Hemp: A new cash crop that brings both challenges and opportunities

Following the Thai government’s decision to legalize the importation of hemp seeds and the growing, processing, possession and distribution of hemp plants and products for prescribed purposes, the commercial cultivation of the crop is beginning to attract significant interest. The plant has a wide range of applications and global demand is forecast to strengthen substantially in the near future, making hemp an interesting and attractive proposition for Thai farmers, and it is thus possible that the crop may become a major source of income for growers and generate considerable added value for the agricultural sector. The nascent domestic industry is now connecting to at least 5 different supply chains, namely, beverages, food, medicines and supplements, apparel, and personal care products, and given Thailand’s natural advantages with regard to hemp cultivation, the country has the opportunity to become a major player in this emerging new industry and to grow with a rapidly expanding global market that is forecast to have a value of around USD 15.8 billion within the next 5 years. However, growers and processors still face significant obstacles, including the necessity of developing new varieties of hemp that better meet market demands and overcoming challenges surrounding the legality of some business activities.

Thailand has legalized hemp cultivation, paving the way to the establishment of a new cash crop

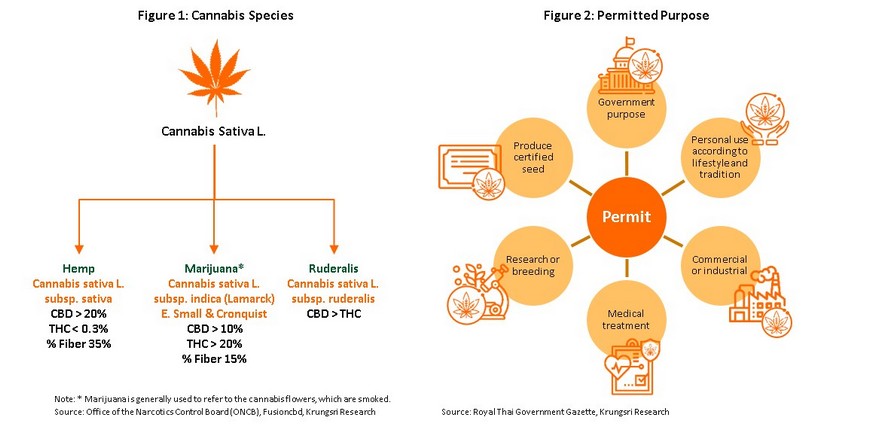

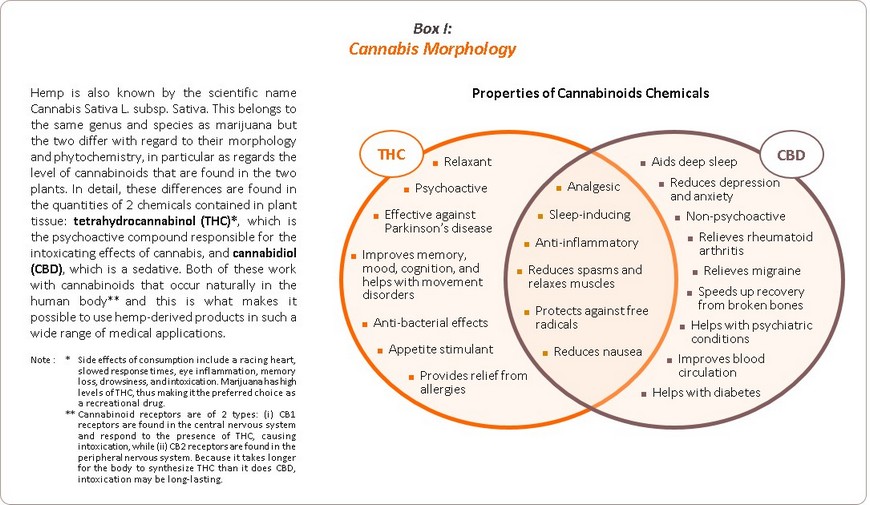

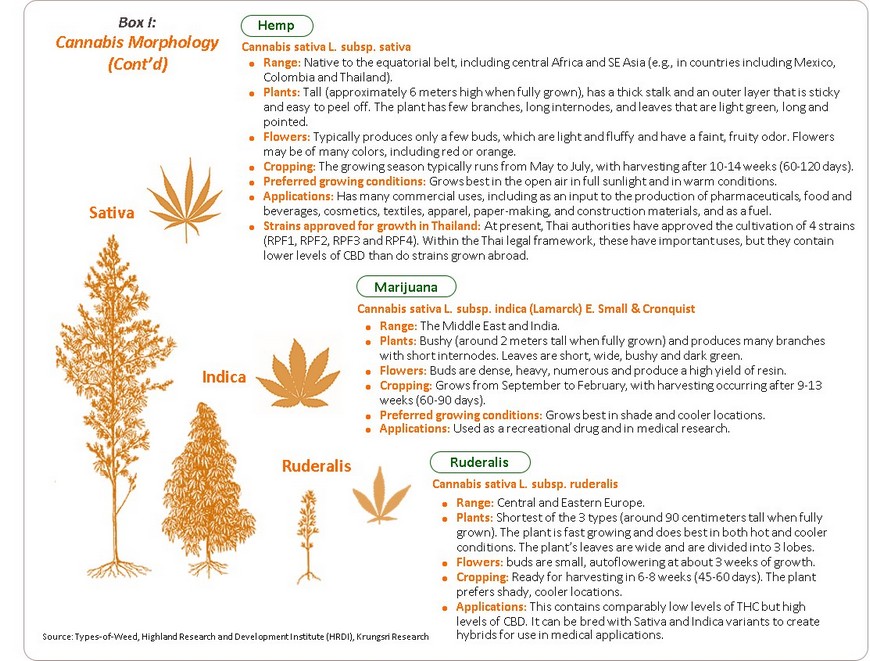

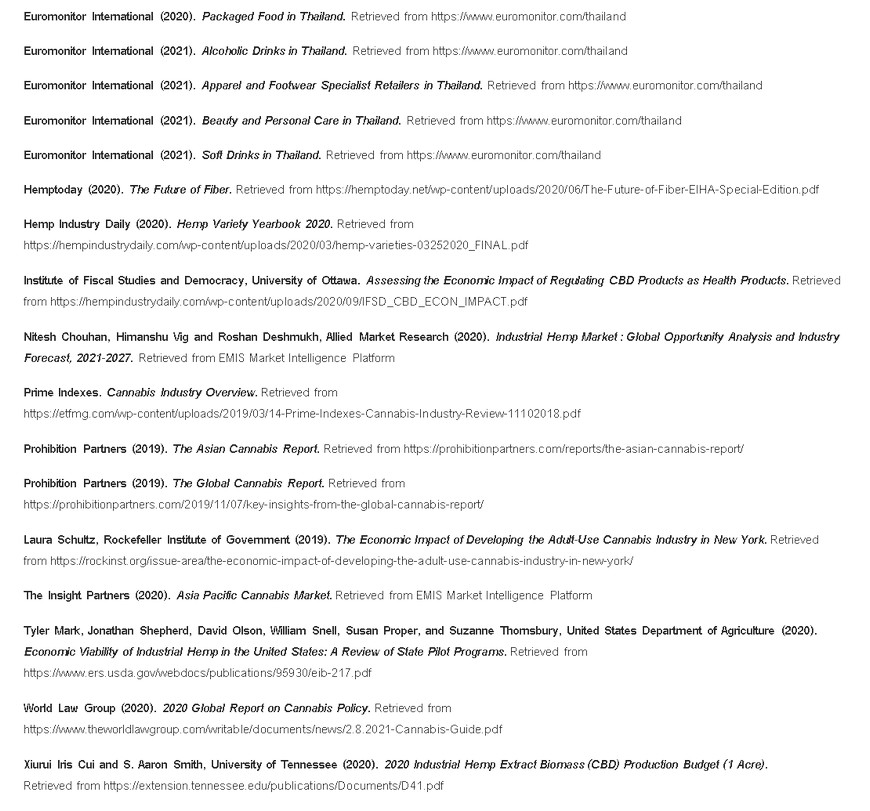

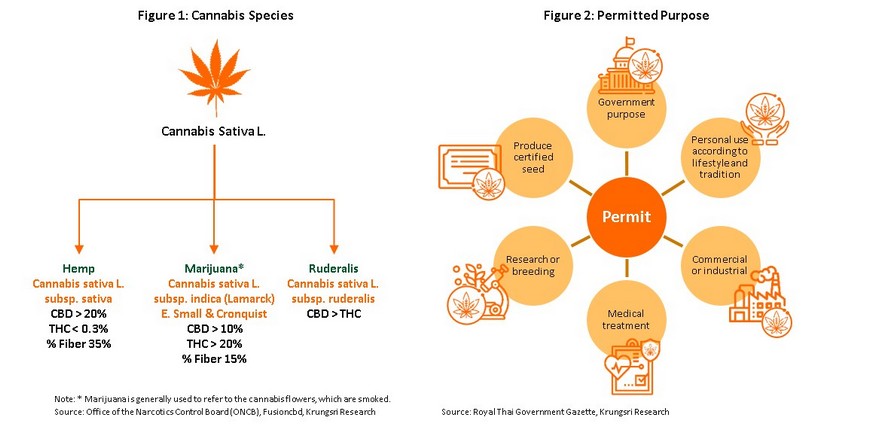

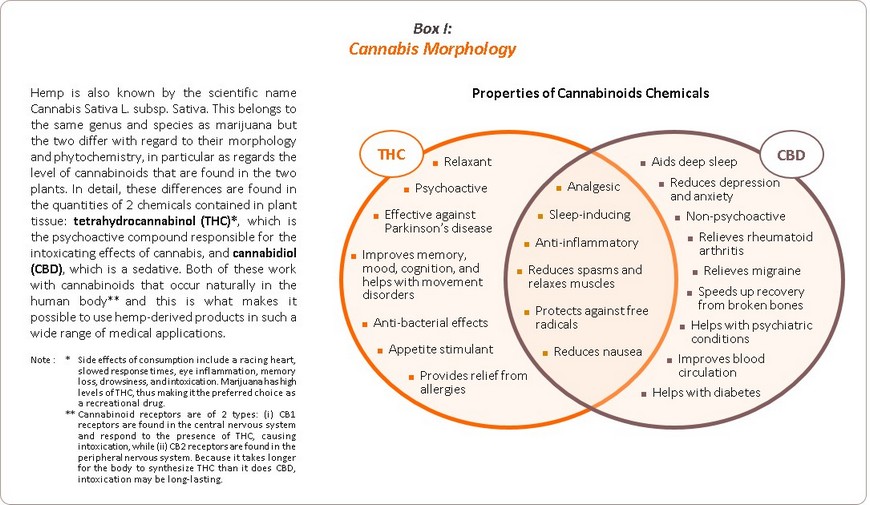

Hemp is the standard name for a particular type of cannabis plant known by the scientific name of Cannabis sativa L. Hemp and marijuana are both types of cannabis, but the former is reserved for those plants that have a tetrahydrocannabinol (THC) level of not more than 1% of dried plant material (THC is the active component that causes intoxication). Marijuana is then used for plants that exceed this threshold. However, although hemp thus has lower levels of THC than marijuana, it has higher levels of cannabidiol (CBD), a compound that has medicinal properties (Figure 1). Now that (as of 29 January 2021), the “production, import, export, distribution and possession” of hemp has been legalized, the commercial cultivation of hemp is generating significant interest in Thailand. In moving to allow hemp production and use, the government has stated that its objectives are to: (i) allow government agencies to better fulfil their mandates; (ii) permit the use of hemp fiber for traditional purposes within households (which are now able to plant up to 1 rai of hemp each); (iii) encourage the commercial and industrial use of hemp; (iv) permit medical uses of cannabis; (v) allow for cannabis-based research and the development of new strands of hemp; and (vi) provide for the production of seeds of certified varieties (see Figure 2 for details).

These reforms, and especially the government’s move to allow the commercial and industrial use of hemp, represent an important attempt by the authorities to establish this as a major commercial crop[1]. Unlike the narcotic marijuana, the use of which remains limited to certain medical and research applications[2], hemp holds out the possibility of becoming a significant cash crop and of generating considerable added value for growers and processors, in particular in the 5 downstream areas of drinks, food, medicines and supplements, apparel and personal care products.

A plant with a multitude of uses and the potential for generating high value-added in downstream products

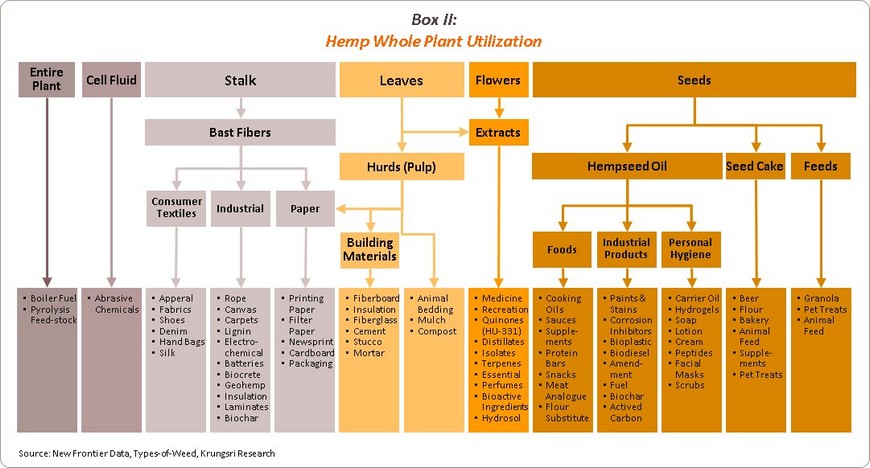

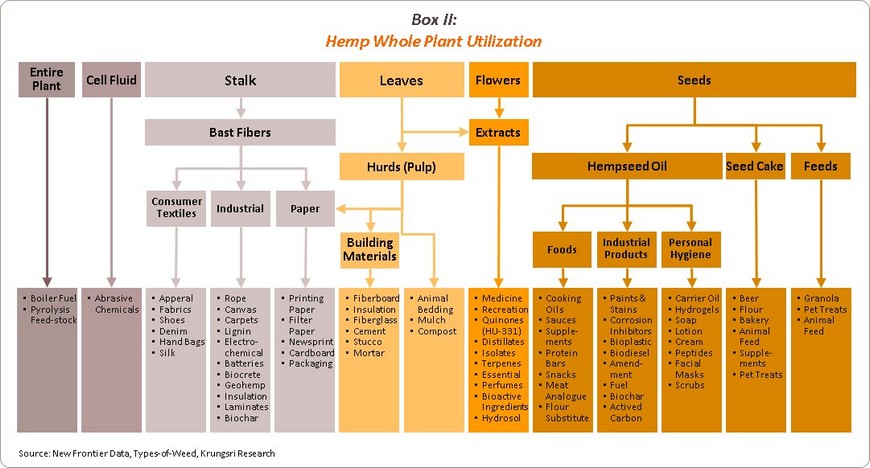

Hemp may be used in a great number of applications, including as a relaxant, a sleeping aid, a remedy for dizziness, and as a cure for headaches and migraines (Box 1). In addition, all of the plant may be used for commercial purposes, from its flowers, through the leaves, seeds and branches to the exterior and interior of the stalks, and even the roots, all of which may be processed into a remarkably wide range of products (Box 2). Thus, the flowers can be processed for the extraction of medicinal phytocannabinoids[3], including CBD (which may be consumed directly or used to generate added value by being mixed with foods and drinks, or by being processed into personal care or cosmetic products) and terpenes (used to make perfumes and essential oils). The leaves may be used in the production of food and beverages, or to make organic fertilizer, building materials, fiberboard and fiberglass. With regard to the stalks, the outer layer can be used to make fiber, clothes, rope, lightweight and high-quality bullet-proof body armor, paper-making pulp, packaging materials, heat insulators, and bioplastics, while the lightweight inner parts of the stalks are used in construction to produce blocks and hempcrete, as well as in auto assembly and furniture production. Oils and other extracts from the seeds find applications as food additives and in the manufacture of personal care products, since these have a high nutritional value (they are rich in protein, vitamin E and omega oils).

Global demand is high and growing

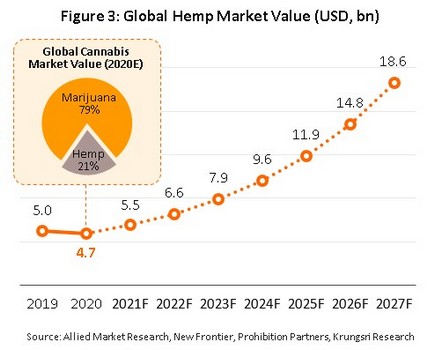

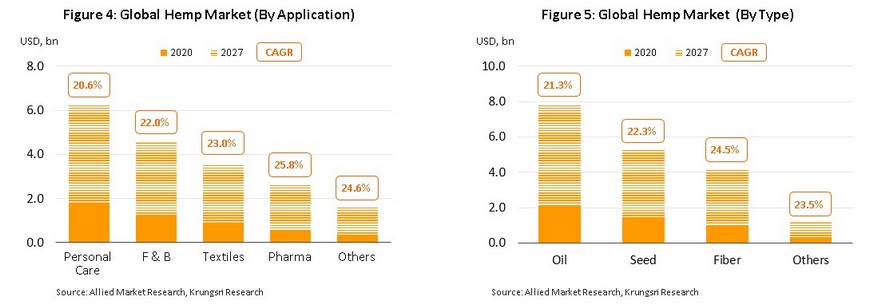

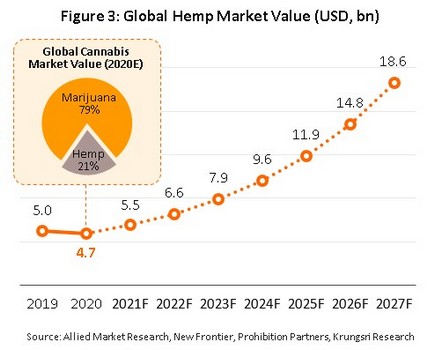

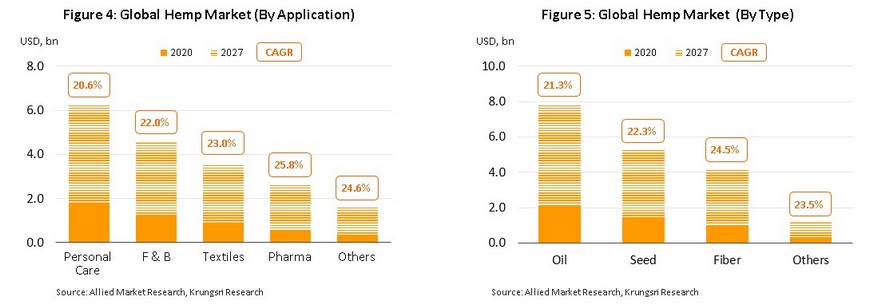

The global market for hemp was valued at USD 4.75 billion in 2020 (Figure 3). Considered by product group, personal care products (e.g., face and skin creams, hand cleaners and other washing and beauty products) had a combined value of USD 1.76 billion (37.1% of the market for hemp products), followed in importance by food and beverages (25.2%), textiles (18.6%) and pharmaceuticals and medicines (11.6%) (Figure 4). However, considered by the hemp product or type of processing, at USD 2.15 billion, hemp oil was the most valuable product (45.2% of the world market), followed by seeds (28.8%) and fiber (20.0%) (Figure 5). Allied Market Research sees strong growth ahead, and predicts that average annual expansion of 21.6% in the global market will take this to a value of USD 18.6 billion by 2027, though this is still somewhat small compared to the world trade in marijuana[4].

High-priced products with good returns

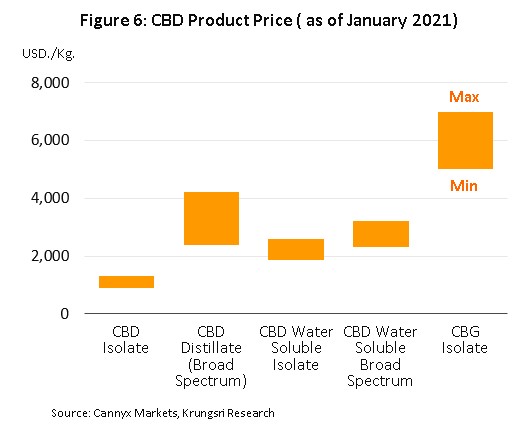

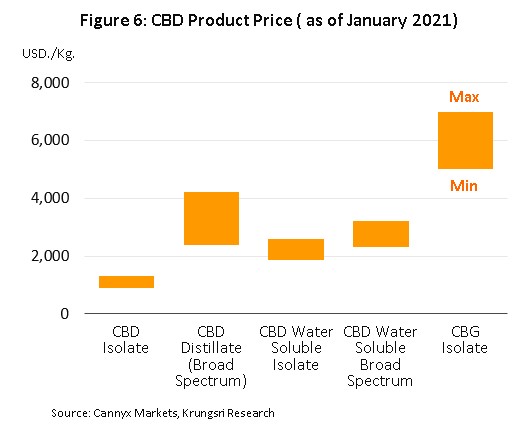

Hemp extracts can be divided into 4 categories, the prices of which vary according to their purity and the method of processing.

- Full spectrum CBD is CBD that still contains both other phytocannabinoids and THC. Full spectrum CBD also contains terpenes, which give it a distinctive smell, and flavonoids, which have anti-oxidant effects.

- CBD isolate is pure CBD, which may be in a crystalline or powder form. This is a fine, white, tasteless, odorless product that is used in the production of food and beverages, and in the manufacture of topical applications (cream, etc.). Average prices come to USD 900-1,300/kilogram.

- Broad spectrum CBD, or CBD distillate, is CBD extract that still contains some adulterants (as with full spectrum CBD) but the THC has either been entirely removed or it is present in only low levels (the thresholds for this are set by individual countries). Demand for broad spectrum CBD is high and prices run in the range of USD 2,400-4,200/kilogram.

- Water soluble CBD differs from the above 3 types of CBD, which are insoluble in water and which therefore need to be dissolved in oil (e.g., cold-pressed coconut oil, fatty acids, or medium-chain triglycerides). Average prices for water soluble CBD are USD 1,850-3,200/kilogram.

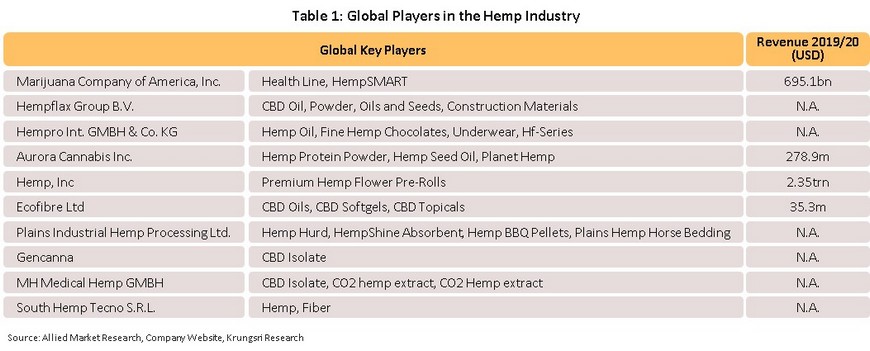

Most players in the market for hemp are found in the US, Canada, China and Australia. Between 2017 and 2019, growth rates were explosive, and went as high as 70-100% per year, but because most businesses are still in their infancy, research and development costs are high and this means that profits remain slim at present.

Opening up the Thai hemp industry has helped to establish new industrial supply chains

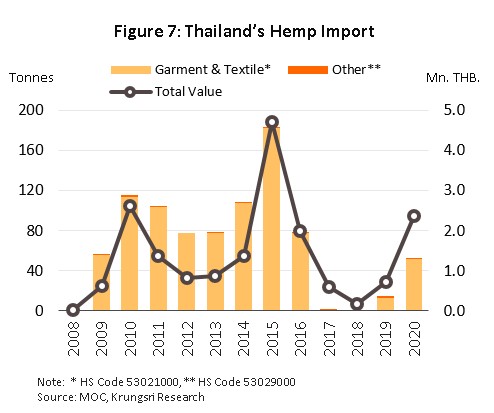

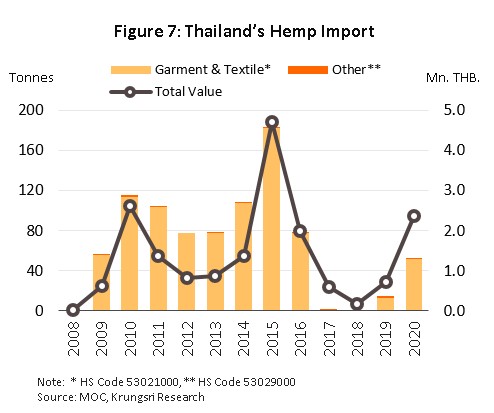

Prior to the introduction of the new rules, the planting and processing of hemp for commercial or industrial uses was prohibited, and so the domestic market for hemp products was very limited and was largely restricted to local textile-based handicrafts that were distributed through arts and craft centers. However, in 2005, the Royal Project Foundation and the Highland Research and Development Institute (HDRI) jointly set up a research project to investigate the growing and processing of hemp. In 2014, the HDRI then moved to promoting the commercial planting of hemp in Baan Mai Khirirat and Baan Mai Yodkhiri Khiri Rat Sub-districts Phop Phra District in Tak Province on a total of 97 rai, which has subsequently been expanded to 150 rai. Thanks to this, Thai imports of semi-processed hemp fell from THB 4.71 million in 2015 to THB 2.36 million in 2020 (Figure 7).

Unlocking access to the hemp industry is helping to establish new supply chains, as described below.

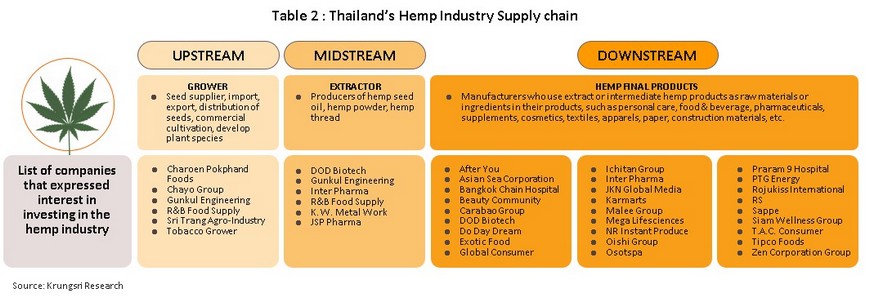

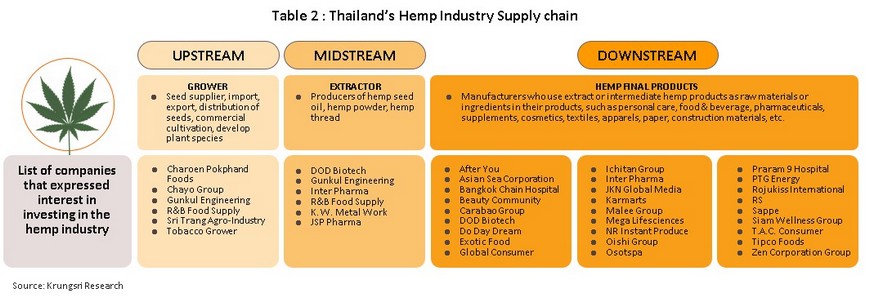

- Upstream production (sourcing seeds, the development of new varieties and the cultivation of these): Upstream sections of the supply chain involve securing or importing seeds (not for planting) distributing these for use in the commercial cultivation of hemp (whole plants or parts of these may be sold) and developing new varieties of hemp that have levels of CBD and THC that better meet market demand. Most players in this segment of the supply chain are farmers, community enterprises, experimental plots operated by universities or other educational institutes, government agencies, or players active in midstream or downstream sections of the supply chain that are beginning to grow plants for use in their own research and development of the government’s projects.

- Midstream production (extraction of oils and other hemp products): The midstream section of the hemp supply chain is occupied by businesses that process hemp into products that are consumed by downstream players. This includes activities such as extracting CBD, a high value-added product that is used as an input to a large number of other processes, as well as extracting oil from hemp seeds, and producing hemp powder, pulp, thread and yarn. Most companies active in this market are from the pharmaceuticals, supplements or food and beverage industries since these have access to the requisite skills and technology required to process hemp.

- Downstream production (e.g., consumer goods): The downstream section of the supply chain takes hemp extracts or processed hemp products from midstream players and uses these to make finished goods or to mix with other inputs to produce new product lines. Downstream producers that have the most potential for growth and/or that are the most important consumers of hemp can be divided into the 5 groups of: (i) beverages, including carbonated drinks, energy drinks, alcoholic beverages, tea, coffee, and ready-to-drink herbal products; (ii) food, including condiments and flavorings, bakery goods, noodles (including instant noodles), cereals, and snacks; (iii) medicines and supplements, including sports supplements, vitamins, weight-loss aids, and traditional herbal goods; (iv) apparel and footwear; and (v) personal care products, such as soap, shampoo, toothpaste, perfume, deodorant, oral hygiene products, and makeup.

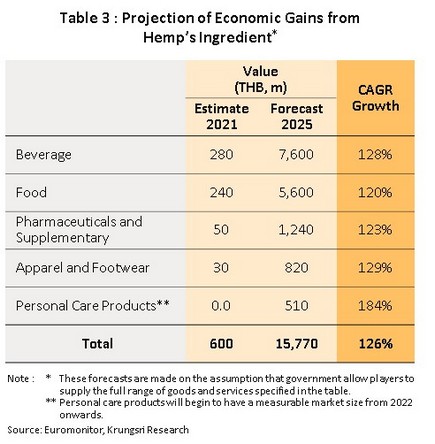

Over the next 5 years, the value of the domestic hemp market is forecast to grow to THB 15.8 billion.

Krungsri Research has assessed the value of the Thai hemp industry through a consideration of the potential of downstream manufacturers and their consumption of hemp, together with an assessment of the proportion of total hemp output that will be diverted to each end user[5]. The results of this analysis are given below.

- Krungsri Research forecasts that in 2021, the biggest consumer of hemp will be beverages producers, which will consume THB 280 million worth of hemp for inclusion in their drinks, followed by food processors, (THB 240 million), medicines and supplements (THB 50 million), and apparel (THB 30 million). Personal care products are still at an early stage of development and so consumption by this segment will be low during these first years of production, but overall, these 5 product groups are expected to consume hemp worth around THB 600 million (Table 3).

- The industry is predicted to see very robust growth over the 5 years following the liberalization of the market by the government. Thus, by 2025, the Thai market for hemp is forecast to have a value of THB 15.77 billion, representing a CAGR of 126% (Table 3).

The current state of the Thai hemp industry

-

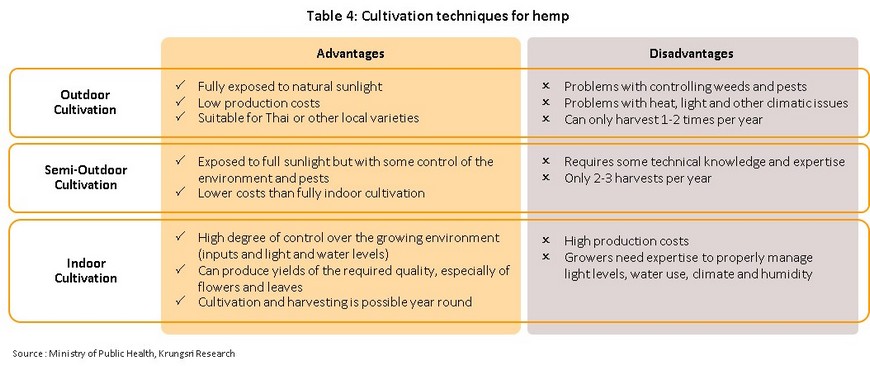

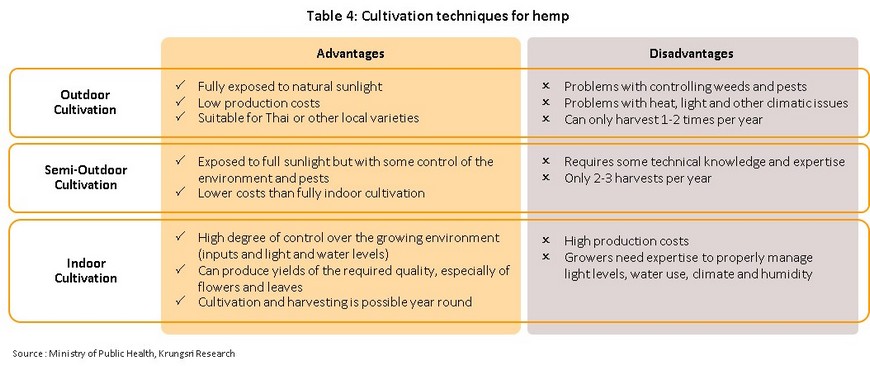

The Thai climate and geography is conducive to hemp cultivation, making the outdoor planting productive especially in the north and upper north-east of the country, where temperatures are typically in hemp’s preferred range of 18-33 degrees Celsius. The growing cycle is also short, with plants being ready for harvest after an average of just 3-4 months and this then allows for 2-3 harvests per year. By contrast, when hemp is planted in Europe, it needs to be grown in expensive indoor temperature-controlled environments which means high cost of cultivation (Table 4).

-

The Thai hemp industry is being established on a solid foundation of knowledge and expertise, thanks to the Highland Research and Development Institute’s (HDRI) decade-long research project. The HDRI was the first organization in Thailand to register its own varieties of hemp, and the institute is also now in a position to supply growers with seed; in April and May 2021, the HDRI provided seed to over 600 individuals, community enterprises and private companies.

-

Growing hemp may be carried out in a number of different ways in Thailand, depending on the desired end products and the costs that the grower is prepared to bear. Open air cultivation is suitable for those looking to harvest fiber, stems and seeds, since these are relatively low value items, for which the sale price does not justify high production costs. However, indoor cultivation is more suitable for growers extracting oil from flowers since this requires higher quality inputs and a more tightly controlled growing environment (Table 4).

Growers and processors are beginning to start operations, but the hemp industry is tightly controlled by the government, especially with regard to the somewhat onerous applications that need to be made to start in business. Prospective growers need to complete a background check, and then present their land title deeds, plans of the planting scheme, plans of buildings/processing units, and plans for how the hemp is going to be processed, together with proof of safety procedures and protocols for disposing of any hemp that remains after processing. Because of these requirements, it is necessary to bundle applications for commercial and industrial uses of hemp with those for growing and processing. Growers will thus need to be on top of procedures from identifying the varieties6/ used through to plans for distribution to downstream consumers, Manufacturers must come with effective investment plan to specify how products will be processed and used for and how surplus stocks or waste will be disposed.

- Hemp farmers: Growers need to have land on which to grow their crop and to have fully planned cultivation, processing and safety. Farmers also need to be extremely clear about who will be processing the harvest or to have a contract farming system already set up and in place. A large number of growers have already registered to cultivate hemp, pointing to the likelihood of an expansion in supply in and after 4Q21.

- Hemp processors: Players in midstream positions in the supply chain need to have expertise in processing agricultural inputs into oils and powders. At present, processors are facing supply bottlenecks due to the fact that the 4 varieties of hemp licensed for growing in Thailand have been bred for their ability to supply fiber, not oils, while it is not yet possible to import alternatives for commercial processing. Players will thus have to wait until new, more suitable varieties have been bred, which should begin to become available at the end of 2021.

Players in the food and beverages and cosmetics industries are currently seeing shortages of inputs. Using hemp products in downstream processes is dependent on the passing of relevant ‘organic laws’. but at present, only those that relate to the food and beverage and cosmetics sectors have been published in the Royal Gazette7/, and despite this, using hemp in these industries is still subject to a number of restrictions. Thus, when adding hemp to food and drink products, only seeds and protein and oil extracted from seeds may be used, while for cosmetics, only oil and other extracts produced from seeds are allowed. Moreover, supplies can only be sourced on the domestic market, and imports are not permitted. As such, downstream consumers of hemp products are having to wait for supplies to arrive from midstream players since producing processed food-quality hemp (as per the FDA regulations for food and medicines) requires the development of new varieties that will then have to be grown and processed for their oil and other extracts. It is hoped that this will be achieved in 2022, when the industrial and commercial distribution of hemp products will begin in earnest, though a large number of players remain interested in entering the market (Table 2).

Challenges facing Thai hemp producers and processors

- Growers need to take into account a wide range of considerations when planning planting schemes, including the market for their products, the varieties that will be planted, their knowledge of and skills in hemp cultivation, the sale price, their competitiveness, the expected climatic conditions, and their access to production technology. This will then help farmers match the quantity and quality of their products to market demand8/, so for example, growing to harvest hemp fiber or seeds is reasonably straightforward since yields are relatively stable, but cultivating hemp with the intention of extracting CBD is more complex since the quantity of finished goods may vary widely, depending on the growing conditions.

- Midstream and downstream players need to consider a wide range of factors when making business plans.

- Strict government regulations: These cover a wide range of business activities, including for example rules that cover the THC content of food and beverages (which must not be in excess of 0.001% THC), the inspection of growing sites, and the tight controls on product labeling and advertising.

- Patents: This effects in particular midstream players, which often have to use more advanced production technology.

- Worthwhile investment: Although many overseas players are seeing very impressive growth, they are also having to invest heavily in the construction and fitting out of facilities, the purchase of machinery, and the funding of research and development of hemp varieties that are a match for their production.

- Competitiveness: An increasing number of players are entering the market, including foreign companies.

- Building consumer confidence: This will include assuring consumers of the safety of hemp products and the absence of unwanted side effects arising from their use.

- Limitations on export markets: Although the UN is helping to reduce controls on the use of CBD, this remains restricted to medical applications and so in many countries, hemp is still classified as a narcotic. This then restricts growth in export markets for downstream hemp products.

- Markets for the buying and selling of hemp are still being developed[9] and although hemp exchanges are direct purchases from growers (i.e., hemp is grown through contract farming-type arrangements), prices are set on a central market set up by the Cooperative Promotion Department. This market helps to act as a central clearing point for hemp exchanges, to establish standards for hemp products, to set reference prices (by connecting all separate markets through a network to a single central market), and to establish fair market mechanisms. In addition, the central market also has a major role to play in facilitating market access for small-scale producers, who can then use this as a vehicle for selling goods to hemp processors or other industrial consumers.

- Legal restrictions on the cultivation and distribution. (i) Hemp inputs can only be sourced from licensed domestic growers, and it is not possible for businesses to import hemp for processing, although exports are allowed (thus allowing Thai industry to generate added value). (ii) When applying for permission to cultivate hemp, growers need to have clearly identified and confirmed buyers. Indeed, to become a licensed grower, farmers need to have not just confirmed buyers but also detailed plans for production and use. (iii) Hemp goods need to meet strict quality controls set by the Ministry of Public Health. In particular, THC levels should not exceed 0.2% of any dried used as an input to further processing, while individual standards have also been set for finished goods. (iv) At present, the law only allows for hemp to be used in the production of food, beverages and cosmetics, to which hemp oil, hemp seeds and hemp seed extract may be added. Other industries will need to wait until the necessary regulatory changes are made before they will be able to use hemp commercially[10].

- Social and culturally-motivated opposition to the use of hemp may restrict market growth since at present, knowledge and acceptance of the positive uses of hemp is limited and instead, opinions tend to be informed more strongly by the fact that hemp has for a long time been classified as a narcotic.

References

[1] Hemp is relatively easy to cultivate and has the advantage of not requiring major inputs of water. In Thailand, the climate allows for open-air cultivation year-round (unlike in Europe, where it is grown indoors in climate-controlled conditions, making production much more expensive). Hemp is also fast growing and can be harvested after only 3-4 months, allowing for 2-3 crops per year, depending on the strain that is grown and the inputs and growing techniques that are used.

[2] An announcement by the Ministry of Public Health issued on 30 August 2019 confirmed that marijuana has not been removed from the list of controlled drugs and that all parts of the plant (e.g., leaves, flowers, stems, or seeds) and any products derived from it (e.g., resin or oil) are still classified as prohibited narcotics.

[3] Over 150 types of chemicals can be extracted from hemp and marijuana, including CBD, CBG, THC, CBC, CBN, CBV, CBGV and CBCV.

[4] The ‘Global Cannabis Market’ report estimates that in 2020, the global trade in marijuana was worth USD 22.9 billion, split between USD 6.12 billion from medical marijuana (26.7% of the total) and USD 16.8 billion from recreational uses of marijuana (73.3%) (source: Mordor Intelligence).

[5] Calculated through an analysis of supply chain capacity, the scale of supporting marketing, the legal framework, the extent of government support, the level of private-sector investment in each industry and consumption of hemp from each, and the overall situation of and trends in each downstream segment of the Thai market.

[6] This includes approved varieties (though those that are licensed for growing in Thailand are used for harvesting fiber only), Thai varieties that are not approved and imported varieties. Varieties that may be used may not have a THC content greater than 1.0% of dried plant matter.

[7] Approved hemp-based cosmetics fall into 2 categories: (i) oral products, feminine hygiene products and soft gelatin capsules, which may not have a THC content higher than 0.001%; and (ii) all other types of cosmetic products, which may not have a THC content higher than 0.2%.

[8] The Department of Agriculture’s assessment of hemp production costs shows that growing to harvest seeds costs THB 8,242]rai, and generates income of THB 26,250]rai and net profits of THB 18,007.82]rai. For fresh hemp, costs average THB 9,029]rai, income is THB 22,500]rai and net profits are THB 12,471]rai. The production cycle takes around 180 days.

[9] The Department of Agriculture (within the Ministry of Agriculture and Cooperatives) and the Food and Drug Administration (within the Ministry of Public Health) have provided guidelines or the promotion of the hemp industry that covers all parts of the supply chain, from upstream cultivation through to downstream production. It is hoped that this will help to support the long-term sustainable development of the industry and to maintain a balance between supply and demand.

[10] Manufacturers of herbal products will likely want to use only hemp extracts, while in the food industry, players will want to add seeds, hemp oil and protein derived from seeds to their products.