Introduction

Over the past decade, Vietnam has experienced remarkable economic growth compared to other ASEAN countries, primarily driven by its export-oriented manufacturing sector and rising inflows of foreign direct investment (FDI). This trajectory aligns with the global trend of supply chain diversification out of China, which began since the U.S.–China trade war in 2018. However, Vietnam’s reliance on exports also exposes the country to significant risks—particularly under the second Trump administration, which has intensified trade tensions.

At the same time, Vietnam’s financial sector remains vulnerable, especially the banking industry, which is heavily exposed to the real estate and manufacturing sectors—both of which face increasing challenges amid the U.S. reciprocal tariff measures.

Nonetheless, these challenges may also introduce new opportunities for financial institutions in Vietnam. There is growing potential to diversify credit exposure toward domestic sectors with high growth prospects and to expand access to financial services among underserved populations and small businesses. This shift would align with the growing role of domestic consumption as a key engine of Vietnam’s economic growth.

This article aims to analyze Vietnam’s economic landscape, financial sector, and the linkages between the real economy and the financial sector—highlighting how financial institutions can seize emerging opportunities in the context of rising global trade and financial uncertainties.

Economic Landscape

Vietnam’s export-driven economy is increasingly vulnerable to escalating trade tensions. However, private consumption is playing an increasingly significant role in driving economic growth.

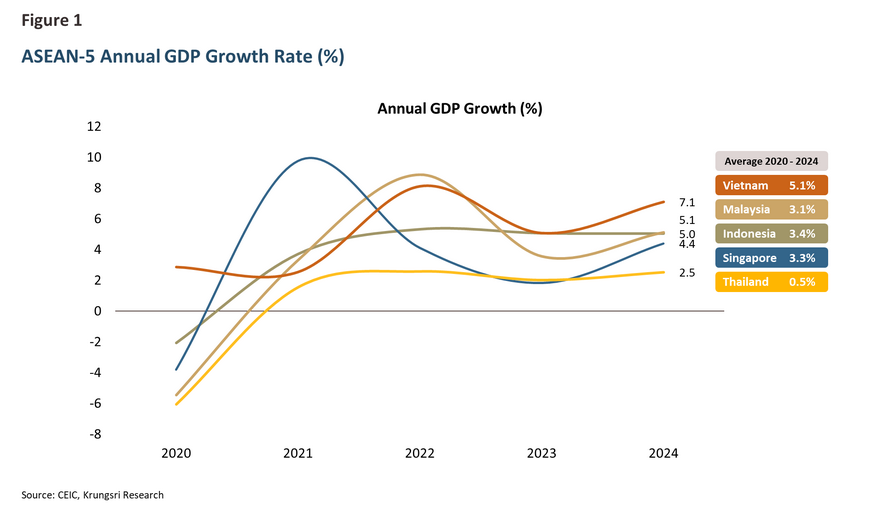

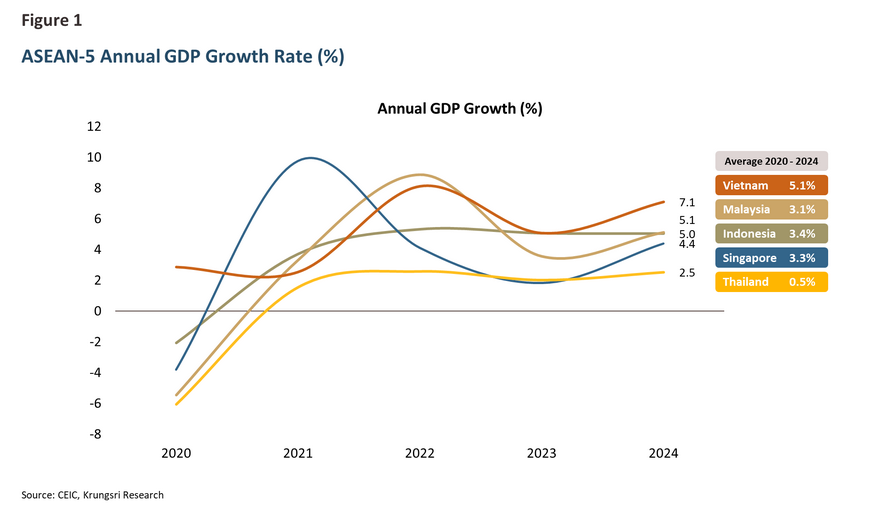

Over the past 5 years (2020-2024), Vietnam recorded the highest average GDP growth rate in ASEAN, at 5.1%—outpacing Malaysia, Indonesia, Singapore, and Thailand (Figure 1). This growth has been largely driven by export sector, largely operated by foreign enterprises that established production bases in Vietnam through foreign direct investment (FDI).

Vietnam’s average merchandise export-to-GDP stood at approximately 86% over the past five years1/, underscoring its high dependence on exports. However, a study by Krungsri Research2/ found that exports of final goods—especially electronics and electrical appliances—to the U.S. and China have surged since 2018, the onset of the U.S.–China trade war. A portion of this growth reflects “Trade Rerouting”, in which Chinese-origin goods are re-exported through Vietnam to the U.S., resulting in relatively limited domestic value-added from final-stage production within Vietnam.

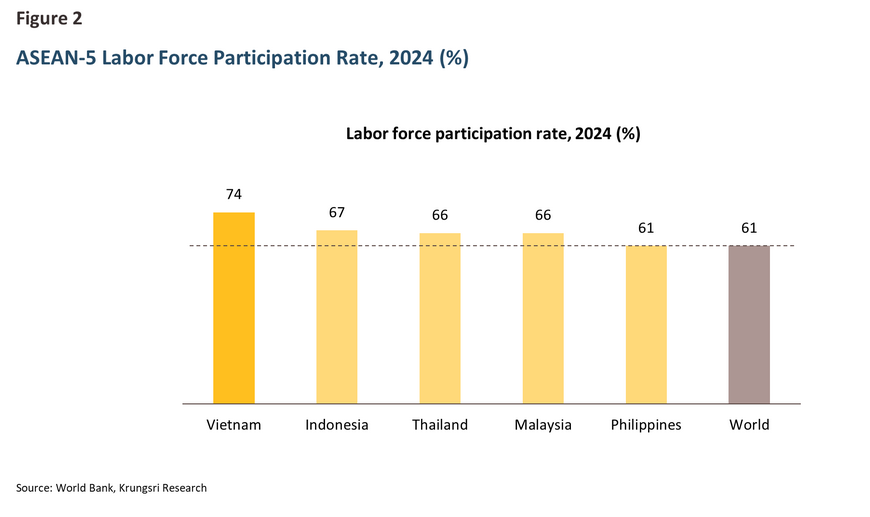

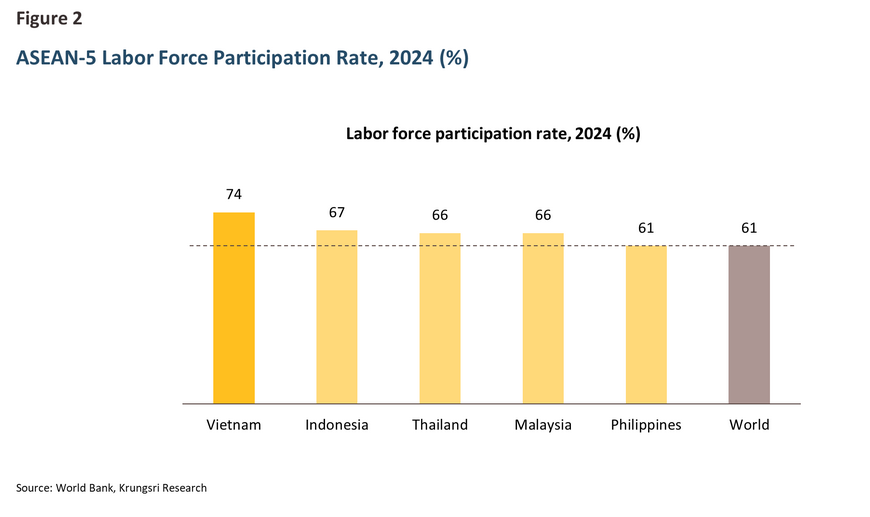

FDI value further emphasizes Vietnam’s role as a regional export-linked manufacturing hub, with over 60% of total FDI directed toward the manufacturing sector—particularly electronics and components3/, which have shown strong export growth. This role has become more prominent as supply chain diversification accelerates in response to trade tensions between the U.S. and China, positioning Vietnam as a prominent production base. The country’s attractiveness stems from several advantages, including its strategic location, a significant number of free trade agreements, and a large labor force with competitive costs. This is reflected in Vietnam’s labor force participation rate4/, which remains among the highest in the region (Figure 2).

However, Vietnam’s key growth engines—exports and FDI—are facing challenges in the near term, especially as a new wave of U.S.–China trade tensions under a second Trump administration (Trump 2.0) may weaken Vietnam’s attractiveness as a manufacturing destination.

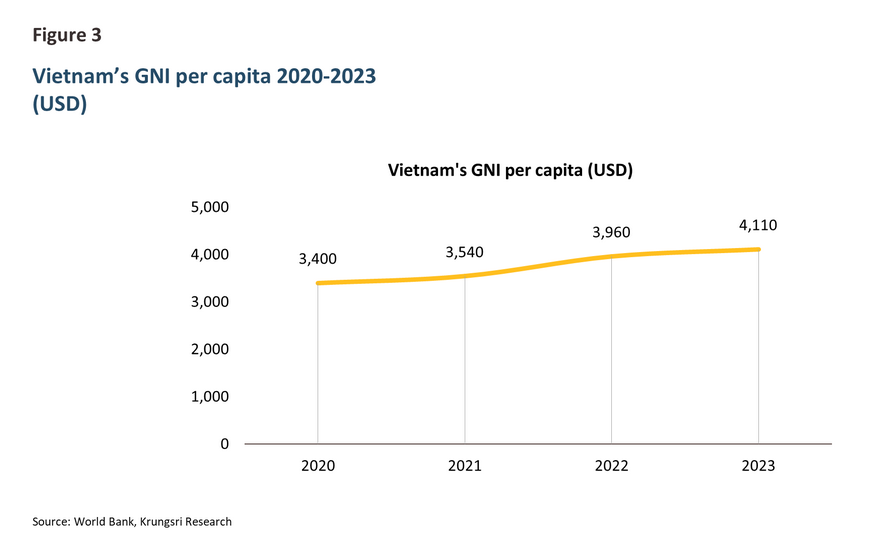

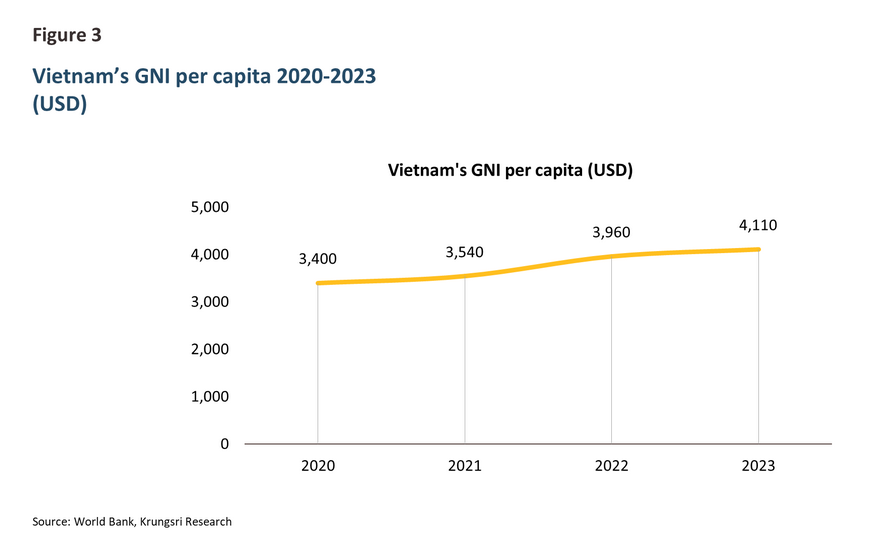

Besides exports, private consumption is playing an increasingly important role in driving Vietnam’s economy. This trend is supported by rising income per capita (Figure 3) and the expansion of the middle class5/, which reflects broader progress in economic development and purchasing power. The Vietnamese government has also set an ambitious goal of attaining upper-middle income6/ status by 2034.

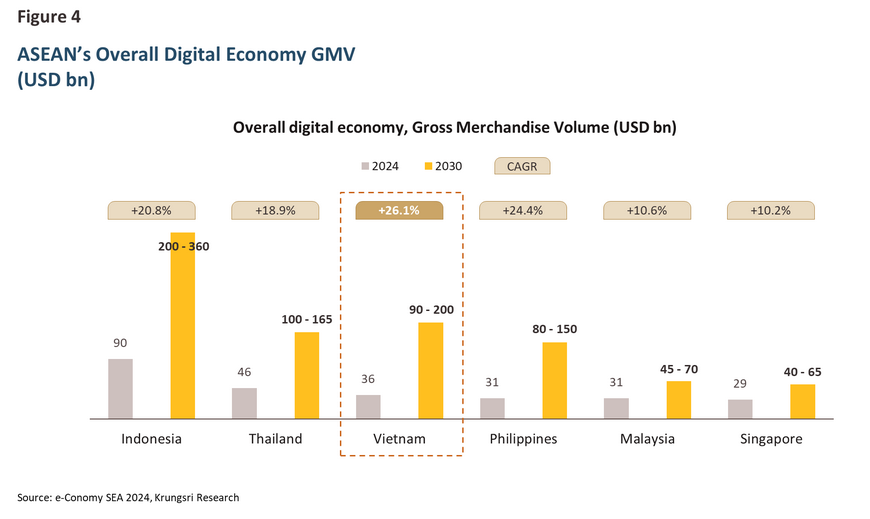

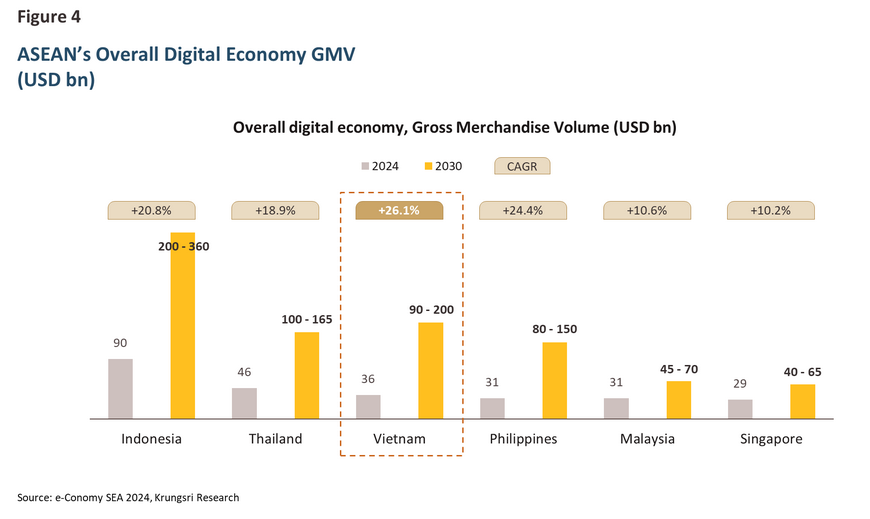

Another important factor bolstering domestic consumption is the rapid expansion of e-commerce. According to the e-Conomy SEA 2024 report, Vietnam now has the third-largest digital economy7/ in ASEAN—measured by gross merchandise volume (GMV)—after Indonesia and Thailand. Moreover, it is projected to register the region’s highest compound annual growth rate (CAGR) of 26.1% through 2030 (Figure 4).

Financial Landscape

Vietnam’s banking sector plays a key role in the country’s financial system, but facing challenges due to its strong reliance on the real estate sector and businesses that are exposed to external factors.

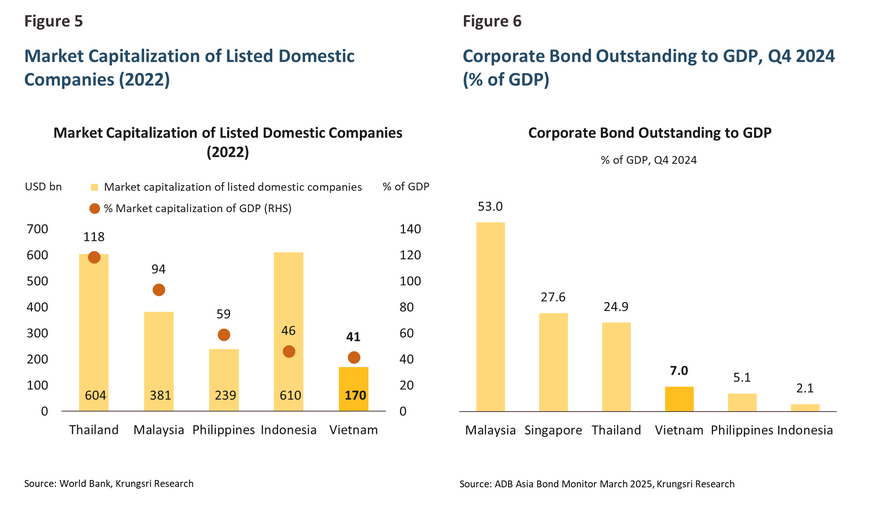

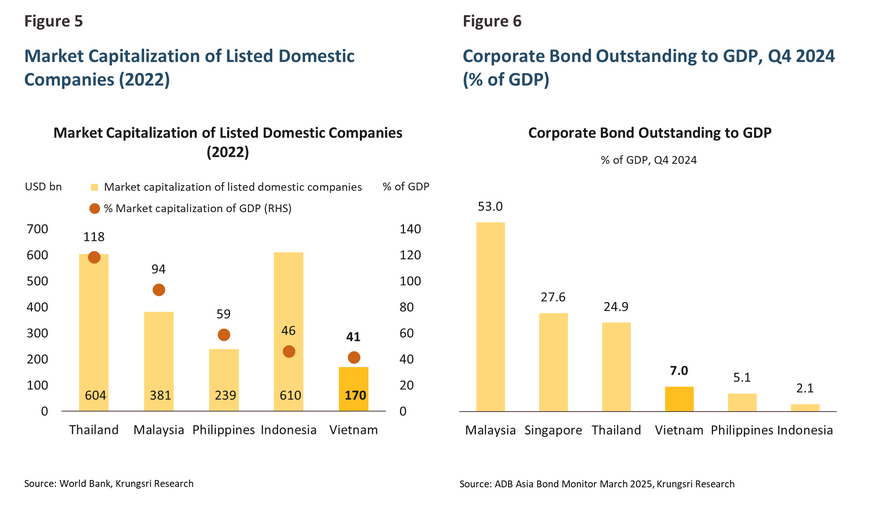

The banking sector dominate Vietnam’s financial system, with total outstanding bank credit equivalent to approximately 135% of GDP, and accounting for over 95% of the total loans8/ provided by credit institutions under the supervision of the State Bank of Vietnam (SBV)9/. This dominance is largely due to the underdevelopment of the bond and equity markets, which limits their contribution to capital mobilization and alternative funding channels.

Although the stock market has seen an increase in the number of listed companies and has relatively high liquidity, it remains small compared to other countries in the region. The market capitalization is around 41% of GDP (Figure 5), and the market is highly volatile due to speculative behavior among retail investors. Meanwhile, Vietnam’s corporate bond market accounts for only around 7% of GDP (Figure 6), which is low compared to other countries in the region. In addition, most corporate bond issuances are still concentrated in the banking and real estate sectors10/.

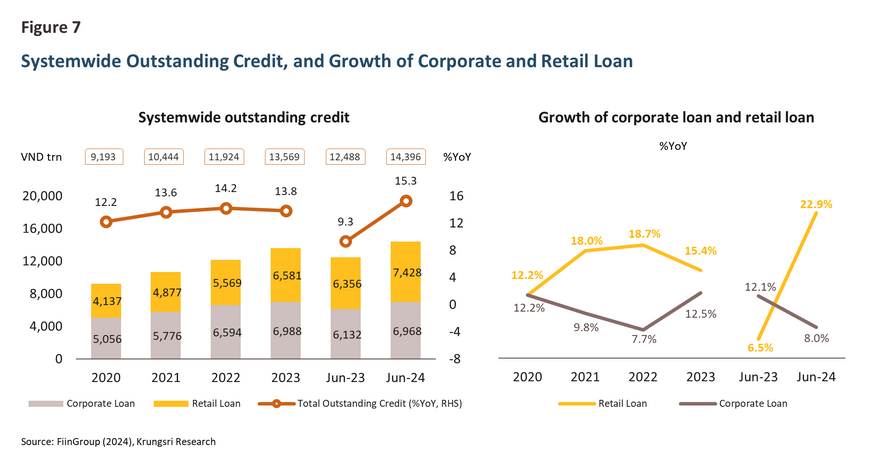

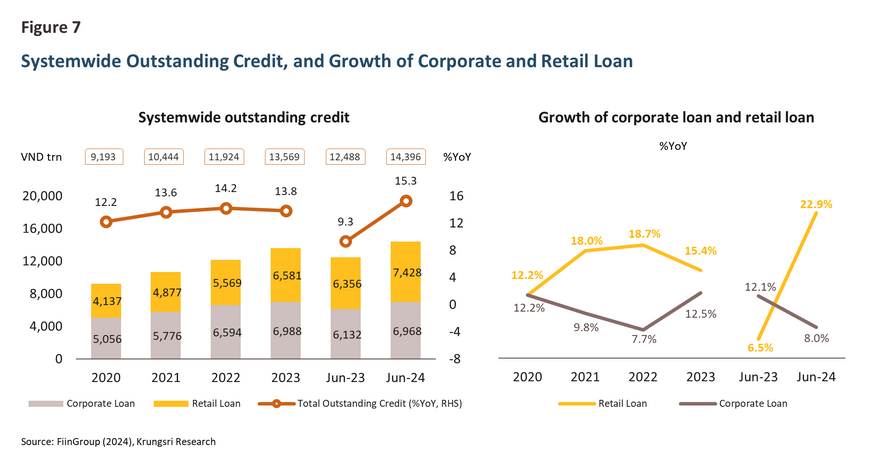

In terms of loan types issued by the banking sector, Vietnamese banks provide a relatively balanced share of corporate loans and retail loans11/, with retail lending gradually increasing in share over time (Figure 7).

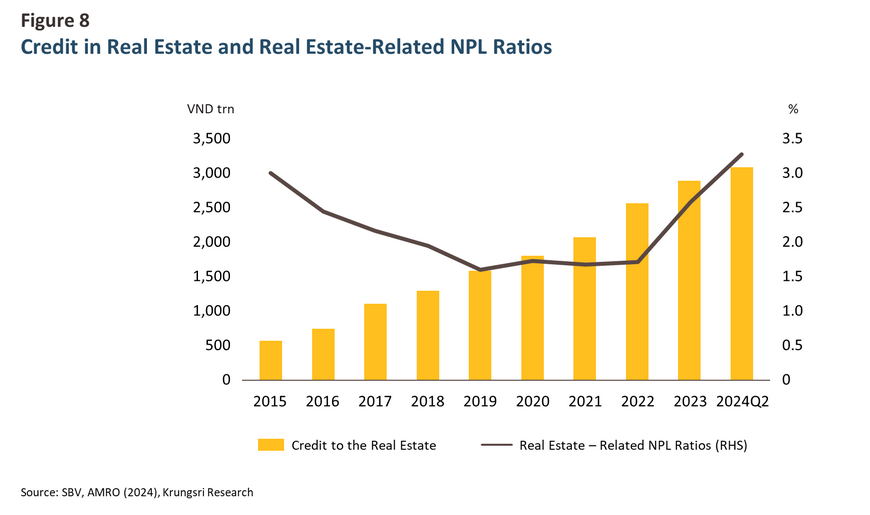

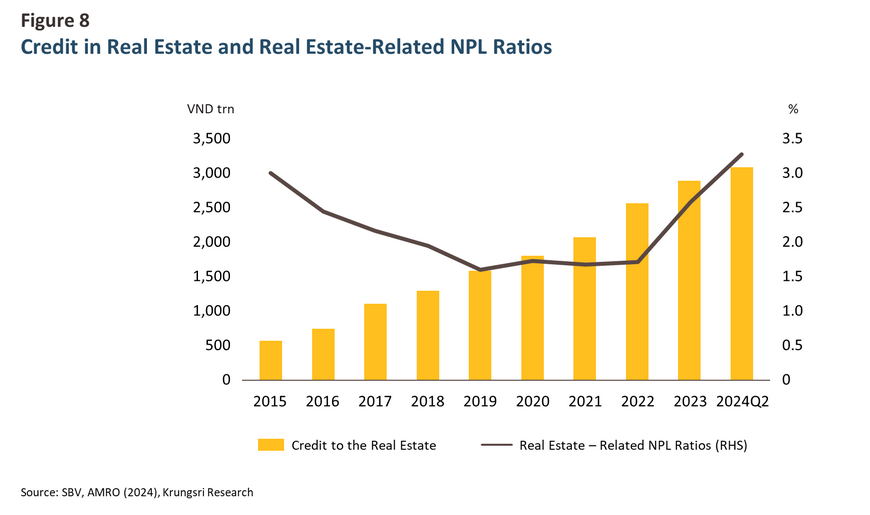

However, since 2023—following the turbulence in the corporate bond market in late 202212/—banks have expanded their lending to real estate-related activities, with credit to the sector exceeding VND 3,000 trillion, accounting for over 21% of total loans outstanding as of Q2 2024 (Figure 8).

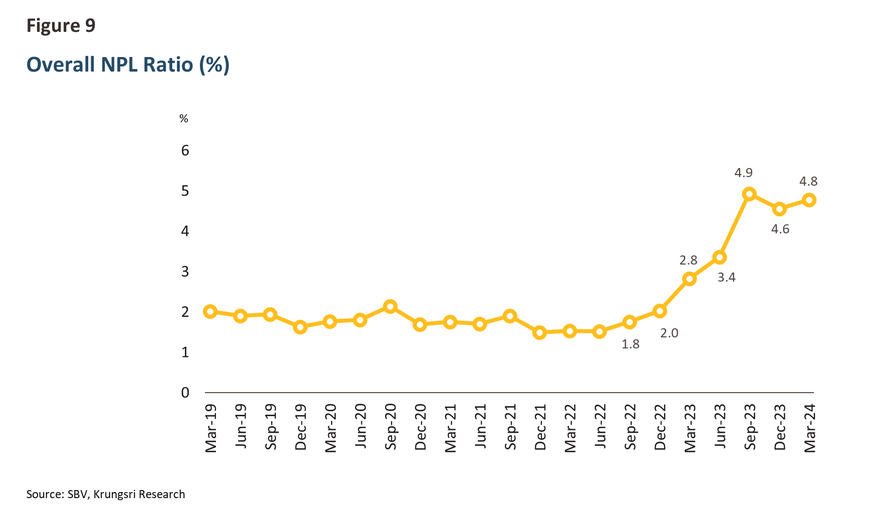

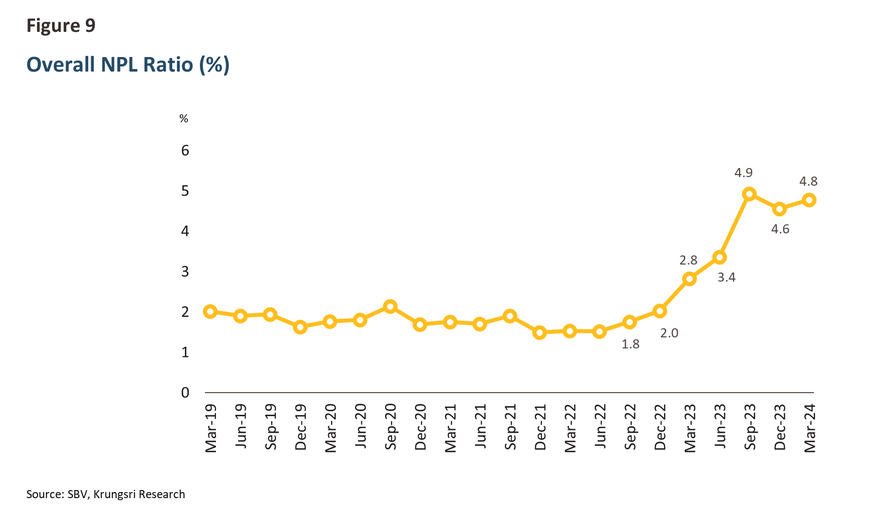

At the same time, the non-performing loan (NPL) ratio has risen sharply, from 2.0% in Q4 2022 to 4.8% in Q3 2024 (Figure 9), with real estate loans making up the majority of NPLs. This reflects a spillover effect of issues in the real estate sector on the banking system, heightening risks to the stability of Vietnam’s banking sector. This is particularly concerning as many large property developers remain highly leveraged and face significant liquidity constraints, increasing the risk of debt default. This trend warrants close monitoring going forward.

Development in Financial Sector and Linkages with the Real Economy

The expansion of digital finance in Vietnam has played a crucial role in increasing access to financial services and accelerating the growth of the digital economy.

One of the most notable developments in Vietnam’s financial sector is the rise of digital finance, which has become increasingly prominent. This is reflected in the growth of digital payment transactions via internet and mobile channels, which surged by 80% and 119%, respectively, from 2021 to 2024—translating into average annual growth rates of 16% and 22%. As a result, in 2024, digital transactions accounted for as much as 98% of total transactions at several commercial banks13/.

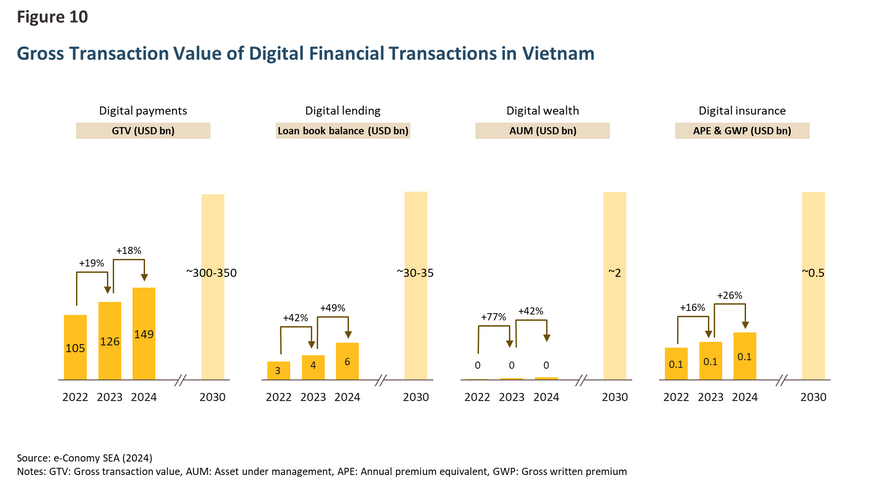

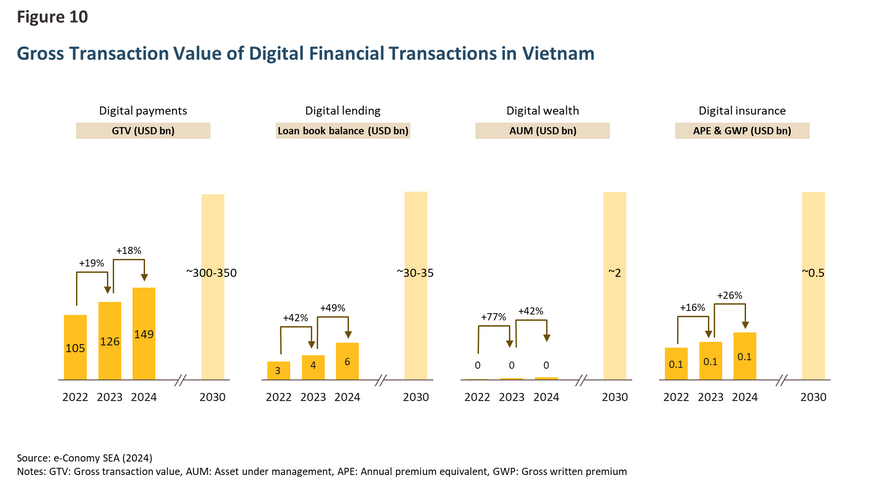

Thus far, digital payment remains the largest component in terms of transaction volume14/. However, other types of digital financial services—such as digital lending, digital insurance, and digital wealth management—are also expected to expand strongly in the coming years, even though their current transaction values are smaller than that of payments. According to the e-Conomy SEA 2024 report, digital lending is expected to be the fastest-growing segment and holds significant market potential in coming years. (Figure 10).

The growth of digital financial transactions in Vietnam has been driven in part by the COVID-19 pandemic, which accelerated the shift toward online financial services by both institutions and consumers. This shift is also supported by several key factors:

- Tech-savvy population: Vietnam has around 28 million people aged 15–34, the third largest in ASEAN after Indonesia and the Philippines. This demographic is highly receptive to new technology and constitutes a major source of purchasing power. As a result, consumer behavior has shifted significantly, helping to drive the continued growth of both e-commerce and online financial services.

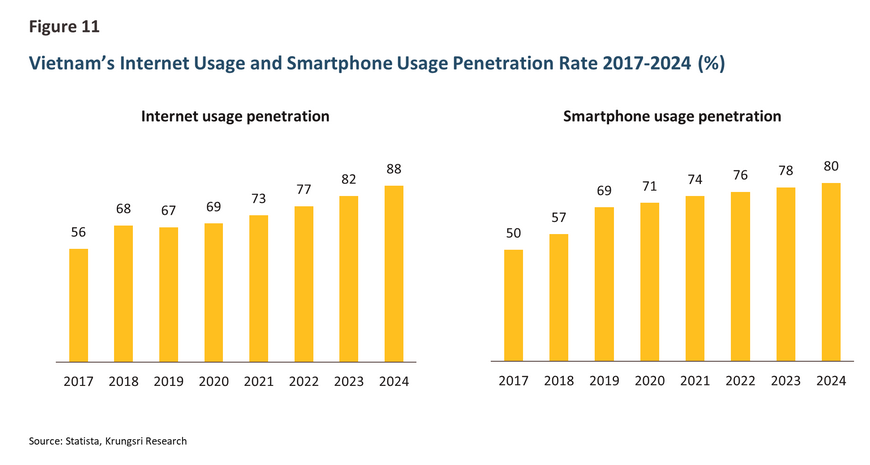

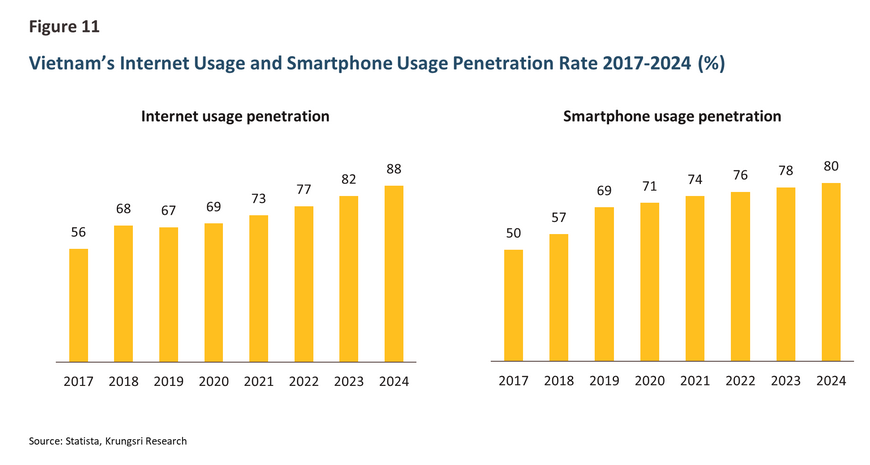

- Broader access to technology: Internet and smartphone penetration have increased markedly—from 56% and 50% in 2017, to 88% and 80% in 2024, respectively (Figure 11). This reflects wider service coverage, lower data costs, and more affordable smartphone prices—factors that have supported the adoption of digital financial transactions.

- Digital infrastructure and government support: The Vietnamese government has invested in digital infrastructure, including expanding 5G networks and developing national digital payment systems such as VietQR15/. These initiatives not only promote digital finance but also stimulate the use of digital platforms in other sectors such as online commerce and digital services that support the broader digital economy.

Digital finance plays an important role in the real economy in the following two aspects.

1. Role in Supporting the digital economy

Digital finance plays a crucial role in enabling the growth of Vietnam’s e-commerce sector by making online transactions faster, more secure, and more convenient. This is reflected in the declining share of cash-on-delivery payments on e-commerce platforms since the COVID-19 pandemic, while bank transfers and e-wallets have increased their share (Figure 12). In addition, digital finance empowers SMEs and startups, especially those in remote areas, to access modern financial tools such as digital payments and online lending. This helps improve their competitiveness and supports continued expansion of Vietnam’s digital economy, which grew by an average of 18% per year between 2022 and 2024 (e-Conomy SEA 2024).

2. Role in Enhancing financial inclusion

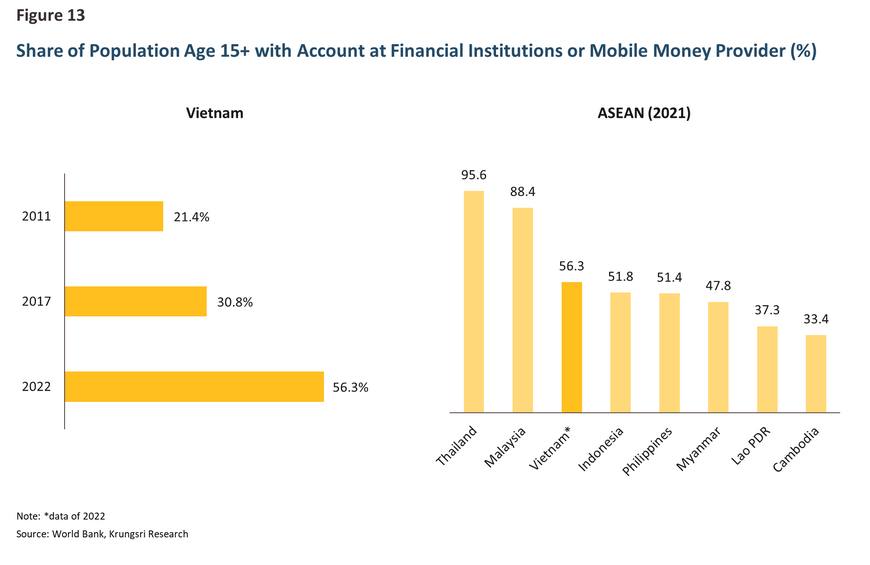

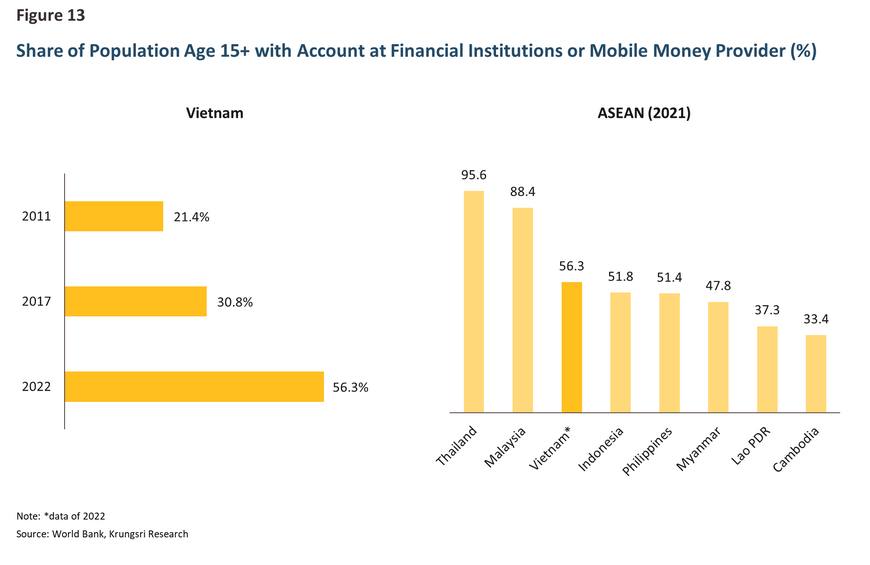

The development of digital finance has been a key driver in improving financial inclusion in Vietnam. The share of the population aged 15 and older with an account at a financial institution or through a mobile money provider increased from 31% in 2017 to 56% in 2022 (Figure 13), placing Vietnam’s financial inclusion 4th in ASEAN, behind only Singapore, Thailand, and Malaysia. The Vietnamese government has also prioritized expanding access under its National Financial Inclusion Strategy16/, alongside the promotion of digital payments and the development of the fintech sector.

Business Opportunities for Financial Institutions in Vietnam

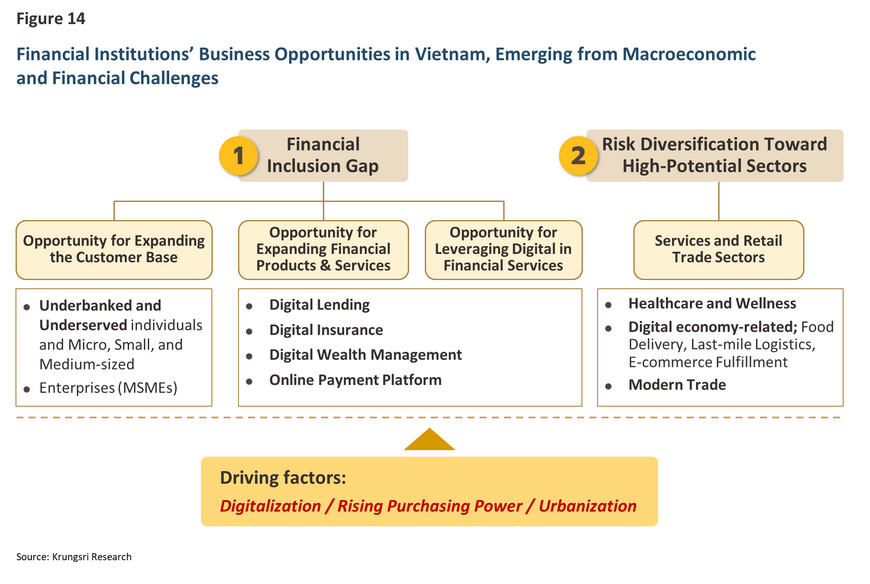

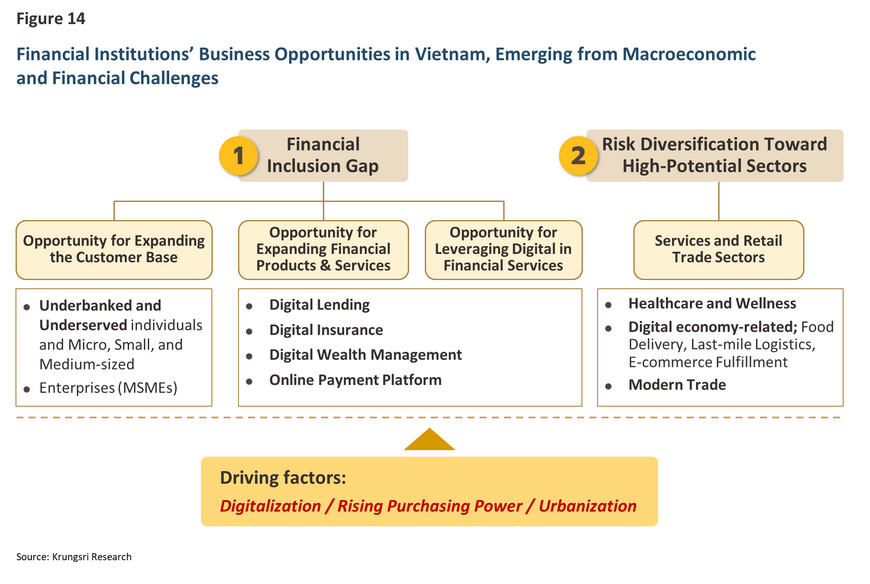

Despite rising risks in the real economy and external headwinds, the rapid expansion of digital finance—coupled with strong domestic demand—has opened up new business opportunities for financial institutions, including both banks and non-bank financial institutions. These opportunities lie in expanding the customer base, diversifying financial products and services, and mitigating risk by tapping into high-potential sectors.

1. Opportunity for Expanding the Customer Base

Today, more than one-third of Vietnam’s population remains underserved to formal financial services—particularly those in remote rural areas, farmers, and ethnic minority groups. At the same time, although micro, small, and medium-sized enterprises (MSMEs)17/ account for around 40% of GDP and contribute to 62% of total employment in the country, they continue to face a substantial financing gap, where their access to credit falls short of their actual financing needs.

According to estimates by the World Bank, this finance gap in 2025 is equivalent to approximately 22% of GDP18/. This financing gap—both at the individual and MSME level—represents a substantial opportunity for financial institutions to expand outreach to these segments. In particular, non-bank financial institutions, which tend to focus on retail clients and operate with greater flexibility, are well-positioned to serve these groups. An important starting point is to broaden access to basic financial services, such as transaction accounts, which will serve as the first step toward accessing other financial services.

2. Opportunity for Expanding Financial Products and Services

The rise of the middle class in Vietnam presents an opportunity for financial service providers. As income levels rise, demand for more diverse and complex financial services also increases. In recent years, digital payments have gained rapid popularity, reflecting strong consumer receptiveness to digital financial platforms. However, as shown in Figure 10, other services—especially digital lending—still have significant room for growth. This suggests a strong opportunity for financial institutions to develop new revenue streams by offering a wider array of financial solutions tailored to customers’ evolving financial needs—not limited to just payments.

3. Opportunity for Leveraging Digital Technology in Financial Services

A World Bank study (2017)19/ identified key barriers to financial access in Vietnam, including the physical distance from financial service providers, high transaction costs, documentation complexity, and a lack of trust in the financial sector. Therefore, digital platforms can help overcome these barriers, enabling financial institutions to expand outreach, improve service delivery, and boost revenues.

Adopting digital technology not only enhances service quality and security, but also reduces operating costs. For example, artificial intelligence (AI) can improve the accuracy of customer assessments and provide insights to personalize financial products based on factors such as behavior, age, and income level.

4. Opportunity from Risk Diversification Toward High-Potential Sectors

Vietnam’s financial sector currently relies heavily on lending to the manufacturing and real estate sectors—both of which are increasingly vulnerable to external shocks, supply chain disruptions, and a domestic property market slowdown. In this context, diversifying credit exposure toward high-growth sectors, particularly those supported by domestic demand, presents a promising opportunity for financial institutions.

The services sector is emerging as a key growth driver, in line with rising purchasing power and consumer needs for higher-quality services. One of the promising sectors is healthcare services, which are evolving toward more advanced medical treatments and expanded access through telemedicine, as well as preventive health services, such as healthy food, wellness services, and holistic health centers. Meanwhile, service industries tied to the digital economy are also expanding rapidly—such as food delivery, last-mile logistics, and e-commerce fulfillment—driven by consumer preferences for convenience, speed, and digital access.

Another potential sector is modern trade, which is gaining ground on traditional retail thanks to urbanization and rising consumer demand. Growth is supported by store network expansion and higher sales, particularly from shopping malls that cater to affluent urban consumers seeking a wide variety of goods, including imported products and elevated customer experiences. At the same time, hypermarkets are expanding to reach the middle-income segment, competing on price accessibility while offering comprehensive product selections.

Krungsri Research View

Krungsri Research assesses that financial institutions in Vietnam—both banks and non-bank financial institutions—still possess strong potential for continued business expansion. This outlook is underpinned by several key structural factors: persistent gaps in financial inclusion among individuals and small businesses; growing demand for new and more personalized financial products that align with rising consumer purchasing power; and heightened external risks, which are expected to strengthen the role of domestic demand as a growth driver. These shifts present important opportunities for financial institutions to diversify their loan portfolios and expand services toward sectors that rely more heavily on domestic markets and demonstrate high growth potential.

Nonetheless, financial institutions continue to face multiple challenges. First, managing risks amid uncertainty in domestic demand, which may slow down as trade tensions could negatively affect domestic manufacturing activity and, in turn, credit quality. Second, the high costs of developing digital infrastructure and technological systems, which may hinder the widespread expansion of financial services. Third, intense competition from both traditional financial providers and new market entrants, pushing financial institutions to accelerate innovation and adapt continuously, particularly in digitally driven business segments.

In this context, investing in digital technology and related infrastructure will become a critical strategy for improving operational efficiency. This must go hand in hand with efforts to enhance financial literacy among the population. In addition, the adoption of advanced technologies—such as artificial intelligence (AI) and advanced analytics—to support real-time credit monitoring and risk assessment will enable institutions to manage credit portfolios more effectively and contain non-performing loans.

At the same time, stronger collaboration among the private sector, government, and regulatory bodies will be essential in designing an enabling regulatory environment that fosters healthy competition, promotes innovation, and reinforces the overall financial system’s stability. This will ensure that the financial sector remains a key engine of Vietnam’s economy in a sustainable manner over the long term.

References

ASEAN +3 Macroeconomic Research Intelligence. (2025, March 6). AMRO’s 2024 Annual Consultation Report on Vietnam. Retrieved from https://amro-asia.org/amros-2024-annual-consultation-report-on-vietnam#:~:text=Vietnam's%20economy%20is%20estimated%20to,7.0%20percent%20growth%20in%202024.

Asian Development Bank. (2025, March). Asia Bond Monitor. Retrieved from https://asianbondsonline.adb.org/documents/abm_mar_2025.pdf

Asian Development Bank. (2024). 2024 Asia Small and Medium-Sized Enterprise Monitor. Retrieved from https://data.adb.org/dataset/2024-asia-small-and-medium-sized-enterprise-monitor

EMIS. (2025). Vietnam Banking Sector Report 2025-2026. Retrieved from https://www.emis.com/php/store/reports/VN/Vietnam_Banking_Sector_Report_2025-2026_en_879097633.html

EY. (2024, November). Improving Vietnam’s Financial Inclusion and FinTech’s Role in Collaboration with Credit Institutions. Retrieved from https://www.ey.com/content/dam/ey-unified-site/ey-com/en-vn/campaigns/transparency-reports/documents/ey-vietnam-improving-vietnam-financial-inclusion-and-fintech-role-in-credit-institutions.pdf

FiinRatings. (2024, September). Vietnam Commercial Banks 1H2024 Review and 2025 Outlook.

Retrieved from https://fiinratings.vn/NewsDetail/11243784/en

Google. (2024). e-Conomy SEA 2024. Retrieved from https://economysea.withgoogle.com/report/

International Finance Corporation, World Bank Group. (2025, March). MSME Finance Gap An updated Estimation and Evolution of Micro, Small and Medium Enterprise (MSEM) Gap in Emerging and Developing markets. Retrieved from https://www.smefinanceforum.org/sites/default/files/Data%20Sites%20downloads/IFC%20Report_MAIN%20Final%203%2025.pdf

International Monetary Fund. (2024, September 27). Vietnam: 2024 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Vietnam. Retrieved from https://www.imf.org/en/Publications/CR/Issues/2024/09/27/Vietnam-2024-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-555679

SHB Finance. (2024, October). Vietnam Market Outlook. Retrieved from https://www.shbfinance.com.vn/

The Ministry of Finance, Vietnam. (2020, February 4). PM approves national financial inclusion strategy until 2025. Retrieved from https://mof.gov.vn/webcenter/portal/vclvcstc/pages_r/l/chi-tiet-tin?dDocName=MOFUCM171877

Vietnam Investment Review. (2024, September 4). Bad debt risks make banks switch focus. Retrieved from https://vir.com.vn/bad-debt-risks-make-banks-switch-focus-114107.html

World Bank. (2017). Vietnam’s financial inclusion priorities: Expanding financial services and moving to a ‘non-cash’ economy. Retrieved from https://blogs.worldbank.org/en/voices/vietnam-s-financial-inclusion-priorities-expanding-financial-services-and-moving-non-cash-economy

1/ Vietnam’s reliance on merchandise exports has been increasing, with the average export-to-GDP ratio rising from 74% during 2015–2019 to 86% during 2020–2024. The United States, China, and the European Union are Vietnam’s top export destinations, accounting for nearly 60% of total export value in 2024.

2/ See also: “Supply Chain Diversification amidst Rising US-China Trade Tension: Implications for Key ASEAN Countries”, Krungsri Research.

3/ Vietnam: 2024 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Vietnam (IMF, 2024)

4/ Labor force participation rate refers to the percentage of the working-age population (aged 15 and above) that is either employed or actively seeking employment.

5/ The Economist Intelligence Unit projects that Vietnam’s middle class will grow from 13% of the total population in 2023 to 26% in 2026.

6/ Upper-middle-income countries are defined as those with GDP per capita between USD 4,515 and USD 14,005 (World Bank, 2024).

7/ The digital economy includes gross merchandise volume from sectors such as e-commerce, online travel, transport and food, and online media.

8/ The remaining 5% of total credit comes from non-bank financial institutions, including finance and leasing companies and People’s Credit Funds (PCFs) or cooperatives. While their share of loan outstanding is small, they continue to play a crucial role in providing credit access to rural and underserved communities.

9/ Total loans outstanding in the systemwide reached VND 15,616 trillion (approximately USD 637 billion) in 2024.

10/ Unlocking the Potential of Viet Nam’s Capital Markets (World Bank, 2023)

11/ Retail loans include consumer loans and other types of retail loans, which are those not for consumption purposes (for investment, business purposes of individual and households, etc.,)

12/ Vietnam’s corporate bond market turmoil in late 2022 was triggered by a wave of defaults among major real estate developers amid tightened liquidity and declining investor confidence. This stemmed from the sector’s excessive reliance on debt financing, lack of transparency, and stricter government regulations on private bond issuance, which triggered severe volatility in an already illiquid market—undermining financial stability.

13/ Vietnam Banking Sector Report 2025 – 2026 (EMIS)

14/ Gross Transaction Value

15/ VietQR is a national QR code payment and transfer standard developed by the State Bank of Vietnam (SBV) to enhance system-wide interoperability. VietQR has also enabled cross-border QR code payments with neighboring countries such as Thailand, Laos, and Cambodia, promoting the use of local currencies in regional transactions.

16/ The National Financial Inclusion Strategy targets at least 80% of Vietnamese adults having access to bank accounts and aims to increase non-cash transaction volume by 20–25% annually.

17/ MSMEs, as defined by the World Bank, include micro, small, and medium-sized enterprises, which meet at least two out of three criteria in terms of employment size, total assets, or annual revenue.

18/ Based on the gap between the potential demand for finance and the supply of finance for MSMEs, as estimated in the MSME Finance Gap Report 2025 by the World Bank Group

19/ Vietnam’s financial inclusion priorities: Expanding financial services and moving to a ‘non-cash’ economy (World Bank, 2017)