EXECUTIVE SUMMARY

The housing market in the Bangkok Metropolitan Region showed signs of recovery at the start of 2022. Unfortunately, as the year has progressed, the cost of oil and construction materials have been impacted by the war in Ukraine, while domestically, the economy remains weak and under pressure from rising inflation that has eaten into consumer purchasing power. The result of this has been that recovery in the market has been limited, though this has been somewhat offset by activity at the upper-middle to upper end of the market, which buyers are real demand group and are less affected by economic turbulence. Over 2023 and 2024, what is expected to be a slow economic recovery will feed into a gradual improvement in the outlook for the housing market. The situation should be improved by greater progress on government megaprojects, and in particular by work on the capital’s metro system and the impact of this on commuting times, as well as by additional demand from overseas/expat buyers working or investing in Thailand.

The industry will also have to face a number of challenges in the near future, including: (i) slow recovery of the economy, which will make it difficult for developers to market their properties; (ii) the tightening of new credit by lenders of the release in the face of persistently high levels of household debt; (iii) changes to the housing market brought about by the COVID-19 pandemic, most notably the increase in demand for larger, low-rise units in more suburban locations; (iv) limited growth in demand, most of which will be real demand, and uncertainty over how the expatriate market will shape up; and (v) the impact of inflation, the rising cost of land purchases, and likely future interest rate rises on the cost of undertaking new developments.

Krungsri Research view

Through 2022 to 2024, the housing markets in the BMR should gradually strengthen on an economic rebound and rising consumer spending power. However, the war in Ukraine has driven up the price of oil and added to inflation globally, and this will continue to affect construction costs. The Thai real estate sector will also be impacted by the rising cost of land and the upward trend in interest rates. Large players should be able to continue to grow through these difficulties, but SME developers will come under greater pressure from stiffening competition that will affect sales, the cost of construction materials, and the price of land (which is becoming harder to find and so correspondingly more expensive). Players will therefore tend to look for partners to work with, whether that be other Thai companies or overseas operators, since by expanding their capital base, they will be better able to raise their competitiveness.

-

Low-rise housing developers (in BMR): Large players will see their revenue rise thanks to a combination of their adaptability and lower costs of financing (a result of being able to raise funds on the stock exchange and on bond markets). However, SMEs will have to contend with a more challenging environment and as such, their market share may shrink. Players that lack established business partners or that are not part of an extensive commercial group will find conditions especially difficult, and those that are on a weaker financial footing or that have trouble accessing credit may become insolvent.

- High-rise housing developers (in BMR): The majority of condominium developers in the central business district and along mass transit lines are large corporations that are skilled in project management, marketing, and securing working capital. Even so, they will still feel the effects of what is likely to be a period of slow growth. The market will be further affected by difficulties travelling internationally and probable repeat waves of COVID-19, especially in China where any continuation of the ‘Zero COVID’ strategy will lead to the reimposition of lockdowns and increase the difficulties faced by Chinese buyers trying to complete purchases. Growth in this segment is therefore forecast to remain low, and it may be necessary for players to increase budgets for marketing and discounts if they wish to increase sales. Given this, competition will increase, and profits will come under pressure. On the other hand, SME developers will tend to concentrate on projects that have a maximum height of 8-storeys and that are located in more distant, suburban areas that are comparatively less attractive. In these districts, rise developments are also often less appealing to buyers than are townhouses and detached houses. Income growth for SMEs will thus tend to drag, and recovery will be a slow and drawn-out process.

OVERVIEW

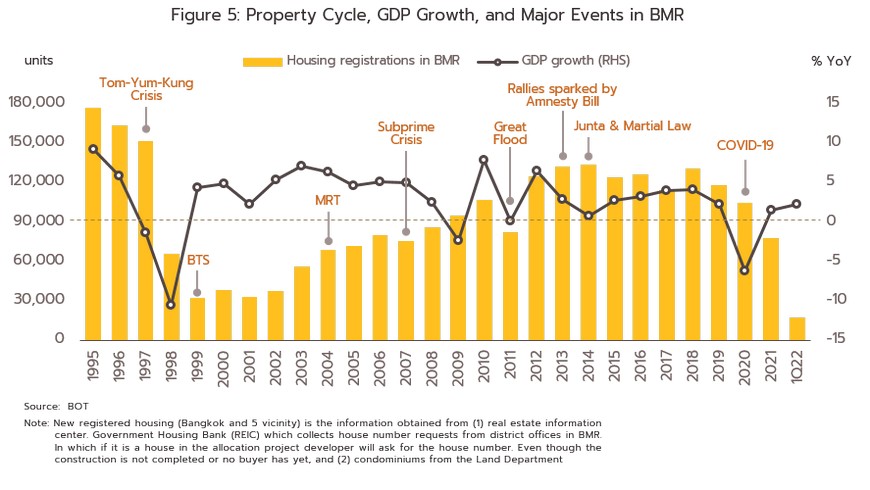

The real estate sector contributed 4.8% of Thailand’s GDP in 2021 (fell sharply from 8% in the pre-pandemic level in 2019), which is significant to the national economy. A large amount of capital circulates within the economic system and supports rising employment and income. The sector also has a large influence on the direction of related businesses such as construction, building materials, consumer electronics, furnishings/ decoration and finance.

The property sector consists of three principal segments: residential, commercial, and industrial. In Thailand, two-thirds of the property market (by value) is derived from residential transactions (source: World Bank). Property development mainly aims to serve domestic market as Thai law stipulates that non-Thais may legally own only condominiums and only up to 49% of total salable area in any project. For detached housing and townhouses (also called rowhouses or shophouses), the ownership regulations for non-Thais are more onerous.

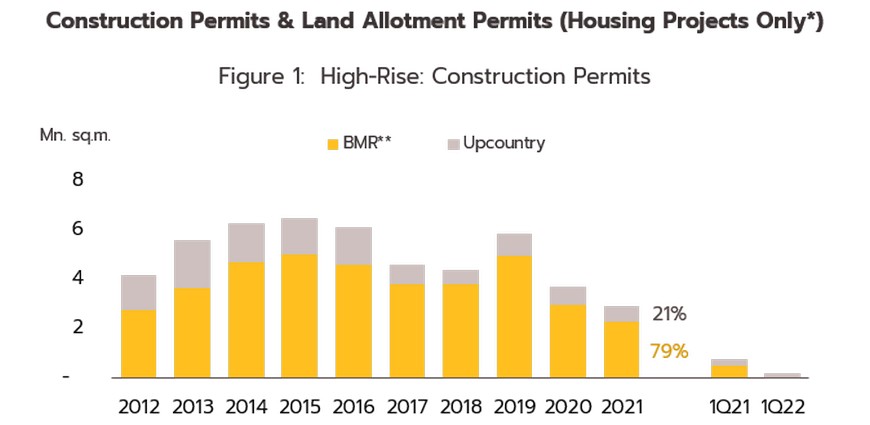

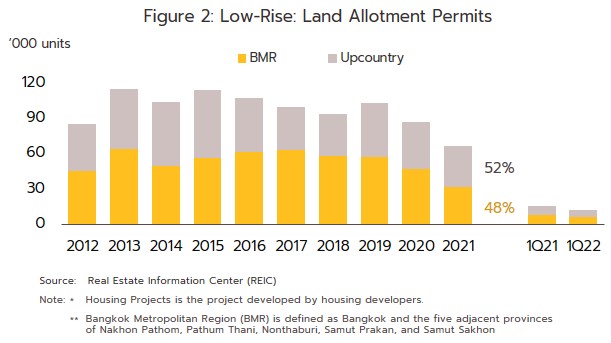

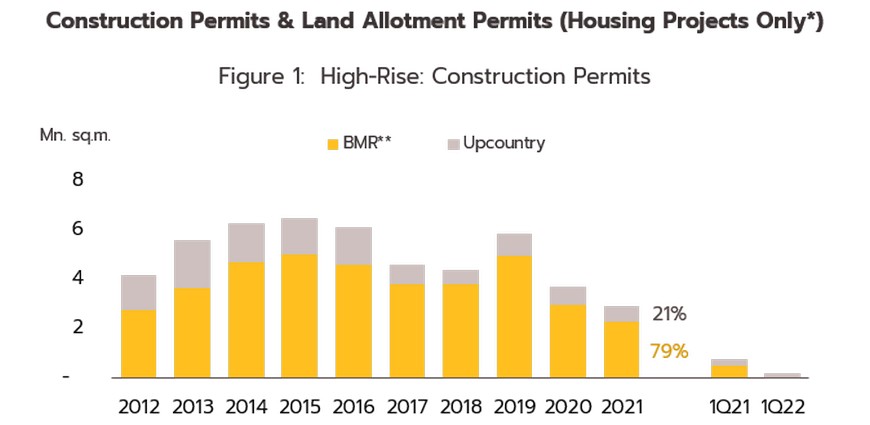

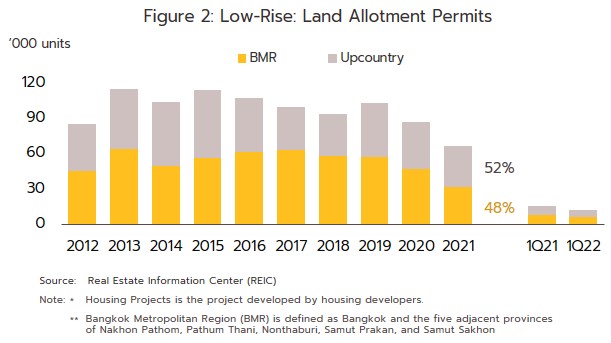

In the past, demand for housing in the Bangkok Metropolitan Region (BMR) was typically stronger than for housing in the regions, and so applications for building permits for both low- and high-rise housing were overwhelmingly made for construction projects in the BMR; over 2015-2019, applications were split between low- and high-rise developments in the ratios of 58:42 for BMR, and 79:21 for upcountry (figures 1 and 2). However, over 2020 and 2021, the COVID-19 pandemic took a lot of steam out of the property market. This weakening of demand was not shared equally, and the market for property in the BMR was disproportionately affected. Thus, within the low-rise segment, the construction permits in the BMR has now dipped beneath that for construction permits in the regions (Figure 2), and although within the high-rise segment, the footprint of BMR-based projects is still greater than that of those taking place elsewhere, the proportion has slipped to a 20-year low.

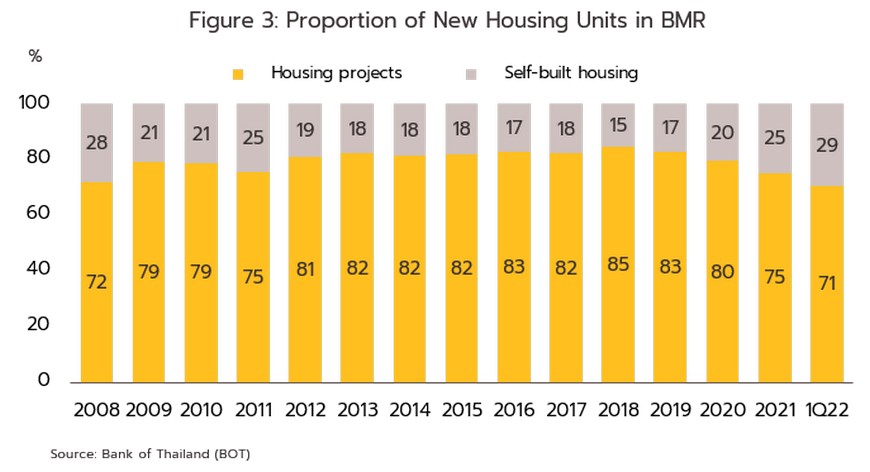

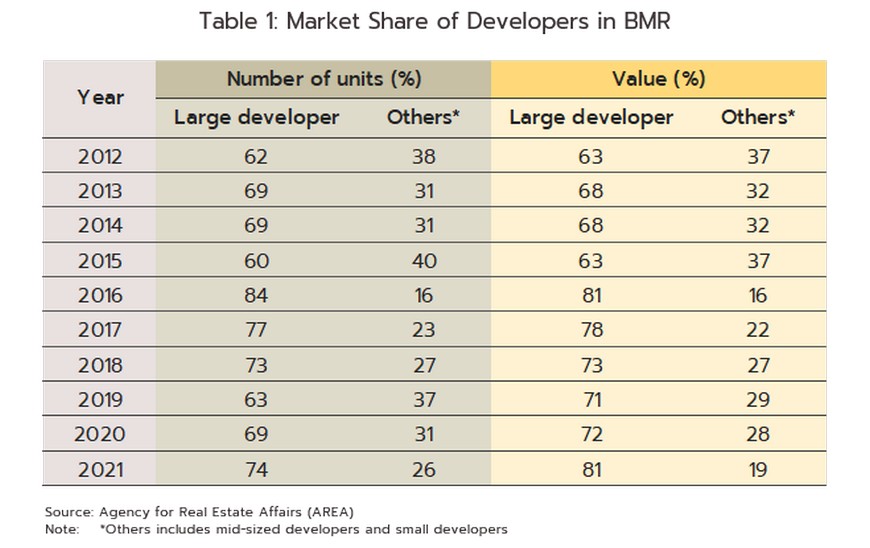

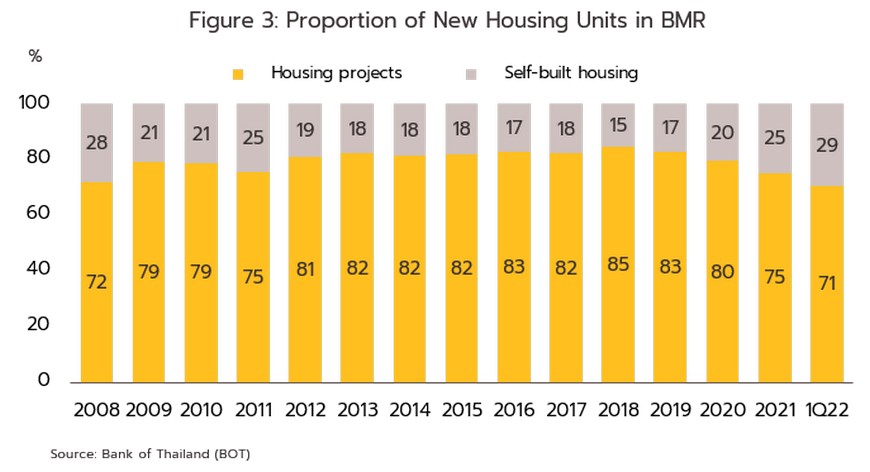

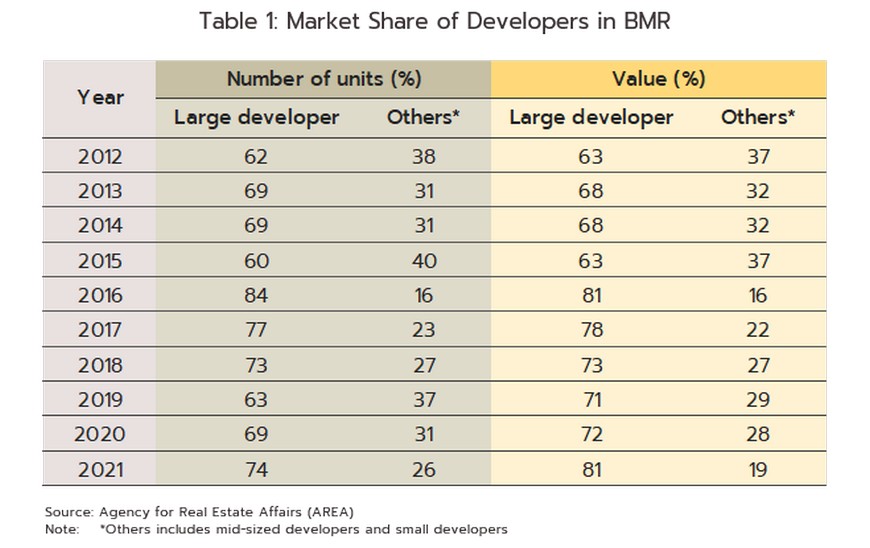

The housing market is split between self-built housing and housing projects (Figure 3). Currently, over 80% of new housing units in the BMR are in projects developed by housing developers, with annual market value of around THB 400-450 bn. Large developers (those listed on the SET) and their subsidiaries control 70-80% of the market by volume and value (Table 1). Because large companies are able to manage costs more effectively than their smaller peers; for example, they are in a position to buy larger land bank that would reduce project development cost. They can also undertake several projects simultaneously and thus achieve economies of scale. Beyond this, they benefit from stronger branding and marketing networks.

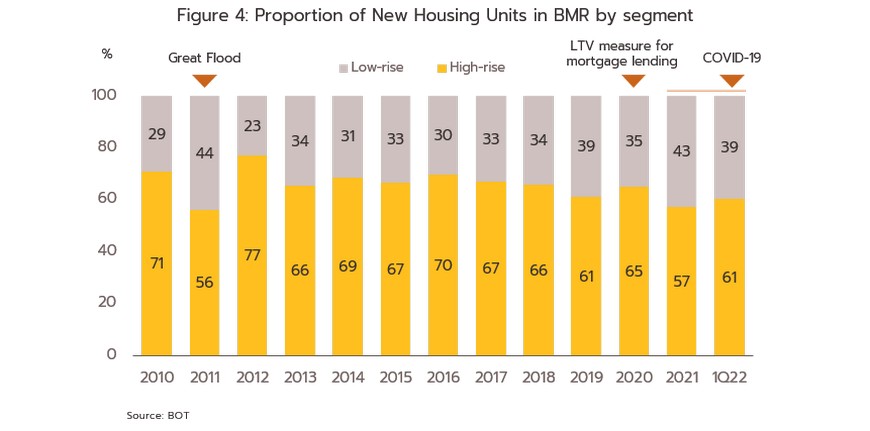

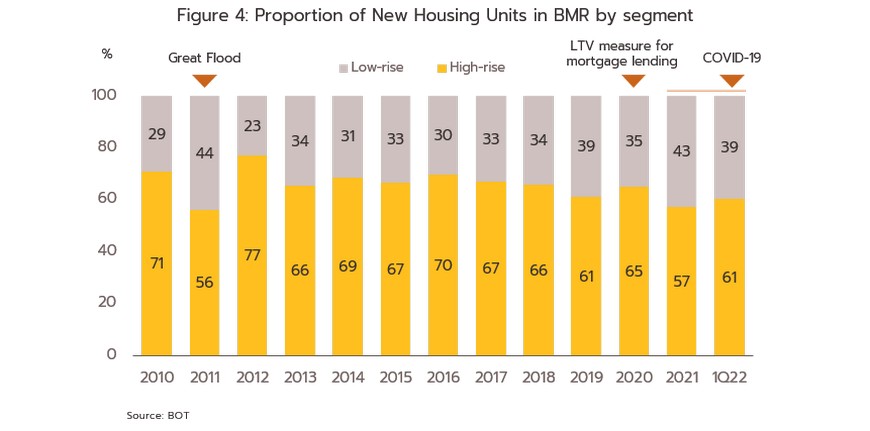

Since 2008, high-rise residential buildings have represented a larger share of new projects in BMR than low-rise segment. An average of 70% of new housing units in the market have been condominium units (Figure 4) due to the declining availability of land, and consequently, higher prices for development land. The extension of rapid mass transit lines (MRT and BTS) has also led to housing projects springing up along new routes and near stations. These led to the increasing popularity of high-rise residential developments.

SITUATION

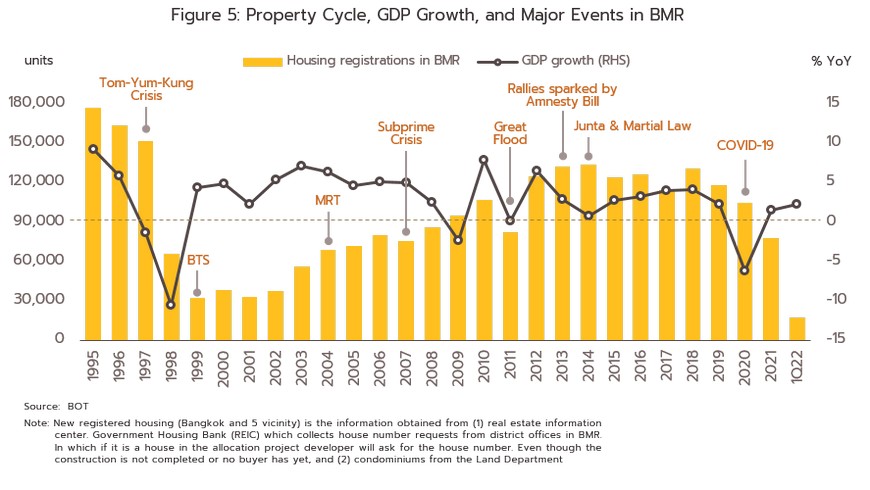

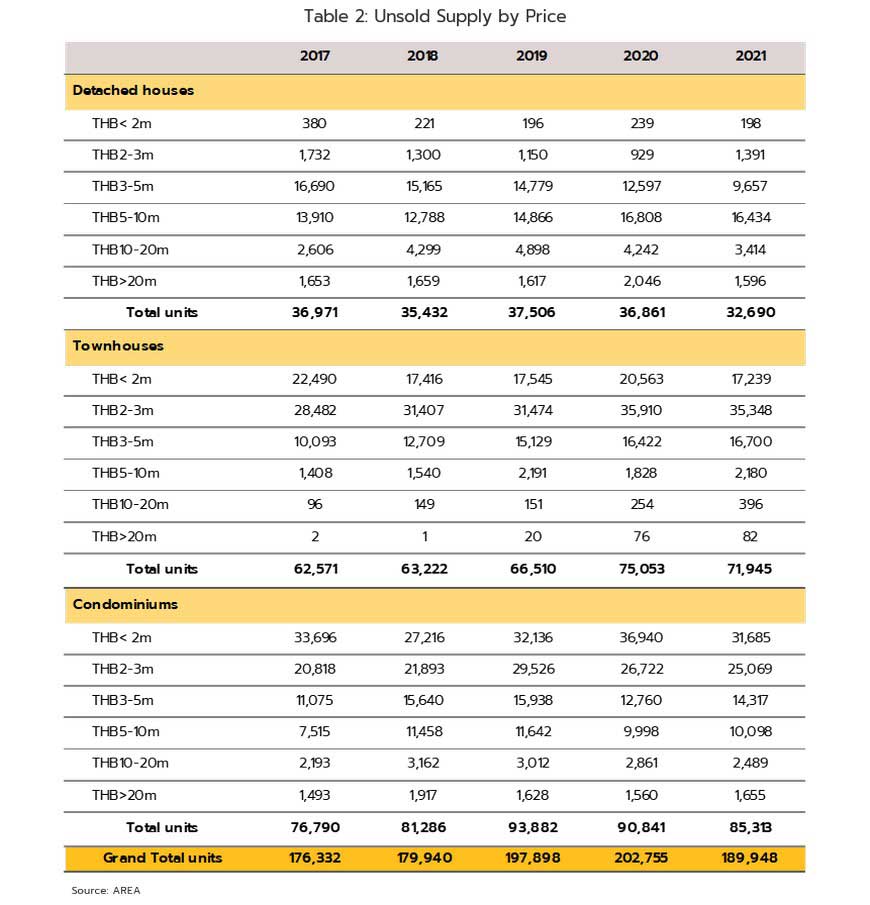

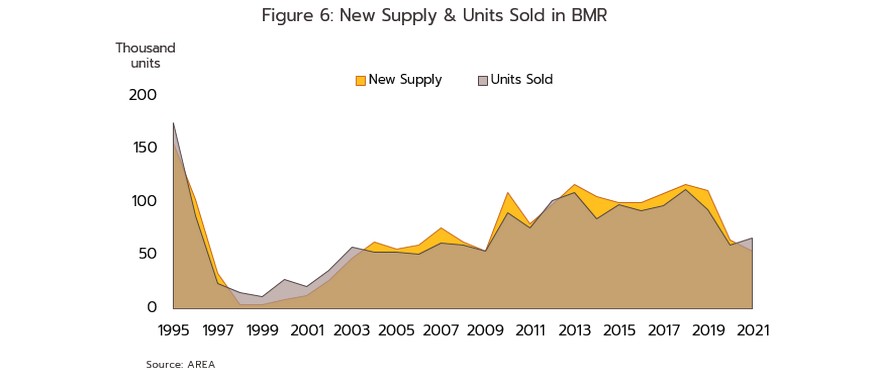

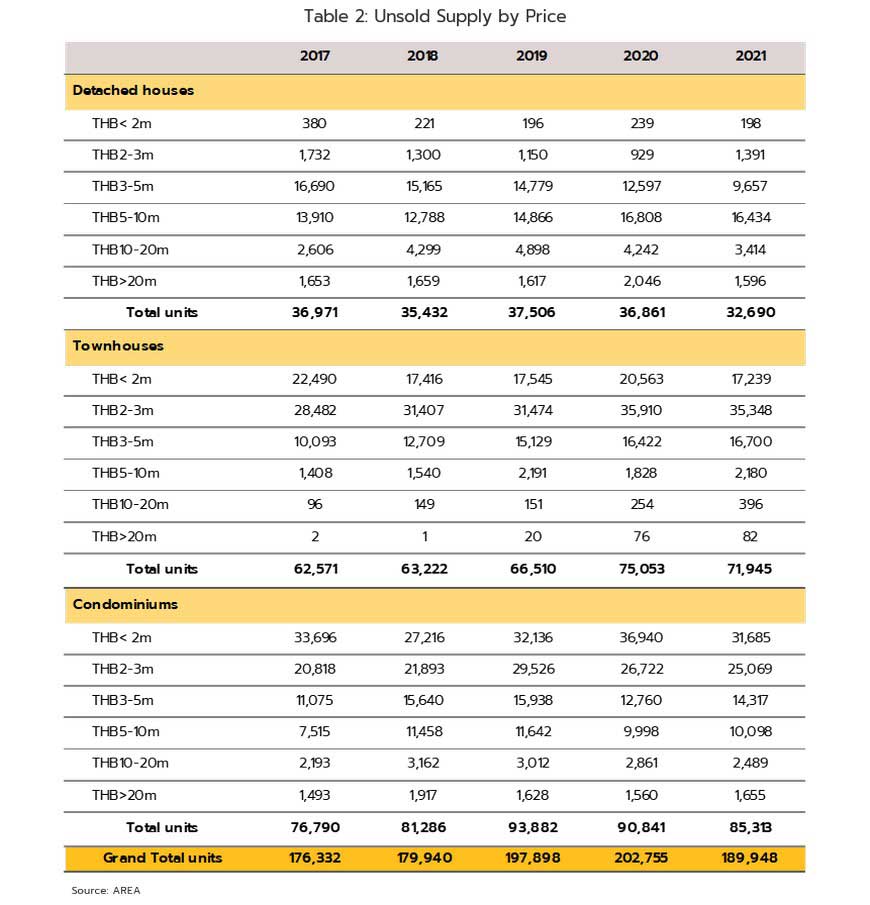

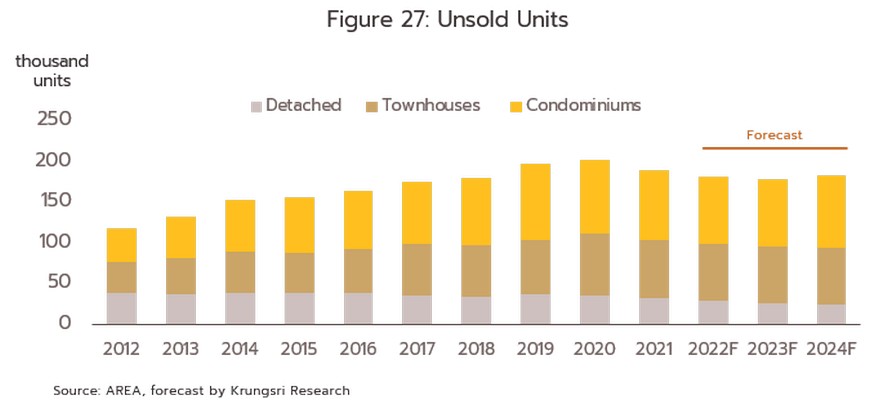

The outbreak of COVID-19 caused a profound slowdown in all parts of the economy in 2020. This combined with a drop-off in government infrastructure spending and the tail-end of a deep drought in the first half of the year to cut a full 6.1% from GDP, making this Thailand’s most severe economic slowdown in 22 years. Faced with this slump, property developers held up work on new projects and so the newly launched units crashed 41.6% YoY, while by value, the total was also down almost 40% YoY to an 8-year low. The condominium segment was particularly hard hit, and across the year, the release of new units slumped 61.0% YoY, meaning that for the first time in a decade, 2020 saw more new low-rise than high-rise housing come to market. As incomes dropped and confidence evaporated, both Thai and overseas buyers tended to defer purchasing decisions and postponed or cancelled purchases and transfers of ownership as their incomes shrank and confidence evaporated, even though the Bank of Thailand relaxed its LTV rules[1] for first-home buyers. To make matters worse, household debt continued to rise, and lenders became more cautious about issuing new credit, and as such, total sales underwent their steepest fall in a decade to crash 36.0% YoY. Alongside this, around 200,000 units were cumulative unsold units, the highest level in 26 years (Table 2), though within this total, units priced at less than THB 3 million accounted for over 60% of the total.

The housing market remained in a depressed state through 2021, especially when the worsening of the COVID-19 pandemic in the third quarter of the year forced the closure of construction workers’ accommodation with the result that both Thai and overseas migrant workers returned to their hometowns in large numbers. Given this, the number of new housing units that were completed fell from a pre-COVID average of 8,500 per month to just 4,900 (source: Bank of Thailand). However, on the positive side, the market was helped by government stimulus measures that included a cut in the fees for registering mortgages and transferring ownership valued at THB 3 million or less (with effect from 1 February, 2021 to 30 January, 2022), the deferral of the new land value appraisals (2021-2024), a 90% reduction in the land and property tax for the 2021 financial year, and a temporary relaxation of the LTV rules [2] (from 20 October 2021 to 31 December, 2022). Details of the housing market through 2021 are given below.

-

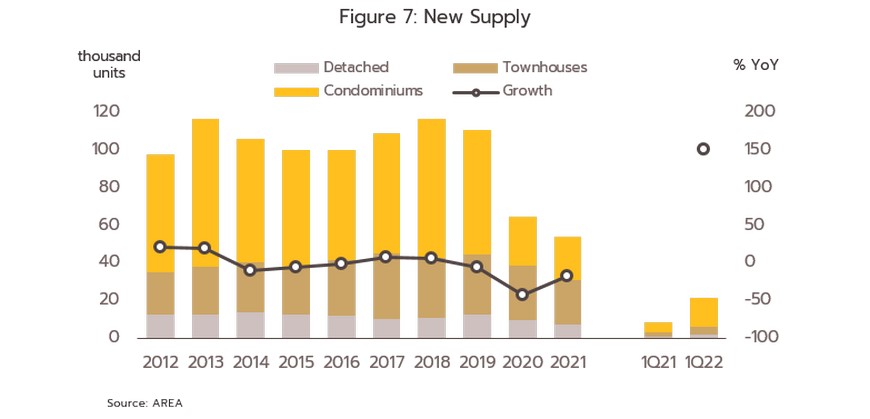

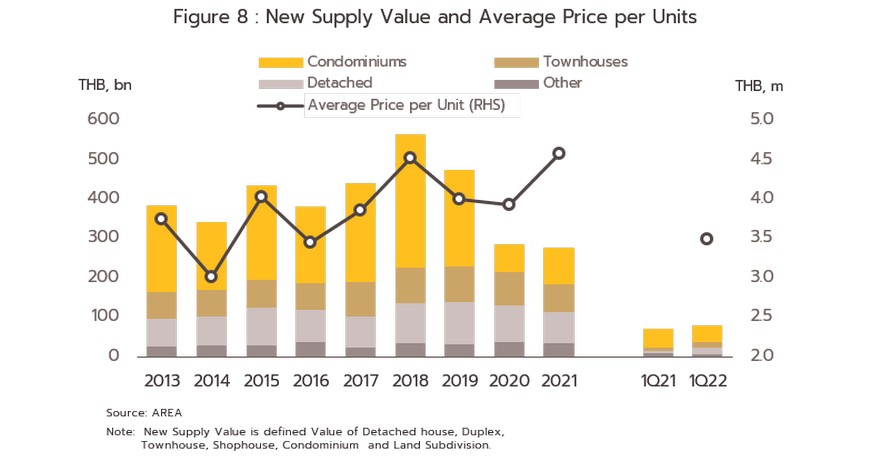

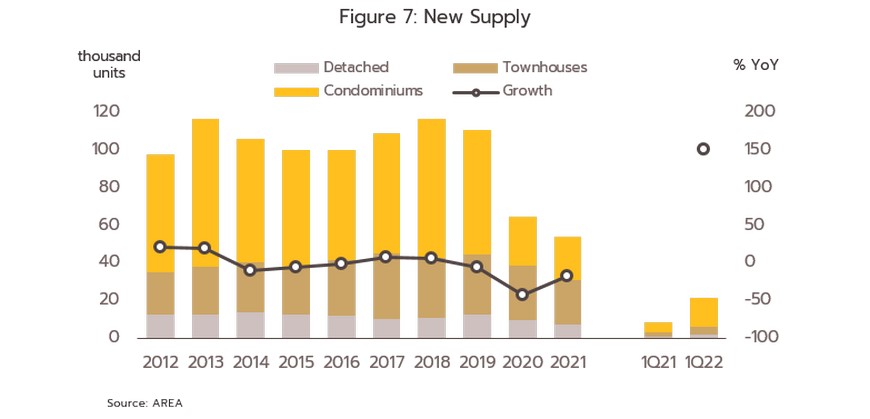

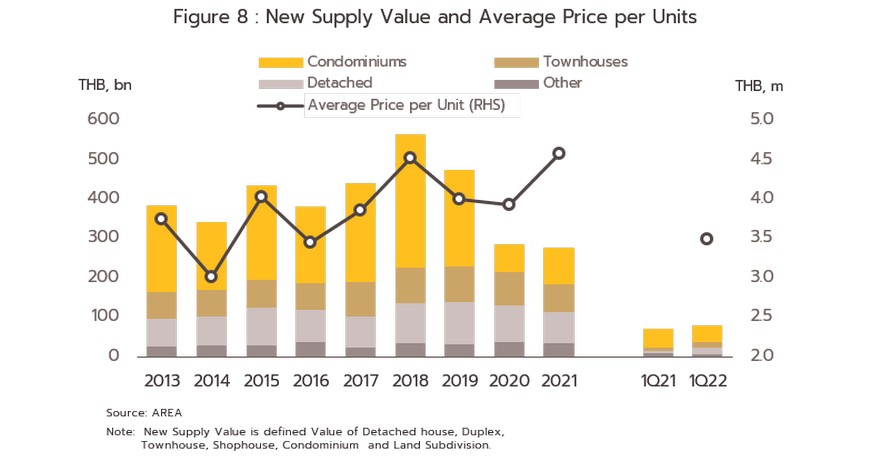

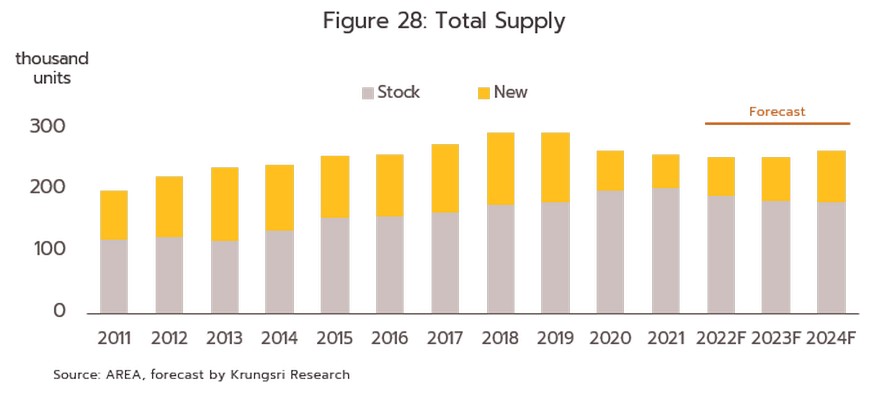

The trend in the new housing units coming to market continued the decline that set in 2020, falling another 16.3% to an 11-year low of 54,464 units (Figure 7), while the total value of these slipped 3.4% YoY to THB 280 billion, its lowest in 9 years (Figure 8). This was partly a result of the significant glut of unsold housing stock, which then encouraged developers to slow work on new projects. Thus, the number of low-rise housing coming to market dropped 20.8% YoY to 31,019 units, and although in percentage terms, the decline was slightly less for condominiums, the fall of 9.5% YoY to 23,445 units was enough to bring the 2021 total for new condominiums down to just a third of what it had been in 2019 (the year prior to the outbreak of COVID-19). This was also the second year running when more low-rise than condominium came to market, these two segments constituting respectively 43% and 57% of the total. In response to these challenging conditions, developers focused their efforts on the upper-mid and higher levels of the market since buyers at these levels were less affected by the economic slowdown.

- The average per-unit price of new units rose 16.7% to THB 4.6 million in the year as developers switched to a tighter focus on higher-priced properties, especially for low-rise units since interest in these has picked up. The value of new large-scale real estate developments came to THB 46 billion, with prices for these starting at over THB 5 million each.

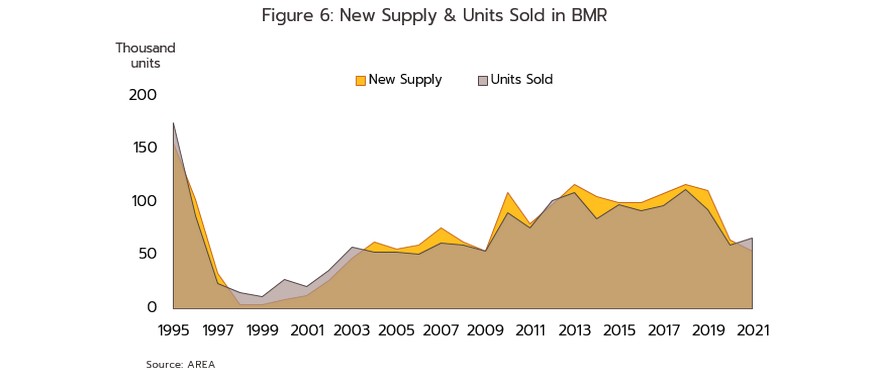

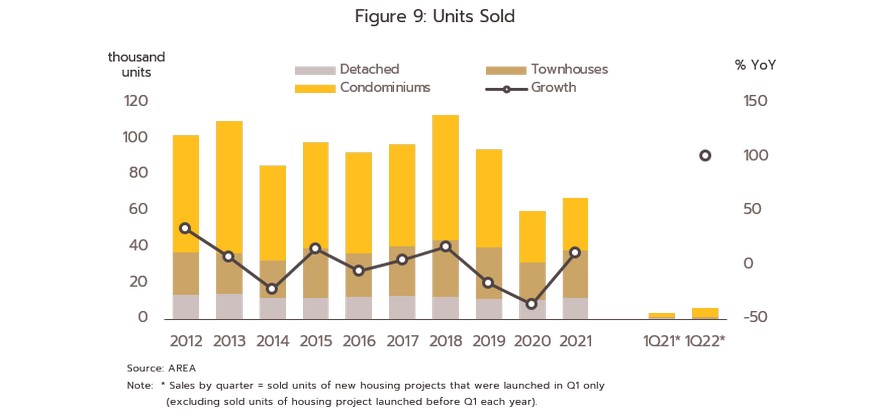

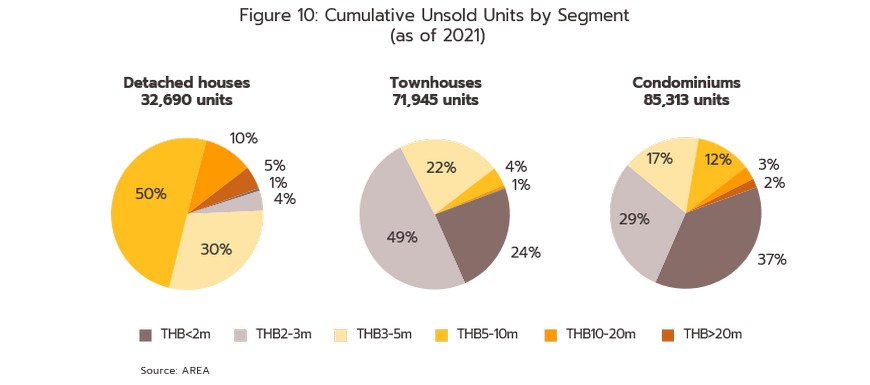

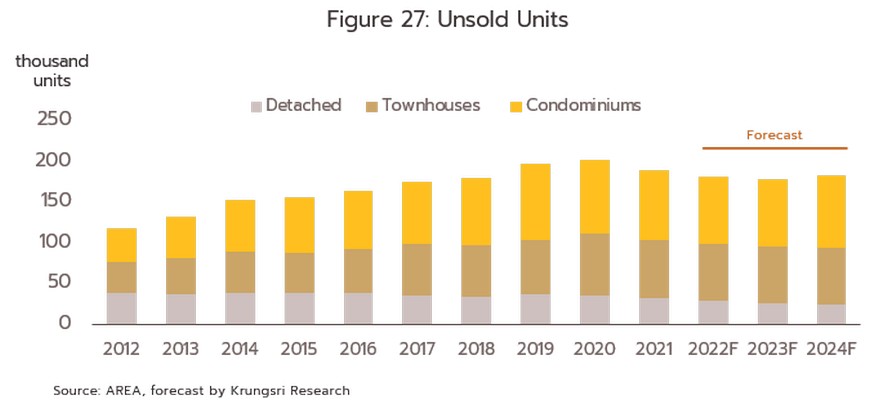

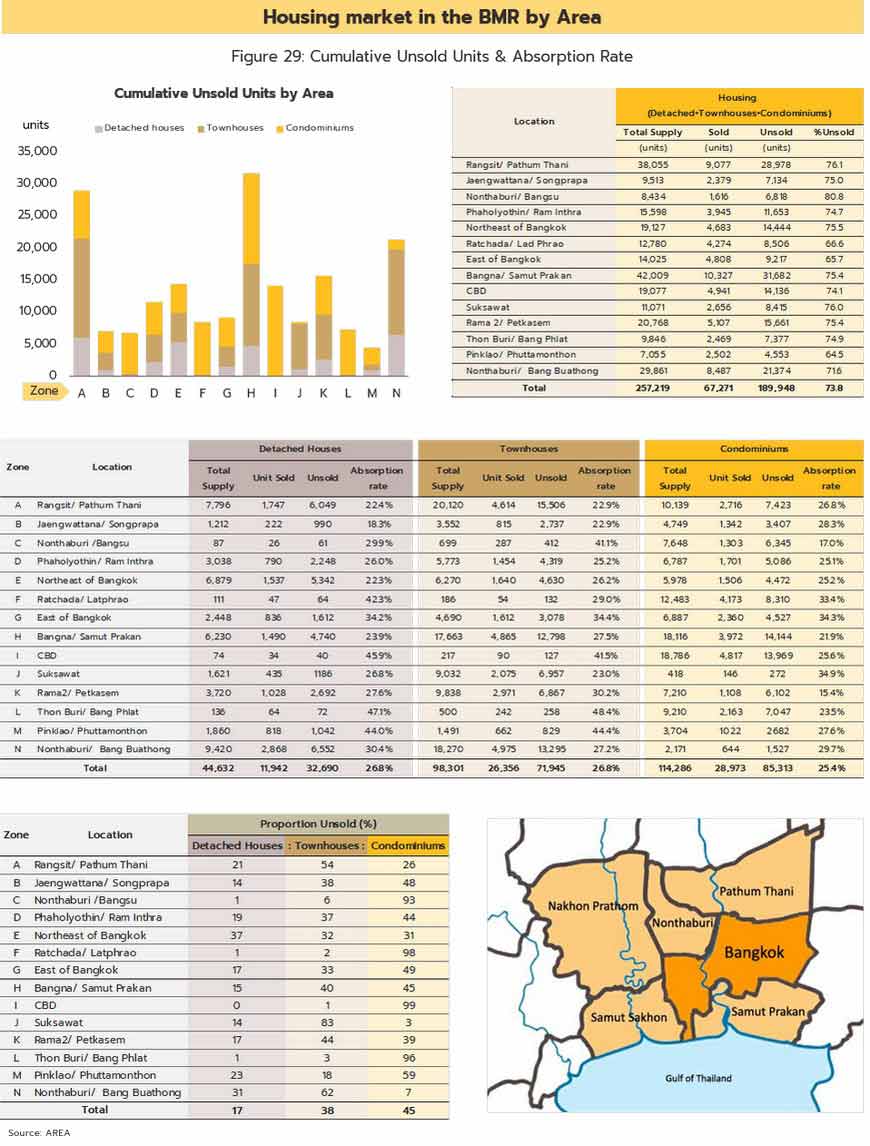

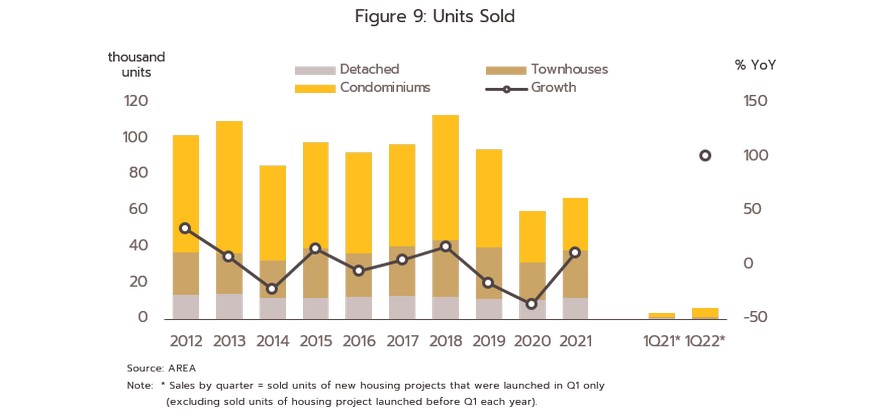

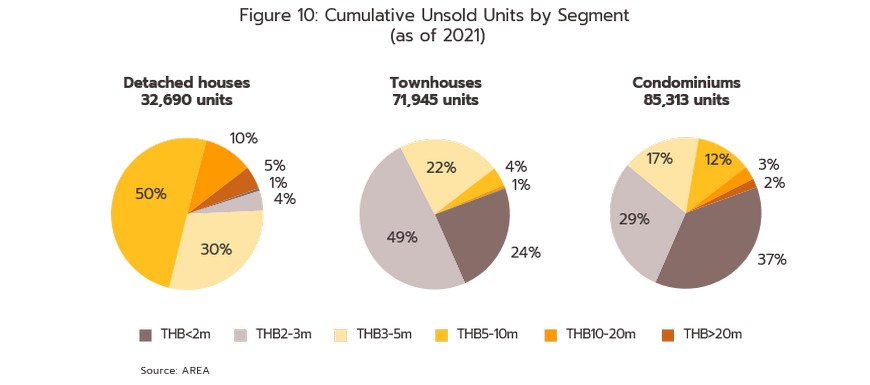

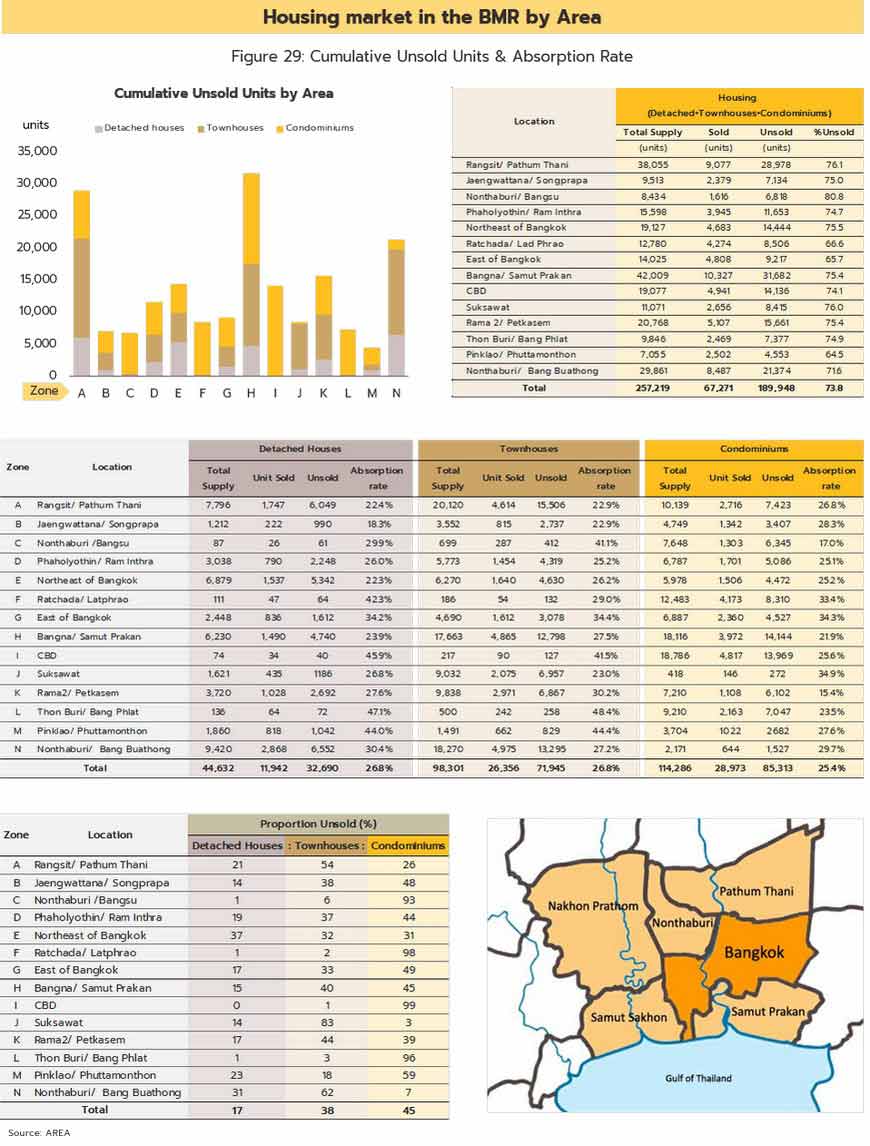

- Sales rose 11.8% to 73,736 units, having fallen continuously since 2019 (Figure 9). The main support for the market came from buyers in the upper-mid and over income segments, who were less affected by the economic problems ushered in by the pandemic, though sales were also helped by government stimulus measures and low interest rates that helped to keep loans cheap. Sales of detached houses and townhouses were thus up 22.6% YoY, bringing these segments back to close to their 2019 pre-COVID state, but sales of condominiums remained at just half their 2019 level. Responding to the switch in consumer demand to a greater interest in low-rise properties, developers used a range of promotional strategies to run down their existing stocks of unsold condominiums rather than beginning work on new projects. Unlike condominiums, low-rise developments were thus relatively unaffected by the year’s troubles, and for the first time in 8 years, overall sales of residential properties in the BMR were greater than the number of new units coming to market. This then helped to run down the cumulative total of unsold properties, which in 2021 dropped 6.3% to 189,948, over 60% of which were valued at less than THB 3 million (Figure 10).

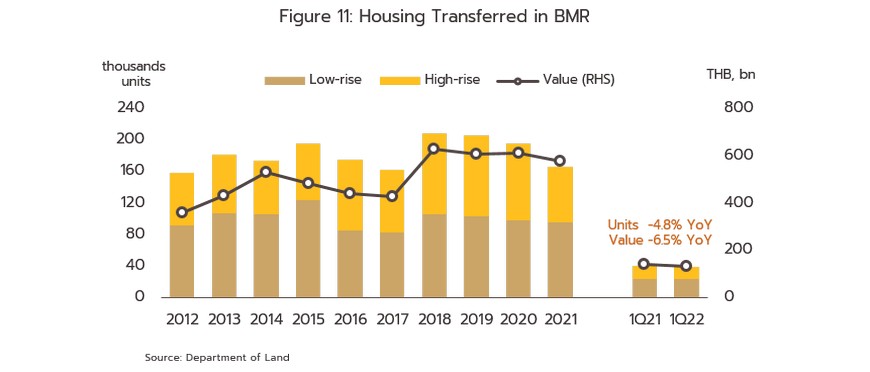

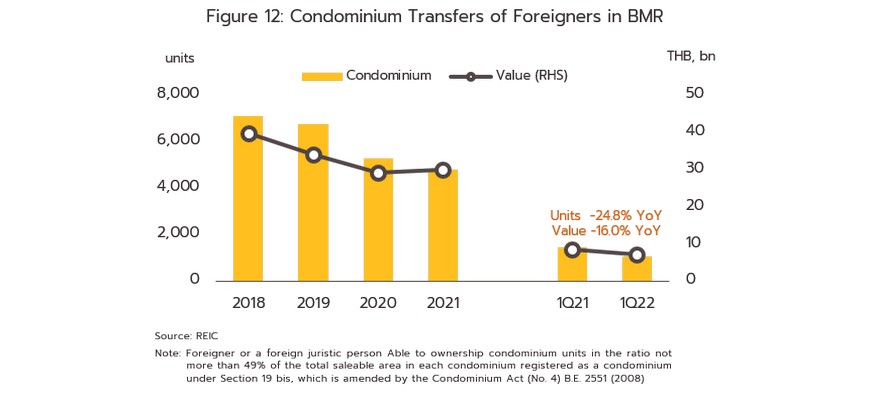

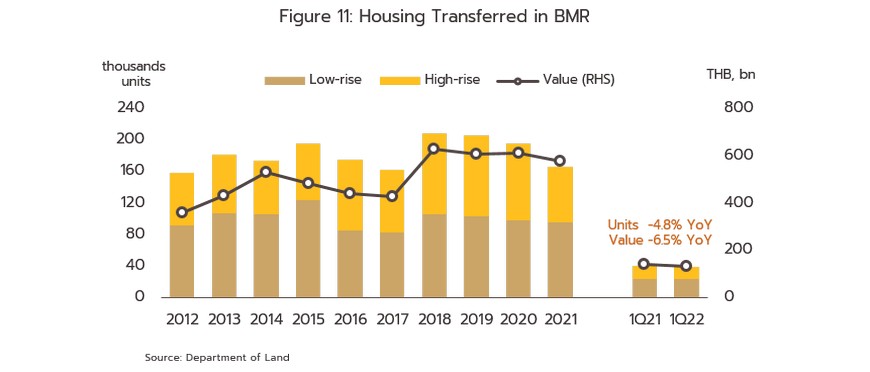

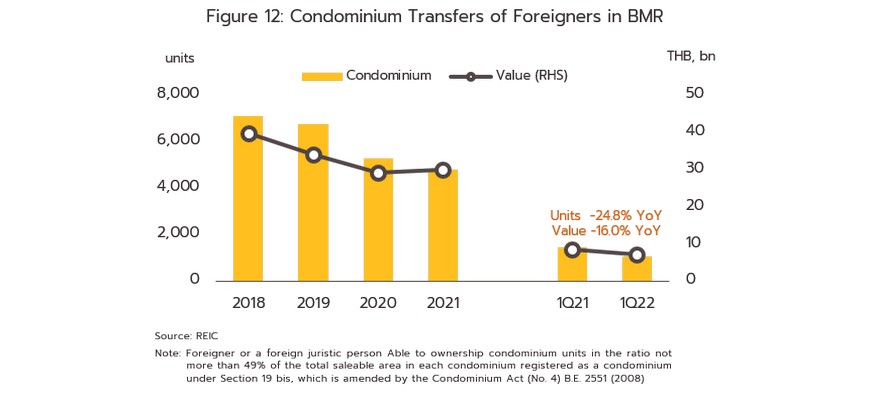

- The number of housing transferred slipped for the fourth consecutive year, dropping 15.5% YoY to 166,402 units (Figure 11). The decline was steepest for condominiums (42% of all transfers of ownership), which were down 29.0% YoY, followed by townhouses (32% of the total and down 4.0% YoY) and detached houses (17% of the total and down 0.2% YoY). Transfers of ownership for other types of property, which includes shophouses and semi-detached houses that comprise 9% of the total, increased by 2.5% YoY. This fall is attributable to the drop in consumer spending power and, for Thai buyers, the impact of repeat waves of COVID-19 infections on the economy and subsequent fears over future income. Meanwhile, for overseas buyers, it was difficult or even impossible to travel to Thailand to complete transfers, causing transfers of ownership for condominiums to foreigners fell 8.9% YoY to just 4,784 units. Nevertheless, despite this depressed outlook, the per-unit value of condominiums for which transfers of ownership were made tended to be somewhat more expensive and so the combined value of all transfers of condominium rose 2.6% YoY (Figure 12).

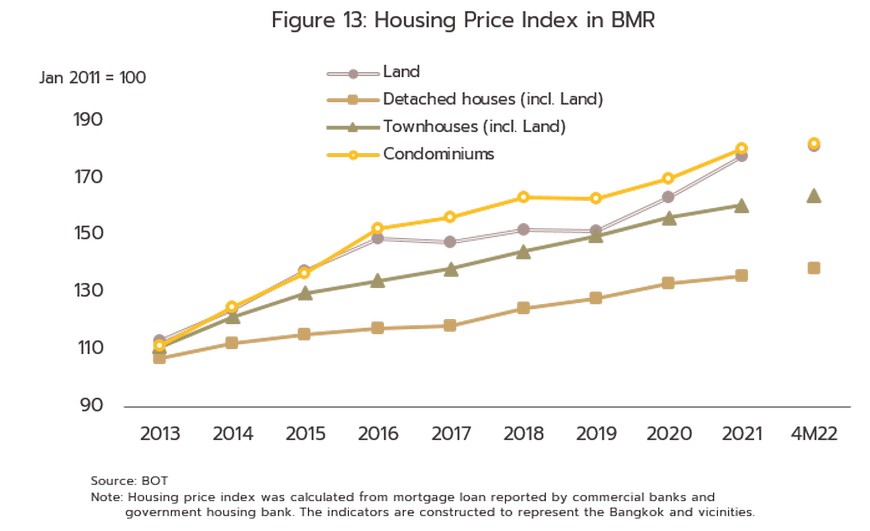

- Housing prices rose in all the main segments in 2021 (Figure 13). The greater focus on upper ends of the market and the rising cost of land near metro lines (the index of land prices was up 8.8% YoY) meant that the index of condominium prices climbed 6.1% YoY. For detached houses and townhouses, the relative indices increased by 1.3% YoY and 2.6% YoY, respectively.

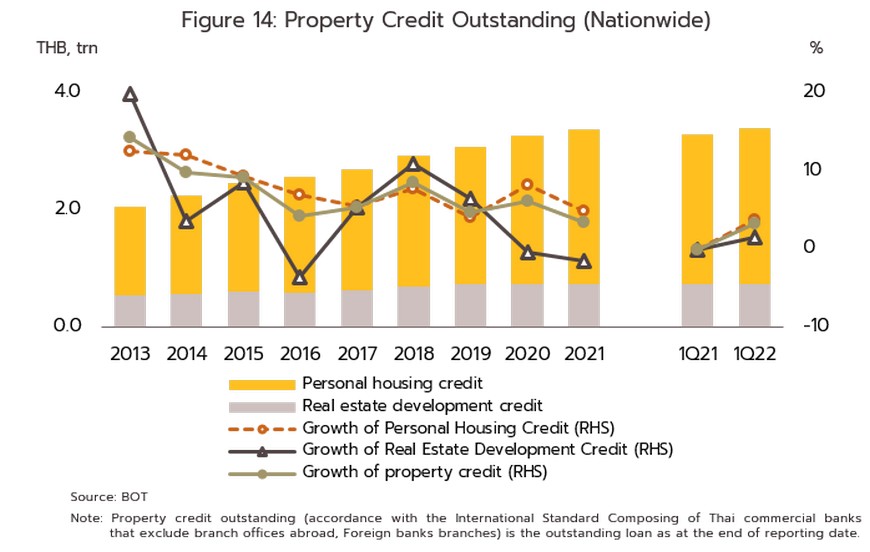

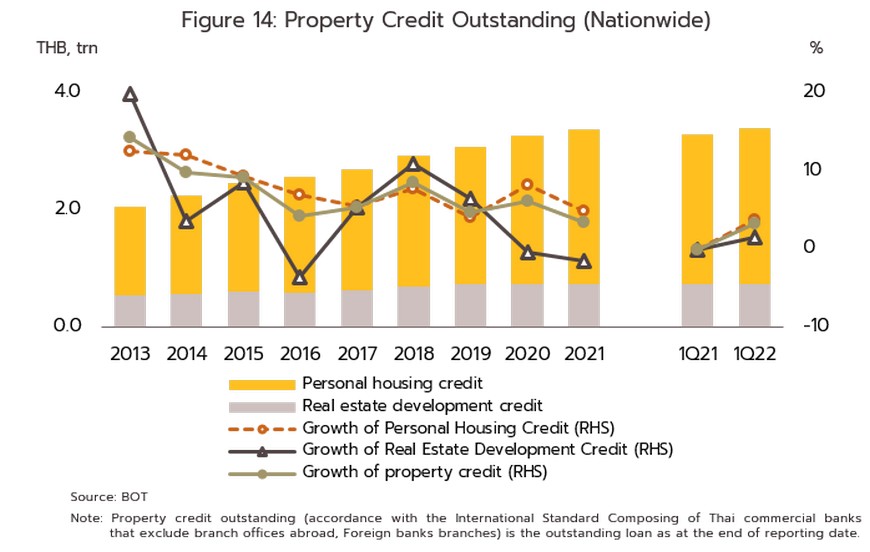

- The Growth of housing loans by commercial banks increased 3.4% YoY in 2021 (Figure 14). This was split between the following:

1) Pre-finance loans: The value of these fell back 1.5% YoY, making 2021 the second year of declines. The market for pre-finance loans weakened as developers postponed projects, and instead adopted a wait-and-see approach to the market. In addition, commercial banks had tightened the release of new credit. However, pre-finance loans were still required for new developments, to meet real demand from owner occupiers, especially for low-rise housing and in expectation of greater interest in developments serviced by new mass-transit lines.

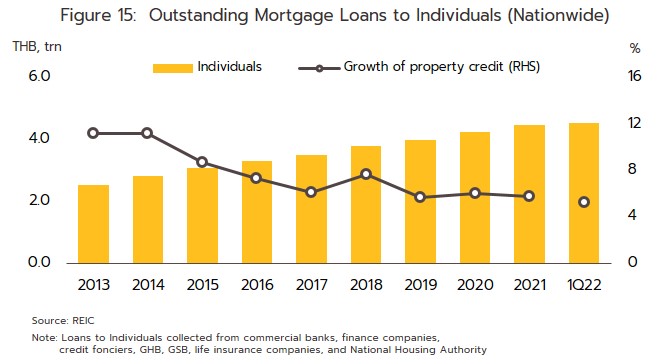

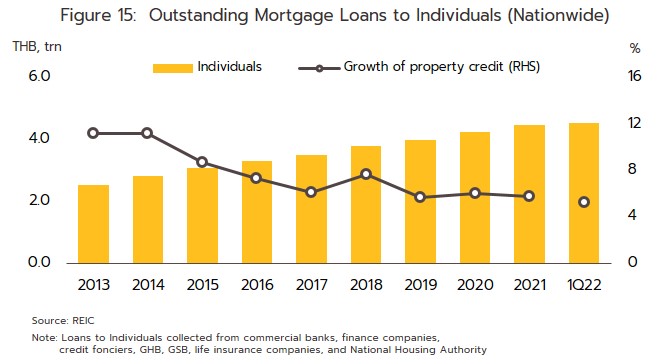

2) Post-finance loans: In 2021, these increased in value by 4.8% YoY (Figure 14) as developers worked to run down stocks of unsold properties through a wide range of marketing and pricing strategies, including by increasing price discounts and offering 1 to 2 years’ free accommodation. The market was also helped by the Bank of Thailand’s relaxation of the LTV rules, which then made it easier for some buyers to access financing. Commercial banks further helped to stimulate uptake of loans by, for example, offering digital mortgages and working with developers to organize special offers for buyers. This all helped to support the market and so for the year, the value of personal housing loans issued across the whole of the financial system[3] increased by 5.8% (Figure 15).

The housing market was boosted through the first quarter of 2022 by the abating of the COVID-19 outbreak and, from the end of 2021, the reopening of the country to foreign arrivals. Unfortunately, these gains have been counterbalanced by the outbreak of war in Ukraine at the end of February, which has added substantially to operators’ costs; the latest data, which are correct as of June 2022, show that prices are up 62.0% YoY for oil, 25.3 YoY for steel (Rebar) and steel products, and 5.7% YoY for concrete products. The home cost construction index therefore rose by 5.3% in 1Q22, and with this, house prices have climbed by an average of 5% (source: Lumpini Wisdom and Solution Ltd.)

-

Developers are restarting work on new projects, and so 21,472 new units are added to the pool of available housing for sale (up 152.6% YoY), of which mostly are condominiums and detached houses. As over the past 2 years the pandemic forced the postponement of sales of new projects, developers are now under pressure to open new income streams and accumulate stocks.

-

Sales of new housing came in at 6,499 units, up 100.6% YoY. The condominium segment enjoyed the greatest increase in sales, rising by more than 200% YoY, with most sales in the sub-THB 3 million price band.

-

Housing transfers were down 4.8% YoY to 38,954 units. This was split between 15,433 condominiums (-10.5% YoY), 12,796 townhouses (+1.2% YoY), 7,043 detached houses (-0.2% YoY), and 3,682 other properties (semi-detached houses and shophouses) (-8.3% YoY).

-

Over 4M22, housing prices continued to rise, led by those for low-rise accommodation. Thus, prices for townhouses and detached houses were up by respectively 3.9% YoY and 3.6% YoY, while condominium prices rose by 3.3% YoY (Figure 13). These increases were principally driven by the rising cost of construction.

- Growth of housing loans by commercial banks increased 3.3% YoY in 1Q22 (Figure 14). Having declined for the previous 5 quarters, loans to developers were up in value by 1.5% YoY on the abating of the pandemic, the reopening of the country, and improving signs of recovery. However, continuing economic weakness and high levels of household debt are encouraging lenders to exercise caution about issuing new loans and so the value of private home loans made by the commercial banking sector expanded by just 3.8% YoY in the quarter. Across the entire financial system, private home loans were up 5.3% (source: REIC), compared to a rise of 7.0% in 1Q21 (Figure 15).

The situation for the main market segments is given below.

Detached houses

-

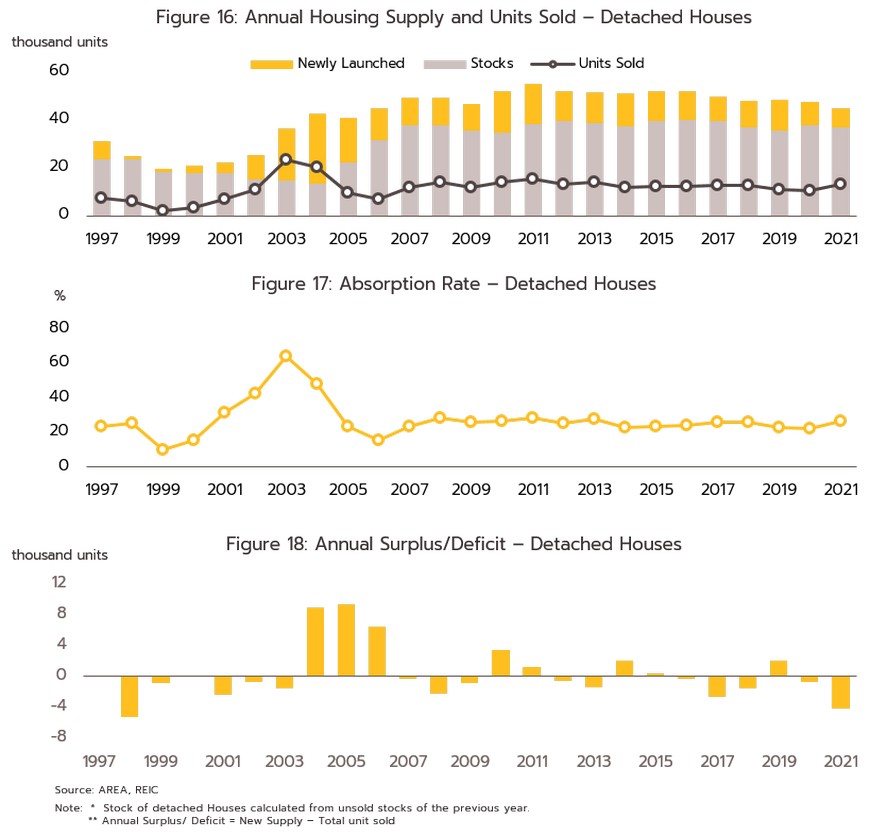

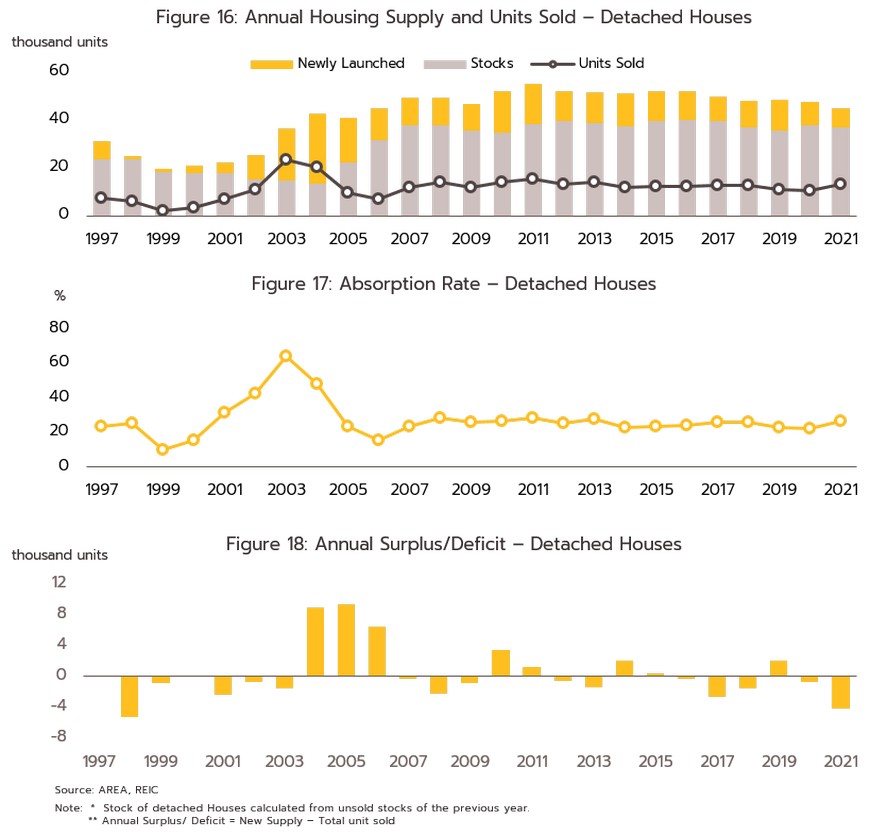

The detached house projects are gradually growing in demand as major transport routes were extended into the suburbs and new roads were constructed. Over several years ago, new supply outpaced demand. As a result, cumulative unsold detached housing continued to rise, and in 2020 the figure accounted for 17% of total unsold housing stock in the BMR. Meanwhile, the absorption rate has remained at 25% since 2005, compared to a high of 64% during the property boom in 2003.

-

The two-year COVID-19 pandemic caused a shift in consumer lifestyles, and with owners spending more time at home, developers have transitioned to a greater emphasis on low-rise projects. Thus, as a proportion of the total, low-rise properties overtook high-rise units for the first time in 2020, though it is particularly noteworthy that detached houses valued at THB 10 million or more comprised a full 22% of all new houses coming up for sale. This is partly due to developers’ increased focus on wealthier buyers, which then increased the 2021 average sale price of new units to THB 10.1 million, up 8.9% from 2020. Total sales also jumped 11.7% to 11,942 units, with properties in the THB 5-10 million band proving to be the most popular. Moreover, because sales outpaced the release of newly launched, the supply of unsold detached houses dropped to 32,690 units, down 11.3% from 2020.

- In 1Q22, the number of new detached houses coming up for sale jumped 163% YoY to 2,110 units. These had a combined value of THB 16.8 billion (up 150% YoY), sales of new detached houses dropped 43% YoY and so the total supply (stocks + newly launched) increased to 34,800 units.

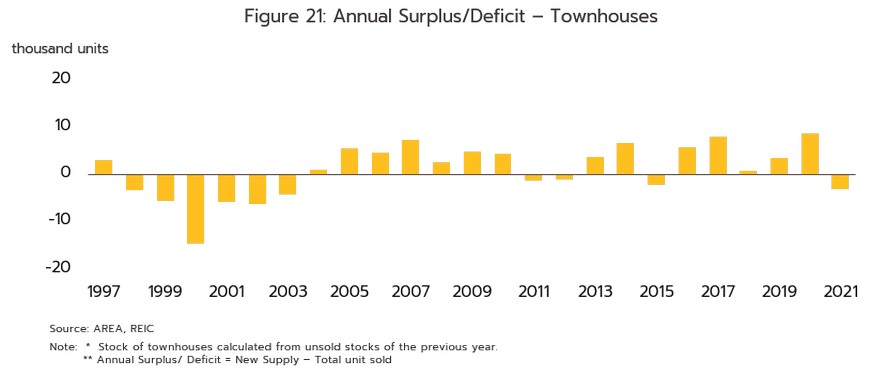

Townhouses

-

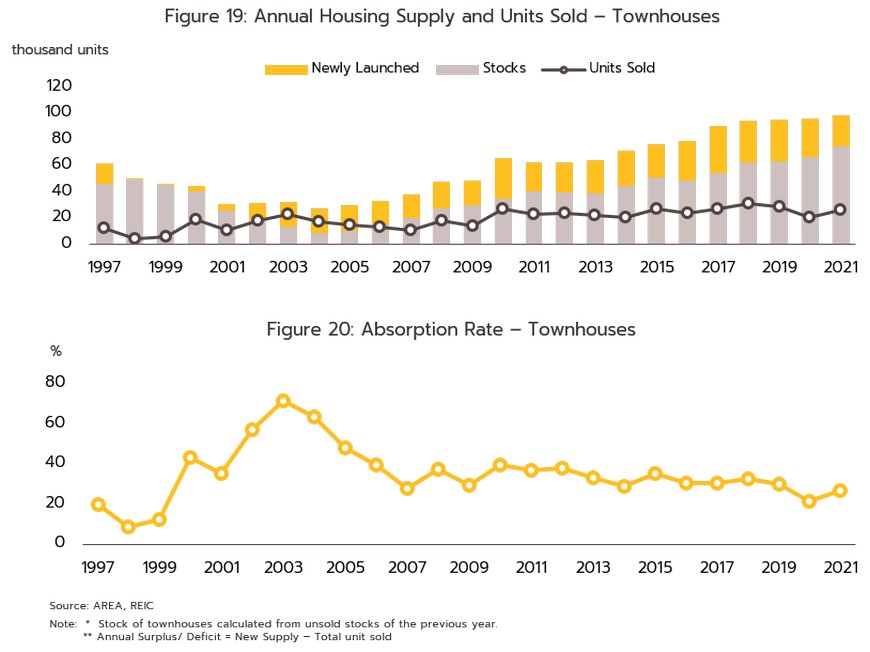

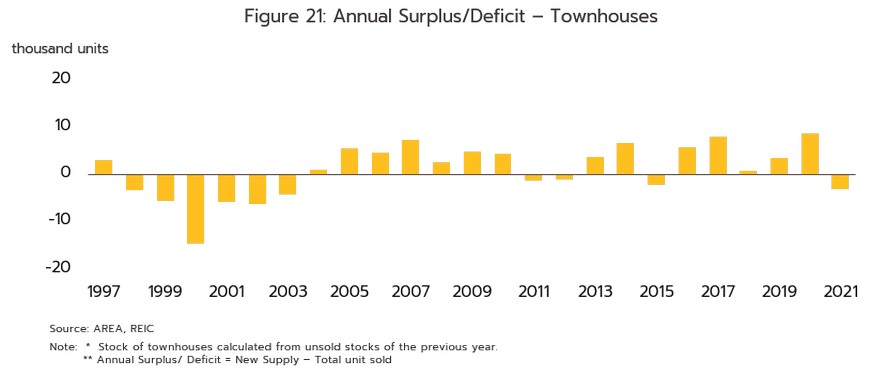

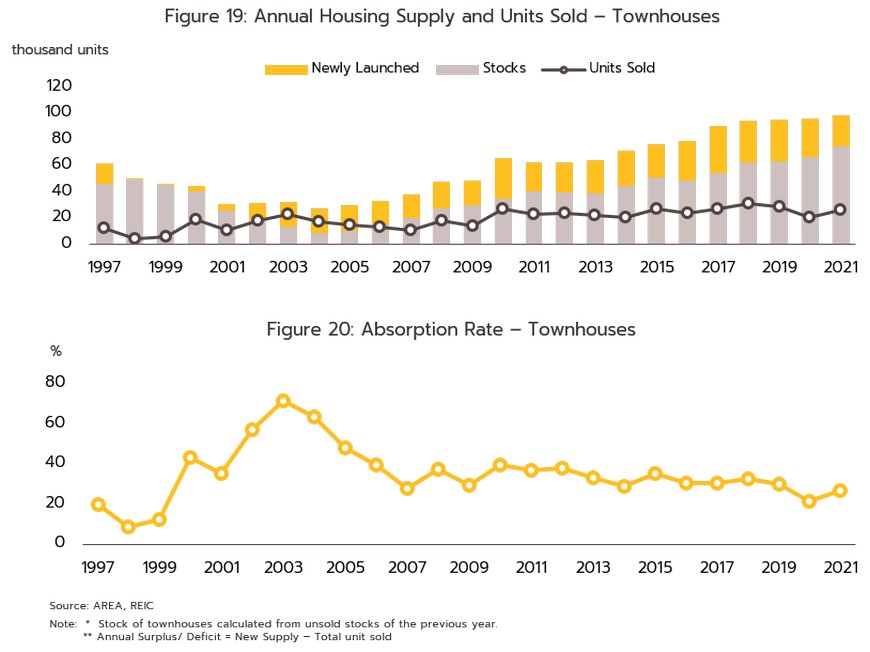

Rising land prices spurred demand for townhouses as alternatives to more expensive detached housing. However, there was falling interest in townhouses in favor of condominiums located near BTS lines (referred to as ‘city condos’), with the latter having advantages in terms of pricing and easy access (via mass rapid transportation) to the city center. These shifts in the market reduced absorption rate for townhouses to an average of 34% from 56% during the townhouse boom period of 2002-2006. Despite this, since 2014, developers had been developing expensive townhouses priced over THB10m per unit. These townhouses typically have three or more floors, are located on the fringe of Bangkok city center, and are relatively close to BTS stations, such as Rama 3, Sathu Pradit, Yannawa, and Lat Phrao. Beyond this, developers also invested in townhouses located in smaller alleyways that connect to mass transit systems, priced at THB2-3m each to target mid-to-low income earners.

-

The pandemic and the need to adapt to new ways of living that emphasize physical distancing increased demand for townhouses among owner occupiers who were put off by the rising price of detached houses and the restricted size of most condominiums. In 2021, the supply of new townhouses fell 20.1% to 23,248 units, (43% of all new housing supply). However, the average sale price of these increased 3.4% YoY to THB 3.0 million, while total sales increased 28.2% to 26,356. This then cut cumulative unsold units by 4.1% YoY to 71,945.

-

In 1Q22, 4,152 new townhouses were added to the market, a jump of 51%, and these had a combined value of THB 12.6 billion (up 44%), but sales of new townhouses dropped 27.1% YoY, meaning that the total supply (Stocks + newly launched) increased to 76,097 units.

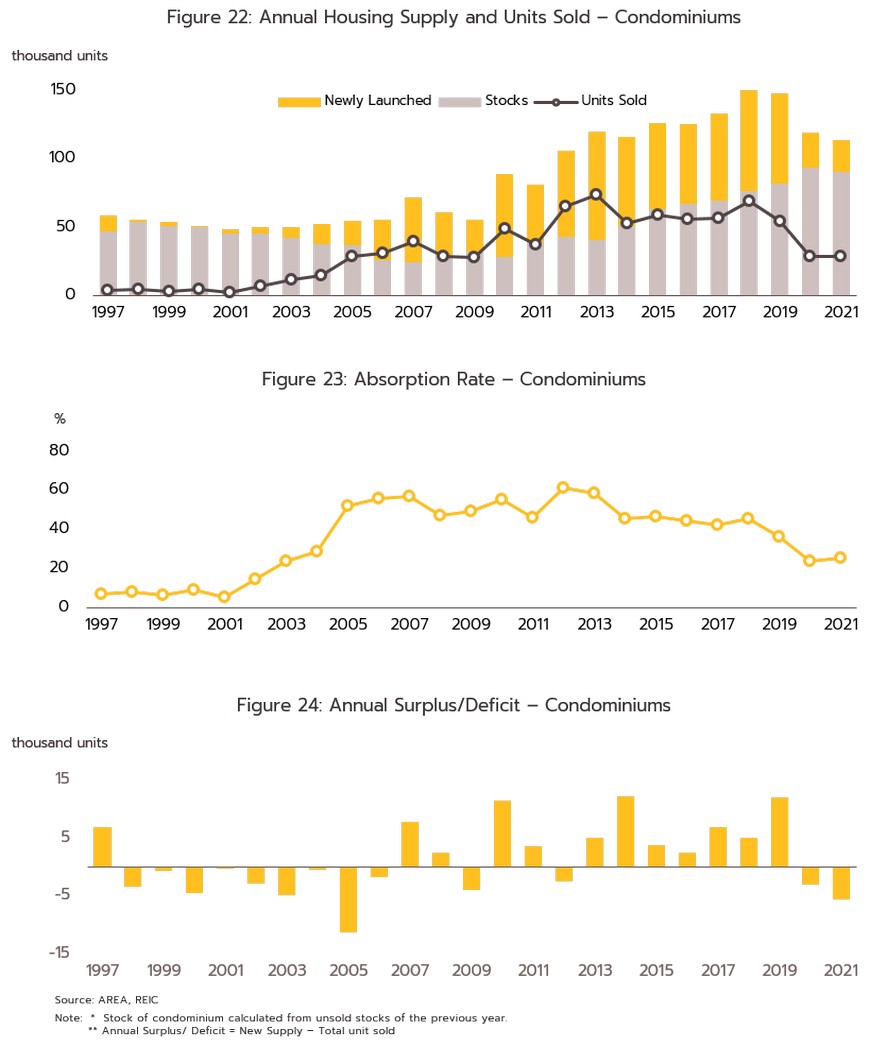

Condominiums

-

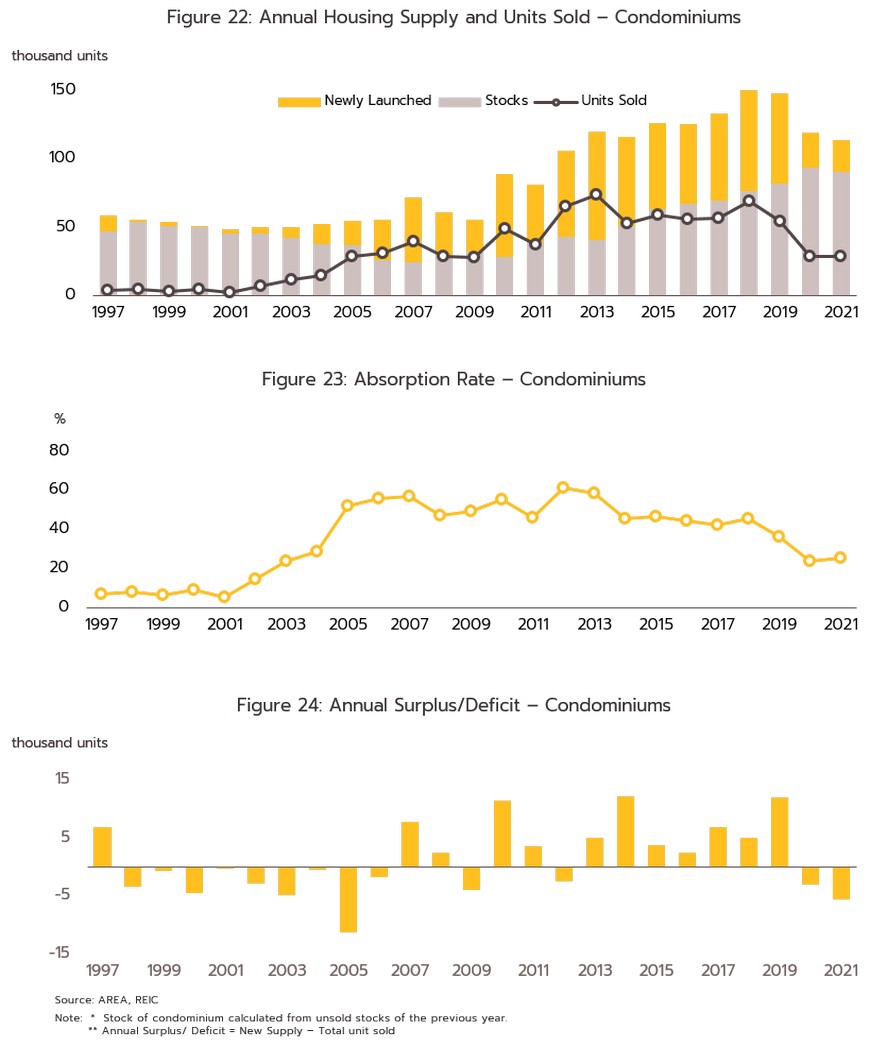

Condominiums have been popular with a rising number of new projects since 2007, as reflected from the supply of condominiums coming to the market with more than 50,000 units per year since 2005. Buyers of these condominium units can be split into two distinct groups: (i) real demand accounts for around 60% of the market; and (ii) those who buy for investment, which can itself be split into those who buy to rent out 25-30% of the market and those who buy for speculation the remaining 10-15%. Thai law specifies that non-Thais may own condominium units with some legal requirements. Therefore, the absorption rate of condominium segment was at 50%, greater than low-rise segment (25% for detached houses and 34% for townhouses) during the same period.

-

Over 2020 and 2021, the condominium segment was badly hurt by the COVID-19 pandemic and its effects of this on domestic spending power. In addition, global lockdowns placed significant obstacles in the way of foreign buyers wishing to come to Thailand to complete sales. Meanwhile, the authorities also kept the new, tighter LTV rules in place for buyers of second homes, and this then ate into demand from investors and speculators. In 2020, the number of new condominium crashed 61.0%, while in 2021, the number of new condominiums slipped 9.5% to 23,445 units (43% of all new housing supply). However, although supply dipped, average sale prices surged 42.3% to THB 4.0 million as developers looked to exploit stronger demand at the more expensive end of the market. Property developers also used a range of pricing and marketing strategies to sell off unsold stock and so 28,973 sales were completed in the year, close to the 2020 level. Because new supply lagged behind sales, the supply of unsold stock shrunk 6.1% YoY to 85,313 properties by the end of the year, but with a slide in the absorption rate to just 25%, it will still take 2 years and 8 months for this to dissipate.

-

In 1Q22, the number of new condominiums coming to market jumped 207% YoY to 15,210 units, these having a total value of THB 43.1 billion (down 9.1% YoY). Sales of new condominiums surged 207.2% YoY, bringing the total supply (Stocks + newly launched) of condominiums to 100,523 units.

OUTLOOK

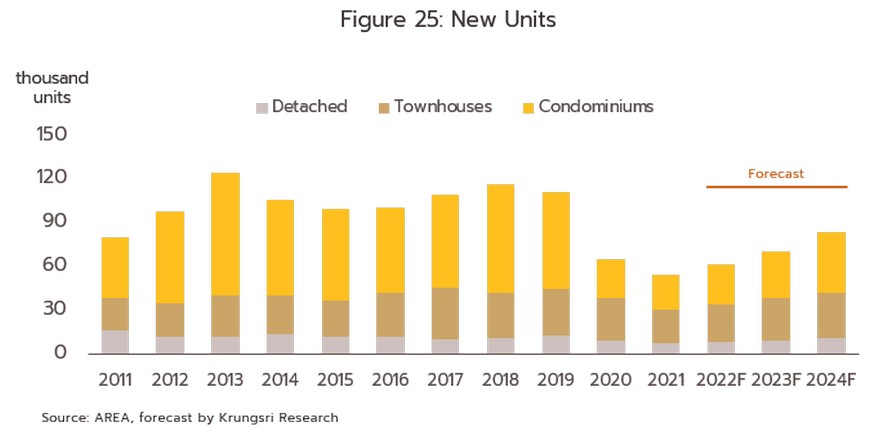

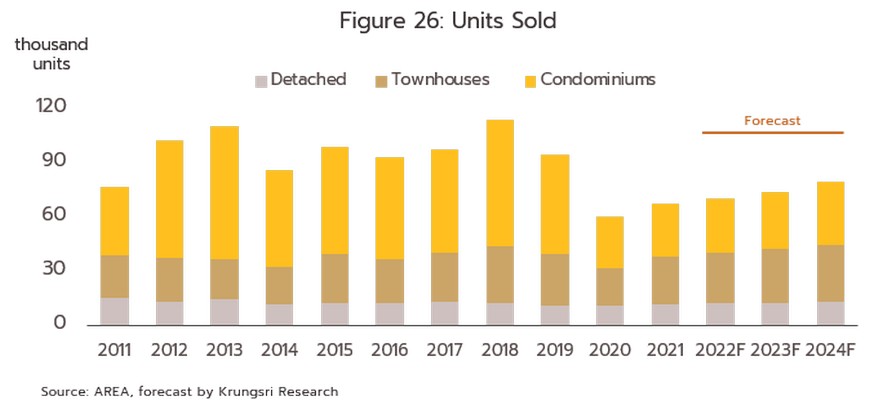

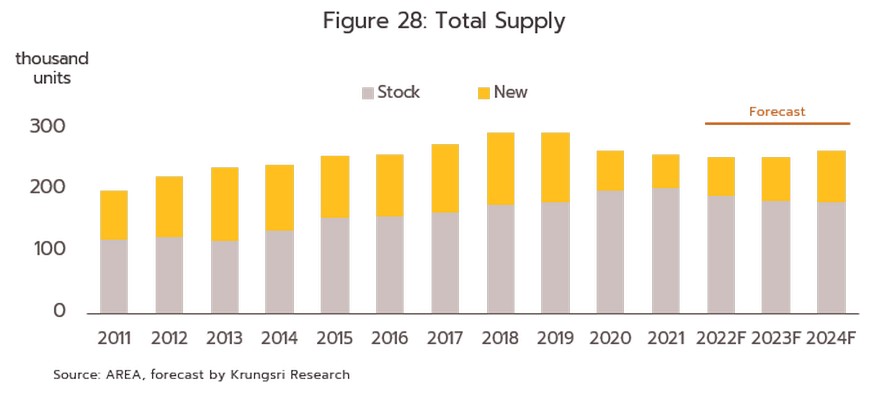

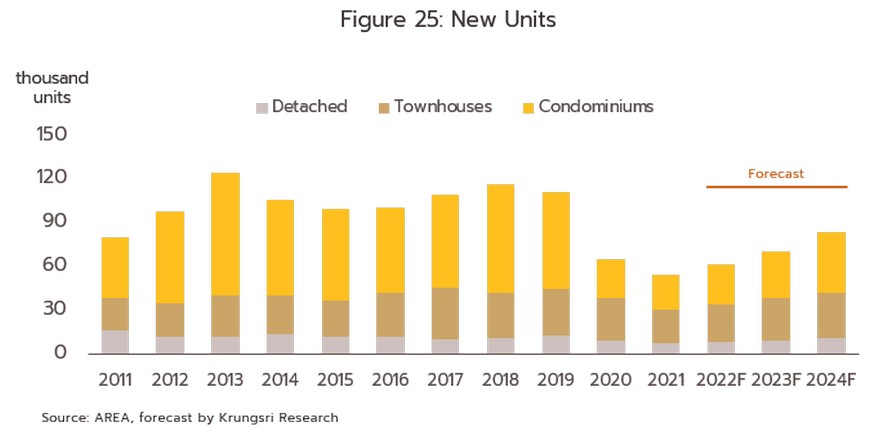

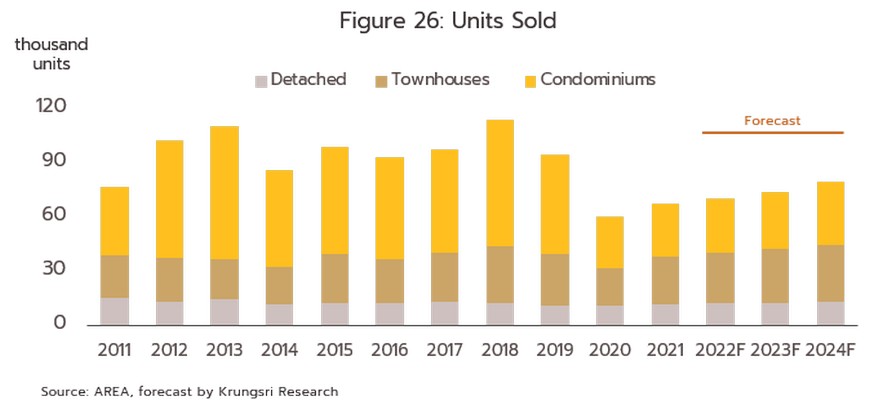

Sales of residential properties in the BMR are now expected to grow by 4.5% in 2022. This is a downgrade on earlier forecasts, and this worsening of the outlook can be attributed to two main factors. (i) The Ukraine-Russia war has pushed up global energy prices (for 2022, prices of Dubai crude are expected to average USD 102.5/bbl, compared to USD 69.5/bbl in 2021), and with this the cost of construction materials also rise. This has then impacted purchasing power, consumer confidence (in May, this dropped to its lowest since September 2021), and overall construction overheads. This situation has been made worse by persistent labor shortages and the subsequent upward trend in wages, and overall, sale prices for newly or soon-to-be released properties have risen by an average of 5-10%. (ii) The strength of overseas demand remains uncertain, especially with regard to Chinese buyers and the intermittent lockdowns that several Chinese cities continue to struggle through (Chinese buyers accounted for 45% of all overseas real estate purchases in Thailand). This is then placing a significant obstacle in the way of attempts to market to overseas buyers and so undercutting demand for condominiums, especially sales to mid-market foreign buyers that may show limited recovery. Developers are expected to respond to these changing circumstances by working on low-rise projects aimed at the wealthier end of the market, where sales have tended to hold up better. Weak signs of recovery may be beginning to emerge in the condominium segment, though supply is still affected by the significant glut of unsold units. For 2022, the number of new housing expected to increase by 14-15% compared to the 2021 level.

Krungsri Research sees a gradual recovery in the housing market over 2023 and 2024, with improvements tending to move in line with the broader economic recovery. Overall annual growth is likely to run in the range of 5-7%, with demand for property lifted by: (i) economic growth of around 3.0-4.0% per year that will support a rebound in consumer purchasing power, which will then be helped by the impetus given to demand from foreign buyers (especially for condominiums) by recovery in investment and tourism; (ii) an acceleration in work on government megaprojects, especially those related to transport and logistics; and (iii) increasing investment in and travel to Thailand by foreigners/expats, which will further add to demand for condominiums. General trends in the property market are given below.

New housing supply is expected to rise by some 15-16% annually. Developers are expected to continue to focus on low-rise projects as they look to meet stronger real demand and changes resulting from the ‘new normal’ that encourages greater work from home. Firmer signs of recovery will also become evident in the condominium segment, and overall, the number of new units coming to market is expected to reach around 84,000 per year, though this will still be less than the 100,000 averaged over 2014-2019 in the pre-COVID era.

-

Low-rise (detached houses and townhouses): Buyers are increasingly concluding that low-rise developments provide a long-term solution to their need for access to more usable space and a wider range of room functions, and so demand should continue to rise steadily. In particular, low-rise developments in suburban locations will tend to attract more interest because: (i) their low price compared to downtown areas, the ability of developers to split developments into different phases, unlike condominiums that have to be completed in full before any units can be transferred; and (ii) outer parts of the BMR are becoming more accessible through the extension of mass-transit lines, including the Light Red Line (Bang Sue-Taling Chan), the Pink Line (Khaerai-Minburi), the Yellow Line (Lat Phrao-Samrong) and the Orange Line (Ramkamhaeng-Lam Sali).

-

Condominiums: The market will improve in some locations, especially in downtown areas and near some mass-transit lines, but sales in other locations will continue to struggle under the weight of the supply glut. This includes areas along the MRT Blue Line (Hua Lampong-Bang Khae) and the MRT Green Line (Bang Na-Samut Prakan), which are somewhat remote and lack the appeal of other areas. New condominium developments will mostly be undertaken by large developers that are skilled in project management, marketing, and that have access to sources of working capital. Condominiums will also be more in demand from renters whose housing budgets have come under pressure from the rising cost of living, and this will tend to attract greater interest from long-term investors in the more affordable buy-to-rent segment (i.e., those priced at less than THB 50,000/sq.m.). The condominium market will be further boosted by the reopening of the country and the additional demand that will come from overseas buyers.

However, the market will face a number of challenges in the near-term future, including: (i) slow recovery of the economy, which will make it more difficult for developers to market their properties (ii) the tendency for household debt to rise (as of Q122, this stood at 89.2% of GDP) and the reduced willingness of lenders to release new credit; (iii) changes in consumer preferences linked to COVID-19 that have increased the relative importance of low-rise housing in the suburbs (e.g., for working from home); (iv) the limited rebound in demand for housing, most of which, however, will be real demand. At the same time, demand from overseas buyers will take until 2024 to return to near its pre-COVID strength; and (v) the rising cost of undertaking new developments thanks to more expensive construction materials (especially of steel) and the upward trend in Thai and global interest rates.

[1] The new LTV rules that had been enforced from 1 April, 2019 were temporarily amended and from 20 January, 2020, buyers of their first home were permitted to take out home loans worth up to 110% of the property’s value (including the value of any top-up loans), while for buyers of second homes, the changes allowed for a reduction in the minimum down payment for those who have been paying the mortgage on their first home for at least 2 years.

[2] These changes raised the ceiling on the value of these loans (the LTV ratio) to 100% of the value of the loan’s collateral (i.e., mortgages may temporarily be taken out that cover the full value of the property being purchased) when these loans are for the purchase of a house, or when the loan is for other purposes but it is secured against a property, or it is a top-up loan. This applies when: (i) the value of the collateral is less than THB 10m and the loan is being made for a second (or more) home; or (ii) the value of the collateral is greater than THB 10m, and the loan is being made for a first (or more) home. These rules will be in effect between 20 October, 2021, and 31 December, 2022.

[3] Loans to Individuals collected from commercial banks, finance companies, credit fonciers, GHB, GSB, life insurance companies, and National Housing Authority

[4] An ‘aged society’ is defined as one in which at least 20% of a society (or a country) is over 60 years old or at least 14% is over 65.

.webp.aspx)