blockchain have been used in a number of different applications, though these all fall into four main categories.

- Key features of blockchain technology

The nature of the technology used to create blockchain is such that they exhibit the following features.

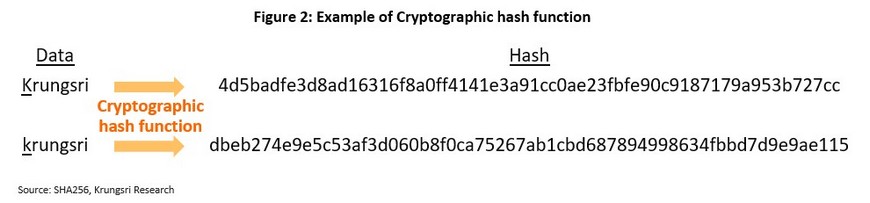

- Trustworthiness and security: Because data verification is carried out by a large number of participants and is only confirmed with the agreement of a majority of users, data is largely immutable. This makes it extremely difficult to make unauthorized changes to a blockchain, ensuring that the information stored in it is trustworthy and secure.

- Efficiency and lower costs: blockchain were designed to obviate the need for costly intermediation when verifying and recording transactions. Reducing the need for middlemen also helps to improve the system’s overall efficiency.

- Transparency and verifiability: Because blockchain are decentralized systems for storing cryptographically protected information that is digitally linked to previous transactions, it is very difficult to alter data that is already recorded. This then makes the stored data both verifiable and transparent.

- Value transmission and tokenization: A further important characteristic of blockchain is that they help to prevent the unlimited digital duplication of information. This then allows them to serve as a vehicle for the transmission of asset values, and so blockchain are being used to transform real-world assets into digital analogues, a process that is referred to as tokenization.

- Programmability: blockchain have been extended with the ability to add conditions or rules for the automatic completion of transactions. These are referred to as smart contracts (Box II) since these specify in advance the conditions under which a set of computer instructions will implement itself, thus doing away with another layer of middlemen and reducing unnecessary processes.

- How are blockchain being used?

blockchain are now being rolled out in a wide range of applications in industries that include banking and finance, trade, tourism, transportation and distribution, and public health. Analysis by Krungsri Research shows that the environments most suitable for the employment of blockchain are marked by four main characteristics: (i) transactions pass through an intermediary or middlemen; (ii) data is in a shared repository but involves or is accessed by many users; (iii) significant levels of trust are required; and (iv) the data is timestamped. Examples of these include financial data, bank accounts, shipping information, employment data, and information relating to treatments and medicines.

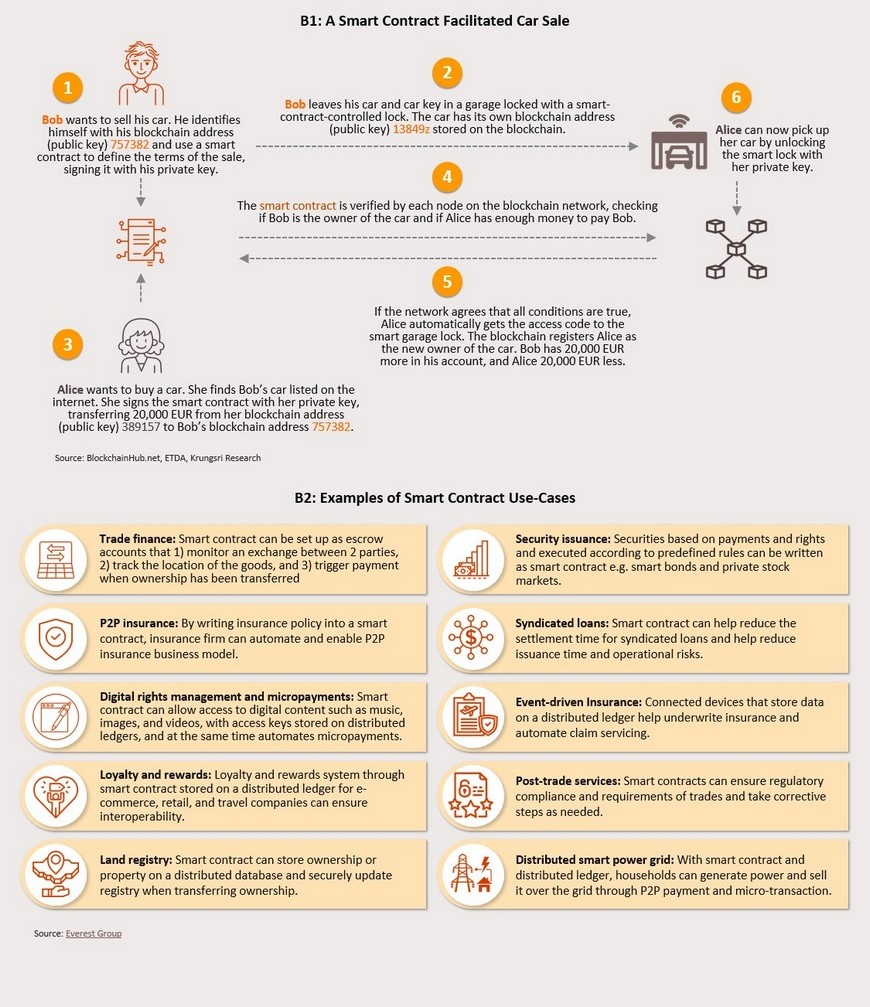

Box II: What are smart contracts?

During the initial period of blockchain development, or what might be called Blockchain 1.0, most uses involved simply recording transactions. The most well-known example of this is the cryptocurrency Bitcoin, exchanges of which are recorded in the Bitcoin blockchain. However, in 2014 Vitalik Buterin, a Russian-Canadian programmer, extended blockchain by giving them the ability to run code themselves. Thus, in addition to recording data, blockchain are now able to respond to these changes, and this was the origin of the Ethereum blockchain, the creation of which marked the beginning of Blockchain 2.0.

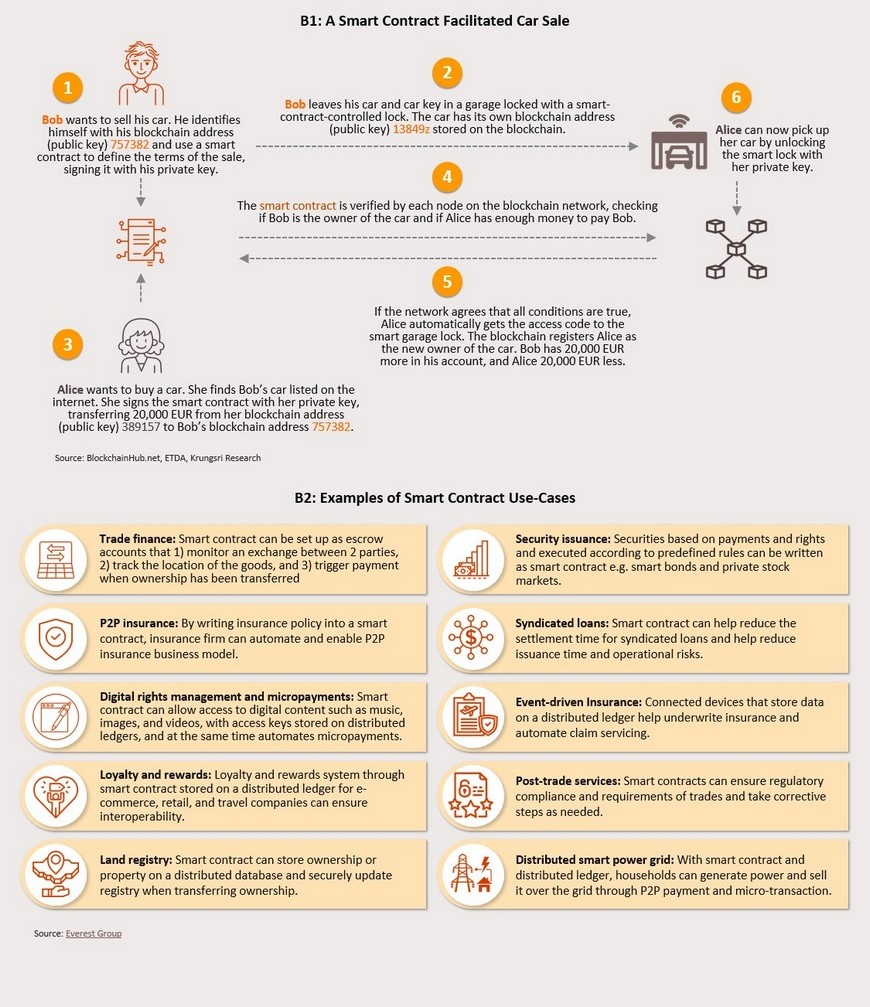

The code that is embedded in blockchain is often referred to as a ‘smart contract’ since it shares many of the features of the traditional paper contracts agreed between buyers and sellers. However, smart contracts differ in that they are self-implementing under the right conditions, though they also maintain many of the other features of blockchain, that is they are public, verifiable, distributed, disintermediated, and trustless.

To illustrate how this works, consider an example in which Alice wants to buy a secondhand car from Bob. In the pre-blockchain era, the two would have no choice but to use standard contracts that would have to be witnessed by a third party (e.g., a government agency tasked with recording changes of vehicle ownership, or perhaps a bank) that would confirm that money had passed in one direction and ownership of the car had gone in the other. However, the situation would change significantly if they were able to use a smart contract to facilitate the transaction. In this case, other participants or blockchain nodes would be able to inspect the transaction and confirm that Bob is indeed the lawful owner of the car and that Alice has sufficient money to meet Bob’s asking price. Moreover, if Bob leaves his car at a site equipped to connect to and process smart contracts, when the transaction is confirmed by the network, the car will be released to Alice automatically, without her having to wait for Bob to deliver it in person. Because this transaction has been recorded on a blockchain, if the car is stolen from Alice in the future, it will be possible for other nodes to check the vehicle’s ownership and confirm that Alice is still the legal owner of the vehicle with that chassis number (Figure B1).

Following the introduction of smart contracts and the emergence of Blockchain 2.0, technological development has continued apace and decentralized applications (DApps) are now on the cutting edge of blockchain technology. These are an extension of smart contracts, though DApps allow the limited functionality of smart contracts to flower into full-blown applications, and because these now allow cross-chain interoperability, they mark a further significant step forward for blockchain functionality. In addition, distributed ledger technology (DLT) is being extended to increase the usability of blockchain across a much broader range of use-cases, including in banking, insurance, logistics, real estate, education, healthcare, the arts, and a large number of other areas.

Blockchain technology

As of 2021, the blockchain market was worth USD 6.92 billion but this is forecast to expand at an annual rate of 68%, bringing the market value to a total of USD 94.89 billion by 2026. Growth will be supported by the need to increase data security in industries including finance and banking, telecommunications, public health, and among public-sector bodies. Some examples of blockchain use-cases are given below.

Speeding up transactions and making these more efficient: Data that is recorded on blockchain is protected by high-quality verification systems that make it difficult to make unauthorized changes to the underlying files. Because the system generates high levels of trust, it is no longer necessary to wait for middlemen to inspect and verify transactions, and this makes business processes quicker, safer, and cheaper. A survey by the European Business Review thus found that by 2024, 66% of the world’s leading banks intend to use blockchain to improve systems for recording financial transactions.

Confirmation of personal identity: At present, digital confirmation of identity generally requires the use of a username and a password, but these systems are often open to attack and personal data is regularly stolen from these. Instead, it is possible to use blockchain to confirm personal identity and to store personal data, and because this would make it easier to manage access to the latter, the use of blockchain would protect against attack, significantly increase security, and make these systems easier to use. It is expected that using blockchain technology to confirm identity will therefore become widespread in industries including banking and public health, as well as in the public sector.

Recording and storing data: Using blockchain to record data increases trustworthiness and security, especially in situations where many users are accessing that information, such as data related to finances, medical treatments, logistics, and logistics.

Integrating the digital and the real worlds: Using blockchain makes it easier to transfer and to manage ownership of digital value, and this then provides a means of digitalizing real-world assets and business activities, for example within the metaverse[1] or in the form of NFTs[2].

Using smart contract-enabled blockchain: Smart contracts are contracts that are embedded in blockchain and that can be used in insurance, to facilitate business transactions, and to protect intellectual property. Smart contracts operate by self-executing if and when transactions are recorded that meet the conditions specified in the contract, though these also preserve the key features of blockchain, which means that one side of the contract cannot unilaterally alter its terms. Given these advantages, smart contracts help to reduce counterparty risk.

Although many observers believe that blockchain technology will become increasingly widespread in the near future, increased uptake will still need to overcome many challenges.

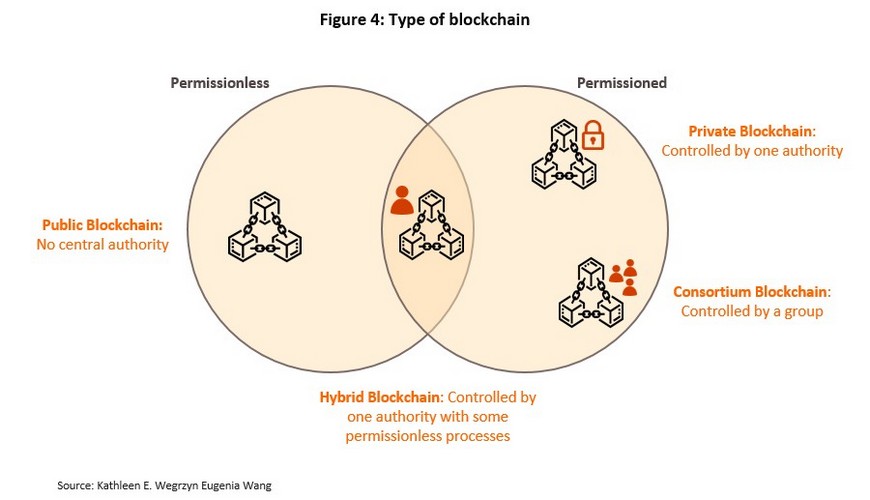

- Blockchain performance depends on quality of nodes: The overall quality of a blockchain is highly dependent on the quality of its individual nodes, and so to maintain this, many public blockchain (within which it is not possible to filter or otherwise select network participants) incentivize participation. This may take the form of offering coins or governance tokens that give holders the right to vote on future platform policy.

- Difficulty scaling: Because the time taken to confirm and verify blockchain transactions grows in proportion to the number of users, these are difficult to scale. For example, confirming Bitcoin transactions now takes around 10 minutes, which is too long for this to be a viable means of making day-to-day payments. Nevertheless, in some more restricted cases, such delays are acceptable. For example, it typically takes 2-3 days to complete international transfers and so by comparison, bitcoin transactions are very rapid.

- High energy consumption: Confirming transactions on blockchain, most obviously when this relies on a proof-of-work mechanism, encourages users to compete against each other to solve extremely complex mathematical problems. This is done using high-end computers that consume tremendous quantities of energy, and it is estimated that on average, recording a single bitcoin transaction uses 1,173 kWh of electricity, which would cover the electricity needs of an average family for 6 weeks. The Cambridge Center for Alternative Finance (CCAF) estimates that in total, recording and confirming Bitcoin transactions uses around 110 TWh annually, or 0.55% of global electricity consumption.

- Data immutability: If data is incorrectly recorded, correcting this is extremely difficult. Likewise, it is nearly impossible to remove information once it has been recorded.

- Large upfront costs: Organizations wishing to transition to blockchain-based operations will need to invest heavily in changing their existing systems to become blockchain-compatible, with additional costs coming on both the software and hardware sides of the upgrade.

- Incomplete security: Although data recorded on blockchain is secure, this security is not 100% foolproof and attacks may still be successful. In the case of a successful hack, losses may be considerable and there is then a risk of repeated attacks, which would severely undermine overall faith in the system’s trustworthiness.

- Access is dependent on private keys: Private keys are a kind of password that is used to access blockchain data but because blockchain systems are decentralized, losing a private key means that access to the linked data is permanently lost. This differs from systems that rely on middlemen, for example banks, which keep your account data for you, even if you forget your password.

- Lack of skilled developers: There is a shortage of individuals with blockchain expertise, and Bloomberg reports that over the past 2-3 years, salaries for blockchain developers have been as much as 50% greater than those for other similarly skilled developers[3].

- Lack of interoperability: At present, connecting different blockchain is dependent on ad hoc cross-chain solutions but if blockchain were able to connect or to communicate with one another natively, this would help significantly in developing the entire blockchain ecosystem. For example, this would allow for the direct exchange of cryptocurrencies without the need for intermediate exchanges into another currency. Alternatively, it would enable smart contracts to be written that would link different blockchain.

Uses for blockchain technology in banking and finance

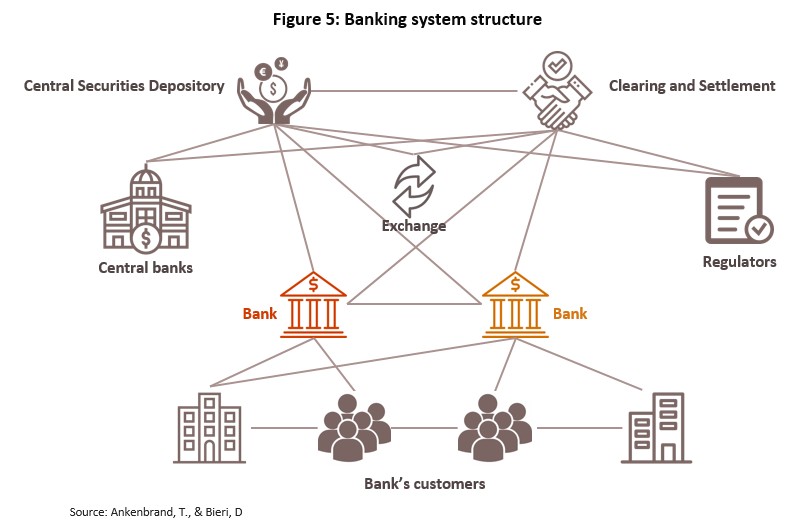

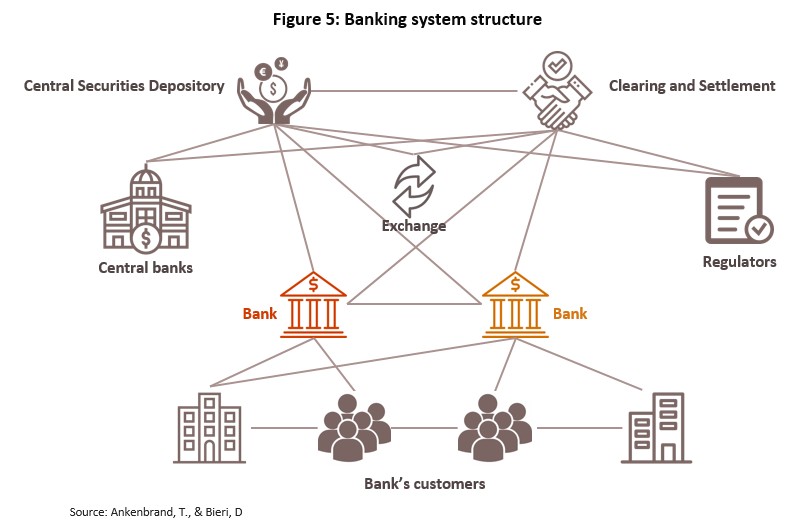

It is highly likely that the application of blockchain technology will bring about significant changes to the global banking and finance industry, with the effects of this felt across areas as diverse as payment systems, capital markets, risk assessment, and banking back-office functions. In particular, the World Economic Forum believes that within this sector, there are three main areas where blockchain technology may find a roll in solving problems.

- The banking industry is heavily intermediated: It is true that one of banks’ central roles is to mediate interactions between its customers, but within the industry, transactions are heavily dependent on middlemen. These include regulators and central banks, but other middlemen can be found in interbank clearing systems, currency exchanges, information storage systems, and credit scoring agencies. These many layers of middlemen then slow transaction times and raise the cost of doing business.

- Information is disconnected and siloed: Data that is held by and swapped between banks may be stored separately by individual banks, which makes it difficult to use and increases the cost of data verification. In addition, because this then requires banks to create and maintain their own data storage systems, this adds unnecessarily to their costs and diverts funds that could be invested in data management. As such, data quality and security is relatively low.

- Standards proliferate but transparency is lacking: Trust in the banking system depends on external sources, for example from audits carried out by the bank itself or by external auditors. Many different bodies may be involved in these audits, and the standards used may vary with each organization, which then makes it difficult to verify the trustworthiness of any particular audit.

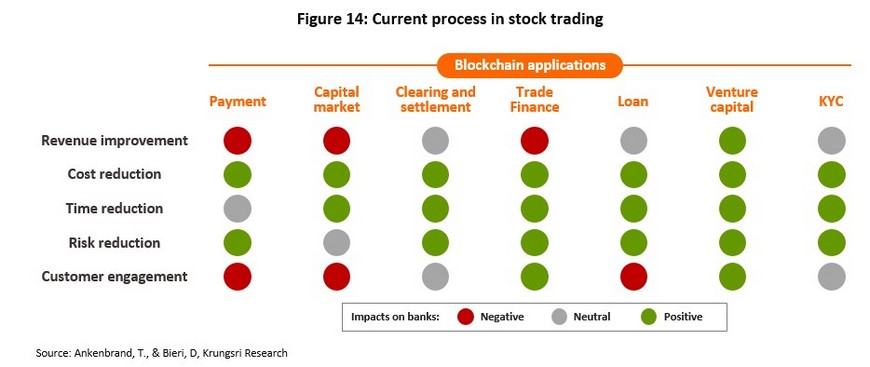

One of the key features of blockchain is their ability to disintermediate transactions and so there is potential for this technology to be used to solve problems related to banking information silos and to increase trust in the banking system. It is hoped that in addition to solving these problems, deploying blockchain technology within banks will also open up new revenue streams, cut costs, streamline business operations, reduce risks, and increase customer engagement.

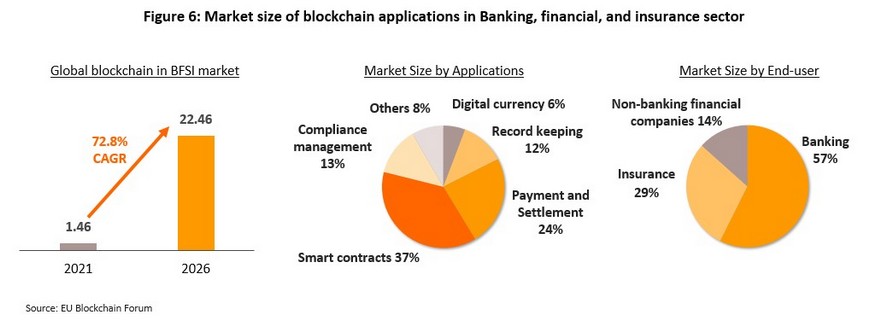

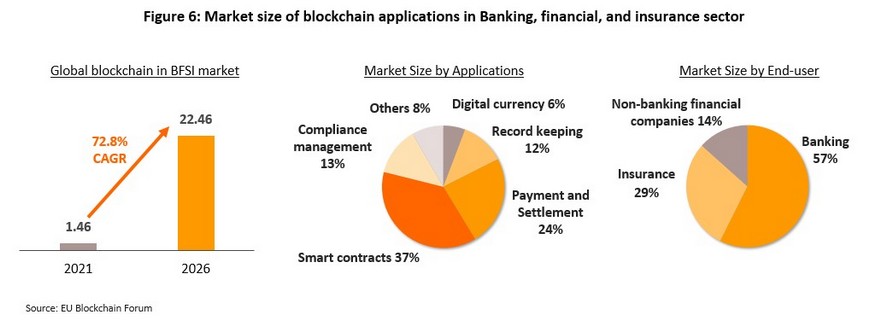

EU Blockchain estimates that the market for blockchain technology within the financial sector will grow at an average rate of 73% annually in the coming period, taking the total value of the market from USD 1.46 billion in 2021 to USD 22.46 billion by 2026. Within the finance sector, the banking industry is the biggest consumer of blockchain services (57% of the total), followed by insurance (29%), and other financial services (14%). In terms of applications, the most common use is for smart contracts (37%), followed by payment systems (24%), and risk assessment and management (13%).

As stated above, blockchain technology is best suited for use in situations that are: (i) intermediated; (ii) structured around the centralized storage of data that relates to a large number of users; (iii) dependent to a significant degree on maintaining trustworthiness and transparency; and (iv) ordered around timestamped data. Krungsri Research has identified several use-cases that meet these criteria and that are thus areas where the deployment of blockchain could be of interest to the banking industry.

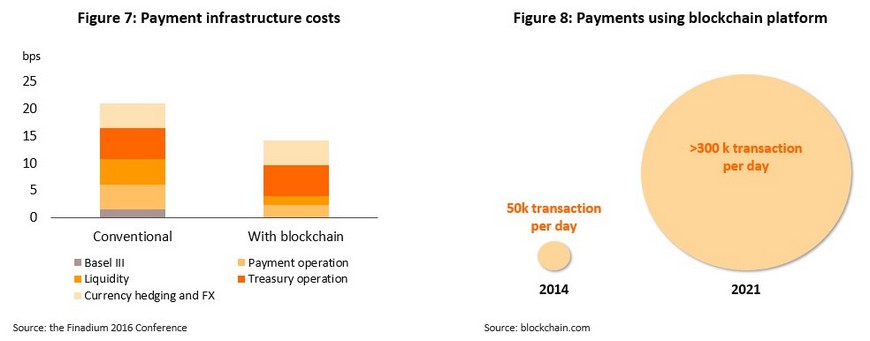

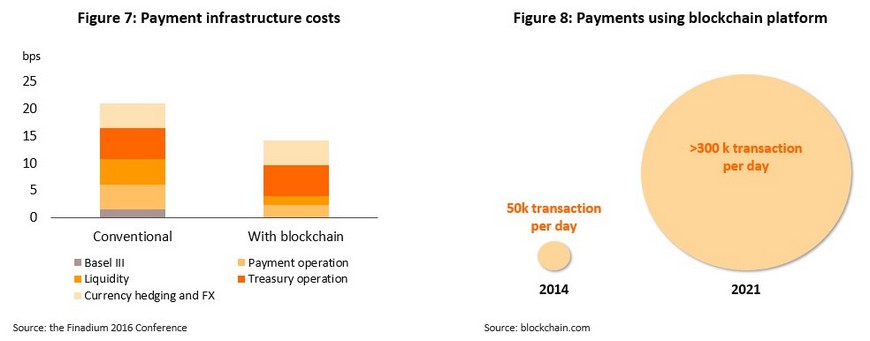

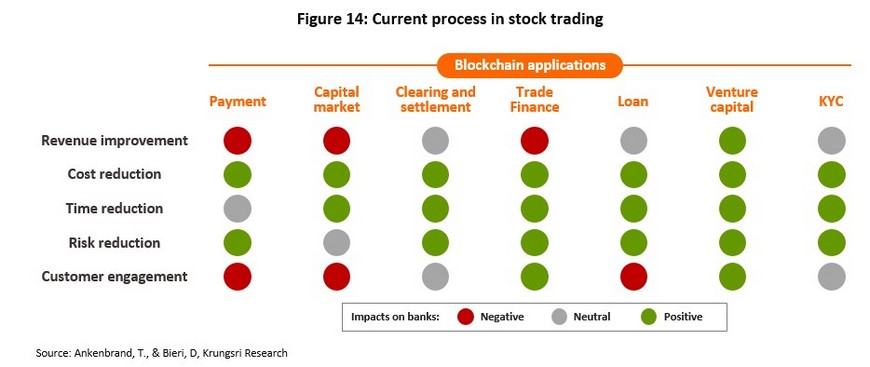

Payment and clearing houses: blockchain simultaneously reduce the need for middlemen to verify transactions and preserve a system’s trustworthiness. Reducing the scale of intermediation within transactions helps to reduce their costs, and within the area of payment processing, it is estimated that the use of blockchain could reduce costs associated with regulatory compliance, operations, and maintaining liquidity by as much as half. This would cut the overall cost of payment and clearing services by up to 35%, which could then be passed on to customers in the form of lower bank charges. These savings are particularly noticeable for international transfers, where the costs of completing a transfer could be cut from the current level of as much as 5-20% of the value of the transaction to a fee in the range of 2-3% of the total. By using blockchain technology, players would also be able to cut the time taken to complete transfers, since a Bitcoin transaction takes an average of around 10 minutes to be verified, while standard international money transfers take hours to days to complete. A further advantage of using blockchain to manage payments and transfers is that the source of the monies being transferred is generally a lot easier to identify than when moving money through intermediated systems. At present, payment systems that are built on blockchain technologies include Ripple, IBM, SatoshiPay, BitPay and R3.

Unfortunately, although using blockchain technology to facilitate these services may help banks to cut their overheads and make transactions simpler, they will also be at risk of income falling and customer engagement worsening. This will be a particular risk for payment services, where in addition to losing income from their fees, banks may also lose customers to new players operating on blockchain-based platforms.

Raising capital and making loans: Using blockchain to raise capital generally takes one of two forms. The first of these involves issuing a digital token[4] in what is called an ICO (initial coin offering). This is similar to raising funds through issuing bonds, though instead of bonds, the company releases digital tokens. Using ICOs to raise funds was particularly popular between 2016 and 2018, when ICOs raised as much as USD 2.4 billion per month. However, a second way of using blockchain in a fund-raising capacity is now becoming more popular. This involves protecting venture capital through the use of smart contracts, which then helps to reduce counterparty risk for investors.

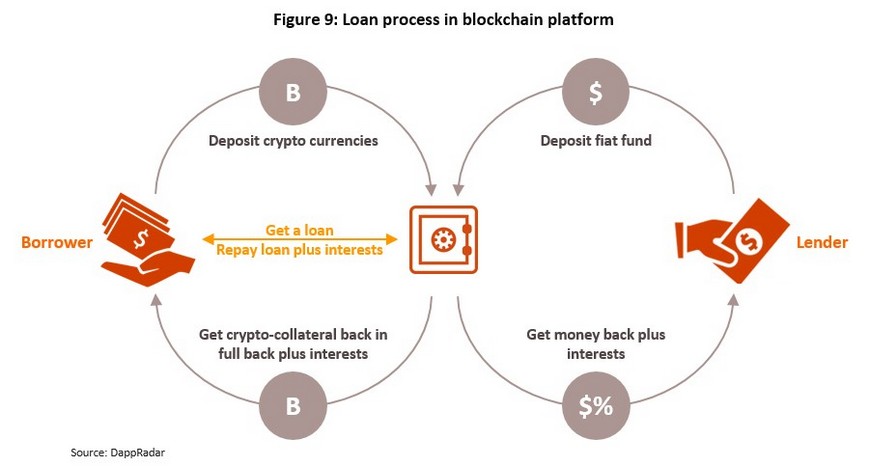

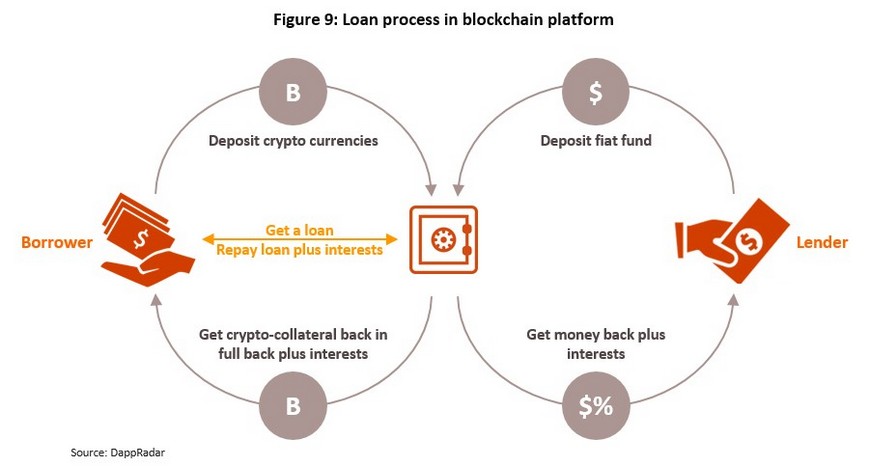

Using blockchain to facilitate loans and credit may take many different forms. Borrowers may secure loans against cryptocurrencies, they may use payments recorded on blockchain to help improve their credit score or as part of the assessment of other risks, or they may manage the loan through a smart contract, which makes the process both quicker and less risky. This is especially popular when raising funds through crowdfunding[5] or P2P lending.

Examples of companies using blockchain technology in fund raising and loan processes include VentureCapital, Valuation, Sequoia, Andreessen Horowitz, Union Square Ventures, SALT, BLOOM and Dharma Labs.

Blockchain technologies can help to cut costs and reduce the complexity of transactions for venture capital operations and for making loans, as well as offering banks a way of improving their customer risk assessment. However, they may face increasing competition in the market for issuing loans to customers, especially from new low-cost entrants to the market such as SALT, Celsius, and BlockFi. These players are able to offer P2P loans to borrowers at rates of around 3-10% per year, which is very attractive when set against the 6-20% that banks charge on personal loans[6]. In light of this, if banks are unable to use blockchain when releasing new credit and loans, they may see their client base shrink, especially among retail customers. However, the market for venture capital may offer banks a way of developing new sources of income and of connecting to new customer groups.

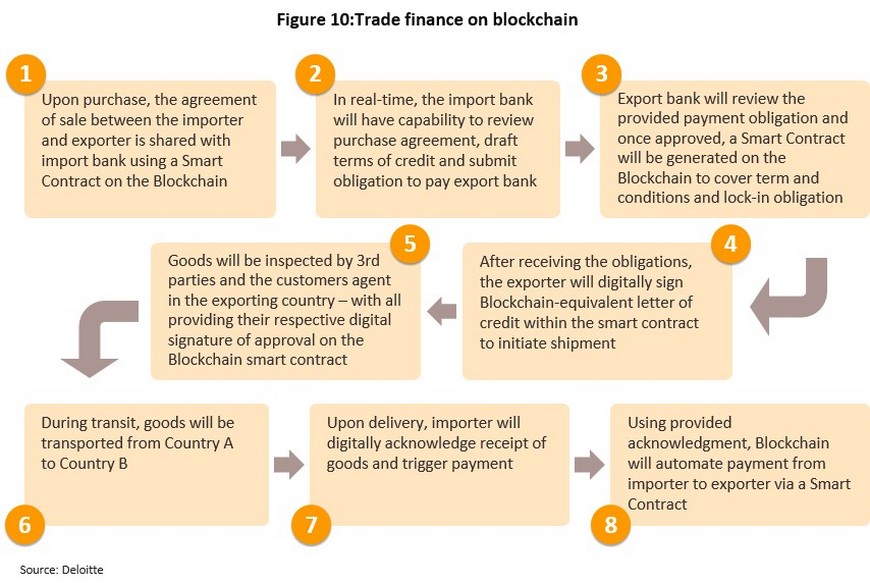

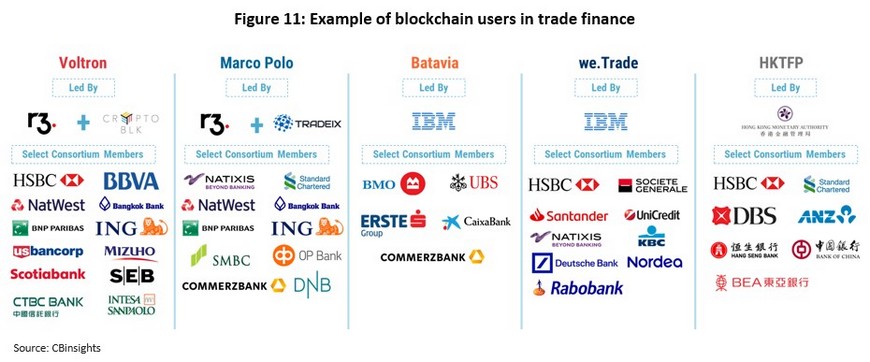

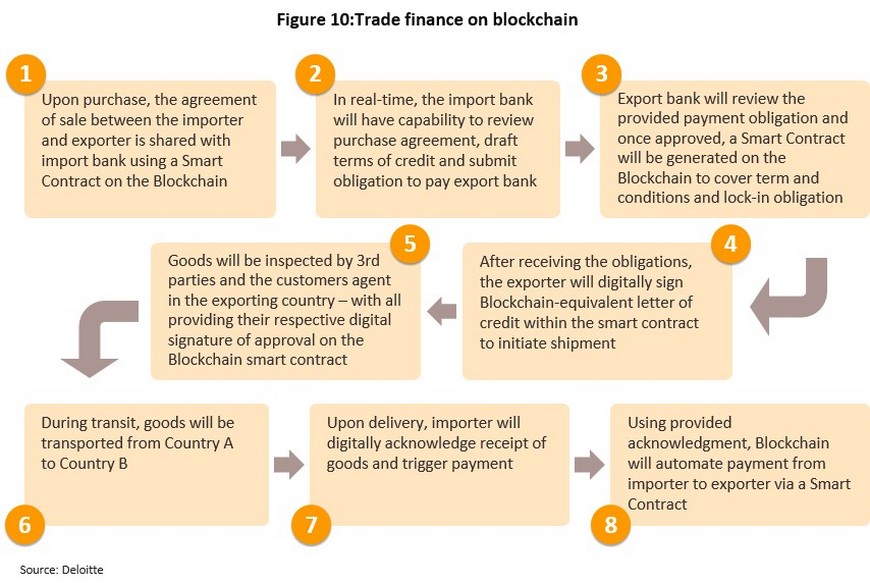

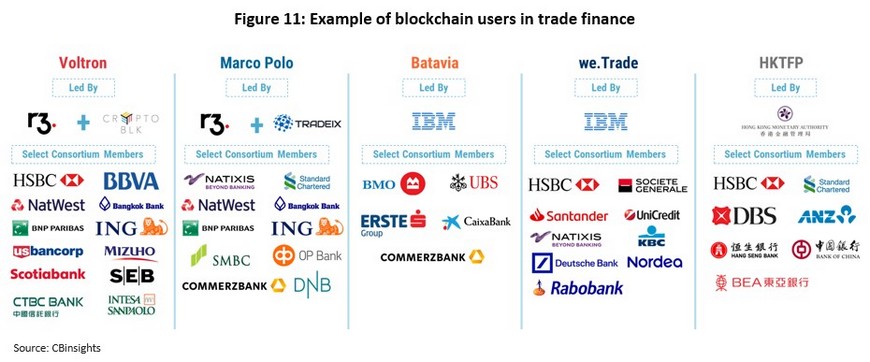

Trade finance: Organizing the financing of international trade is a complicated and lengthy process that could be significantly simplified through the deployment of blockchain systems, and in particular, the use of smart contracts could automate many of these procedures. Using blockchain would also help companies prevent the release of certain types of data, such as sensitive pricing information, since by using the right type of blockchain, players are able to specify which information will be made public and which will be kept private. At present, within the area of trade finance, blockchain are used in Thailand as letters of guarantee[7]. In addition, as discussed above, blockchain can be used to make international transfers and this will make it easier to arrange international trade finance. Companies active in the area of providing blockchain-enabled trade finance include Ornua, IBM, Standard Chartered, HSBC, BBVA, DBS, UBS, and Mizuho.

It can be seen that blockchain technology can help banks to simplify their operations, cut their costs, and reduce their exposure to risk. This will then allow banks to better serve their client base, leading to a richer customer experience and higher rates of customer engagement.

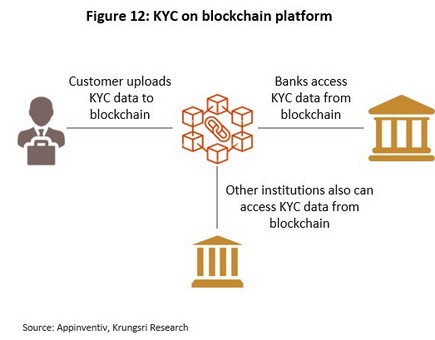

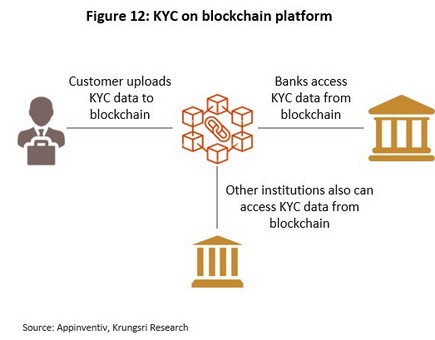

Know-your-customer (KYC) and fraud prevention: Within non-blockchain-enabled systems, every bank and organization that is required to carry out KYC procedures has to separately inspect and confirm the identity of its customers, which causes an enormous duplication of work that then adds unnecessarily to costs. By contrast, using blockchain to identify customers would not only save money for banks but would also reduce the difficulties experienced by those who have to establish their identity. In addition, using blockchain would increase data security and reduce the risk of customers’ identities being stolen. Deloitte thus estimates that blockchain-based e-KYC would help to save over USD 160 million annually that is currently spent on KYC. Indeed, many organizations are already using blockchain for this, including HSBC, Barclays, Deutsche Bank, MUFG, IBM, KYC-chain, and Thailand’s NDID (National Digital ID).

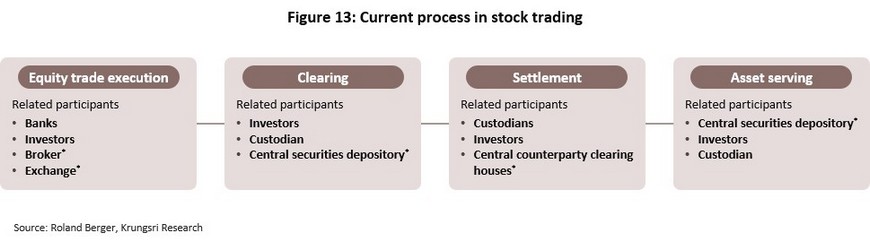

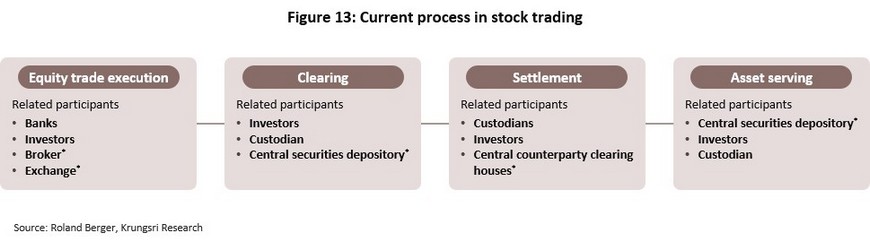

Capital markets: This is another area where blockchain technology could bring benefits since these involve: (i) many participants, whether that is buyers, sellers, providers of market exchange services, or brokers; and (ii) complicated business processes that impose high costs in terms of both money and time. This is especially notable for processing of payments and settlements, which typically takes 2-3 days to process. blockchain would help to reduce the extent of intermediation involved in matching buyers and sellers, and within clearing and settlement systems, which would then translate into lower costs. Bloomberg has therefore estimated that introducing blockchain technology into capital markets would save USD 17-24 billion per year. This would also have the benefit of reducing brokers’ monopolization of sales data, which would have the effect of increasing the transparency of financial markets. Companies in the financial space that are currently using blockchain technology include Chain, PolyMath, tZero, Blocktrade, Alphabit Fund, Blocktower Capital, CoinShares, and Crypto Asset Fund.

For banks, more widespread use of blockchain within capital markets may be a mixed blessing because while this would reduce the cost of trading assets, banks would also likely have to face increased levels of competition, and this may lead to their losing income from the fees charged for managing and trading these assets. It is thus estimated that if financial assets were tokenized, US banks would lose over USD 3 billion in income annually.

It is clear that blockchain technology will bring overall benefits to the global financial and banking system, but from the point of view of banks themselves, the effect of the impacts will vary according to the context within which blockchain are used. Generally, banks will benefit from lower costs, the streamlining of business activities, and better risk assessment. However, the introduction of blockchain may also lead to banks having to contend with more intense competition. This would then increase the risk that they would lose income and see their customer base eroded, and against this background, it is essential that banks plan for the business transformation that the transition to blockchain will usher in.

However, if banks are planning how to apply blockchain technology, given their role as intermediaries within the currently established financial system, they should not begin by rushing to adopt blockchain blindly. Rather, they should consider what the weaknesses of the current system are and how it generates pain points for customers, before identifying what consumers’ primary needs are and how they hope to use banking services. Having done this, banks will be much better placed to use modern technology, including blockchain, as tools to solve the problems experienced by consumers. In this case, by providing high-quality, efficient services, banks will be able to preserve their place as intermediators within the financial system, even as those around them expect blockchain to fulfil their role as disruptors of the status quo and destroyers of middlemen.

Reference

Ankenbrand, T., & Bieri, D. (2017). A structure for evaluating the potential of blockchain use cases in finance

CBinsights (Aug 23, 2018) How Banks Are Teaming Up To Bring Blockchain To Trade Finance Retrieved May 15, 2022, from https://www.cbinsights.com/research/banks-regulators-trade-finance-blockchain/

Chirag (April 7, 2022) Blockchain technology for KYC: The Solution to Inefficient KYC Process Retrieved May 18, 2022, from https://appinventiv.com/blog/use-blockchain-technology-for-kyc/

Deloitte (Retrieved May 26, 2022) How Blockchain Can Reshape Trade Finance? From https://www2.deloitte.com/content/dam/Deloitte/global/Documents/grid/trade-finance-placemat.pdf

Federal Reserves (Feb 2019) Beyond Theory: Getting Practical With Blockchain

Goldman Sachs Blockchain the new technology of trusts

Gwyneth Iredale (April 17, 2020) Top Disadvantages Of Blockchain Technology Retrieved May 25, 2022, from https://101blockchain.com/disadvantages-of-blockchain/

Josh Galper, (Feb 24, 2016) Blockchain and settlements: are there real savings or is this hype? Retrieved May 20, 2022, from https://finadium.com/blockchain-and-settlements-are-there-real-savings-or-is-this-hype-premium/

Kathleen E. Wegrzyn Eugenia Wang (Aug 2021) Types of Blockchain: Public, Private, or Something in Between Retrieved May 10, 2022, from https://www.foley.com/en/insights/publications/2021/08/types-of-blockchain-public-private-between

Oliver Wyman (2016) Unlocking economic advantage with blockchain

Shawn Tully (Oct 27, 2021) Every single Bitcoin transaction—even buying a latte—consumes over $100 in electricity, says a new report Retrieved May 25, 2022, from https://fortune.com/2021/10/26/bitcoin-electricity-consumption-carbon-footprin

ภาคภูมิ เอี่ยมจิตกุศล (Sep 15, 2020) เทคโนโลยี Blockchain กับธุรกรรมทางอิเล็กทรอนิกส์ Retrieved August 25, 2021, from

https://www.depa.or.th/th/article-view/blockchain-electronic

สำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์, “รู้เขา รู้ระวัง รู้เท่าทันสินทรัพย์ดิจิทัล” คู่มือลงทุนสินทรัพย์ดิจิทัล https://www.sec.or.th/TH/Documents/DigitalAsset/DigitalAssetInvestment-Guide.pdf

[1] The metaverse is a 3-D immersive environment that seamlessly combines the real and the virtual worlds, providing a space within which users may live out their lives. This may be to work, relax, consume entertainment services, play games, socialize, or to engage in activities with others as you do in offline spaces, though in all these cases, entry to the metaverse is dependent on access to the internet and suitable headgear. For more details, please see … The Metaverse: When virtuality becomes reality

[2] NFT is an abbreviation of ‘non-fungible token’. These are digital assets that carry with them built-in certificates of authenticity that establish proof of ownership or confirm some other particular kind of right to the NFT. These can take the form of digital content, such as images, photographs, or music, or they may refer to physical assets, such as land. NFTs can thus be thought of as a digital token that confirms ownership or copyright. For more details, please see … The role of banks in the new world of NFTs

[3] Bloomberg Industry Intelligence (2021) Job report during COVID-19

[4] A digital token is a unit of digital data that has been created to assign rights to a share of income or of other goods and services, or to assign other rights (i.e., it is a utility token), as specified by the token issuer.

[5] Crowdfunding is a way of raising funds that relies on sourcing money from individuals rather than from banks or other financial institutions. Members of the public are appealed to directly for money to support an activity, a project, or another type of business, with the nature of the returns made to those who have contributed varying according to the type of crowdfunding and the goals of those organizing it (source: https://flowaccount.com/blog/crowdfundingforsmes/).

[6] Forbes

[7] For example, BCI (Thailand) Ltd., a joint venture between banks, state enterprises, and many leading business organizations that have cooperated under the Thailand Blockchain Community Initiative. Six Thai banks have invested in the company: Krungsri Ayutthaya, Bangkok Bank, Kasikorn Bank, Krungthai Bank, SCB, and TMBThanachart Bank, which all operate under the supervision of the Bank of Thailand.