EXECUTIVE SUMMARY

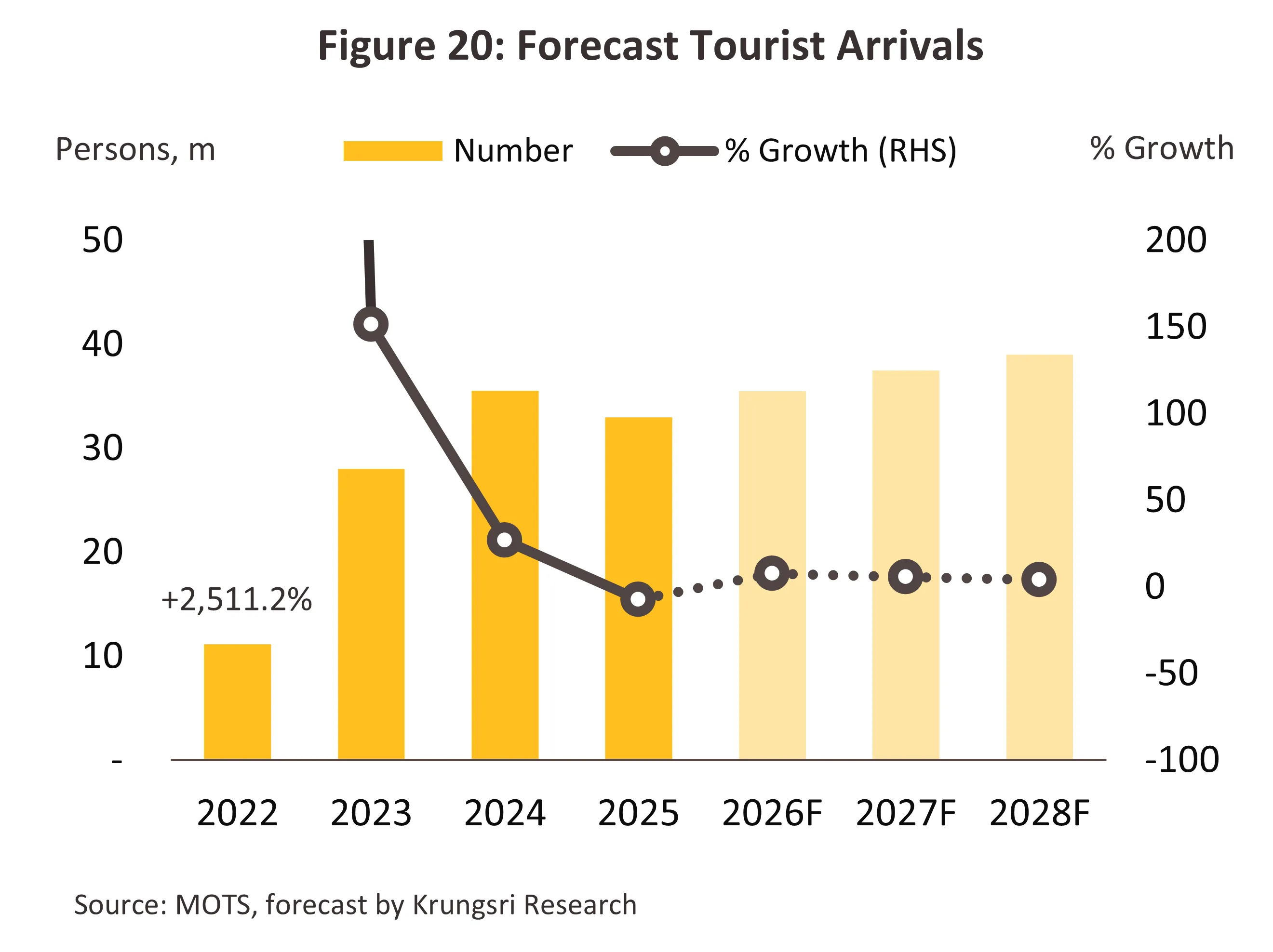

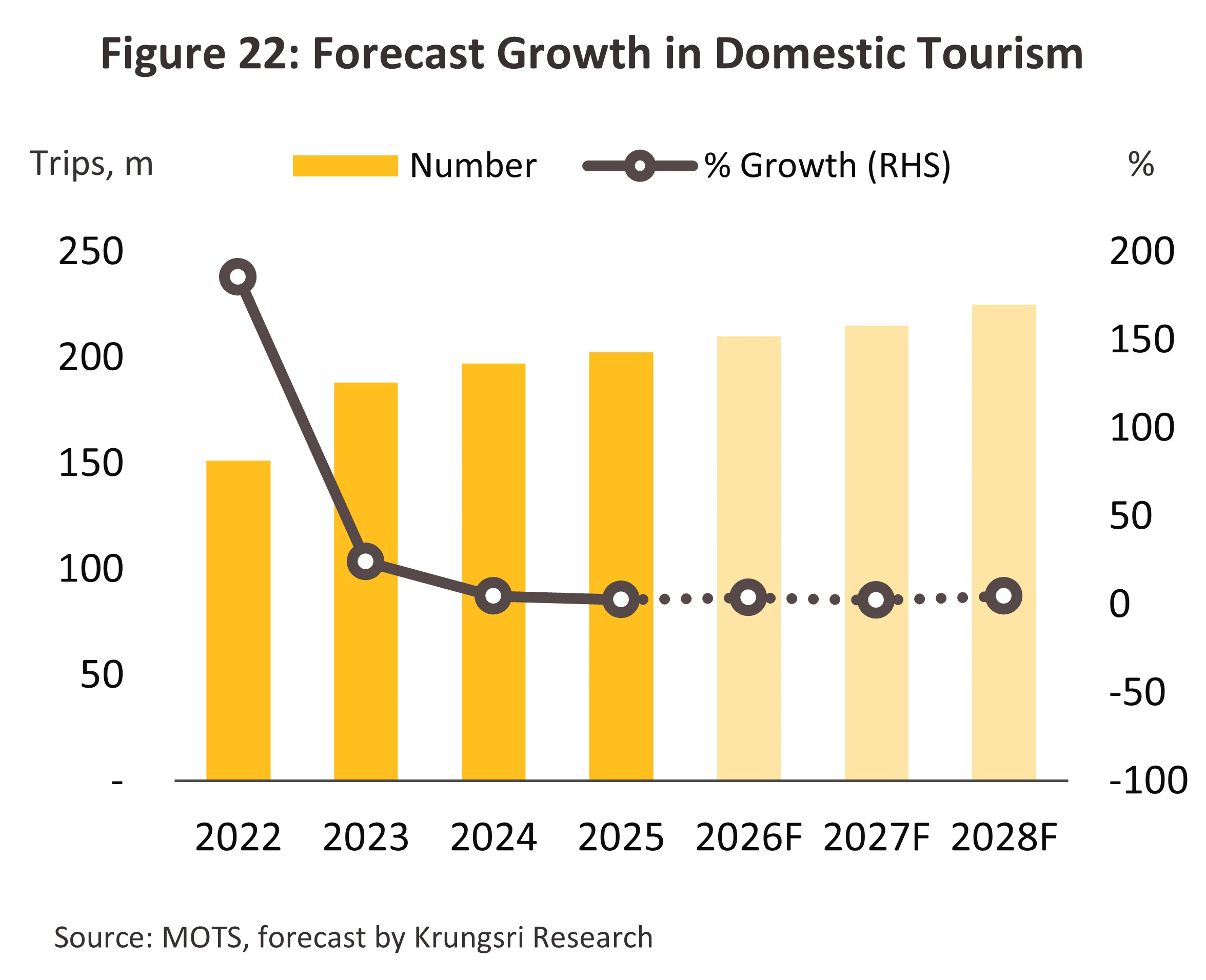

The Thai hotel industry is expected to continue expanding over 2026-2028, supported by a gradual recovery in international tourist arrivals, which are projected to reach around 39 million in 2028, in line with an increase in direct flights to major destinations. However, international arrivals over the next 3 years are unlikely to return to pre-COVID-19 levels, as the Chinese market is expected to recover more slowly amid lingering safety concerns. Moreover, competitors in Asia, particularly Vietnam, are also intensifying efforts to attract Chinese tourists, similar to Thailand. Domestic tourism is projected to rise to approximately 215-220 million trips during 2026-2028, supported by ongoing government initiatives promoting travel to secondary cities and the expansion of the MICE segment in regional hubs. Nevertheless, a weaker economic environment and political uncertainty, especially regarding budget disbursement for tourism-support measures, remain downside risks to domestic travel growth, particularly in 2026. Overall, these factors are expected to keep the nationwide hotel occupancy rate at around 72-73%, while large hotel operators are likely to continue expanding investment in major tourist destinations.

Krungsri Research view

-

Hotels in the major tourist destinations (Bangkok, Pattaya, and Phuket): Revenue is expected to grow in line with the recovery of international tourism, with the average occupancy rate of this hotel segment likely to reach 75% from 2026 onward.

-

Hotels in regional centers and other important tourist areas1/: Revenues are expected to increase gradually, supported by the recovery in domestic tourism and spillover benefits from government stimulus measures. However, political uncertainty, particularly in 2026, may pose downside risks to tourism-support measures.

-

Hotels in other provinces: Revenue is expected to improve gradually, supported by government measures promoting travel to secondary cities, but average occupancy rates are likely to remain below those of major tourist destinations.

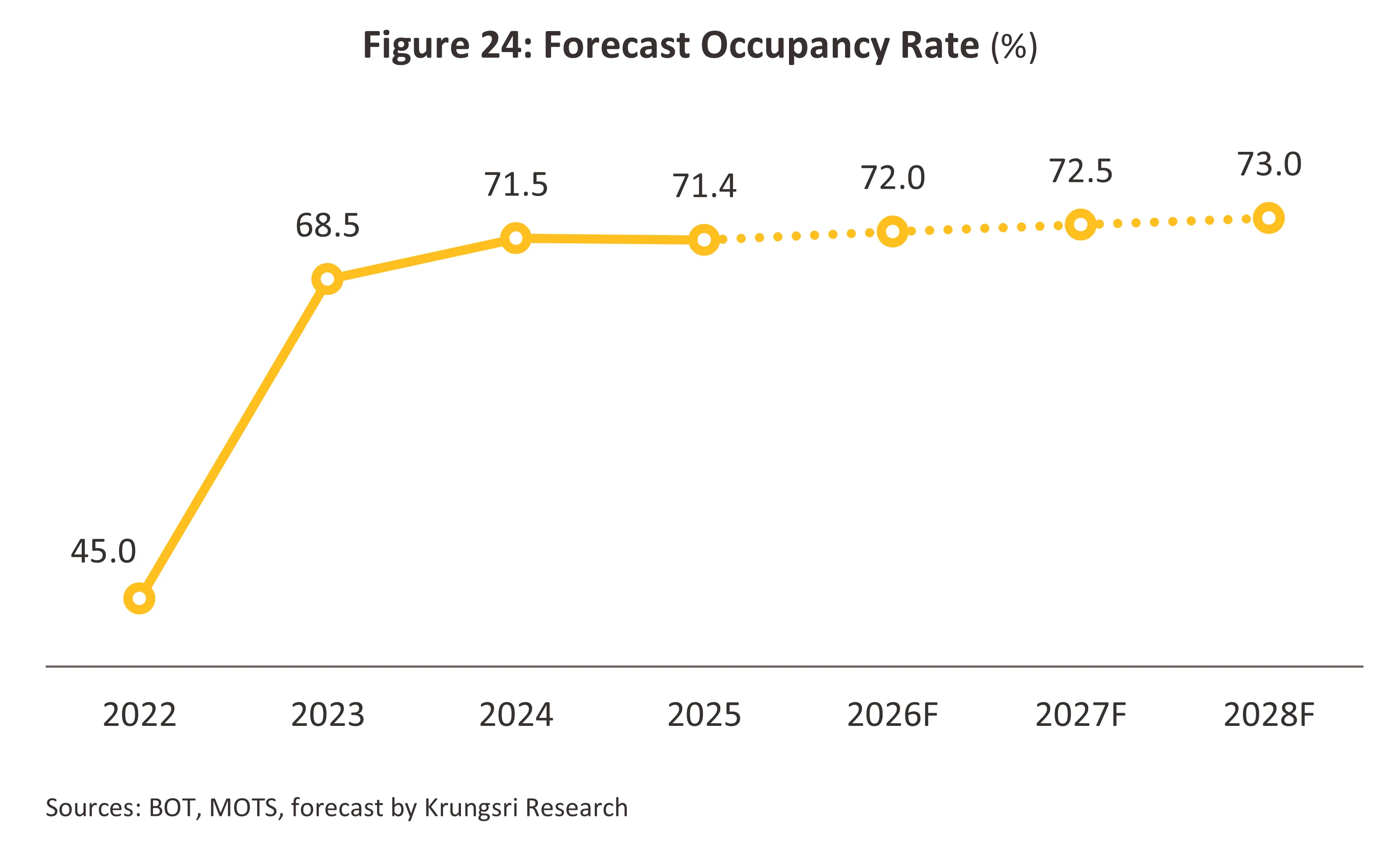

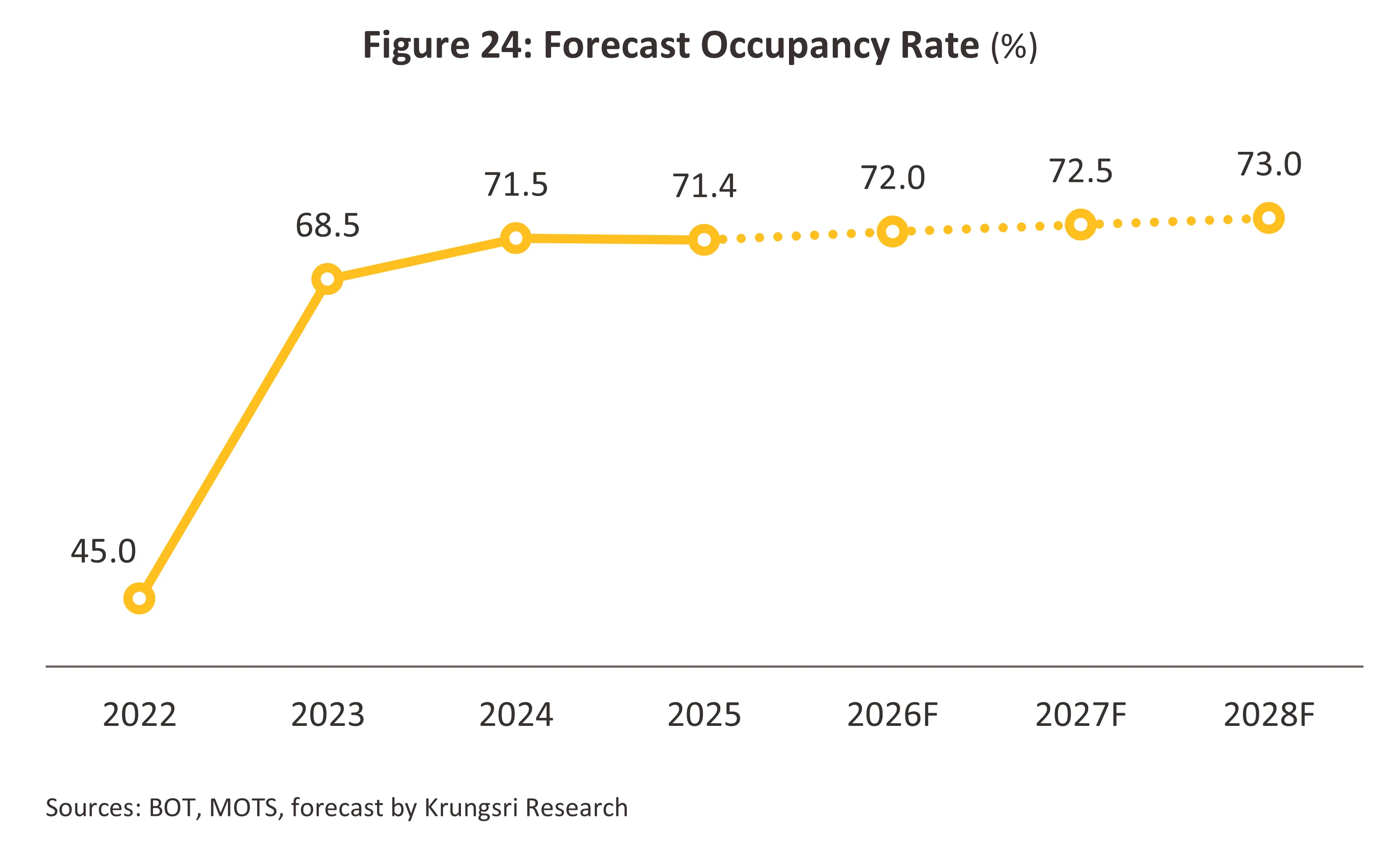

Across the industry, competition remains intense, driven by excess supply from both hotels and alternative forms of short-term accommodation. Combined with the gradual recovery in overall tourism demand, this is expected to keep the nationwide average occupancy rate in 2026 at 72.0%, before slightly edging up to 72.5% and 73.0% in 2027 and 2028, respectively.

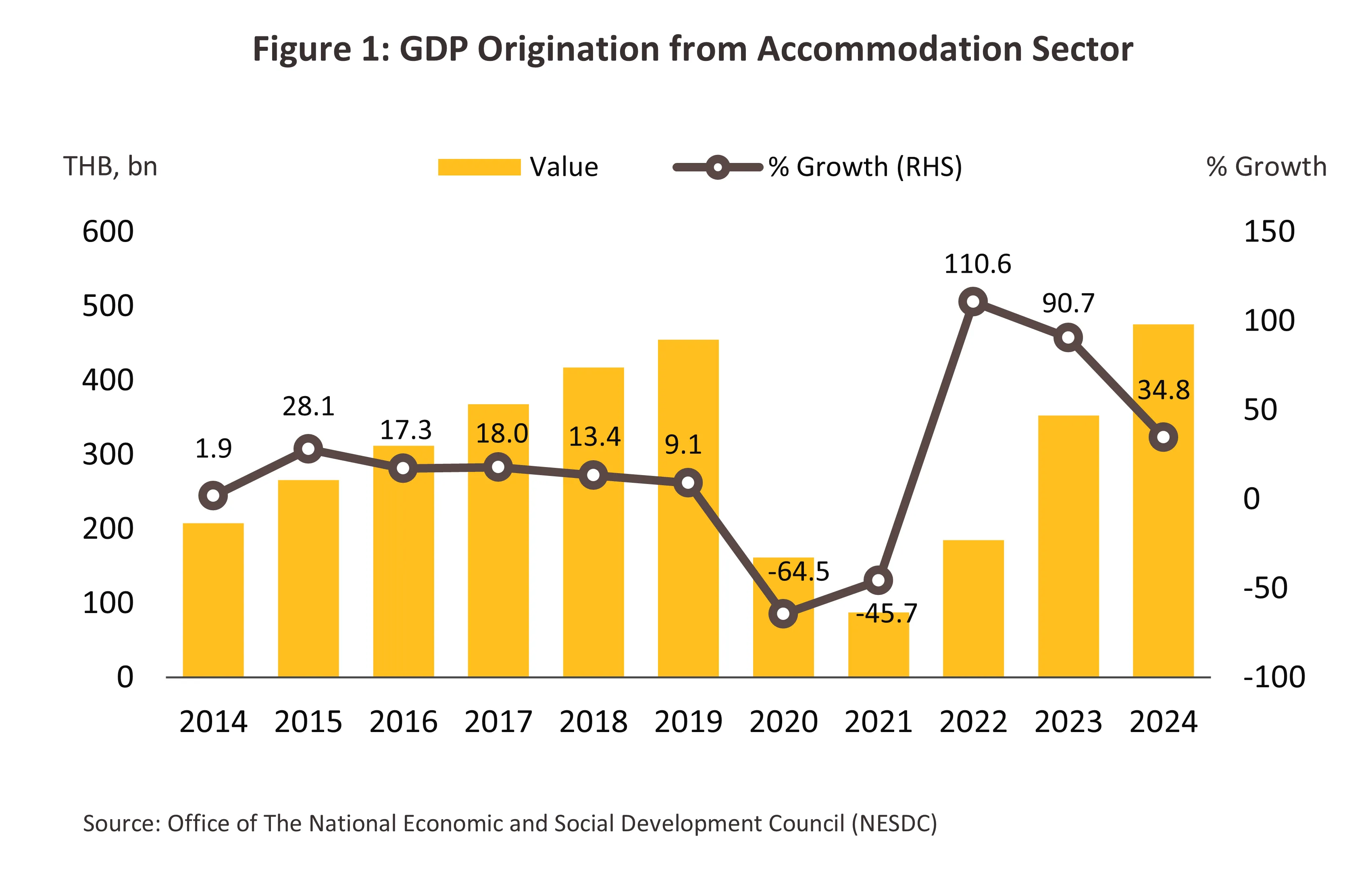

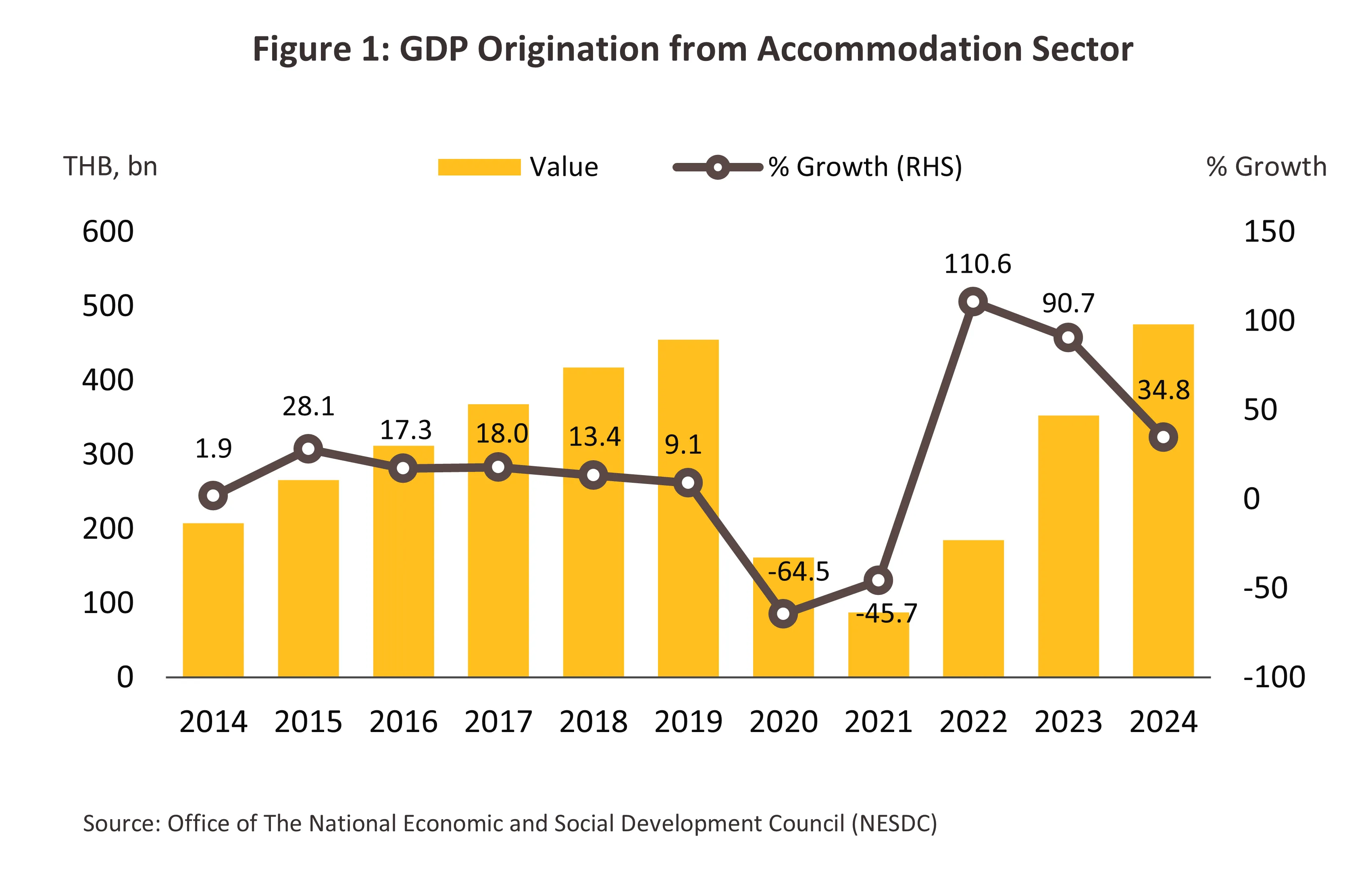

Overview

The hotel business (including resorts and guesthouses) is a tourism-related sector. During 2017-2019, the accommodation category accounted for around 2.5% of Thailand’s total GDP before declining sharply to 1.0% in 2020 and 0.6% in 2021 due to the severe impact of the COVID-19 pandemic, which caused a significant contraction in accommodation-related GDP. The sector began to recover in 2022 as the COVID-19 situation eased (Figure 1), with its share of GDP continuing to rise to 2.0% in 2023 and returning to 2.5% in 2024. Hotel revenues are derived primarily from room sales, which account for an average of 65-70% of total revenue. This is followed by food and beverage income, representing around 25%, with medium-sized and larger hotels—particularly those in the 4-5% star segment—generating a higher proportion of revenue from food and beverage services than smaller hotels. The remainder comes from other sources (around 5-10%), such as laundry services and rental income from retail space.

International tourists: Historically, Thailand has been one of the world’s most popular tourism destinations and continues to demonstrate strong potential to attract international visitors. This is supported by several key factors: i) the country’s wide range of world-class tourist attractions located across different regions, particularly Bangkok, Chonburi (Pattaya), and Phuket, which serve as major tourist destinations and are internationally recognized as world-class destinations; ii) Thailand’s cost advantage, with relatively lower living costs and hotel room rates compared with many competitors in the Asia-Pacific region (Figure 2), reinforcing its value-for-money positioning; iii) improved accessibility resulting from the continued development of transportation infrastructure; and iv) the ongoing expansion of low-cost airlines. However, the latest Travel & Tourism Development Index 2024 published by the World Economic Forum in May 2024 indicates a clear decline in Thailand’s tourism competitiveness. Thailand was ranked 47th out of 119 countries globally, down from 36th in 2021, placing it 9th in the Asia-Pacific region and 4th within ASEAN, behind Singapore, Indonesia, and Malaysia (Figure 2). Thailand underperforms these peers particularly in the area of Safety & Security, despite maintaining comparative strengths in air transport infrastructure, natural resources, and the promotion of non-leisure travel.

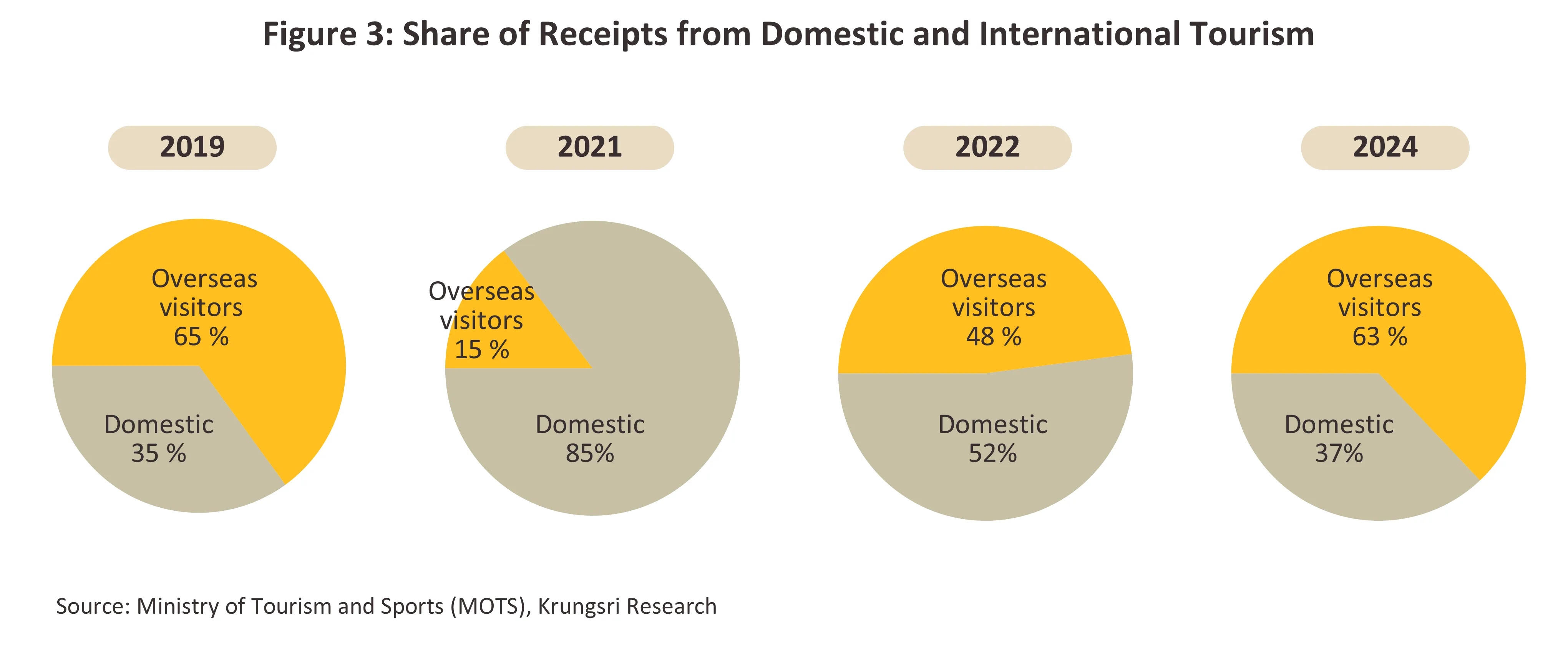

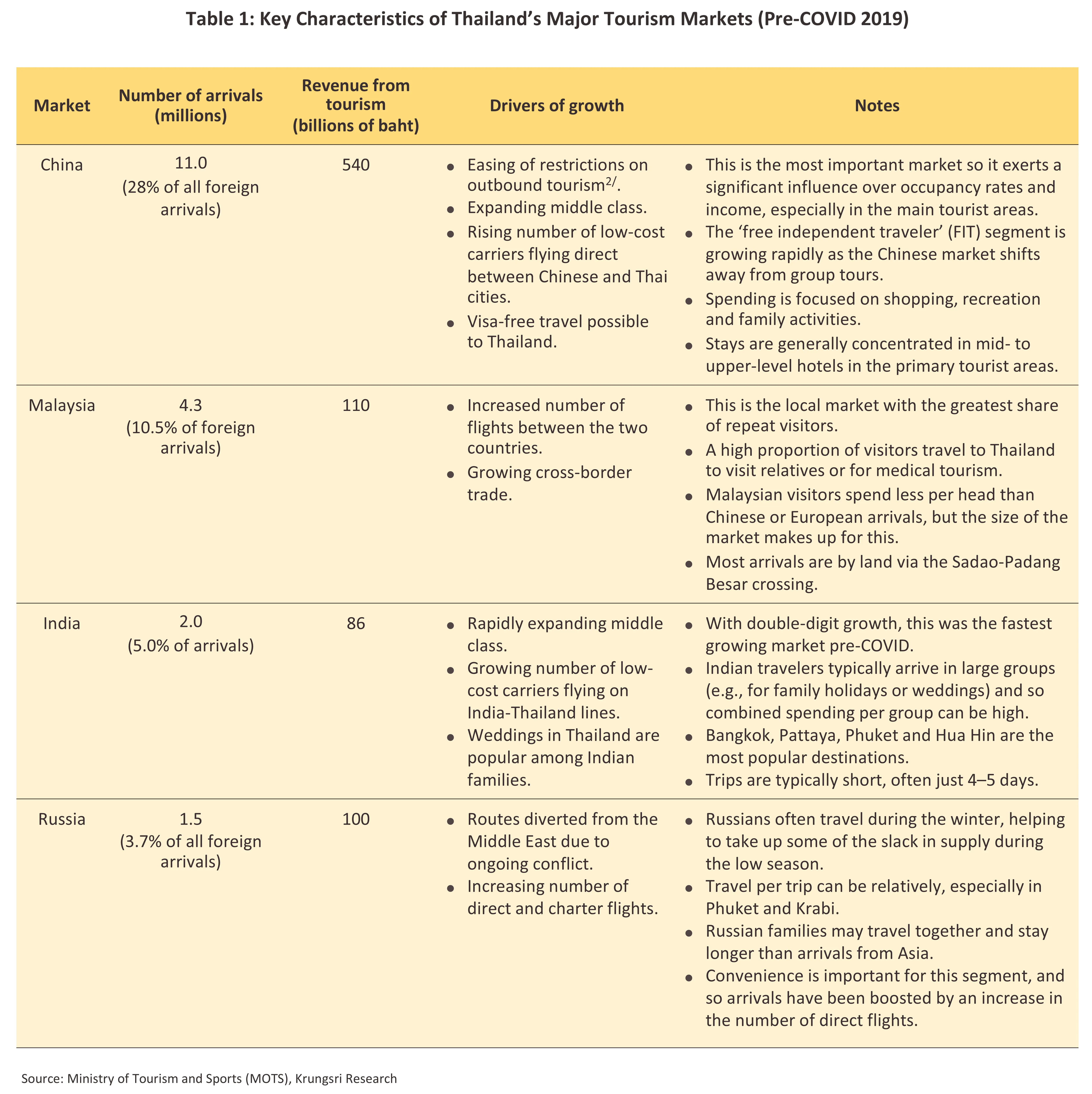

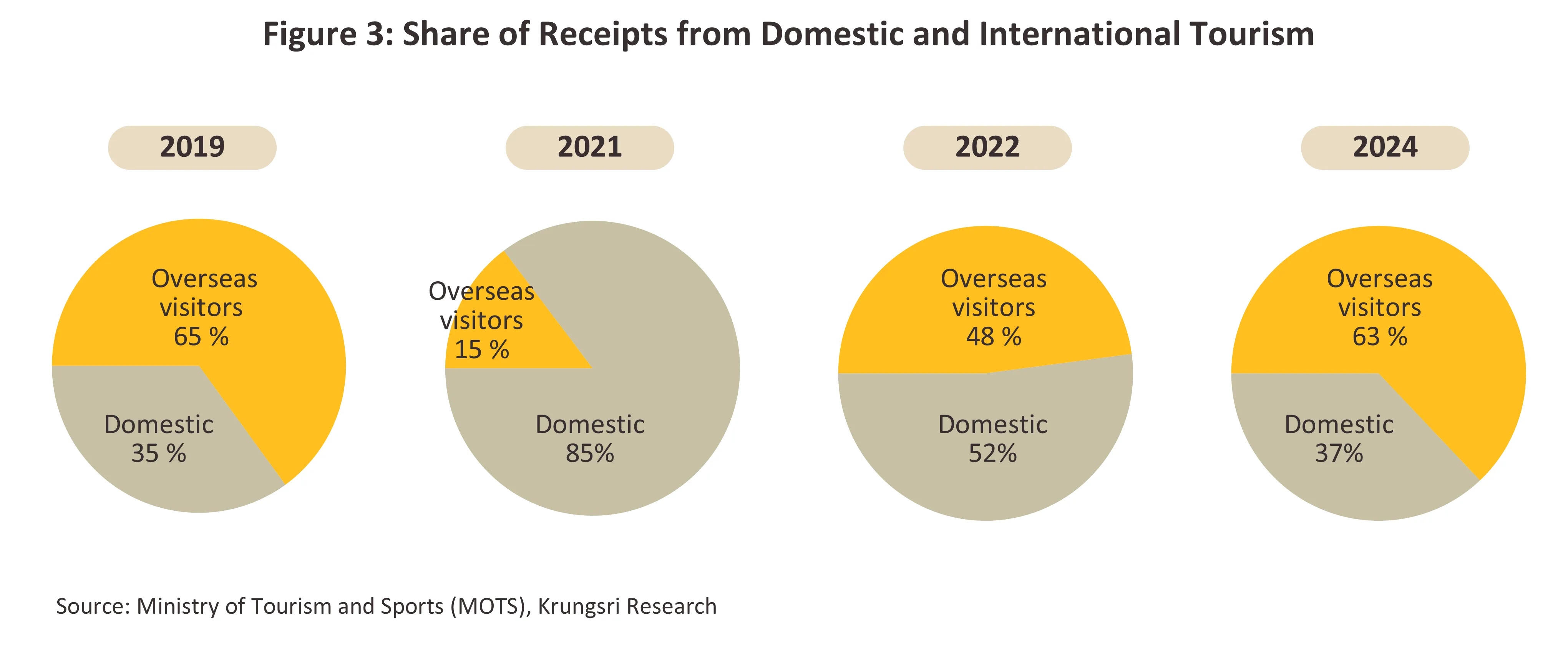

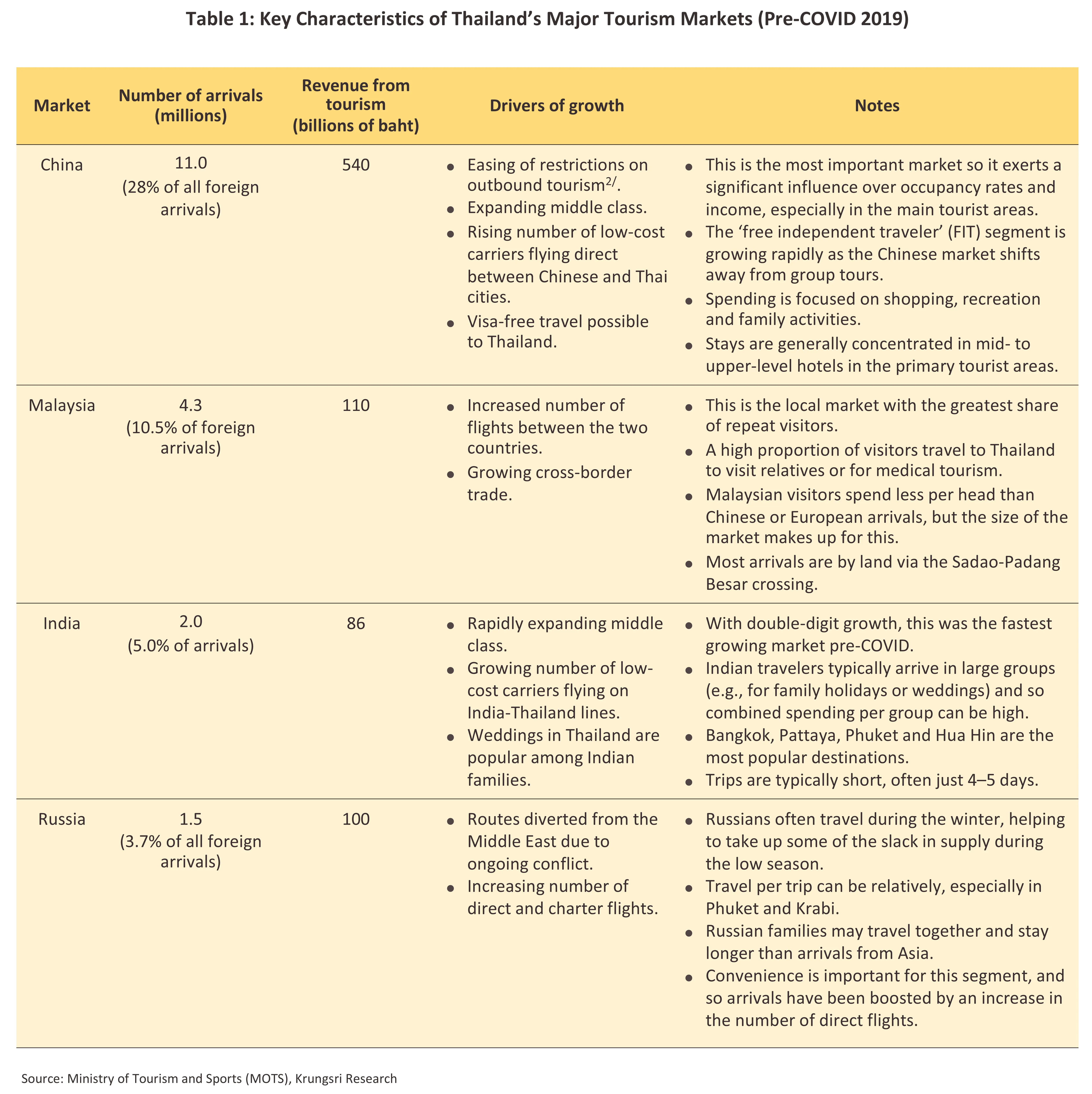

Tourism is a key source of revenue for Thailand. Prior to the COVID-19 crisis, in 2019, revenue from international tourists national accounted for around 65% of total tourism receipts, as international tourists tend to have higher per-capita spending and longer lengths of stay than domestic tourists. East Asia was the largest market, accounting for 41% of international tourism revenue and 42% of total foreign arrivals. During the COVID-19 crisis in 2020-2021, international tourist arrivals declined sharply, causing the share of revenue from foreign visitors to fall to just 15% in 2021. Following the gradual easing of travel restrictions in many countries, Thailand’s tourism sector began to recover, with the share of international tourism revenue rising to 48% in 2022 and further to 63% in 2024 (Figure 3). In terms of market structure, prior to COVID-19, the majority of international tourists to Thailand came from East Asia—including China, Japan, South Korea, and Taiwan—with China long ranked as Thailand’s largest market, accounting for nearly 30% of total international arrivals in 2019% This was followed by ASEAN and Europe. However, in the post-pandemic period, the share of East Asian tourists has declined noticeably, while the European market has expanded significantly. This shift partly reflects China’s prolonged restrictions on outbound travel, as well as the higher sensitivity of East Asian travelers to tourism-related risks, which has resulted in a slower recovery compared with other regional markets.

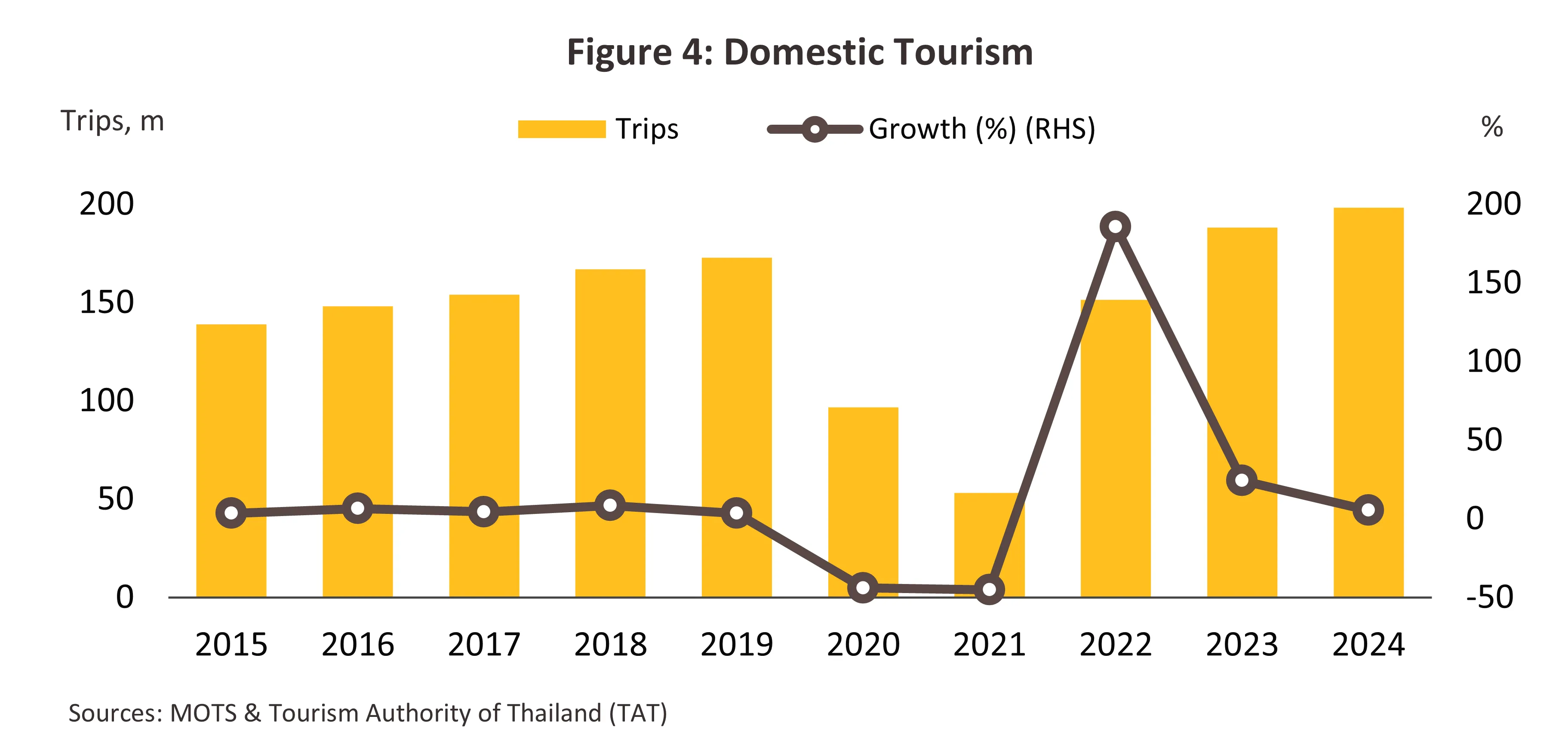

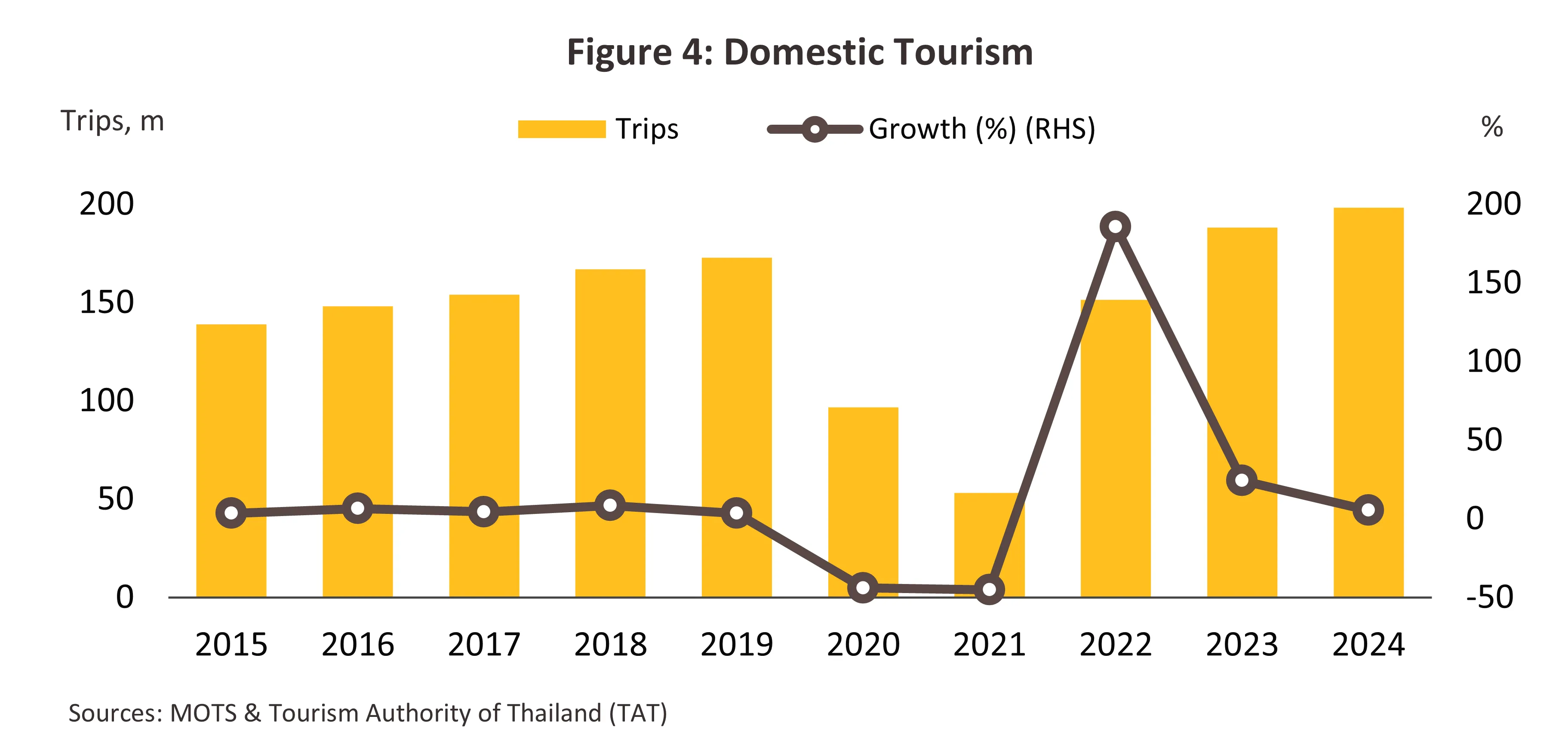

Thai tourists: Prior to the COVID-19 crisis, domestic travel expanded steadily, with Thai tourist trips averaging 144.8 million per year. Growth was supported by government measures promoting regional tourism, implemented in collaboration with the private sector through the development of new and attractive tourist destinations, alongside the expansion of low-cost airlines and continued improvements in transportation infrastructure. During 2020–2021, domestic travel contracted sharply, declining by an average of 43.6% per year to around 53 million trips as a result of strict COVID-19 containment measures. As the pandemic situation eased, domestic tourism began to recover from 2022 onward, rising to 151.5 million trips. This recovery was partly driven by domestic tourism stimulus measures, particularly the “We Travel Together” program, which subsidized travel-related expenses, as well as other government measures providing tax deductions to stimulate tourism spending—especially for travel to secondary cities across the country. In parallel, the private sector continued to organize annual tourism promotion campaigns, helping lift domestic tourism to nearly 200 million trips in 2024 (Figure 4).

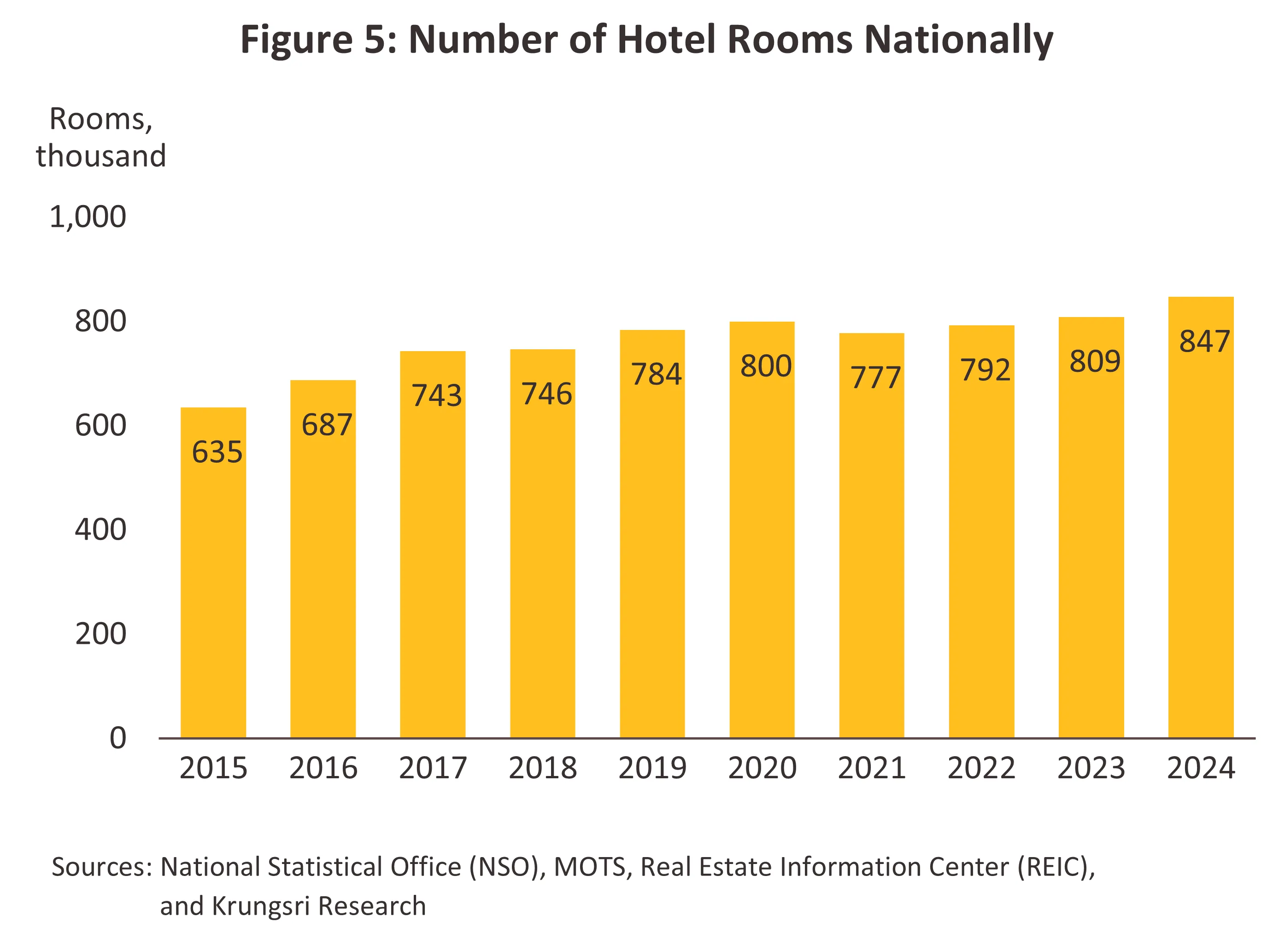

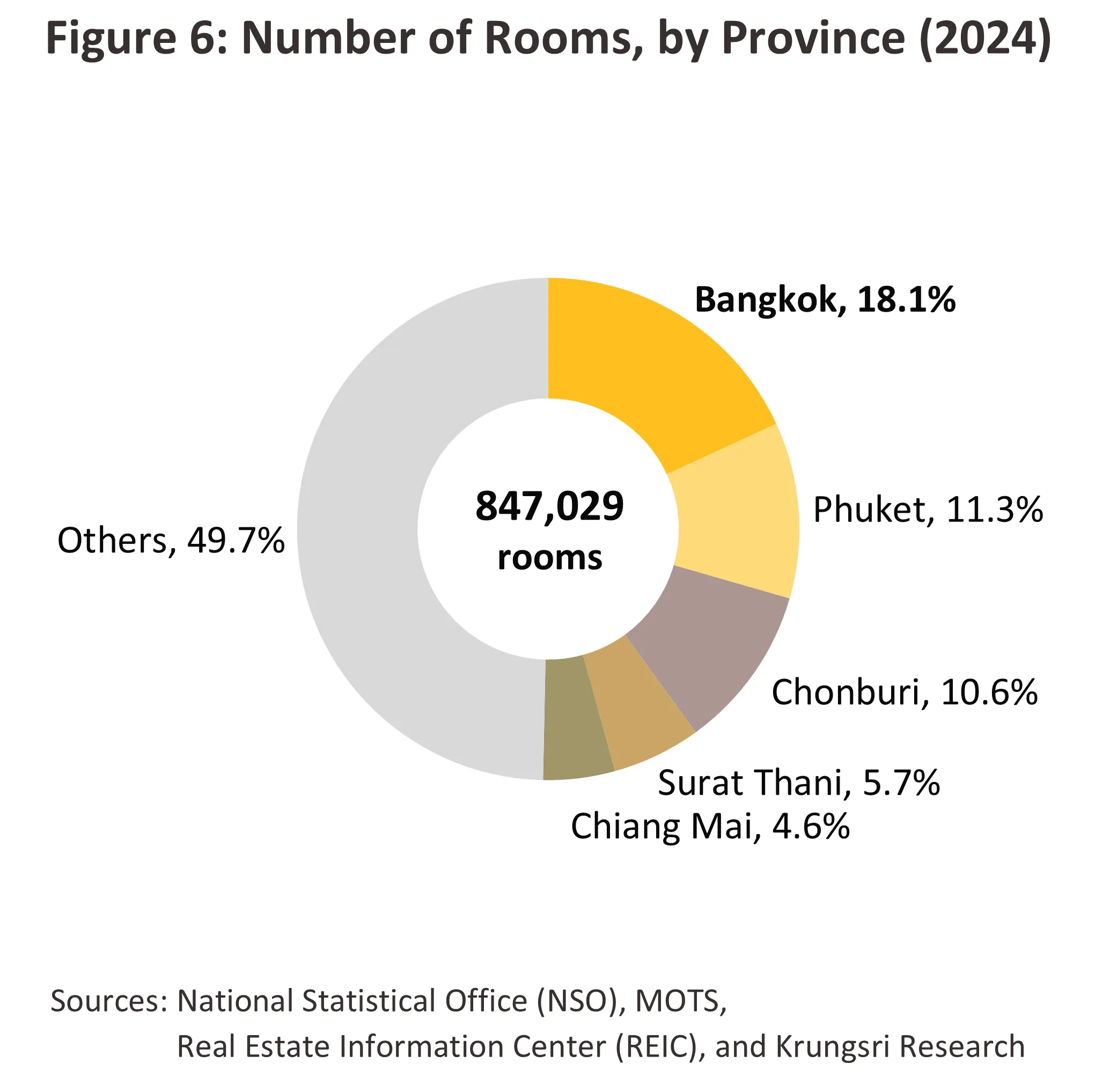

The number of hotels and hotel rooms has continued to expand in major tourist destinations, with accommodation supply remaining highly concentrated in Bangkok, Phuket, and Chonburi (Pattaya), which serve as key destination markets for international tourists. In recent years, the government has placed greater emphasis on policies to promote the dispersion of tourism to secondary cities, alongside continued development of transportation infrastructure and regional airports across several provinces. These factors have, in turn, encouraged increased investment in hotel developments in regional hubs and tourist destinations such as Chiang Mai, Krabi, and Surat Thani (Ko Samui). As a result, the nationwide supply of hotel rooms has continued to rise—except during the COVID-19 period in 2020–2021—from 634,855 rooms in 2015 to 847,029 rooms in 2024, representing an average annual growth rate of 3.3% (Figure 5). In 2024, rooms located in major tourist destinations accounted for around 50% of total national supply. Bangkok recorded the largest number of rooms at 153,473 (18.1% of the total), followed by Phuket with 96,048 rooms (11.3%) and Chonburi with 89,416 rooms (10.6%), respectively (Figure 6). These key tourist areas host both Thai hotel operators and international hotel chains (Figure 7).

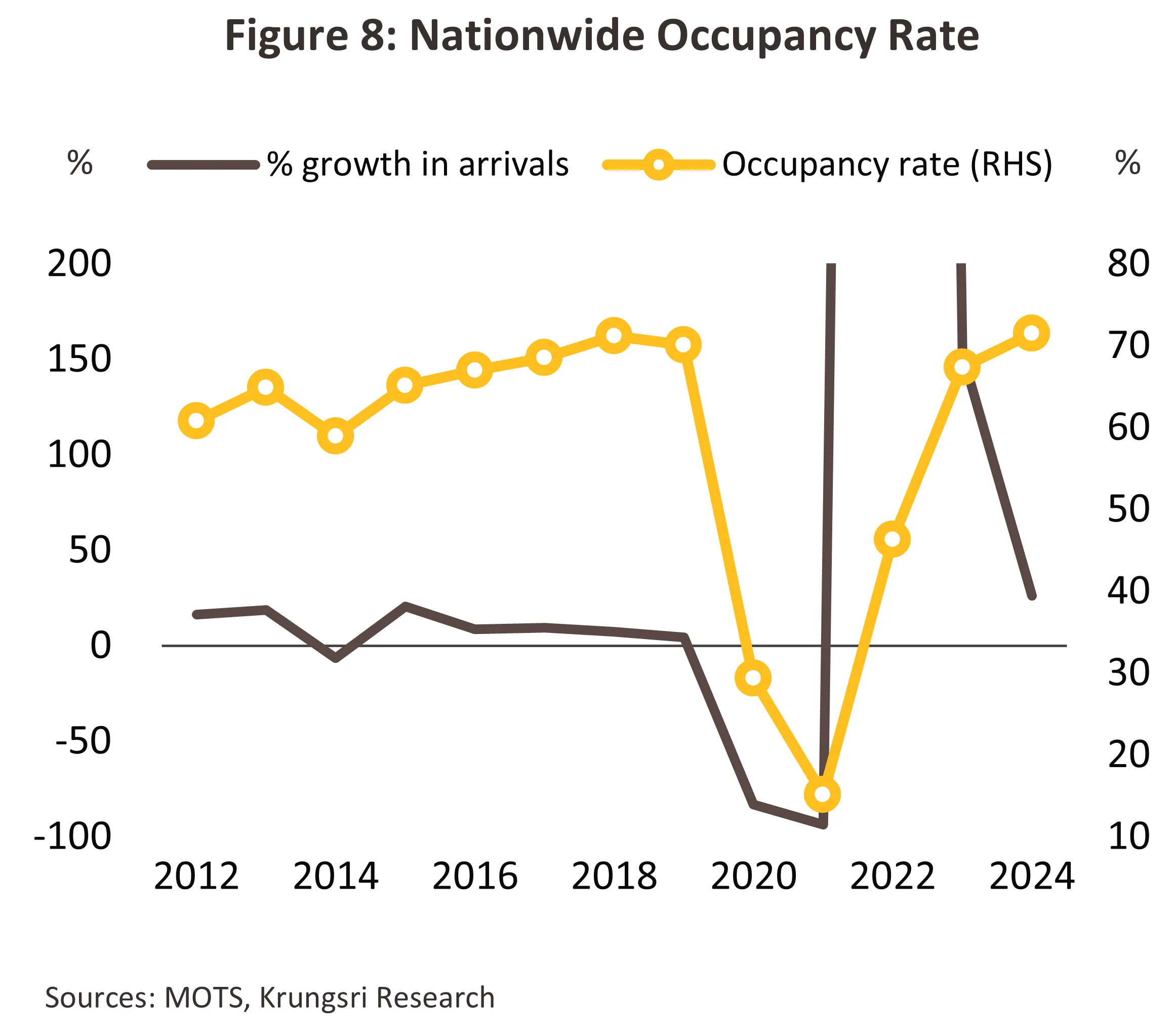

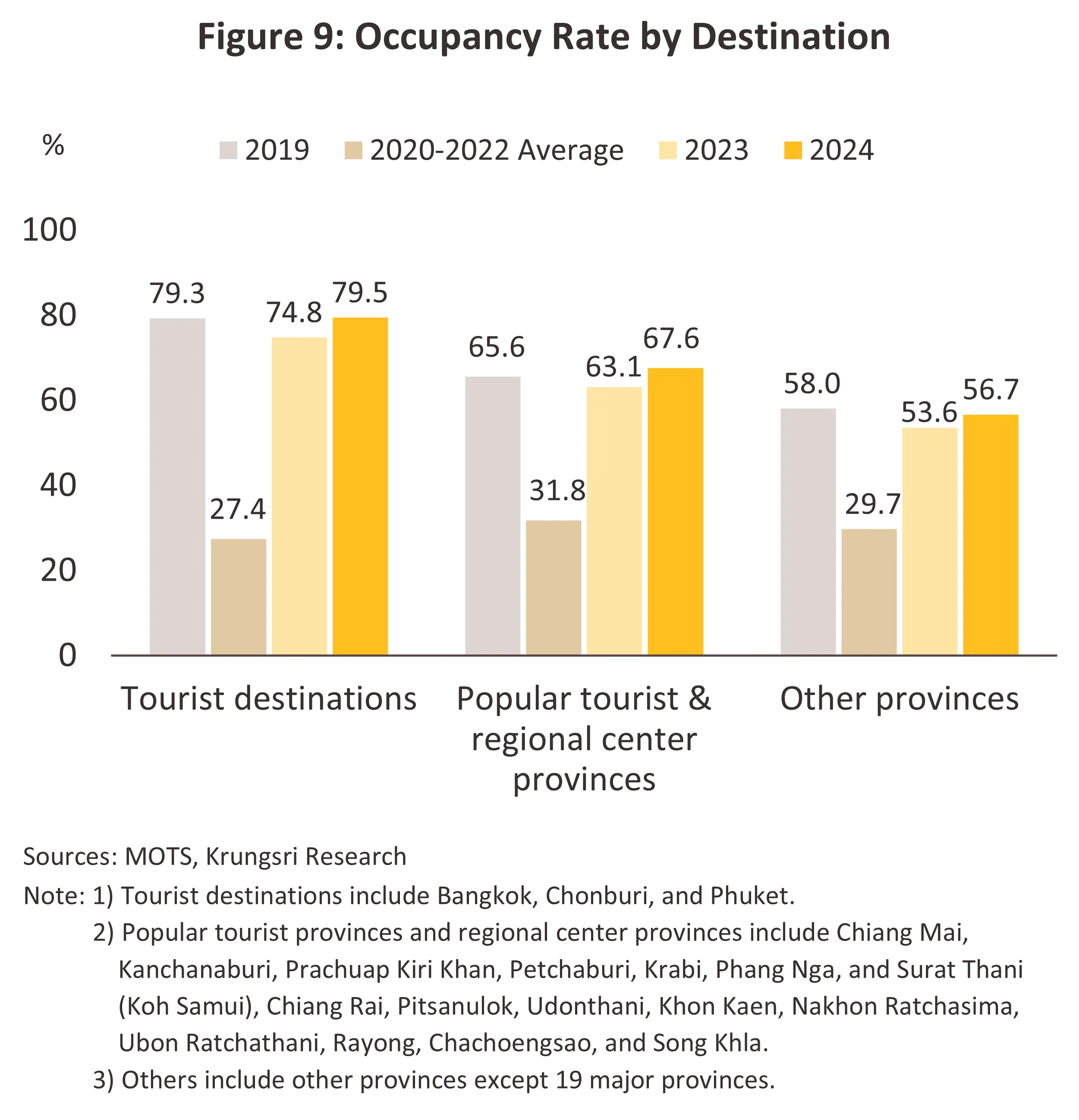

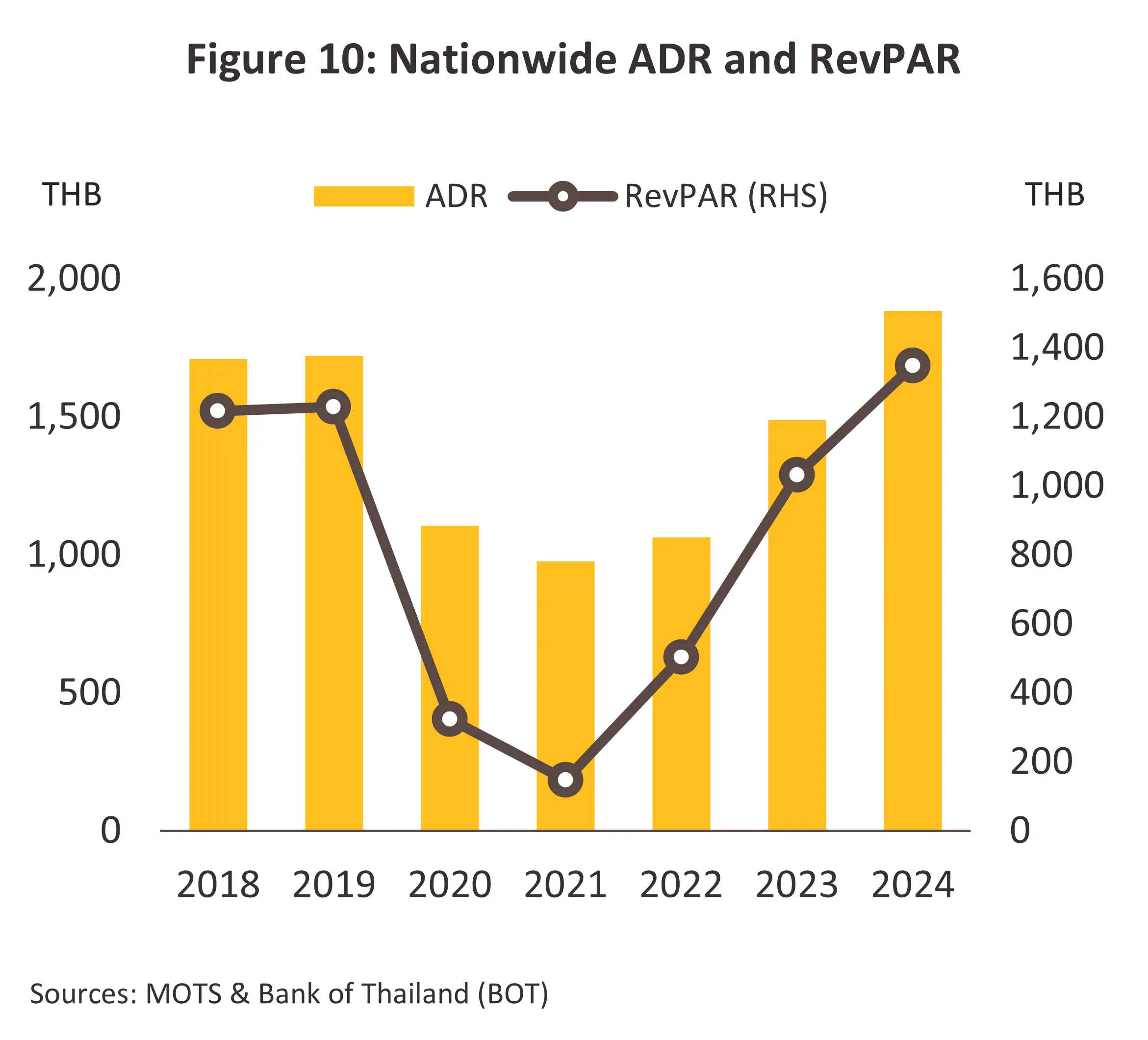

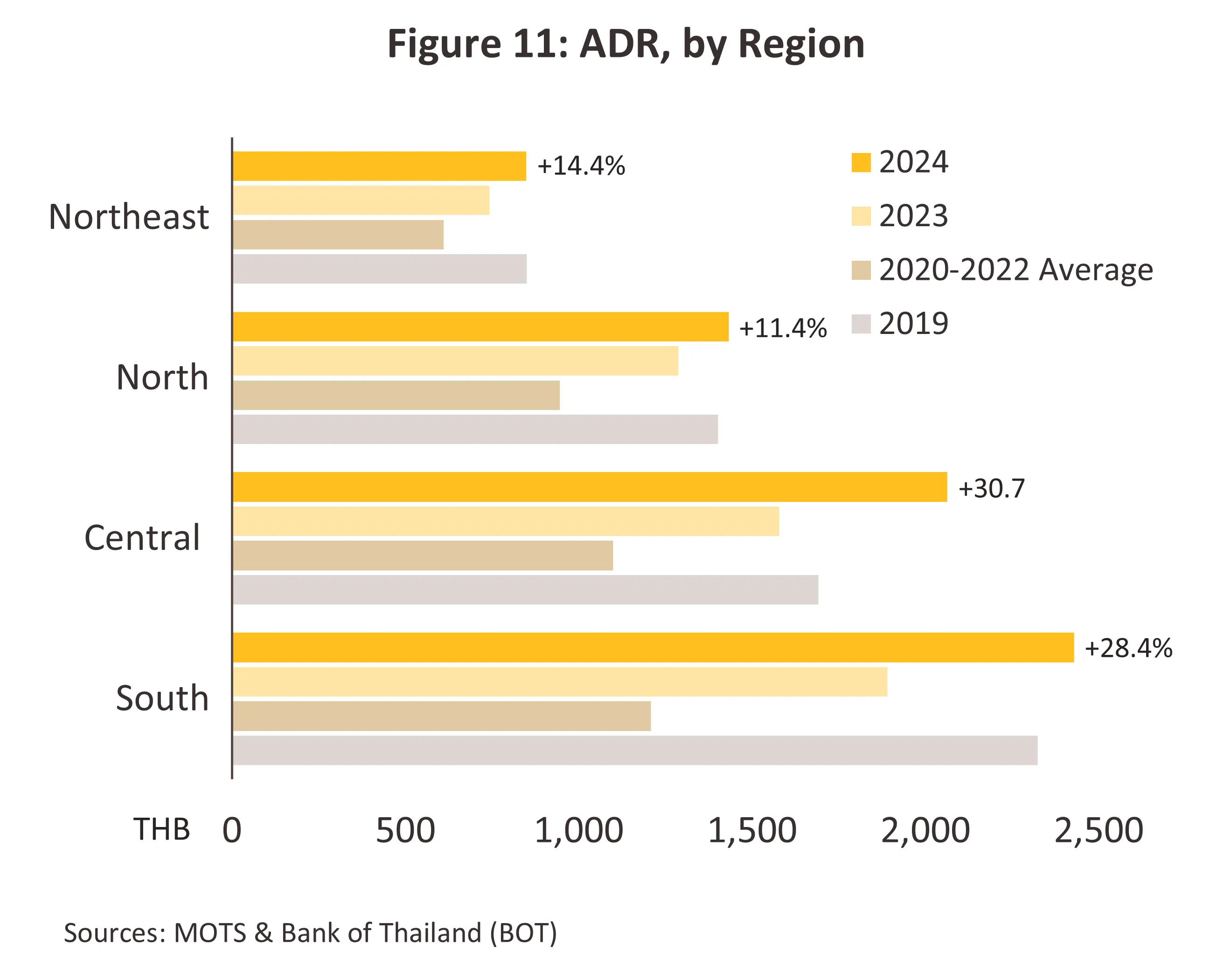

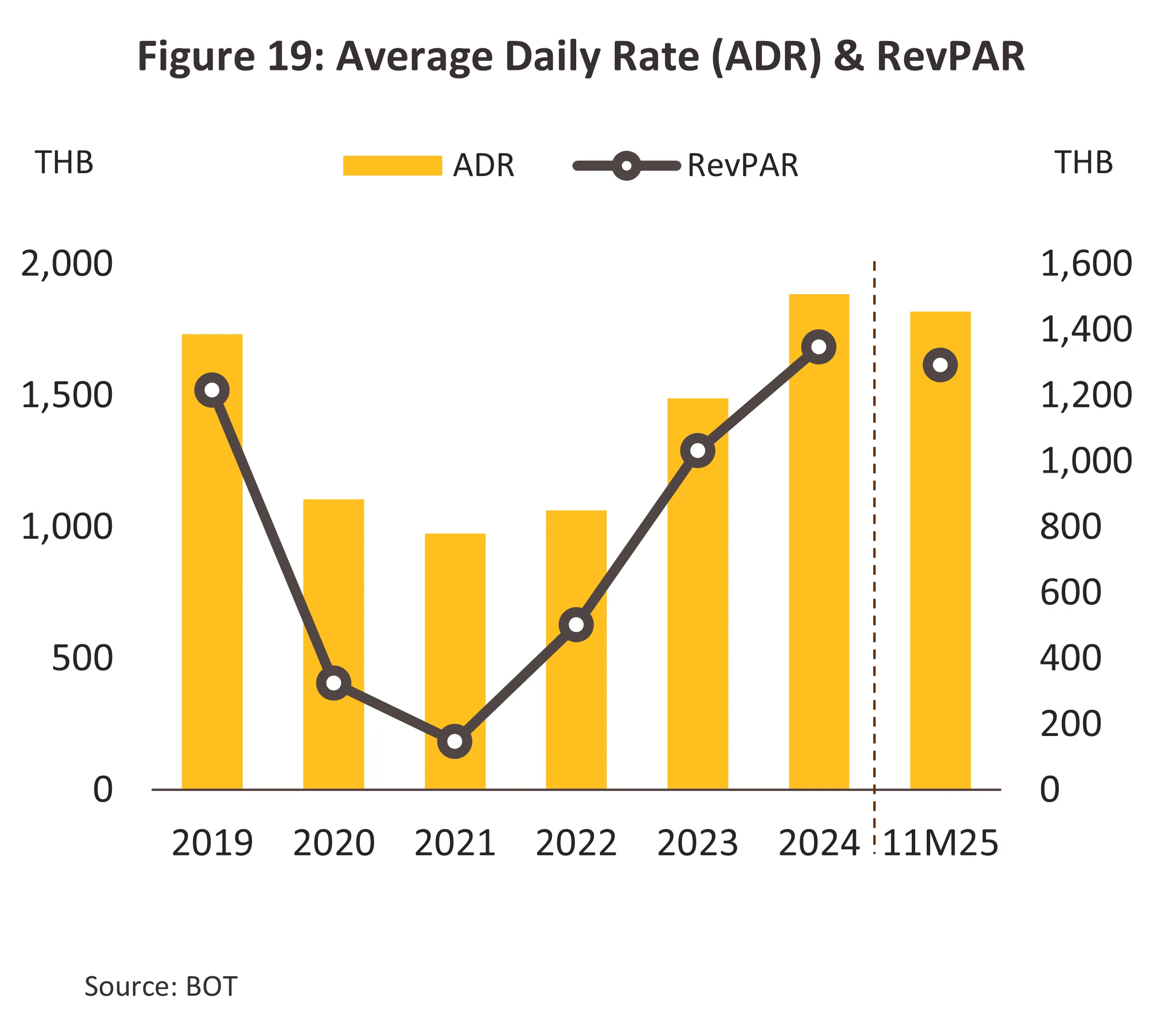

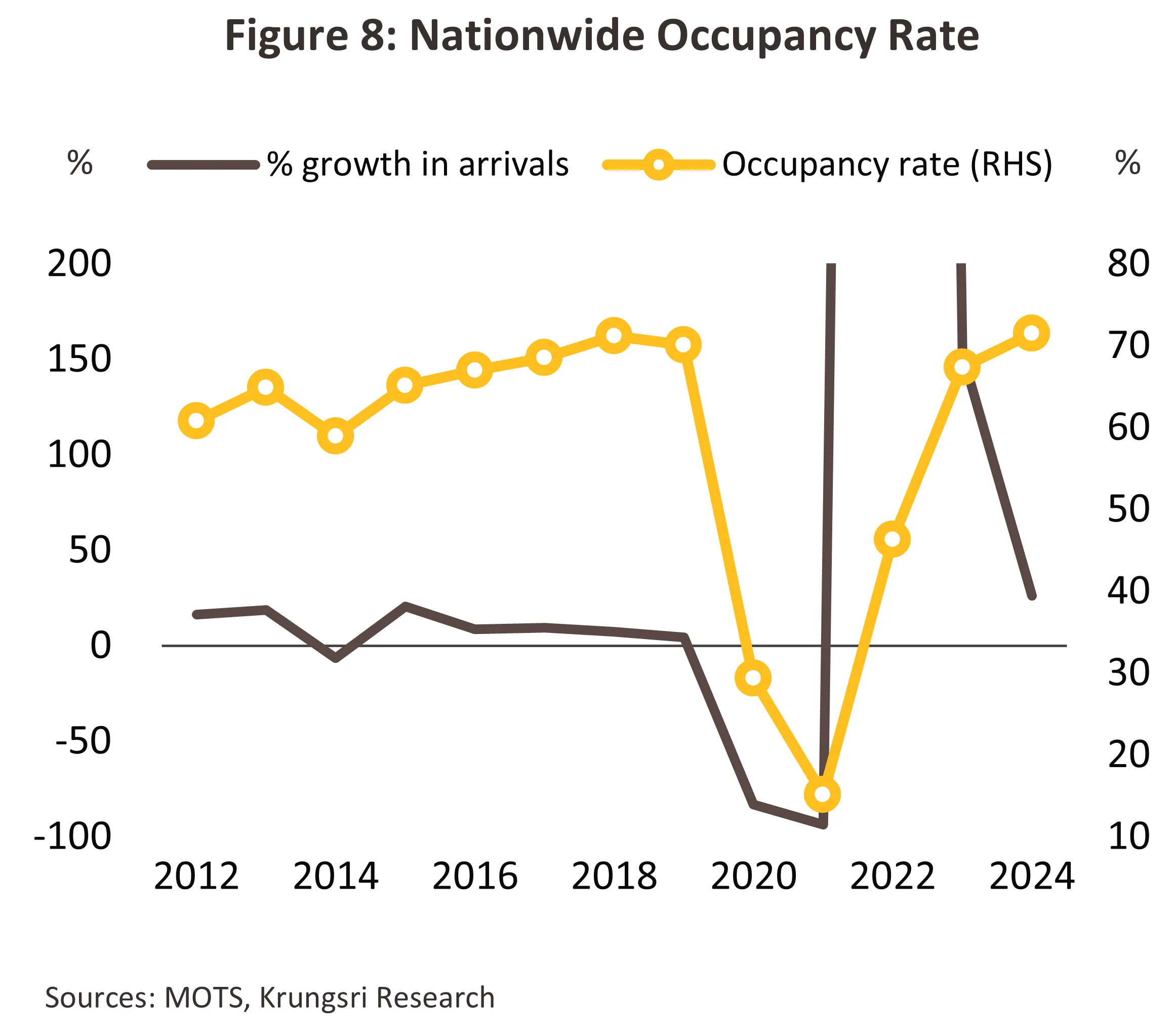

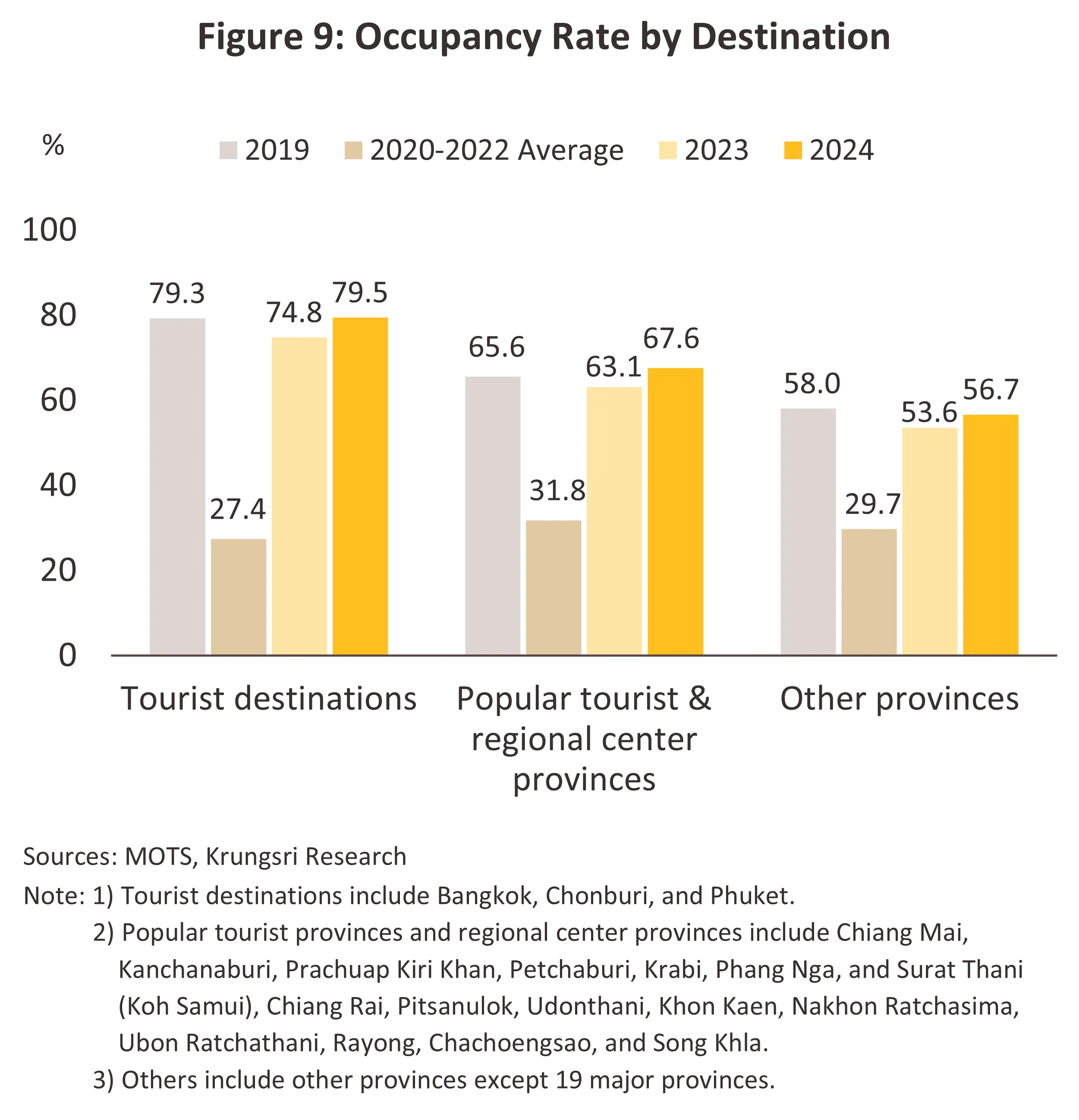

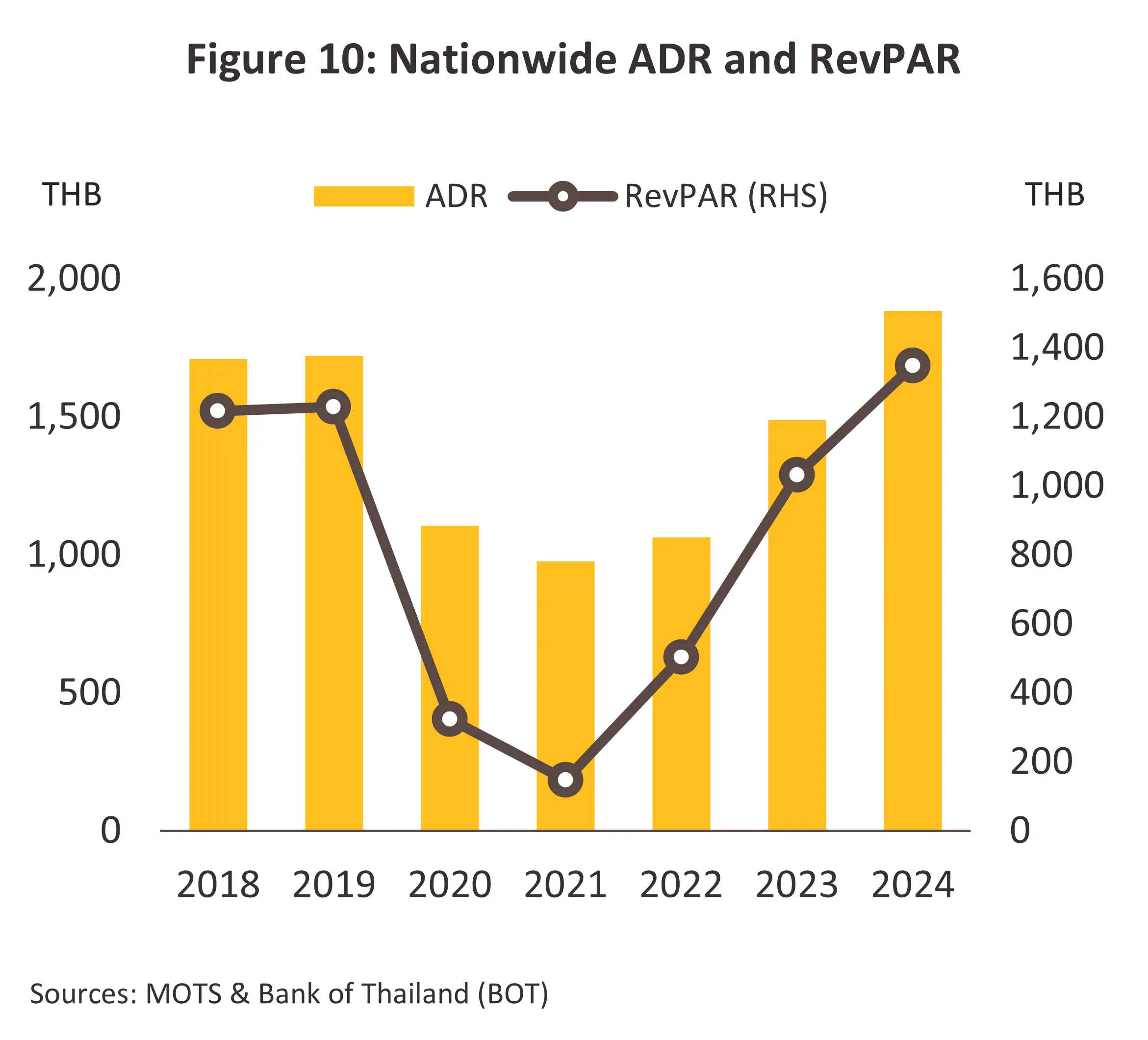

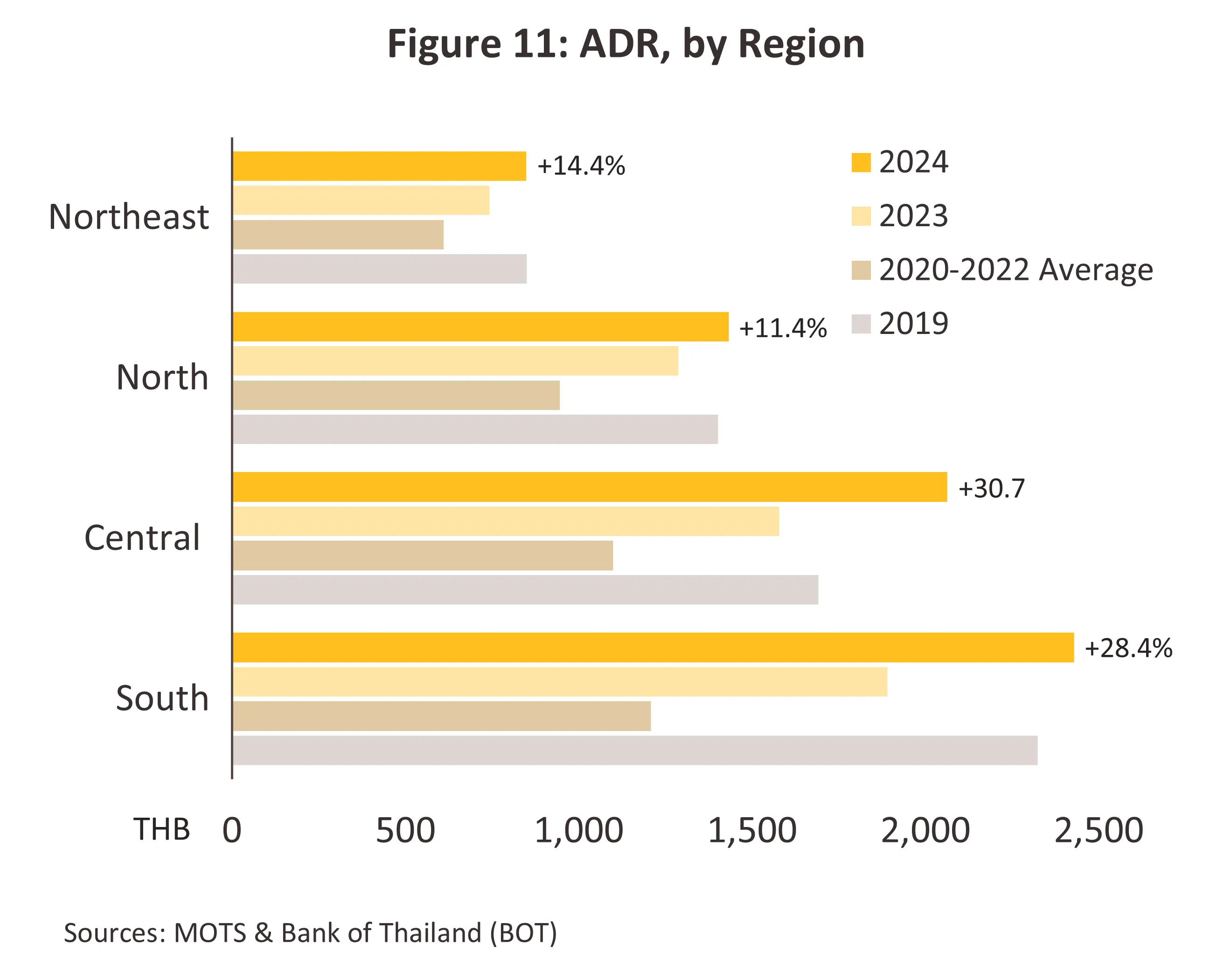

Over the period 2007–2019, Thailand’s average hotel occupancy rate (OR) generally ranged between 60–70%, except during periods of major disruptions. These included episodes of political unrest in 2009–2010, when the OR fell to 49.7%, and the 2014 military coup, when it averaged 58.9%. The most severe impact, however, occurred during the COVID-19 pandemic, with the nationwide occupancy rate plunging to 29.5% in 2020 and further to just 14.0% in 2021 (Figure 8). The decline was particularly pronounced in major tourist destinations, which rely heavily on international visitors, compared with other areas (Figure 9). Average daily room rates (ADR) followed a similar pattern, falling sharply from around THB 1,700 in 2019 to THB 1,121 in 2020 and THB 914 in 2021. As a result, revenue per available room (RevPAR) also declined significantly (Figure 10). The southern region, which is more dependent on foreign tourist markets, was the most severely affected (Figure 11). Nevertheless, as the COVID-19 situation began to ease in 2022, tourism and hotel market conditions gradually improved. This recovery led to a continued rise in the nationwide occupancy rate, average room rates, and RevPAR through 2024 (Figure 10).

Situation

During the first nine months of 2025, global tourism and hotel market conditions continued to expand. International tourist arrivals worldwide totaled approximately 1.1 billion, representing an increase of around 5% YoY and a 3% rise compared with the same period in 2019 (the pre-COVID-19 period). Growth was supported by the release of pent-up travel demand and the continued recovery in flight capacity. By region, Africa recorded the strongest growth at 10% YoY, driven largely by the expansion of the middle class with strong demand for travel. This was followed by the Asia-Pacific region, where arrivals increased by 8% YoY (Figure 12), led mainly by growth in Japan, South Korea, and Vietnam, despite slight declines in markets such as Thailand, China, and Singapore. Nevertheless, international tourist arrivals from the Asia-Pacific region remain 10% below the corresponding pre-pandemic level. Meanwhile, the global average hotel occupancy rate stood at 66.0% during 9M25, up from 64.0% in the same period of 2024 (Statista, November 2025).

For Thailand, the tourism sector contracted in 2025, with declines seen in the major Chinese and Malaysian markets, though this was partly balanced by continuing growth in domestic travel.

-

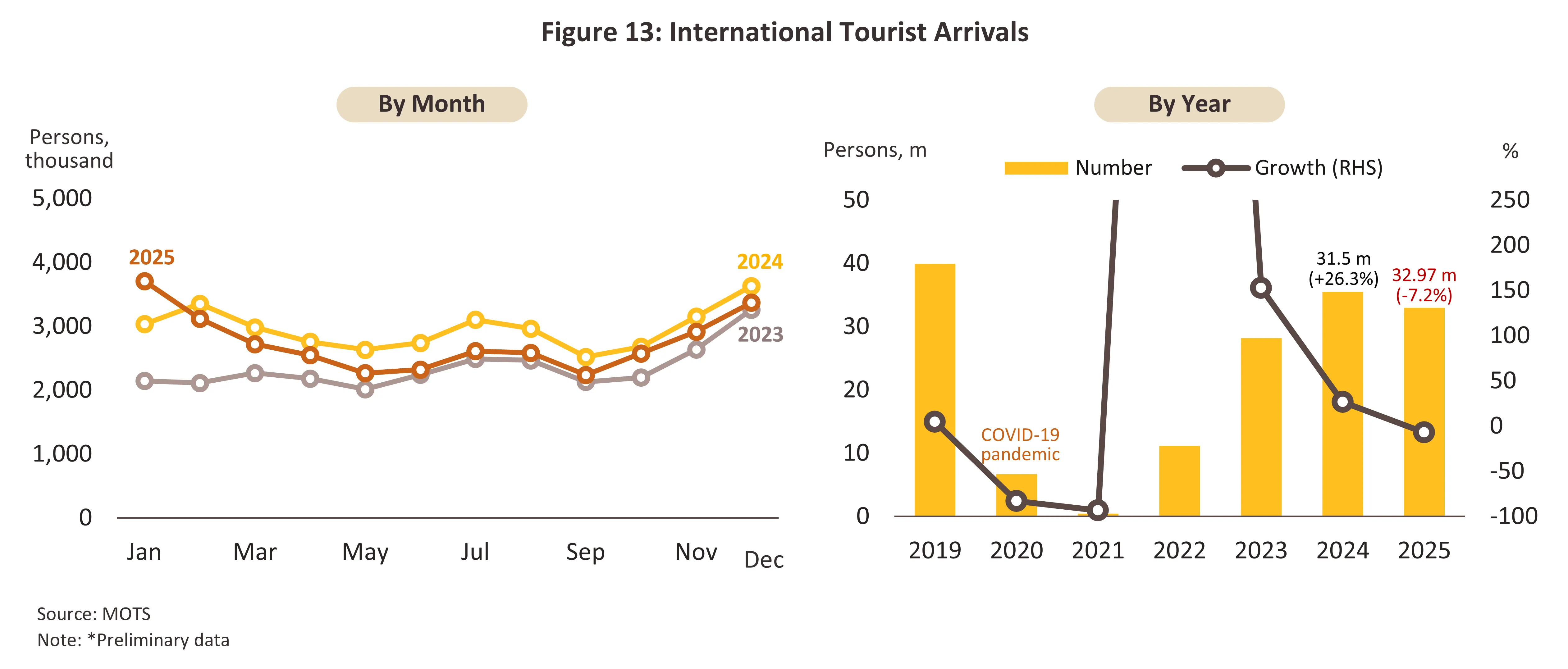

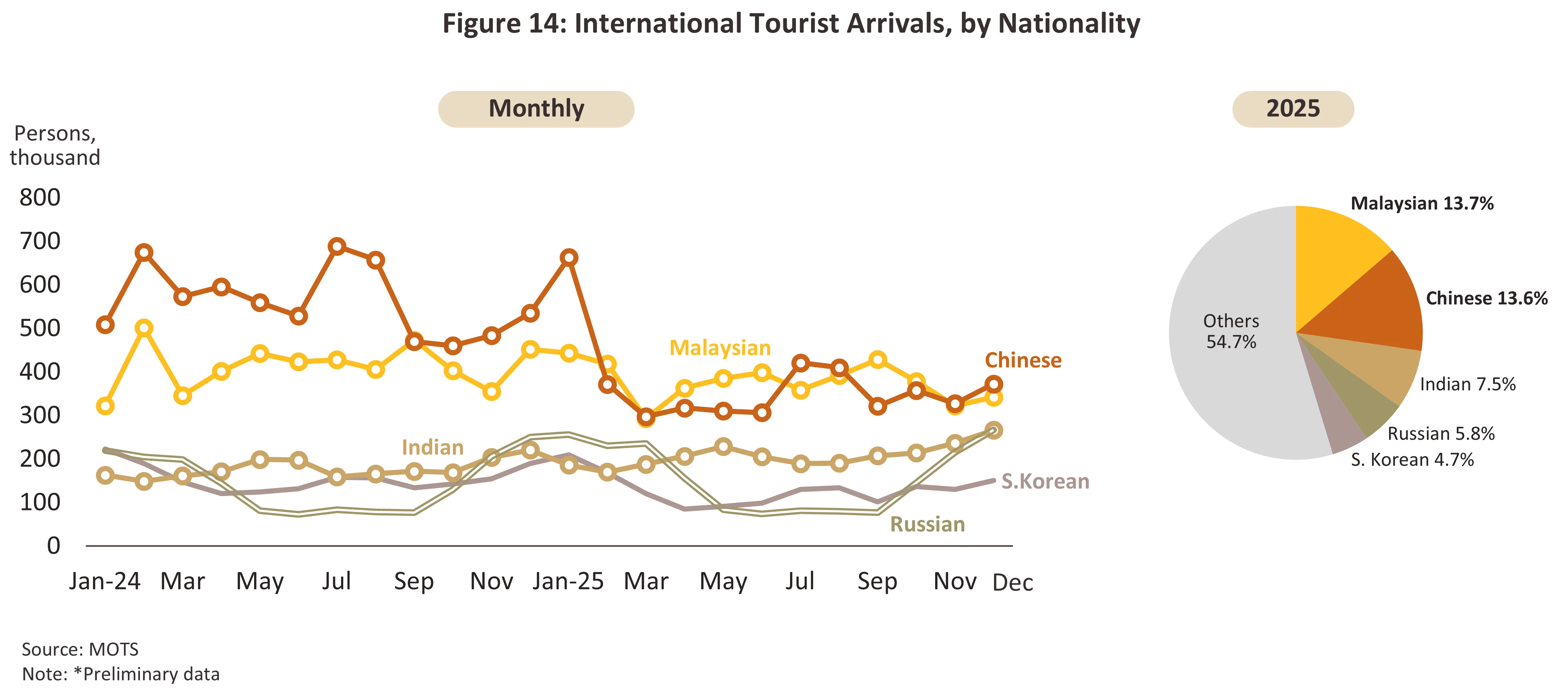

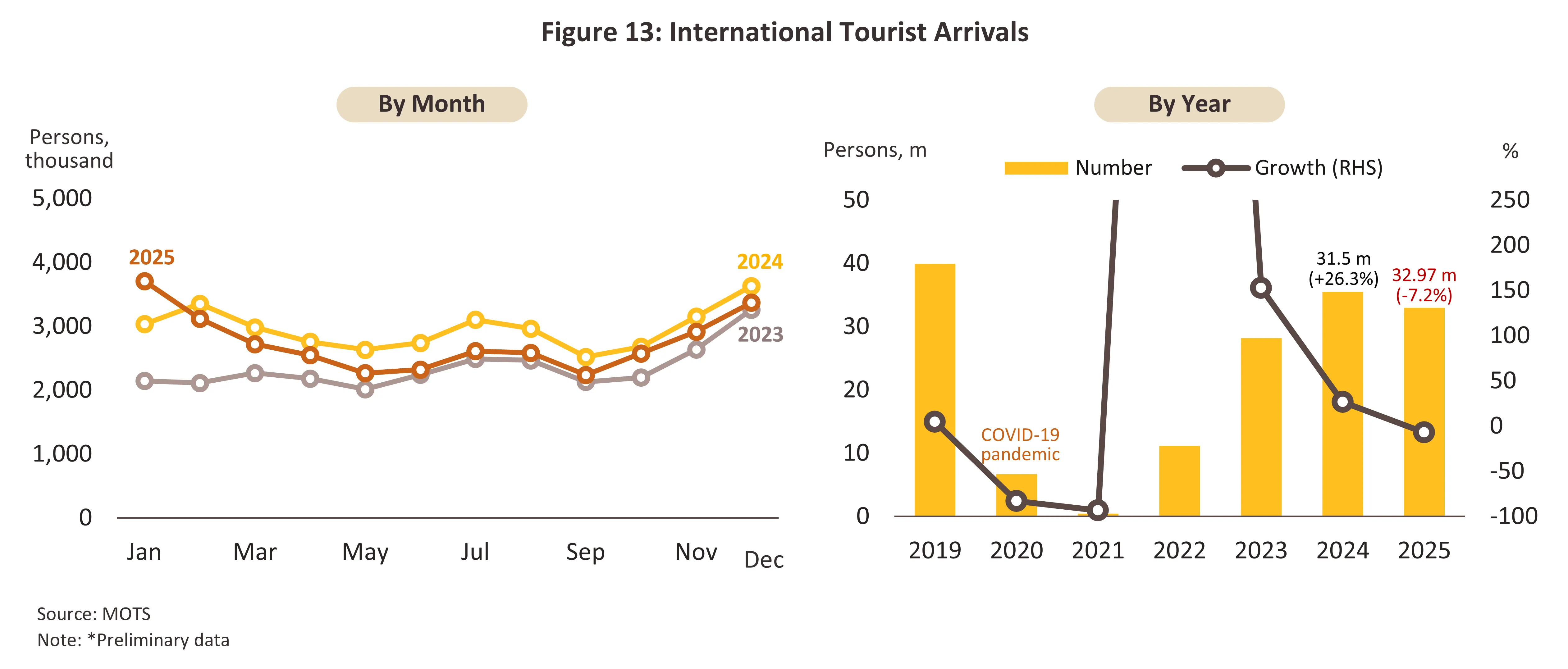

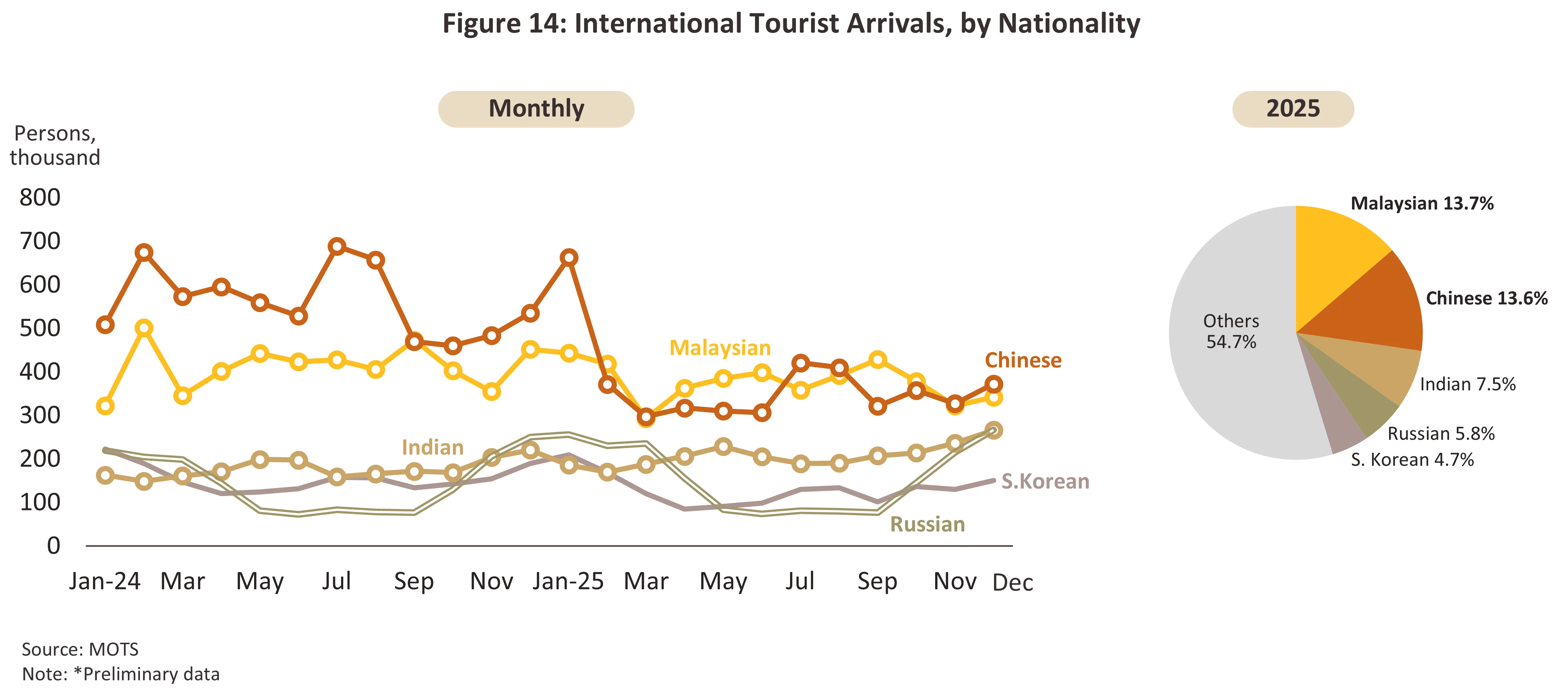

International tourist arrivals totaled 32.97 million in 2025, down -7.2% (Figure 13), reflecting a slowdown in key markets—most notably China. Chinese visitors accounted for 13.6% of total international arrivals in 2025, but their numbers declined sharply by -33.6%, largely due to heightened safety concerns related to a series of high-profile incidents in Thailand. These included cases of assaults, ongoing enforcement actions against so-called “zero-dollar tours,” and the widely reported involvement of call-center gangs linked to the kidnapping of a Chinese actor. As a result, many Chinese tourists opted to travel to alternative destinations perceived as safer destinations, such as Vietnam and Japan, where arrivals rose by 41.3% in 2025 and by 37.5% YoY during the first 11 months of 2025, respectively. Similarly, arrivals from Malaysia—which accounted for 13.7% of total international visitors—declined by -8.7%. This was driven by a slowdown in the Malaysian economy and higher travel costs, compounded by flooding in southern Thailand toward the end of the year, particularly in Hat Yai, a major destination for Malaysian tourists. These factors encouraged Malaysian travelers to shift toward domestic tourism.

However, several key markets continued to perform well, led by India (7.5% share) and Russia (5.8% share), which remained important drivers of Thailand’s tourism sector (Figure 14). Arrivals from India increased by 12.1%, supported mainly by an expansion in flight capacity and resilient domestic economic conditions, which helped sustain outbound travel demand. Meanwhile, arrivals from Russia grew by 8.8%, broadly in line with the expansion of the European market (+12.4%). This growth was supported by additional direct flight connections to Thailand, particularly to Phuket, the primary destination for Russian tourists. Overall, these developments underscore the importance of direct air connectivity as a key structural factor underpinning Thailand’s competitiveness as a leading global tourism destination.

-

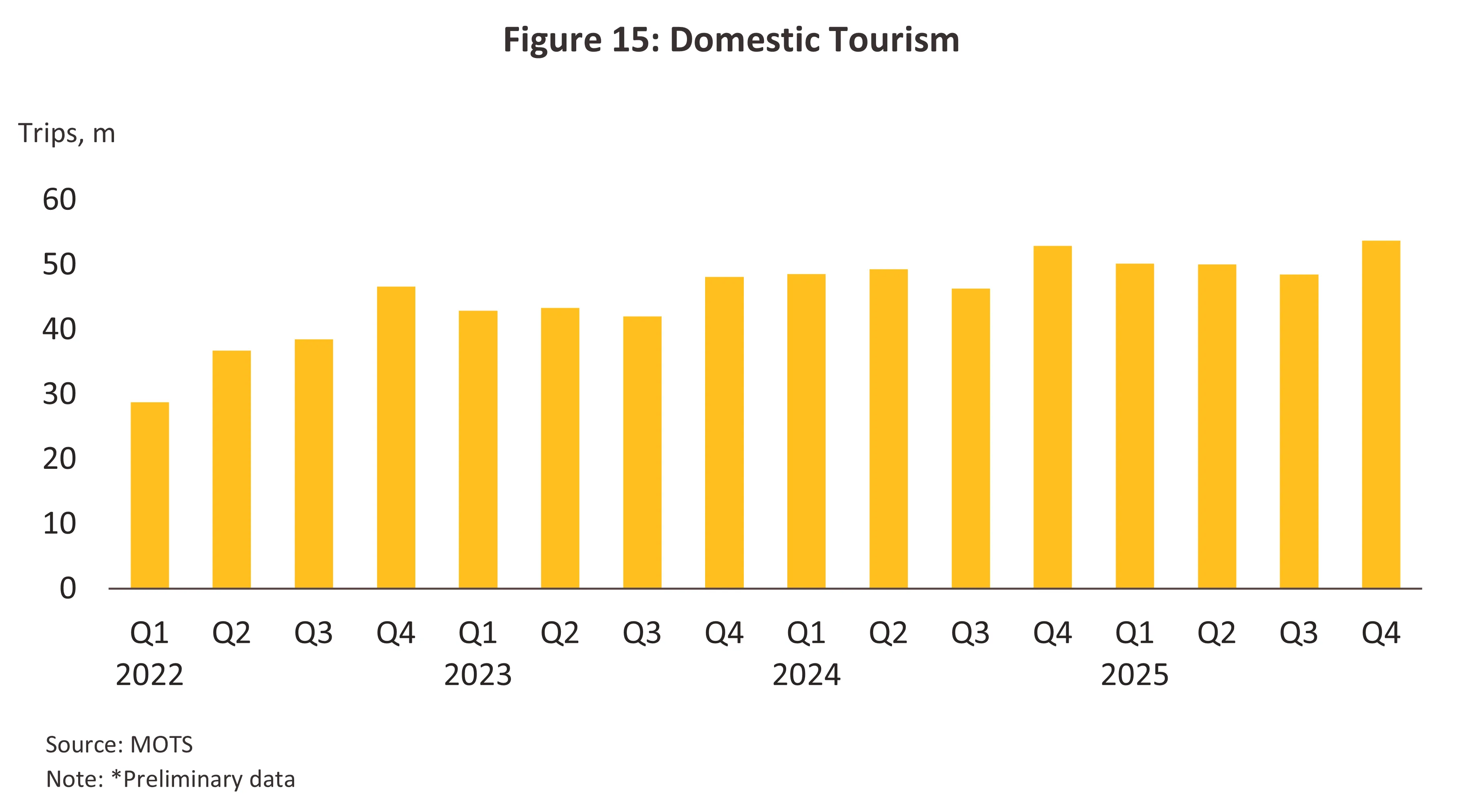

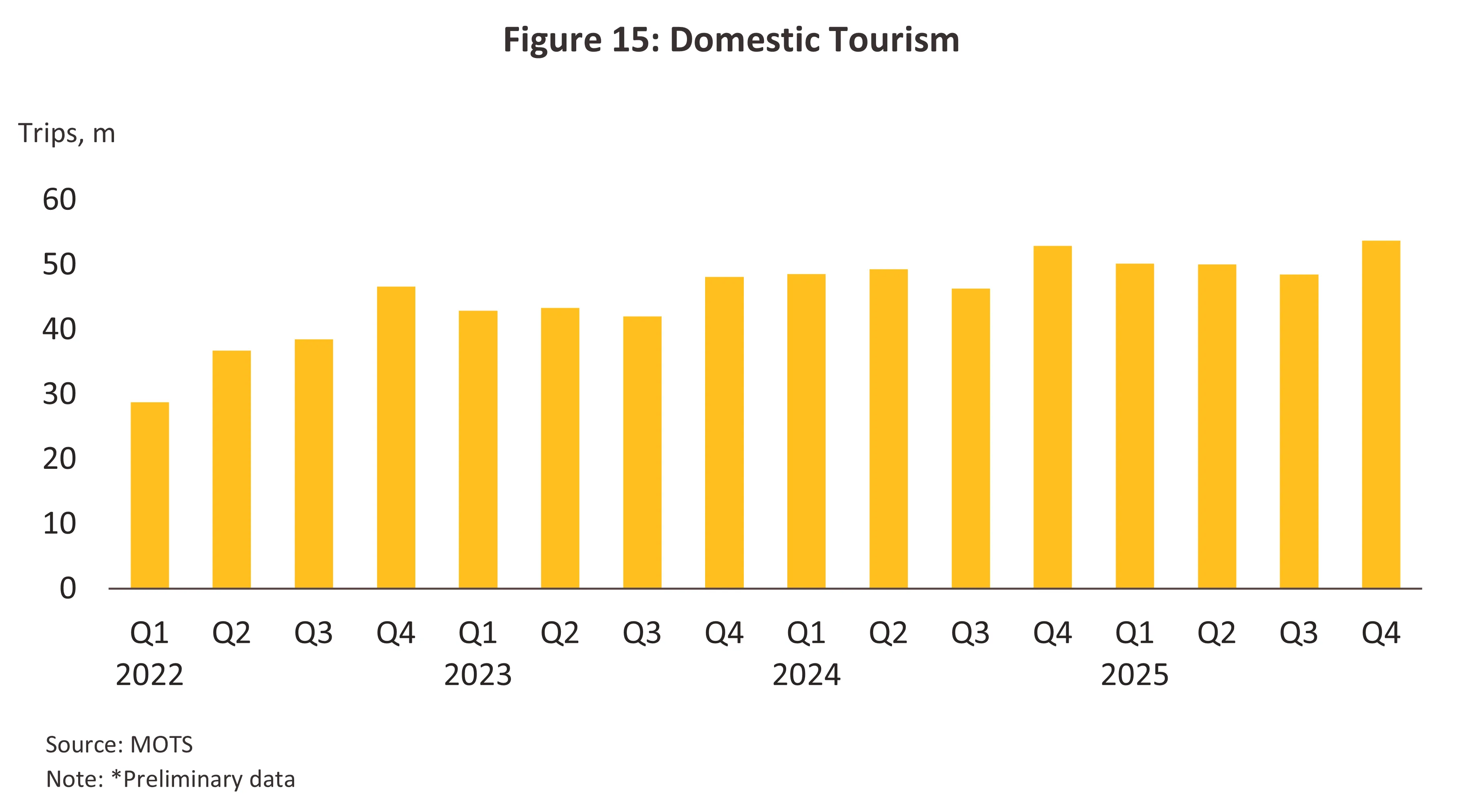

Domestic tourism by Thai travelers totaled 202.4 million trips in 2025, up 2.7% (Figure 15). Growth was supported by several factors: (i) the government continued to run promotional campaigns, particularly the “Amazing Thailand Grand Tourism and Sports Year 2025” campaign (Jun–Sep 2025), which helped stimulate travel to 55 secondary cities (mainly provinces outside major tourist destinations, including some regional hubs and alternative destinations), in cooperation with the private sector through campaigns offering special privileges such as discounts on hotels and shops; the government also introduced the Thai Travel Co-payment Scheme, which provided 40-50% subsidies for hotel stays (Jul 4– Oct 31, 2025), alongside tax deductions under the “Tiew Dee Mee Kuen” scheme (Oct 29–Dec 15, 2025), helping to reduce travel costs and encourage travel decisions; (ii) the announcement of additional bridge holidays in 2025, which resulted in longer consecutive holidays and helped stimulate tourism activities nationwide; and (iii) the growing influence of social media and influencers in driving interest in new destinations and promoting off-season travel.

Nevertheless, while the number of visitors to primary tourist destinations remained significantly higher than that of secondary cities, many secondary destinations recorded faster growth in visitor arrivals than primary destinations, reflecting the impact of government policies that focused on promoting tourism in secondary cities and encouraging the discovery of new destinations.

-

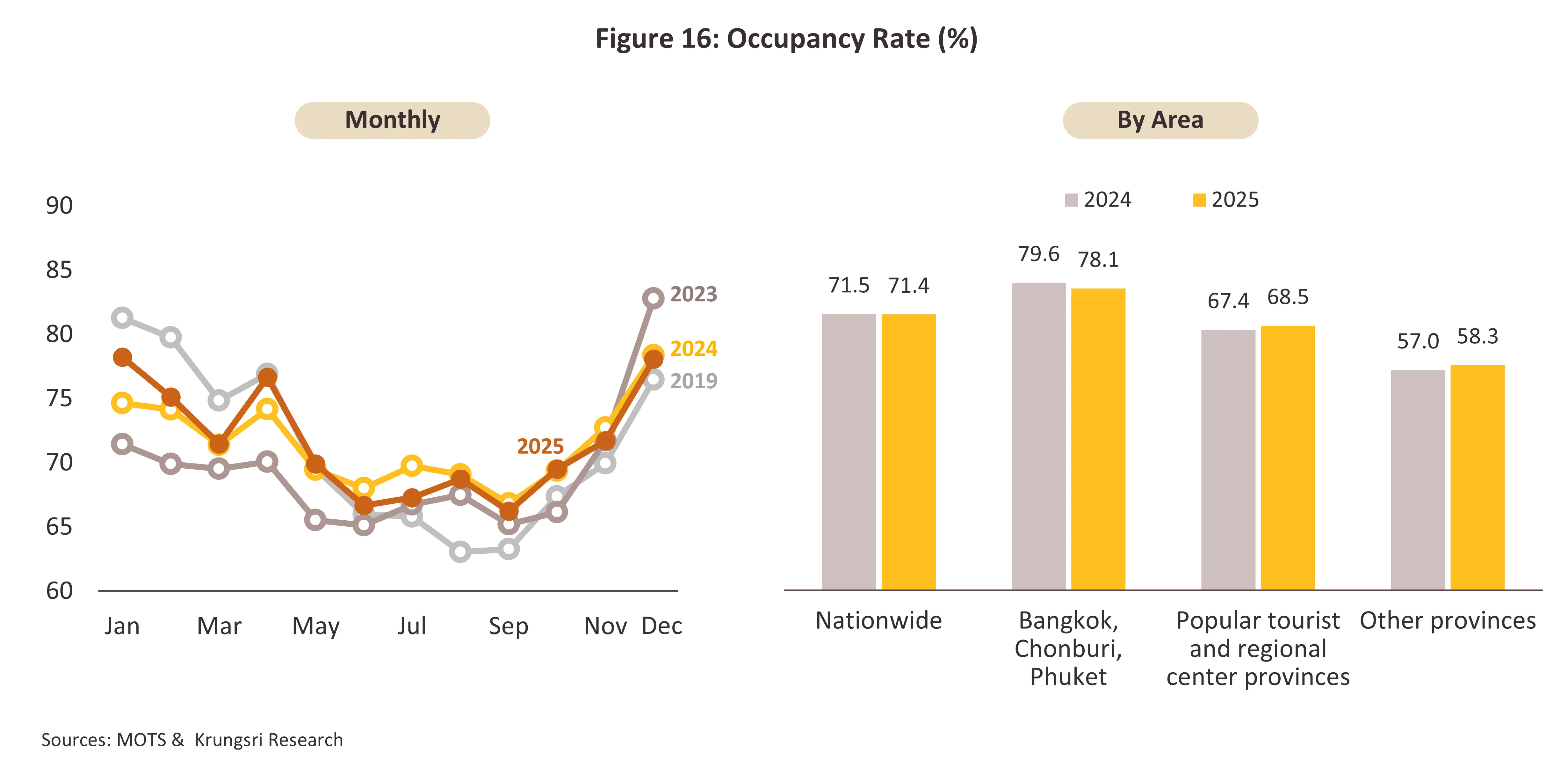

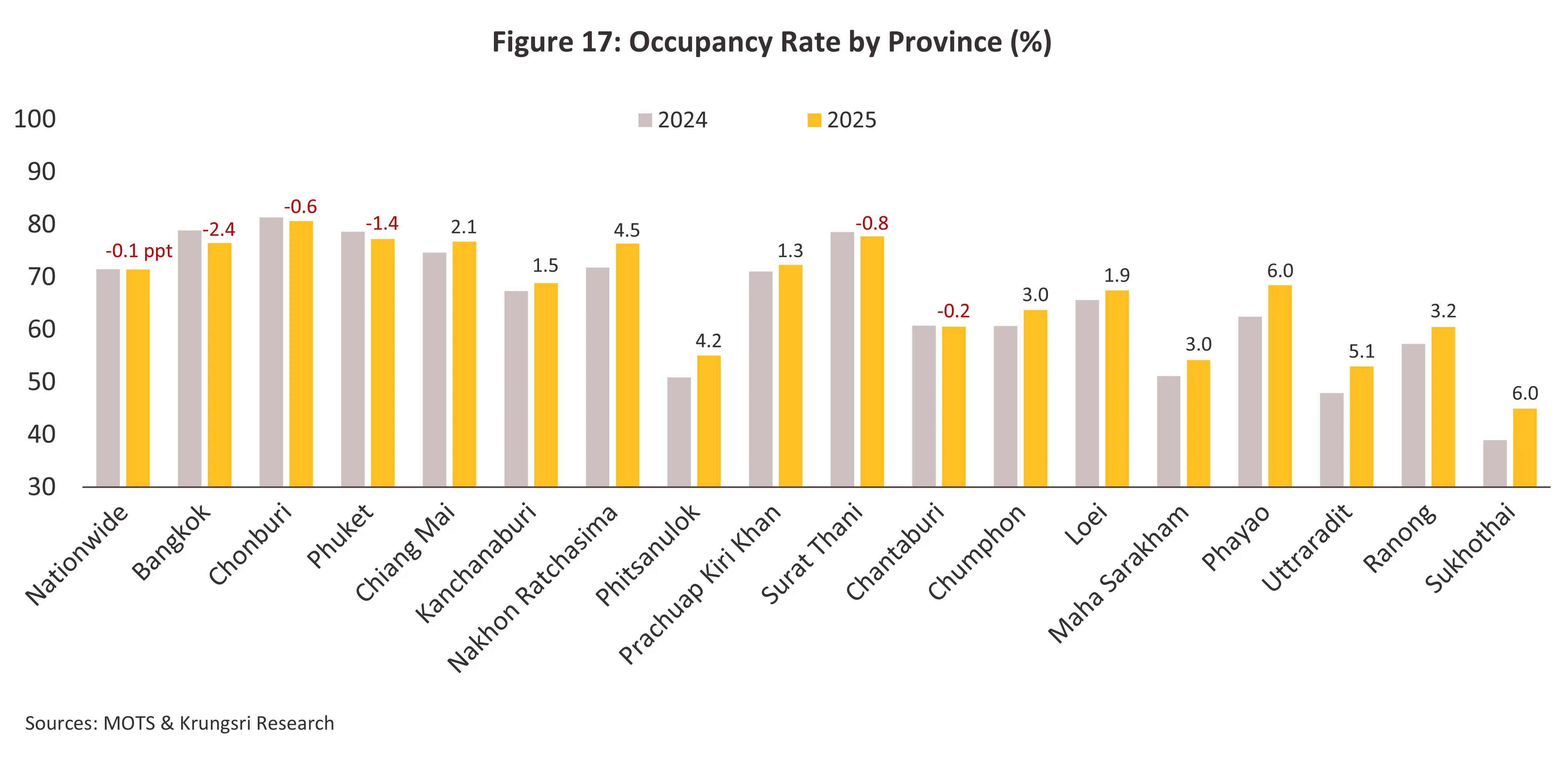

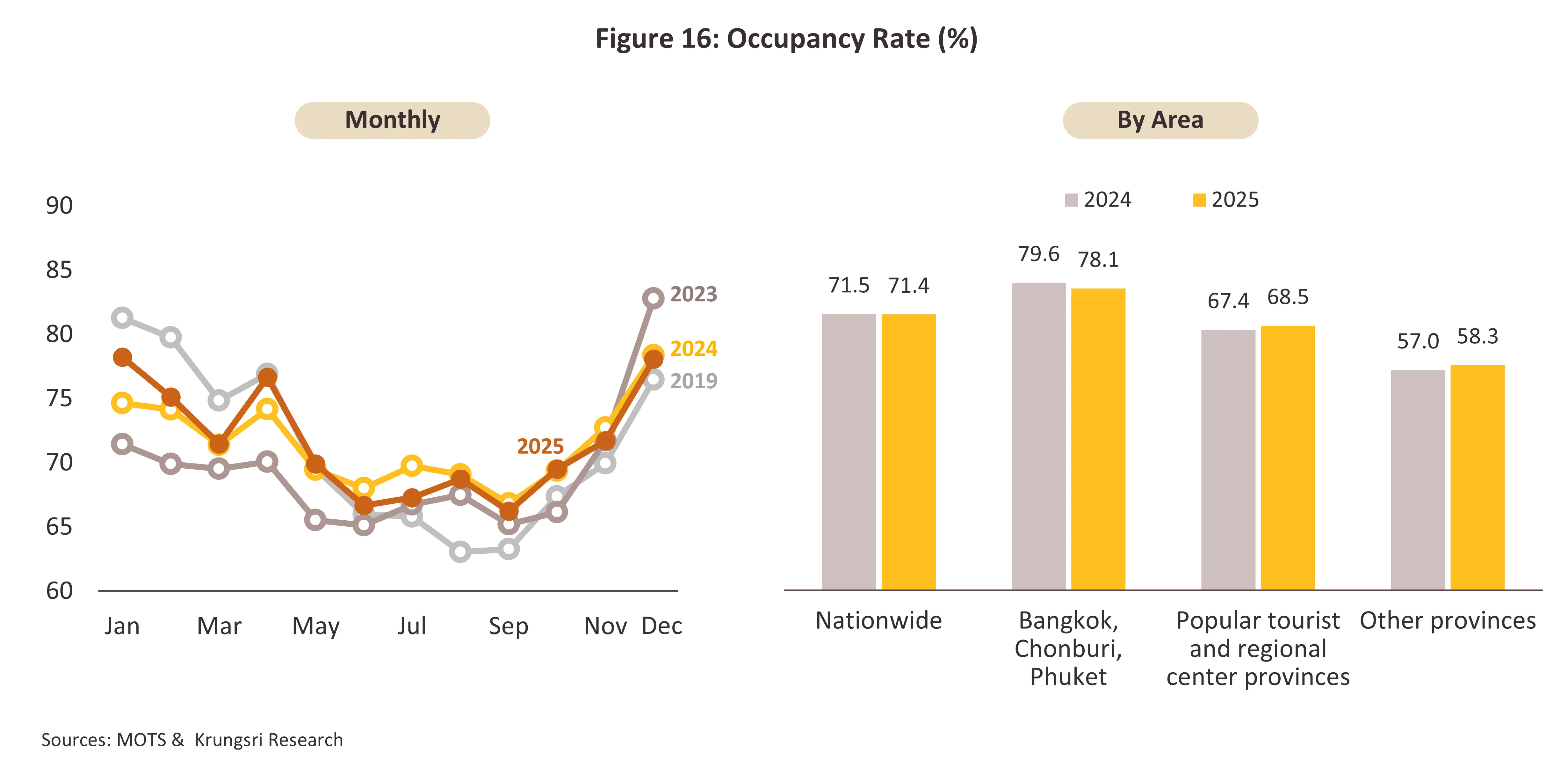

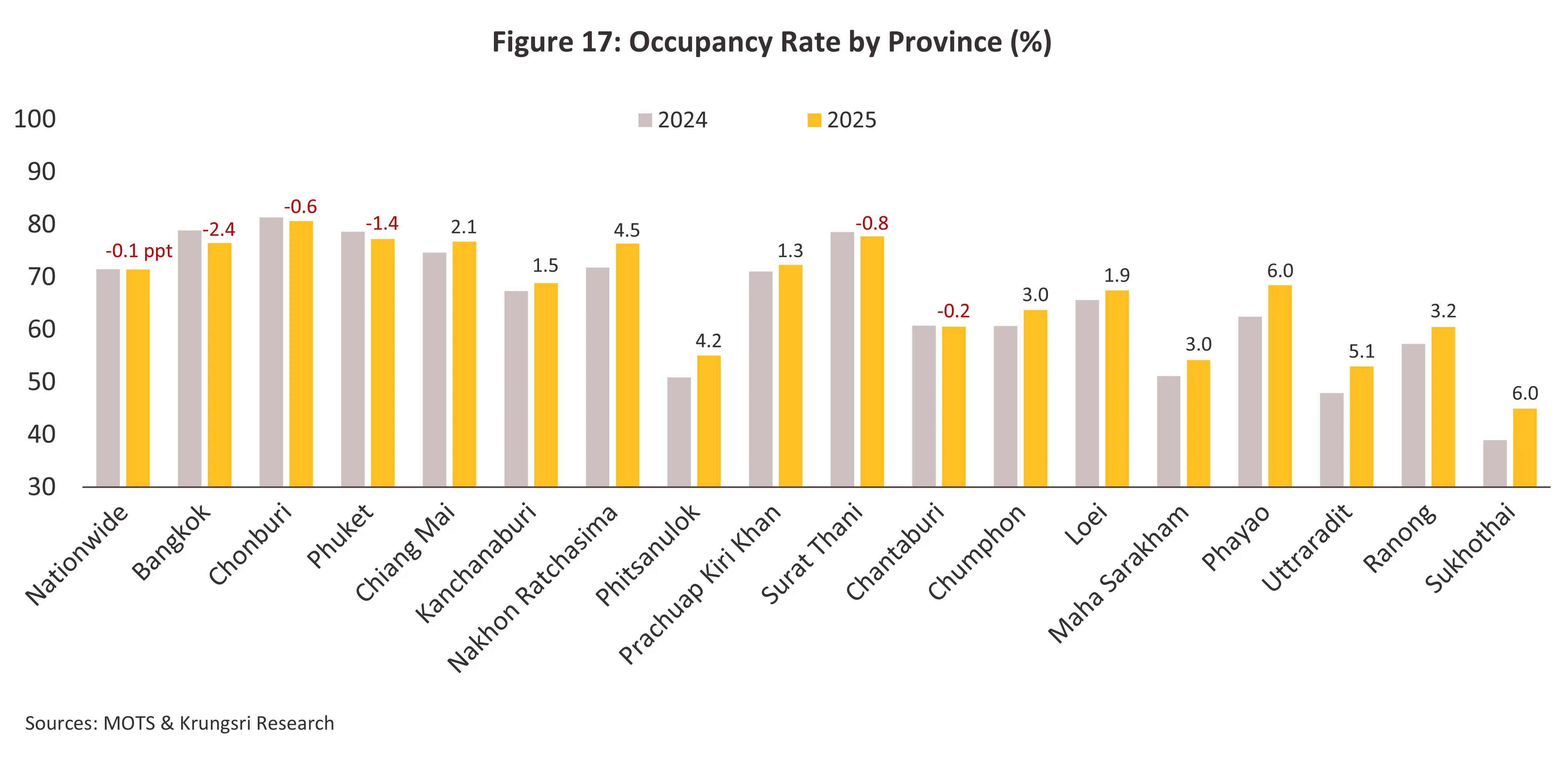

The nationwide occupancy rate averaged 71.4% in 2025, broadly unchanged from 71.5% in the same period last year (Figure 16). In major tourist destinations such as Bangkok (-2.4 ppt) and Phuket (-1.4 ppt), which rely heavily on foreign tourists, occupancy rates declined in line with the contraction in international arrivals, particularly from the Chinese market. By contrast, Chonburi (-0.6 ppt) was supported by domestic tourism, which accounted for 62% of total visitors, as well as by an increase in business travelers following the expansion of investment activity in the EEC, helping its occupancy rate to contract at a slower pace than in Bangkok and Phuket. As for other tourist provinces, although occupancy rates in secondary cities remain lower than those in major destinations, their average change has moved in an upward direction (Figure 16). This was driven by: i) continued government policies aimed at promoting tourism in secondary cities, and ii) weak domestic purchasing power, which has encouraged Thai tourists to opt for domestic travel instead of overseas trips in order to save costs—particularly travel to regional hubs and key tourist provinces such as Nakhon Ratchasima and Chiang Mai, as well as other destinations including Phayao, Uttaradit, Maha Sarakham, and Ranong. As a result, occupancy rates in these provinces improved, in contrast to major destinations such as Bangkok and Phuket (Figure 17).

-

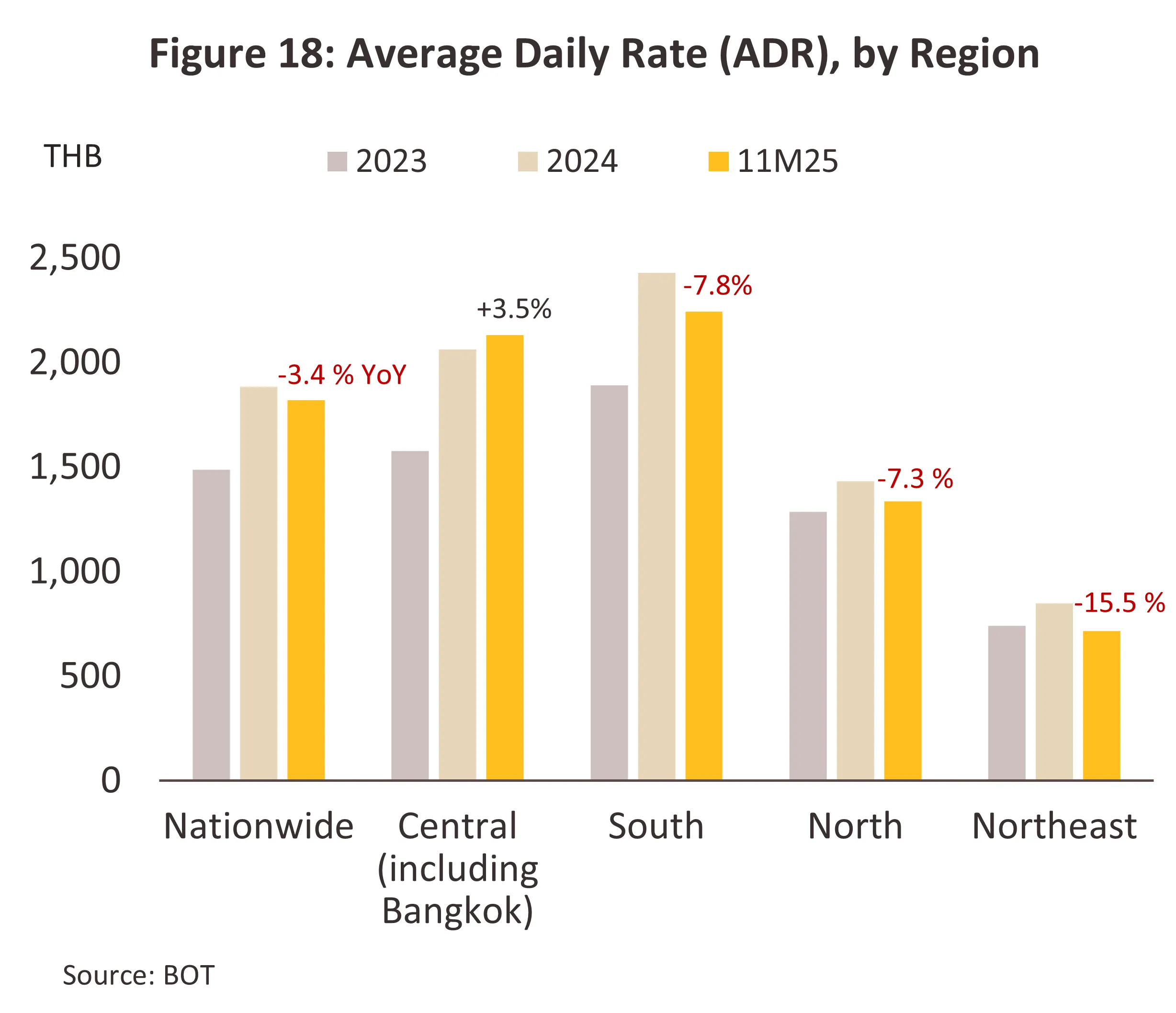

The nationwide average daily rate (ADR) stood at THB 1,819, down -3.4% YoY over the first 11 months of 2025, in line with the contraction trend in international tourist arrivals. The South remained the region with the highest average room rate at THB 2,244 (-7.8% YoY), reflecting the strong potential of major tourist destinations in the region, which have a large supply of beachfront accommodation and remain particularly popular among foreign tourists, allowing room rates to be consistently set at higher levels than in other regions. By contrast, the Northeast recorded the lowest average room rate at THB 717 (Figure 18), in line with its lower number of guests compared with other regions. With occupancy rates remaining broadly stable while average room rates declined, nationwide revenue per available room (RevPAR) decreased by -3.2% YoY to THB 1,292 (Figure 19).

Data from the ‘FreeTour Global Hotel Price Study, 2025’ shows that in the year, Thai room rates averaged around USD 100 per night, below rates for Japan, South Korea and Singapore, where they run in the range USD 145–185 per night and sharply beneath the USD 230–270 seen in the US and UK. Thai hotels thus represent significant value for money for foreign visitors, and this is a major driver of demand. Indeed, these price differentials will continue to be a source of growth potential if the country is able to address worries over traveler safety in a concerted fashion. Success in this would then help to improve confidence in the industry, especially among Chinese visitors, who are particularly sensitive to these issues. This could also create opportunities for hotels in Bangkok, Phuket, and Chonburi to further increase room rates.

Outlook

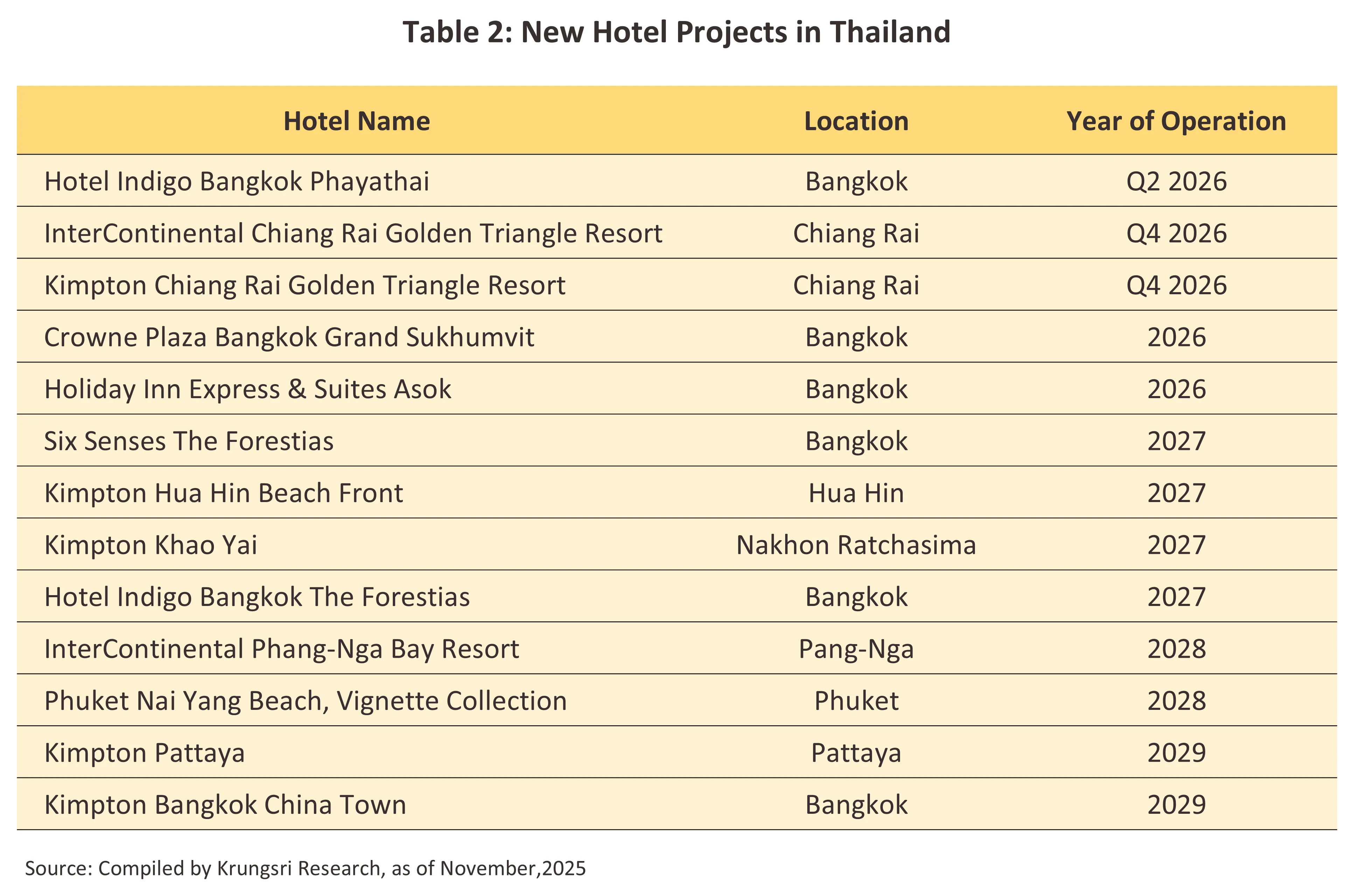

The Thai hotel business is expected to continue expanding over 2026-2028, supported by a gradual recovery in international tourist arrivals. Growth will be driven mainly by the Indian and European markets, in line with the expansion of direct flight connections to key destinations such as Phuket, Samui, and Chiang Mai. However, the sector will continue to face several headwinds. These include: i) a global economic slowdown following the U.S. tariff hikes, which is expected to weigh more visibly on purchasing power and travel sentiment in some markets, particularly in 2026; ii) domestic issues, including safety concerns, which continue to affect Thailand’s image, especially in the Chinese market; and iii) intensifying competition from other Asian destinations, notably Vietnam, which is increasingly targeting Chinese tourists. Together, these factors are likely to limit the recovery in international arrivals, which is expected to remain below the pre-COVID level of 39.9 million recorded in 2019, even by 2028. Meanwhile, domestic tourism is expected to continue growing, supported by ongoing government measures to promote travel to secondary cities and by the expansion of the domestic meetings and seminars market, particularly in provinces that serve as regional hubs. At the same time, major hotel operators are expected to continue expanding their investments in key tourist destinations.

-

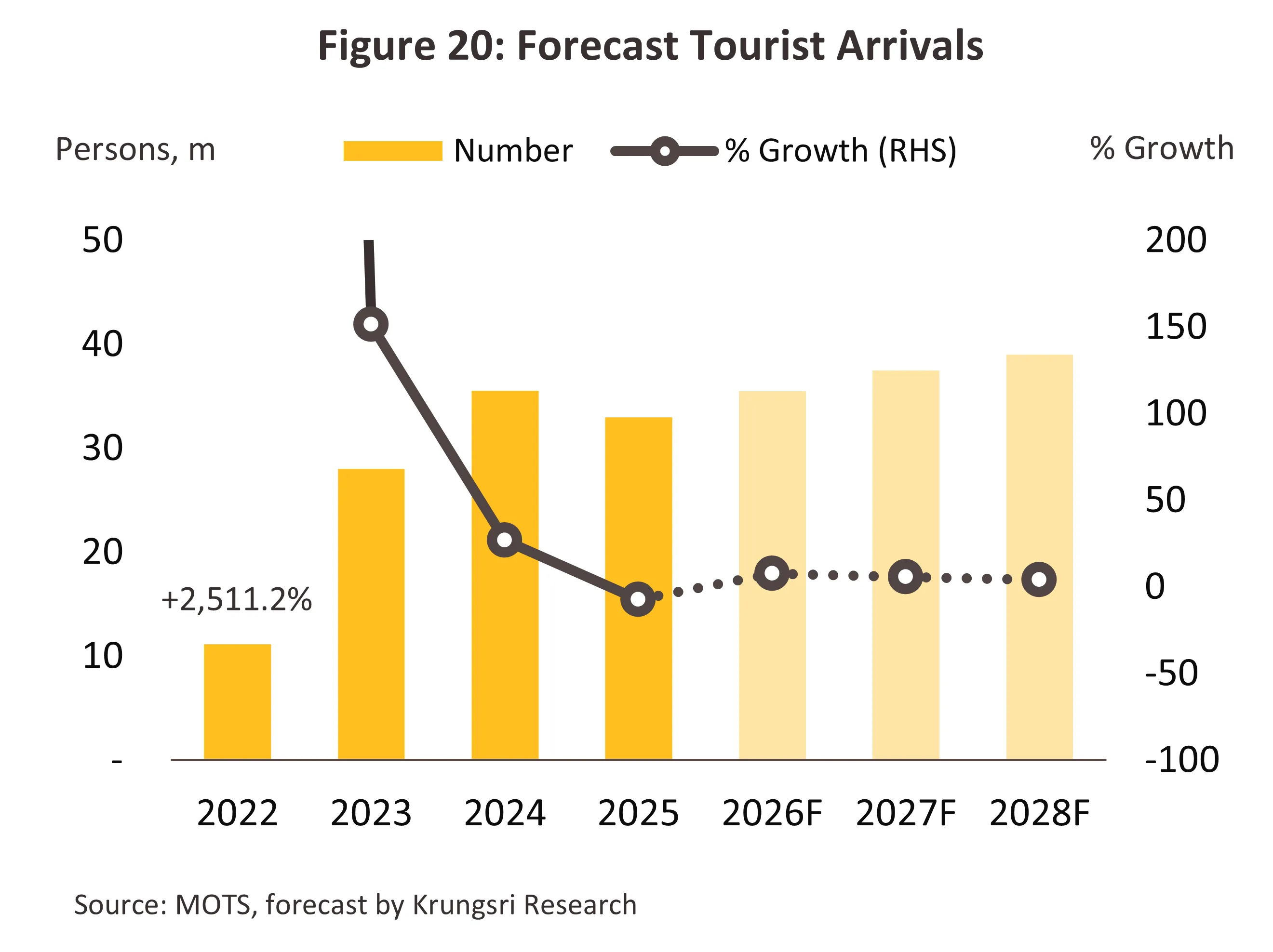

International tourist arrivals are expected to continue rising. Krungsri Research projects arrivals of 35.5 million in 2026, increasing to 37.5 million in 2027 and 39.0 million in 2028, respectively (Figure 20). At this pace, arrivals are likely to approach the pre-COVID level of 39.9 million recorded in 2019 only after 2028. The key supporting factors include:

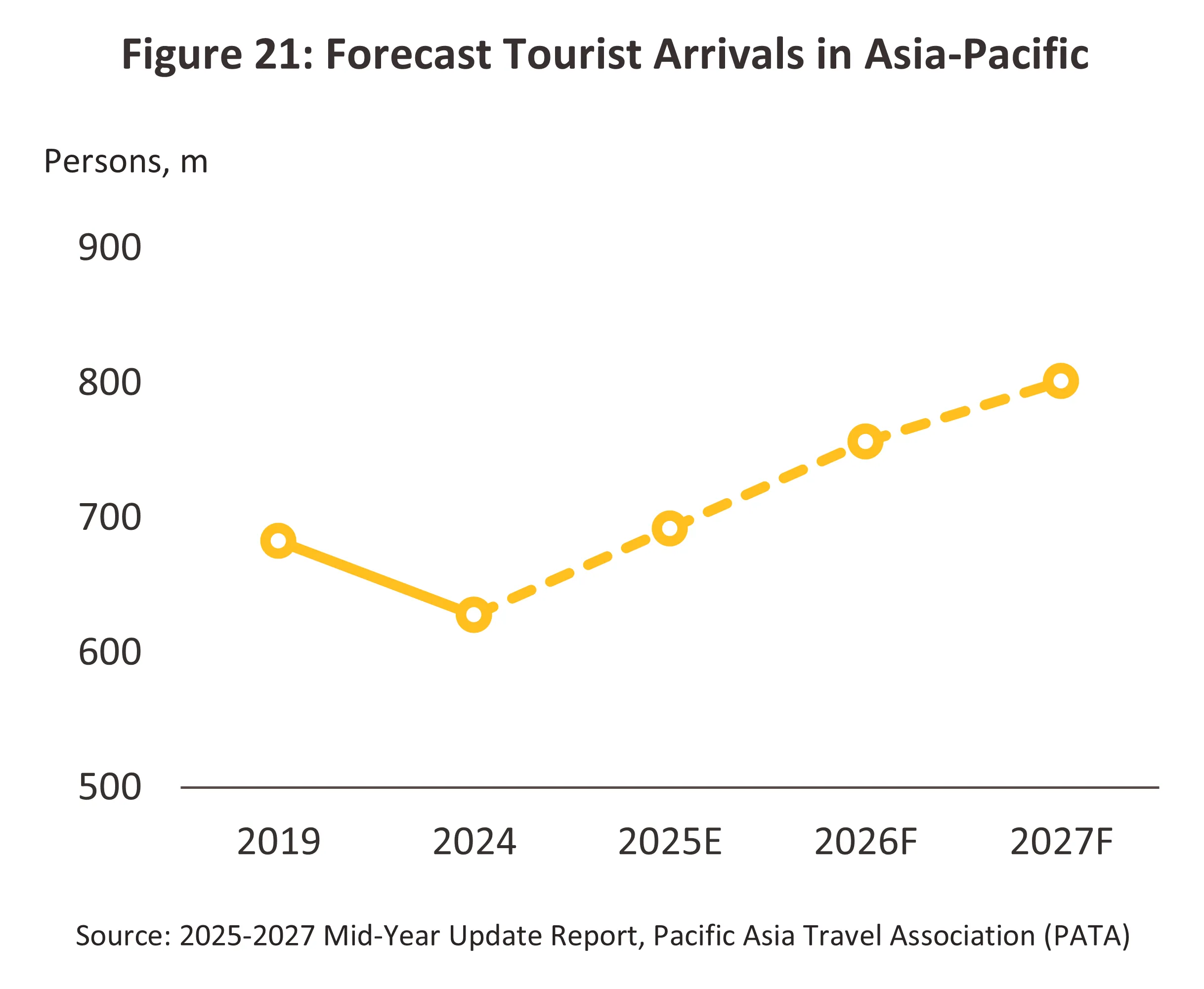

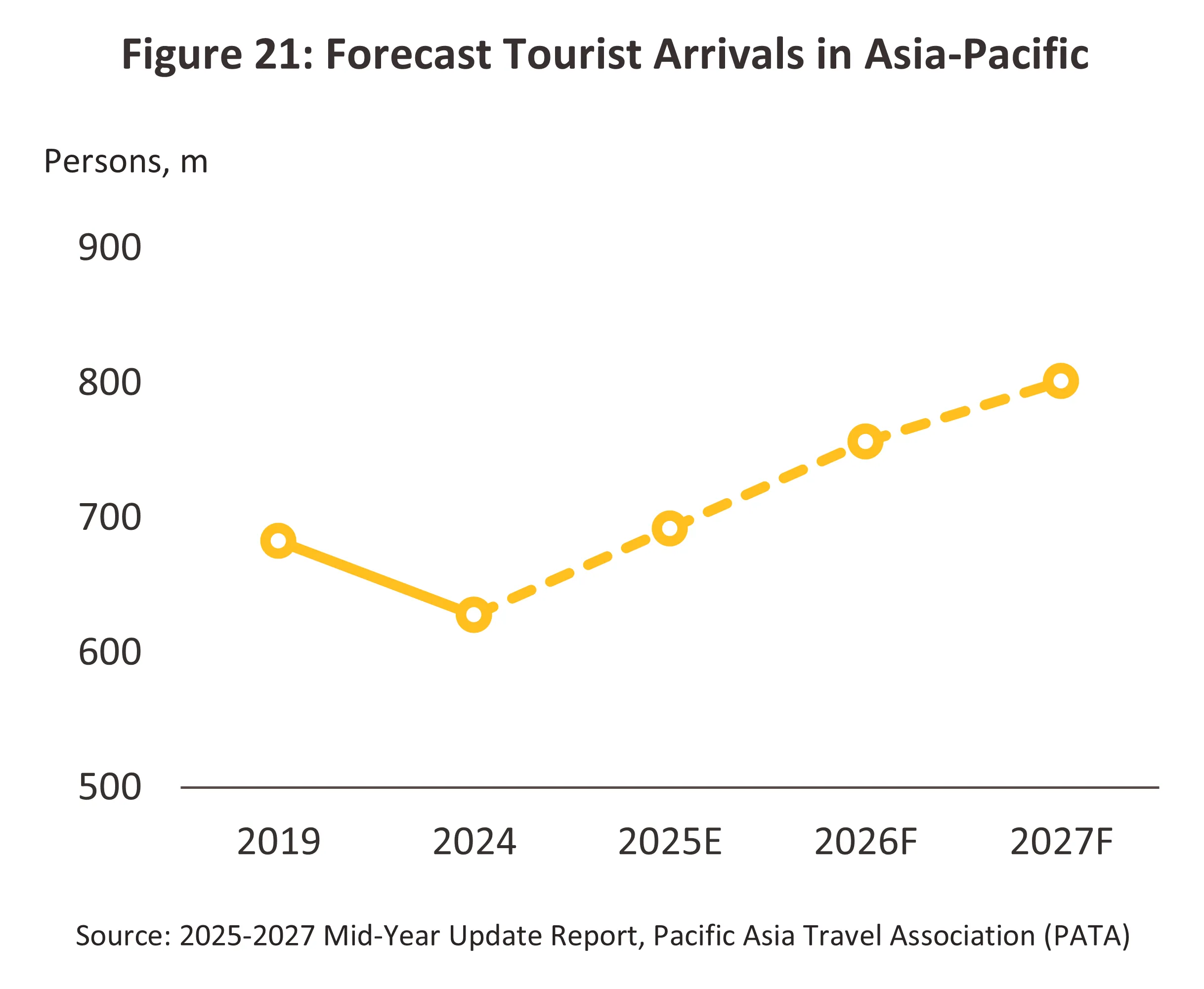

i. The global outlook for tourism is positive, and this will be a notable influence on the Thai tourism industry. Data from the Pacific Asia Travel Association from 2025 show that by 2027, almost 800 million people will travel to the Asia-Pacific region, one of the world’s most important tourism destinations (Figure 21). If Thailand is able to maintain its strong appeal for value-for-money while simultaneously raising its services to international standards, this will represent an important avenue for growth, especially for long-haul travelers from Europe and North America, who often use Thailand as a gateway for travel on to other parts of Asia.

ii. International flight capacity to Thailand is expected to increase further. According to the Civil Aviation Authority of Thailand (CAAT), more than 80 international airlines have submitted requests for a combined total of over 270,000 additional flight slots for the 2026 season. At the same time, European carriers such as Finnair plan to increase flight frequencies to Thailand in the winter 2026/2027 season to around 25 flights per week, covering routes to Bangkok, Phuket, and Krabi (TTR Weekly, Nov, 2025). This will help improve connectivity with long-haul markets. Meanwhile, airlines from Asia continue to expand services to Thailand in line with gradually recovering demand.

iii. Government measures are also expected to continue placing strong emphasis on stimulating tourism, in particular by offering visa-free travel for arrivals from target markets. This will help to reduce friction and remove obstacles to travel, as well as to extend the time that visitors are in the country, thereby increasing spending on accommodation, food, shopping, travel and other activities. However, other countries in Asia are following the same playbook, and Thailand is having to compete with Malaysia and Vietnam, which are both targeting the Chinese market through visa-free travel as they look to establish themselves as regional tourism hubs.

iv. Thailand’s tourism competitiveness and overall readiness also remain a key strength relative to regional peers. The country continues to benefit from strong price competitiveness and a rich endowment of tourism resources that appeal to travelers worldwide. According to the Top 100 City Destinations Index published by Euromonitor International on Dec 18, 2025, Bangkok was ranked as the world’s number one city destination. Similarly, a report by Lonely Planet released on Oct 26, 2025 ranked Phuket among the world’s top 25 destinations for 2026.

-

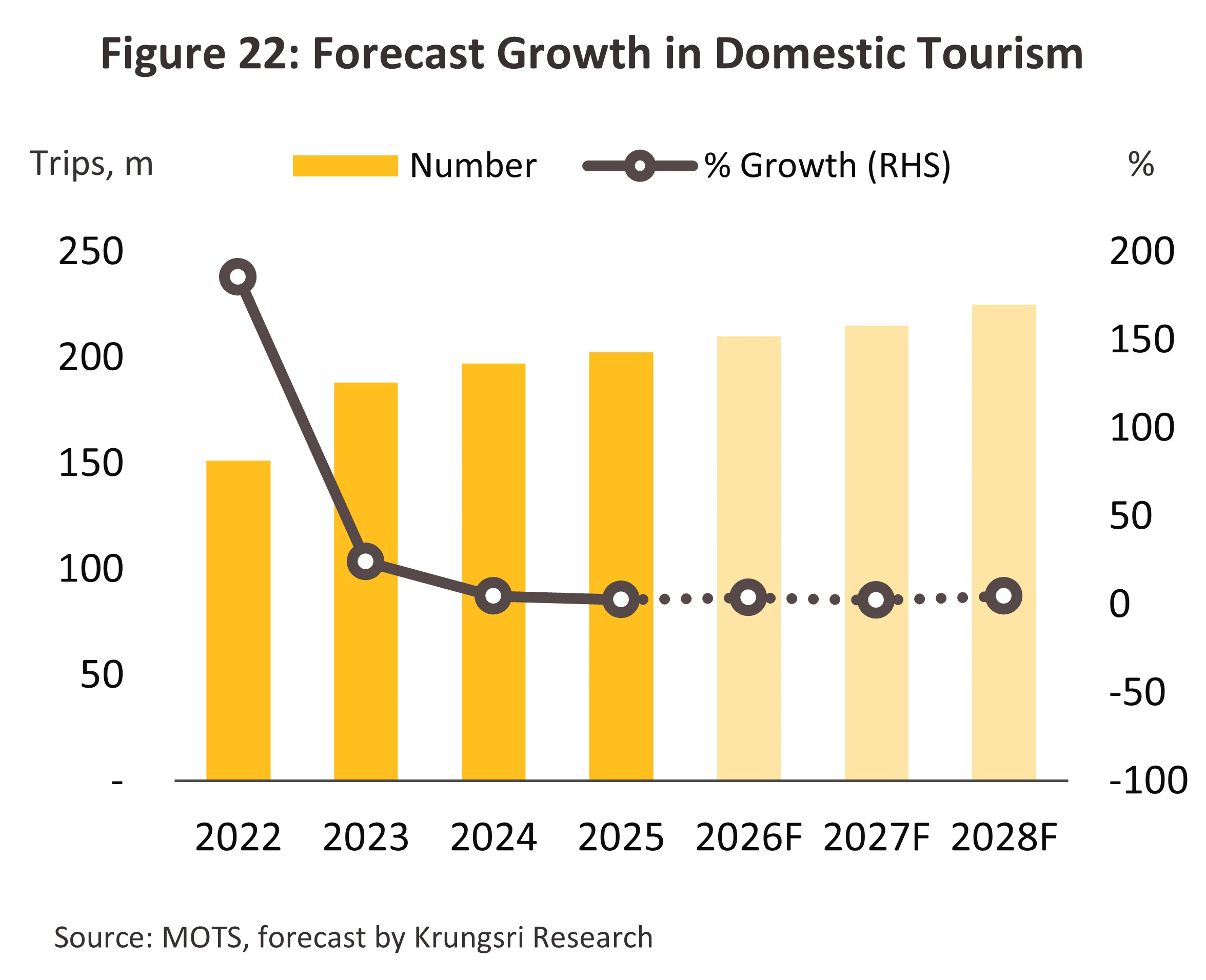

Domestic tourism by Thai travelers is expected to continue expanding. Over 2026–2028, domestic trips are projected to average 210 million in 2026, increase to 215 million in 2027, and further rise to 225 million in 2028 (Figure 22), supported by the following factors:

i.Government measures and programs to stimulate domestic tourism are expected to continue, especially programs that aim to expand the market into secondary cities. However, political uncertainty following the dissolution of parliament and during the interim period before a new government is formed could delay budget disbursements related to tourism support measures, particularly in 2026.

ii. Growth in the domestic MICE market (meetings, incentives, conventions, and exhibitions) is expected to be supported by two main factors; i) demand for meetings and conferences from both the public and private sectors is likely to become more geographically diversified, spreading more widely across major tourist provinces nationwide; and ii) the development and opening of new convention centers will support efforts to promote secondary cities as MICE destinations and strengthen Thailand’s competitiveness as a regional MICE hub. In this regard, several major convention center projects are scheduled for development over 2026-2028, including the Phuket Convention & Exhibition Centre (PCEC), the Chiang Mai International Convention & Exhibition Centre, and the Khon Kaen International Convention & Exhibition Center (KICE).

iii.The development of infrastructure is expected to provide further support to the tourism sector. This includes upgrades and expansions of airports in both major tourist destinations and secondary provinces, as well as extensions of rail and road networks, which are expected to help spread tourism more widely to secondary cities, although political uncertainty may continue to delay budget disbursements for some public infrastructure projects in 2026.

-

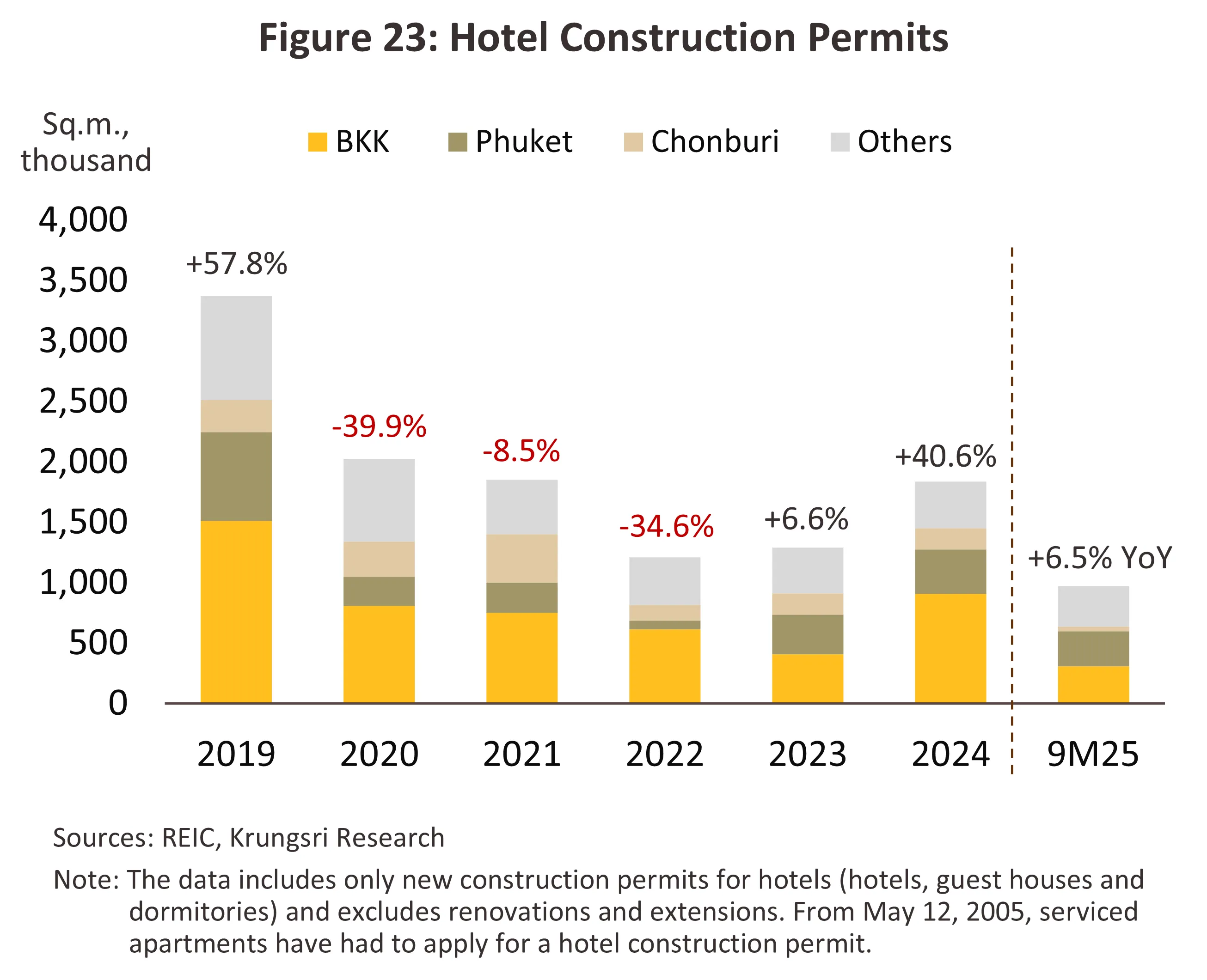

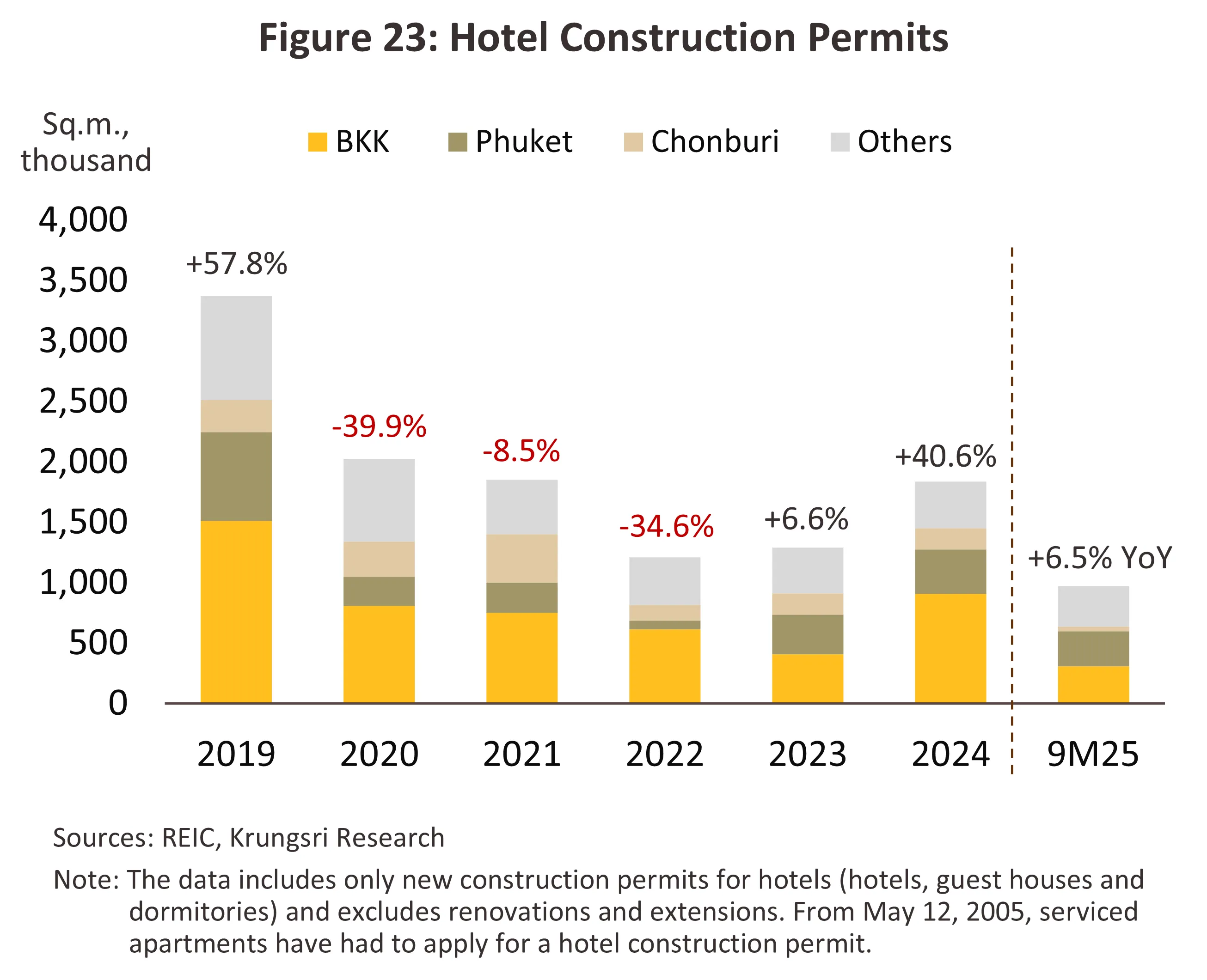

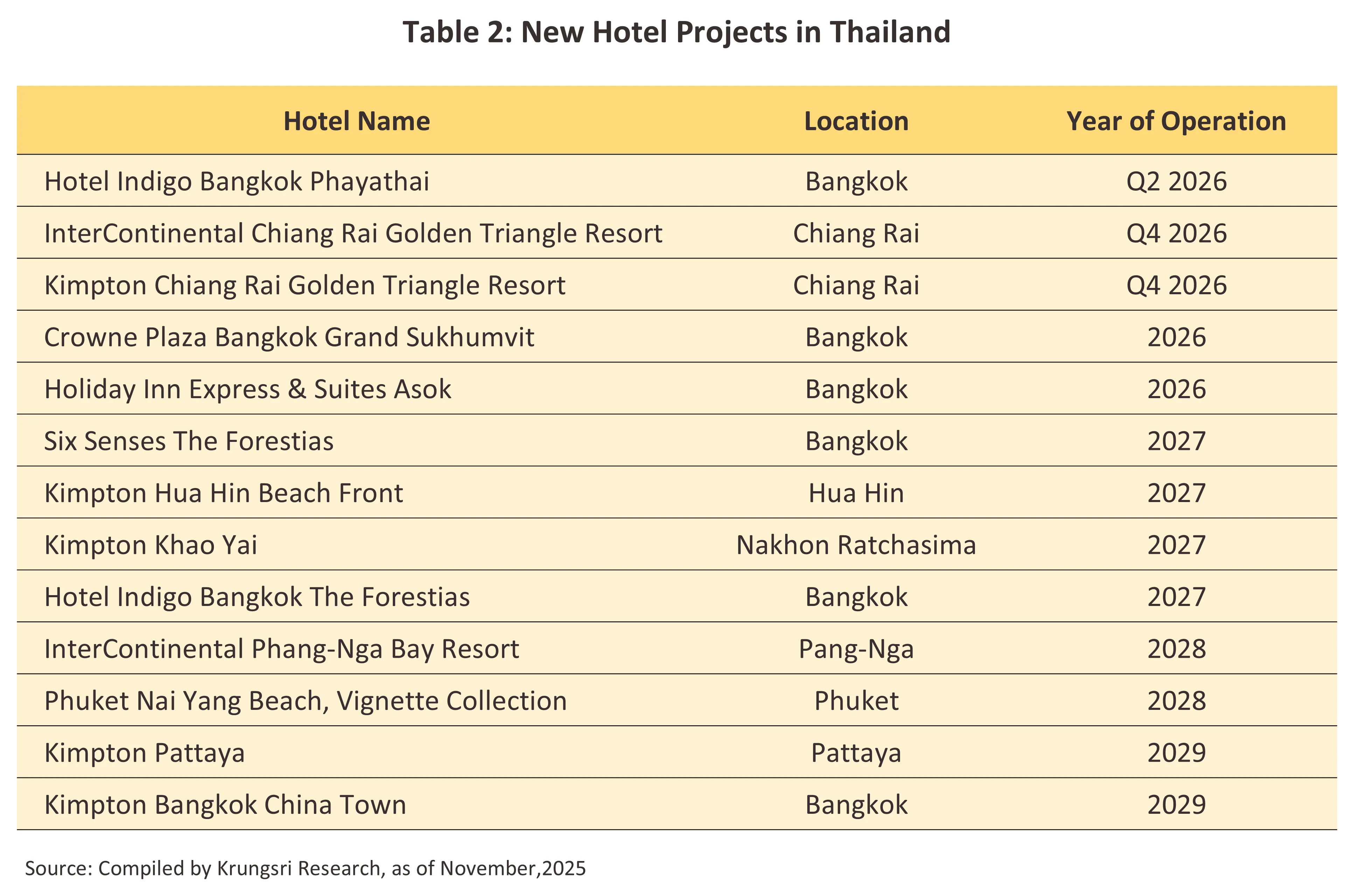

The nationwide supply of hotel rooms is expected to continue expanding, reflecting hotel operators’ confidence and their more positive outlook for the recovery of the tourism sector over the next two to three years. This is evident from applications for hotel construction permits—an indicator of new room supply likely to enter the market over the next one to two years—which totaled 0.97 million square meters in the first nine months of 2025, up 6.5% YoY (Figure 23). Key tourist destinations remain the main drivers of this expansion. In Phuket, which accounted for 30% of total hotel construction permit applications over 9M25, the permitted area increased by 19.4% YoY, while in Bangkok, which accounted for 31%, applications surged by 95.6% YoY. This contrasts with Chonburi, which accounted for 4% of the total and saw a contraction of -70.6% YoY, following a sharp expansion of 89.1% YoY in 9M24. Meanwhile, permitted construction areas in tourist provinces that rely mainly on domestic travelers and in regional hub provinces continued to expand strongly, including Chiang Mai (+66.3% YoY), Rayong (+56.3% YoY), and Prachuap Khiri Khan (+179.3% YoY).

-

The nationwide occupancy rate is expected to average around 72–73% over 2026–2028. In major tourist destinations such as Bangkok, Chonburi, and Phuket, occupancy rates are projected to exceed 75%, supported by the recovery in international tourist arrivals (Figure 24). Meanwhile, average occupancy in other key tourist provinces and regional hubs is also expected to improve in line with the continued increase in domestic travel. Despite the gradual opening of new hotels in Bangkok, Phuket, and other destinations, the pace of new room supply entering the market remains modest. As a result, occupancy rates are expected to improve steadily, allowing operators to maintain room rates and potentially raise prices during the high season.

i. Geopolitical conflicts are likely to continue weighing on international travel worldwide. Key risks include the conflict between Israel and Hamas in the Gaza Strip, the ongoing war between Russia and Ukraine, persistent tensions between China and the United States over Taiwan, and the recent rise in tensions between the United States and NATO members over the Greenland issue, all of which remain sources of uncertainty. If these situations become prolonged, they could hinder the recovery of the global economy and international tourism. In addition, uncertainty over oil price trends could affect travel costs, particularly for long-haul travelers from markets such as Europe and the United States.

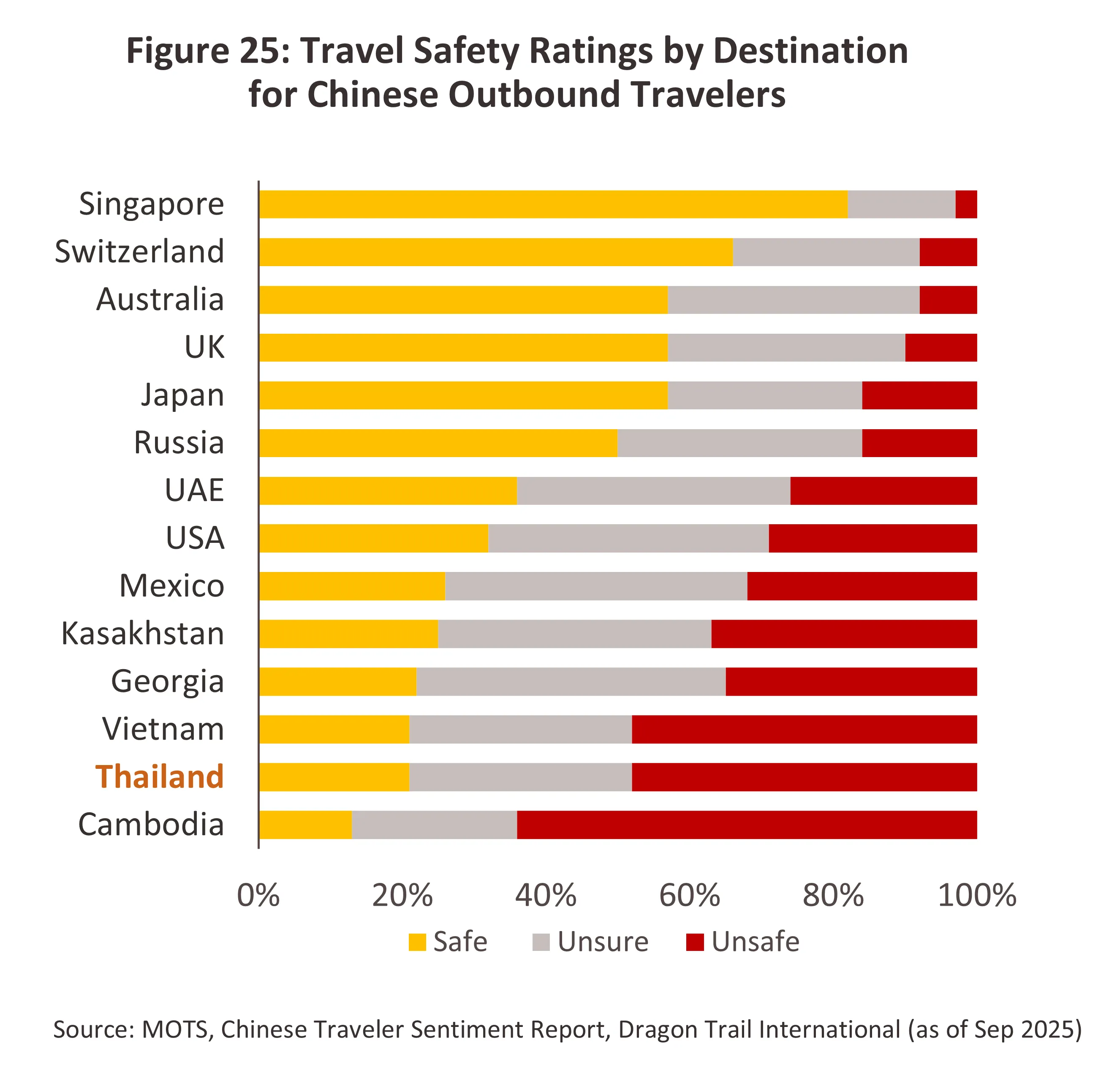

ii. The Chinese market may not return to its previous high of 11 million visitors (in 2019). The market has been particularly damaged by worries over the safety of travel to Thailand that have originated in: i) the widely reported case of a Chinese actor being kidnapped and forced to work in a scam center, which seriously hurt Thailand’s ability to present itself as a safe destination for Chinese tourists, thereby causing the country to lose ground to regional rivals (Figure 25); and ii) widespread complaints made online regarding over-charging for accommodation, food and taxi services, which has eroded Thailand’s reputation for value for money. As a result, it is unlikely that Chinese arrivals will break the 11 million-barrier by 2028.

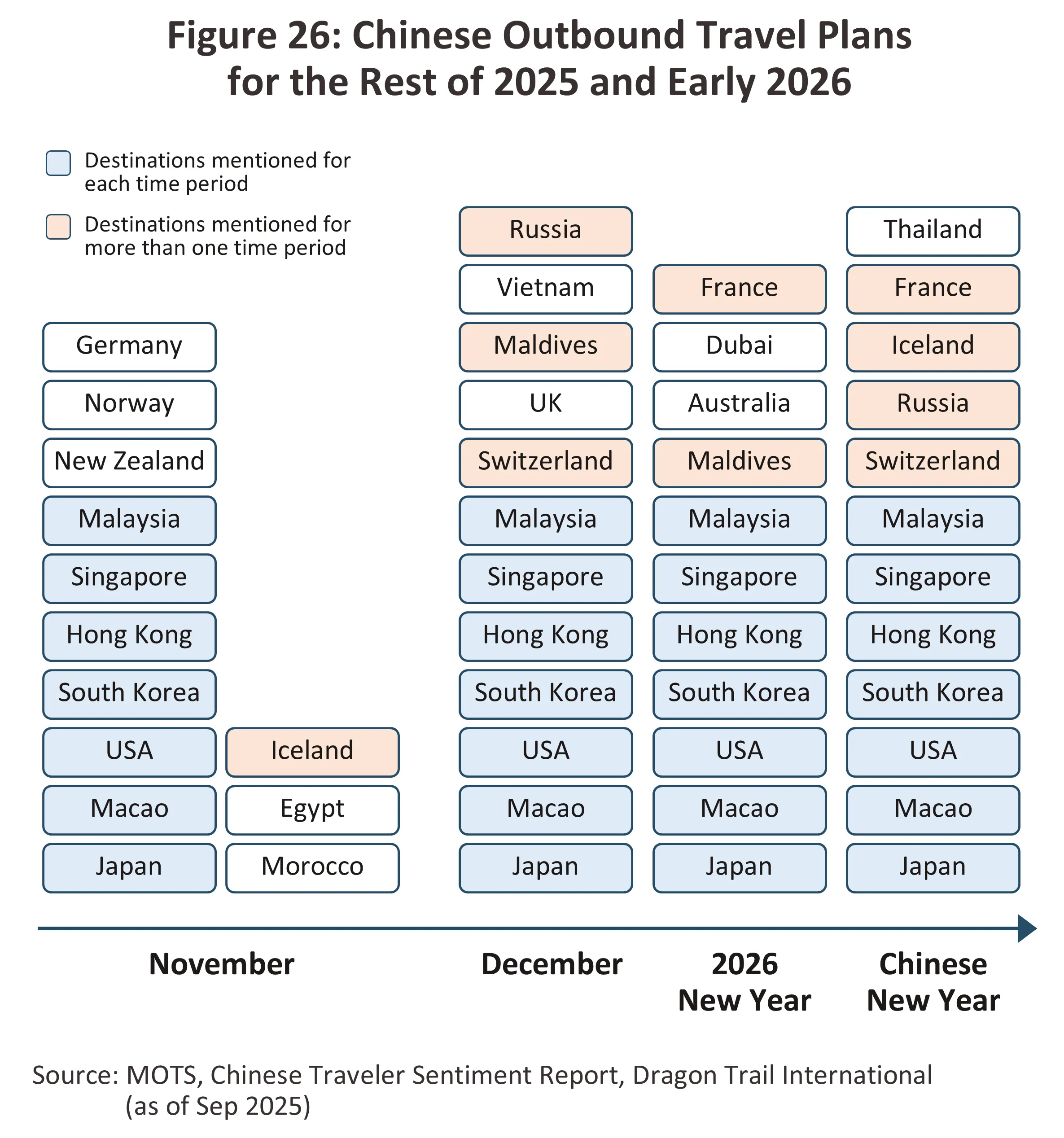

The Chinese Traveler Sentiment Report (published September 2025) shows that Thailand is no longer counted among the top seven destinations that Chinese travelers plan to revisit more than once through the remainder of 2025 and start of 2026. Instead, Thailand is perceived as a destination suitable for seasonal travel (notably winter holidays), rather than a consistently prioritized primary choice (Figure 26). Escalating tensions between China and Japan—following Japan’s stance in support of Taiwan’s self-governance separate from China’s authority—have prompted the Chinese government to issue safety advisories for Chinese tourists traveling to Japan (Source: Krungthep Turakij, Nov 16, 2025). While this situation may provide some support to Thailand’s tourism through the diversion of a portion of Chinese travelers, the positive impact is expected to be limited, as safety concerns among Chinese tourists regarding travel to Thailand persist. In addition, competing destinations such as Vietnam continue to successfully attract Chinese tourists through ongoing tourism stimulus measures3/, while Cambodia has recently announced a pilot visa exemption for Chinese tourists from Jun 15-Oct 15, 2026, allowing stays of up to 14 days (Source: Matichon, Dec 4, 2025).

iii. The global economic slowdown stemming from U.S. tariff hikes is expected to become more evident in 2026, with broader and more visible impacts on business activity worldwide. This is likely to weigh on travel sentiment and dampen spending by both international and domestic tourists.

i. Competition within the hotel industry is expected to remain intense. Hotel operators continue to expand investment in major tourist destinations and regional hub cities, adding to supply and keeping competitive pressure high. At the same time, accommodation platforms such as Airbnb are playing a more prominent role. In addition, the sector also faces competition from substitute accommodation such as apartments, serviced apartments, and condominiums rented out on a daily basis—which is illegal under the Hotel Act B.E. 2547 (2004). These alternatives typically have lower average rental rates and lighter tax burdens than hotels4/, and as a result, price pressure in the market is likely to remain elevated.

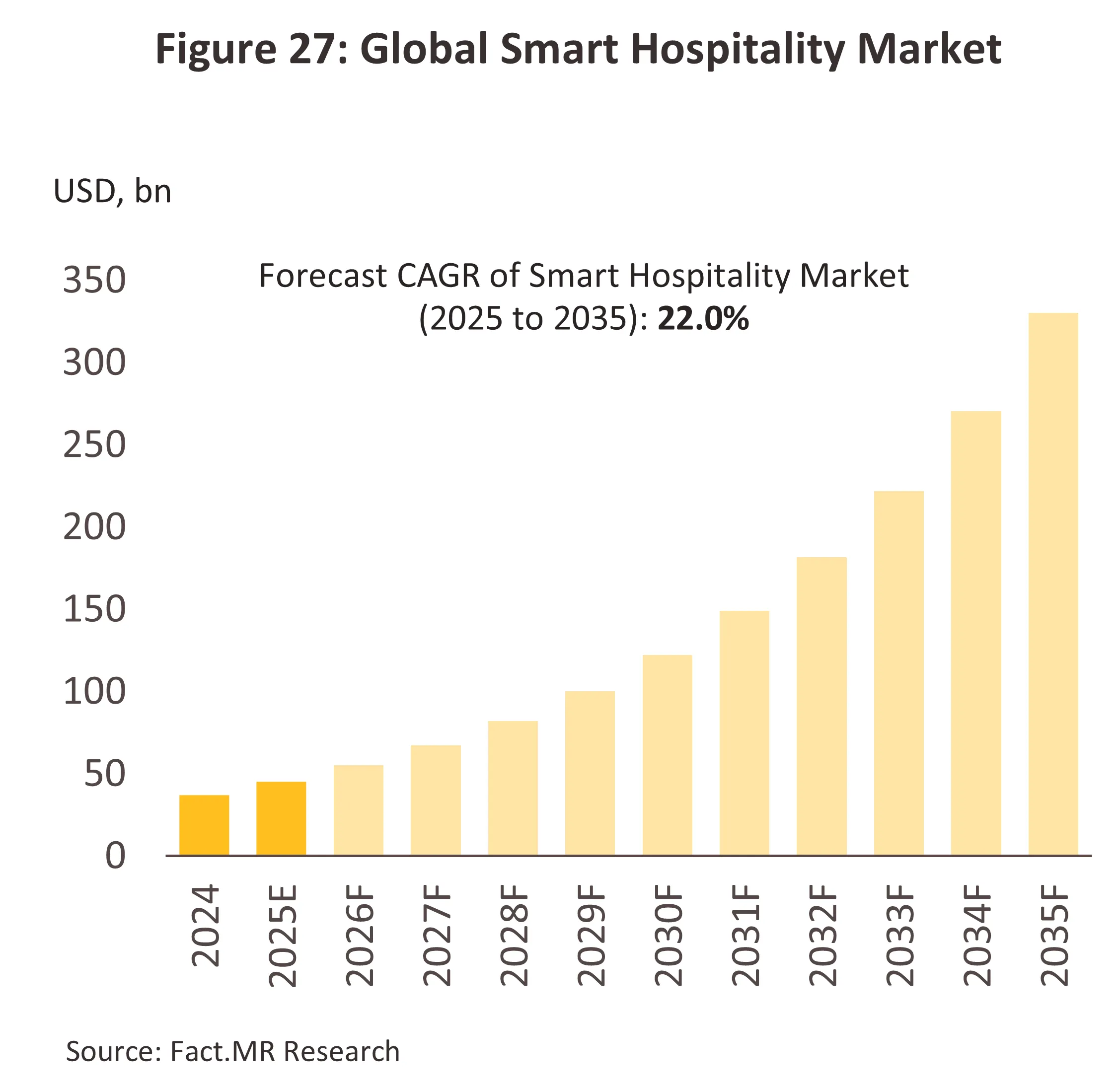

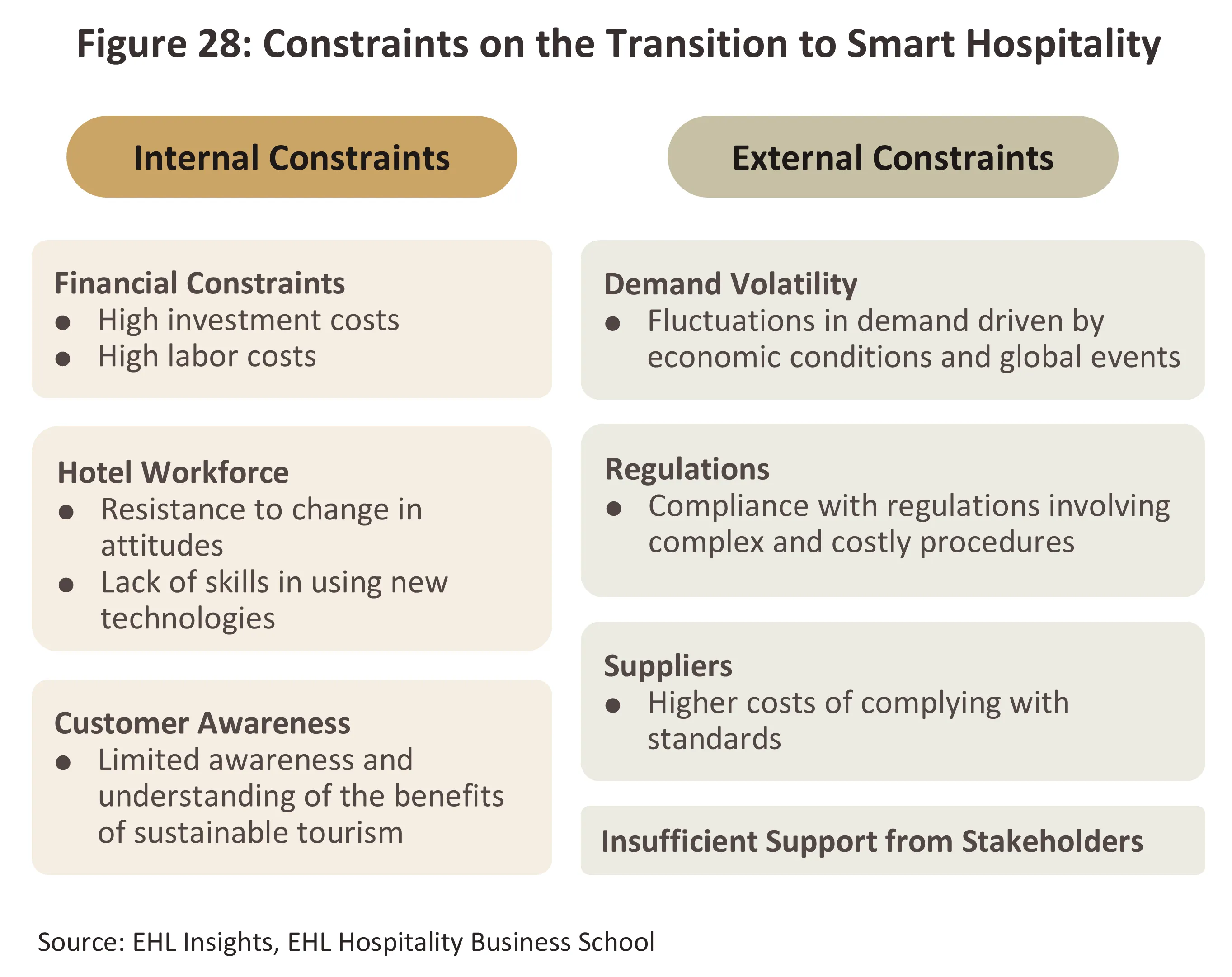

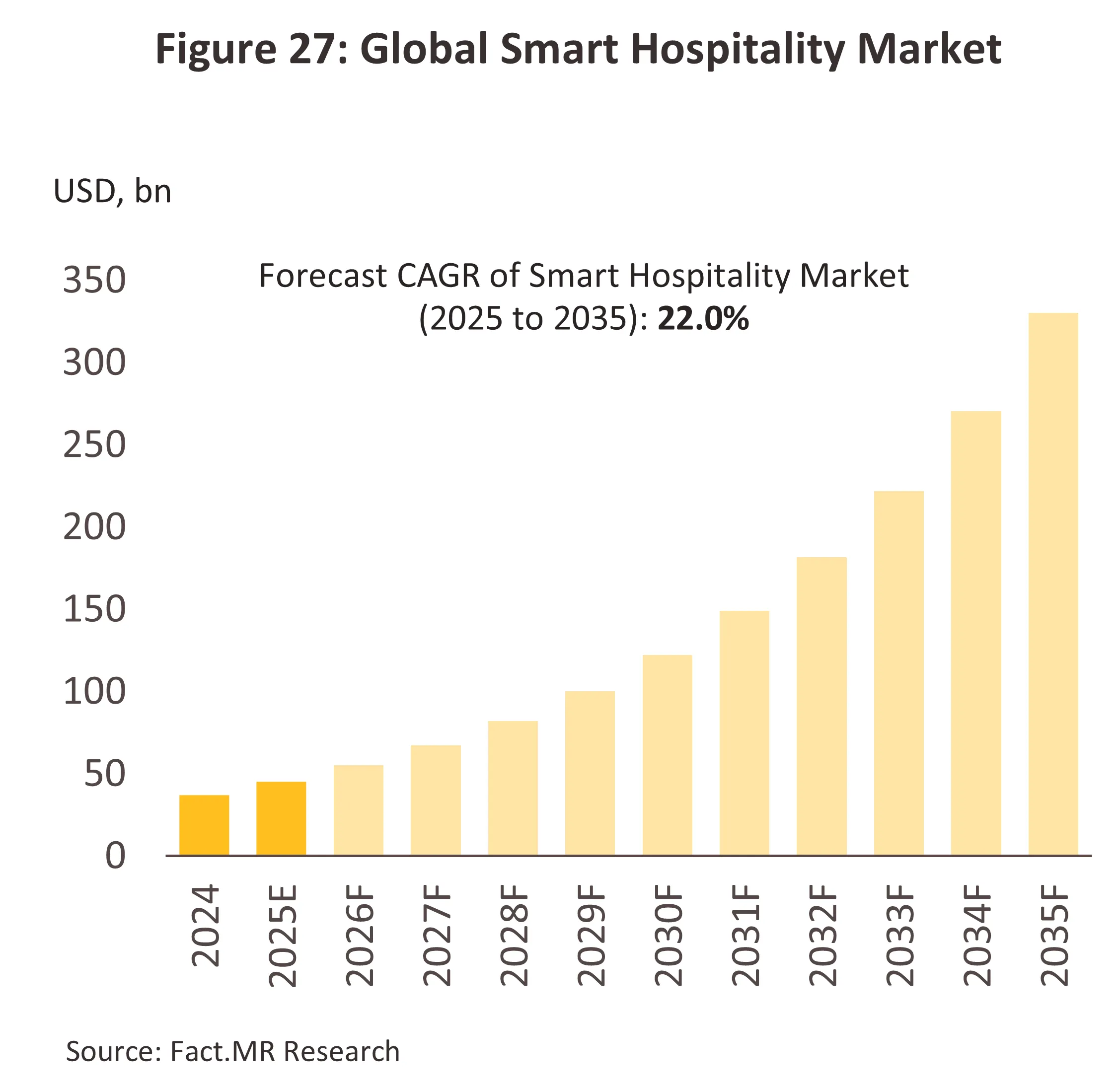

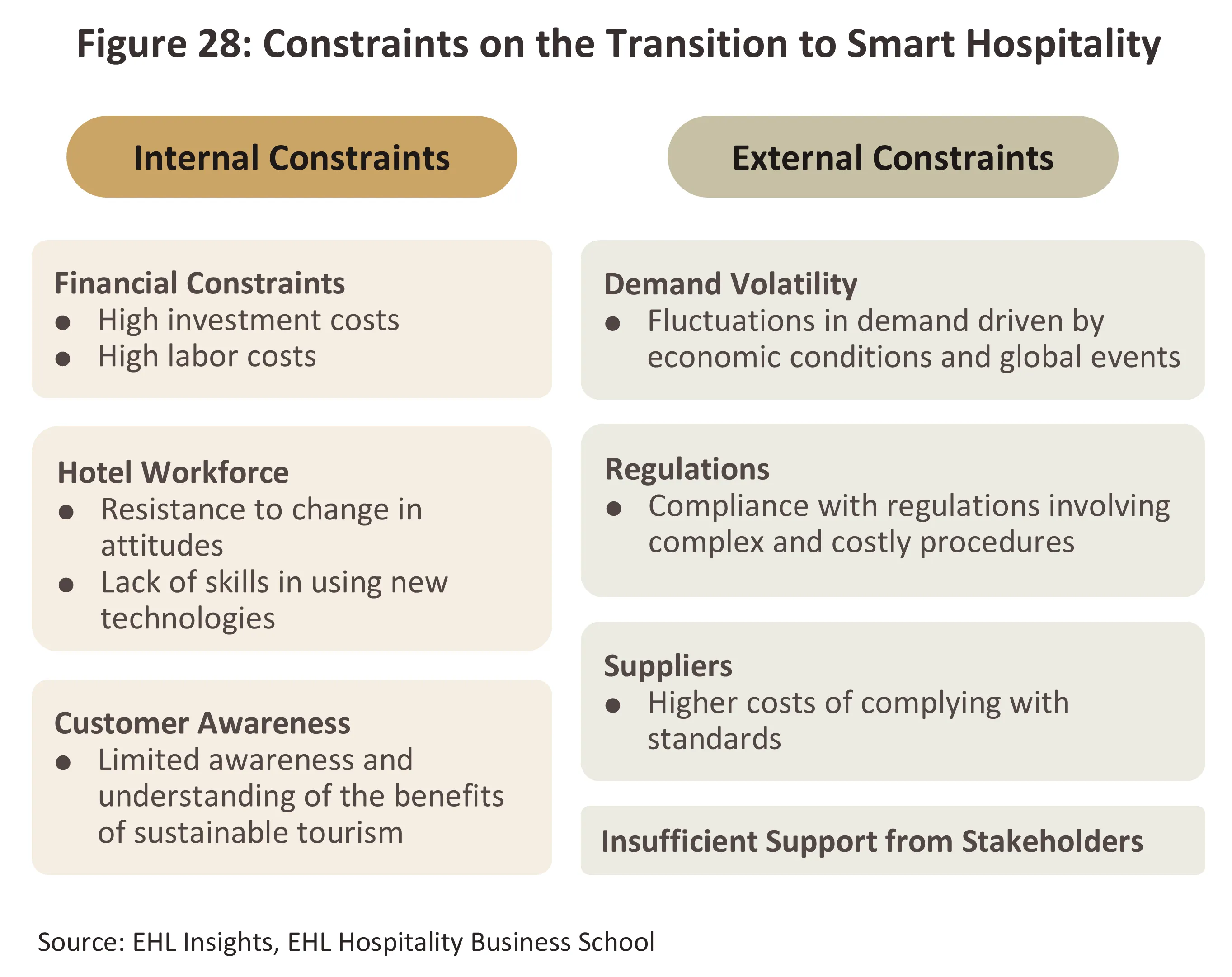

ii. Hotel operators are facing higher cost burdens from the need to invest in digital transformation and sustainability initiatives. Hotel operators need to integrate digital technologies across all aspects of their operations to evolve into smart hotels with sustainability as a core objective—a segment expected to grow further in the coming period (Figure 27). Smart hotels span the entire value chain, from marketing and reservation systems to internal operations, such as using technology to control in-room equipment to enhance guest convenience through greater internet-connected devices. This aligns with the lifestyle of younger generations, who rely heavily on smartphones for transactions and activities, including contactless room booking and payment. These technologies play a critical role in improving resource efficiency and delivering superior guest experiences, which are key factors underpinning the growing emphasis on sustainable tourism among modern travelers. However, the ability of Thai operators to transition toward smart hotels remains concentrated among hotel chains and large players, while small and medium-sized hotels continue to face constraints related to capital, workforce readiness, and awareness of the benefits of sustainability practices (Figure 28). As a result, the adoption of technology and sustainable tourism concepts in practice remains limited to certain operator groups, despite their importance in strengthening the long-term competitiveness of Thailand’s hotel industry.

iii.Safety regulations governing hotel buildings have become more stringent, as reflected in the Ministerial Regulation prescribing structural and safety standards, which was published on Aug 30, 2023, and came into effect 60 days thereafter. The new rules are intended to accommodate the growing diversity of buildings that are being converted into hotel-type accommodation, including properties not originally designed for this purpose. While these requirements will increase construction and renovation costs for operators seeking to bring buildings up to standard, they may also make it easier for owners of other types of commercial buildings that can be upgraded to meet the requirements to enter the hotel business. As a result, existing hotel operators may face more intense competitive pressure.

iv. Labor shortages in the service sector, together with increases in the minimum wage, could continue to put upward pressure on operating costs.

1/ Chiang Mai, Chiang Rai, Phitsanulok, Kanchanaburi, Rayong, Chachoengsao, Nakhon Ratchasima, Khon Kaen, Udon Thani, Ubon Ratchathani, Phetchaburi, Prachuap Kiri Khan, Songkhla, Krabi, Phang-gna and Surat Thani (Ko Samui).

2/ In November 1983, the Chinese government first allowed Chinese citizens to travel abroad, initially permitting travel to Hong Kong and Macau for those visiting family members. The process of travel liberalization was accelerated by China’s entry to the WTO in 2001 and the requirement that China operate under WTO regulations regarding tourism. The result of this has then been to dramatically increase the number of Chinese tourists traveling abroad (Bank of Thailand, June 2014).

3/ These measures have included relaxing the conditions for issuing visas, extending the permitted length of stay, and increasing the number of direct flights running between Vietnam and China.

4/ Hotels tend to bear higher tax and regulatory costs than apartments, as they are classified as commercial properties, subject to higher land and building tax rates, and required to comply with regulations specific to hotel operations.

.webp.aspx)