Introduction

The emergence of El Niño conditions has begun to impact the climate in Thailand, though the full effects of this are likely to manifest in 2024 and 2025 as the country suffers under higher temperatures, the delayed onset of seasonal rains, and overall precipitation that falls below average. Both natural aquifers and manmade reservoirs will therefore likely be under supplied, and because water levels are already low, this may lead to water shortages and drought, with knock-on effects for consumption, ecosystems, and agriculture and related industries.

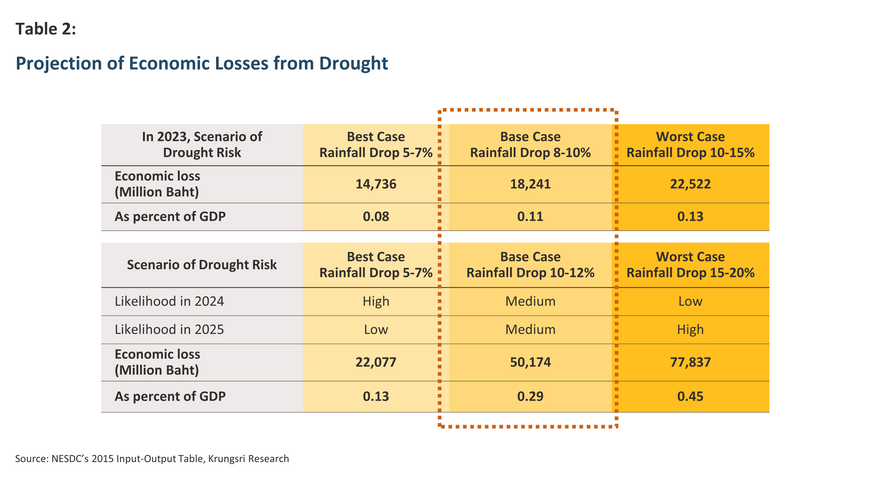

Krungsri Research believes that in 2023, impacts will show up most clearly in outputs of crops that are most sensitive to water shortages, such as off-season rice and cassava. However, in 2024 and 2025, the reach of these negative impacts will widen to include many other major crops, including sugarcane, corn, fruits, and forestry goods, though in some cases, the effects will be felt more strongly in downstream industries than among upstream suppliers. In the baseline case, overall drought-related losses are expected to run to THB 50 billion, or 0.29% of GDP, though this may rise to as much as THB 78 billion, or 0.45% of GDP, if impacts are more severe.

Clear indications of an emerging El Niño

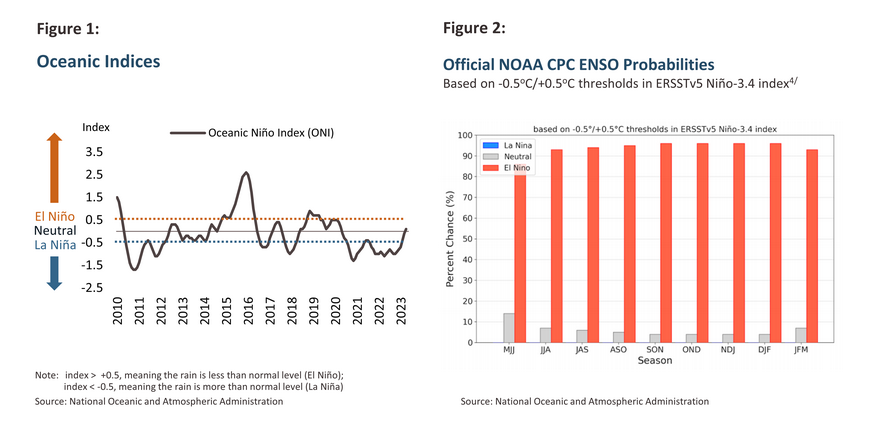

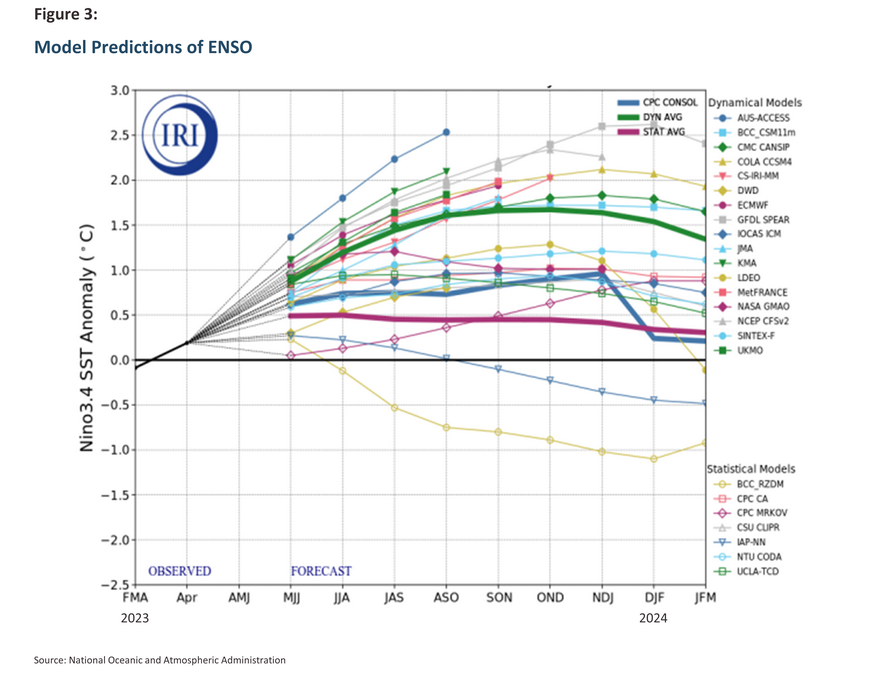

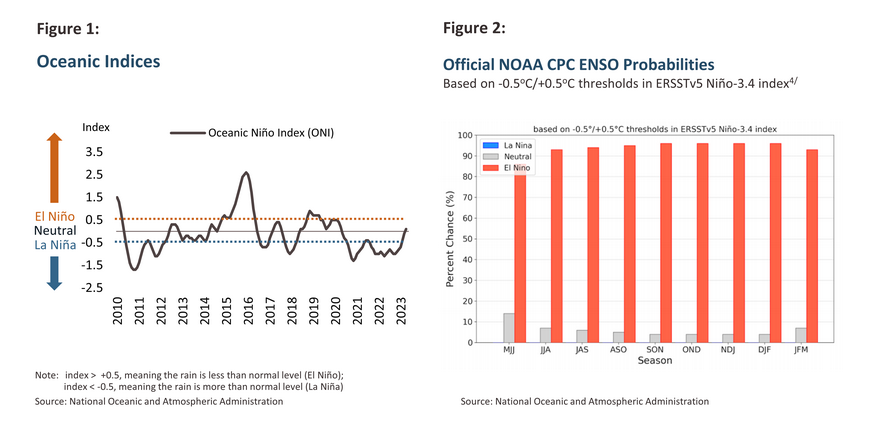

Thanks to La Niña conditions that extended from mid-2020 through to the start of 2023, over the past few years, Thailand has enjoyed lower than average temperatures but higher than normal rainfall. However, the signals of an emerging El Niño are becoming increasingly clear, and there is thus a growing risk that this will affect the climate through the rest of 2023. Indications of the approaching El Niño are seen in the Oceanic Niño Index (ONI), which uses the temperature of the sea surface of the equatorial Pacific to reflect the current balance of La Niña/El Niño conditions. Having been below average (and thus in La Niña conditions) since 2020, this has returned to ‘neutral’ conditions, or between -0.5 oC and +0.5 oC of the mean value. For Thailand, this tends to be accompanied by average levels of rainfall[1] (Figure 1) but the direction of change is from negative to positive and the ONI is continuing to trend upwards. The ONI thus moved from weak La Niña[2] conditions to neutral negative conditions in February 2023, and then into neutral positive conditions in April (at +0.1). The likelihood of El Niño conditions emerging is thus now considered to be greater than 90%, with this expected to persist at least until the first quarter of 2024 (Figure 2). It should be noted that it is normal for El Niño and La Niña conditions to alternate every 2-5 years[3].

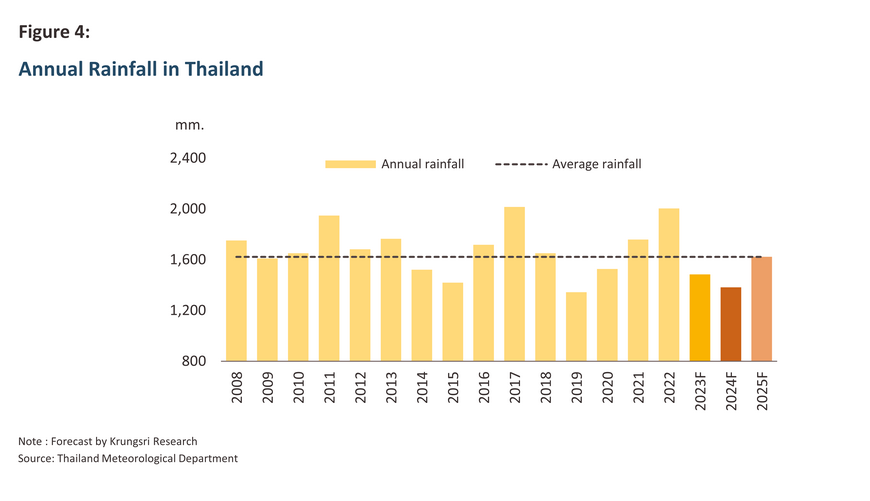

Given these trends, it is highly likely that from the end of 2023 through 2024, Thailand will see El Niño conditions predominate. It is expected that the ONI will rise above 0.5 °C in June, therefore confirming that a weak El Niño has begun, with the dynamic average (DYN AVG) of a suite of models now pointing to the increased likelihood of this intensifying into a strong El Niño in August (Figure 3). On average, El Niño conditions persist for 8-19 months.

What will the consequences be if an El Niño emerges in 2023-2024?

- Higher temperatures and a greater possibility of heatwaves: During an El Niño, Pacific sea-surface temperatures are elevated, and these warm equatorial surface waters flow easterly across the ocean from Asia towards South America. This then causes warmer and drier air currents to blow towards the Western side of the Pacific (i.e., to Southeast Asia), one consequence of which is to raise temperatures in Thailand. This may then lead to a number of unwanted consequences, including an increased risk of forest fires and with this, greater smoke and air pollution, as well as a host of negative impacts for flora and fauna. The latter may include extensive coral bleaching, problems for marine species breeding and growing, crop losses, and food shortages, which can then push up prices for agricultural products and consumer goods.

- Disruptions to rainfall and intermittent dry spells: Although the Meteorological Department announced that Thailand officially entered the rainy season on 22 May, it is quite possible that El Niño conditions will disrupt the onset of the rains between the end of June and mid-July. This would then result in a shorter overall period during which water stores can be replenished, potentially leading to water shortages in agricultural areas that are outside the reach of the irrigation system.

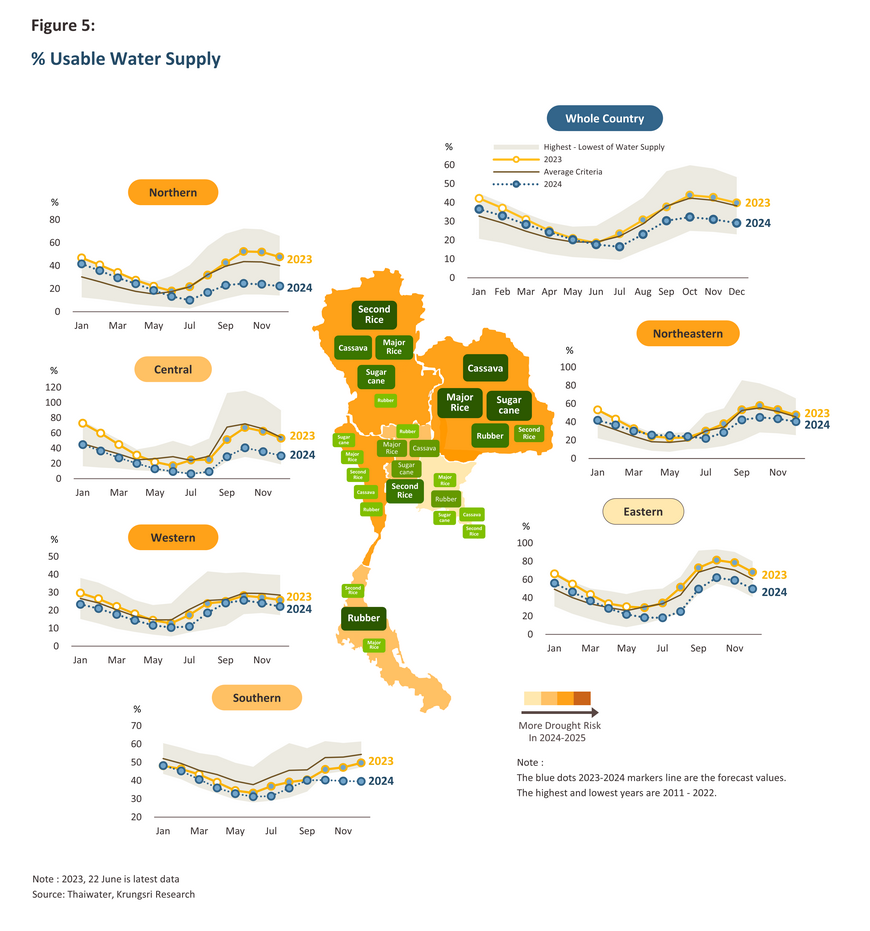

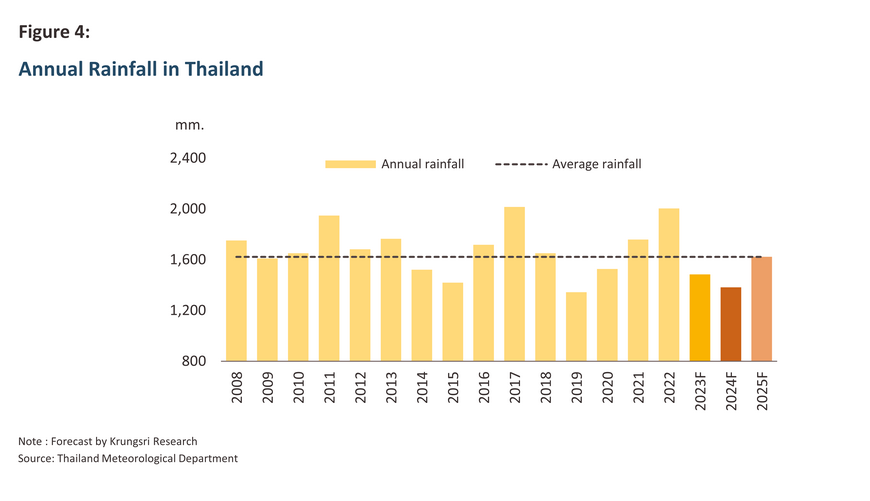

- Lower than average overall rainfall: Krungsri Research estimates that 2023 rainfall will dip below the average by between -5% and -10%5/, which would then result in annual rainfall of around 1,484mm. This would be close to the level in 2014, prior to the drought in the following year, when this came to 1,420mm. Precipitation will likely then drop by -10 to -15% in 2024 as El Niño conditions intensify, bringing forecast rainfall down to some 1,382mm, thus close to the 1,343mm recorded in the 2019 drought (Figure 4). Reduced rains through 2023 and 2024 will therefore tend to cut access to useable water, and the latter may well be insufficient to meet demand.

-

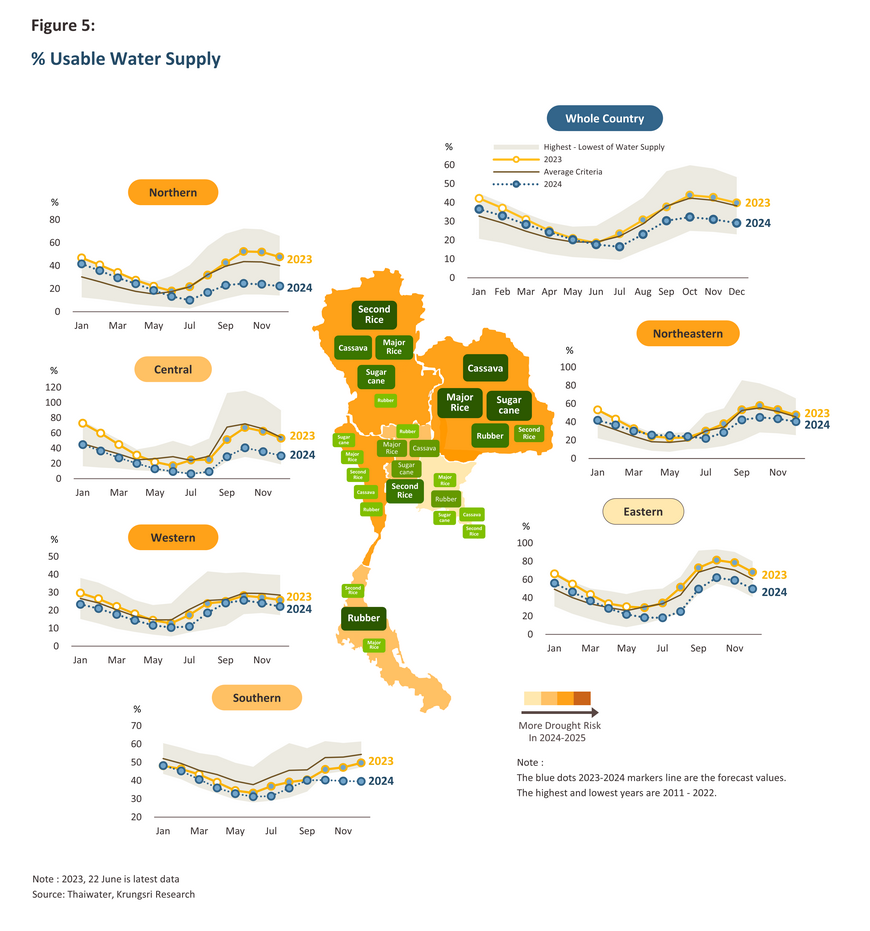

Reduced access to water from reservoirs and aquifers: Given (2) and (3) above and the fact that some rain will fall outside catchment areas, the volume of water available from natural and man-made storage will be below average. This will then increase the risk of drought conditions emerging, as happened in 2018. (Figure 5).

The extent of the El Niño’s impacts will be determined by a combination of its intensity and the effectiveness of water management policies

As a result of a significant fall in water supply, at the end of May 2023, Thailand’s reservoirs held a total of 38.39 billion m3 of water, or 54% of capacity. This is lower than in 2018 when prior to the onset of the 2019 drought, these contained 42.81 billion m3 of water (60% of capacity). Perhaps more noteworthy is the fact that as of May 2023, useable water stores stood at only 21% of capacity, below the 27% recorded at the same point in 2018 (Figure 5). If the coming El Niño is intense, this will cut rainfall further, reducing water stores and amplifying the impacts of the drought. It is thus extremely important that efficient and effective water management policies are put in place, though unfortunately, this will be against an unfavorable backdrop of rising demand from agriculture, industry, and households. Other negative factors affecting the outlook include increased rates of evaporation because of rising temperatures, rising sea levels that are increasing saltwater intrusion, which must be combated by the release of upstream freshwater, and rain falling outside reservoir watersheds, and which therefore cannot be gathered and stored. If rainfall is insufficient to meet demand, the impacts of this may be wide-reaching, and rather than being limited to only the agricultural sector, industrial supply chains, and the wider economy could also be impacted. Water management policies will therefore need to manage supply and to balance demand from four separate sources, in order of importance these being:

- Water for household consumption and for distribution through the mains water system.

- Water for the preservation of ecosystems and the maintenance of infrastructure services[6], e.g., to flush away salt- or waste-water, and to sustain river basin flora and fauna[7].

- Water for use in the agricultural sector, in particular during the dry season (from November to the following April).

- Water for use in industrial processes[8].

Although water supplies may be sufficient for 2023, poor management of these would result in a difficult situation that would then have to be dealt with in 2024, and so establishing a comprehensive plan to manage and preserve water resources should now be considered a top priority.

Impacts on supply chains and the broader economy

Krungsri Research believes that this El Niño will last for 1-2 years, and so the economic impacts of this will be felt from 2023 through to 2025.

1) Impacts on agricultural outputs

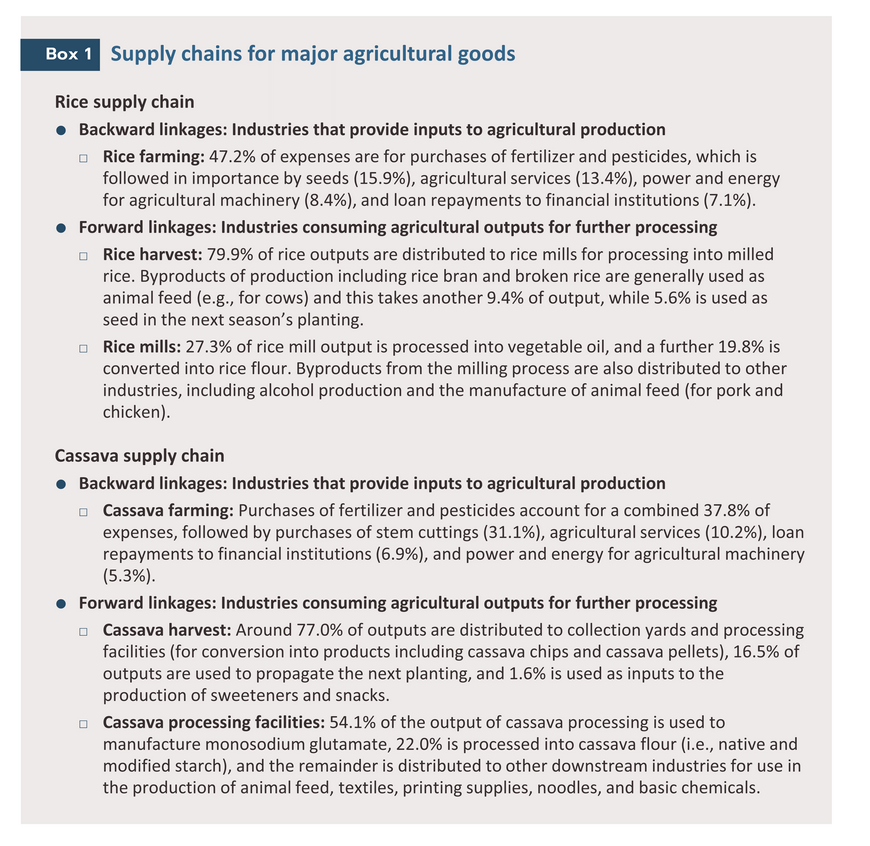

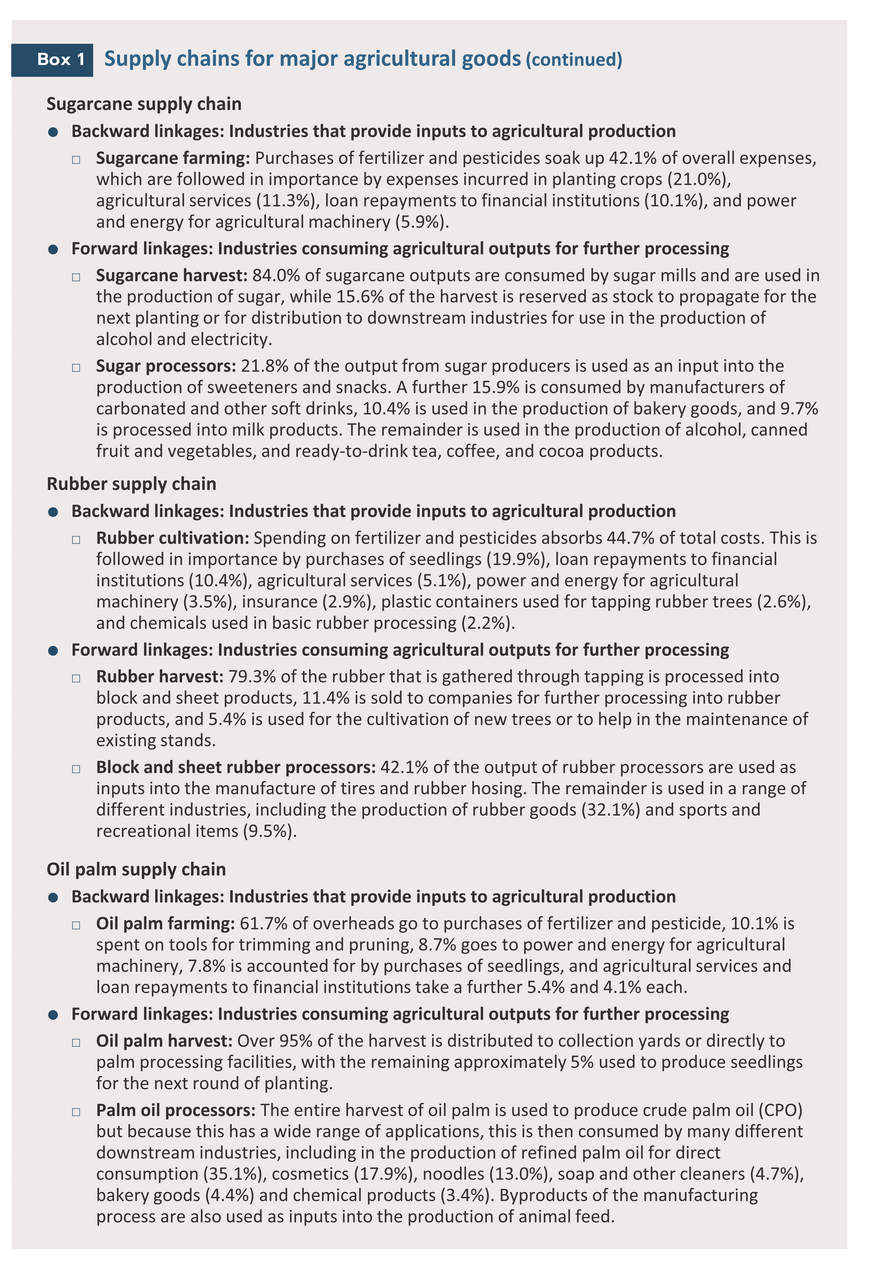

Drought will have a significant impact on a wide range of cash crops, including rice, cassava, sugarcane, rubber, oil palm, and fruits including mango, durian, and pineapple. However, cuts to outputs will vary and will depend on the type of crop, where and when it is grown, and when it is harvested. Agroforestry products such as rubber, oil palm, mango, and durian are typically more resistant to drought than are short-lived or annual crops. Nevertheless, depending on where these are growing, outputs can still be expected to suffer. For crops such as rice, cassava, sugarcane, and corn, impacts will likewise be affected by the timing of planting, growing, and harvesting.

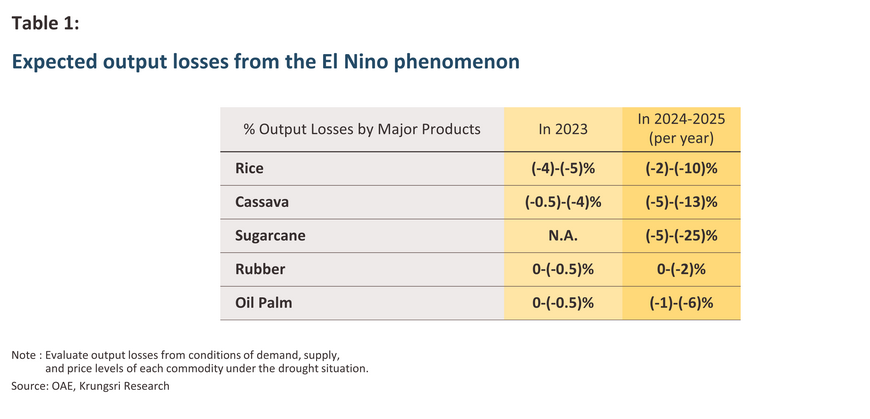

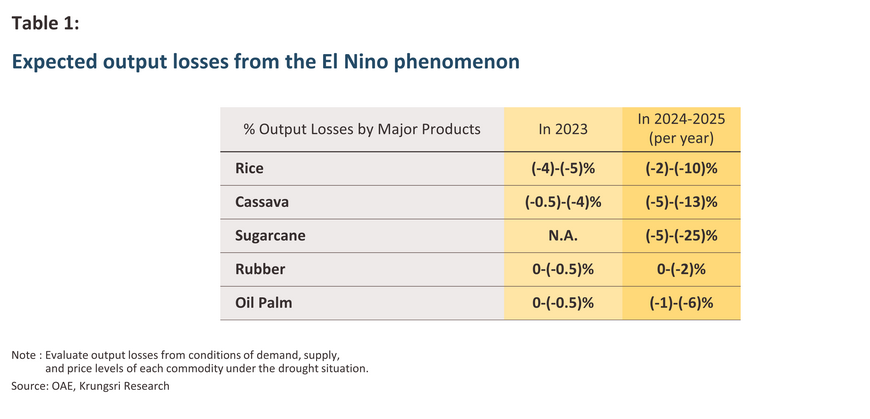

The most important crops that are expected to see major drought-induced cuts in outputs are rice, cassava, sugarcane, rubber, and oil palm, since these are not only drought-sensitive, but they also play an important role in a range of downstream supply chains[9]. These impacts are summarized in Table 1, though overall, the effects of weaker outputs and the resulting supply shortages will most clearly manifest in rising prices for agricultural goods.

Considering the combined effects of the limited extent of irrigation networks, likely only intermittent rainfall, the significant total area under cultivation and its extensive reliance on water, limited water stores, and rising production costs, 2023 outputs of rice and cassava are expected to suffer, and in 2024 and 2025, these losses will spread to other crops. The most seriously affected regions are likely to be in the north, northeast, and west of the country, while in the central region, impacts will fall most heavily on rice growers (Figure 5). Declining outputs will feed into a drop in household incomes for those in the agricultural sector and will also indirectly affect labor markets. Those most affected by this will generally be those on low incomes, and these households will be exposed to an increased risk of having to shoulder an even higher debt burden.

2) Impacts on manufacturing supply chains

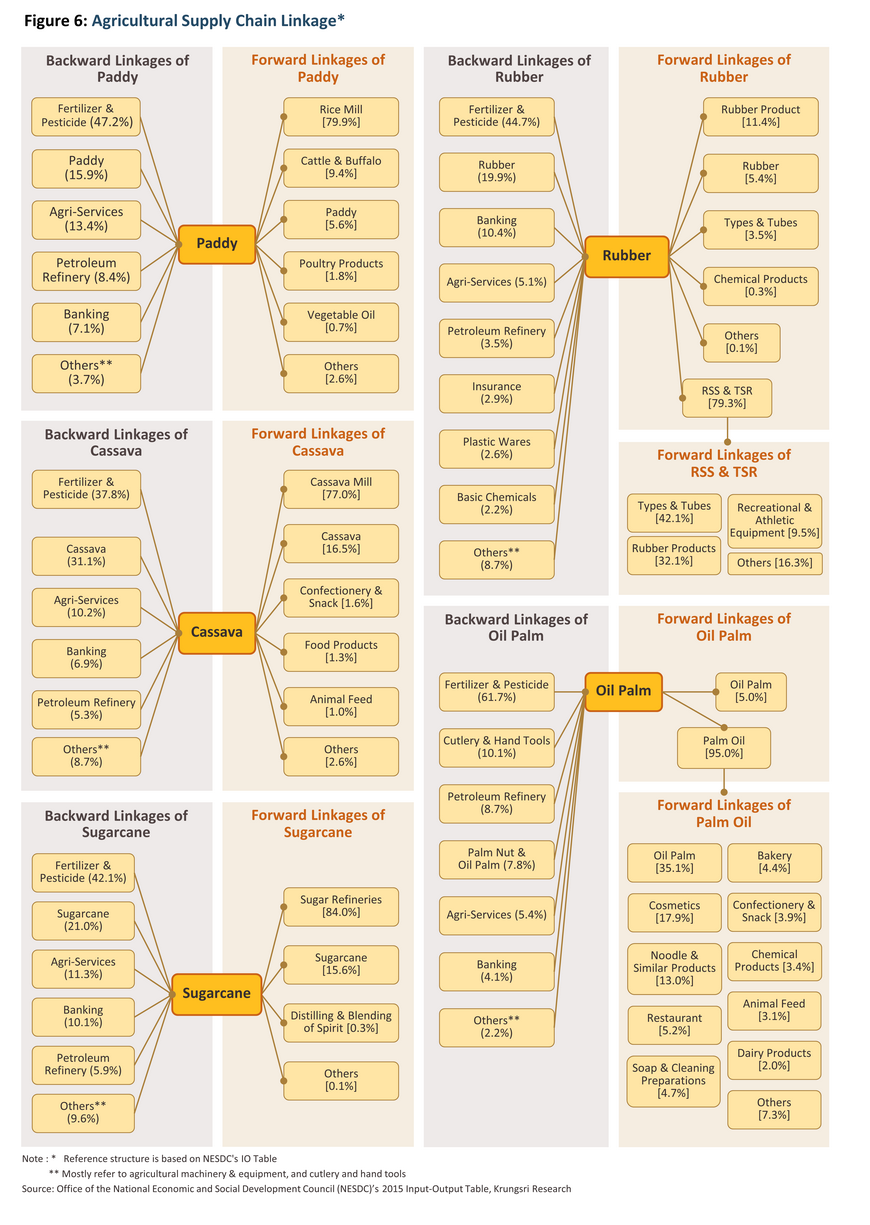

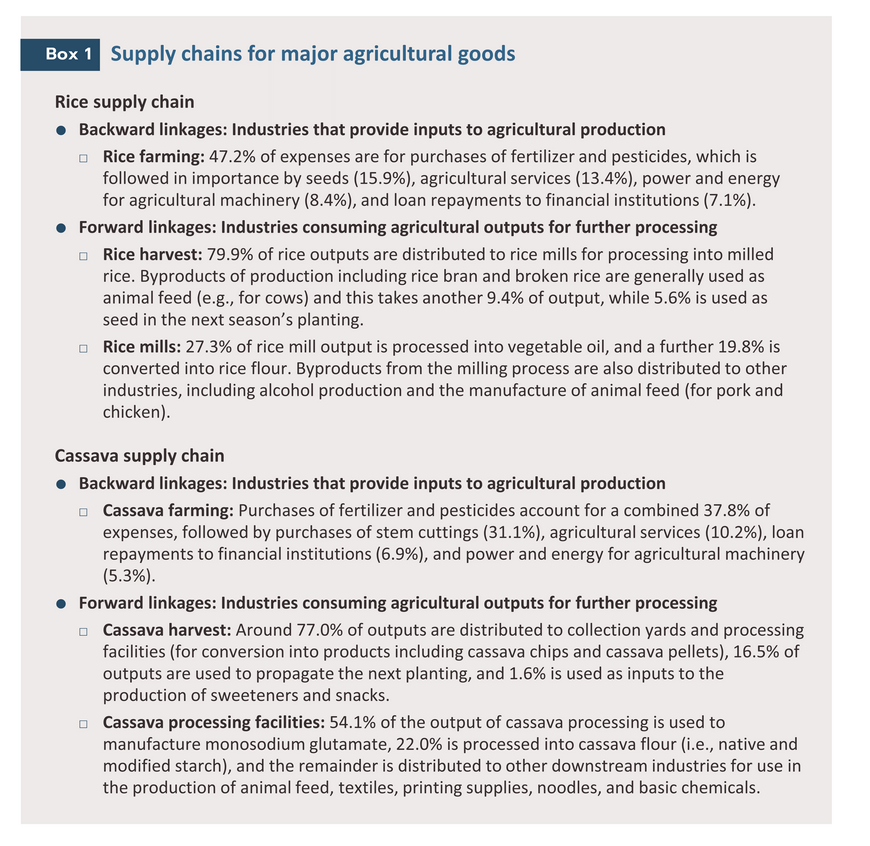

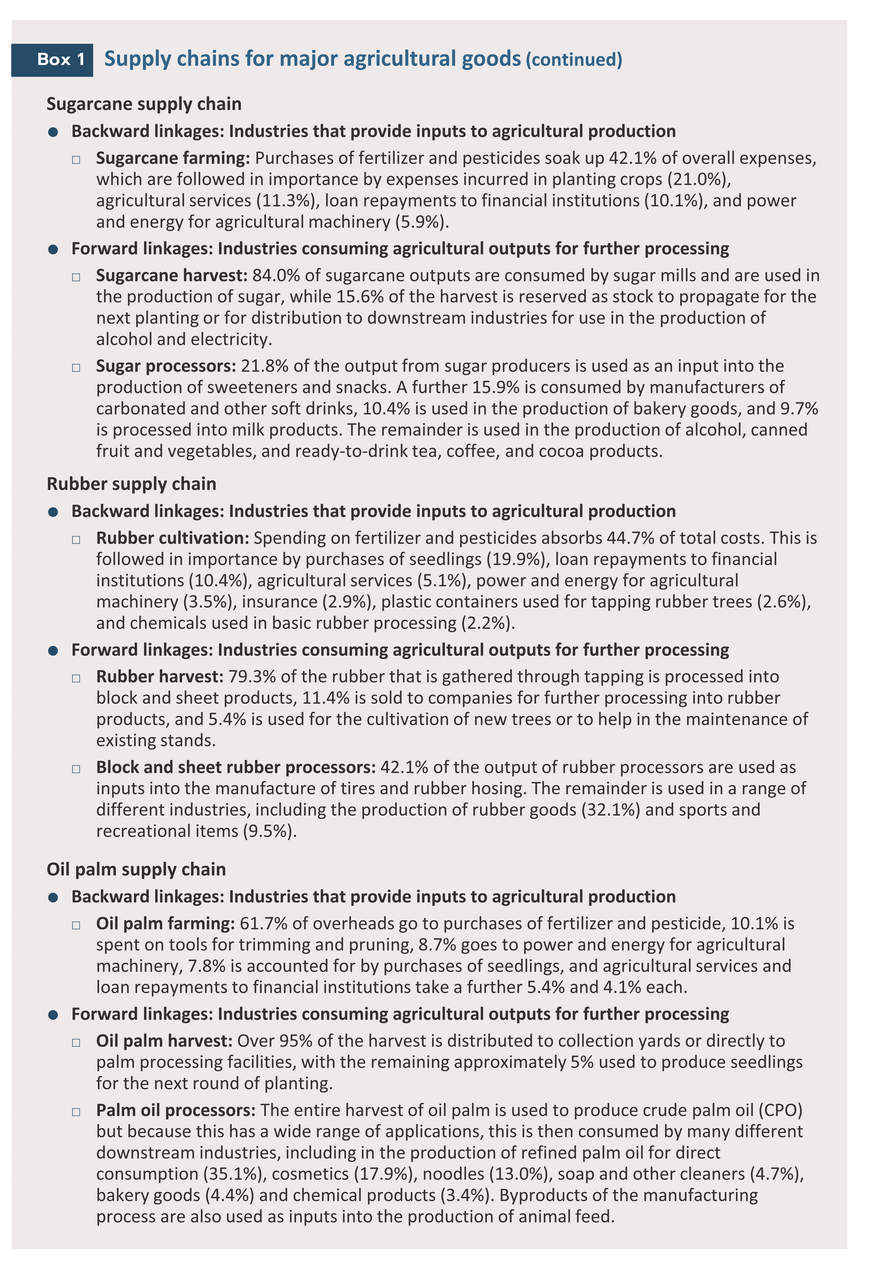

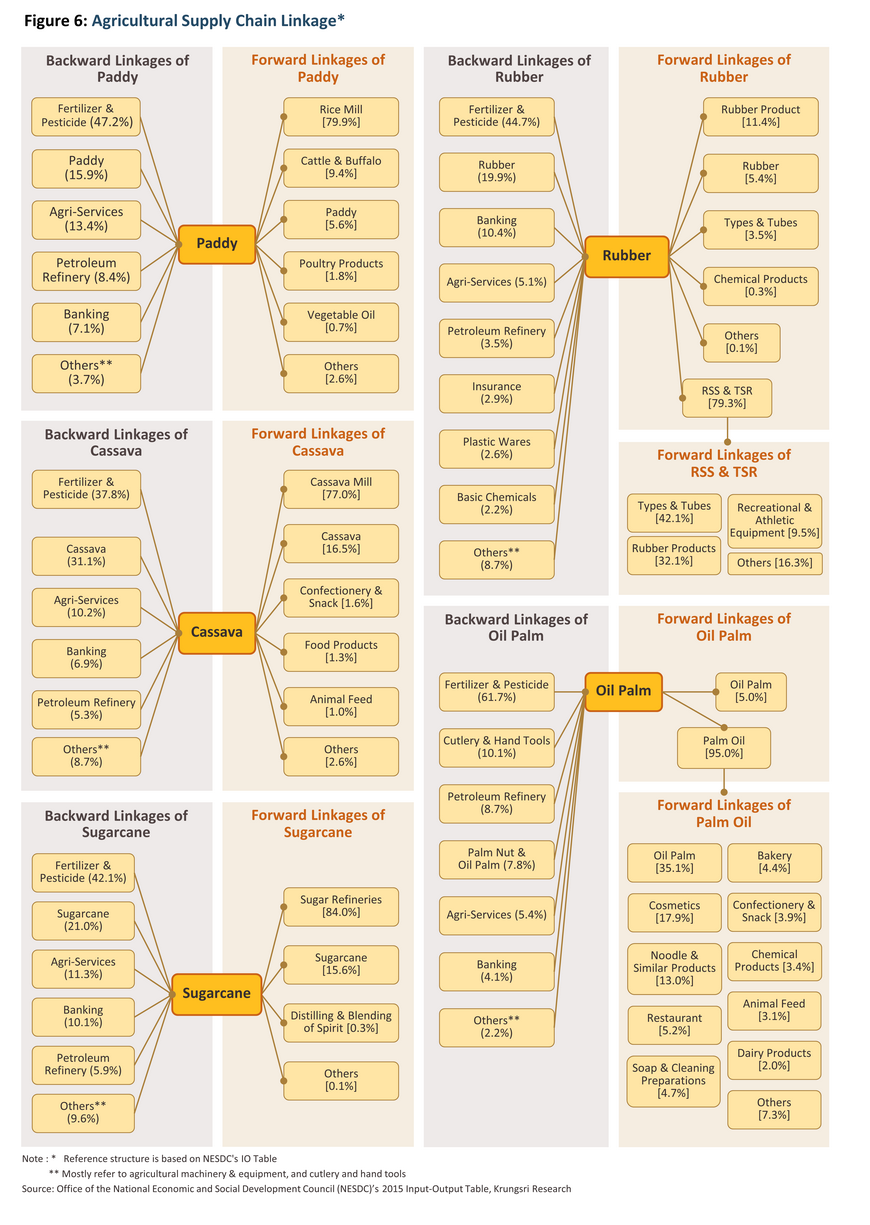

When evaluating the impacts of the forthcoming drought on the wider economy, attention was given to the linkages with other manufacturing industries that touch on the agricultural sector. Krungsri Research thus looked at the structure of agricultural supply chains and in particular those for goods that are most exposed to the impacts of drought, namely rice, cassava, sugarcane, rubber, and oil palm. As part of this, the 2015 Input-Output Tables (published by the Office of the National Economic and Social Development Council (NESDC)) were used to analyze production.

The results of this analysis indicate that drought-induced losses will not be limited to the agricultural sector. Rather, upstream industries will be affected by falling outputs and the impact of this on demand. Meanwhile, downstream industries that use agricultural goods as inputs will see capacity reduced and/or will need to source alternative products, which will likely then entail higher production costs. It is therefore clear that the consequences of any future drought will not be restricted to the agricultural sector but will ripple out to agro-industrial businesses and on to a wider circle of manufacturing and service sector businesses connected directly or indirectly across the economy (Figure 6).

3) Krungsri Research view: Expected impacts of the drought on Thai GDP

The coming drought is expected to be roughly equal in severity to those experienced in 2014-2016 and 2018-2019, and so using these as a benchmark, Krungsri Research estimates that in the base case, the drought will cut -0.1% from baseline GDP in 2023 and an average of -0.3% in each of 2024 and 2025.

However, the data show that the impacts on the GDP of an El Niño are affected by its timing and duration, and the effects of this on access to water. Thus, future rainfall and the effectiveness of water management policies will have a very important role to play in determining the severity of the drought. Initially, Krungsri Research sees El Niño persisting through 2025 and so modeling of the situation and its impacts are divided into two time periods and three levels of intensity (Table 2).

- 2023: Onset of the El Niño

- Best case: Supply chain losses will total THB 14.74 billion, or 0.08% of GDP.

- Base case: Supply chain losses will total THB 18.24 billion, or 0.11% of GDP.

- Worst case: Supply chain losses will total THB 22.52 billion, or 0.13% of GDP.

- 2024-2025: El Niño conditions reach their full intensity.

The impacts over the following two years may differ from one year to the next, depending on the intensity of El Niño in each year and how much usable water is remaining from the previous year.

- Best case: Annual supply chain losses will total THB 22.08 billion, or 0.13% of GDP. This is the most likely outcome for 2024.

- Base case: Annual supply chain losses will total THB 50.17 billion, or 0.29% of GDP.

- Worst case: Annual supply chain losses will total THB 77.84 billion, or 0.45% of GDP. This is the most likely outcome for 2025.

[1] 30-year average rainfall (calculated from 1991-2020).

[2] An El Niño is said to be in effect when Pacific sea-surface temperatures in a particular area are above normal for an extended period. Typically, this will then result in lower-than-normal rainfall and thus drought in Southeast Asia. The intensity of any given El Niño is measured by the ONI Index. Thus, if this is in the range 0.5-0.9, this is a weak El Niño, if it is between 1.0-1.4, it is a moderate El Niño, between 1.5 and 2.0 is regarded as a strong El Niño, and above 2.0 is a very strong El Niño. Likewise, values below -0.5 indicate La Niña conditions, with the same (negative) ONI values being used to classify this as weak to very strong.

[3] On average, El Niño occur every 2-5 years. The last El Niño was in 2018-2019, though strong El Niño emerge around every 10-15 years. The last of these was in 2015-2016, and so it is quite possible that another will be seen in 2023-2024.

[4] The Pacific Ocean in the area 5oN-5oS and 170oW-120oW. This is referred to as the Niño 3.4 Region.

[5] The Meteorological Department sees this falling -5% below the long-term average. Source: Announcement of the Meteorological Department on the start of Thailand’s 2023 rainy season,19 May, 2023.

[6] For example, releasing freshwater to counter inflows of saltwater at high tide and so preserve tap water quality and prevent damage to water processing equipment, maintaining water levels to prevent damage to reservoirs and dams, flushing away wastewater, and preserving ecosystems.

[7] For example, mammals, reptiles, aquatic animals, and local plants.

[8] The impacts of water shortages on industrial production are likely to be limited since most players have already prepared for the possibility of this by maintaining their own water reserves and/or securing alternative supplies. This is especially so for companies located on industrial estates, which often have their own on-site reservoirs. Alternatively, factories not on industrial estates may have facilities to purify groundwater for their own use or they may recycle their own wastewater. Nevertheless, the industrial sector is still exposed to the impacts of drought through indirect channels, for example, by the lower availability of agricultural inputs for use in production processes, the more variable quality of these, and higher costs, which may be lifted by both the need to spend more on inputs and to shoulder the costs associated with more extensive water management policies.

[9] Factors considered included the normal harvest season, where crops are grown and whether this area is irrigated, the type of product, the likelihood of lower yields, and current prices.