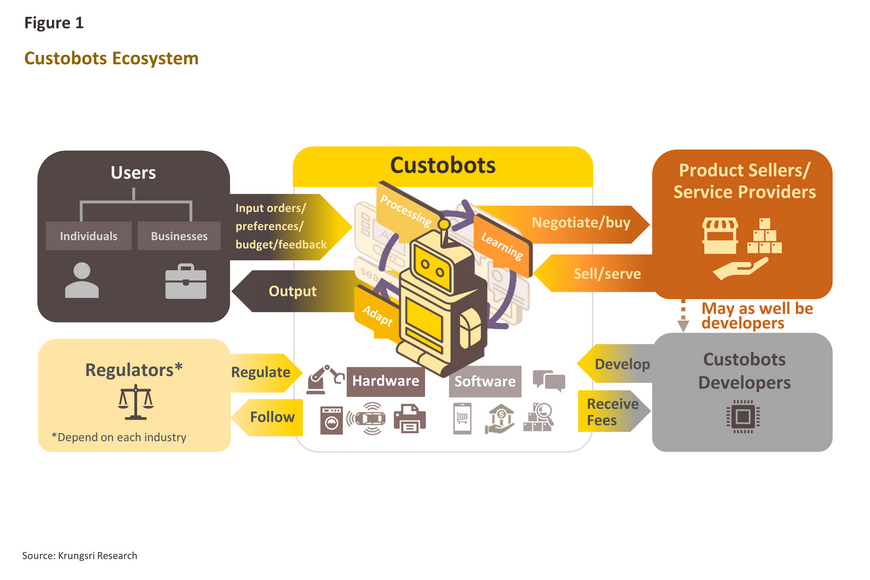

The wave of technological progress has introduced numerous innovations into the mainstream, with artificial intelligence (AI) being the most recent and high-profile arrival. AI’s capabilities are vast, particularly in assisting with decision-making processes. These systems can identify core issues, gather information, compare choices and outcomes, and make decisions. As AI can complete all stages of this process, it is now possible for humans in business transactions to be replaced by AI-driven ‘machine customer’, or ‘custobots’ (a portmanteau of ‘customer’ and ‘robot’). Because custobots are at an early stage of development, their abilities remain limited. They are typically deployed in contexts where their operations are controlled by a human user. However, in the future, custobots may operate independently of immediate human oversight. This has the potential to generate significant economic impacts, with estimates suggesting these developments could generate over USD 300 billion in income by 2030. Nevertheless, deploying custobots remains a challenge. Issues such as customer worries over transparency, uncertainties in marketing to custobots, the divergence between technical services required by human and machine customers, and the impact of further technological progress and regulatory changes need to be addressed. In the financial sector, custobots may support customer services or back-office operations. It may also become necessary to develop ‘non-human agents’ to interact with custobots as they become more effective and numerous.

Artificial intelligence (AI) has rapidly evolved from a novel technology to an integral part of the technological backdrop that supports modern consumer life. AI is thus transitioning to a mainstream product, integrated into decision-making systems like AI-enabled object-detection inventory monitors that alert when stocks are low, or virtual personal assistants that gather and collate data for users. These human-support systems are being rapidly developed, and an inflexion point may soon be reached when AI applications become fully fledged independent agents, managing activities within their domain without human intervention.

‘Custobot’ is a combination of the words ‘customer’ and ‘robot’ and is also known as a ‘machine customer’. The IT and management consultancy Gartner1/ defines custobots as non-human economic agents that can source and negotiate for goods and services in exchange for payment automatically. These have been designed as ‘customer agents’ that offer personalized experiences to their users. Unlike virtual assistants like Alexa and Siri, smart devices, or general automated systems, custobots can continuously learn from interactions with users and trade partners and adapt organically to changing situations. This allows custobots to act as full customer agents in the market. By 2028, an estimated 15 billion internet-enabled devices able to function as customer agents, and by 2030, custobots are predicted to generate USD 300 billion in earnings. This rapid expansion will elevate the importance of custobots above digital commerce2/.

Nevertheless, the prediction that ‘human customers will be replaced by machines’ is not new. In 2019, David G.W. Birch suggested in an online article3/ that human customers would gain greater access to high-performance AI systems provided by leading tech companies. These AIs would take over the assessment and negotiation of financial products. Consequently, financial service providers might shift their efforts to selling primarily to robots rather than humans.

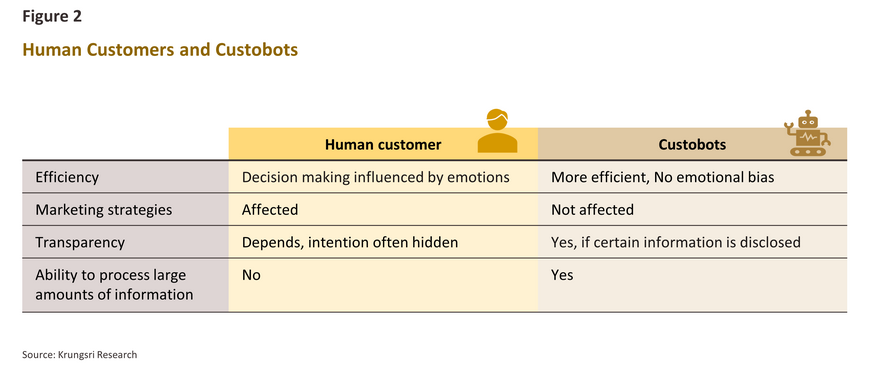

Although custobots have been developed to mimic humans’ natural decision-making abilities, research shows that there is still a significant gap between machine and human decision-making processes6/. Nevertheless, custobots embody the following features that help them provide support to users (Figure 2).

Factors influencing the development of custobots

Demand-side factors

Customers, whether individuals or companies, will benefit from being able to access an assistant that makes the purchasing process quicker, more convenient, and less costly. This is providing a significant impetus from the demand side of the market to the development of custobots. In detail, demand for custobots is driven by the following factors.

-

Assistance with repetitive tasks: Enterprise clients may see the need for AI assistants for repetitive work tasks like drawing up purchase agreements, recruiting staff, managing inventory, submitting purchase orders to suppliers, and outsourcing general administrative duties. Individuals might use automated assistants to source and buy consumer goods, manage pantries, make repeat purchases, and manage subscription services.

-

Assistance with negotiations: Enterprise clients may use custobots for simpler, non-critical tasks like managing appointments and undertaking initial customer negotiations. For individuals, these systems could act as agents in day-to-day situations, such as negotiating over sales prices, interest rates, fines, and service cancellations.

-

Assistance with decision-making over complicated products: As consumer needs evolve, goods and services are becoming more complex, making it harder for consumers to accurately assess alternatives. This is especially true for financial products, where many factors must be considered before coming to a firm decision. In this context, Custobots can assess vast quantities of data almost instantaneously, including product ranges, market conditions, returns, and risk levels, tailored to a consumer’s needs. This capability helps reduce the burdens associated with purchasing decisions.

Supply-side factors

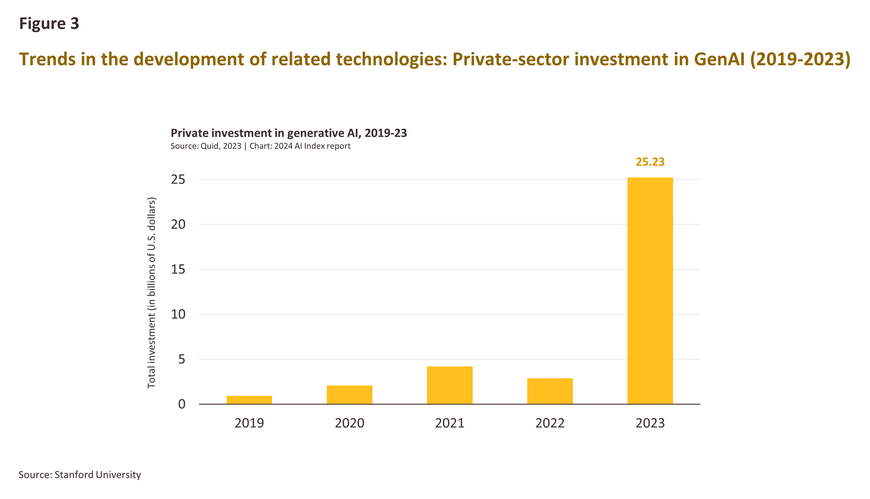

- Progress on the underlying technology and supporting infrastructure: The inception of AI, spanning from 1955 to 197410/, led to the development of technologies such as natural language processing, machine learning11/, and large language models. These technologies have laid the groundwork for the development of generative AI (GenAI). Furthermore, these advancements have been integrated to emulate human-like understanding and decision-making in computers, which has in turn given rise to custobots.

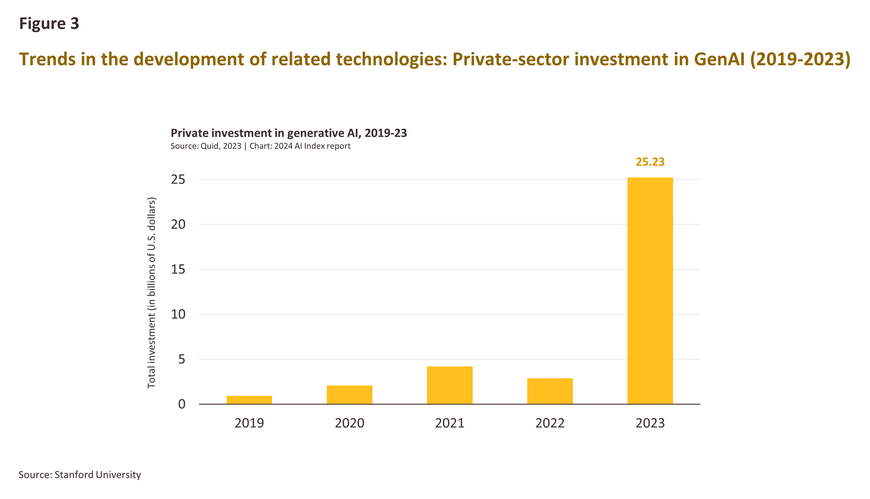

These areas have also benefited from significant ongoing investment. Most recently, private-sector funding for GenAI has exploded, jumping nine-fold in 2023 compared to the previous year12/ (Figure 3). Consequently, the technological foundations for developing custobots will remain secure in the foreseeable future.

Development of custobots

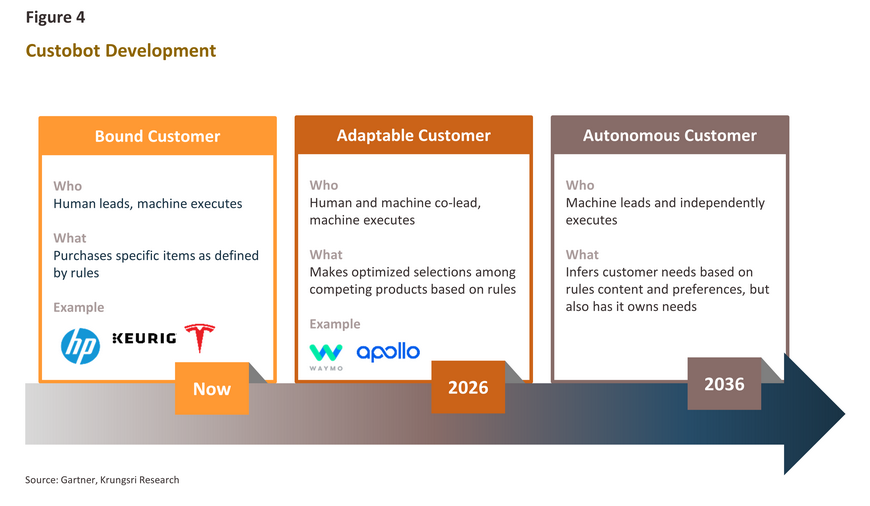

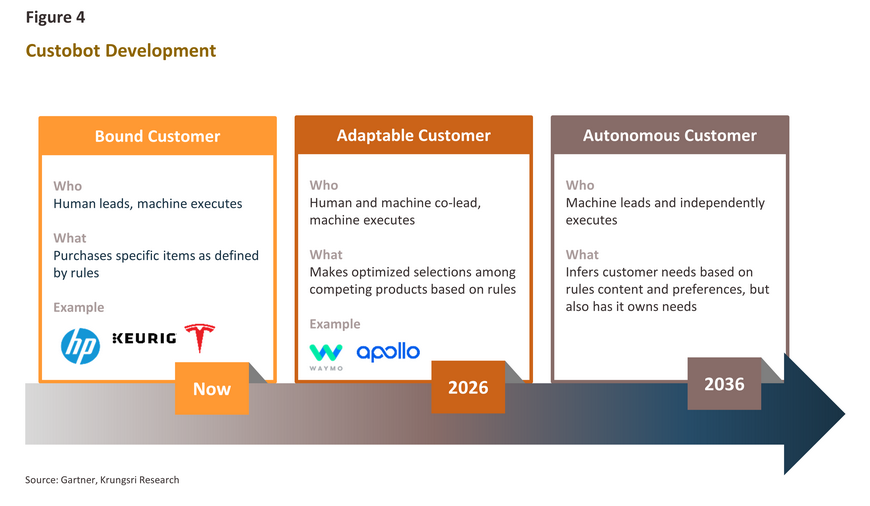

Gartner sees the development of custobots occurring in three phases13/, marked by progress in the abilities and the period when their services become widely adopted. These three stages are described below (Figure 4).

-

Phase 1 - Bound Customers: At the initial stage of development, the rollout of custobots is limited to ‘providing assistance’ to human users. While they can identify patterns in customer behavior, they still rely on human input to guide their actions and follow explicit instructions. Examples of Phase 1 custobots include automatic reordering systems like HP Instant Ink14/ and Keurig BrewID, as well as some parts of the Tesla in-car system. Custobots currently fall under this phase of development.

-

Phase 2 - Adaptable customers: In phase 2, custobots will improve their ability to learn and behave flexibly. While they can be adaptable to user interactions, custobots will still primarily support human decision-making. Phase 2 custobots will also be able to gather data and use it for continuous learning and self-improvement. Examples include investment robo-advisors and autonomous vehicle systems, which may then be used to offer robotaxi services. Examples of the latter include Alphabet’s Waymo One, available to the public in Phoenix and San Francisco, and Baidu’s Apollo Go available in major Chinese cities such as Beijing, Shanghai, and Guangzhou. Phase 2 services are expected to become more widely available from 2026 onwards.

-

Phase 3 - Autonomous customers: At the last of Gartner’s three stages, custobots will be able to understand the current situation, predict the outcome and adjust their own performance according to different scenarios. They will be able to make independent decisions on complex topics without human intervention. Phase 3 is currently expected to begin in or around 2036.

Custobot services available today

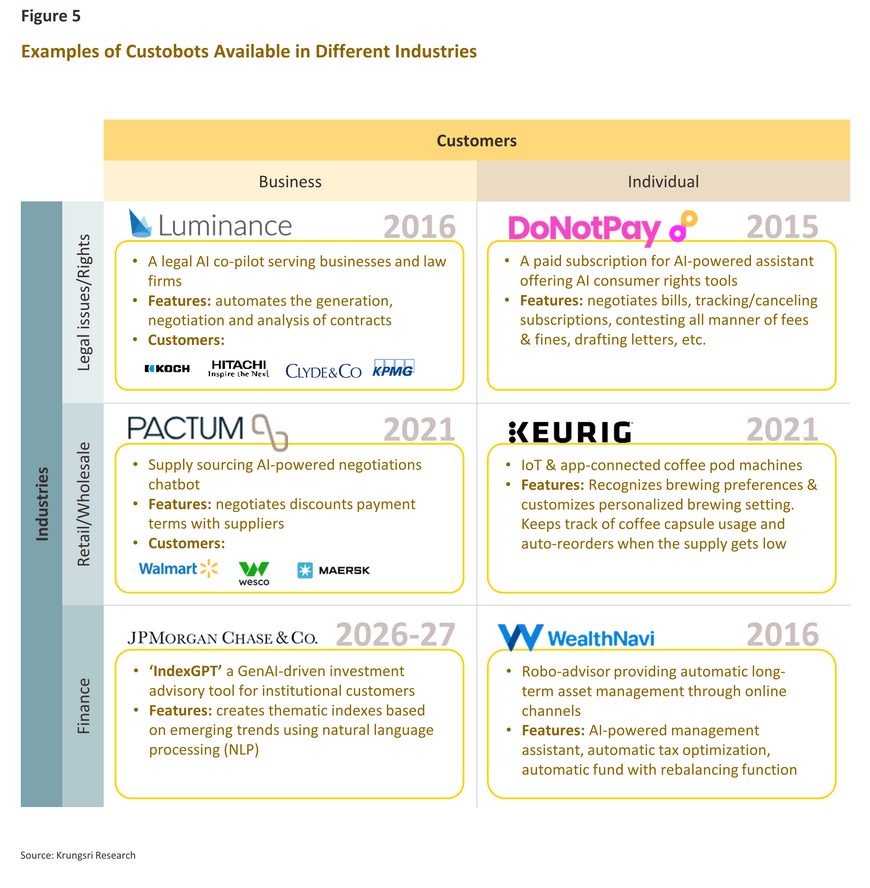

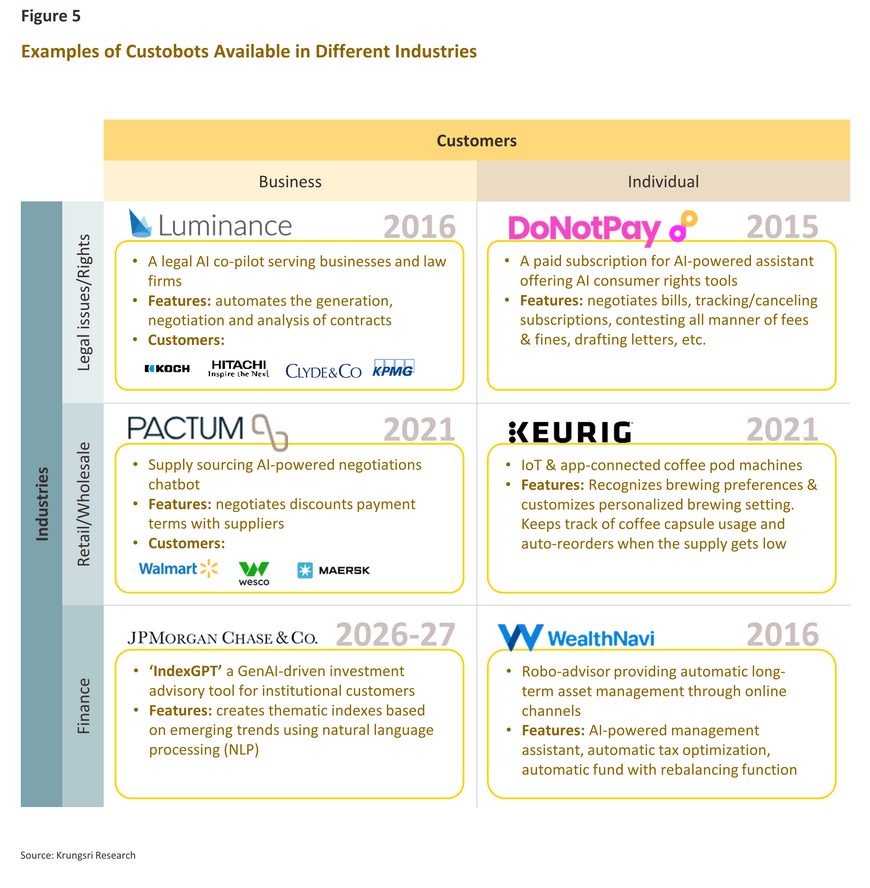

An increasing range of commercial custobots are becoming available as developers move to meet the demand from both consumer and corporate customers. Their services span a wide range of industries, including law and consumer rights, retail and wholesale businesses, and financial services. Some examples of custobots that are being developed or that are currently available are discussed below (Figure 5).

-

Law: In addition to mirroring the basic services provided by general legal AIs, such as carrying out research, drafting documents, and analyzing contracts, legal custobots also offer more advanced services, particularly by representing users in legal negotiations. Luminance is one such provider, which sells to both legal offices and other businesses. The company began offering AI negotiating services to companies in 2016, with a key feature being their ability to automatically negotiate contract details with AI counterparties. On the consumer market, DoNotPay, which began operations in 2015, uses a chatbot to gather claims and related information from customers, then negotiates with third parties on their behalf. DoNotPay can act as a consumer representative in disputes related to bill negotiations, service cancellations, and the payment of fees and fines.

-

Wholesale and Retail: Within this segment, a wide range of custobots are available, tailored to individual needs. Pactum AI, which began operations in 2021, provides corporate retail clients with a ‘chatbot purchasing representative’ that can compare and make a selection from a range of products, as well as automatically negotiate with suppliers over discounts and payment terms. In contrast to other areas, most consumer custobots are developed by product manufacturers themselves. One example is Keurig, a manufacturer of capsule coffee machines. The company provides users of its machines with access to a custobot that records stock levels and usage of the capsules favored by individual users, then reorders these automatically as necessary. Keurig began offering these customer support services in 2021.

-

Financial services: Because the financial services industry is tightly regulated, financial custobots are typically developed by financial institutions or fintech companies. On the corporate side of the market, IndexGPT is a GenAI tool that will provide investment advice to institutional investors starting in 2027. In the retail segment, WealthNavi has been offering robo-advisor services to the public since 2016. These help retail customers engage in long-term financial planning and can automatically adjust client portfolios according to market conditions.

Custobots in banking and finance

Custobots have the potential to act as significant drivers of growth for the finance industry, and these may be deployed across a broad range of contexts, including in support of internal enterprise operations, the development of new financial products, and customer services.

1) Enterprise operations: Custobots may play a significant role within the banking and finance sector, supporting various enterprise duties, especially straightforward and repetitive tasks, or those requiring contact with external parties. For enterprises, custobots can complete work more efficiently and accurately than humans alone, thus helping organizations save workforce and time devoted to these tasks. Applications include legal work, for example assisting with negotiation of simple contracts, human resource management, and purchasing and procurement. Custobots will assist with selections, scheduling appointments, negotiating, and automatically closing tasks. This will help reduce employee workloads, allowing them to focus on more complex tasks.

2) Developing new financial products and services: The financial sector is highly competitive, with banks and financial institutions constantly racing to bring new products and services to market. Custobots can assist in this area. By effectively roleplaying as customers during product development, custobots enable researchers to explore how potential customers might react to changing circumstances. For example, the Commonwealth Bank of Australia uses a GenAI chatbot to study customer responses during the initial stages of product research, focusing on how models equipped with details on customers’ daily lives react to different experiences. The R&D team is particularly interested in investigating how the models react to low-probability, high-impact events such as natural disasters, war, and sudden economic changes. The results of these experiments are then utilized as inputs in the design of new products.

3) Customer service: Custobots have the ability to provide AI-driven investment advice. For retail customers, robo-advisors offer investment recommendations based on individual circumstances, drawing from data on assets, investment goals, and other relevant areas. In the corporate sphere, IBM’s Watson AI platform leverages NLP technology to collate data from news, social media, industry analysis, economic reports, financial reports, and other economic indicators, all of which inform its analysis. Watson AI powers AIEQ’s quantitative model for structuring its ETF. Meanwhile, JPMorgan Chase is also developing IndexGPT15/ (Figure 5), a GenAI-based platform that uses NLP to source data on mega trends and provide thematic investment advice to institutional investors. The company is the first financial institution to use the ChatGPT platform to deliver investment advice specifically for its clients. Overall, Forbes believes custobots will likely replace humans in performing analysis and making financial decisions.16/ Consequently, financial product providers like banks, fintech players, and other financial institutions, may need to develop AI systems that can interact with clients’ own custobots.

Challenges in Custobot Development and Deployment

Although the concept of the custobots is still novel and relatively unknown, their importance is expected to multiply rapidly, becoming a significant source of earnings. Stakeholders, including consumers, sellers of goods and services, and developers, will need to overcome several challenges. These include the following.

I. Consumers

-

A lack of transparency: Some consumer-facing custobots are developed by manufacturers of consumer goods looking to build brand awareness or to make it easier to connect with potential buyers. This raises concerns about their independence and fairness, even though they appear to source goods from a wide range of suppliers. These services might therefore be open to abuse by those operating them. For example, a custobot service provider that claims to help individuals source general consumer goods might also produce its own house brand. This custobot can analyze customer interactions to gain insights into shopping patterns, which the company could exploit. This data could be used to manipulate custobot responses by ‘keyword stuffing’ descriptions of its own less relevant items, making them appear more often in custobot responses, even if other items better meet consumer needs.

-

Responsibility in the case of losses: Regulators typically strive to stay abreast of new technological developments, but new technologies often escape full oversight during their initial rollout, and custobots are no exception. Nevertheless, if services provided by companies that are properly registered in Thailand cause losses to consumers due to their custobots actions, those individuals should have the right to legal protection and redress, as custobots are clearly a type of service. Additionally, tightly regulated services requiring commercial operating licenses, such as financial advice, should also be overseen by specific regulatory agencies.

II. Sellers of goods and services

-

Changes to marketing strategies: Tactics developed for human customers may have limited results with custobots. Companies will need different techniques to spark interest and provide access to product information. Unlike human customers, custobots focus tightly on a product’s value proposition. An item must offer very high performance to stand out among thousands of similar goods. Product information and descriptions should also be in a format easily accessible to custobots and sufficient for further AI analysis.

-

Providing customer services for non-human actors: Machine customers run on deep-learning algorithms, requiring different technical services than human consumers. For example, Custobots need access to external digital resources, typically provided through an API (Application Programming Interface), to furnish the AI with sufficient data for it to carry out its analysis. Sellers and distributors may also need to develop intermediary agents to automate interactions and sales with their customers’ custobots.

III. Developers and providers of custobots

-

User-friendliness: While most interactions with custobots will be initiated by sellers showcasing their products, it’s crucial that these systems feature an intuitive and user-friendly interface. They should process inputs and respond rapidly and smoothly at all stages, from entering instructions and tracking operations to users reviewing responses and providing feedback on the custobots’ activities. Ensuring user-friendly interfaces will likely increase long-term customer retention. Additionally, developers must assure user data privacy and security, transparency of AI algorithms, and full legal protection in case of service failures.

-

Increasing complexity of custobot technology: New technologies like augmented intelligence, edge AI, and quantum computing will soon be integrated into the development of custobots, enabling engagement in much more complex decision-making. Developers must stay attuned to these advancements and implement them rapidly in commercial settings to gain a competitive advantage in a crowded market.

-

Future changes to the regulatory environment: The regulatory landscape for technology, particularly AI, is expected to tighten globally, increasing costs for developers. Key regulations already in place or forthcoming include the EU AI Act17/ and the General Data Protection Regulation (GDPR)18/ from the EU, as well as China’s temporary regulations on the provision of generative AI services19/. In Thailand, aside from the 2019 Personal Data Protection Act, which regulates the storage and use of personal data, AI regulations are still being developed according to the 2022-2027 National AI Action Plan.

Krungsri Research view: How will banks respond to the advent of machine customers?

Although knowledge of custobots or machine customers remains limited, they have been spreading within the commercial environment and providing services to consumers for some time. Going forward, their performance and number will continue to increase. For the finance and banking sector, custobots will represent both opportunities and threats, requiring close attention to developments in this field. The various ways the industry may integrate custobots into their operations are described below.

Firstly, banks and financial institutions can deploy custobots in back-office roles to perform repetitive and straightforward tasks, freeing up staff for more productive work and contributing to cost savings over the long term. This can be applied in areas like legal issues and human resource management, especially when contacting external bodies or individuals. Introducing custobots in these contexts is the fastest and most effective application. However, banks must ensure that using custobots in back-office operations does not cause regulatory compliance issues, such as breaching rules on data privacy.

Custobots will also find a place in customer service roles. In the short term, this might entail providing support services focused on suggesting a bank’s financial products to customers. Over the longer term, this could extend to developing robo-advisors that assist with customers’ financial planning, especially for younger workers who are both comfortable with technology and interested in saving for retirement. Robo-advisors are easily accessible to retail customers and investors, since these typically have low upfront costs and are often more knowledgeable than novice investors. However, on the downside, many Thai robo-advisors are limited by their inability to update portfolios quickly and the restricted range of financial products they offer. To attract greater public interest, developers will therefore need to build up flexible portfolio rebalancing features and extend the range of investment options, including new investment vehicles alongside traditional mutual funds.

If banks proceed with deploying custobots in back-office roles or as customer service agents, they will need to decide whether to develop these in-house or work with an external developer. This decision will involve careful consideration of how to maximize business value, including the required and available technological expertise, the ability to customize and fine-tune custobots, data security, and the long-term maintenance costs of developing their own systems.

Finally, once the use of custobots has become more widespread, banks will face new challenges, including intensifying competition between banks and other financial institutions to attract these agents. Moreover, fintech players will likely release more custobots to negotiate loans, credit cards, and interest rates with banks on behalf of customers. In this environment, banks may need to develop their own ‘customer service agents’ to interact seamlessly and instantaneously with custobots. Nevertheless, this development must consider the industry’s tight regulations, ensuring that any agents promoting financial products to custobots comply with relevant rules.

Overall, custobots are likely to expand their scope of use to cover a wider range of activities. However, due to the differences between human customers and custobots in terms of needs, access to information, and decision-making abilities, stakeholders—including users, product and service providers, developers, as well as banks and financial institutions—should thoroughly understand these conditions and differences. This understanding will then allow them to simultaneously maximize the benefits of these new technologies, while remaining conscious of their potential future impacts.

References

Banerjee, S., Singh, P., & Bajpai, J. (2019). “A Comparative Study on Decision-Making Capability Between Human and Artificial Intelligence”. Research Gate. Retrieved from https://www.researchgate.net/publication/320214054_A_Comparative_Study_on_Decision-Making_Capability_Between_Human_and_Artificial_Intelligence

Birch, D. (2019). “The future of banking is basically robots running everything”. Wired. Retrieved from https://www.wired.com/story/future-of-banking-robots/

Birch, D. (2023). “When The Bank’s Customers Are Replaced By Custobots”. Forbes. Retrieved from https://www.forbes.com/sites/davidbirch/2023/10/30/when-the-banks-customers-are-replaced-by-custobots/?sh=3f6ecff6b03a

Gartner (2023). “Gartner Identifies the Top 10 Strategic Technology Trends for 2024”. Gartner. Retrieved from https://www.gartner.com/en/newsroom/press-releases/2023-10-16-gartner-identifies-the-top-10-strategic-technology-trends-for-2024

Perrault, R. & Clark, J. (2024). “Artificial Intelligence Index Report 2024”. Stanford University. Retrieved from https://aiindex.stanford.edu/report/#individual-chapters

PWC (2023). “AI Adoption in the Business World: Current Trends and Future Predictions”. PWC. Retrieved from https://www.pwc.com/il/en/mc/ai_adopion_study.pdf

Raskino, M. (2023). “How AI tech like ChatGPT could help Machine Customers disrupt markets”. Linkedin. Retrieved from https://www.linkedin.com/pulse/how-ai-tech-like-chatgpt-could-help-machine-customers-mark-raskino?trk=portfolio_article-card_title

Raskino, M. (2024). “Our Bots Can Negotiate That”. Linkedin. Retrieved from https://www.linkedin.com/pulse/our-bots-can-negotiate-mark-raskino-xlbme?trk=article-ssr-frontend-pulse_more-articles_related-content-card

Rice Business. (2016) “The Hidden Role Of Emotion In Decision Making”. Rice University. Retrieved from https://business.rice.edu/wisdom/peer-reviewed-research/hidden-role-emotion-decision-making#:~:text=Not%20necessarily%2C%20George%20and%20Dane%20found.%20Research%20suggests,and%20underestimate%20the%20chance%20of%20a%20negative%20one

Scheibenreif, D., & Raskino, M. (2022). “Machine Customers Will Decide Who Gets Their Trillion-Dollar Business. Is It You?”. Gartner. Retrieved from https://www.gartner.com/en/articles/machine-customers-will-decide-who-gets-their-trillion-dollar-business-is-it-you

Scheibenreif, D. (2023). “CIOs must prepare for the machine customers of the future”. CIO Dive. Retrieved from https://www.ciodive.com/news/gartner-robots-customers-technology/645891/

Son, H. (2023). “JPMorgan is developing a ChatGPT-like A.I. service that gives investment advice”. CNBC. Retrieved from https://www.cnbc.com/2023/05/25/jpmorgan-develops-ai-investment-advisor.html

1/ https://www.gartner.com/en/newsroom/press-releases/2023-10-16-gartner-identifies-the-top-10-strategic-technology-trends-for-2024

Digital commerce describes the overall digital system within which goods and services are distributed, and includes backend service providers, and all associated processes, technologies, and consumer experiences. These may be delivered through different parts of the internet, including e-marketplaces, mobile phone apps, and social media platforms. By contrast ‘e-commerce’ has the more specific meaning of the sales of goods and services and the building of brand awareness through online channels (Read more at https://www.trade.gov/ecommerce-definitions)

3/ https://www.wired.co.uk/article/future-of-banking-robots#:~:text=Financial%20institutions%20are%20already%20using,for%20customers%20and%20by%20customers

4/ https://www.linkedin.com/pulse/machine-customers-absorb-work-companies-foist-us-mark-raskino

5/ NLP is a machine learning technology that gives computers the ability to interpret, manipulate, and

comprehend human language. (Read more at https://aws.amazon.com/th/what-is/nlp/)

6/ Decision making of human intelligence is different from AI in such parameters: Strength of emotions, Strength of intelligence, Cognitive skills, Reasoning, Memorization and Response time. (Read more at https://www.researchgate.net/publication/320214054_A_Comparative_Study_on_Decision-Making_Capability_Between_Human_and_Artificial_Intelligence)

7/ https://onlinelibrary.wiley.com/doi/full/10.1002/hfm.20336

8/ Inbound marketing refers to the strategy of building interest in a product or company from potential customers by delivering attractive value-building content across a range of channels, including blogs, social media and influencer marketing, all of which helps to improve SEO.

9/ https://www.mdpi.com/2504-2289/5/2/20

10/ For more details on ‘Generative AI: A World-Changing Technology’, please see: https://www.krungsri.com/th/research/research-intelligence/generative-ai-2023

11/ Machine Learning is part of the study of AI, using algorithms that learn from data sets to develop

models that can behave similarly to humans, such as separating images, analyzing data, or forecasting data.

12/ https://aiindex.stanford.edu/report/#individual-chapters

13/ https://www.gartner.com/en/articles/machine-customers-will-decide-who-gets-their-trillion-dollar-business-is-it-you

14/ HP Instant Ink is a subscription-based service that dispatches new ink cartridges automatically when

the customer’s supplies are running low.

15/ https://www.cnbc.com/2023/05/25/jpmorgan-develops-ai-investment-advisor.html, https://www.bloomberg.com/news/articles/2024-05-03/jpmorgan-unveils-indexgpt-in-next-wall-street-bid-to-tap-ai-boom?sref=s4Mndd0n

16/ https://www.forbes.com/sites/davidbirch/2023/10/30/when-the-banks-customers-are-replaced-by-custobots/?sh=3f6ecff6b03a

17/ https://artificialintelligenceact.eu/the-act/

18/ Under the GDPR, companies processing and analyzing data are required to give data owners the opportunity to learn about how AI is being used in these processes, and to provide them with the opportunity to object to this. For more details, please see: https://www.europarl.europa.eu/RegData/etudes/STUD/2020/641530/EPRS_STU(2020)641530_EN.pdf

19/ China’s temporary regulations require generative AI services developed in China to undergo a safety assessment. Content produced by AI systems must also be truthful and accurate. The regulations came into force in July 2023