2026-2028 THAILAND INDUSTRY OUTLOOK

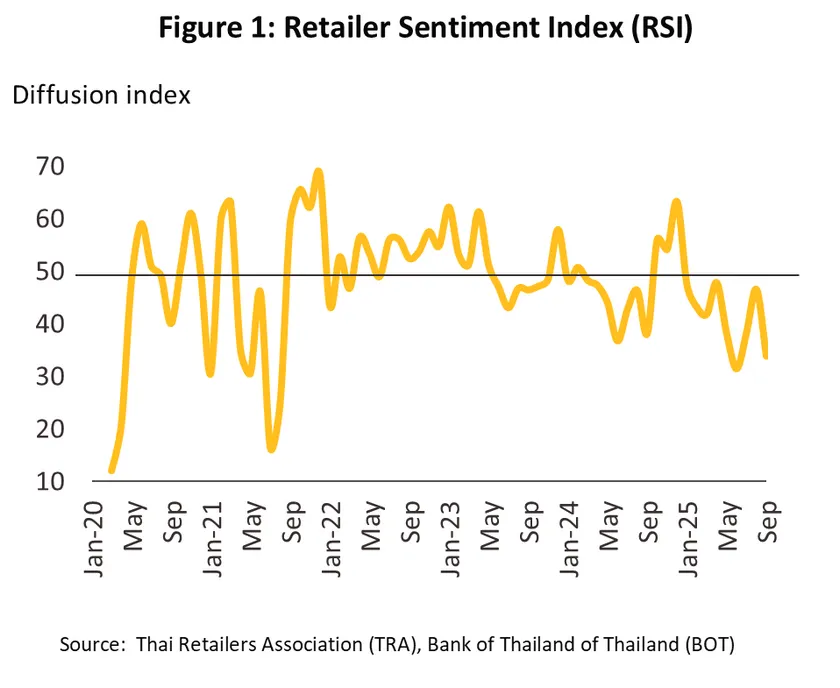

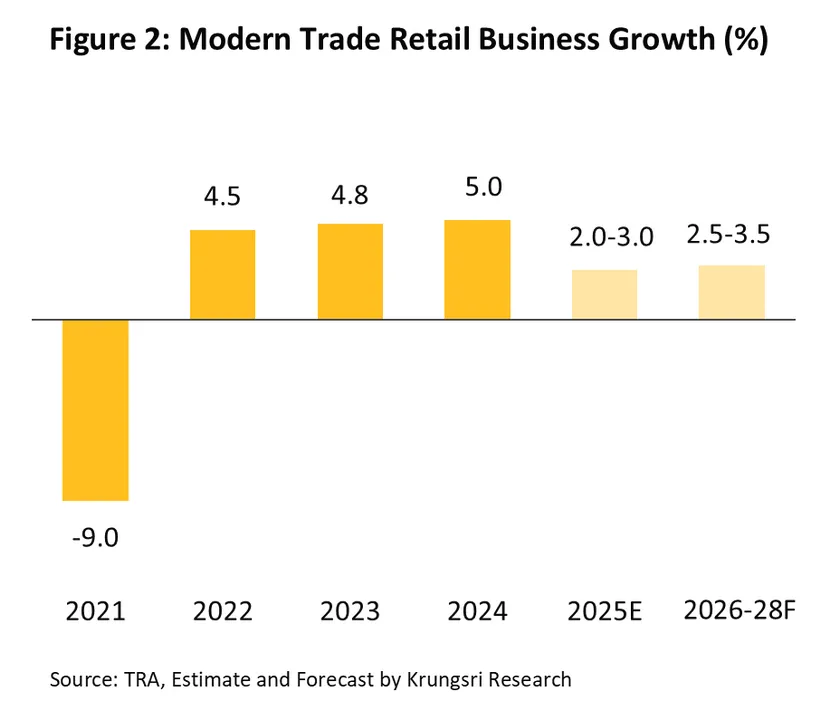

The overall outlook for Thailand’s industries considers both opportunities and challenges that reflect the business attractiveness of each sector. This assessment is based on macroeconomic conditions and structural shifts that are expected to influence business and industry trends over the next three years.

The macroeconomic environment

-

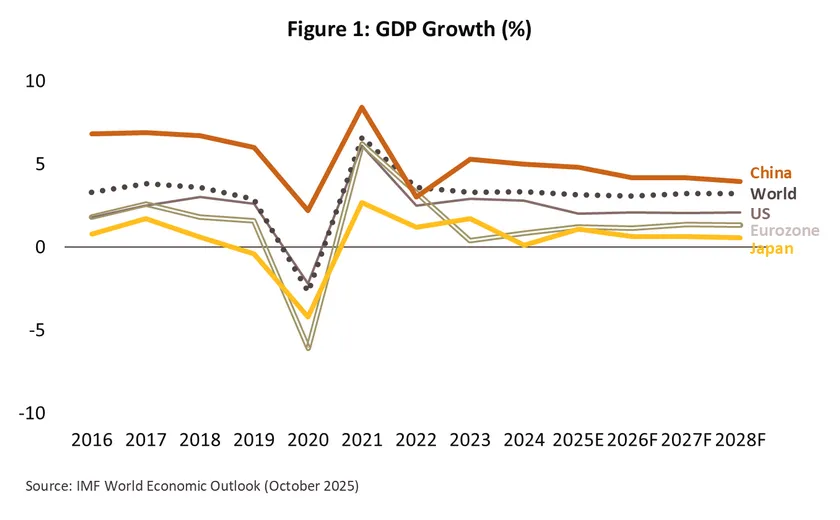

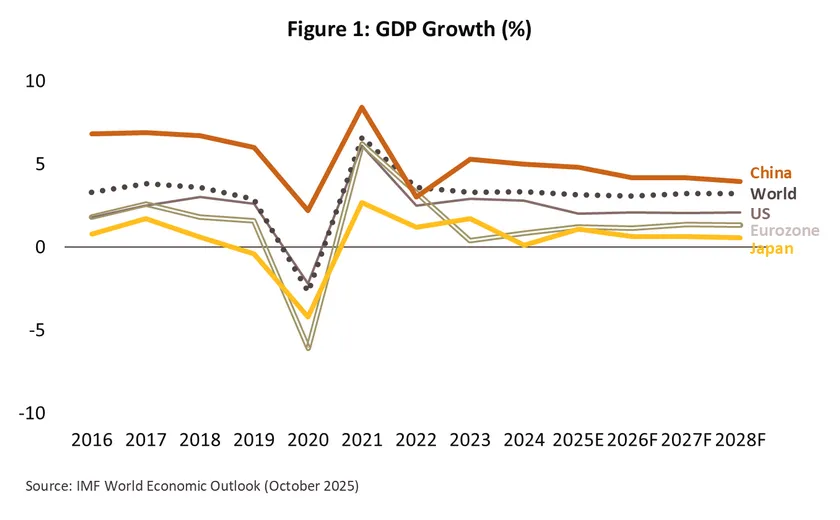

Global economy in 2026-2028 may grow modestly amid trade wars and geopolitical tensions: The global economy in the next 3 years is expected to remain subdued at 3.2%, close to 2025 growth rate and below the pre-COVID average of 3.7% recorded during 2011–2019. Although fiscal stimulus measures in many countries, along with rising investment in digital sectors and AI, will provide some support, multiple factors continue to weigh on growth. These include trade protectionism, geopolitical tensions, elevated debt levels, and country-specific structural challenges. The U.S. economy is projected to expand modestly by an average of 2.1% per year during 2026–2028, compared to 2.0% in 2025. Higher tariffs and tighter immigration measures will pressure production, jobs, and consumption. AI-related investment should lift productivity over the longer term, but it also carries risks of bubble in speculation market. The Federal Reserve may end its rate-easing cycle by 2026 as inflation edges up, staying within a contained range. Eurozone growth is expected to hover at a low 1.3% per year during 2026-2028, compared with 1.2% in 2025. Germany’s fiscal support and a gradual recovery in tourism and consumption will support growth momentum. However, the drag from U.S. tariff increases and the persistent weakness in manufacturing will limit momentum. The European Central Bank (ECB) may also face increasing constraints in delivering further rate cuts as inflation moves closer to the 2% target. Japan’s economy is projected to grow by only 0.6% per year on average during 2026–2028, down from 1.1% in 2025. The manufacturing sector is expected to remain weak, and exports are likely to slow amid heightened trade tensions and intensifying competition in the automotive industry. Nonetheless, proactive fiscal policies—aimed at easing living costs and promoting investment in strategic industries—should help reinforce Japan’s longer-term growth potential. Chinese economy is projected to grow at a slower pace from 4.8% in 2025 to an average of 4.1% during 2026–2028, as it continues to face multifaceted pressures. These include the real estate crisis, public and private sector debt, excess supply, an aging society, and trade and technology wars. However, key measures to support growth momentum include stimulating consumption and investment, supporting “New Productive Forces,” curbing intense price competition (Anti-Involution), alleviating the government debt, easing monetary policies, investing in infrastructure, and accelerating the recovery of the real estate sector.

-

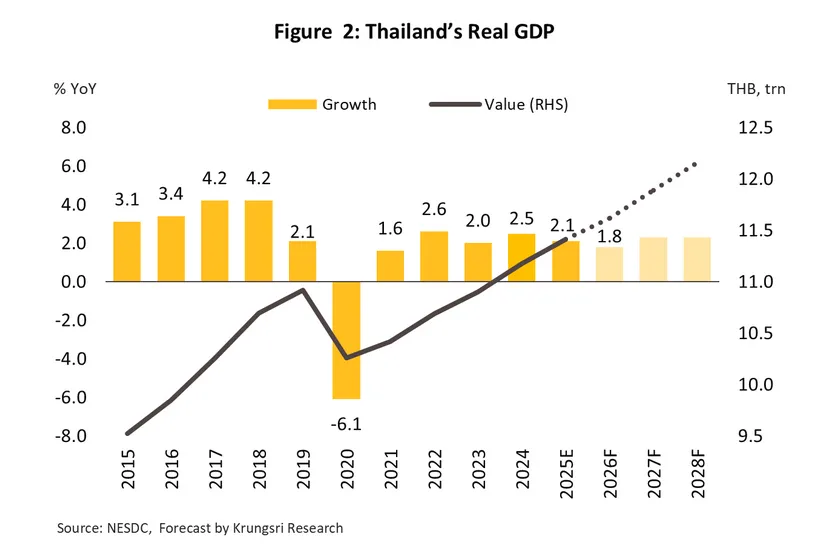

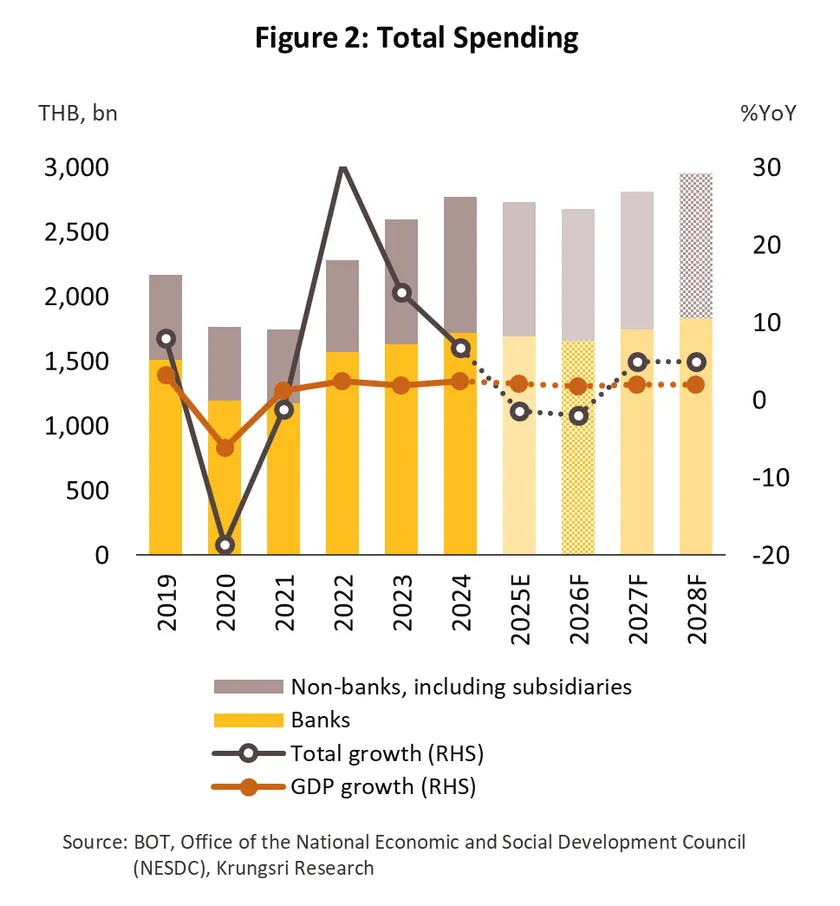

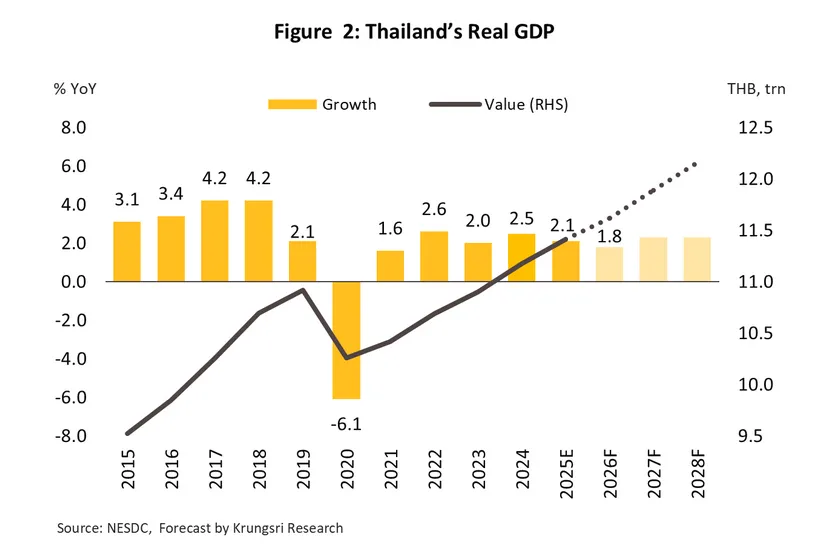

Thailand’s Economy in 2026–2028: Slow and below potential growth amid both domestic and external headwinds: During 2026–2028, the Thai economy is expected to grow at an average pace of 2.1% per year (Figure 2), close to the subdued growth rate projected for 2025. This marks a significantly lower rate compared with Thailand’s pre-pandemic average of 3.6% during 2010–2019. Several headwinds continue to weigh on medium-term growth momentum:

-

The 19% U.S. tariff on Thai exports, effective since August 2025, combined with the payback effect following front-loaded orders in 2025, is expected to lead to a slowdown in exports. Meanwhile, rising uncertainty of U.S. tariff policy and trend of trade protectionism add further pressure on Thailand’s export-oriented manufacturing and employment.

-

Domestic political uncertainty during the caretaker-government period and the general election in 2026 may disrupt government spending, particularly capital budget expenditure in the first half of the year and may delay the formulation of the FY2027 budget bill.

-

High public debt levels continue to narrow fiscal policy space, limiting the government’s ability to implement additional stimulus measures during 2026–2028.

-

Although household debt has begun to decline, it remains elevated at over 86% of GDP as of the second quarter of 2025—the highest in ASEAN-5—while household income recovery remains slow. This will weigh on private consumption and reduce the effectiveness of future stimulus measures.

-

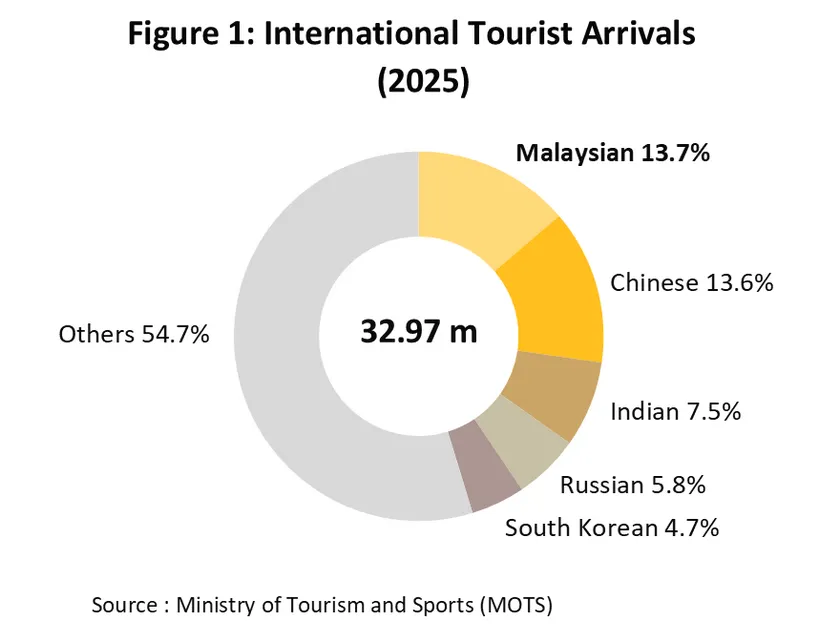

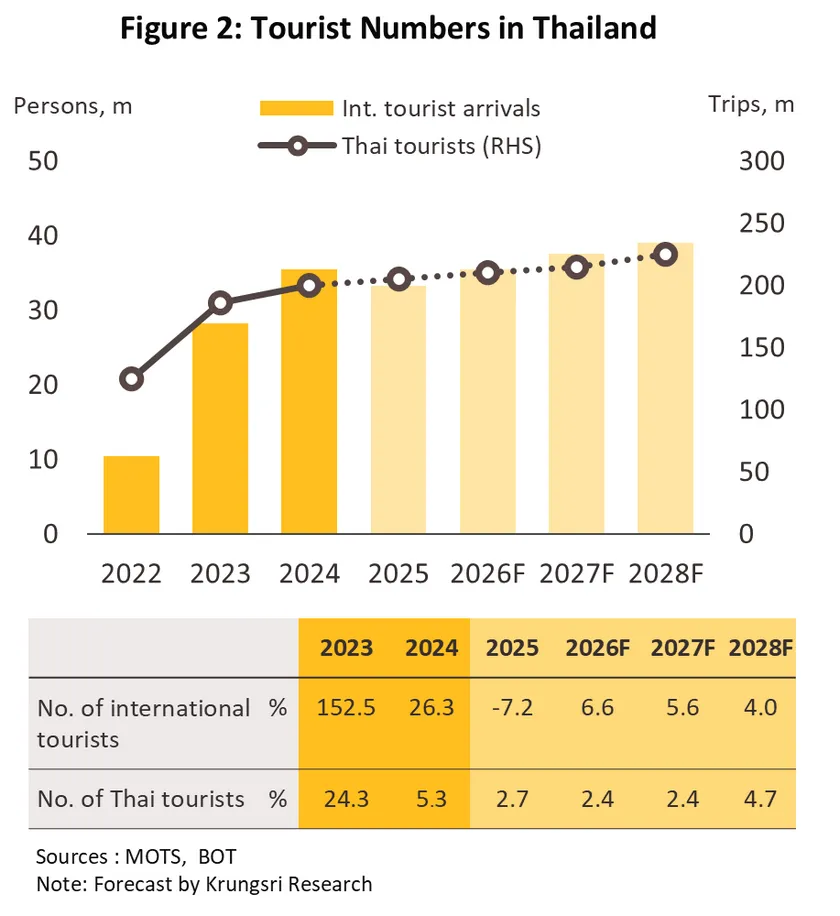

Despite these structural and cyclical challenges, some supportive factors remain. (1) Tourism is expected to recover gradually after contracting in 2025 due to weakened Chinese arrivals driven by safety concerns. A stronger global tourism momentum, together with rising international flight frequencies and new routes from China and India, is projected to boost foreign tourist arrivals to 35.5 million in 2026 and further to 37.5–39.5 million in 2027–2028. (2) Private investment shows some positive signs, supported by a nearly twofold increase in investment applications for BOI incentives to a record-high level, driven by digital industries, electric vehicles, and renewable energy. In addition, the BOI’s “Thailand FastPass” initiative aims to accelerate the realization of roughly THB 480 billion worth of promoted projects approved between 2023 and early 2025, helping to support investment growth in the foreseeable future.

Thailand’s economic outlook over the next three years (2026–2028) points to a gradual and subdued recovery, with growth remaining below the ASEAN-5 average. The IMF projects ASEAN-5 economies to expand by around 4.2% per year, while Thailand is expected to grow at a noticeably slower pace. The outlook is weighed down by several external headwinds, including uncertainty over U.S. trade policy, a slowdown in the Chinese economy, and prolonged geopolitical tensions. Domestically, structural challenges persist—such as declining industrial competitiveness, labor shortages and low labor productivity, as well as elevated household and public debt levels. These factors will continue to constrain private consumption and reduce fiscal policy flexibility. In addition, political uncertainty remains a key risk. Although a general election is scheduled for 2026, any lack of continuity in economic policy or slippage in fiscal discipline could undermine growth momentum and potentially affect Thailand’s sovereign credit rating. Taken together, these pressures suggest that Thailand will continue to operate below its potential growth rate over the medium term.

The Structural shifts shaping the future business and industrial landscape.

-

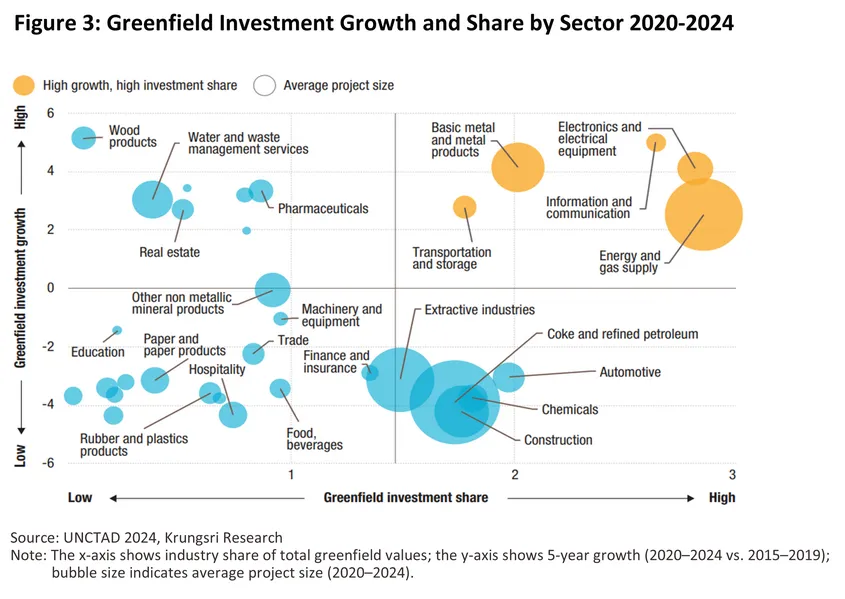

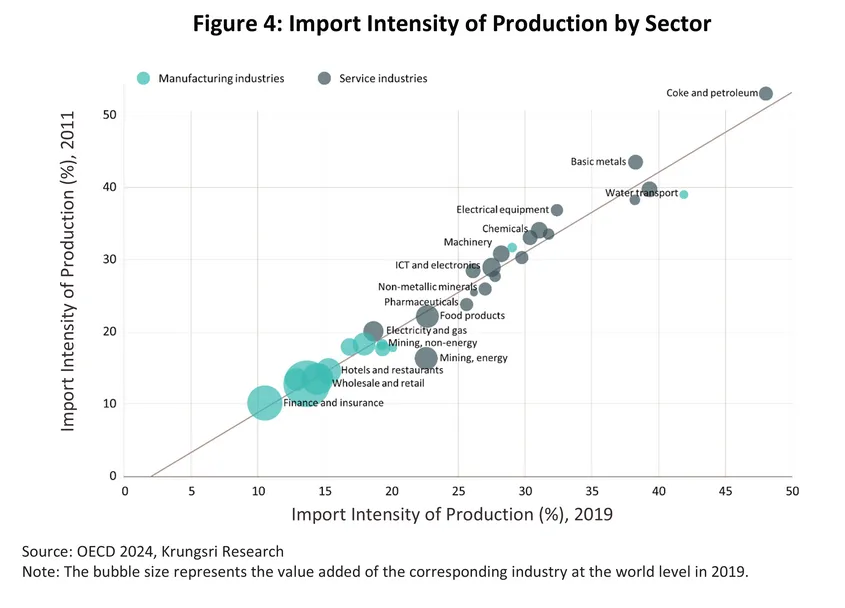

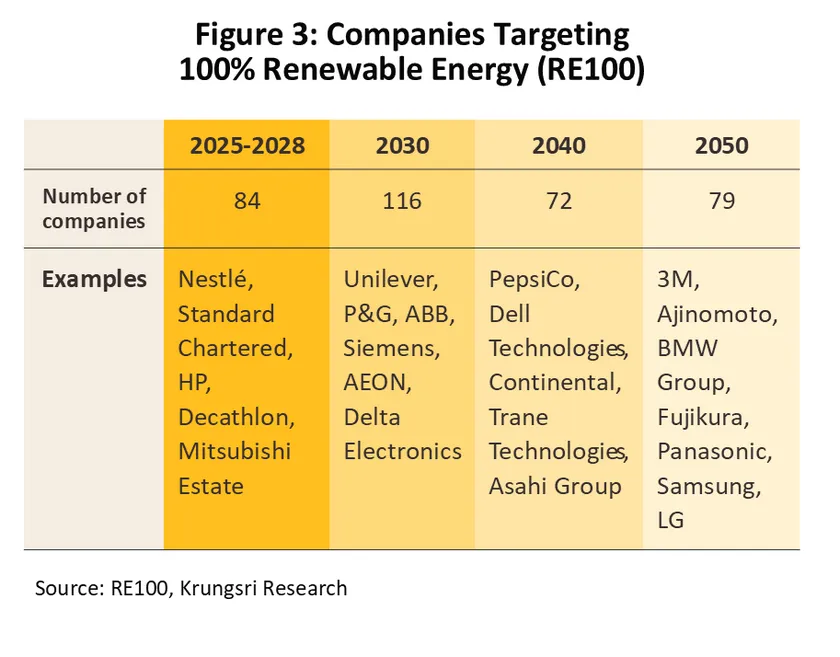

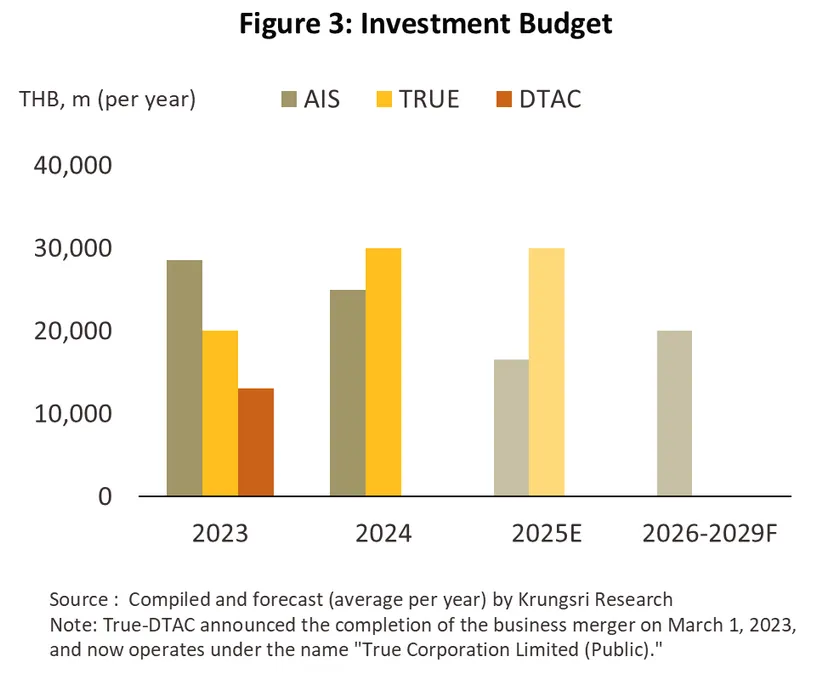

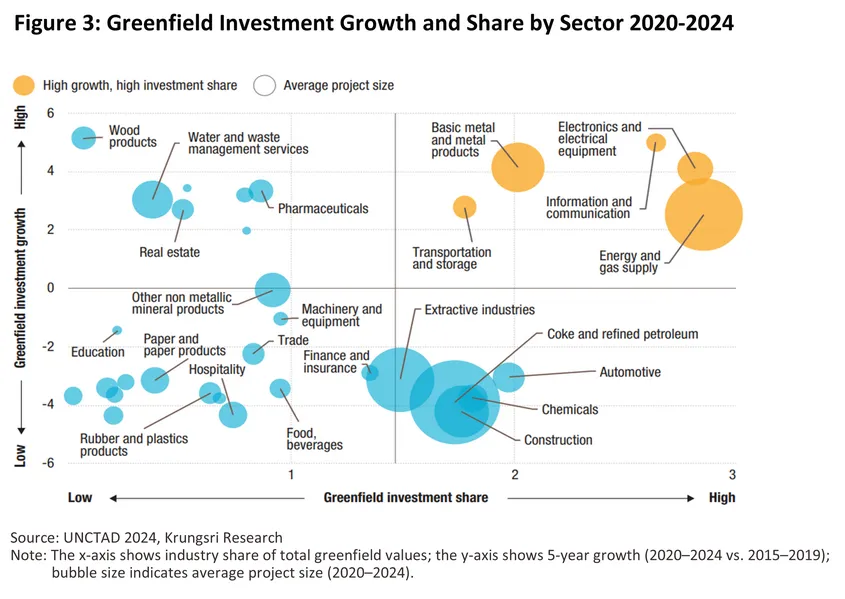

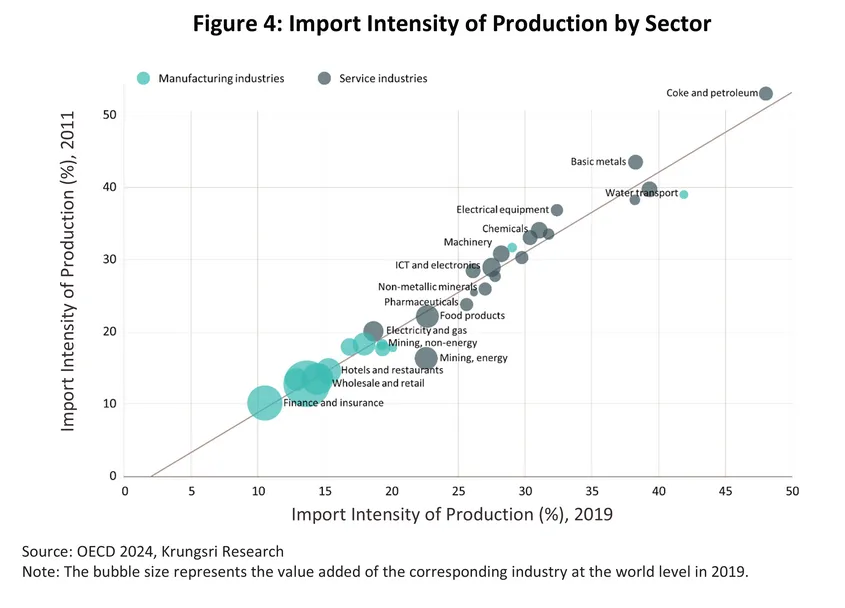

A sustainable-oriented supply chain with a stronger focus on upstream industries: Rising global economic uncertainty and persistent trade protectionism—particularly from the U.S.’s reciprocal tariff policies against multiple trading partners beyond China—along with recurring geopolitical conflicts, have heightened instability in global supply chains. These dynamics are prompting major economies to expand investment bases into developing Asian countries. High-potential industries attracting primarily new (greenfield) investments include modern, technology-driven, and sustainability-oriented sectors such as electronics, IT and digital services, clean energy, and advanced materials supporting smart devices and next-generation vehicles (Figure 3). Most of these industries are in the upstream segment of modern production chains, helping developing Asian countries become more self-reliant—whereas such upstream products previously relied heavily on imports. This trend aligns with the global supply-side adjustment observed even before the COVID-19 crisis, as reflected by the declining import intensity of production for these product groups between 2011 and 2019 (Figure 4). In the subsequent period, foreign direct investment (FDI) flowing into developing Asian countries, including Thailand, has continued to concentrate on upstream industries rather than downstream ones. China has rapidly emerged as a leading source of FDI, rivaling the United States amid intensifying technological competition.

Looking ahead, investment in upstream segments of the production value chain is expected to play an increasingly critical role for developing economies across Asia, to enhance sustainability and resilience amid mounting trade policy uncertainties and escalating technology rivalries.

-

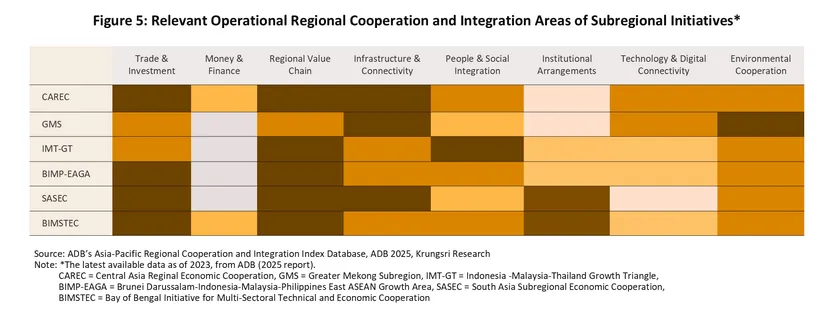

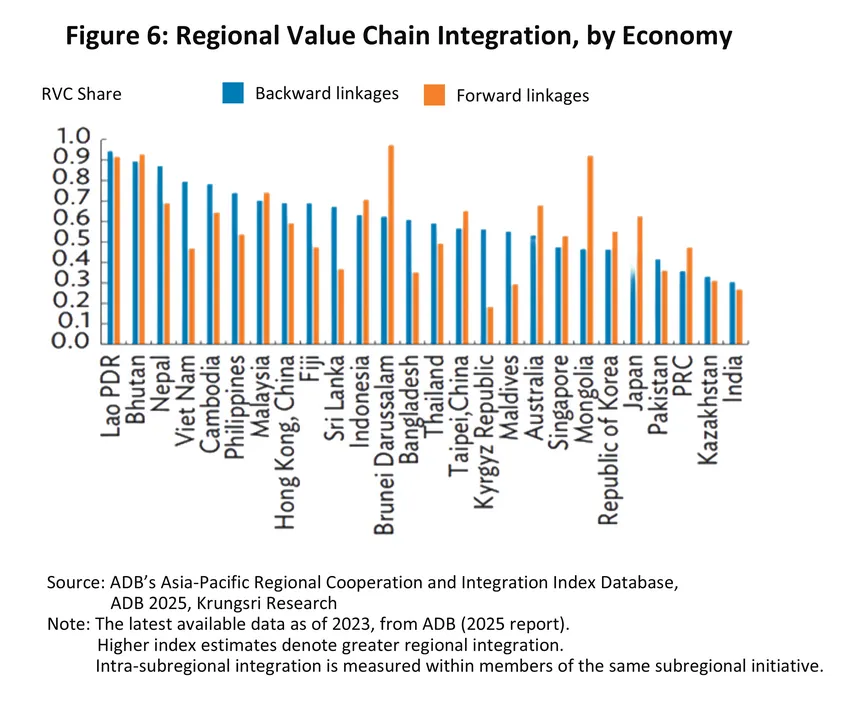

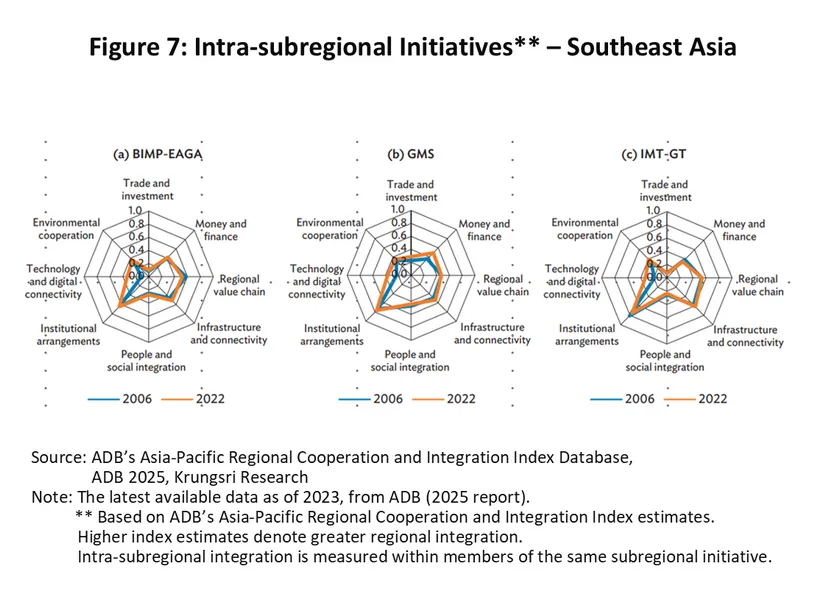

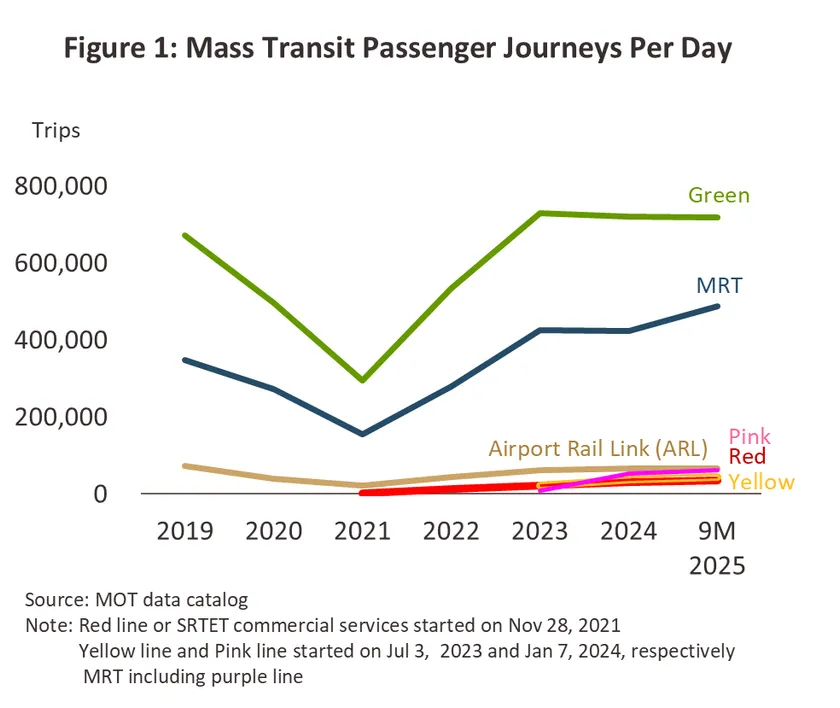

Building value chains through regional cooperation and integration (RCI): Regional alliances and integration are expected to become increasingly important to strengthen collective bargaining power and sustain competitiveness amid intensifying inter-regional trade protection measures. Such regional cooperation will primarily focus on reinforcing regional value chains (Figure 5). Beyond trade collaboration, this also requires broader cooperation in other key areas, including investment, infrastructure, logistics, and environmental management. In the case of Asia, current regional value chain alliances primarily focus on linking strategic industries, including semiconductors, IT and digital technologies, clean energy equipment, medical products, and basic raw materials. The cooperation model emphasizes strengthening the production base in upstream industries (Figure 6). Nevertheless, while trade, investment, and physical infrastructure remain the core pillars of regional cooperation to enhance collective competitiveness, future collaboration is expected to increasingly emphasize technology and digital connectivity within the region. This trend is particularly evident in ASEAN, where cooperation in these areas among member countries has expanded in recent years (Figure 7). Such initiatives aim to support investment in emerging, technology-intensive industries, focusing primarily on fiber-optic telecommunications networks, cross-border data exchange, and other joint digital projects. However, cooperation in this area remains relatively limited, as it is still in the early stages of development.

In the context of the ASEAN Summit 2025, held in late October 2025, discussions emphasized the expansion of digital cooperation among member states. Key priorities included integrating cross-border e-commerce and digital payment systems, enhancing data interoperability, and establishing AI standards to strengthen ASEAN’s readiness for a fully integrated digital economy.

-

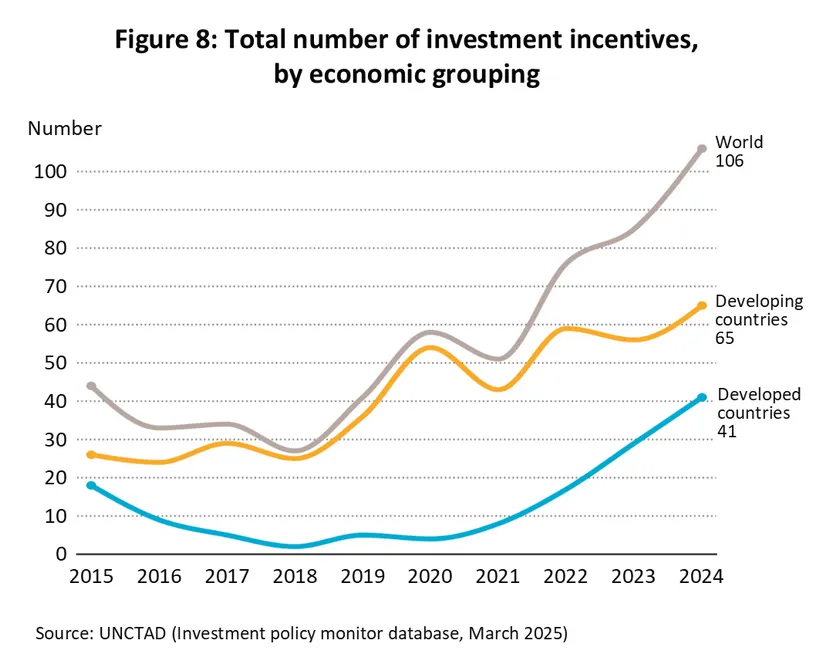

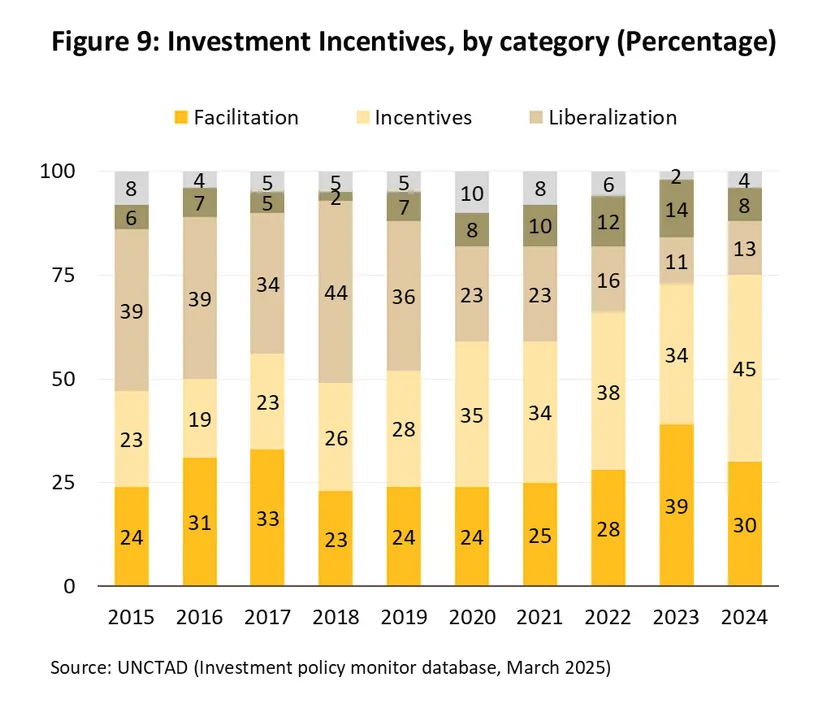

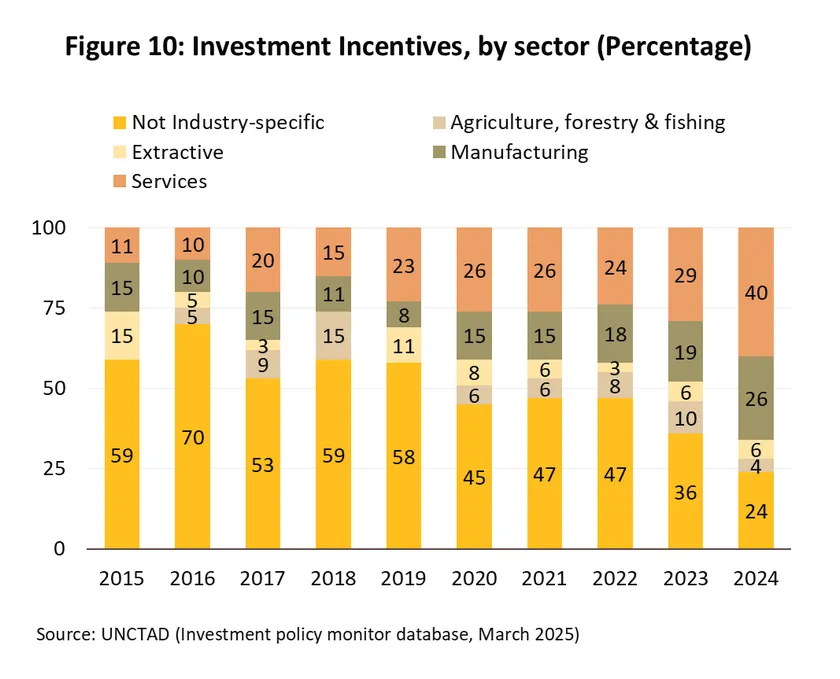

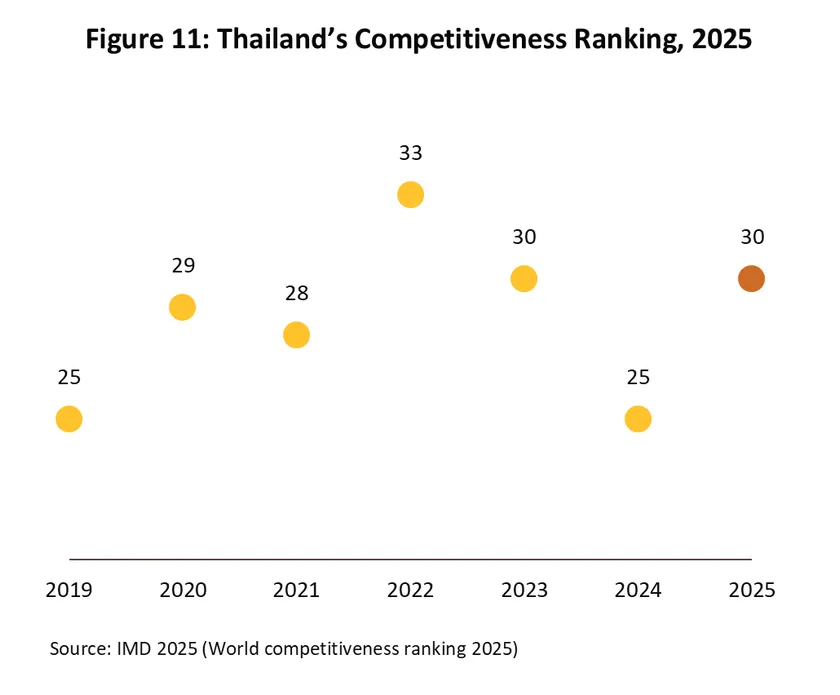

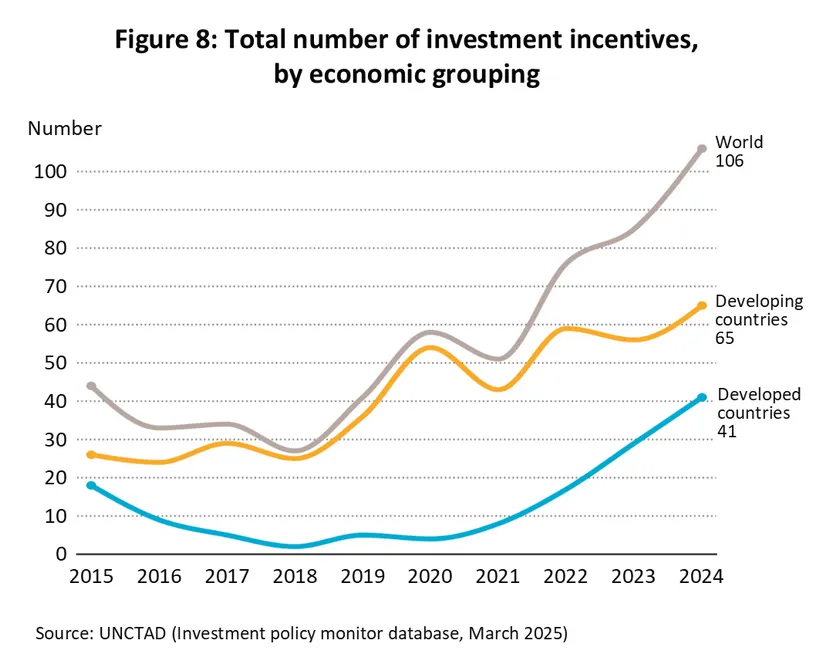

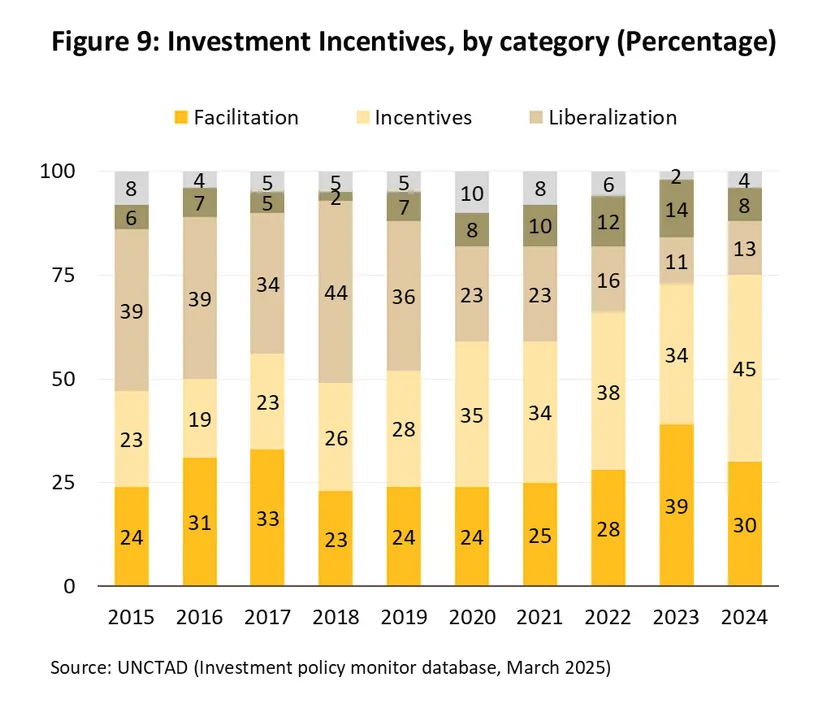

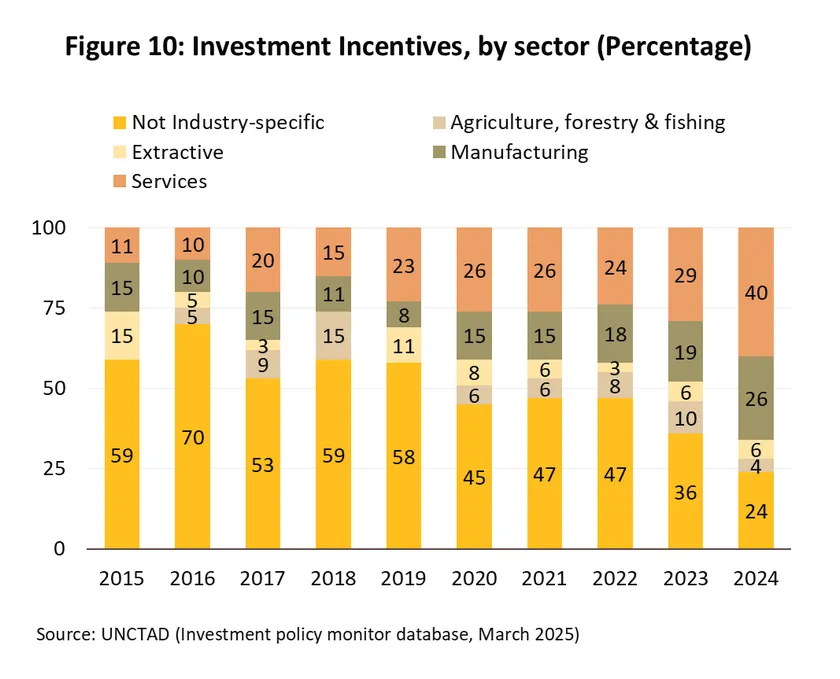

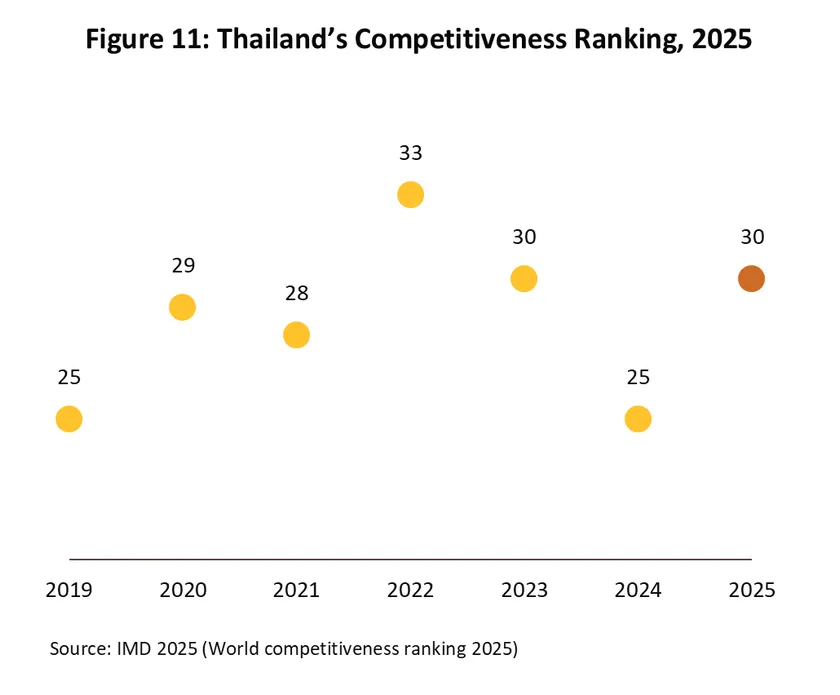

An intensifying investment incentive war to attract investment (Investment incentive war): With major global powers increasingly retreating behind trade barriers, economies that are dependent on their manufacturing base (and especially those in Asia) are having to fight ever more fiercely to attract investment inflows. Countries that find themselves engaged in this new ‘war’ are thus being forced to fight for space using an ever-growing list of tax breaks and financial inducements; data on the incentives offered by developing and newly industrialized countries (Figure 8) shows a global trend towards expanding tax holidays, rate reductions and extensions of preferential periods for investors in both the manufacturing and service sectors (Figure 9 and Figure 10). This race to the bottom is the backdrop to the Organization of Economic Cooperation and Development’s (OECD) decision to introduce the Global Minimum Tax (GMT), which requires participating nations to impose a minimum 15% tax on multinational enterprises with an annual turnover in excess of EUR 750 million. The tax is being rolled out over 2024 and 2025 according to countries’ individual circumstances, but it is hoped that this will help to level the playing field and to promote fairer competition between nations. However, although the GMT should help to deescalate the war over investment incentives, competition between nations to attract investment inflows will continue. In the particular case of Thailand, declining competitiveness will have a strong impact on future policy decisions. Thus, in the 2025 IMD World Competitiveness Ranking, Thailand slipped to 30th position, down from 25th a year earlier (Figure 11), with declines seen in: (i) economic performance (from 5th to 8th), (ii) infrastructure (from 43rd to 47th), (iii) business efficiency (from 20th to 24th), and (iv) government efficiency (from 24th to 32nd). This will therefore likely mean that as it competes on the world stage, the country will have little option but to continue to lean heavily on the use of investment-promotion tools.

-

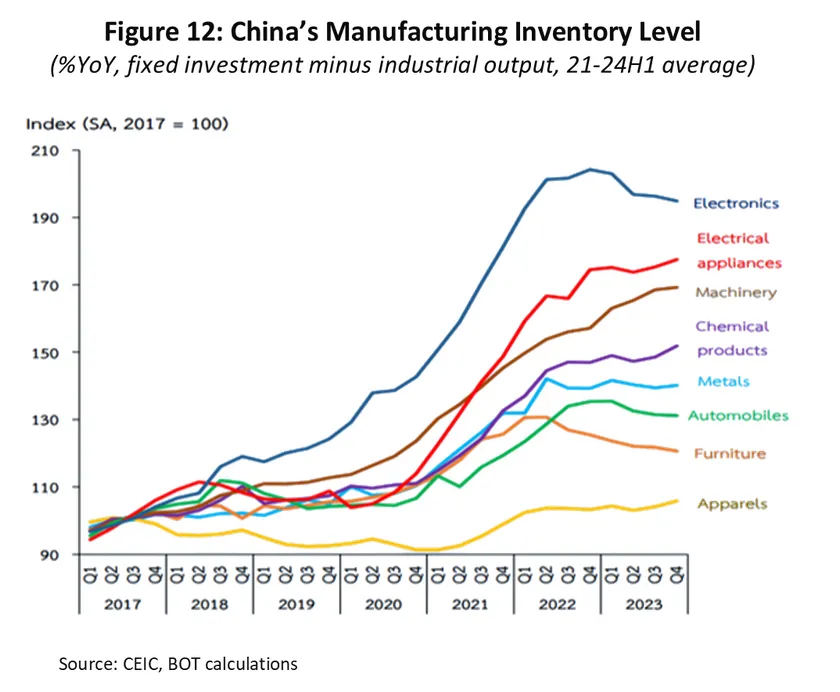

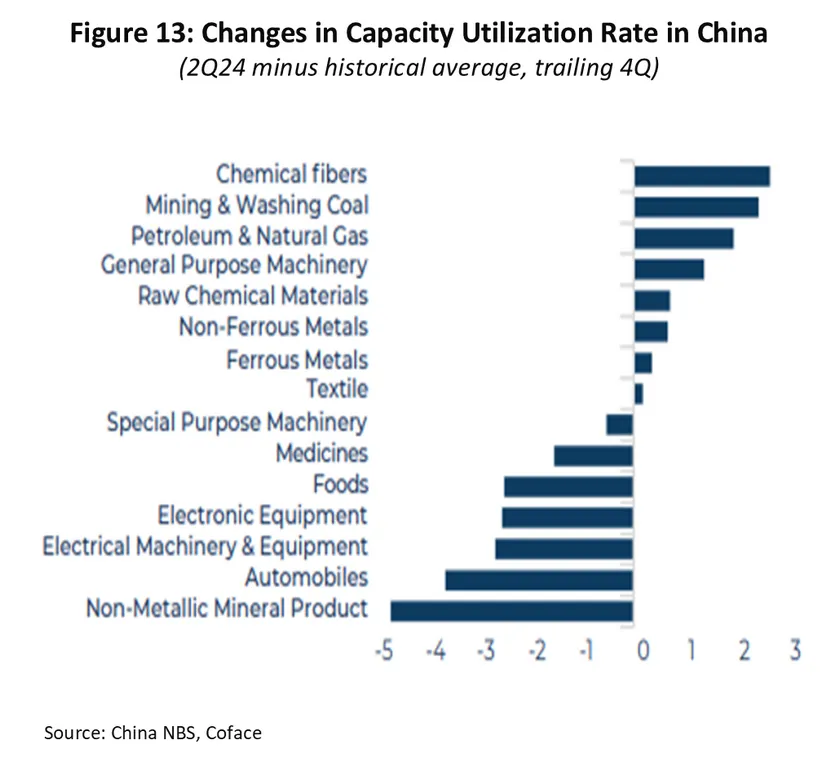

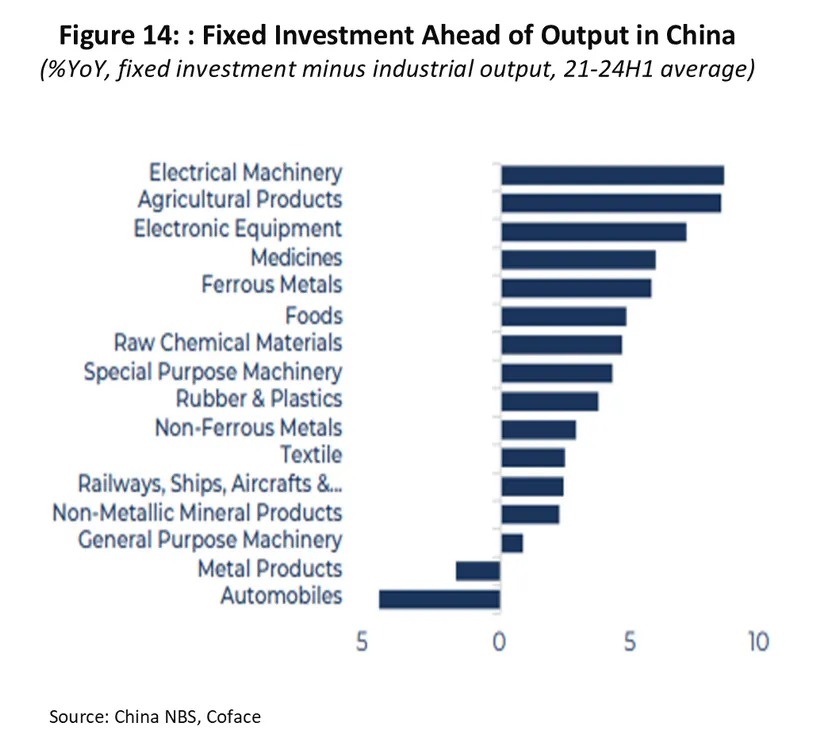

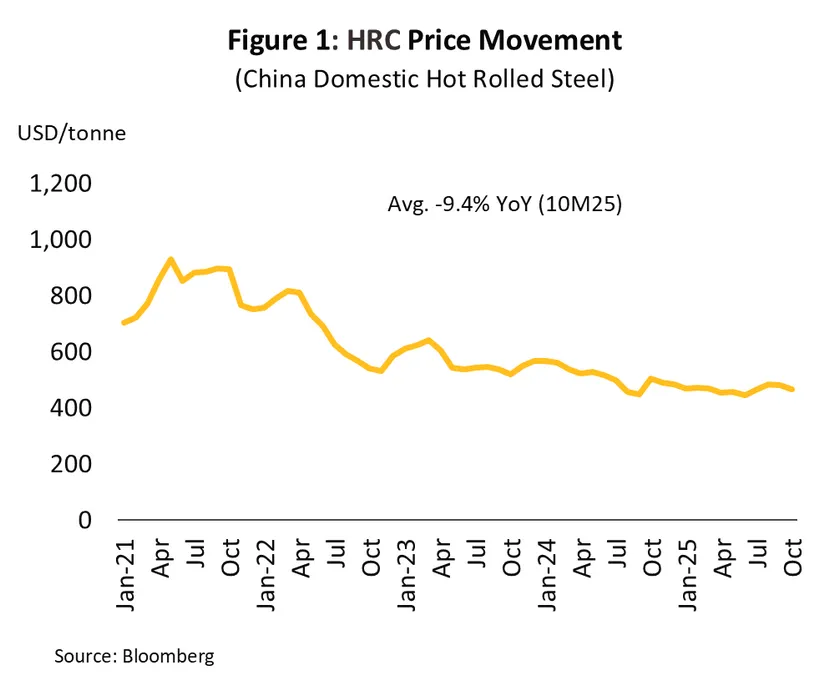

Chinese overcapacity and pressure on local markets: The surge of Chinese goods released to offload excess supply continues to exert pressure on local products around the world. The extent of Chinese industrial overcapacity can be seen in the steady run up in domestic inventories (Figure 12). This aligns with a decline in the capacity utilization and an excess investment in fixed assets. These imbalances are especially clear in technology-intensive parts of the economy, including electronics, EV production and their components, and electrical machinery. It also extends into food processing, pharmaceuticals, and certain chemical products (Figure 13 and Figure 14). This differs from earlier periods, when Chinese overcapacity was largely restricted to the production of commodities (e.g., textiles, steel, and aluminum). Combined with its significant economies of scale and mounting pressure from the intensifying US-China trade war, China has accelerated the export of these excess goods to global markets. As a result, many countries have imposed tariffs to protect their domestic industries. Notably, the US raised import tariffs on Chinese EVs to 102.5%, up from 27.5% (effective September 27, 2025), while the EU increased tariffs on Chinese EVs by 7.8–38.1%, up from 10% (effective July 4, 2025). In addition, both anti-dumping and countervailing duties have become more stringent, particularly on commodities such as metals and plastics.

Going forward, Thai businesses will face two key challenges. (i) The influx of low-cost goods from China will continue to weigh on local manufacturers, especially SMEs that struggle to achieve economies of scale. In addition, there are rising concerns over problems with transshipments, in particular with regard to both Chinese players using Thailand as a re-export base for Chinese goods and the possibility of Thai manufacturers becoming excessively reliant on inputs and materials sourced from China. In either case, there is a risk that US authorities could decide that Thai companies are guilty of ‘origin circumvention’, which would then open them up to potentially harsh retaliatory measures. (ii) China’s relocation of production bases to ASEAN countries, including Thailand, to offload its industrial overcapacity may create opportunities to strengthen certain supply chains but also poses risks to existing domestic industries that cannot compete on costs. Moreover, if Thailand serves merely as an assembly hub dependent on Chinese parts and labor, the benefits to the local value chain will remain limited.

-

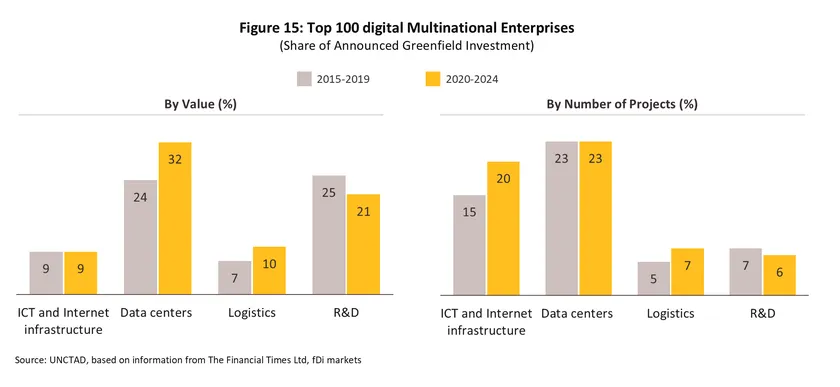

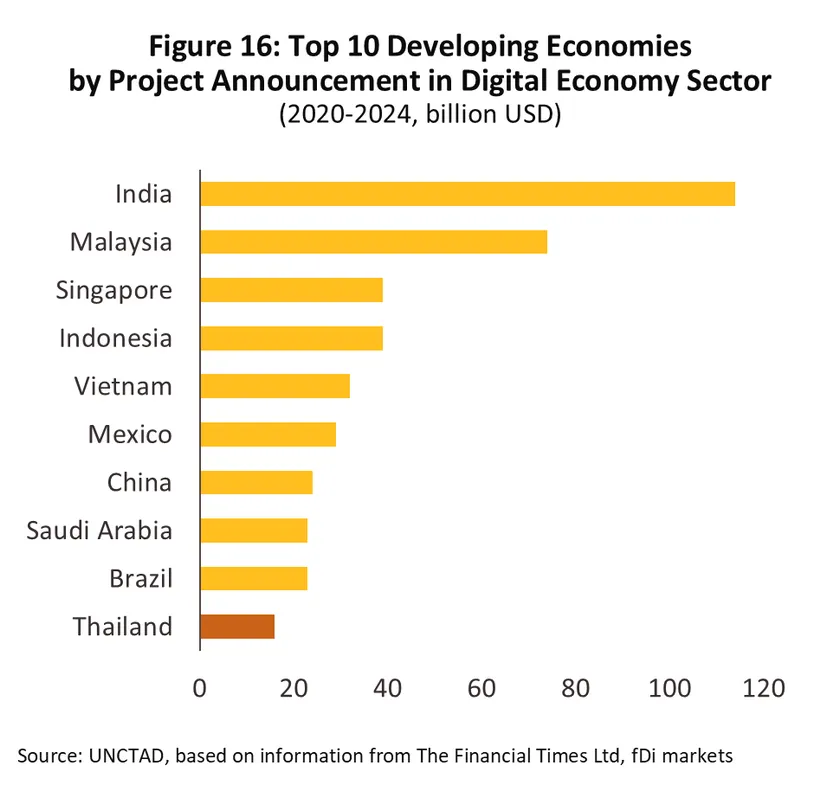

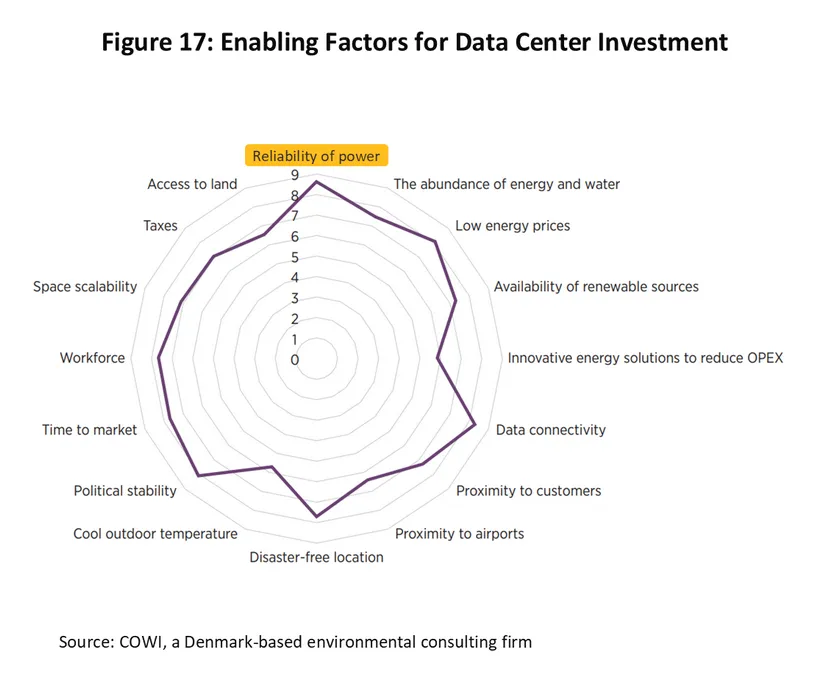

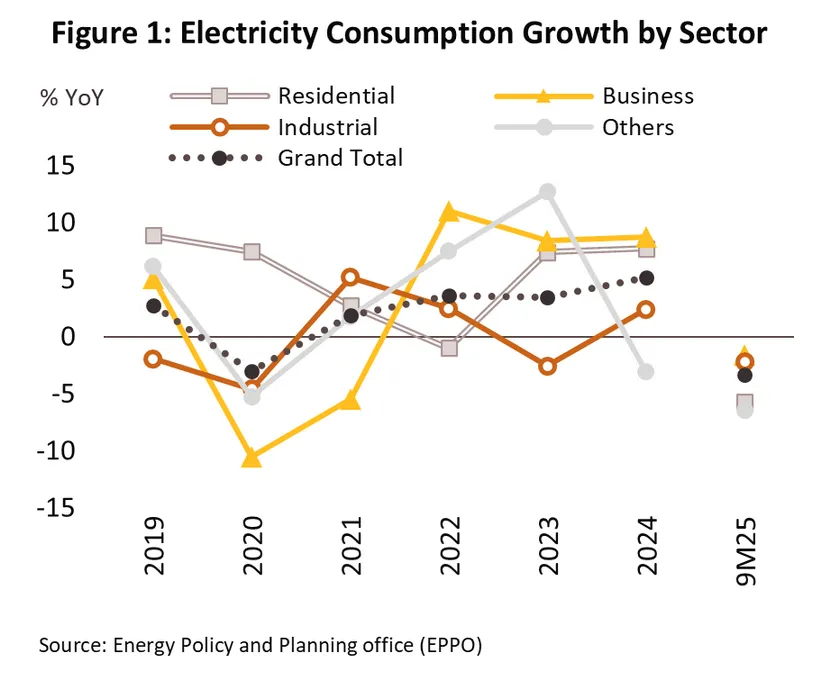

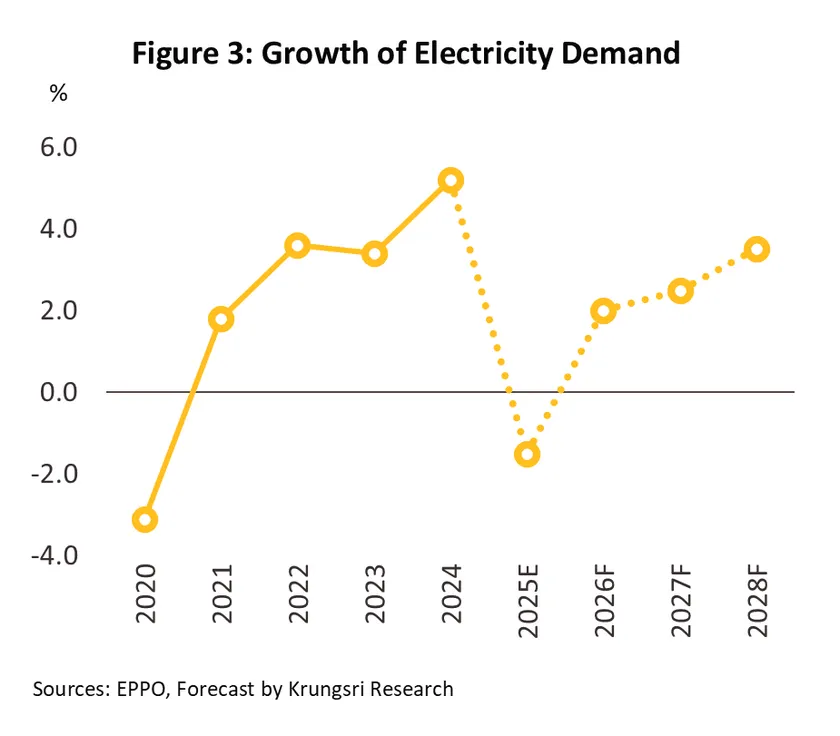

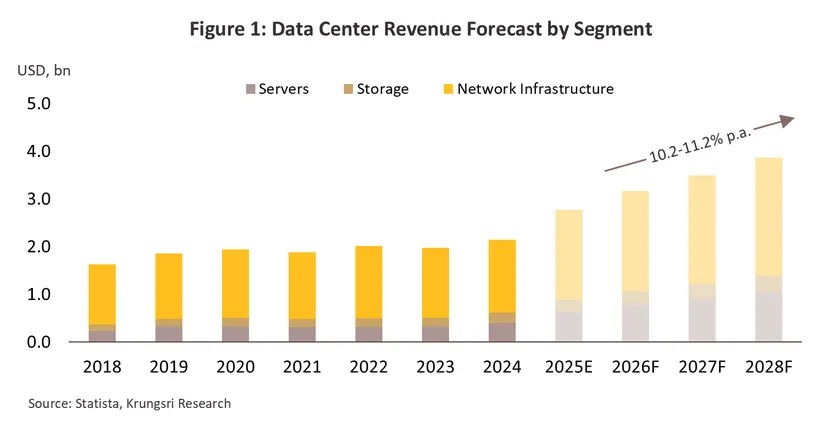

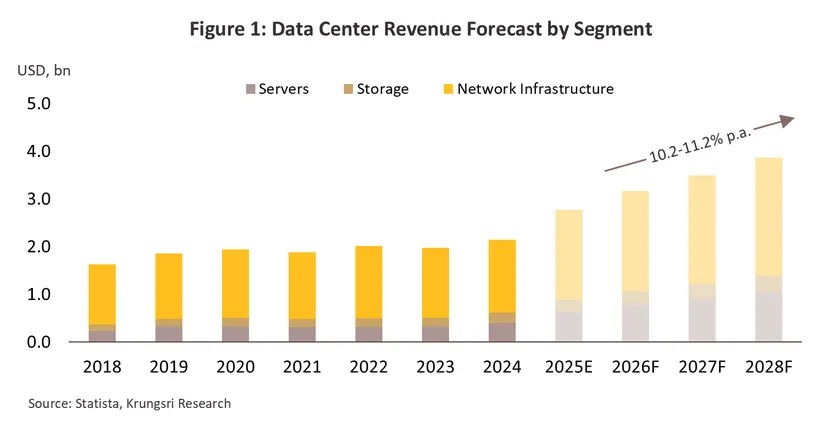

The digital economy as a key driving force behind modern industrial development. Although global foreign direct investment (FDI) has shown signs of deceleration, digital investment continues to expand at an average annual rate of 10–12%, exceeding the growth rate of global GDP. In particular, investment in data center businesses has recorded a higher number of projects and investment value than other new (greenfield) investment projects by multinational corporations in developing countries during 2020–2024 (Figure 15). During this period, Thailand ranked among the top 10 countries with the highest value of data center investment under multinational corporations’ investment plans (Figure 16) (Source: UNCTAD, 2025). Such investment aims to drive new technologies such as AI, cloud computing, and big data analytics, while supporting upstream industries such as electronic devices, semiconductor components, and digital infrastructure, as well as e-commerce businesses to strengthen supply chains in advanced technology industries, including smart electronics, next-generation vehicles, and digital services, in line with Thailand’s targeted industrial strategy. However, alongside these investment opportunities, operational challenges remain, particularly the adequacy of energy supply, which is a critical enabling factor for the success of data center investment (Figure 17). The industry requires clean energy to align with sustainability goals aimed at achieving a fully green society in the future. Yet, Thailand’s renewable energy supply still needs further development to reach sufficient levels that can reduce the unit cost of electricity. Achieving this goal also faces obstacles, including the increasing severity of climate change, such as natural disasters, and delays in establishing clear regulatory frameworks to implement direct power purchase agreements (Direct PPAs) in a timely and practical manner.(Source: Direct PPA: A New Opportunity to Enhance Business Sustainability in Thailand, Krungsri Research, 2025).

-

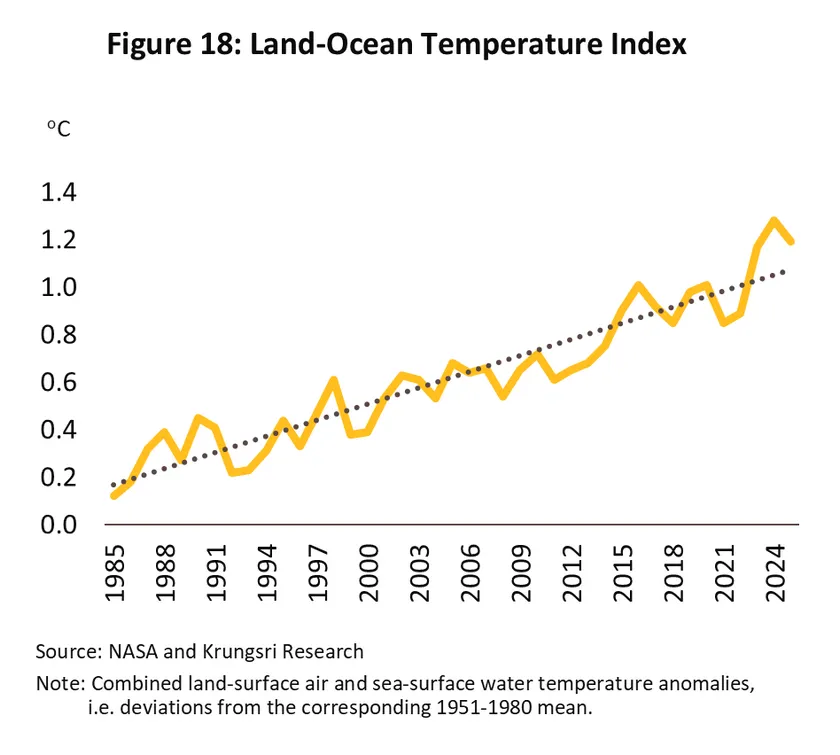

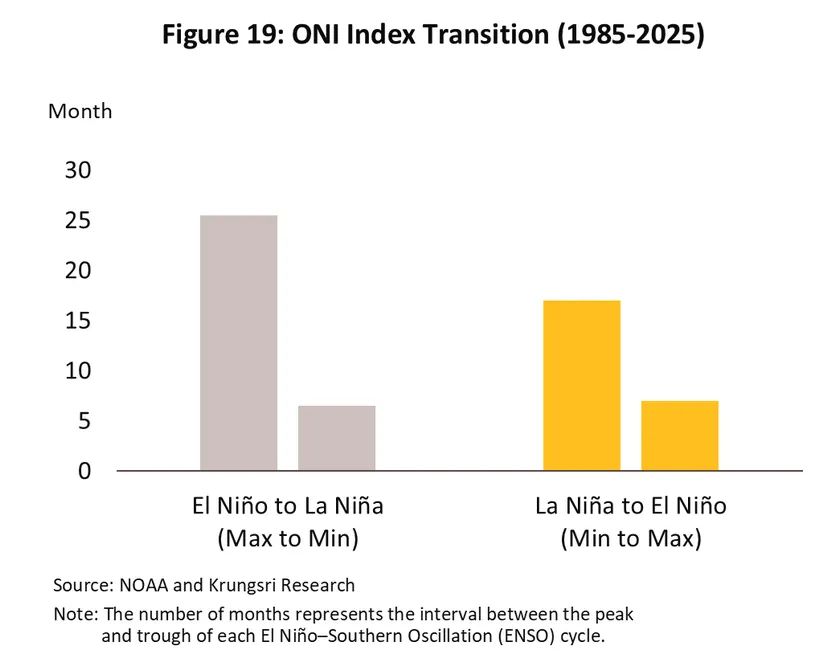

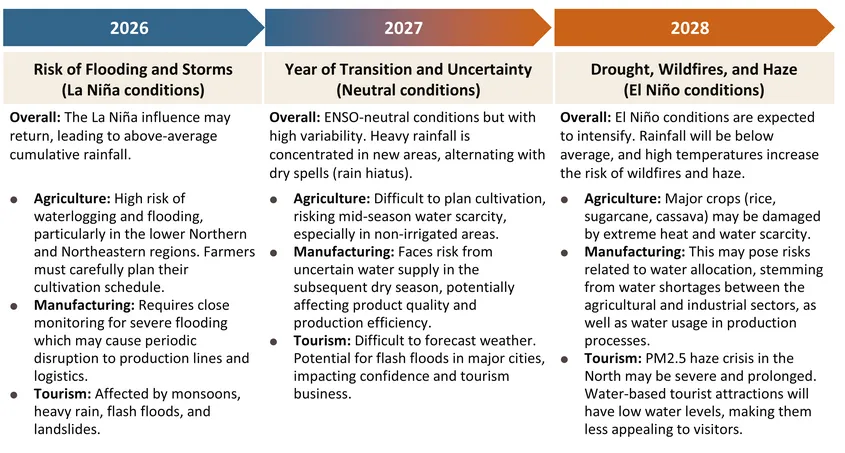

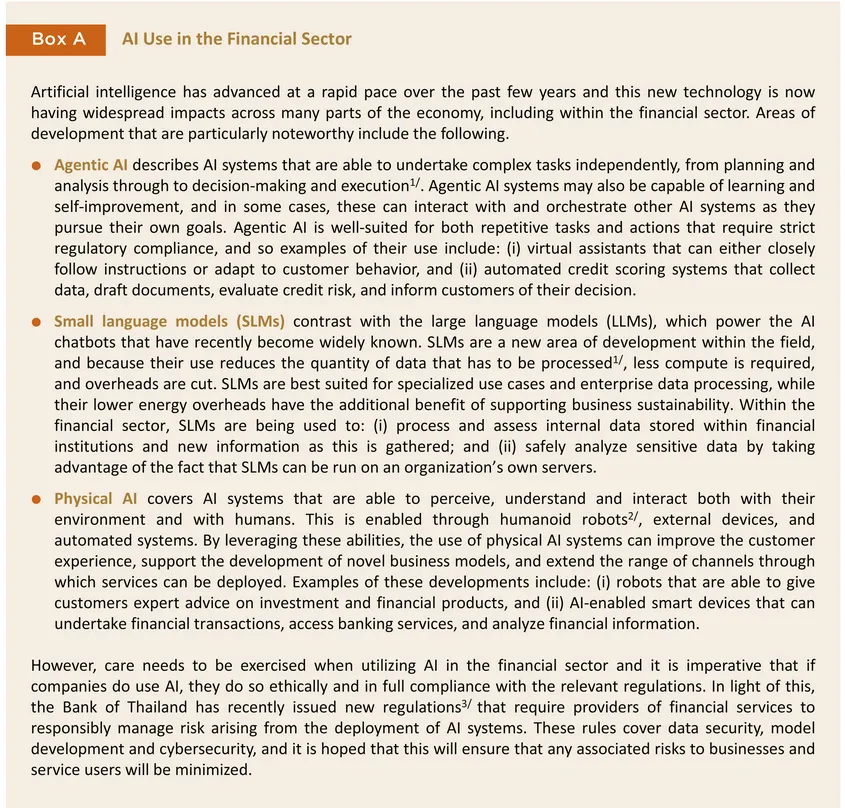

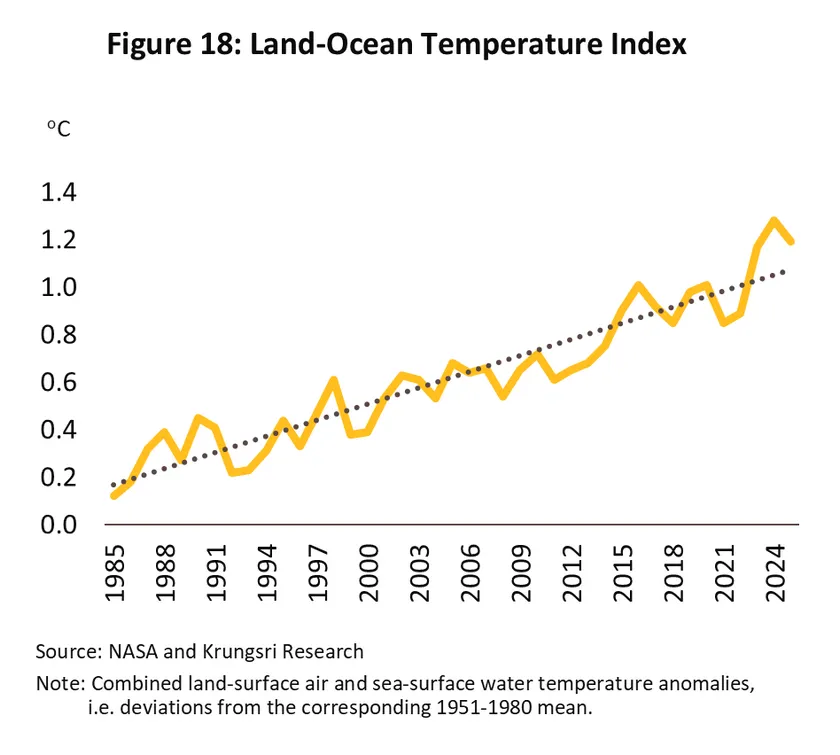

Global climate disruption (GCD), stemming from the shortening cycle of La Niña and El Niño events: The increasing intensity of climate variability due to the accumulation of greenhouse gases in the atmosphere, is not only driving a continuous upward trend in global temperatures (Figure 18) but is also a phenomenon that is currently destroying the balance of the Earth's hydrological cycle. The disruption manifests as a rapid acceleration in the cycle of water evaporation and condensation into rain. The effect of greenhouse gases allows the atmosphere to absorb significantly more moisture before releasing it as severe heavy rainfall (flooding), while simultaneously accelerating the rate of water evaporation (drought). This trend is consistent with the Oceanic Niño Index (ONI) values over the past 40 years (1985-2025), which indicate that the interval between an El Niño event and a subsequent La Niña event has decreased to only 6–8 months (2002-2025) from the previous 24–26 months (1985-2001). Similarly, the interval between a La Niña event and a subsequent El Niño event has also decreased to 6–8 months from the previous 16–18 months (Figure 19).This signifies an alarming risk of extreme, alternating fluctuations between "flooding" and "drought" occurring over shorter timescales and with greater severity.

Between 2026 and 2028, Thailand is likely to face GCD that could severely damage the public and economic sectors. Krungsri Research has assessed the potential impacts of GCD across various industries, from the agricultural sector to related downstream industries, as follows:

- The silver economy and growing wellness trend driving the expansion of modern health-related service value chains.

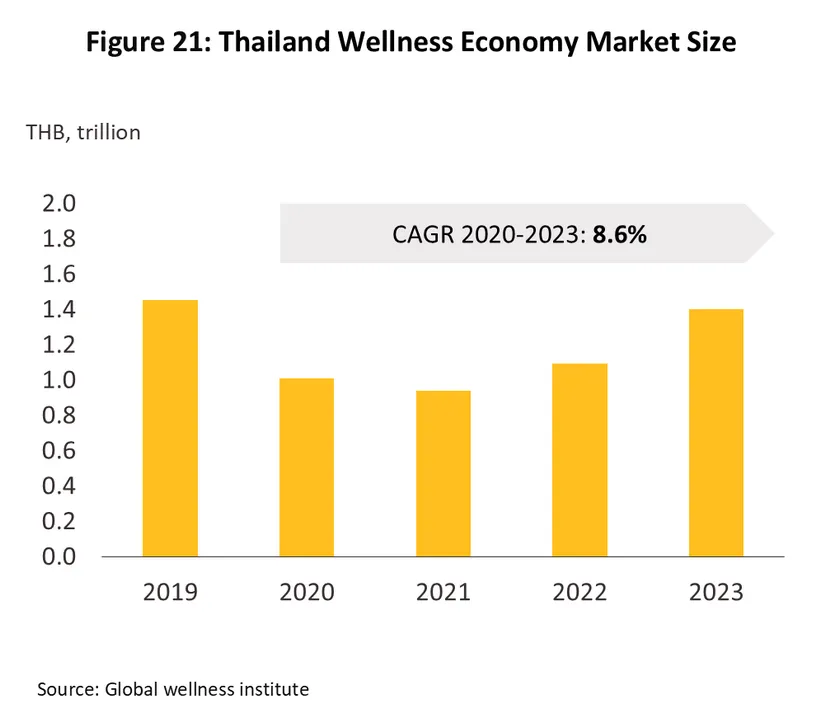

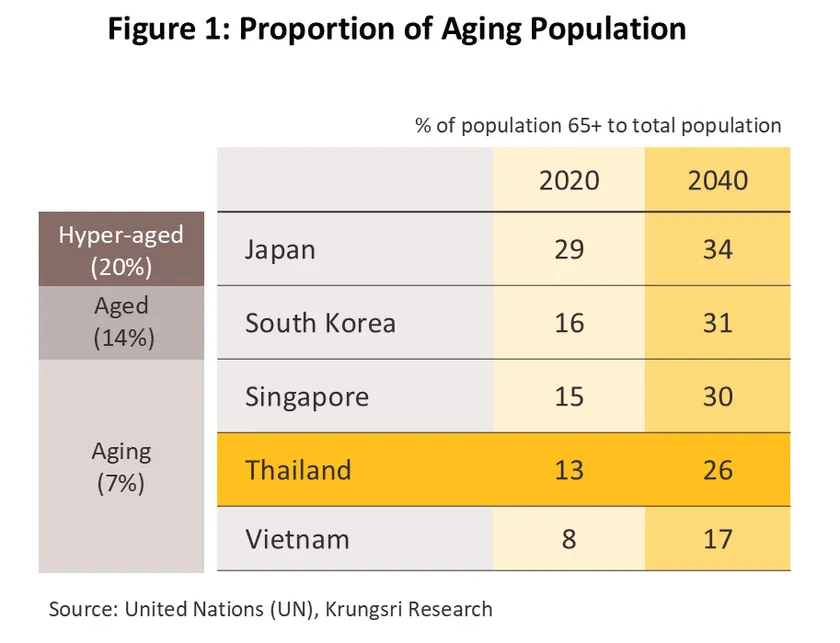

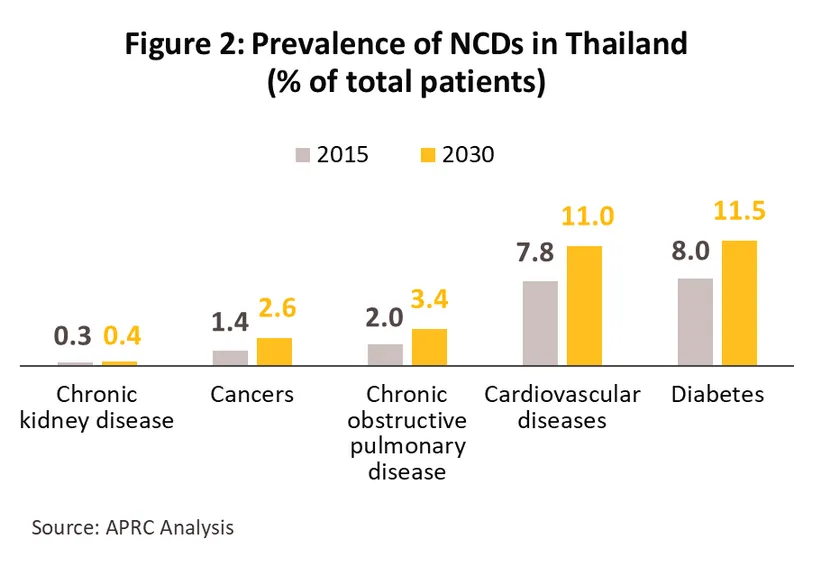

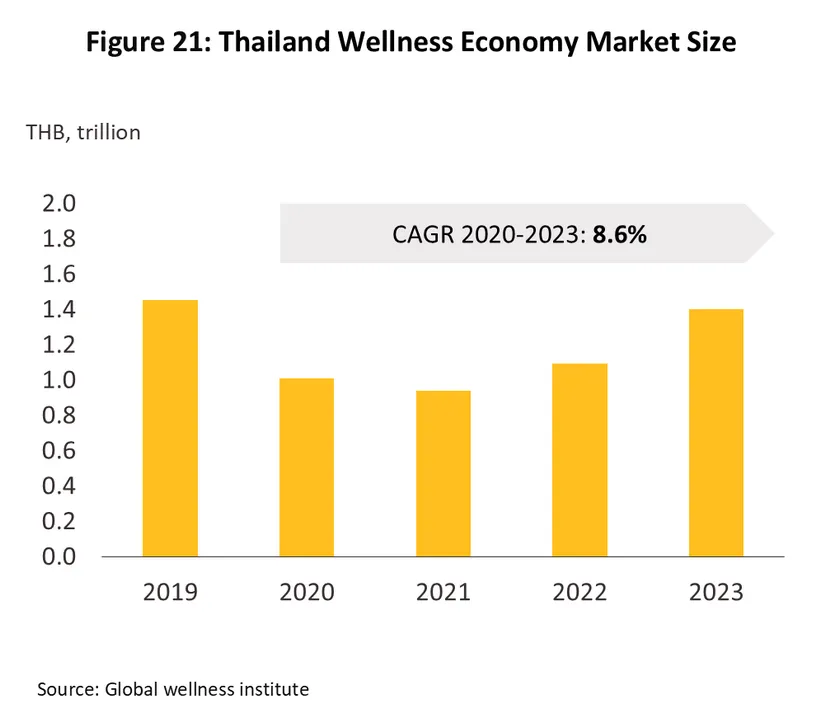

The aging of societies is boosting the development of the ‘silver economy’, while growing demand for health, financial, residential, technology and tourism services targeting the elderly will generate both opportunities and threats for businesses worldwide. On present trends, the global population of over-65s will more than double between 2024 and 2054, rising from the current 0.83 billion to 1.7 billion over this period, with over 1 billion of these in Asia. The latter will thus comprise a major market and businesses targeting this demographic will see opportunities multiply, especially in areas related to healthcare. In line with this, the worldwide value of the silver economy will surge from USD 2.8 trillion in 2024 to USD 5.5 trillion by 2033, which would translate into annual growth of 7.9%4/. These trends are also adding to demand for wellness services, and businesses targeting the silver market will increasingly integrate these into their offerings. As a result, the wellness economy, which encompasses holistic healthcare, physiotherapy and rehabilitation, and lifestyle services, will see strong growth, and the total market should thus expand from a value of USD 6.8 billion in 2024 to USD 9.8 billion by 2029, or by 7.6% annually.

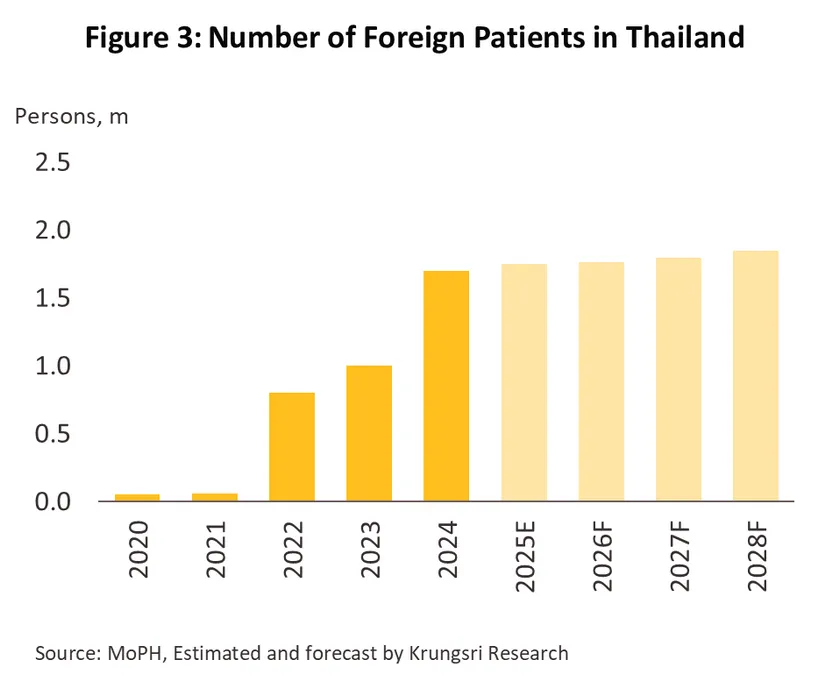

Thailand is on track to become a super-aged society (i.e., at least 25% of the population will be over 60) by 2030, and this will then expand opportunities within the healthcare and wellness value chain. As of 2023, the market for these services was worth USD 40.5 billion, a 28.4% jump from a year earlier, but within this, health and medical tourism has particular potential for growth given the government push to establish Thailand as an international medical and wellness hub. This is being achieved through support for traditional Thai massage, Thai herbal medicines, health tourism, the manufacture of medical devices and advanced therapy medicinal products (ATMPs), personal health and beauty treatments, wellness real estate (forecast to grow by 15% annually), and health foods, which are increasingly popular thanks to their protective effects. The government is also supporting the industry through tax incentives targeting investors in medical services, healthcare, and health-product R&D. Nevertheless, the industry will have to face a number of challenges, including the high cost of medical technology, which will drag on spending and investment by SMEs, intensifying competition from domestic and international players, and a shortage of skilled professionals, including physicians, nutritionists, and wellness specialists. In light of these problems, businesses will need to act proactively, embrace innovation, and invest in capability development if they are to sustain long-term growth.

-

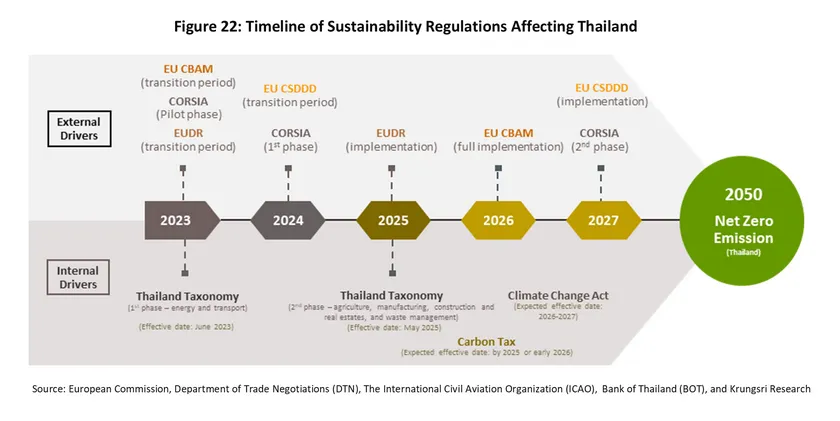

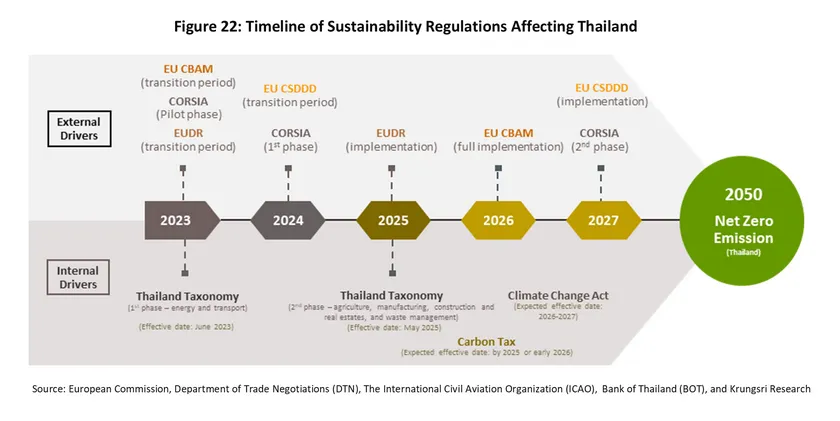

The need to meet net zero goals will both necessitate a change in business operations and add to overheads as environmental regulations tighten and extend to include responsibility for social and environmental issues across supply chains. At present, regulations in this area can be split into the following two groups.

-

Measures that require companies to report their carbon emissions and pay a carbon price include: (i) The EU’s Carbon Border Adjustment Mechanism (CBAM), which came into force in October 2023, covering six product groups—cement, electricity, fertilizer, iron and steel, aluminium, and hydrogen. Exporters of these will need to pay a carbon fee starting in 2026. Other countries, including the UK, Australia and Canada, are also considering implementing their own CBAMs; (ii) The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), which will become mandatory from 2027 onwards, adding costs for the international aviation industry.

-

Measures that require companies to ensure the sustainability of their operations across supply chains include the EU Deforestation Regulation (EUDR) and the EU’s Corporate Sustainability Due Diligence Directive (CSDDD), which will be fully implemented within the next 1-2 years. In particular, the CSDDD is expected to be adopted by other jurisdictions (e.g., Norway and the state of California), which will then require companies selling into these markets to comply with the new regulatory requirements.

Thai businesses are expected to face increasingly stringent domestic regulations in line with global trends and Thailand’s newly revised net zero target for 2050 (moved forward from 2065). These include:

-

Mandatory mechanisms: The government is in the process of drafting the Climate Change Act, which will require companies to report their greenhouse gas emissions. It also aims to accelerate the introduction of mandatory carbon pricing instruments, including a carbon tax (initially on oil products) and an emissions trading scheme (ETS), particularly for carbon-intensive industries such as cement, metals, and petrochemicals.

-

Voluntary mechanisms: The authorities have introduced the Thailand Taxonomy, which defines criteria for environmentally sustainable economic activities. The current version covers six sectors—energy, transport, agriculture, manufacturing, real estate, and waste management—encouraging businesses in these sectors to align their operations with the Taxonomy. Doing so will help maintain competitiveness and enhance access to sustainable finance.

Krungsri Research assesses that both global and domestic sustainability measures will present both challenges and opportunities for Thai businesses. Key challenges will stem from rising costs related to: (i) measuring, reporting and verification (MRV) and conducting due diligence; (ii) paying carbon prices; and (iii) transitioning to more sustainable business processes. Firms that adapt more quickly than their peers will benefit from greater opportunities in trade, investment, and access to ESG finance. Meanwhile, businesses operating in sustainability-related fields such as MRV services, sustainability consulting, and climate tech will gain from the growing drive toward net zero across all sectors.

Thai businesses therefore need to recognize the importance of these developments and accelerate their transition toward sustainable practices to stay competitive in a global economy increasingly shaped by environmental imperatives.

Changes to policies and regulatory frameworks and their impact on businesses

-

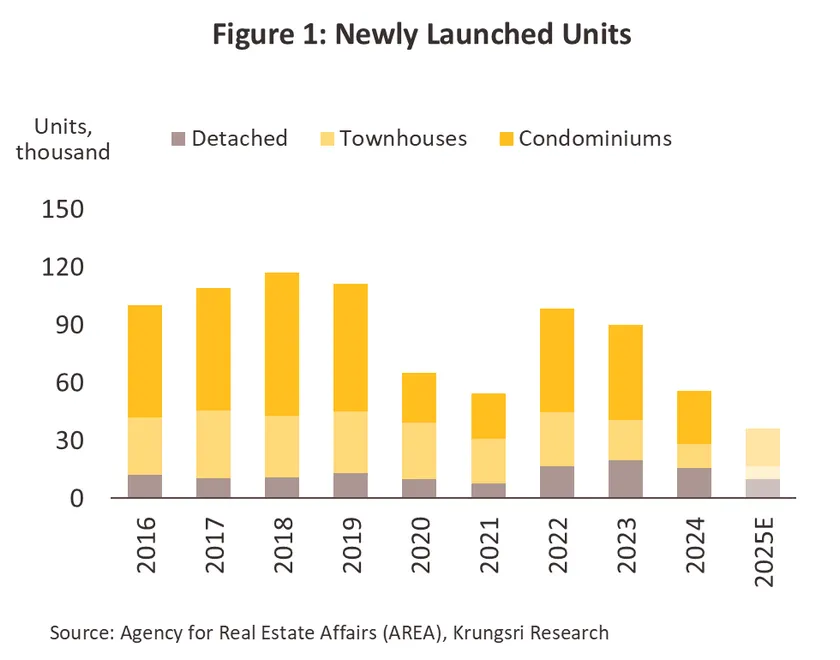

Real estate

-

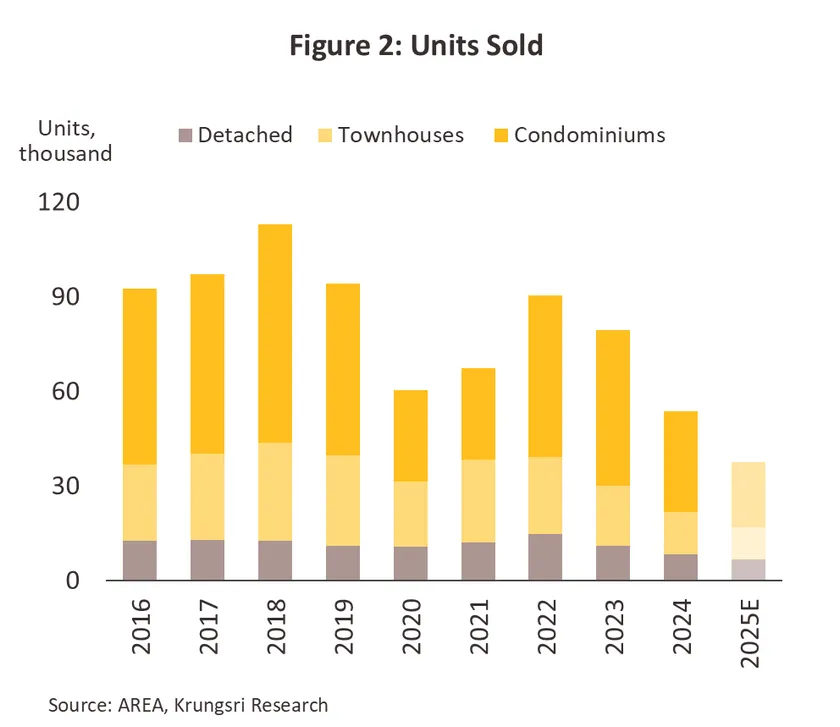

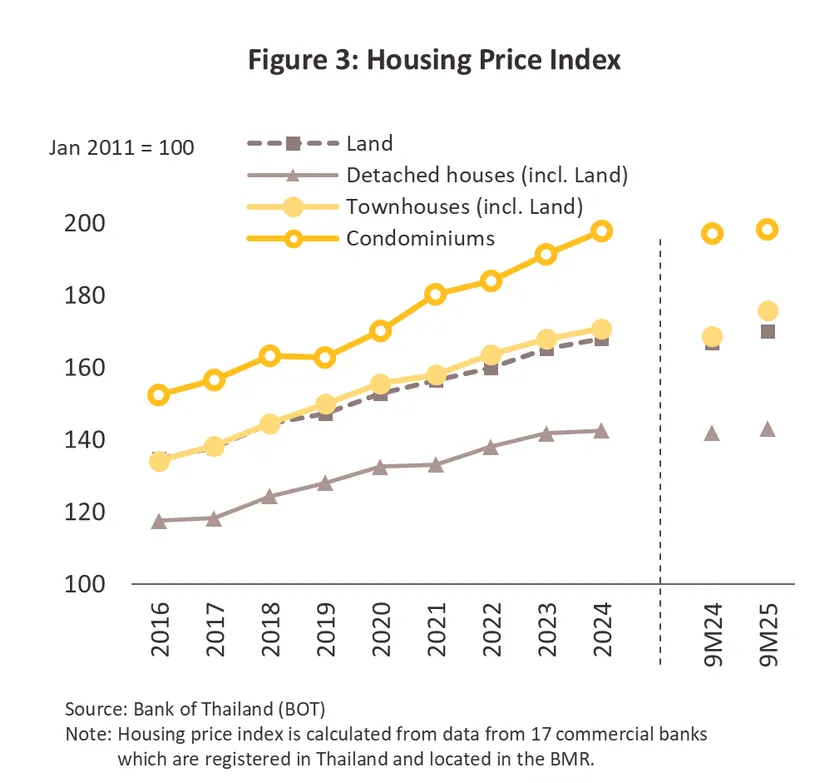

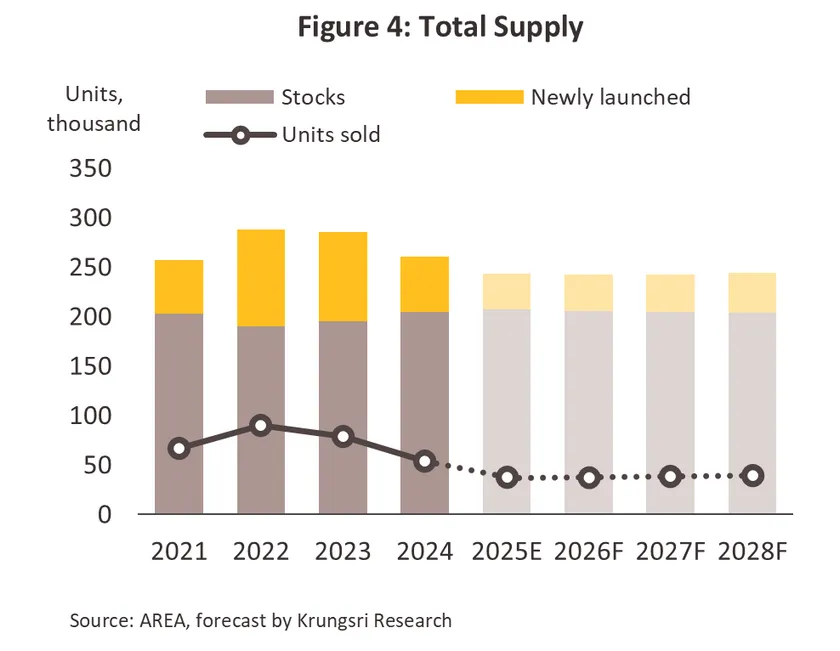

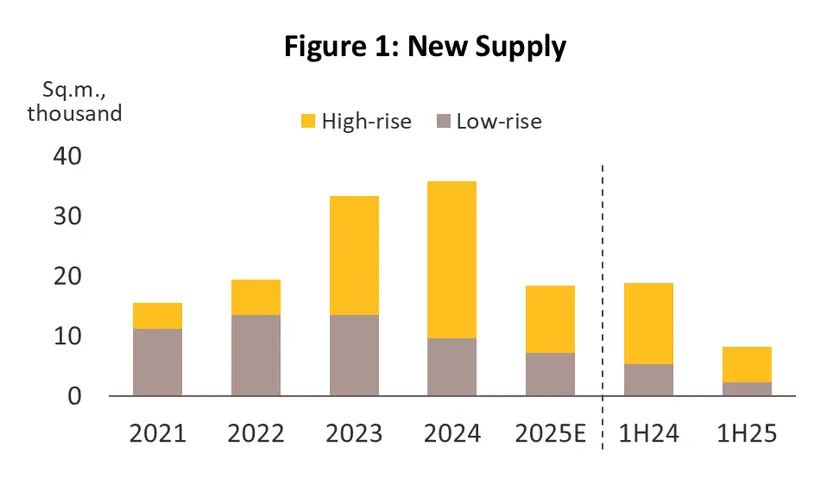

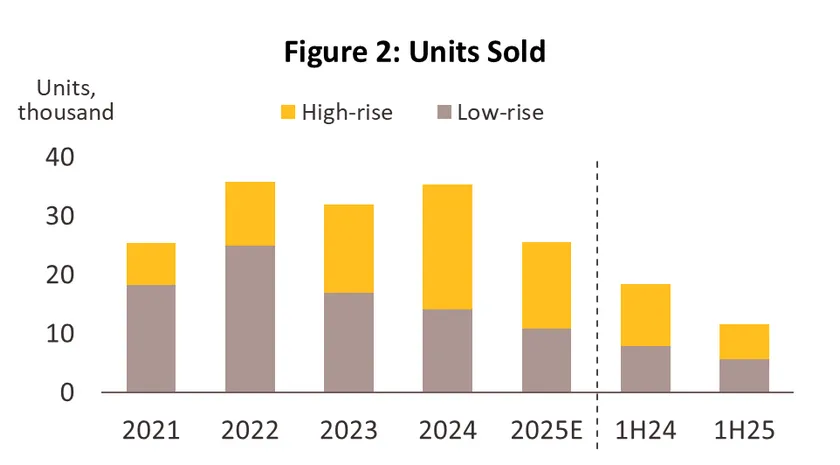

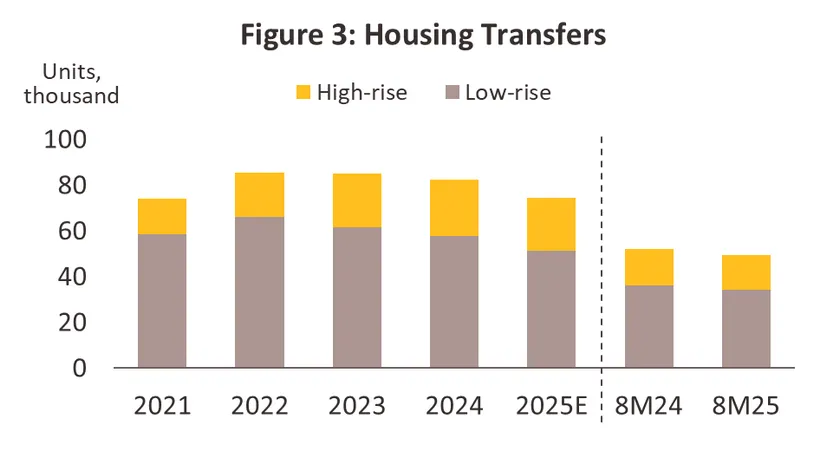

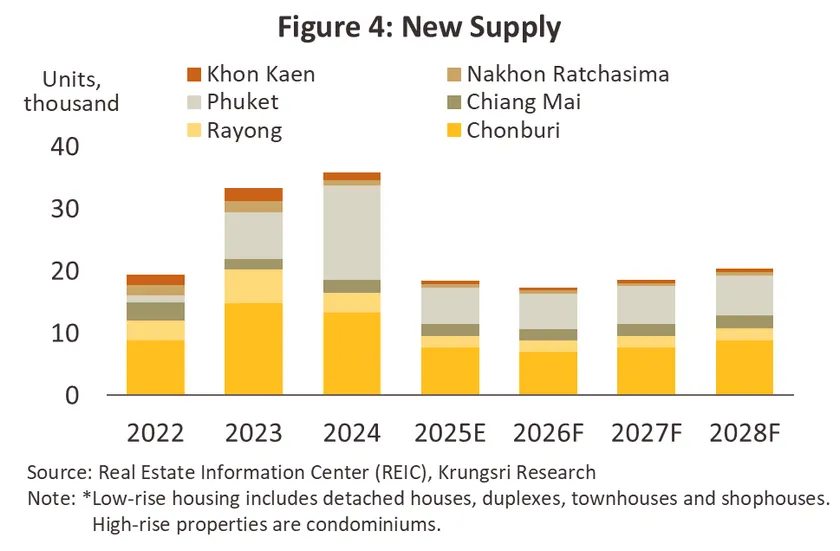

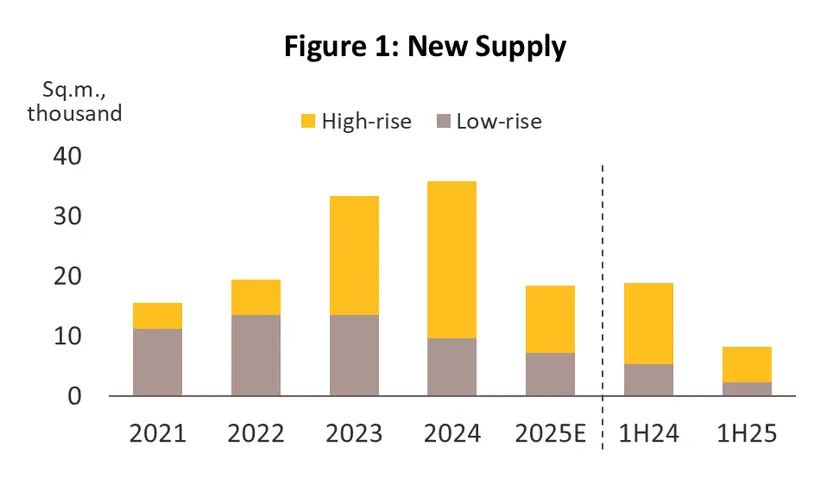

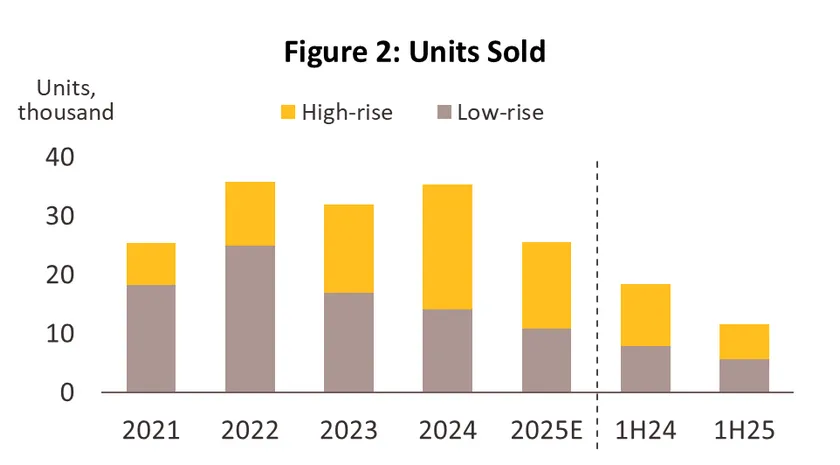

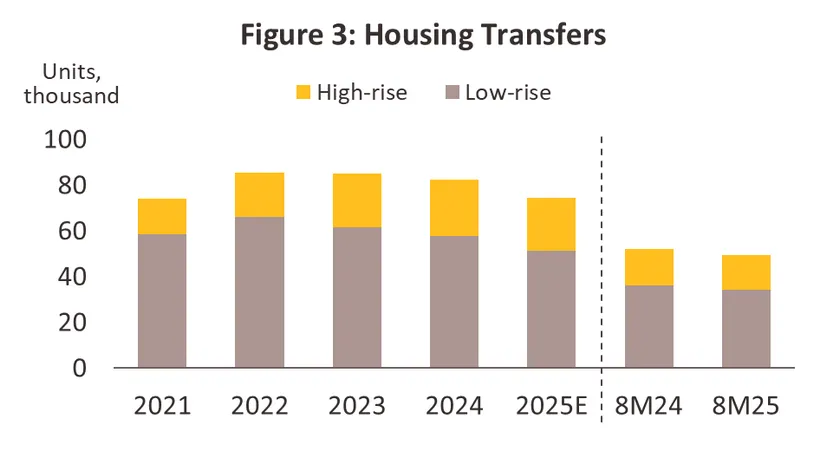

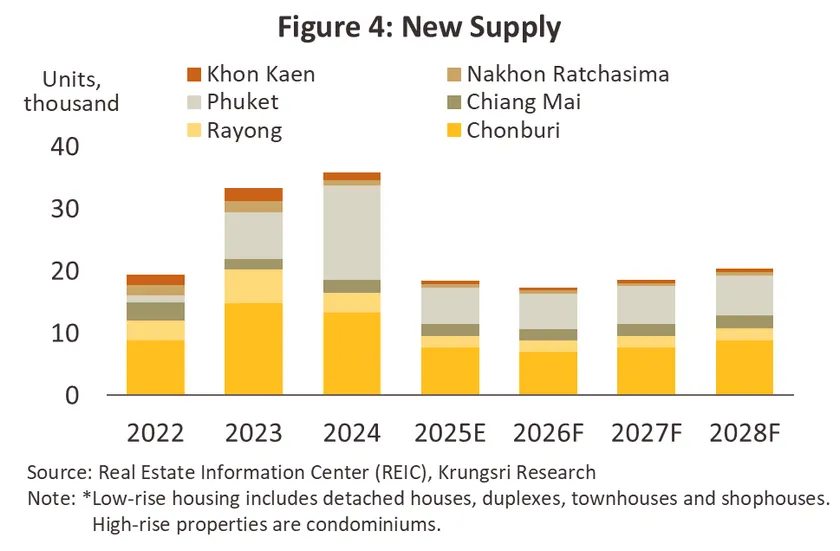

Rules regulating the loan to value ratio for real estate credit have been relaxed and so lenders are now authorized to issue loans of up to 100% of the value of the assets against which they are secured when: (i) the collateral is valued at less than THB 10 million and the loan is for the purchase of a second home, or (ii) the collateral is valued at more than THB 10 million and the loan is for either a first or a second home. These changes will be in effect from May 1st, 2025, until June 30th, 2026. It is hoped that this will provide additional support for the real estate sector and associated industries, ease problems with a significant supply glut, improve access to home loans, and stimulate the economy more broadly.

-

The fees charged for registering property-related transactions have been cut. In detail, charges have been reduced for: (i) registering changes of ownership of a property, which have been cut from 2% to 0.01% of the property’s value; and (ii) registering mortgages secured against a property, which have been reduced from 1% to just 0.01% of its value. These changes apply to new and pre-existing homes valued at up to THB 7 million when bought by a Thai national. These measures will be in effect from the date of their announcement in the Royal Gazette until June 30th, 2026, and should stimulate home sales, help developers sell-off unsold inventory and so improve their cashflow, and encourage lenders to extend more home loans, thereby injecting additional liquidity into the economy.

-

Changes to laws and regulations that are under way or being considered

-

The proposed Property Rights Act (draft) will extend the maximum permissible lease on a property from 30 to 99 years. It is proposed that: (i) the initial lease would be for a maximum of 50 years (up from the current 30), and (ii) when this expired, it would be possible to extend this once for up to 49 years, giving a total length of 99 years, though to be valid, it would be necessary for the second contract to be registered at the Land Office. Currently, the Ministry of the Interior is seeking public consultation on the new legislation, and opinions can be lodged via the Land Office website and other public channels. By allowing more efficient planning of how land and property will be used, the new act will help to underpin long-term business confidence among property developers and overseas investors. In addition, the law will also support growth in large-scale real estate projects such as mixed-use and extended commercial developments that have distant payback horizons and through this, stimulate increased investment in the real estate sector overall.

-

The new Condominium Act (draft) will raise the maximum area of a condominium block that may be owned by non-Thais from 49% to 75% of the total, though with the following restrictions: (i) This will apply in the three provinces of Bangkok, Phuket and Pattaya only (all popular with overseas buyers); (ii) developments should have a footprint of no more than 5 rai (0.8 hectares); (iii) companies owning or managing condominiums may be no more than 49% foreign owned; and (iv) local authorities are free to impose additional restrictions (e.g., prohibiting building on agricultural land or in areas that are militarily sensitive). As with other similar measures, the authorities hope that this will encourage developers to start work on new projects and to further stimulate sales in the three target provinces, accelerate the run down in the backlog of unsold stock, and boost developers’ cashflow. Moreover, while these changes will have a beneficial impact on labor markets and the economy overall, the restrictions on the size and location of properties that will fall within the scope of the law will prevent excessive disruption to property markets and ensure that Thai citizens are still able to access these.

-

Manufacturing

-

The US has imposed anti-dumping and countervailing duties on solar cells imported from Thailand, Malaysia, Vietnam and Cambodia. These came into effect on April 21st, 2025, and for Thailand, these were set at the very high rate of 375.19-972.23%. As such, there is a significant risk that Thai players will lose competitiveness and market share in the US, though manufacturers are transitioning to a greater focus on the domestic market and this will help to offset losses overseas.

-

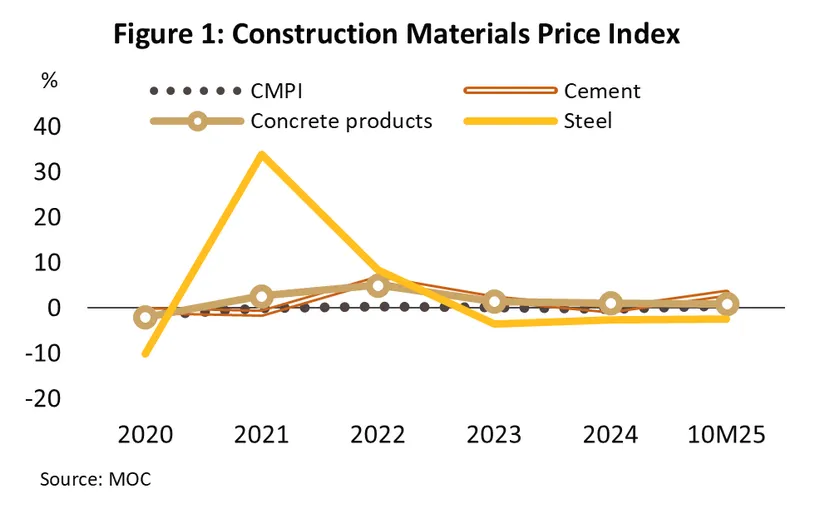

The Ministry of Industry has announced industrial standards for hydraulic cement, prompting manufacturers to enhance their products through improved production processes and quality control. The move aims to build consumer confidence and align with the government’s environmental and sustainable development policies.

-

New regulations from the Ministry of Industry targeting manufacturers of roofing tiles made from concrete, reinforced concrete, terracotta, and cement-fiber aim to improve the thermal performance of these products, thereby reducing heat transfer to the interior of buildings and cutting energy consumption from cooling. To meet these new standards, manufacturers will need to improve the production technologies that they use, though doing so will enhance product quality and raise consumer confidence.

-

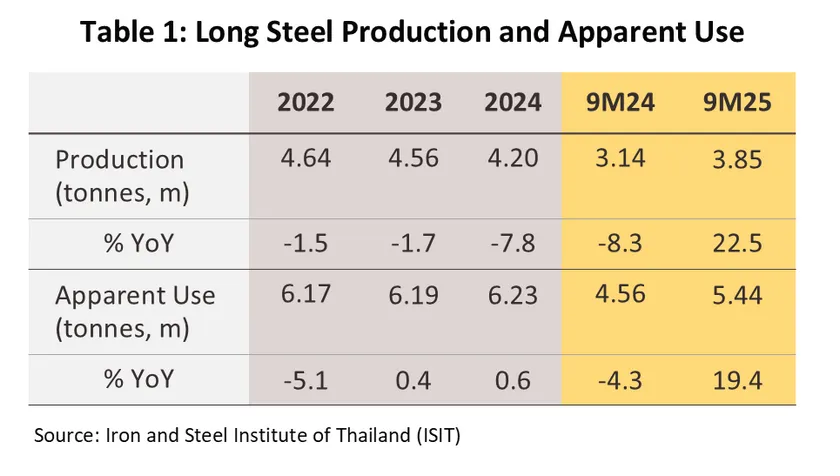

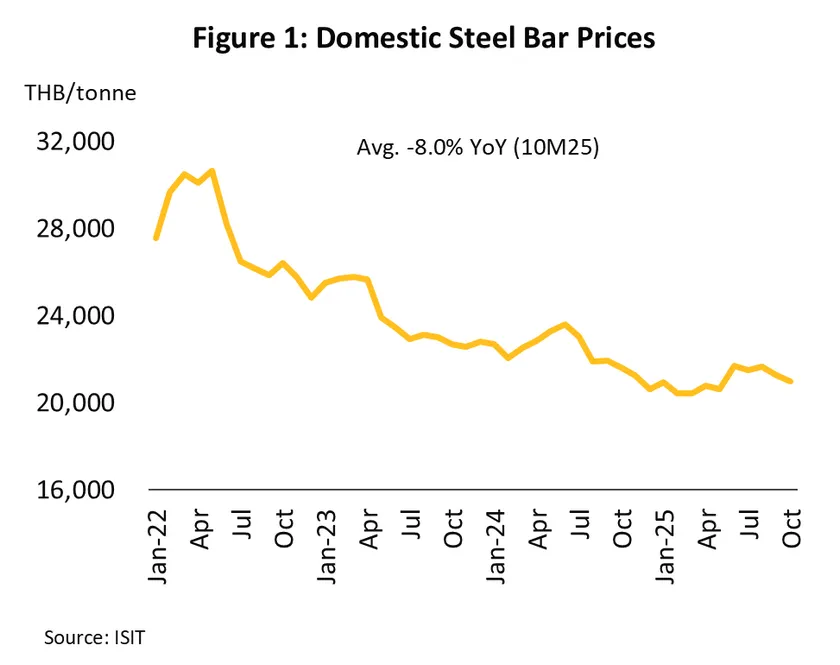

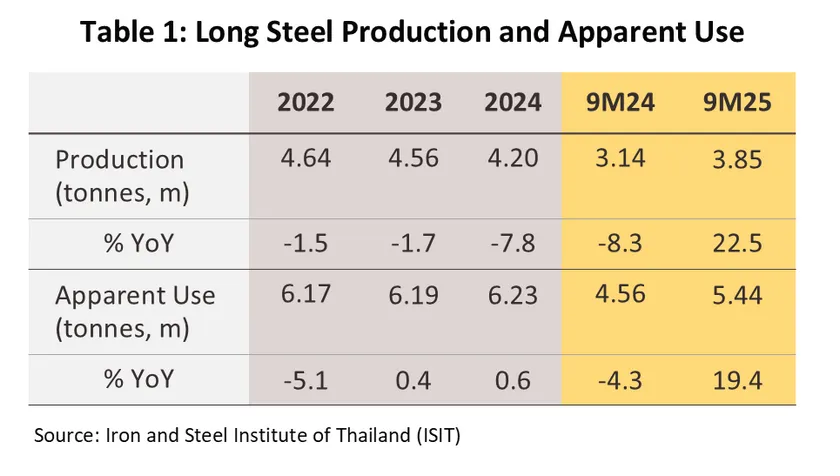

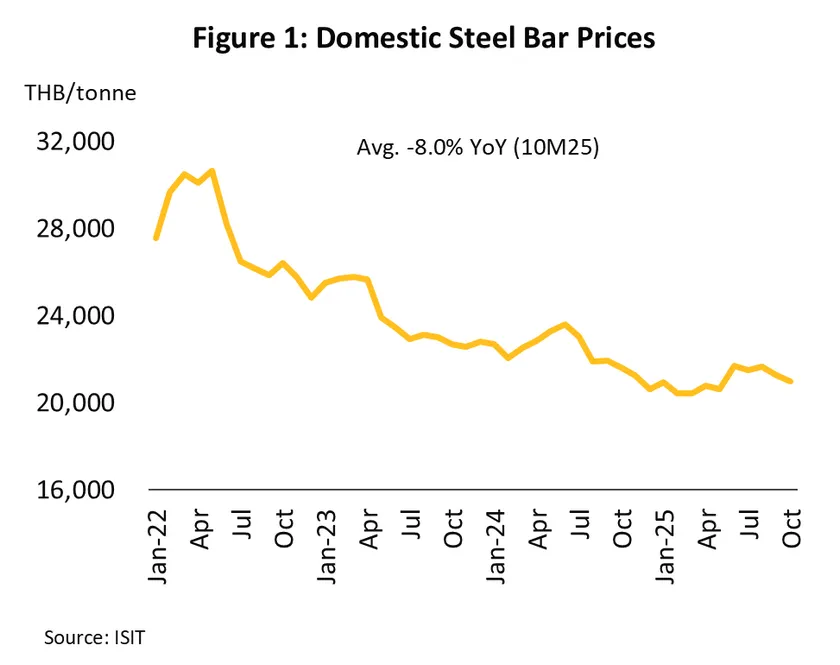

The Ministry of Industry has also banned the construction or expansion of foundries producing rebar and billet, with effect from September 10th, 2025. The measures aim to tackle the current supply glut, address problems with the underutilization of current manufacturing capacity, and stabilize the market. Businesses currently involved in the production of these goods will also need to improve product quality to ensure compliance with ‘green steel’ standards. This will then help players better compete against imports (especially from China, where standards are similarly being raised) and on the global stage more widely.

-

The Anti-Dumping and Subsidy Review Committee has agreed to impose retaliatory measures targeting the dumping of coil, sheet and strip cold-rolled stainless steel with a thickness of 0.3-3.0 mm and a width of up to 1,320 mm. The measures will affect 33 product categories and will run from October 11th ,2025 to October 10th , 2030. This has been prompted by dumping by Vietnamese producers that has caused material damage to the Thai steel industry. Thai manufacturers should now be able to grow their sales and expand their market share, and at a minimum, this will reduce their losses.

-

Auto industry

-

Changes have been made to vehicle excise rates with the goal of reducing greenhouse gas emissions. These consist of the following.

-

The bands for CO2 emissions have been tightened and so to improve energy efficiency and reduce emissions, these have been split into the 5 (up from the earlier 4) groups of: CO2<100 g/km, 100-120 g/km, 121-150 g/km, 151-200 g/km, and >200 g/km.

-

Emissions-based excise rates for HEVs (hybrid electric vehicles) and PHEVs (plug-in hybrid electric vehicles) are now as follows:

-

Excise rates for HEVs and MHEVs5/ that emit fewer than 120 g/km of CO2 are held at 6-9 and 10-12% respectively. Manufacturers that have taken advantage of the BOI’s investment promotion schemes are required to invest in the domestic production of hybrids, source high-value parts manufactured within the country, and install advanced driver-assistance systems (ADAS).

-

PHEVs with an engine capacities of up to 3,000 cc, a range of at least 80 km per charge, and a petrol tank capacity of no more than 45 liters will see excise rates set at 5%. For PHEVs with a similar engine capacity but a range of less than 80 km/charge or a petrol capacity of more than 45 liters, excise doubles to 10%, while for PHEVs with an engine capacity greater than 3,000 cc, excise rates are set at 30%. This is with effect from January 1st, 2026.

-

Excise duties will be levied on traditional internal combustion engine (ICE) powered vehicles according to their CO2 emissions. These will rise in stages, beginning in 2026.

-

For autos with an engine capacity of not more than 3,000 cc, in phase 1 (January 1st, 2026 - December 31st, 2027) excise rates will be in the range of 13-34% as per vehicles’ CO2 emissions. Phase 2 will run from January 1st, 2028, to December 31st, 2029, when the rate will increase to 14-36%, and from January 1, 2030, onwards, excise duty will be set at 15-38%.

-

For autos with engines larger than 3,000 cc, excise rates will be fixed at 50% from January 1st, 2026, onwards. It is hoped that this will encourage the development of more environmentally friendly technology.

-

Excise tax on BEVs will be cut from 8% to 2% to encourage their manufacture and use, as per the resolution of the national committee on EV policy, which has set a target of 30% of cars coming off Thai production lines being zero emission vehicles (ZEVs) by 2030.

-

To increase the competitiveness of Thai-made pickups and similar vehicles and to help Thailand maintain its position as a regional center of auto production, the authorities are supporting the use of alternative energy other than biodiesel and promoting the production and use of BEVs and FCEVs (fuel cell electric vehicles). As part of this strategy, excise duties on these will be set at respectively 2% and 0%.

-

As with autos, excise duties for motorcycles, both ICE-powered and HEV and PHEV models, will be set according to their CO2 emissions. The first stage of the new regime will run from January 1st, 2026, to December 31st, 2029, with excise rates set at: 4% (CO2 emissions < 50 g/km), 6% (CO2 emissions 51-90 g/km), 10% (CO2 emissions 91-130 g/km), and 20% (CO2 emissions > 130 g/km). In phase 2 (from January 1st, 2030, onwards), rates from 5-25%.

-

The EV Board has revised the rules on the number of EVs that need to be manufactured in Thailand for companies participating in the EV3 and EV3.5 schemes, and so to help boost exports, from 2025 onwards, every EV manufactured in Thailand and then exported counts as 1.5 EVs for the purpose of meeting the BOI requirements. This change should then help to lift exports by 12,500 vehicles in 2025 and a further 52,000 vehicles in 2026. Beyond this, to better align with operating procedures and to allow companies to be more flexible in their planning, the deadline for registration for the two schemes has been extended by a month. Thus, the deadline for EV3 and EV3.5 registration is now January 31st, 2026, and January 31st, 2028, respectively.

-

Energy

-

The action plan for the transition to a carbon-neutral economy should be rolled out in 2026. This will entail the enforcement of: (i) the 2024 Power Development Plan; (ii) the Gas Plan; (iii) the Alternative Energy Development Plan; (iv) the Energy Efficiency Plan; and (v) the Oil Plan. This will help Thailand meet its goal of reaching carbon neutrality by 2050 and net-zero GHG emissions by 2065. These measures should also help to increase investment in electricity generation, natural gas extraction and importation, and oil refining.

-

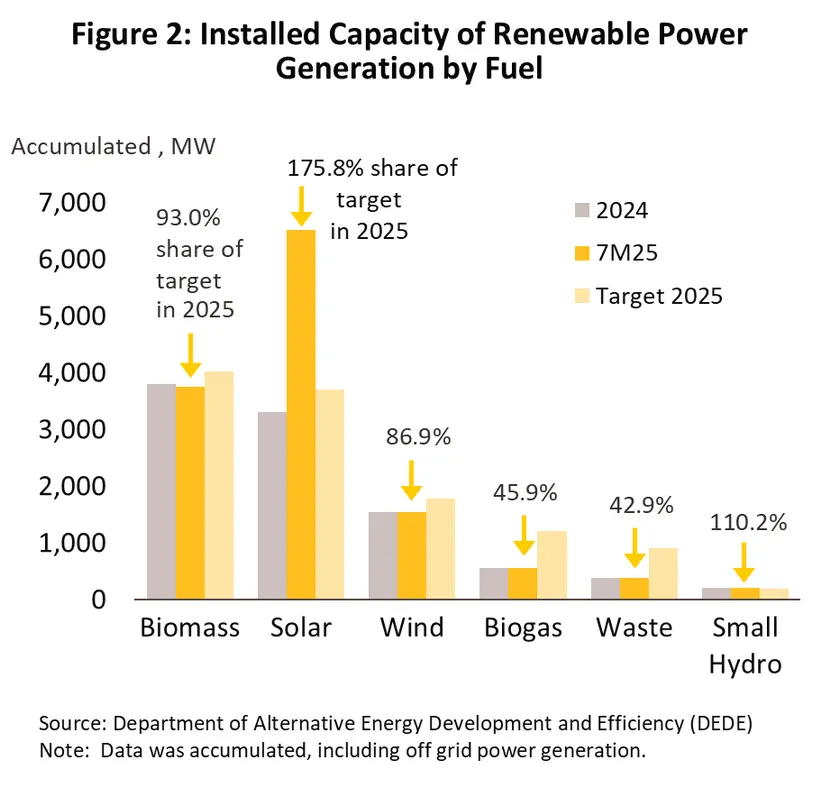

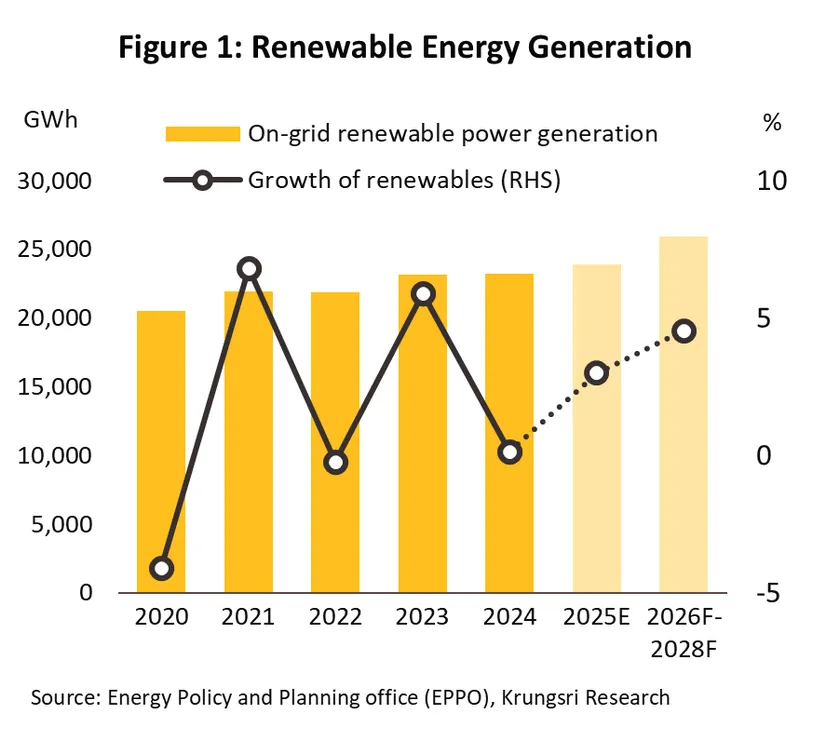

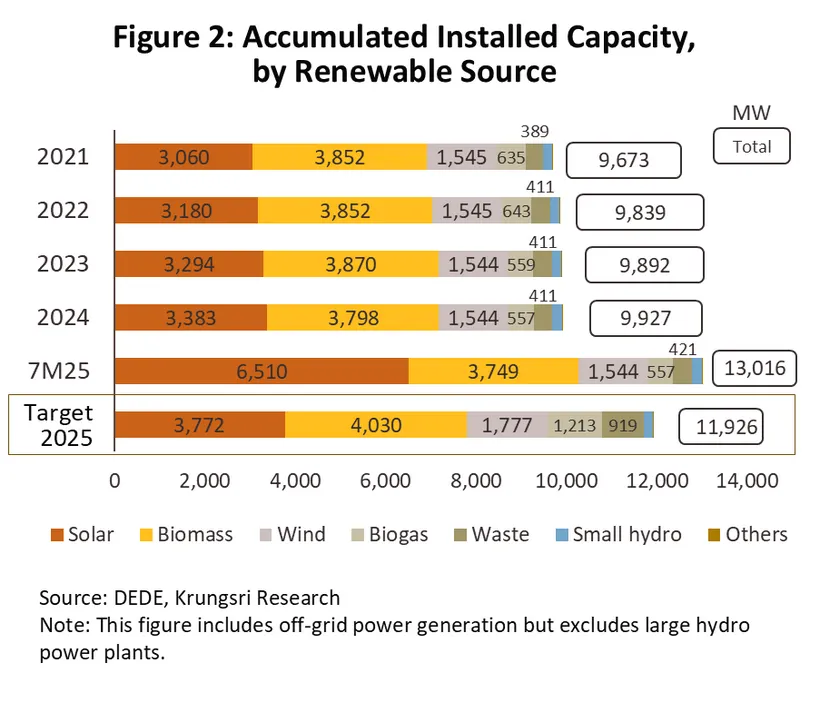

Revisions to the Power Development Plan (the draft PDP2024) and the Alternative Energy Development Plan (AEDP2024) divide the expansion in renewables generation into two phases: 2021-2030 and 2031-2037. These plans call for at least 50% of electricity supply coming from clean energy/renewables by 2037 (source: draft PDP 2024, EPPO), and these targets will help to support an increase in investment inflows into the industry and the buildout of new private-sector generating capacity in: (i) production from sources such as wind, biogas and solar (rooftop, ground-mounted, and ground-mounted with energy storage) for which there are no associated fuel costs; and (ii) biomass and municipal and industrial waste-to-energy generation.

-

Agriculture

-

The Department of Fisheries has revised 71 provisions under the draft amendment to the Royal Ordinance on Fisheries B.E. 2558 (2015), which is expected to be submitted for consideration by the new Cabinet in 2026. These include expanding the areas where artisanal fishing is permitted, restricting the issuing of fishing licenses to Thai nationals, updating penalties for legal infringements, and streamlining legislation by repealing redundant laws. This process should be completed before the end of 2025, and it is hoped that these changes will better regulate fishing, protect marine resources, strengthen labor rights, and revitalize the industry. By helping to raise competitiveness and reduce barriers to trade (a result of Thailand’s earlier problems meeting international labor and environmental standards), the industry as a whole will benefit. Additional positive impacts will include deepening cooperation between state organizations and local fishing communities, and a much fairer and sustainable redistribution of income across the fisheries supply chain.

-

Services

-

Hotels - The Ministry of the Interior has suspended the payments normally required for businesses to legally operate as a hotel for the 2 years between July 1st, 2024, and June 30th, 2026. This has been motivated by a desire to provide support for hoteliers hurt by the only sluggish recovery in the tourism industry, and the move will help smaller businesses continue to operate through challenging conditions. Alternatively, some businesses may be able to use the resulting savings to invest in renovations or other areas.

-

Environments

-

The EU’s Carbon Border Adjustment Mechanism (EU CBAM) entered its transition period on October 1st, 2023. Exporters of the six product categories (cement, electricity, fertilizer, iron and steel, aluminum, and hydrogen) are required to report the greenhouse gas emissions embedded in products exported to the EU. Full enforcement started on January 1st, 2026, when exporters must both report product emissions and potentially pay for the associated carbon costs. This will raise operating costs, particularly for exporters of carbon-intensive goods.

-

The International Civil Aviation Organization (ICAO) is introducing the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) for all 193 member states, including Thailand. The scheme has two principal components: (i) measuring, reporting, and verifying (MRV) carbon emissions arising from international aviation on an annual basis; and (ii) offsetting emissions that exceed agreed quotas through the purchase of carbon credits. CORSIA will be enforced on a voluntary basis from 2024 to 2026, but from 2027 onwards, compliance will be mandatory, leading to higher costs for airline businesses.

-

The EU Deforestation Regulation (EUDR) has established new laws requiring that importers and exporters of seven products (rubber, oil palm, cattle, wood, coffee, cocoa, and soy, together with their derived products such as gloves and wooden furniture) will need to demonstrate that any products placed on or exported from the EU market are deforestation-free. The EUDR entered its transition phase on June 29th, 2023, with full enforcement beginning on December 30th, 2025. Rubber exports will be the most seriously affected, followed by wood and palm oil.

-

The EU's Corporate Sustainability Due Diligence Directive (CSDDD) requires large businesses to assess and report on their environmental and social responsibilities throughout their supply chains. This includes monitoring emissions and protecting labor and human rights. The directive entered its transition phase on July 25th, 2024, and will be fully implemented across all EU member states from July 26th, 2027. This should increase compliance costs for Thai businesses within European supply chains—i.e., those exporting to or investing in the EU—particularly in the electronics, automotive, rubber, and retail sectors.

-

Thailand is preparing to advance its net zero target to 2050, 15 years earlier than the previous goal of 2065. This will likely expose businesses to stricter environmental policies and regulations, particularly in the energy and transport sectors, which together account for roughly two-thirds of the country’s greenhouse gas emissions and will need to transition to lower-carbon energy sources. Next in line are hard-to-abate industries, such as cement, chemicals, and steel, which must modify their production processes to reduce carbon emissions.

-

The Department of Climate Change and Environment is drafting the Climate Change Act (approved in principle by the Cabinet and expected to take effect in 2026). Its key provisions require that businesses report their carbon emissions and set targets for climate actions. The law will also promote the development of a carbon pricing mechanism including a carbon tax, an emission trading scheme (ETS), and a carbon credit market, to encourage all sectors to take concrete action to control carbon emissions.

-

The Ministry of Finance is preparing to introduce a carbon tax by issuing a ministerial regulation on excise tax rates for carbon pricing mechanisms (approved in principle by the Cabinet, with collection expected to begin in 2026), initially targeting oil products at a rate of THB 200 per tonne of carbon dioxide equivalent. The tax will be implemented through a restructuring of the excise tax system, so it will not increase the overall tax burden for consumers. For example, the current diesel excise tax of THB 6 per liter will be adjusted to include a carbon tax of THB 0.5 per liter. This measure is intended to help exporters to countries implementing CBAM, such as the EU, which allows the carbon tax paid in the country of origin to be credited against CBAM costs.

-

The Ministry of Commerce issued a notification banning the import of plastic waste from abroad in order to reduce impacts on the environment and domestic plastic prices. This law applies to products classified under the Harmonized Code 39.15 (waste, parings, and scrap, of plastics) and came into effect on January 1st, 2025.

-

Finance

-

The Ministry of Digital Economy and Society6/ on Measures for the Prevention and Suppression of Technological Crimes (No. 2) BE 2568 (2025) came into force on April 13th, 20257/. This requires financial institutions, providers of payment services, telecoms companies, operators of social media platforms, and businesses offering services related to digital assets to: (i) prevent customers and clients from opening accounts and using mobile banking services under false pretenses or with assumed identities; and (ii) halt financial transactions and prevent customers opening new accounts when existing accounts are flagged as ‘black’, ‘dark gray’ or ‘light gray’ money mule accounts (i.e., the account has been identified with varying degrees of certainty as having been opened using a false or assumed identity) and investigate further when accounts are flagged as ‘dark brown’ or ‘light brown’ (i.e., there is a suspicion that this is a money mule account). To minimize the disruption suffered by legitimate account holders, the Bank of Thailand now also requires that account locks be lifted within 4 hours (down from the earlier 72 hours)8/.

-

The Bank of Thailand (BOT) has rolled out its ‘Your Data’ project, which under the tagline ‘Your data: building financial services that meet your needs’ allows consumers to easily and securely transfer their financial data from one service provider to another, for example when applying for credit or using a personalized financial management system. This improvement in data interoperability allows consumers to access more personalized financial products at more appropriate price points, while also boosting access to financial planning and management services. On the other side of the market, the costs associated with data processing and verification will fall, and service providers will be better placed to develop new and enhanced data-driven financial products.

-

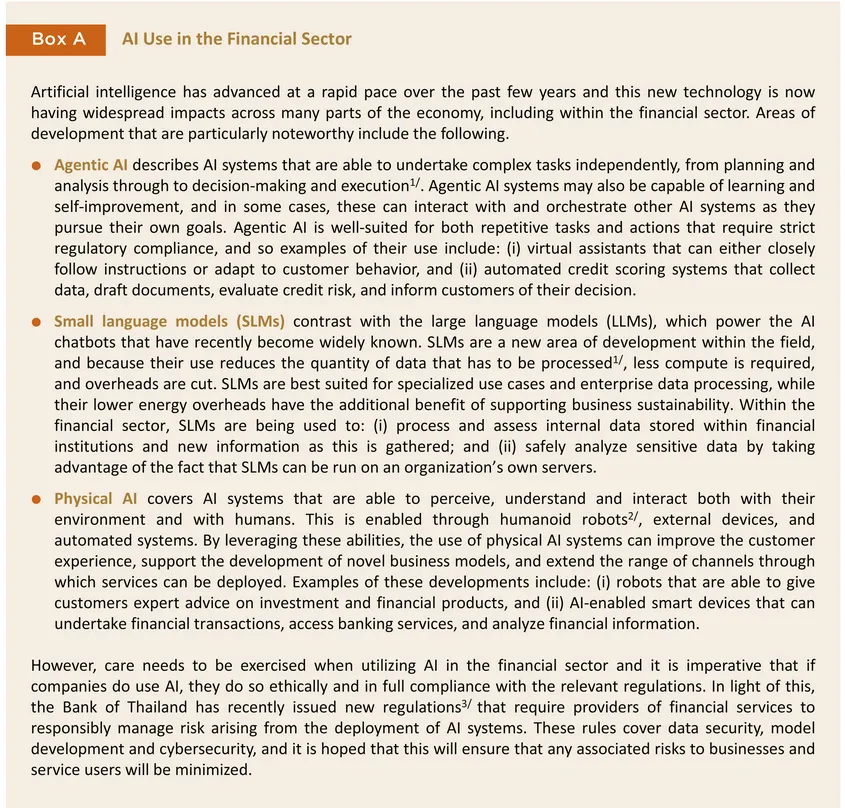

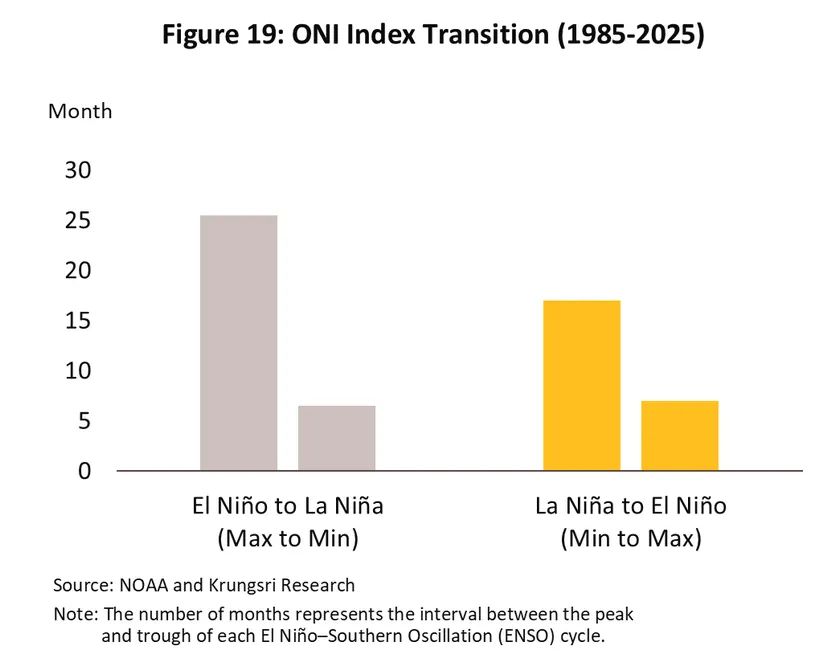

The BOT has issued guidelines on the management of risk arising from the use of AI in the financial sector9/ (in effect from September 12th, 2025). (i) Governance: Financial service providers are required to clearly identify responsibilities related to AI use, including deciding whether to implement ‘human in the loop’ or ‘human over the loop’ approaches to human involvement in or oversight of strategies or processes that may impact clients, and to inform customers when AI systems are tasked with client communication. (ii) Security and business development: Providers should implement measures to prevent unauthorized data disclosure, conduct model testing both before and after deployment, monitor the performance and reliability of outputs, and continuously test for potential cyberattacks. They should also update their threat-prevention frameworks in accordance with international standards.

-

The Ministry of Finance10/ bringing auto and motorcycle hire-purchase and leasing businesses within the scope of the Financial Institution Business Act comes into force on December 2nd, 202511/ , thereby giving the BOT the power to investigate these businesses and to order corrective actions or if necessary that they cease operations altogether. These measures recognize the fact that these companies provide credit to their customers and given their volume, these activities have a broad impact on the public and on Thai economy more generally.

-

The BOT has approved the establishment of three virtual banks. These will be run by: (i) ACM Holdings Ltd.; (ii) a consortium comprised of Krungthai Bank PLC, Advanced Info Service PLC, and PTT Oil and Retail Business PLC; and (iii) a second consortium consisting of SCB X PLC, WeTechnology Limited, and KakaoBank Corp. These will be able to offer financial services to the public from June 19th, 202612/ , Virtual banks are expected to expand financial access to a customer base that will encompass SME and retail accounts, though this will especially include currently underserved parts of the market among low-income earners, those in irregular employment, and underbanked and unbanked groups. By delivering financial services entirely through digital channels that take advantage of the possibilities offered by agile modern technologies, these banks should be able to reduce costs and meet customer needs more directly.

Krungsri Research sees the macroeconomic factors described above presenting both opportunities and challenges to businesses and industries, and companies will thus have to adapt rapidly to changing macroeconomic and social conditions. Players will also have to adjust to a regulatory framework that is evolving as the authorities look to build a robust foundation for businesses and create an environment conducive to long-term sustainable growth.

1/SLMs may operate with up to 30 billion parameters, or around a fifth of the size of an LLM (OpenAI’s GPT-4 is based a 100-billion-parameter model).

2/A robot designed with a human-like shape and movement

3/For more details, please see https://www.bot.or.th/content/dam/bot/fipcs/documents/FOG/2568/ThaiPDF/25680178.pdf

4/https://www.businessresearchinsights.com/market-reports/silver-economy-market-119281

5/MHEVs, or mild hybrid electric vehicles, are HEVs that have low-voltage direct-current motors that draw fewer than 60 volts.

6/On 8 April 2025, the Cabinet approved the draft Emergency Decrees on the prevention and suppression of technology-related crimes and on the regulation of digital asset businesses.

7/BOT media briefing on enforcement of Royal Decree on Measures for the Prevention and Suppression of Technology Crime

8/Joint Media Briefing: Progress on measures to suppress money mule accounts

9/In accordance with the Notification of the Bank of Thailand on the Management of Risks Associated with the Use of Artificial Intelligence Systems (12 September 2025).

10/The Ministry of Finance has issued a royal decree placing the business of hire purchase and leasing of cars and motorcycles

11/Oversight of vehicle hire-purchase and leasing operations

12/Results of applications to operate a virtual bank

AGRICULTURE

Rice

Situation in 2025

-

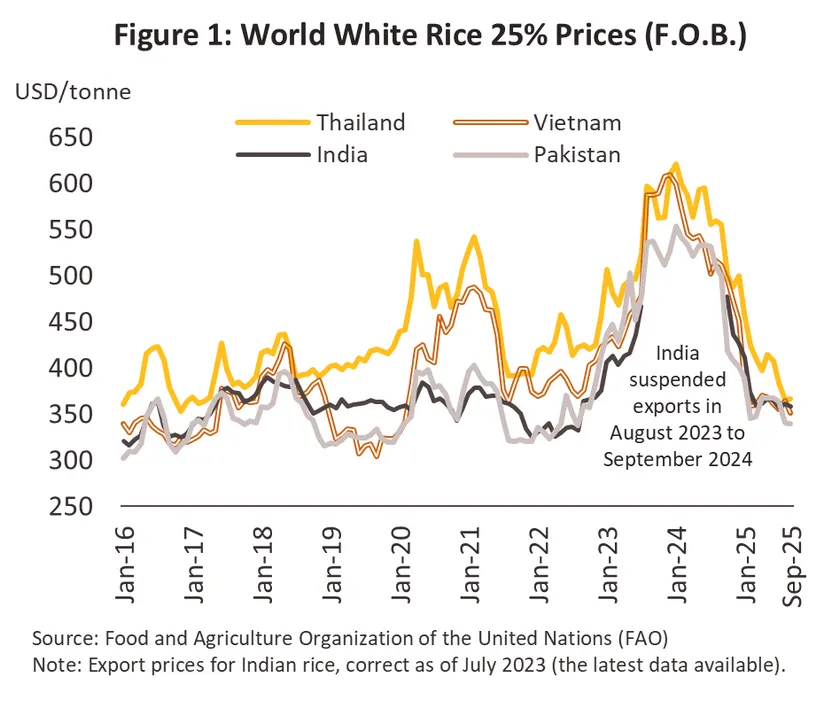

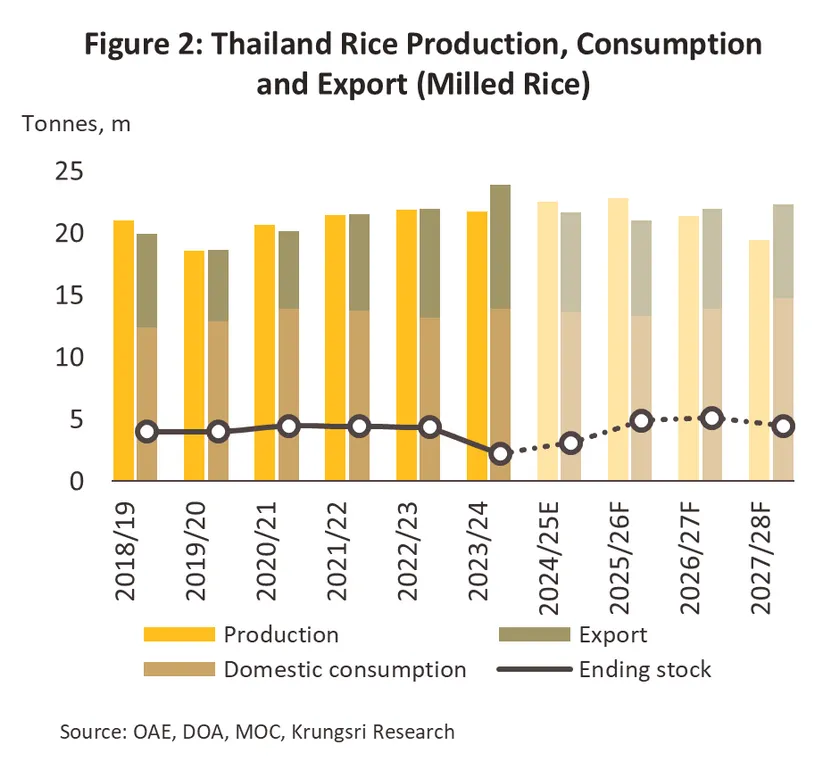

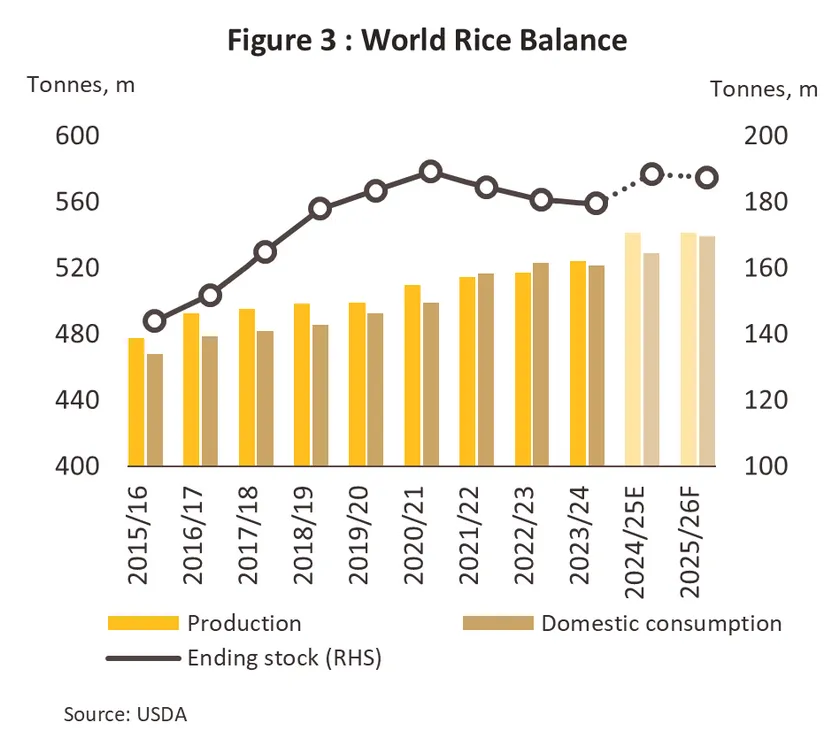

Over 9M25, the paddy rice output index expanded 17.6% YoY, driven by (i) global climate conditions returning to normal and La Niña conditions, fostering favorable weather and rainfall for cultivation in Thailand, thus increasing overall output and yield per rai, and (ii) farmers increasing rice cultivation due to price incentives from the previous year. Consequently, full-year 2025 paddy rice output is projected to expand 2.9-3.9%, reaching 34.4-34.8 million tonnes (MT) of paddy or 22.4-22.6 MT of milled rice.

-

Export volume contracted -23.1% to 5.8 MT of milled rice during 9M25, constrained by (i) favorable global climatic conditions for cultivation have led major producing countries to increase rice output supplied to the global market, (ii) reduced import demand from trading partners like Indonesia and the Philippines due to sufficient domestic rice production, and (iv) a strengthening Thai Baht reducing the price competitiveness of Thai rice. For the remaining year, Thai rice export volume is expected to continue contracting due to increased competition from high global market supply, particularly for white rice. Consequently, full-year 2025 export volume is projected to contract approximately -19.9% to -20.9%, reaching 7.9-8.0 MT of milled rice.

-

Domestic rice consumption in 2025 is projected to contract by approximately -1.3% to -2.3%, totaling 13.6-13.7 MT of milled rice. This contraction is driven by expected decreases in the food and animal feed industries, which is projected to shrink by -9.1% to -10.1%, reaching 2.5-2.6 MT of milled rice. Conversely, direct consumption demand is expected to remain flat or increase slightly at 0.0-1.0%, totaling 11.0-11.2 MT of milled rice. Overall domestic market constraints stem from weakened purchasing power due to economic conditions and a slowdown in the tourism sector and restaurant businesses.

2026-2028 Outlook

-

In 2026, output is projected to expand 0.8-1.8%, reaching 34.9-35.2 MT of paddy rice or approximately 22.7-22.9 MT of milled rice. Positive factors include La Niña and normal climate conditions expected to provide favorable weather, rainfall, and sufficient reservoir water for cultivation. Conversely, 2027-2028 rice output is projected at 29.9-32.9 MT of paddy rice or 19.4-21.4 MT of milled rice, a decline of -7.2% to -8.2% p.a., primarily due to the anticipated return of El Niño conditions causing damage and reduced yield.

-

Rice exports are projected to contract an average of -1.3% to -2.3% p.a., totaling 7.5-8.0 MT of milled rice p.a.. Constraints include (i) severe competition from increasing global rice supply, particularly from key competitors (e.g., India, Vietnam, and Pakistan), and (ii) reduced import demand from trading partners due to higher domestic production and significant prior advance/stockpiling purchases.

-

Domestic rice consumption is projected to grow 2.1-3.1% p.a., totaling 13.3-14.8 MT of milled rice p.a.. Demand-side drivers include (i) gradually increasing tourist numbers boosting demand from restaurants and hotels, (ii) demand from other downstream industries, particularly food manufacturing, which will require more rice for processing raw materials, and (ii) gradual recovery in consumption demand supported by improving purchasing power aligned with employment trends across business sectors. Supply-side support comes from domestic high rice stock drawdown (Destocking).

Rubber

Situation in 2025

-

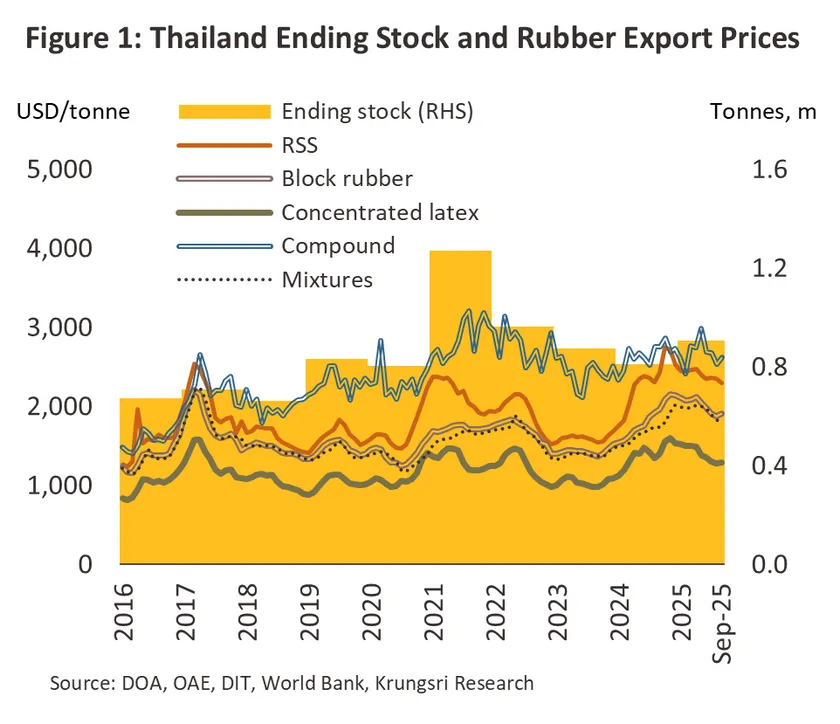

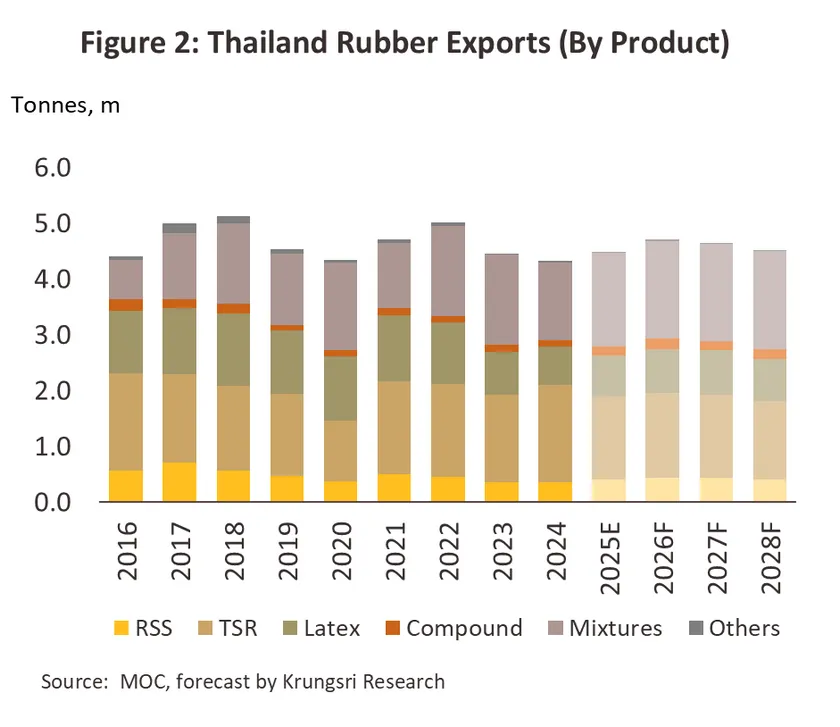

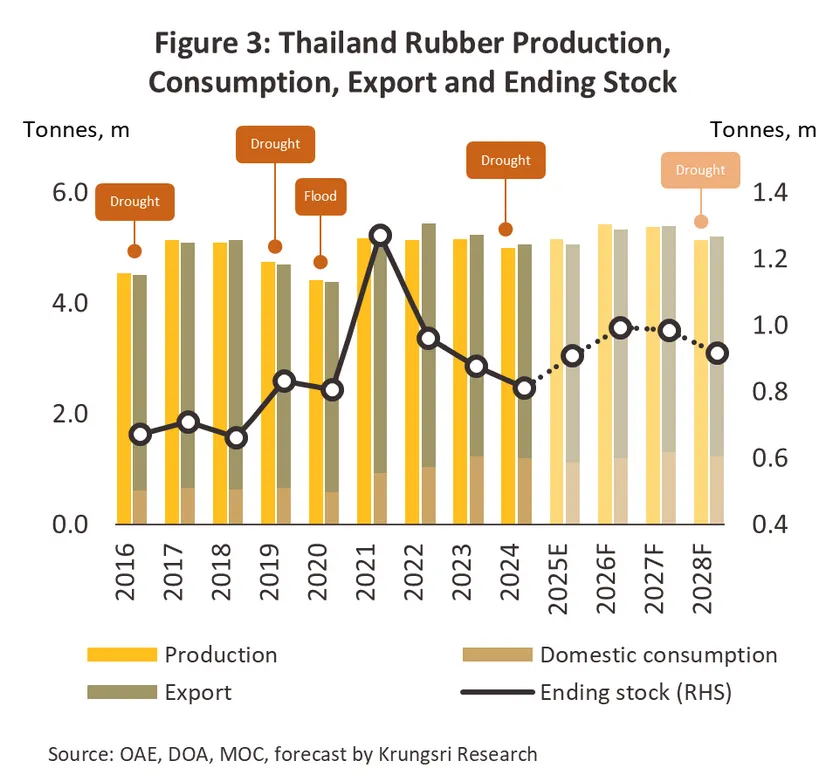

Over 9M25, the natural rubber output index declined -0.5% YoY, primarily due to government and private-sector measures to slow rubber tapping—by postponing the opening of the tapping season from May to June—significantly reduced raw rubber output in the first half of the year. However, in the second half, favorable weather conditions led to a gradual increase in primary rubber supply entering the market. Although flooding occurred in southern Thailand toward year-end, the impact on raw material supply remained limited. Together with partial imports of raw materials, this supported continued growth in output from midstream rubber processing plants. The intermediate rubber production index grew approximately 5.7% YoY, mainly driven by sheet rubber (+28.4% YoY) and mixed rubber (+30.6% YoY). This expansion catered to rising foreign downstream industry demand and increased inventory build-up to replenish stocks depleted in prior years. Consequently, full-year intermediate rubber output is projected at 5.1-5.2 million tonnes (MT), representing 2.4-4.4% growth.

-

9M25, export volume expanded 6.9% YoY to 3.4 MT, with growth across almost all key products: sheet rubber at 0.3 MT (+22.4% YoY), concentrated latex at 0.6 MT (+10.0% YoY), mixed rubber at 1.3 MT (+39.3% YoY), and compound rubber at 0.1 MT (+46.0% YoY). This momentum was bolstered by demand from the automotive and parts industry, particularly in China and Japan, driving export prices up over 14.8% YoY and supporting export value expansion to reach USD 6.6bn (+22.7% YoY). However, export momentum is expected to moderate for the rest of the year due to (i) the impact of US tariff policy potentially dampening orders from both the US and other trading partners amid a slowing global economy, and (ii) lower synthetic rubber prices following global crude oil price declines. Full-year export volume is projected to grow modestly at 2.6-4.6%, totaling 4.4-4.5 MT. Similarly, export price growth is expected to slow to 8.3-10.3%, leading to an overall export value expansion of 12.3-14.3%, estimated at USD 8.7-8.8bn.

-

9M25, domestic intermediate rubber consumption contracted across key products: sheet rubber (-3.7% YoY), concentrated latex (-9.5% YoY), and mixed rubber (-9.5% YoY). This was attributed to operators utilizing existing raw material stocks or importing intermediate rubber for downstream production to fulfill orders from trading partners. Consequently, full-year domestic rubber consumption is projected to contract by -6.4% to -8.4%.

2026-2028 Outlook

-

In 2026, rubber output is projected to expand 4.1-6.1%, supported by (i) favorable weather and rainfall, leading to higher yield, and (ii) elevated prices incentivizing farmers to tap and maintain trees for increased production. Conversely, output is anticipated to contract by an average of -1.6% to -3.6% p.a. in 2027-2028, constrained by warmer weather and reduced rainfall associated with the onset of El Niño conditions, and the new strain of natural rubber leaf fall disease.

-

In 2026, export volume is projected to expand 3.8-5.8%, driven by restocking demand in related industries of trading partners, particularly automotive, tires, and parts, supporting an anticipated market recovery trend. Volumes are expected to contract by -0.8% to -2.8% p.a. in 2027-2028, constrained by (i) the return of El Niño conditions causing raw input supply shortages, and (ii) downstream rubber product manufacturers delaying purchases due to having already built advance reserves and to manage raw material cost risk from anticipated higher rubber prices resulting from the shortage.

-

Domestic consumption is projected to grow 2.2-4.2% p.a., supported by (i) downstream industries, particularly automotive parts and tires, which are expected to recover gradually, (ii) gradual recovery in both public and private construction sectors, and (ii) anticipated continued government measures to absorb output and maintain price stability.

Cassava

Situation in 2025

-

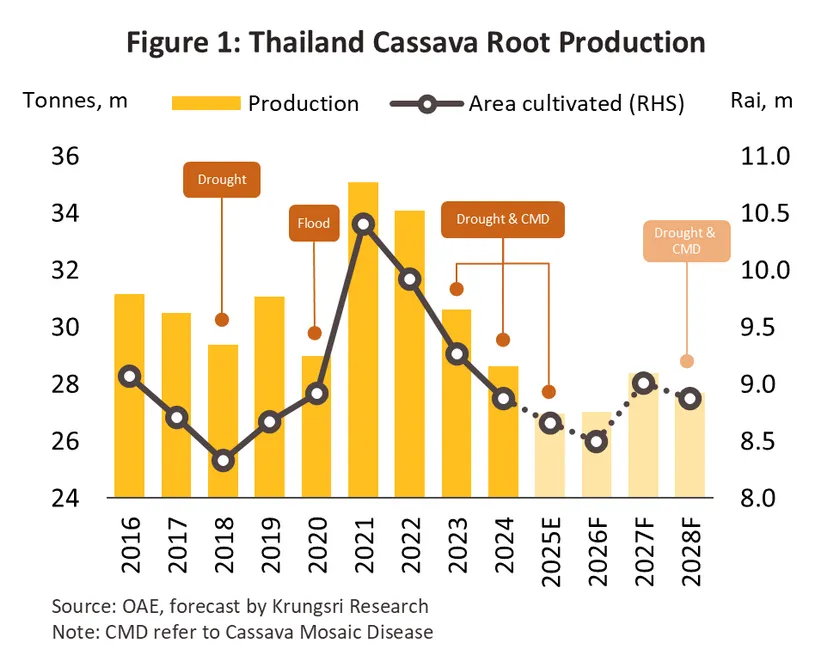

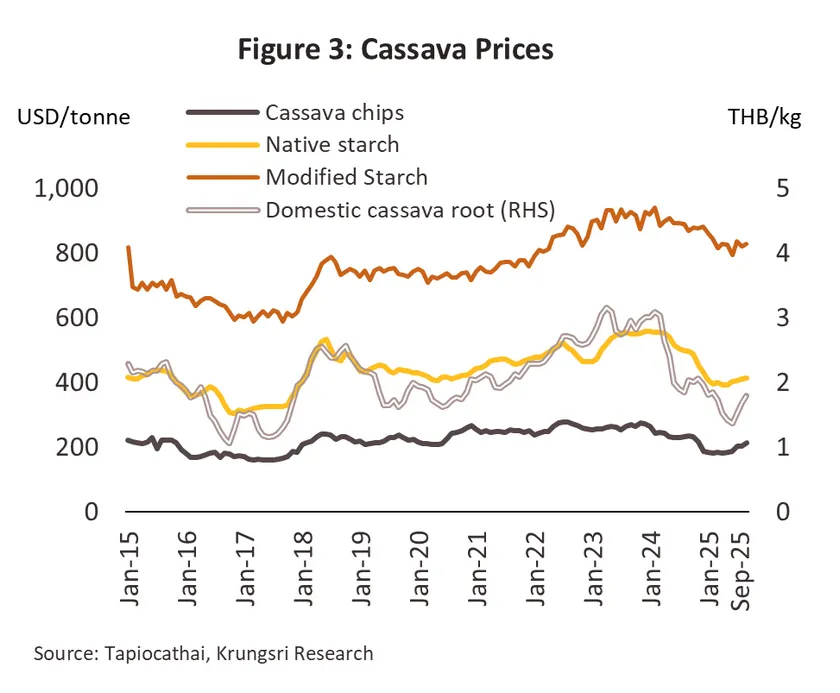

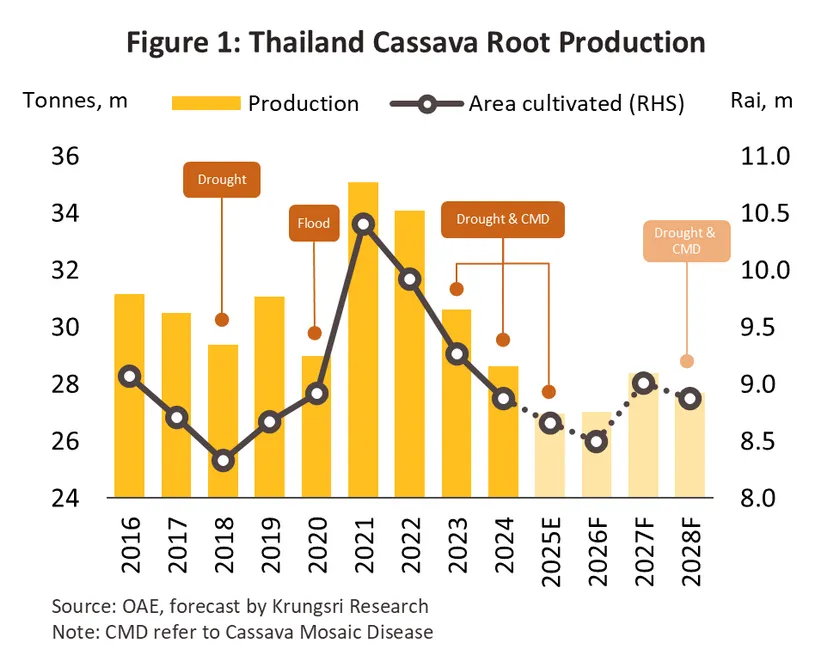

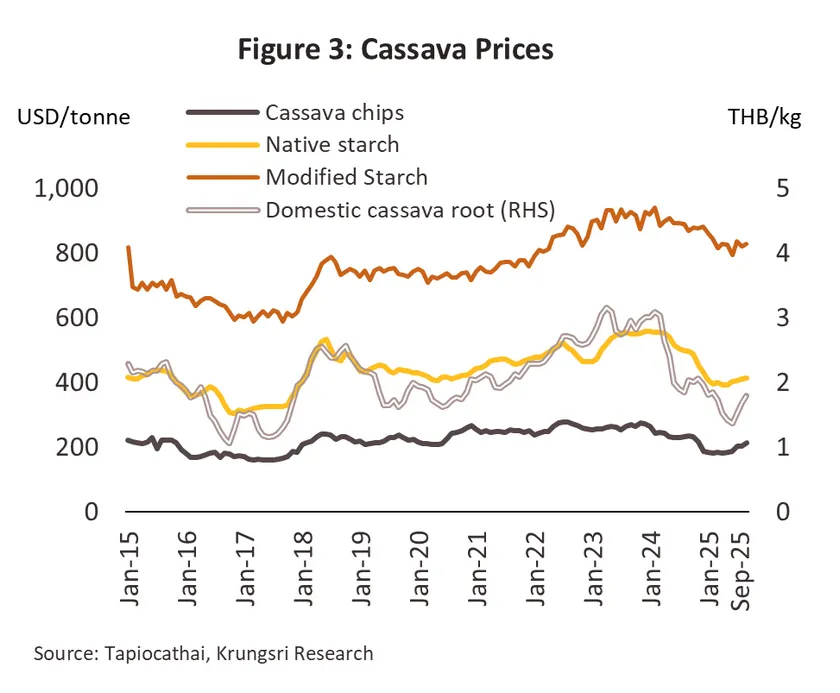

Over 9M25, the Fresh Cassava Output Index contracted -5.4% YoY, constrained by i) drought conditions and below-average rainfall in H1 2024 due to El Niño, followed by flooding in H2 2024, leading to reduced 2025 harvests; ii) persistent Cassava Mosaic Disease (CMD) outbreaks, lowering output and yield per rai, and causing planting stock shortages for farmers; and iii) some farmers shifting to higher-yield or lower-risk crops. Consequently, 2025 fresh cassava root output is projected at 26.8-27.3 million tonnes (MT), contracting -4.5% to -6.5% after a -6.5% contraction in 2024.

-

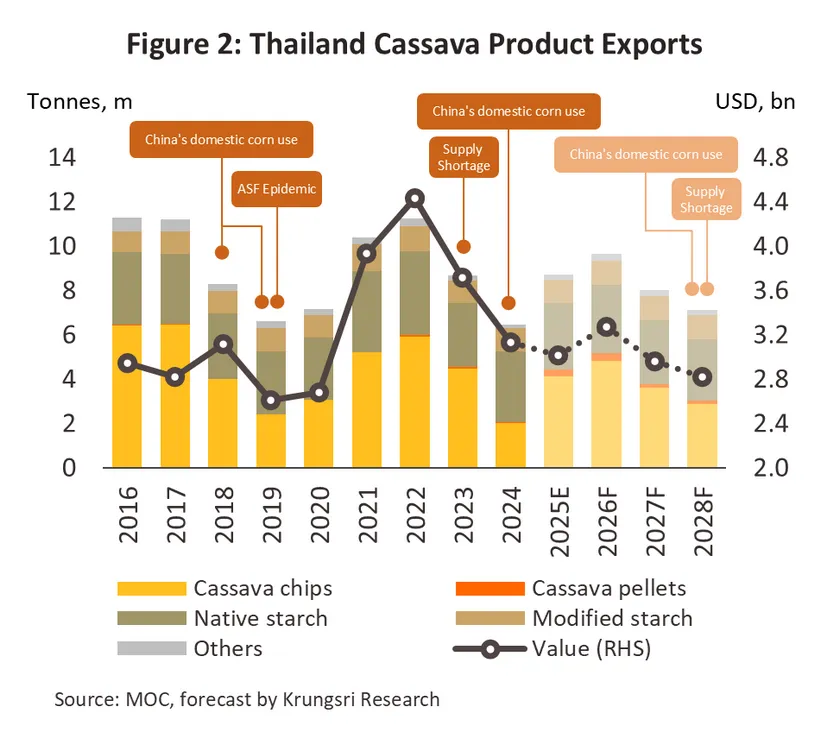

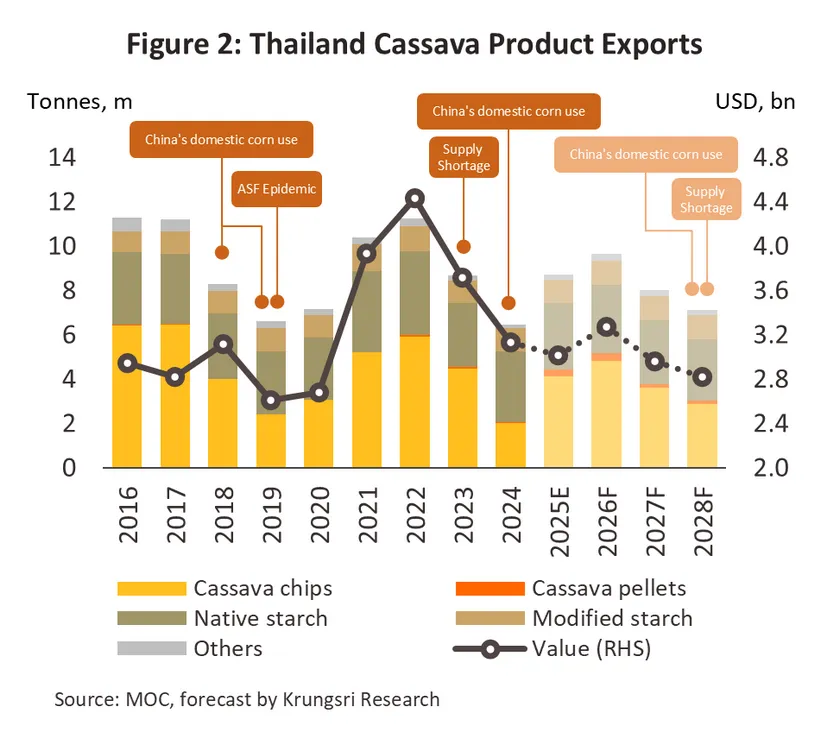

Cassava product export volume increased 36.6% YoY to 6.9 MT during 9M, while export value declined -5.8% YoY to USD 2.3bn, tracking a price reduction (-31.1% YoY) due to intense competition. Export volumes of key products are as follows:

-

Cassava chip export volume reached 3.4 MT (+97.5% YoY), driven by a 91.3% YoY increase in Chinese cassava chip demand. This was fueled by i) heightened usage in the feed and energy industries, and ii) downstream industries substituting cassava chips for corn when the latter's price exceeded that of chips.

-

Cassava starch export volume reached 3.1 MT, contracting -4.5% YoY, mainly due to a -6.2% YoY shrinkage in the raw starch export market. This decline stems from severe price competition against both substitute products and competitors, notably Vietnam. Conversely, modified starch exports saw marginal growth (+0.7% YoY) as operators adapted by focusing on exporting higher-value, innovative products supported by diversified market channels.

For the remainder of the year, demand in the Chinese market is expected to remain strong, particularly for cassava chips. Consequently, full-year cassava product export volume is projected to expand 33.7-35.7%, reaching 8.6-8.8 MT.

-

Domestic market sales volume is projected to contract by -2.0% to 0.0%, primarily constrained by a reduction in cassava usage for ethanol production, projected to shrink -8.4% to -10.4%. This decline is attributed to reduced fuel consumption across economic, transport, and tourism activities, despite expected growth of 1.5-3.5% in cassava usage by other downstream industries.

2026-2028 Outlook

-

Fresh cassava root output is projected to expand 1.6-3.6% p.a. in 2026, driven by favorable weather, sufficient rainfall, and adequate reservoir water levels resulting from La Niña and neutral climate conditions. Conversely, output is expected to contract -1.5% to -3.5% during 2027-2028 due to the anticipated return of drought conditions, coupled with the ongoing issue of CMD.

-

Export volume is projected to expand an average of 9.5-11.5% in 2026, driven by i) rising Chinese cassava chip demand to compensate for declining domestic corn stocks, ii) recovering downstream industries aligned with trading partners' economies, and iii) sustained demand for food security. Conversely, export volume is anticipated to contract -13.1% to -15.1% p.a. in 2027-2028, constrained by i) supply shortages resulting from the return of El Niño conditions, and ii) the projected increase in corn output (a substitute product) in both Chinese and global markets.

-

Domestic market demand volume is projected to expand 1.1-2.3% p.a., driven by expected recovery in downstream industries aligned with economic activity trends. Specifically, the ethanol production industry is set to benefit from the gradually recovering transport business in the tourism sector, government infrastructure investment, and an increasing cumulative fleet of gasoline vehicles utilizing gasohol.

Sugar and molasses

Situation in 2025

-

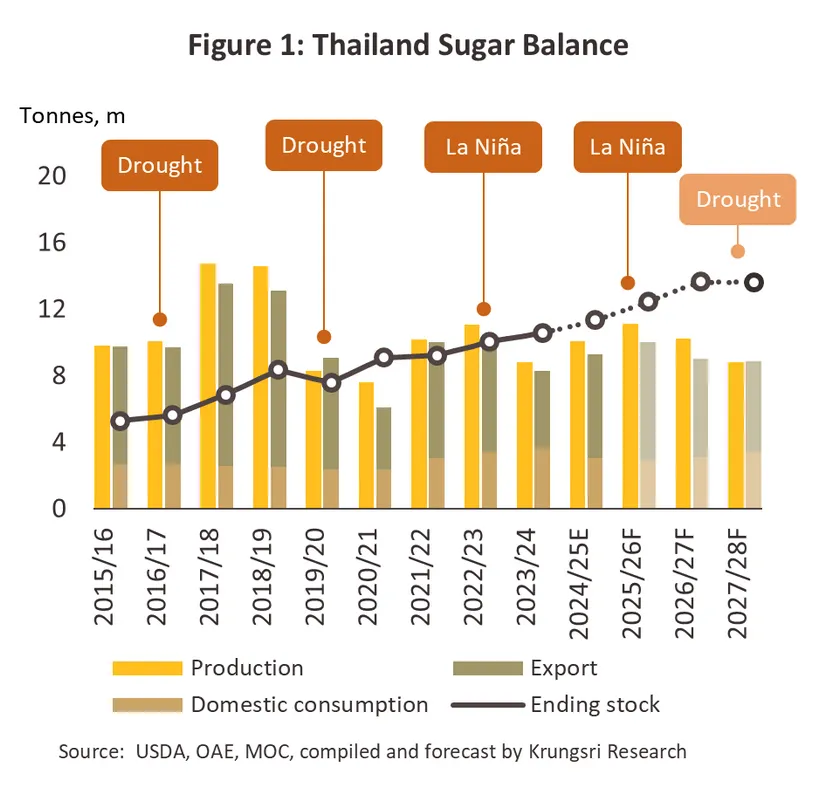

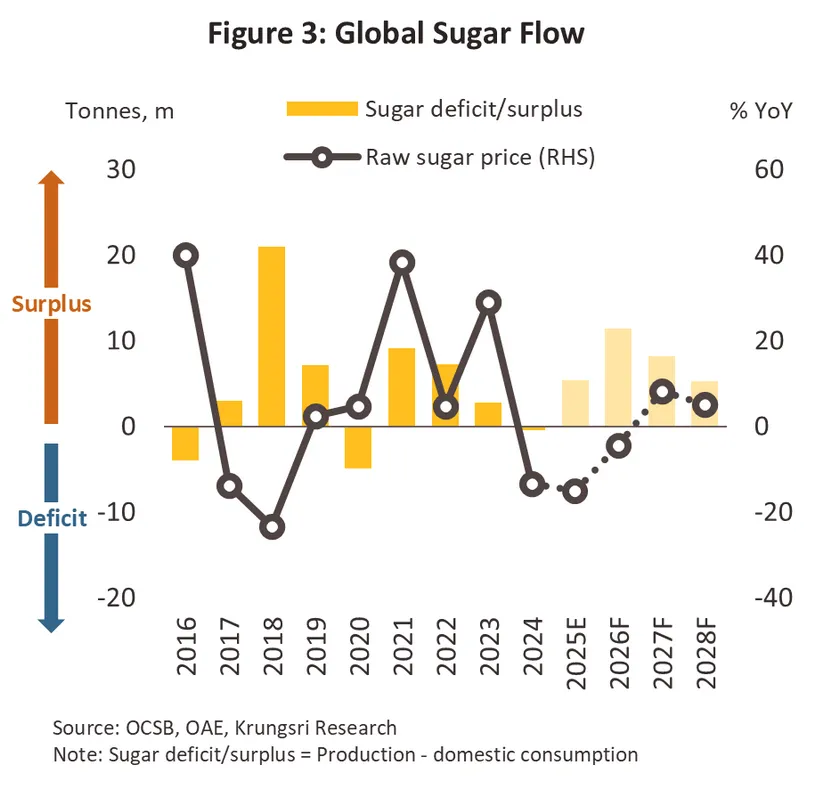

Sugarcane crush volume in the 2024/25 season expanded 12.0% to 92.0 million tonnes (MT) of cane, yielding 10.1 MT of sugar (+14.4%). Growth drivers include: (i) favorable weather/rainfall conditions, and (ii) incentives promoting new cultivation expansion, specifically record-high prior-year cane prices, fresh cane harvesting subsidies, and revenue-boosting measures from cane leaves/tops.

-

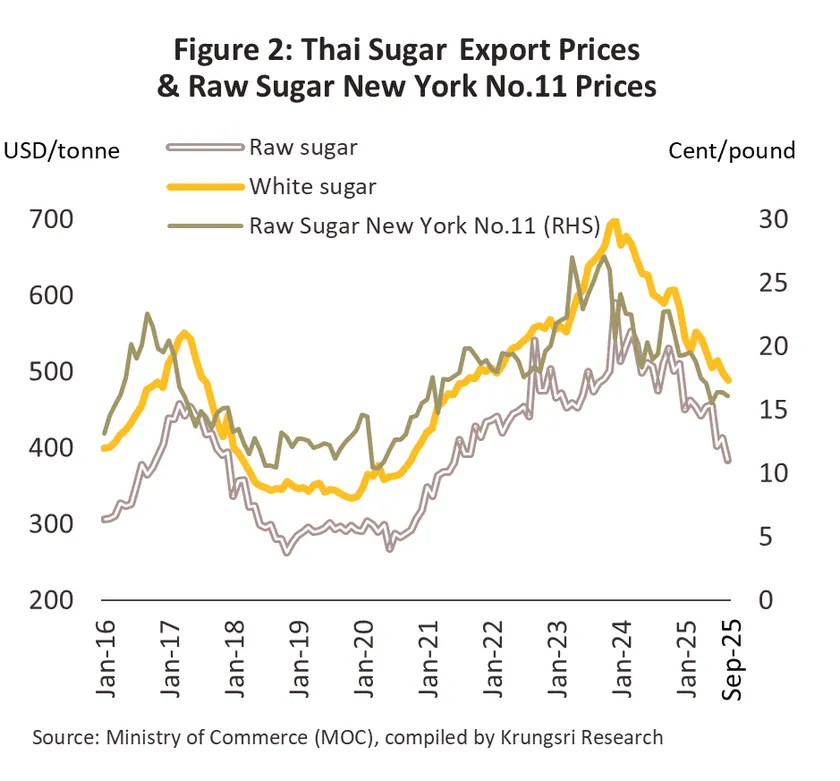

Over 9M25, sugar and molasses export volume totaled 5.2 MT (+37.8% YoY), valued at USD 2.4bn (+12.3% YoY). This was driven by: (i) higher cane output due to more favorable weather/rainfall, and (ii) depletion of significant refined sugar stocks held by Thai exporters from the previous year. For the entirety of 2025, total sugar and molasses export volume is projected at 5.95-6.04 MT, expanding 34.3-36.3%, while Thai export prices for sugar and molasses continued to decline by -18.5% YoY.

-

Domestic consumption of white and refined white sugar for the 6M25 totaled 1.17 MT (-8.8% YoY). Direct consumption was 0.70 MT (-7.5% YoY), due to weakened purchasing power from economic activity slowdown, particularly in the tourism, restaurant, and beverage sectors, amidst a health trend that reduces both direct and indirect sugar demand. Similarly, the volume of sugar used in related industries was 0.47 MT (-10.6% YoY), notably the beverage industry, which was pressured by the Phase 4 (highest tier) sugar tax, followed by pharmaceuticals and bakery sectors (incl. beer and spirits). For the rest of the year, negative factors will persist in the domestic market, specifically from increasing economic deceleration, projecting 2025 domestic sugar usage at 2.23-2.28 MT, contracting approx. -8.5% to -10.5%.

2026-2028 Outlook

-

Sugarcane output in the 2026 crop year is projected to increase to 98.8-100.6 MT of sugarcane, equating to 11.0-11.2 MT of sugar, an expansion of 9.0-11.0%, driven by (i) global climate entering a normal phase and La Niña conditions, resulting in favorable weather and rainfall for cultivation, and (ii) farmers incentivized by high prices in the prior growing season. However, in 2027-2028, sugarcane output is expected to contract to 77.2-92.3 MT/year, equating to 8.8-10.2 MT of sugar/year, contracting approximately -10.1% to -12.1% p.a., due to (i) projected hot weather from El Niño impact, reducing output, (ii) some farmers switching to drought-resistant crops like cassava, replacing sugarcane, and (ii) cultivation costs expected to remain high, prompting farmers to reduce crop maintenance.

-

Sugar and molasses exports in 2026 are expected to expand by an average of 11.9-13.9% to 6.7-6.8 MT, driven by (i) increased supply available for delivery to trade partners as the sugarcane raw material shortage eases, (ii) the start of a new inventory accumulation cycle to meet food security and gradually recovering related industry demand, and (ii) progress in Free Trade Agreements (FTA). However, sugar and molasses exports in 2027-2028 are projected at 5.2-5.6 MT/year, contracting -11.4% to -13.4% p.a., dragged by (i) the expected return of the El Niño phenomenon damaging sugarcane yields, and (ii) intense competition from Brazil, the world's major producer and exporter.

-

Domestic consumption is projected at 2.9-3.4 MT/year, an increase of 3.4-5.4% p.a., supported by (i) direct consumption mirroring the gradual recovery of economic activity and the tourism business, and (ii) demand from related industries, notably the improving food and beverage sectors, aligned with household consumption trends and the service sector, particularly restaurants and hotels.

Palm Oil

Situation in 2025

-

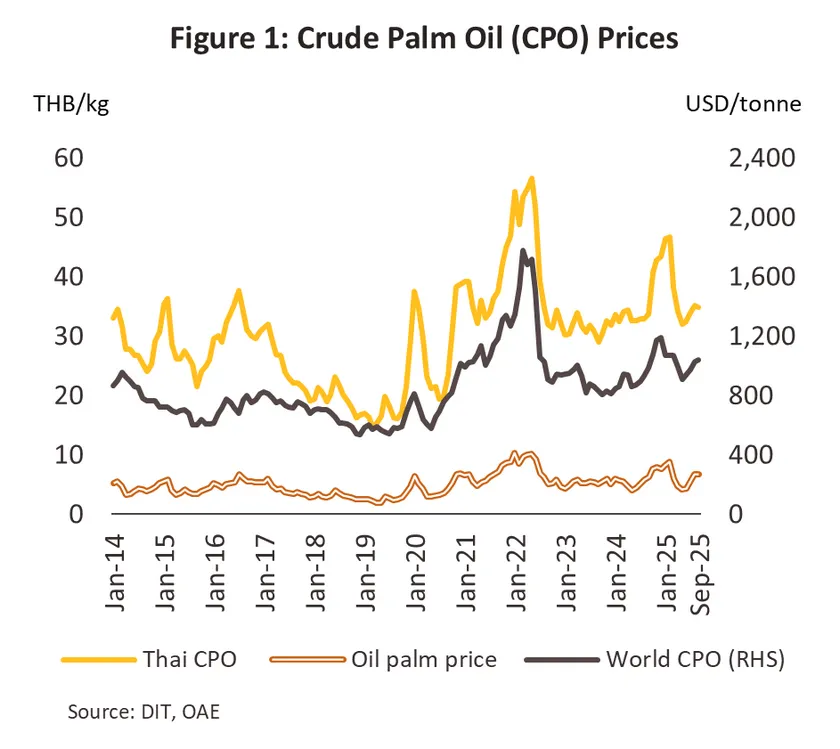

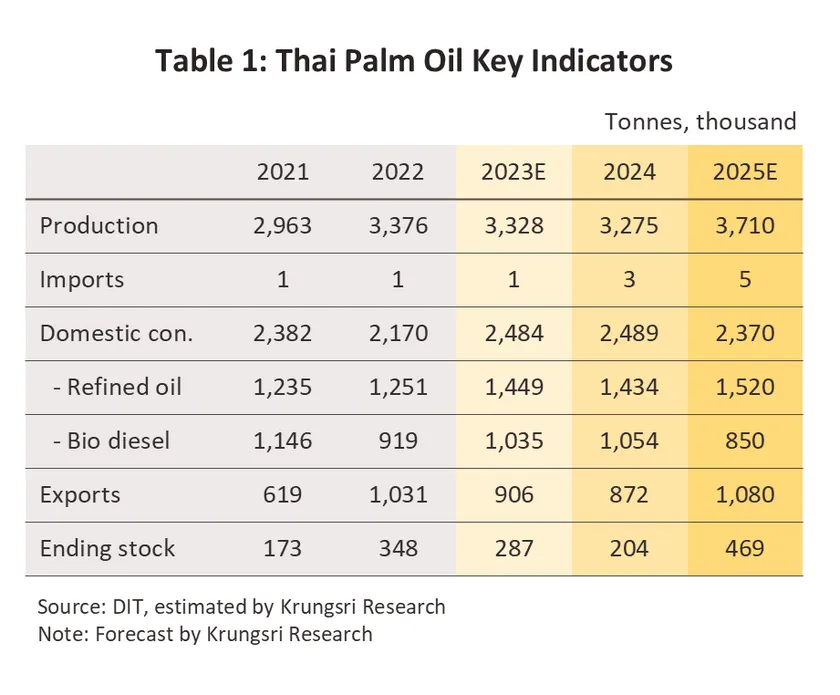

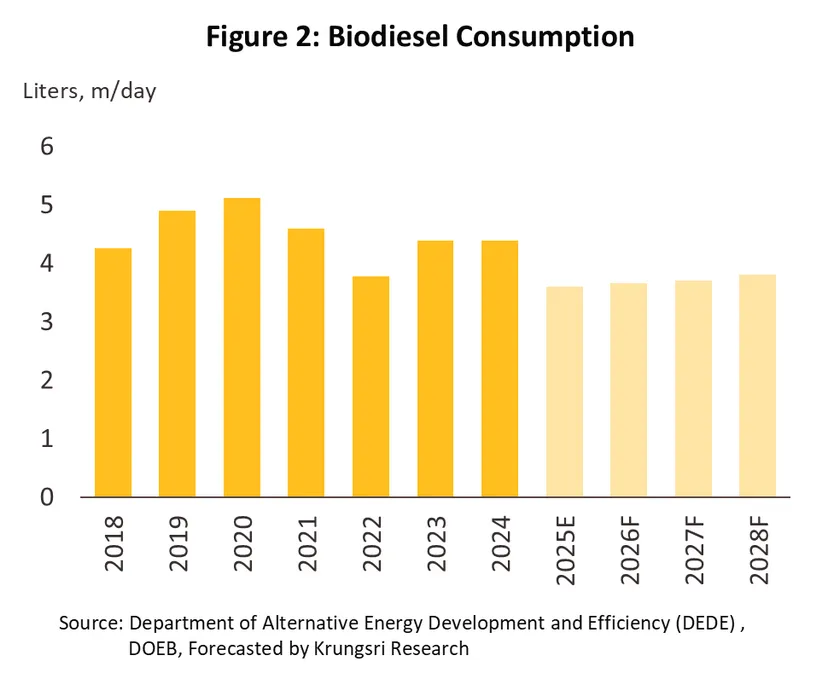

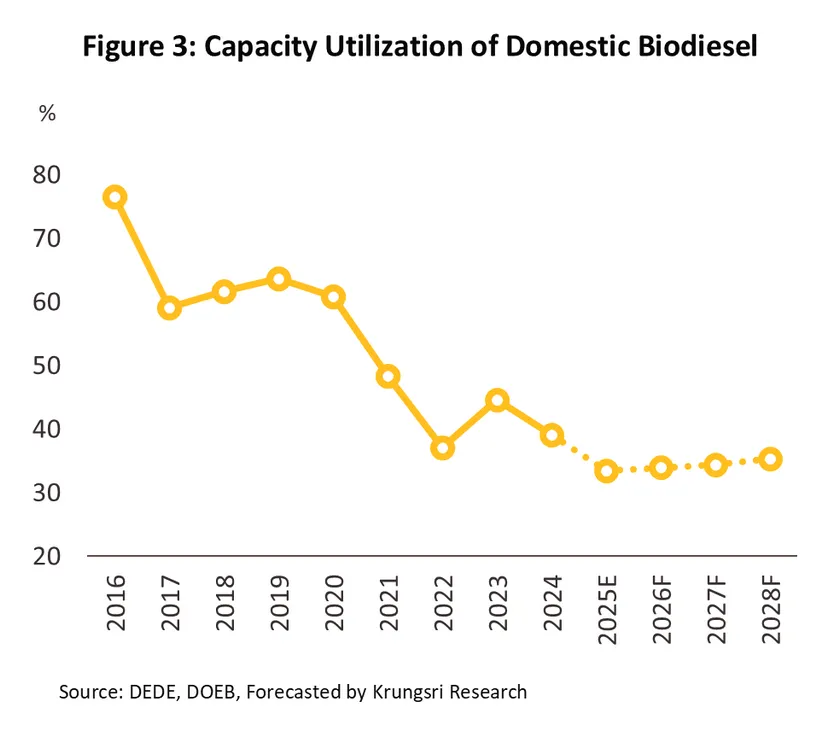

Over 9M25, the quantity of Fresh Fruit Bunch (FFB) used for Crude Palm Oil (CPO) reached 16.8 million tonnes (MT) (+6.3% YoY). Supported by (i) More favorable weather conditions, (ii) Expanded cultivation by farmers driven by high prices in 2021-2022, (ii) Incentivizing government minimum purchase price measures, and (iv) Increased Oil Extraction Rate. Consequently, CPO output rose to 3.0 MT (+10.1% YoY). Conversely, domestic CPO consumption contracted -7.0% YoY to 1.8 MT, primarily due to decline in biodiesel production input, settling at 0.6 MT (-22.8% YoY). This contraction reflects lower energy demand in the transport sector stemming from the overall slowdown in business and trade activity. This occurred despite an increase in refined palm oil (RPO) production input to 1.2 MT (+4.6% YoY), driven by sustained demand from downstream industries, particularly for export-oriented RPO and oleochemicals production, which continued to grow. Meanwhile, CPO product exports increased to 0.95 MT (+16.7% YoY), meeting the demand of key partners: India (+22.1% YoY), Malaysia (+10.8% YoY), and China (+173.2% YoY).

-

For the remainder of the year, previously identified tailwinds and headwinds are expected to persist. Although flooding occurred in southern Thailand toward year-end, the impact on raw material supply remains limited. As a result, fresh palm fruit output for CPO production in 2025 is projected to rise to 20.4–20.8 million tonnes, representing growth of 9.4–11.4%, yielding approximately 3.6–3.7 MT of CPO (12.2–14.2% growth). Conversely, domestic CPO demand is anticipated to contract by -3.9% to -5.9%, following reduced energy requirements in both commercial transport and the tourism sector's travel activity. Meanwhile, CPO export volume is forecast to expand by 22.2–24.2%, driven by increased stockpiling for food and energy security, especially in the Indian market. This is primarily due to concerns over declining supply from major exporters, namely Indonesia and Malaysia due to disease outbreaks and increased usage in the energy sector. This environment is expected to boost the average annual domestic prices for both FFB and CPO, as well as export prices for palm oil products, by around 5.0–10.0%.

2026-2028 Outlook

-

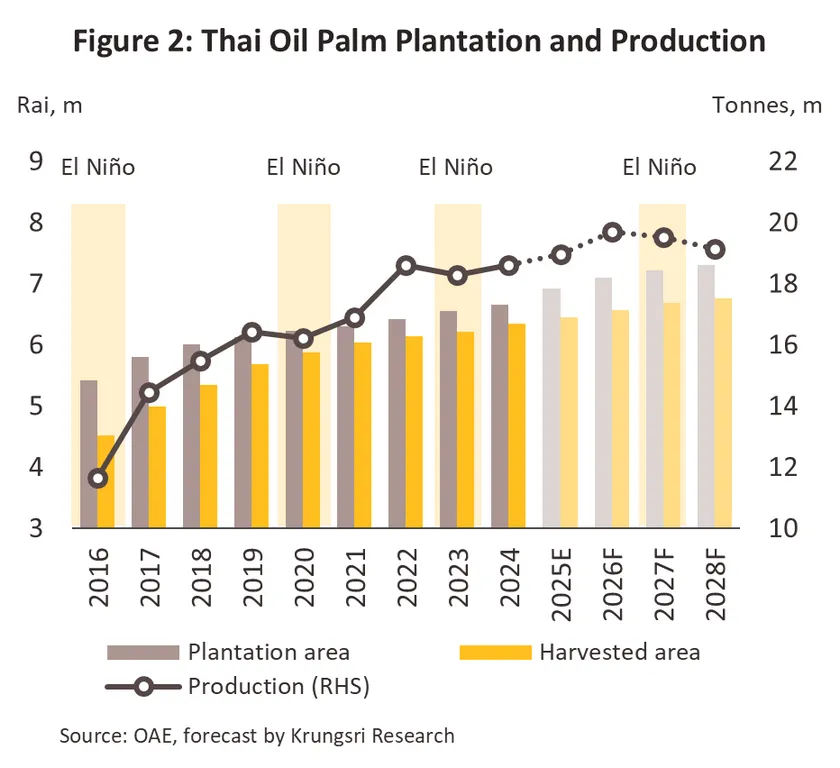

FFB and CPO output in 2026 is projected to expand by an average of 4.0–6.0%, primarily driven by global climate transitioning to normal conditions, i.e., La Niña phase, resulting in more favorable weather and rainfall for yield volume. During 2027–2028, oil palm supply is expected to contract by -4.6% to -6.6% p.a.. This drag is attributed to the anticipated return of the El Niño condition, mixed by the continued prevalence of basal stem rot (BSR) outbreaks.

-

In 2026, domestic CPO consumption volume is forecast to expand at 5.2–7.2%, primarily bolstered by government measures, including: (i) Adjusting CPO blending ratios in the energy sector from B5 to B7, and (ii) Stimulus measures for domestic consumption and tourism support. These factors favor demand in the food and oleochemical industries, further supported by rising palm output. In 2027–2028, consumption volume is expected to contract by -3.4% to -5.4% p.a.. This decline by (i) Hot weather conditions causing yield damage, and (ii) EV industry growth curtails biofuel demand.

-

Export volume is projected to accelerate in 2026 to 28.5–30.5% growth. This surge is driven by (i) Indonesia's likelihood of increasing its biodiesel blending ratio from B40 to B50, and (ii) Reduced output volumes from key exporters (Indonesia and Malaysia) due to disease outbreaks and harvesting labor shortages. These circumstances create an opportunity for Thailand to increase its exports. Over 2027-2028, the export market is expected to contract by -7.3% to -9.3% p.a.. This decline is attributed to anticipated government measures restricting exports to ensure sufficient domestic supply during a period of projected economic recovery, simultaneously with a decrease in domestic raw input supply due to drought conditions.

Chilled, Frozen and Processed Chicken

Situation in 2025

-

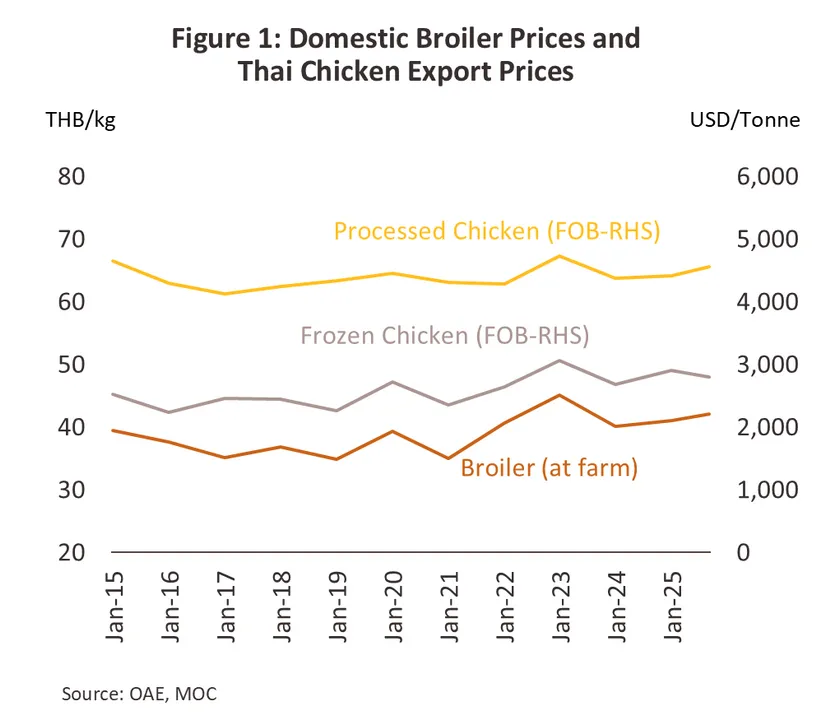

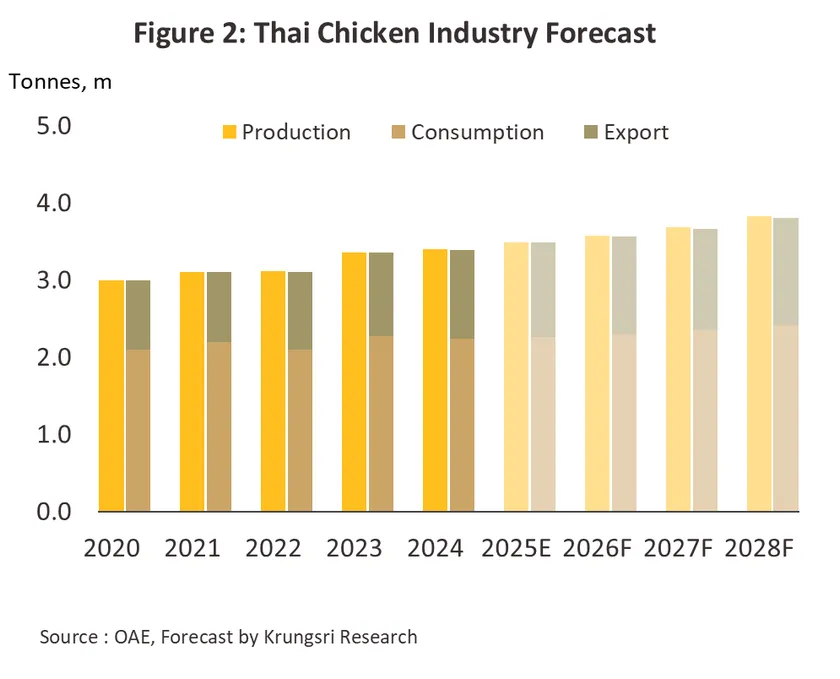

In 2025, Thailand's broiler chicken production is likely to expand at a modest rate of 0.8-1.8%. The upward momentum from rising chicken prices incentivizes farmers to increase production, while both domestic and export markets are experiencing slower growth due to indirect impacts of U.S. import tariffs on the economic conditions and purchasing power of both Thailand and its trading partners. Domestic consumption is expected to grow by 0.5-1.5% from (1) some consumers shifting to increased chicken consumption as a substitute for pork, which has seen price increases at a higher rate than chicken; (2) health-conscious consumers choosing to consume more chicken as it is a healthy food with high protein and low fat at an affordable price, which suits the current situation of high cost of living; (3) government measures to stimulate consumption in the latter part of the year (‘Half-Half Plus’ co-payment program, effective from 29 October – 31 December 2025). Meanwhile, export volume in the first 9 months grew by 6.1% YoY, with full-year 2025 export volume expected to expand by 6.0-7.0% from (1) the competitive advantage of chicken products as an affordable protein source; and (2) greater export market expansion into the Middle East region, which represents a consumer group with continued purchasing power and confidence in the quality and safety of Thailand's production processes according to Halal standards. Meanwhile, the impact from U.S. tax policy remains limited, as exports of chicken products from Thailand to the U.S. market account for a small proportion, accounting for only 0.003% of the total value of Thailand's processed chicken exports in 2024.

2026-2028 Outlook

-

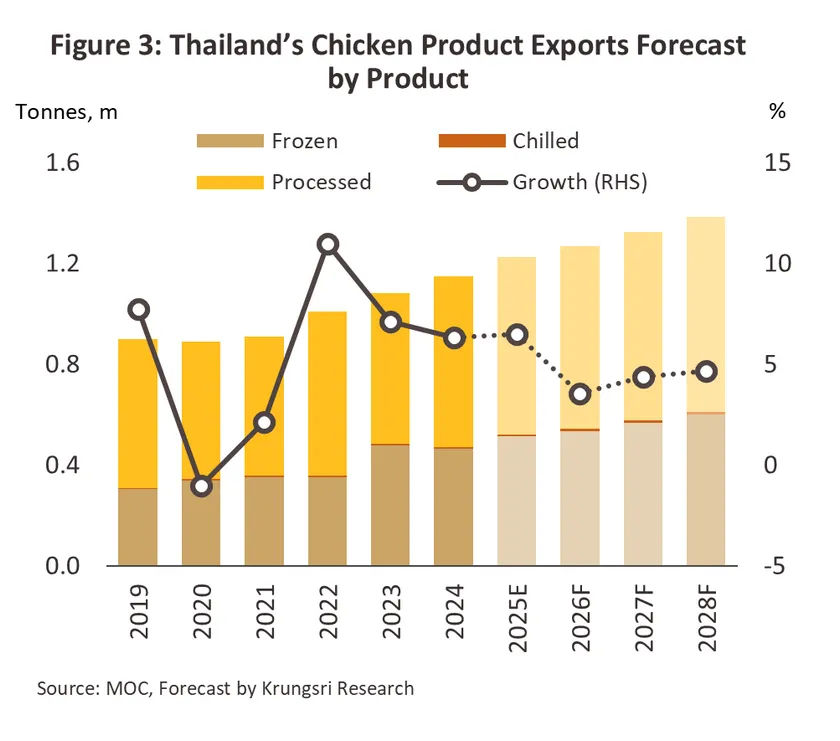

Overall chicken-product production volume is projected to grow by 1.7-2.7% per year, reaching 3.6-3.8 million tons annually, supporting both domestic and foreign demand, which tends to increase. Similarly, domestic sales volume is expected to expand by 1.7-2.7% per year. Demand is still likely to slow down in 2026 due to purchasing power that will remain subdued in line with economic conditions, before gradually recovering in 2027-2028. The momentum comes from (1) activities in the business sector, tourism sector, and restaurant business that will pick up; (2) consumers still seeking affordable products, with chicken meat remaining a primary option, and if Thailand imports more corn or soybean meal from the U.S., it will help reduce animal feed costs; (3) the health-conscious trend favoring high-protein, low-fat foods; (4) chicken meat meeting religious and sustainability requirements, emitting less greenhouse gases than pork or beef; and (5) the development of diverse ready-to-eat processed chicken products that are convenient for fast-paced lifestyles.

-

As for chicken product export volume, growth is expected to slow to 3.7-4.7% per year. Growth will be driven by (1) market expansion through trade cooperation, both with Middle Eastern countries as a Halal market and with neighboring countries such as Lao PDR and Malaysia, where Thailand still has a logistics cost advantage; (2) foreign consumers still choosing to consume affordable protein amid high cost of living; (3) Thailand's reputation for quality standards in frozen-processed chicken production. Nevertheless, a slowing global economy remains a key constraint on the overall growth of Thailand’s chicken product exports in 2026. Meanwhile, the direct impact on exports to the U.S. and Cambodia is expected to be limited, as these two markets together account for only 0.3% of Thailand’s total chicken product export value.

Canned Fish

Situation in 2025

-

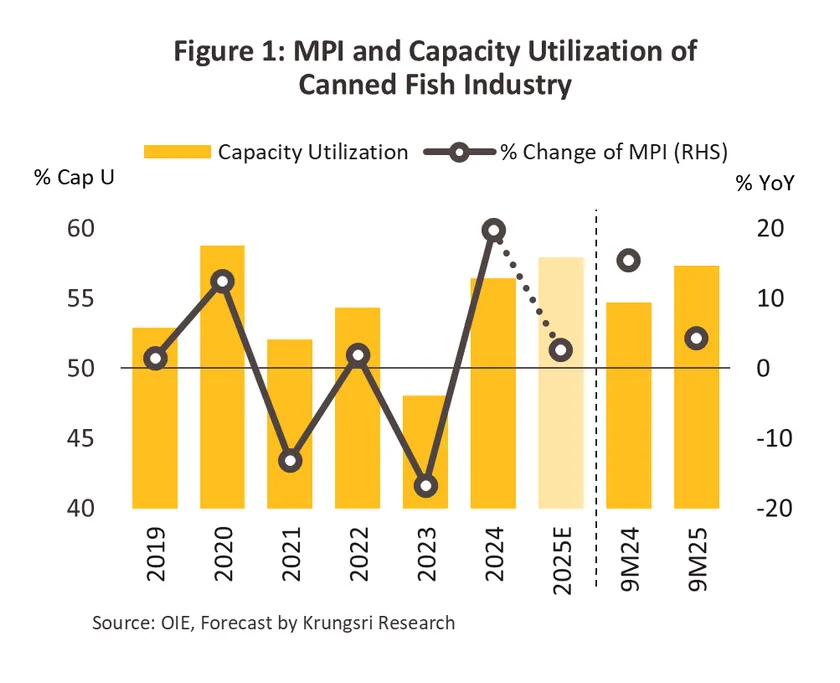

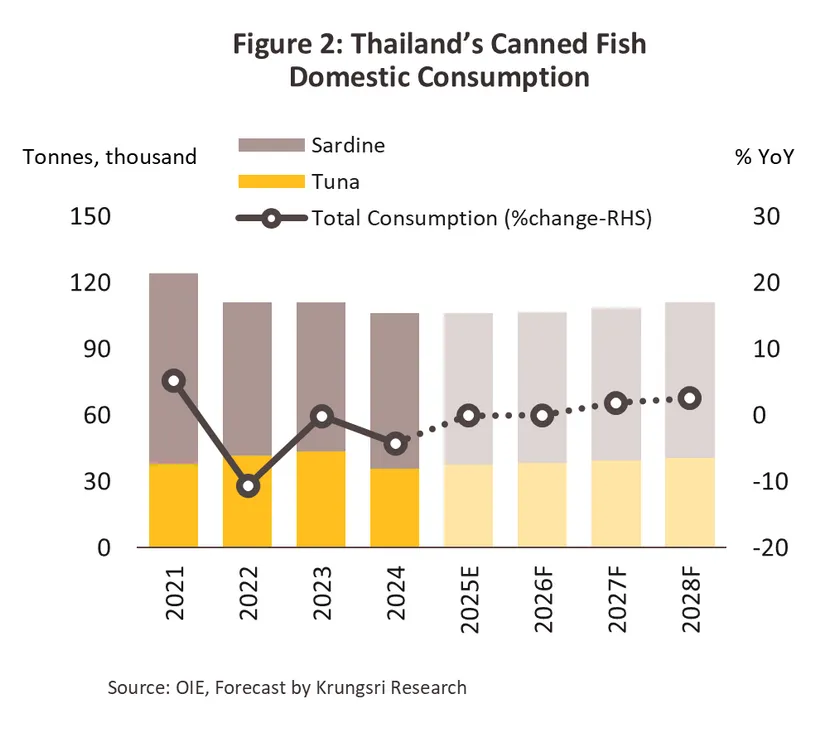

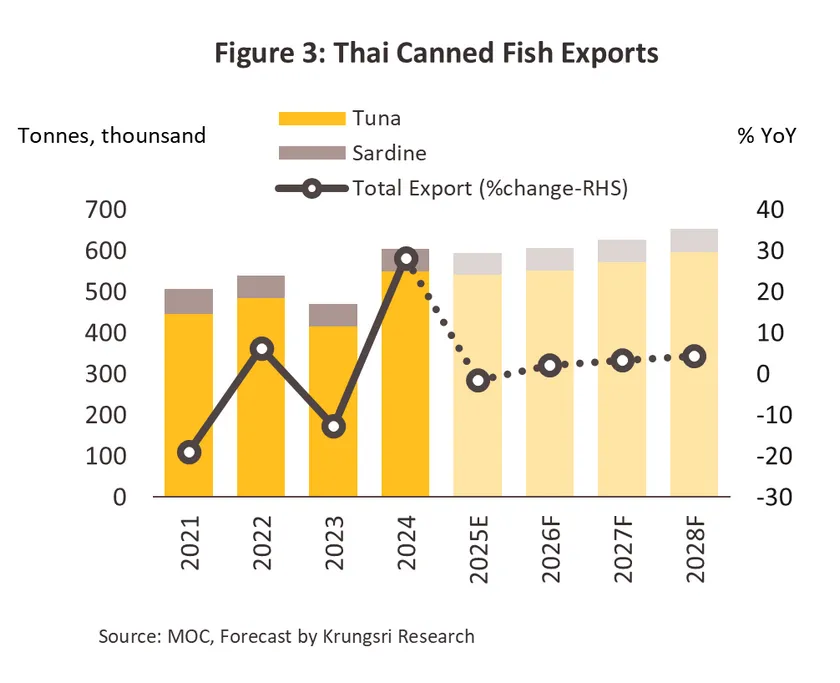

In the first 9 months, production volume expanded by +4.6% YoY, comprising canned tuna (+3.9% YoY) and canned sardines (+8.8% YoY). The main reason was accelerated production for export before the implementation of U.S. tariff barrier measures. Domestic consumption volume remained flat at +0.1% YoY, with tuna expanding by +6.7% YoY due to more diverse product development and meeting health-conscious consumption needs, especially among middle-to-upper income groups; while sardines contracted by -3.1% YoY as consumers reduced food stockpiling and shifted to consuming more fresh food and food outside the home. Thailand's canned fish export volume contracted slightly by -0.3% YoY to 442.9 thousand tons, valued at 1.8 billion U.S. dollars (+0.2% YoY). Canned tuna export volume decreased slightly by -0.2% YoY from the contraction of Middle Eastern markets such as Saudi Arabia, the United Arab Emirates, and Israel following the earlier export surge during the period of geopolitical conflict, as well as U.S. tariff barrier measures causing export volume to the U.S. to expand at a slower rate (+0.3% YoY). Meanwhile, canned sardine export volume contracted by -1.6% YoY from shrinking demand, particularly in South Africa, which is a major market (-20.6% YoY), as it shifted to importing from lower-cost countries, and Cambodia (-19.1% YoY) from the conflict issues along the Thai-Cambodia border and anti-Thai product sentiment.

-

For the remainder of the year, the above supply and demand factors are expected to continue influencing the market, leading to an expected full-year 2025 production volume expansion of 3.3-4.3%. Domestic consumption volume is expected to remain flat, while export volume is expected to contract by -1.1 to -2.1%.

2026-2028 Outlook

-

Canned fish production is expected to expand at a limited rate of only 1.0-2.0% per year from the continued impact of U.S. import tariff policy and constraints on aquatic supply, which will decrease due to the effects of climate change and increasingly severe seawater temperatures, with Thailand still heavily reliant on imported raw materials. Domestic consumption is expected to grow by 1.0-2.0% per year, in line with domestic economic conditions and purchasing power that still tends to be subdued in 2026 before gradually recovering. Canned tuna remains a product with good recovery potential driven by the health-conscious trend. Export volume is expected to expand at an average of 2.7-3.7% per year. Export trends will still have limited expansion in 2026 under pressure from U.S. import tariff measures, but after that, Thai operators are expected to be able to adapt through production process improvements and export market diversification to countries where demand still has growth potential and that accept Thailand's production standards, especially countries in the Middle East region.

FOOD & BEVERAGES

Ready-to-eat food

Situation in 2025

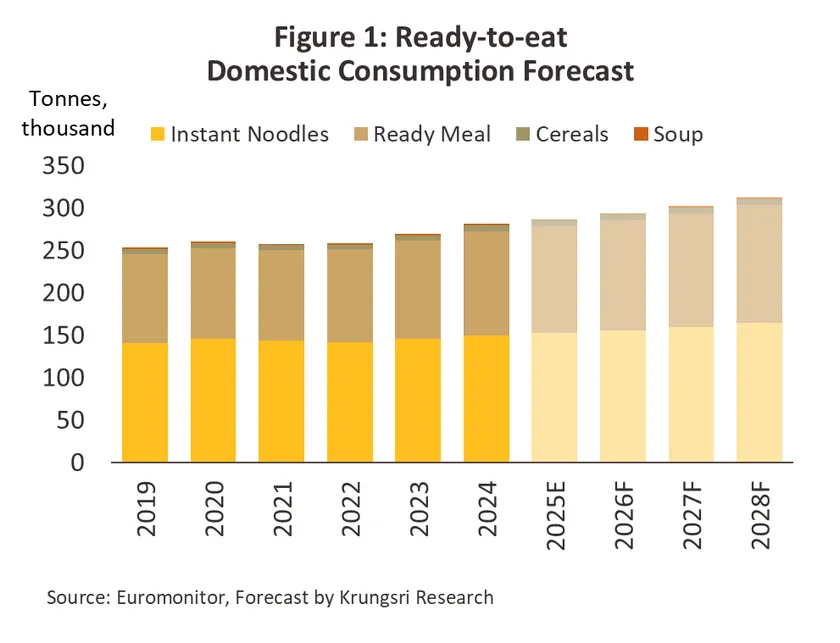

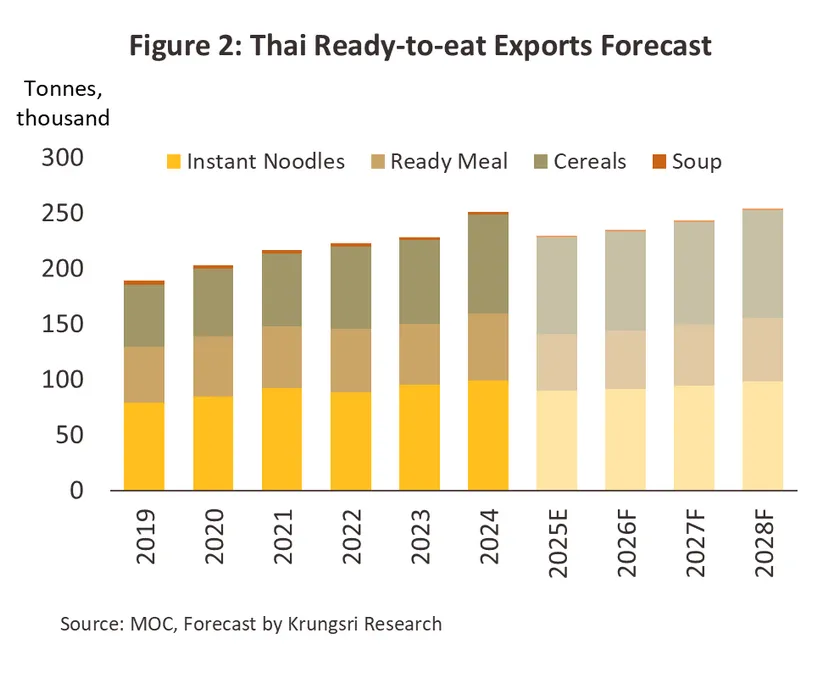

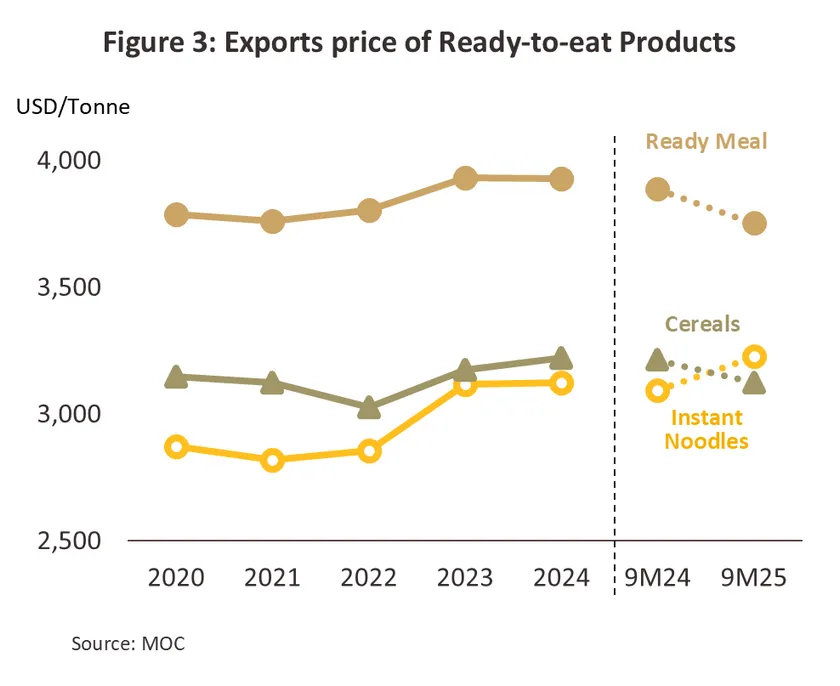

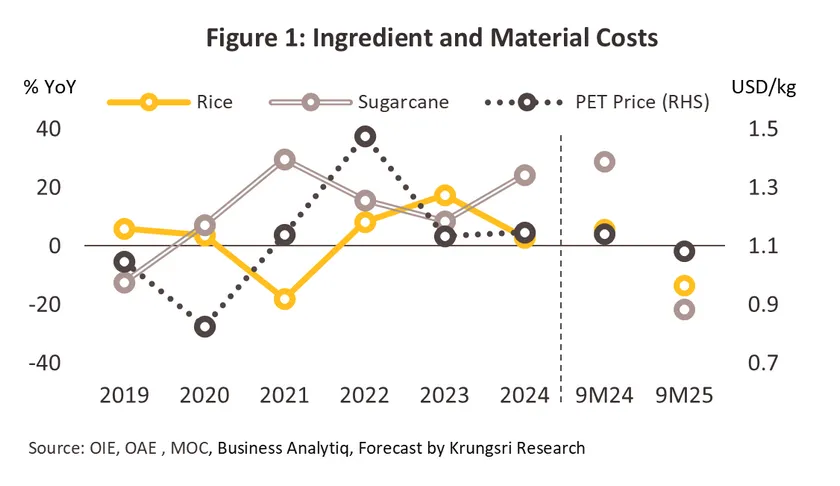

In 2025, domestic sales volume is projected to expand at a low rate of only 1.5-2.5% due to the slowdown in the domestic economy under pressure from U.S. retaliatory tariff measures, the decline in tourist numbers, and political uncertainty, despite positive factors from demand for affordable and convenient food, as well as government measures to stimulate consumption at year-end. Export volume of ready-to-eat food is expected to contract by -8.0 to -9.0% (with the first 9 months contracting -6.6% YoY) from (1) the impact of U.S. tariff barrier measures affecting the import costs of Thai products in the U.S., which is Thailand's number one export market, and (2) the tense situation along the Thai-Cambodia border and anti-Thai product sentiment in Cambodia, which is a major export market for instant noodles from Thailand. The full-year 2025 outlook by product category is as follows:

-

Instant Noodles: Domestic sales are expected to expand by 1.4-2.4% as weak purchasing power causes consumers to be cautious in spending and shift focus to low-priced semi-prepared foods, while exports are expected to contract by -9.0 to -10.0% (9M25 contracted -8.7% YoY) from declining exports to Cambodia.

-

Chilled and Frozen Ready Meals: Domestic sales are expected to expand by 1.8-2.8% from the popularity trend of value for money and time savings amid intense competition from restaurants. Exports are expected to contract by -14.5 to -15.5% (9M25 contracted -12.7% YoY) from the effects of U.S. retaliatory tariff measures.

-

Cereals: Domestic sales are expected to expand by only 0.4-1.4% due to weak economic conditions and purchasing power, causing consumers to choose more filling and value-for-money foods. Exports are expected to contract by -2.5 to -3.5% (9M25 flat at 0.0% YoY) from intensifying competition due to U.S. tariff barrier measures.

-

Soups: Domestic sales are expected to contract by -0.5% to -1.5% as consumers prefer freshly cooked food, coupled with the global health-conscious trend, particularly reducing high-sodium foods, resulting in the export market expected to contract by -10.0 to -11.0% (9M25 contracted -10.2% YoY).

2026-2028 Outlook

-

Domestic sales volume is projected to grow by an average of 2.3-3.3% per year from (1) fast-paced lifestyles causing consumers to focus on convenient and long-shelf-life foods; (2) the use of technology enabling manufacturers to understand consumer behavior and develop products more targeted to specific groups; (3) the expansion of convenience stores that increase distribution channels; and (4) product development in collaboration with stores and celebrity chefs to create a new image for products. However, growth will still be pressured by the economic slowdown, resulting in a modest expansion rate in 2026 before gradually increasing in 2027-2028.

-

Export volume of ready-to-eat food is expected to grow at an average of 2.9-3.9% per year. In 2026, growth will still be limited from (1) the slow global economic recovery; (2) U.S. retaliatory tariff measures that increase import costs for Thai products; and (3) slowing exports to Cambodia from border issues and anti-Thai product sentiment. However, expansion during 2027-2028 is likely to increase from (1) the gradual recovery of purchasing power in trading partner countries; (2) market expansion in Asia under FTA and RCEP, especially ASEAN, Japan, China, as well as Europe, Australia, and New Zealand; (3) fast-paced lifestyles supporting demand for convenient food; and (4) Thailand's potential as the kitchen of the world from raw material advantages and trading partners' confidence in Thailand's production quality.

Beverages

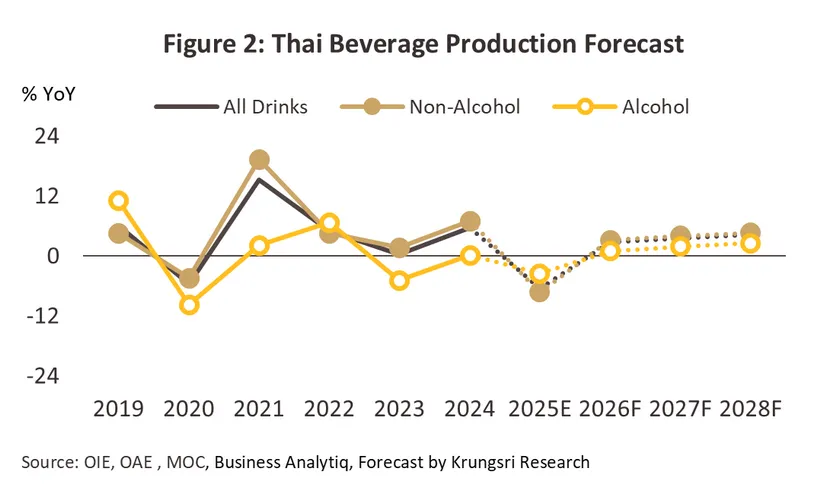

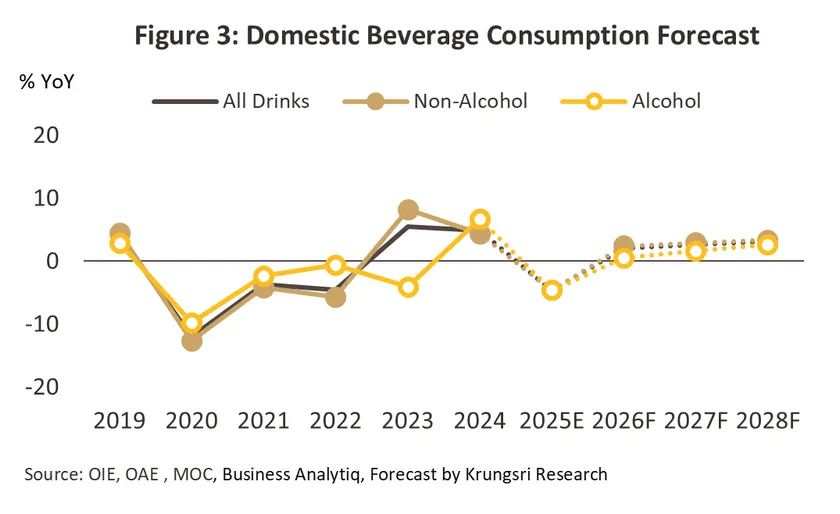

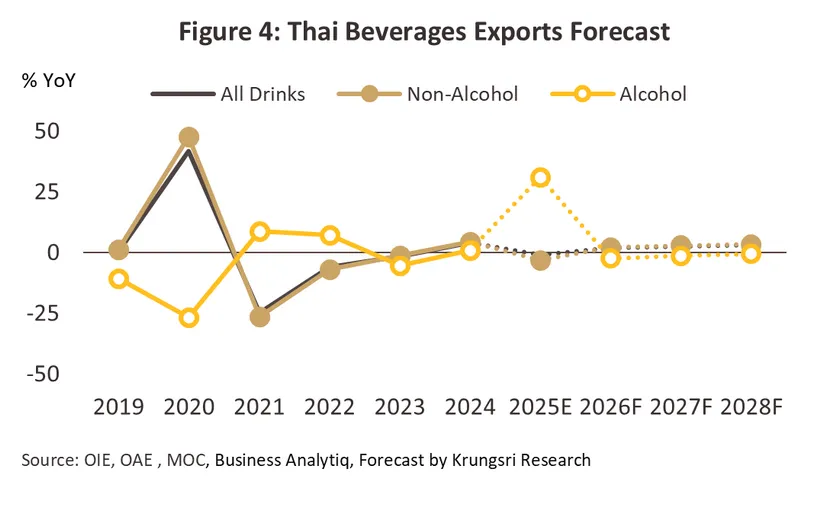

Situation in 2025