Executive Summary

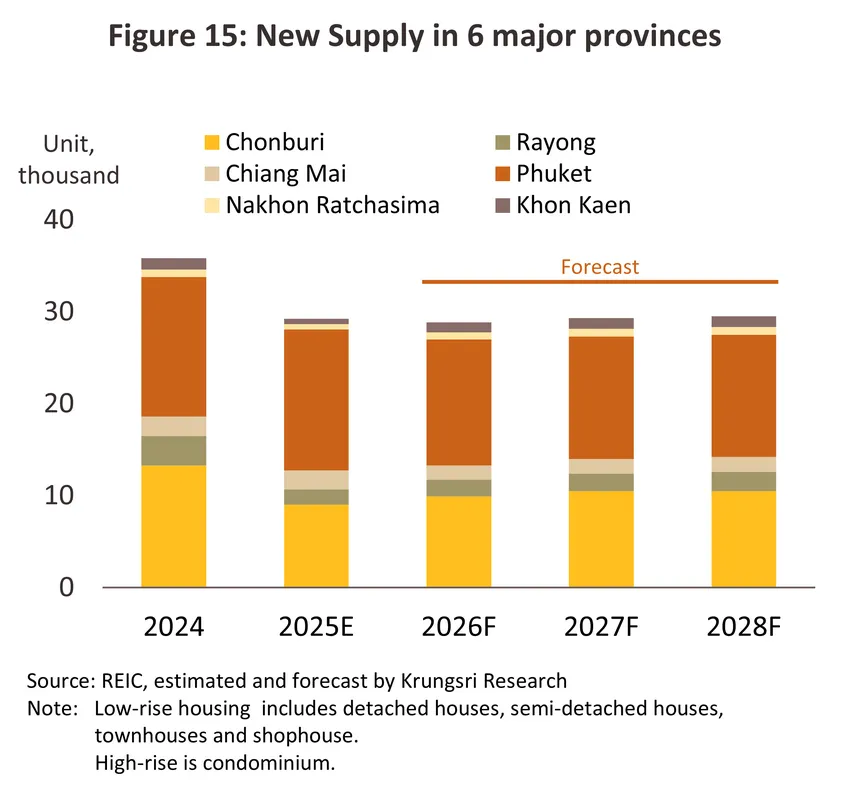

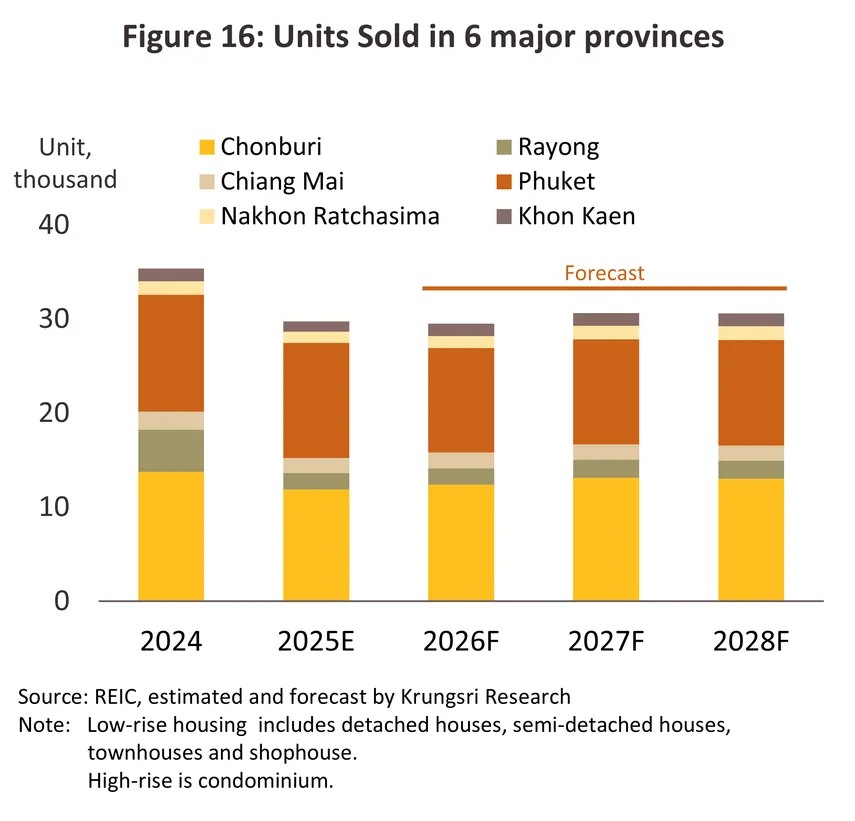

In 2026, the housing market in the six major provinces1/ is expected to slow in line with Thailand’s economy, which is projected to grow by only 1.8%, amid high household debt and limited purchasing power, particularly among middle- to lower-income groups. As a result, developers are focusing on clearing existing inventory and developing high-end projects, including branded residences, to cater to demand from high-income buyers and foreign purchasers. New project launches and total sales are expected to continue declining from the previous year. Meanwhile, key tourism provinces such as Phuket, Chonburi, and Chiang Mai are likely to see a recovery only in selected segments where purchasing power remains resilient. For 2027–2028, the market is expected to recover gradually, supported by Thailand’s economic growth projected to average 2.3% per year, along with the expansion of the tourism sector and housing demand from foreign workers. These factors will enhance the potential of tourism cities, particularly Phuket, Chonburi, and Chiang Mai.

Key challenges for the industry will stem from subdued domestic purchasing power, which constrains access to credit, while foreign buyers are expected to adopt a more cautious investment stance due to fragile global economic conditions. This will add pressure on housing demand from foreign purchasers, who represent a key customer segment in major tourism provinces.

Krungsri Research view

The outlook for the housing business in the six major provinces during 2026–2028 can be summarized as follows.

-

Low-rise housing developers (in major cities): The sector will face intense competition due to an increasing number of developers. Most mid-sized and small developers are local players or those with accumulated land holdings, while large developers are increasingly expanding investment into regional markets to broaden their revenue base and reduce risks arising from fierce competition in Bangkok and its metropolitan area. Large developers hold advantages in terms of financial capacity, marketing strategies, and brand credibility. In contrast, mid-sized and small developers will face pressure from rising costs and liquidity constraints, which may affect their competitiveness and financial performance.

-

High-rise developers (in major cities): Most mid-sized and small developers focus on low-rise condominium projects targeting the middle-income segment. Large developers, however, benefit from stronger capital positions and strategic flexibility, enabling them to develop branded residences that attract high-purchasing-power buyers, both Thai and foreign. This trend is driving an upgrade of the regional condominium market toward higher-quality segments. Nevertheless, the market continues to face pressure from foreign demand that has yet to fully recover, resulting in intense competition. This situation places additional strain on mid-sized and small developers, who face capital constraints and higher financing costs than large developers, increasing the risk of losing market share and profitability.

Overview

Real estate remains a major driver of the Thai economy, and it is estimated that the entire industry value chain (such as construction, construction materials, furniture ,electrical appliances, and finance) accounts for more than 10%2/ of Thailand’s GDP. The residential property market in Thailand is driven primarily by domestic demand, as Thai law allows foreigners to purchase and hold ownership rights only in condominiums, with a maximum of 49% of the total saleable area in any project. By contrast, ownership of low-rise housing is subject to much stricter legal restrictions.

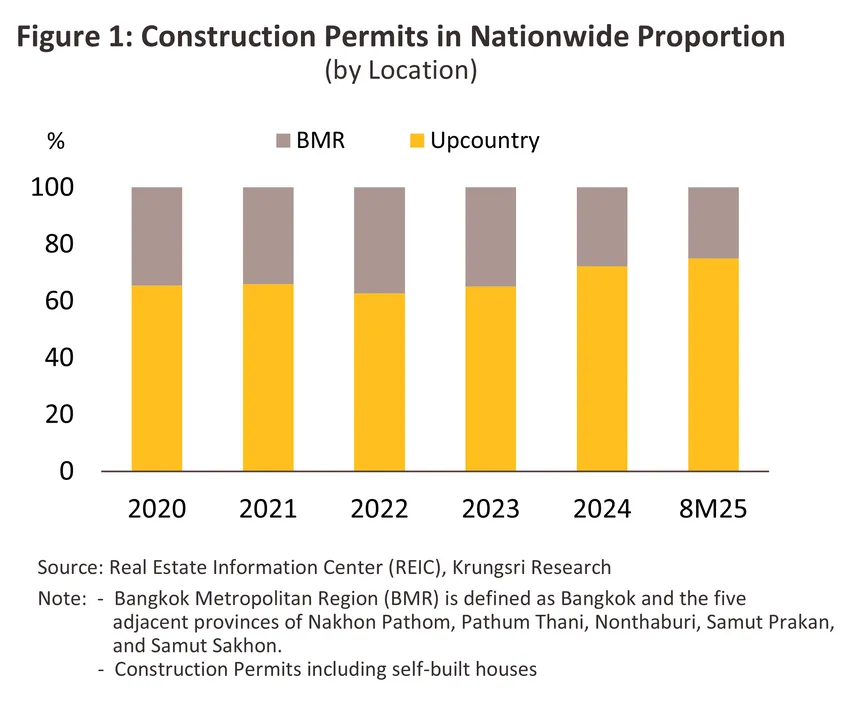

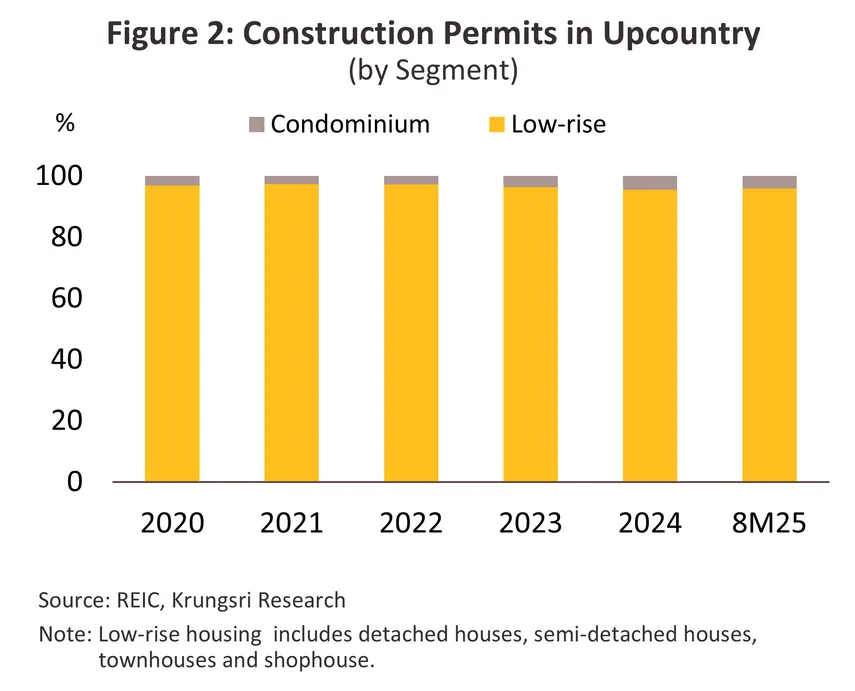

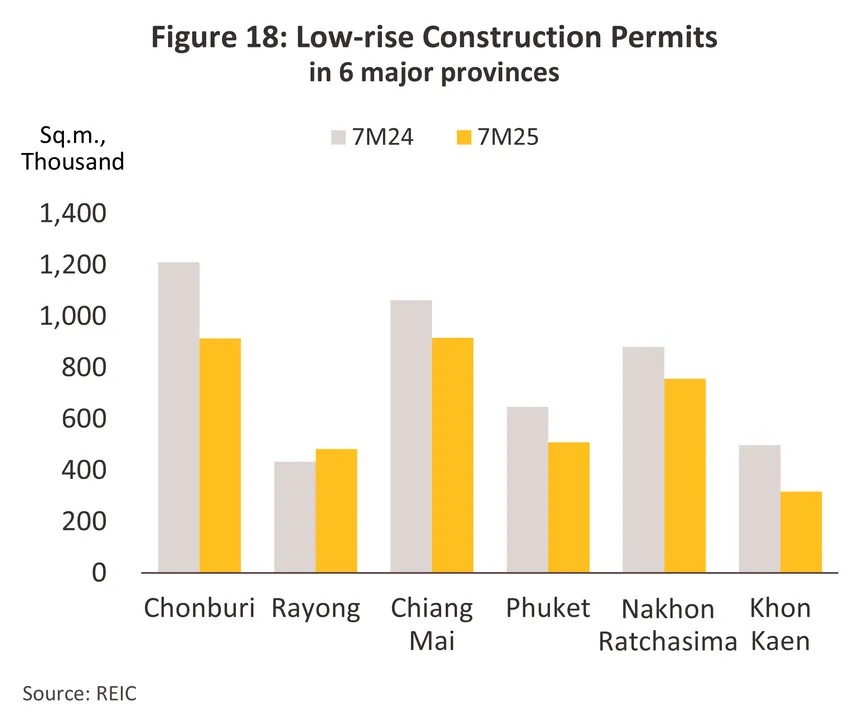

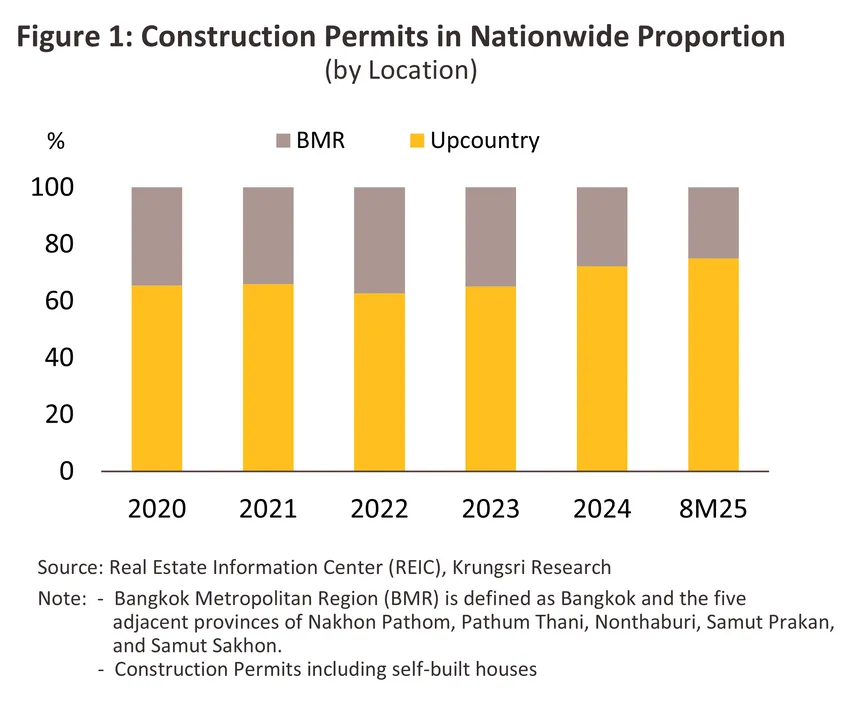

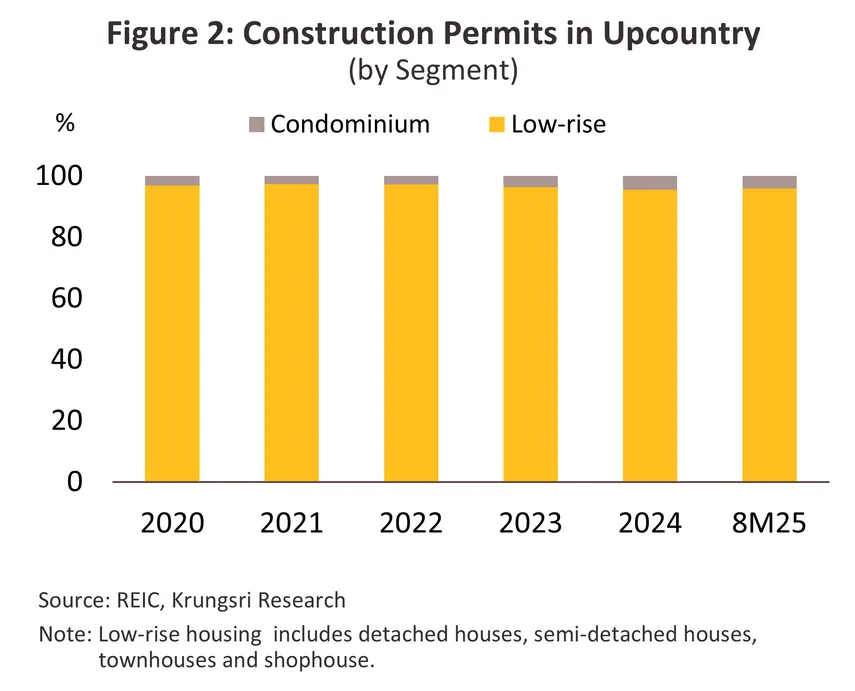

As of 2024, 72% of applications for residential construction permits were for developments outside the BMR, up from 66% in 2020 (Figure 1). The greater supply of land and resulting lower prices mean that upcountry, per-meter construction costs are typically higher for condominiums than for low-rise projects3/ (Figure 2) and so the market is tilted in favor of the latter. However, developers active in the provinces face difficulties due to provincial economies’ greater dependency on agricultural activities, and because these are prone to more volatility than other parts of the economy, residential property markets may likewise be less predictable. Nevertheless, despite these difficulties, the provinces continue to have an important role to play in determining the overall health of the national market for residential property.

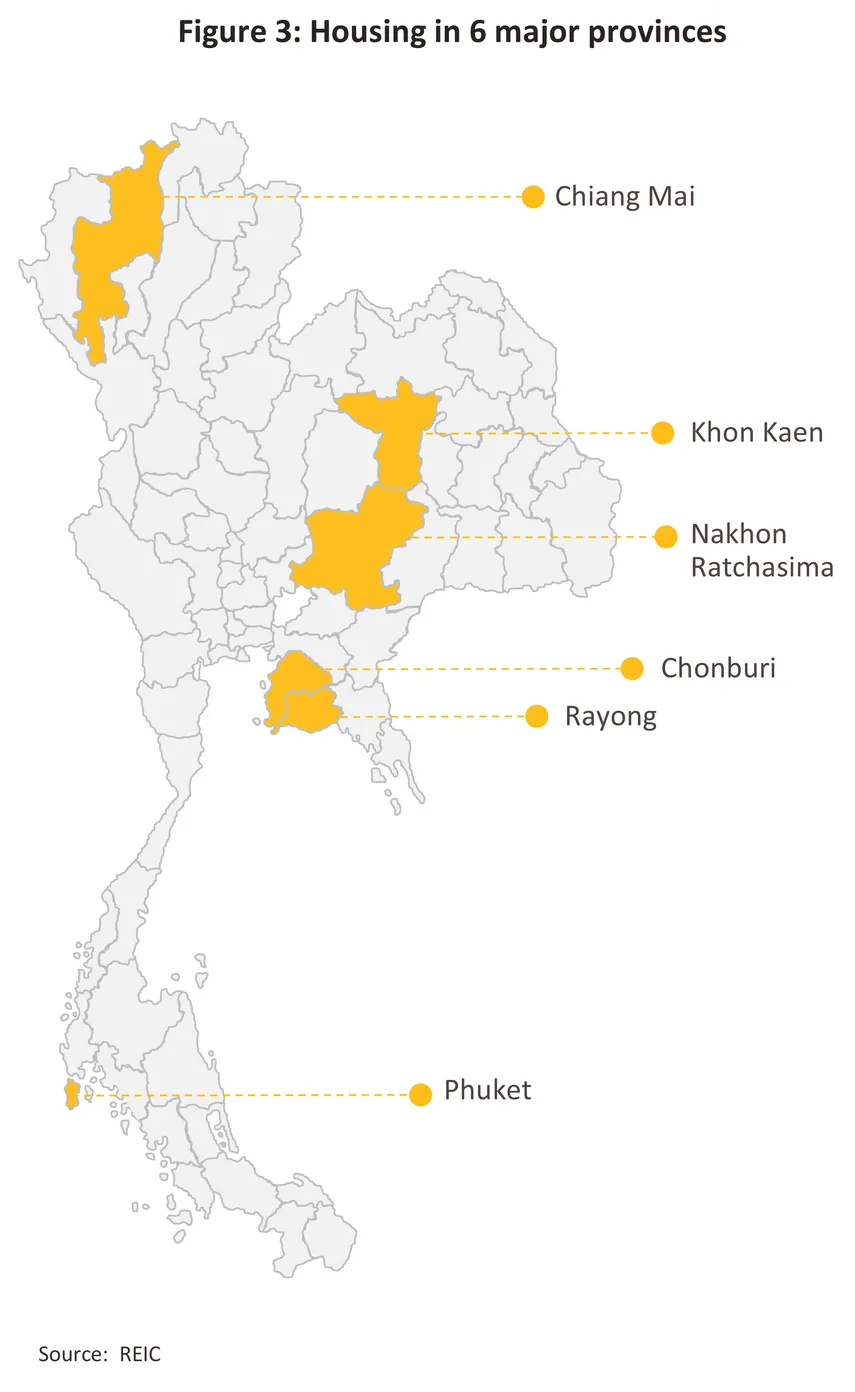

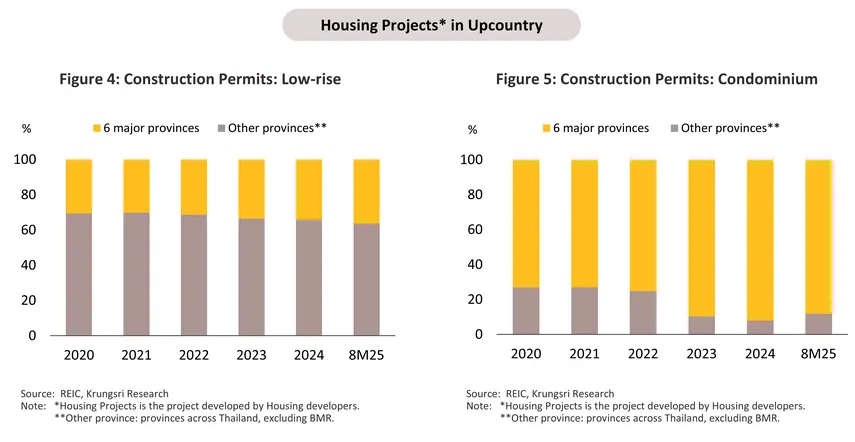

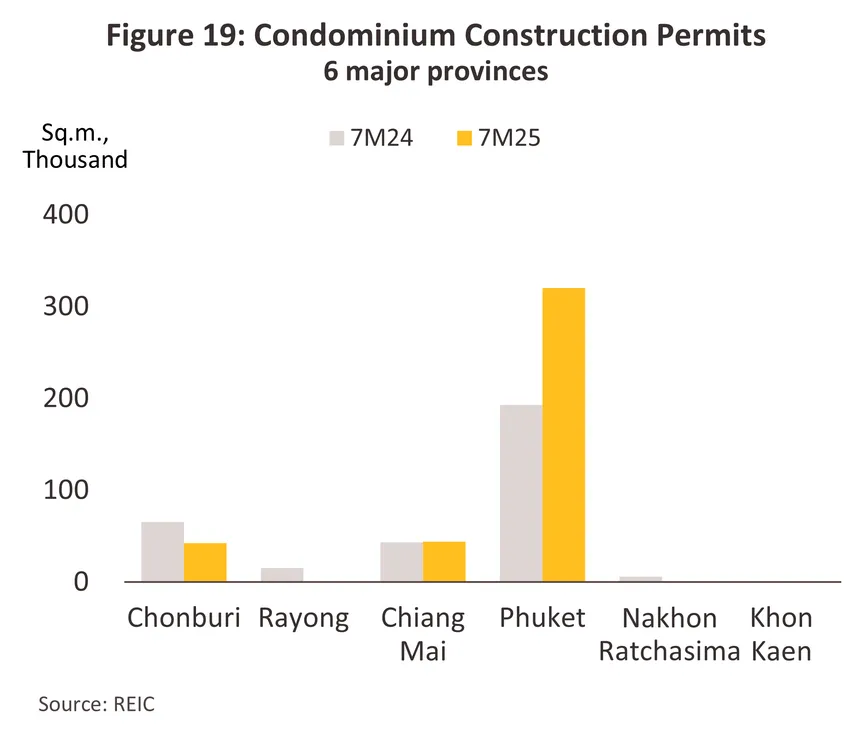

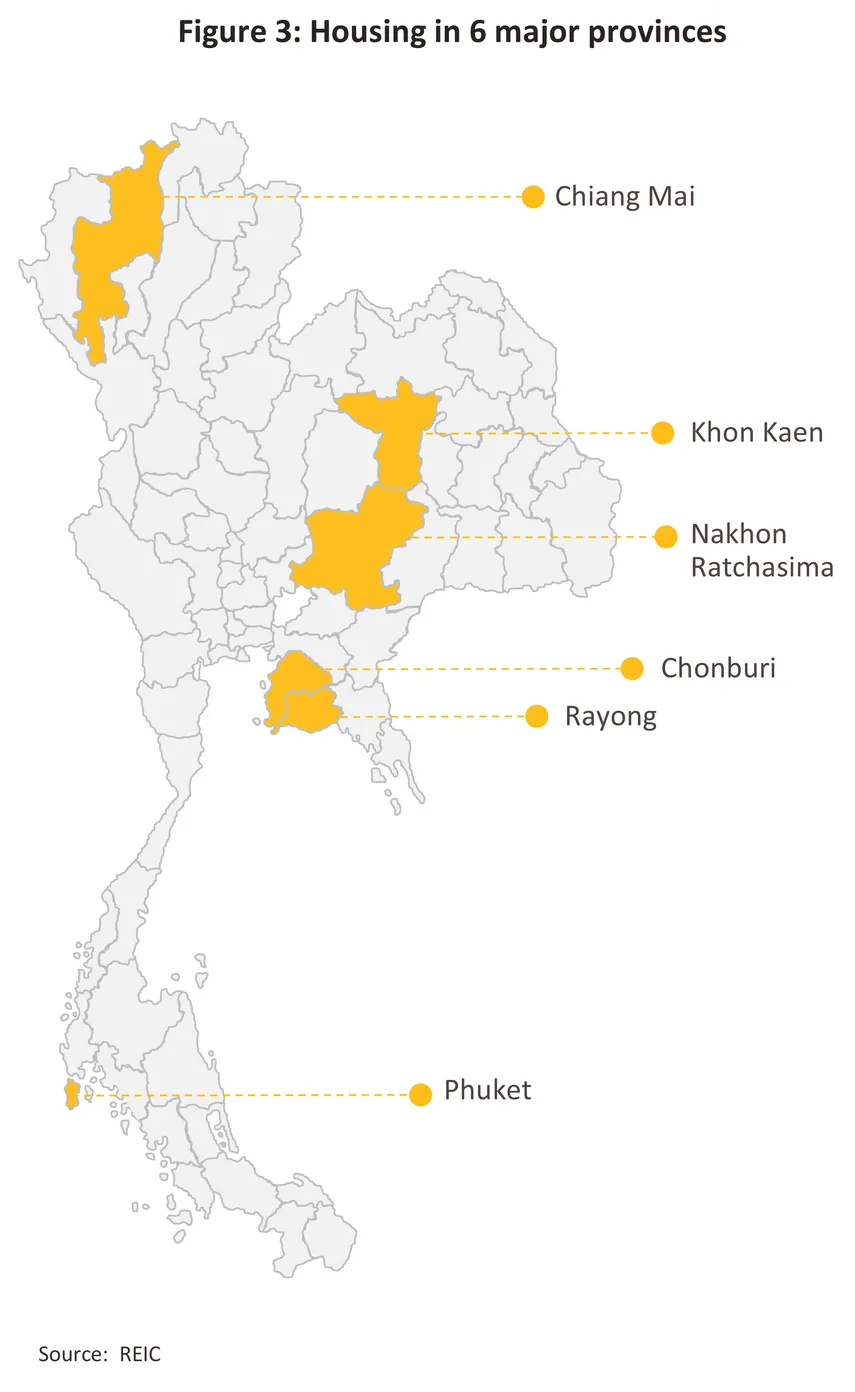

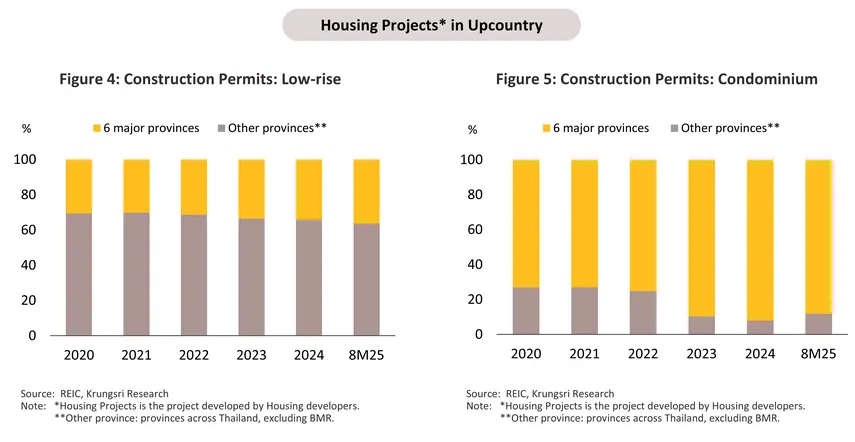

Measured by construction permit applications, the six major provincial markets of Chiang Mai, Chonburi, Rayong, Nakhon Ratchasima, Khon Kaen, and Phuket accounted for 26% of the national market and 37% of the provincial property markets. Excluding the BMR, these six provinces also represented 34% of the market for low-rise units and a full 92% of the market for condominiums (Figure 4 and Figure 5). Moreover, the latter is further concentrated in the main tourist areas of Chonburi, where demand is bolstered by the development of the Eastern Economic Corridor (EEC) and the presence of foreign buyers; Phuket, where condominiums are bought both by owner-occupiers and for rent to non-Thais, especially Chinese and Russians; and Chiang Mai, which is popular with foreign retirees, digital nomads, and students.

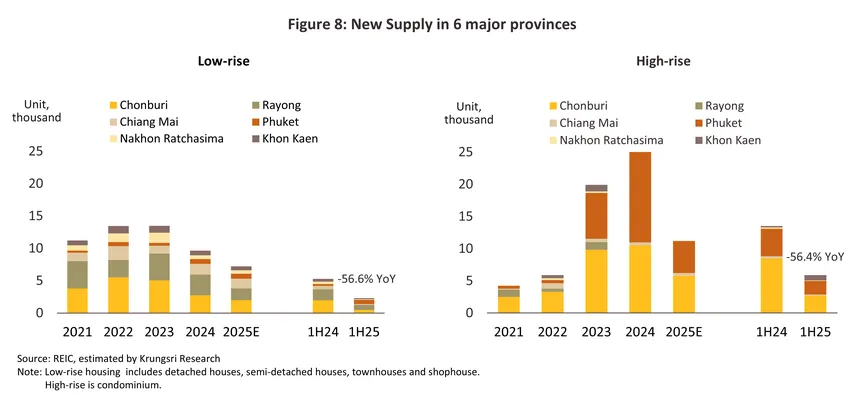

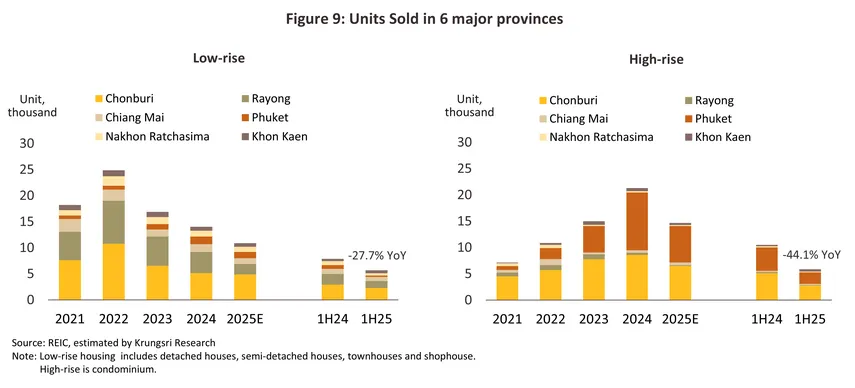

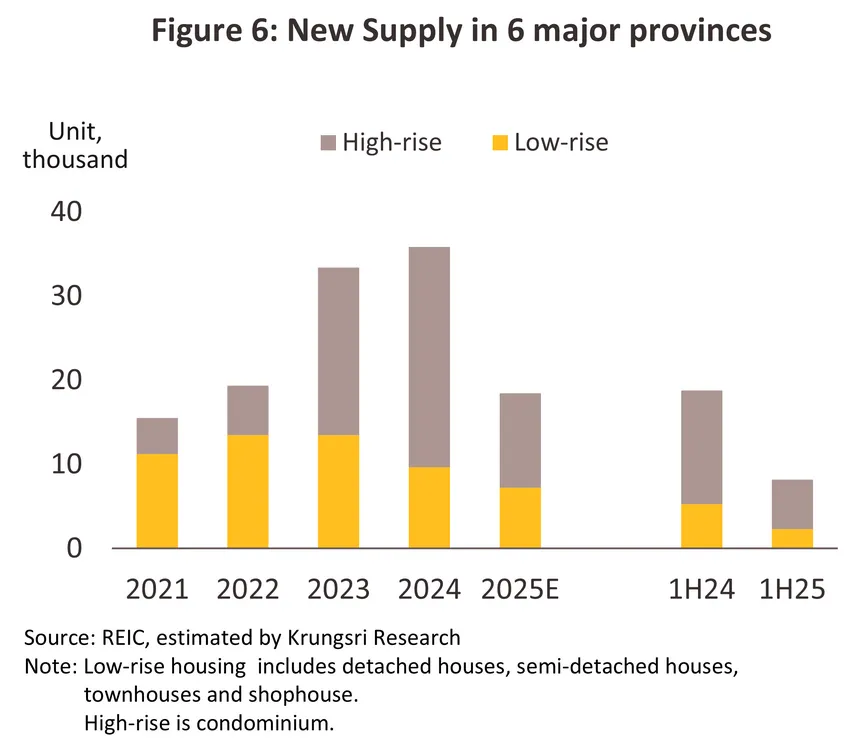

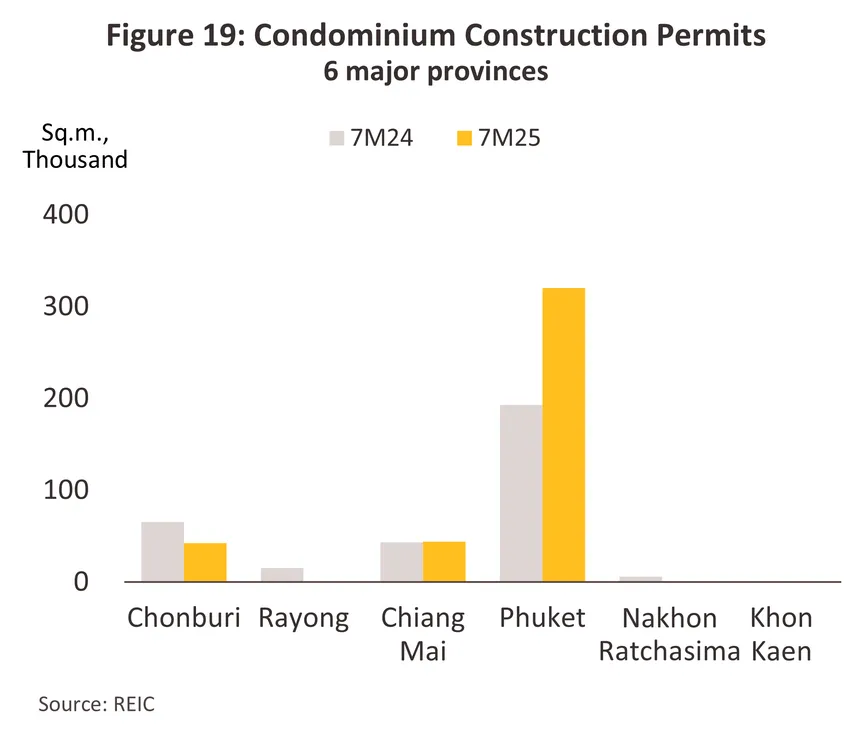

Demand for properties in these six major provinces has strengthened following the shock of the Covid-19 pandemic and the resulting shift among buyers toward purchasing property upcountry. Prospective buyers are attracted by the lower cost of living, the greater value for money offered by regional property markets, and the spread of more flexible work arrangements, which allow staff to “work from anywhere” and therefore reduce, or at least relax, the need for housing to be clustered near downtown employment centers. Many buyers have consequently sought to improve their quality of life by returning to their hometowns or relocating to other upcountry locations. The influx of owner-occupiers, second-home buyers, and investors seeking income from long-term rentals has lifted regional property markets—particularly in these six provinces—and prompted a significant increase in residential development by major Bangkok-based developers. Over 2022–2024, while the supply of new low-rise properties in these provinces edged down by -2.8% per year, the number of new condominiums coming to market surged by 102.2% annually, with much of this concentrated in Chonburi, Chiang Mai, and Phuket. Likewise, annual sales of residential properties rose by 13.7%, driven by a 44.0% jump in condominium sales, despite a -4.2% decline in sales of low-rise units. The condominium market has benefited from stronger demand from foreign buyers, including those purchasing properties as long-term residences, second homes, or sources of rental income. These buyers have come in particular from China, Russia, Europe, and East Asia, where potential purchasers often view the Thai real estate market as offering high potential while remaining competitively priced relative to regional alternatives.

Situation

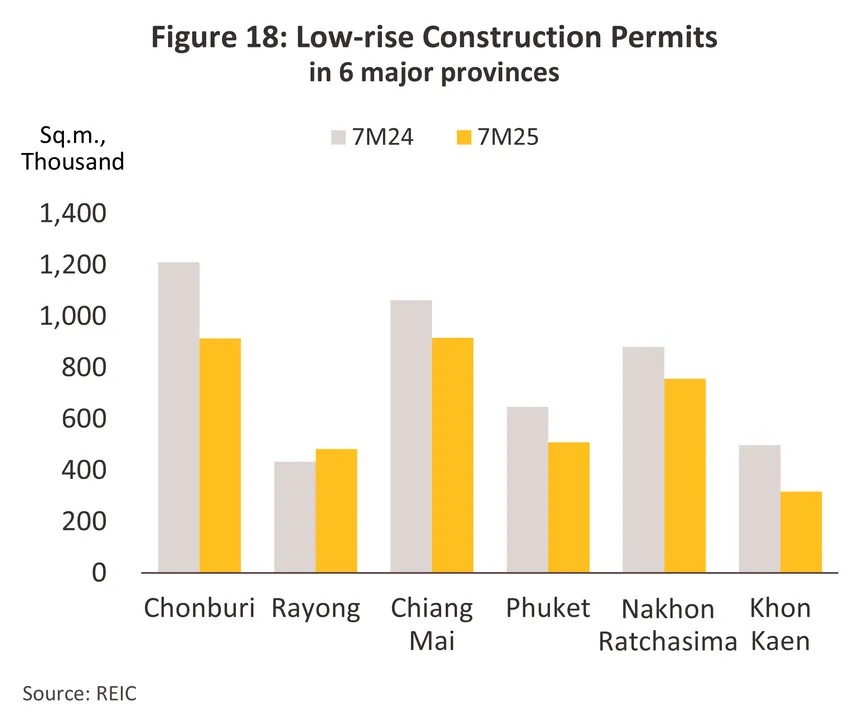

In 2025, the housing market in the six major provinces continued to face subdued demand, in line with the nationwide housing market, due to several negative factors: (i) Thailand’s economic growth slowed to 2.1%, compared with 2.5% in 2024, as intensified global trade tensions weighed on the country’s manufacturing, trade, and investment sectors, prompting some businesses to postpone new investments. At the same time, the tourism sector recovered more slowly, with foreign tourist arrivals declining by 6.2% from 2024; (ii) household debt remained persistently high, eroding the ability to purchase housing, particularly among middle- to lower-income groups. This constrained banks’ capacity to expand lending, as borrowers’ credit quality often failed to meet lending criteria; and (iii) purchasing power from foreign buyers showed signs of slowing amid heightened global economic uncertainty, leading foreign investors to delay investment decisions. This was accompanied by a decline in leisure travel, further pressuring property sales in Thailand—especially from Chinese buyers—whose demand fell in tandem with a sharp decline in Chinese tourist arrivals of 33.8% year-on-year (January–November data). This trend was reflected in a continued contraction in foreign condominium ownership transfers. Against a fragile market environment and weak purchasing power, developers have been compelled to adjust their marketing strategies, such as offering more flexible price reductions aligned with the affordability of genuine owner-occupiers and diversifying into new foreign markets beyond China (e.g., Myanmar and Taiwan). Meanwhile, the government introduced measures to stimulate purchasing decisions, including a reduction in transfer and mortgage registration fees4/ to 0.01% for homes priced at no more than 7 million baht, easing of loan-to-value (LTV)5/ requirements, and a cut in the policy interest rate to 1.5% per year. Overall, the housing market situation in the six major provinces can be summarized as follows.

-

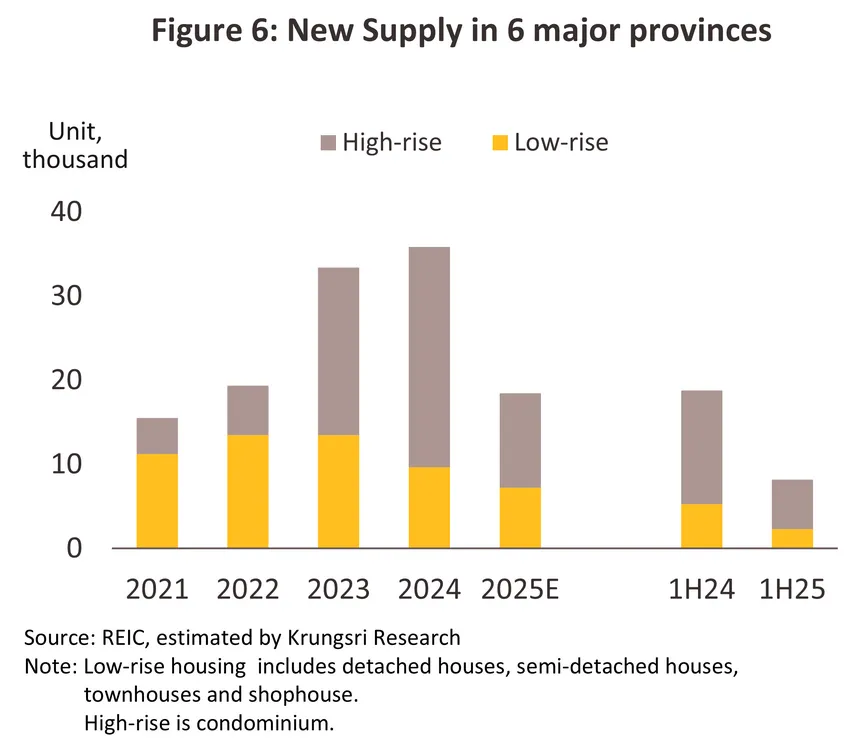

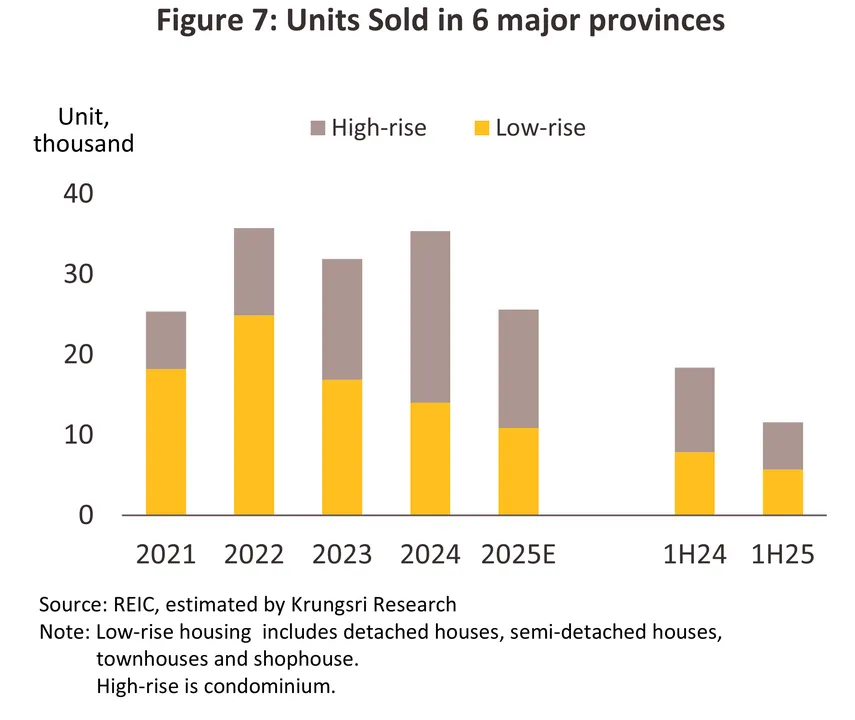

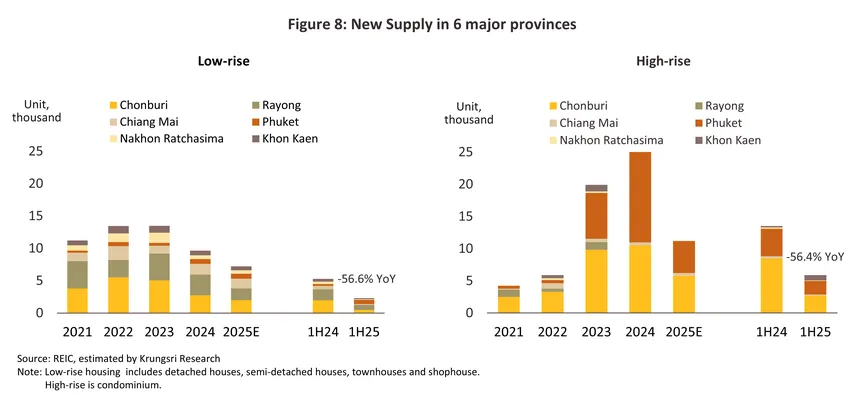

New project launches declined significantly (Figure 6). New housing supply fell by 56.4% year-on-year to 8,189 units, of which 72%—or approximately 5,900 units—were newly launched condominiums (−56.4% YoY), while the remaining 28%, or about 2,300 units, were low-rise housing projects (−56.6% YoY) (Figure 8). This decline reflects developers’ heightened caution in launching new projects as they seek to manage risks and clear existing inventory. The condominium segment, in particular, had seen a large number of new units launched during 2023–2024, many of which were postponed from the COVID-19 period. Most newly launched housing projects were located in Chonburi and Phuket, primarily in the mass-premium and luxury segments. Although these segments are relatively small in market size, they are supported by a stable base of high-purchasing-power customers and are concentrated in provinces popular among investors and foreign buyers. As a result, developers have increasingly focused on launching higher-end projects to mitigate risks associated with the sharp slowdown in the lower-end market. For the remainder of the year, weaker economic growth in Thailand is expected to prompt developers to further delay new project launches in order to prioritize the sale of completed, ready-to-transfer units in their inventory. Consequently, for the full year 2025, the number of newly launched units is projected to decline by 48.5% from 2024, to 18,435 units.

-

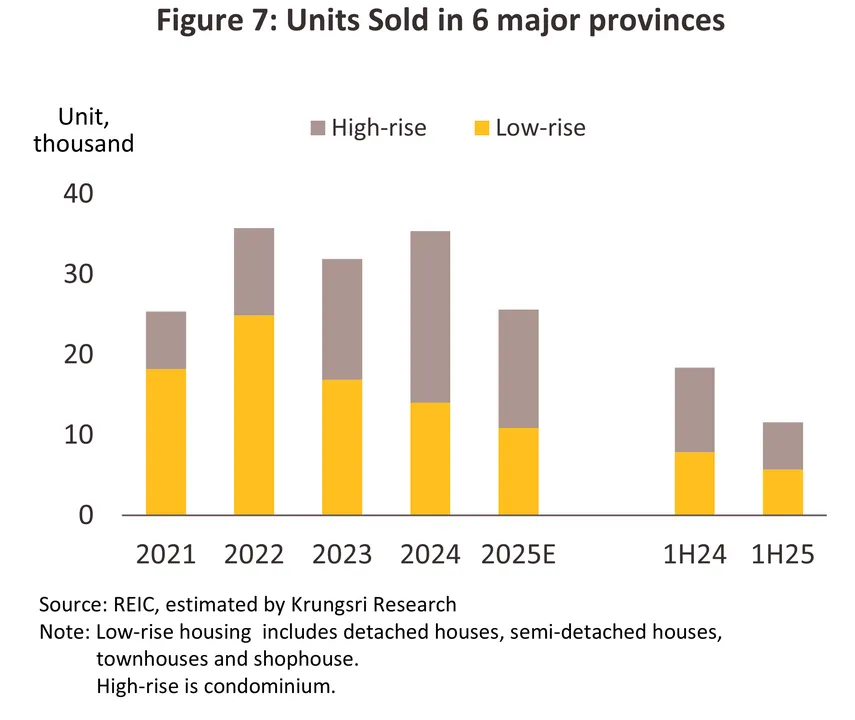

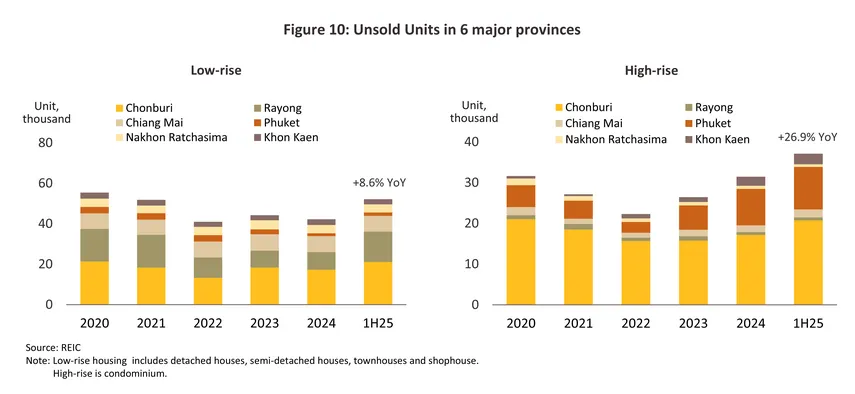

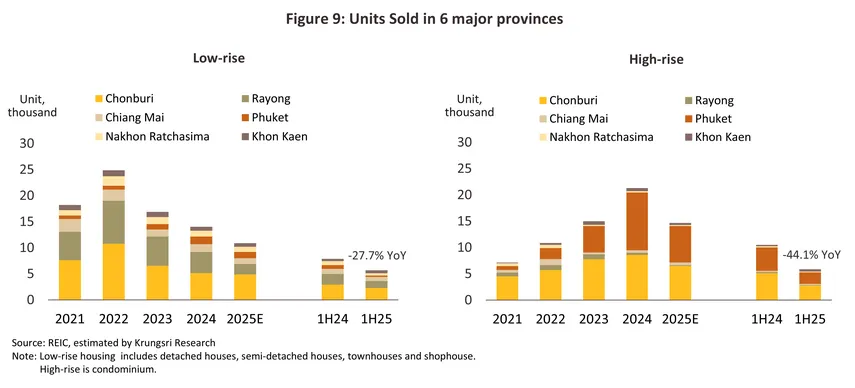

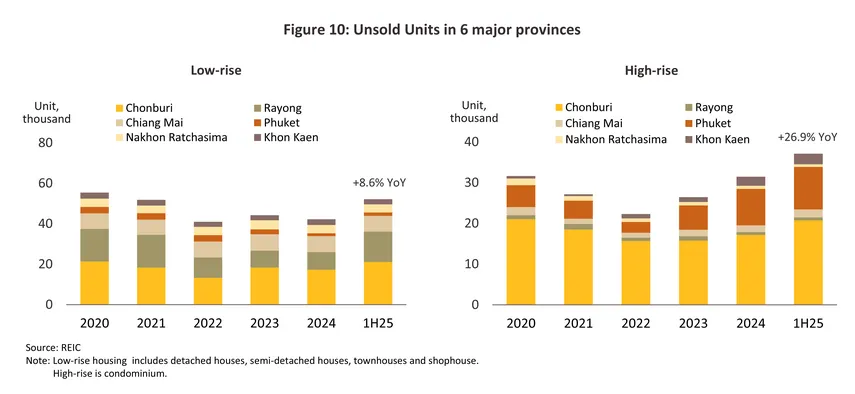

Overall sales contracted amid subdued purchasing power. In the first half of the year, total housing sales declined by -37.0% year-on-year to 11,562 units. This comprised a -27.7% YoY decrease in low-rise housing sales to 5,695 units, while condominium sales fell by -44.1% YoY to 5,867 units (Figure 9). Sales declined across all provinces, except Khon Kaen, which recorded growth compared with the same period of the previous year, supported by real demand—particularly for housing priced between 3–10 million baht in urban areas, where demand remained relatively strong. As a result, cumulative unsold units increased by 15.4% YoY to 89,329 units. Of these, 52,203 units were low-rise housing (+8.6% YoY), with Chonburi accounting for the largest share (40.5% of total unsold low-rise units across the six provinces), followed by Rayong (28.8%) and Chiang Mai (14.9%). Unsold condominium units totaled 37,126 units (+26.9% YoY), with Chonburi holding the largest share at 55.8%, followed by Phuket at 28.2% (Figure 10). In the second half of the year, support from government measures helped prevent a more severe downturn in sales. As a result, for the full year 2025, housing sales in the six major provinces are estimated to decline by -27.6%, totaling 25,590 units.

-

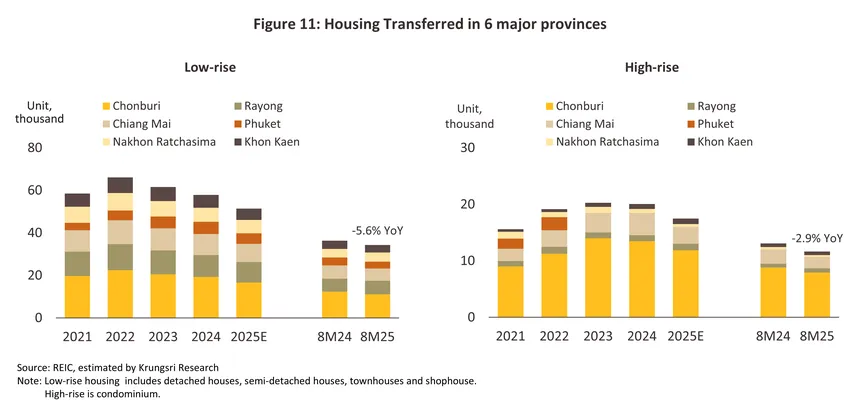

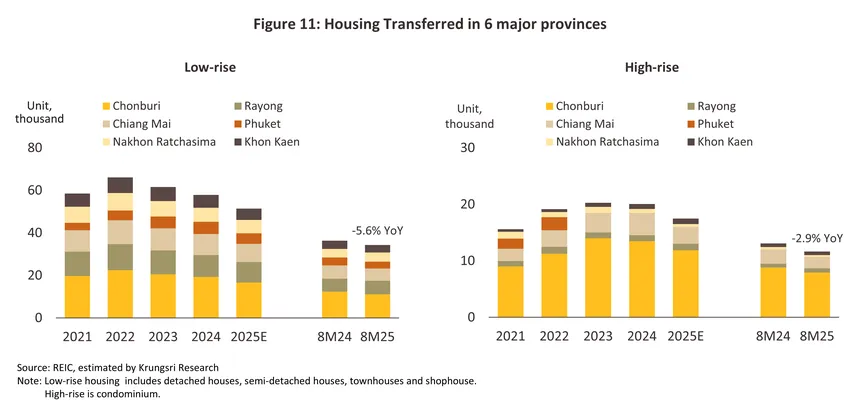

Housing ownership transfers in the six major provinces continued to decline. Data for the first eight months show total transfers of 49,548 units, down -4.8% year-on-year. Transfers of low-rise housing (accounting for 69% of total transfers—38% detached houses, 20% townhouses, 7% semi-detached houses, and 5% others) fell by -5.6% YoY to 34,292 units (Figure 11). Declines were recorded in Phuket (−11.2% YoY), Chonburi (−10.2% YoY), and Chiang Mai (−8.0% YoY). Meanwhile, condominium transfers (31% of total transfers) decreased by -2.9% YoY to 15,256 units, with sharper contractions in Nakhon Ratchasima (−22.0% YoY), Chiang Mai (−20.0% YoY), and Chonburi (−10.0% YoY). Nevertheless, transfers of low-rise housing increased in Rayong (+4.7% YoY) and Nakhon Ratchasima (+3.0% YoY), while condominium transfers rose significantly in Phuket (+37% YoY) and Rayong (+11% YoY), provinces with strong tourism potential and industrial investment. For the remainder of the year, Krungsri Research expects positive effects from government real estate stimulus measures to support an increase in ownership transfers, particularly in the condominium segment. As a result, total transfers for the full year are projected to decline by -10% from 2024, with low-rise housing down -7.6% and condominiums down -11.1%.

-

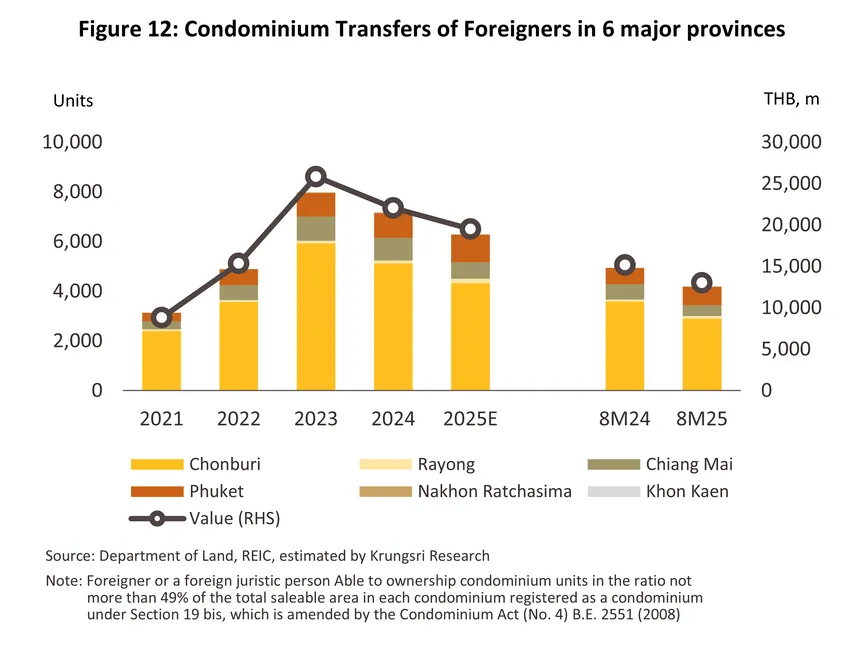

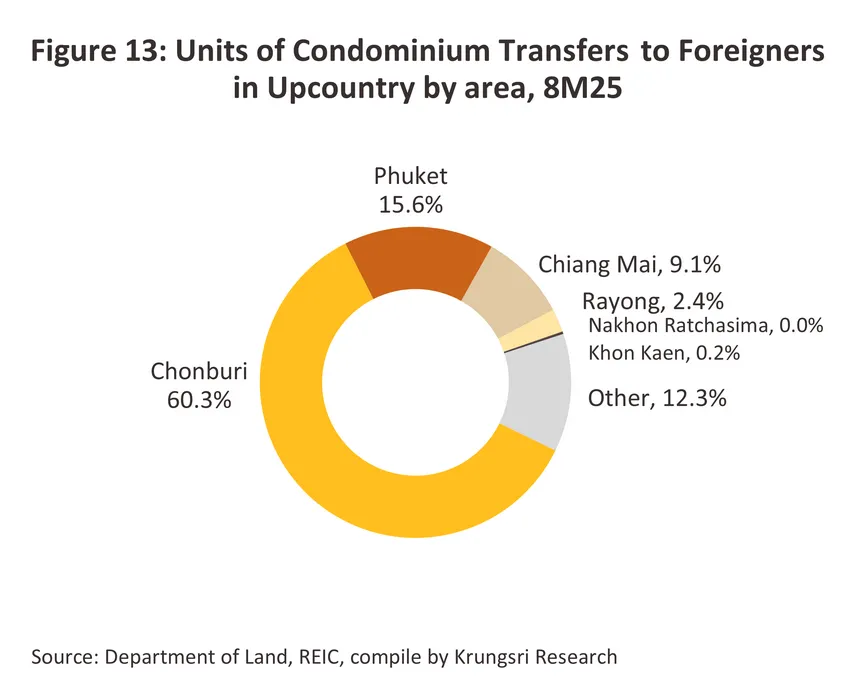

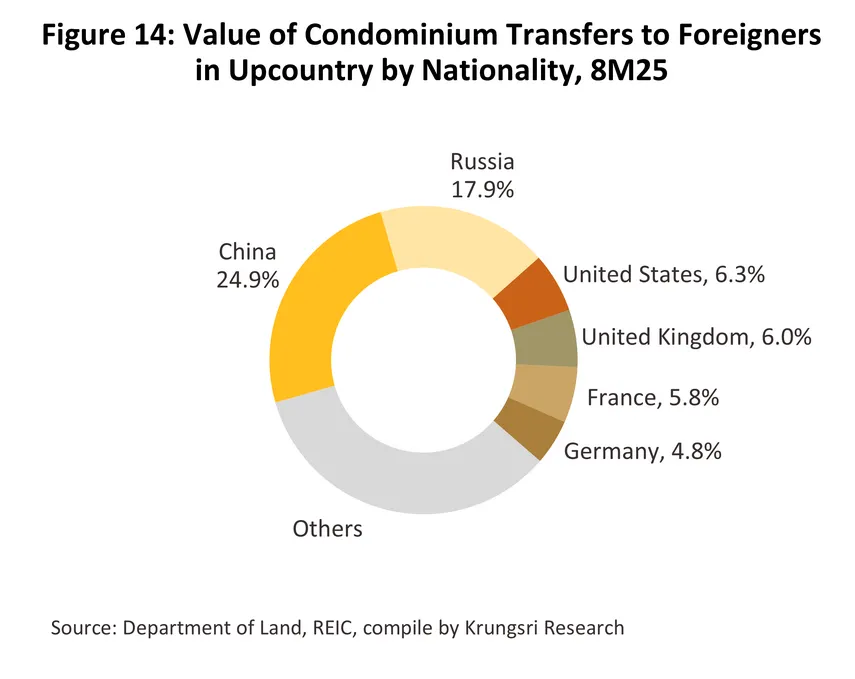

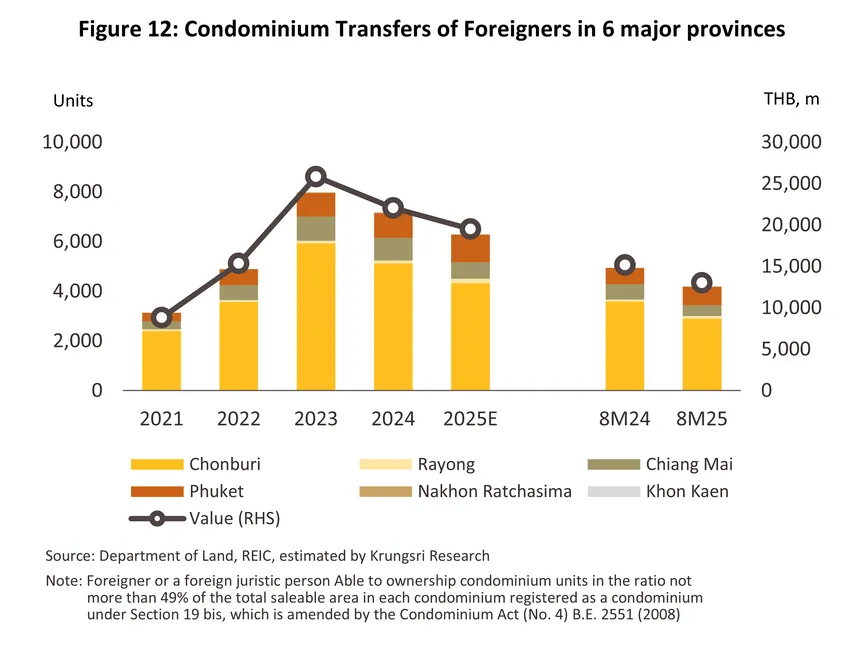

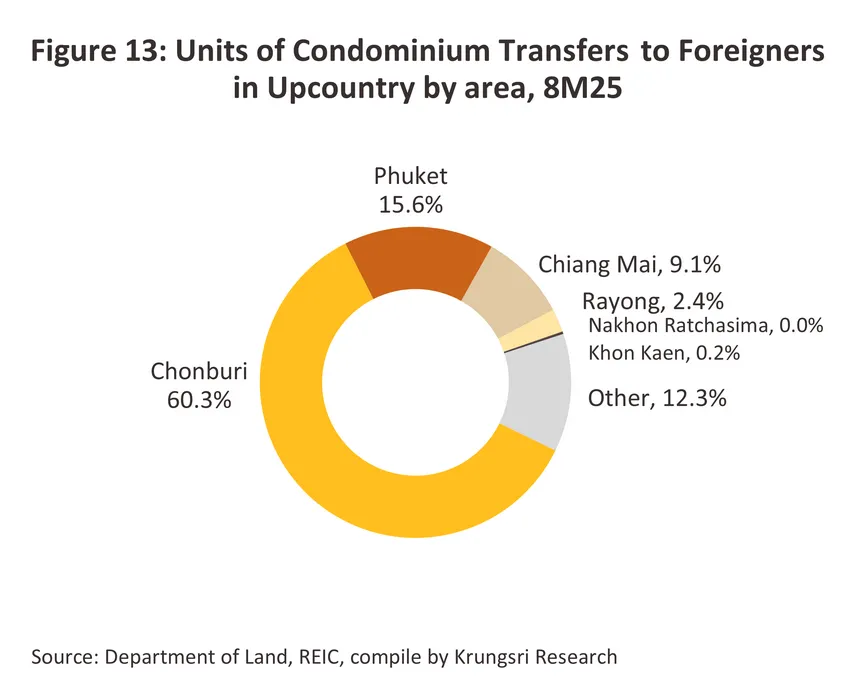

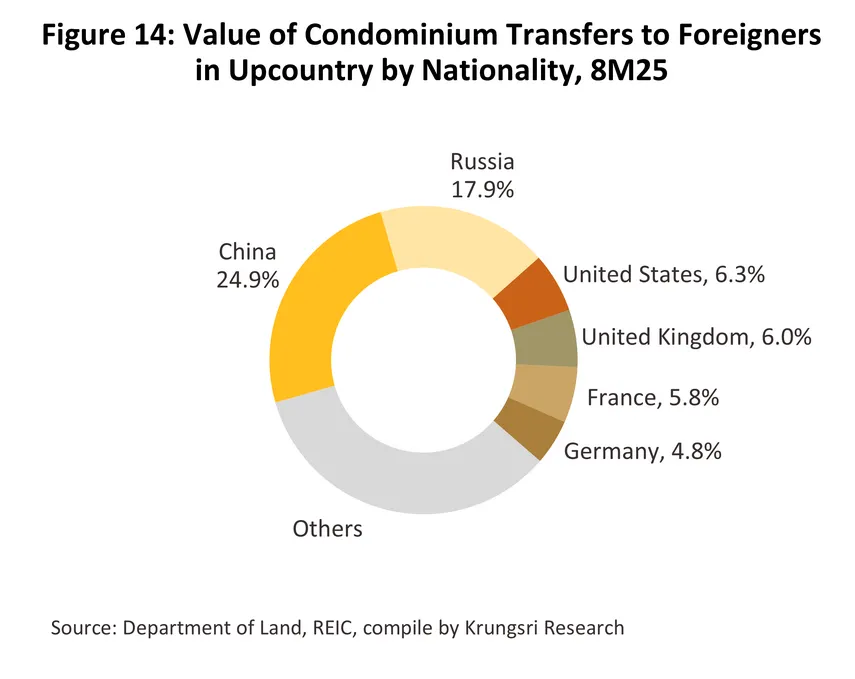

Foreign condominium ownership transfers in the six major provinces continued to decline, in line with the reduction in foreign tourist arrivals. Data for the first eight months show that the number of transferred units fell by -15.4% year-on-year to 4,199 units (accounting for 88% of total foreign ownership transfers in provincial areas, totaling 4,786 units) (Figure 12). The leading provinces were Chonburi (60.3%), Phuket (15.6%), and Chiang Mai (9.1%) (Figure 13), all of which are major cities with strong tourism appeal. In terms of value, foreign ownership transfers declined by -14.3% YoY to THB 13 billion. The nationalities with the highest transfer volumes were Chinese buyers (accounting for 24.9% of foreign transfer units in provincial areas), followed by Russians (17.9%) and Americans (6.3%) (Figure 14). For the remainder of the year, a slowdown in the global economy is expected to cause foreign buyers to curb spending and adopt a more cautious investment approach. As a result, in 2025, total foreign ownership transfers are projected to decline by -12.4% from 2024. Although Chinese buyers are expected to remain the largest foreign buyer group relative to other nationalities, their share of condominium ownership transfers is likely to continue declining. This trend is partly driven by China’s domestic economic conditions and concerns over Thailand’s safety image among Chinese tourists, which have reduced both travel to Thailand and property purchases by Chinese buyers.

Outlook

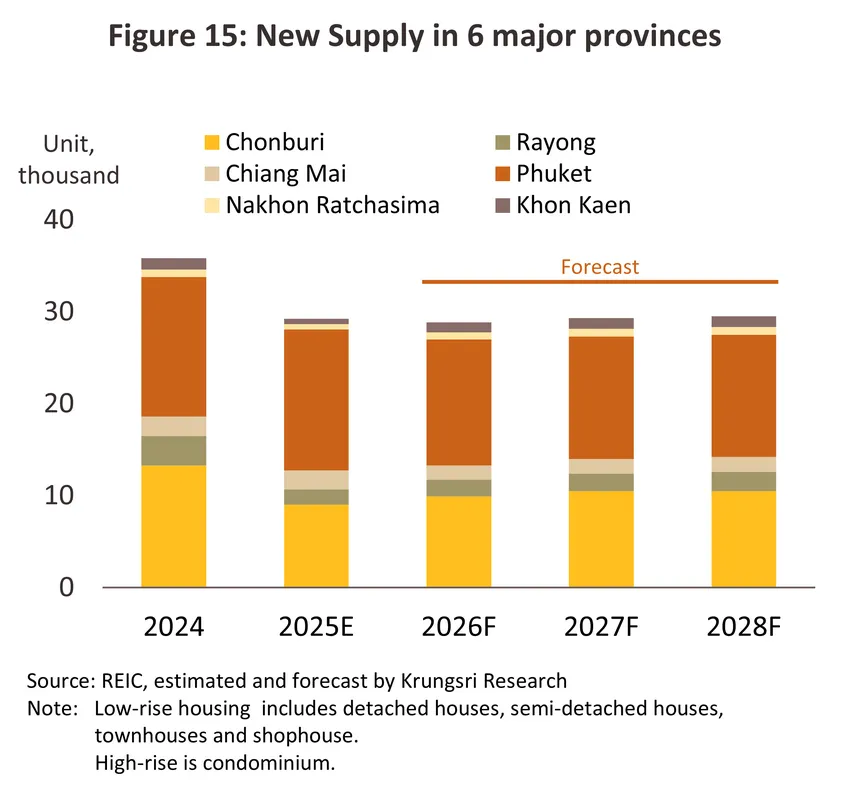

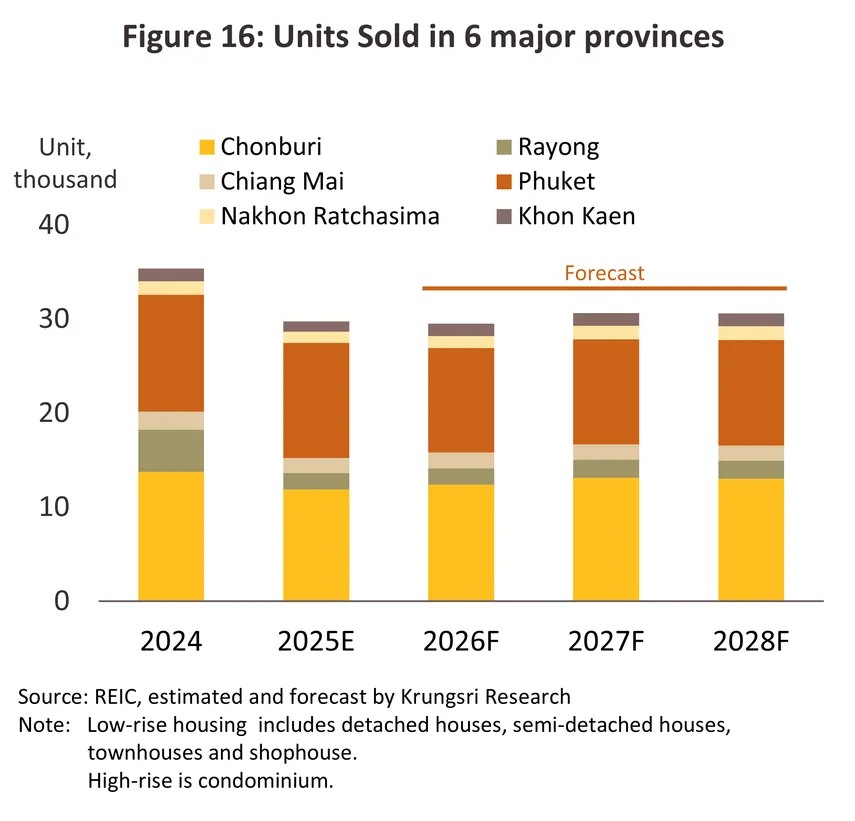

In 2026, the housing market in the six major provinces is expected to experience slower growth, reflecting the projected modest economic expansion of 1.8%. At the same time, U.S. trade policies are likely to continue exerting pressure on the manufacturing sector and employment. Combined with persistently high household debt, these factors will constrain purchasing power and limit access to credit, particularly among middle- to lower-income groups. Nevertheless, growth in the tourism sector is expected to support a gradual improvement in housing demand from foreign buyers. As a result, developers are anticipated to delay the launch of new projects—especially low-rise developments—and focus on clearing existing inventory, while high-rise project launches are likely to improve in tourism provinces, particularly Phuket. In addition, developers are expected to place greater emphasis on high-end projects, including branded residences developed in partnership with leading hotel chains, to cater to demand from upper-middle- to high-income buyers and affluent foreign purchasers. These groups are likely to remain the primary target segments, as they are less affected by slow economic growth. Consequently, the housing market is expected to show signs of recovery in key tourism provinces such as Phuket, Chonburi, and Chiang Mai, limited to selected segments with sufficient purchasing power (selective recovery), while the market serving middle- to lower-income groups is likely to require more time to recover. Overall, new project launches are projected to decline by -5.9%, while total sales are expected to fall by -8.8%.

For 2027–2028, the housing market in the six major provinces is expected to recover gradually, supported by several key factors: (i) Thailand’s economy is projected to grow at an average rate of 2.3% per year, alongside continued large-scale infrastructure investments (such as motorway projects, double-track railways, and the high-speed rail linking three airports), which will enhance connectivity between major provinces and key tourism destinations. These developments will also increase the development potential of areas along transport corridors, stimulating new housing projects, particularly in locations near railway stations, transport hubs, and areas connected to industrial estates; (ii) the recovery of the tourism sector and related service industries is expected to stimulate the economies of major tourism provinces (Phuket, Chiang Mai, and Chonburi), with foreign tourist arrivals projected to reach 39 million in 2028, thereby increasing demand for housing for long-term residence and investment for rental purposes; (iii) the relocation of foreign investment bases to Thailand is expected to generate housing demand from foreign workers who relocate for employment or long-term residence, particularly in provinces with special economic zones and industrial estates (Chonburi and Rayong); and (iv) the continued growth of more flexible working arrangements, such as co-living and workation models that integrate remote work, residential living, and community-building. Thailand is regarded as one of the preferred destinations for digital nomads and employees who can work from anywhere, leading to rising demand for co-living housing and co-working spaces. These factors will enhance the potential of tourism cities, particularly Chiang Mai, Pattaya, and Phuket, increasing the likelihood that large developers will expand project development in these provinces.

In addition, data from Frasers Property Home indicate that homebuyers in provincial areas are increasingly opting for housing estate projects rather than self-built homes, particularly detached houses priced at 4–6 million baht and townhomes priced at 2–3 million baht. This trend reflects growing opportunities for developers to expand their market presence. The housing market outlook for the six major provinces can be summarized as follows.

New project launches are expected to increase at an average rate of 3.2–3.8% per year, or approximately 19,000 units per year, which remains below the average of 36,000 units recorded during 2018–2019. Meanwhile, total sales are projected to expand at a relatively modest pace, averaging 1.9–2.5% per year, as outlined below.

-

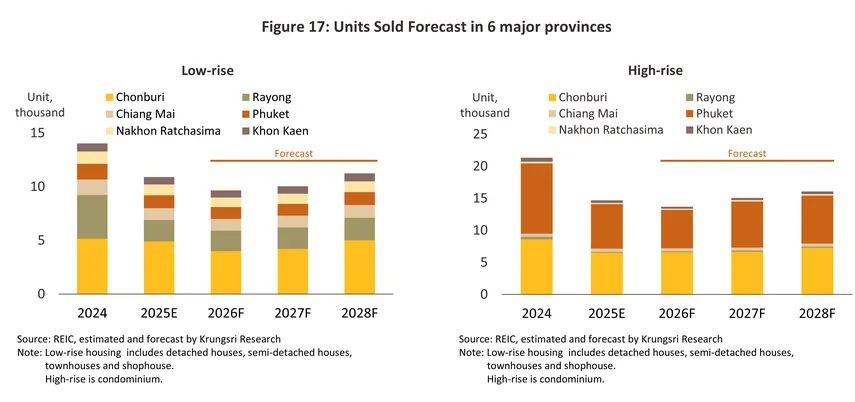

Low-rise housing: Sales are expected to recover gradually, averaging 0.7–1.5% per year (Figure 17), driven by real demand from middle- to high-income groups. Buyers will include both local purchasers and those relocating from other provinces for employment, as well as demand for second homes or vacation homes in key tourism provinces (such as Phuket, Chonburi, and Chiang Mai). This trend will be supported by the rise of hybrid workplace arrangements and workation lifestyles. In contrast, purchasing power among middle- and lower-income groups is expected to recover more slowly, in line with subdued economic growth.

-

High-rise housing (condominiums): Sales are projected to increase by 2.6–3.4% per year (Figure 17), supported by demand from investors and foreign buyers. Key tourism provinces, particularly Phuket and Chonburi, are expected to recover more rapidly than other areas, driven by growth in tourism-related service businesses and industrial investment, which will increase housing demand from foreign tourists and the local workforce. This includes purchases for investment purposes and second homes. In addition, the rental market for serviced-residence-style condominiums is gaining popularity among younger generations and working professionals, Thai buyers who are unable to obtain housing loans (source: Primo Service Solutions, an Origin Group affiliate), foreign tourists seeking better value compared with higher-cost hotels while enjoying greater lifestyle flexibility, and expatriates working in Thailand. At the same time, branded residences are expected to attract strong interest from high-purchasing-power Thai and foreign buyers—particularly in Phuket—supporting continued growth in absorption rates.

Housing developers are likely to adapt by placing greater emphasis on marketing luxury homes priced at 10 million baht and above to serve high-income customers. This is expected to increase the supply of luxury housing in high-potential locations such as Phuket and Pattaya. Developers may also seek to reduce non-essential costs—for example, by using more cost-effective materials—to maintain current selling prices, while expanding their customer base into new markets such as Taiwan to offset the expected continued slowdown in purchases by Chinese buyers.

The housing situation by province can be summarized as follows.

-

Chonburi: The housing market is expected to continue expanding across both low-rise housing and condominiums, supported by major transport infrastructure developments such as Laem Chabang Port Phase 3 and the high-speed rail linking three airports, as well as the Eastern Economic Corridor (EEC). These developments enhance industrial and tourism potential and attract new investment into the area, generating housing demand from both Thai buyers and foreign investors (e.g., from China, Japan, and Singapore) for owner-occupation, rental investment, and second homes—particularly in Bang Lamung and Si Racha. As a result, land prices are expected to continue rising. Pattaya also remains one of the key destinations for workation lifestyles, encouraging developers to continue launching both low-rise and mid- to premium-segment condominium projects, despite pressures from development costs and price competition in certain segments. New housing supply is projected to increase by an average of 4.3% per year, while new sales are expected to grow by an average of 2.5% per year.

-

Rayong: The housing market is driven by Rayong’s role as Thailand’s “industrial capital.” The province hosts more than 2,854 factories, employs over 200,000 workers, and accommodates more than 10,000 foreign workers with work permits, primarily from Japan, China, and South Korea. Ongoing infrastructure development and new investment arising from the relocation of foreign manufacturing bases have increased demand for land for factory development both within and outside industrial estates. Emerging industries such as electric vehicles and data centers are expected to attract skilled labor and foreign specialists to reside in the area. Rayong also records the highest per capita income in the country, supporting strong demand for mid- to high-end low-rise housing, particularly in Ban Chang, Rayong City, and Pluak Daeng. In addition, demand for condominiums from buyers seeking accommodation close to factories or industrial estates is driving rapid growth in the condominium rental market. With land prices rising less aggressively than in Chonburi, Rayong remains conducive to the development of housing estates and townhomes catering to genuine owner-occupiers. New housing supply is expected to increase by an average of 3.0% per year, while new sales are projected to grow by an average of 2.0% per year.

-

Chiang Mai: As the economic and tourism hub of Northern Thailand, Chiang Mai is undergoing urban development under the Smart City policy, with infrastructure investment enhancing its long-term potential. Key projects include the Bangkok–Phitsanulok–Chiang Mai high-speed rail and the expansion of Chiang Mai International Airport to accommodate 20 million passengers per year by 2030, up from the current 8 million. Chiang Mai is widely recognized as a digital nomad hub in Southeast Asia, offering a wide range of co-living and co-working spaces, which continues to drive demand for both short- and long-term rental accommodation. Housing demand is supported by high-income buyers seeking primary residences or second homes, including local residents, Bangkok-based buyers, and retirees relocating permanently. Foreign buyers—primarily from China, Japan, and South Korea—favor inner-city locations near the airport and represent a key source of demand in the condominium market. The low-rise housing segment continues to expand in suburban areas such as Hang Dong, Saraphi, and San Sai, where land prices remain suitable for development. Health-oriented housing innovations are expected to gain popularity in response to long-standing air pollution issues. Popular locations include Nimmanhaemin, the Irrigation Canal area, San Kamphaeng, Hang Dong–Mae Hia, and San Pa Tong. New housing supply is projected to increase by an average of 2.3% per year, while new sales are expected to grow by an average of 1.6% per year.

-

Phuket: Phuket continues to demonstrate strong growth potential as a global tourism destination. The government has plans to further develop transport infrastructure, including Phuket International Airport Phase 2 (with capacity for up to 18 million passengers, expected to open in 2029), a seaplane terminal at the airport, a light rail transit system connecting the airport to Chalong Circle, and a comprehensive Smart City development plan. The province also hosts international schools, co-working spaces, and co-living facilities that cater to global professionals, attracting tourists and investors seeking properties for rental investment or leisure use. Foreign buyers—particularly from China and Russia—constitute the main purchasing power in the vacation home and luxury condominium segments, including both leisure travelers and foreign workers. This has driven continuous increases in land prices, with CBRE Thailand reporting average land price growth of 10–15% per year, especially in increasingly scarce beachfront locations. Recently, Pa Khlok has emerged as a new area of interest for residential development. New housing supply is expected to increase by an average of 3.3% per year, while new sales are projected to grow by an average of 2.2% per year.

-

Nakhon Ratchasima: The housing market is expected to continue expanding, reflecting the province’s role as the “economic and transportation hub of Northeastern Thailand.” Growth is supported by major infrastructure projects, such as the Bang Pa-in–Nakhon Ratchasima motorway, which is expected to be fully operational by 2026, and the Thai–Chinese high-speed rail (Bangkok–Nakhon Ratchasima section). These projects will improve connectivity and attract greater investment into the area. Housing demand continues to be driven primarily by local residents and workers in the Suranaree and Navanakorn Korat industrial estates. At the same time, the “second home” and “work from anywhere” trends continue to support growth in the vacation home market in the Khao Yai–Pak Chong area, particularly among Bangkok-based buyers and investors purchasing properties for rental purposes. New housing supply is expected to increase by an average of 1.8% per year, while new sales are projected to grow by an average of 1.4% per year.

-

Khon Kaen: The housing market is expected to expand steadily, supported by the province’s position as a center for economic activity, education, and innovation in Northeastern Thailand. Key growth drivers include major infrastructure developments such as the Thai–Chinese high-speed rail (Nakhon Ratchasima–Khon Kaen–Nong Khai section), double-track railway projects, and plans for a light rail transit (LRT) system within Khon Kaen city, currently being implemented by the local private sector. In addition, the expansion of hospitals, universities, and shopping centers is boosting housing demand from students, young professionals, and public- and private-sector employees seeking residences close to workplaces and educational institutions. As a result, residential development has become more diversified, encompassing mid- to high-end low-rise housing to serve stable real demand, as well as a growing condominium market in urban areas near Khon Kaen University and government complexes, catering to both buyers and renters among students and young professionals. New housing supply is expected to increase by an average of 1.6% per year, while new sales are projected to grow by an average of 1.2% per year.

Key challenges facing housing developers in the six major provinces include the following: (i) weakening domestic purchasing power, in line with Thailand’s slow economic recovery, while trade tensions may continue to weigh on investment and exports, affecting income levels and limiting homebuyers’ access to credit. At the same time, developers may be unable to raise selling prices despite rising costs; (ii) foreign buyers are likely to adopt a more cautious investment stance amid a fragile global economy and heightened geopolitical tensions in multiple regions. This will weigh on housing demand from foreign purchasers, who represent a key customer segment in major tourism provinces such as Phuket, Chonburi, and Chiang Mai; (iii) intensifying competition from large developers that perceive market opportunities, which will place pressure on local developers with weaker capabilities, as well as from Chinese capital groups focusing on projects targeting buyers of the same nationality in locations near industrial estates, factories, and special economic zones. As a result, Thai developers face the risk of losing market share; and (iv) demographic transition toward an aging society, particularly in Chiang Mai and Nakhon Ratchasima, where the proportion of elderly residents has continued to increase.6/ This trend is expected to reduce demand for new housing in certain segments. These factors are likely to constrain market growth in the period ahead.

1/ Housing markets in the key provincial centers of the regions comprise six provinces: Chiang Mai, Chonburi, Rayong, Nakhon Ratchasima, Khon Kaen, and Phuket.

2/ From Ministry of Finance

3/ Low-rise housing, i.e., detached houses, semi-detached houses, townhouses and shophouse.

4/ Borrowers are permitted to obtain loans with loan-to-value (LTV) ratios of up to 100% for first homes with a value exceeding THB 10 million, as well as for second homes with a value not exceeding THB 10 million. This measure is effective from 1 May 2025 to 30 June 2026.

5/ The government has reduced registration fees for residential property transactions to 0.01%, including (i) a reduction in the property transfer fee from 2% to 0.01%, and (ii) a reduction in the mortgage registration fee from 1% to 0.01%. The measure applies to both new and existing residential properties with a mortgage amount not exceeding THB 7 million per contract. Eligible buyers must be individual Thai nationals. The measure is effective from the date of its publication in the Royal Gazette until 30 June 2026.

6/ According to the “Survey of the Elderly Population in Thailand, 2024, at the Provincial Level” conducted by the National Statistical Office (NSO), the five provinces with the largest elderly populations are Nakhon Ratchasima, Chiang Mai, Ubon Ratchathani, Khon Kaen, and Samut Prakan. Chiang Mai records an elderly population share of 25.3%, while Nakhon Ratchasima stands at 23.1%. These figures reflect a rapid pace of population aging in rural and agricultural areas.

.webp.aspx)