Through 2019, the housing market in the Bangkok Metropolitan Region (BMR) is expected to keep growth flat or slow down due to a high base effect in 2018. The market will also encounter headwinds in the form of: (i) the new, stricter regulations governing housing debt that determine loan limits on a loan-to-value ratio; (ii) the introduction of the Land and Building Tax Act, which will come into effect in 2020; and (iii) a weakening of the spending power of overseas (and especially Chinese) buyers caused by a softening of the world economy. These factors may then feed into higher operating costs, and a decline in both investor confidence and the willingness of buyers to purchase new properties. However, in 2020 and 2021, the market is expected to rebound on the effects of government spending on major infrastructure projects and on greater demand for accommodation from non-Thai buyers investing or working in Thailand.

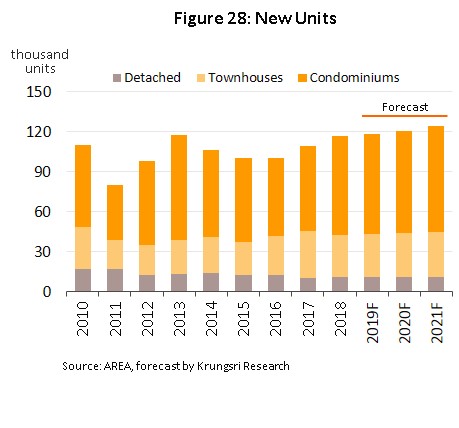

In 2020-2021, the number of new projects available for sale is likely to increase. Condominiums will be the main driver of the market, and developers will tend to focus their efforts on the upper-mid to luxury segments as customers at this level have the greatest spending power. By contrast, continuing high levels of household debt and tighter rules on the release of credit will weigh on the outlook for sales at the lower-mid to low end of the market.

Overview

The real estate sector accounts for 6% of Thailand’s GDP and so is thus of some significance in terms of the national economy. A considerable amount of capital circulates within the economic system and this supports increasing levels of employment and income, and at the same time, the sector is tied to related businesses such as construction, building materials, finance, consumer electronics, furnishings and decorations, and so on.

The property sector consists of three principal segments: residential, commercial, and industrial. In Thailand, considered by value, some two-thirds of the entire property market is residential (source: World Bank). Developers of residential property sector will mainly focus on Thai customers because Thai law stipulates that non-Thais may legally own only condominiums, but no more than 49% of total salable areas. As regards detached housing and townhouses (also called rowhouses or shophouses), the regulations covering ownership by non-Thais are more onerous.

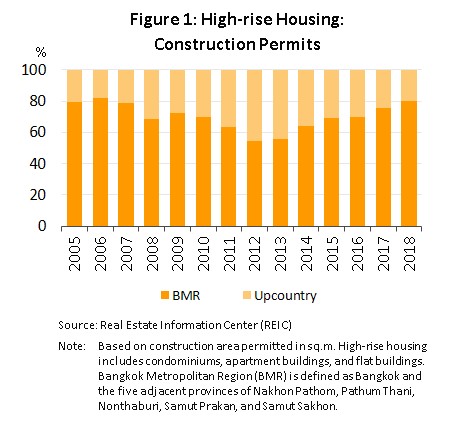

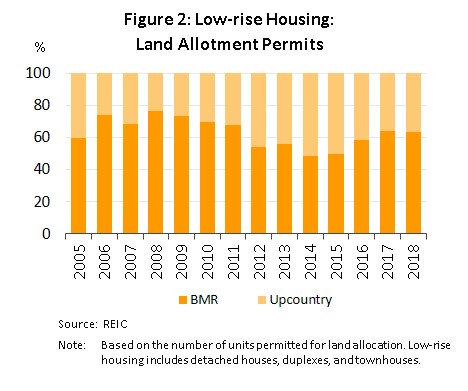

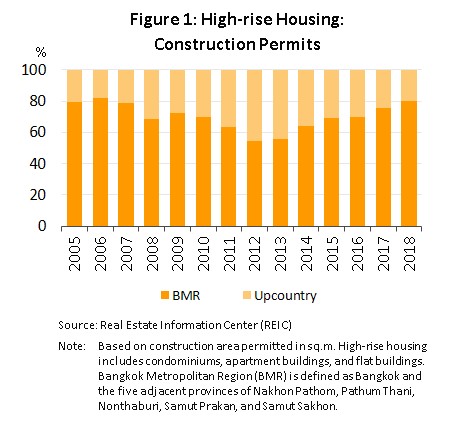

The housing market is split between self-built housing and housing projects. Over the past five years (2013-2017), the housing project was concentrated in BMR and in fact around 60-70% of all housing units constructed nationally are found in this area (figures 1 and 2). This market has had an annual value of around THB 400 bn but since 2012, developers have started to look beyond the Bangkok region. This shift in focus occurred due to the major flooding of BMR and the central region that happened towards the end of 2011 and to the decision by the government in 2012 to increase spending on infrastructure in the provinces. Developers thus placed a greater emphasis on investing in housing projects in provincial centers, the majority of which has been low-rise housing due to the ready availability of land outside Bangkok. However, upcountry consumer purchasing power weakened in 2015 and 2016 as the price of agricultural goods dropped and this caused developers to switch their attention back to projects in the BMR.

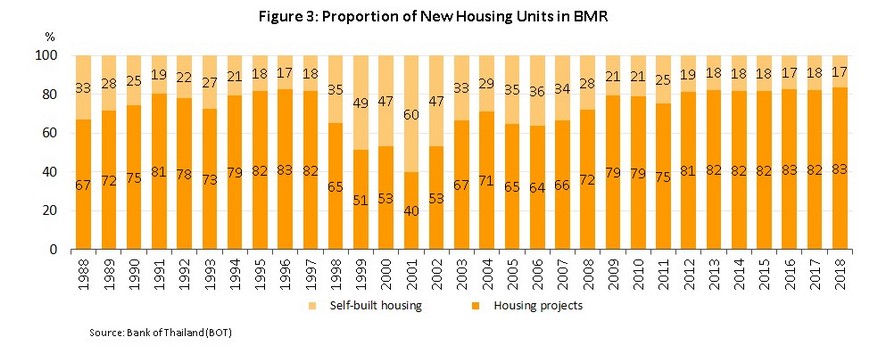

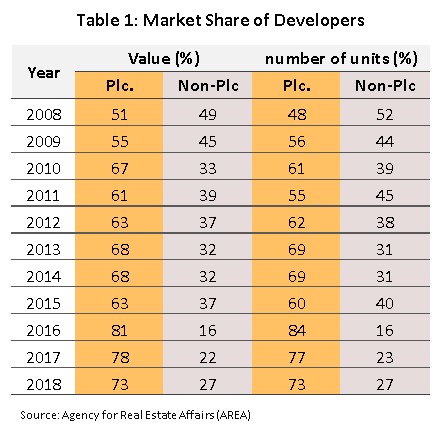

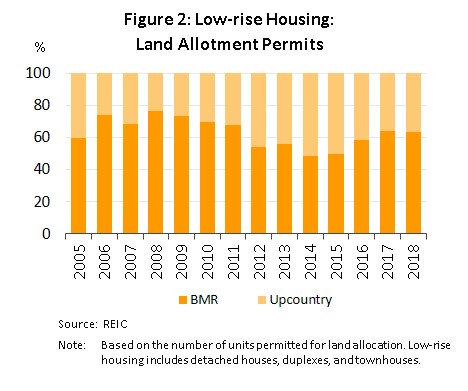

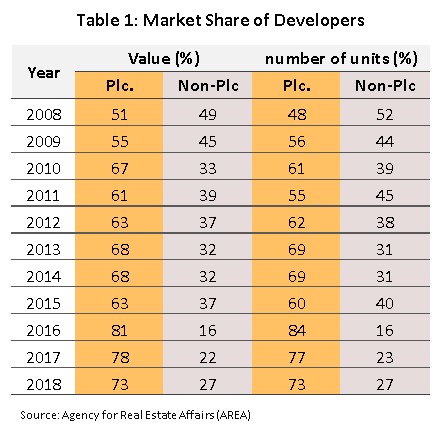

Currently, over 80% of new housing units in the BMR is the project developed by housing developers (Figure 3). The data for 2018 show that large operators (those that are listed on the stock market and their subsidiaries) control over 70% of both in terms of housing units and market value (Table 1). Because large companies are able to manage costs more effectively than can medium-to- small companies; for example, they are also in a position to assemble plenty of land banks which help lower their costs of project development. In addition, they could undertake many projects simultaneously that lead to economies of scale. Also, they benefit from their expertise as a way of building consumer trust in their brand.

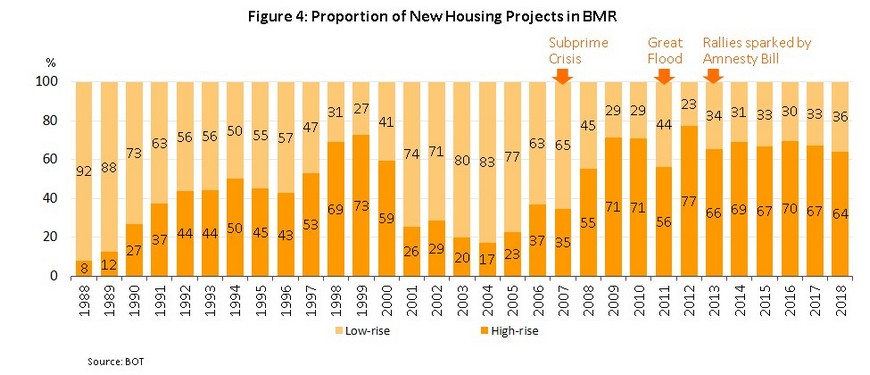

Since 2008, high-rise buildings have represented a higher proportion of new projects than have low-rise structures. This has been due to the declining availability and consequent rising price of land that has potential for development, and to the post-2006 extension of rapid mass transit lines (MRT and BTS), which has led to developments springing up alongside these new routes. The outcome of these changes is that high-rise developments have become increasingly popular and since 2008, an average of almost 70% of new housing units have been in condominium developments (Figure 4).

Situation

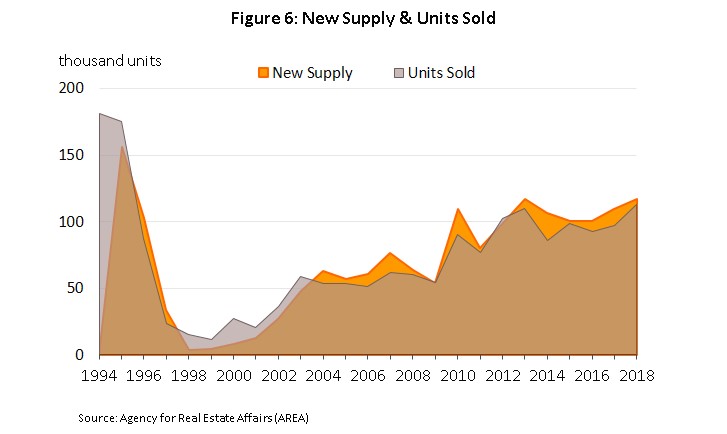

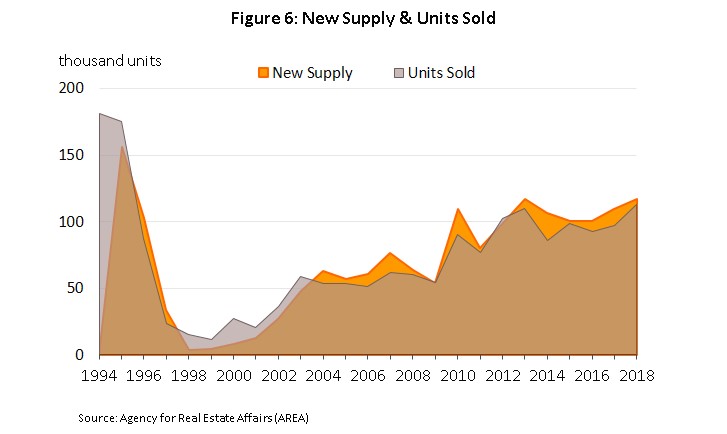

Following the Financial Crisis of 1997, the housing market flipped from being in a state of over-demand to being in one of steadily increasing over-supply, as new supply to the market outpaced sales over a period of years.

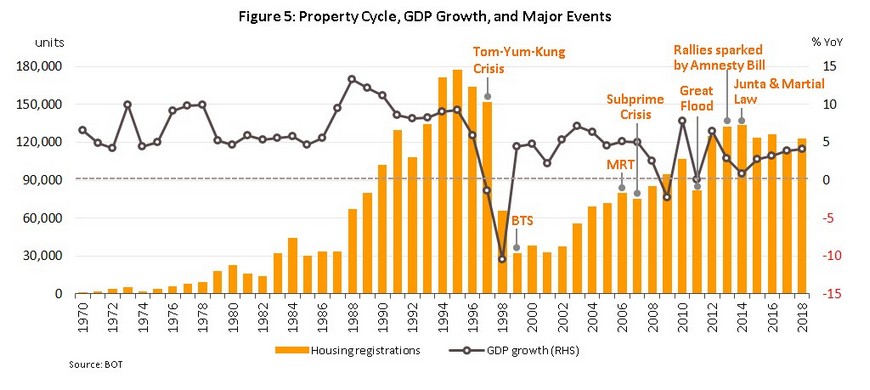

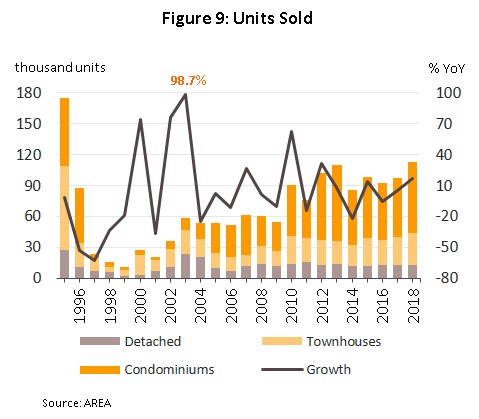

1997-2006: The Asian financial crisis of 1997 led to a five-year depression in the property market in BMR (1997-2001), a collapse in consumer purchasing power triggered a dramatic slide in the number of sales of new units, which came to an average of only 20,000 units per year. This compares starkly to the pre-crisis average annual figure of 148,000 units for 1994-1996, years in which the market was driven by excess demand. However,

in 2003, after the economy recovered, new investment started to pick up again (Figure 6). During 2003-2004, significant investments were made in low-rise housing for high-end market on the western Bangkok Outer Ring Road, although this area remains over-supplied with detached housing to this day. Following this, in 2006, work on the expansion of the BMR rapid mass transit networks prompted a corresponding increase in investment in high-rise buildings, with condominiums selling well and seeing a shorter absorption period than did low-rise housing.

2007-2009: The subprime crisis in the USA had effects across the world, and Thailand was no exception. The crisis helped to slow the domestic property market, both in terms of supply and demand; in 2009, 59,000 units were sold, a 10% YoY fall, though the market rebounded the following year on an improving economy.

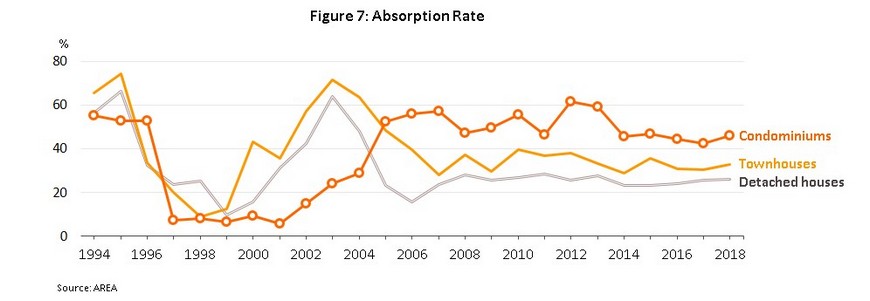

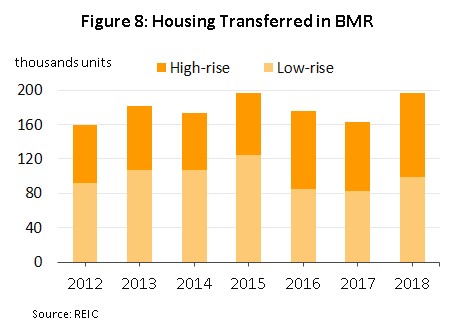

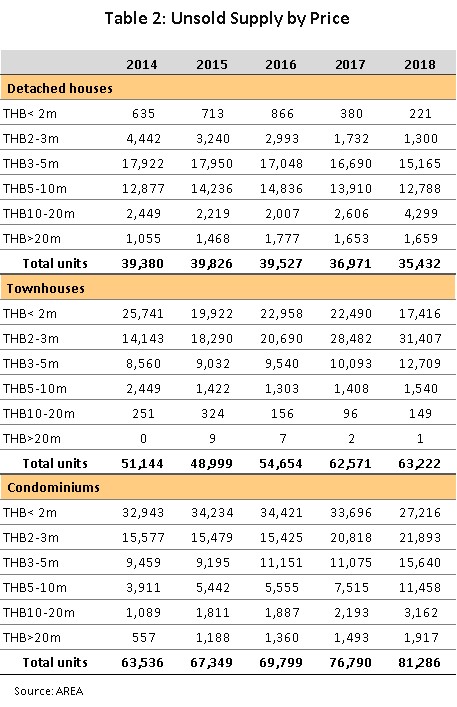

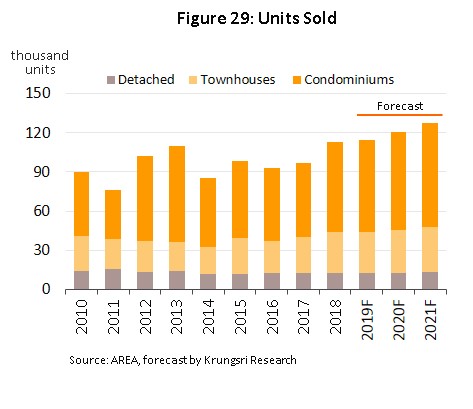

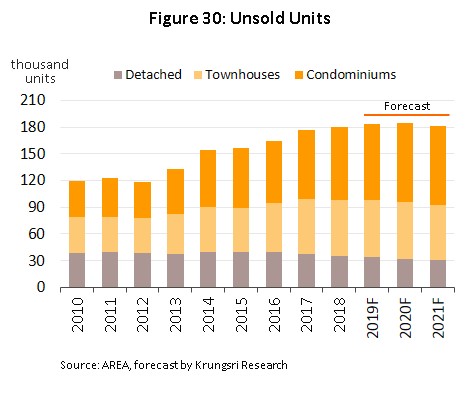

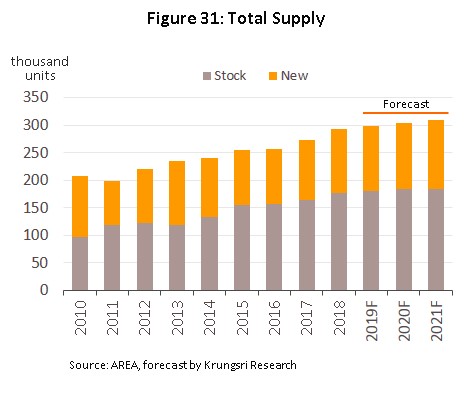

2010-2017: An average of 102,000 new units came to market in BMR each year , but only around 94,000 were sold (Figure 6), with the result that the stock of unsold housing has increased. This imbalance between supply and demand was partly caused by the private sector’s response to the government’s first-time house buyer scheme during 2011 and 2012. This was caused by record-breaking investments in condominium projects in 2012-2013, problems arising because the latter stimulated sales of housing units, especially of condominiums, and this helped to pull forward future demand. In addition, the ongoing domestic political conflicts in 2014-2017 and the weakness of the Thai economy through these years also suppressed demand for housing market. A fact that is reflected in the decrease in the absorption rate (Figure 7) and the number of housing transfers that were made (Figure 8). Furthermore, weakening consumer spending power and high household debt (around 80% of GDP) caused financial institutions to tighten lending regulations. These factors caused the housing market in some areas of the BMR to experience great amount of over-supply. For example, new housing near BTS lines in the outer regions of the city, which typically carry a price tag of less than THB 3 m, became hard to sell. Despite the government’s efforts to stimulate the market by cutting fees for mortgage registration and transfer[1] at the end of 2015, a total of 176,000 units (+7.5% YoY) remained unsold in 2017, of which almost 77,000 were condominiums (Table 2).

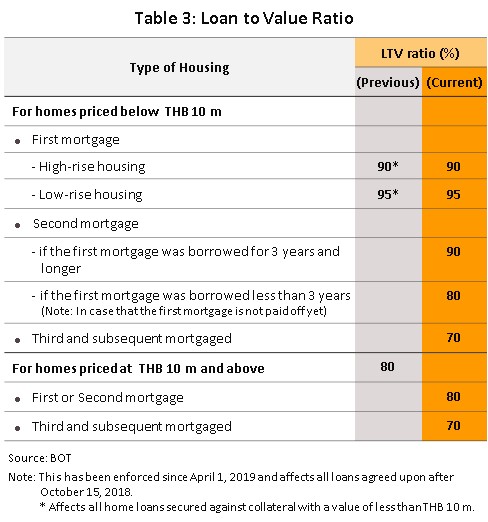

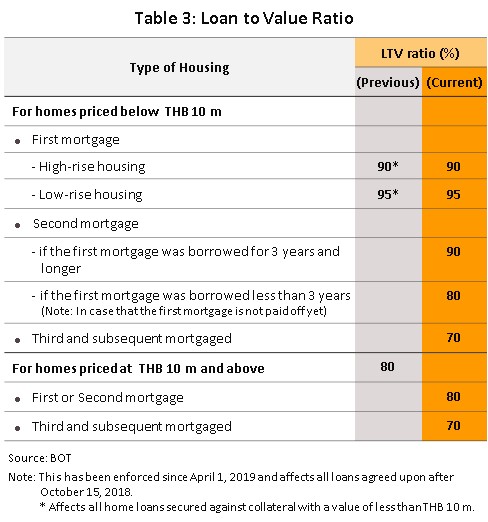

In 2018, demand for residential properties in the BMR grew on recovering purchasing power and improving consumer confidence that was lifted by the year’s 4.1% growth in the economy. This improvement in the property market was especially noticeable among mid- to high-income earners, as was reflected in these buyers increasingly purchasing second homes, especially condominiums in locations from which travel to the center of Bangkok is convenient. Demand from foreign buyers also rose in the year, and within this group, the increase in purchases by Chinese buyers was very noticeable, In terms of supply, property developers have rushed to invest in condominiums alongside both the new mass transit lines and the extensions to existing ones, as well as increasing the proportion of upper-level projects in their portfolios. However, the outcome of these changes in the market has been to prompt the Bank of Thailand (BOT) to revise the rules governing housing loans and, to reduce the level of risk arising from speculative purchases in the property market, the BOT has increase the relative size of down-payments that need to be made for home loans. (i) The BOT has specified new loan-to-value ratios (LTV ratios) that determine the level of collateral or down-payment required for home loans for second (or more) homes when loans for the first home are still outstanding or when loans are for more than THB 10 m (Table 3) and (ii) it has also laid out new rules setting ceilings on the ratio of loan size to collateral (for top-up[2]and house loans).

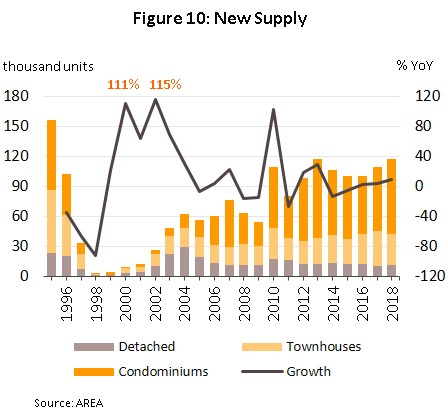

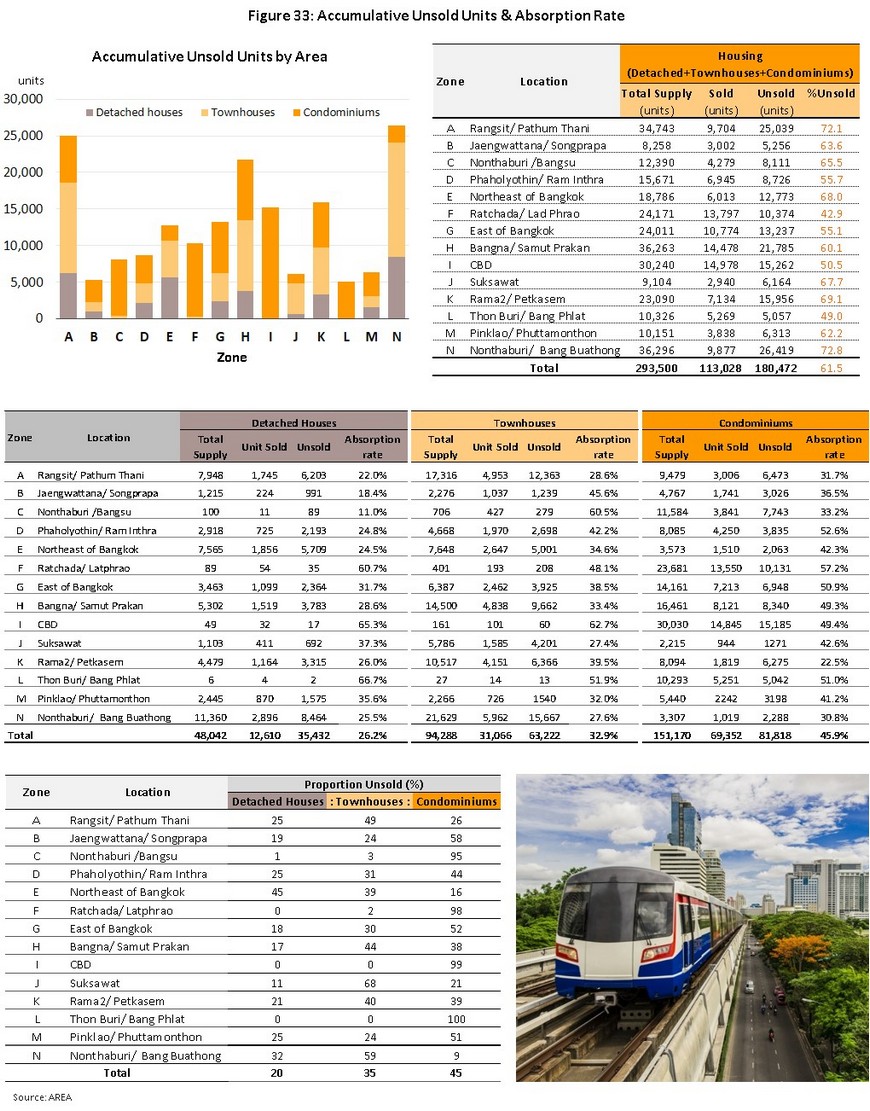

- A total of 113,028 properties were sold[3] in the year, a figure that represented a rise of 16.4% YoY and which was the strongest rate of growth seen in the last 5 years (Figure 9). The number of newly launched units came to 117,168 properties, up 7.2% YoY (Figure 10). For the year, the rate of growth of sold stock was thus somewhat above that of newly launched units and this helped to keep the cumulative total of unsold properties at 180,472 units, an increase of just 2.3% YoY. This latter figure was substantially lower than the average growth in unsold stock of 7% per year that was recorded for the previous 2 years (2016 and 2017).

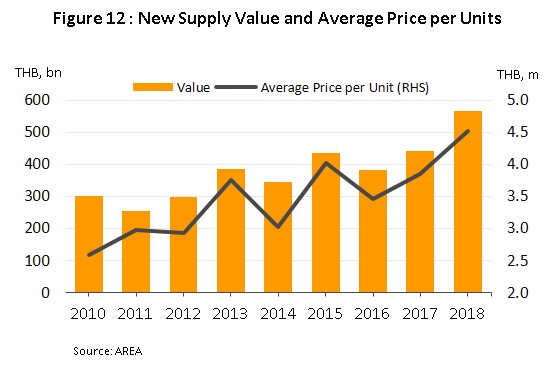

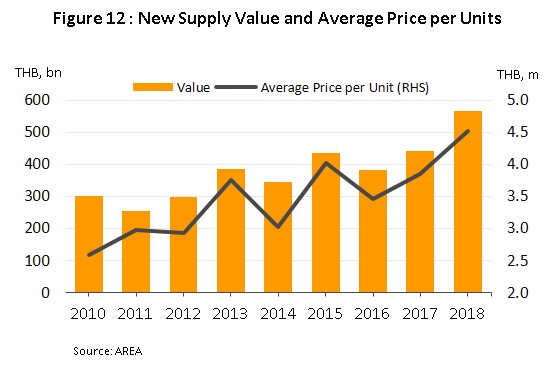

- New property projects in 2018 had a total value of THB 565 bn, up 28.1% YoY and the highest value in 25 years; the large number of high-value properties (i.e. those with a value of over THB 10 m) thus had a significant impact on the market and helped to increase the average prices of residential properties in the BMR by 11.6% to a historical high of THB 4.5 m per unit (Figure 12).

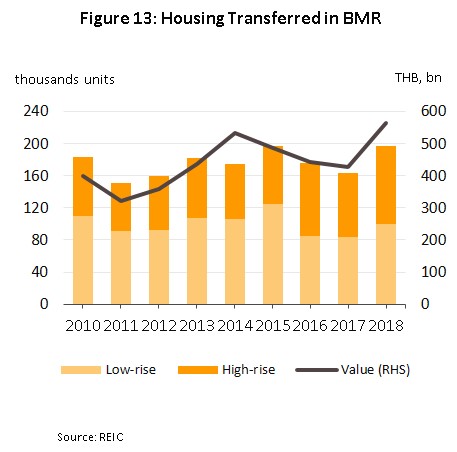

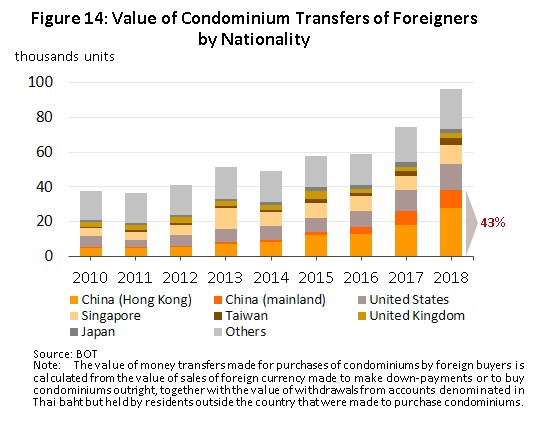

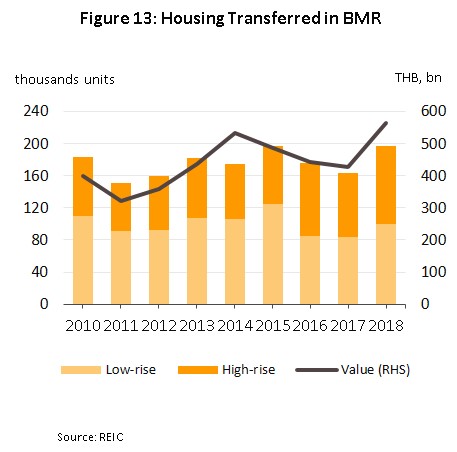

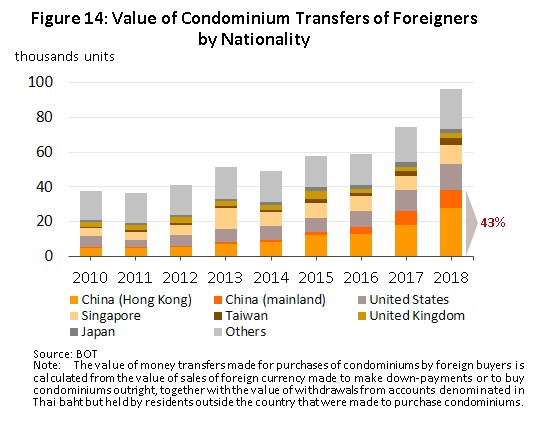

- In 2018, a total of 196,630 housing transfers were completed (up 20.3% YoY) (Figure 13). This was the highest number in 2 years and was split between 97,319 condominiums (up 21.3% YoY), or some 50% of the total, followed in importance by 55,812 townhouses (up 16.7% YoY and 28% of the total), and 27,153 detached houses (up 21.9% YoY and 14% of all residential units transferred in the year). The remaining 8%, or 16,346 transfers, was for ‘other’ types of accommodation, a rise of 24.3% YoY. In the year, the number of housing transfers was lifted by buyers trying to rush through purchases before the implementation of the new Bank of Thailand regulations on home loans, and by heavy demand from overseas buyers, whose spending on condominiums rose by 30% YoY to around THB 92 bn representing a 28% of total value of condominiums transferred, with buyers from China and Hong Kong alone accounting for 43% of the latter figure (Figure 14).

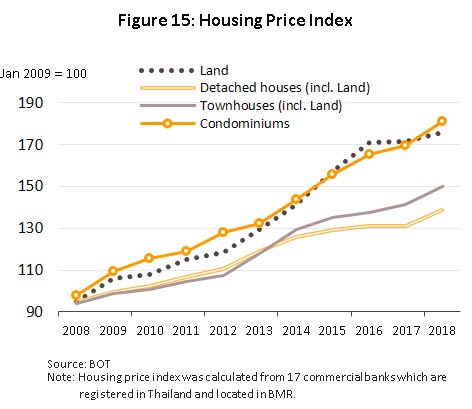

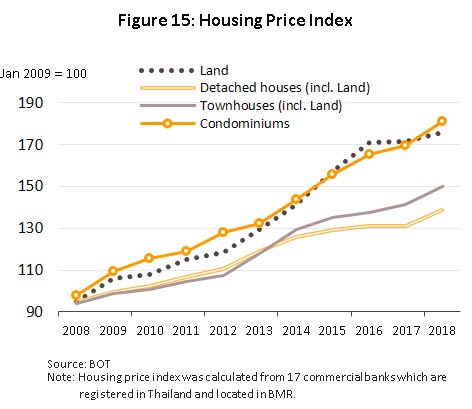

- Prices for residential property increased in all segments of the market in 2018. The condominium price index rose at the fastest rate of 6.6% YoY to end at 180.9 points. The indices for townhouses and detached houses rose at the slightly slower rates of 6.2% YoY and 6.0% YoY to end at 149.9 and 138.9, respectively. This strengthening of the market was in line with the move by developers to release new projects that tended to be aimed at mid- to upper-level customer segments and/or that were located in areas close to mass transit lines, which are built on more expensive land and so finished units also tend to carry a higher price tag. Land prices in the BMR also increased, though the index of land prices rose at the lower rate of 2.4% YoY to 175.9 points as the market leveled off somewhat following sharp average annual price rises of 9.7% in 2014 to 2016 (these had been driven by the ongoing expansion of the BMR mass transit network).

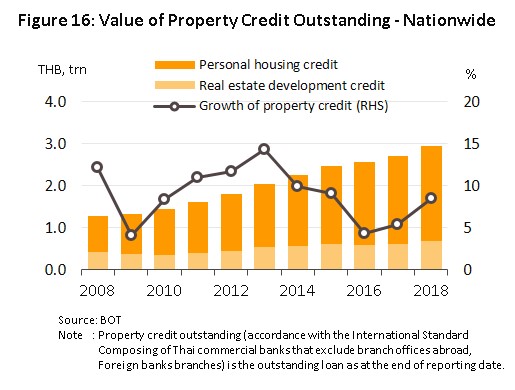

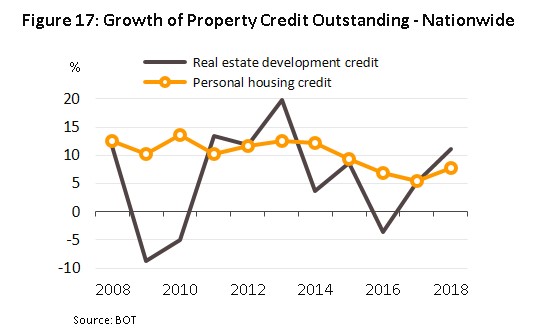

- Home loans issued by domestic commercial banks rose by 8.5% YoY in 2018, again the highest level in 2 years (Figure 16), though this was in step with the general direction of the housing market. The details of loans offered by commercial banks are as follows:

- Pre-finance loans (loans for developers) increased in value by 11.0% YoY to THB 690 bn due to more investor confidence on release new projects to the market. This was in turn boosted by a recovery in consumer purchasing power and by a desire to meet anticipated demand that is forecast to materialize when construction work on the new BMR mass transit lines is completed. Thus, in 2018, 450 new projects came on to the market, an increase of 11.9% on the total for 2017.

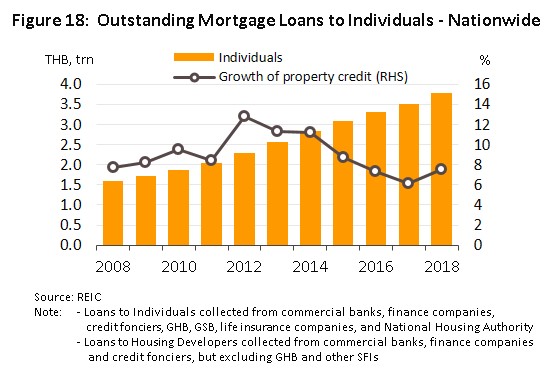

- Post-finance loans (loans for property buyers) had a combined value of THB 2.2 trn, up 7.8% YoY. Demand for property was boosted by better economic conditions leading to stronger consumer confidence and higher spending power. In addition, 2018 purchases tended to be pushed through in advance of the new LTV regulations on home loans, which came into effect in the second quarter of 2019. Overall, for the year, the value of personal home loans, including those from finance companies, credit fanciers/landed credit businesses, the Government Housing Bank, the Government Savings Bank, life insurance companies and the National Housing Authority increased by 7.5% YoY to THB 3.8 trn (Figure 18).

The housing market situation in 2018

- Detached housing

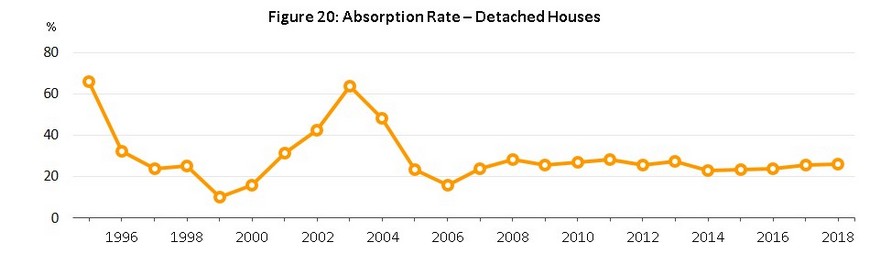

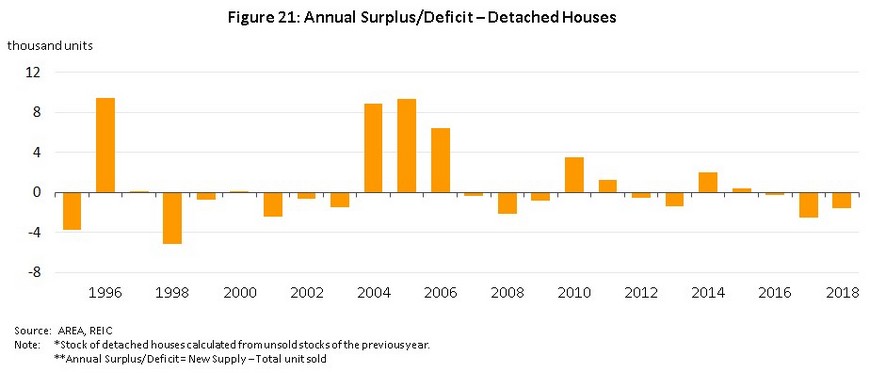

- Following the development of major transportation routes links to outer Bangkok in 2003-2004, the market for detached housing experienced a significant increase in supply, especially alongside the main transport arteries. However, this expansion in supply outpaced demand and this discrepancy naturally caused an increase in the stock of unoccupied housing, which became evident from 2005 but which persists at a high level through to the present. At the same time, the absorption rate of detached housing in the period 2005-2017 slumped to an average of 25%, significantly down from the 64% recorded during the boom in detached housing in 2003.

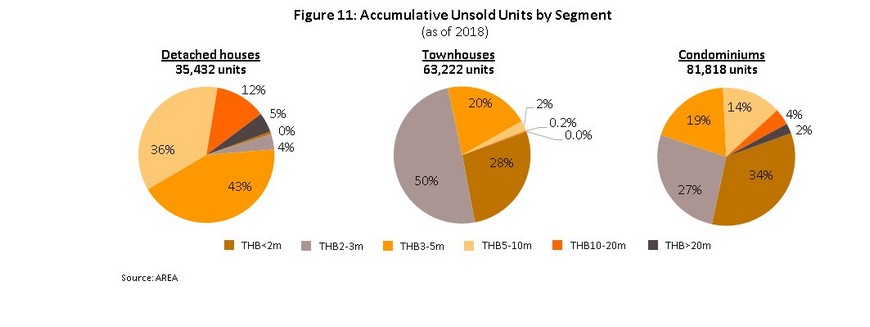

- In 2018, the number of new detached houses in the BMR increased by 8.3% YoY to 11,071 units (9.4% of total new housing units). The average price per unit jumped by 21.9% from 2017’s average to THB 9.2 m because of the shift by property developers to focusing more on the over-10 million baht housing market which accounted for 17% of all new housing units in the BMR in 2018, compared to only 12% in 2017. This allowed developers to concentrate on buyers in niche markets with greater spending power, but these properties also typically take longer to sell. Therefore, the total number of units sold in the year slipped by 1.3% YoY to 12,610 units. Overall, houses in the THB 5-10 m price band sold best, while over the year, the number of unsold houses dropped by 4.2% YoY to 35,432 units.

- Townhouses

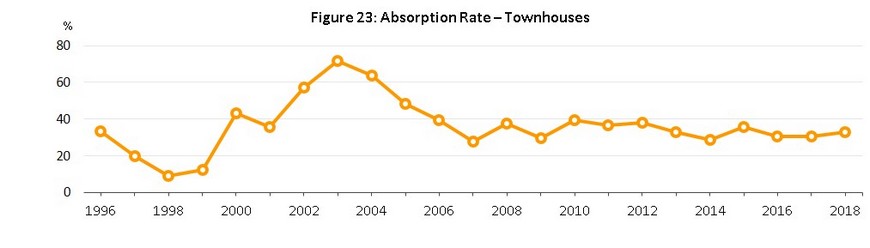

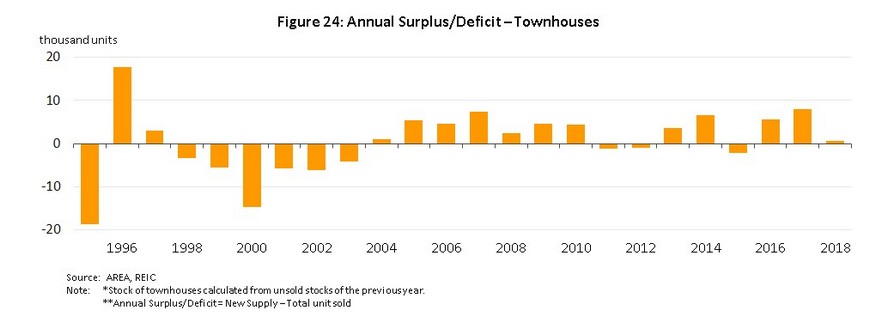

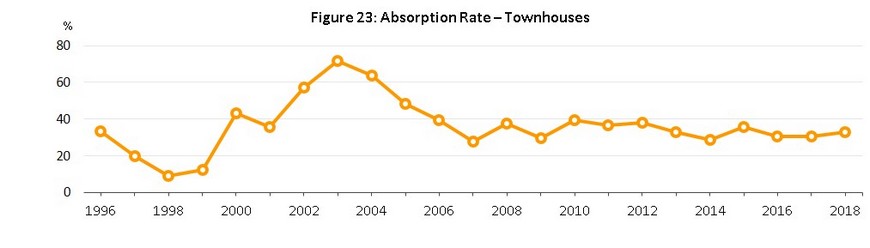

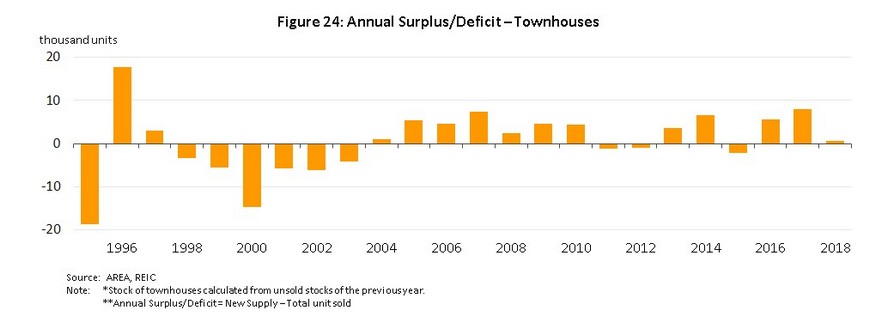

- Increasing land prices have spurred demand for townhouses as alternatives to more expensive detached housing. Between 2002 and 2004, the number of townhouse developments increased substantially. However, as with other market segments, supply increased at a faster pace than demand and since 2005 the number of unsold townhouse units has steadily risen. In addition to this, over the decade between 2008 and 2017, townhouses have declined in favor relative to condominiums located near BTS lines (sometimes referred to as ‘city condos’), with the latter having advantages in terms of price and the convenience of being able to travel rapidly into the city center. The result of these shifts in the market has been that the absorption rate for townhouses has slipped to an average of 34%, down from 56% in the townhouse boom period of 2002-2006. Despite this, though, Since 2014, more expensive townhouses were developed with prices in excess of THB 10 m/unit. These townhouses typically have three or more floors and were built around the edges of the center of Bangkok and not too far from BTS lines, for example, near Rama 3, Sathu Pradit, Yannawa, and Lat Phrao. In addition, developers also invested in townhouses located in smaller alleyways that connect to mass transit systems and which are priced in the THB 2-3 m price range targeting mid-low end customers.

- 31,717 new townhouses (27% of all new housing stock) were released to the property market by developers in 2018. In terms of raw numbers, this was a slide of 10.6% YoY, but the average price per unit of new townhouses projects rose by 12.7% YoY to THB 2.8 m. Sales also rose in the year, increasing by 12.8% YoY to 31,066 properties, driven by demand from buyers looking for low-rise properties with easy access to mass transit networks, and this then helped to hold back the increase in unsold townhouses to a rise of just 1.0%, or 63,222 properties.

- Condominiums

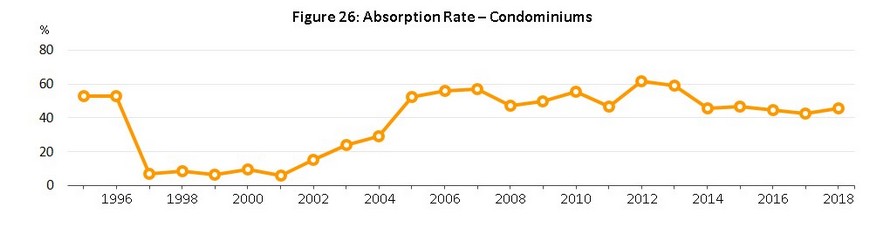

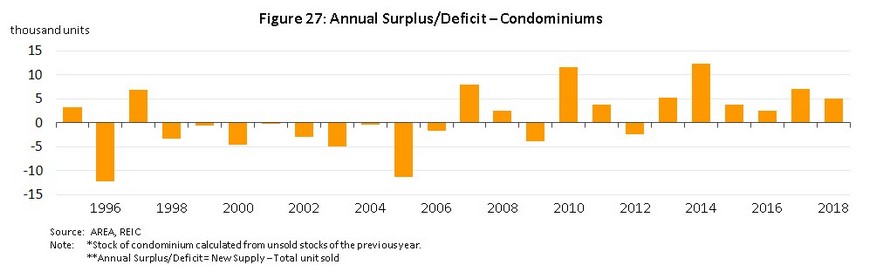

- Condominiums have been popular. New projects has been steadily developed since 2007 due to: (i) the extension of mass rapid transit lines and increasing connections within the communications network, which is making its use more convenient; (ii) changing consumer behavior driven by a desire to save money and to reduce commuting time that is causing a switch in preferences from low-rise housing in the suburbs to high-rise accommodation in the city center; (iii) changing social structures within Thailand, with more people living in smaller, nuclear families; and (iv) the declining availability of land on which to build and subsequent rising costs. The outcome of these factors is that developers have increasingly turned to condominiums to meet more consumer demand for housing, with the result that over 50,000 new units typically become available annually. Customers for these condominiums can be split into two distinct groups. 1) Real demand accounts for around 60% of the market; and 2) those who make purchases for investment purposes, a group which is itself split between those who then rent out the property (25-30% of the market) and those who wish to speculate (the remaining 10-15%). Thai law specifies that non-Thais may own condominiums provided that not more than 49% of the total floor-space in the building, and this has also led to condominiums having a higher absorption rate than low-rise buildings. Thus, between 2008 and 2017, the absorption rate for condominiums averaged 49.8%, significantly higher than the 25.8% of detached houses 34.0% of townhouses.

- Despite this, from 2014 to 2017, the condominium market somewhat slowed down, especially at the mid- to lower-end (i.e. units under THB 3 m), as high levels of debt and a sluggish economy took their toll. As a result, and customers at this end of the market were forced to be careful about their spending and so to delay purchases of condominiums. At the top end of the market, though, units continued to sell well and to remain popular among those with higher levels of purchasing power.

- The number of new condominiums jumped by 16.9% YoY to hit a four-year high of 74,380 units in 2018 (these comprised 63% of new BMR housing stock). The average price of these also increased and rose to THB 4.5 m (up 15.7% YoY). The market was lifted by the extension of mass transit lines to more outer parts of the BMR and work on the Pink Line (Khae Rai-Minburi), Yellow Line (Lat Phrao-Samrong) and Orange Line (Thai Cultural Centre-Minburi) is helping to support greater demand for condominiums in areas around these lines. Beyond this, demand in the foreign market has also been strong, especially from Chinese buyers, with this group having invested heavily in condominiums near mass transit lines over the last 1-2 years, attracted by relatively cheaper prices (compared to those in Singapore, Hong Kong and Australia) and for Chinese speculators, satisfactory returns on investments. Indeed, fund transfers made by Chinese and Hong Kong citizens for the purpose of buying properties came to almost THB 40 bn, a 65.9% increase from the 2017 figure and an 11.9% of the value of all condominiums transfers made in the year across Thailand (source: BOT). Therefore, sales of condominiums, increased by 22.5% to 69,352 units, while the supply of unsold stock slowed to 6.5% (or 81,818 units). However, at 46%, the absorption rate is reasonably high and this indicates that the supply of unsold high-rise accommodation will likely be sold off more rapidly than will low-rise properties.

Industry Outlook

- In 2019, the housing market in BMR is forecast to remain relatively flat, or to see only low levels of growth, compared to 2018 due to high base effect, but partly also, the market will face a number of challenges in the year. These will include 1) the introduction of the new loan-to-value based rules governing home loans, which may prompt buyers to put off purchases; 2) the enforcement from 2020 of the Land and Building Tax Act, which may encourage land to be sold for development to avoid tax and so add to the preexisting oversupply to the market; and 3) a possible weakening of the spending power of foreign buyers, especially in the Chinese market, where spending may come under pressure from a slowing of the world economy. These developments may then have an impact on businesses’ operating costs, investor confidence, and the willingness of buyers to make new purchases of properties. Despite this, purchasing power at the upper end of the market is expected to remain solid and so demand for residential property from this segment is expected to grow steadily. In 2020 and 2021, market conditions should improve in step with the growth of the economy, which will in turn benefit from government spending on infrastructure construction and the increase in investor confidence that this will bring. In addition, the rollout of new infrastructure will also help to stimulate demand for new properties directly, in particular near the new mass transit lines, while both increasing investment by non-Thais and a rise in the number of foreigners working in the country will also drive additional demand for property in BMR.

- The volume of new housing coming to the market is forecast to grow by 1-3% per year between 2019 and 2021 (Figure 28). The majority of this new supply will come from projects undertaken by large developers. Condominiums will remain the mainstay of the market, followed in importance by townhouses and detached housing. However, developers will tend to increase the proportion of low-rise developments in their portfolios as this will help them to retain their profit rates (at around 3-6 months, returns are made more rapidly on low-rise developments) and because market demand for low-rise properties reflects a higher level of ‘real demand’. The market for condominiums is also expected to be adversely affected by the introduction of the LTV rules (for second and third homes), which is likely to remove demand from one segment of buyers from the market and in response to this, developers will instead switch to the upper-mid and upper levels of the market, where spending power remains solid. As for buyers at the lower-mid to lower levels of the market (i.e. properties with a value of less than THB 3 m), this group continues to deal with high household debt. In addition, supply in this price band remains high at 53% of all unsold properties.

- ompetition within the residential property market is also intensifying, with this coming not just from other players within the real estate sector but increasingly also from operators with roots in other domestic industries, such as Singha Estates and BTS Group Holdings, and from foreign players such as Japan, Singapore, Hong Kong and China. This is particularly the case in the condominiums segment, where interest from overseas investors and buyers has been especially strong; in 2018, joint ventures between foreign investors and Thai companies were active in the development of over 30 residential projects. Over 75% of these joint ventures involved Japanese companies, and examples include those between AP (Thailand) and Mitsubishi Estate Group, and between Ananda Development and Mitsui Fudosan. Chinese players are also beginning to have a more important role in the market, as in for example the partnership between Charn Issara Development and Junfa Real Estate. The greater importance of foreign companies within the BMR property market is helping to raise the value of the projects that are undertaken as well as to increase the level of technology that is deployed in real estate developments, and to expand the potential customer base of new projects to include a higher number of foreign buyers. In the near future, it is expected that an increasing number of joint ventures between Thai and foreign developers will take place and that to expand business opportunities and reduce exposure to risk, the level of investments in other types of real estate development will also rise, especially in mixed-use developments[4], which may include hotels, retail space, and residential units all within the same project. At the same time, the importance of foreign buyers to the BMR residential property market is expected to continue to increase such as China, Hong Kong, Singapore, Britain and Japan, some part of this coming from investments in buying to let.

- In the coming period, several factors will exert a strong influence over of the property market, including the high supply of unsold housing stock in some areas, the slow recovery in consumer purchasing power in certain segments of the market, and the persistently high levels of household debt. The combined effect of these factors will be to hold back price rises for the housing market , while simultaneously, financial institutions are tending to show greater care in the issuing of new loans, in particular to low-income earners. In addition, the sector will face the possibility of increasing costs for land, building materials and labor, all of which will feed into greater costs when developing new projects.

- Housing market structure may also be affected by the new Land and Building Tax Act[5], which is expected to come into force in 2020. The proposed act will impose taxes on unused land and this may lead to land changing hands more rapidly and developments being pushed through in the run up to the law’s enforcement, though if this happens, this may then lead to the oversupply of unsold housing stock.

The outlook for potential areas in BMR in 2019-2021

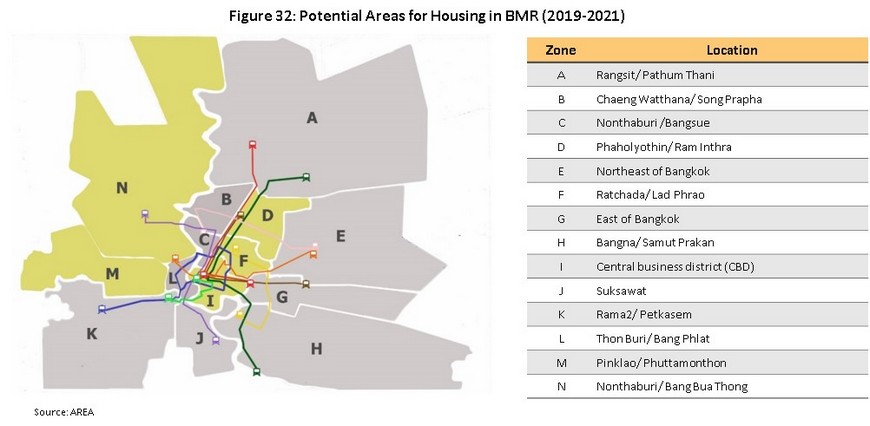

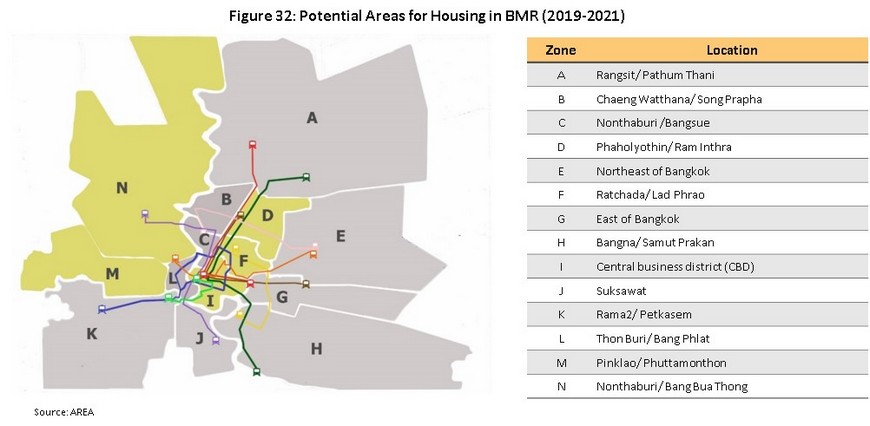

Krungsri Research believes that within the BMR there are three zones near rapid mass transit extensions and two further zones in the center of Bangkok that will show significant commercial potential between 2019 and 2021.

1)The Green Line extension (north) (Mo Chit – Saphanmai – Khu Khot, zone D) is an older residential area, especially the area’s housing projects and apartment. However, it is currently seeing condominium developments springing up to meet higher demand, which is anticipated to increase further following the scheduled completion of the BTS extension in 2020. The area is also home to a number of government offices, hospitals, universities and is near to Don Muang airport. At present, the average of absorption rate for townhouses in the area is 44.3%, while that for detached housing is 34.0%. Condominiums are the most common form of new housing, and these have an absorption rate of 37.8%.

2) Ratchada and Lat Phrao (zone F) are centers for housing, business activities and entertainment and can in fact be considered new extensions of the central business district (CBD). Within the area, work is being conducted on the Yellow Line (Lat Phrao-Samrong) and this should be completed by the end of 2020, with the result that travel connections to the rest of Bangkok and areas further afield will be much improved. Currently, the majority of property developments in zone F are condominiums and the area is popular with both Thai and foreign residents, especially the Chinese. The absorption rate for condominiums is thus 50.2%. As regards low-rise developments, although demand exists in the market, the supply of suitable land is limited. The average of absorption rate for detached housing and for townhouses is 60.5% and 30.9%, respectively.

3) The center of Bangkok (zone I) consists of Silom, Sathorn, Rama IV Road, Ploenchit, Wireless Road, Asoke and Sukhumvit enjoys good travel connections, being served by two rapid mass transit networks (the BTS and the MRT) and the elevated expressway. The area is popular with foreigners, a large number of whom live in zone I and for these reasons, residential prices is more expensive here than in other zones. Currently, developments are mostly high-end condominiums and these are attracting the interest of foreign investors. The absorption rate is 55.4%.

4) The area serviced by the Blue Line extension and the western side of Bangkok (zone M) is an area from which central Bangkok and the central business district is easily accessible. This includes Silom and Sathorn, which can be reached by BTS and by Kanlapaphruek and Ratchaphruek Roads. Condominiums are again the main type of accommodation in these areas and have an average absorption rate of 44.5%, while detached housing and townhouses have absorption rates of 26.3% and 19.5%, respectively.

5) The western bank of the Chaophraya River (zone N) is on the outskirts of the BMR but it has potential given the area’s communications connections, including an expressway which takes commuters into central Bangkok. The zone is also served by two major retail developments (Central Westgate and Mega Bangyai) and in the future, the Bangyai-Kanchanaburi motorway will provide additional transport links. These combine to make the area attractive to property developers, especially for low-rise developments, which have been well received; with a 26.9% absorption rate, townhouses are the best-selling type of accommodation followed in second place by detached housing, these having a 25.8% absorption rate.

Typically, new housing projects that are located near rapid mass transit lines will show a higher absorption rate than will projects in other areas. But over the past two years, a number of such developments have been rushed onto the market with the result that in some districts a considerable volume of units remain unsold. This is especially the case near the Purple Line in zones N, M, C and D and it is expected that it will take some time for the market to absorb this surplus. New developments in these areas will thus not typically show high absorption rates. Nevertheless, given the potential for demand for property in these areas to grow in the future and the possibility the ability of developers to cut back on the release of new housing projects, problems with the oversupply should gradually abate with time.

The housing market in the BMR by Area

Krungsri Research’s view

In 2019-2021, large property developers in BMR are likely to grow steadily continue to enjoy solid levels of growth. Small- and medium-sized operators will; however, encounter both stiff competition on the steadily increasing cost of land for development, which is becoming more difficult to find, especially in the heart of Bangkok. Developers will therefore tend to engage in joint ventures or mergers with both Thai real estate operators and foreign investors as a way of building competitiveness and the effect of this will then be to change the structure of the real estate market, which would shift from the current situation, where one large developer controls a significant market share to a situation where developers increasingly work in partnerships with other operators. In addition, in the coming period, the sector will employ a greater level of high technology in its construction operations, and this will help to build trust in businesses in the real estate market.

- Income for large developers will continue to grow, as these players are able better to adjust themselves to changing circumstances and because they enjoy advantages over small- and medium-sized players in almost all areas, though especially with regard to their lower costs of financing. This arises from the fact that most large players are able to raise capital through the stock market, in addition to their being able to invest in assembling land banks of sites with potential for future development thanks to their strong financial footing.

- Small- and medium-sized developers will face greater levels of difficulty and will see their market share shrink because, relative to large players, smaller operators lack the flexibility to adjust their business activities and this in turn reduces their competitiveness. Some smaller developers may also face limitations on their capital and lenders may be stricter about agreeing to new loans, with the result that some players run may face risk from liquidity squeeze.

As for trends in the development of condominiums in the BMR, projects in the center of Bangkok and along rapid mass transit lines will mostly be undertaken by large developers that have the requisite capacity in project management, marketing and financing, together with access to land for development. Mid- and small-sized players will focus more on developing low-rise condominiums (i.e. those with eight or fewer floors) in less potential area in BMR which are less popular than detached housing and townhouses in the same location.

[1]Officials cut the fees for mortgage registration and transfer of home ownership were temporarily reduced to 0.01% for housing at all price levels. These measures were in place for the 6 months between October 19, 2015 to April 30, 2016.

[2]Additional (specific) loans on top of the existing loan based on the same collateral/property. The amount of loans may be given either when mortgage loans approved or during installment payment period e.g. home for cash. Exemptions are granted to certain top-up loan products: 1) life insurance, non-life insurance and 2) SME loans.

[3]Sold units include both units that were sold in that period and those that were sold in that period but which had been released to the market at an earlier time.

[4]Mixed-use real estate developments include both commercial and residential uses. Mixed-use developments may thus contain retail units, office space and residential accommodation within the same project

[5]The Land and Building Tax Act B.E. 2562 was announced in the Royal Gazette on March 13, 2018. Payment of land and building tax under the new Act will be required from January 1, 2020, onwards. Fixed Maximum tax rates for Land and Buildings are classified by category as follows: 1) agricultural - 0.15%; 2) residential - 0.30%; 3) others - 1.20%; and 4) vacant/unused - 1.20% (if the land or building is unused for more than three years, the rate will be increased by 0.30% every three years, until the rate reached 3.0%)

.webp.aspx)