Central Bank Digital Currencies: A Challenge for Commercial Banks

As the name suggests, central bank digital currencies (CBDCs) are a form of digital currency issued by a nation’s central bank, but that name may lead some astray because although CBDCs have an electronic form, they are somewhat dissimilar to more widely known digital assets such as virtual currencies and stablecoins, and CBDCs are in fact not unlike digitized versions of the coins and notes that grease the wheels of daily economic life. Many central banks now hope that CBDCs will provide a comprehensive solution to the needs of digital consumers since their use would sidestep the requirement to change physical cash into a digital equivalent. For central banks, CBDCs also offer the advantage of extending the points of contact between the central bank and the general population and of reducing the costs associated with supplying money to the economy.

CBDCs may be categorized according to a variety of criteria including what type of transactions they facilitate, the extent of private sector participation in the management or use of the CBDC, whether they pay interest, and the technological base on which they are built or that is deployed at each stage of their use. With regard to the type of transactions that they target, CBDCs can be split between wholesale CBDCs, which are used in transactions between central and commercial banks or financial institutions, and retail CBDCs, which may be used for the small-scale transactions that occur between, on the one hand, central banks or providers of financial services and on the other, individual consumers.

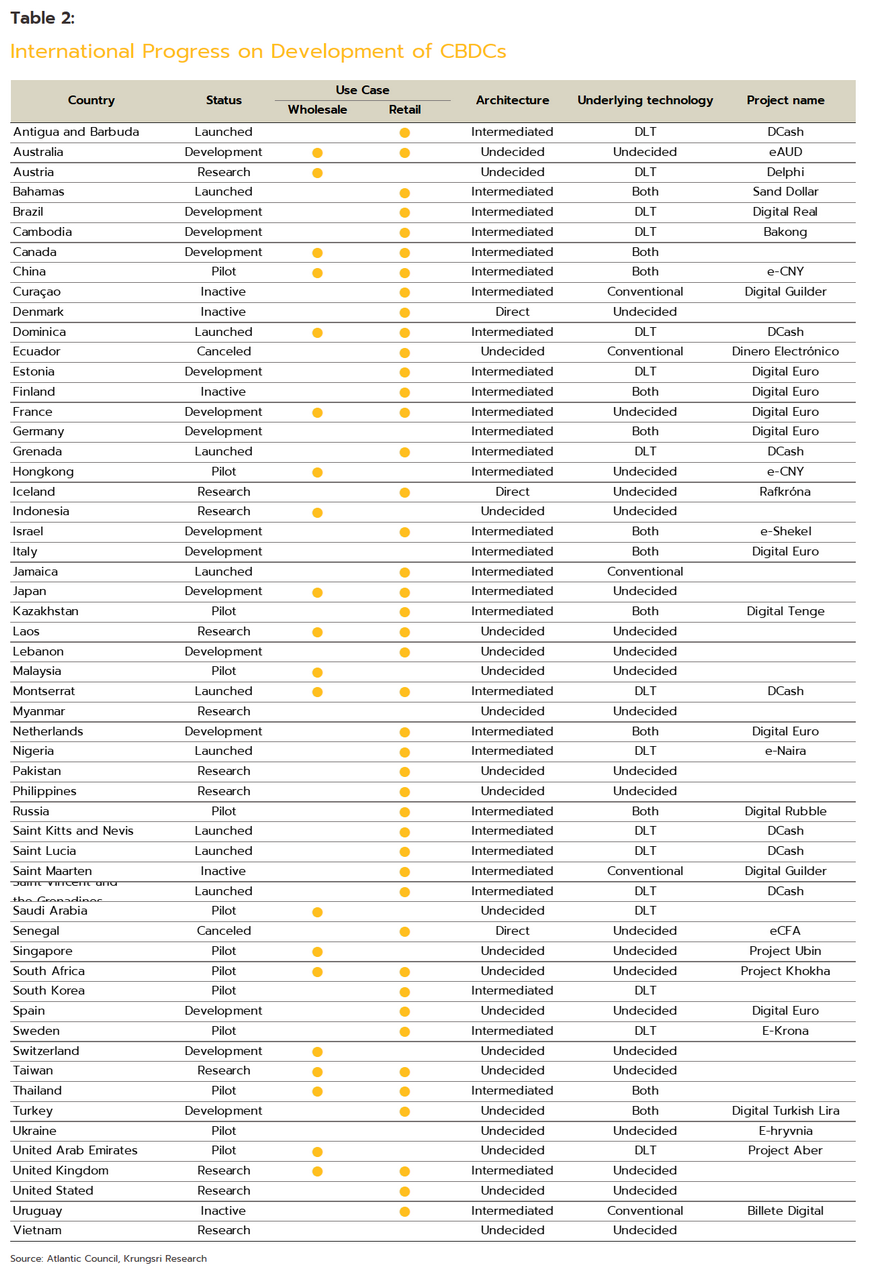

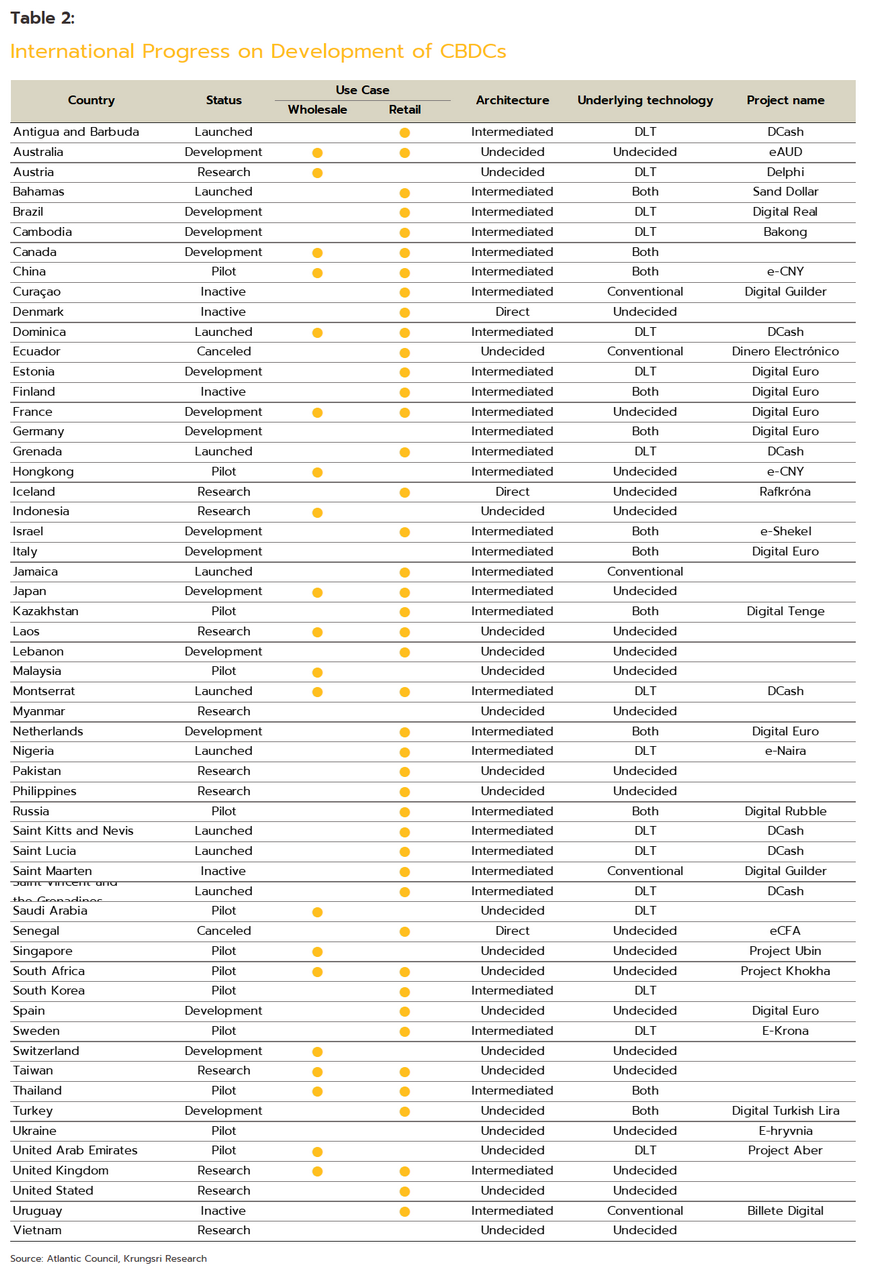

CBDCs have been under development since 2017 and at present, the Bahamas, Nigeria, Jamaica, and a number of other countries in the Caribbean have all officially introduced their own CBDC. Generally, this has been done to address inefficiencies in the domestic processing of financial transactions and to overcome problems with access to financial services, which remains spotty and incomplete in these countries. Beyond this group, many more countries are in the process of developing their own CBDCs, though progress on this naturally varies from one country to the next. Around the world, financial authorities are attracted to CBDCs due to their ability to increase the speed and efficiency with which digital financial transactions may be completed, whether that is in domestic markets or internationally, though their use may also be extended into new areas as financial innovation progresses. However, the traffic has not all been one way, and countries such as Ecuador and Senegal, which were among the first wave of CBDC pioneers, quickly folded and abandoned their forays into this area.

In the view of Krungsri Research, because CBDCs are both issued by central banks and benefit from all the advantages of digital currencies, their use will significantly improve the ease, convenience and efficiency of completing financial transactions within the digital space, and this has the potential to be of significant value to society. The impetus that this will give to the development of CBDCs will also open up access to financial technology and this will feed through into an expansion in financial innovation. However, this positive outlook needs to be balanced with an awareness of potential pitfalls, including the need to make CBDCs work in offline environments since some users may lack internet access and to date, many consumers have been unable or unwilling to use mobile or internet banking. In addition, the development of CBDCs also needs to take into account their potential future use in virtual worlds.

The era of globalization has been marked by constant change and uncertainty, but through this, the basic human urge to look for opportunities for personal betterment has persisted. Within the world of investment, technology has also carved out an ever more central role for itself, and the incessant pushing forward of technological boundaries has had the consequence of generating enormous new sources of value. Thus, investing in virtual currencies[1] and other types of digital assets has attracted widespread interest, and one consequence of this has been feverish speculation that in future, these have the potential to replace fiat or e-money[2] as the central axis around which financial transactions turn. In addition, technological advances in big data analytics and in areas such as the blockchain hold out the potential to disintermediate financial transactions, which would then displace traditional financial institutions from their central role in the economy.

The rapid pace of these developments has meant that across both the public and private sectors, the digital financial space is playing a steadily growing role in the financial world. In response, central and commercial banks in many countries have stepped up research into how technology such as the blockchain can be used to improve the efficiency of financial systems. As part of this response, within the more restricted area of central banking, some countries have also begun to experiment with the official use of central bank digital currencies (CBDCs).

This current wave of innovation in the financial system and in particular, the growing interest among central banks in CBDCs has led many parts of society, including banks, other types of financial institution, and even members of the public, to ask what changes we can expect to see in payment systems, business transactions, and how we live our daily life if CBDCs become a reality.

An overview and brief history of CBDCs

Central bank digital currencies, or CBDCs, are a type of digital currency issued by central banks, so in the case of Thailand, a Thai CBDC would be issued by the Bank of Thailand. Full CBDCs have a legal status as an official currency in the issuing country so these can be used to pay for goods and services exactly as coins and notes have been used globally for hundreds of years. However, before a CBDC can be officially launched, the central bank of the issuing country will need to work hard to build confidence in the currency and as part of this, the CBDC’s value will be pegged to the more familiar national currency. This will help to ensure that the CBDC can be exchanged for the normal, non-digital variety of the currency at a fixed rate and this will then underpin faith in the digital version of the currency.

In addition, because the value of a CBDC should be exactly equal to the value of the national currency, there will be no fluctuation in the value of one relative to the other, unlike the often wild swings in value seen for virtual currencies and other types of digital asset. This is because CBDCs are created with the intention of providing ease-of-use to consumers, not as an investment vehicle or as a source of speculative profit.

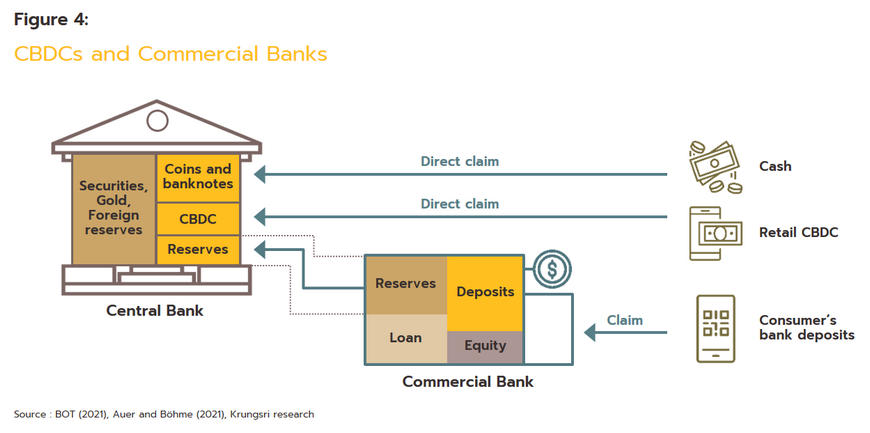

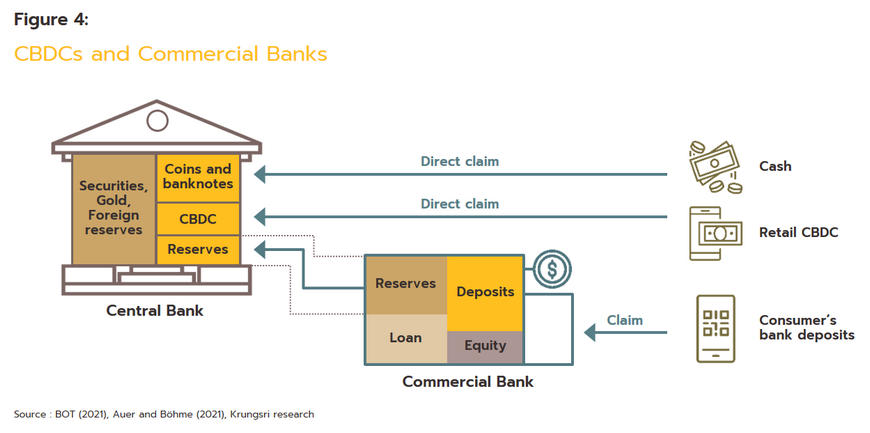

From a superficial point of view, making a CBDC-based payment might look indistinguishable from using the mobile banking app of a regular commercial bank, with the only salient difference perhaps appearing to be that one involves the central bank and the other involves a commercial bank. However, the currency being used to facilitate these two transactions is fundamentally different because although making a payment through a mobile or internet banking service is entirely digital, it is still made in the same currency as the notes and coins used in high street shops, just a digitized version of this. In the case of the CBDC transaction, however, this is made in a new and entirely native digital currency, even though it has the same value as its non-digital twin. It is also important to distinguish CBDCs from stablecoins3/ and e-money, which are issued by commercial players in the private-sector.

In many instances, central banks are attracted to digital currencies because these offer a means of extending financial inclusion and of making financial transactions safer and more convenient than is the case when using cash. In addition, introducing a digital currency will reduce costs and raise efficiencies within the financial system, while also opening up new possibilities for financial innovation.

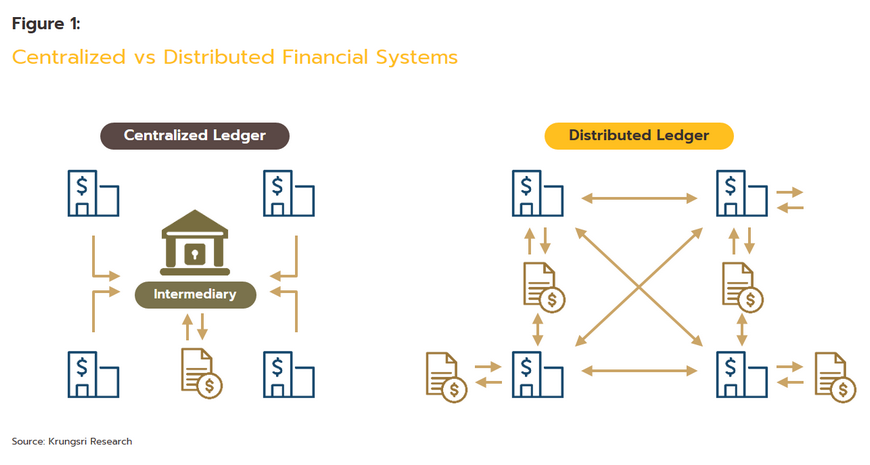

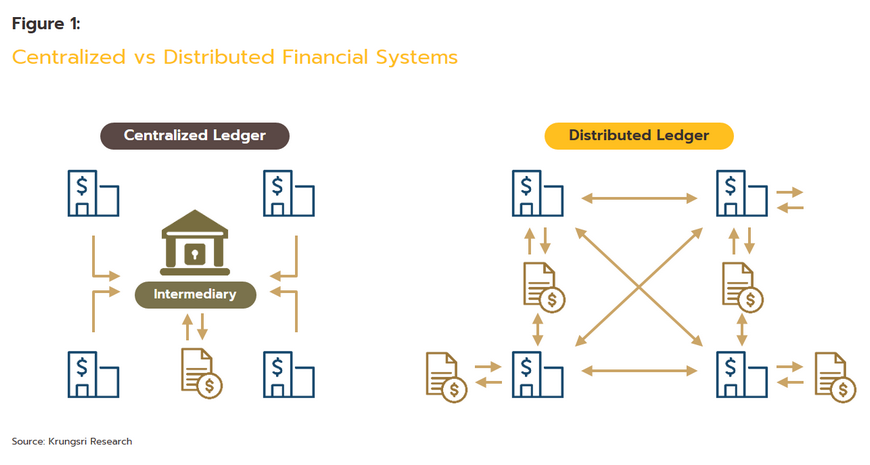

During the first stages of CBDC development, central banks may form technology partnerships with businesses that have expertise in developing digital assets so that they may work together to test and develop the CBDC system. This may be developed both as a centralized system that collects and stores financial information at a central node, much as commercial banks do, and as a system based on distributed ledger technology (DLT). The latter is a decentralized system within which members may exchange information directly without the need to pass through an intermediary or a central node

Another reason behind central banks’ growing focus on CBDCs is the huge interest in digital assets that has been building over the past few years, and major global organizations have clearly felt the need to enter this space and to lay down their own digital landmark. This process has been led by Facebook, which with a userbase that extends over more than half of the global population is the world’s largest social media platform. Several years ago, Facebook announced the creation of its own digital currency, which was first named Libra and then Diem, and although the project has since been shelved, its announcement triggered shockwaves that reverberated across the technological and financial worlds (Box 1).

The creation of Libra and other stablecoins has been another important factor pushing the traditional financial system, and especially central and commercial banks, through a major transformation as they look to avoid seeing their core business swallowed up by big tech. As such, the financial sector has shifted away from a sole focus on notes and coins and has instead expanded its area of concern to include digital assets, including CBDCs.

Box 1: Was Facebook’s digital currency a major step forward or just an idle daydream?

Diem, or as it was initially named, Libra, was a digital currency that Facebook revealed to the world in 2020. Libra, or LBR, was a fiat-backed stablecoin that ended up being structured in such a way that some coins were tied to a single currency while others were backed by a basket of these. Libra’s value was thus determined through two systems.

- Multi-currency-backed stablecoins: Initially, Libra was backed by a basket of currencies, though the mix was weighted towards those from major economies that have a significant impact globally, such as the US dollar, the euro, the pound sterling, the yen, and the yuan. This was how Libra was structured when it was first unveiled.

- Single-currency-backed stablecoins: In its second form, Libra coins were backed by a single currency to which they were pegged at a 1:1 exchange rate, though coins were issued against a number of different currencies. Thus, USD-backed Libra coins could in theory have been exchanged at a 1:1 value against the USD, GBP-backed coins could have been exchanged at a 1:1 value against the GBP, and so on. The switch to single-currency coins was made in November 2020 following objections by the authorities to the initial plans for a multi-currency-backed coin and subsequent efforts to scale back the size of the project.

Initially, Facebook wished to see Libra become a digital currency that enjoyed CBDC-levels of trust, despite the fact that the latter is built on central banks’ considerable shared reputation, their legally enshrined right to issue the national currency, the role that central banks play in regulating the financial system, the decades (in many cases centuries) of experience that they have managing financial crises, and the considerable institutional experience and expertise that they have therefore amassed. As it tried to emulate this, Facebook therefore created the Libra Association, a non-profit organization that gathered together representatives from twenty-seven businesses drawn from a range of different industries and that intended to look after the future development of the new stablecoin. Thus, Andressen Horowitz, Thrive Capital and Rabbit Capital came from the world of investment, blockchain players were represented by Coinbase and Anchorage, eBay and Mercado Libre came from the e-commerce industry, non-profits were represented by Women’s World Banking, Kiva and Mercy corps, and Mastercard, PayU, PayPal, Stripe and Visa spoke for the financial sector. Entry to this elite club came with a USD 10 million entry fee, which was exchanged for Libra Investment tokens and this then gave participants the right to maintain, manage and direct the development of Libra.

However, Facebook rapidly ran into problems in the shape of stiff opposition from both the US Congress and governments around the world, which feared that because Libra was partly backed by the US dollar and other currencies, permitting its use would carry the risk of running an external currency alongside the domestic one, i.e., allowing a kind of dollarization of the economy. This would then create a potentially dangerous situation because digital currencies such as the Libra are not under the control of the government or the central bank and so the ability of the authorities to influence the domestic economy would potentially be significantly eroded. In addition, allowing the use of a currency such as Libra would likely make it easier to evade legal controls on, for example, money laundering, and so in addition to the US, countries including France and Germany objected strongly to the creation of the currency. The upshot of this was then that companies such as PayPal, MasterCard and eBay, which had announced that they would participate in the project, withdrew from it.

At the end of 2021, Facebook changed its name to Meta as part of the company’s efforts to underline its commitment to the metaverse, but despite this and Libra’s rebranding as Diem at the close of 2020, the company failed to overcome either hostility from the US Congress or ongoing opposition from regulators, including the Fed[4]. To make matters worse, David Marcus, a senior executive at Meta who has considerable expertise with fintech and who had been responsible for the initial launch of Libra/Diem, announced that he would be leaving Meta in December 2021. This then further clouded the project’s already troubled future, and perhaps inevitably, Meta announced that the Diem project would be officially wound down on 31 January, 2022, with assets and intellectual property connected to payment systems sold to Silvergate Capital[5].

Types of CBDC

CBDCs can be categorized along a number of different axes, and the main ways of classifying these are given below.

1) Type of transaction supported: CBDCs can be split into wholesale and retail CBDCs. The former are used to facilitate transactions between central and commercial banks or other financial institutions, whereas the latter are used by banks’ retail customers.

Classifying CBDCs with regard to their scope of use or the type of transaction that they support is the most common categorization schema. Using CBDCs in transactions between commercial banks or other parts of the finance sector falls into the area of wholesale CBDCs, and in this case, their use would help to increase the efficiency with which transactions are completed and security settlements are made, as well as to reduce exposure to counterparty credit risk. At present, there is considerable interest in the use of wholesale CBDCs, research into their use is underway across a broad front, and in some cases, they are beginning to be deployed in the field. Their use is attracting particular attention in the area of cross border payments, where cooperative efforts among central banks are being pushed forward by a small group of these. In addition, wholesale CBDCs can clearly be used domestically in transactions between financial institutions, with the central bank acting as an intermediary between these, though to increase efficiency and convenience, players in the finance sector that are able to use wholesale CBDCs in this way generally record these transactions on a distributed ledger or blockchain. Thus, Dr. Aruna Sharma, former secretary, and member of the Reserve Bank of India Committee on Deepening of Digital Payment has said that wholesale CBDCs can be thought of as “a means by which the central bank can transfer newly minted and as-yet unused banknotes to commercial banks, which are then able to distribute these into the wider economic system” [6].

By contrast, if CBDCs are able to make their way into the hands of consumers, these are considered to be retail CBDCs. These are discussed in detail in the next chapter.

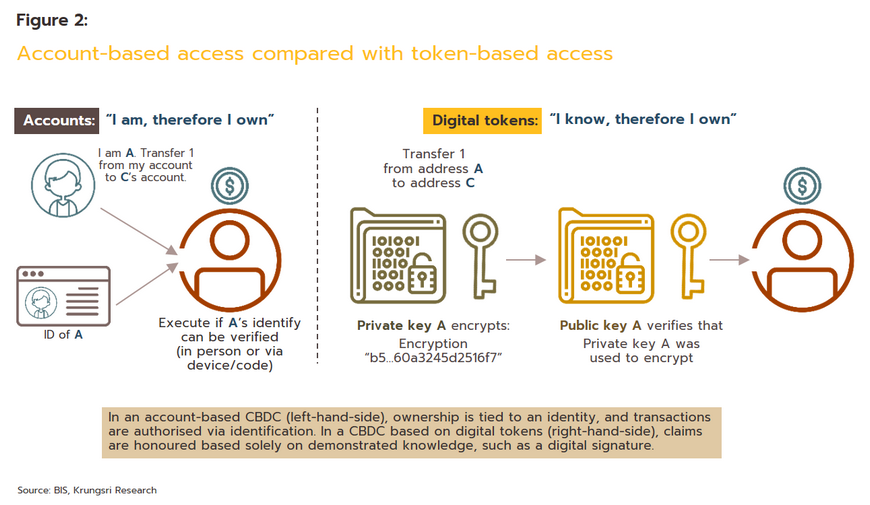

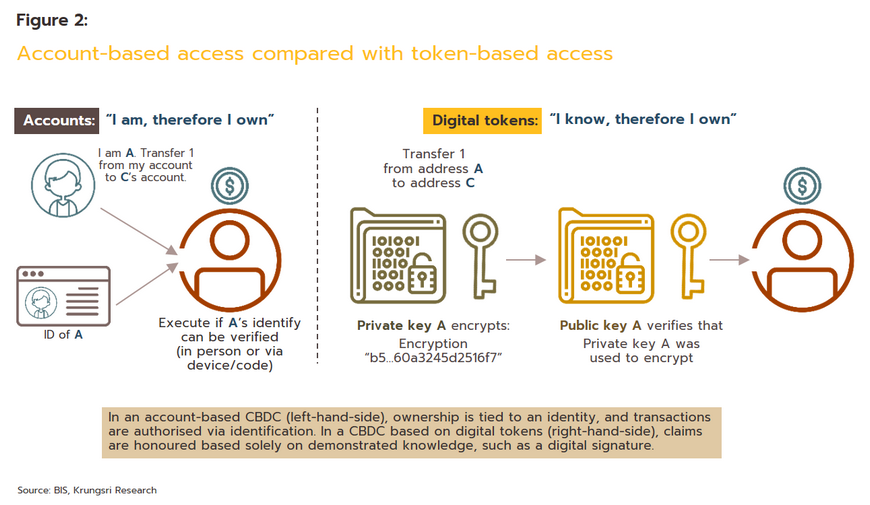

2) Token-based or account-based CBDCs

Account-based CBDCs are built on a foundation of individual accounts. These are used to store information relating to all the transactions connected to that account together with its remaining balance. These transactions are tied to individually identifying information that marks out those making the transaction, in much the same way as emails are tied to the email address of senders and recipients, and so there is little anonymity in this system. By contrast, token-based CBDCs are based around tokens and it is these that record data relating to transactions, which may or may not be linked to individually identifying information. In these systems, confirmation of identity is carried out through the use of a digital signature and so token-based systems offer greater potential for anonymity than do account-based alternatives. Nevertheless, the digital trail that they leave behind means that token-based systems are still less anonymous than cash, though they offer the potential of significantly easing the friction involved in making cross-border payments.

3) Interest bearing and non-interest bearing CBDCs

Unlike cash, the use of CBDCs provides central banks with a mechanism for making interest payments to CBDC holders. However, making these interest payments would have implications for the central bank monetary policy transmission mechanism, as well as for how commercial banks would set interest rates paid on savings and the scale of the overall deposits that they held (Garratt and Zhu, 2021).

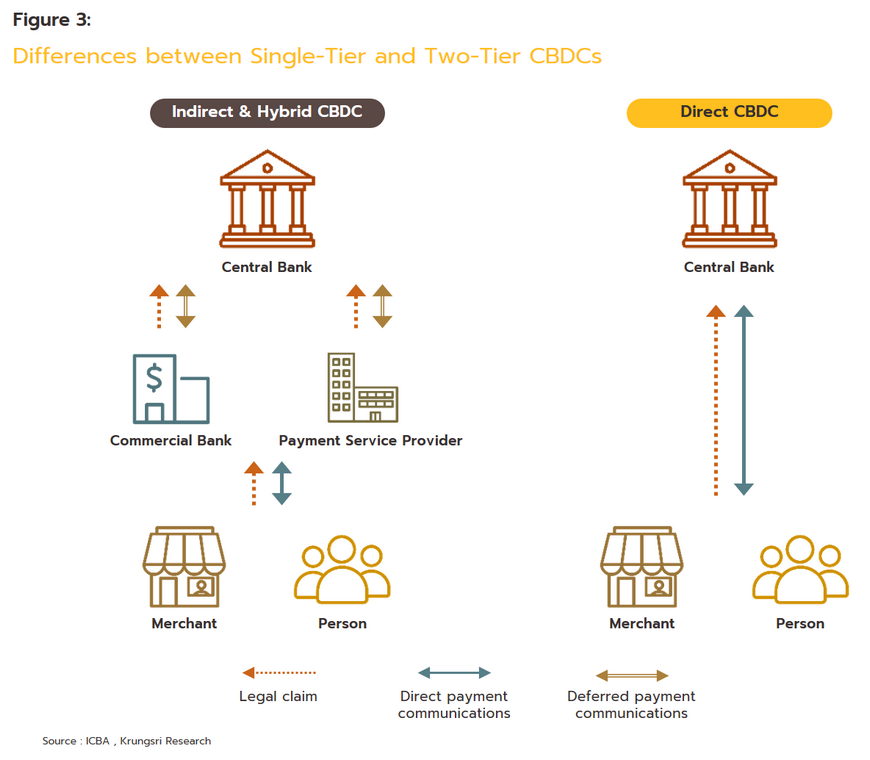

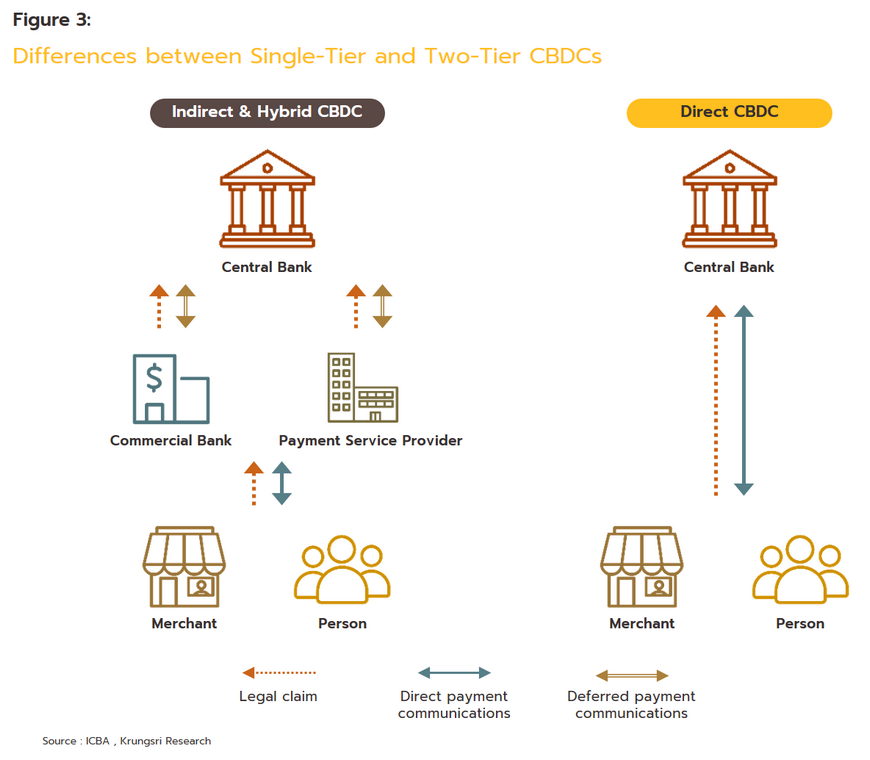

4) The extent of private-sector participation: CBDCs may be split into single-tier and two-tier variants according to the degree of private-sector involvement.

In the single-tier model, central banks design the currency in such a way that they alone are responsible for operating and managing all points of the financial chain, including dealing directly with retail customers. These systems are therefore also referred to as direct CBDCs. However, if central banks were to take on these roles, this would raise a new set of potential problems since historically, central banks have generally had no direct interactions with individual consumers and so they lack knowledge and expertise in many crucial areas, such as implementing ‘know your customer’ regulations.

The two-tier model differs from this in that the central bank manages the CBDC indirectly, and so these are also called indirect or hybrid CBDCs. Under these models, the central bank transfers some of the responsibilities it maintains in the single-tier model to commercial banks or other payment interface providers since these have expertise in dealing with retail customers. At the same time, the central bank would reserve for itself the power to issue and to authorize transfers of the CBDC. Given the natural advantages offered by this system, this is the more favored of the two options.

5) Technological foundations of the CBDC: The technology used to record transactions may be based around either centralized or decentralized ledger technology

When CBDCs are built on a centralized system, those wishing to make a payment need to connect to a central data provider, which could be the central or a commercial bank, and this will then be responsible for authorizing the payment and adjusting account balances accordingly. By contrast, in a decentralized system, when a transaction is made, data from the relevant accounts is duplicated and distributed to all the network nodes operated by permissioned verifiers, which will then confirm or refuse the transaction. This is similar to how virtual currencies operate, though with the very important difference that a particular virtual currency is an open system and anyone may participate in the blockchain without prior authorization, whereas banking and payment systems are necessarily open only to verified participants. In the case of two-tier CBDCs, interactions between payment interface providers and the central bank are recorded directly in the central bank’s ledger, while records of interactions between payment providers and individual users might be based on the principles governing distributed systems (i.e., they would make extensive use of cryptography and programmability). Another core feature distinguishing these systems from virtual currencies is that issuance of new currency and control of the overall money supply would remain with the central bank.

Retail CBDCs: A major step forward for central banks

As described above, retail CBDCs are a form of digital currency issued by central banks but which may be used by retail customers, or in other words, by members of the public. Central banks in many countries therefore see these as a way of providing consumers with easy access to trustworthy and highly secure payment systems and of lowering the credit risk associated with alternative digital currencies. On the other hand, while cash may lack some of the efficiencies gained through the use of digital currencies, it is also less risky since it is backed by the government and it can legally be used to settle transactions.

In theory, the introduction of a retail CBDC would offer many benefits to the financial system, the economy and to the wider society. These are briefly laid out below, following the work of the Bank of Thailand (2021) and the World Bank (2021)

1. Increasing efficiencies for both consumers and the finance sector

-

Speeding up the settlement of transactions: Both consumers and businesses wish to conclude transactions as quickly as possible, and retail CBDCs offer one way of achieving this end; because they operate digitally, retail CBDCs allow for universal real-time payment services that link across different time zones.

-

Lowering service charges: Because CBDCs are built on digital foundations, the cost incurred for processing individual transactions is negligible, and the marginal cost may in fact be close to zero. These low costs may have the additional advantage of encouraging private-sector payment processors to cut their fees, too.

-

Facilitating international payments: Using CBDCs should make it easier to complete cross border transactions, and the system would gain significantly by becoming transparent, verifiable, rapid and low- (or even close to zero-) cost.

2. Building support for innovation and competition

-

Smoothing the transition to the digital economy and encouraging greater use of digital assets: Because CBDCs are issued by a central bank, it is possible to easily exchange these for other types of digital asset, such as investment tokens issued by the private sector. Moreover, because CBCDs can be used directly in place of non-digital currencies, transactions such as this can be completed instantaneously.

-

Increasing competition between financial service providers: Like all digital products, the costs involved in using CBDCs to settle transactions are very low, and this is likely to encourage greater competition among private-sector providers of payment services, which should then lead them to improve the quality of their services and to cut their prices. In fact, it is not necessary for the use of CBDCs to be mediated by commercial banks at all, and in theory it is possible to settle transactions directly with the central bank. This might then help to overcome the problems faced by individuals excluded from the financial system as it is currently organized.

3. Expanding the role of the central bank within the financial system

-

Reducing the costs arising from printing and managing the supply of cash: Unlike notes and coins, issuing currency in the form of a CBDC implies no extra costs for printing, storage and transport, and as such, the overheads associated with their use are lower than for cash. However, it is important to remember that CBDCs rely on an extensive and highly advanced IT infrastructure and maintaining this must be considered one of the costs of using CBDCs. Nevertheless, as these become more widely accepted and so increasingly replace cash in day-to-day life, the marginal costs of greater CBDC use will fall accordingly.

-

Creating a new role for central banks: Traditionally, central banks have only interacted directly with other financial institutions but with the creation of retail CBDCs, the role of central banks will expand from managing the supply of money to the economy to having an immediate and direct relationship with individual consumers. This then opens up new possibilities for much more targeted monetary policy.

-

Strengthening central banks’ traditional functions: Using CBDCs will help central banks expand their involvement in settling electronic payments, which has historically been something largely handled by the private sector, most obviously by commercial banks and fintech operations. Using CBDCs will also provide a way for central banks to deploy financial tools with greater efficiency, to distribute monetary assistance more easily, and to better ensure that fiscal policy has an effect on the unbanked population.

4. Increasing government efficiency

-

Increasing the efficiency with which transfers are made and payments are processed: In many countries, completing financial transactions that involve government bodies is a complicated and time-consuming process. However, if different government agencies were able to participate in a common, shared platform that made payments through a CBDC, this would help to smooth and to accelerate inter-agency transfers. Moreover, in the event of a natural disaster occurring and the government having to make emergency transfers to local government offices and to support payments to the general public, being able to use CBDCs alongside traditional types of currency would help to accelerate the whole process.

-

Increasing the transparency of government finances: Using CBDCs will help to drastically reduce problems with tax avoidance, money laundering, and making illegal payments since although CBDCs can be designed in such a way that transactions may be completed anonymously, the digital footprint that is left behind may still allow investigators to assemble a considerable quantity of information relating to these payments.

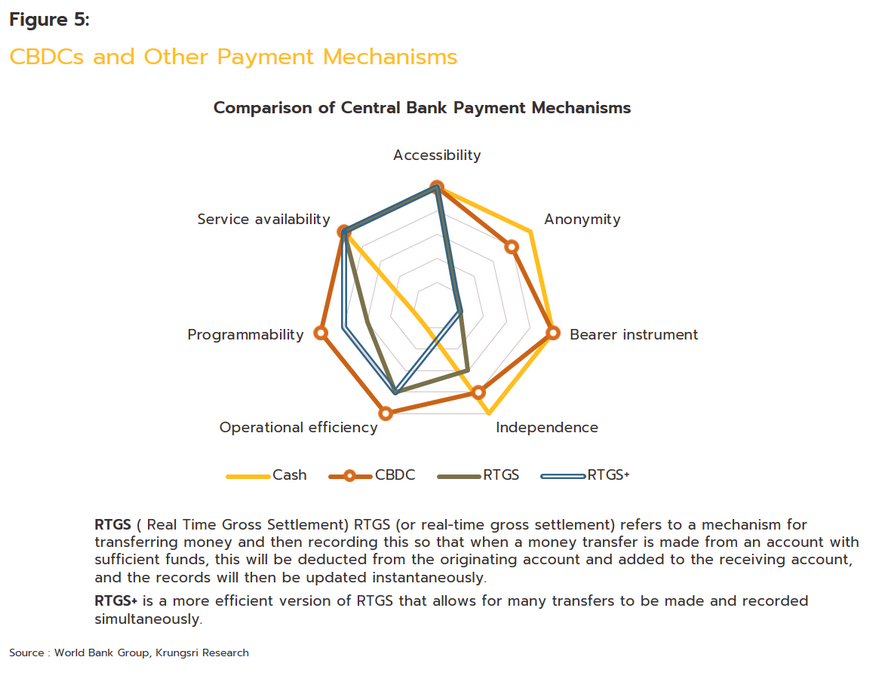

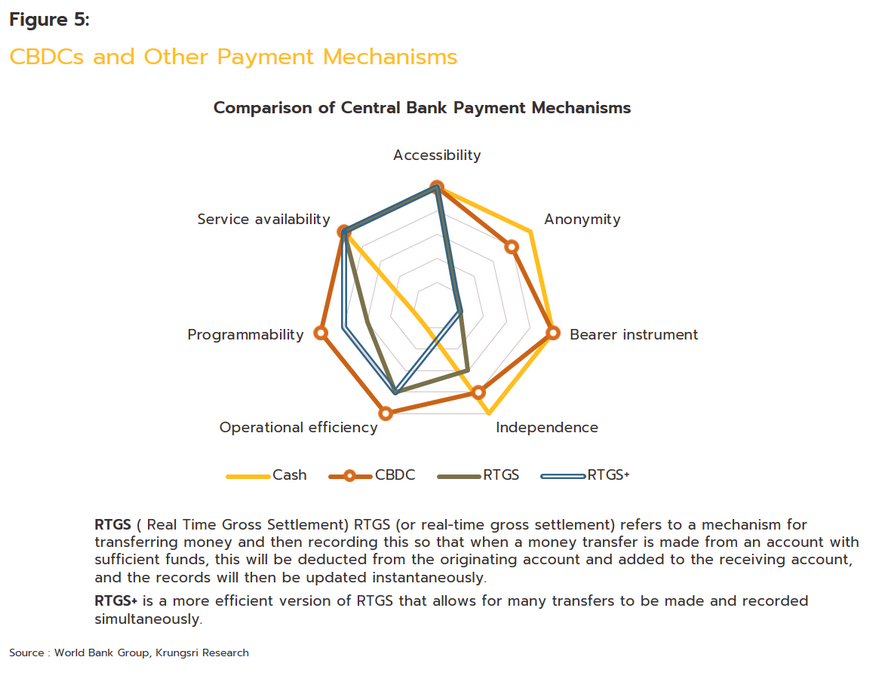

Retail CBDCs and other types of electronic payment systems

In addition to traditional ways of making payments such as cash, cheques, and debit and credit cards, many different types of electronic payments have recently begun to gain wider acceptance. These include internet and mobile banking apps, types of e-money, and the new kids on the block, virtual currencies, stablecoins, and retail CBDCs, though depending on the payment method used, the consequences of their use for the individual and for the overall financial system will vary.

Although as described above, the potential benefits to a country of introducing a retail CBDC may be considerable, the actual deployment of a central bank digital currency may require overcoming a large number of challenges. For example, it is quite possible that a CBDC would compete for deposits currently held in the commercial banking system. Thus, if in the future, the broad use of a retail CBDC were to be announced, it is quite conceivable that many bank retail customers would withdraw their deposits and instead place these in a retail CBDC wallet. This would then have potentially serious consequences for the banking system and could add substantially to the interest rates that banks had to offer for deposits. Unfortunately, outcomes such as this are particularly likely in countries where the banking system is less stable. Moreover, because retail CBDCs are built on digital systems and the transaction details that they record would be an irresistible attraction to threat actors, issues relating to cybersecurity are absolutely central to the future of retail CBDCs. It is therefore essential that the security protocols surrounding retail CBDCs are sufficient to ward off even the most sophisticated attacks and so ensure that user data remains secure.

It has also been widely observed that it may be difficult for retail CBDCs to fully replace cash since in some circumstances, the latter can be much easier to use, especially for those who are not comfortable using modern technology, those who have no access to this, or those who simply do not wish to reveal their identity with every financial transaction that they make. Comparing retail CBDCs to e-money reveals further relative weaknesses with the former. For its part, e-money enjoys advantages with regard to the promotional efforts (and hence the resulting benefits to consumers) of the private-sector companies that issue and manage e-money. Retail CBDCs also come off poorly when compared to traditional cheques drawn on current accounts because of the more advantageous legal position of cheques; in Thailand, fraudulent use of these is covered by Article 341 of the Criminal Code[7].

Comparing retail CBDCs to a range of other ways of making electronic payments shows that their relative strengths and weakness vary according to the alternative. These are described below.

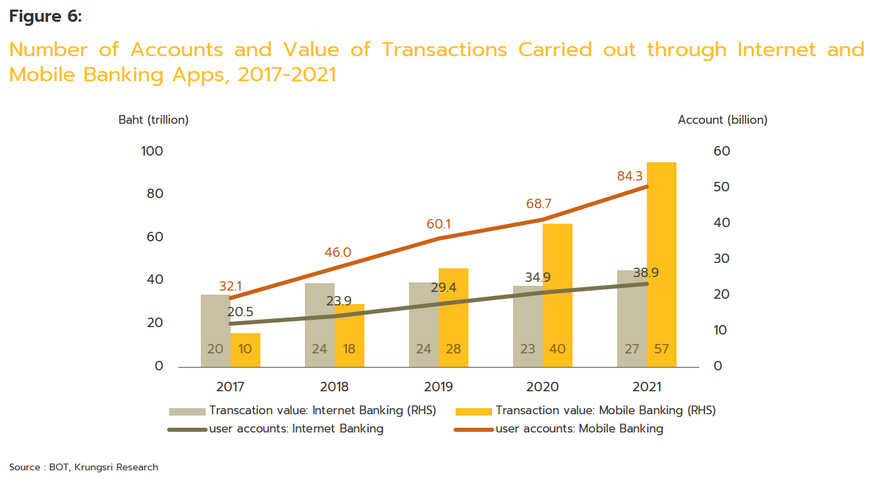

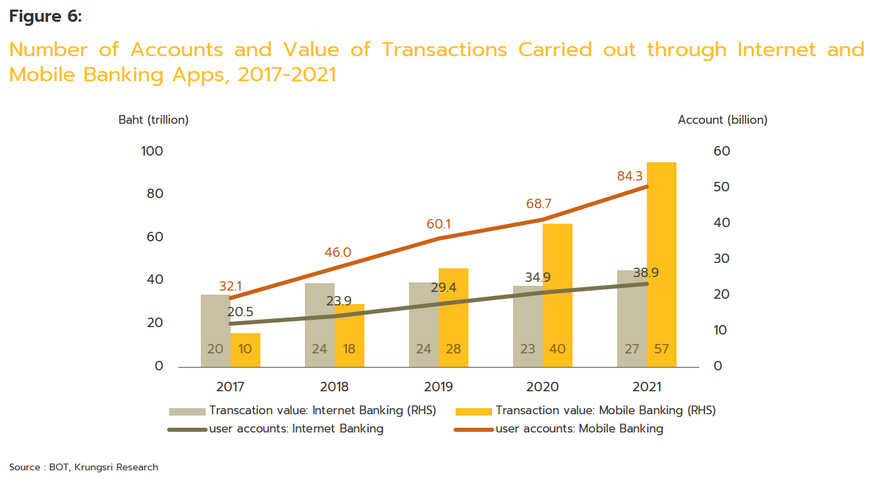

Internet and mobile banking are both channels for the online delivery of banking services. Since completing financial transactions through these does away with the need to visit a bank branch in person or to seek out a banking agent, these are extremely convenient to use, and this is one reason behind their increasing popularity in Thailand (Figure 6). Users of internet and mobile banking services generally have money on deposit at some kind of banking institution, and so internet and mobile banking apps could be said to be an additional service offered to the bank’s creditors. The money that these creditors have on deposit at the bank is generally considered to be extremely safe due to the tight regulation of the banking sector. This means that there is little risk that the bank will be unable to return deposits to account holders, and even in the event of extreme distress in the banking sector, retail deposit accounts are covered by the Deposit Protection Agency[8]. In a similar way, retail CBDCs can be compared to a digitized form of cash that is backed up by the central bank, so one could say that CBDCs are a form of debt owed by the central bank to the public. In this regard, CBDCs are again similar to cash, although because they are high-tech digital products, they are able to support further financial innovation, such as the use of smart contracts. This is because CBDCs provide for the use of digital vehicles that implement a detailed set of instructions when certain conditions are met (this is what is meant by their ’programmability’). As such, CBDCs have the potential to support the development of other digital systems, such as asset tokenization, storing and confirming digital identities, and creating digital wallets.

CBDCs overseas

Over the past few years, interest in different types of digital assets has been rising sharply, and this has included widespread discussion of the role of CBDCs in the wider economy. Thus, the Atlantic Council, a non-partisan US body that is tasked with researching important issues related to the economy, politics and security, reports that as of August 2022, 105 countries had expressed an interest in developing a CBDC, these economies comprising a full 95% of the global GDP. These figures reflect the dramatic uptick in public discourse around CBDCs that has been seen over the past two years because as of May 2020, a mere 35 countries were looking at developing their own CBDC. In addition, over 50 countries are now in the final stages of researching and developing their CBDC, and for these nations, the next phase is to begin the actual use of the new currency, a step already made by the 10 countries that have officially rolled out their own CBDC. Details of the progress made by countries on the development of CBDCs is given below.

-

Research: Countries at this stage of the development cycle are employing academics and other individuals with expertise in financial products to research the implications of developing their own CBDC. This work involves investigating domestic and international case studies and exploring the possible impacts of using a central bank digital currency. 46 countries are currently at this stage, including Austria, Iceland, Indonesia, Lao PDR, Myanmar, Pakistan, Taiwan, the UK, the USA, and Vietnam.

-

Development: At this point of the cycle, CBDCs begin to be used in a controlled environment so that their operations can be tested in a way that avoids any risk to the economic system prior to their official deployment in a much wider role. 26 countries are now at the stage of developing their CBDC, and these include Australia, Brazil, Cambodia, Canada, Estonia, France, Germany, Israel, Italy, Japan, Lebanon, the Netherlands, Spain, Switzerland, and Turkey.

-

Piloting: At the piloting stage, countries begin to allow CBDCs to be used to settle real transactions and to facilitate the exchange of goods that have a genuine market-based value. However, use of the CBDC is still restricted to only those authorized persons or organizations participating in the pilot scheme. Generally, enrollment in pilot schemes is limited to financial institutions and so in these, the use of the new currency is as a wholesale CBDC. 14 countries are currently piloting CBDCs: China, Hong Kong, Kazakhstan, Malaysia, Russia, Saudi Arabia, Singapore, South Africa, South Korea, Sweden, the UAE, Ukraine, and Thailand itself.

-

Launched: Following its deployment as a wholesale CBDC, countries introducing CBDCs will then move to announcing the official opening of the CBDC to use by businesses and private individuals. At this point, individuals may choose to use the new digital currency to buy goods or pay bills just as they would previously use cash. 11 countries have so far made it to this stage, including the Bahamas, Jamaica, Nigeria, and another 8 countries in the Caribbean[12].

-

Canceled: A small number of countries have abandoned plans to develop CBDCs having encountered problems that were unforeseen during the research phase. These were then sufficiently troubling to lead to the whole project being suspended and the CBDC being given up, though to date, only Ecuador and Senegal have gone through this.

-

Inactive: In these countries, central banks have begun investigating the development of a CBDC but at present, these are neither moving forward with development of the CBDC nor has an official announcement been made indicating that the plan has been abandoned. 10 countries have inactive CBDC programs, including Curaçao, Denmark, Finland, and Uruguay.

-

Other: Some countries have yet to officially begin work on a CBDC, while others have not revealed how far they have progressed along the path towards developing their own central bank digital currency, even though they may have developed systems to manage digital wallets or built out new domestic payment infrastructure.

Although in general, CBDCs have generated a lot of interest among central banks globally, in Ecuador and Senegal, local difficulties have led to their being abandoned. In the case of Ecuador, the national CBDC, which was called the Dinero Electrónico (DE), was introduced in 2014 but this was withdrawn in March 2018 as problems with its use became overwhelming. The DE suffered from the fact that it could only be used as a payment for transactions that took place domestically (there were problems with using it to pay for international transactions) and the public were confused about the financial structure behind the DE since although it was not backed by the US dollar, it was backed by US dollar-denominated assets. The local media further muddied the waters by incorrectly claiming that the DE was used to support illegal activities and that it infringed users’ privacy, while the private sector never warmed to the project, and in particular, the commercial banking sector remained hostile to the currency’s use, fearing that if the DE gained ground, this would rob banks of their central place in the payment system. In Senegal, the local CBDC, the eCFA, came into use in 2016 but commercial banks were worried about potential confusion between the eCFA and the local currency, the West African CFA franc[13], and this developed into outright opposition that ended with the abandonment of Senegal’s CBDC. With this, the dream that the DE and the eCFA would be the world’s first and longest lived CBDCs came to an end.

The lesson to be drawn from the experiences of Ecuador and Senegal is that in addition to ensuring the currency’s security and the viability of the technology behind it, when developing a retail CBDC, central banks should only gradually roll out the currency to end users and that testing should be thorough and continuous through all stages of development. The new CBDC should therefore be positioned as a payment choice alongside the coins and notes that consumers are already familiar with; this gradual introduction of the CBDC will help the public and business sector become steadily more familiar with the currency, and as this happens, fears and opposition will subside. At the same time, the central bank will need to launch a comprehensive public education campaign to ensure that all parties understand how the CBDC is used domestically, how it is similar to and differs from the normal currency and virtual currencies, and how the value of the CBDC is determined and how it may legally be used to make payments. This will then help build confidence in the new currency and assure the public that it is a safe and valid choice for them in both normal and unusual circumstances.

The development of a Thai CBDC: New blood for the Thai financial sector

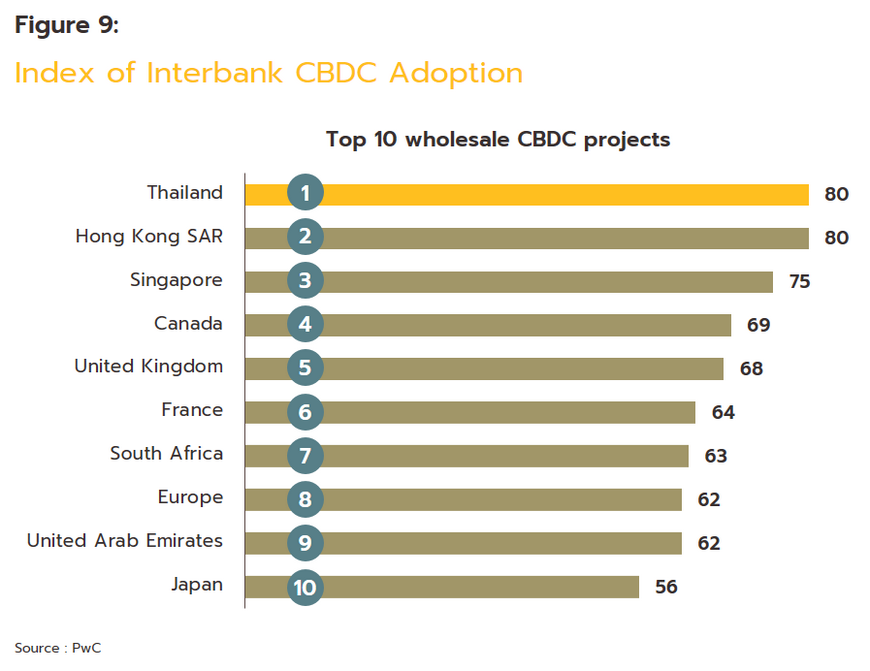

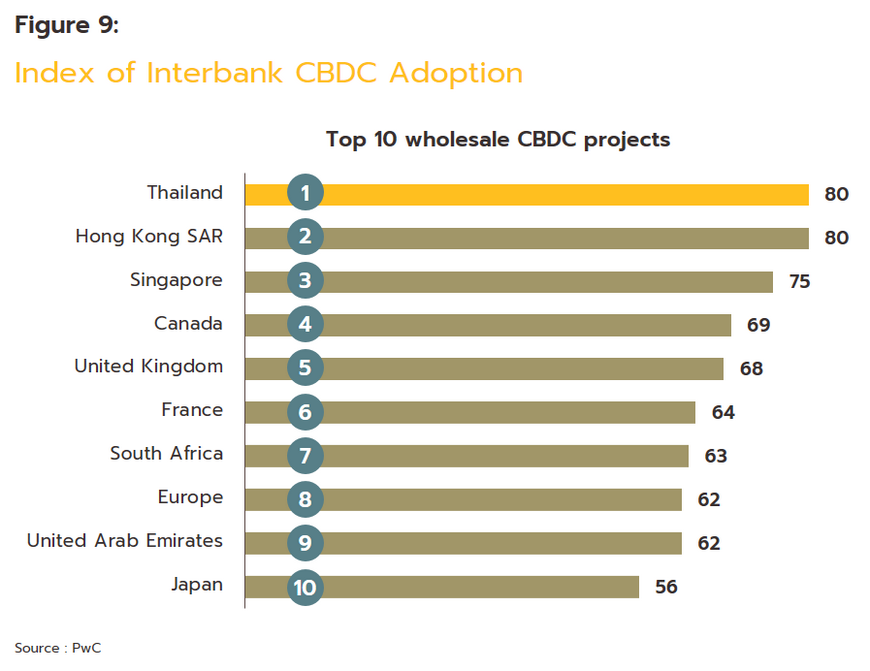

Against this background, Thailand’s progress towards the development of a central bank digital currency, and in particular a wholesale CBDC, has been very impressive. Indeed, with a score of 80, the PwC Global CBDC index 2021 (published April 2021) ranked Thailand and Hong Kong SAR first-equal in the global league table of interbank CBDCs (another name for wholesale central bank digital currencies).

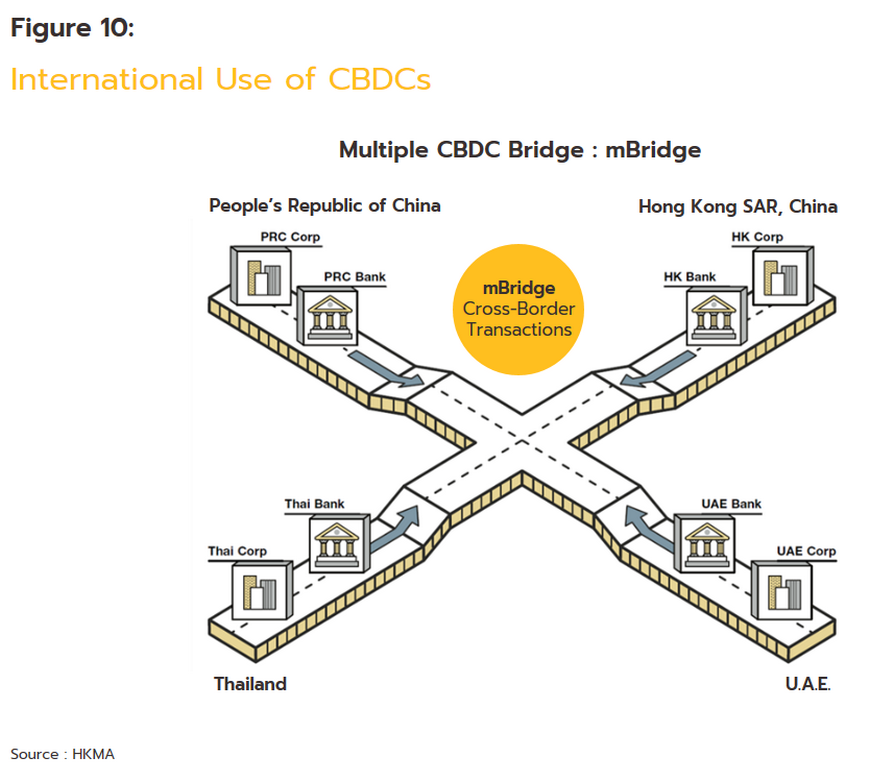

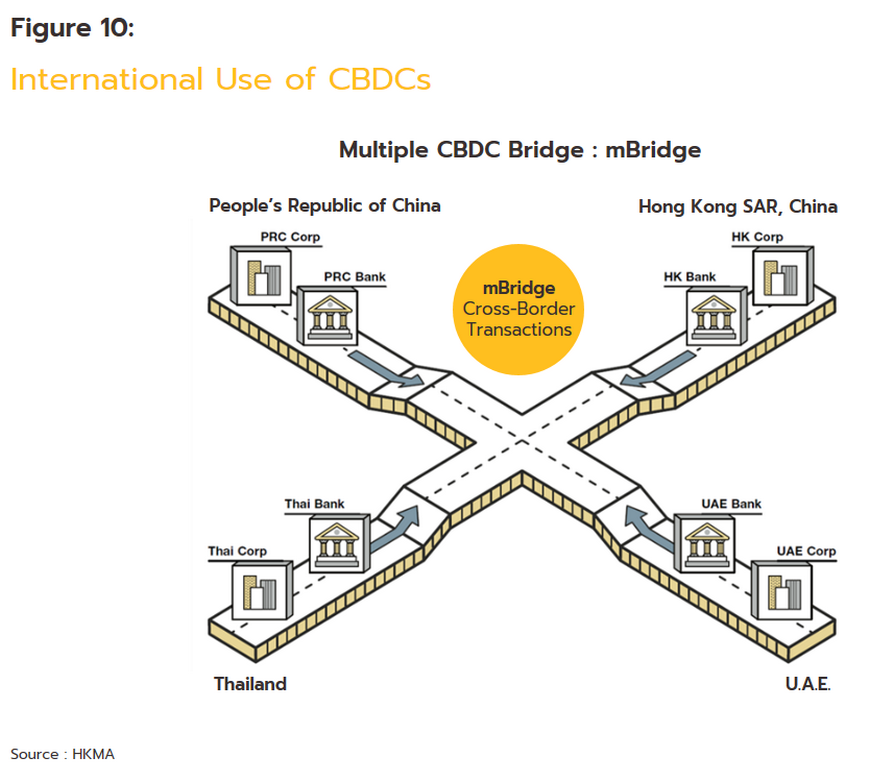

This success is attributable to the close cooperation between the Bank of Thailand and the Hong Kong Monetary Authority (HKMA), which since 2019 have worked together on the joint LionRock-Inthanon project. The HKMA initiated the LionRock program, the codename for the HKMA’s wholesale CBDC, in 2017, but seeing the potential value of CBDCs in facilitating transactions not only between domestic financial institutions but also across borders, the bank began researching and developing a CBDC suitable for deployment in a bilateral cross-border use case. Following this, in 2021, the HKMA joined with the Bank for International Settlement (BIS) and the central banks of China and the UAE to work on developing the financial infrastructure needed to coordinate wholesale CBDC transactions across a broader range of national frontiers. This then led to the project’s being extended to become a multiple central bank digital currency, or m-CBDC bridge that could be used in multiple jurisdictions and for multiple currencies.

The introduction of a retail CBDC is clearly a favored option for developing a country’s financial infrastructure and improving the speed and efficiency of and access to payment systems. The Bank of Thailand’s retail CBDC is therefore likely to have the following features[14].

-

Users will be able to access their CBDC both when online (for example, through a mobile phone application) and offline (for example, by using a smartcard that facilitates cash-like transactions). This will help to ensure that all members of society are able to use the CBDC and so gain equal access to financial services.

-

To ensure equal and fair access, users should not face any kind of charge or fee, payment channels should operate efficiently, and the public should be able to play a role in determining how the CBDC is developed in the future.

-

The retail CBDC should be distributed to consumers and to the economy through financial institutions or providers of other financial services since they are skilled in this and have expertise in areas such as confirming personal identities and ‘Know Your Customer’ regulations.

-

The CBDC will not pay interest and there will be controls on how much may be exchanged and how much any individual may hold. Prohibiting excessively large withdrawals from the system will help to prevent the economy being destabilized and should protect against the CBDC being used for money laundering.

-

The system should draw on the benefits of centralized finance (CeFi), which is able to settle transactions rapidly, and decentralized finance (DeFi), which instead offers stability. As such, consumers will enjoy the highest possible levels of efficiency.

In August 2022[15], the Bank of Thailand released details on its most recent progress with developing a CBDC, and to assess how the CBDC fares in the wild, the bank now plans to begin live testing of a retail CBDC at the end of 2022, though with this initially restricted to a pilot phase. The BOT has also laid out its policies regarding the CBDC and how the design of the retail CBDC may change in the future following work carried out in cooperation with the business sector on establishing the retail CBDC proof of concept. This forthcoming testing phase will be split into two parts.

-

During the foundation track, testing will evaluate the efficiency and safety of the system and this will involve using the digital currency in real-life situations. Thus, in this phase of the testing cycle, the retail CBDC will be used to pay for goods and services in a restricted setting, with around 10,000 individuals selected by the BOT participating in the project. Alongside these individuals, 3 private-sector players will be joining the testing, these comprising 2 banks (Krungsri and SCB) and the payment provider 2C2P. These field tests will utilize technology supplied by the German company Giesecke+Devrient[16] and will run from the end of 2022 to the middle of 2023.

-

During the innovation track, testing will be extended to investigate how the digital currency’s programmability might be used to extend the CBDC and through this, develop new innovations that use the currency as a platform to meet consumer demand from a broad and varied user base. This will also allow the BOT to refine the development of the retail CBDC and to make it a better fit for the particularities of Thai society. Access to this is open to businesses and members of the public, who were able to present their use cases at the ‘CBDC Hackathon’ that ran from 5 August to 12 September, 2022.

The view from the banking and finance sector

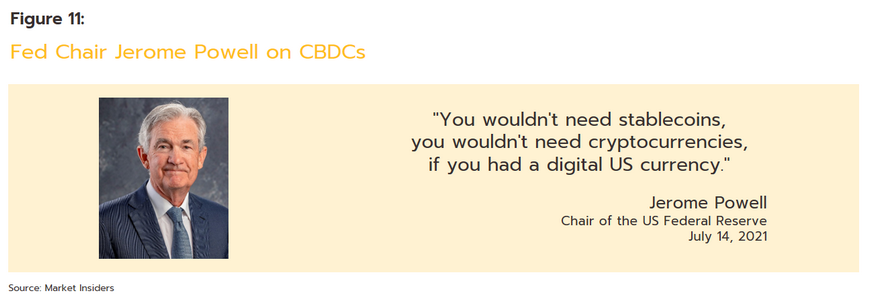

As described above, work on developing CBDCs is underway in central banks around the world, but when these projects reach fruition and CBDCs enter use as a new form of money, the consequences may be significant for stakeholders across the economy, whether that is the state, commercial banks or other financial institutions, the business sector, or consumers themselves. Given the scale of this potential disruption, it is perhaps not surprising that academics and industry experts from within the finance sector have been vocal in expressing their opinions on CBDCs. Among these, Jerome Powell, Chair of the Fed and so perhaps one of the most influential voices in this space, has said that he is broadly pro CBDCs since their introduction would mean that consumers would be less incentivized to hold stablecoins or other types of virtual currencies. Powell has also said that CBDCs will provide a means by which the public would be able to secure their assets safely, which again marks them out from stablecoins and virtual currencies[17].

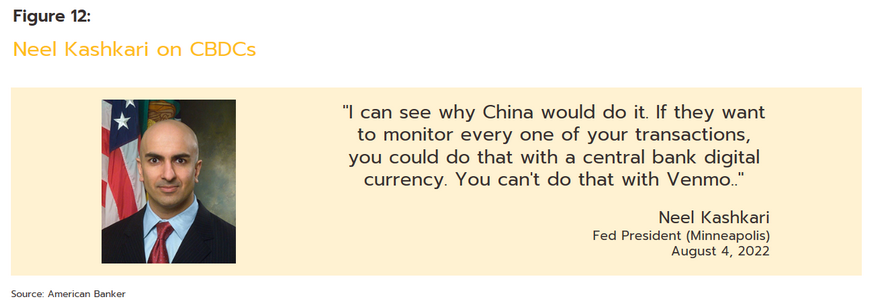

However, although Powell is clearly in favor of them, other influential voices at the Fed are less committed, and Neel Kashkari, president of the Minneapolis Federal Reserve, has expressed worries over potential problems with security and privacy. Kashkari has thus stated that CBDC’s could become a backdoor through which the government is able to spy on the individual transactions carried out by members of the public, and in the case of the USA, using the Venmo[18] system is both convenient and secure from the point of view of individual privacy. Moreover, if individuals would like to speculate on digital assets, Kashkari believes that it is better that they do so through offerings made by private companies that are already active in this space[19].

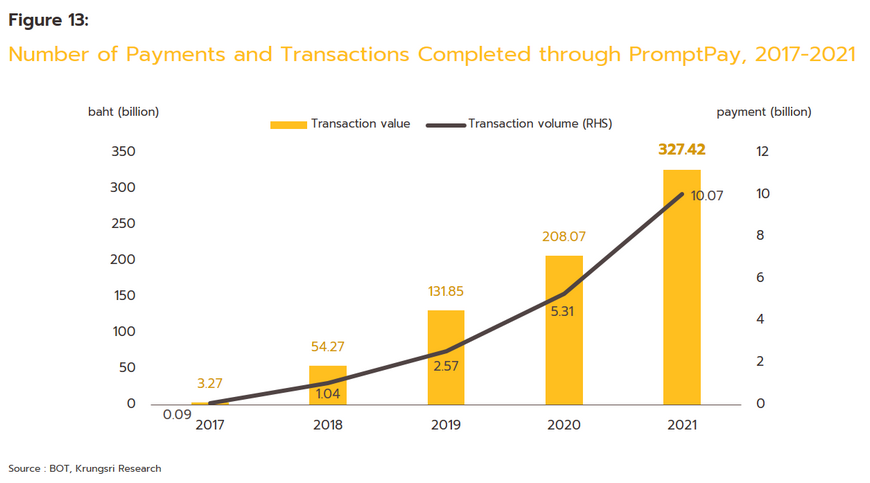

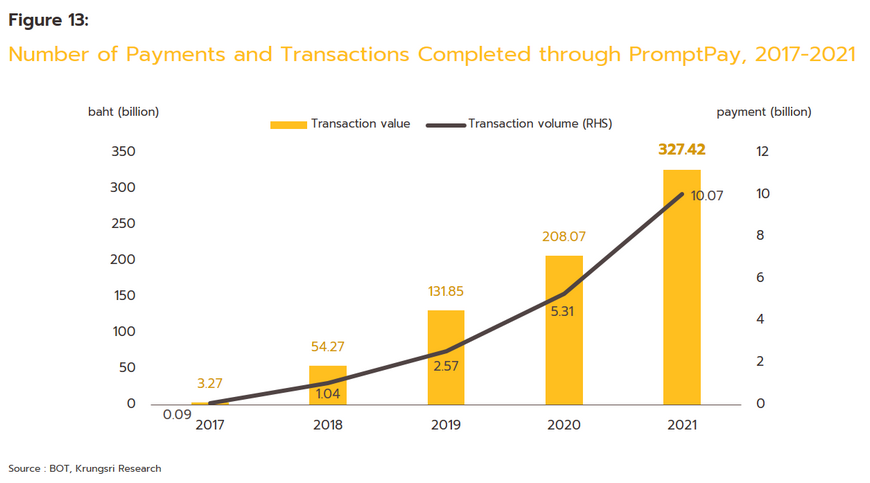

Returning to Thailand and the domestic banking and finance sector, there has recently been a profound change in how this operates, and since 2010 use of internet and mobile banking services to make payments and complete business or shopping transactions has made great strides, with this now a routine and unremarkable feature of daily life. This is especially the case for the PromptPay[20] payment system, use of which received an enormous boost thanks to the outbreak of Covid-19. Throughout the pandemic, officials restricted travel and announced periodic controls on the opening of shops, offices, and places of entertainment, but while these restrictions were in place offline, the online world remained open and free and so consumers were able to carry on their lives there unchanged. Through this, the ubiquity of online payment systems meant that in effect, when consumers were online, they were permanently accompanied by their own virtual bank. As such, demand for in-branch services has crashed and instead the Interbank Transaction Management and Exchange (ITMX) system, which runs behind the scenes to connect domestic banks, has assumed a much greater importance.

However, although internet and mobile banking services have made great inroads into Thai society, a sizeable slice of the population still has a strong preference for cash, and a survey carried out by the Bank of Thailand at the start of 2021[21] showed that at that time, over 65% of respondents planned to return to the use of cash when pandemic-era government stimulus packages ended. By contrast, only 36% planned to increase their use of mobile banking services, and so it is clear that Thai society still has a strong orientation towards the use of cash.

An important question that remains unanswered is therefore whether using a CBDC in place of cash or more familiar internet and mobile banking services has any identifiable benefits for the population at large or exactly where it stands as a value proposition in the eyes of the population. In addition, it is as yet not clear what the consequences of introducing a CBDC will be for the Thai banking system.

Krungsri Research view: CBDCs are a challenge for the commercial banking sector

Over the past 2-3 years, central banks around the world have become increasingly interested in how CBDCs might be developed and deployed. This interest has built against a background of, at least initially, exploding growth in markets for digital assets and a broadening of the user base for these. This process was then sped up further by the 2020-2022 Covid-19 pandemic, which greatly increased consumers’ exposure to how technology could be used to replace many normal day-to-day activities. The global surge in interest in CBDCs is thus further evidence of how digital currencies are moving towards taking a much more central place within the economy.

Nevertheless, one should be careful not to overstate the inevitability of these trends and while it is the case that most countries are pursuing CBDC projects, some are not. Among these, the Danish central bank22/ has yet to identify clear benefits to Danish citizens or to their national payment system of creating a CBDC, largely because the country already has a mature and widely used digital money system. Likewise, as described above, Ecuador and Senegal had previously introduced CBDCs but after only a relatively short period of time, for different reasons both countries were forced to withdraw these.

However, the Thai banking sector is highly developed, is quick to deploy recent technological advances, and because its workforce is skilled and draws on a wide range of disciplines, it has been able to work steadily to improve national payment systems. As such, Thailand’s electronic payments infrastructure is widely recognized as being world-class, and Thai banks compete fiercely against one another to further improve their internet and mobile banking services as they look to better meet consumer needs. Alongside this, the ITMX system provides the back-office services needed to maintain the rapid, seamless and incessant interchange of data between banks, and the outcome of this situation is that Thai consumers are now used to the benefits that come from having permanent access to easy-to-use but comprehensive financial services. However, the introduction of a CBDC may have significant consequences for the liquidity of financial institutions and their ability to act as intermediaries in financial transactions, as has been shown by the Bank of Thailand. Krungsri Research therefore sees CBDCs posing a continuing challenge to the financial system in several different regards.

Firstly, the CBDC might be developed in such a way that it takes a different path to the internet and mobile banking apps that are now so widely used. It is possible that a retail CBDC could be developed in Thailand that was programmable, and this would then allow it to be used in smart contracts. For example, when certain pre-agreed conditions were met, it would be possible to automatically complete a transaction, or alternatively, it would be possible to program a contract in such a way that if something unusual was detected, the transaction would be canceled. This could also ensure compliance with regulatory and legal requirements, and overall, providing these kinds of abilities to the CBDC would add to the economy’s overall efficiency by, for example, making it much easier to make deposits, withdrawals, transfers, and payments, to check for fraud and money laundering, and to automatically collect tax[23]. Having access to this level of functionality would in practice make the CBDC very similar to Ether (ETH), the world’s second most traded virtual currencies, and in addition to raising its efficiency, being able to program a CBDC would also help to directly address structural problems with the Thai economy and society. However, on the flip side, producing a CBDC such as this would pose a direct challenge to Thai banks. These might then be forced into a position of upgrading and developing their internet and mobile banking services such that the value proposition that these represented was not simply that they allowed users to make regular banking transactions such as transfers and payments, but rather that they provided users with CBDC-type capabilities.

In addition, CBDCs are typically designed to be used on the internet, so clearly access to this is important. The Office of the National Broadcasting and Telecommunications Commission estimates that indeed, around 50 million Thais have access to the internet, though this means that almost another 20 million do not and so for the time being, these individuals are not able to take advantage of commercial banks’ internet and mobile banking services. With internet access very patchy in some communities, the CBDC is likely to be designed in such a way that it can be used offline without having to depend on internet access. This kind of offline CBDC might be based on a smartcard that uses an intermediary device to complete transactions through an offline payment system (OPS). Alternatively, an offline CBDC could use biometrics-based cryptography to confirm a user’s identity before access to the CBDC is granted, and this could all be stored in some kind of personal electronic hardware that again would not need to connect to the internet to function. However, although there are clear benefits to such a system, it would also have disadvantages in that the offline system would likely impose limits on the number of transactions that could take place and on the total volume of money that could pass through the system. Under this type of arrangement, there would also be the possibility of counterfeit CBDCs being created and used, and indeed, central banks in many countries have raised red flags regarding exactly these possibilities[24].

Finally, because CBDCs are being developed by central banks as digital-native currencies, rather than simply working as an alternative to current payment systems, they should also do more to make life easier in the digital space. Krungsri Research therefore expects that in the coming period, CBDCs may take on a much more prominent role in virtual worlds or in the metaverse[25] since in these cases, CBDCs would have a clear advantage thanks to their programmability. Moreover, their use within the metaverse would be a clear improvement on the current situation because at present, completing a transaction in the metaverse requires exchanging normal currency for a digital variant, which is then generally particular to that platform and so cannot be used in other virtual environments. The ability of developers to encode conditions in CBDCs that need to be met before the currency can be spent or a transaction completed would also allow for controls to be placed on spending in the metaverse. For example, it would be possible to add money to a child’s wallet but to restrict its use so that this could only be spent in schools or in other environments within the metaverse that are suitable for children26/. It is clear from this that the development of virtual worlds will open a broad swath of new use cases for CBDCs. Moreover, holding CBDCs for use in the metaverse will have distinct advantages over other forms of digital currency given CBDCs’ stability and the lack of variability in their value, which will add considerably to users’ confidence in these.

In conclusion, the rapid evolution of the digital environment and the increasing extent to which we will all have to keep a foot in both the regular day-to-day world and newly developing virtual worlds will mean that we will no longer be able to avoid the use of digital currencies. Among the latter, CBDCs’ stability and trustworthiness will mark them out as a preferred choice, and so these will help consumers navigate a world that is increasingly marked by volatility, uncertainty, complexity and ambiguity (the so-called VUCA world).

References

A. Arauz, R. Garratt and D.F. Ramos F (Jun 2021) Dinero Electrónico: The rise and fall of Ecuador's central bank digital currency. Web. Retrieved Oct 4, 2022 from https://www.sciencedirect.com/science/article/pii/S2666143821000107

A.H. Elsayed and M.A. Nasir (2022) Central bank digital currencies: An agenda for future research. Web. Retrieved July 27, 2022 from https://www.sciencedirect.com/science/article/pii/S0275531922001246

Atlanticcouncil (2022) Central Bank Digital Currency Tracker. Web. Retrieved July 6, 2022 from

https://www.atlanticcouncil.org/cbdctracker/

Beartai (2022) Diem-Libra ของ Facebook ประกาศปิดตัวแล้ว. Web. Retrieved Aug 30, 2022 from

https://www.beartai.com/brief/business/928835

Bigdata (2021) CBDC: ระบบการเงินที่กำลังเปลี่ยนโลก และโอกาสของนักวิทยาศาสตร์ข้อมูล, Part 1. Web. Retrieved Aug 5, 2022 from

https://bigdata.go.th/movements/introduction-to-cbdc-1/

Blockchain-review (2020) Blockchain-review : CBDC คืออะไร. Web. Retrieved July 22, 2022 from

https://blockchain-review.co.th/blockchain-review/cdbc-central-digital-curreny

Clare Harrop, Cyrus Pocha (Dec 2021) Does the metaverse provide a usecase for central bank digital currency? Web. Retrieved Oct 3, 2022 from https://technologyquotient.freshfields.com/post/102hefa/does-the-metaverse-provide-a-usecase-for-central-bank-digital-currency

Digital Currency. Web. Retrieved July 5, 2022 from

https://www.outlookindia.com/business/jamaica-launches-jam-dex-becomes-first-nation-to-legalise-digital-currency-news-201592

Erin English (Mar 2021) Finding a secure solution for offline use of central bank digital currencies (CBDCs). Web. Retrieved Sep 29, 2022 from https://usa.visa.com/dam/VCOM/global/sites/visa-economic-empowerment-institute/documents/veei-secure-offline-cbdc.pdf

IBF Singapore (2020) An Introduction to Central Bank Digital Currencies. Web. Retrieved Aug 10, 2022 from

https://www.ibf.org.sg/newsroom/Pages/ibfsg_stories_30.aspx

Investopedia (2022) news : Fed Releases Discussion Paper on US Central Bank Digital Currency (CBDC). Web. Retrieved July 18, 2022 from https://www.investopedia.com/fed-paper-on-central-bank-digital-currency-cbdc-5216571

Isabelle Lee (Jul 2021) Fed Chair Jerome Powell says and stablecoins won't be needed once the US has a digital currency. Web. Retrieved Sep 16, 2022 from https://markets.businessinsider.com/news/jerome-powell--cbdc-stablecoins-digital-currency-testimony-2021-7

Jiraboon Narktong (2022) โครงการเหรียญ ของ Facebook ‘Diem’ อาจไปไม่ถึงฝัน สมาคมพิจารณาขายสินทรัพย์คืนเงินนักลงทุน. Web. Retrieved Aug 31, 2022 from https://siamblockchain.com/2022/01/26/zuckerberg-s-stablecoin-ambitions-unravel-with-diem-sale-talks/

John Kiff (Sep 2022) Taking Digital Currencies Offline. Web. Retrieved Sep 30, 2022 from

https://www.imf.org/en/Publications/fandd/issues/2022/09/kiff-taking-digital-currencies-offline

Krungsri Plearn Plearn (2021) รู้ก่อนใช้ “Libra” สกุลเงินดิจิทัลใหม่จาก Facebook. Web. Retrieved Aug 29, 2022 from

https://www.krungsri.com/th/plearn-plearn/libra-digital-currency

Kyle Campbell (Aug 2022) Kashkari calls CBDC a threat to privacy, defends regional bank independence. Web. Retrieved Sep 20, 2022 from https://www.americanbanker.com/news/kashkari-calls-cbdc-a-threat-to-privacy-defends-regional-bank-independence

Ndtv (2020) Business: These Countries Are Considering A Central Bank Digital Currency. Here Are Their Timelines And Status. Web. Retrieved July 15, 2022 from https://www.ndtv.com/business/here-are-the-timelines-and-status-of-central-bank-digital-currencies-in-some-countries-2820164

Outlookindia (2022) Jamaica Launches “Jam-Dex”, Becomes First Nation To Legalise

Patrick McConnell (Sep 2021) CBDC – How Dangerous is Programmability? Web. Retrieved Sep 26, 2022 from

https://sites.duke.edu/thefinregblog/2021/09/21/cbdc-how-dangerous-is-programmability/

Ploy Ten Kate (2021) PwC เผยไทยติดอันดับ 1 ของโลกด้านการพัฒนาสกุลเงินดิจิทัลแบบ Wholesale CBDC. Web. Retrieved Aug 12, 2022 from

https://www.pwc.com/th/en/press-room/press-release/2021/press-release-17-05-21-th.html

R. Morales-Resendiz, J. Ponce, P. Picardo et al. (Mar 2021) Implementing a retail CBDC: Lessons learned and key insights. Web. Retrieved Aug 18, 2022 from https://www.sciencedirect.com/science/article/pii/S2666143821000028#!

Rahul Nambiampurath (2020) How Digital Currency Could Change Senegal’s Financial System Forever. Web. Retrieved Sep 5, 20 from

Rodney Garratt, Haoxiang Zhu (Sep 2021) On Interest-Bearing Central Bank Digital Currency with Heterogeneous Banks. Web. Retrieved Aug 15, 2022 from https://www.mit.edu/~zhuh/GarrattZhu_CBDC.pdf

Susan Galer (Mar 2021) As Programmable Money Emerges, Central Banks Ramp Up For Tokenized Economy. Web. Retrieved Aug 27, 2022 from https://www.forbes.com/sites/sap/2021/03/25/as-programmable-money-emerges--central-banks-ramp-up-for--tokenized-economy/?sh=1ef72c02c402

Thaipublica (2021) Retail CBDC สกุลเงินดิจิทัลธนาคารกลาง กับเศรษฐกิจการเงิน (ตอน1). Web. Retrieved Aug 2, 2022 from

https://thaipublica.org/2021/11/retail-central-bank-digital-currency-implication-to-economy-and-financial-system/

Thailand Development Research Institute (Jan 2022) คิดยกกำลังสอง: สารพัดย้อนแย้ง... แห่งเงิน VDO File. Retrieved Sep 30, 2022 from https://tdri.or.th/2022/01/thinkx_430/

Wolfram Seidemann (Jul 2021) CBDC systems should focus on programmable payments. Web. Retrieved Sep 28, 2022 from

https://www.omfif.org/2021/07/cbdc-systems-should-focus-on-programmable-payments/

World Bank (2021) Central Bank Digital Currency: A Payments Perspective. Web. Retrieved Aug 15, 2022 from

https://openknowledge.worldbank.org/handle/10986/36765

แฟ้มภาพและคำพูดนายกรัฐมนตรี (2022) ครม. ยกเลิกกฎหมาย “เช็คเด้ง” มีผลหลังประกาศในราชกิจจาฯ 120 วัน ปรับโทษใหม่เป็น ตั้งใจฉ้อโกงรับโทษอาญา ไม่เจตนาใช้ฟ้องทางแพ่ง. Web. Retrieved Sep1, 2022 from https://www.thaigov.go.th/infographic/contents/details/5634

กลุ่มงานยุทธศาสตร์องค์กร ธนาคารแห่งประเทศไทย (Apr 2022) “Retail CBDC PromptPay แตกต่างกันอย่างไร ” พระสยาม Magazine, ฉบับที่ 1 เดือนมกราคม - มีนาคม 2565. Web. Retrieved Sep 9, 2022 from https://www.bot.or.th/Thai/BOTMagazine/Documents/PhraSiam0165/BOTMAG1-65.pdf

ทีมโครงการสกุลเงินดิจิทัล ธนาคารแห่งประเทศไทย (Sep 2020) “ทำความรู้จักกับ CBDC และความคืบหน้าในประเทศไทย” พระสยาม Magazine, ฉบับที่ 4 เดือนกรกฎาคม – สิงหาคม 2563. Web. Retrieved July 11, 2022 from https://www.bot.or.th/Thai/BOTMagazine/Documents/PhraSiam0463/4-63BOT%20MAG_Final.pdf

ทีมโครงการสกุลเงินดิจิทัล ธนาคารแห่งประเทศไทย (Sep 2021) “สกุลเงินดิจิทัลที่ออกโดย ธปท. กับการต่อยอดใช้งานระหว่างประเทศ ” พระสยาม Magazine, ฉบับที่ 4 เดือนกรกฎาคม – สิงหาคม 2564. Web. Retrieved Sep 13, 2022 from https://www.bot.or.th/Thai/BOTMagazine/Documents/PhraSiam0165/BOTMAG1-65.pdf

ธนาคารแห่งประเทศไทย (2021) Building a multi CBDC platform for international payments. Web. Retrieved July 21, 2022 from https://www.bot.or.th/Thai/DigitalCurrency/Documents/mBridgeBrochure.pdf

ธนาคารแห่งประเทศไทย (2021) สกุลเงินดิจิทัลที่ออกโดยธนาคารกลางสำหรับประชาชน: นัยต่อนโยบายการเงินและเสถียรภาพระบบการเงินของไทย.Web.Retrieved July 30, 2022 from https://www.bot.or.th/Thai/PressandSpeeches/Press/News2564/n6064t_annex.pdf

ฝ่ายนโยบายระบบการชำระเงิน ธนาคารแห่งประเทศไทย (2014) การชำระเงินที่มีการดำเนินการทีละรายการและมีผลสมบูรณ์ทันที : Real Time Gross Settlement. Web. Retrieved Aug 11, 2022 from https://www.bot.or.th/Thai/PaymentSystems/Publication/PS_Quarterly_Report/Payment%20Systems%20Insight/Insight_2014_Q2.pdf

ฝ่ายนโยบายระบบการชำระเงิน ธนาคารแห่งประเทศไทย (Apr 2022) “Payment Diary: เจาะลึกพฤติกรรมการชำระเงินประจำวันของคนไทย” พระสยาม Magazine, ฉบับที่ 1 เดือนมกราคม - มีนาคม 2565. Web. Retrieved Sep 23, 2022 from https://www.bot.or.th/Thai/BOTMagazine/Documents/PhraSiam0165/BOTMAG1-65.pdf

[1] Cryptocurrencies are encrypted digital currencies that record and confirm transactions on blockchains. For more information, please refer to our papers “Traditional Banking and DeFi: What Role will be Left for Banks if the Financial System is Disintermediated?” and “The role of banks in the new world of NFTs”

[2] E-money is a type of money that is recorded and stored on electronic devices, such as chips on a card, or on mobile or internet networks. Before spending any money, e-money users transfer money to e-money service providers that is then credited to them(i.e., as a kind of prepayment) and this then allows consumers to pay for goods or services at outlets that accept this form of payment. Using e-money is convenient because it avoids the problems involved in carrying cash, as well as being quick, since shoppers do not have to wait for change. For more information, please https://www.1213.or.th/th/serviceunderbot/payment/Pages/e-money.aspx

[1] Stablecoins are a type of digital asset that have a value that is pegged to a non-digital asset, and this then keeps their value stable. For example, the value of 1 Dai is set at 1 USD, and this should not change. For more information, please refer to our research papers, “Traditional Banking and DeFi: What Role will be Left for Banks if the Financial System is Disintermediated?” and “The role of banks in the new world of NFTs”

[4] https://fortune.com/2022/01/25/mark-zuckerberg-stablecoin-diem-sale-talks/

[5] https://www.bloomberg.com/news/articles/2022-01-31/meta-backed-diem-association-confirms-asset-sale-to-silvergate

[6] https://www.outlookindia.com/business/all-you-need-to-know-about-wholesale-and-retail-central-bank-digital-currency-cbdc--news-192971

[7] https://www.thaigov.go.th/infographic/contents/details/5634

[8] The Deposit Protection Agency (DPA) is a government agency tasked with responsibility for looking after deposits made by Thai and overseas private citizens and companies that are held by commercial Thai banks. The DPA’s remit covers accounts opened in accordance with the Thai Deposit Protection law and is reserved for deposits made in baht into accounts held in Thailand. This covers money deposited in current accounts, savings accounts, fixed deposit accounts, and certificates of deposit (as yet, digital currencies are not covered by the DPA). At present, deposits are insured up to a total of THB 1 million per account holder per financial institution (note that this is not per account). For more information, please see https://www.dpa.or.th/site/index

[9] https://tdri.or.th/2022/01/thinkx_430/

[10] https://www.sec.or.th/TH/Template3/Articles/2564/250164.pdf

[11] https://www.bot.or.th/Thai/PressandSpeeches/Press/2021/Pages/n9064.aspx

[12] These include Angola, Saint Kitts and Nevis, Antigua and Barbuda, Montserrat, Dominica, St. Lucia, Saint Vincent and the Grenadines, and Grenada.

[13] West African CFA franc is the currency used in the 8 independent states in West Africa consists of Benin, Burkina Faso, Cote d'Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo.

[14] https://www.bot.or.th/Thai/PressandSpeeches/Press/News2564/n6064t_annex.pdf

[15] https://www.bot.or.th/Thai/PressandSpeeches/Press/2022/Pages/n3965.aspx

[16] Giesecke+Devrient is a German company headquartered in Munich. Its business focuses on printing bank notes, and producing asset smart cards and cash management systems.

[17] https://markets.businessinsider.com/news/cryptocurrencies/jerome-powell-cryptocurrencies-cbdc-stablecoins-digital-currency-testimony-2021-7

[18] VEMO is US-based Fintech application for money transfers which is broadly used in the US.

[19] https://www.americanbanker.com/news/kashkari-calls-cbdc-a-threat-to-privacy-defends-regional-bank-independence

[20] The PromptPay system allows for money transfers to a recipient using a proxy ID. This might be an individual’s ID number, a company registration number, or a telephone number that is linked to an account.

[21] https://www.bot.or.th/Thai/BOTMagazine/Documents/PhraSiam0165/BOTMAG1-65.pdf

[22] https://coingeek.com/denmark-central-bank-downplays-need-for-new-forms-of-digital-money-including-cbdc/

[23] https://sites.duke.edu/thefinregblog/2021/09/21/cbdc-how-dangerous-is-programmability/

[24] https://usa.visa.com/dam/VCOM/global/sites/visa-economic-empowerment-institute/documents/veei-secure-offline-cbdc.pdf

[25] The metaverse is an immersive 3-D environment to which users connect via the internet and that seamlessly mixes the real and virtual worlds. Within the metaverse, users experience the world from a first-person point-of-view, seeing objects and people around them exactly as they do in the real world. Thus, once it is more fully developed, it will be possible to live out one’s life within the metaverse, and people will work, rest, consume entertainment, play games, socialize and engage in shared and joint activities within it, just as they would in offline environments. For more information, please see our paper "The Metaverse: When virtuality becomes reality“

[26] https://technologyquotient.freshfields.com/post/102hefa/does-the-metaverse-provide-a-usecase-for-central-bank-digital-currency