Executive Summary: Near-term growth severely hit by the pandemic, but long-term positive growth prospects and fundamentals remain intact

Philippines: A Country Overview

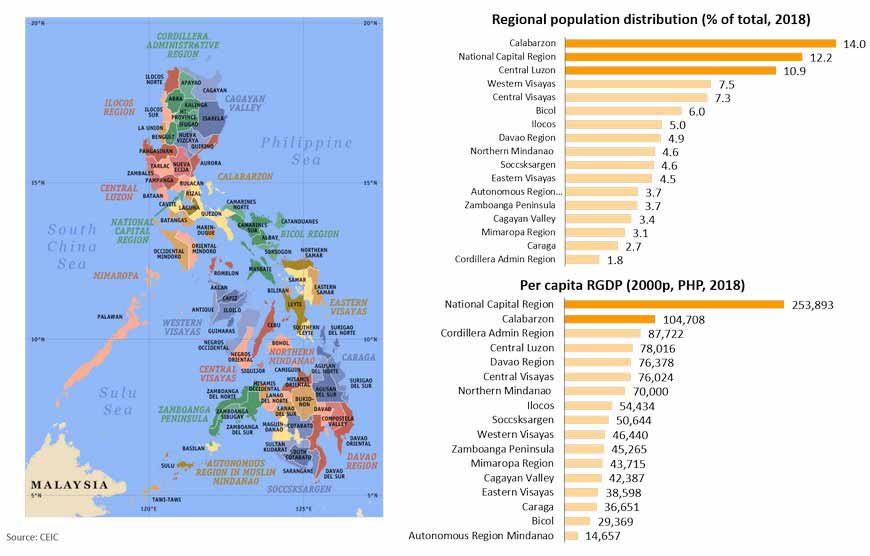

The Philippine archipelago constitutes of over 7,000 islands with the economic activity concentration in Luzon

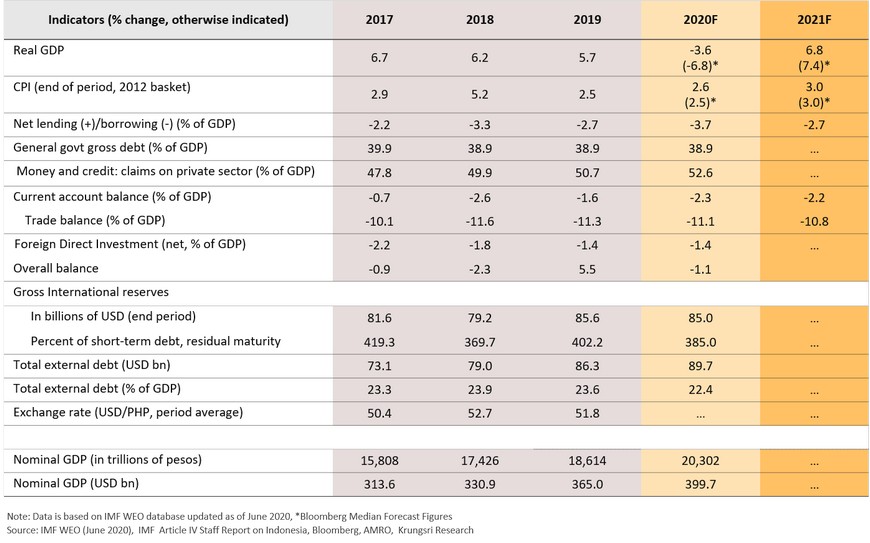

Macro forecasts: The pandemic weighs on the near-term outlook, but positive long-term views remain intact

Growth is expected to slip deep into a negative territory in 2020, but it should resume its potential trajectory of 6.0% - 7.0% p.a. in the long term

Covid-19 pandemic shocks are likely to weigh on the Philippines’s growth through different channels

Growth slump in 2Q20 depicts the severe impact of the pandemic on the economy; however, the economy should slowly recover starting from 2H20

The pandemic could pose a negative impact of 5.0% on the Philippines’ growth in 2020 according to our model

The outbreak would reduce global GDP growth substantially by 5.5ppt from baseline forecast (pre-outbreak). Krungsri Research now projects the outbreak would pose a negative impact to the Philippines’ economy of 5.0 ppt, which is relatively significantly compared to that of regional peers in ASEAN. The impact of the pandemic to the economy is passed through different channels – tourism, supply disruption at home and abroad, and multiplier effect.

Sets of policy measures have been deployed to cushion the dire impact caused by the covid-19 pandemic, but their effectiveness remains to be seen

The Philippines reported its first cases of confirmed COVID-19 on 30 January 2020. Recently, on 19 August 2020, the government has moved Metro Manila and other high-risk areas from a “modified enhanced community quarantine” to a “general community quarantine,” allowing more businesses to reopen and mass transportation to resume in phases. International travel restrictions largely remain in place, but domestic flights are allowed under limited capacity. Financial market volatility has subsided recently, with the USD/PHP exchange rate staying stable. Meanwhile, real GDP in the first quarter and second quarter of 2020 contracted by 0.7% and 16.5%, respectively, on a year-on-year basis. This therefore marks the technical recession for the Philippines.

In the post-pandemic era, Philippines’ growth potential of 6.0-7.0% p.a. is likely to be reinvigorated due to its favorable underlying fundamentals

Major milestone of Philippines’ developments

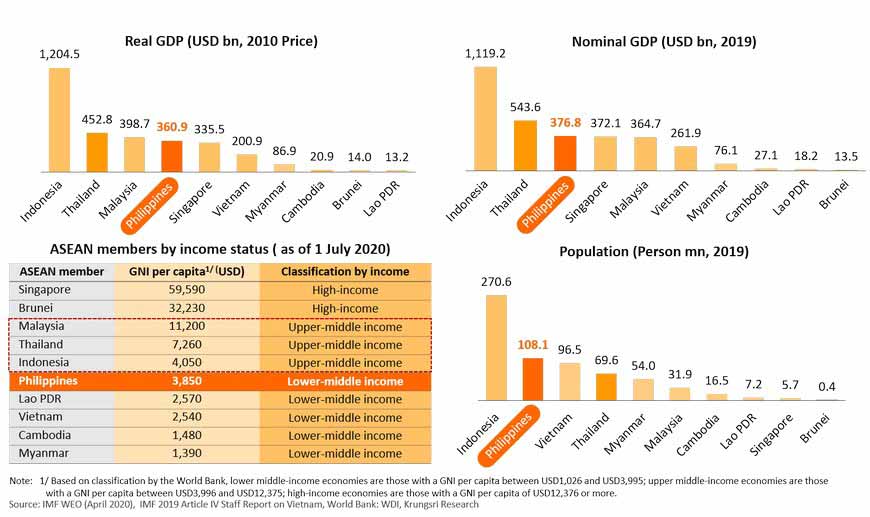

Philippines among ASEAN peers: It aims to be an upper-middle income country by 2022

The Philippines is currently listed as an lower-middle income country with the GNI per capita of USD3,850 (still slightly below the upper bound of a lower-middle income group of USD3,995) by the World Bank in July 2020. High economic growth over the last decade with the annual growth rate of around 6.3% leads to a continuous increase of Filipinos’ GNI per capita. With the strong growth momentum, the country aims to achieve the upper-middle income country status by 2020.

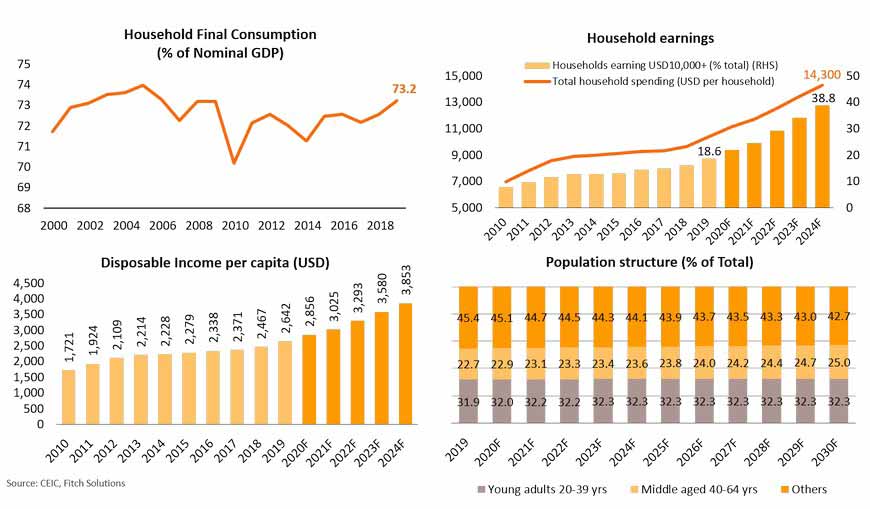

Household consumption is to remain a major growth driver on the expenditure side

Household consumption which currently accounts for about 73.2% of nominal GDP (as of 2019) is expected to be a main driver for the Philippines’ growth over the periods ahead. Sustained and strong economic growth in the last decade results in rising annual household earnings and annual disposable income per capita which is expected to reach USD3,859 in 2024. And, over the 2020s, over 50% of the population is in the working age (below 64 years old) and this favorable structure of population will be a great boon to the country’s domestic consumption.

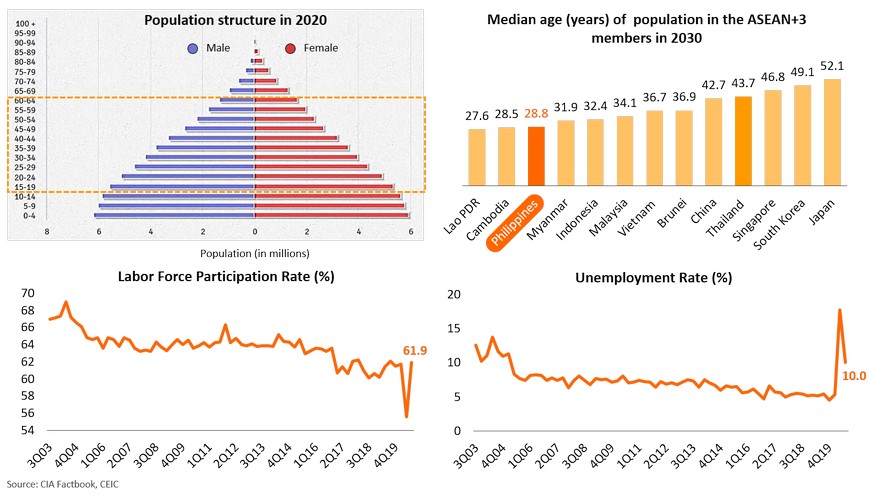

…to continuously driven by favorable demographic structure and strong labor market conditions

While the labor market conditions are being worsened in the near term due to the impact of the pandemic, we view that favorable demographic structure and benign conditions in the labor market against a backdrop of high economic growth would underpin household consumption in the years ahead.

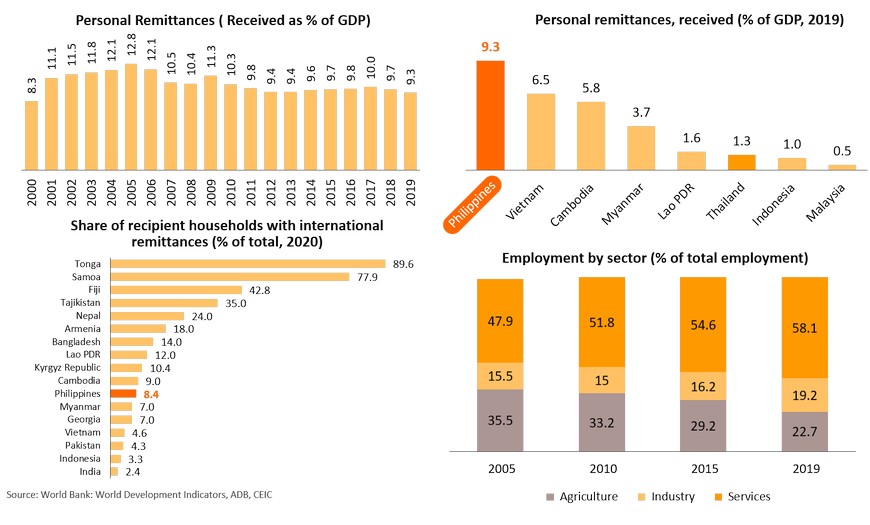

Remittances should continue to support household consumption of Filipinos

Remittances which currently account for about 9.3% of the Philippines’ GDP have played a crucial role by being a main source of income for a number of households in the Philippines or around 8.4% of the total households, according to the figure provided by the ADB. We expect that inflows of remittances should resume strongly once the pandemic is effectively contained and the global economic activity starts to recover in the medium term.

On the production side, developments of the export-oriented manufacturing sector remain lagged behind regional peers in ASEAN and this limits exposure to disruptions to cross-country supply chains

Main exports are concentrated on the low-end of electronics products accounting for a significant share of the country’s total exports

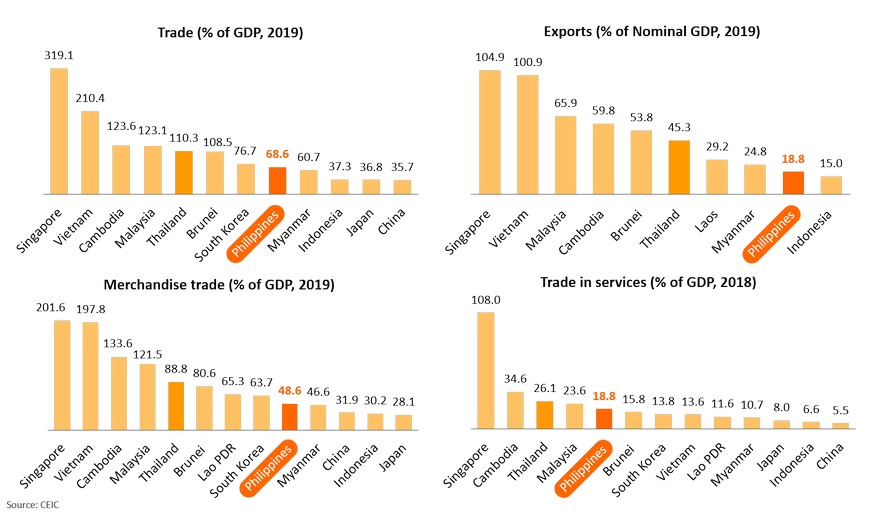

…and this is reflected by the country’s narrow international trade structure

Degree of openness to international trade is also reported relatively low compared to that of regional peers

Due to its less-advanced export-oriented manufacturing sector compared to that of regional peers in ASEAN, the Philippines has been less dependent on international trade (both merchandise trade and trade in services), with the trade-to-GDP ratio of 68.6% (as of 2019) compared to 123.1% of Malaysia and 110.3% of Thailand.

Philippines is one of the key trading partner in ASEAN for Thailand

Sound macroeconomic stability has been maintained and should help the country weather external challenges and shocks induced by the pandemic

The exchange rate movement has been in line with its fundamentals

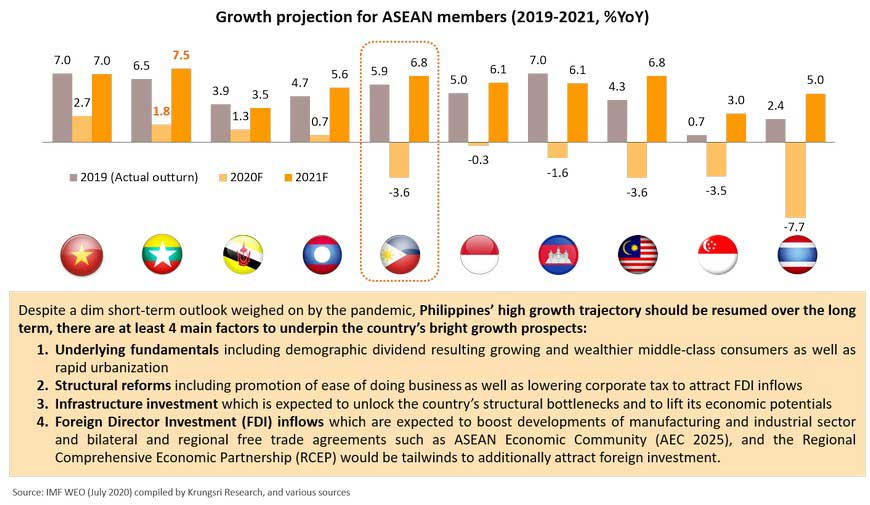

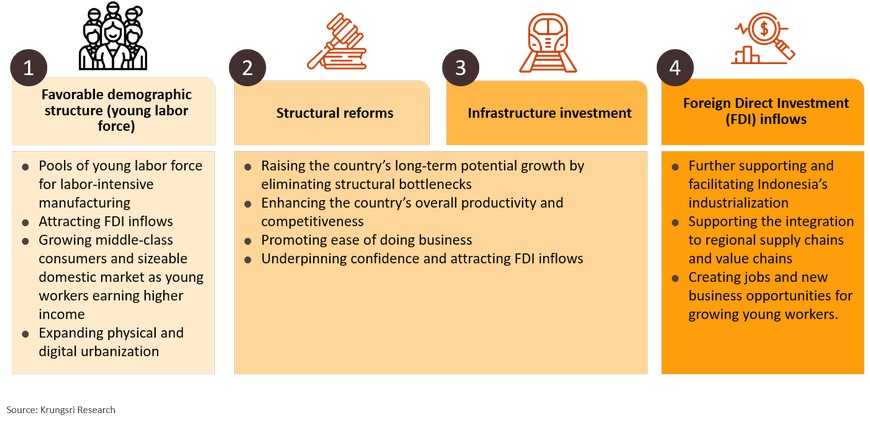

Favorable underlying fundamentals will support the economy to resume its potential trajectory in the years ahead

Although the pandemic is expected to substantially erode the Philippines’ potential growth path, over the medium to long term, we view that the economy should be able to eventually follow its potential trajectory of 6.0%-7.0%. There are 4 main drivers comprising (1) demographic dividend, (2) structural reforms, (3) infrastructure investment, and (4) foreign direct investment (FDI) inflows. These factors will enable the Philippines to remain one of the fastest growing economies regionally.

Demographic dividends will support the Philippines’ growth over the years to come

Young middle-class consumers are expected to become wealthier and have higher purchasing power

Structural reforms should help promote ease of doing business and attract foreign investment

Philippines is implementing the long-term plan to become a a prosperous society by 2040

- The Government of the Philippines is implementing the Ambisyon Natin 2040, a long-term vision of becoming a prosperous middle-class country free of poverty by 2040.

- Hence, there are priority sectors promoted by the government to improve market linkages, simplify government procedures, and facilitate access to finance. And those priority sectors are:

The ‘Build, Build, Build’ program should help enhance the potential growth and unlock infrastructure bottlenecks

FDI inflows are likely to be continuously attracted and to support the industrialization

Low wage levels should support attractiveness of the Philippines in attracting labor-intensive manufacturing

Cost of production in the Philippines could be further lowered in the long term should the structural reforms and infrastructure investment are accomplished

Overall business environment has also been slightly improved over the past few years

Despite the improvement, the ease of doing business may not be conducive enough compared to that of regional peers

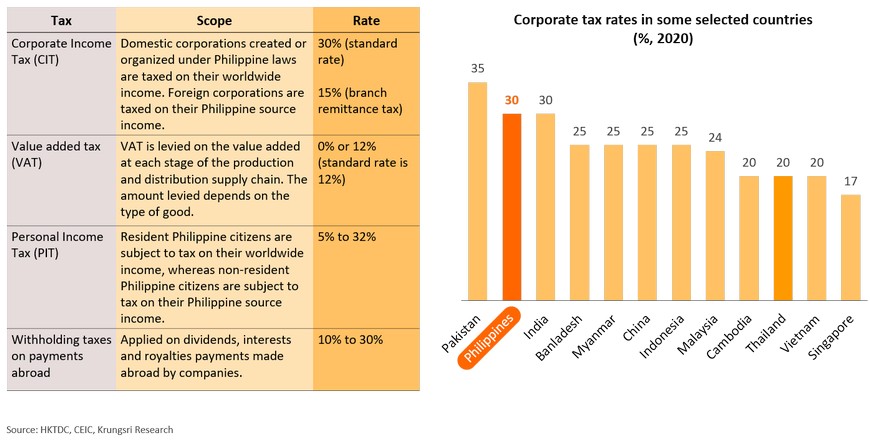

In addition, the corporate tax rate in Philippines is among the highest in the region

Currently, the corporate income tax (CIT) of the Philippines is the highest among peers in ASEAN, 30% compared to that of Singapore of 17% . Although the government is implementing the CIT reforms to promote both domestic investment and FDI, it will take at least 5 years to become competitive regionally. This is because the CIT rates is reduced to 20 percent in annual increments of 1 percentage point over a 10-year period starting in 2020 according to the Corporate Income Tax and Incentives Rationalization Act (CITIRA) introduced in September 2019.

Japanese direct investment to the Philippines has been flat compared to that flowing to other regional peers

Thailand is moving toward service-based economy and could shift some labor-intensive activities to the region

Thailand is in line with the world economy in moving toward a service-based economy, and this is depicted by a rising contribution of service sector to GDP from 50.3% in 2008 to 56.9% in 2017. Based on the recent data, we found that Thailand also has relatively high valued-added labor productivity in the services sector. Thai businesses may be able to reap the advantages to shift labour-intensive manufacturing activities as well as export services to countries in the region including the Philippines.

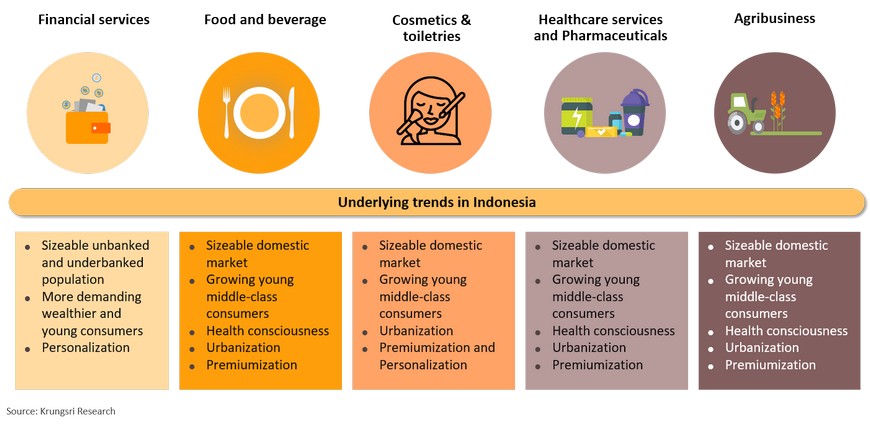

Sizeable domestic demand and growing wealthier middle-class Filipino consumers offer business opportunities for Thai investors

The Philippines will become home for around 124 million inhabitants by 2030. On the back of high economic growth, this would mean that there would be a sizeable young and wealthier consumers. Therefore, looking ahead, the Philippines should remain one of the most vibrant economies regionally and provide business opportunities for Thai firms seeking markets to grow their business in the region. And, some potential sectors that are on the top of our mind are (1) financial services, (2) food and beverage, (3) Cosmetics & toiletries, (4) healthcare and pharmaceuticals, and (5) Agribusiness.

Financial services: Unbanked and underbanked population remain sizeable in the Philippines

…Despite there are a large number of banks and other types of financial service providers: mobile-led financial services could be used to promote financial inclusion

Food: Thailand’s competitive advantages in the food and agricultural industries should support Thai firms to penetrate Philippines’ food and healthy food sectors

Beverage: Demand for healthier alternative drinks1/ are likely to be boosted by increased local consumers’ health-consciousness

Cosmetics & toiletries [1]: Demand is expected to be driven by a growing wealthier middle-class consumers and a premiumization trend

Healthcare and pharmaceuticals: Unmet demand is sizeable

Agribusiness: Philippines is the net importer of food products and demand is increasing in line with population growth