Executive Summary: Indonesia’s positive long-term prospects offer business opportunities for Thai businesses

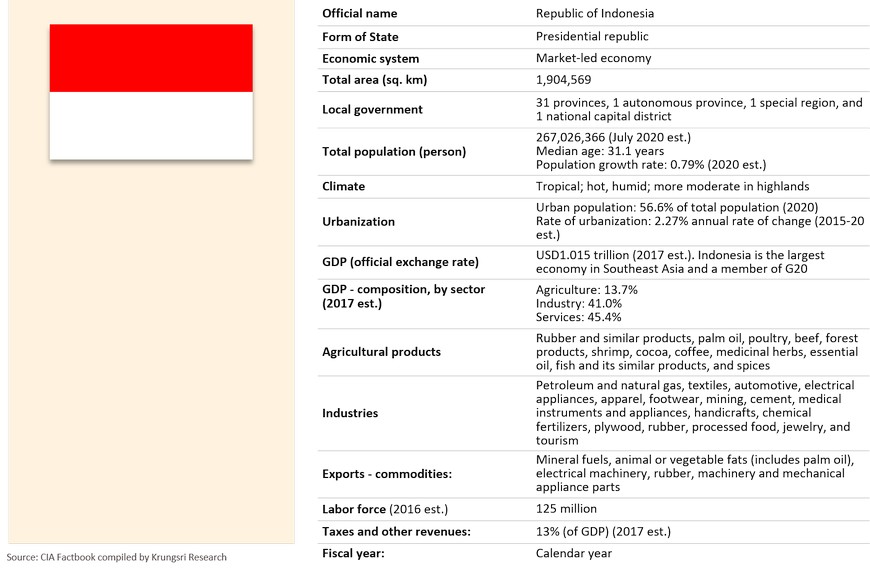

Indonesia: A Country Overview

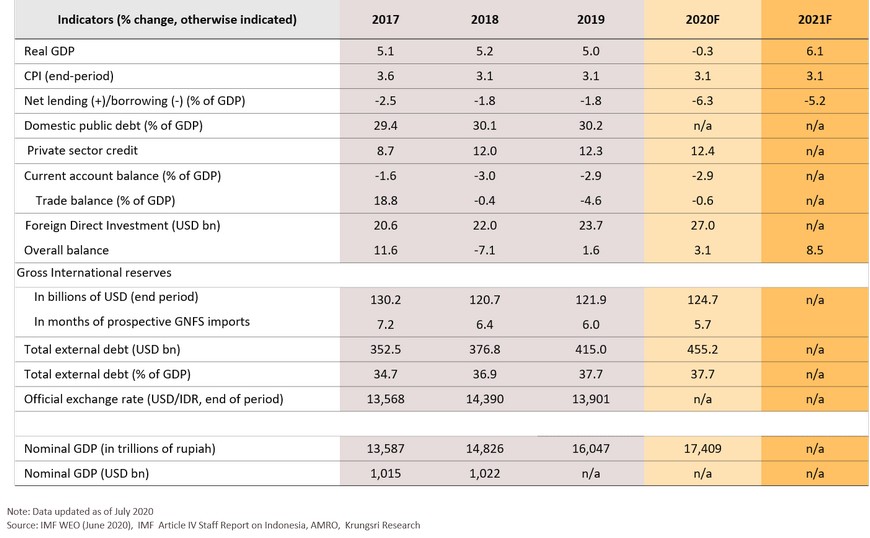

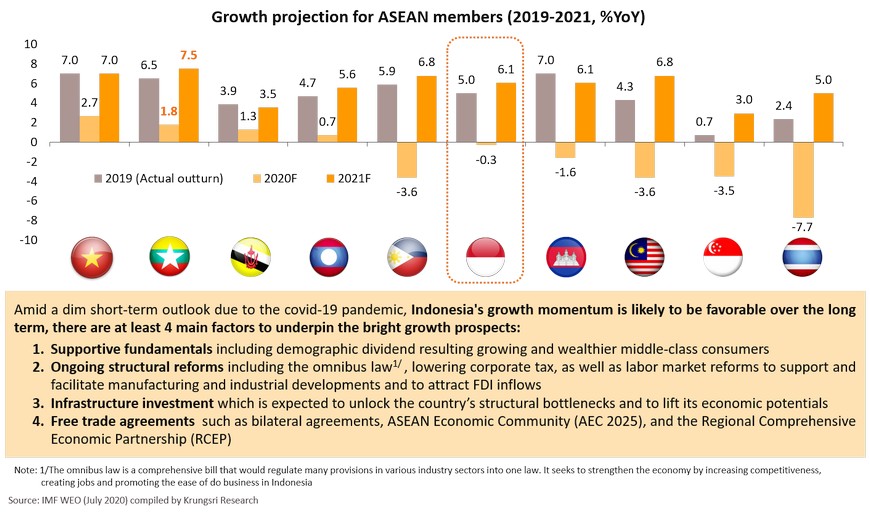

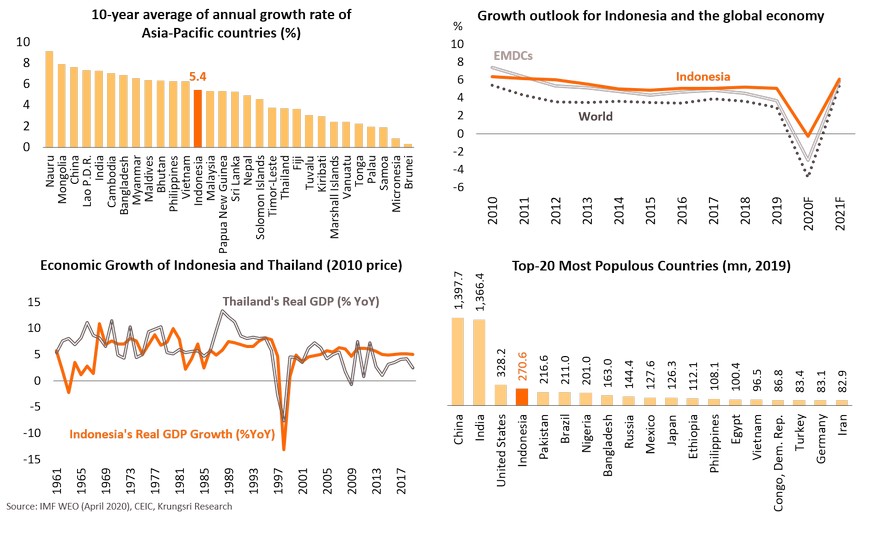

Macro forecasts: The covid-19 pandemic will harm the immediate growth outlook, but long-term prospects remain favorable

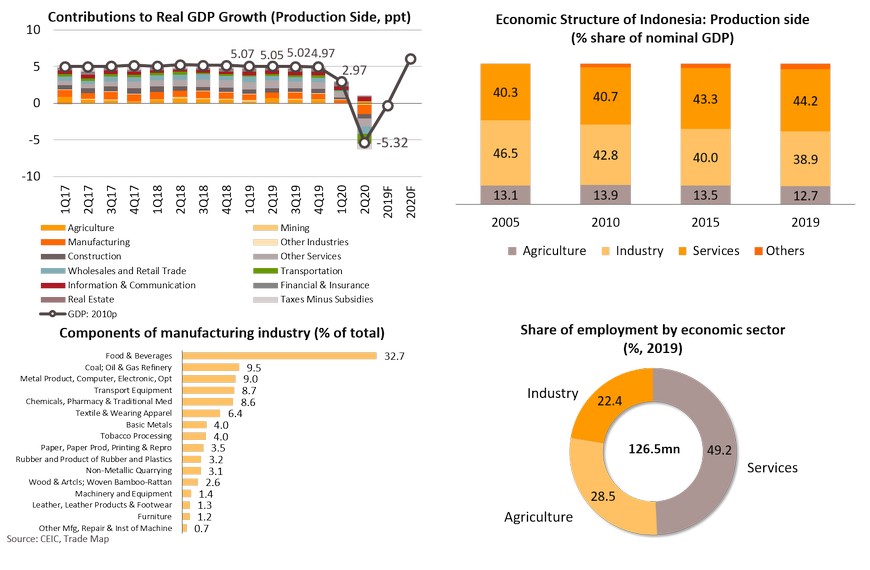

Growth is expected to slip into a negative territory in 2020, but it should resume its potential path of 5.0% - 6.0% p.a. in the medium term

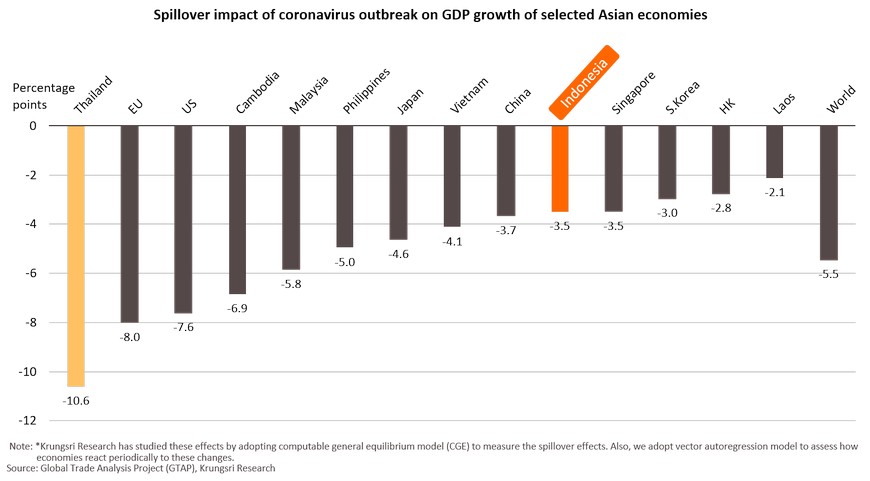

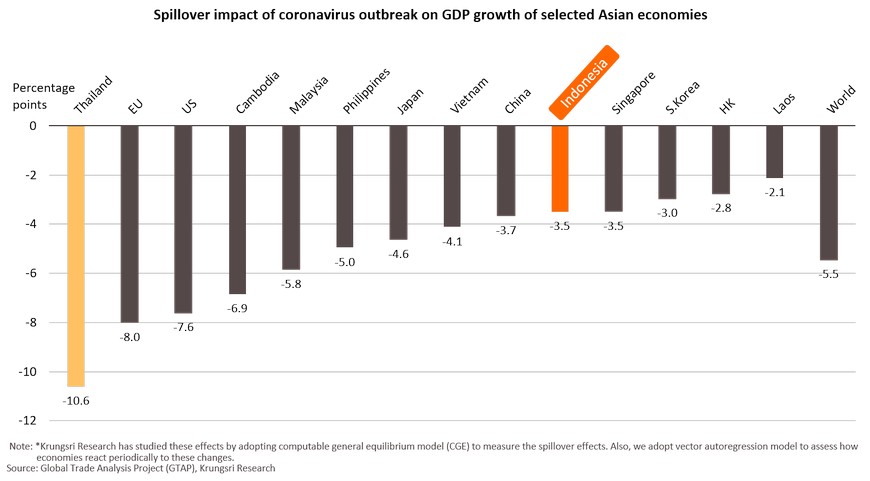

The pandemic could pose a negative impact of 5.5%on 2020 global growth according to our model

The outbreak would reduce global GDP growth substantially by 5.5ppt from baseline forecast (pre-outbreak). Krungsri Research now projects the outbreak would pose a negative impact to the Indonesian economy of 3.5 ppt, at the same magnitude as Singapore. We estimate the impact on Indonesia’s GDP through the following channels – tourism, supply disruption at home and abroad, and multiplier effect.

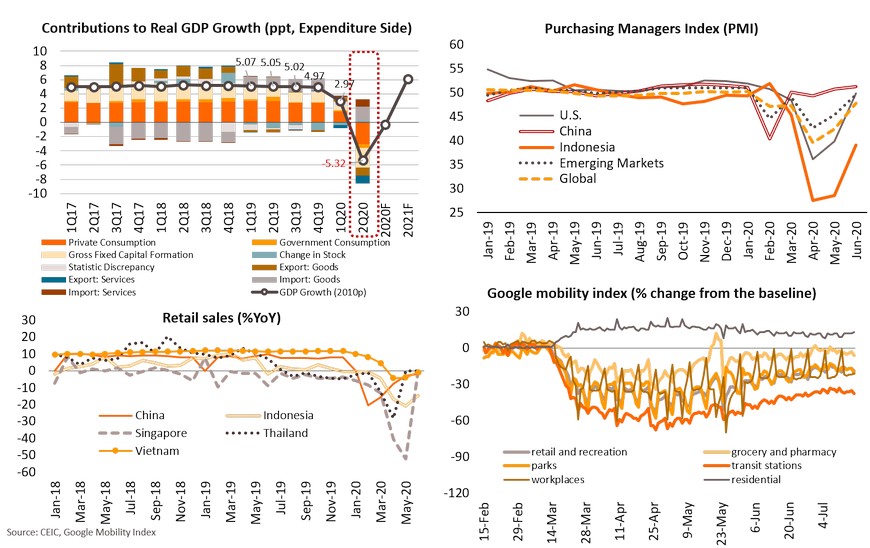

However, the economy is likely to bottom out in 2Q20 and start to pick up gradually in 2H20 should the outbreak is successfully contained

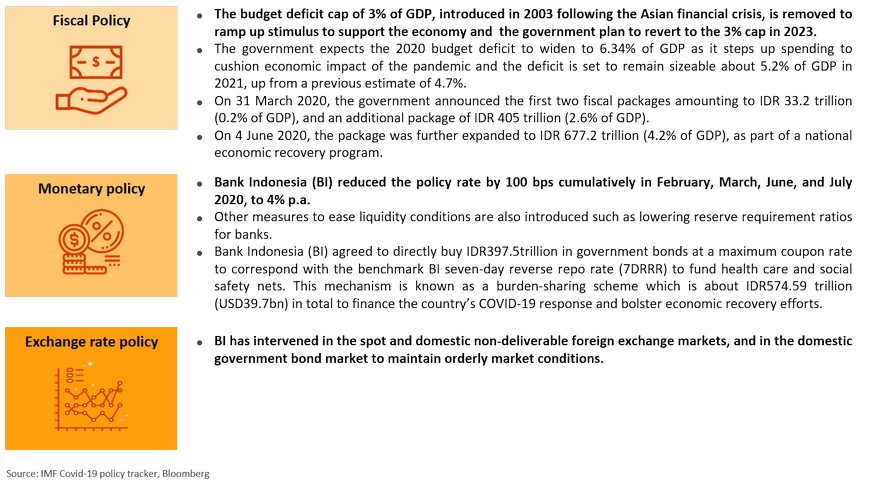

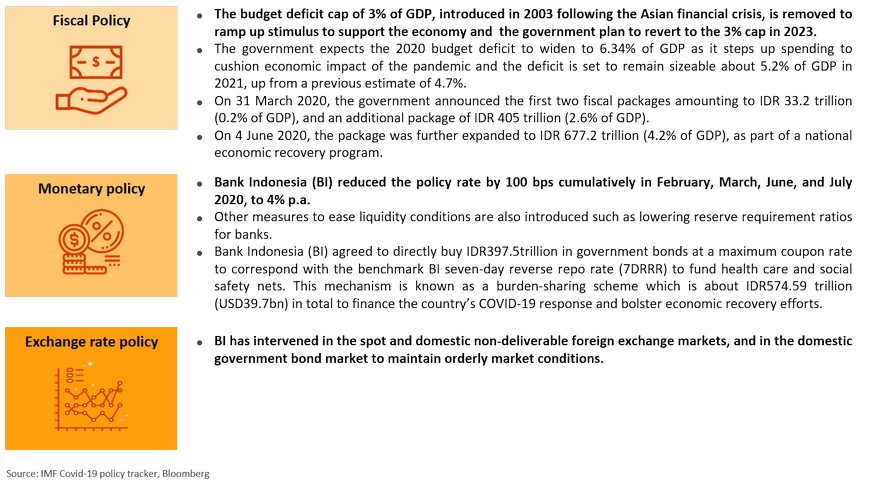

A series of measures to counter the impact of the covid-19

The government adopted various containment measures, including mobility restrictions, travel bans on domestic and international air and sea travel, screening at ports of entry, school closures, and other restrictions on public events since the report of the first confirmed COVID-19 case on 2 March 2020. Indonesia has recently begun easing some containment measures under a “new normal.” The city of Jakarta has started a transitional phase from large-scale social restrictions on 5 June and further eased restrictions on malls on 15 June and parks and recreation areas on 20 June 20.To weather the impact of the pandemic, the government has launched a series of stimulus policies as follows:

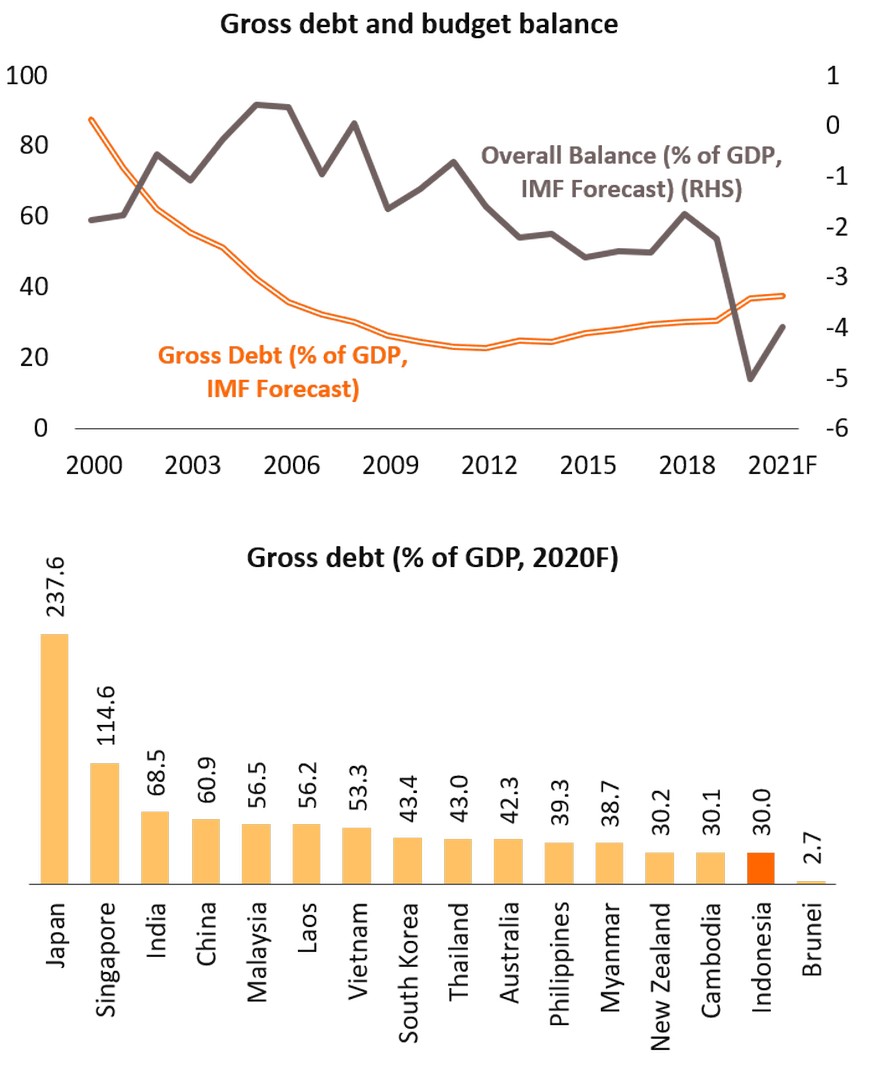

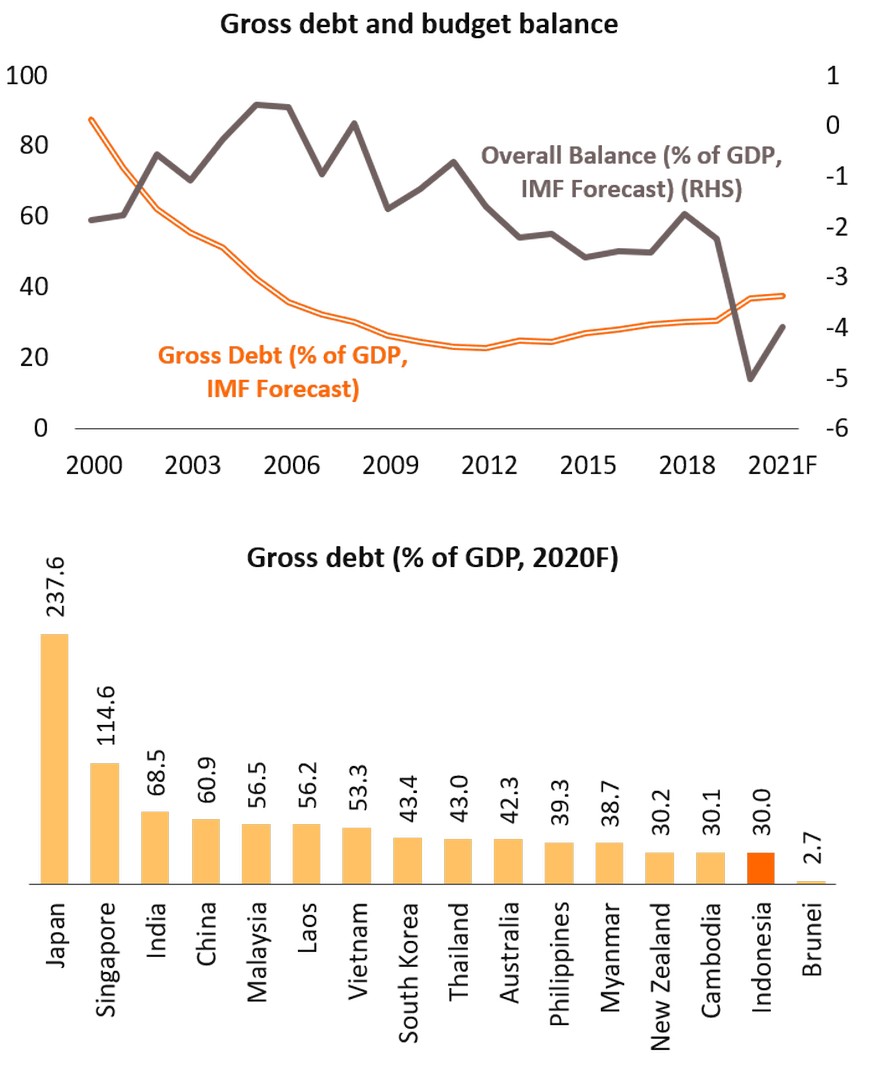

Fiscal prudence has been well maintained since the AFC in 1997

Indonesia’s fiscal rule

- As the country was suffered the most during the Asian Financial Crisis (AFC) of 1997-98, Indonesia has adopted a strict fiscal rule with the annual budget deficit capped at 3% of GDP and the public debt ceiling of 60% of GDP since 2003.

- The Government of Indonesia lowered its debt-to-GDP ratio from a peak of 100% shortly after the Asian financial crisis in 1999 to below 30% until the outbreak of the covid-19 pandemic.

- Performance of Indonesia over the last decade has been recognized by the international rating agencies. Fitch Ratings raised Indonesia’s sovereign rating to BBB- in December 2011, and to BBB in December 2017, taking the country back to investment grade status some 14 years after it lost this status. Moody’s joined Fitch as the second major ratings agency to upgrade Indonesia to investment grade with a sovereign rating of Baa3 in January 2012 and then to Baa2 in April 2018. Standard & Poor’s (S&P) upgraded it in April 2011 to BB+ and then to BBB- in May 2017 and BBB in May 2019. Based on weak growth prospects in 2020 given the coronavirus shocks, S&P downgraded the rating outlook from stable to negative in April 2020.

- With an investment grade rating from the three major rating agencies, Indonesian bonds can be included in a wider range of investment funds.

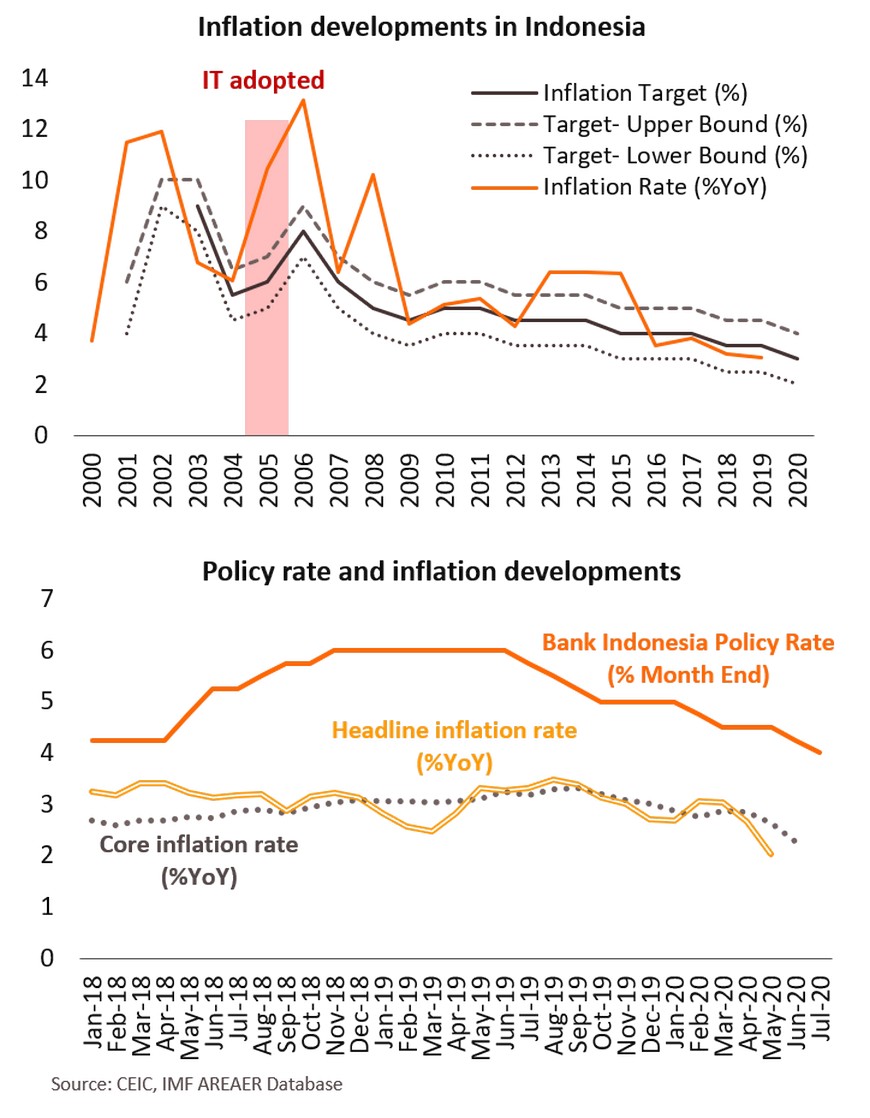

Price stability has been well anchored through the inflation targeting framework adopted since 2005

Inflation targeting adopted by Bank Indonesia (BI) in 2005

- BI has adopted the inflation targeting (IT) framework, along with a managed floating exchange rate regime since 2005.

- While price stability is the primary objective of the IT framework, ensuring financial stability, limiting excessive volatility of the exchange rate, and maintaining attractiveness to capital inflows to finance the fiscal and current account deficits have also been part of the framework.

- The Central Bank has also introduced macroprudential measures and capital flow management measures to influence credit growth and capital flows, respectively. Overall, the framework achieved positive macroeconomic outcomes with growth stable at about 5% since 2013, inflation within the target band since 2016, and public debt at about 30% of GDP since the global financial crisis.

Inflation has been within the BI’s target band of 2% - 4%

- Over the past few years, the annual inflation rate has been successfully managed to be within the Bank Indonesia's 2%-4% target. Going forward, in the absence of both demand and supply pressure, we view that price pressures are likely to remain muted for the remainder of 2020, and this should open room for the Central Bank to take care of growth.

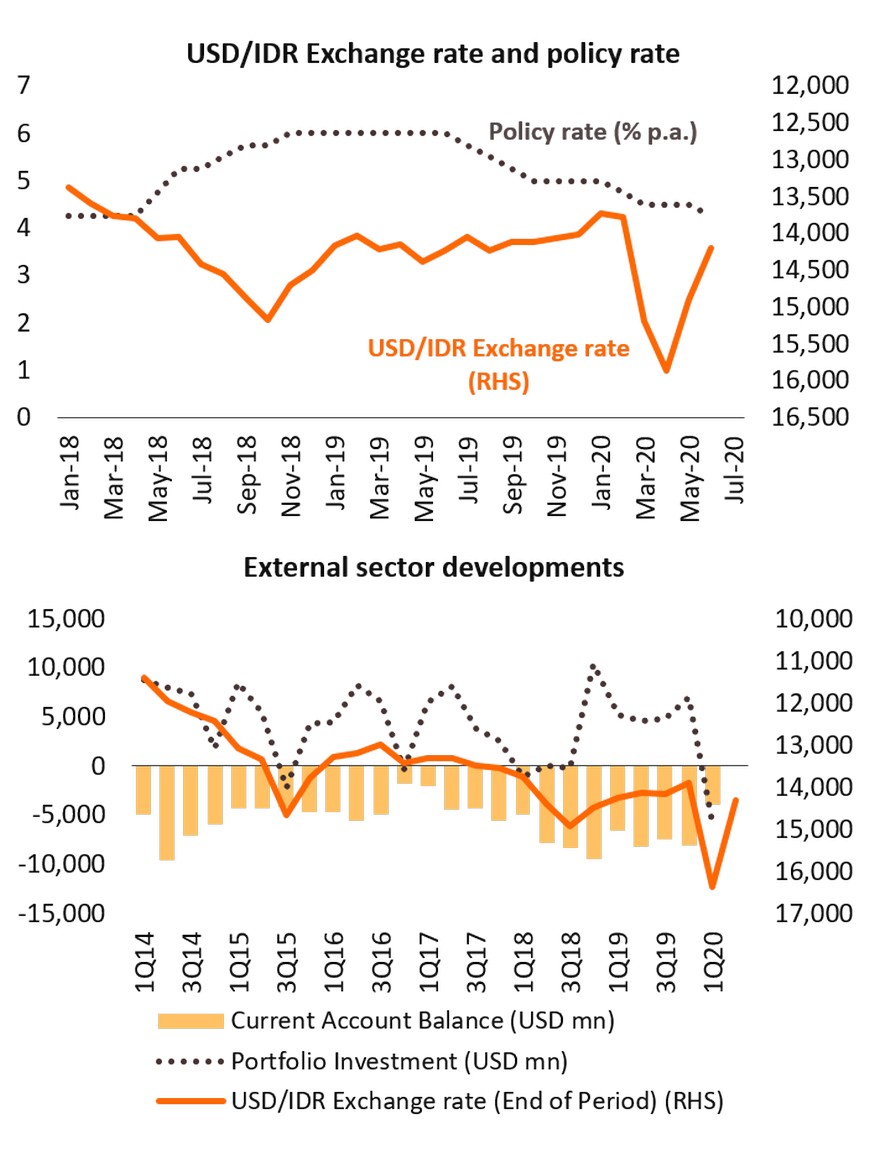

Maintaining exchange rate stability has been critical for Indonesia

Exchange rate policy

- The currency of Indonesia is the Indonesian rupiah (IDR). The de jure exchange rate arrangement is free floating adopted on 14 August 1997. The exchange rate is determined by supply and demand in the foreign exchange market. Bank Indonesia (BI), however, may intervene—as part of a policy mix—whenever necessary to achieve the inflation target and to maintain macroeconomic stability.

- However, based on the IMF’s report, the de facto exchange rate arrangement is classified as stabilized since the exchange rate has been stabilized within a 2% band against the U.S. dollar since January 2017.

Exchange rate stability

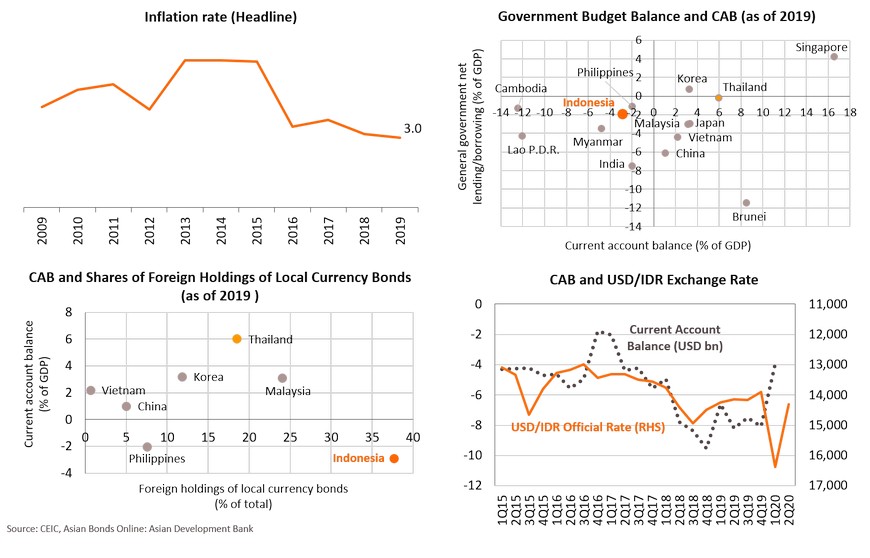

- Exchange rate stability has been crucial for Indonesia as the country has significantly been dependent on foreign portfolio inflows to finance its saving-investment gaps. BI’s monetary policy setting has always to strike balance between growth and exchange rate stability. Indonesia has the highest share of foreign holdings of local currency bonds (as of 2019 ) among regional peers about 38% of total, compared to 24% and 19% for Malaysia and Thailand, respectively.

…to contain the country’s external vulnerabilities as it has the highest foreign claims on domestic assets among peers

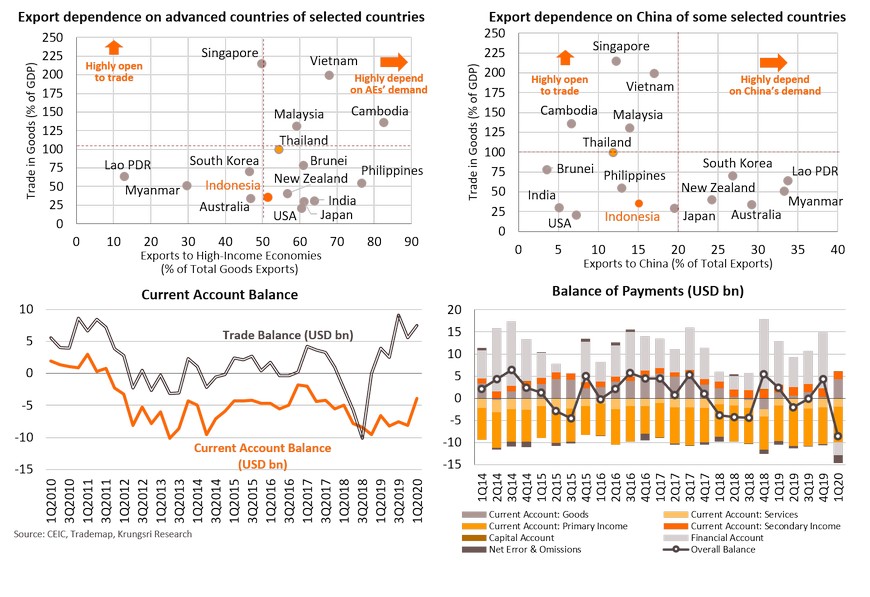

Low openness to trade is expected not to insulate Indonesia from a weak global demand

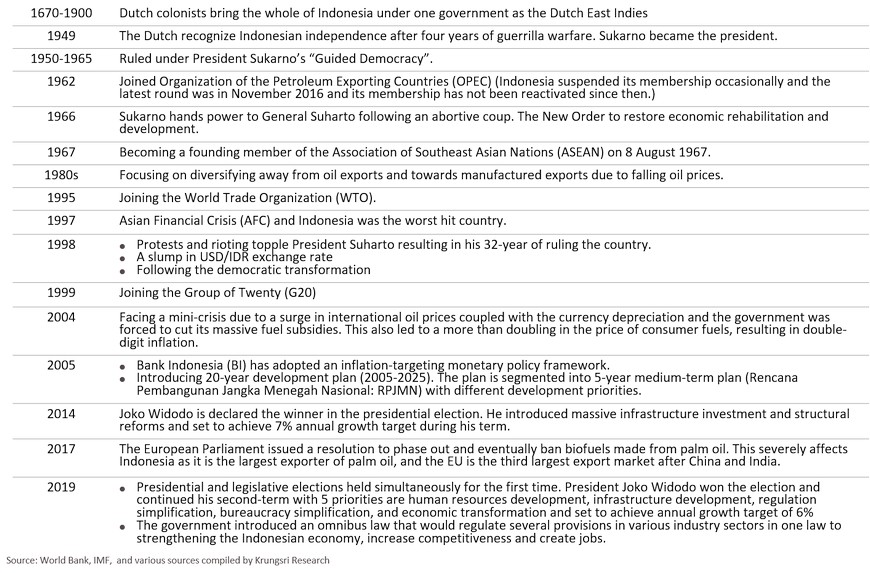

Major milestone of Indonesia’s developments

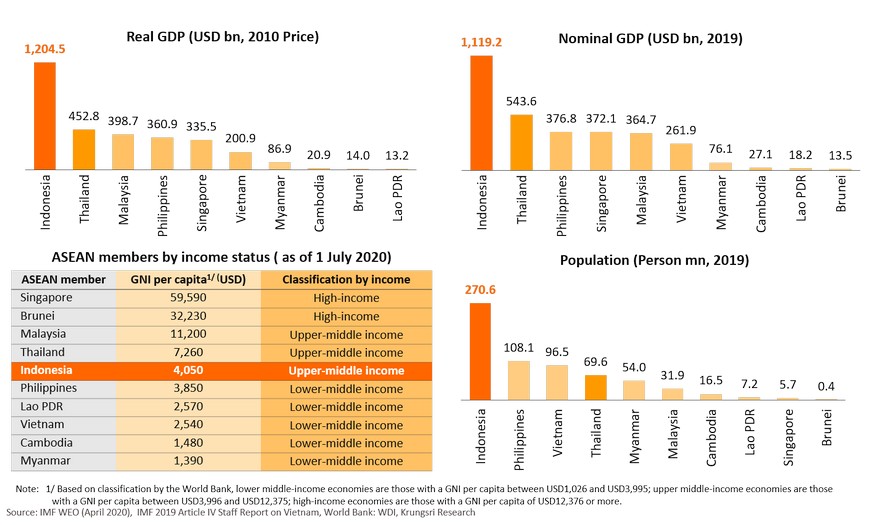

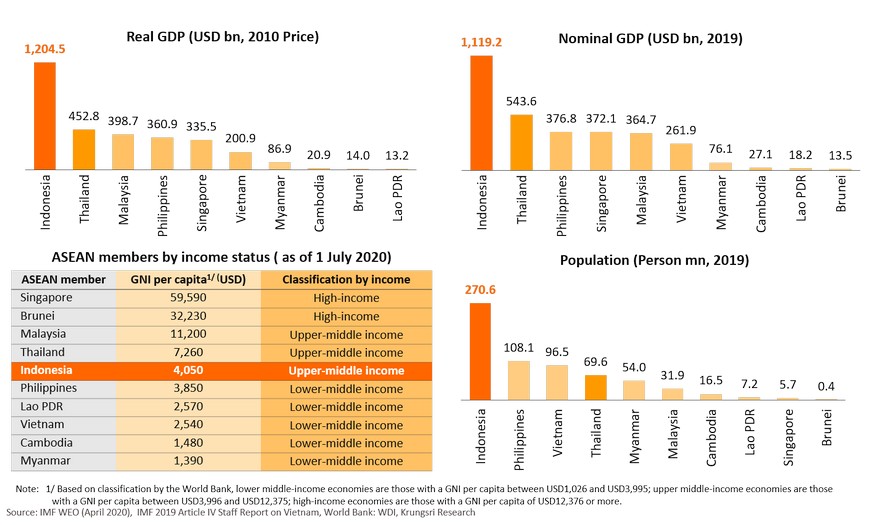

Indonesian among ASEAN peers: It has been recently upgraded to be an upper-middle income country

Indonesia – a trillion dollar economy – has been recently listed an upper-middle income countries joining Malaysia an Thailand with the yearly GNI per capita of USD4,050 by the World Bank in July 2020. This reflects the country’s relatively sustained high growth over the last decade. This would also help enhance and support Indonesia’s economic fundamentals.

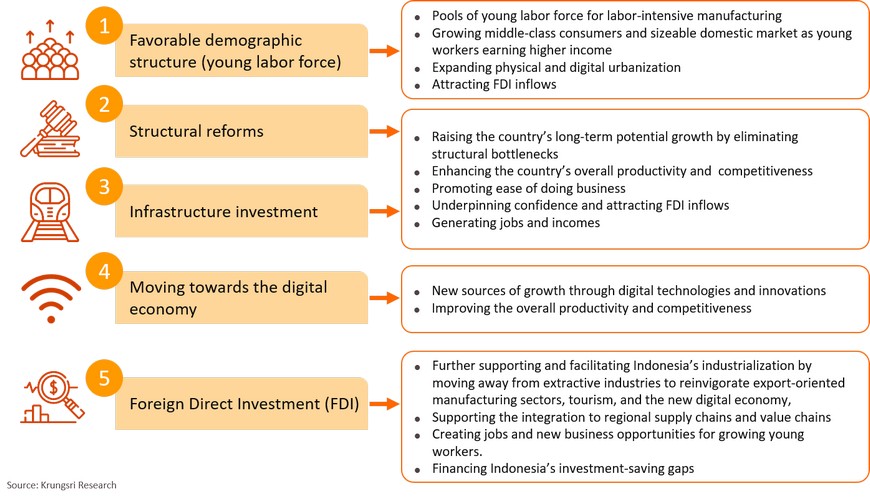

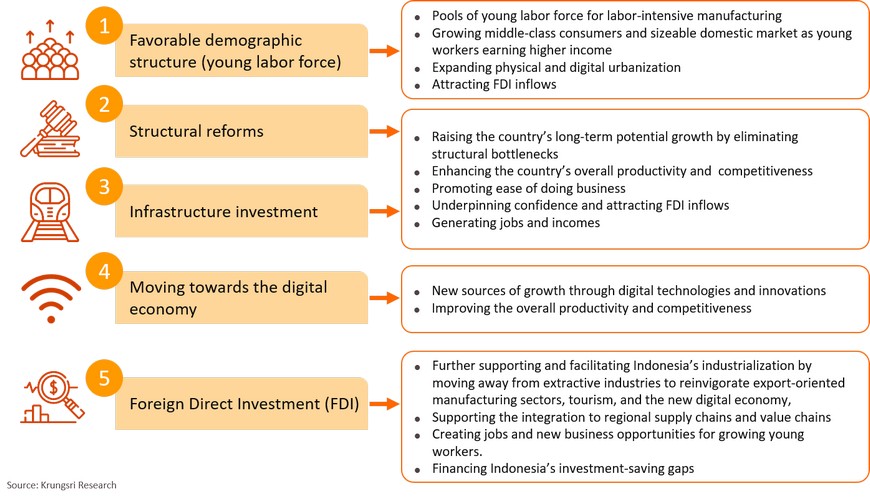

Indonesia’s growth potential of 5.0-6.0% p.a. is likely to be sustained over the long term driven by its underlying fundamentals

Supportive underlying fundamentals will drive Indonesia’s growth potential

Over the medium to long term, we are optimistic that Indonesia’s economy will follow its potential growth trajectory of 5.0%-6.0% enabling it to remain one of the fastest growing emerging markets. Its potentials are likely to be driven by its favorable underlying fundamentals as follows:

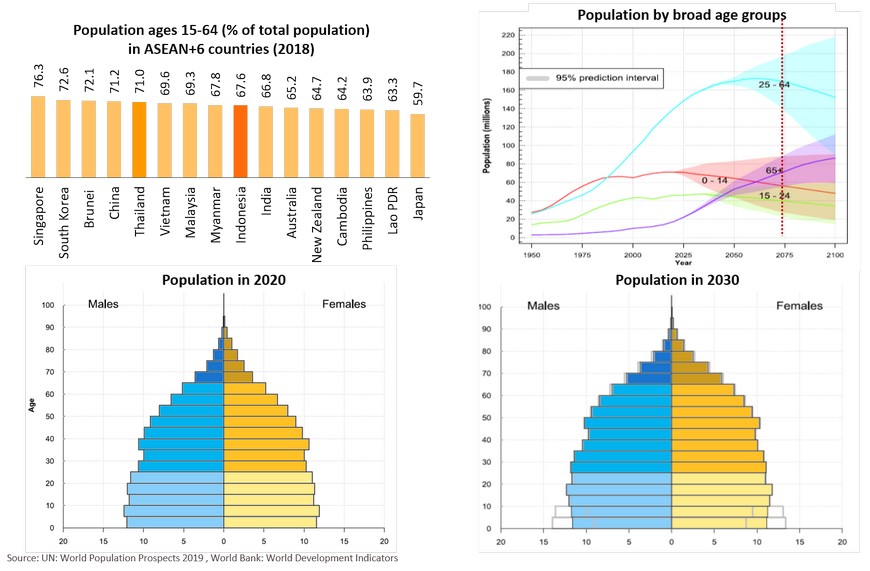

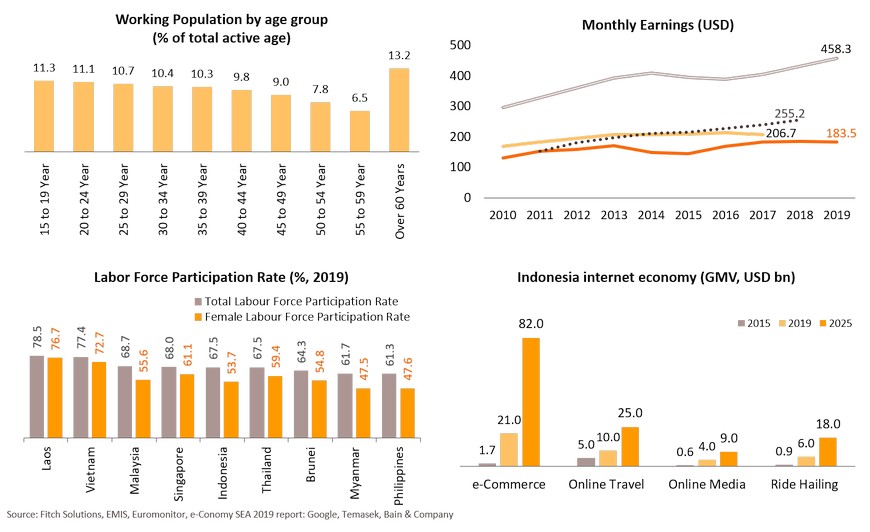

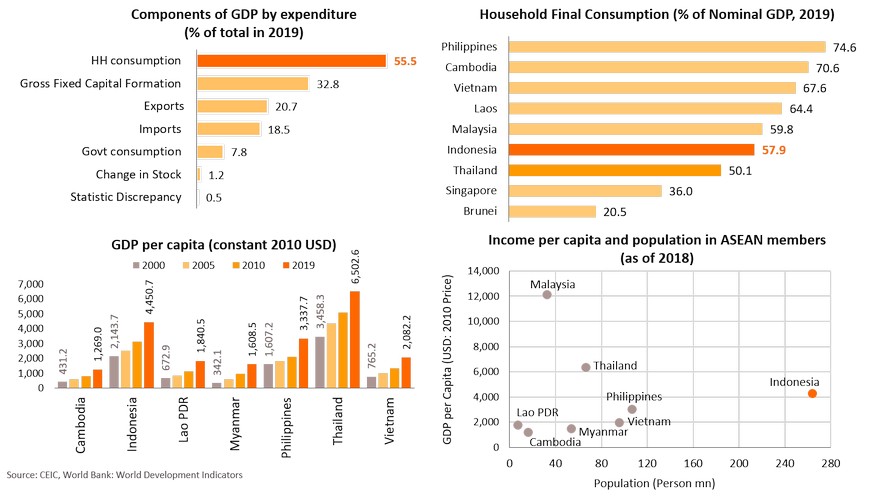

Sizeable young population soon becomes middle-class consumers who will fuel domestic consumption

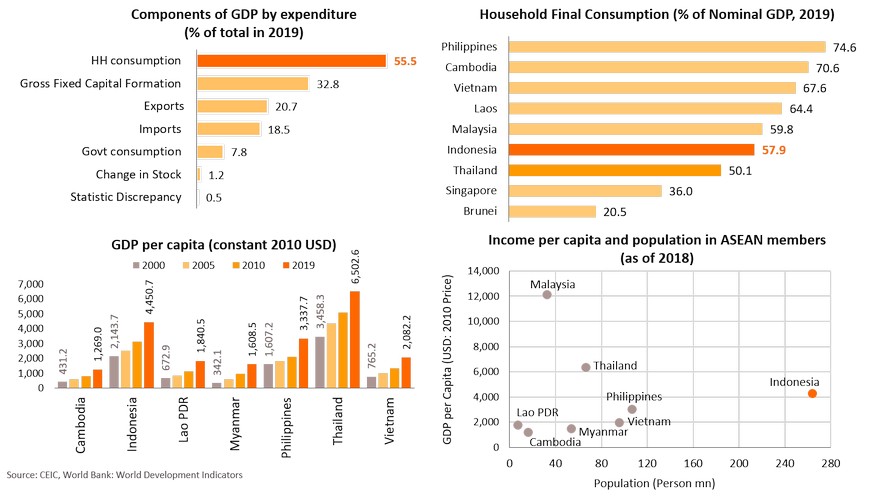

Private consumption accounting for almost 60% of GDPwill therefore remain the main economic driver for Indonesia

Over the medium to long term, we are optimistic that Indonesia’s economy will follow its potential growth trajectory of 5.0%-6.0% enabling it to remain one of the fastest growing emerging markets. Its potentials are likely to be driven by several favorable underlying fundamentals, particularly sizeable and growing wealthier consumers.

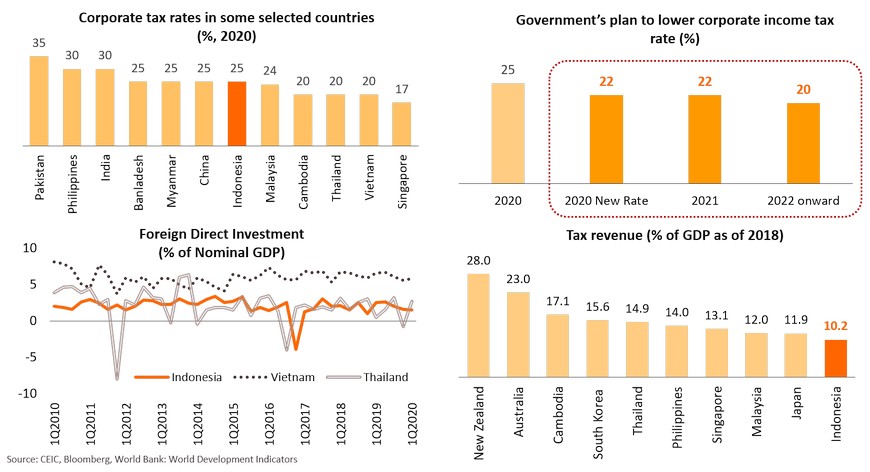

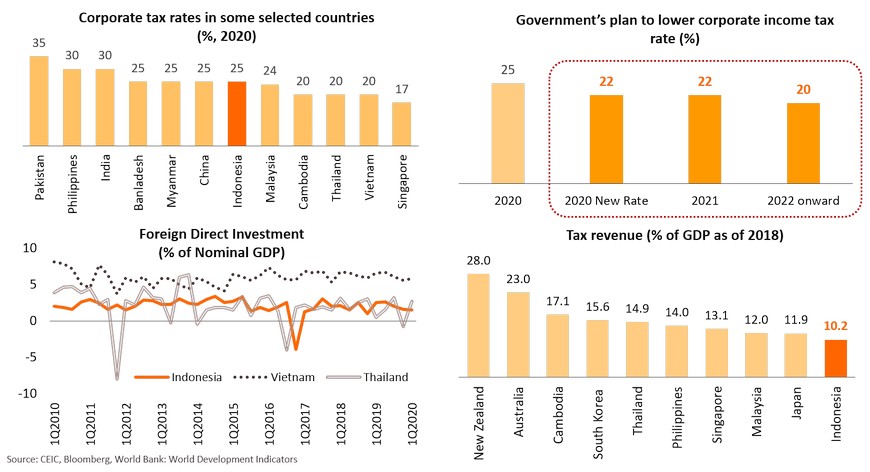

Corporate tax rate will be lowered and expected to boost investment and attract more FDI inflows

Indonesia’s corporate income tax rate of 25% is higher than that of regional peers including Vietnam and Thailand. The government is planning in phrase to reduce the rate to 20% by 2022. Once endorsed by the parliament, the tax rate will be reduced from 25% to 22% for 2020 and 2021 and will be further reduced to 20% in 2022. As a part of the omnibus bill on taxation aimed at creating a more conducive business climate and attracting FDI to boost the country’s economic growth. Currently, Indonesia, compared to some regional peers, has the lowest tax revenue-to-GDP ratio of around 10.2% in 2018 .

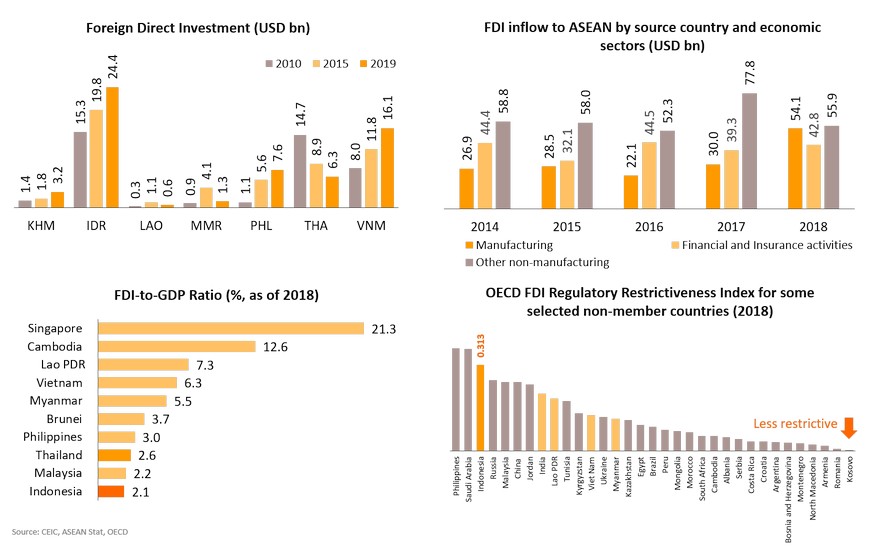

Attracting more FDI inflows remains challenging due to regulatory restrictiveness

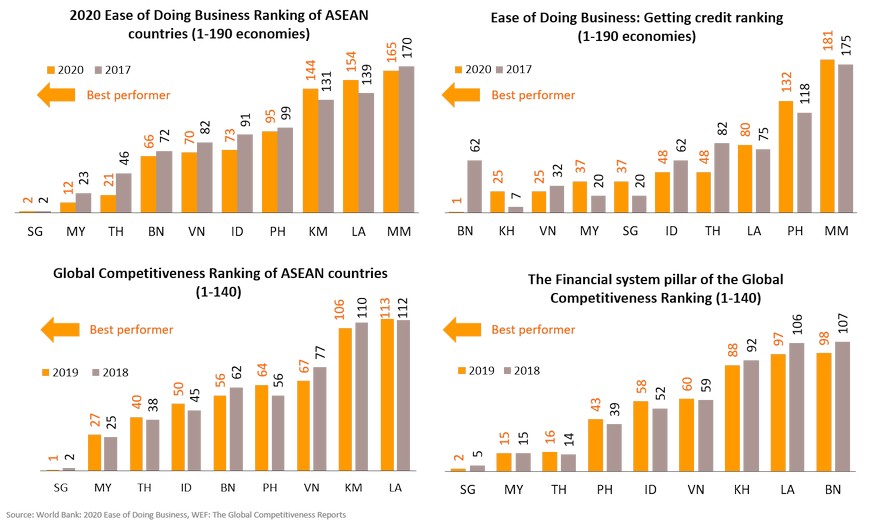

Business environment has been improved over the past few years

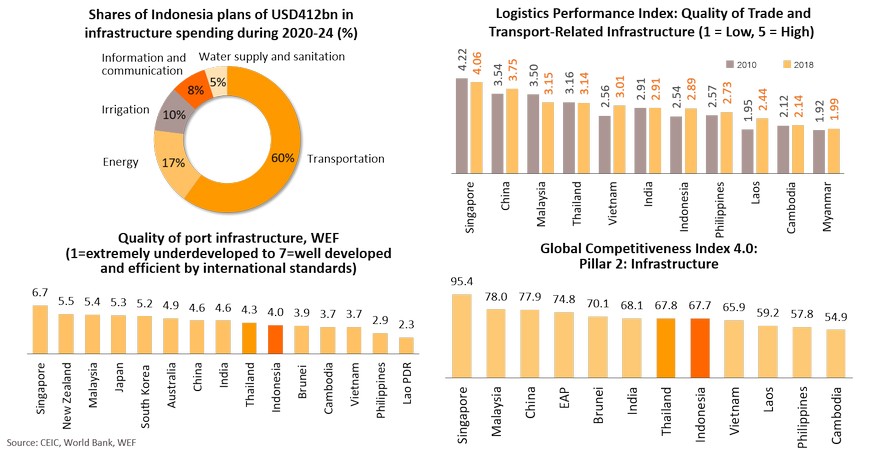

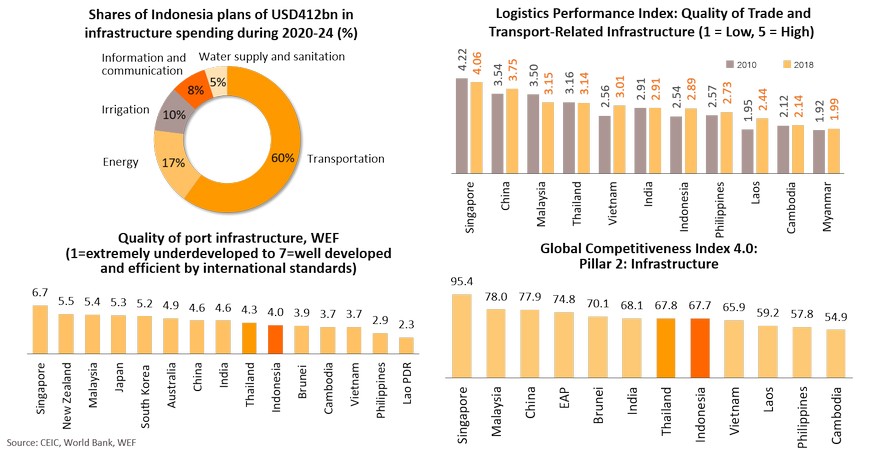

Infrastructure investment has been on the top agenda of President Jokowi to enhance long-term growth potential of Indonesia

President Joko Widodo’s development strategy is using infrastructure as a key plank to boost economic growth and spread wealth beyond the main island-powerhouse of Java, where the capital is located. During his first term, there is a proposed investments over USD350bn for infrastructure investment. In his second term, the new spending plan for infrastructure across the country is equivalent to about 5.7% of GDP from 2020 to 2024, during which the government has targeted economic growth of 5.4% to 6%. If realized, this would help enhance the country’s economic potentials and significantly improve its competitiveness.

Infrastructure development has been driven through the national strategic projects located across the country

Relocation of the capital city to East Kalimantan by is one of the infrastructure development plans

In August 2019, the Jokowi’s administration announced that it would relocate the capital city which will be a new town on a 180,000-hectare situated between North Penajam Paser and Kutai Kertanegara regions in East Kalimantan. The government is currently working on a master plan for the new capital city, with a target of being finalized by the end of 2020. The construction is to be started in 2021 and the relocation is planned to begin in 2024. The relocation is expected to help ease congestion in Jakata and inequality across all the regions. The project is estimated to cost around USD33bn.

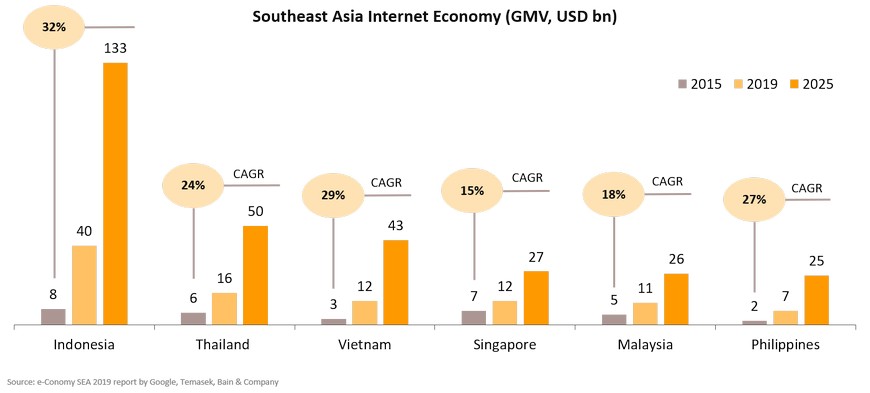

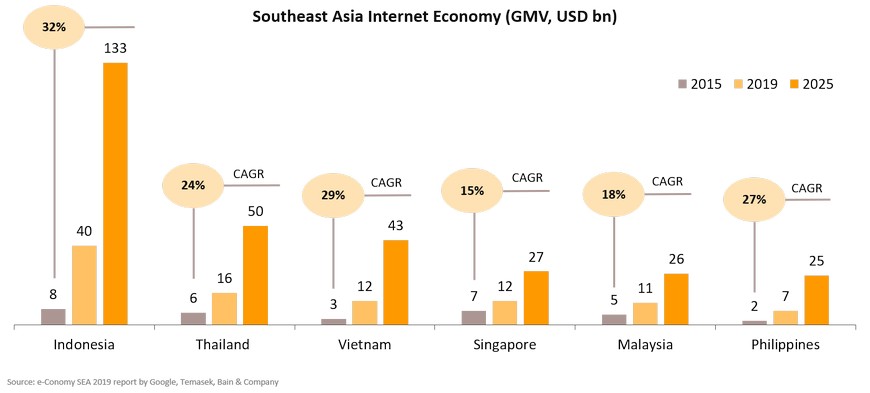

The digital economy will become another pillar of Indonesia’s economic growth as the growth of the internet economy is expanding

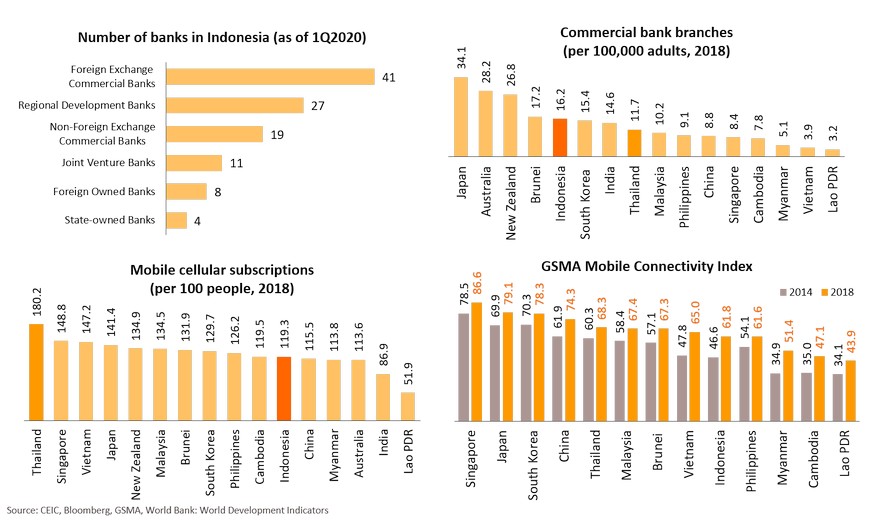

Indonesians are among the world’s most enthusiastic users of digital technology. The digital economy is expected to expand to USD133bn by 2025 from USD40bn in 2019 (about 32% CAGR). Currently, the digital sector, especially e-commerce, is already a major source of jobs for Indonesian. President Jokowi has vowed to improve the investment climate to support the country’s digital economy. Indonesia already has 5 unicorns –startups worth at least USD1bn – including the ride hailing and delivery app Gojek, the travel app Traveloka, e-wallet provider Ovo and online market places Bukalapak and Tokopedia. These digital platforms have play vital roles in supporting and connecting domestic small and medium enterprises to an already huge and rapidly growing consumer market.

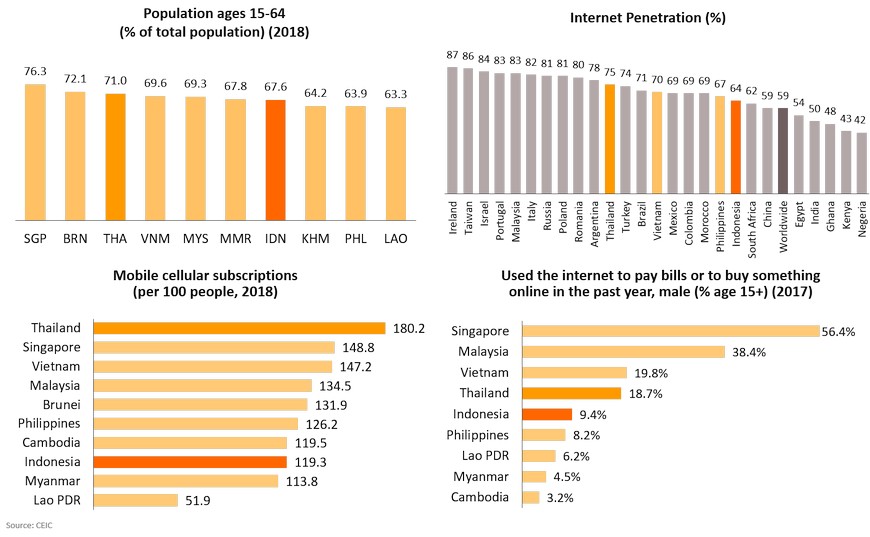

Young and digitally savvy demographics will be a key underlying driver of the country’s growing digital economy

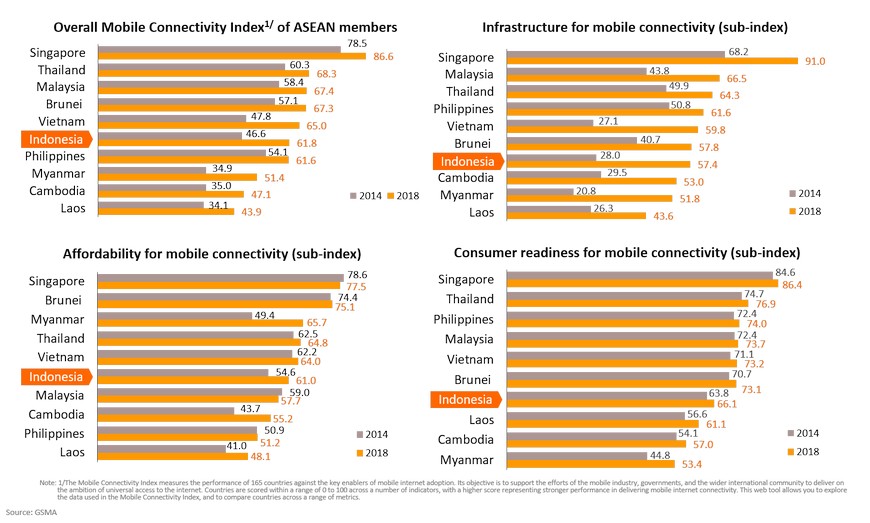

Better telecommunication infrastructure has also played a vital role in driving the digital adoption in Indonesia

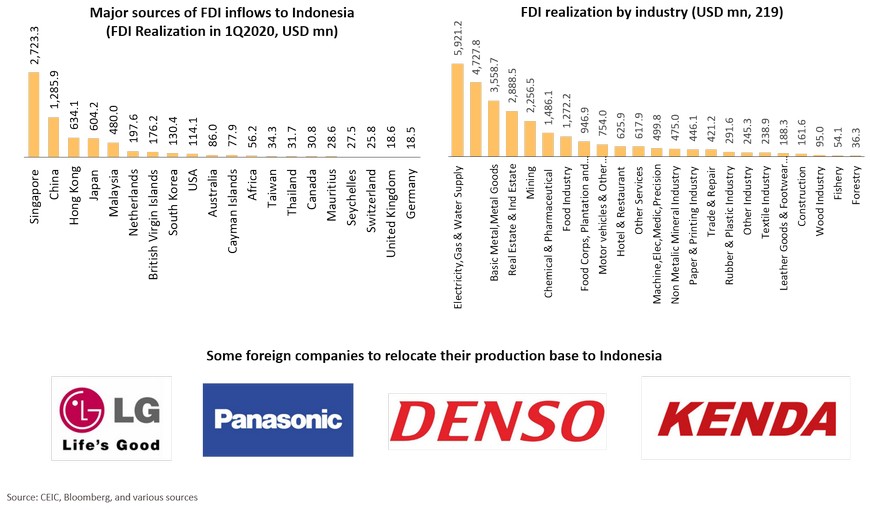

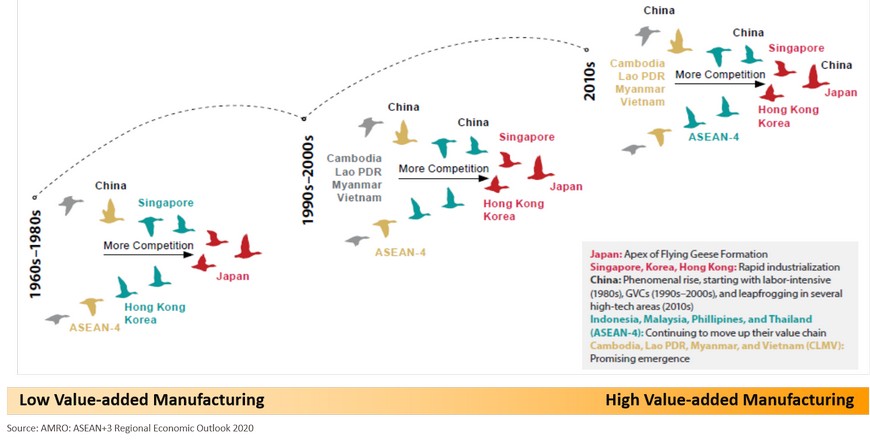

FDI inflows to be attracted by structural reforms, long-term fundamentals, and shifts in global supply chains are likely to help reinvigorate Indonesia’s manufacturing sector

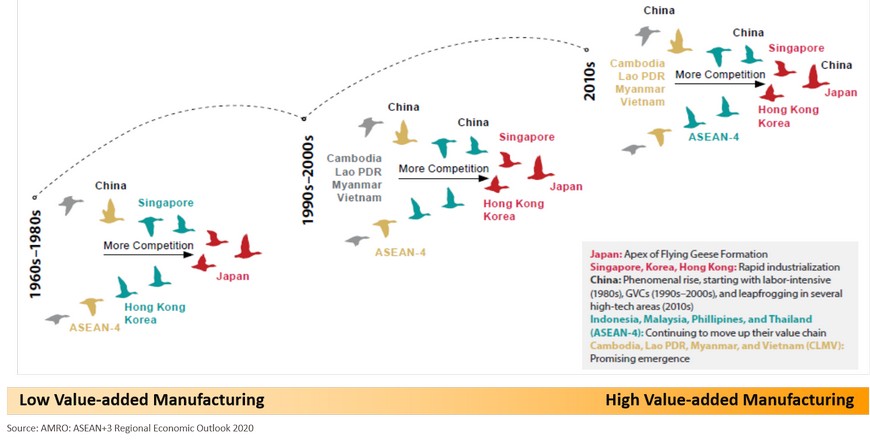

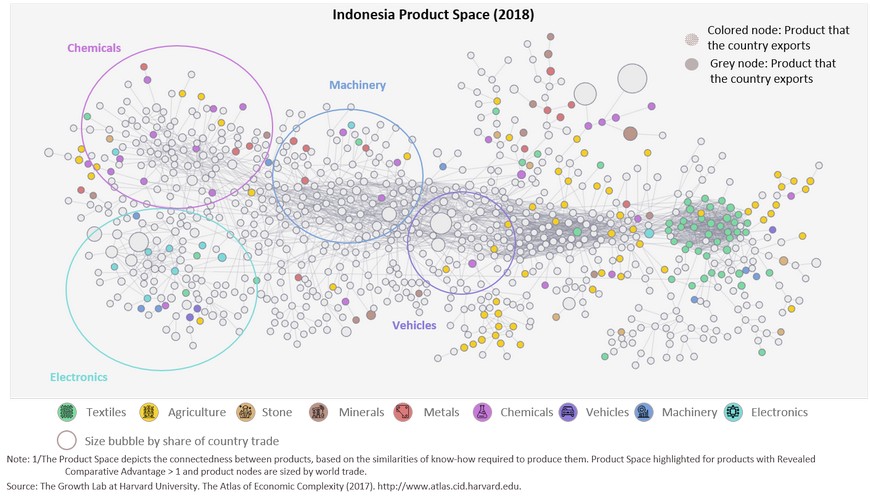

Developments of Indonesia’s manufacturing sector has been stunted following the Asian Financial Crisis in 1997 reflected by a decrease in the sector share in the country’s GDP. There are also small connections between domestic manufacturing firms and global supply chains. In addition, imports of components are subject to costly and time-consuming pre-shipment inspections and tariffs resulting in uncompetitive manufacturing exports against a backdrop of the rising of regional rivals such as Vietnam and Bangladesh.

More foreign investment should support Indonesia’s industrialization and moving up to higher value chains

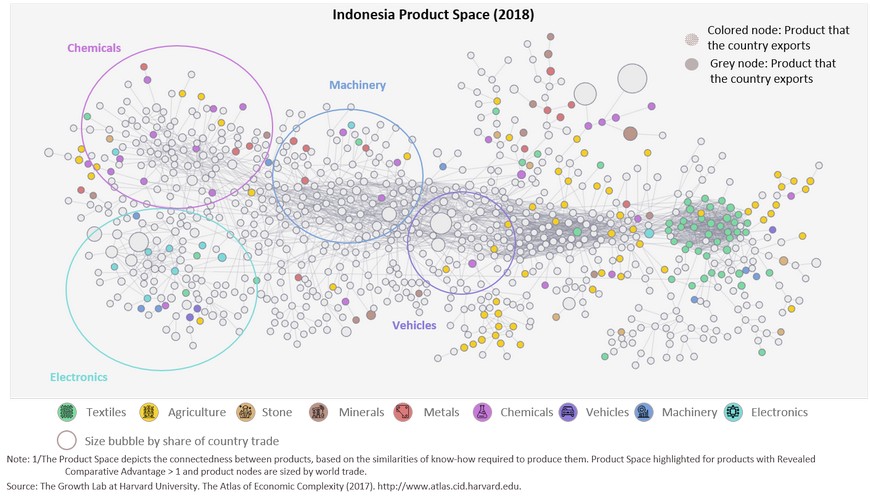

Indonesia’s manufacturing sector is currently focused on textiles where local factories supply their products to major retailers such as H&M, Walmart and J.C. Penney. Some activities on electronics and chemicals are being developed.

Manufacturing sector should contribute more to the economy on production side over the long term

Relocation of foreign firms to Indonesia should boost Indonesia’s efforts to become the region’s manufacturing hub

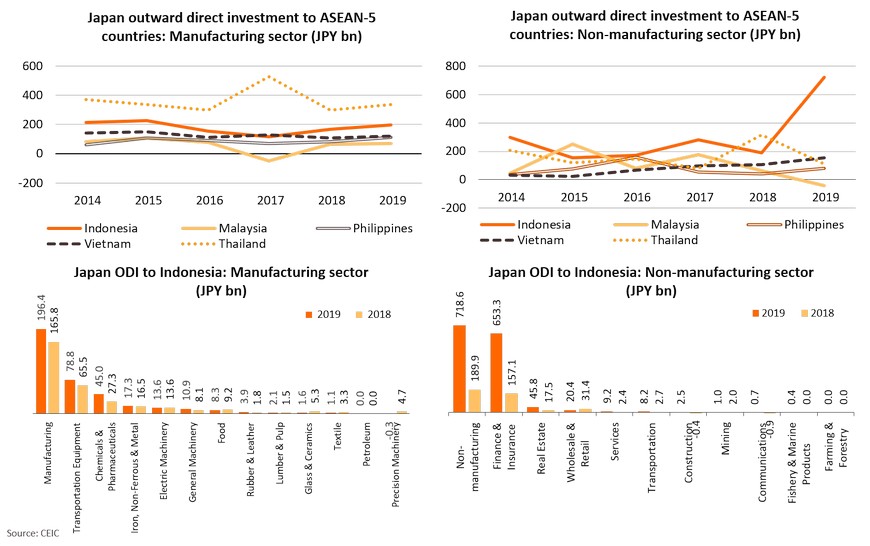

Japanese direct investment in Indonesia has been rising, particularly the manufacturing sector

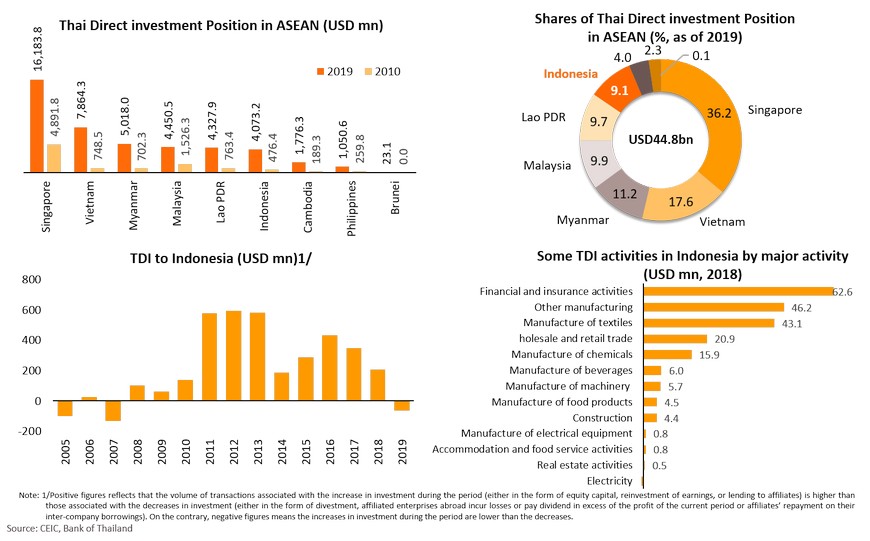

Financial services and insurance are the top areas for Thai Direct Investment in Indonesia

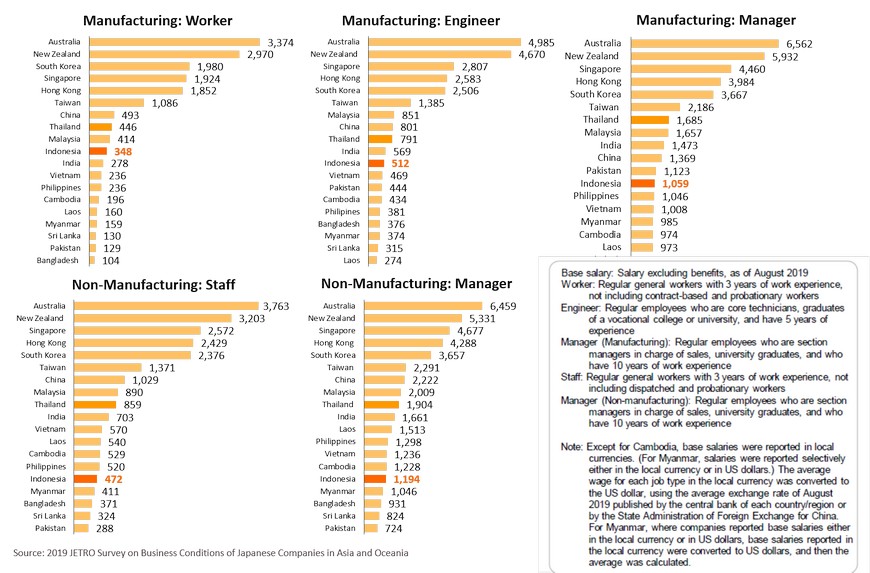

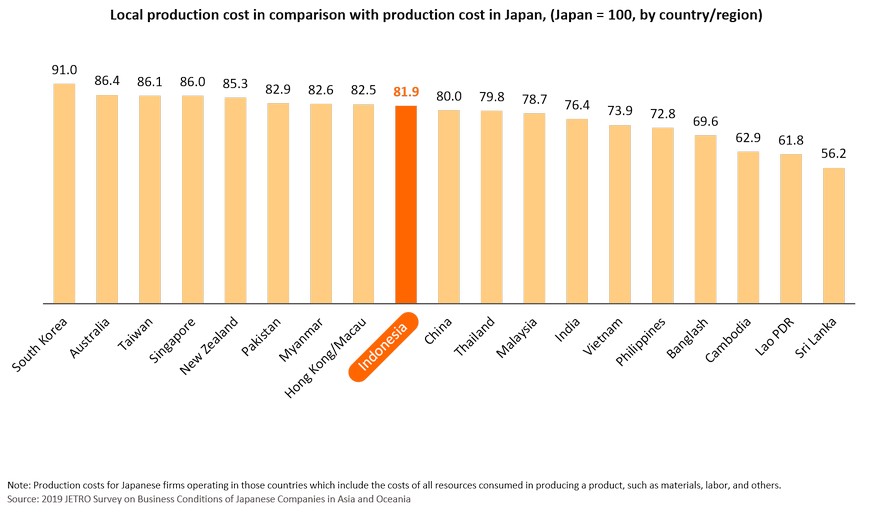

Relatively low wage levels should support attractiveness of Indonesia in attracting labor-intensive industries

Cost of production in Indonesia could be lowered in the medium term should the structural reforms are accomplished

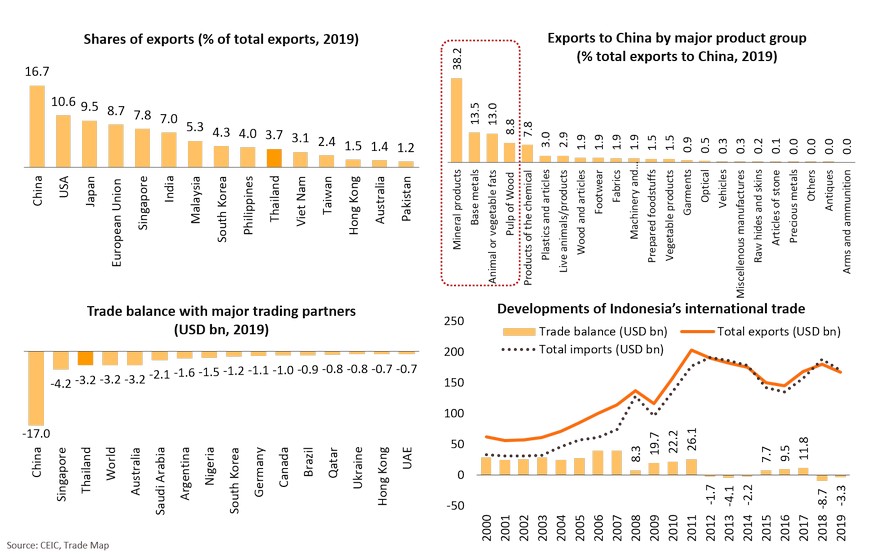

Industrial developments and reforms are expected to help diversify Indonesia’s trade structure away from commodity exports

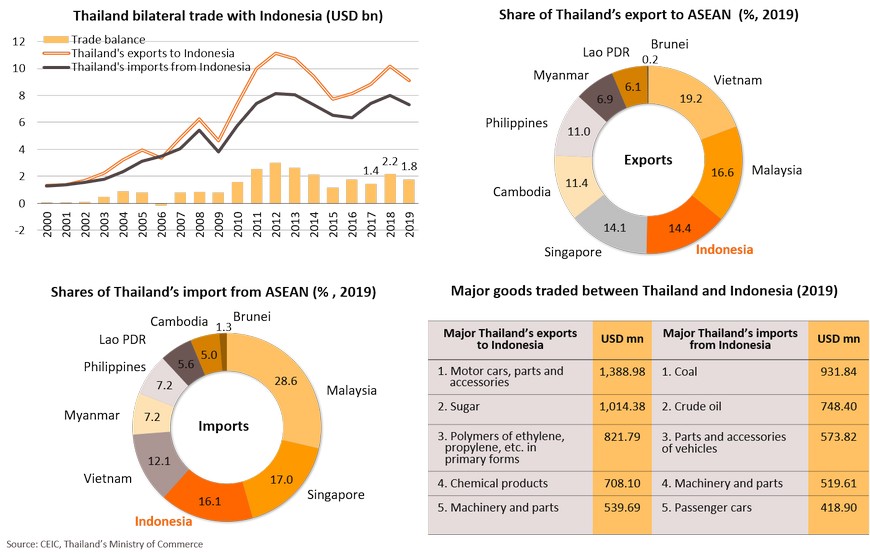

Indonesia is one of the key trading partner in ASEAN for Thailand

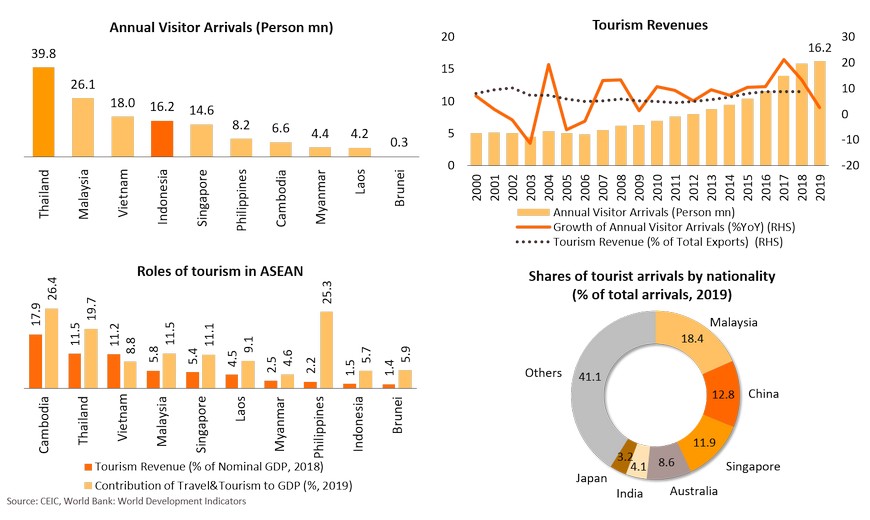

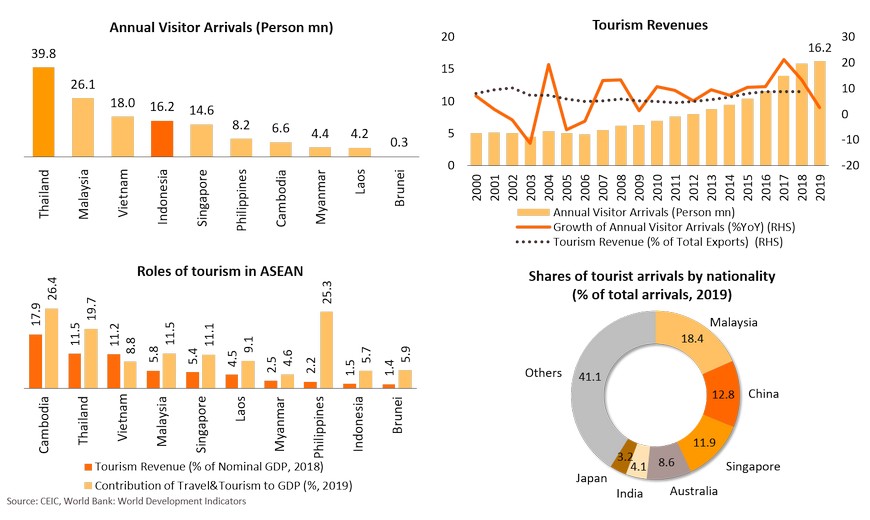

Tourism sector: The government is putting efforts to generate revenue and address its current account deficit

Better infrastructure would also complement the government’s efforts to attract more tourists to help narrow the current-account deficit, which widened to a four-year high in 2018 and pressured the nation’s currency, bond and stock markets.

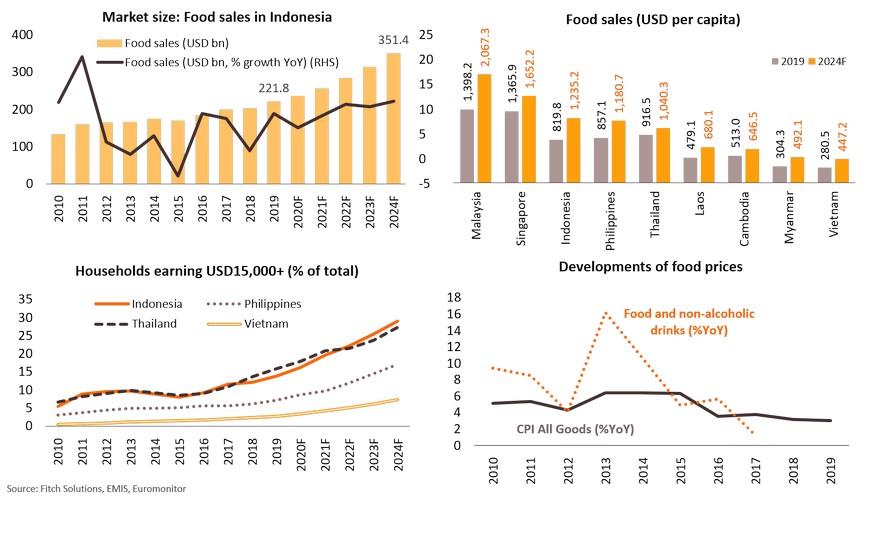

Growing wealthier young Indonesian consumers open up business opportunities for Thai investors

Indonesia is projected to home over 295 million inhabitants by 2030. This would also mean that there would be a sizeable young and wealthier consumers as the country is expected to enjoy a stable and sustained high growth trajectory over the medium to long term on the back of favorable economic drivers. We therefore view that this would provide business opportunities for Thai firms seeking markets to grow their business in the region. Some top sectors in our mind are (1) financial services, (2) food and beverage, (3) consumer goods, (4) healthcare and pharmaceuticals, and (5) homewares.

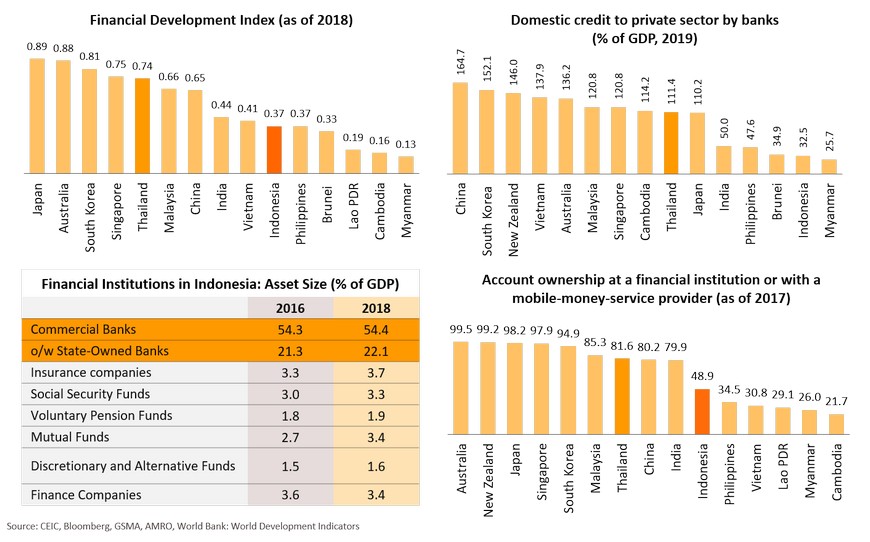

Financial services: Unbanked and underbanked population remain sizeable in Indonesia

…Despite there are a large number of banks and other financial service providers: mobile-led financial services could be used to promote financial inclusion

Consumer goods: Sizeable middle-class and young consumers coupled with growing e-commerce are underlying drivers for the future growth

Food: Thailand’s competitive advantages in the food and agricultural industries should support Thai firms to penetrate Indonesia’s halal food and healthy food sectors

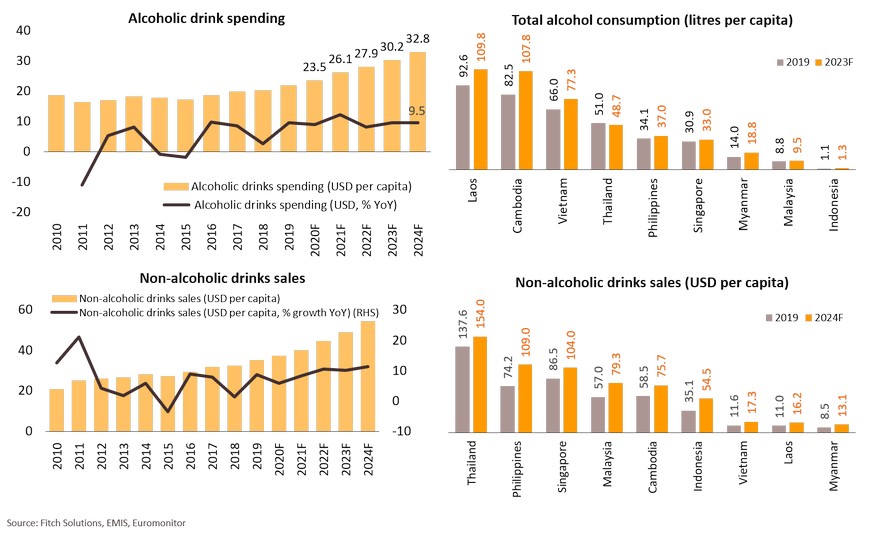

Beverage: Demand for healthier alternative drinks [1] are likely to be boosted by increased local consumers’ health-consciousness

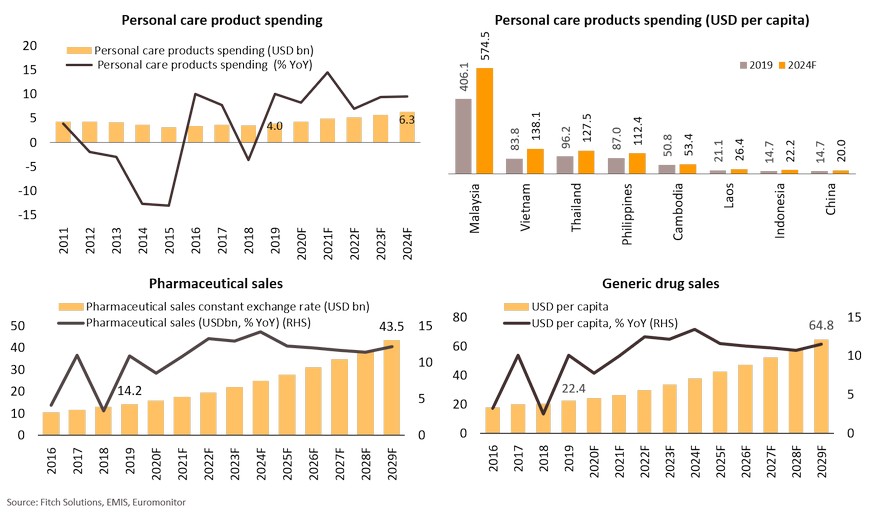

Personal care products and pharmaceuticals: Higher demand for quality goods will be increasing in line with higher disposable income of young consumers

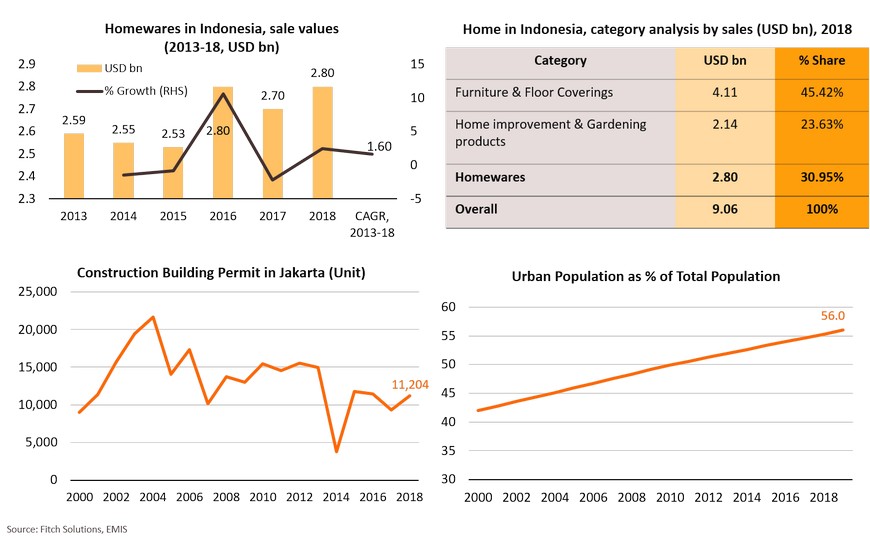

Homewares: Booming real estate sector and rising urbanization are supportive underlying for its future growth

Note: [1] including energy drinks, bottled water and fruit juices functional beverages as well as non-alcoholic drinks such as higher-value coffee products