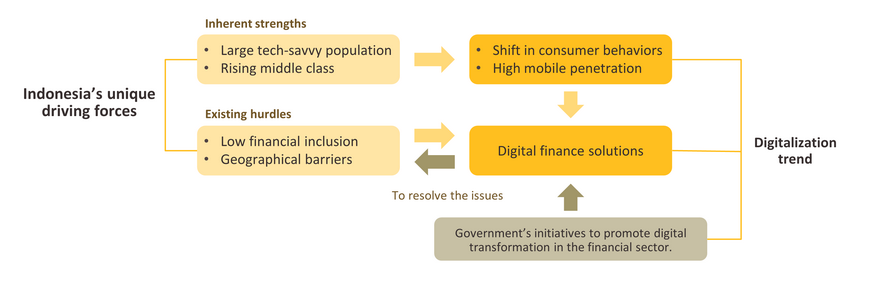

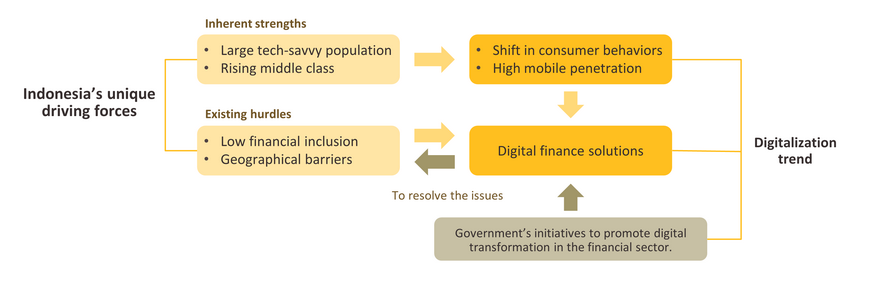

Indonesia's digital financial innovation is strengthened by a youthful demographic, low financial inclusion, geographic diversity, and proactive government initiatives.

Apart from the innovation in financial technology contributing to increased convenience, lower transaction costs, and improved operational efficiency, the rapid growth of digital finance is also fueled by the combination of consumer demand and supportive government policies. This synergy is a unique driving force in Indonesia. The strengths in this context can be categorized as follows:

-

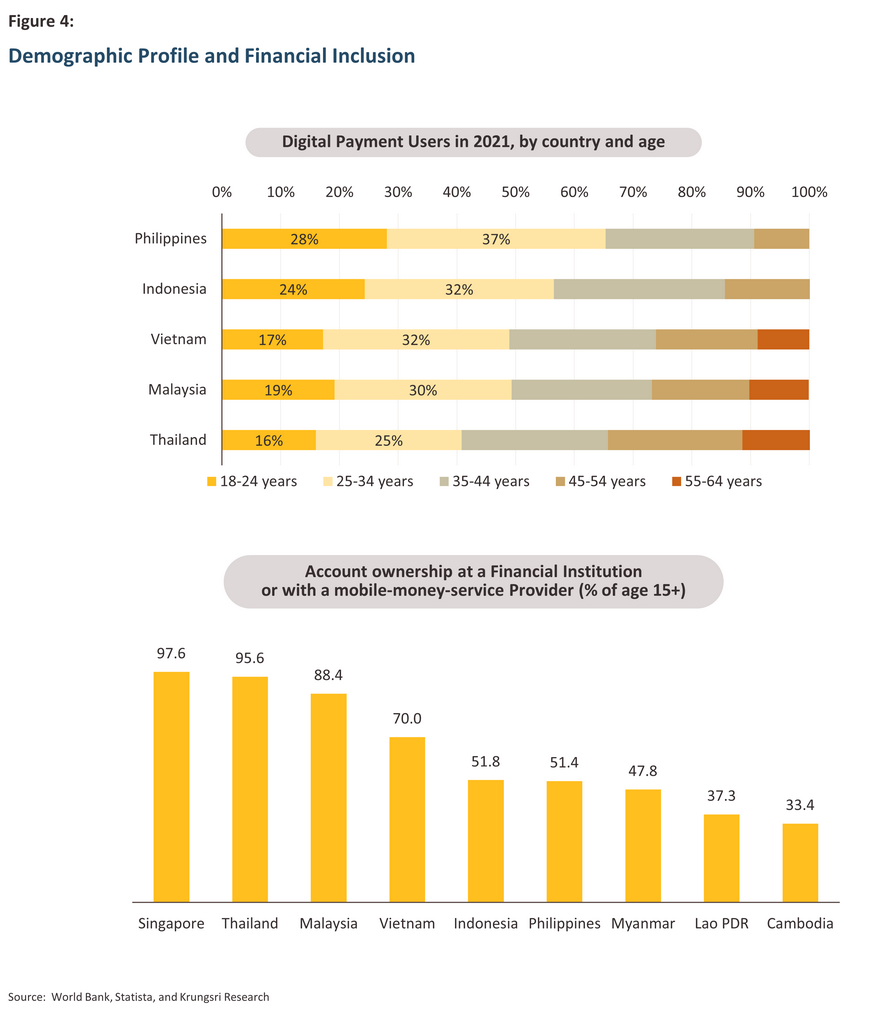

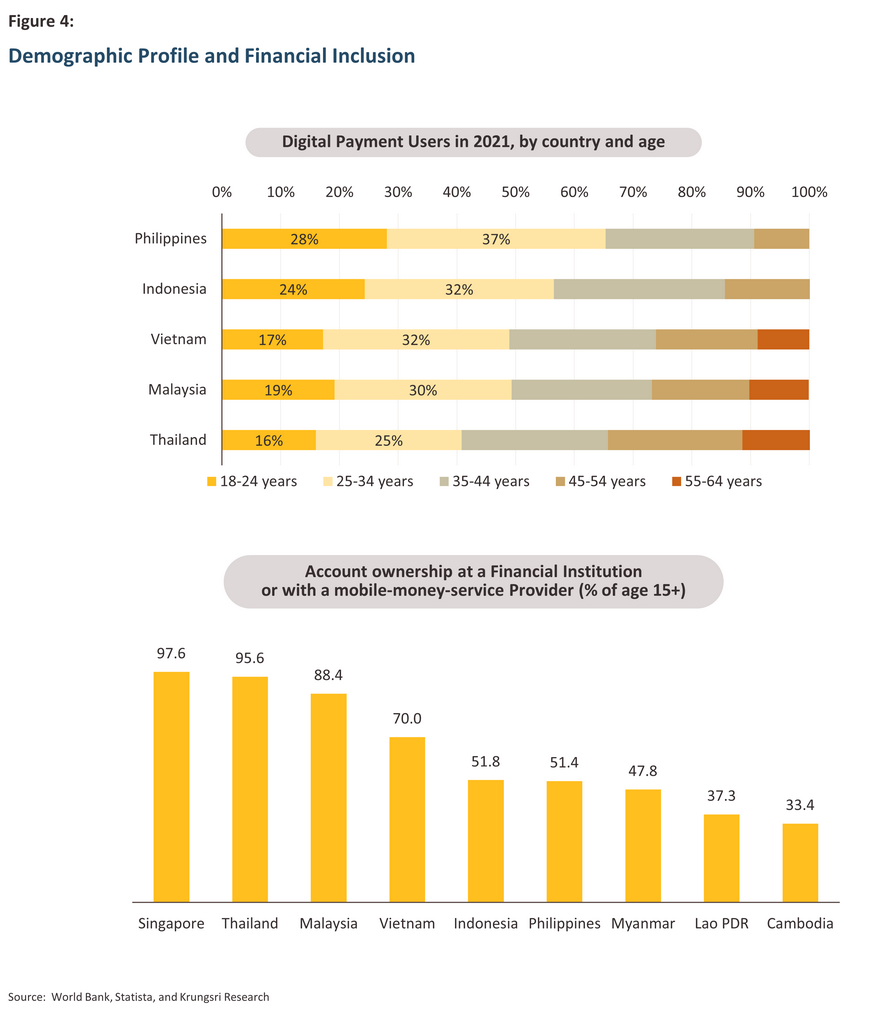

Demographic dividend: Indonesia has a large, tech-savvy youth population, with over half of the population aged below 35, who are fast and early adopters of digital financial tools. By 2021, Indonesians aged 35 and below constituted about 56 percent of digital payment users. This implies that these consumers of the productive age will dominate the population in the future and will be ready to adopt other digital solutions (Figure 4).

-

Low financial inclusion: According to the World Bank, Indonesia has the world’s third-largest unbanked population of 52 percent in 2021. Digital financial solutions are bridging this gap, offering financial services to populations previously outside the traditional financial system.

-

Geographic diversity: Indonesia consists of thousands of islands, making traditional banking infrastructure development challenging. Digital innovative services offer a promising channel to overcome this geographical barrier where traditional financial institutions are absent.

- Government initiatives: the Indonesian government has shown support for financial inclusion, launching initiatives and regulations that promote the adoption of digital financial services. Indonesia has set a target to achieve 90% financial inclusion by 2024, up from 77 percent (share of unbanked and underbanked population) by 2022; MSMEs are the focus of this vision.

Impacts of financial digitalization in Indonesia

Financial digitalization is having an impact on both the broader economy and the financial system in Indonesia.

In terms of economic impact, digital finance plays a crucial role in addressing two structural challenges that limit the economic growth potential of Indonesia. These challenges are related to the limited access to finance for Medium, Small, and Micro Enterprises (MSMEs) and the low financial service penetration among the population at the lower income levels.

For the MSME sector, a pivotal component of the economy that employs 97 percent of the workforce and contributes to 60 percent of Indonesia’s GDP, there are still challenges in accessing financial resources. As of 2022, approximately 28 percent of MSMEs in Indonesia still lack access to formal financing yet, while the remainder still require additional financing for business capital and investment1/. Digital finance has provided MSMEs with easier access to essential financial services. Notably, the release of digital lending by Fintech service providers has been instrumental as it is addressing the MSME financing gap, given that the majority of Fintech borrowers target MSMEs, with only a small portion being consumer-focused2/.

In terms of financial inclusion, digital finance presents an opportunity to address financial inclusion challenges, providing an effective means to overcome Indonesia’s geographical barriers, which is the most cited reason for lacking a financial account. According to the World Bank, financial inclusion in Indonesia has improved; the percentage of people owning accounts at financial institutions or with mobile money service providers has risen from 20 percent in 2011 to 52 percent in 2021. This aligns with the country's digital finance trends. However, it's evident that the accessibility ratio remains relatively low, and digital finance is poised to further support financial inclusion in the future. Enhanced access to financial services is expected to contribute to economic growth potential. Research conducted in 2009 found that a 1 percent increase in financial service access correlates with a 0.03 percent annual growth in per capita income3/.

For a broader perspective, expanding access to financial services, particularly through digital means, not only addresses current challenges but also holds the potential to boost economic growth in the long term. The evolving digital financial landscape will strengthen the entire digital ecosystem. This progression is vital for an economy, as transitioning up the value chain through a well-developed digital economy is a strategic move towards achieving high-income status.

Under this ecosystem, digitalization would foster new investment opportunities and enhance economic activities and efficiency. Indonesia is aiming to become a key player in Southeast Asia's digital economy. According to a recent study in 20234/ , Indonesia’s digital economy reached USD 76 billion in 2022. The size is predicted to reach USD 109 billion in 2025 and reach USD 210-USD 360 billion in 2030. The e-commerce sector, amplified by the rising use of digital payments, is anticipated to primarily drive this notable growth (Figure 5).

The shift towards digitalized finance not only has positive implications for the economic landscape but also for the financial system. The traditional financial institutions in Indonesia still hold market shares in deposit and credit markets. This is partly a result of incorporating financial technology to overcome challenges that traditional financial institutions have faced, such as reducing operational costs, expanding financial services online, and leveraging digital payment histories combined with big data analytics to enhance efficiency in credit screening. Importantly, the emergence of numerous new financial service providers has intensified competition in the financial sector. As a response, traditional financial institutions in Indonesia are increasing their digitalization efforts to raise efficiency and improve services to attract new customers5/.

Challenges facing Indonesia’s digital financial landscape

Challenges for the full realization of Indonesia's digital financial landscape remain, particularly in gaps related to financial literacy, infrastructure, and culture.

Although the use of digital financial products has significantly increased, especially in the post-COVID-19 era, the full potential of leveraging digital finance in Indonesia has not yet been realized. This is due to several key challenges that limit the growth of digital finance in Indonesia, as outlined below.

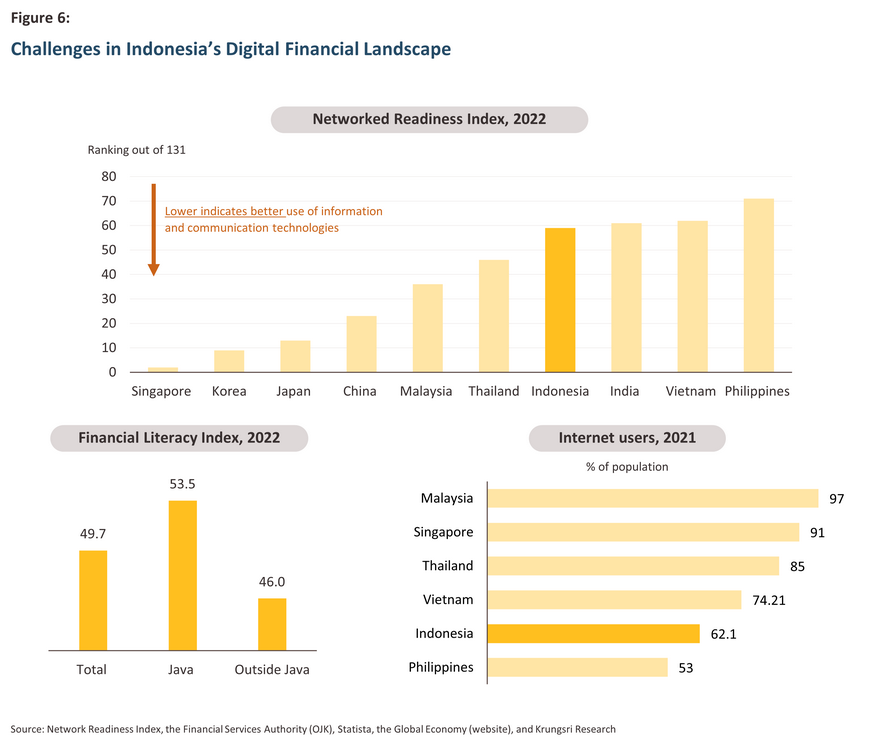

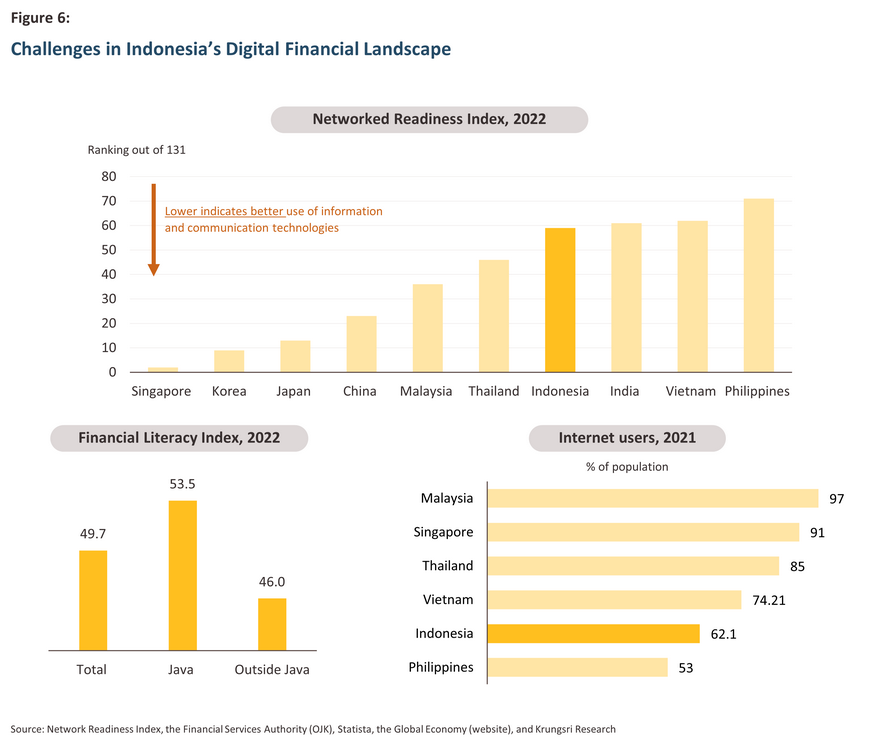

- Infrastructure and connectivity hurdles: although smartphone and internet penetration rates in Indonesia have increased over the years, they remain low compared to other countries in Asia. Many remote areas lack a stable connectivity infrastructure, which could pose challenges for real-time data exchange required for digital finance. This is reflected in Indonesia's Networked Readiness Index6/, which remains at a low level in comparison. (Figure 6)

-

Low financial literacy: one of the challenges in reaching clients in rural areas (outside Java) is the low level of financial literacy, which is frequently cited as the primary obstacle in serving financial services in these regions, as half of the population remains financially illiterate.

-

Cultural and linguistic diversity: Indonesia is incredibly diverse in terms of culture and languages, and certain religious constraints, especially in the context of lending. This diversity presents a significant challenge for financial service providers when offering products and services that efficiently meet the varied needs of their customers.

-

Concerns on security: a lack of trust in non-traditional institutions especially regarding holding funds, and worries over data privacy, are often cited as barriers to adopting digital finance solutions.

-

Sustainability in question: some of digital banks and Fintech companies shift their focus more towards MSMEs and lower income borrowers and given their less strict credit scoring and screening processes compared to traditional banks, a sharp deterioration in loan quality is possible in context of high interest rates and sluggish economic recovery. According to the OJK, the Non-performing Loans ratio (NPLs) for Fintech platforms surged from 3 percent in 2019 to 9 percent in 2020. In contrast, the NPLs ratio of traditional banks remained relatively stable during that period.

-

Balancing regulation and innovation: while digital payment standards and frameworks have sparked a steep incline in digital payments adoption, regulatory bodies’ protectionist policy with stricter regulations may have a negative impact on overall market. A prime example would be the recent new rule banning e-commerce to support and protect local merchants. This protectionist approach may reduce competition in overall market and lead to a decline in sales for MSME relying on e-commerce.7/

-

Other constraints: a shortage of skilled workers in digital technologies, as well as high cost of implementing digital technologies are constraints for further growth of digital financial products.

Business opportunities

Promising business opportunities arise, particularly within untapped market segments.

Financial services have become increasingly digitally accessible to Indonesians. However, much of the broader retail market for digital financial services remains untapped. This presents significant business opportunities to tap into market segments that are currently underserved..

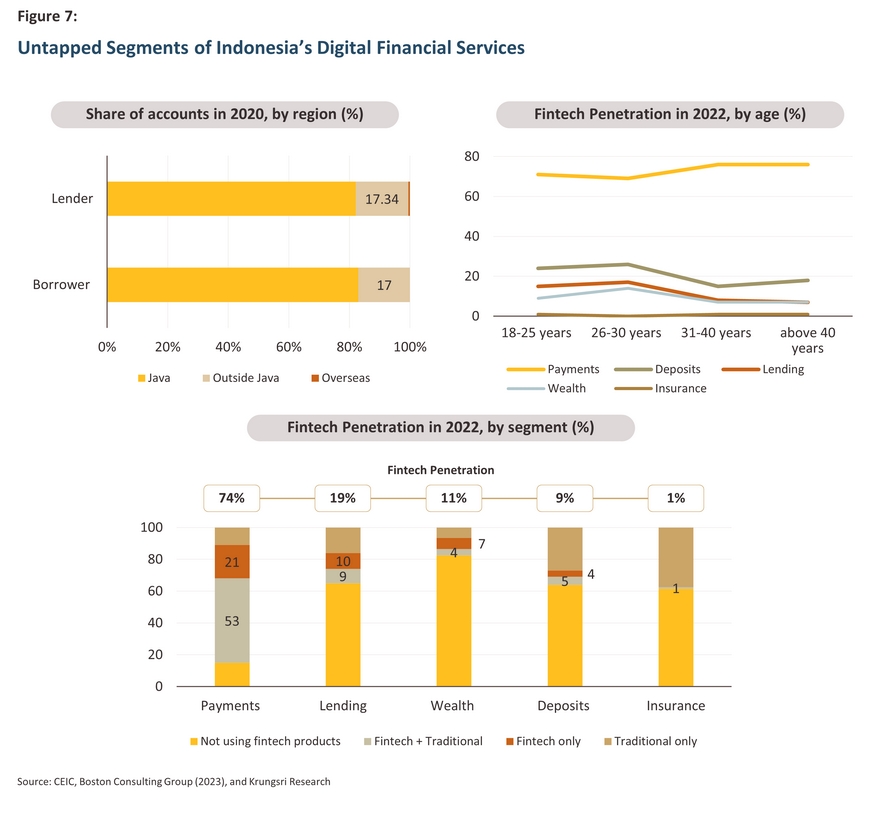

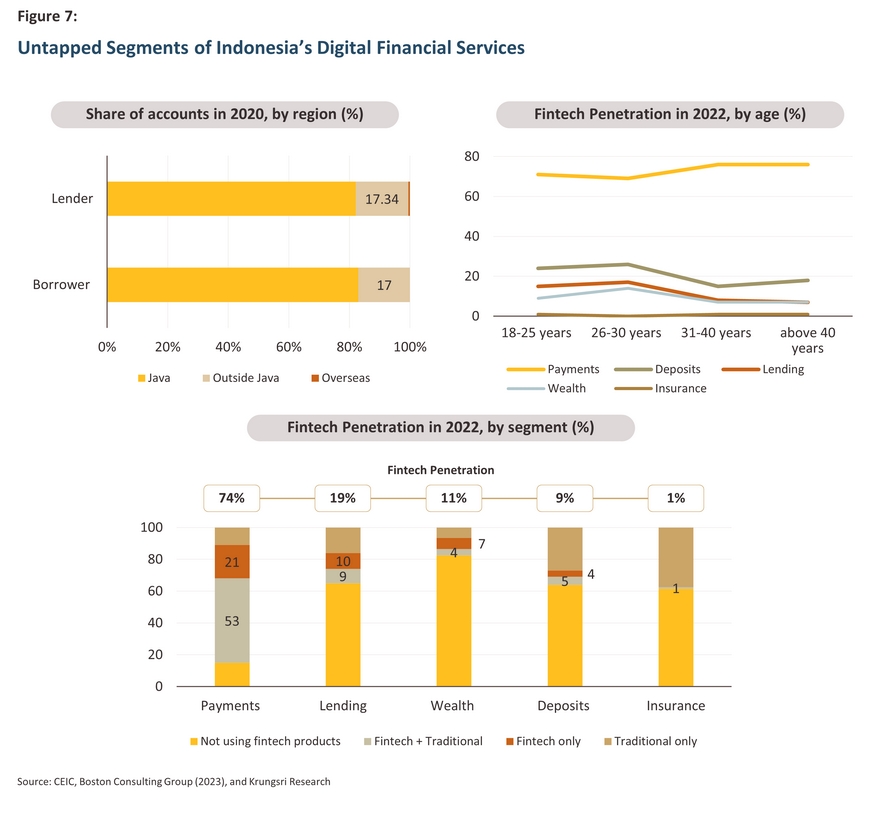

- Unique opportunities in diversity and low financial inclusion: while the geographical barriers and cultural and linguistic diversity in Indonesia, evident in the financial access disparities between Java and other regions (Figure 7), are challenges for digital financial adoption mentioned above, they also present business opportunities. Digital financial solutions can be specifically designed and tailored to meet these unique needs. Additionally, they can reach out to new target groups that have not yet accessed financial services.

-

Opportunities across product segments: according to the Boston Consulting Group, customers use traditional banks as their primary providers for financial services other than payments, particularly deposits, wealth, and insurance products. In fact, 60-80 percent of customers have not utilized financial technology in these segments. This presents an opportunity for banks to grow the shares of digital financial products in these segments.

-

Opportunities among older age groups: Currently, consumers aged 18-30 are the most tech-savvy, showing a higher adoption of digital financial technology across various financial services compared to other age groups. While the older age groups demonstrate lower usage of digital financial services, aside from digital payments, this indicates a business opportunity to tap into the older demographic. Developing products and services that cater to the needs of individuals aged over 30, such as easily understandable, user-friendly, and cost-effective financial products and services, presents a significant market opportunity.

-

Regional expansion from cross-border payment connectivity: at the regional level, the Regional Payment Connectivity (RPC)8/. aims to improve the region’s payment infrastructure and promote more efficient and seamless cross-border payment and settlements. Indonesia is playing an active role in developing common standards and promoting the use of instant payments through its QRIS platform. The advancement can also play a significant role in business opportunities in Indonesia. It can help businesses to expand into new markets, reduce costs, improve cash flow, and mitigate risk, particularly from currency fluctuations. Recently, Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam have joined the RPC initiative. Additionally, Indonesia plans to expand its QRIS collaboration regionally with other ASEAN countries, including China, Japan, and Korea.

Krungsri Research View: Conclusion

In conclusion, Indonesia’s economic productivity has been capped by low financial inclusion and a large financing gap in the MSME sector. The country’s financial landscape, which is now being reshaped by digital transformation, offers immense potential to overcome such financial structural constraints, unleashing the country’s economic potential. Furthermore, there are business opportunities in the digital finance arena with a largely untapped broader financial services market. Challenges like literacy and infrastructure gaps remain. Nevertheless, with strategic policy efforts focusing on addressing remaining financial gaps and the country’s unique inherent strengths, Indonesia is positioned to lead Southeast Asia's digital financial future.

References

ADB Working Paper Series. (2021). The COVID-19 pandemic and Indonesia’s fintech markets, No. 1281.

Bank Indonesia. (2019). 2019 Economic Report on Indonesia (Chapter V. Innovation for Integration of Digital Economy and Finance).

Boston Consulting Group. (2023). Indonesia’s fintech industry is ready to rise.

Chaia, A., Dalal, A., Goland, T., Gonzalez, M., Morduch, J., and Schiff. (2009). Half the world is unbanked. Financial Access Initiative.

Deloitte. (2016). The Future is Now: Digital Financial Services in Indonesia

Economic Research Institute for ASEAN and East Asia No. (2023). Redefining Indonesia’s digital economy, No. 2022-06.

Fintech Singapore. (2020). Indonesia fintech report 2020. Fintech News Network.

Google, Temasek, & Bain & Company. (2019). Fulfilling its promise: The future of Southeast Asia’s digital financial services.

Google, Temasek, & Bain & Company. (2022). The e-Conomy SEA 2022 report.

Google, Temasek, & Bain & Company. (2023). The e-Conomy SEA 2023 report.

International Finance Corporation. (2017). MSME financing gap: Assessment of the shortfalls and opportunities in financing micro, small, and medium enterprises in emerging markets.

International Monetary Fund [IMF]. (2021). Digitalization: A safe path to a more inclusive recovery in Indonesia, Volume 2021-047.

Kearny. (2022). Accelerating Indonesia’s economic growth with a digital transformation.

McKinsey & Company. (2016). Unlocking Indonesia’s Digital Opportunity, October (Jakarta: McKinsey Indonesia Office).

Suryanto, Rusdin, & R. Meisa Dai. (2020). Fintech as a catalyst for growth of micro, small, and medium enterprises in Indonesia. Academy of Strategic Management Journal, 19(5).

1/ https://setkab.go.id/en/govt-to-maintain-msmes-role-as-economic-backbone/

2/ IMF, 2019

3/ Chaia et al., 2009

4/ Google, Temasek, & Bain & Company, 2023

5/ McKinsey and Company, 2016

6/ This index is a composite measure evaluating how efficiently a country utilizes Information and Communication Technology (ICT)

7/ On September 28, 2023, Indonesia introduced stricter regulations on e-commerce transactions, including banning e-commerce on social media platforms and barring overseas sellers from operating on domestic e-commerce platforms. It also requirese-commerce platforms, including ones that are not social media, to set a minimum price of USD 100 for certain items directly purchased from abroad. While it does not explicitly target TikTok, this app is a prominent online platform in Indonesia. According to the government, the law will safeguard domestic e-commerce platforms and protect offline businesses.

8/ Regional Payment Connectivity (RPC) is an initiative by the central banks of Indonesia, Malaysia, Philippines, Singapore, and Thailand, launched in November 2022. The State Bank of Vietnam (SBV) officially joined RPC on August 25, 2023. In terms of progress, Indonesia has already implemented its payment system using QR codes with Thailand in August 2022 and Malaysia in May this year. A pilot of cross-border QR code payments Singapore has successfully completed in August 2023. The idea is to allow users from either country to use the QR code standard, managed by Bank Indonesia, for payments in another country, eliminating the need for currency exchange or a credit card.