Executive Summary: Cambodia’s economy could resume its strong growth path in the post-pandemic era due to its favorable growth drivers

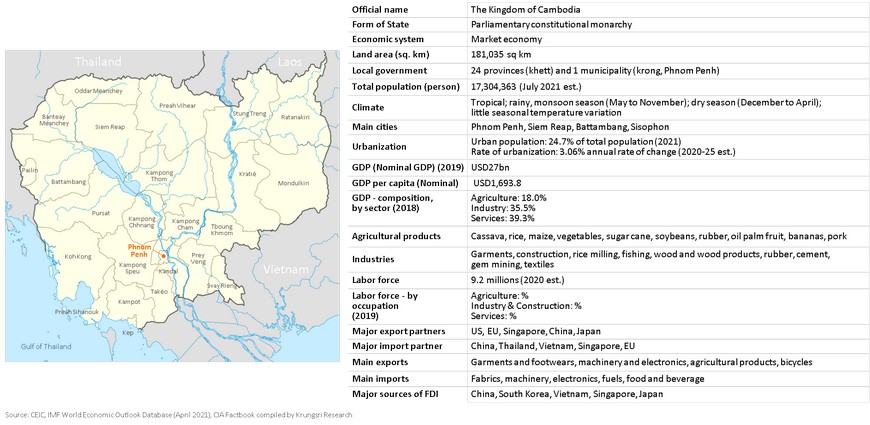

Cambodia in brief

Cambodia is expected to resume its high growth trajectory in the medium term boosted by FDI-driven manufactured exports and domestic demand

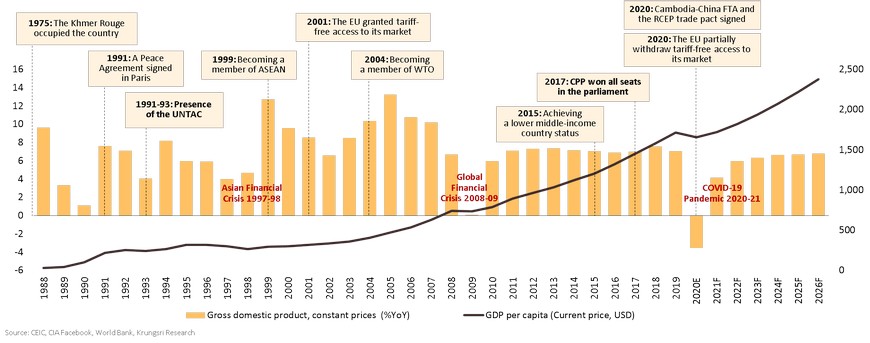

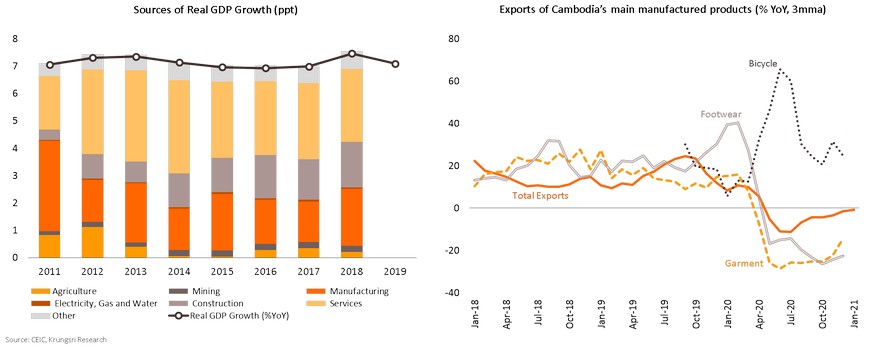

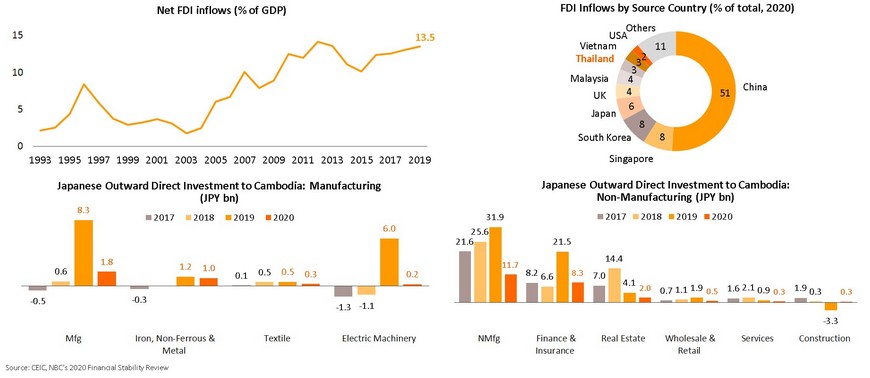

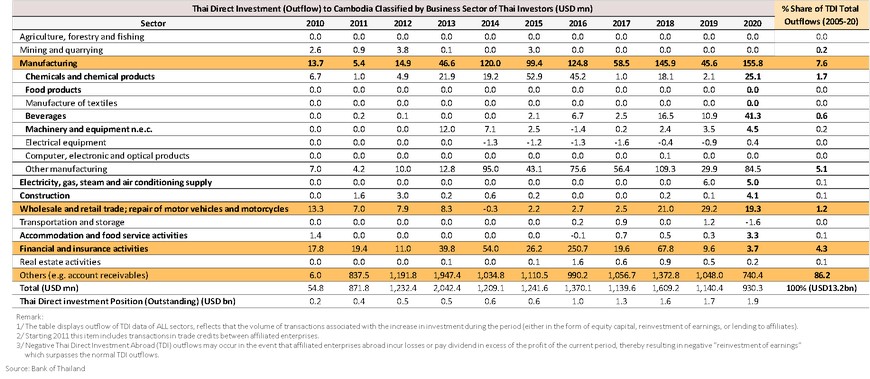

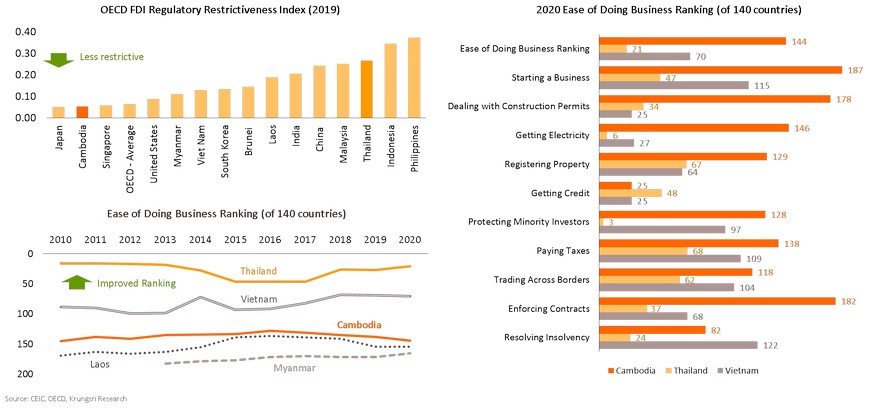

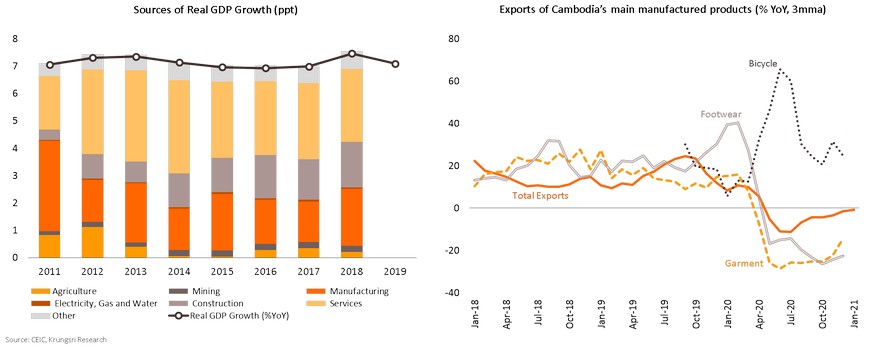

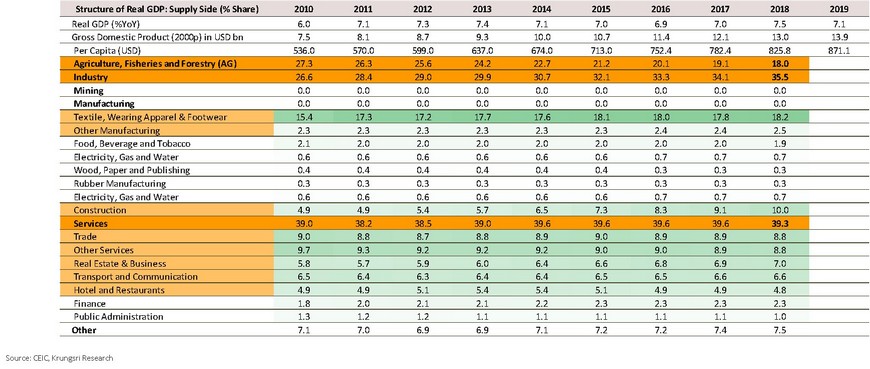

Cambodia has achieved an impressive growth path over the past two decades and achieved a lower-middle income status in 2015. Trade privileges granted by major markets, low regulatory restrictiveness to foreign investment, and a large pool of labor force have attracted foreign direct investment (FDI) inflows and driven labor-intensive manufacturing sector. Sustained inward FDI has fueled the growth of export-oriented garment and footwear industry which has turned to be a main source of foreign exchange earning and income and job opportunities for the local population.

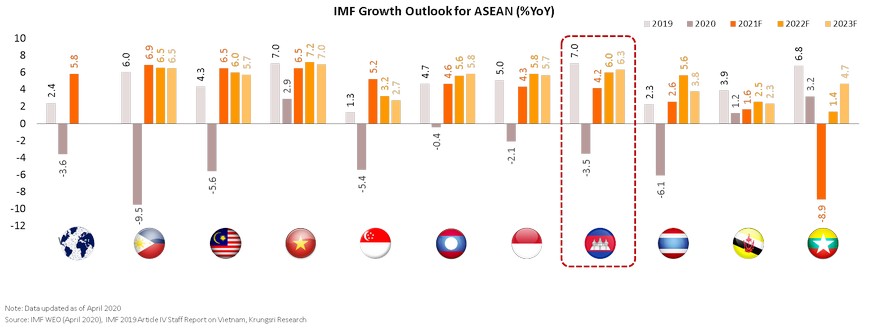

Growth will turn positive in 2021, but the outlook is tilted to the downside as risks and challenges remain immense

Cambodia’s economy is expected to gradually recover and likely to expand in the range of 3.0% - 4.0% in 2021 following a negative growth of -3.5% in 2020 due to the adverse impact of the pandemic at home and abroad. Key growth drivers – exports, tourism, and construction – have been paralyzed. However, in 2021, a partial pickup of domestic demand at home and economic recovery of major markets will support Cambodia’s economy. Risks to growth stem mainly from resurging of local outbreaks leading to renewal of lockdown and other containment measures. These would weigh on economic activities and could hinder the recovery.

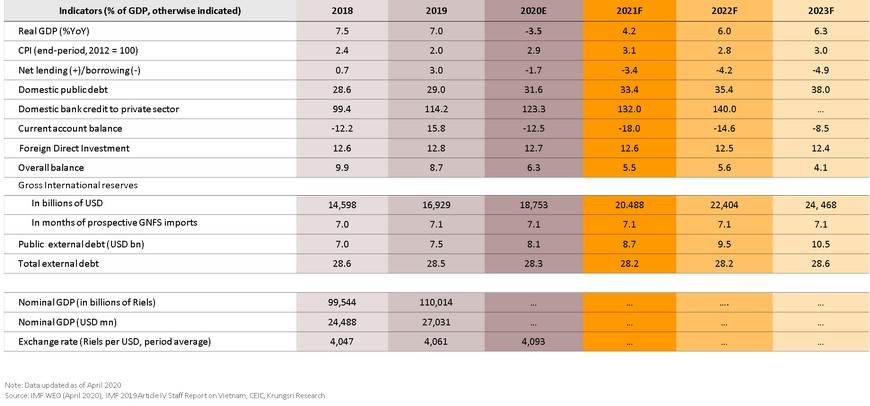

Medium-term macro forecasts: Growth will turn positive, and the economic recovery could be delayed due to resurgence of the pandemic

Recent Economic Developments

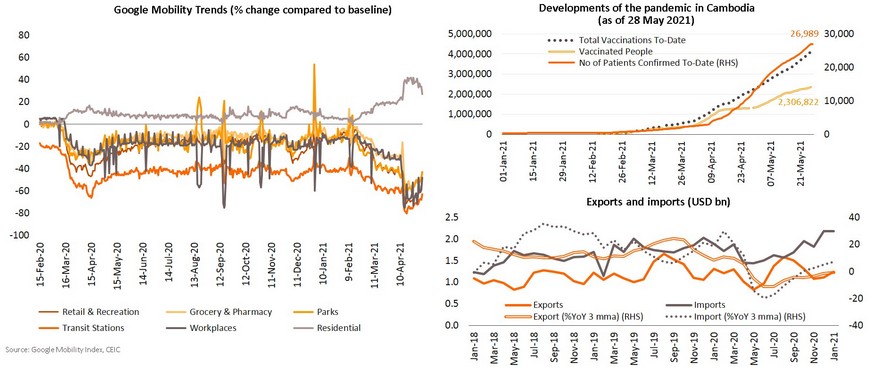

The recent outbreaks of the pandemic could jeopardize the economic recovery in 2021, while accommodative policies and a pickup in exports would help cushion the adverse impact

The recent local outbreaks started in February 2021 have led to lockdowns in Phnom Penh and major cities. As a result, economic activities have dropped substantially reflected by the Google Mobility Trends. This will weigh on t the economy and could delay the recovery in 2021; however, the impact would hinge on the government support packages and the effective of vaccination program. In addition, a pickup in exports would be a tailwind to nurture Cambodia’s early stage of the economic recovery in 2H2021.

Exports of garments and footwears will lead the economic recovery over the medium term

Among the key growth drivers of Cambodia, we view that exports of manufactured products, particularly garment and footwear products, will be the key in supporting the recovery in 2021 owing to the normalization of economic activities in Cambodia’s major markets including the US, and the EU. Construction dominated by real estate developments is expected to be resumed in 2H2021 if new infected cases of the COVID-19 subside along with a higher number of vaccination and mobility restriction measures are eased.

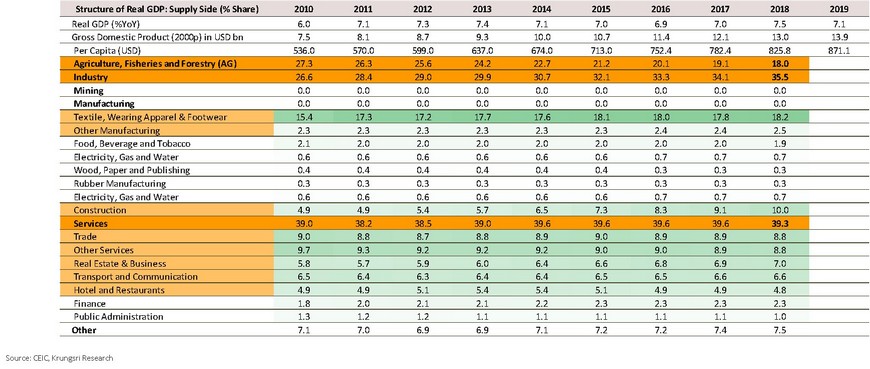

Garment production and construction have been key sectors in the industrial sector, while the agriculture sector remains crucial for the economy

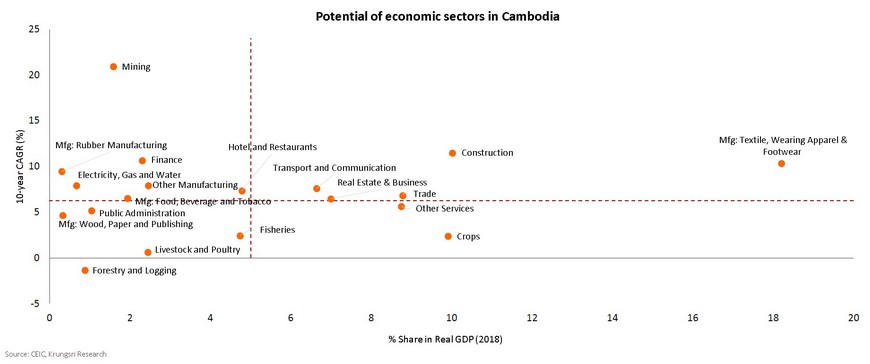

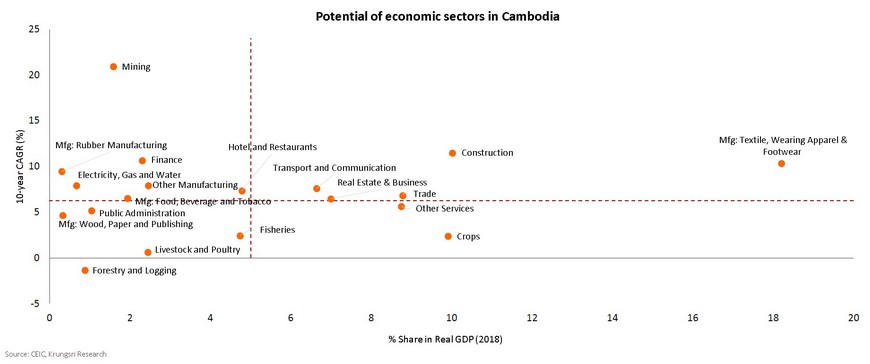

Cambodia’s economy has been transformed to be one of the garment and footwear production hubs in the region thanks to a pool of relatively low costs of labor and tariff-free access to major markets such as the US and the EU. The production of garment products accounts for 18.2% in the country’s GDP in 2018. With the share in GDP of about 10%, construction has benefited from FDI inflows, especially from China, leading to booms in real estates in major cities. Roles of agriculture have subsided but remain essential as a source of employment. Service sector dominated by tourism and trade is also a key source of growth.

Business opportunities arise in the service activities such as food and beverage as well as ICT for foreign investors

With relatively small shares in the GDP, several areas in the services sector have been growing fast in Cambodia over the past decade. Those include finance, transport and communication, food and beverage, and trade. This offers ample business opportunities for both domestic and foreign investors. Regarding the manufacturing sector, the production of garment and footwear products remains sizeable and growing. Products and services relating to construction and real estate are also attractive for foreign investment.

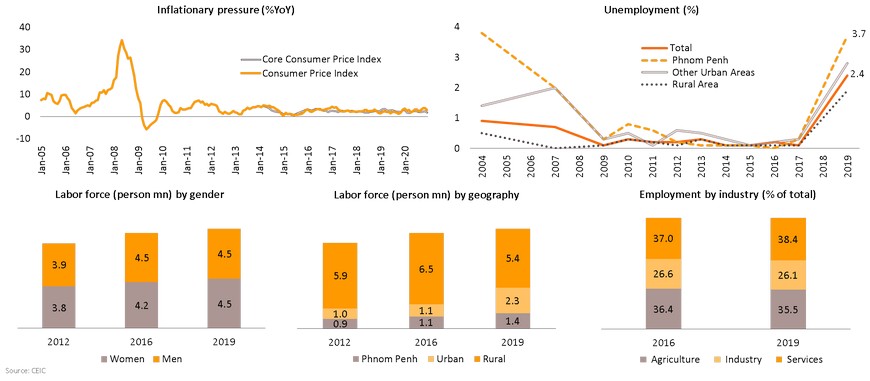

Price stability is well anchored, while the labor market shows signs of higher vulnerabilities

While inflationary pressure remains muted, unemployment in both urban and rural areas is rising and this may reflect vulnerabilities in the labor market.

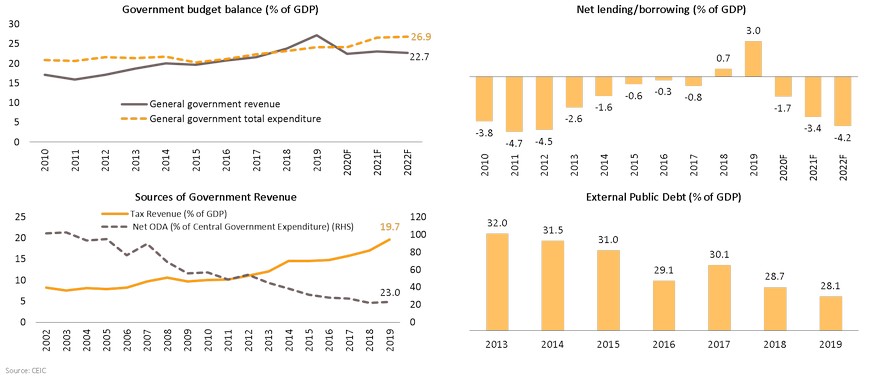

The government is expected to run budget deficits over the medium term to nurture the recovery and to contain the adverse impact of the pandemic

Debt sustainability remains manageable for Cambodia. In the medium term, the government may need to run budget deficits to nurture the economic recovery in the post-pandemic world.

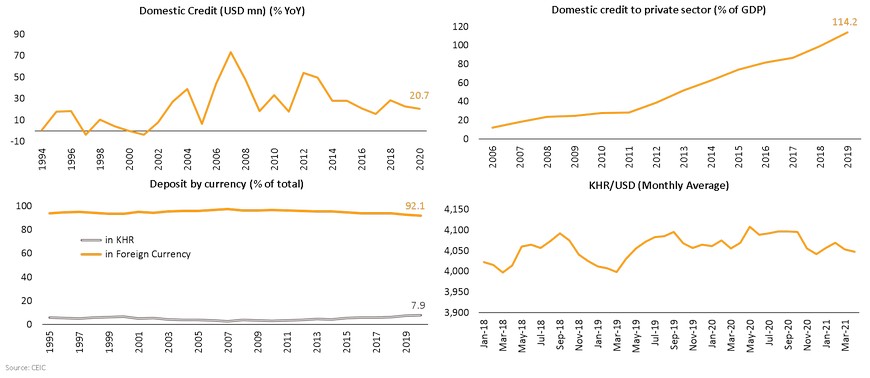

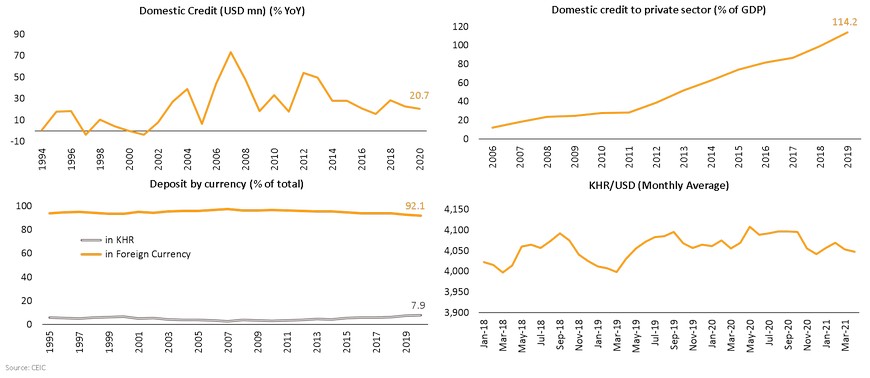

Credit growth has declined over the past decade against a backdrop of a highly dollarized economy

Credit growth which has supported economic expansion has recently slowed down. This may help contain booms in the real estate sector and vulnerabilities in the financial sector. The degree of dollarization remains substantial, and this has hindered the maneuver of monetary policy in achieving macroeconomic aims.

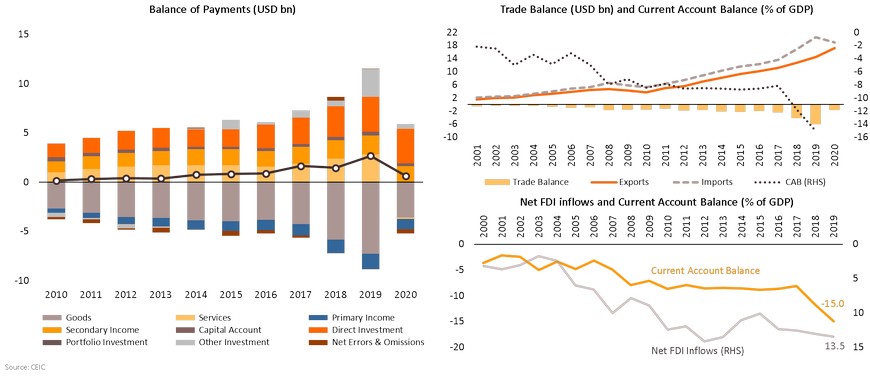

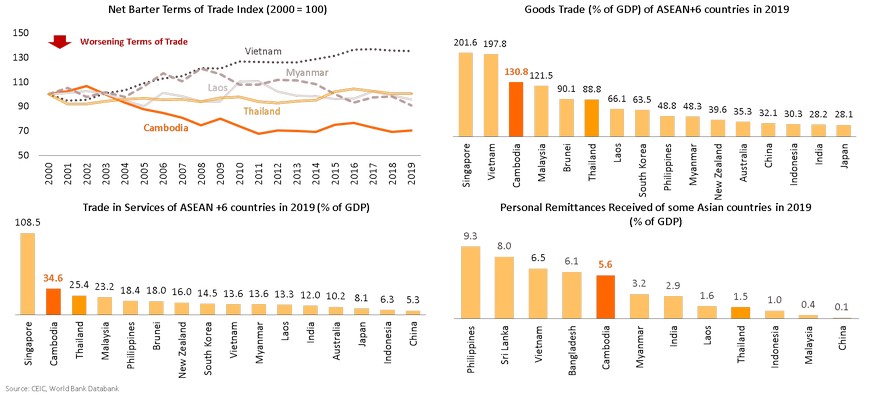

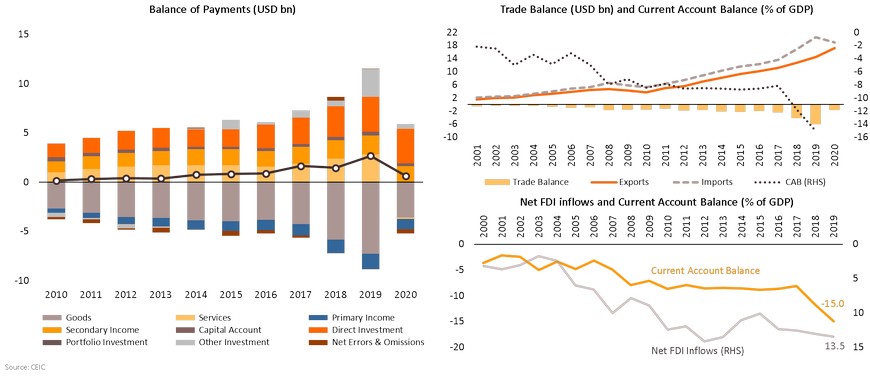

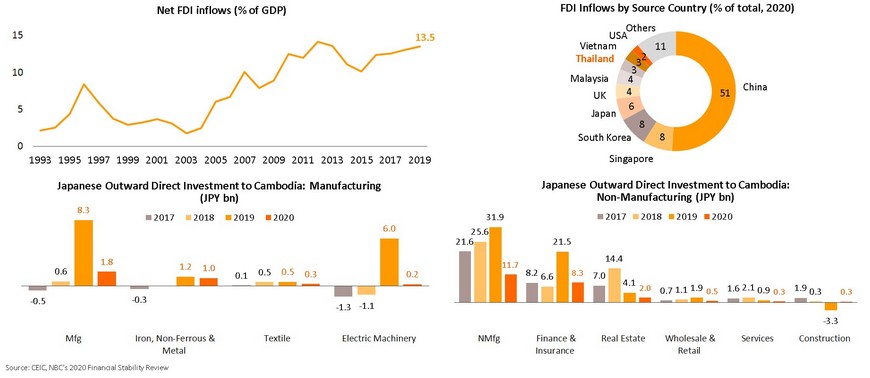

Direct investment and remittances have played essential roles in financing chronic trade deficits

Twin deficits – government budget deficits and current account deficits – have been a chronic macroeconomic symptom for Cambodia. However, foreign direct investment (FDI) inflows along with surpluses in services and remittances have fully financed those deficits. We expect this trend will continue in the post-pandemic era.

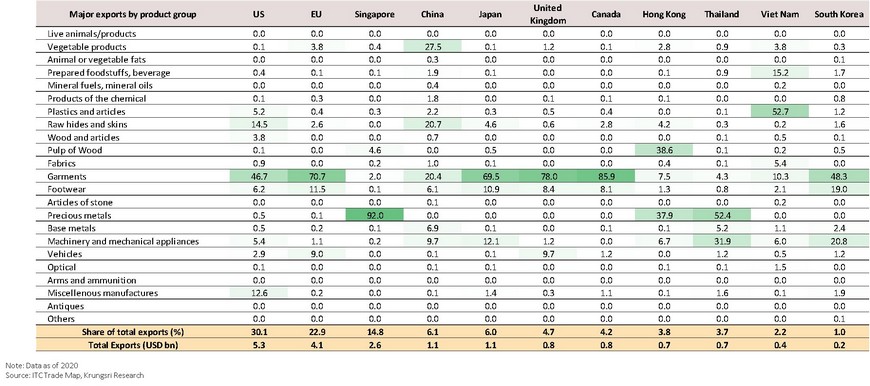

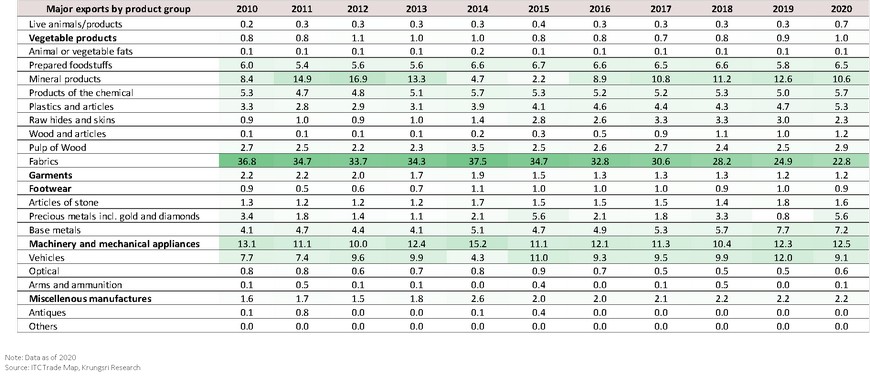

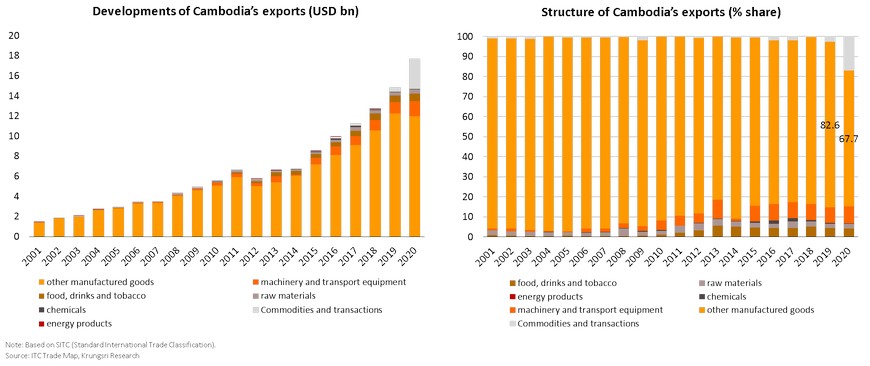

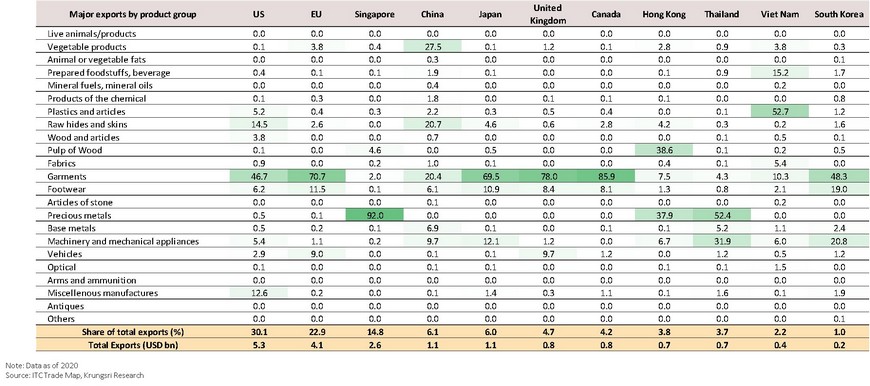

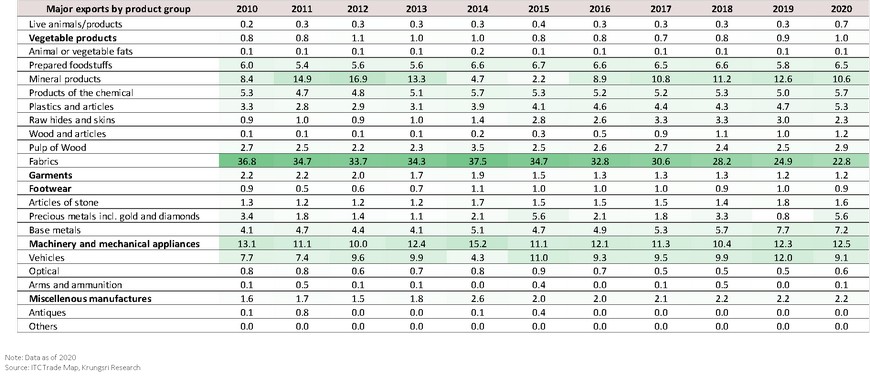

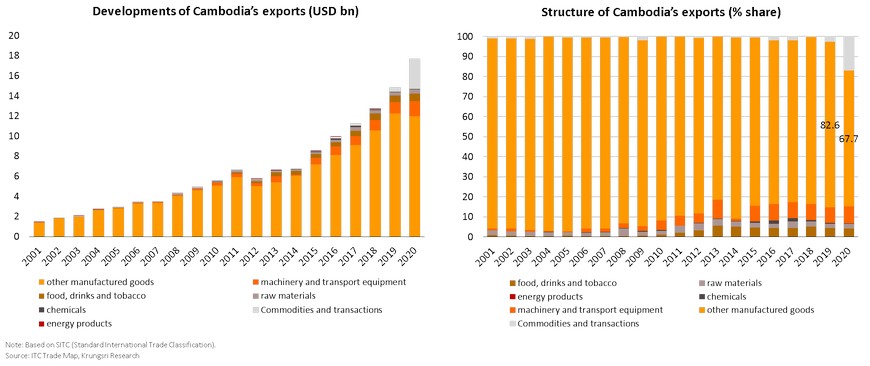

Garment and footwear products have dominated Cambodia’s exports, while exports of machinery and electronics have grown gradually

Despite its diversification efforts, Cambodia’s export structure remain dominated by garment and footwear products, which account for about 50% of the country’s total export value in 2020. Exports of alternative products such as electronics and vehicles (bicycles) are on the rise.

The US and the EU remain the two largest export markets for Cambodia

On the export markets, Cambodia has been dependent on the US and the EU, which together account for more than 50% of the total value in 2020. This is due primarily to trade privileges under the Generalized System of Preferences (GSP). For example, the EU’s GSP scheme called Everything but Arms (EBA), have led to a massive surge in Cambodia’s exports of garments to the bloc since the tariff-free access was granted in 2001.

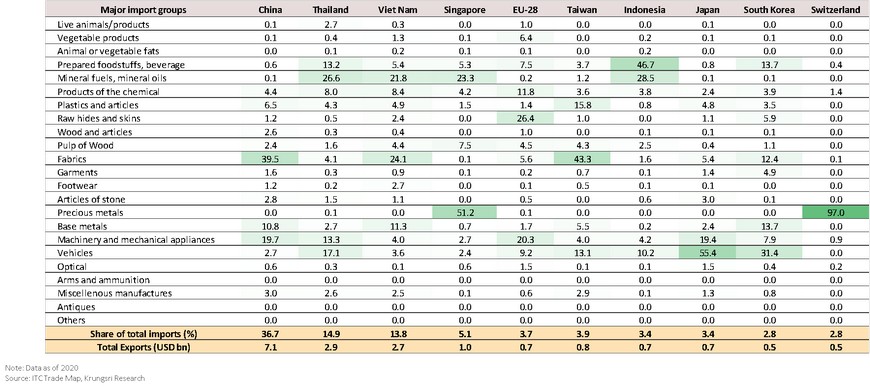

Intermediate inputs for the manufacturing sector have dominated Cambodia’s imports

The share of imports of intermediate inputs for the garment production and consumer products together has been sizeable. In 2020, the imports of fabrics accounts for more than a fifth of Cambodia’s total imports.

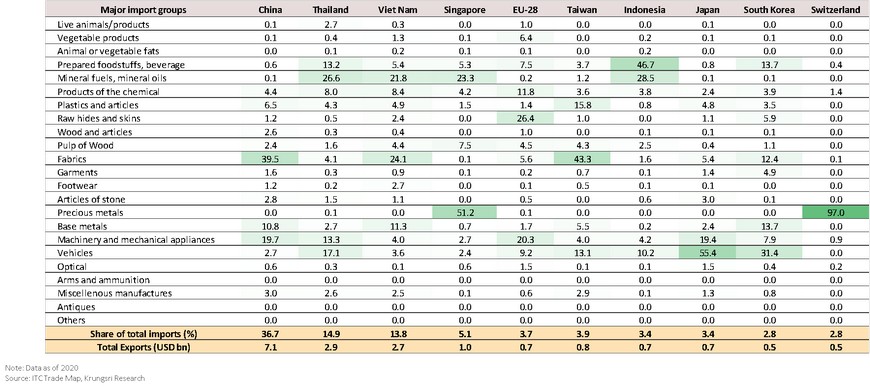

China is the single largest source of imports for Cambodia

Currently, China is the largest source of Cambodia’s imports with the share of 36.7% in 2020. The imports are dominated by inputs for the garment industry and machinery and electronics. Vietnam, Taiwan, and South Korea are also sources of fabric imports. Imports from Thailand – the second largest source of imports – are dominated by food and beverage, fuels, base metals, and vehicles.

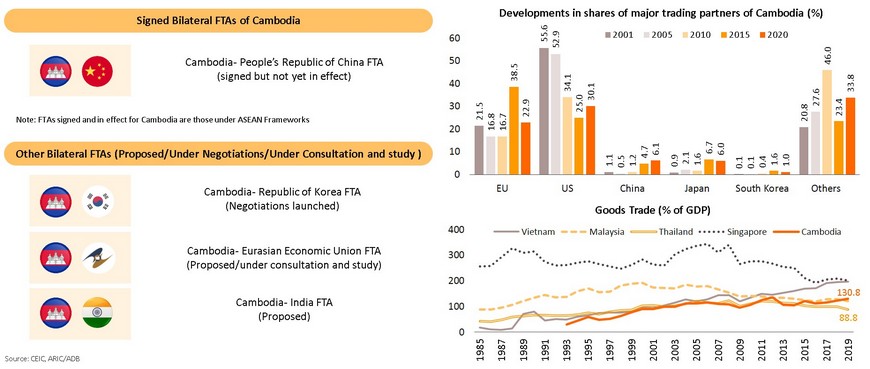

Free trade agreements at the regional and bilateral levels could provide a boost to its exports in the medium term

Cambodia has recently been active in engaging bilateral free trade agreements (FTAs) with its trading partners to help gain greater market access and to diversify export markets. Over the past two decades, Cambodia has been crucially dependent on the US and the EU for its exports, mainly garments and footwears. Diversification of export markets has become vital for the country following the EU’s decision to partially suspend tariff-free access to the bloc’s single market in 2020. Currently, Cambodia is in talk with countries like South Korea, and India for FTAs following its first free trade deal with China signed in October 2020.

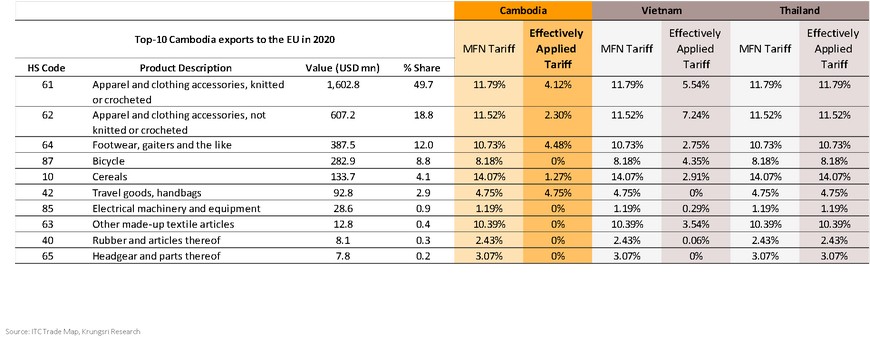

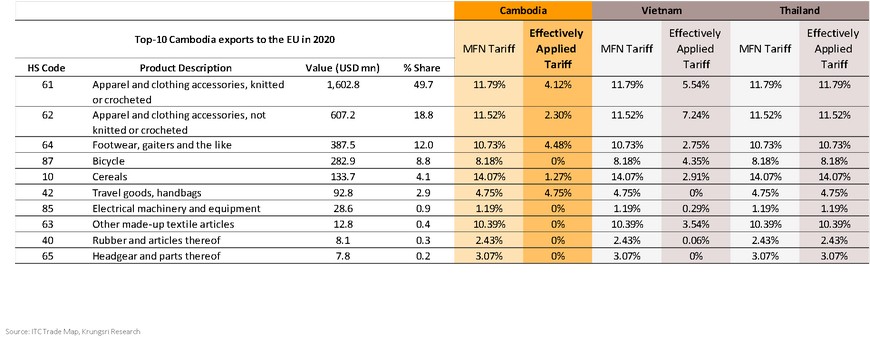

EU’s partial suspension of tariff-free access to its single market under the EBA scheme undermines Cambodia’s competitiveness

In August 2020, The EU’s partial withdrawal of the preferential treatment enjoyed by Cambodia under Everything But Arms (EBA) – the EU's trade arrangement for Least Developed Countries (LDCs) has been in effect due to perceived setbacks in democracy and human rights in the country. Cambodia has enjoyed the EBA privileges since 2001. Under the partial suspension, it is estimated that about 20% of the exports or about USD1bn of the annual export value of Cambodia has been reimposed higher tariffs by the EU. To assess competitiveness of Cambodia’s exports compared to that of Vietnam by tariffs imposed, it is clear that Cambodia’s export competitiveness has been eroded, particularly footwears, travel goods and handbags.

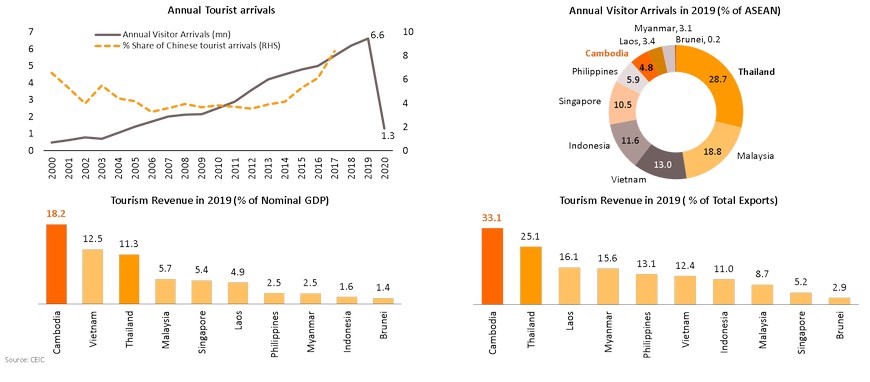

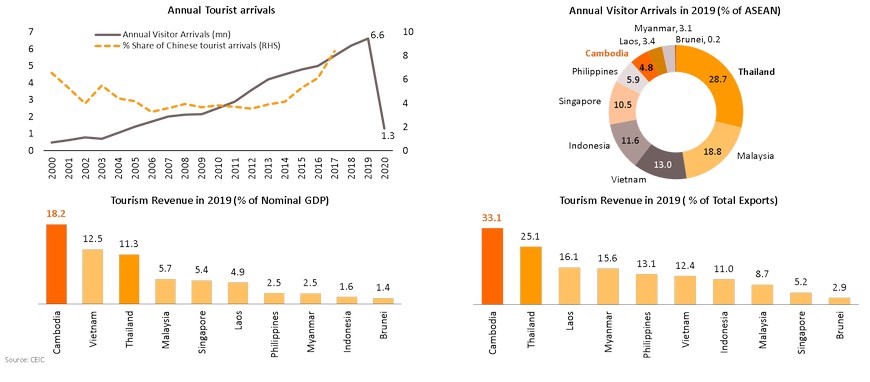

Tourism sector has been a key source of foreign exchange earnings over the past decade

Tourism sector has recently emerged as not only one of the key economic drivers, but also one of the main sources of foreign exchange earnings for Cambodia. Despite its a relatively small share of ASEANS’s annual tourist arrivals, the sector accounts for almost a fifth of Cambodia’s GDP in 2019 and tourism revenues account for more than a third of the country’s total exports.

External competitiveness of Cambodia has deteriorated, while its openness to cross-border trade both in terms of goods and services is among the highest regionally

Medium-term prospects

Favorable underlying trends will help sustain Cambodia’s strong growth in the long term

A strong growth path of 6.0% -7.0% p.a. is expected to be resumed in the post-pandemic era due to Cambodia’s favorable trends. These include sustained inflows of FDI, exports of manufactured goods – garment and footwear products, increasing middle-class consumers, the rise of digital economy, as well as political stability. In our view, against this backdrop, business opportunities for both local and foreign investors arise, particularly in the sectors such as e-commerce, financial services, healthcare, food and beverage, logistics, and education technology (EdTech).

FDI inflows into key sectors are expected to surge should the pandemic outbreak subsides

Inward FDI is expected to resume its upward trend should the outbreak subsides. FDI inflows from major sources, especially from China, to key sector such as construction and real estate are likely to surge. In addition, Cambodia could benefit from FDI diversion from Myanmar.

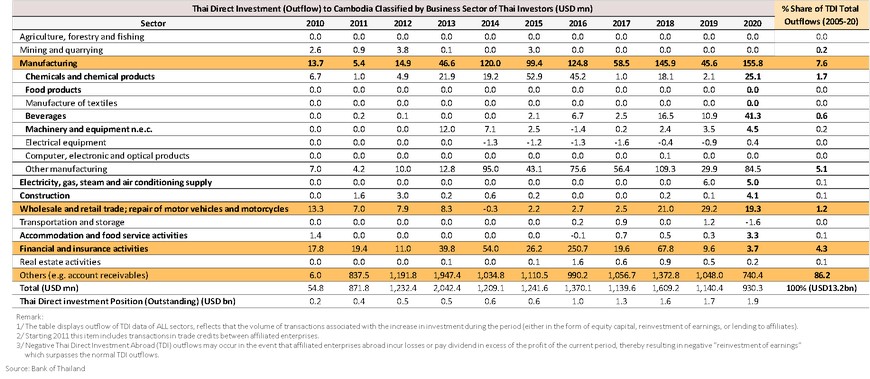

Thailand Direct Investment (TDI) to Cambodia is dominated by manufacturing and financial activities

TDI to Cambodia’s service sector is expected to increase, and sub-sectors such as financial services and wholesale and retail trade are likely to be major beneficiaries. This may be because the sector is attractive and has sizeable room to grow going forward.

Low costs of production provide Cambodia competitive advantage as an investment destination for labor-intensive manufacturing production

Low regulatory restrictiveness offers conducive business environment for foreign investors, while overall ease of doing business remains challenging

Exports of manufactured products will continue to sustain Cambodia’s growth in the post-pandemic world

Despite a high concentration, exports of manufactured goods dominated by garments and related products will remain a key growth driver for Cambodia in the post-COVID 19 era, and garment exports account for about 80% of the total exports in the past decade. In addition, Cambodia could benefit from foreign direct investment (FDI) diversion from Myanmar as a result of political turmoil.

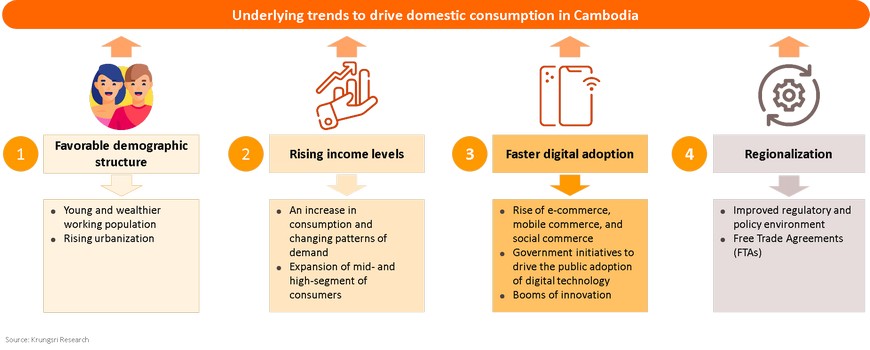

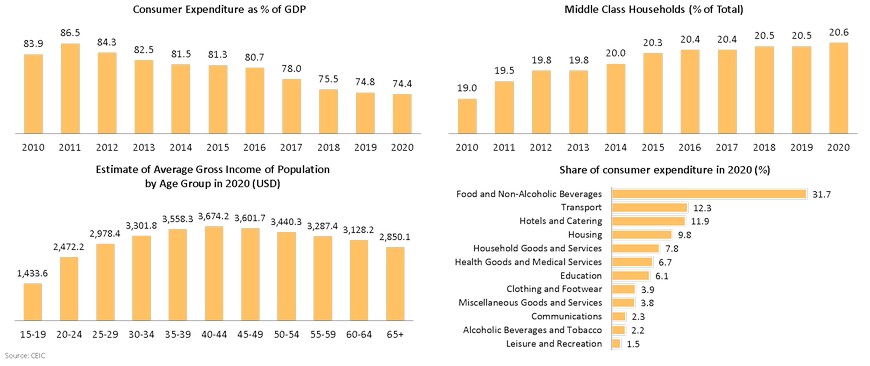

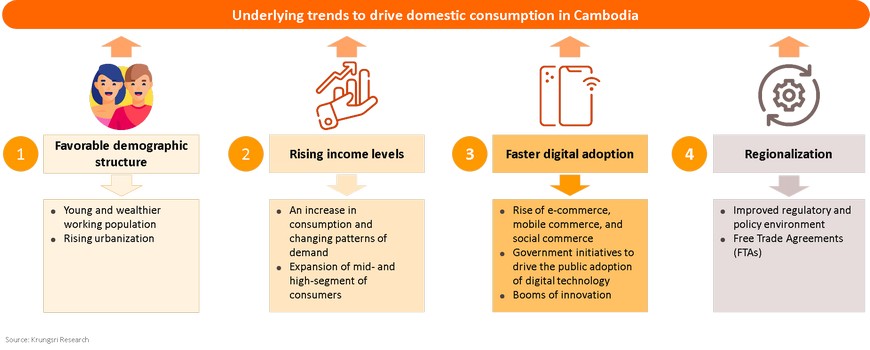

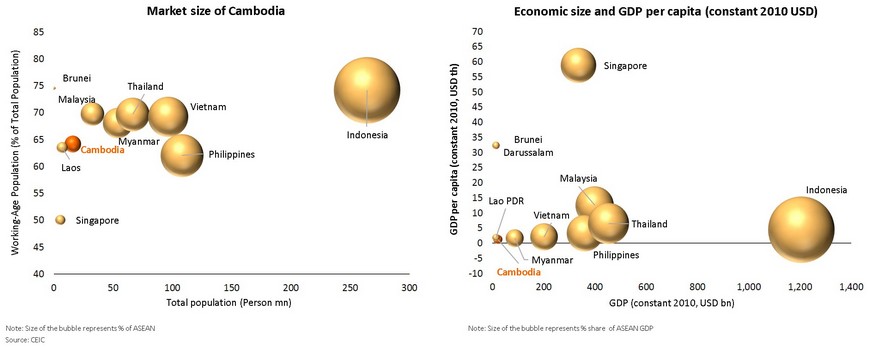

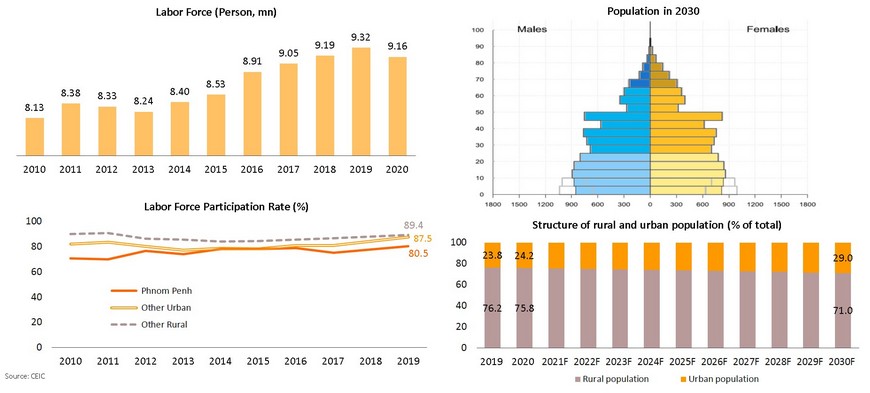

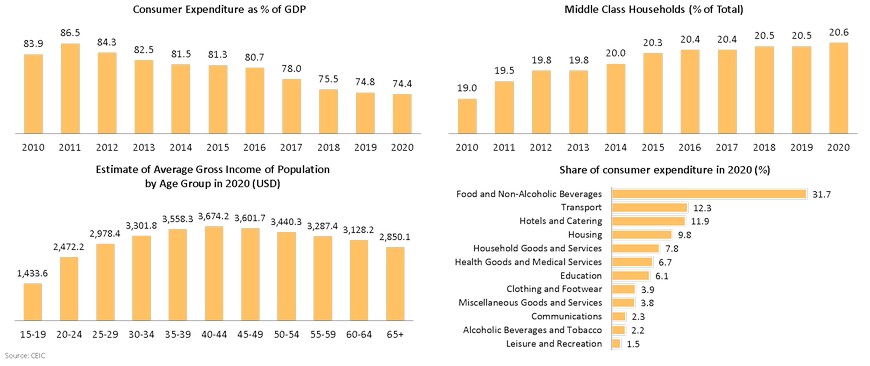

Young and wealthier population will drive domestic consumption in Cambodia in the periods ahead

The strong economic growth of 7.0 - 8.0% in the past decades has resulted in growing middle-class consumers in Cambodia. In 2020, it is estimated that there is about 20% of middle-class households and we view that, by 2030, the number will certainly increase as a result of sustained and strong economic growth in the post-pandemic world. On the back of higher income levels, we view that favorable demographic structure, faster digital adoption and regionalization – engaging free trade agreements (FTAs), will be tailwinds in boosting domestic consumption in Cambodia.

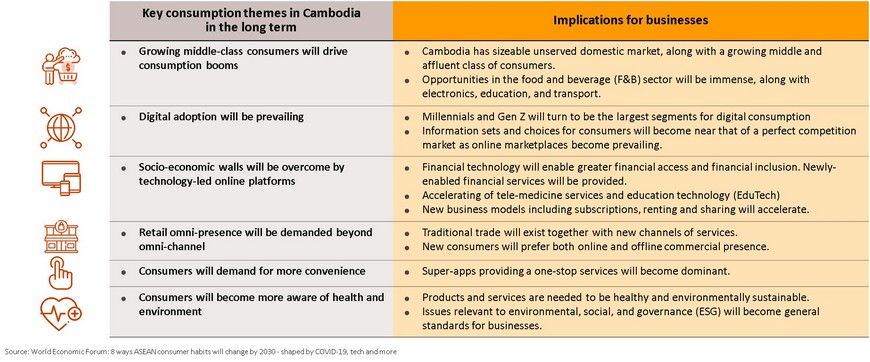

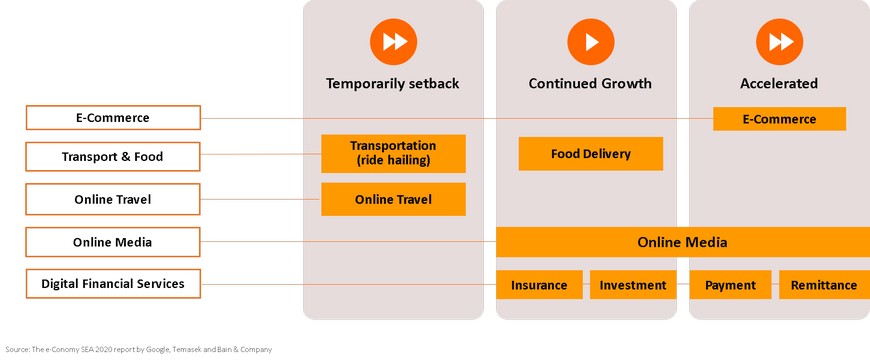

Consumer behaviors are changing, and some are accelerated by the COVID-19 pandemic

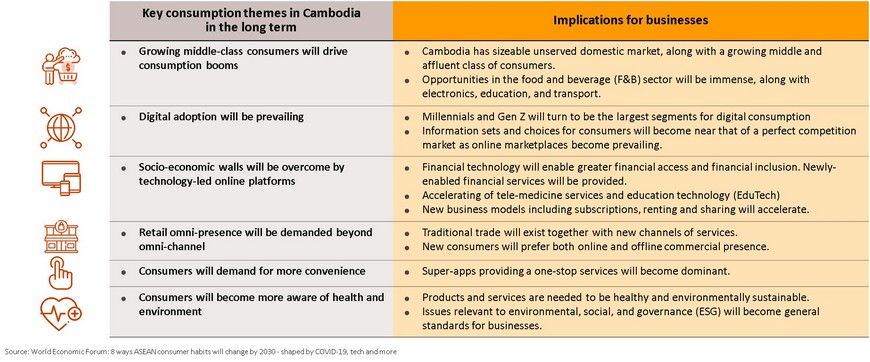

New consumer habits will emerge in Cambodia, and some are driven by the pandemic, in line with other ASEAN countries. In our view, there are six key themes that will shape consumption patterns in Cambodia in this decade.

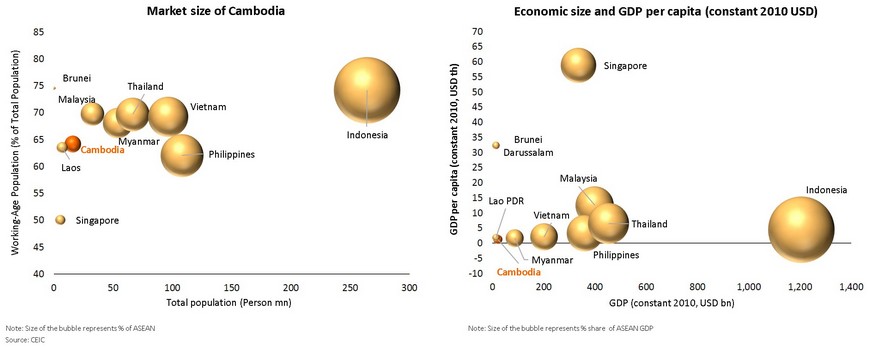

Untapped domestic consumer market remains sizeable with high growth potentials as income levels of working-age population are rising

While the total population of about 17 millions may be considered relatively small, an unserved domestic market is sizeable and growing. As a result of sustained and strong growth in the past two decades, Cambodia is currently a lower-middle income country with the annual GNI per capita of 1,480 USD (as of 2020). And income levels of labor force are expected to be higher in the periods ahead as economic growth will remain strong. The increase income levels will shape new patterns of domestic demand.

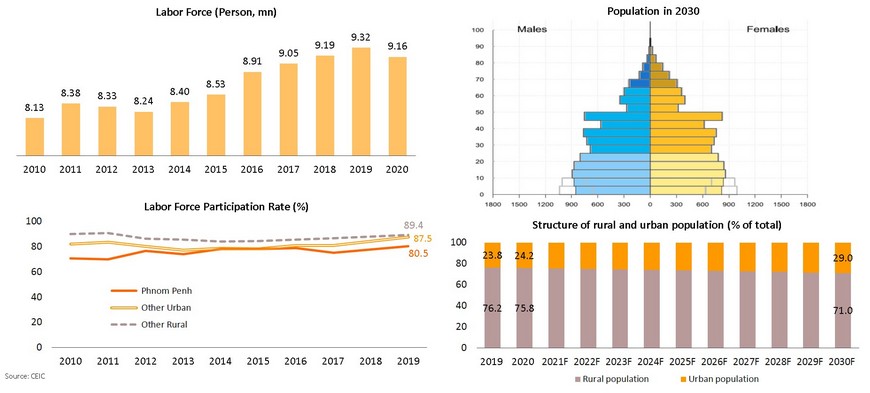

Favorable demographic structure will be a key boost to Cambodia’s economy

By 2030, Cambodia will enjoy demographic dividend by having a sizeable workforce earning high income on the backdrop of strong economic growth. Undoubtedly, domestic consumption will be boosted. In addition, the country has relatively high rates of labor force participation, more than 80% on average, and this would be mean large and sizeable consumers. In addition, urbanization will be advanced across major provinces.

Domestic consumption will be sizeable and dynamic as working-age population become wealthier

Size of Cambodia’s domestic consumption in percent of GDP is relatively large compared to that of regional peers in ASEAN, more than 70% of GDP. And it has been a key driver of the country’s economic growth, along with exports, on the demand side. This trend is expected to continue as young working-age population become wealthier. Regarding the consumption pattern, consumers’ expenditure is dominated by categories such as food and transport, housing, and health.

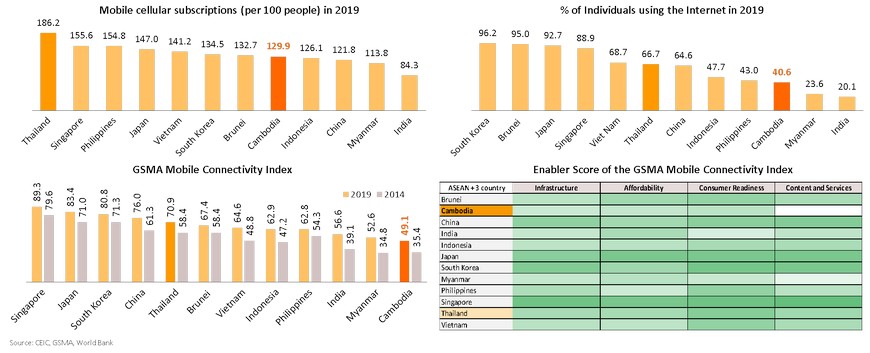

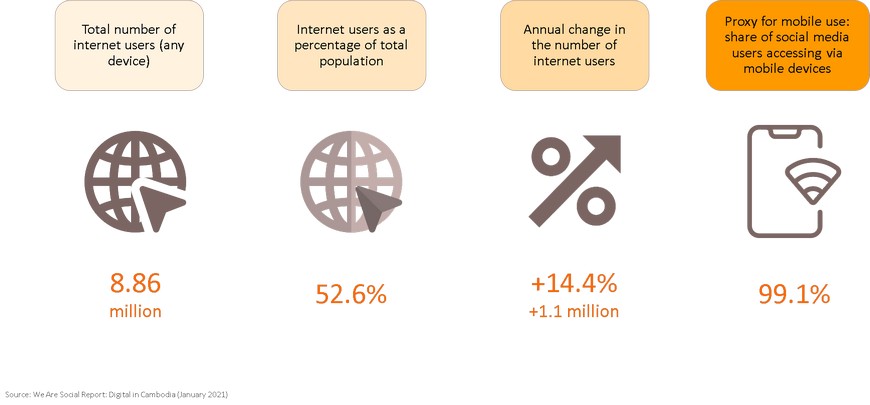

Digital economy will boom as young population tend to embrace new technologies as enablers are becoming more conducive

Cambodia is another country that have a large young and tech-savvy consumers, and they are embracing new technological trends to become indispensable parts of their lifestyles. Against this backdrop, it would help drive the digital economy such as e-commerce and digital financial services to flourish. While the number of consumers using the internet is relatively low compared to that of peers, this means that there is more room to grow as the ownership of smartphone and mobile cellular subscriptions are high. In terms of digital infrastructure, it has been improved considerably reflected by higher GSMA Mobile Connectivity Index.

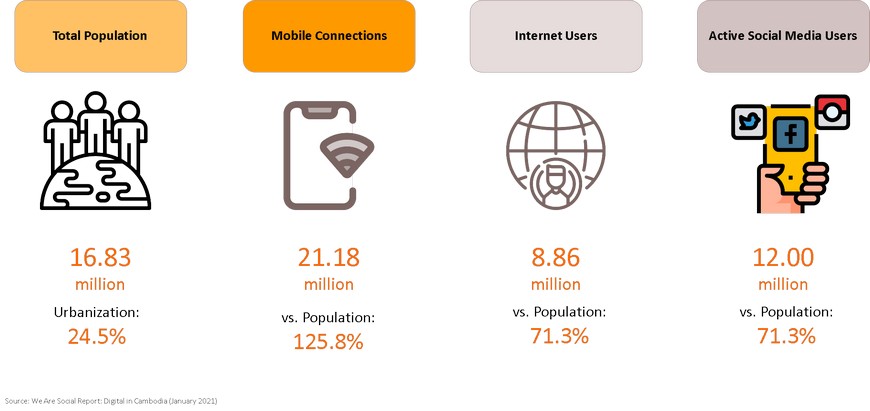

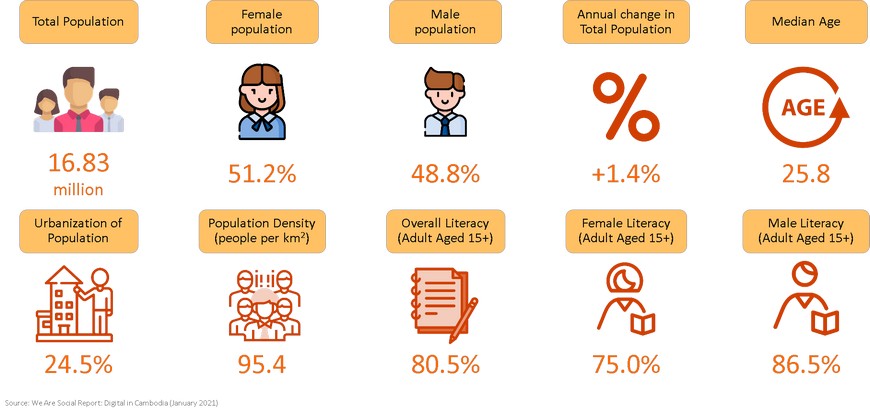

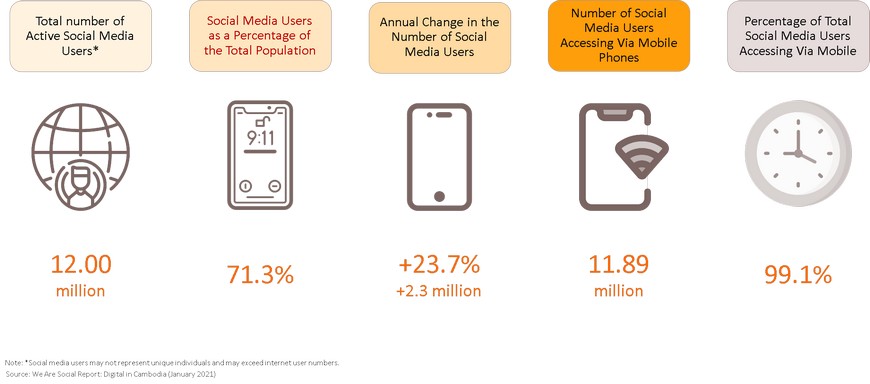

Majority of Cambodia’s population become digitally connected

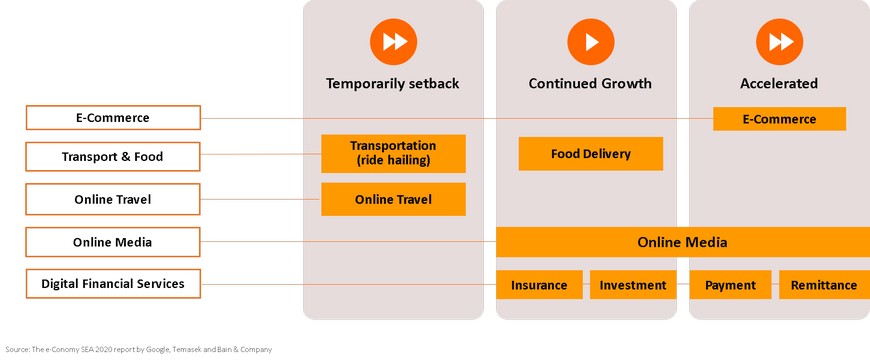

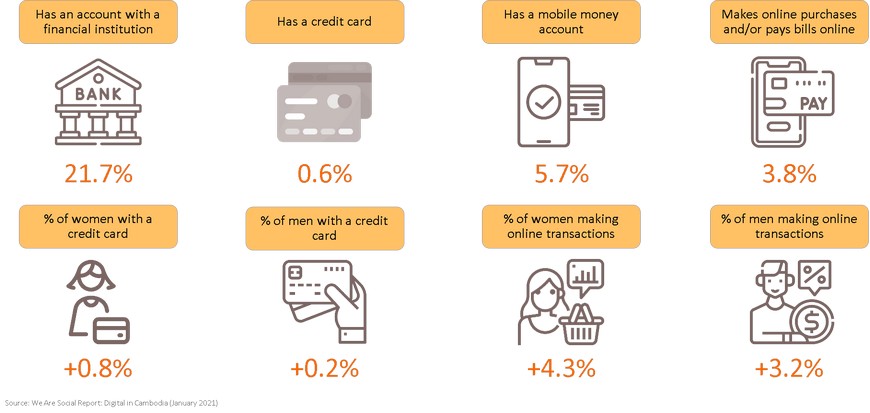

E-commerce and digital financial services will be accelerated by COVID-19 and consumer adoption is expected to grow faster

In line with other countries in the region, e-commerce, especially mobile commerce, and digital financial services in Cambodia are among the sectors that will grow rapidly as consumers are adapting to the new normal of the post-pandemic world. While the number of the unbanked population remains large, higher adoption of digital financial services such as e-wallets and mobile money would promote greater access to financial services. And this will in turn fuel the growth of mobile commerce.

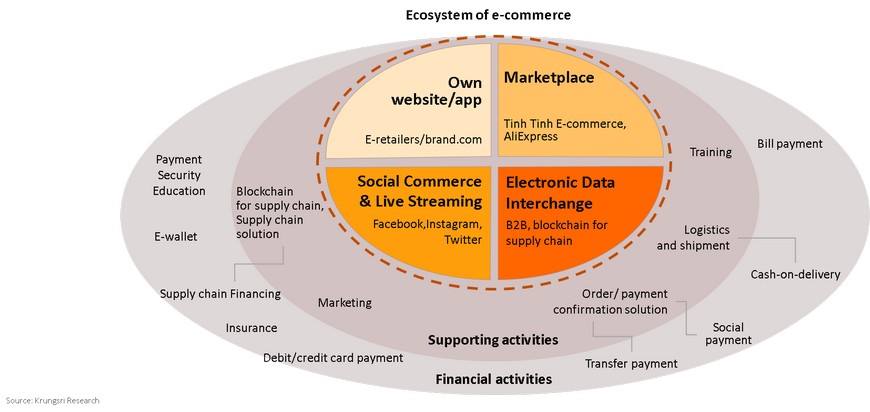

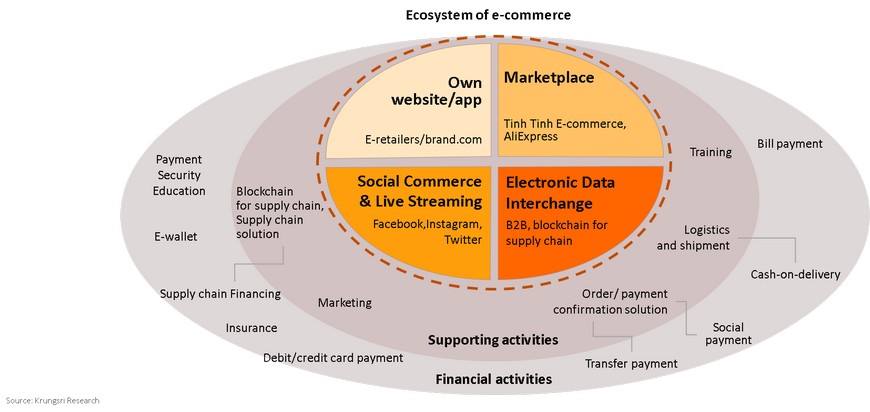

Growing e-commerce in Cambodia offer business opportunities for both local and foreign investors within its grand ecosystem

Against a backdrop of growing digital economy in Cambodia, ample business opportunities for both local and foreign players arise in the country’s e-commerce ecosystem, particularly supporting activities from training to supply chain solutions as well as financial activities and financial solutions.

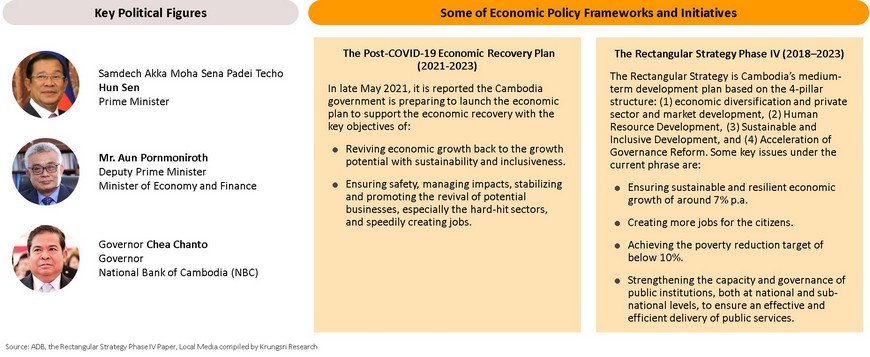

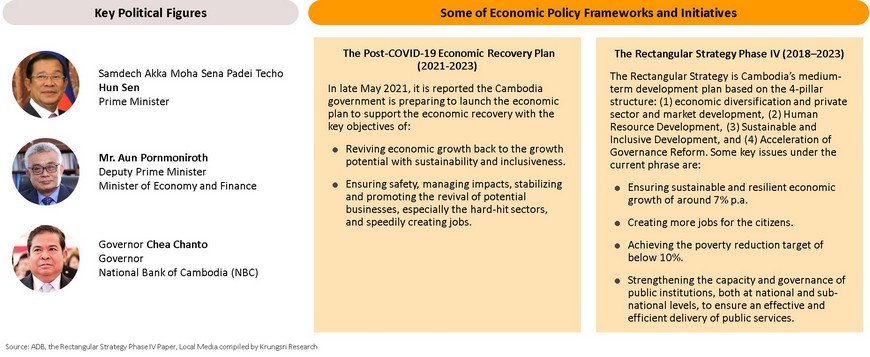

Cambodia’s political stability will continue, and investment-friendly policies will be ensured

It is widely recognized that Prime Minister Hun Sen, who is now 68 years old, faces no challenge to his position until the next general election in 2023. And, going forward, his party, Cambodian People's Party (CPP), will remain in power. As a result, political stability in Cambodia will be ensured. We also view that the current administration will continue to adopt the economic liberalization approach and pursue policies that are friendly to foreign investors to help attract inward FDI to boost the economic recovery in the post COVID-19 era.

Appendix: Overview of Online Behaviors in Cambodia

Overview of Population in Cambodia

Overview of internet use

Social media use

Overview of financial inclusion in Cambodia